Content

-

Weekly Highlights

- Market Commentary

- Risks

Last week, the roaring rally in spot prices took a breather, with HRC indexes and transactions both settling near $600/st. Lead times remain extended, with most mills quoting December availability. The big news headline of the week was Cleveland Cliffs purchasing most of ArcelorMittal’s U.S. assets, making Cliffs the largest flat rolled producer in the United States. While this likely will have minimal effects on domestic supply levels, it is another obstacle that buyers have to maneuver. Specifically, this is affecting buyers in the mist of contract negotiations with these two producers. A more important issue regarding domestic producers is the next round of price increases initiated by ArcelorMittal today, meant to push spot transactions meaningfully above $600. However, there is doubt as to how effective an announcement would be with lead times pushed out to December. Moreover, the forward curve is expecting spot prices in December to be lower. When discussing the current dynamics, we must understand that the market for steel on the ground today is very different from the “spot” market at the mills. Buyer’s willingness to pay high prices for material delivered today is not the same as their willingness to book tons to be delivered in 3 months. The direction that prices go from here will be determined by how long the tightness in supply lasts, which was caused by this divergence in the two different markets.

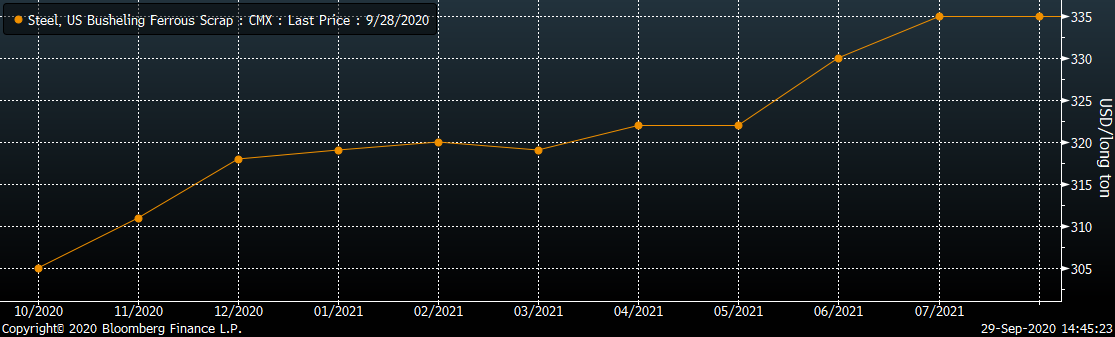

From the mill perspective, in order to for the current tightness to last as long as possible, they have to be continually filling their order books at extended lead times and elevated prices. They do this through either contract business or spot orders. As buyers are looking to lock up 2021 contracts, mills have expressed their desire to reduce the amount of contract business, shifting more tons to the spot market. Right now, this appears advantageous for the mills because the spot market is elevated and spot sales do not provide the same discount to buyers as contract tons. However, the same is not true in a down cycle where mills rely on contract obligations to fill order books. Additionally, history shows us the mini mills, which are increasing their market share, tend to be the lowest offers in the spot market when prices are declining. This would cause finished steel prices to fall faster and reach lower levels. There are also ramifications in the scrap market, where there will be increasing demand from EAFs going forward as Big River adds additional capacity. The below chart shows the busheling forward curve, which displays the market’s expectations for spot prices over the next nine months.

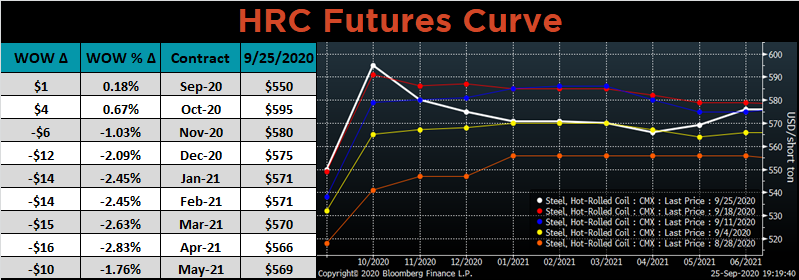

The market is pricing in steadily increasing scrap prices for the next several quarters, which makes sense given an increasing demand environment. However, this is somewhat unexpected given the downward sloping (backwardated) HRC curve, which shows prices peaking in the fourth quarter before falling during the beginning of 2021. Due to the historical correlation between the two products, something must give. This should be a reminder that while the curve displays market expectations for the future, it is not an accurate predictor of what actually occurs. Additionally, the changes in the HRC curve over the past week present a new opportunity for buyers looking to mitigate the current tight spot market. Looking into the first quarter of 2021, buyers can lock in prices that are at least $25/st less than the current spot price. With lead times pushing out towards the end of December, securing first quarter tons and prices is an attractive strategy.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

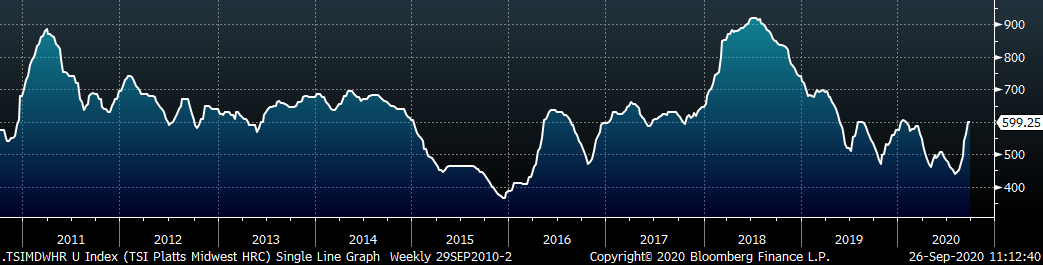

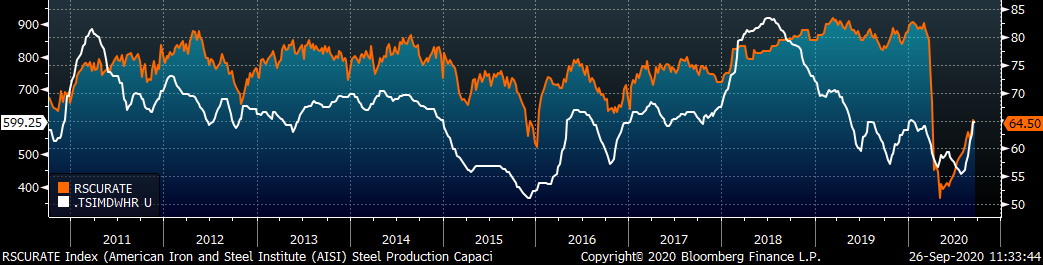

The Platts TSI Daily Midwest HRC Index rose slightly, up $0.50 to $599.25.

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The back of the curve moved $10-15 lower this week, starting with the December expiration.

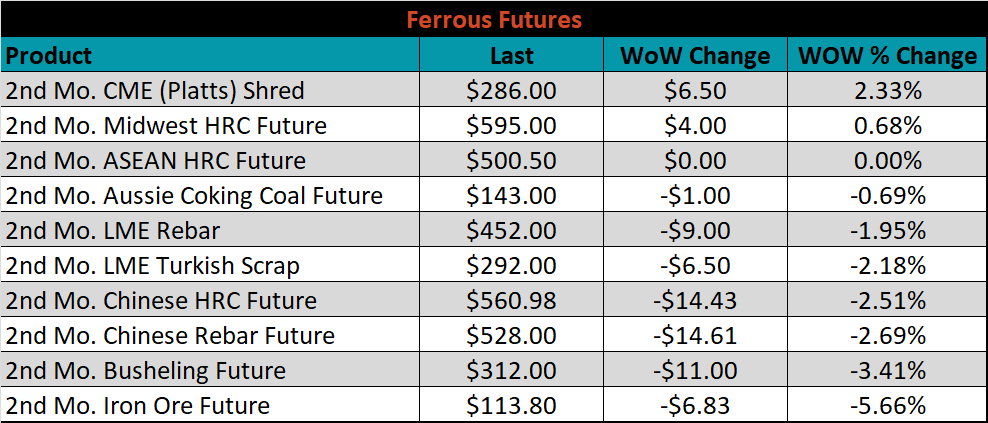

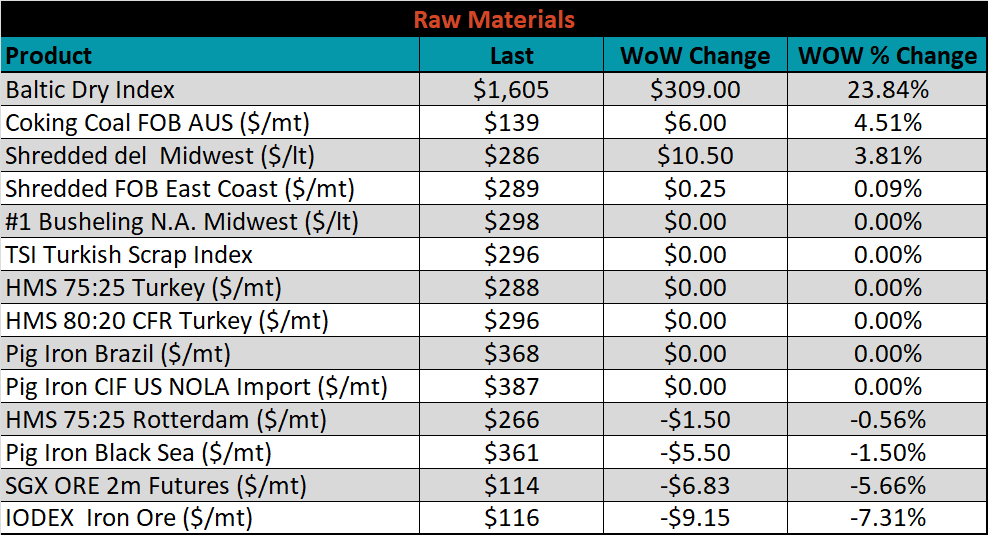

October ferrous futures were mixed. CME Shredded gained 2.3%, while iron ore lost another 5.7%.

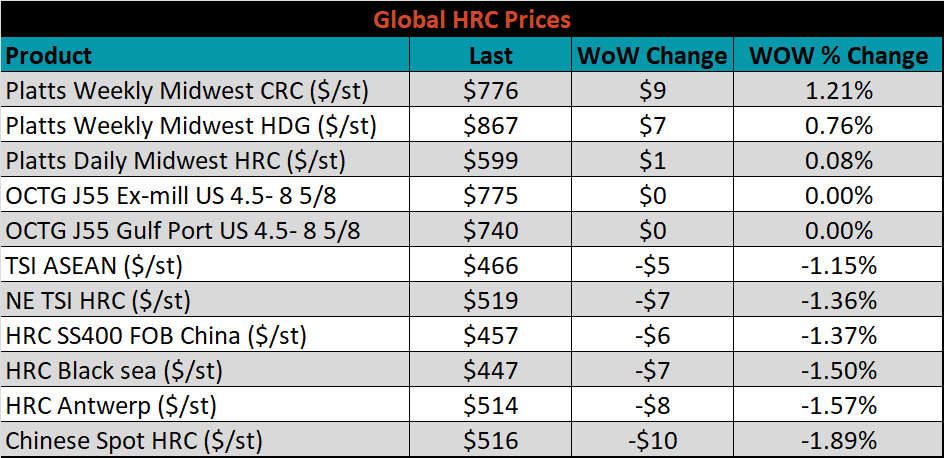

The global flat rolled indexes were mixed. TSI Platts Midwest CRC was up 1.2%, while Chinese Spot HRC was down 1.9%.

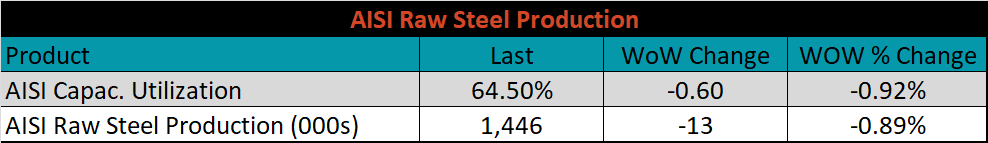

The AISI Capacity Utilization rate was down 0.6% to 64.5%.

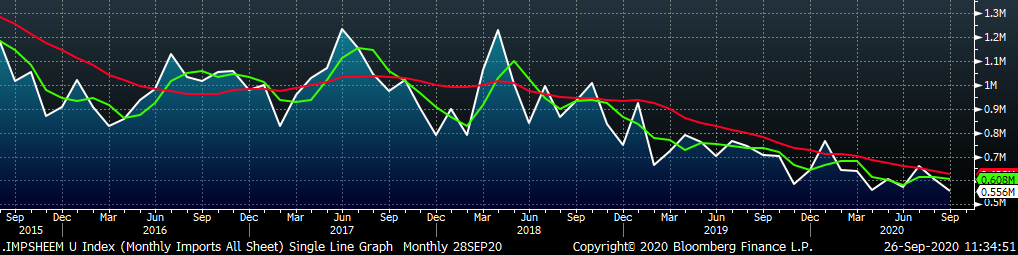

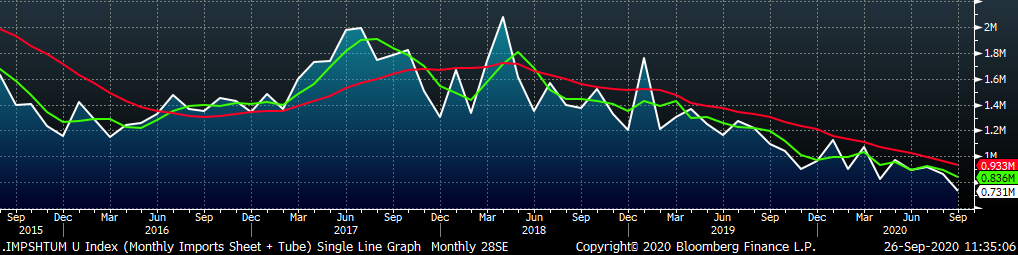

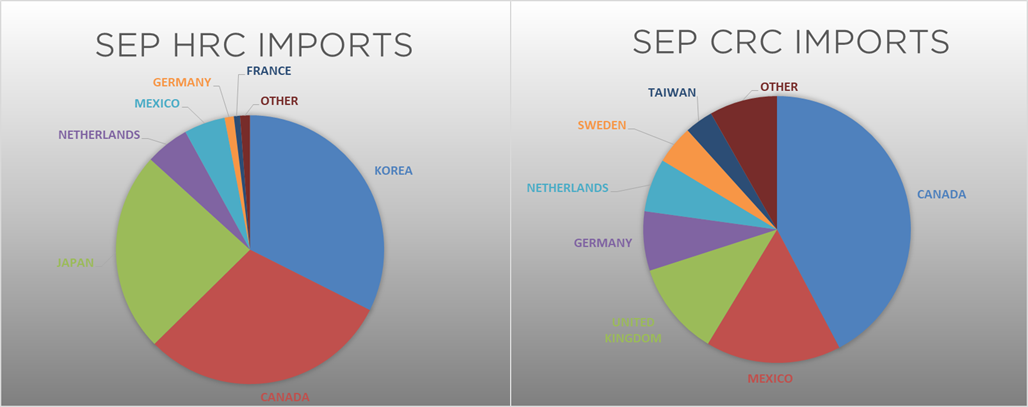

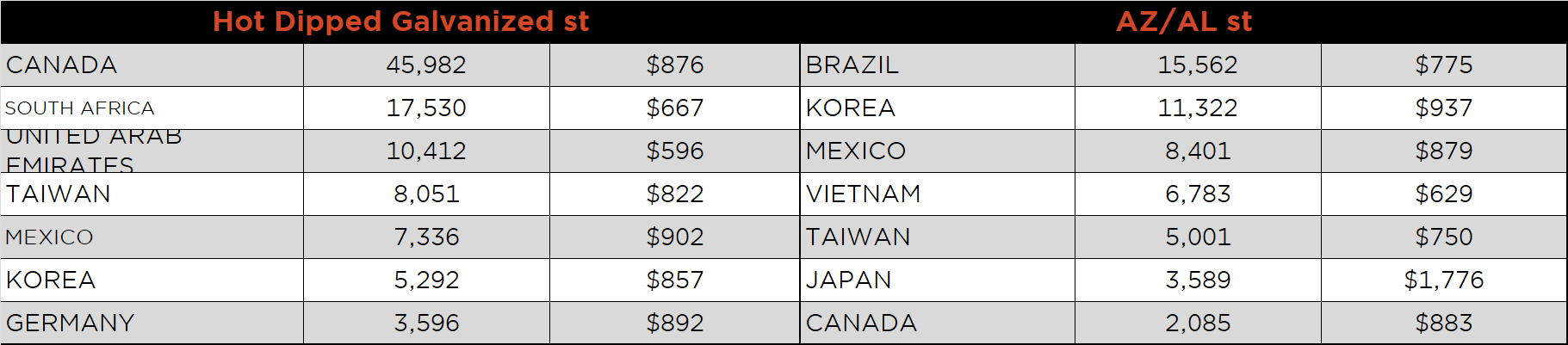

September flat rolled import license data is forecasting a decrease of 51k to 556k MoM.

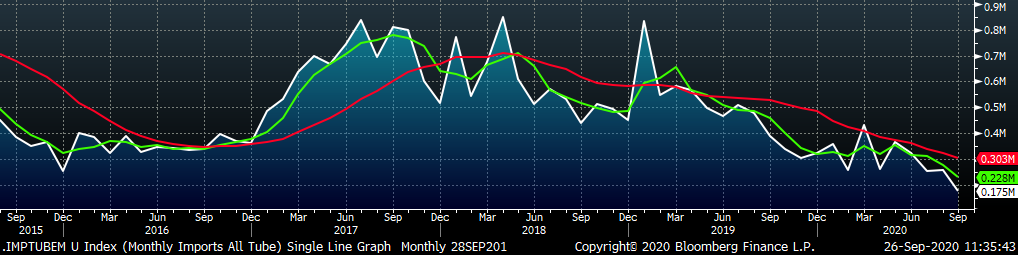

Tube imports license data is forecasting a decrease of 82k to 176k in September.

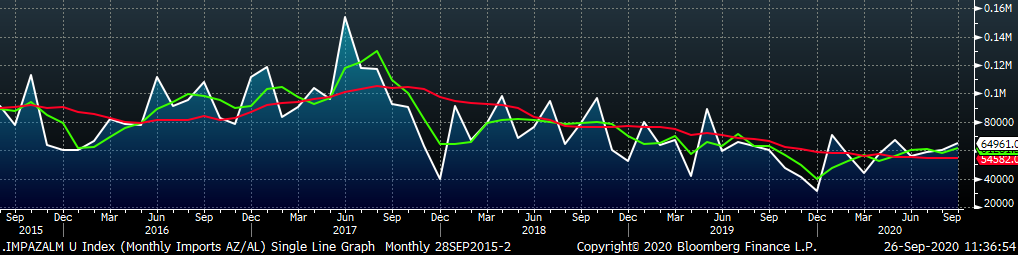

September AZ/AL import license data is forecasting a 5k increase to 65k.

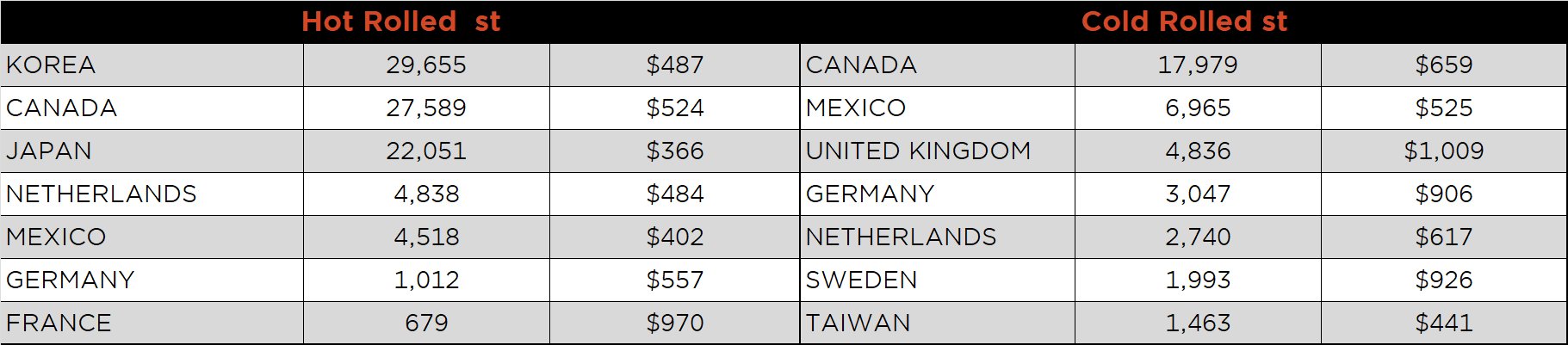

Below is September import license data through September 22, 2020.

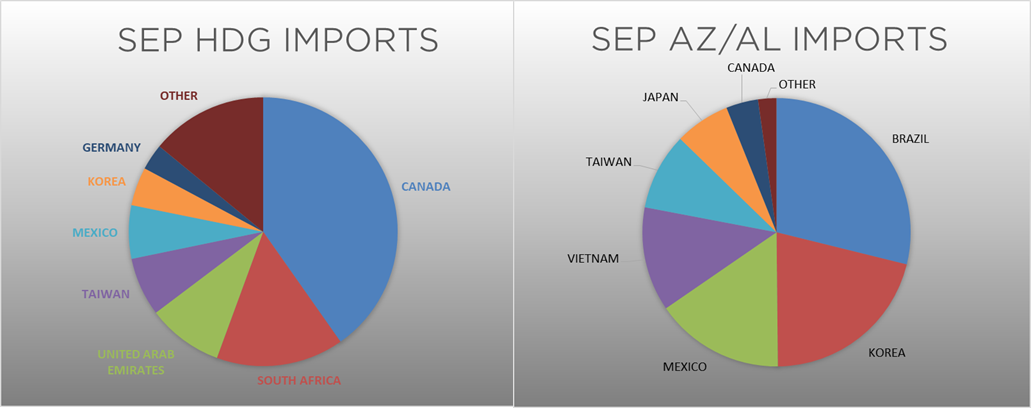

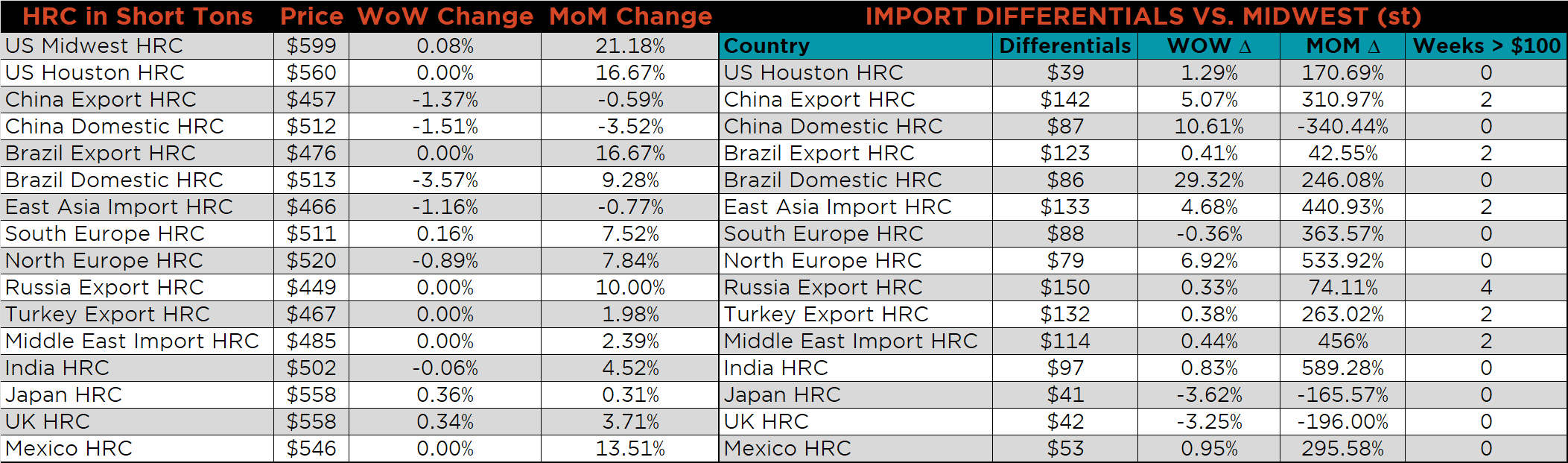

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The differentials for all watched countries were slightly higher this week, as the U.S. price ticked higher and global prices were largely unchanged or slightly lower.

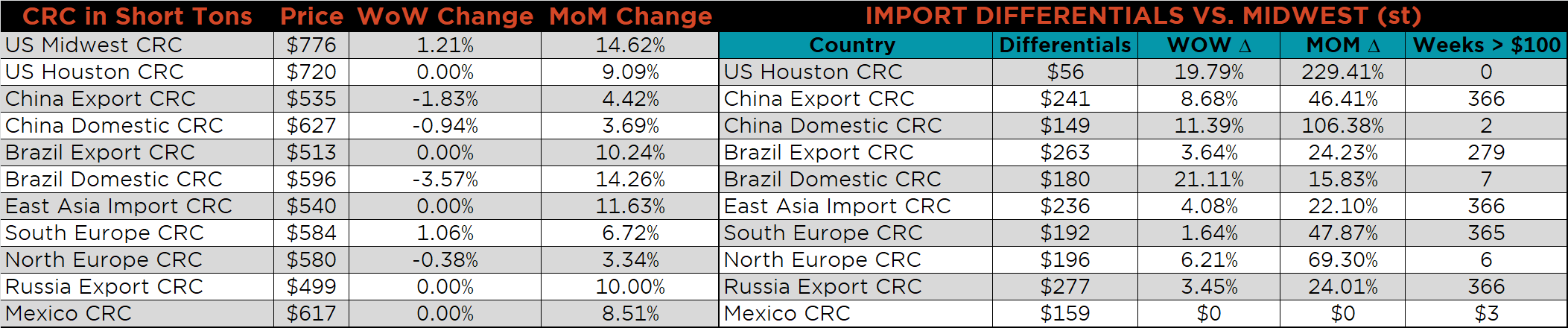

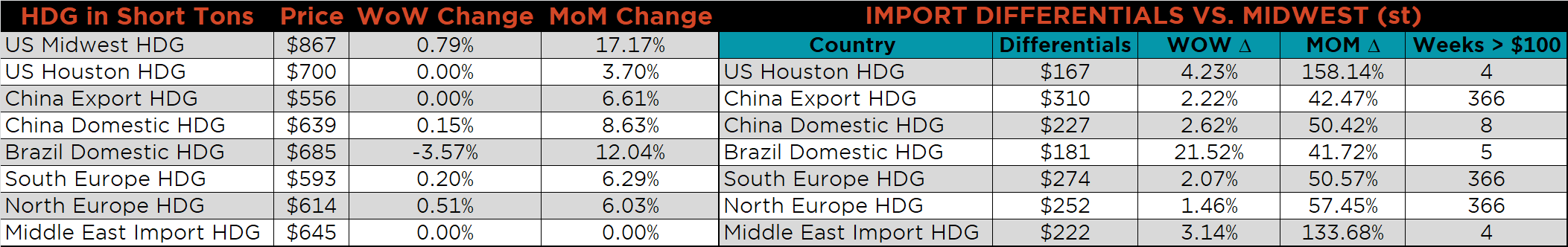

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest CRC, HDG and HRC prices were up, 1.2%, 0.8% and 0.1%, respectively. Globally, the Chinese export HRC price was down 1.4%.

Raw material prices were mixed. Aussie coking coal was up another 4.5%, while the IODEX Index was down another 7.3%.

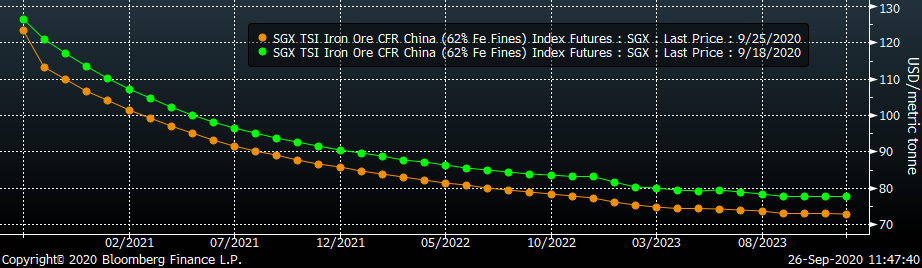

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the curve was lower equally across all expirations.

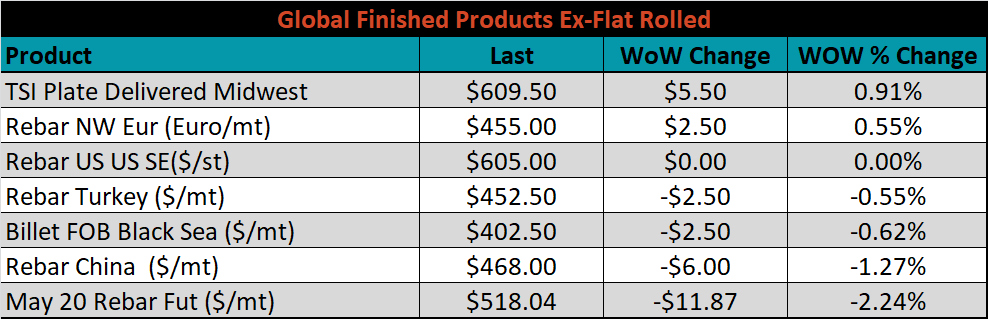

The ex-flat rolled prices are listed below.

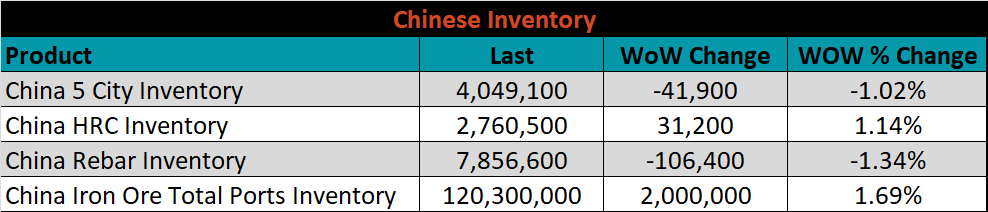

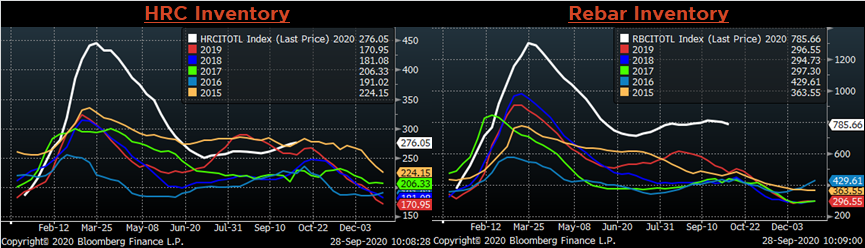

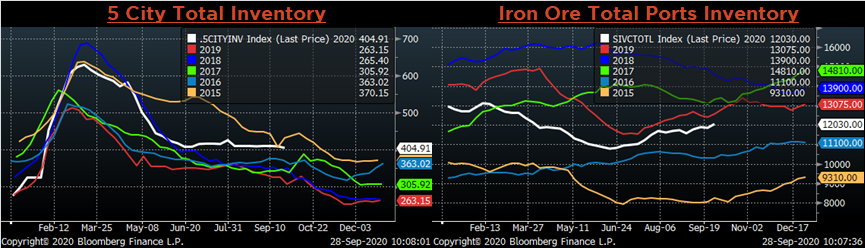

Below are inventory levels for Chinese finished steel products and iron ore. Last week, the rebar and 5-city inventory levels were lower, while HRC and iron ore inventory levels both increased. HRC inventories remain at their highest seasonal levels in the last 6 years and have been slowly building after the initial effort to destock from historic levels.

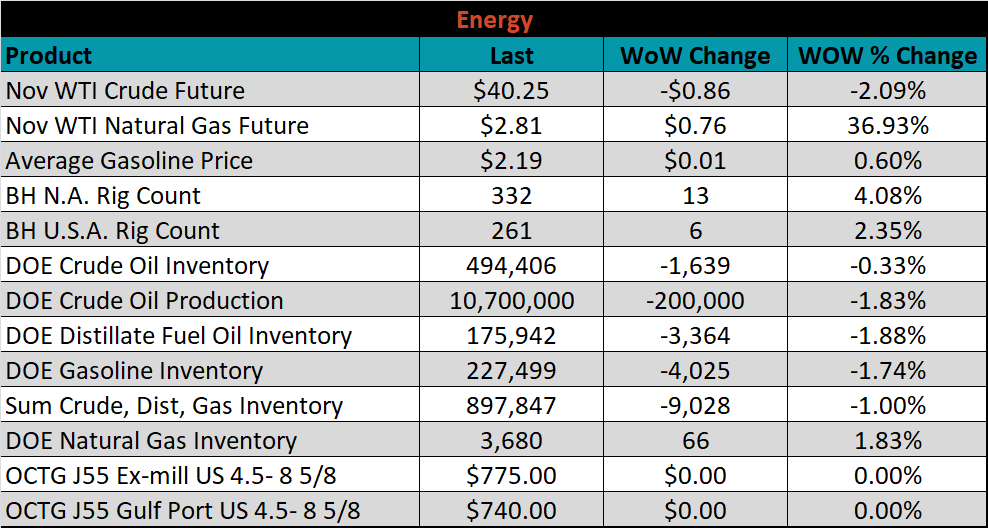

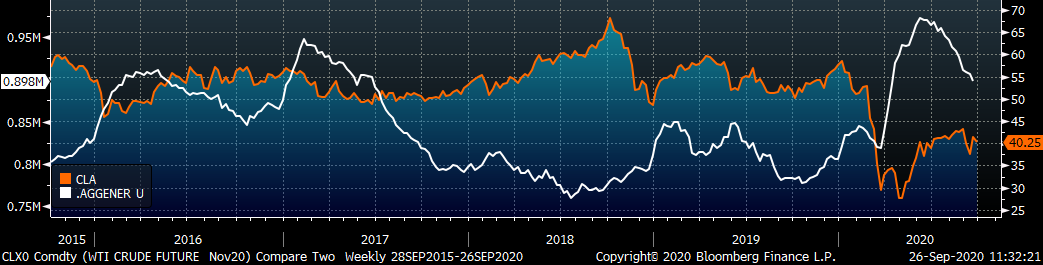

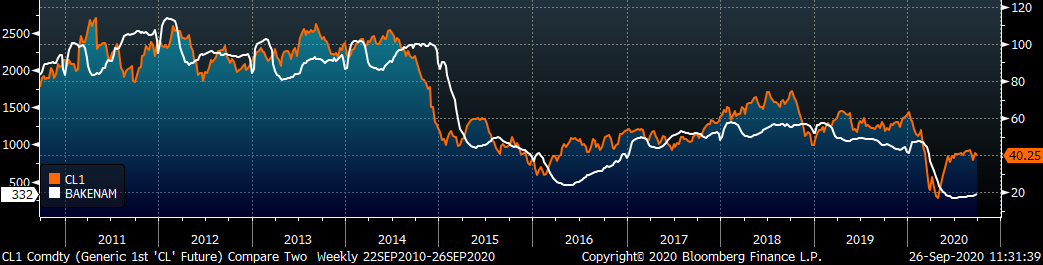

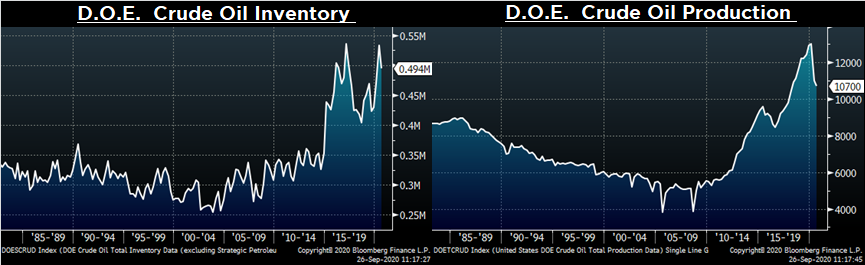

Last week, the November WTI crude oil future lost $0.86 or 2.1% to $40.25/bbl. The aggregate inventory level was down another 1%, while crude oil production fell to 10.7m bbl/day. The Baker Hughes North American was up 13 rigs and the U.S. rig count was up 6 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: