Content

-

Weekly Highlights

- Market Commentary

- Risks

Compared to recent weeks, the domestic HRC market was relatively quiet going into the long holiday weekend. Spot prices and mill offers continue to grind steadily higher, now well above the $1,600 level with no changes in the dynamics that have brought the rally this far. As demand continues to push the physical market forward, our view remains bullish, as automobile production has begun to restart, and the energy sector appears prime to start building additional rigs as crude prices stabilize above their $60-65 break even point. This week, we will look at some of the dynamics within the futures market since the sell-off earlier this month, while we wait for the new economic data released on next week.

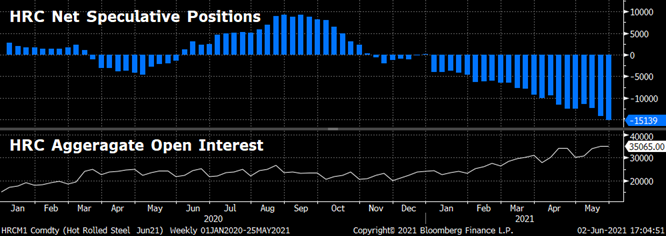

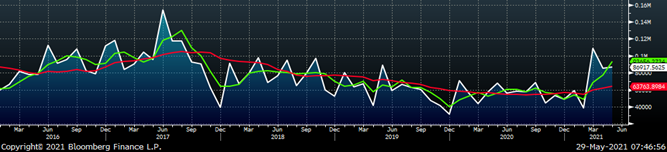

The chart below is the HRC Net Speculative position (in blue) and HRC open interest (in white).

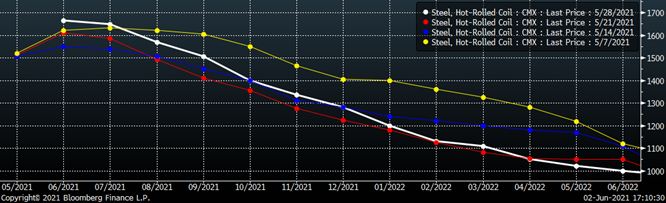

As we have referenced in prior reports, commercial participants are on the opposite side of speculative positions, which means the hedging community is “longer” than ever before. Additionally, current open interest levels slightly surpass the previous high in April, meaning hedgers continue to open new positions as prior contracts settle against the index. With this in mind, we look to the chart below, which is the HRC future’s curve from the last four weeks going out to June of 2022.

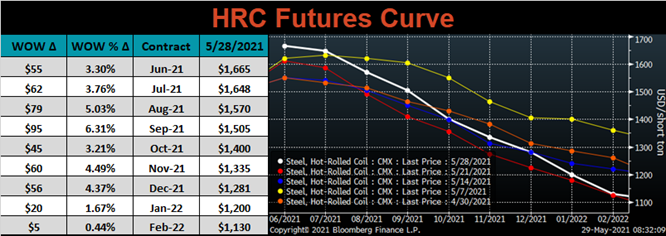

After the overall curve peaked and sold-off in early May, the front of the curve has rebounded, with June and July at all-time highs, while the back of the curve remains severely depressed from the elevated levels 3 weeks ago. The movement of these three datapoints: price, open interest and net spec positioning suggests that the buying (from commercial participants) and selling (from speculators) has occurred more significantly in near-term expirations. From a business and hedging perspective all this attention on the front of the curve could be a good opportunity to start looking at 2022 before contract negotiations, which will be much earlier than usual and provide additional upside pressure to the curve.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

The Platts TSI Daily Midwest HRC Index increased by $21.25 to $1,616.

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the entire curve shifted higher, with the front month (June) settling at an all-time high, while the back of the curve continues to lag, $200 below the highs established at the same time.

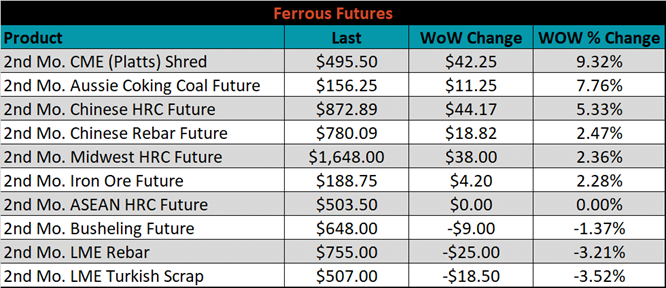

July ferrous futures were mixed. Aussie coking coal future gained another 7.8%, while Turkish Scrap was down 3.5%.

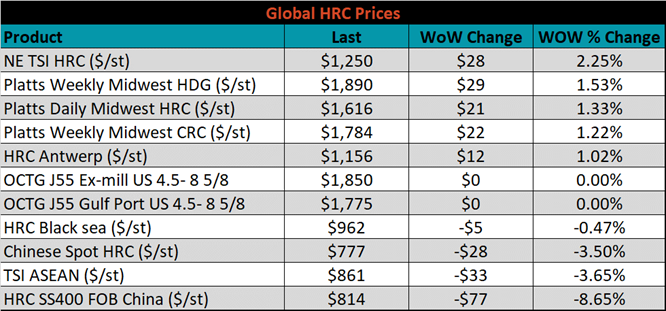

Global flat rolled indexes were mixed, with Northern European HRC up 2.3%, while Chinese export HRC was down 8.7%.

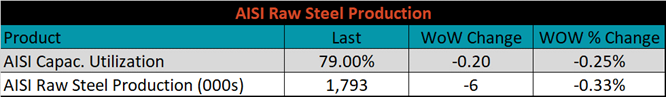

The AISI Capacity Utilization rate decreased 0.2% to 79%.

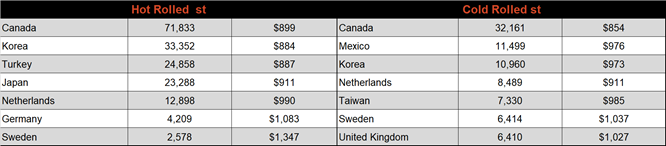

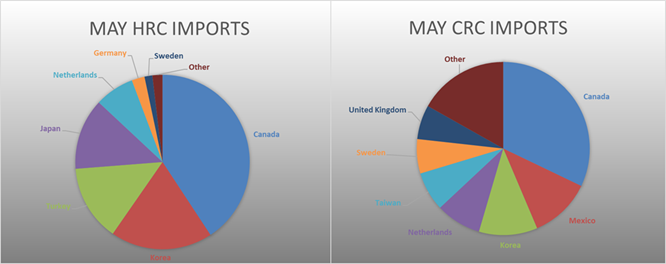

May flat rolled import license data is forecasting an increase of 132k to 898k MoM.

Tube imports license data is forecasting an increase of 17k to 336k in May.

May AZ/AL import license data is forecasting an increase of 1.5k to 87k.

Below is May import license data through May 25, 2021.

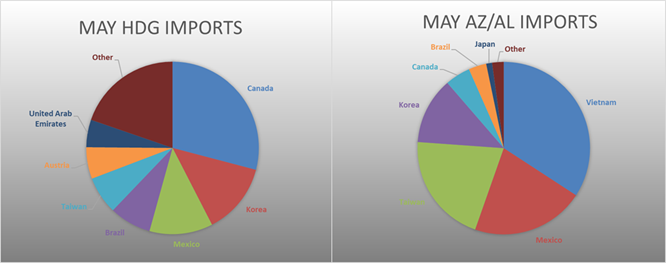

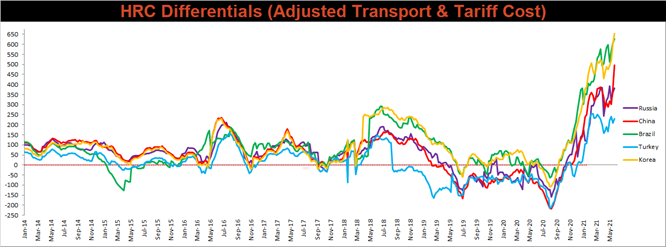

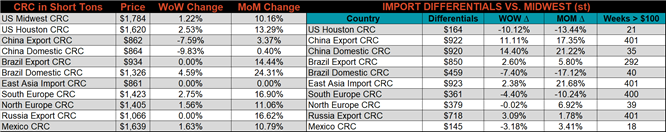

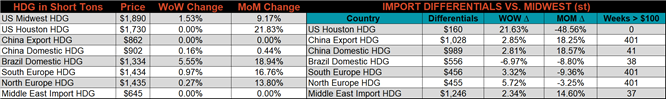

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The differentials increased for all the watched countries again this week as the U.S. domestic price continues to outpace the rest of the world.

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, HRC & CRC prices were up, 1.5%, 1.3% and 1.2%, respectively. Globally, the Chinese export HRC price was down another 8.7%.

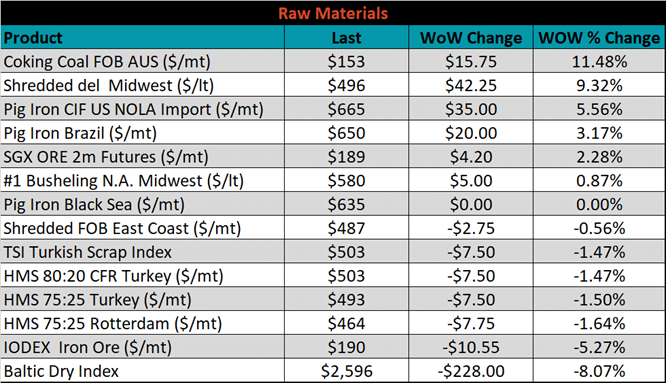

Raw material prices were mixed, with Aussie coking coal up another 11.5%, while the IODEX was down 5.3%.

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted slightly lower.

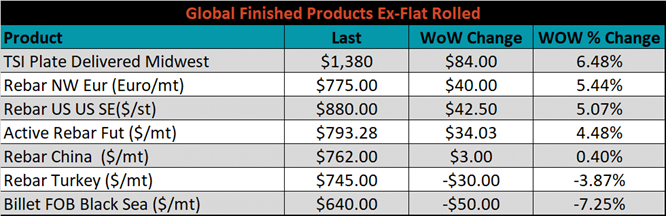

The ex-flat rolled prices are listed below.

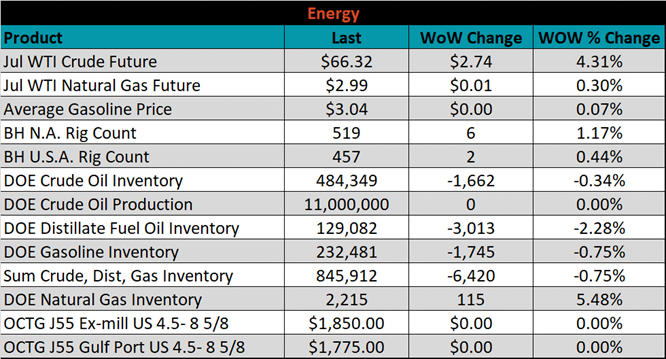

Last week, the July WTI crude oil future was up $2.74 or 4.3% to $66.32/bbl. The aggregate inventory level was down another 0.8%, while crude oil production remains at 11m bbl/day. The Baker Hughes North American rig count was up 6 rigs, and the U.S. rig count was up 2 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: