Market Commentary

Last week was another strong week in both the physical and financial steel markets, as the spot price continued its grind higher, and the remaining 2021 futures expirations all reached record highs. With little clarity on ongoing 2022 mill contract negotiations, planned outages right around the corner, and strong demand for steel (detailed below with recently released economic data), our outlook on the physical market remains bullish through the end of the year. As it currently stands, the market has already surpassed pre-pandemic supply levels, imports remain elevated (and we expect them to increase further), significant additional domestic production will be online before the second half of next year. Yet, the price continues to rise. Through our extensive analysis, we’ve found that nearly 65% of the changes in steel prices are a result of changes in demand and our models continue to show that demand for steel remains robust. While downside pressure on steel prices continue to mount, the consolidation of suppliers, low inventories and our outlook on demand consistently point to higher prices for the foreseeable future.

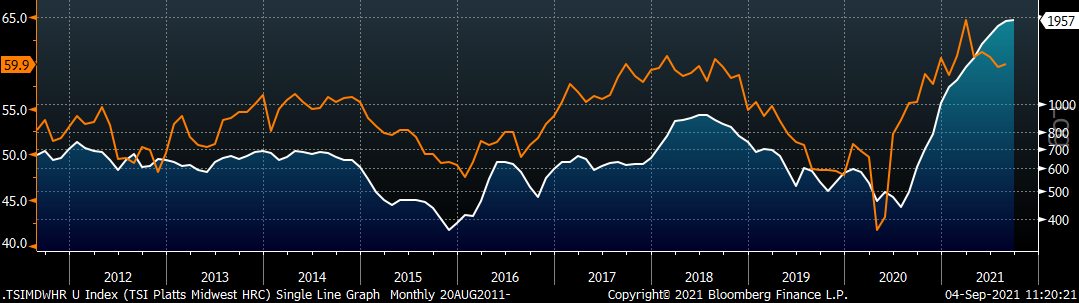

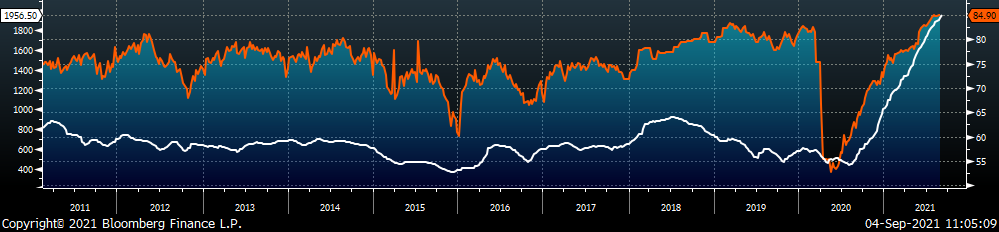

The chart below is the Platts Midwest HRC index (white) and the ISM Manufacturing PMI (orange). Sustained expansion (prints above 50) in the manufacturing sector continues to supportive of elevated HRC prices.

ISM PMI

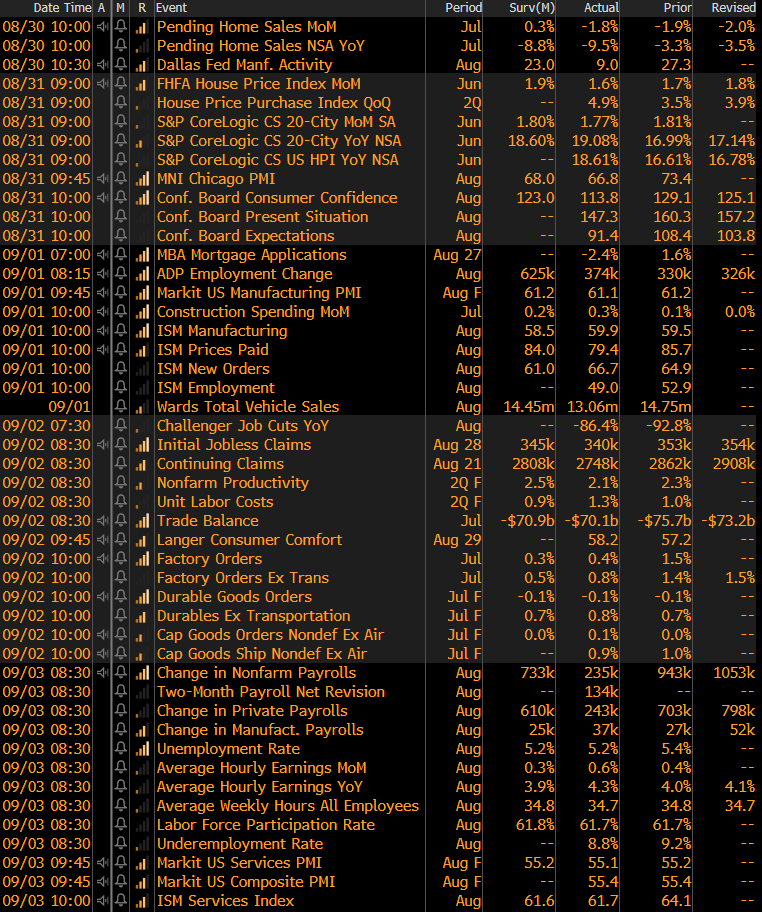

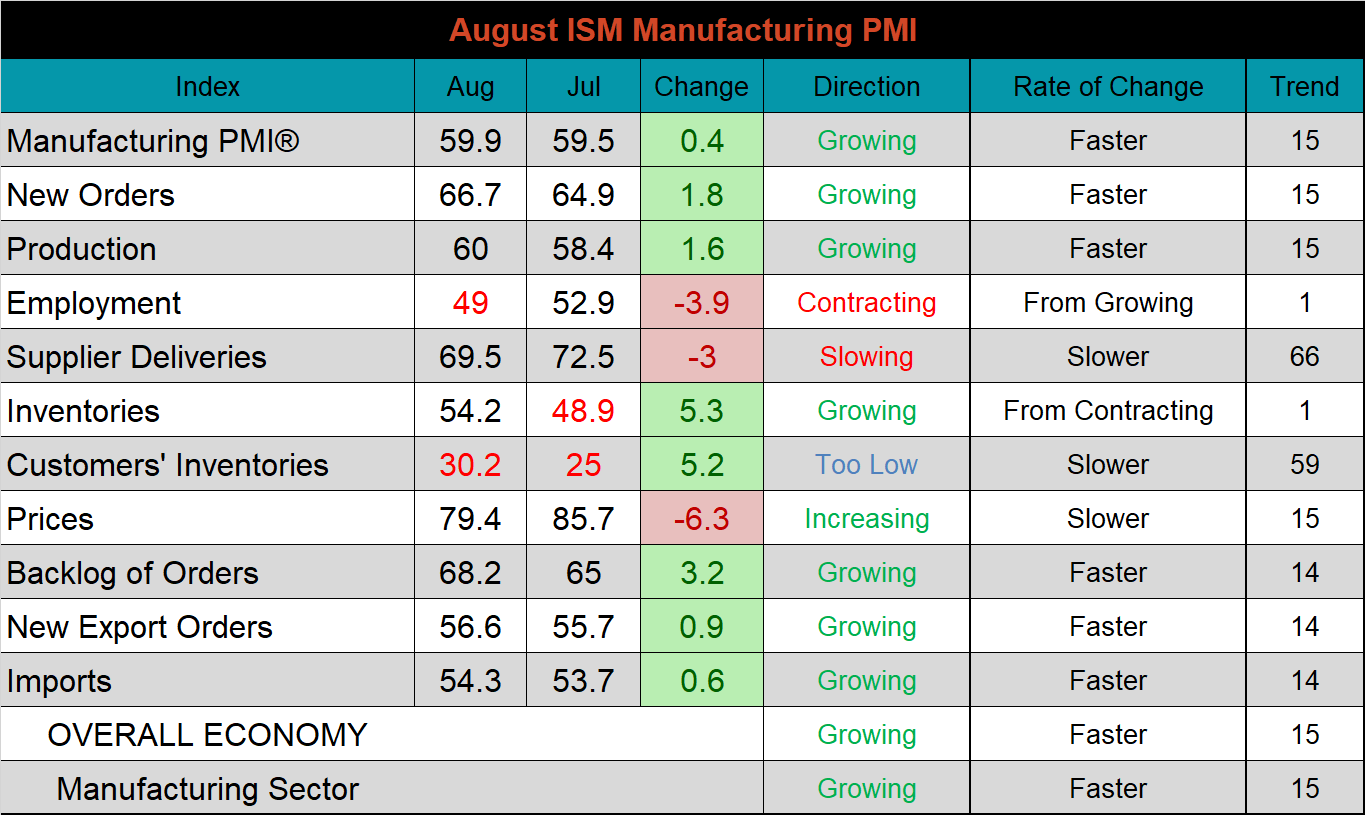

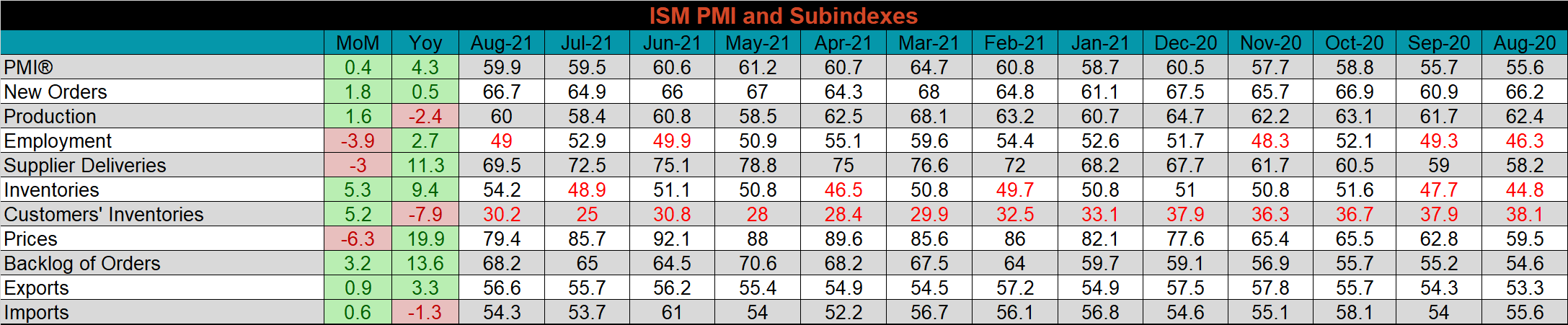

The August ISM Manufacturing PMI and subindexes are below.

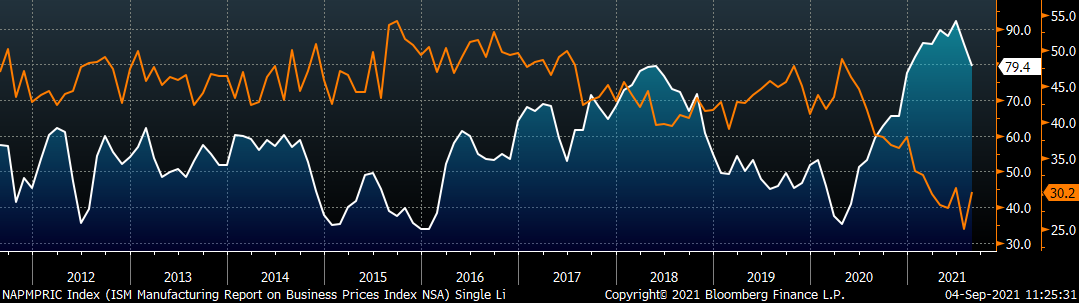

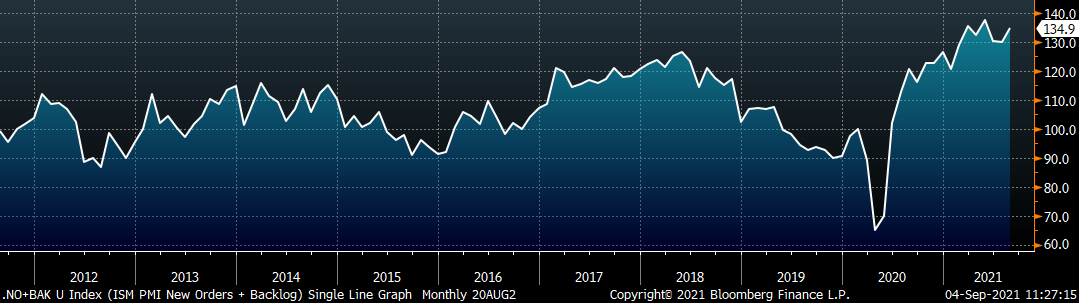

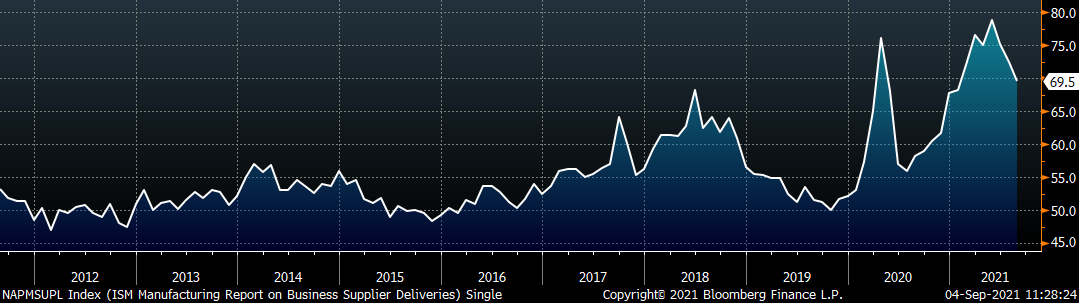

The chart below compares the ISM prices subindex with the ISM customer inventories subindex. This month, the customer inventories subindex rebounded off last month’s record low, while the prices subindex remains in expansion but slowed for the second month in a row. The second chart shows the new orders plus backlog subindexes with both printing higher into expansion territory. The final chart shows the supplier deliveries subindexes, which continues to ease but remains historically elevated, confirming that the supply chain fallout from the pandemic is far from over.

ISM Manufacturing PMI Customer Inventories Subindex (orange) & Prices Subindex (white)

ISM Manufacturing PMI New Orders plus Backlog sub-indexes

ISM Manufacturing Supplier Deliveries

The prices, employment and supplier deliveries subindexes were lower MoM; however, each of those readings is well above last year’s levels, when the current rally in HRC prices began.

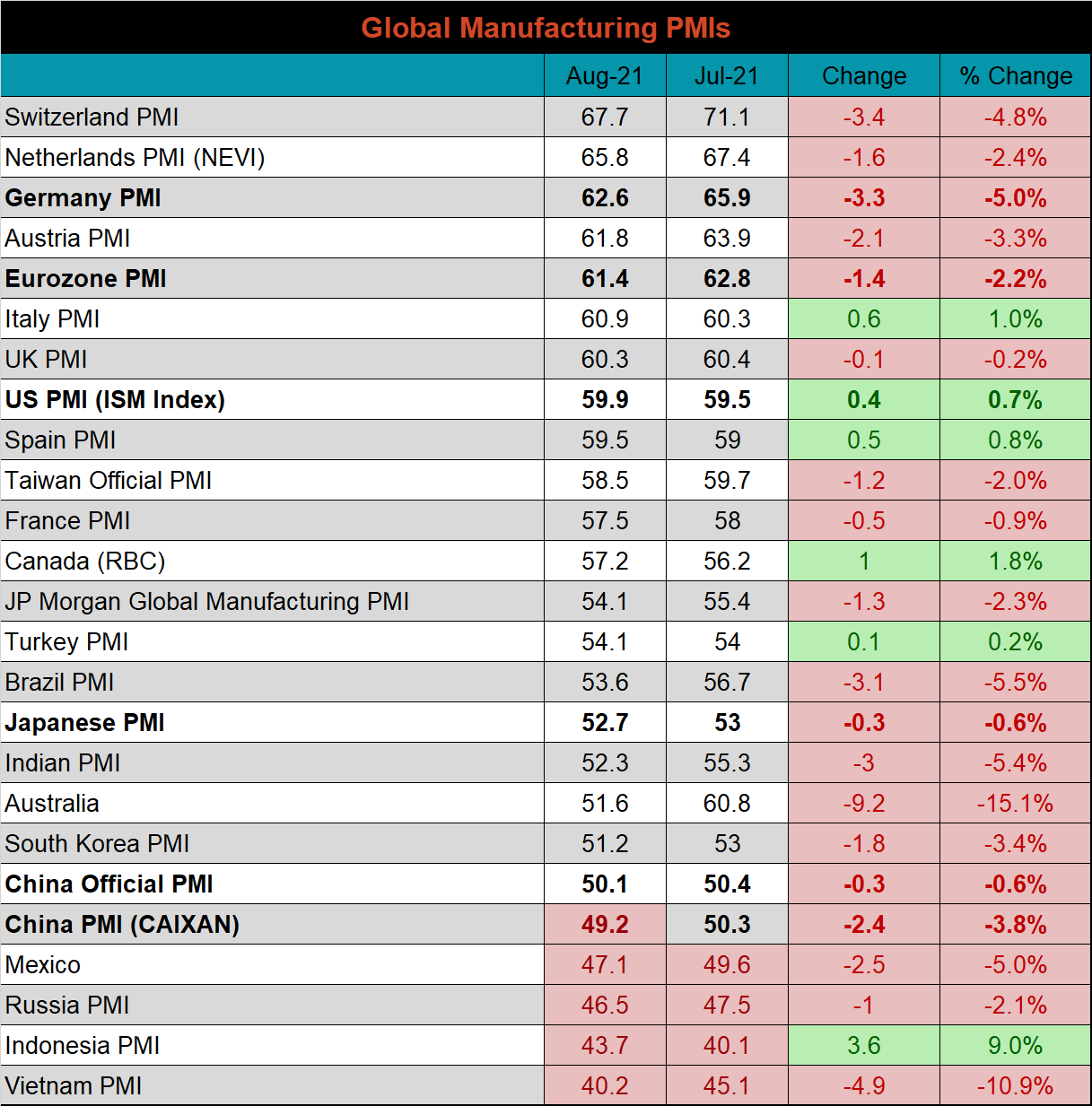

Global PMI

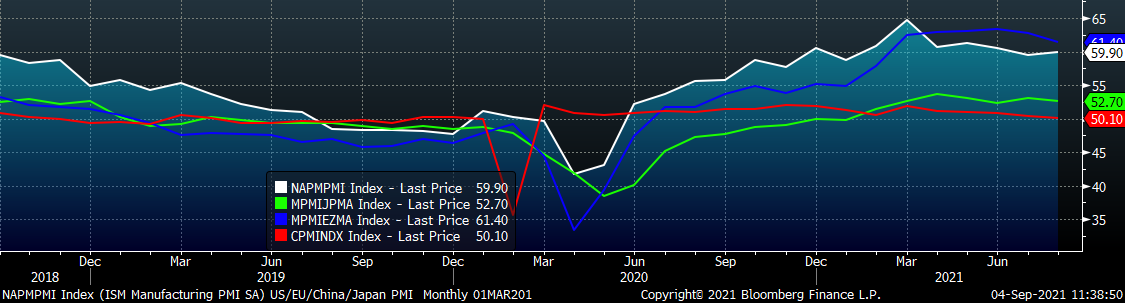

The August global PMI printings shifted slightly lower overall, while most remain in expansion territory with 20 of the 24 watched countries expanding. The five most significant countries (bold) continue to expand, while the Caixan version of China’s PMI moved into contraction territory for the first time since April 2020.

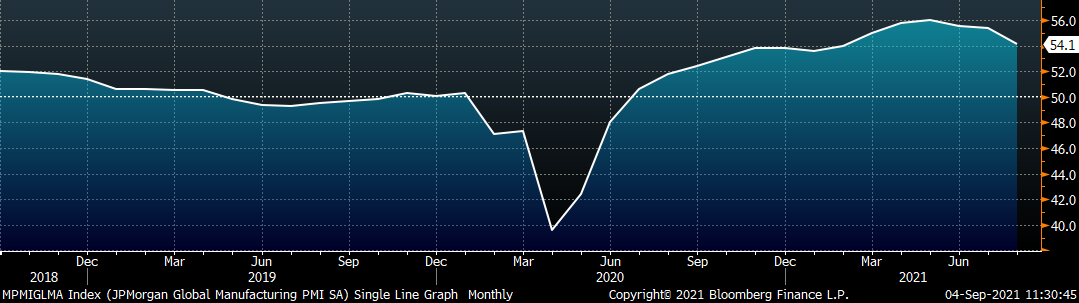

J.P. Morgan Global Manufacturing

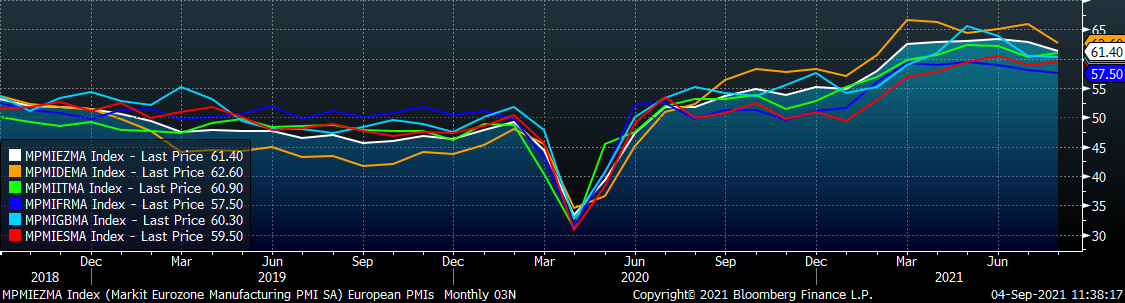

Eurozone (white), German (orange), Italian (green), Spanish (red), and French (blue), U.K. (teal) Manufacturing PMIs

US (white), Euro (blue), Chinese (red) and Japanese (green) Manufacturing PMIs

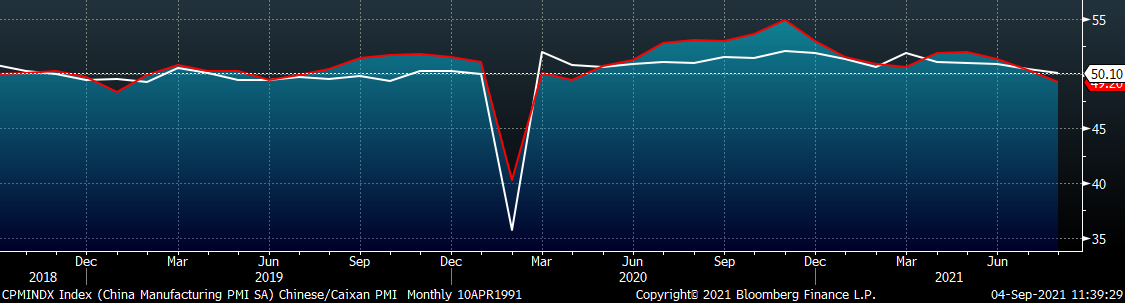

Both China’s official manufacturing PMI and the Caixan PMI were slightly lower. As mentioned above, the Caixan reading (reflecting small, private manufacturers) moved into contraction, while the official government reading continue to expand, slightly.

China Official (white) and Caixan (red) Manufacturing PMIs

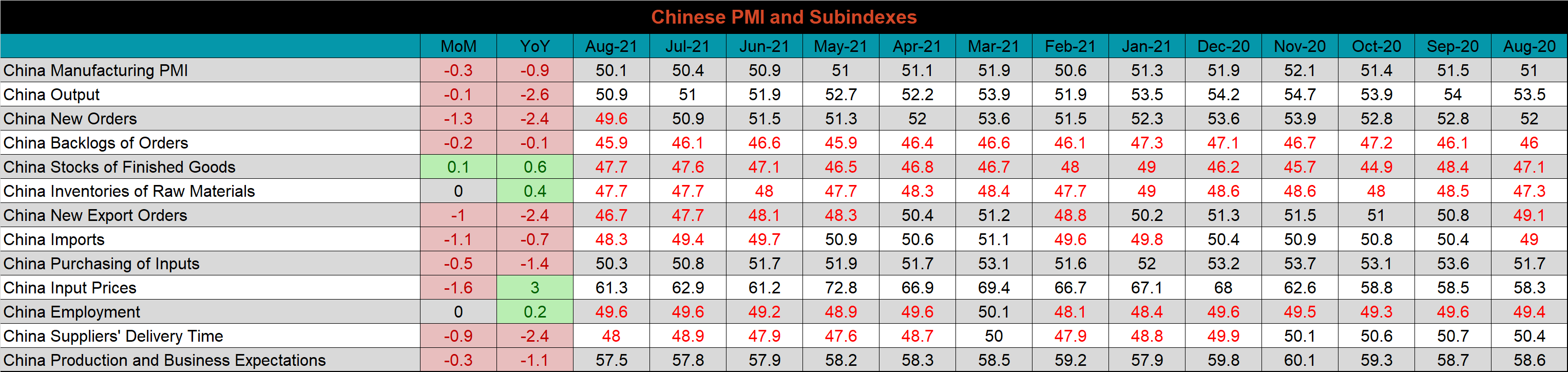

The table below breaks down China’s official manufacturing PMI subindexes. New Orders continued to slide, while the only subindex with a MoM increase is the stock of finished goods. Additionally, input prices were down the most significantly, however, the overall reading remains well in expansion territory.

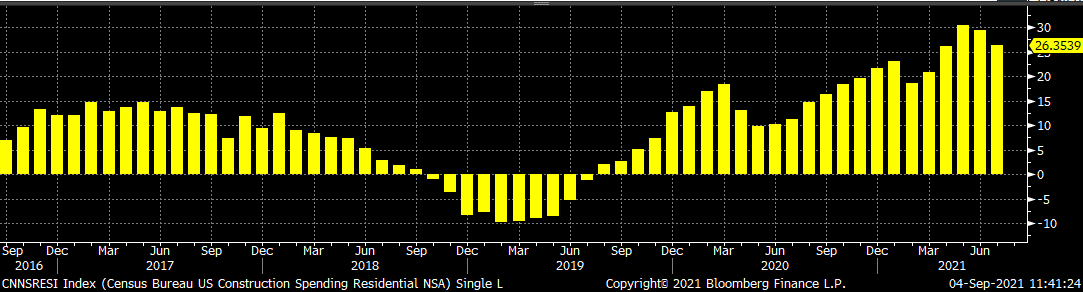

Construction Spending

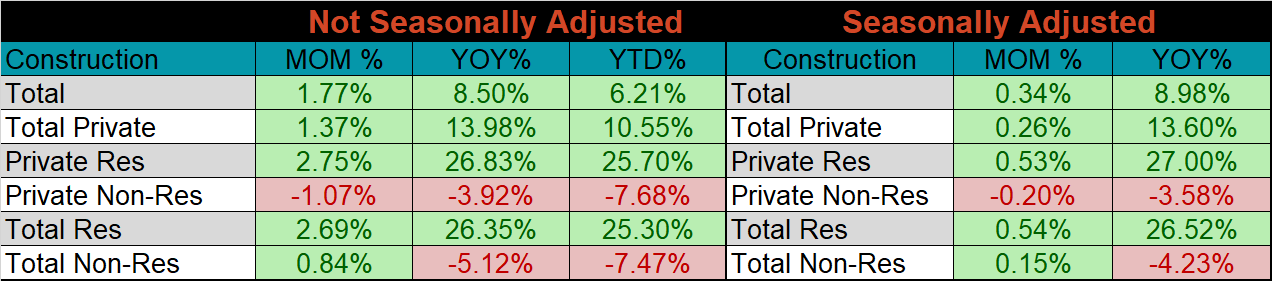

July seasonally adjusted U.S. construction spending was up 0.3% compared to June, and 9% higher than July 2020.

June U.S. Construction Spending

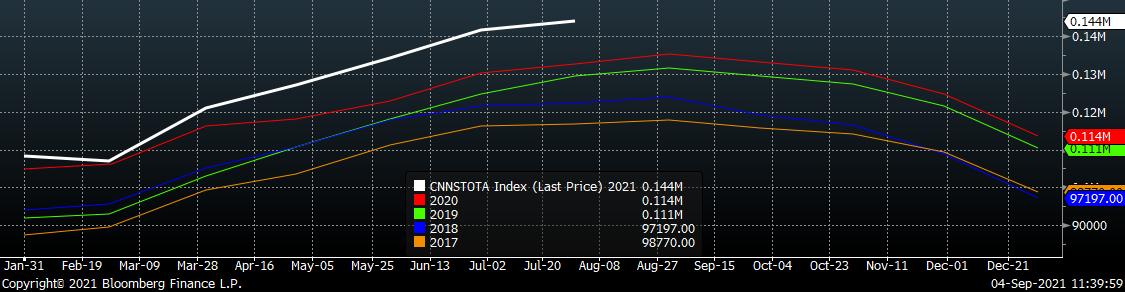

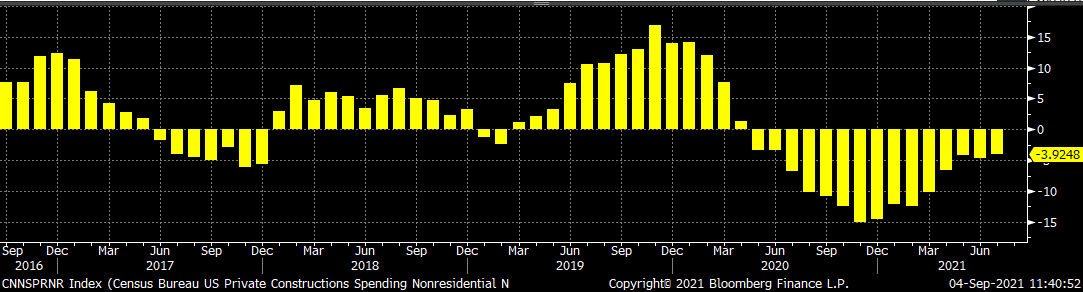

The white line in the chart below represents not seasonally adjusted construction spending in 2021 and compares it to the spending of the previous 4 years. Total spending continues to expand and is at its highest level in the last 4 years. The last two charts show the YoY changes in construction spending. Private non-residential spending decreased further in July, for the fifteenth month in a row. However, it does appear the turnaround is in progress, with leading indicators pointing to YoY growth before the end of the year. Residential spending continued its strong run of YoY growth, now up to 23 straight months.

U.S. Construction Spending

U.S. Private Nonresidential Construction Spending NSA YoY % Change

U.S. Residential Construction Spending NSA YoY % Change

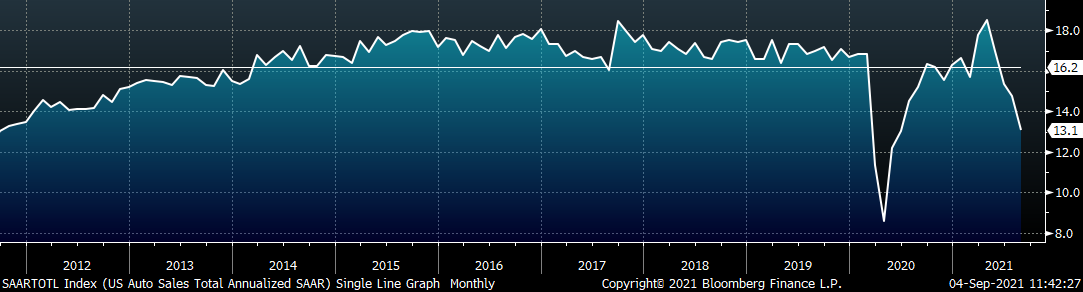

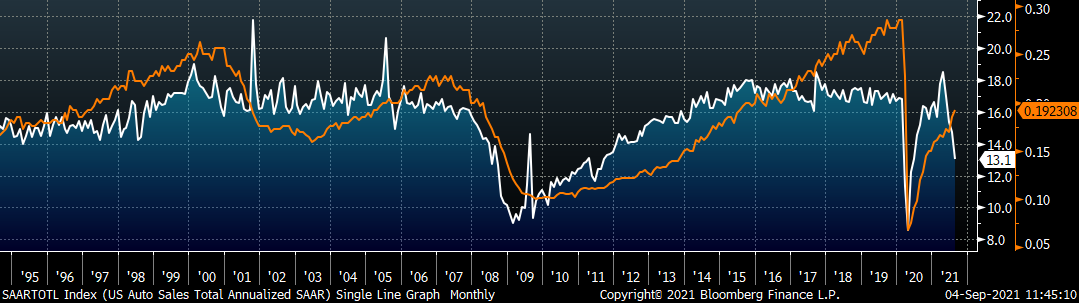

Auto Sales

August U.S. light vehicle sales continued to slide, down to a 13.1m seasonally adjusted annualized rate (S.A.A.R), the lowest pre-pandemic level since late 2011. The second chart shows the relationship between the unemployment rate and auto sales. The unemployment rate is inverted to show that declining unemployment typically leads to increasing auto sales. The labor market recovery continues albeit at a slower pace in August, while auto sales remain artificially constrained by a lack of inventory and additional production shutdowns due to the chip shortage. The divergence between the two is extremely supportive of the argument that pent-up demand for autos will sustain increased production through 2022 once the chip shortage is resolved.

June U.S. Auto Sales (S.A.A.R.)

June U.S. Auto Sales (orange) and the Inverted Unemployment Rate (white)

Risks

Below are the most pertinent upside and downside price risks:

Upside Risks:

- Inventory at end users and service centers below normal operational levels

- Higher share of discretionary income allocated to goods from steel intensive industries

- Changes in China’s policies regarding ferrous markets, including production cuts and exports

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Limited spot transactions skewing market indexes to extreme levels

- Energy & construction industry rebound

- Prolonged 2022 contract negotiations creating availability concerns in the short term

- Easing labor and supply chain constraints allowing increased manufacturing activity

Downside Risks:

- Increased domestic production capacity

- Increasing price differentials and hedging opportunities leading to sustained higher imports

- Steel consumers substitute to lower cost alternatives

- Steel buyers and consumers “double ordering” to more than cover steel needs

- Tightening credit markets, as elevated prices push total costs to credit caps

- Supply chain disruptions allowing producers to catch up on orders

- Limited desire to restock at elevated prices, causing a “Buyer’s Strike”

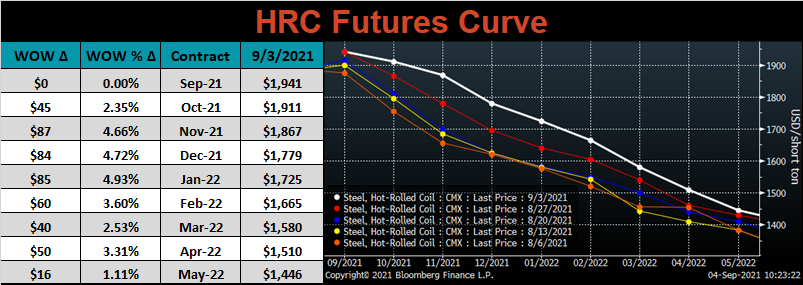

HRC Futures

All of the below data points are as of September 3, 2021.

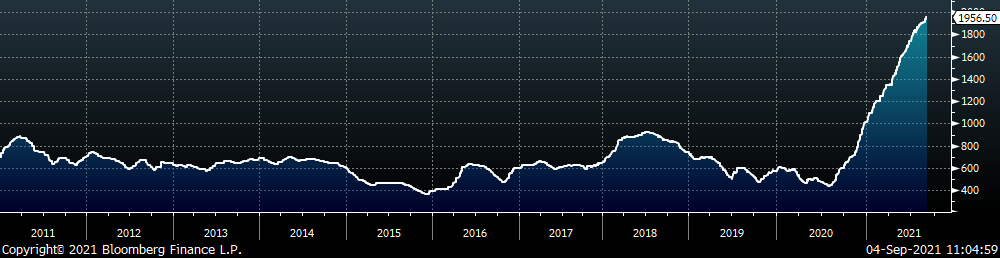

The Platts TSI Daily Midwest HRC Index increased by $34.25 to $1,956.50.

Platts TSI Daily Midwest HRC Index

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the entire curve shifted higher, the most significant upward pressure came in 4Q21.

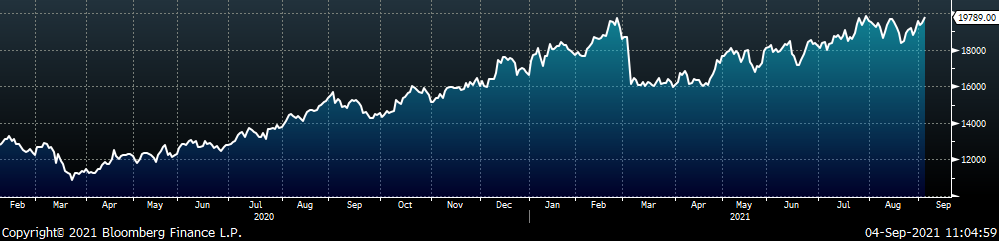

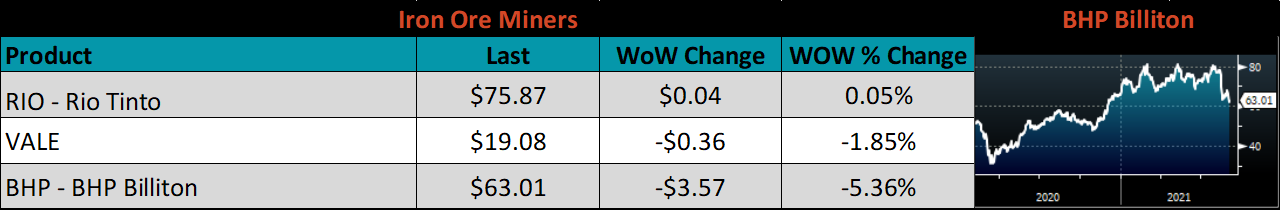

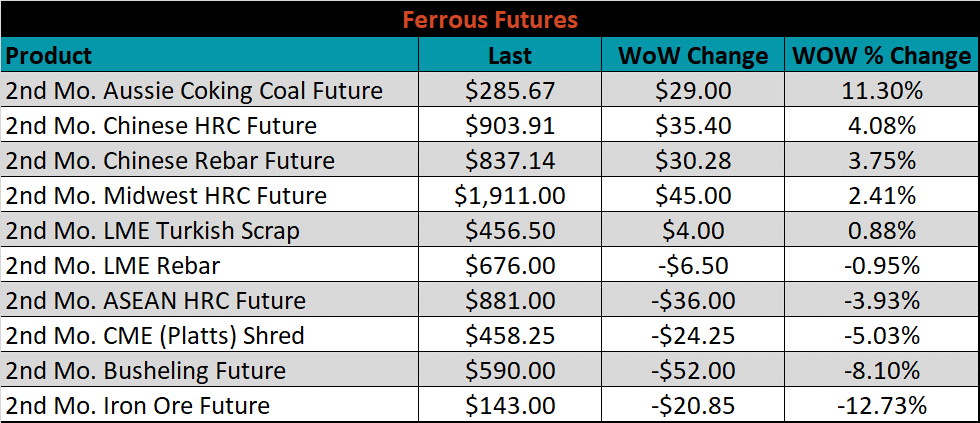

October ferrous futures were mixed. Iron ore lost 12.7%, while Aussie coking coal gained 11.3%.

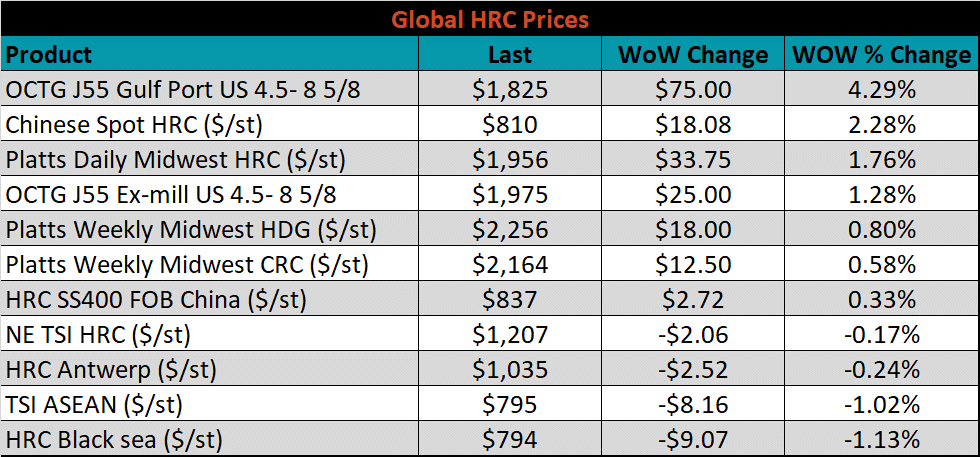

Global flat rolled indexes were mixed. The Chinese spot HRC price was up 2.3%, while Black Sea HRC was down 1.3%.

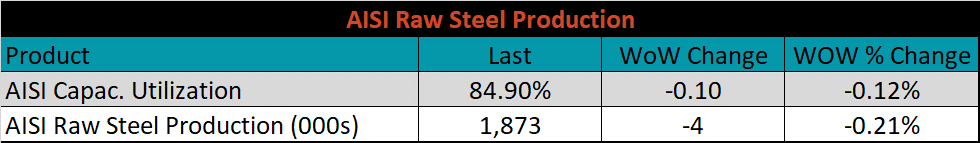

The AISI Capacity Utilization rate decreased 0.1% to 84.9%.

AISI Steel Capacity Utilization Rate (orange) and Platts TSI Daily Midwest HRC Index (white)

Imports & Differentials

August flat rolled import license data is forecasting an increase of 3k to 1,073k MoM.

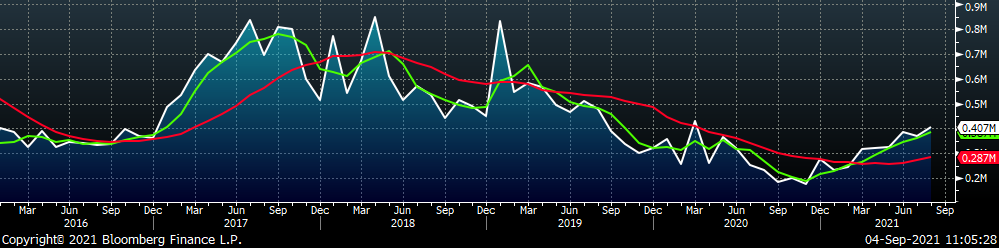

All Sheet Imports (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

Tube imports license data is forecasting an increase of 40k to 407k in August.

All Tube Imports (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

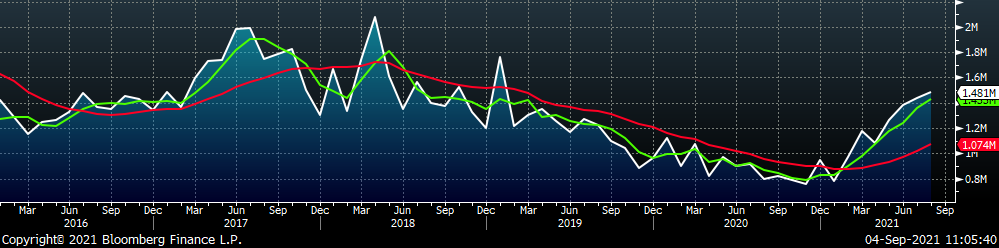

All Sheet plus Tube (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

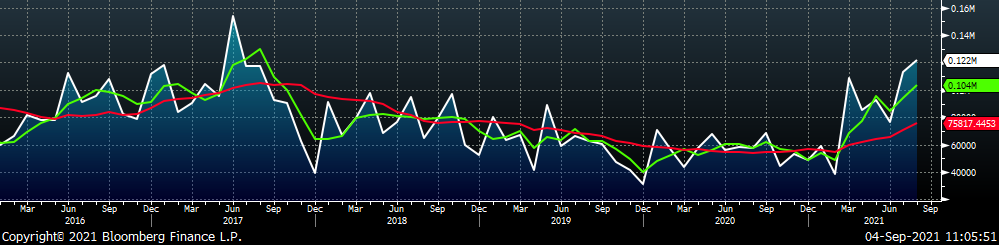

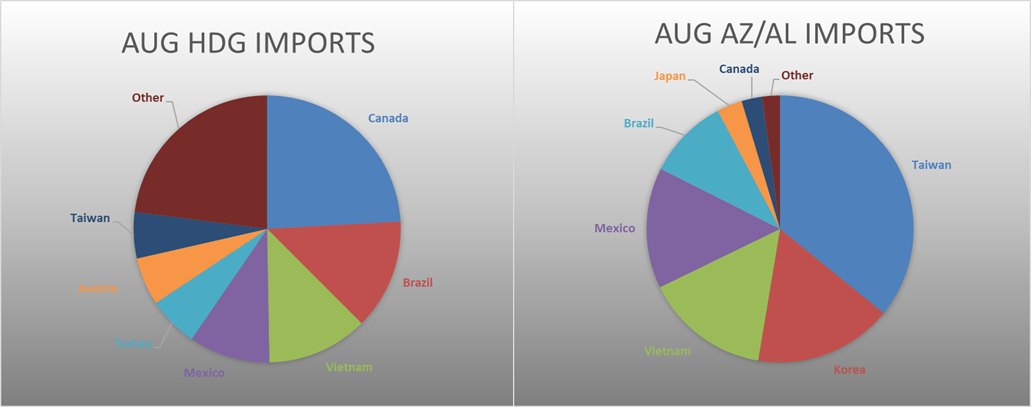

August AZ/AL import license data is forecasting an increase of 9k to 122k.

Galvalume Imports (white) w/ 3 Mo. (green) & 12 Mo. Moving Average (red)

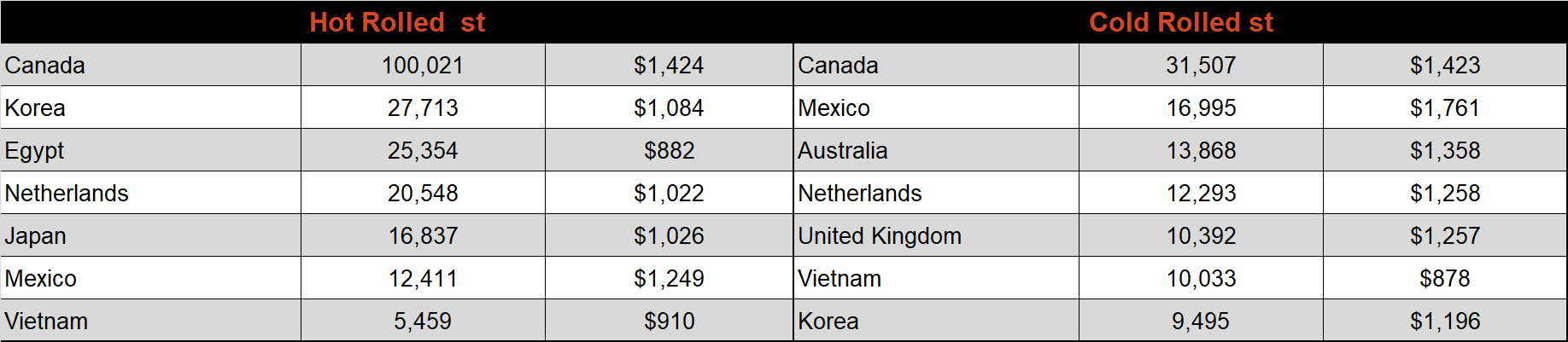

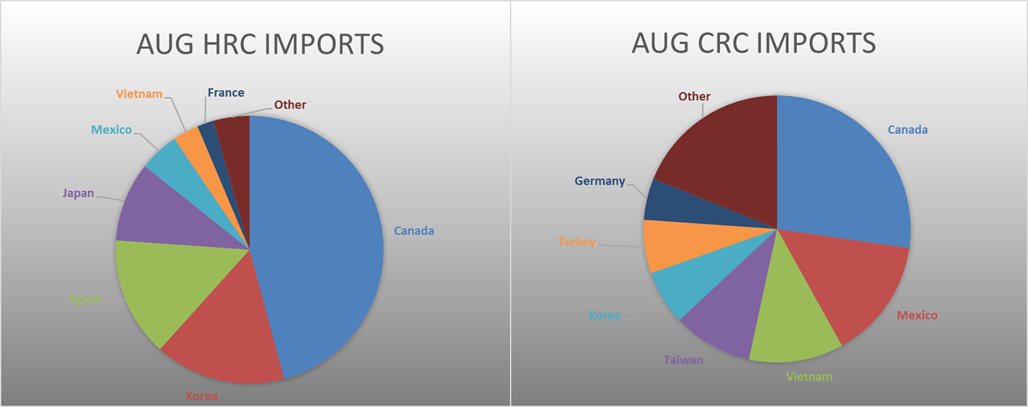

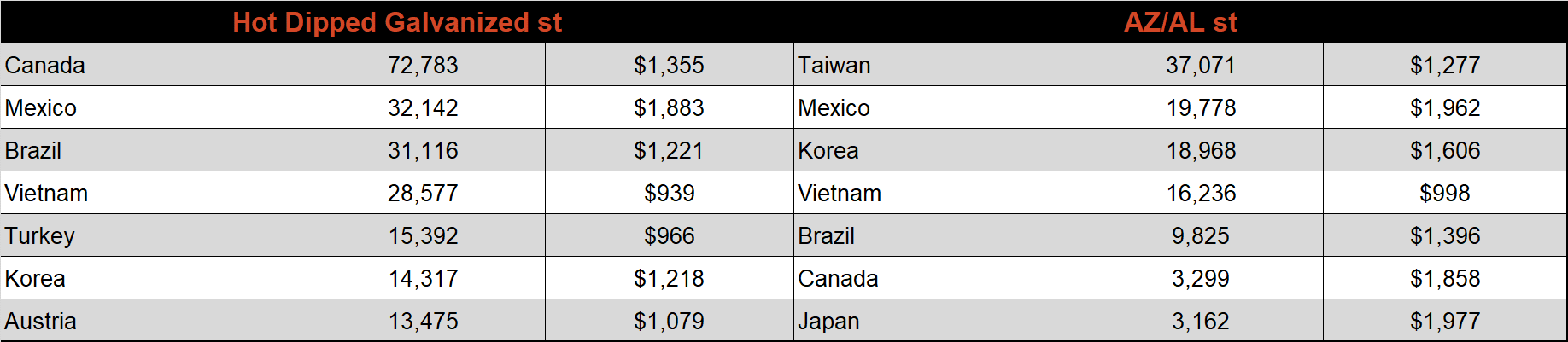

Below is August import license data through August 30th, 2021.

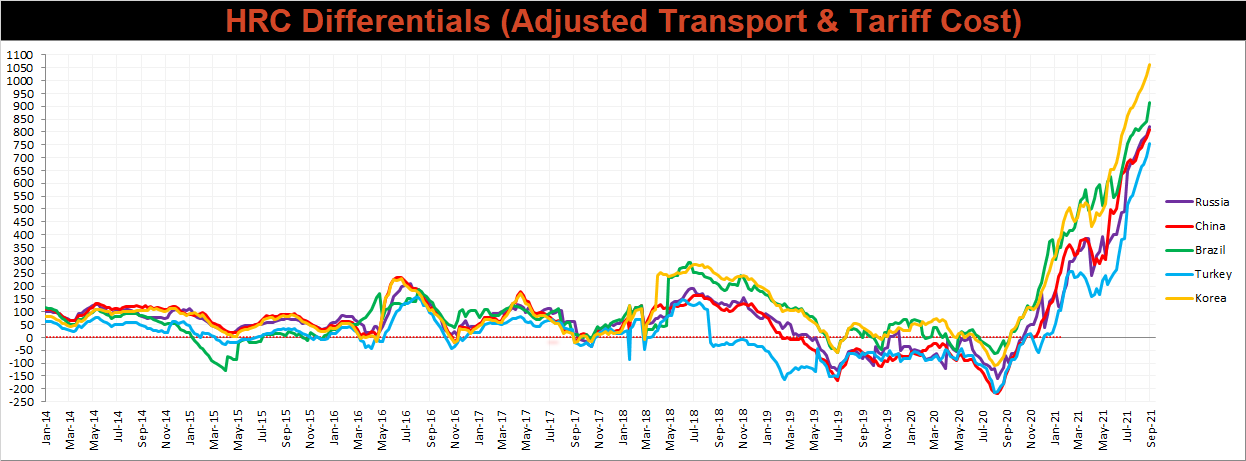

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials for all watched countries increased further this week, as the U.S. price continues grinding higher.

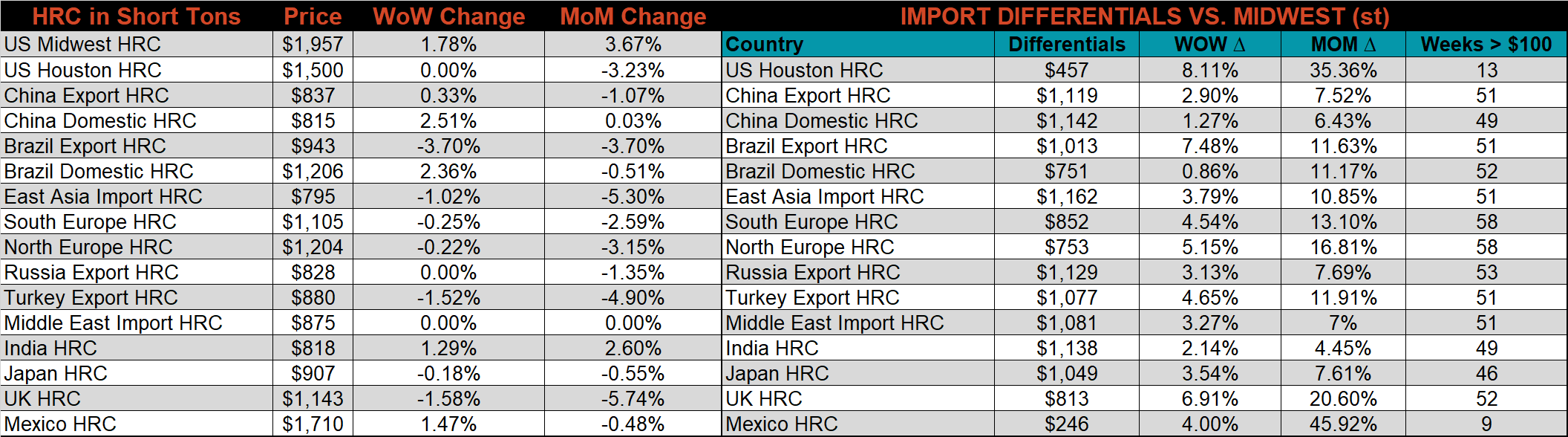

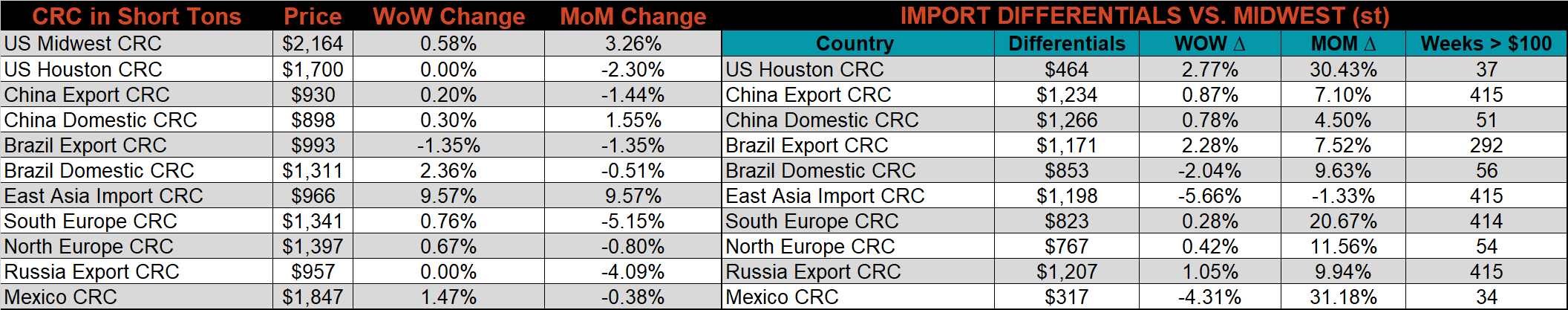

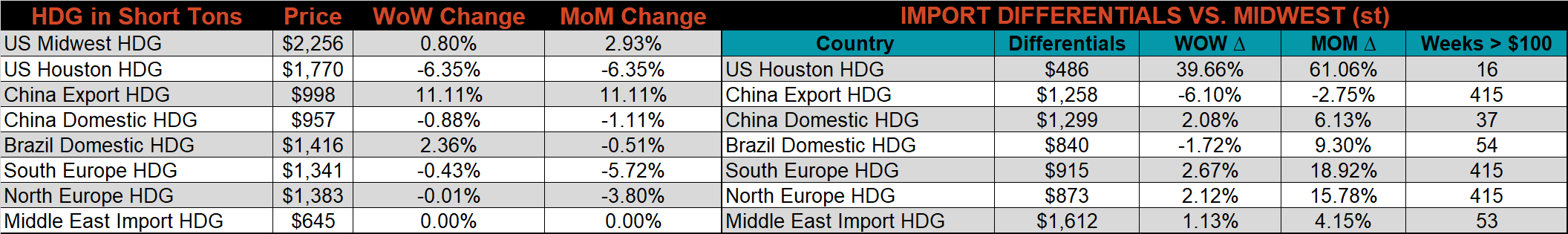

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, HDG, & CRC prices were up by 1.8%, 0.8%, and 0.6%, respectively. Outside of the U.S., the Chinese HDG export price was up 11.1%.

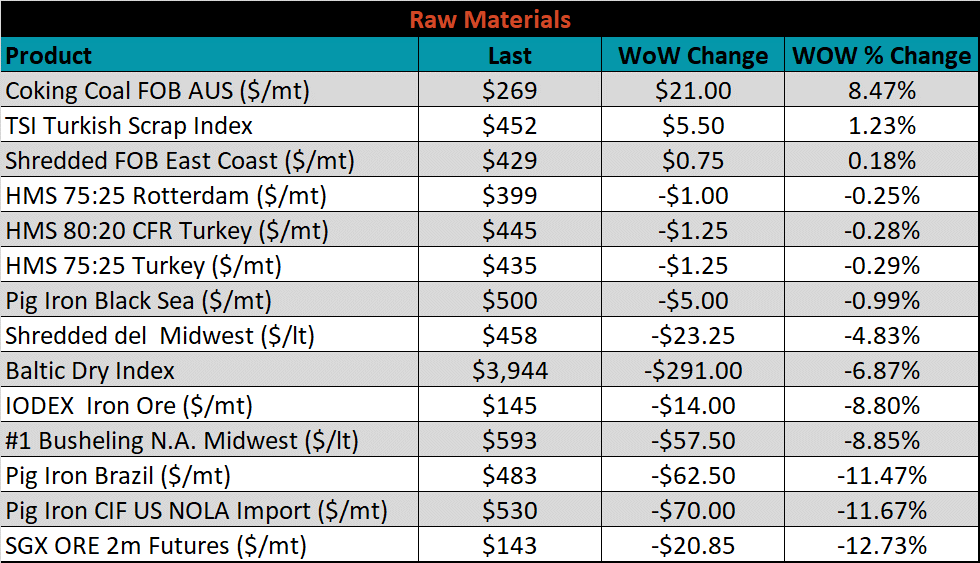

Raw Materials

Raw material prices were mostly lower, led by iron ore futures down 12.7%, while Aussie coking coal gained 8.5%.

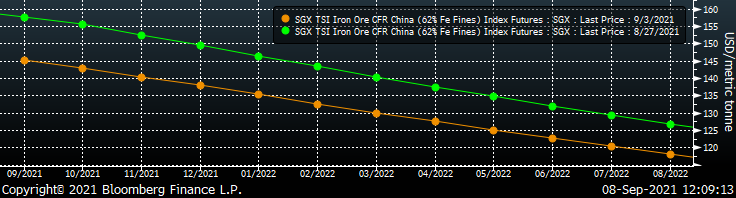

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted lower, after last weeks rebound.

SGX Iron Ore Futures Curve

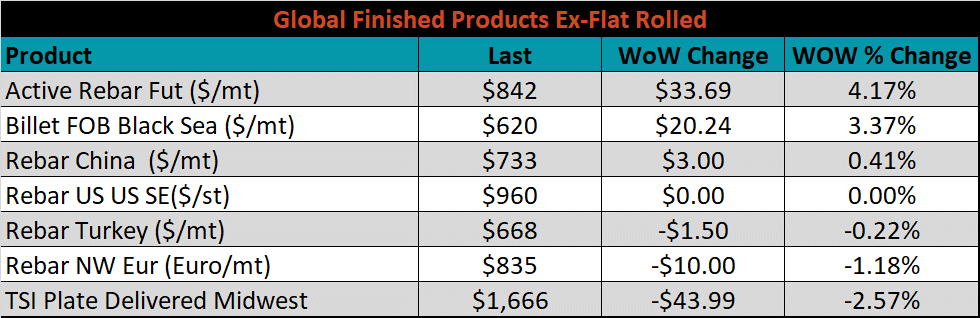

The ex-flat rolled prices are listed below.

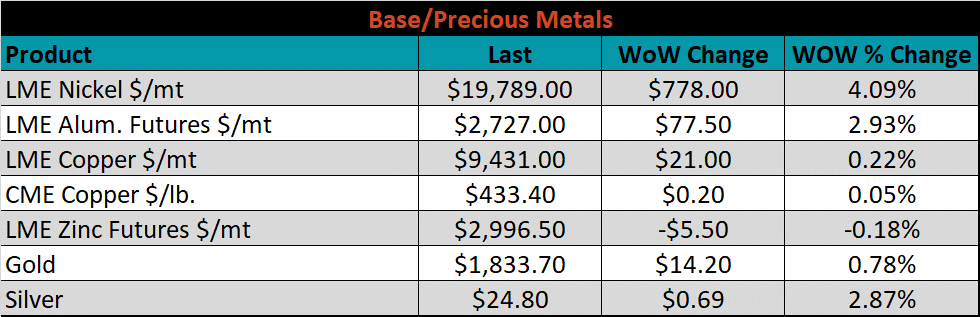

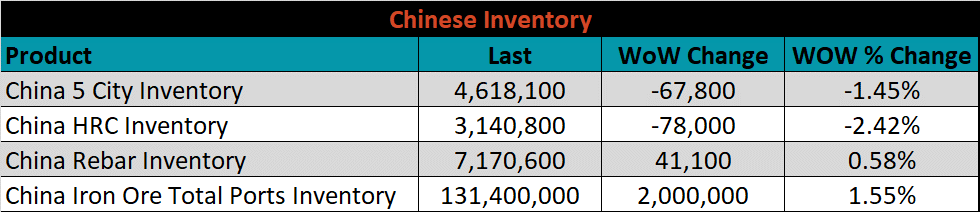

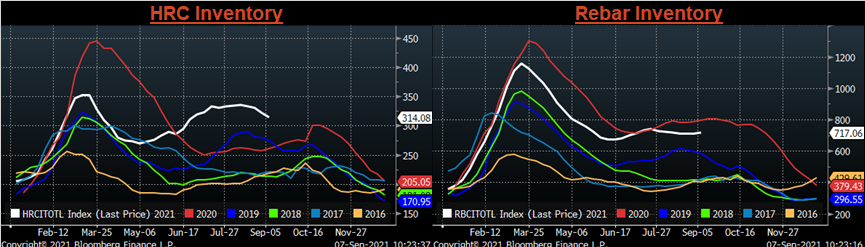

Chinese Inventory

Below are inventory levels for Chinese finished steel products and iron ore. HRC and the 5-city inventory levels continued to decline, while rebar moved slightly higher. The iron ore inventory level has been increasing steadily as downward pressure on the price has continued to mount over the past 5 weeks.

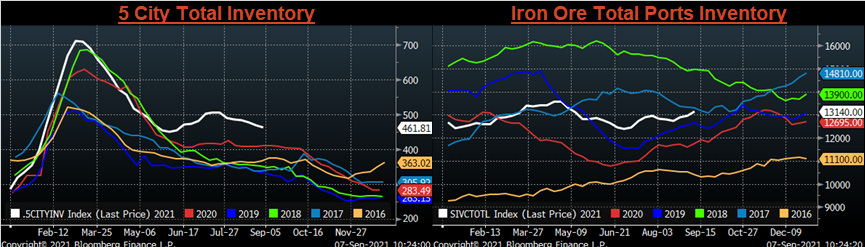

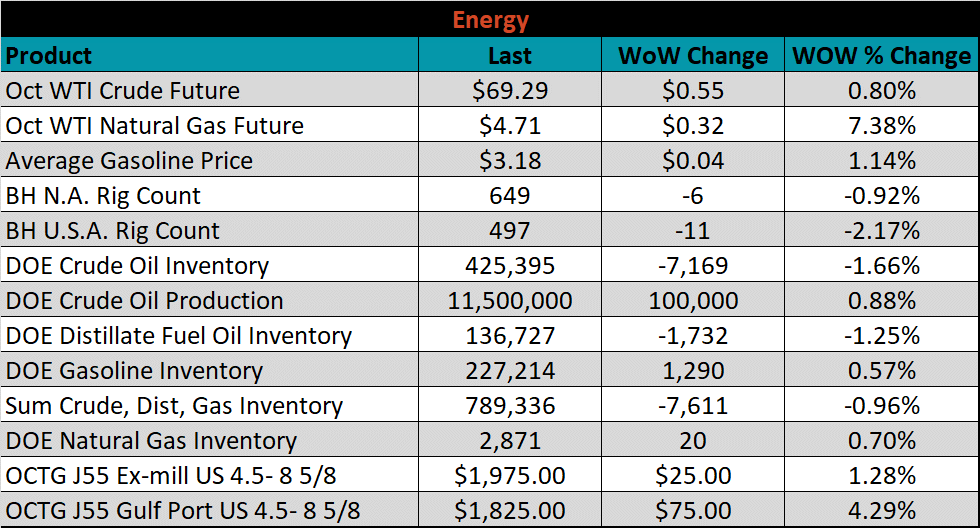

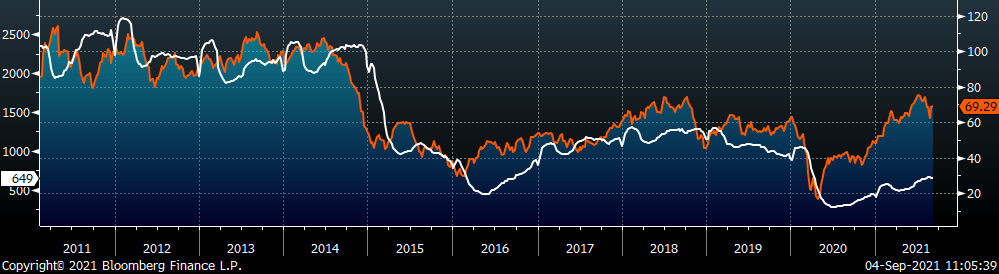

Energy

Last week, the October WTI crude oil future was up $0.55 or 0.8% to $69.29/bbl. The aggregate inventory level was down another 1%, and crude oil production rose to 11.5m bbl/day. The Baker Hughes North American rig count was down another 6 rigs, and the U.S. rig count was down 11 rigs.

October WTI Crude Oil Futures (orange) vs. Aggregate Energy Inventory (white)

Front Month WTI Crude Oil Future (orange) and Baker Hughes N.A. Rig Count (white)

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

- Inventory at end users and service centers below normal operational levels

- Higher share of discretionary income allocated to goods from steel intensive industries

- Changes in China’s policies regarding ferrous markets, including production cuts and exports

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Limited spot transactions skewing market indexes to extreme levels

- Energy & construction industry rebound

- Prolonged 2022 contract negotiations creating availability concerns in the short term

- Easing labor and supply chain constraints allowing increased manufacturing activity

- A weakening US Dollar

- Fiscal policy measures including a new stimulus and/or infrastructure package

- Fluctuating auto production, pushing steel demand out into the future

- Low interest rates

- Threat of further protectionist trade policies muting imports

- Unexpected and sustained inflation

Downside Risks:

- Increased domestic production capacity

- Increasing price differentials and hedging opportunities leading to sustained higher imports

- Steel consumers substitute to lower cost alternatives

- Steel buyers and consumers “double ordering” to more than cover steel needs

- Tightening credit markets, as elevated prices push total costs to credit caps

- Supply chain disruptions allowing producers to catch up on orders

- Limited desire to restock at elevated prices, causing a “Buyer’s Strike”

- Reduction and/or removal of domestic trade barriers

- Political & geopolitical uncertainty

- Chinese restrictions in property market

- Unexpected sharp China RMB devaluation