Flack Capital Markets | Ferrous Financial Insider

February 10, 2023 – Issue #366

February 10, 2023 – Issue #366

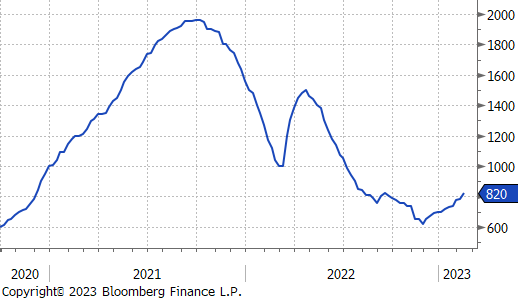

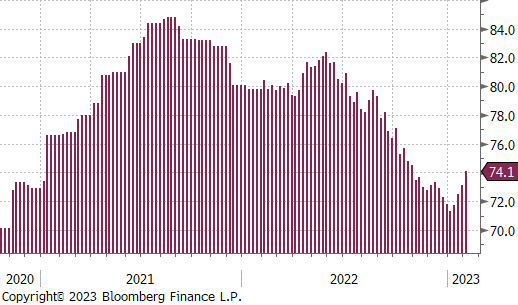

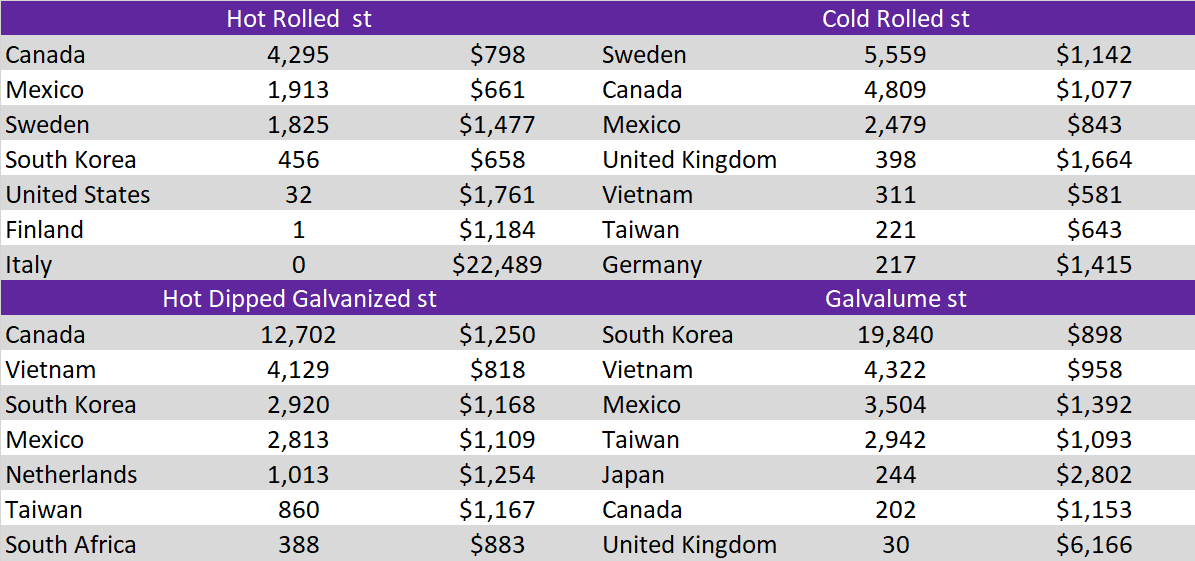

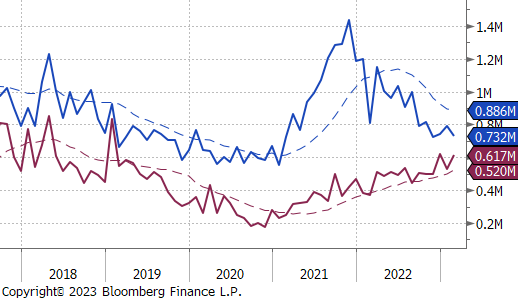

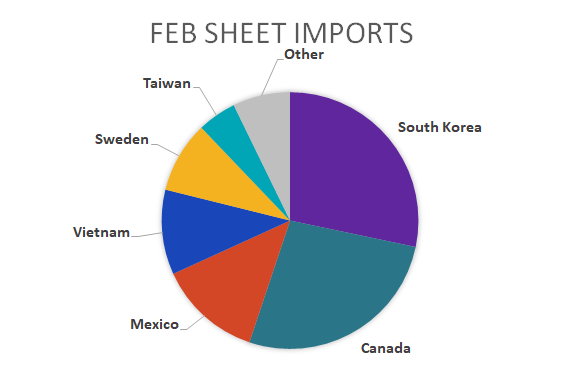

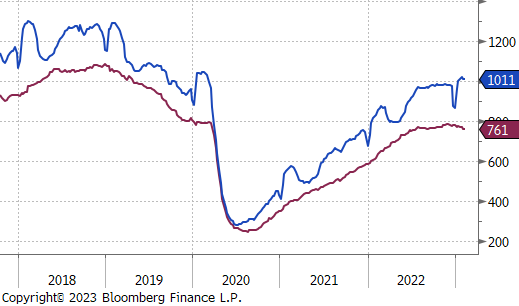

This week, we received the first look at February steel imports and preliminary data is projecting sheet arrivals to come in at 732k tons. If the trend continues through the end of the month, this would be the 4th of the last 5 months where imports were below 800k. Since November, the average level of arrivals is 745k/tpm, which is below the post-232/pre-pandemic average (dashed line).

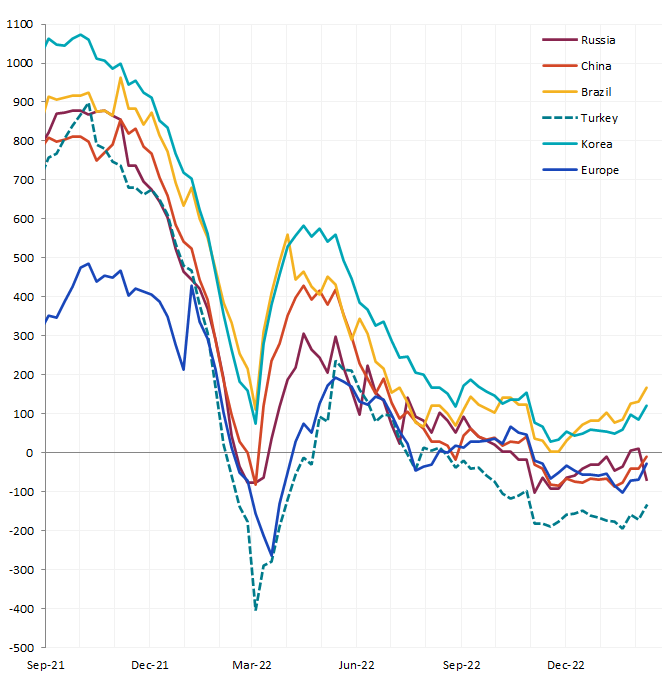

We view this as one of the most supportive signals for higher domestic prices in the short-term. Furthermore, the outlook on imports continues to be restrained, with global differentials in negative territory since October. This means that domestic material has been cheaper relative to global prices for the last 5 months. As long as this dynamic remains intact, coupled with steadily increasing global prices, the domestic market has plenty of runway for higher steel prices.

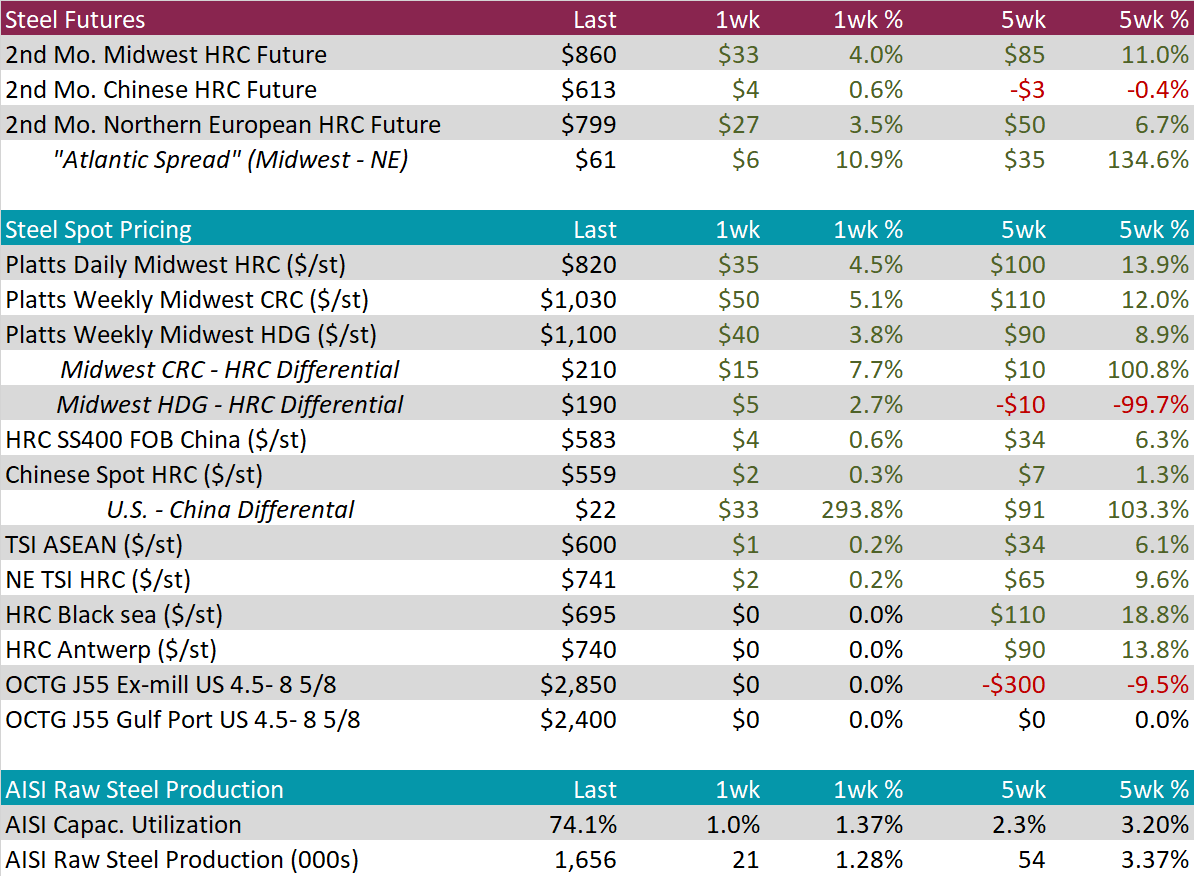

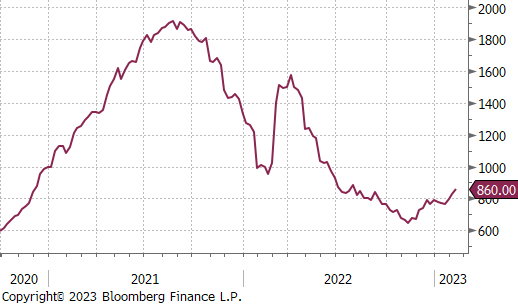

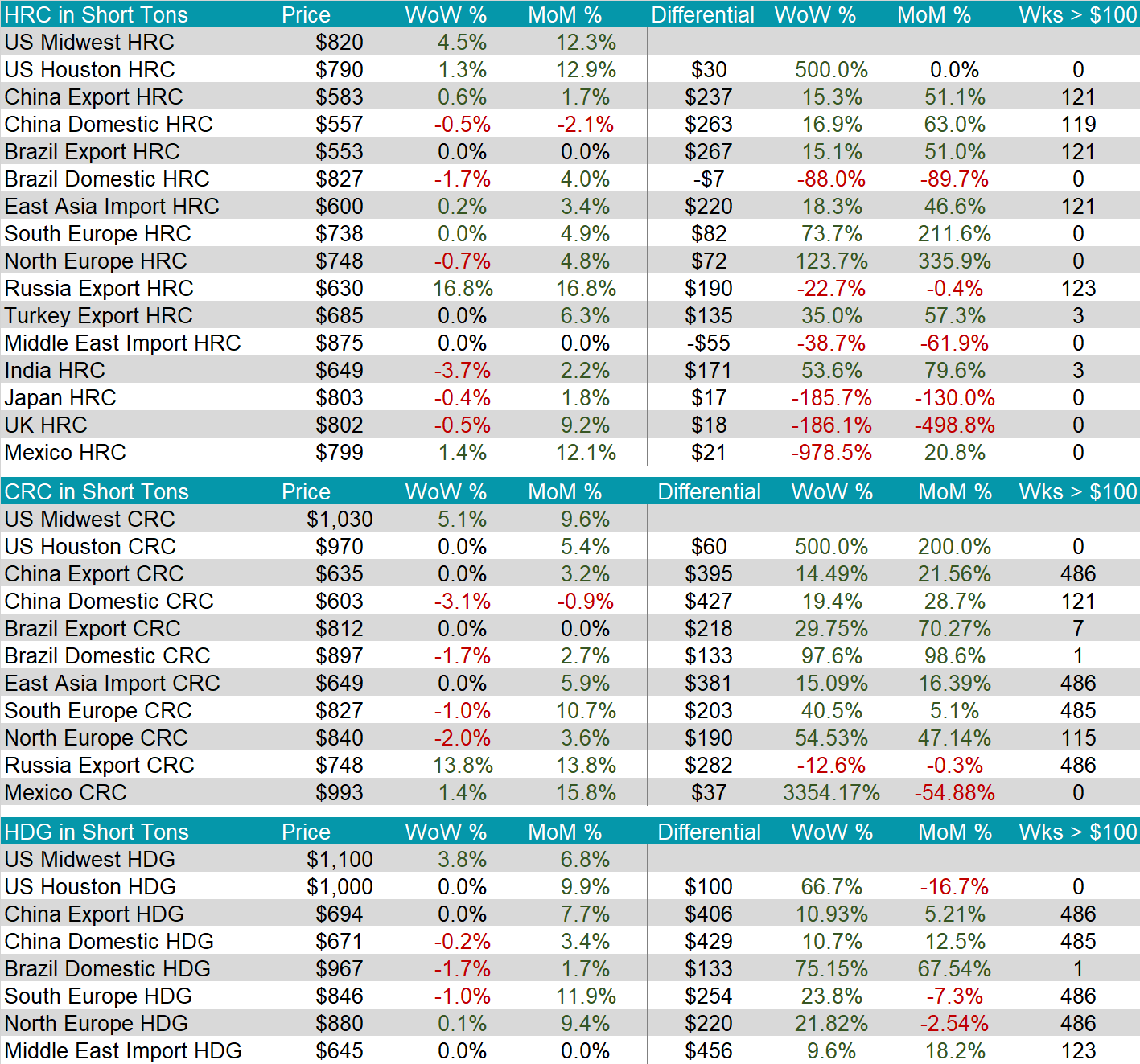

U.S. Domestic HRC was up another $35 last week to $820 s.ton. This is the 11th straight week of increasing domestic spot pricing. Domestic mills continue to be aggressive with price increase announcements, but fundamental support still suggests higher prices are ahead.

Tandem products both increased more significantly than HRC in the spot market this week, with CRC up $50, and HDG up $40.

Production was up for the 4th week in a row, and at this point, it’s clear mills are going to produce steel at higher levels than the end of last year.

Over the last 4 weeks, the HRC futures market started sending a signal of a mild shortage in the steel market. The curve flipped from contango on January 20th to flat the next week, then followed by two weeks of steepening backwardation. Backwardation in the market means that prices in nearby expirations are higher than longer dated futures. It tells us that there is an urgency to get material today instead of waiting to see what happens. This mirrors a change in the physical market that we have started to see as well.

February Projection – Sheet 732k (down 57k MoM); Tube 617k (up 87k MoM)

January Projection – Sheet 788k (up 45k MoM); Tube 530k (down 91k MoM)

Differentials increased for all the watched countries this week, except for Russia. The incentive structure continues to suggest that domestic mills have an advantage compared to imports.

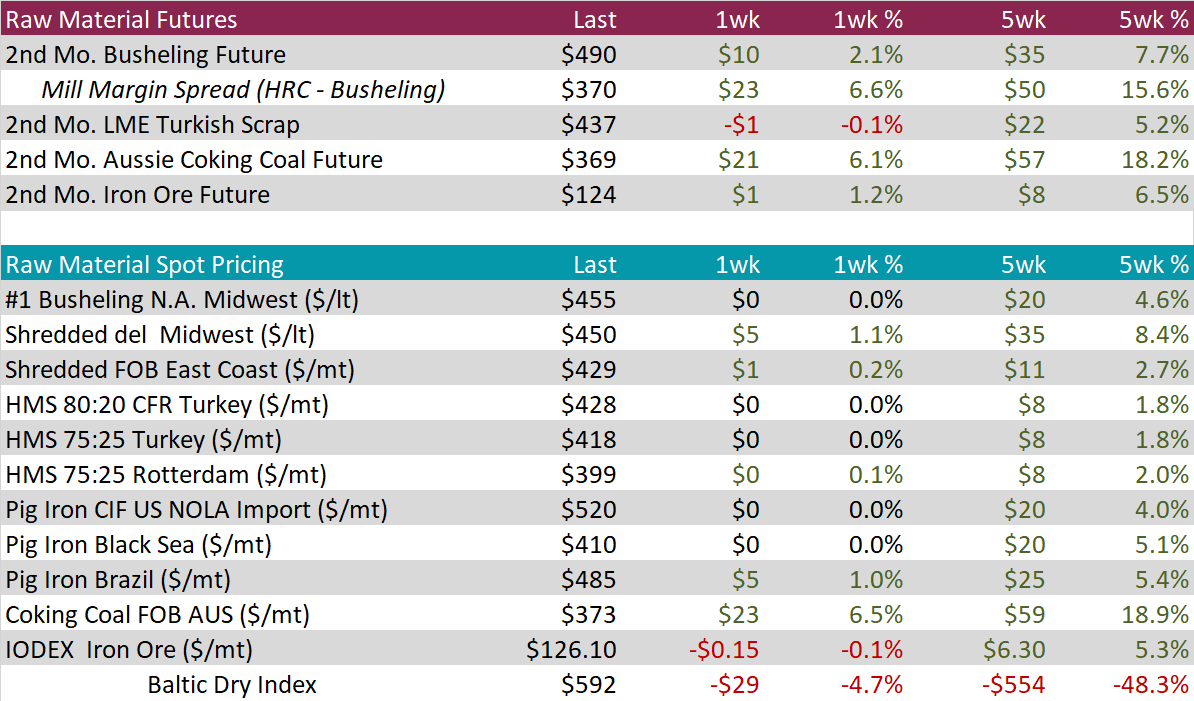

The 2nd month busheling future was up another 2.1% last week, after February’s scrap print settled $26 higher to $475. The gap between busheling and shredded narrowed this month as well, with reduced flows of obsolete. The futures are currently pricing in an additional $15 increase in March, but this will depend on demand from the export market after Turkish mills delayed deliveries for February.

Interestingly, even after the 7.7% busheling increase over the last 5 weeks, the mill margin spread (2nd mo HRC – 2nd mo busheling) has increased to its highest level since mid-September last year.

The coking coal 2nd month future was the biggest mover again last week, further signaling increased demand from Chinese mills, even though iron ore has faltered over the last two weeks.

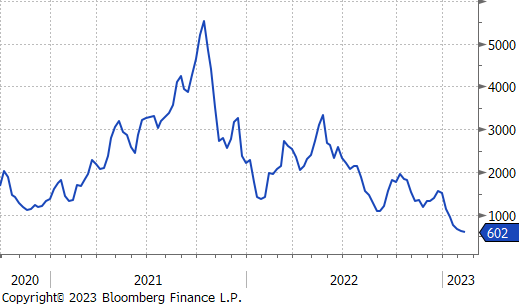

The Baltic dry index continued its recent decline and was down another 4.7% last week. The index has now sold off 61.4% since mid-December when hit $1,560. This is largely driven by reduced exports from Brazil and Australia, which should be supportive of higher iron ore prices over the longer-term if demand from China continues to firm.

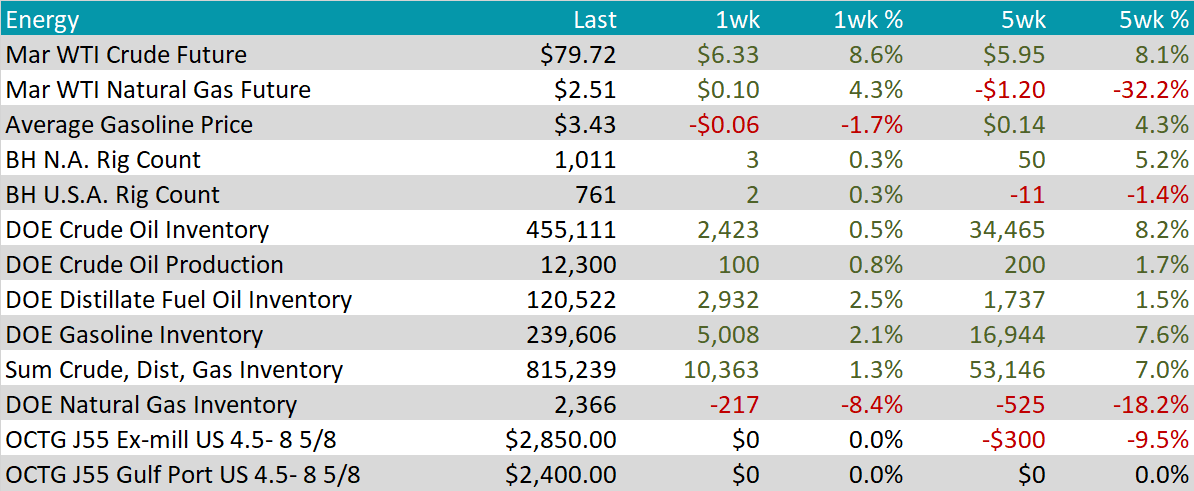

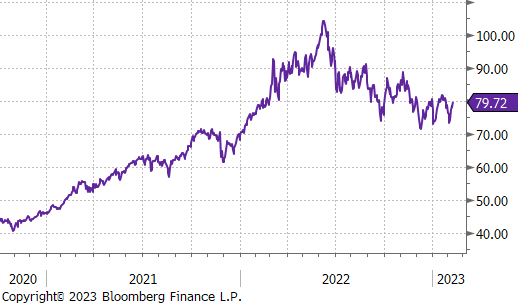

March WTI crude oil future gained $6.33 or 8.6% to $79.72/bbl. Last week, the main driver of the higher crude price was news about the production cuts coming out of Russia.

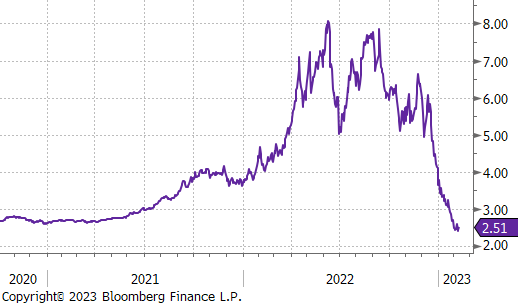

March WTI natural gas future gained $0.10 or 4.3% to $2.51/bbl.

The aggregate inventory level rose another 1.3% this week.

The Baker Hughes North American rig count increased by 3 rigs and the U.S. rig count increased by 2 rigs.

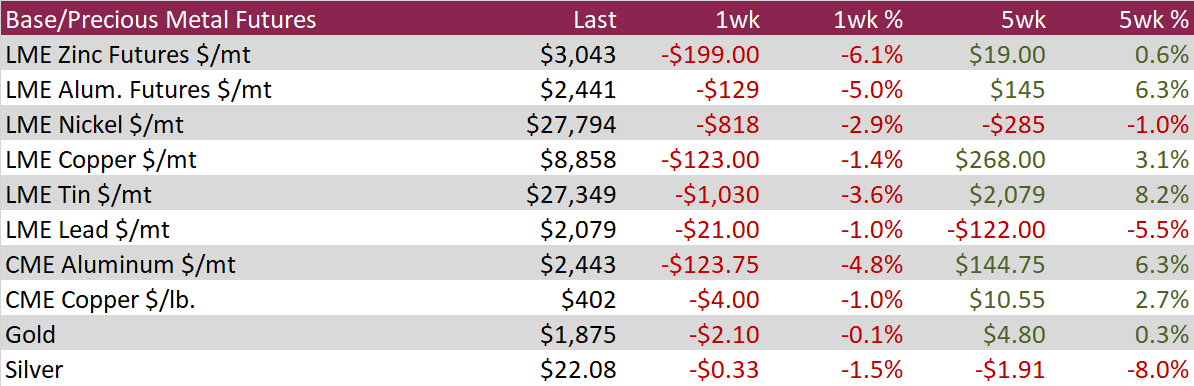

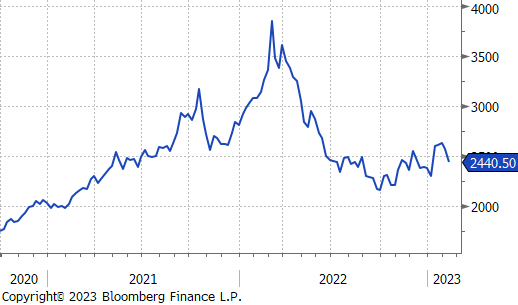

Aluminum futures fell 5% during the week, consolidating in 4 out of 5 trading days to cap off a two-week decline that follows an extended rally during January. Prices trimmed after stockpiles tracked by the LME jumped to the highest since April on the back of another large inflow into Asian locations—a key storage location for Russian Aluminum. Participants are nervous about unwanted Russian supplies being offloaded on the LME.

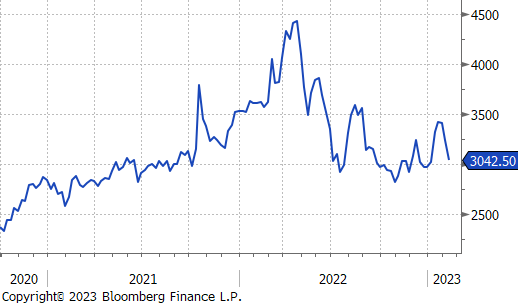

LME Zinc futures fell by more than 6% during the week driven by rising inventory stockpiles held in LME warehouses. On-Warrant LME Zinc inventory increased 128% during the week to 18,400 metric tons, helping to temporarily ease supply concerns as visible zinc inventories have fallen to multi-year lows.

Silver futures on the CME consolidated 1.5% on the week, mostly driven by a stronger USD and concerns about the Fed’s rate hike path following US Consumer sentiment data that climbed to a more than one-year high.

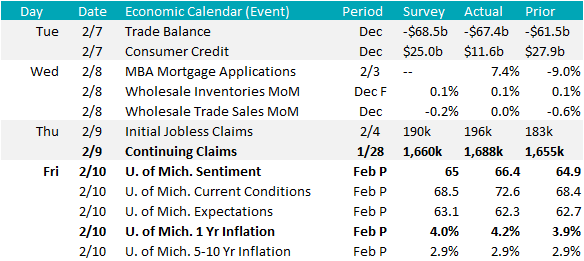

Compared to last week, there was less significant data released, but both initial and continuing jobless claims further confirm that the labor market remains hot. Both were slightly above expectations, but initial jobless claims remain subdued at 196k on the week and continuing claims increased to 1,688k but are down compared to this time last year (1,787k).

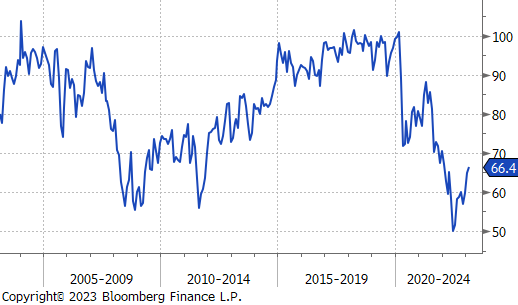

Finally, preliminary February University of Michigan consumer survey data show improving sentiment but slightly worse expectations. Another important factor to keep in mind is that Federal Reserve Chairman Jerome Powell has frequently noted that they are working to ensure that inflation mindsets are not being engrained. While it is only one survey, the 1-yr inflation expectations printed 4.2% which was above consensus estimate of 4%, this is the 2nd month in a row where this index has come in above expectations. If this trend continues, or is confirmed in other economic releases, we anticipate the FOMC will continue the rate hiking cycle well above current market assumptions.

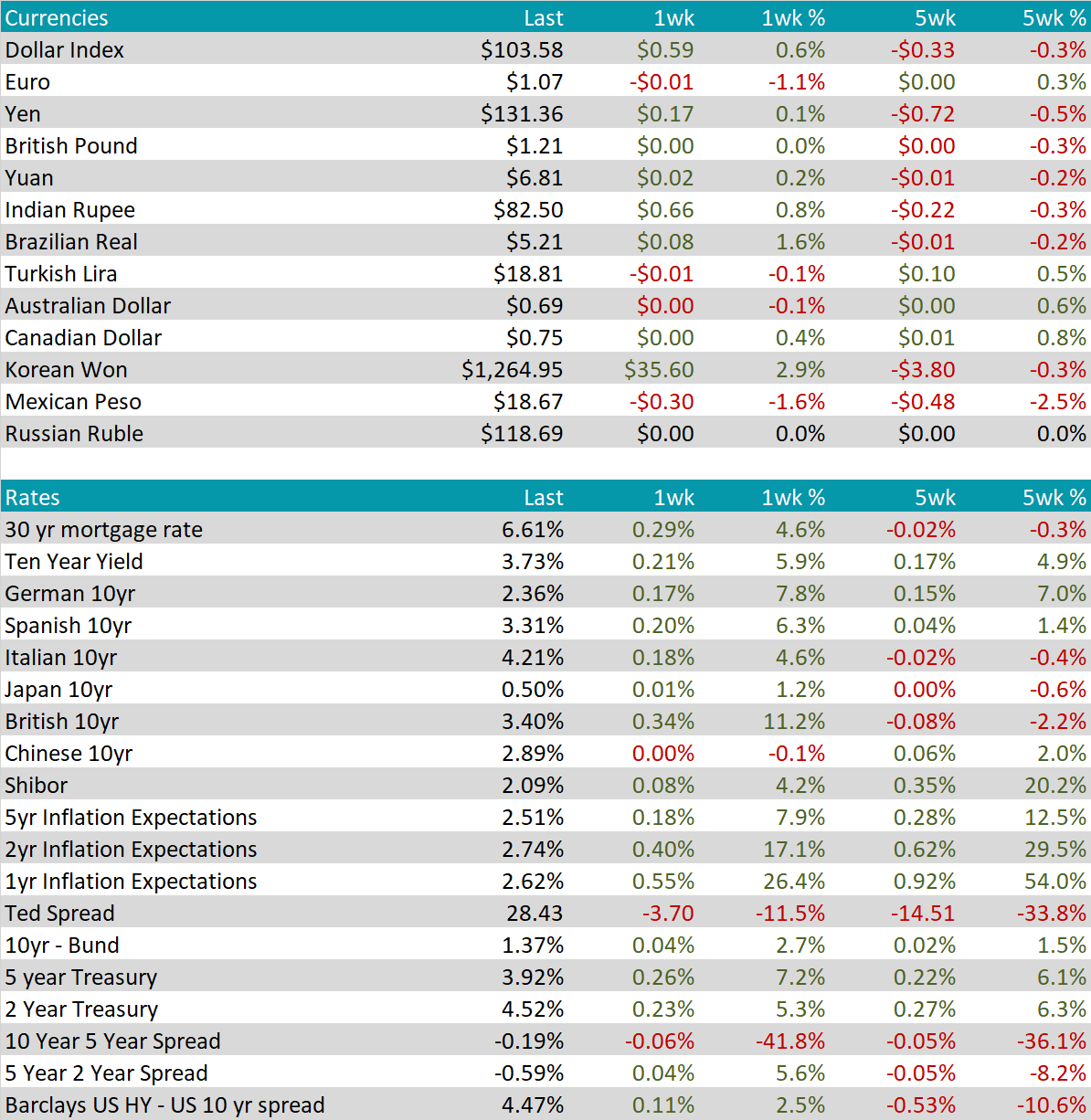

The US dollar traded flat this week after surging on last Friday’s nonfarm payrolls. Inflation data comes out next week and will give investors a signal into the path ahead for the Federal Reserve. Fed officials this week reaffirmed their commitment to bring inflation down with further tightening. Fed Chair Jerome Powell said this week that “the disinflationary process has started” but signaled that more rate increases would be required due to the strong labor market.

The Euro fell again this week and is now down 5.92% on the year versus the USD. While policy makers on the ECB have called for the need for even more tightening, they have also said that hikes to date are having the desired impact on inflation. Interest rates are now at the highest levels since late 2008. Price action over the past week has signaled that investors may now be expecting more hawkish policy out of the US FOMC compared to the ECB.

The British pound finished around 1.21, holding above the 1.1958 level that was reached on February 2nd. This was the weakest level since January 6th. Britain’s economy narrowly avoided recession during the fourth quarter. The UK central bank is seen as more dovish relative to the ECB and US Fed. The Bank of England hiked rates for the 10th straight meeting last week but signaled that inflation had likely peaked and that the tightening cycle may come to an end.