Flack Capital Markets | Ferrous Financial Insider

April 28, 2023 – Issue #377

April 28, 2023 – Issue #377

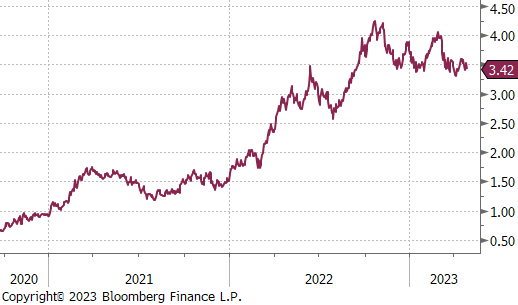

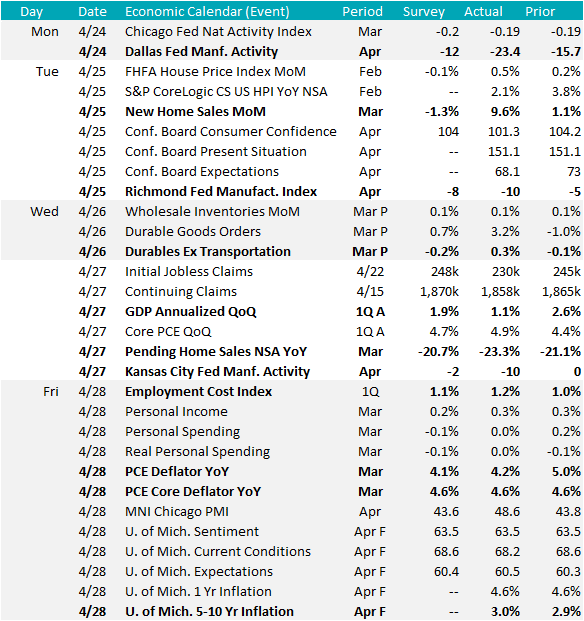

The two most important economic data points last week were the preliminary 1Q GDP and the PCE (Personal Consumption Expenditures) deflator for March. Starting with the 1Q GDP, the first quarter reading showed a 1.1% annualized increase from 4Q21 compared to expectations for a 1.9% increase. This signals a further deceleration of growth in the U.S. economy over the last three quarters. One of the most notable findings when looking more closely at the data is found in business inventories. Here, we see how the tendency to reduce inventory levels impacted economic growth, resulting in a subtraction of 2.3% from 4Q22 inventory levels. While we have seen this acutely in steel-related industries, it does highlight concerns in the broader market around demand for the remainder of this year. On the other hand, the data also shows that the American consumer remains strong, with annualized spending on both goods and services up 6.5% and 2.3%, respectively.

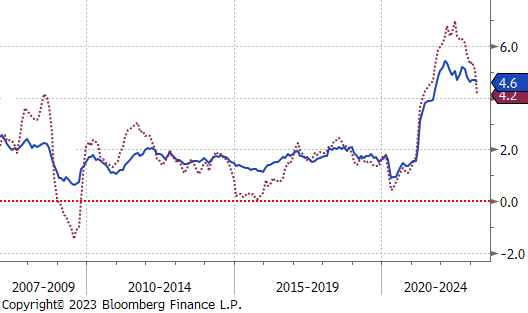

This resilience, while an important aspect for economic growth, could also be viewed as a headwind for what the Federal Reserve is trying to accomplish regarding inflation. The March PCE Deflator was also released last week, with the topline reading showing further deceleration down to 4.2% YoY, while core prices (excluding food and energy) remain stubbornly elevated and sticky at 4.6% YoY. It is important to remember that the Fed prefers the PCE readings versus CPI and that the target for inflation is 2%. The sharp increase in prices over a brief period beginning mid-2021 led to the historic rate-hiking cycle, which began 14 months ago.

With a signaled pause in hikes on the horizon, the next question is what will give way first: inflation or the economy? Since the end of last year, many have been predicting that a recession is around the corner, yet data shows the labor market and economy remain resilient.

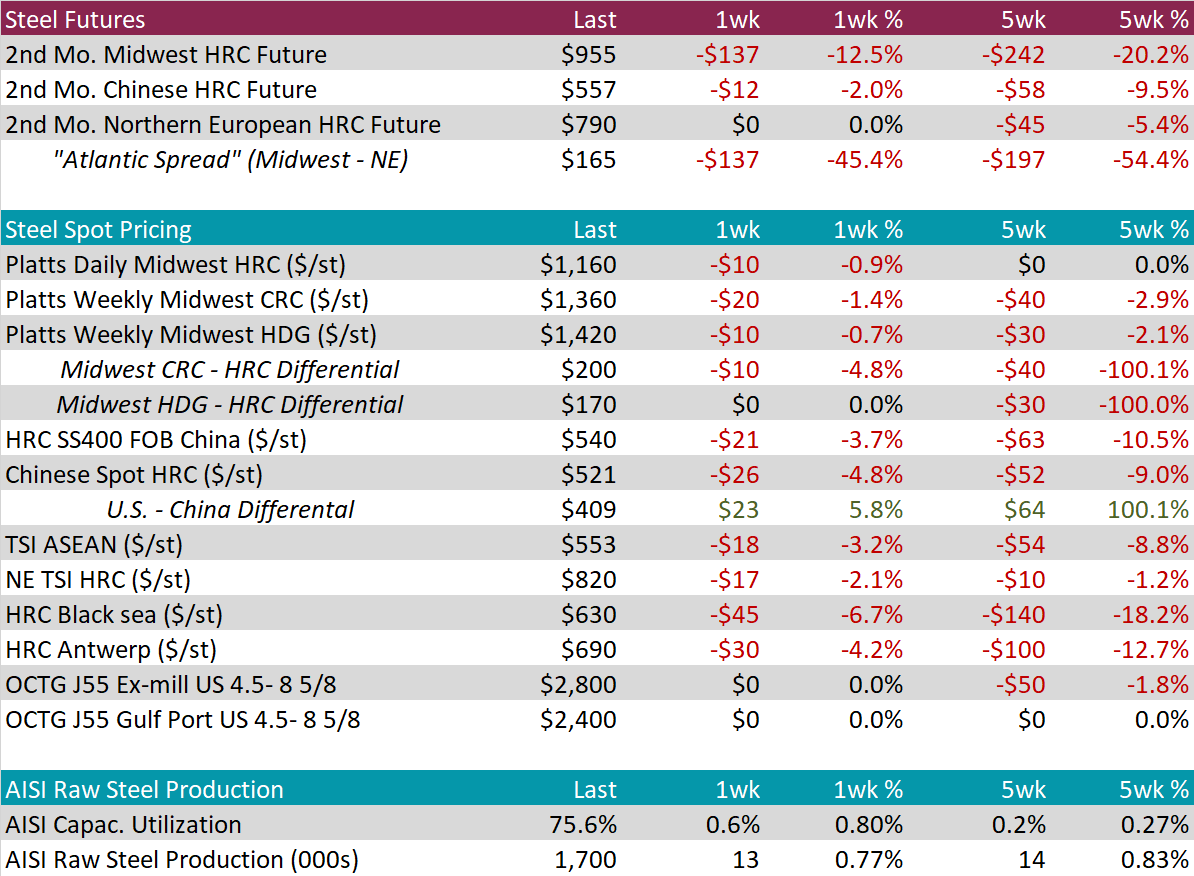

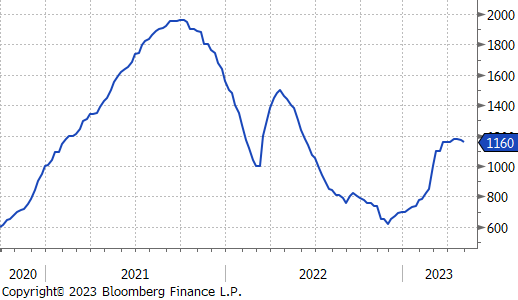

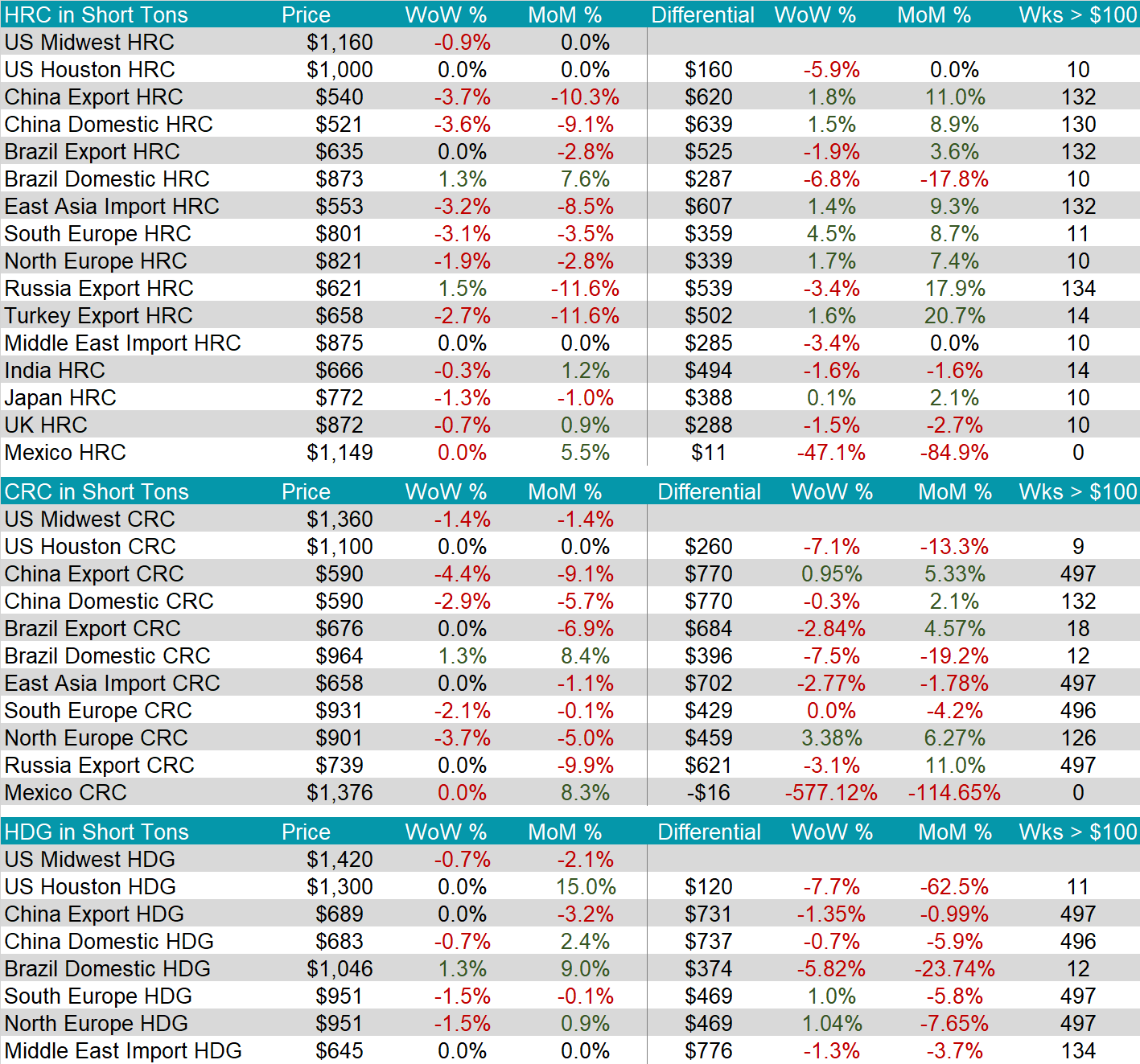

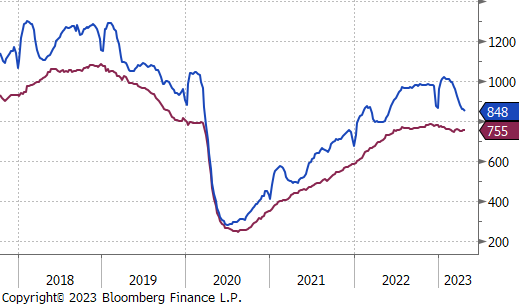

The HRC spot price was down another $10, or 0.9% this week, ending at $1,160. It is now in line with the price from 5 weeks ago. The 2nd month future was down much more sharply, but most of that decline was the result of the future rolling from May to June. The June future itself was down $35, or 3.5%, ending the week at $955.

One trend throughout the rally that does remain intact is that Tandem products continue to have more availability compared to HRC. The result has been a less significant rally and a tightening spread. The HDG – HRC differential is now down to $170.

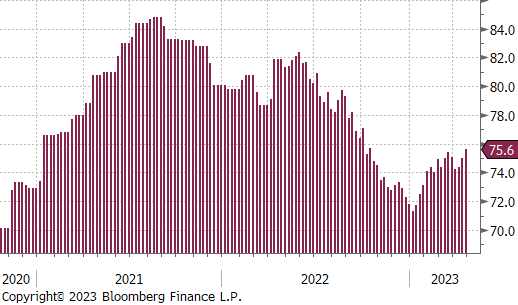

This week, Domestic production increased to its highest level of 2023, with raw steel production increasing to 1.7M tons per week at 75.6% capacity utilization.

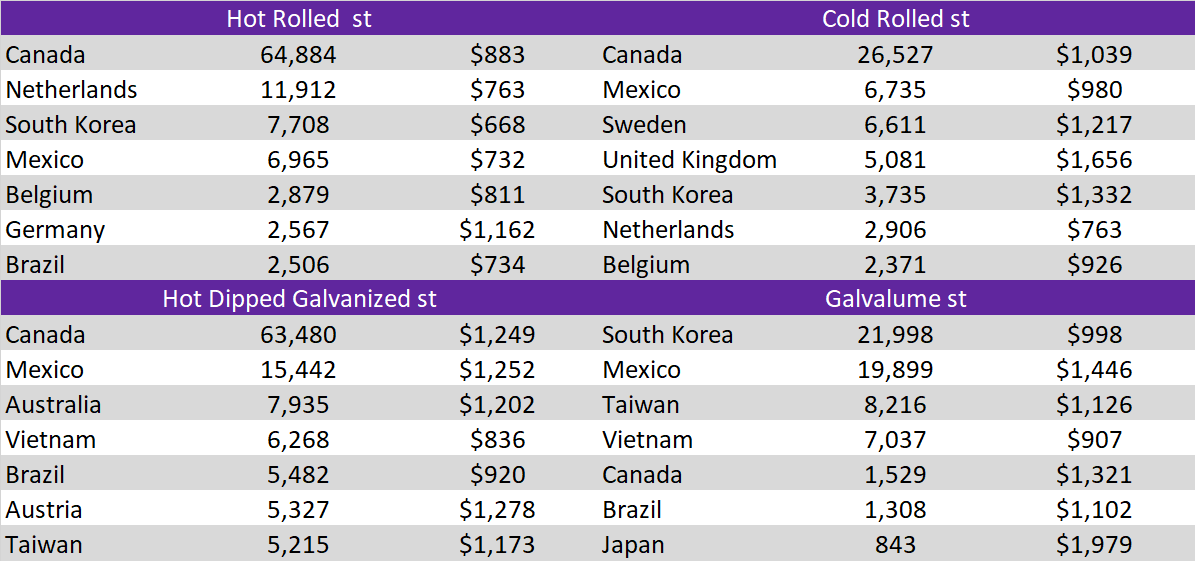

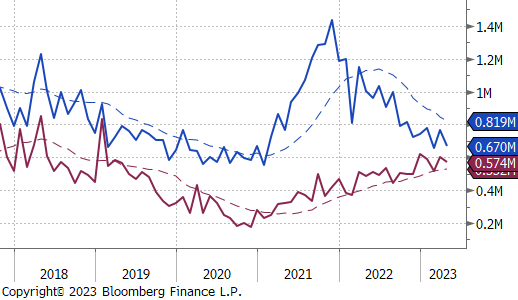

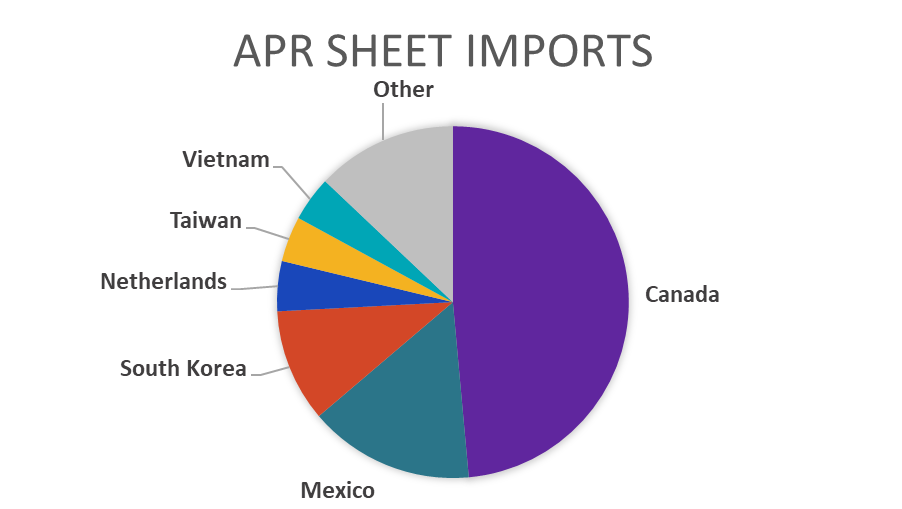

April Projection – Sheet 670k (down 95k MoM); Tube 574k (down 27k MoM)

March Projection – Sheet 764k (up 106k MoM); Tube 601k (up 82k MoM)

Current price dynamics suggest we should see an increase in arrivals, however, market expectations around lower domestic prices will likely put a ceiling on how many tons buyers are willing to purchase.

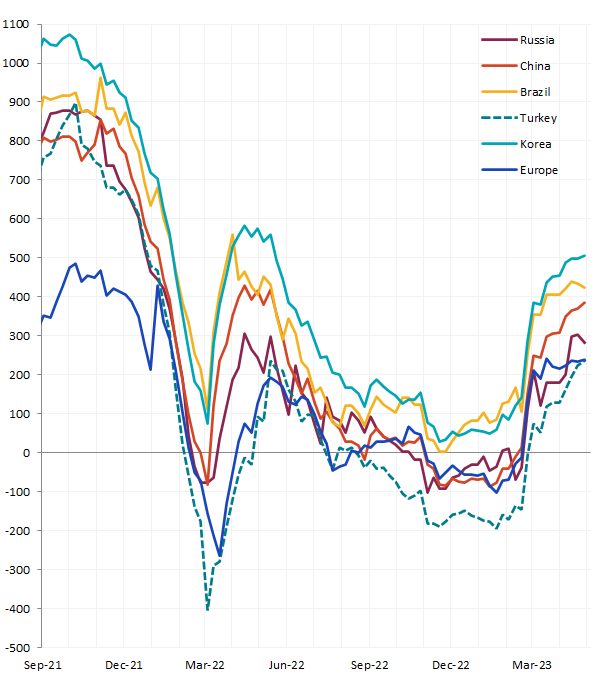

Global differentials were mixed this week, with the Korean, Turkish, Chinese, and European all higher, while Brazil, and Russia decreased. The countries with higher differentials were the result of sharper declines in price compared to the U.S. domestic price.

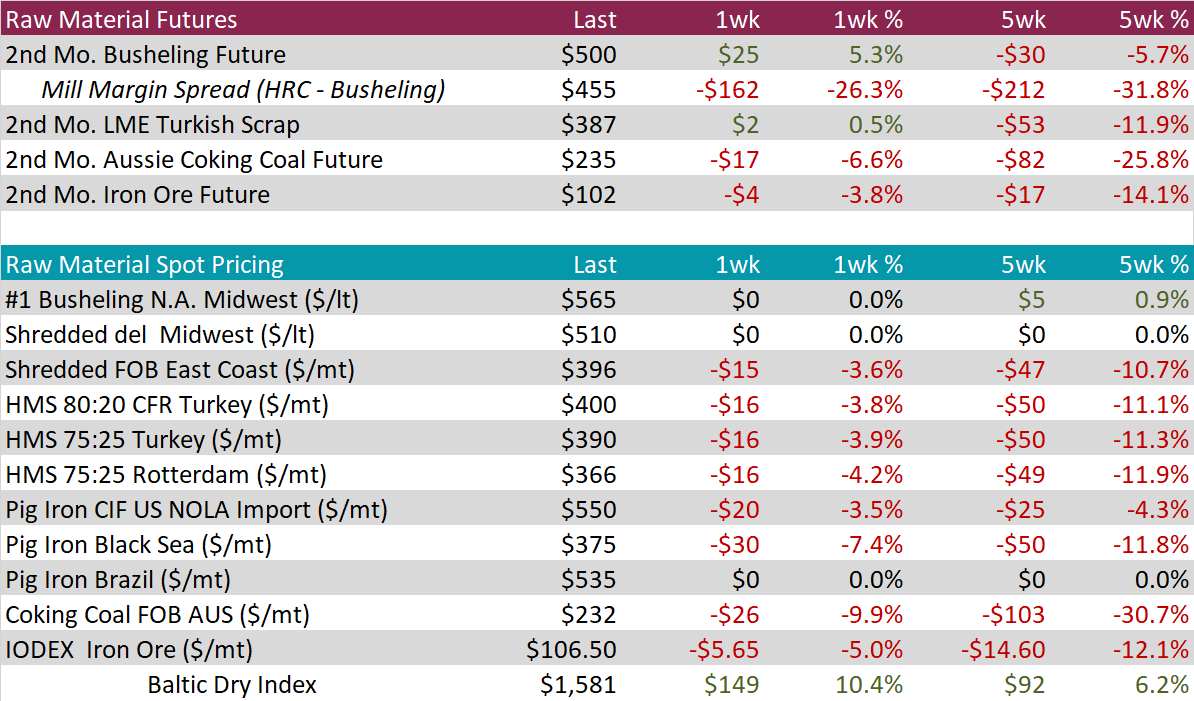

Overall, raw materials continue to trend lower as macro sentiment around the 2nd half sours. However, the 2nd month busheling future increased this week. As we get closer to the May settlement, expectations are that it would not be as bad as previously rumored. Higher busheling and significantly lower 2nd month HRC resulted in a 26.3% decrease to the mill margin spread now at $455.

The 2nd month Iron ore future continued its downtrend this week, losing another 3.8%. Recent losses in this and Aussie coking coal are largely directed towards growing concerns around Chinese demand.

Dry Bulk / Freight

The Baltic dry index was up 10.4% this week, it continues to hold up despite slowing, depressed iron ore shipments.

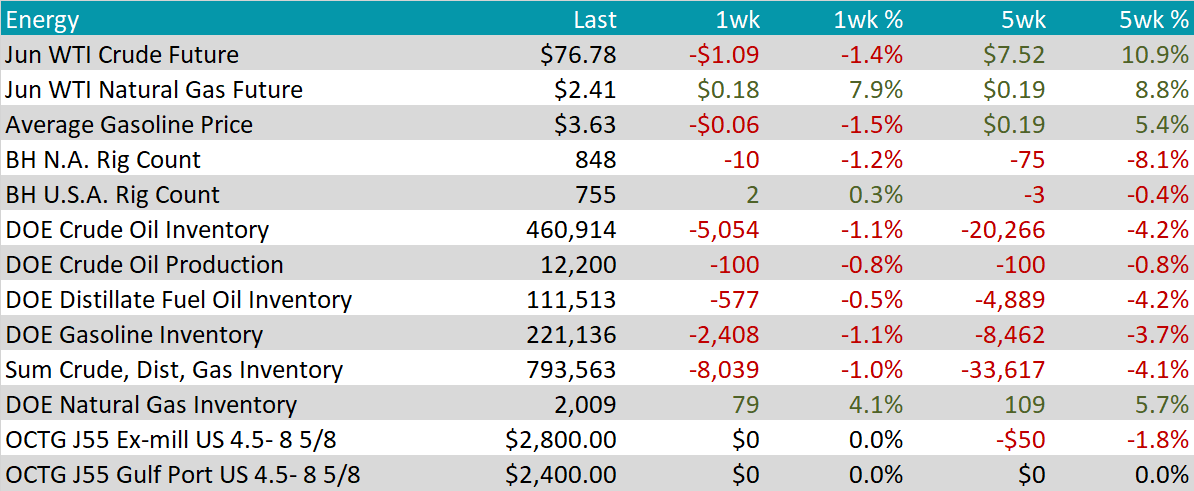

June WTI crude oil future lost $1.09 or 1.4% to $76.78/bbl.

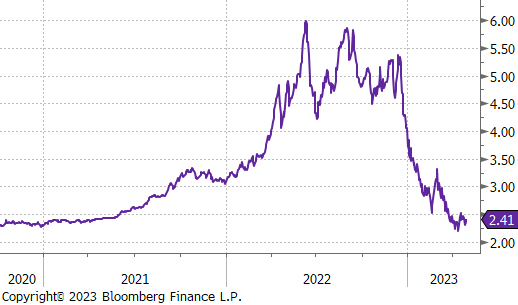

June WTI natural gas future gained another $0.18 or 7.9% to $2.41/bbl.

The aggregate inventory level continues to fall, down another 1% this week.

The Baker Hughes North American rig count was down 10 rigs, while the U.S. rig count increased by 2.

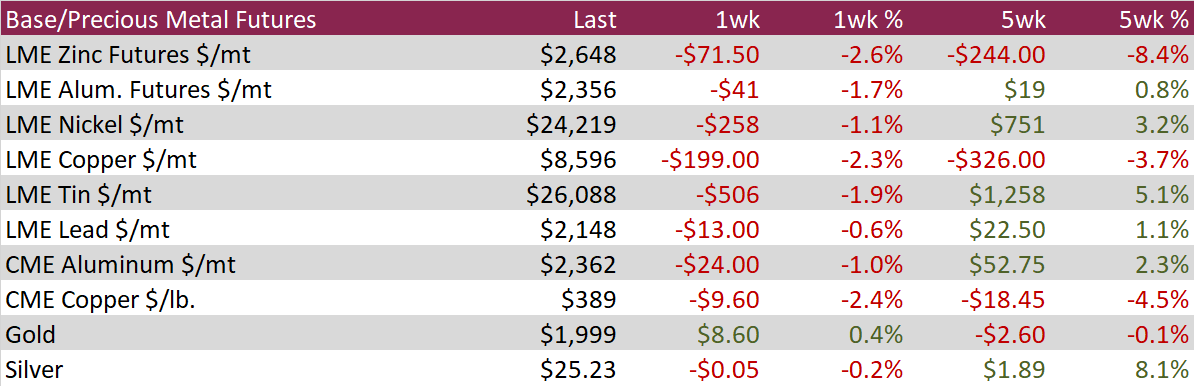

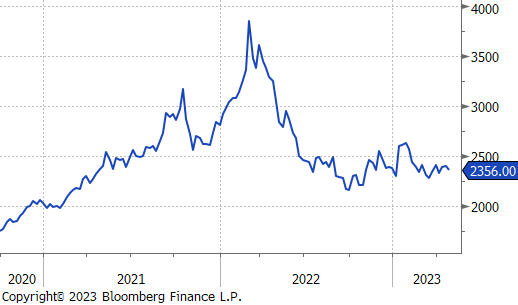

Aluminum futures on the LME decline for the first time in 3 weeks after failing to hold a break above $2400 per metric ton. There was little industry news out during the week, but the price decline comes despite a small drop in on-warrant inventories held in LME registered warehouses. Shanghai inventories also decline 10% during the week.

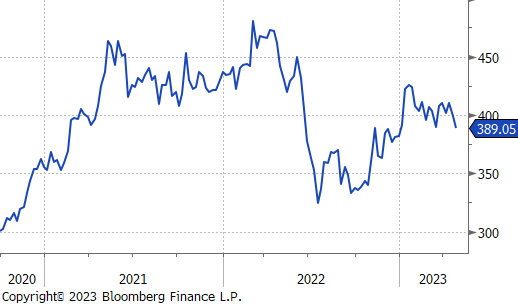

Copper futures declined for a second consecutive week, falling 2.26% to the lowest settlement since the middle of March. LME on-warrant inventories rose by 13kt during the week, however ShFE stocks fell 6%. In industry news, Reuters reports that Indonesia will allow Freeport Indonesia and Amman Mineral Nusa Tenggara to continue exporting copper concentrate until next year, despite a ban that is supposed to start in June.

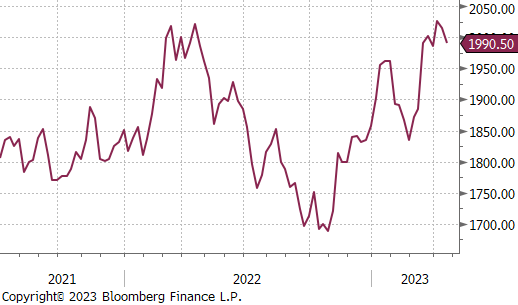

Gold finished the week relatively flat, recording a marginal gain of 0.4% and settling $1 below the psychological $2,000 level. Precious metals have benefitted from a softer greenback, which recorded an overall monthly decline during April. Money managers have decreased their bullish gold bets to the least bullish in four weeks, but also trimmed their short-only positions during the week.

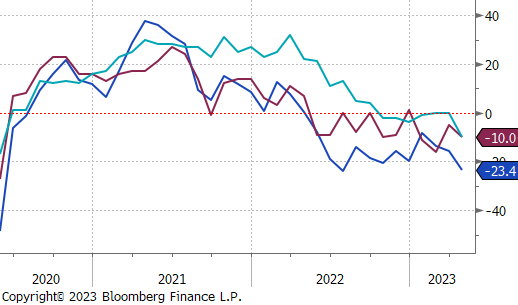

This week, we receive the remainder of the Regional Fed Manufacturing surveys, signaling further contraction in activity. Dallas, Richmond, and Kansas City all printed below expectations -23.4 vs -12, -10 vs -8, and -10 vs -2, respectively. However, after looking more closely at the underlying data, the new orders subcomponents have started to improve across the board, while remaining in contraction. While it is too early to say we have reached a bottom in activity, it could mark a turning point.

Additionally, New home sales (SAAR) continue to surprise to the upside, up 9.6% MoM versus expectations of a slight decline of 1.3%. This is a welcome sign of continued resilience in the residential construction demand.

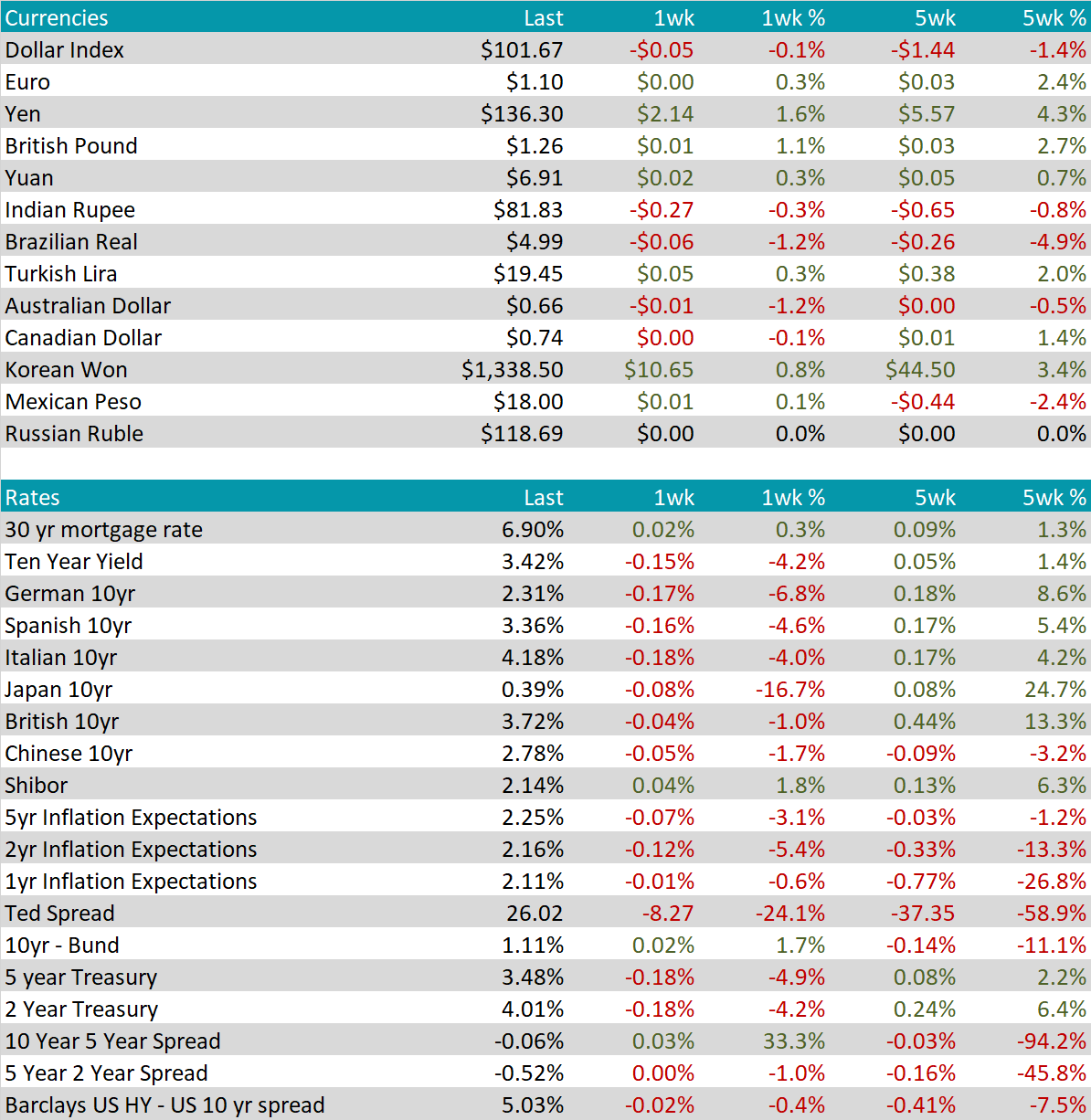

The U.S. dollar was down slightly, $0.05 or 0.1% on the week, but the biggest news in currencies came from the Bank of Japan. The BOJ announced that it would maintain its ultra-easy monetary policy with no adjustments to its yield curve control. This announcement sent the Japanese yen falling vs major currencies, losing $2.14 compared to the USD and depreciating toward 137. This marked the lowest levels seen in 7 weeks. The pound sterling moved above a key 1.25 level last week vs the USD, marking the highest levels seen since last June. Investors expect a 25bps rate hike in May for both the Bank of England and the US Federal Reserve. However, market participants continue to expect more rate hikes from the BOE, while pricing in that the federal reserve is done after this next hike. Inflation remains the key focal point as the latest CPI report showed that the British inflation rate remains above 10% for a seventh consecutive month in March.

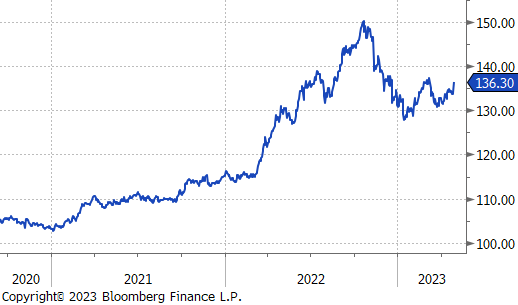

Rates were lower across the board, with the U.S. 10yr Treasury yield down 15 bps last week.