Flack Capital Markets | Ferrous Financial Insider

September 13, 2024 – Issue #449

September 13, 2024 – Issue #449

Overview:

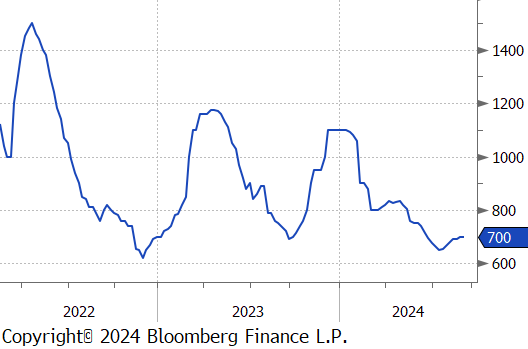

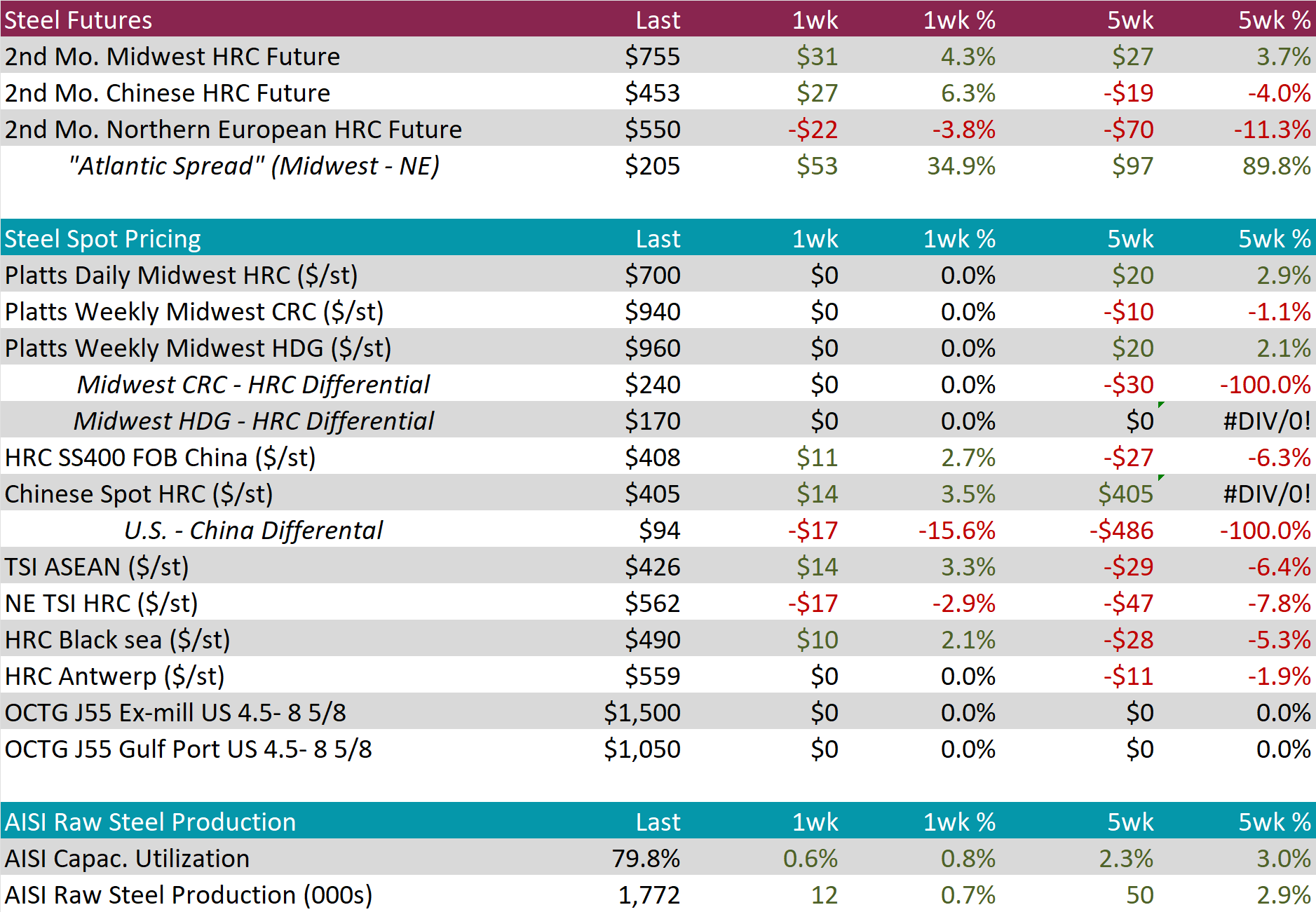

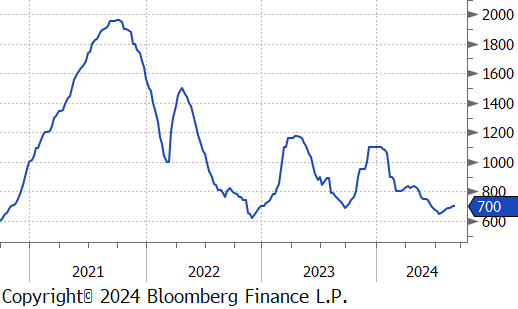

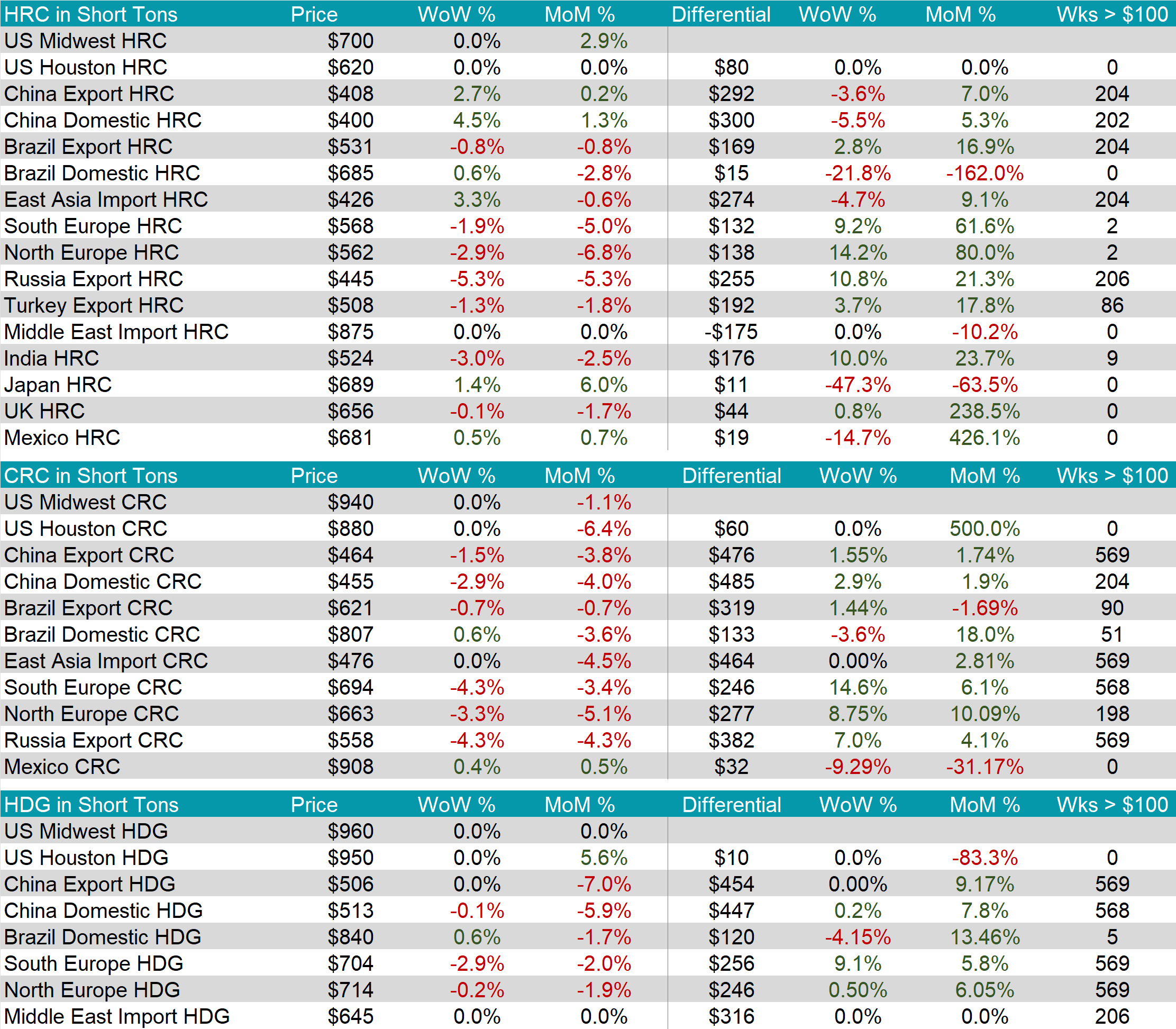

The HRC spot price held steady week-over-week at $700. At the same time, the HRC 2nd month future rose by $31 or 4.3% to $755, reaching the highest price since May.

Tandem products both remained unchanged, resulting in the HDG – HRC differential to also remain unchanged at $170.

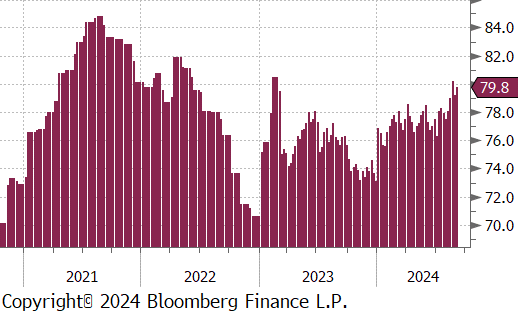

Mill production continued to remain on the higher end of its recent range, with capacity utilization ticking up by 0.6% to 79.8%, bringing raw steel production up to 1.772m net tons.

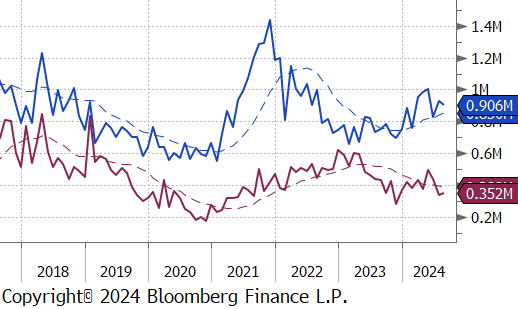

August Projection – Sheet 906k (down 25k MoM); Tube 352k (up 15k MoM)

July Projection – Sheet 931k (up 105k MoM); Tube 337k (down 76k MoM)

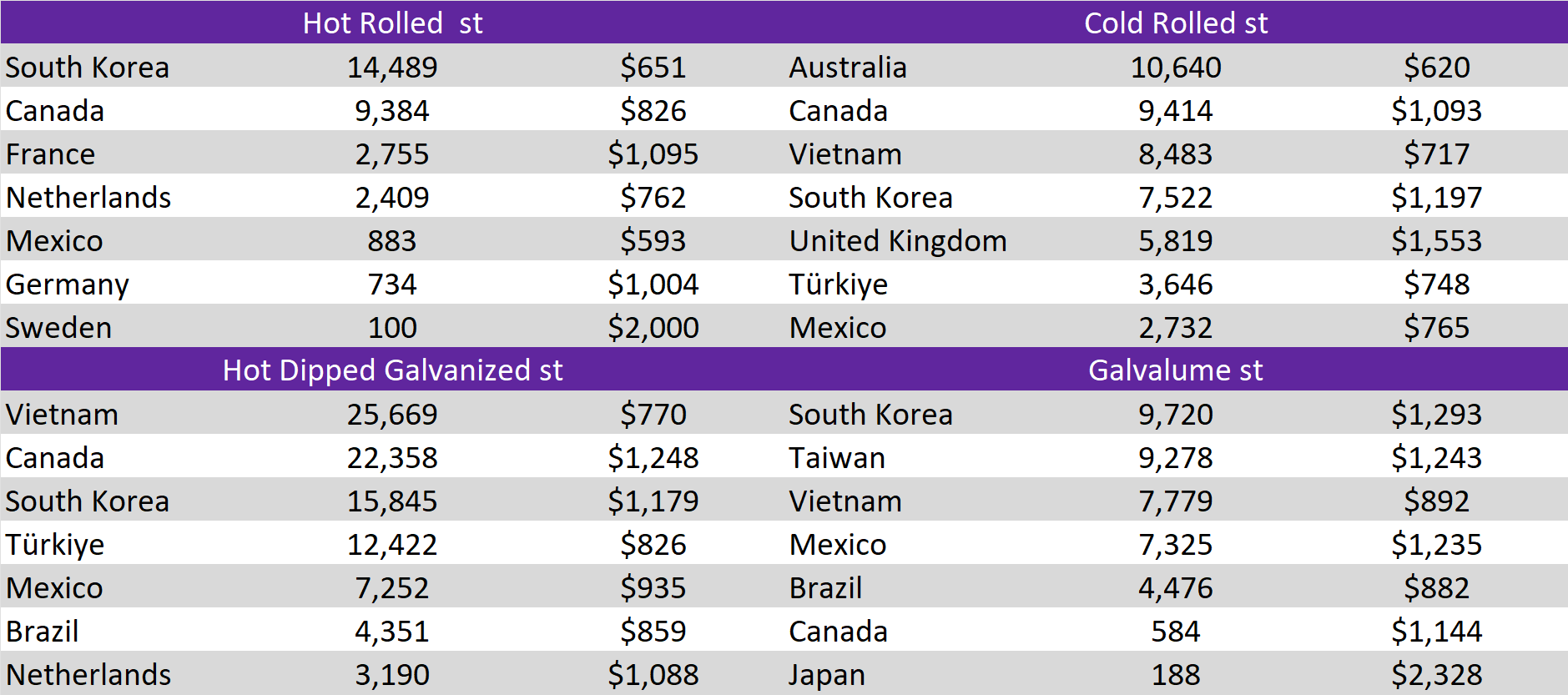

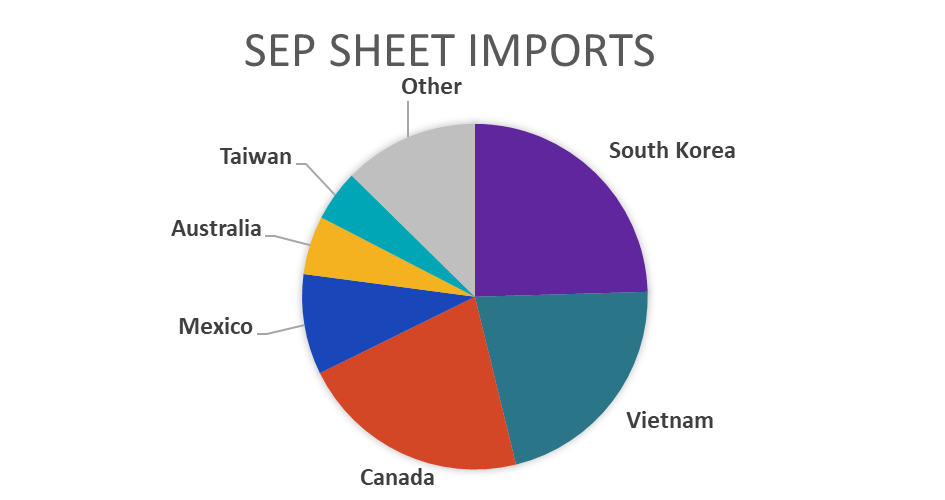

The ten countries that have been noted in the trade cases make up approximately 80% of the imported corrosion resistant steel market and are currently on track to bring in around 3m net tons of corrosion resistant steel for this year alone.

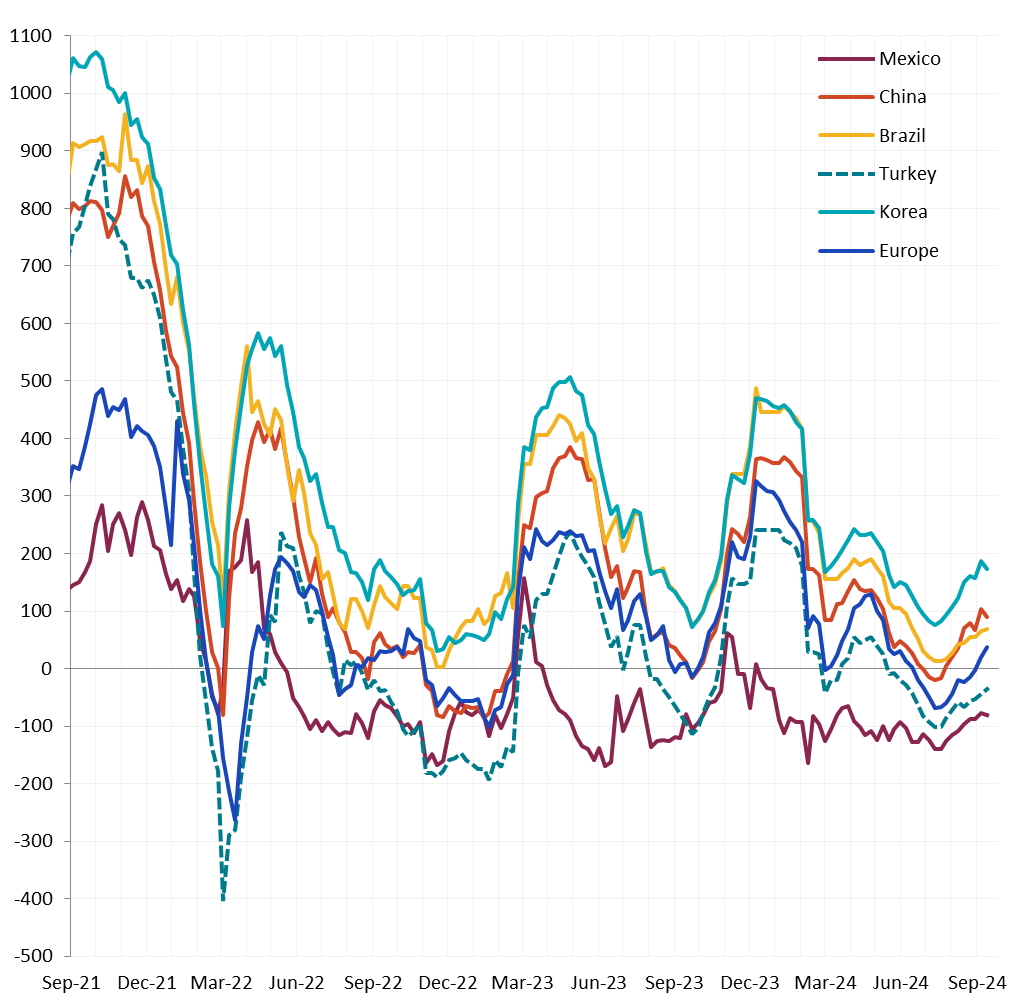

Watched global differentials varied this week, with China Export HRC increasing by 2.7% and Korea’s HRC price rising by 3.3%, while Russia Export HRC dropped by -5.3% and N Europe fell by -2.9%.

Scrap

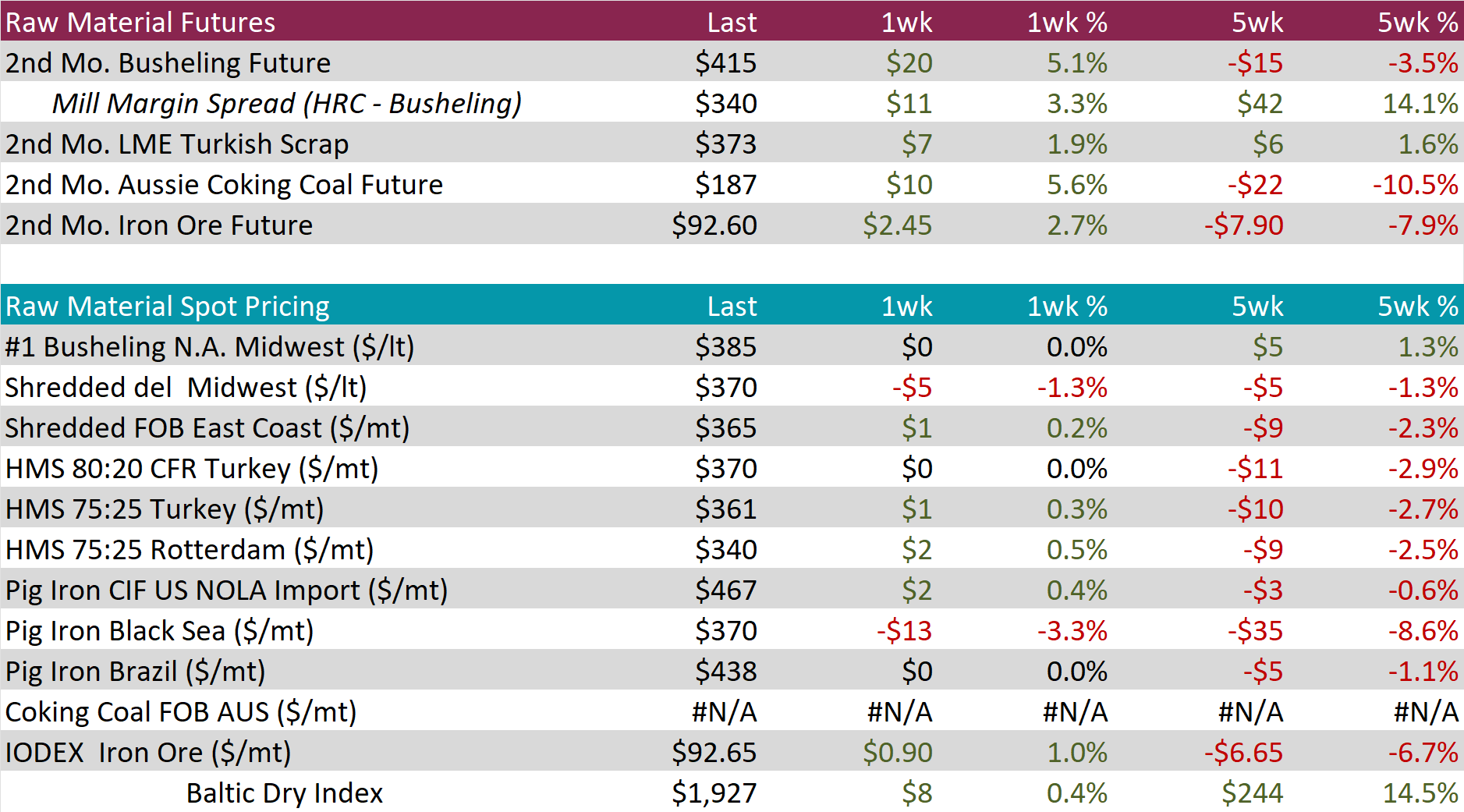

The busheling 2nd month future rose by $20 or 5.1% to $415, rebounding from last weeks drop.

The Aussie coking coal 2nd month future jumped up by $10 or 5.6% to $187, also rebounding from last weeks drop, yet still under the $200 price level.

The iron ore 2nd month future climbed by $2.45 or 2.7% to $92.60, continuing to maintain above the $90 price level.

Dry Bulk / Freight

The Baltic Dry Index edged up by $8 or 0.4% to $1,927, building off last weeks gain and reaching the highest level since July.

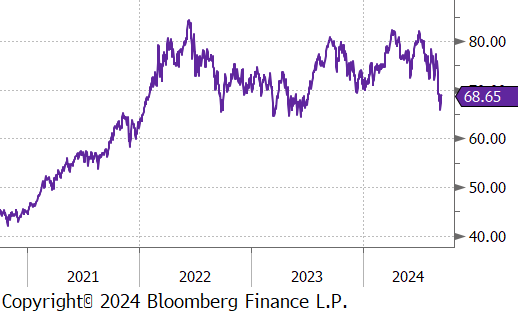

WTI crude oil future gained $0.98 or 1.4% to $68.65/bbl.

WTI natural gas future gained $0.03 or 1.3% to $2.31/bbl.

The aggregate inventory level experienced a slight increase of 0.7%, ending its downtrend.

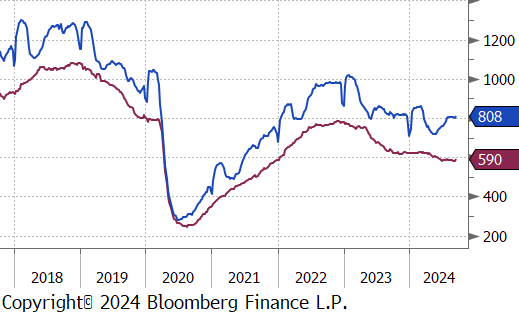

The Baker Hughes North American rig count added 6 rigs, bringing the total count to 808 rigs. Similarly, the US rig count added 8 rigs, bringing the total count to 590 rigs.

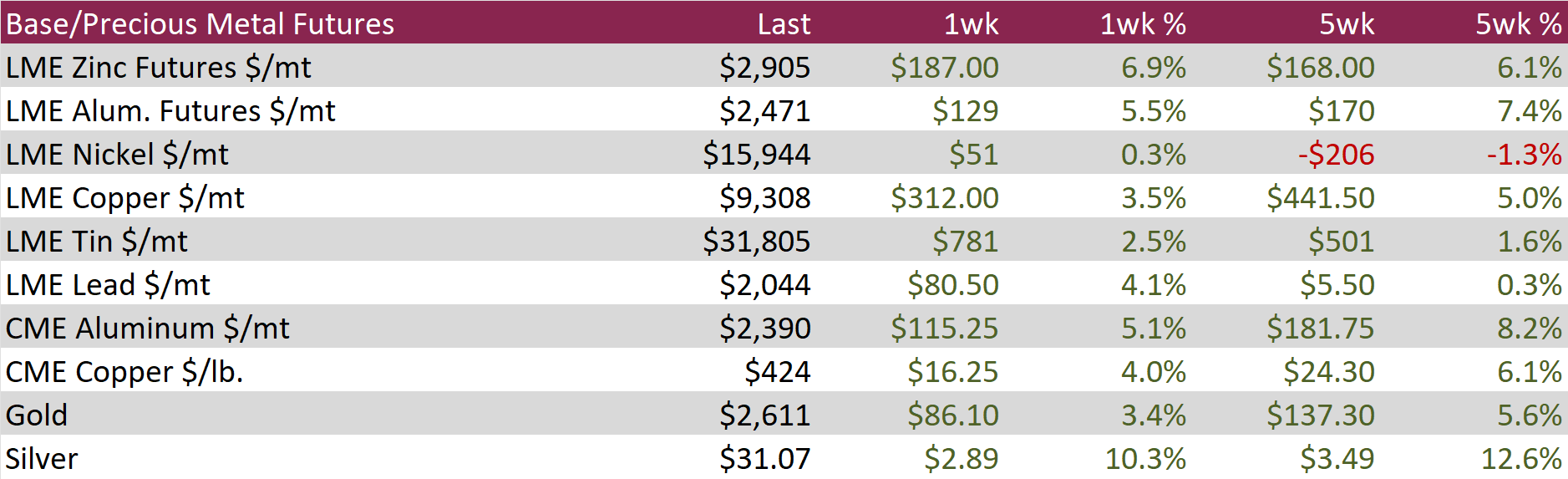

Aluminum futures increased by $129 or 5.5% to $2,471 driven by a weaker US dollar and expectations of an interest rate cut by the Federal Reserve this week. Markets are anticipating a 25-basis point cut on Wednesday, with some speculation that the Fed might opt for a larger 50 basis point reduction. Such monetary easing could stimulate economic growth and increase demand for industrial metals like aluminum. Additionally, a weaker dollar makes dollar-denominated commodities more affordable for buyers using other currencies, potentially boosting global demand. Meanwhile, China—the world’s largest consumer of metals—reported a slowdown in industrial output growth to a five-month low in August, alongside declines in retail sales and home prices. These signs of economic cooling have raised the likelihood of the Chinese government implementing stimulus measures to achieve its growth targets. Potential fiscal or monetary stimulus from China could further support demand for aluminum.

Copper futures rose by $16.25 or 4.0% to $424, similarly buoyed by a weaker dollar and expectations of a US Federal Reserve interest rate cut this week. A weaker dollar makes metals more affordable for investors holding other currencies. A rate cut could stimulate economic growth, boost demand for metals, and put additional pressure on the dollar. However, recent data from China shows weaker-than-expected industrial output, retail sales, and fixed asset investments for August, raising concerns about demand from the world’s largest metal consumer. Additionally, China’s urban unemployment has reached a six-month high, and home prices are falling at their fastest rate in nine years.

Silver soared by $2.89 or 10.3% to $31.07, reaching a two-month high, driven by growing expectations of a more aggressive Federal Reserve interest rate cut at this week’s meeting. The market is now pricing in a 59% probability of a 50-basis-point cut on Wednesday, up from 25% a month ago, while the likelihood of a 25-basis-point reduction stands at 41%, according to CME’s FedWatch Tool. These expectations have been fueled by signs of a weakening labor market, which overshadowed stronger-than-expected inflation data last week. Meanwhile, disappointing economic data from China has raised concerns about demand from the world’s largest metal consumer.

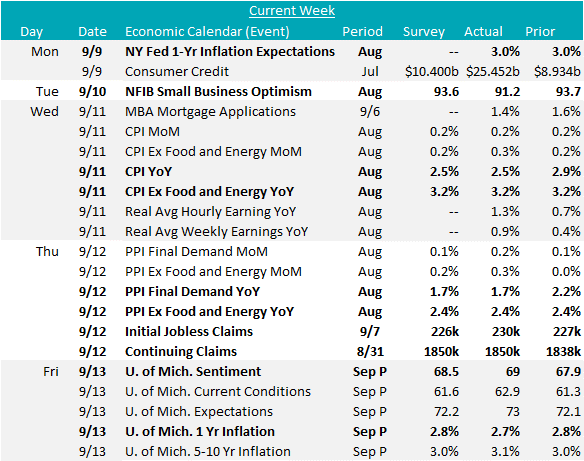

In August, the Core (Ex Food & Energy) CPI (Consumer Price Index) and overall CPI both met expectations, holding steady at 3.2% and 2.5% YoY, respectively. However, producer price data was slightly below forecasts: the Core PPI (Producer Price Index) came in at 2.4% YoY, versus an expected 2.5%, and the overall PPI was 1.7% YoY, below the anticipated 1.8%. For inflation expectations, the NY Fed’s 1-Year Inflation Expectations remained steady at 3.0%, while the University of Michigan’s 1-Year Inflation Expectations decreased to 2.7%, falling short of the 2.8% forecast.

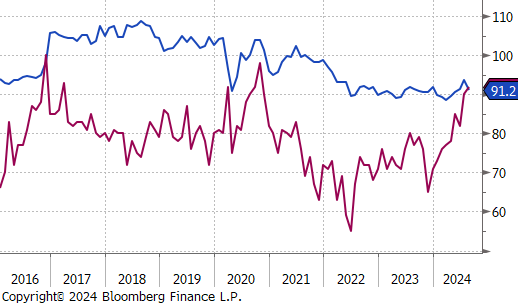

Additionally, August’s NFIB Small Business Optimism Index dropped to 91.2, missing the expected slight decline to 93.6. One of the main drivers for the downtick was the Uncertainty Index increasing, which reflects the ongoing uncertainty related to the upcoming election, which always tends to spike during presidential elections.