Content

-

Weekly Highlights

- Market Commentary

- Durable Goods

- Risks

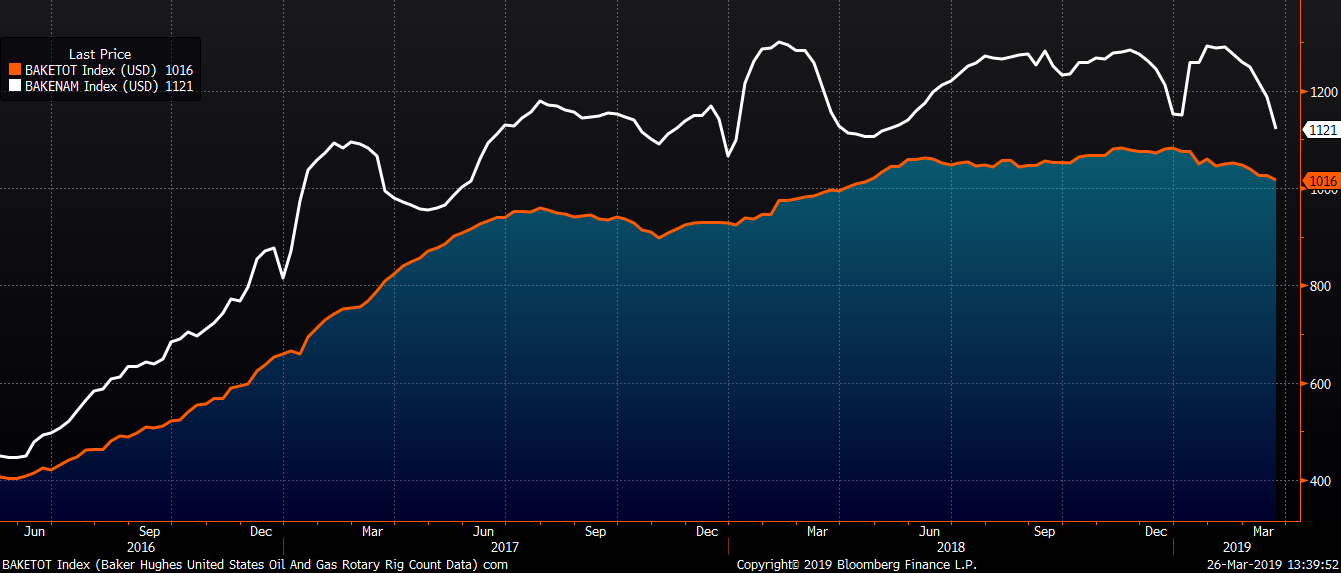

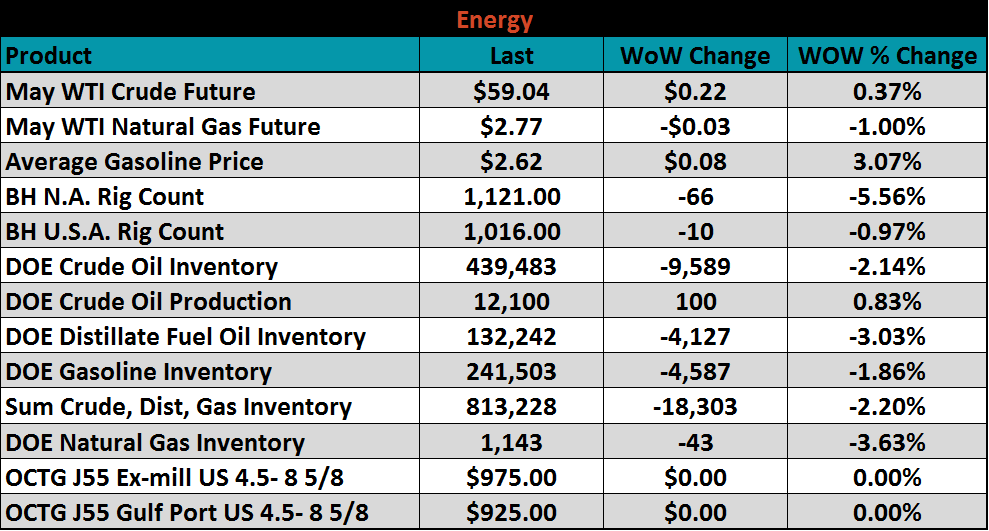

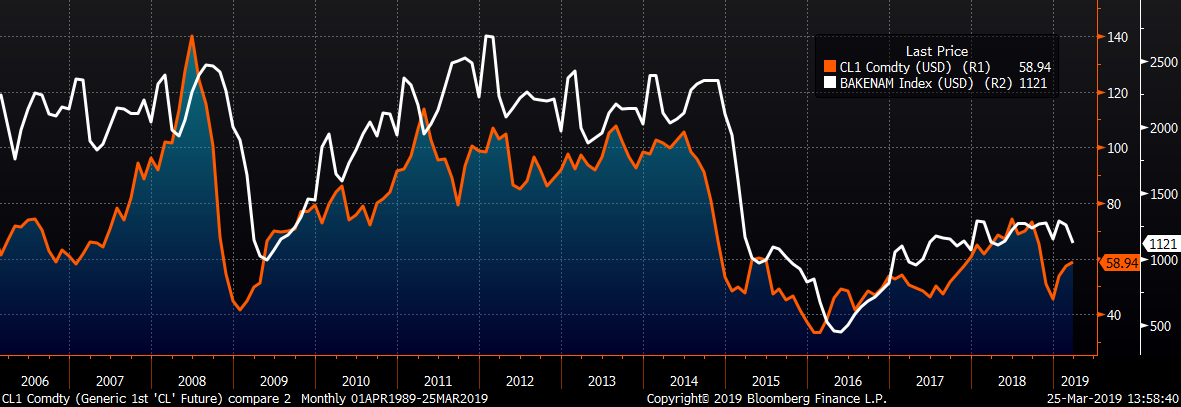

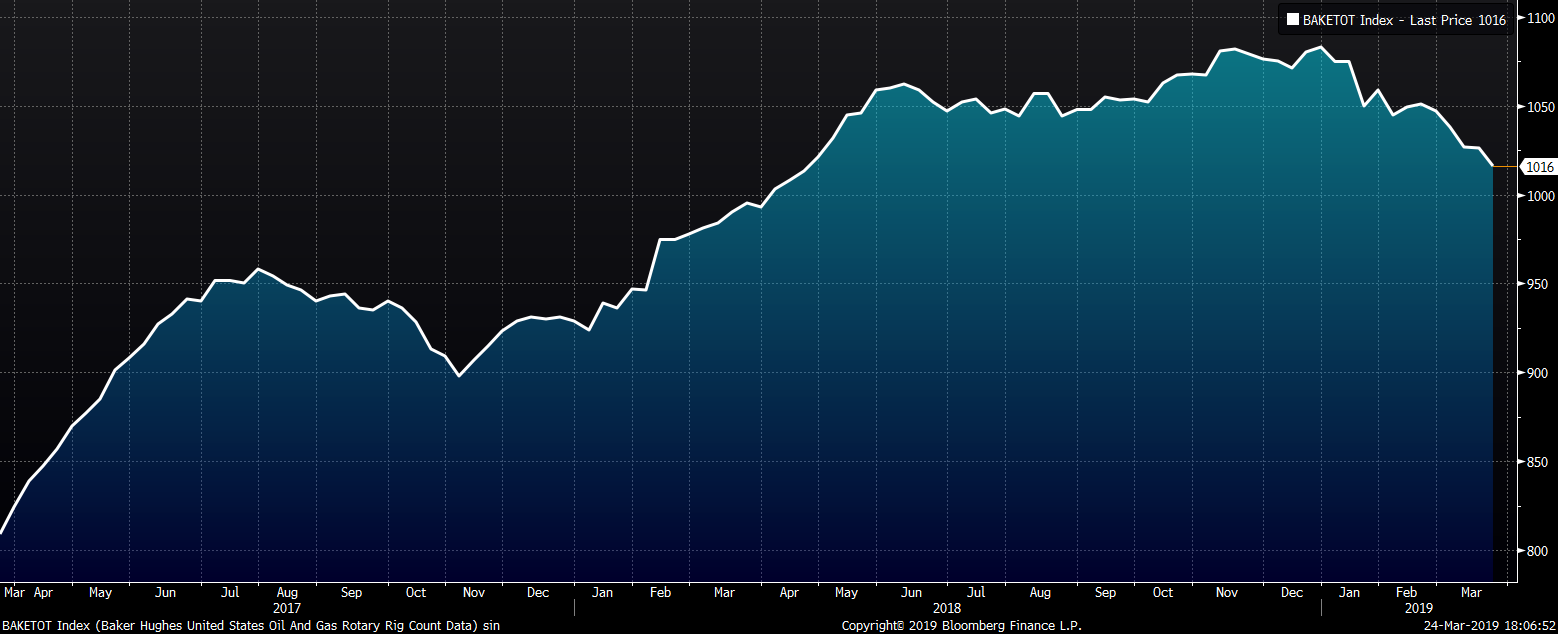

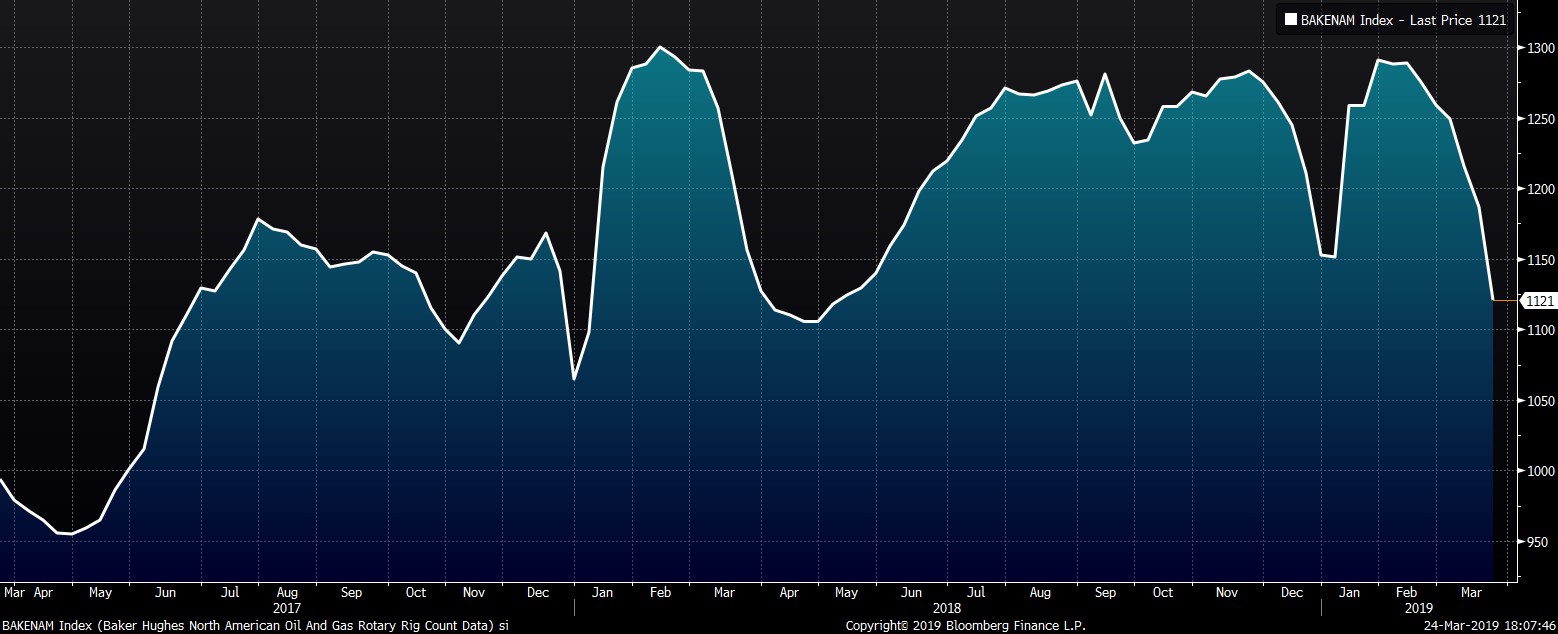

It was another sleepy week in the steel business as hot rolled prices continue to be range bound. Domestic mills continue to overproduce according to AISI raw steel production data. Flat rolled imports continued to remain subdued. January factory orders ex-transportation and durable goods ex-transportation declined MoM. The March Richmond Fed Manufacturing Index fell to 10 from 16. The March Dallas Fed. Manufacturing Activity Index fell to 8.3 from 13.1 missing expectations of 8.9. Rig counts saw a dramatic drop last week with the U.S. rig count falling ten rigs to 1,016 rigs after its most recent peak of 1,083 the last week of 2018 while the North American rig count fell sixty-six rigs in just the last week down from its most recent peak of 1,291 rigs at the end of January.

There were a couple bright spots on the economic front. The March Philadelphia Fed Index saw a solid expectations beating rebound jumping to 13.7 from -4.1 in February. February Existing Home Sales saw an unexpected increase to a S.A.A.R. of 5.51m units.

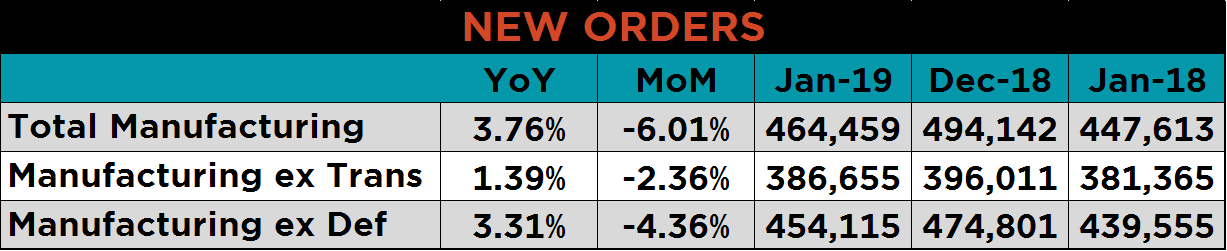

The following table shows YoY and MoM percentage change in January new orders from the durable goods report. Similar to many other industries, the data indicated the manufacturing industry experienced slowing growth. For comparison, January 2018 saw these three categories each post YoY growth in excess of 5%.

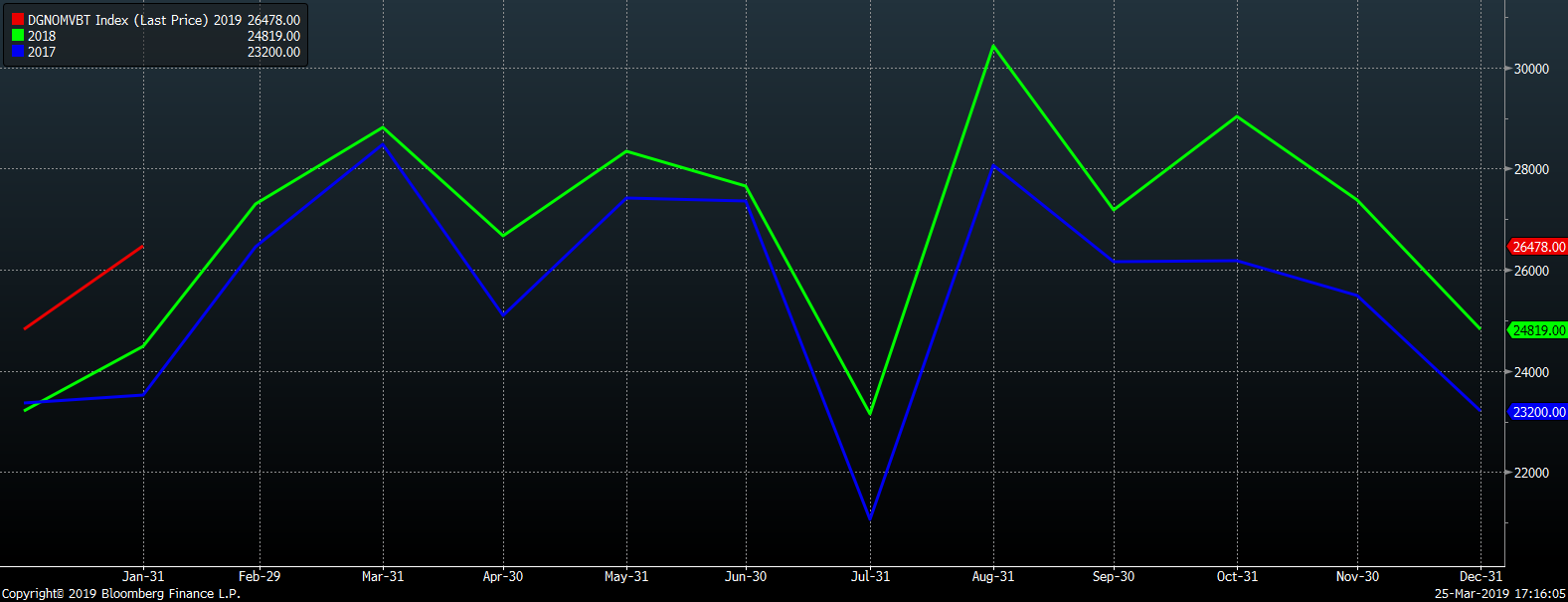

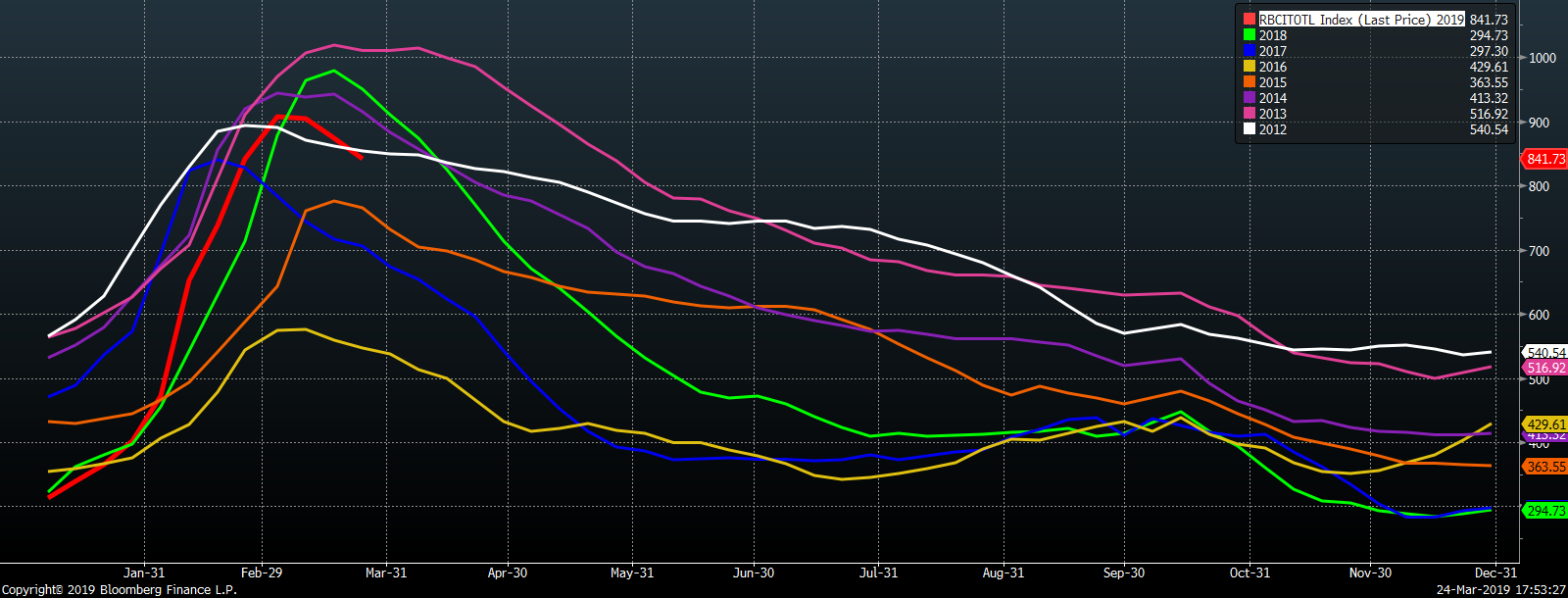

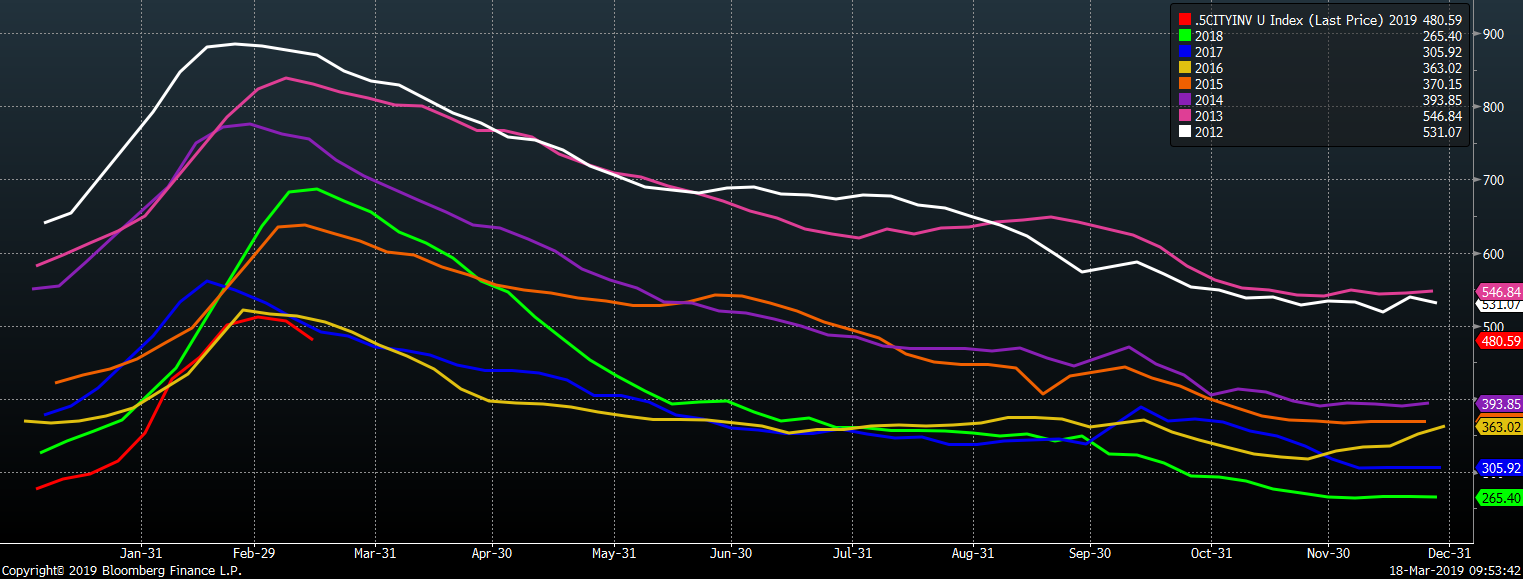

The next series of charts show the unadjusted new orders data on a monthly basis over the last three years, with 2019 in red, 2018 in green and 2017 in blue.

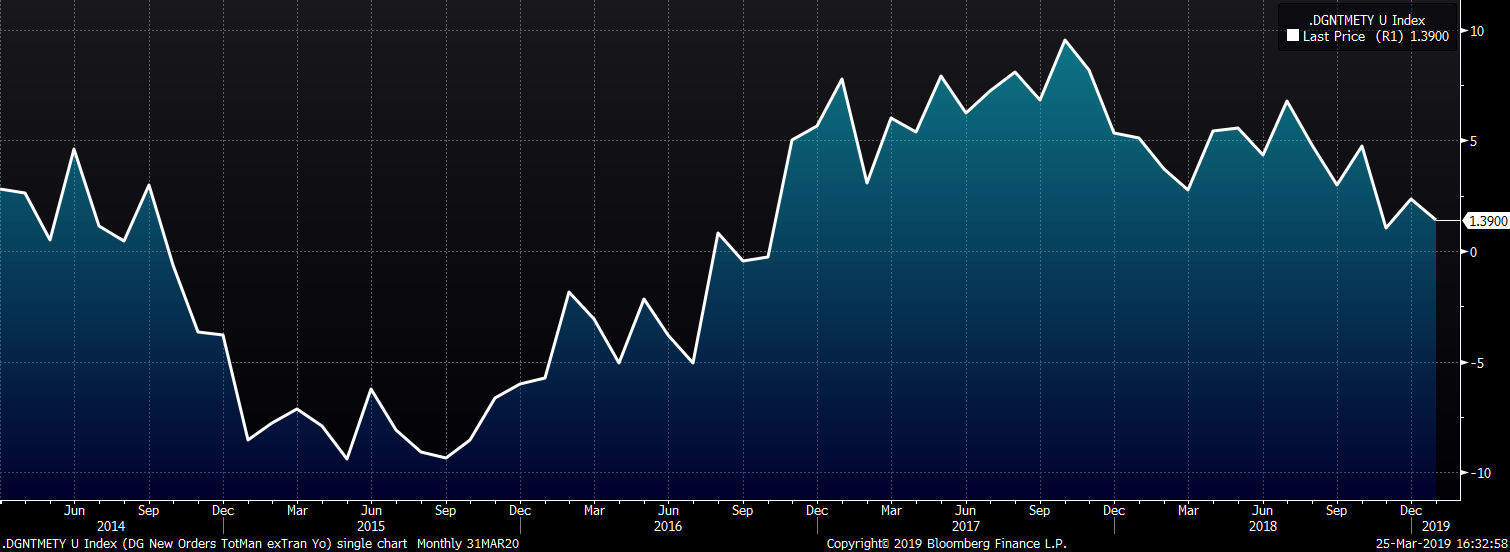

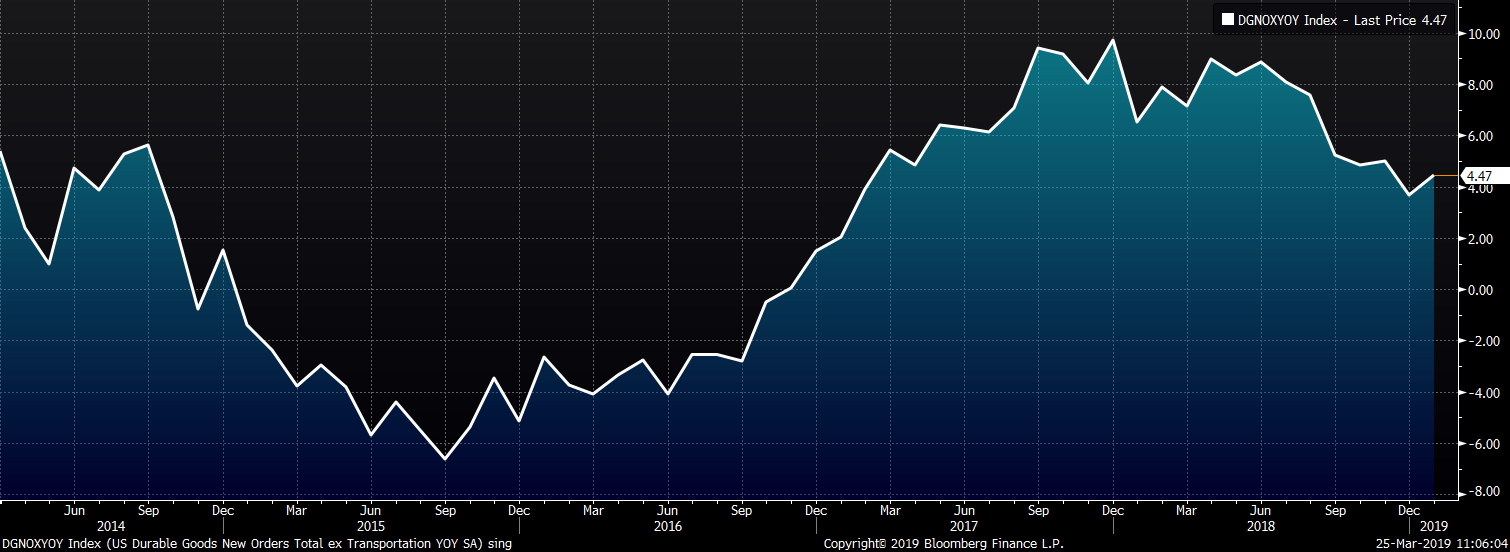

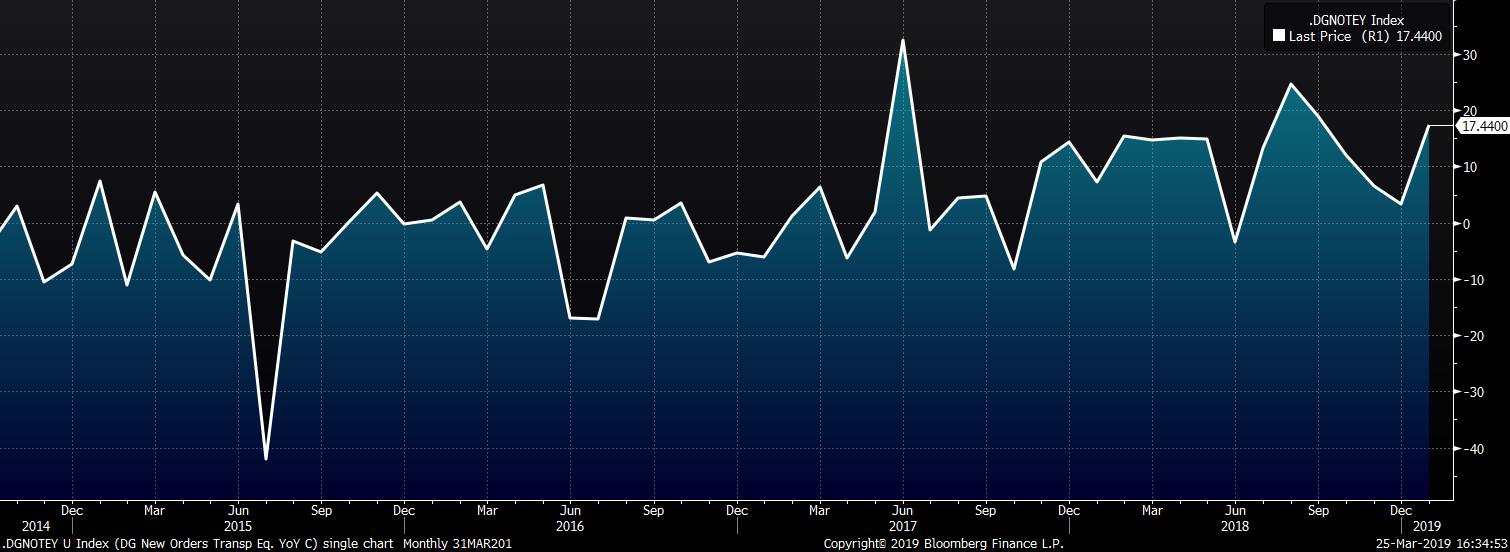

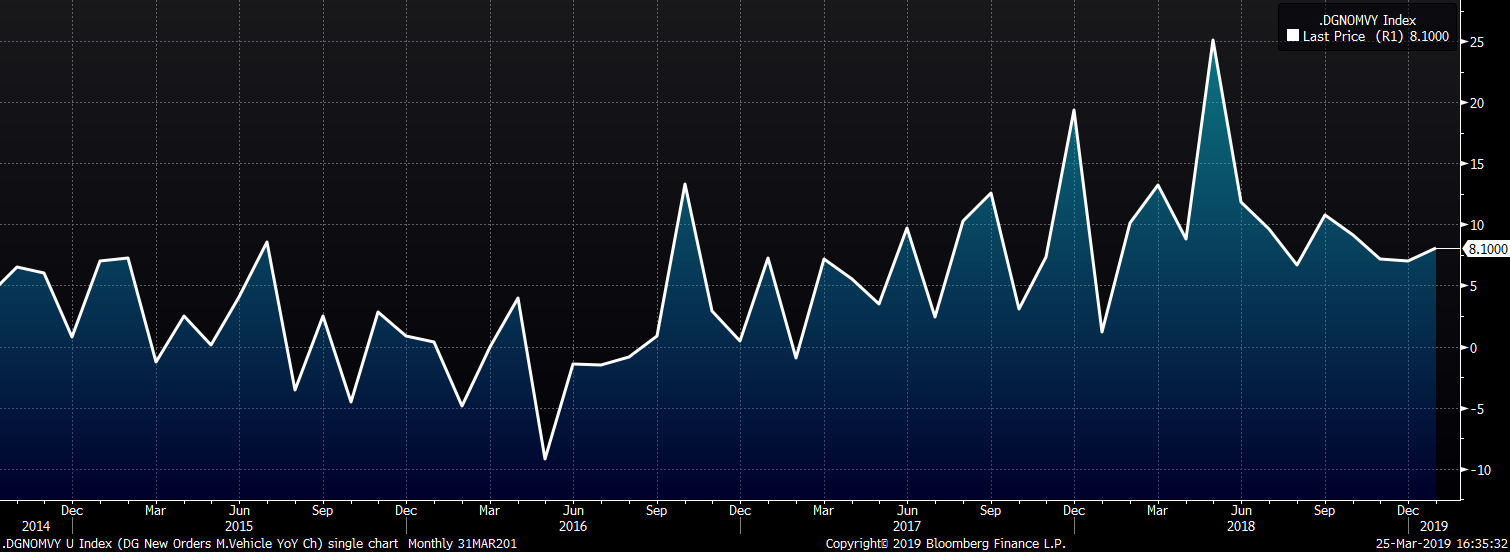

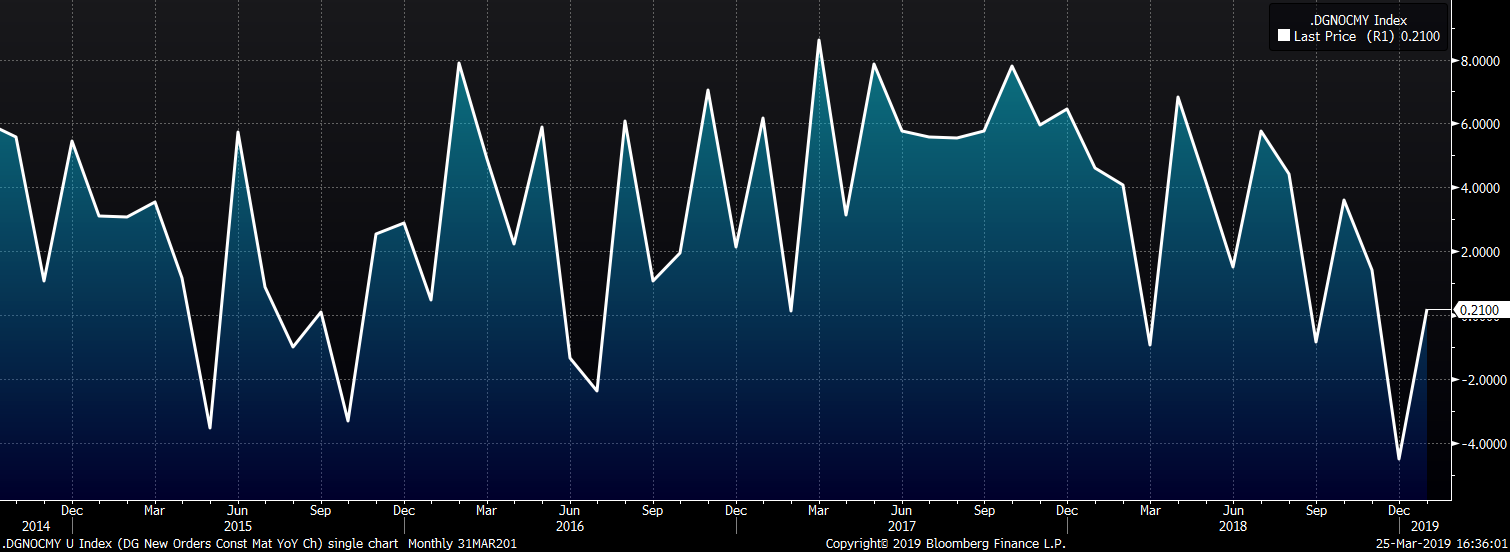

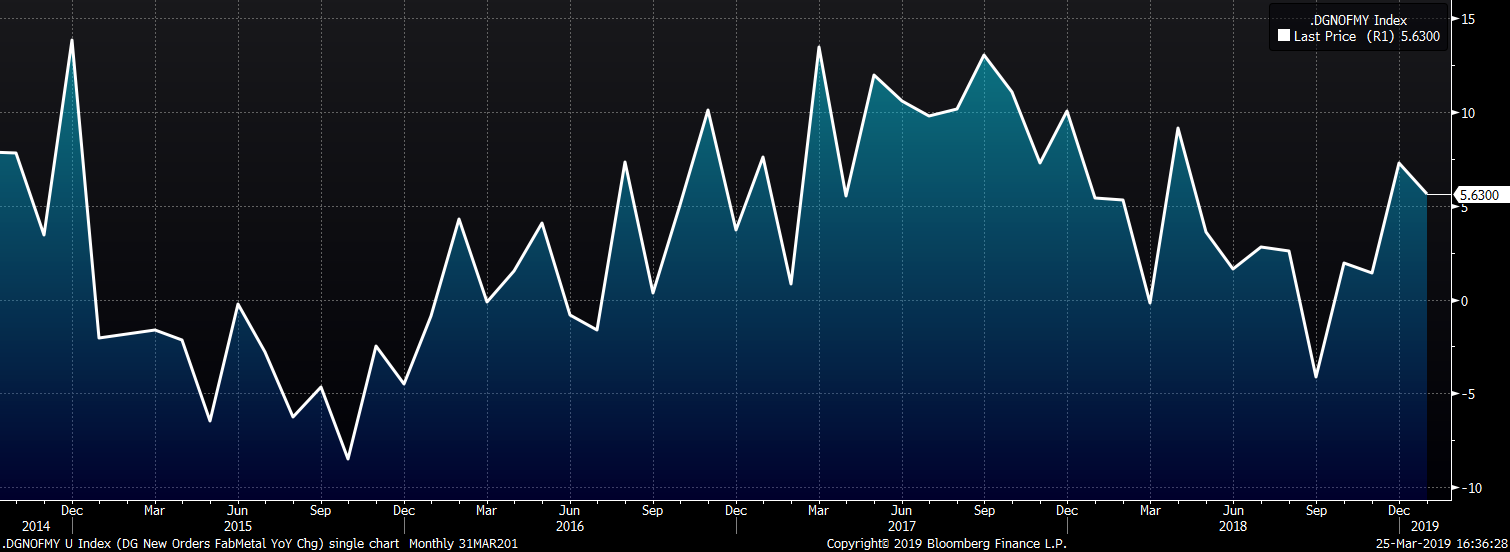

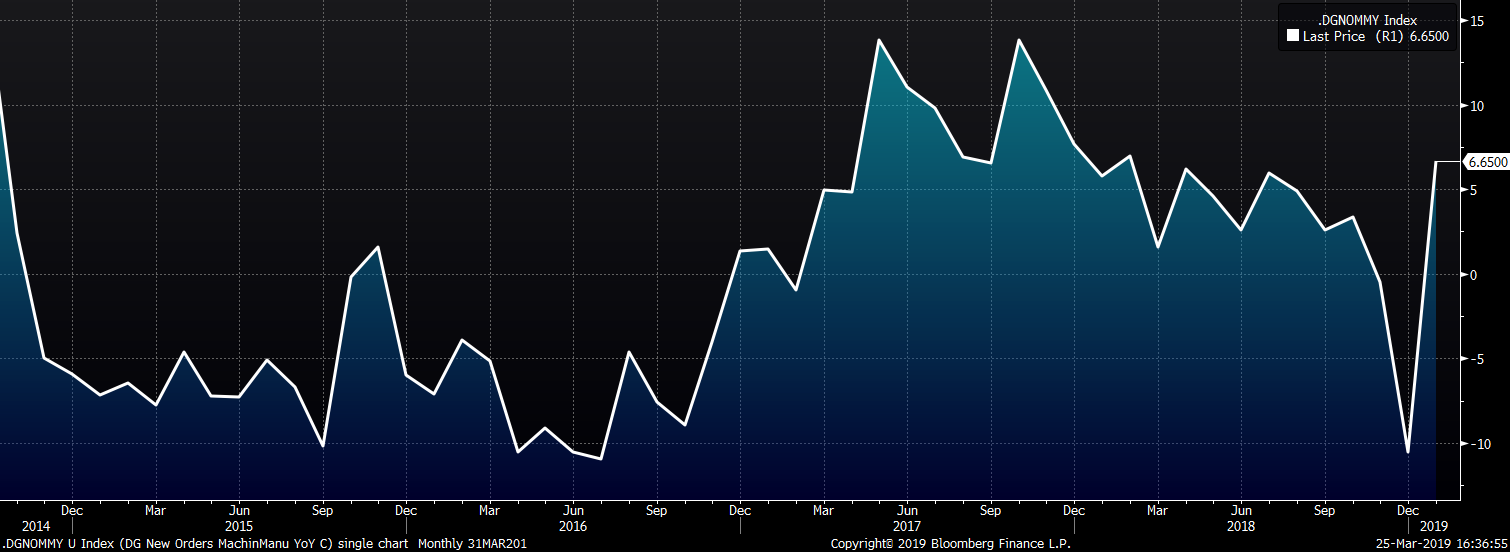

These charts show the YoY percentage change in new orders for the following categories. These charts show a clearer picture of slowing growth across the manufacturing industry with most categories showing a downtrend in YoY growth.

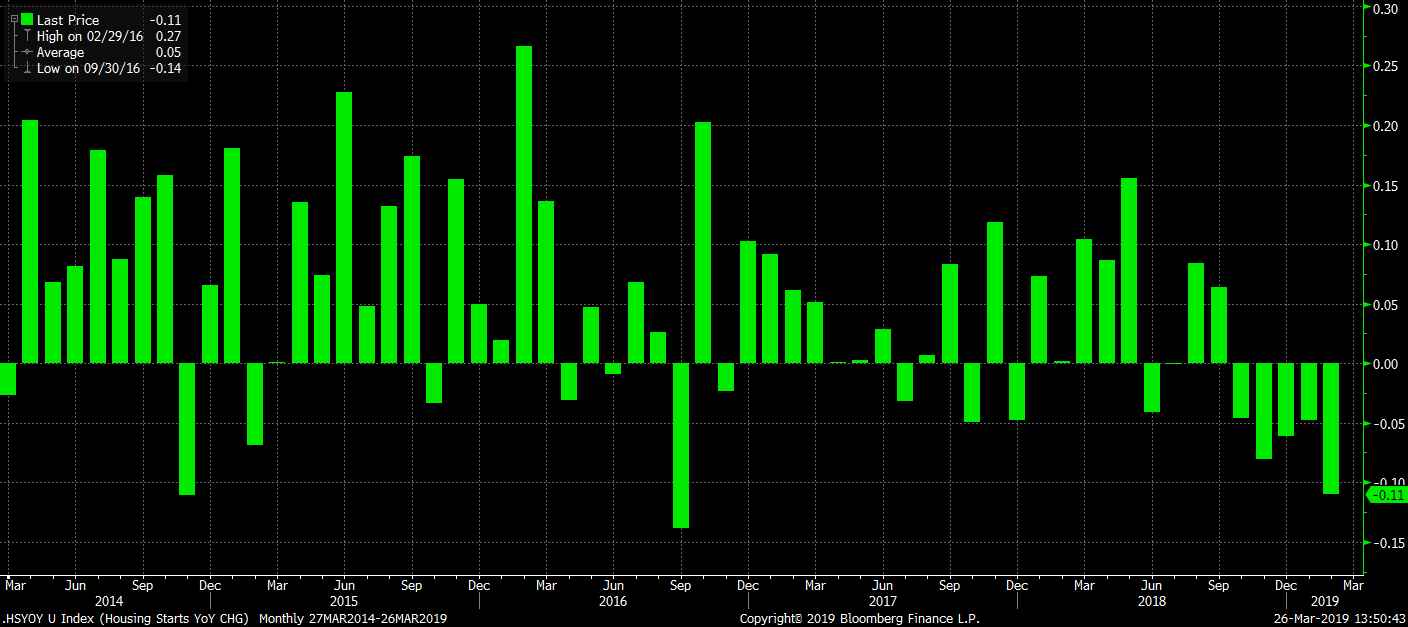

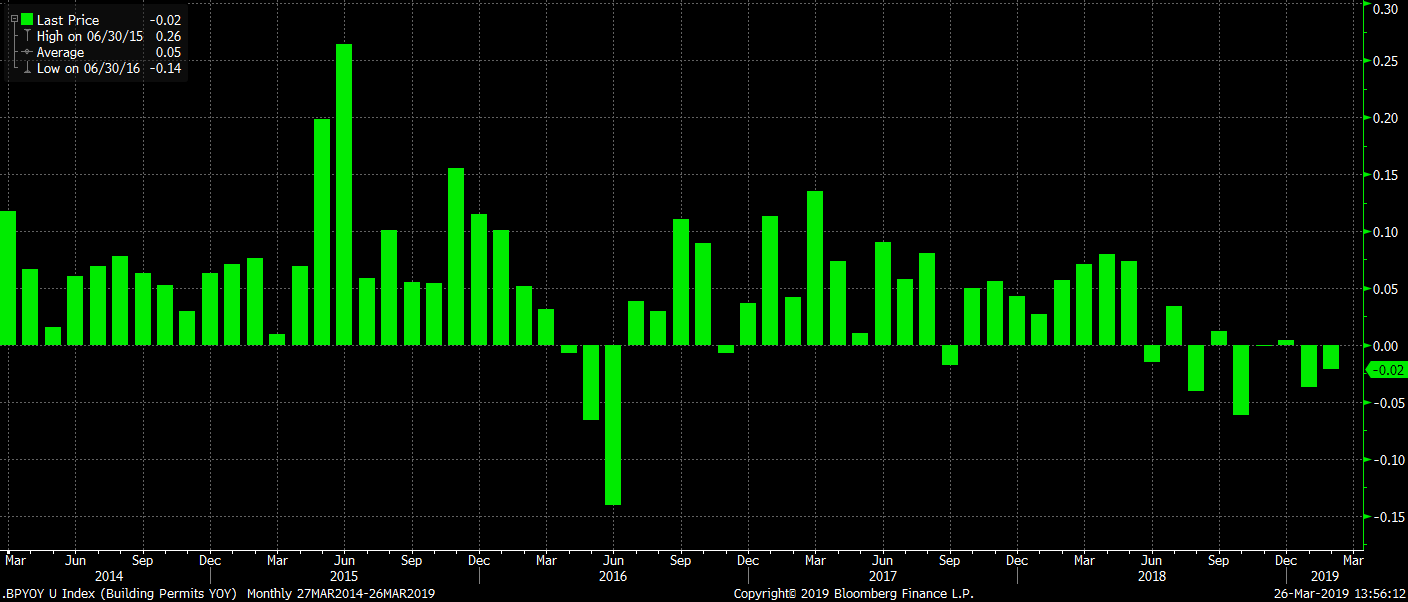

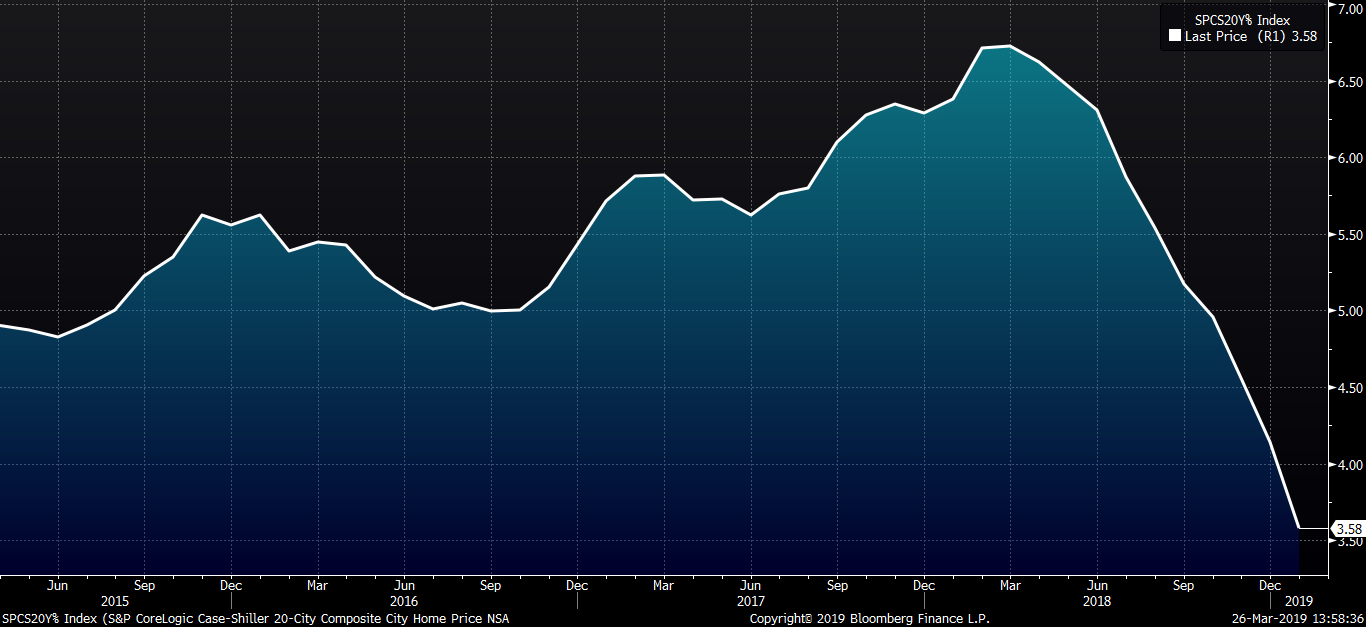

Residential construction data continues to worsen. February housing starts and building permits fell MoM, saw negtive YoY growth and disappointed expectations. The Case-Shiller 20-City Home Price Index NSA YoY % Change continues to plummet.

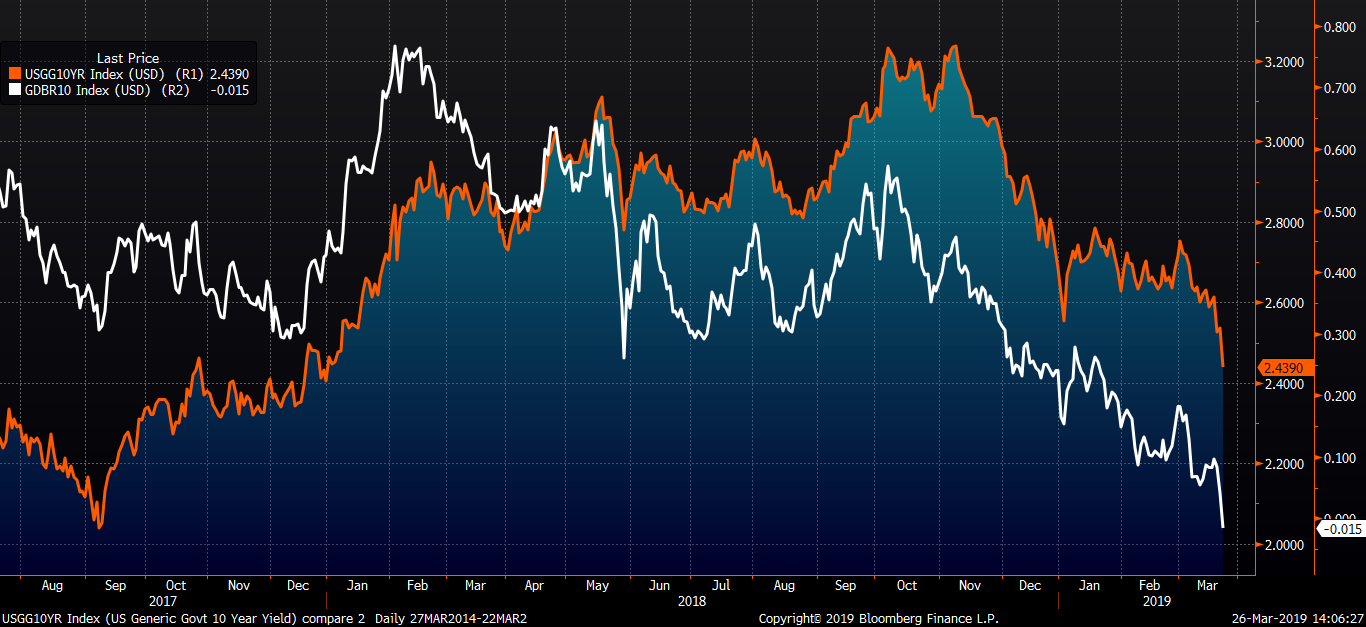

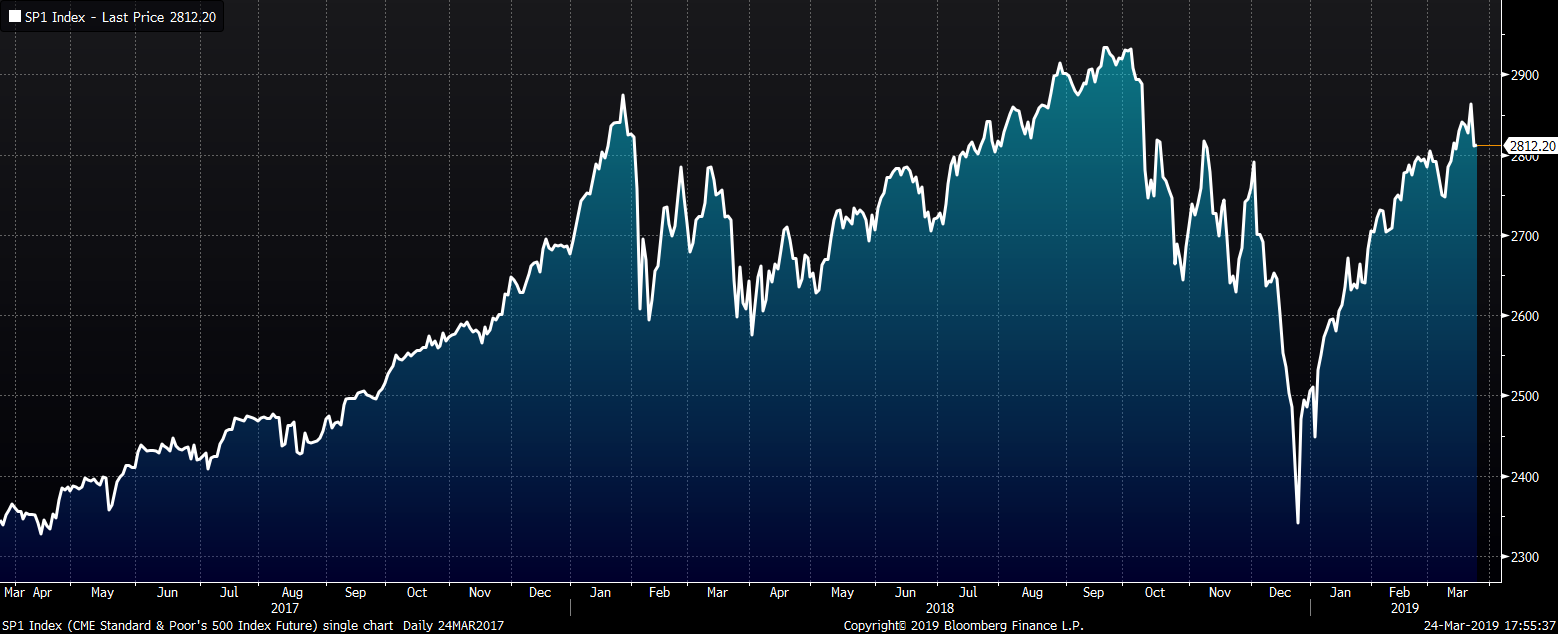

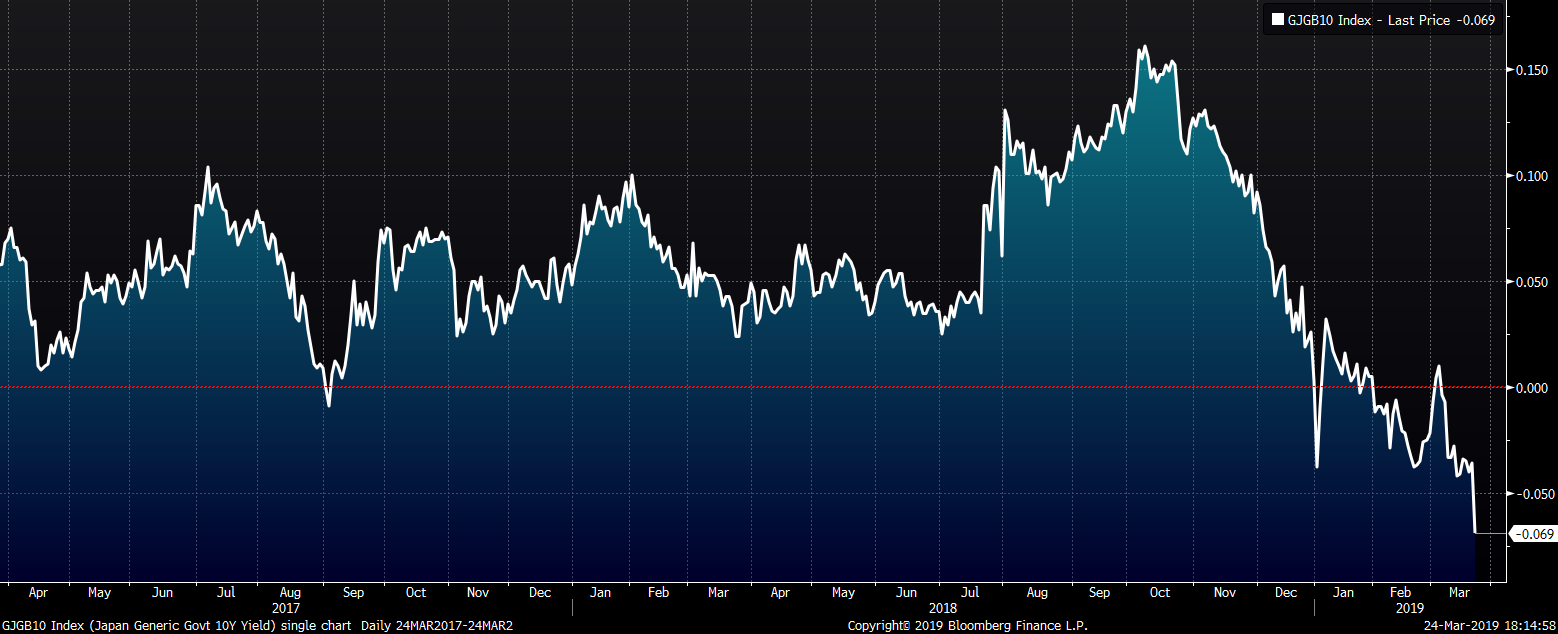

Following the FOMC’s rate decision to keep rates unchanged, dovish statement and dovish press conference, the U.S. ten-year Treasury fell to close the week at 2.44%, the lowest level since January 2018 while the yield on the German ten-year Bund fell into negative territory.

Seasonally adjusted January U.S. construction spending was up a better than expected 1.3% MoM and 0.3% YoY.

Upside Risks:

Downside Risks:

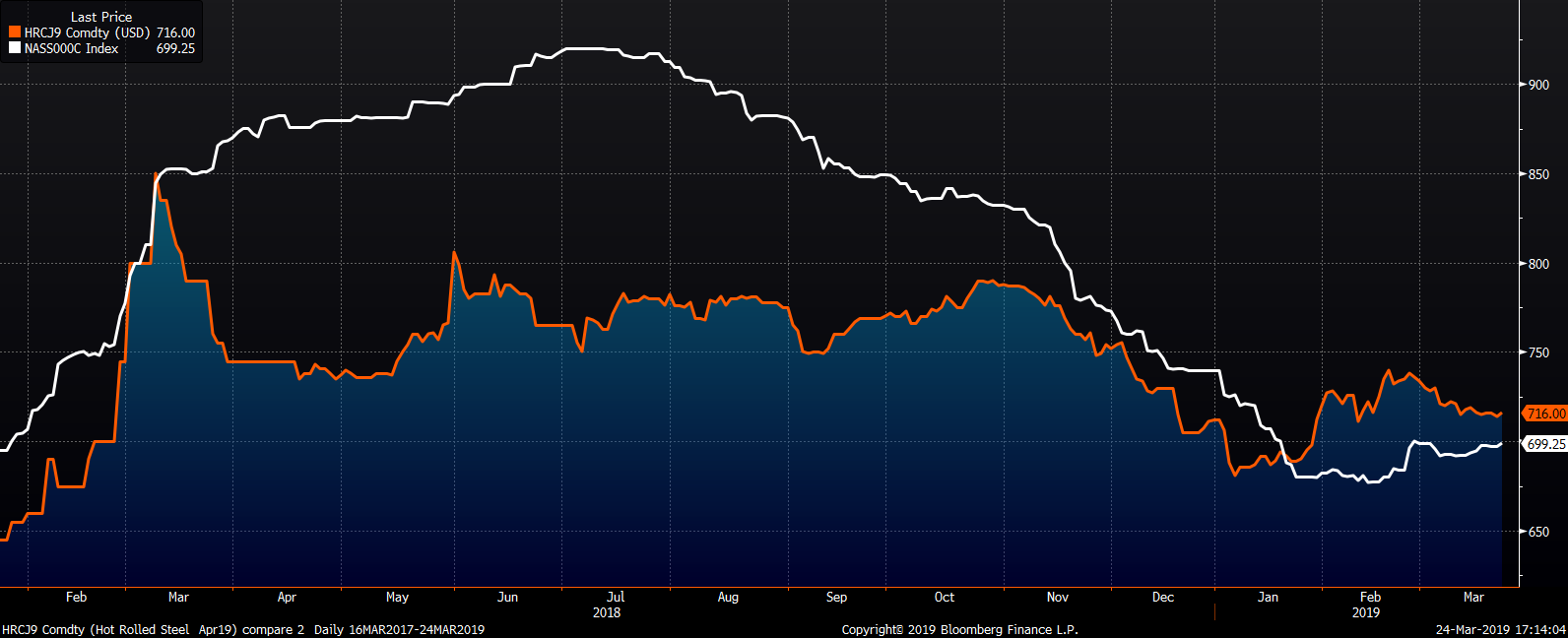

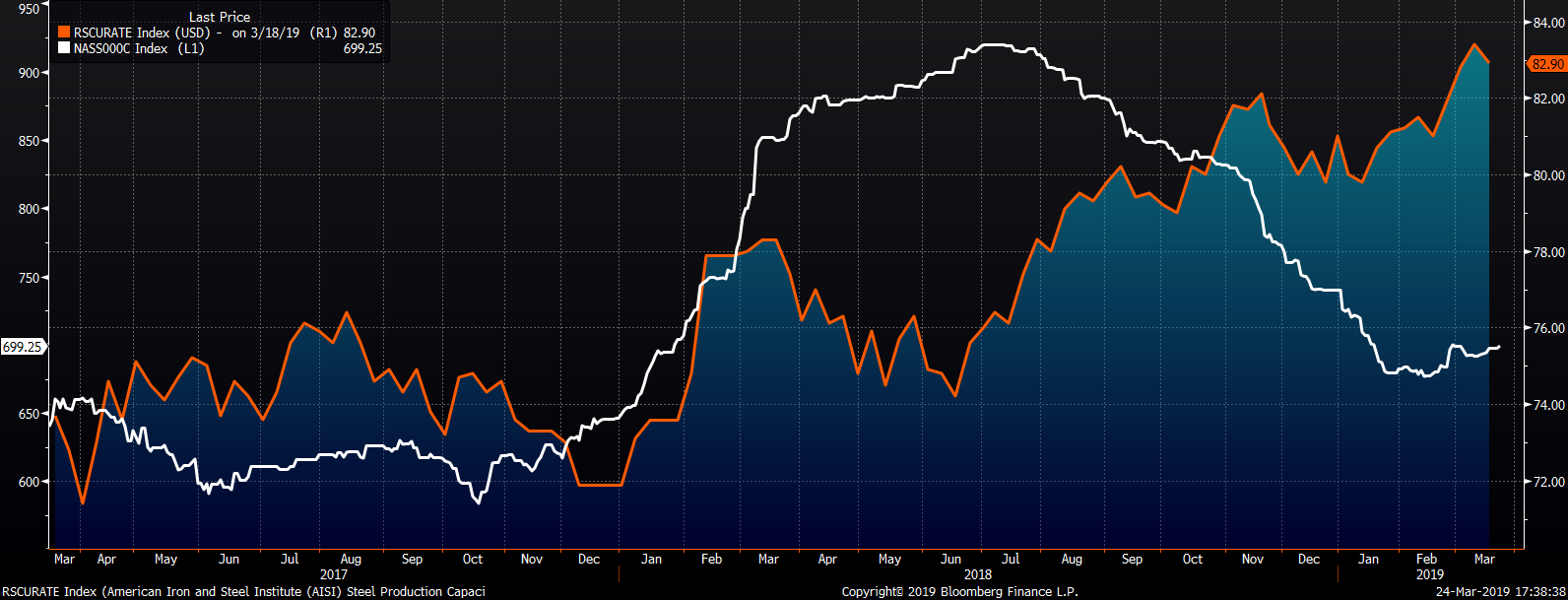

The April CME Midwest HRC future was unchanged at $716, while the Platts TSI Daily Midwest HRC Index was up $4.75 to $699.25.

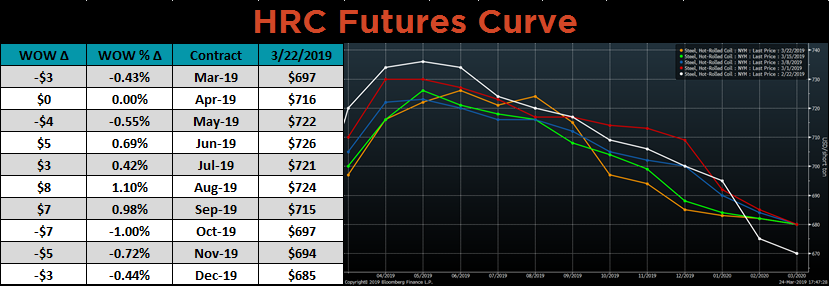

The CME Midwest HRC futures curve shown below with last Friday’s settlements in orange.

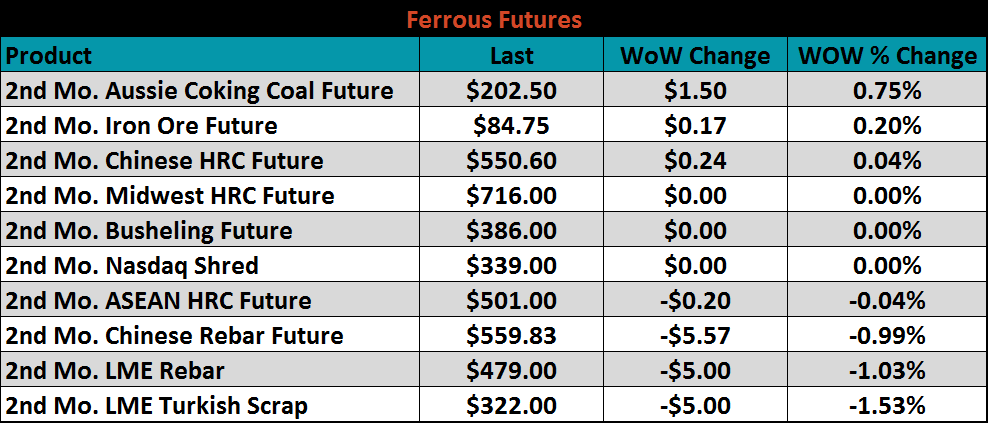

April ferrous futures saw little change. April LME Turkish scrap lost 1.5%.

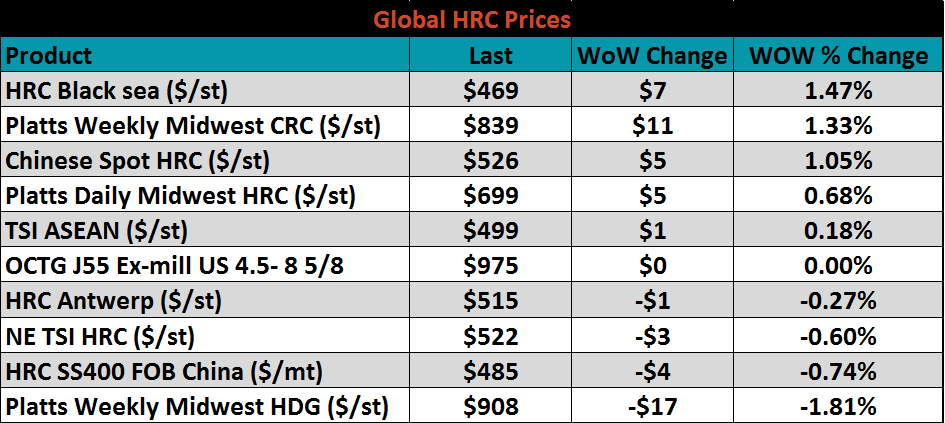

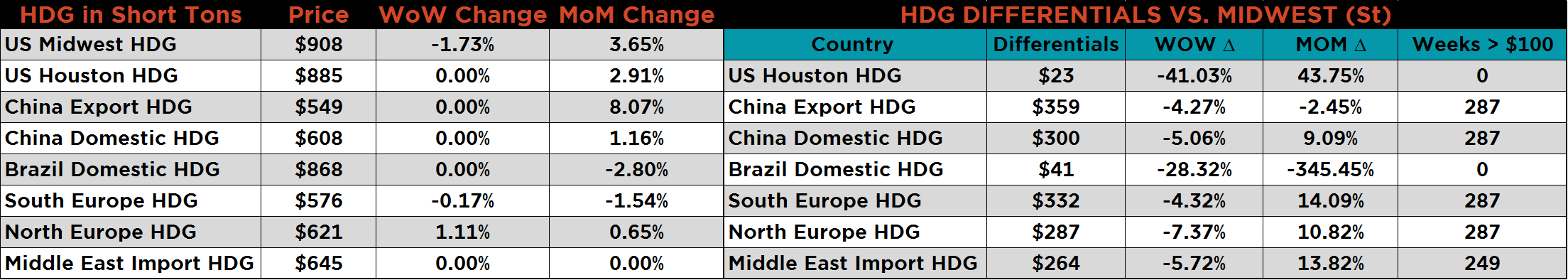

Flat rolled indexes were mixed. Midwest HDG was down 1.8%.

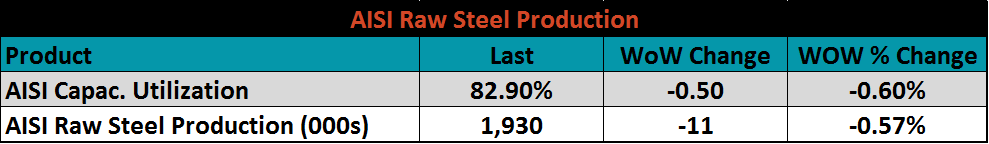

The AISI Capacity Utilization Rate decreased to 82.9%.

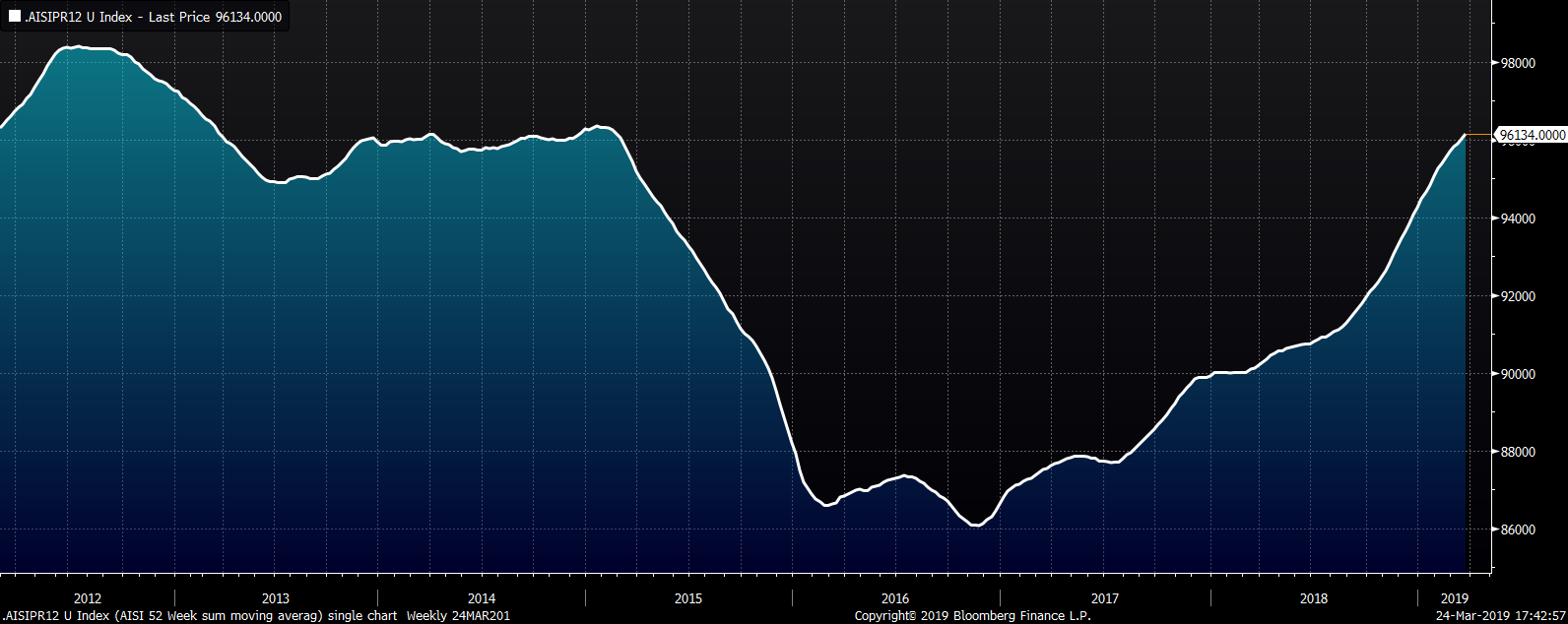

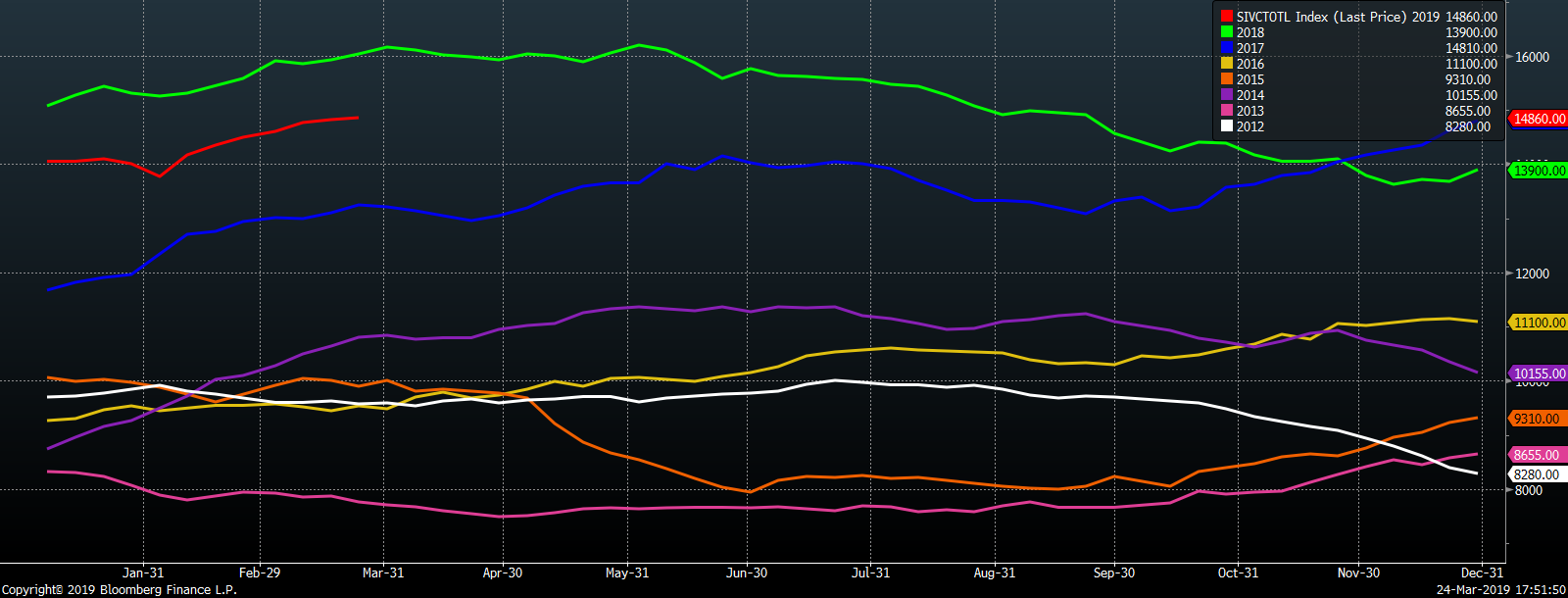

This chart is a moving sum of the last fifty-two weeks of AISI crude steel production data and show AISI mills are producing crude steel at a tonnage rate not seen since 2014. This is likely a major factor muting higher flat rolled prices, despite ultra-low flat rolled imports and service center inventory.

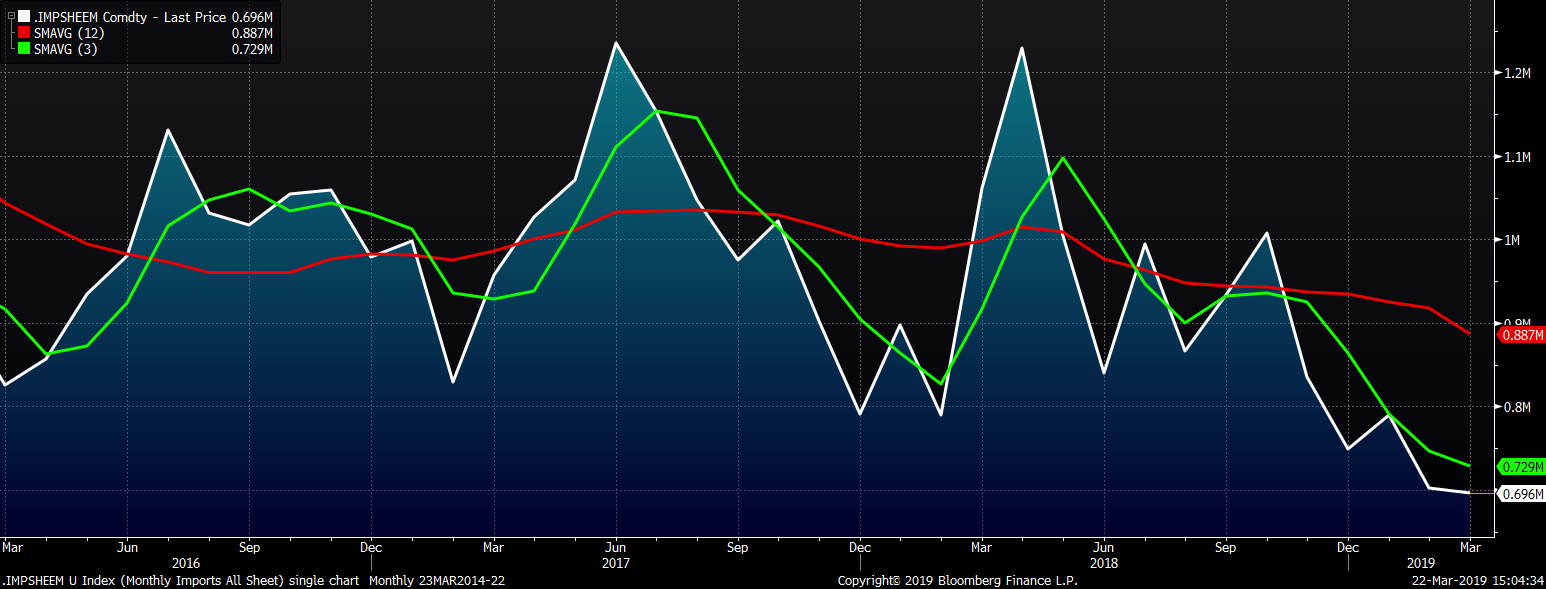

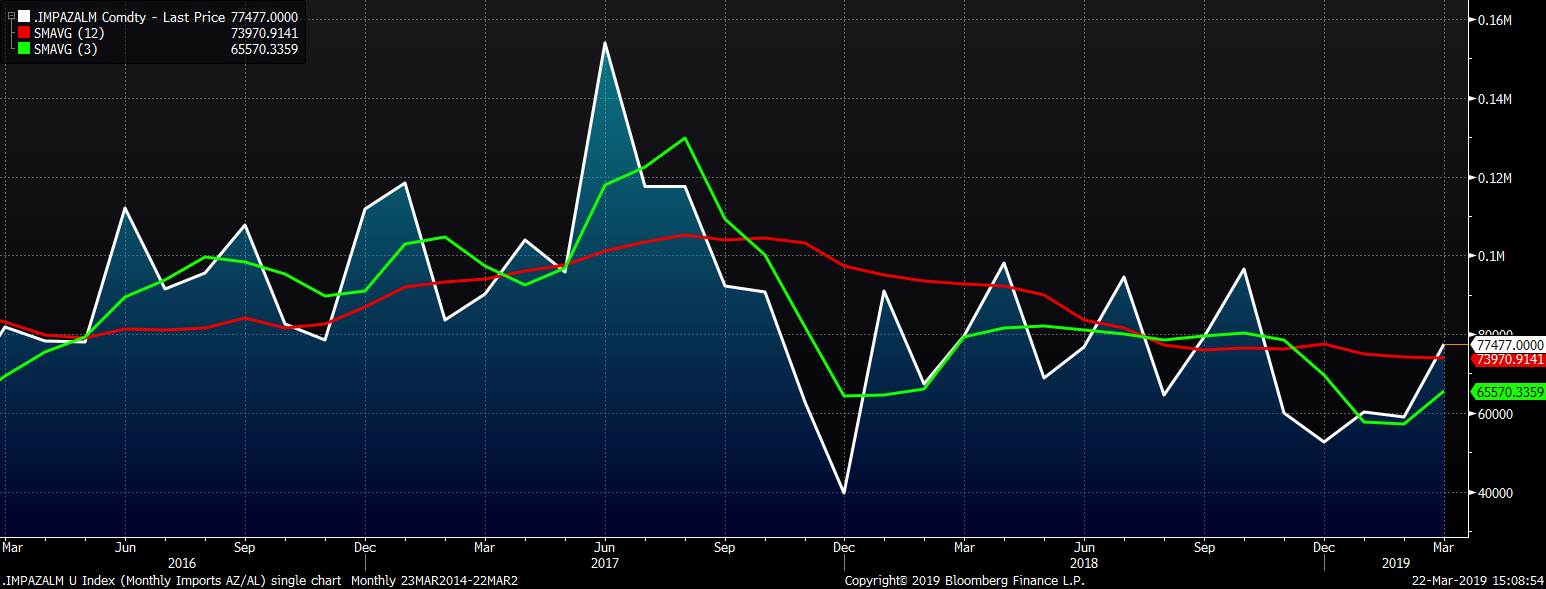

March flat rolled import licenses are forecast to fall slightly MoM to 696k while February flat rolled import licenses are forecast to fall 88k tons MoM to 702k.

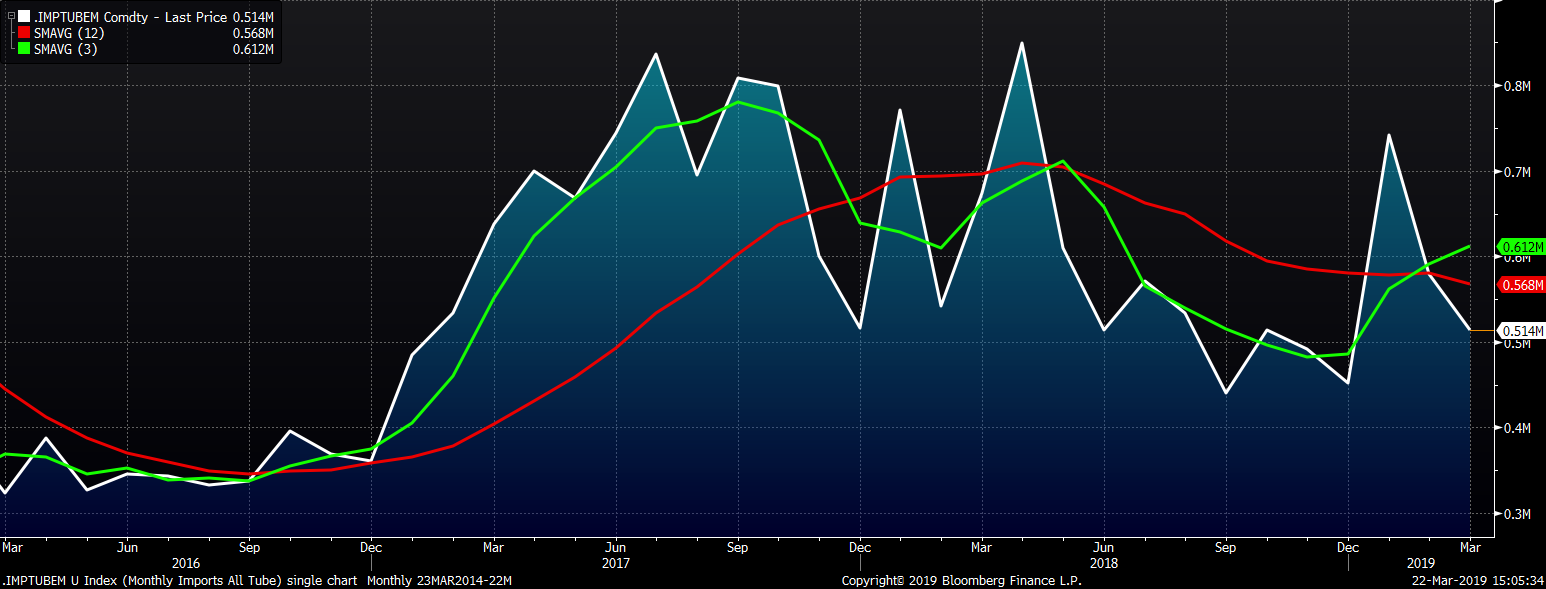

March tube import license data is forecasted to fall 67k to 513k tons MoM after another steep drop in February.

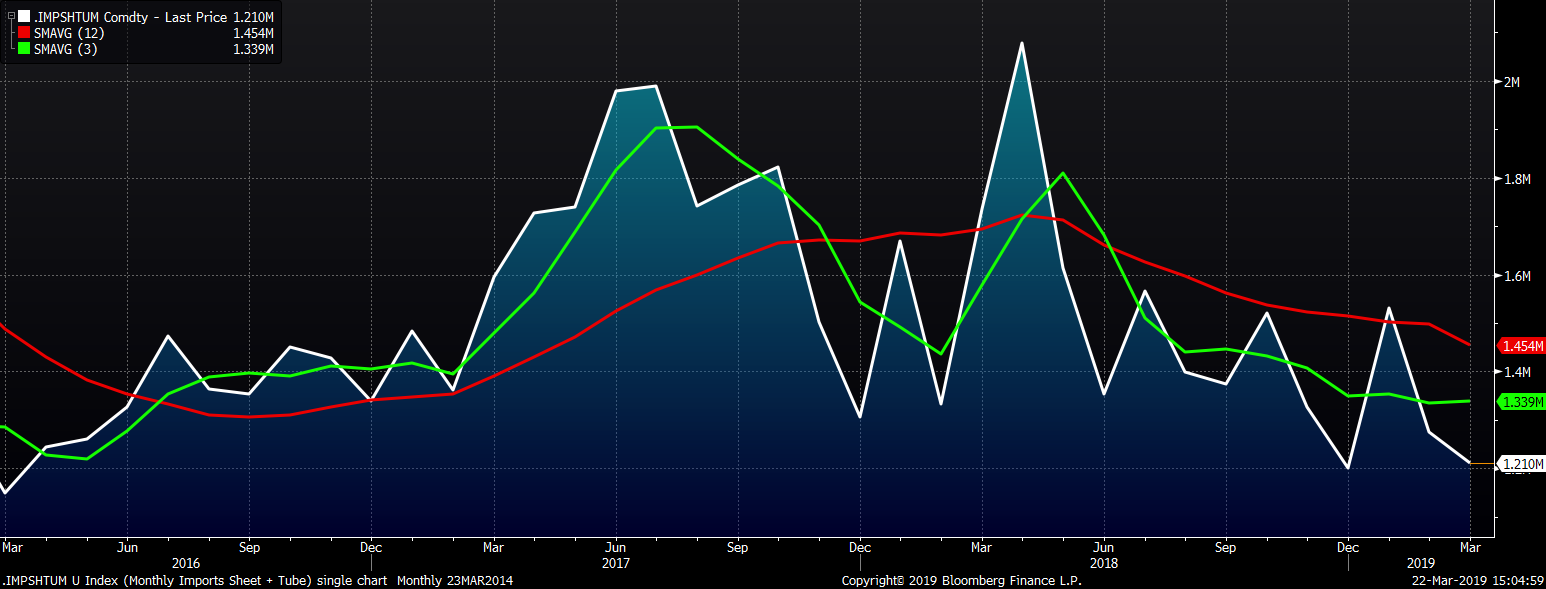

The combined flat and tube import license forecast looks to fall 70k tons in March after a 257k decrease in February.

AZ/AL import licenses are forecast to increase 19k to 77k in March.

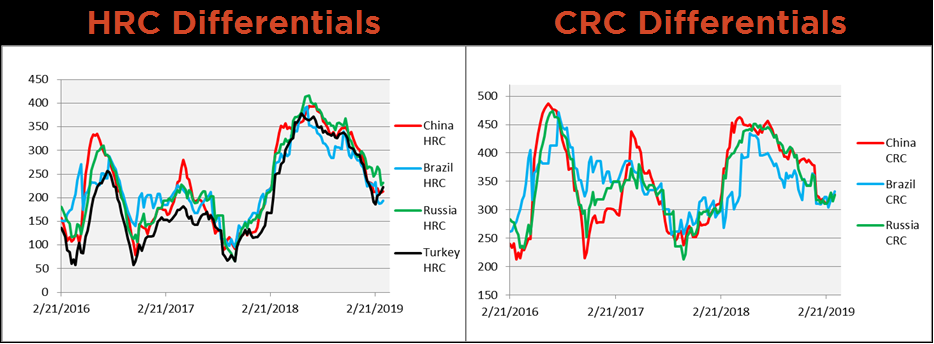

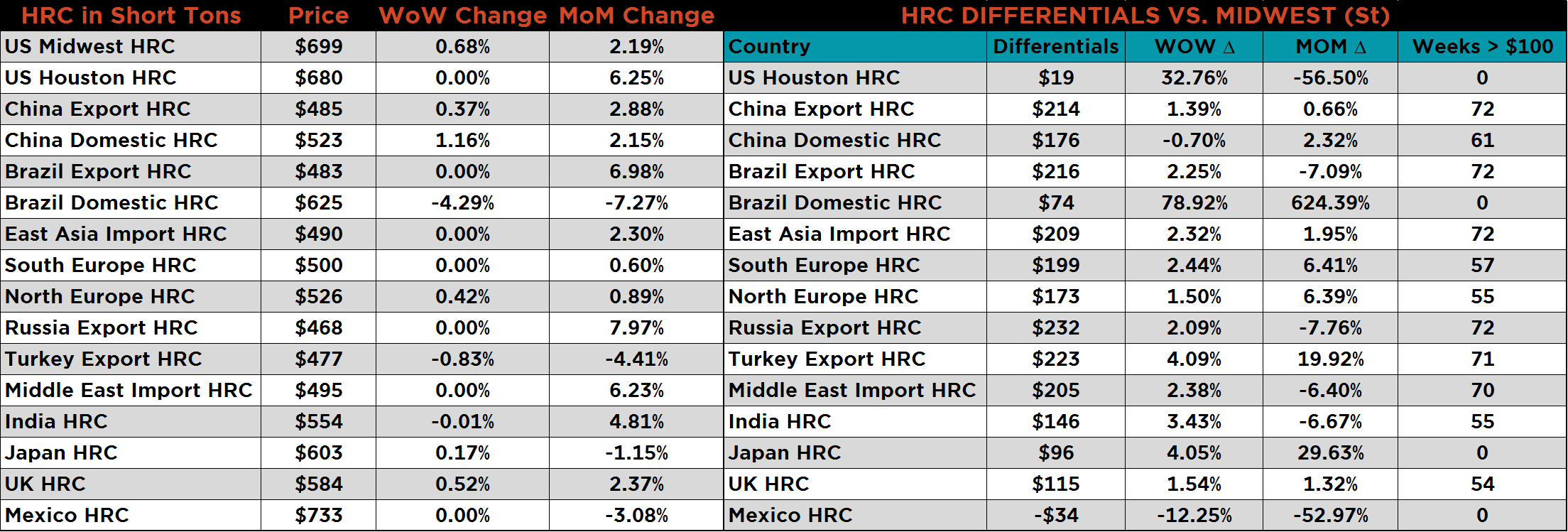

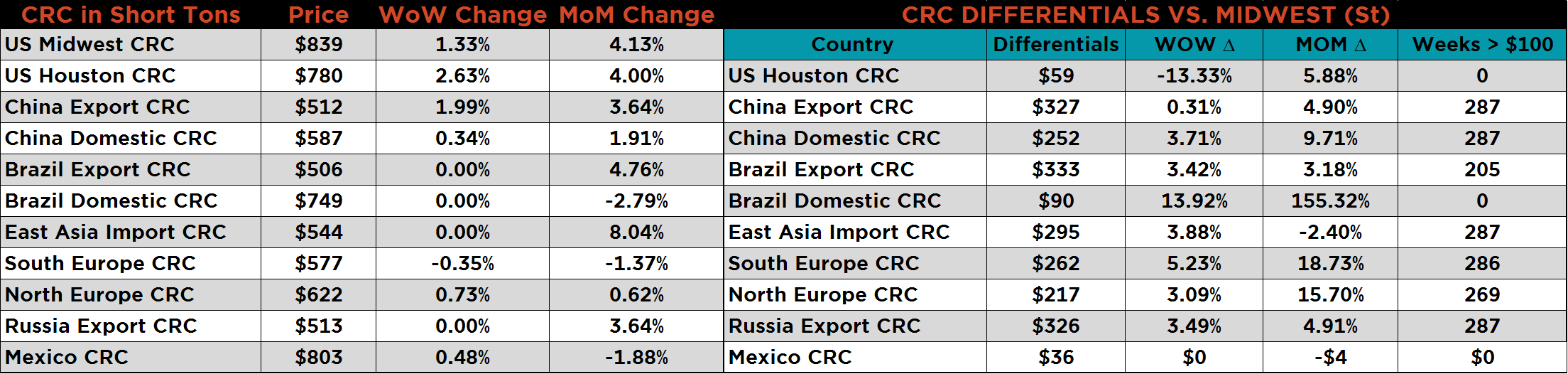

Below are HRC and CRC Midwest vs. each country’s export price differentials using pricing from SBB Platts. Each of the four HRC and three CRC differentials increased last week.

SBB Platt’s HRC, CRC and HDG WoW pricing is below. Midwest HRC and CRC gained while HDG fell. Houston CRC gained 2.6%. Brazilian Domestic HRC fell 4.3%.

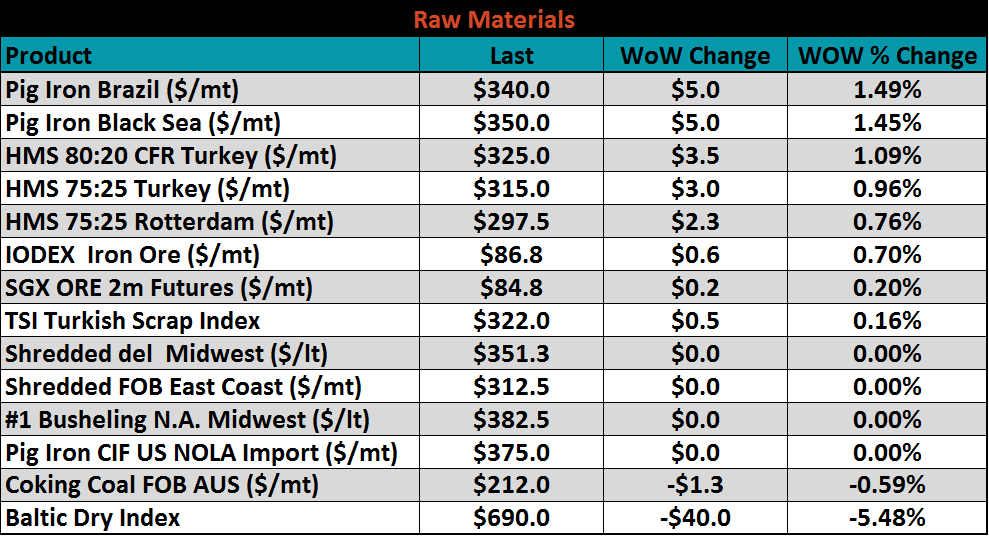

Scrap prices were slightly higher. Brazilian and Black Sea pig iron were each up 1.5%.

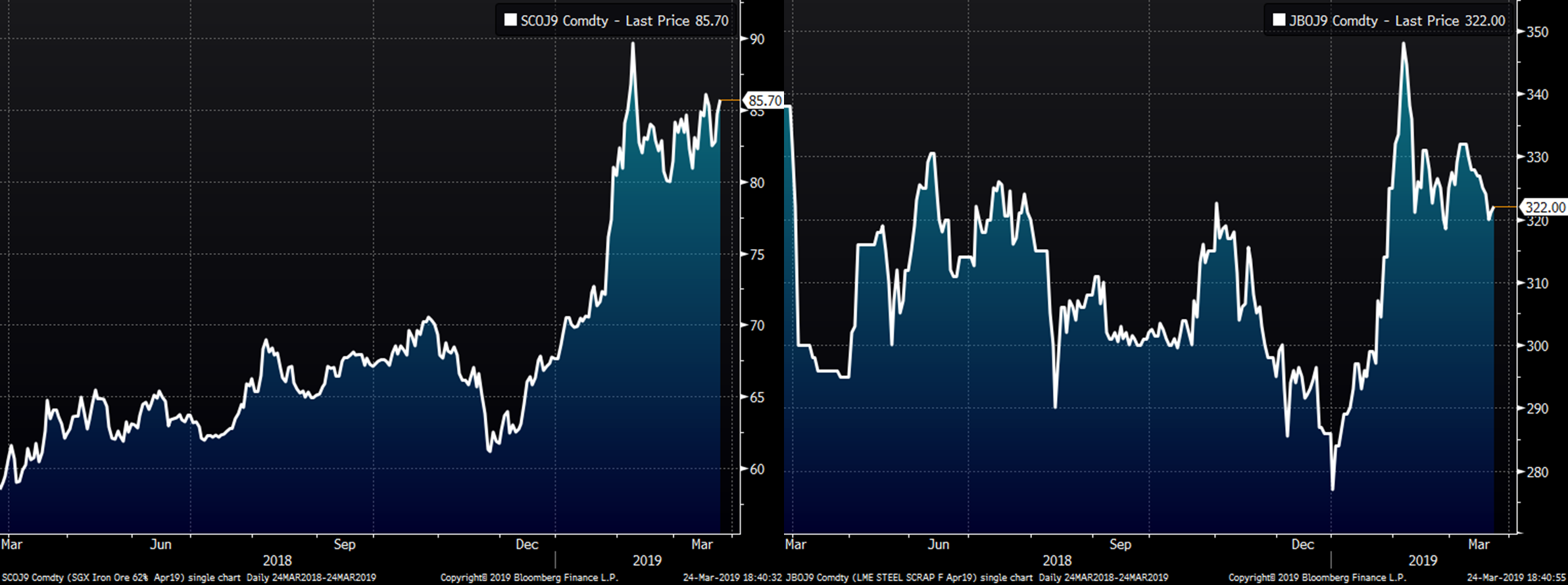

The April SGX iron ore future gained $1.12 to $85.70 and the April Turkish scrap future lost $5 to $322.

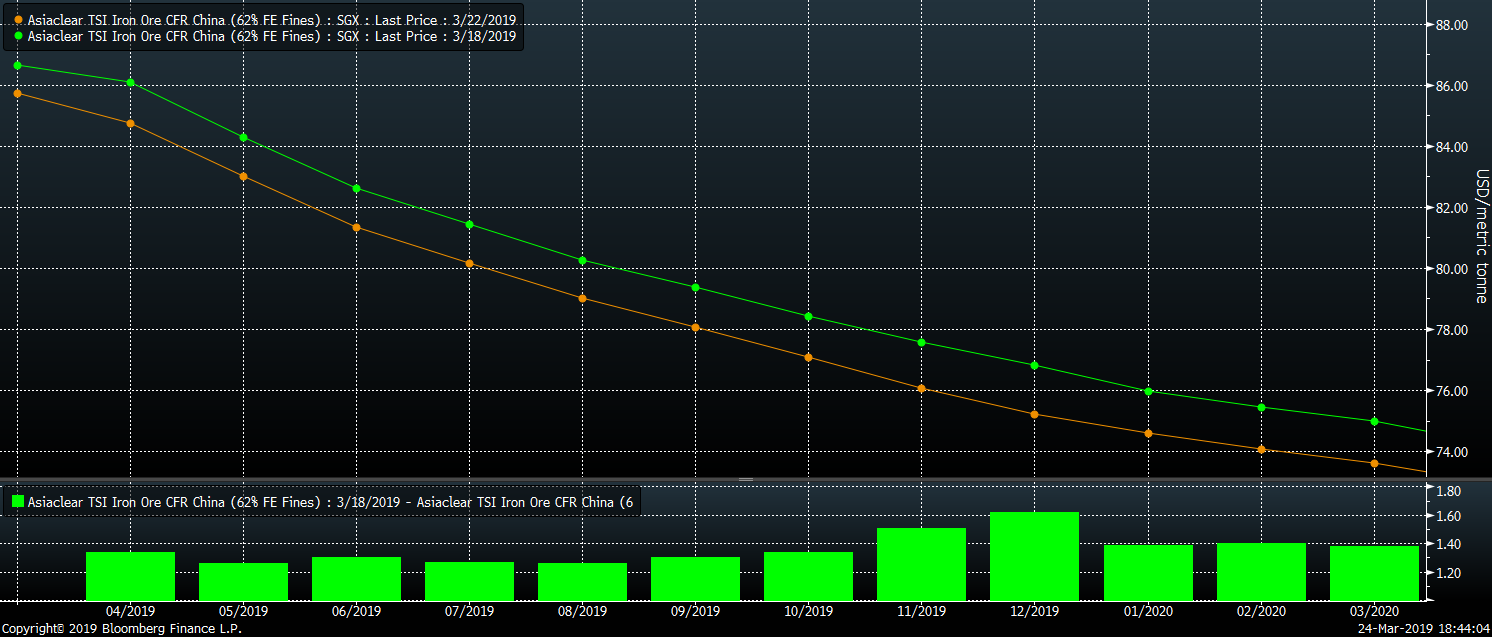

The SGX iron ore futures curve has held most of the gains made following the Vale dam disaster.

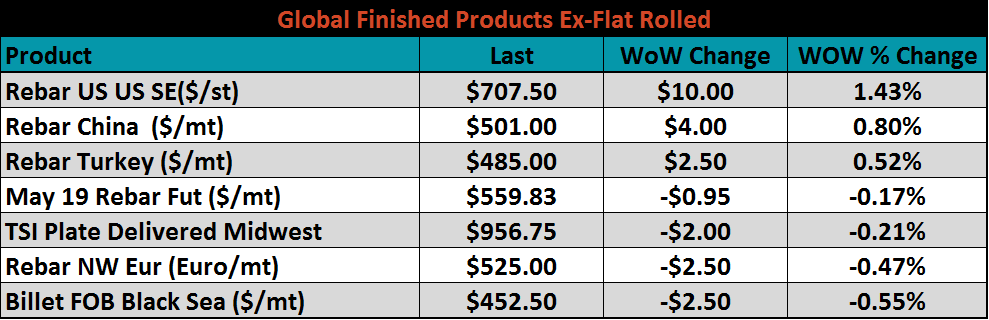

Ex-flat rolled prices saw little movement.

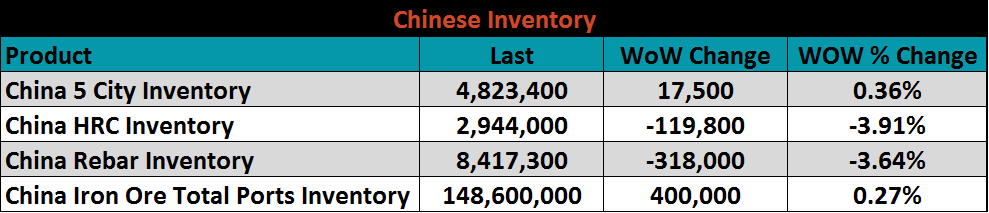

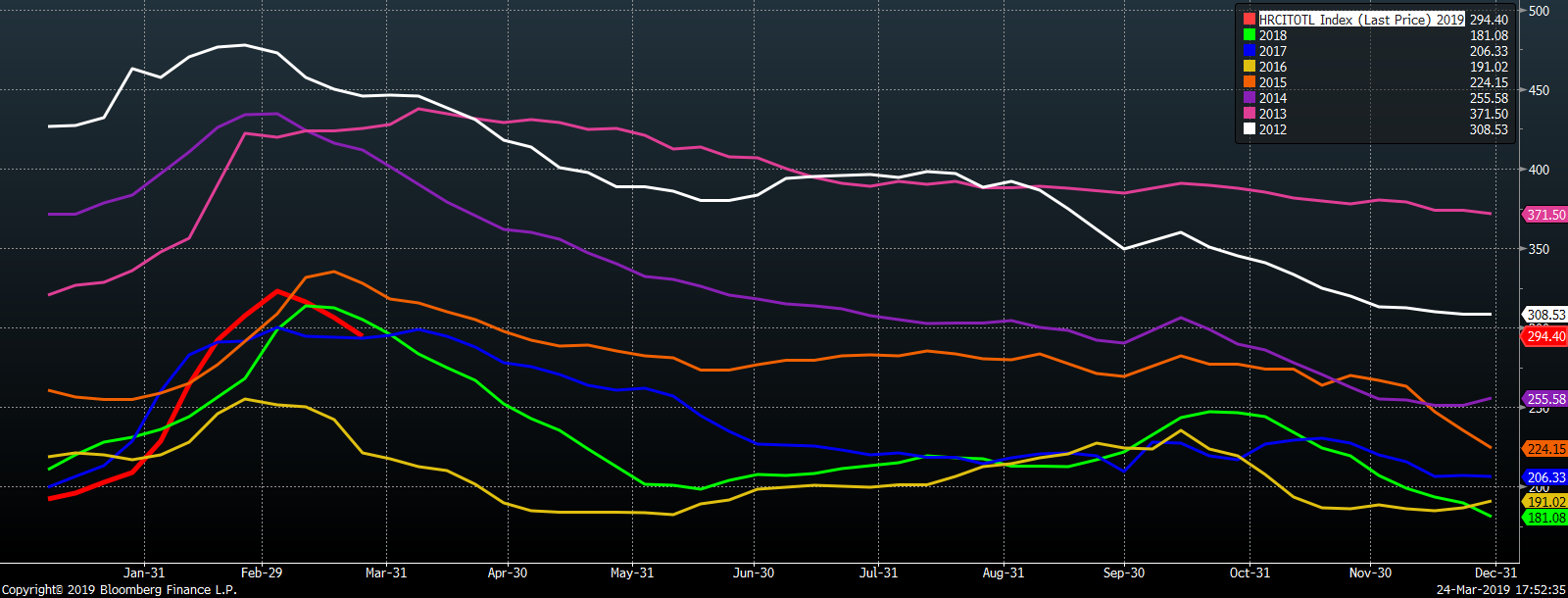

Below are inventory levels for Chinese finished steel products and iron ore. Chinese finished steel inventory levels look to have reached their seasonal peak and started to trend lower.

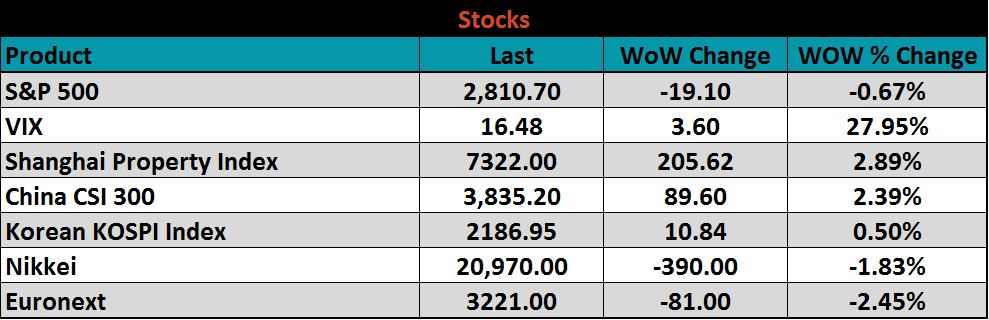

The S&P 500 was down 0.7%. Global markets were mixed. The Shanghai Property Index and the China CSI 300 rose 2.9% and 2.4%, respectively.

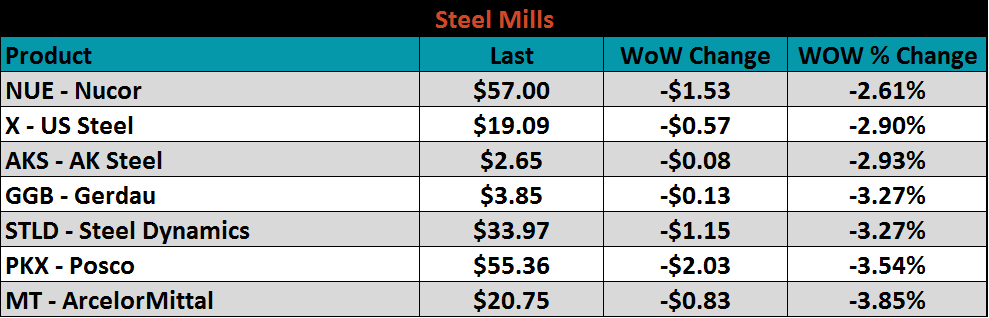

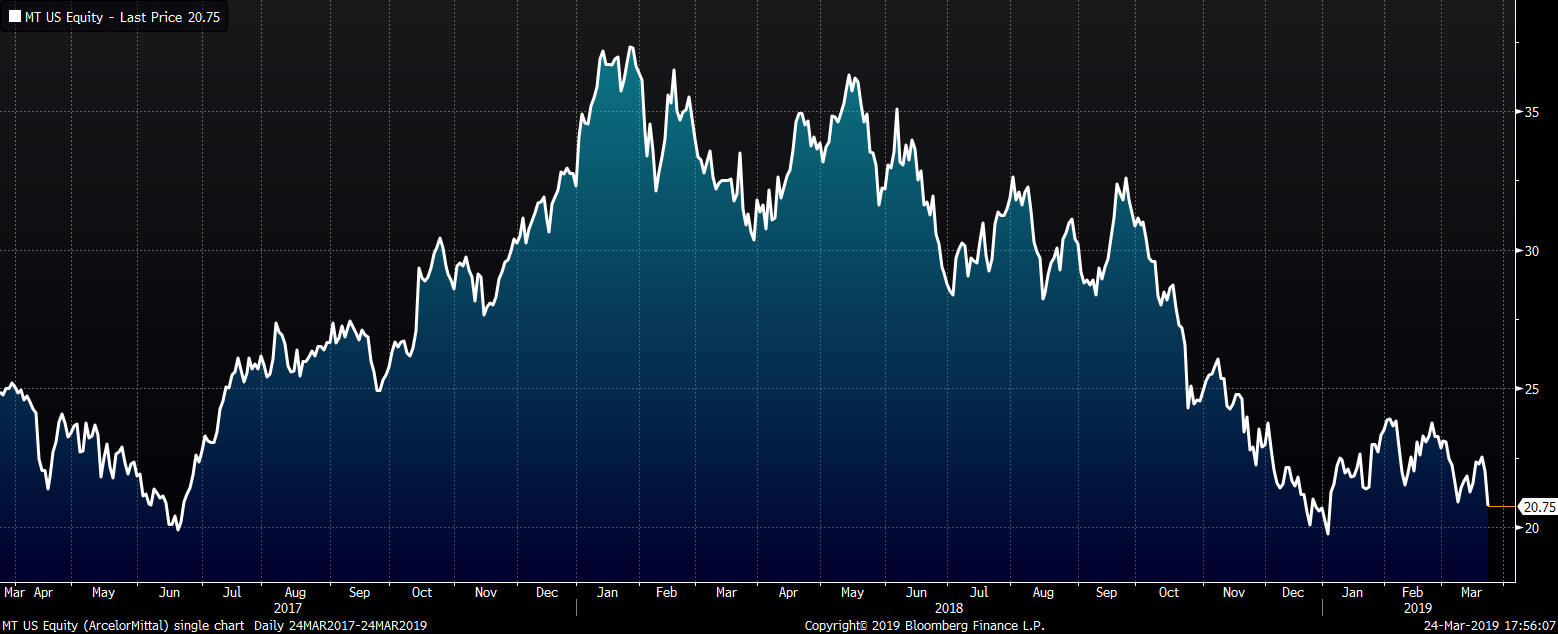

Steel mill stocks were all lower last week. ArcelorMittal led the group, falling 3.9%.

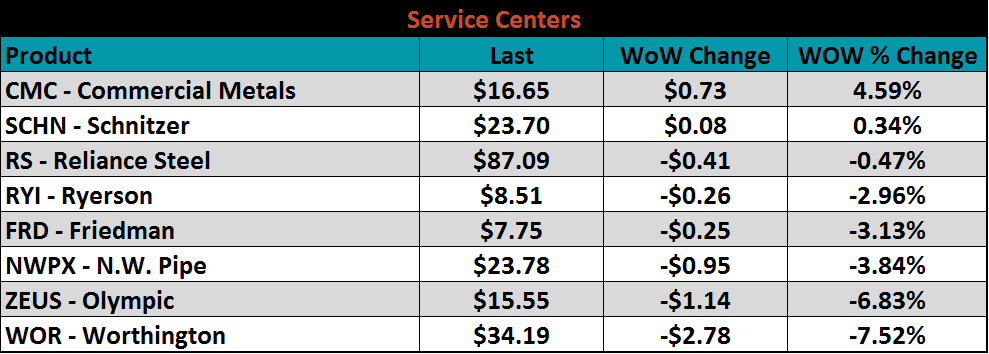

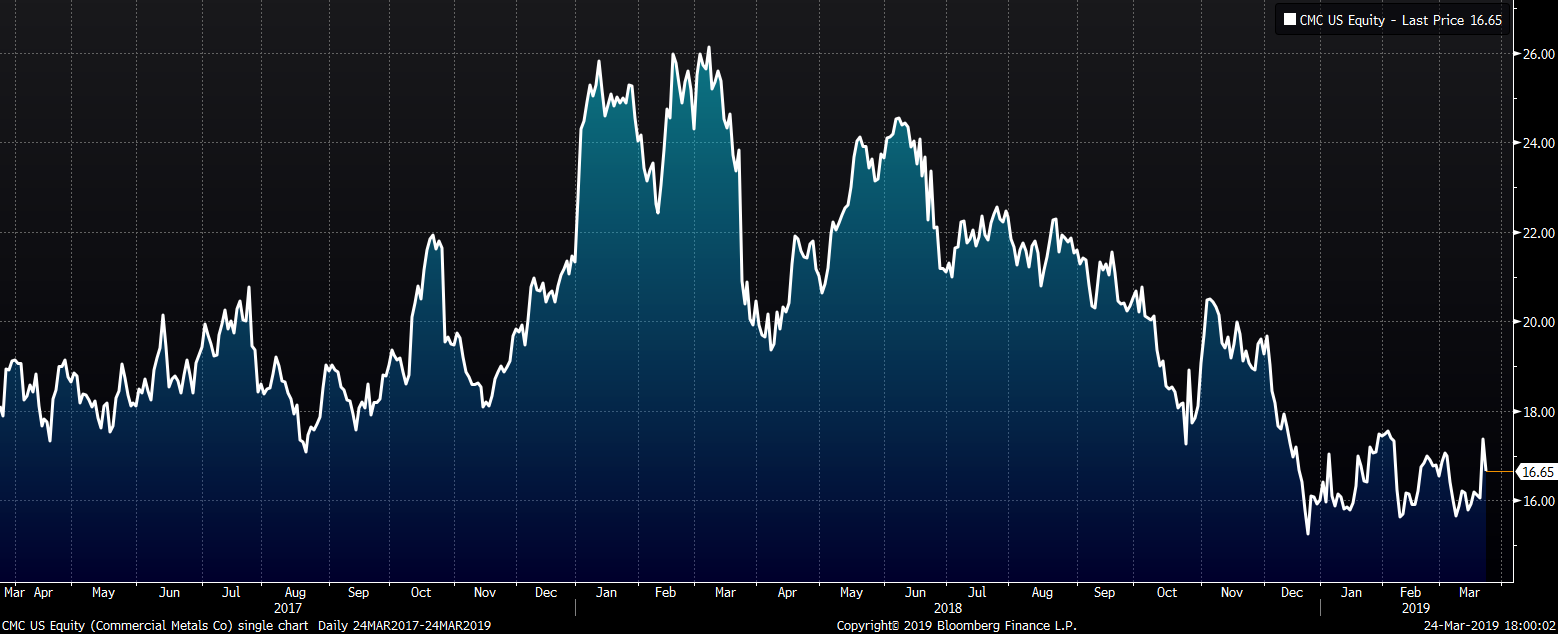

Service center stocks were mostly lower, led by Worthington, which lost 7.5%, while Commercial Metals rose 4.6%.

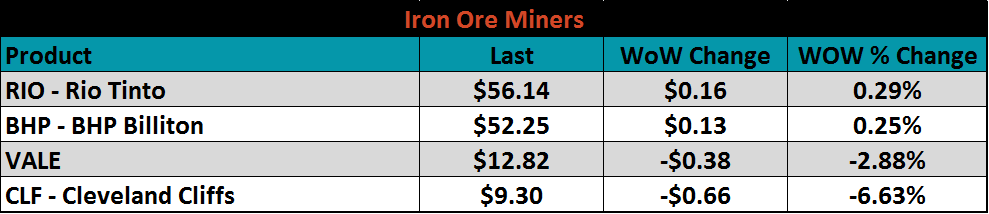

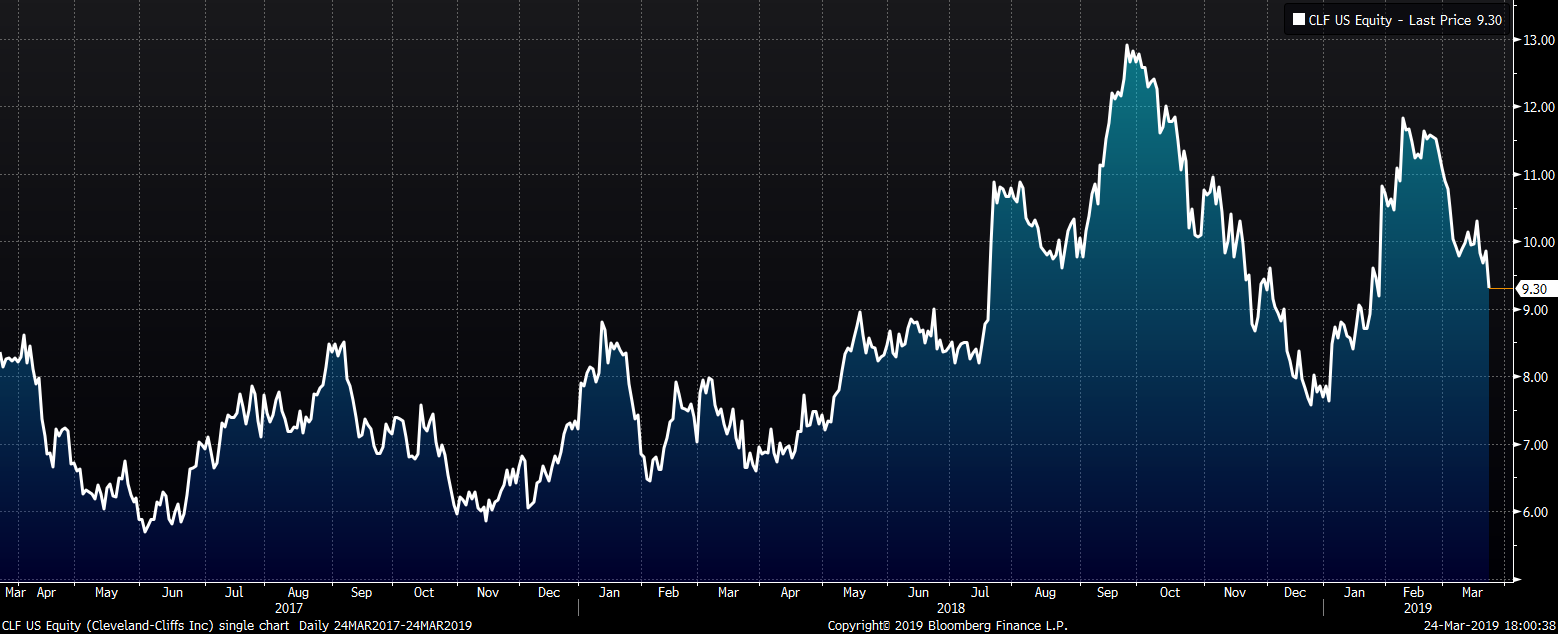

Mining’s stocks were mixed. Cleveland Cliffs fell 6.6%.

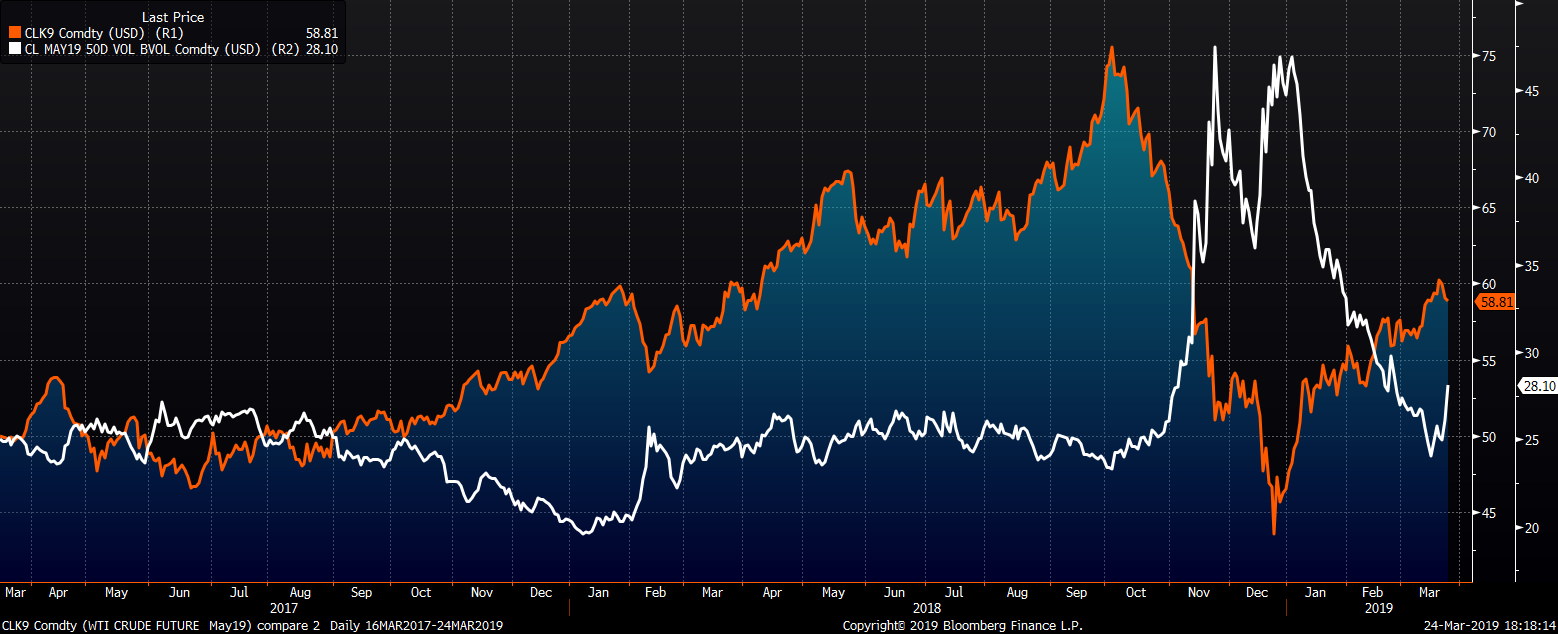

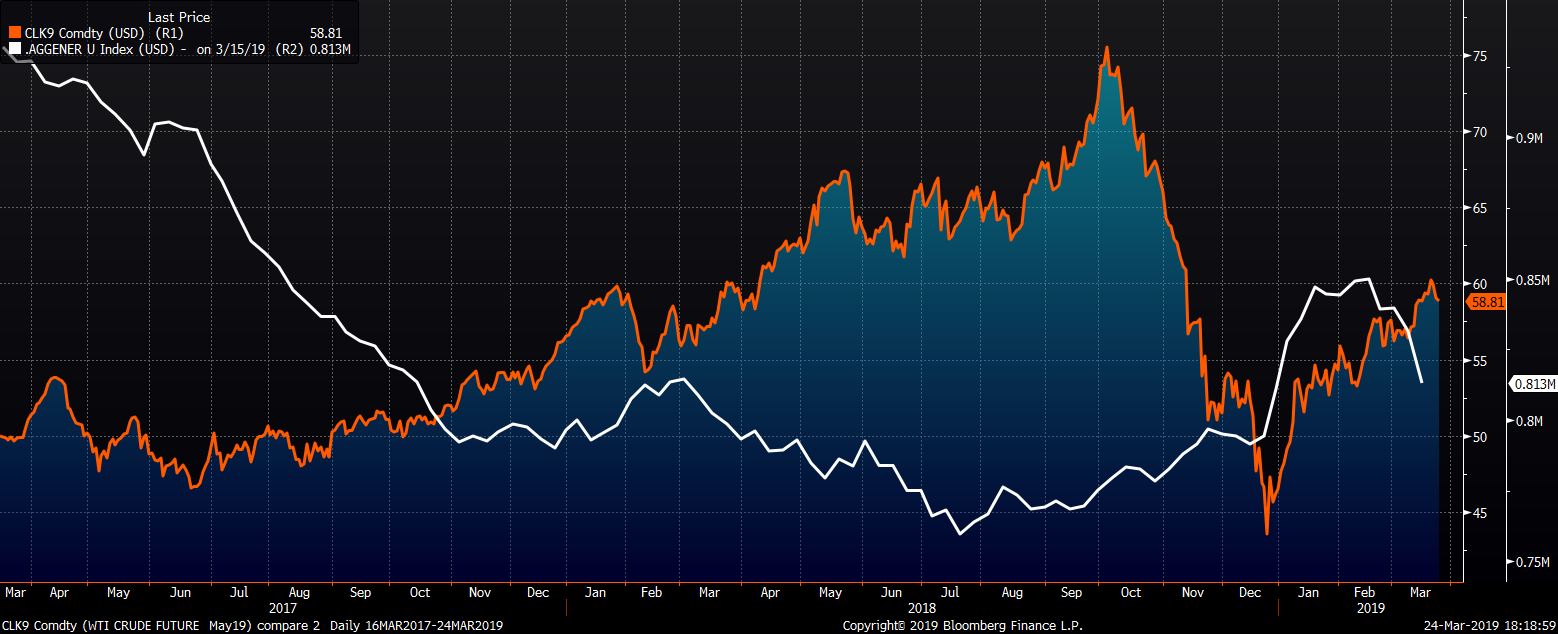

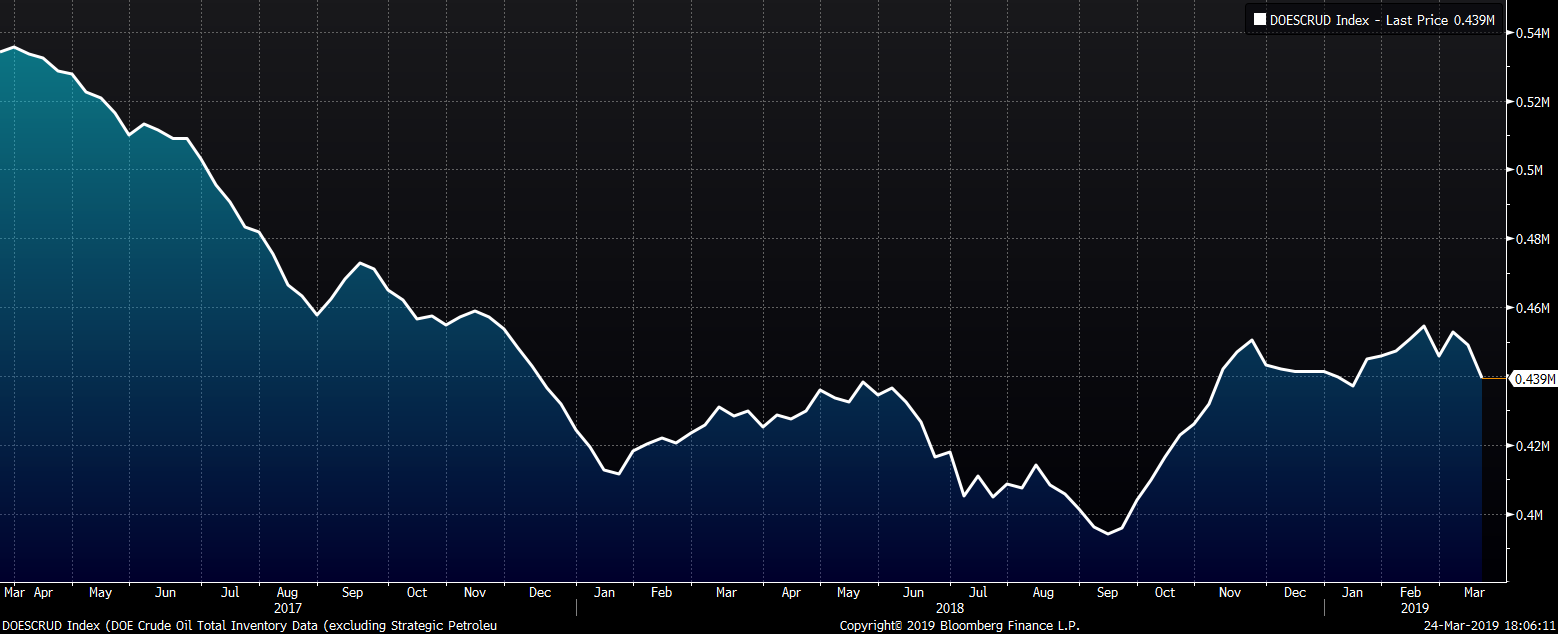

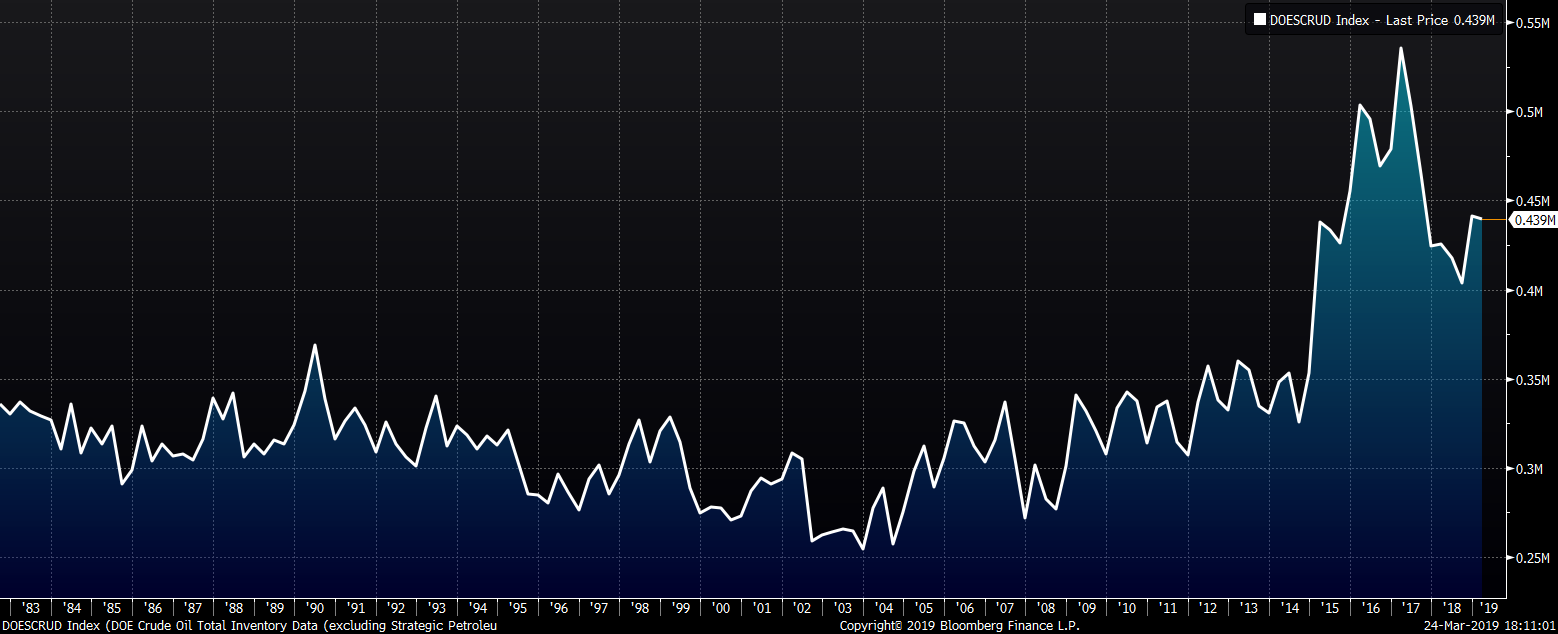

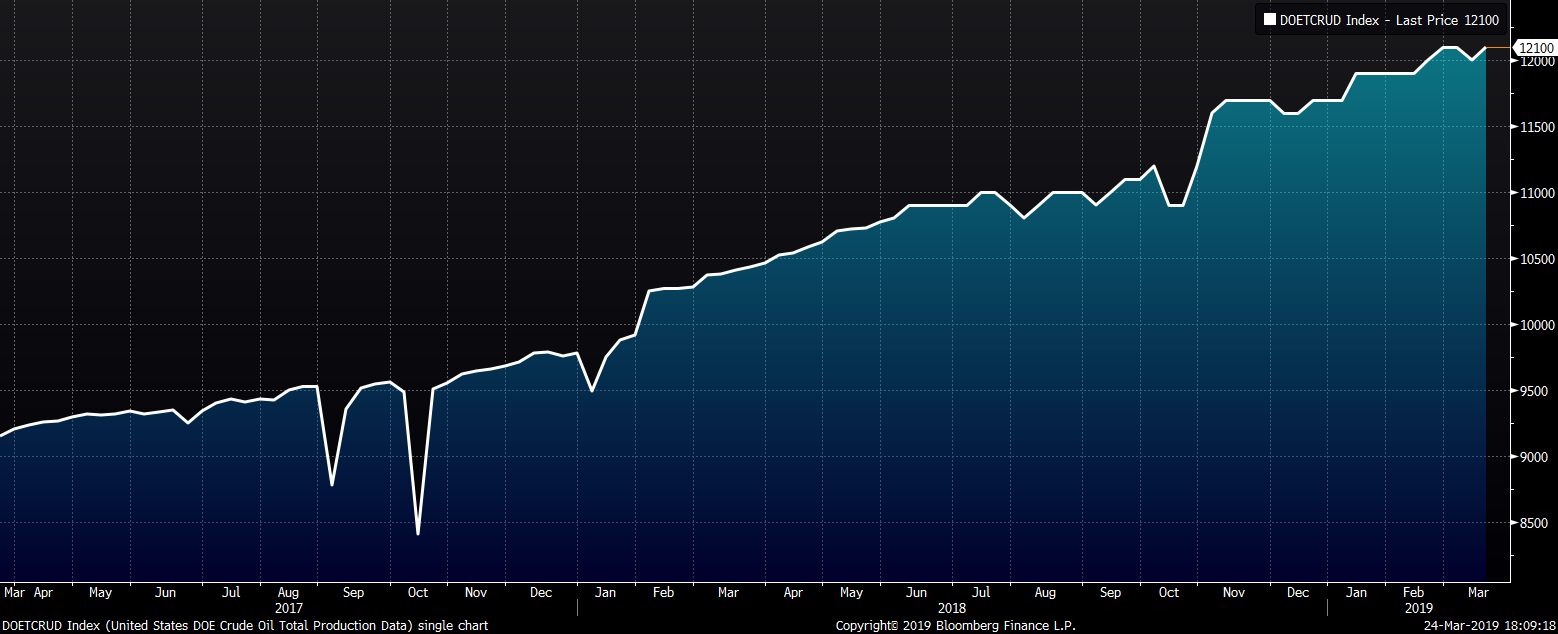

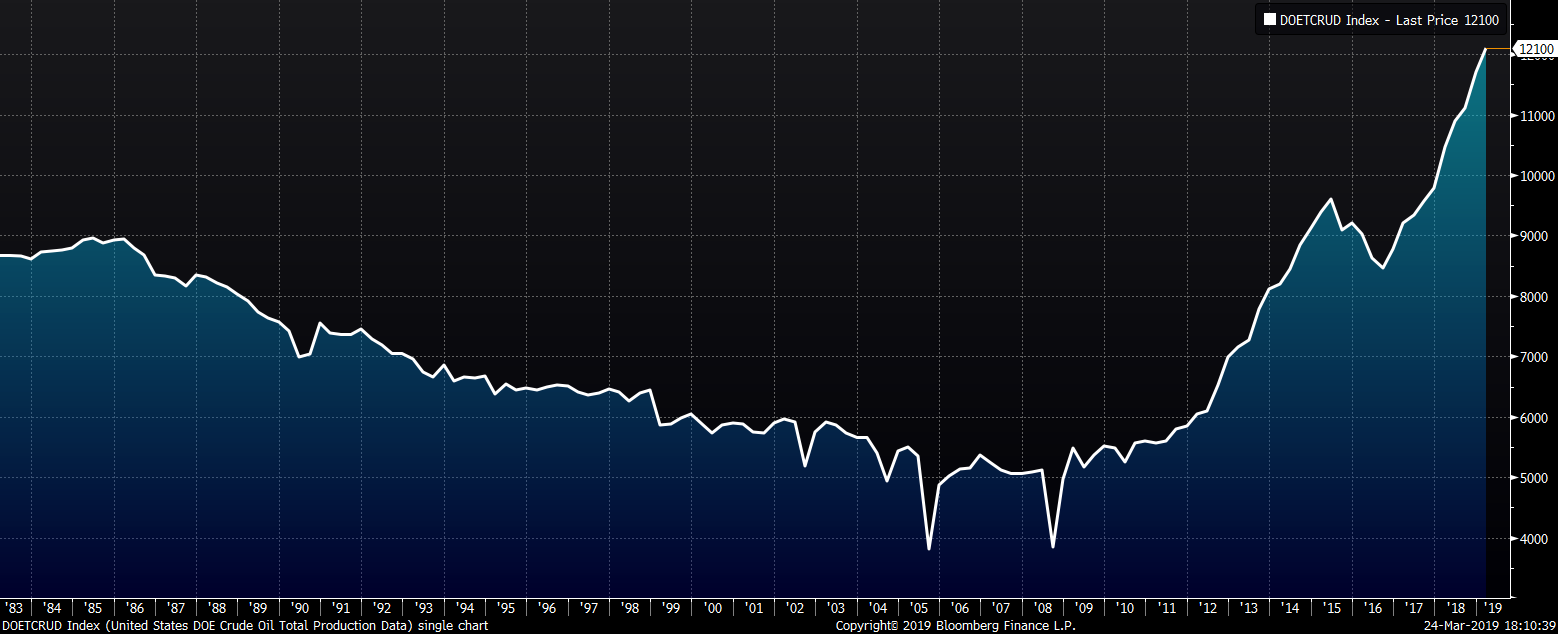

Last week, the May WTI crude oil future gained $0.22 or 0.4% to $59.04/bbl. Crude oil inventories fell 1.9% while distillate and gasoline inventory fell 3% and 1.9%, respectively. The aggregate inventory level was down 2.2%. Crude oil production rose to 12.1m bbl/day. The U.S. rig count lost ten rigs while the North American rig count lost sixty-six rigs. The May natural gas future lost $0.03 or 1% to $2.77/mmBtu. Natural gas inventory fell 3.7%.

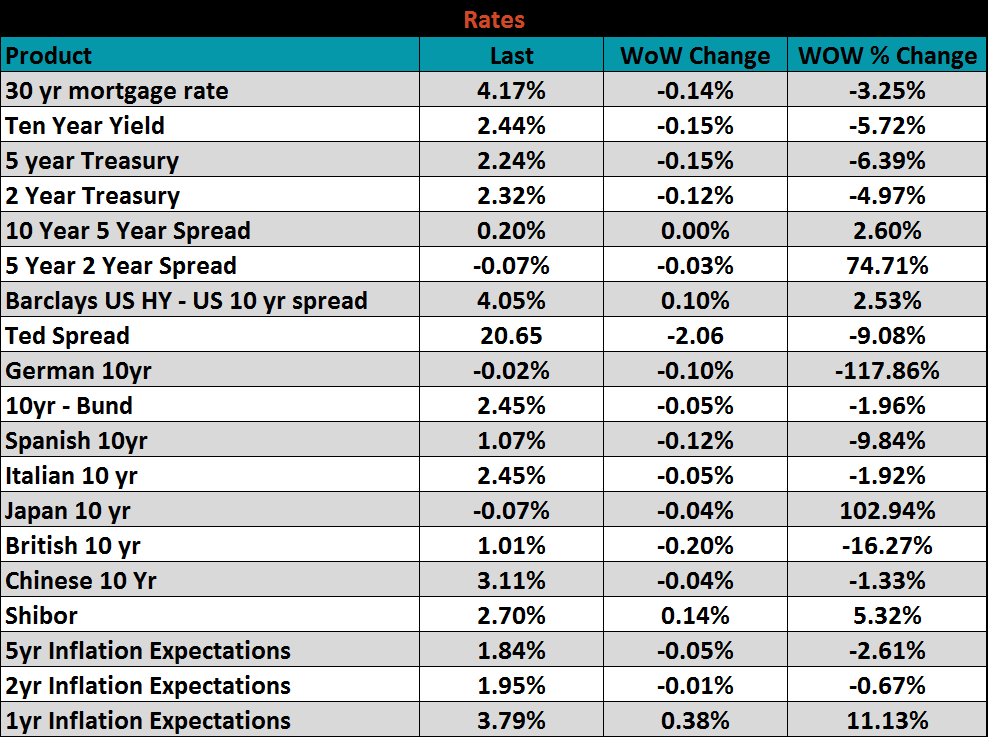

The U.S. 10-year treasury yield was down fifteen basis points closing the week at 2.44%. The German 10-year yield was down ten basis points turning negative to -0.02% while the Japanese 10-year yield was down four basis points to -0.07%.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely.

Upside Risks:

Downside Risks: