Content

-

Weekly Highlights

- Market Commentary

- Risks

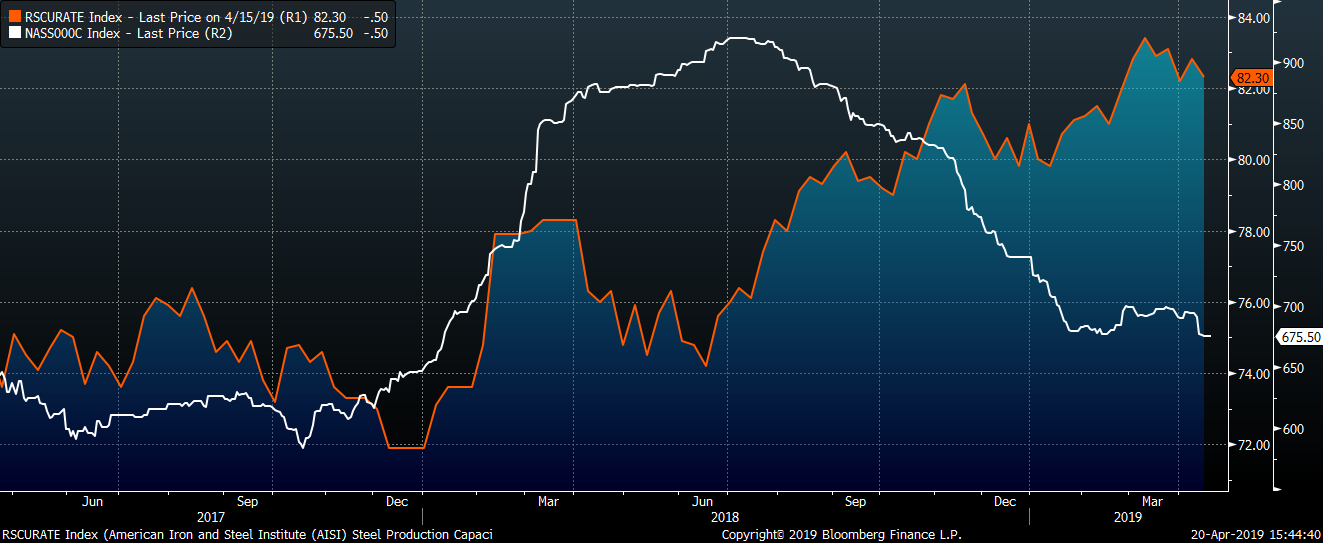

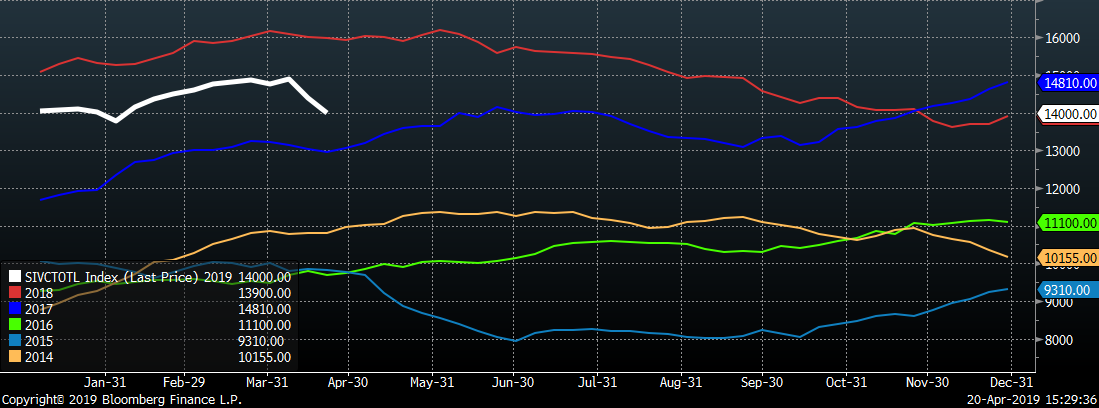

Flat rolled inventories at service centers declined only slightly over the last month, suggesting that the inventory hangover of 2018 continues to roil the market. Shipments have remained steady, implying that high cost material sold at losses is being replaced at current market prices. However, service centers have not restocked amid an uncertain outlook. Imports continue to remain at historically low levels, driving most of the purchasing to domestic mills. Current import prices, including tariff, will prevent any significant amount of material coming in from abroad, with the exception of countries that have import quotas in place, such as Korea.

There continues to be strong demand for domestic material. However, exports have decreased and production has increased, preventing higher prices. Furthermore, these market dynamics, steady demand, declining inventory, low import and low exports, are likely to continue. Without a catalyst, sideways pricing will continue.

An update on the USMCA and Mexica/Canada tariffs: Last week, the U.S. International Trade Commission released their report about medium term impact of the USMCA, finding that it will have a modest positive impact on economic growth and employment. This outlook contrasted the robust growth the administration forecasted, possibly leading to reduced support for the agreement among Democrats in Congress. This assessment assumed the tariffs would remain in place. Trump has expressed and shown his desire to maintain tariffs in order to ensure compliance with trade deals. Turkey’s steel tariffs still sits at 50%, despite significant lobbying and concessions to the U.S. In the China trade deal negotiation, the U.S. wants to maintain tariffs on goods from China well after a deal is reached. The tariffs on Mexico and Canada appear to be firmly in place.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

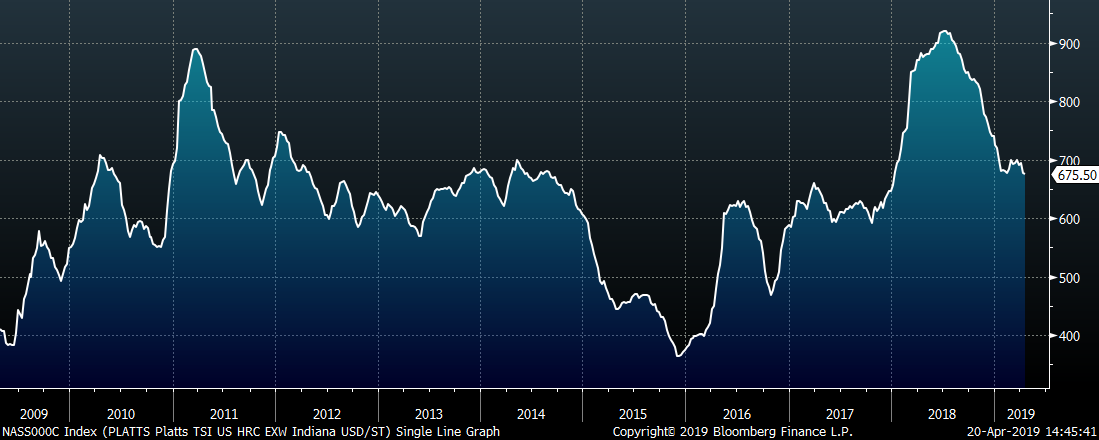

The Platts TSI Daily Midwest HRC Index was down $1.25 to $675.50.

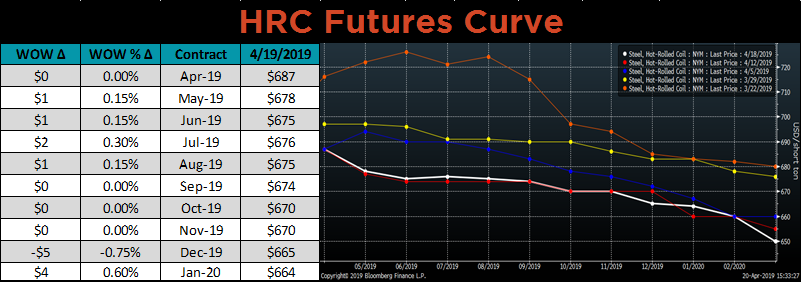

The CME Midwest HRC futures curve shown below with last Friday’s settlements in white. There was very little change in the curve WoW.

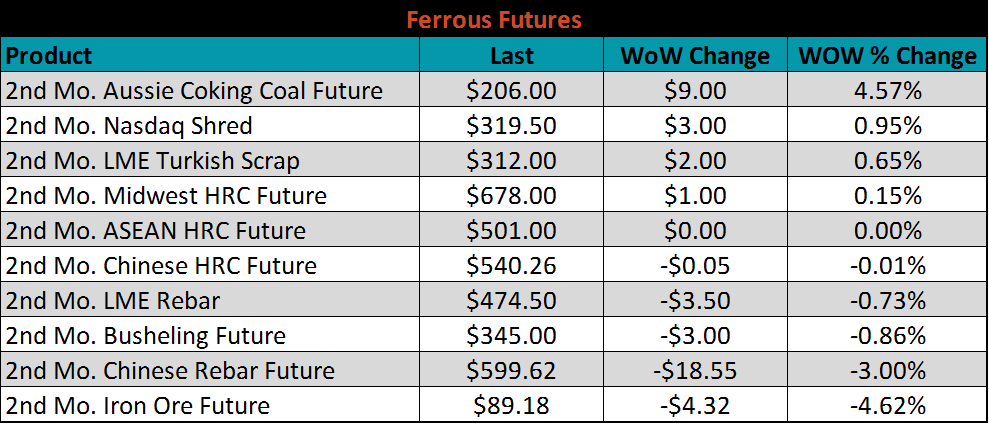

June ferrous futures were mixed. Aussie coking coal gained 4.6%, while iron ore lost 4.6%.

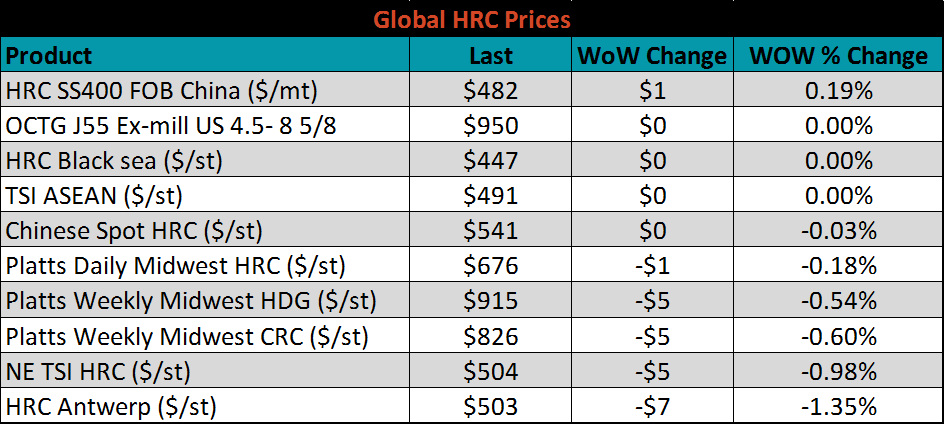

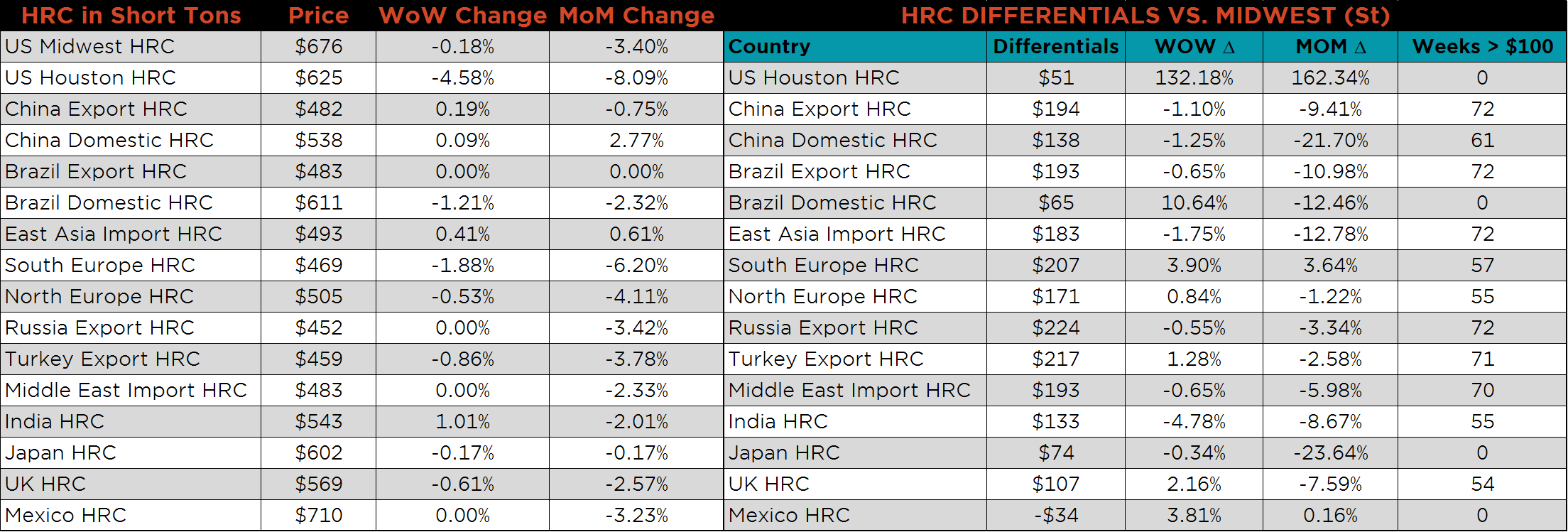

The global flat rolled indexes saw little change or were lower. The only exception was a slight $1 increase to the Chinese HRC structural steel price. Prices have been stable for an extended period of time, this is a one explanation for why imports have remained so low. Buying from domestic mills will be more attractive compared to importing as long as this trend continues.

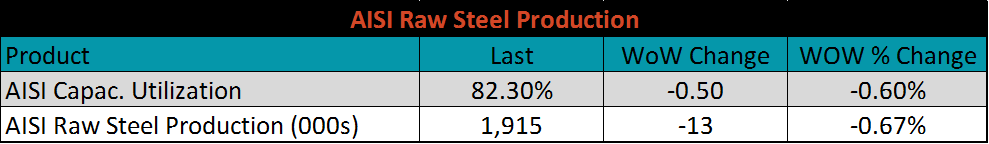

The AISI Capacity Utilization Rate is down 0.5 points to 82.3%. The Trump administration’s goal of 80% Capacity Utilization Rate has held since October 2018.

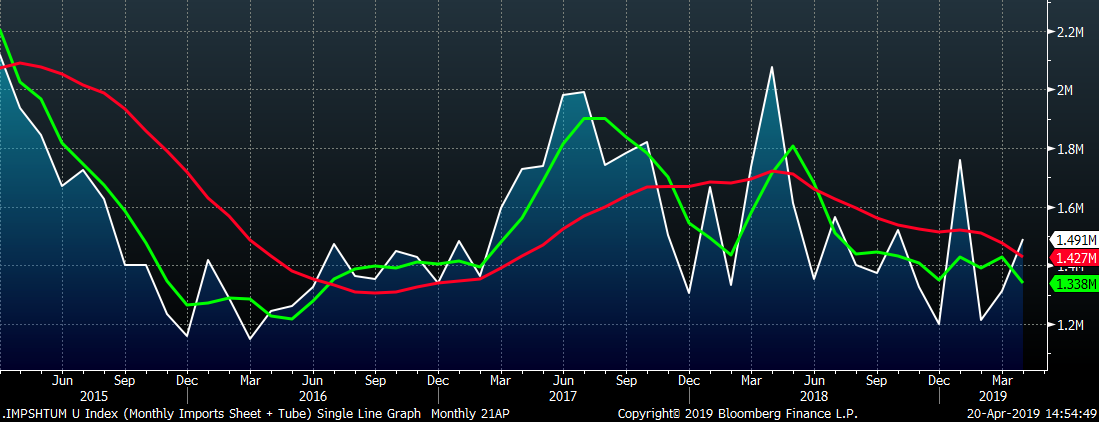

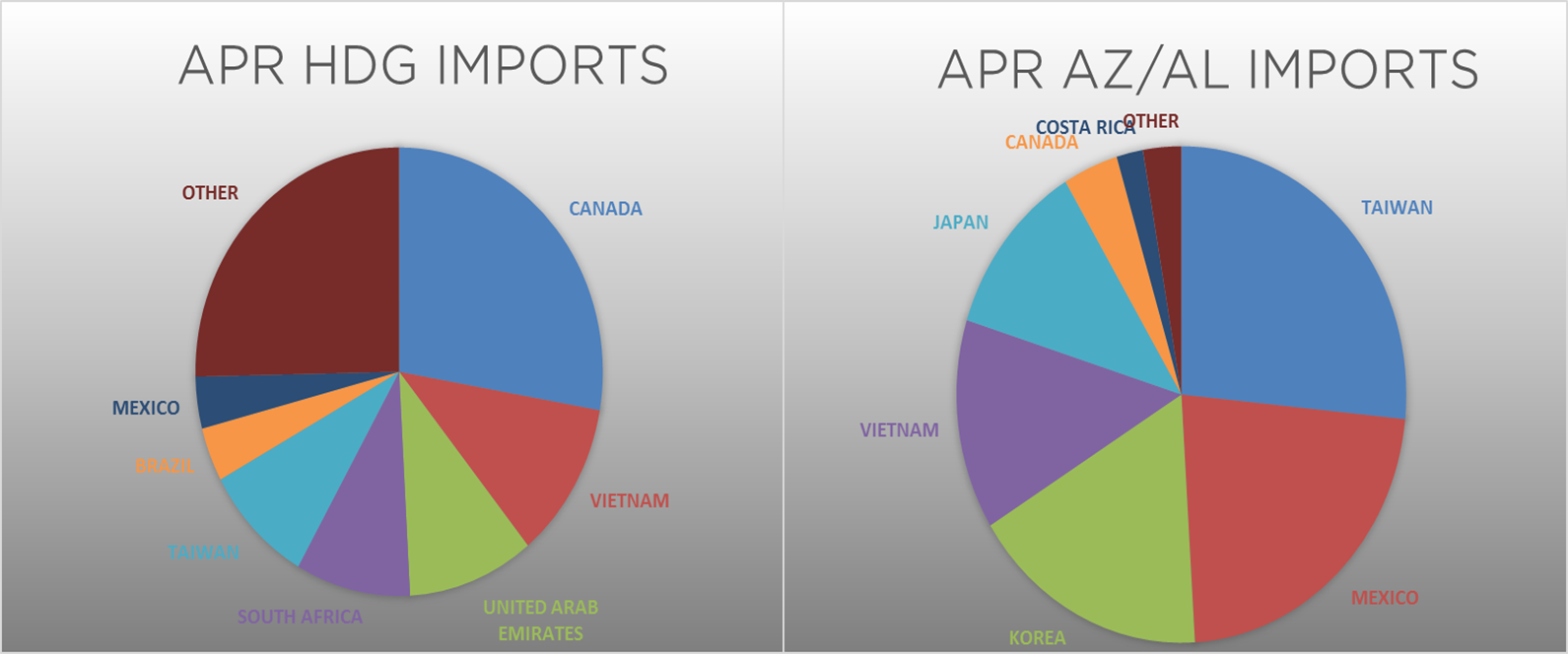

April flat rolled import licenses are forecast to decrease slightly to 762k MoM.

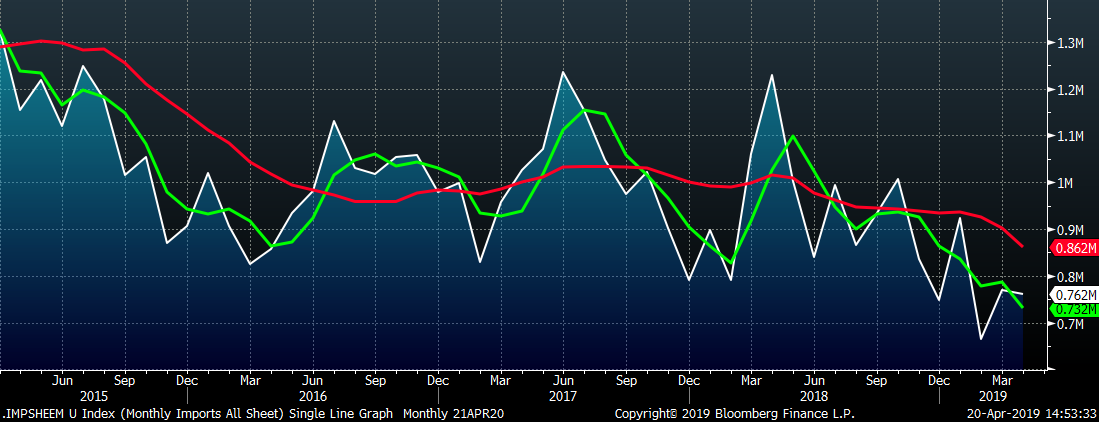

April tube import license data is forecasted to increase 187k to 728k tons after March fell slightly.

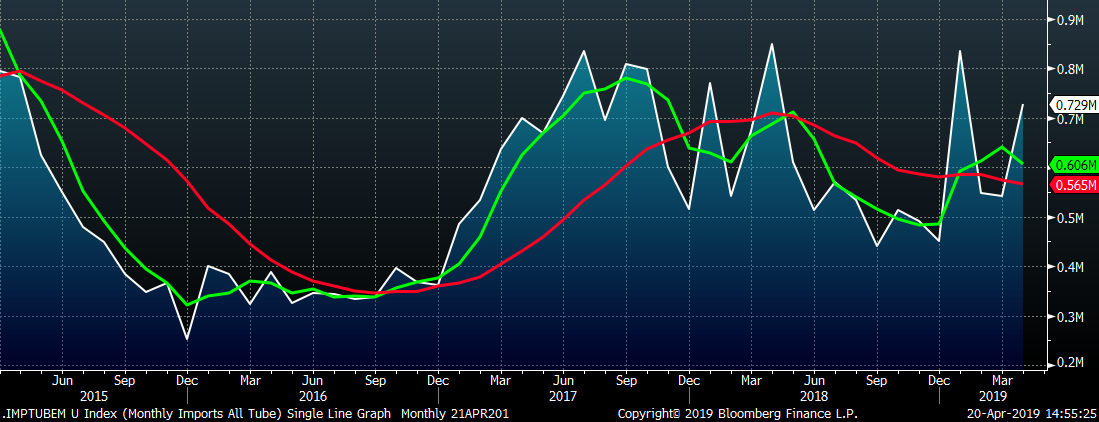

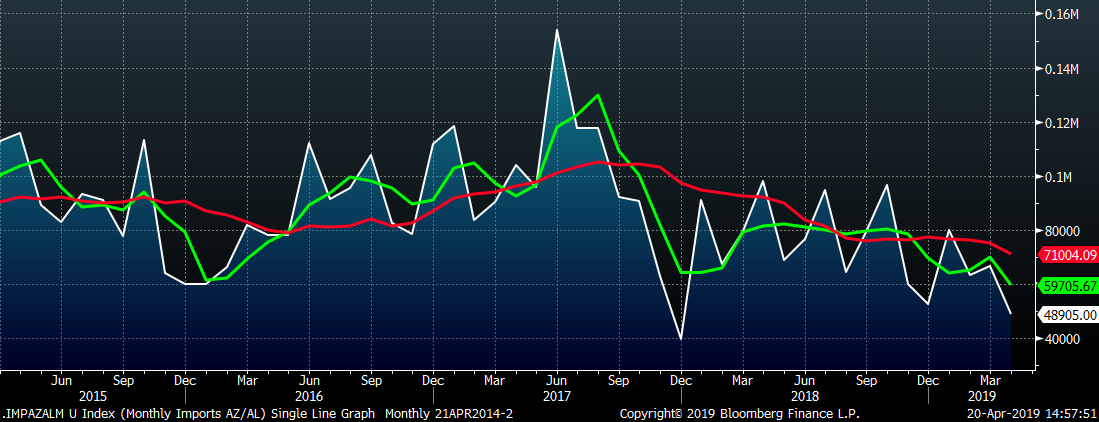

AZ/AL import licenses forecast a decrease of 18k to 49k in April.

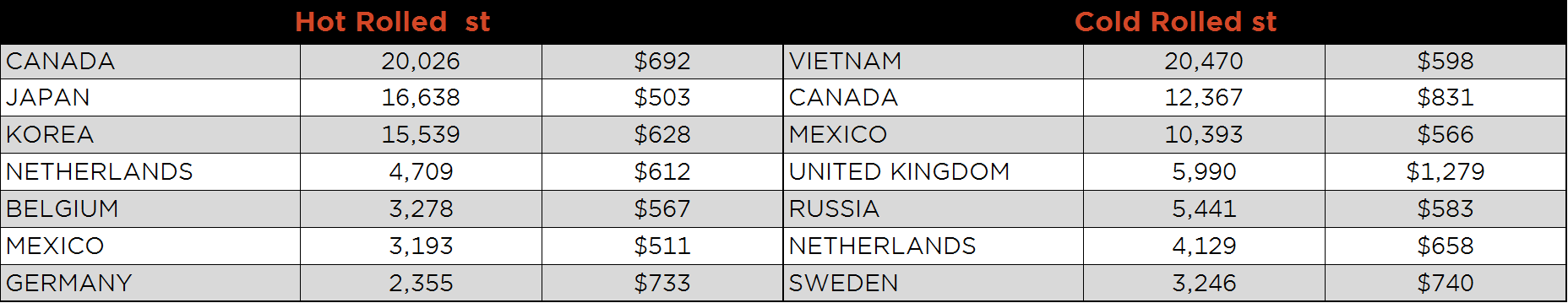

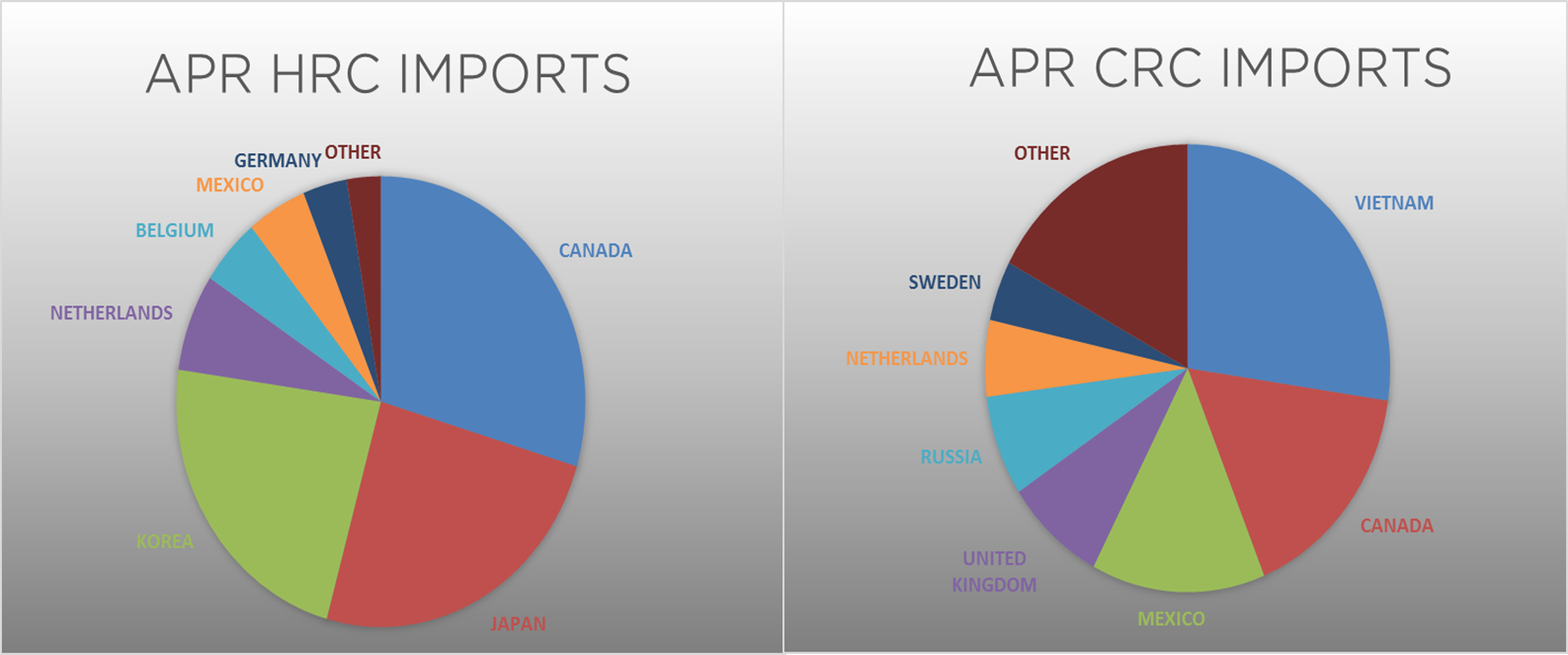

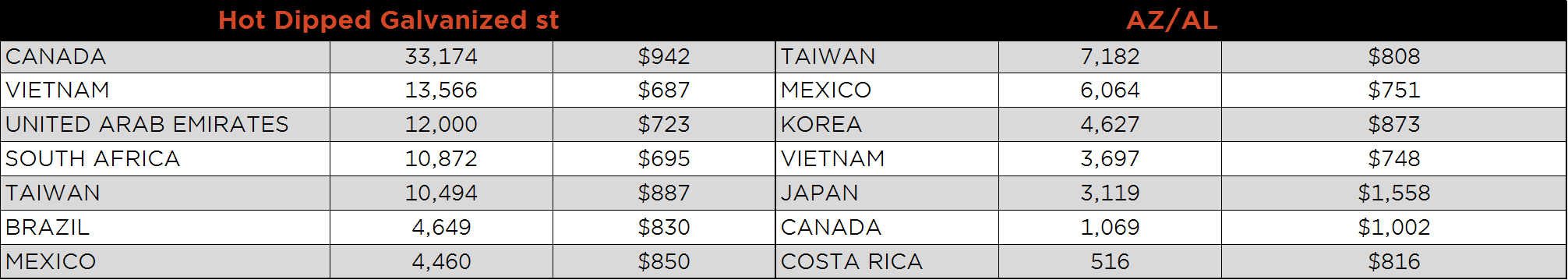

Below is April import license data through April 17, 2019.

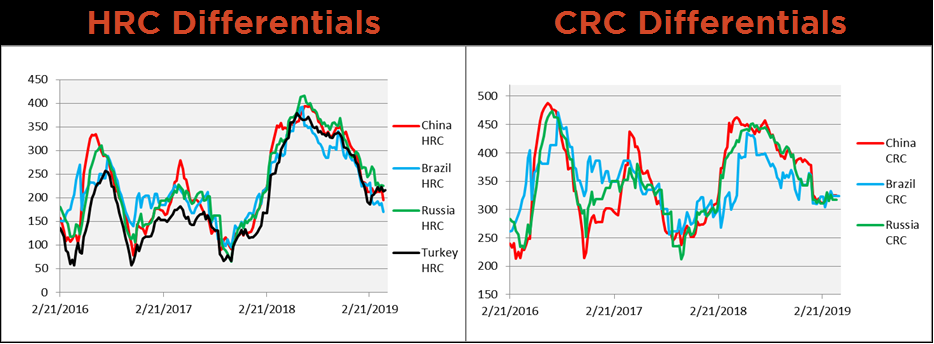

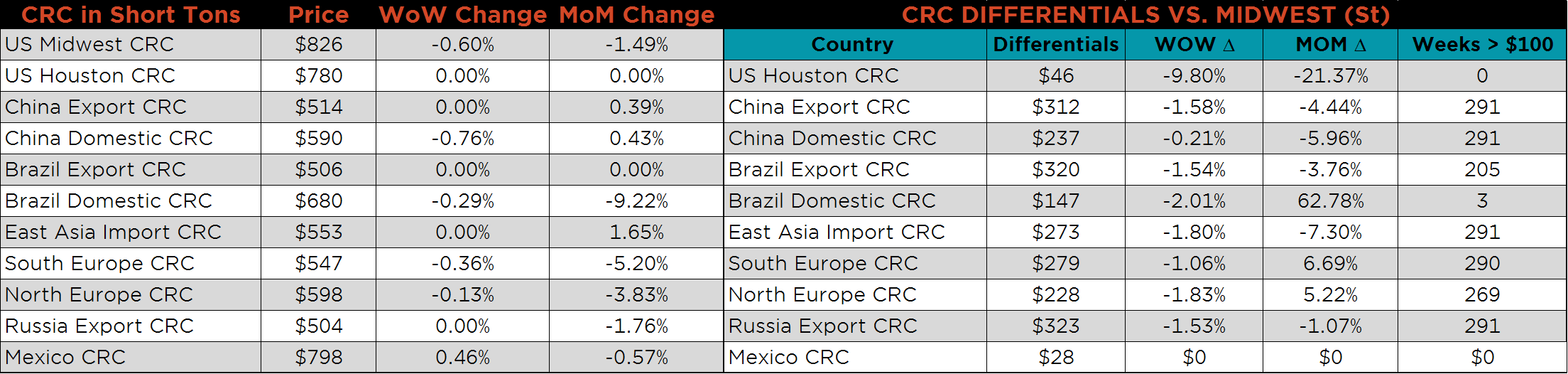

Below are HRC and CRC Midwest vs. each country’s export price differentials using pricing from SBB Platts. The Turkish HRC differential appears to be stuck in a recent range, while the Chinese, Brazilian and Russian differentials all continue to trend lower. All three CRC differentials have shown little change since early January.

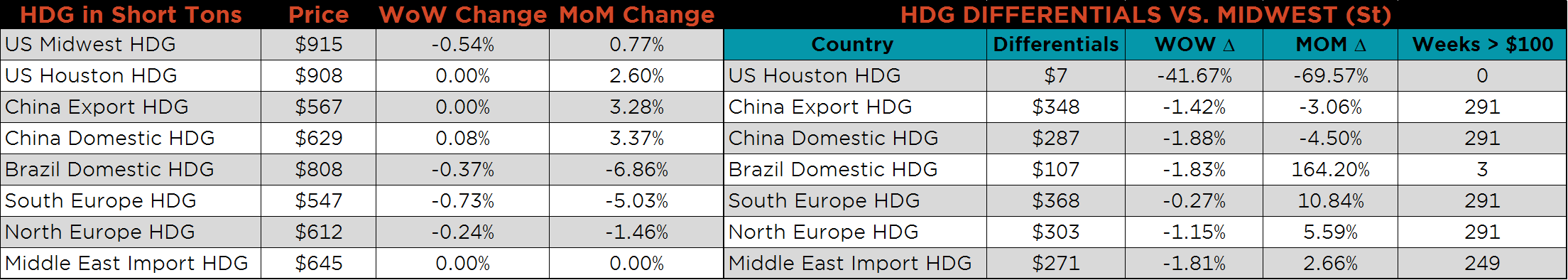

SBB Platt’s HRC, CRC and HDG pricing is below. Midwest HRC, CRC and HDG prices showed very little change. Houston HRC prices showed the most significant WoW change, down 4.6% while the Southern European HRC price was down 1.9%

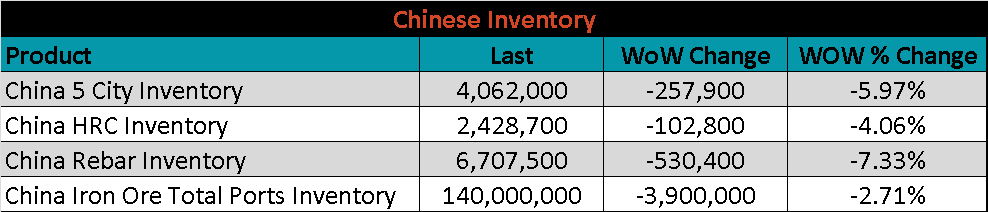

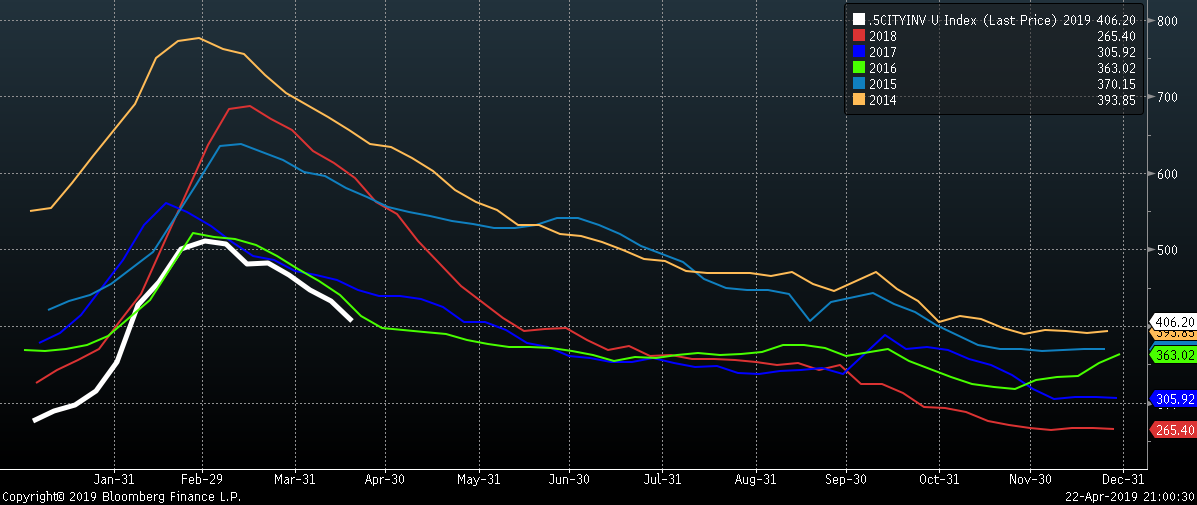

Below are inventory levels for Chinese finished steel products and iron ore. Inventory levels continue to move lower across the board. Iron ore ports inventory continue to decline and the Five City Inventory level is still at the lowest level in the last 6 years.

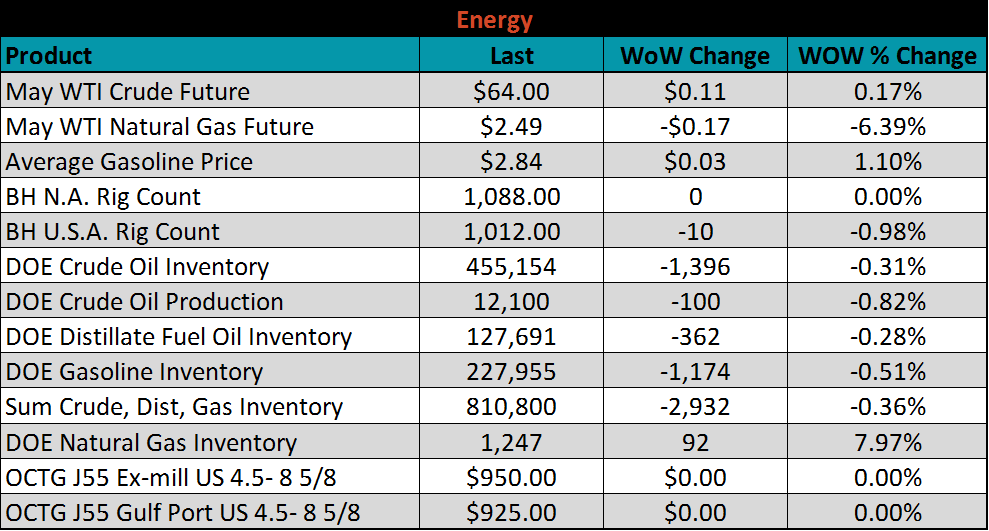

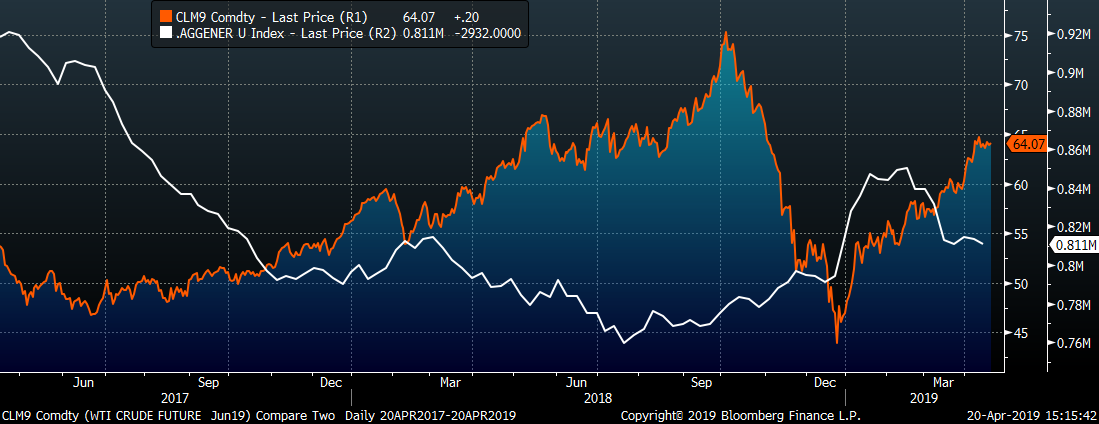

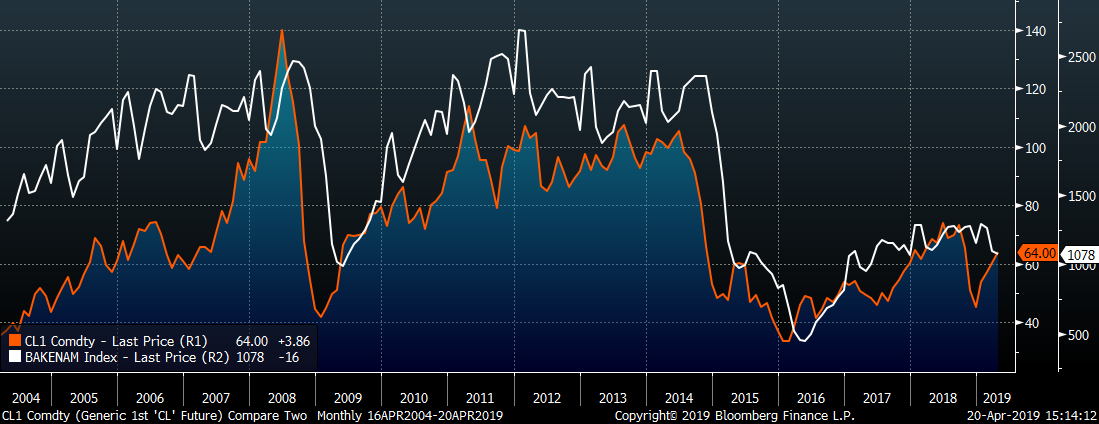

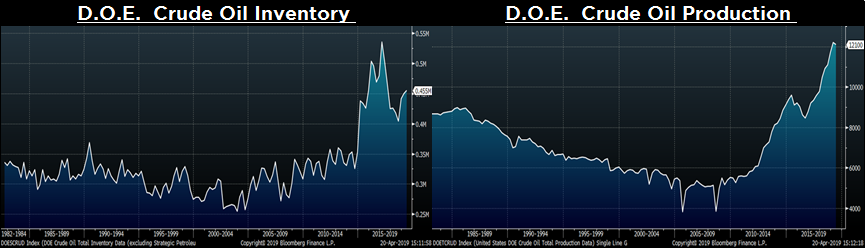

Last week, the May WTI crude oil future gained $0.11 or 0.2% to $64/bbl. The aggregate inventory level was slightly down 0.4%. Crude oil production was down 0.8% to 12.1m bbl/day. The U.S. rig count lost ten rigs while the North American rig count was unchanged. With crude prices at this level or higher, operators will be profitable running more rigs, which is encouraging in the tubular market.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: