Flack Capital Markets | Ferrous Financial Insider

April 5, 2024 – Issue #426

April 5, 2024 – Issue #426

Overview:

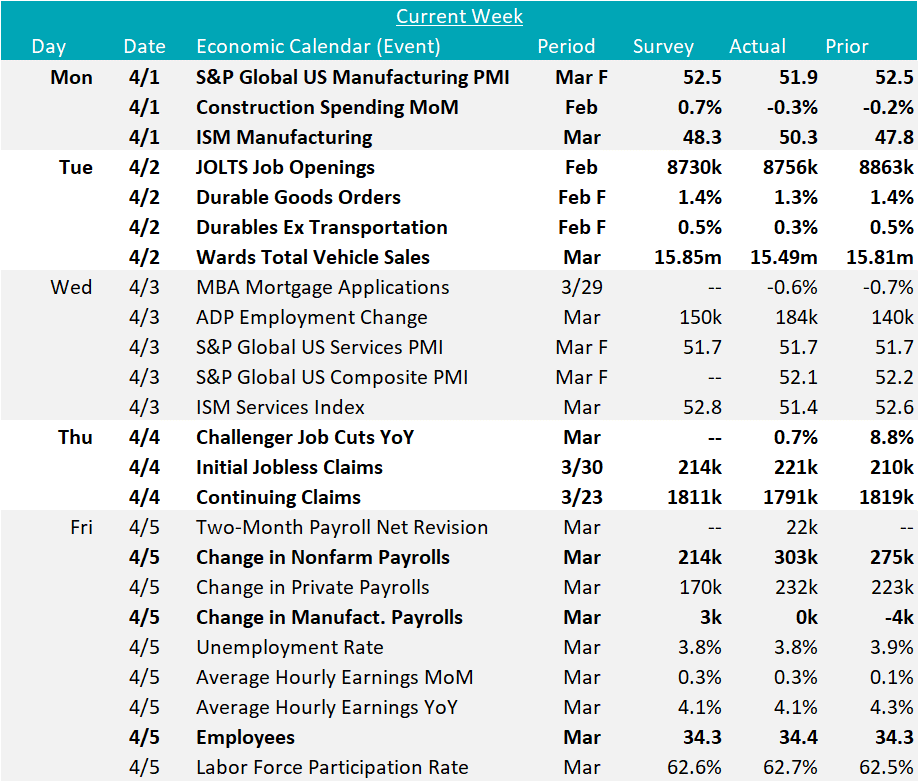

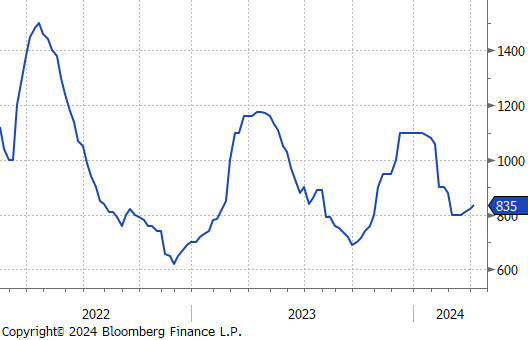

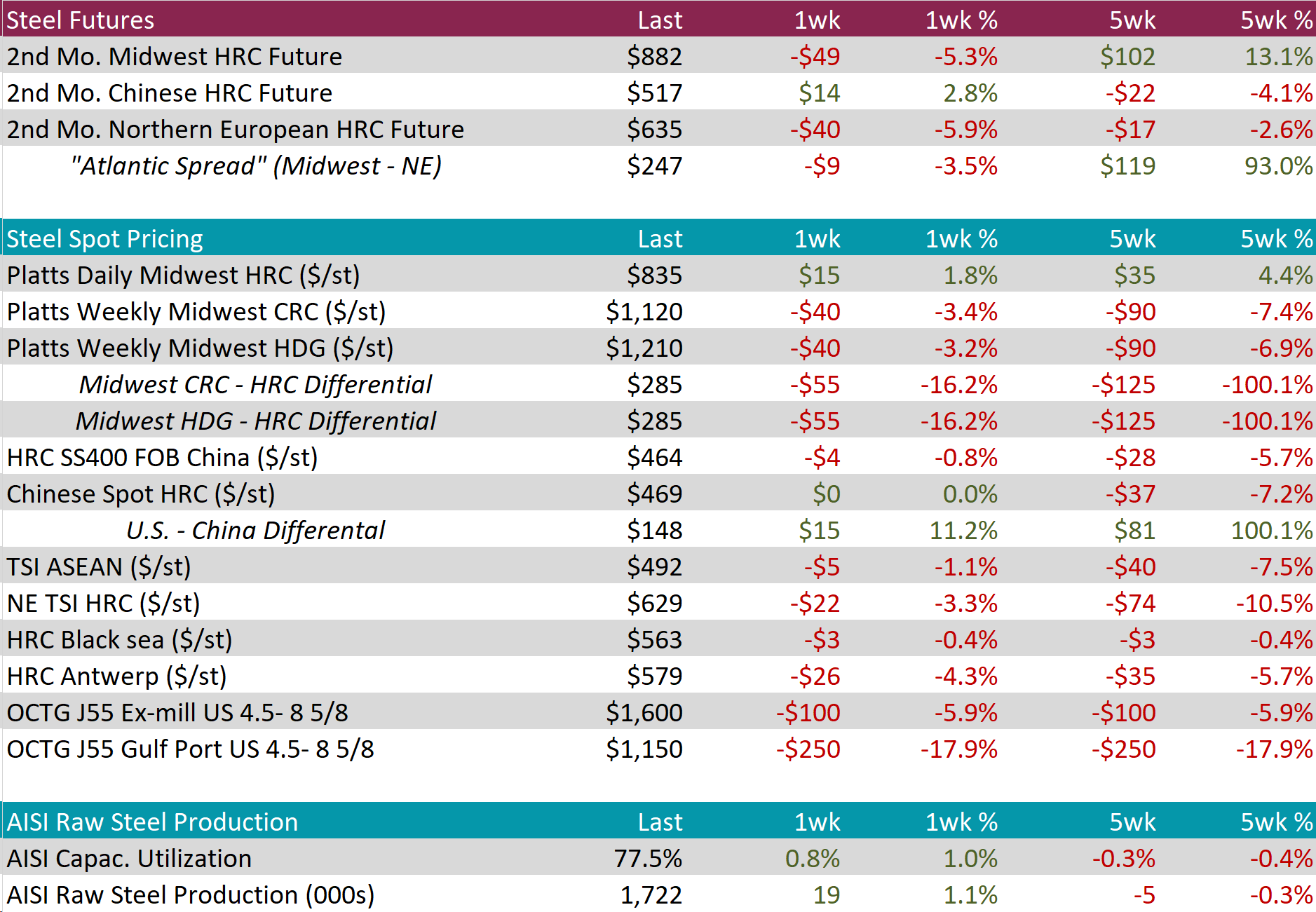

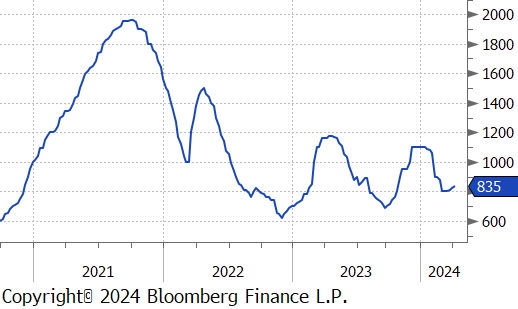

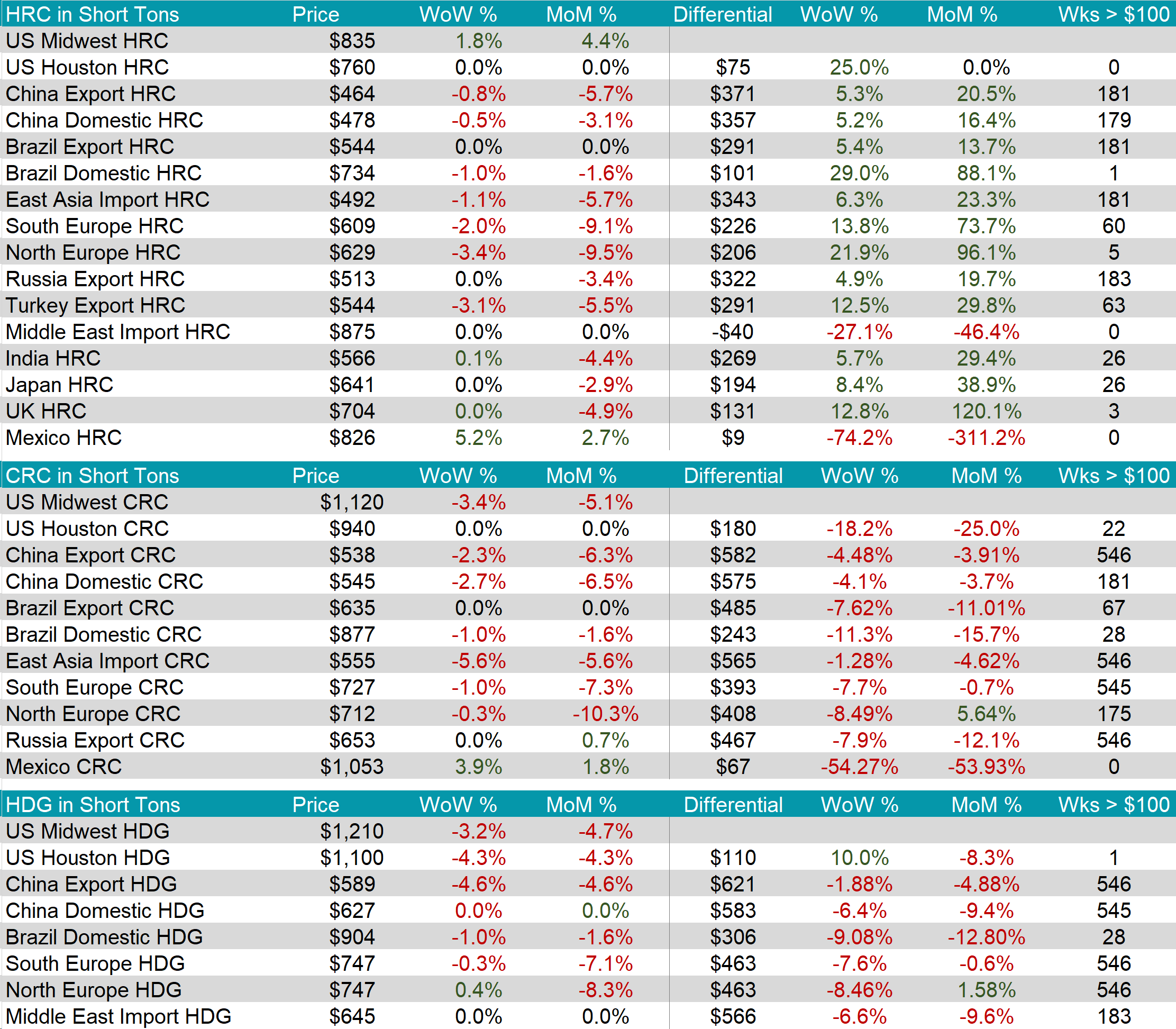

The HRC spot price increased further, rising by $15 or 1.8% to $835. At the same time, the 2nd month future dropped by $49 or -5.3% to $882, marking the first decline in two weeks.

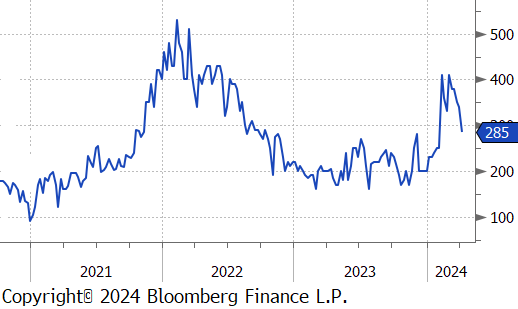

Tandem products both fell by $40, resulting in the HDG – HRC differential decline by $55 or -16.2% to $285.

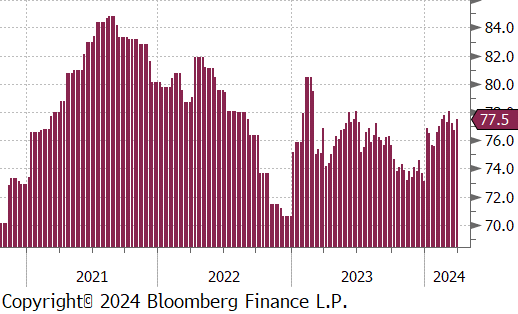

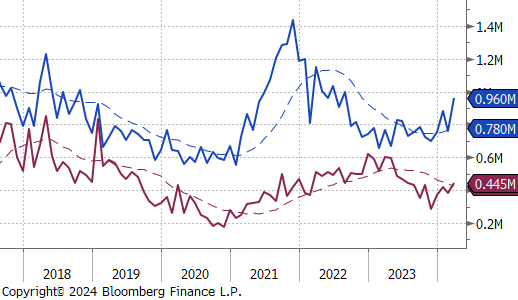

Mill production jumped back up, with capacity utilization ticking up by 0.8% to 77.5%, bringing raw steel production up to 1.722m net tons.

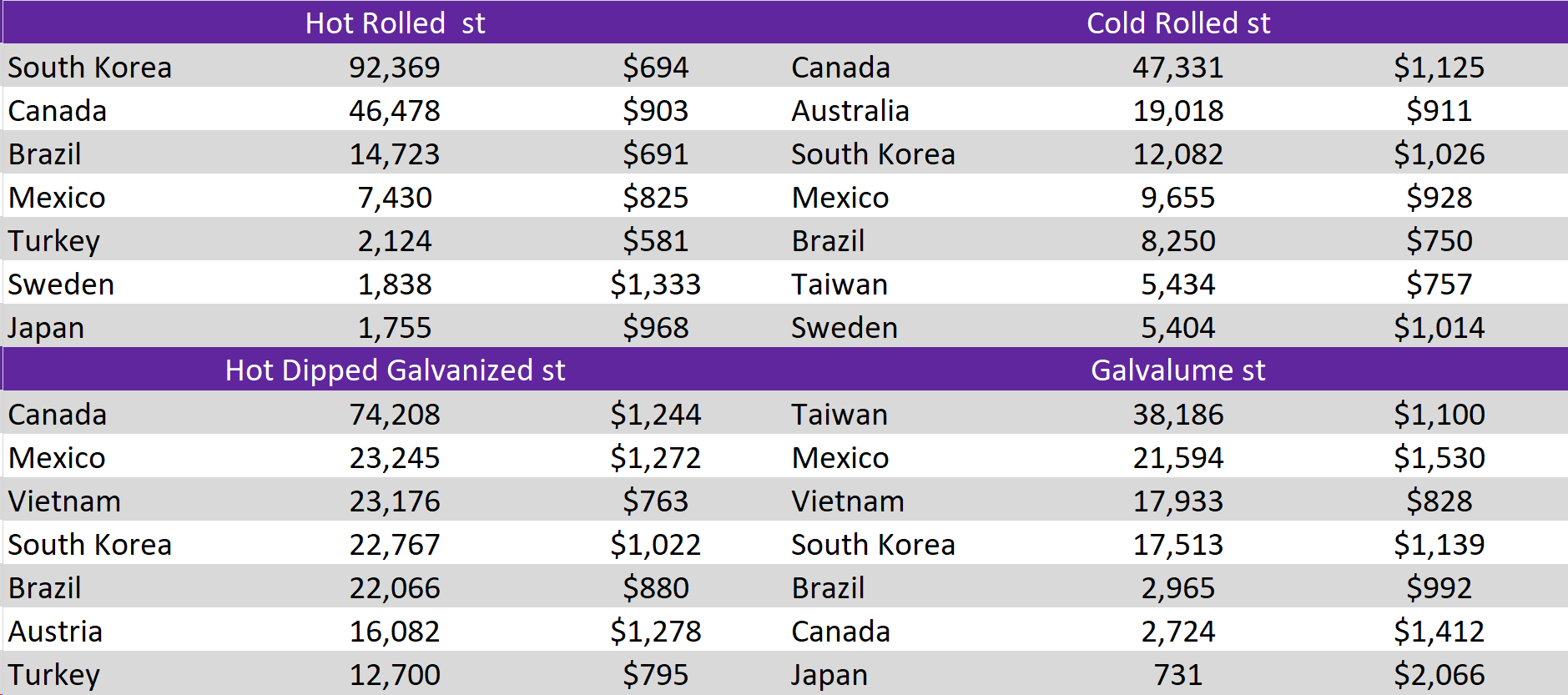

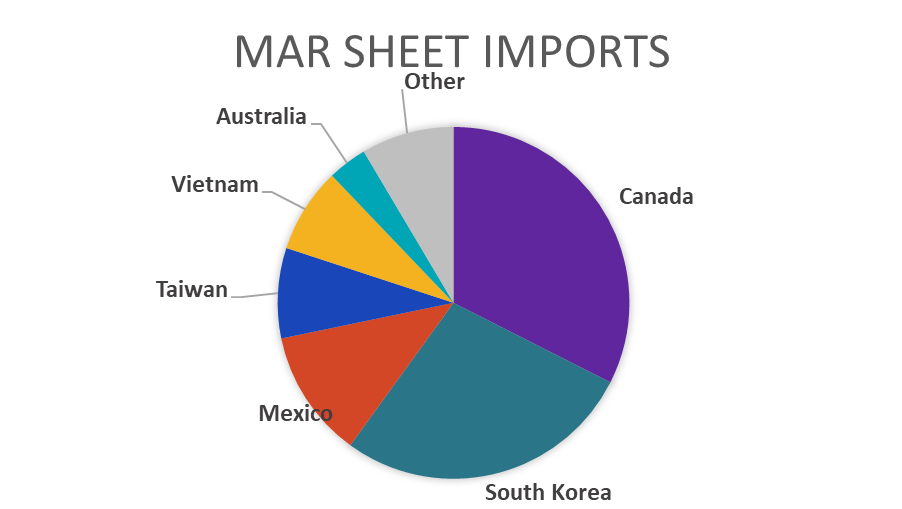

March Projection – Sheet 960k (up 201k MoM); Tube 445k (up 61k MoM)

February Projection – Sheet 759k (down 123k MoM); Tube 383k (down 37k MoM)

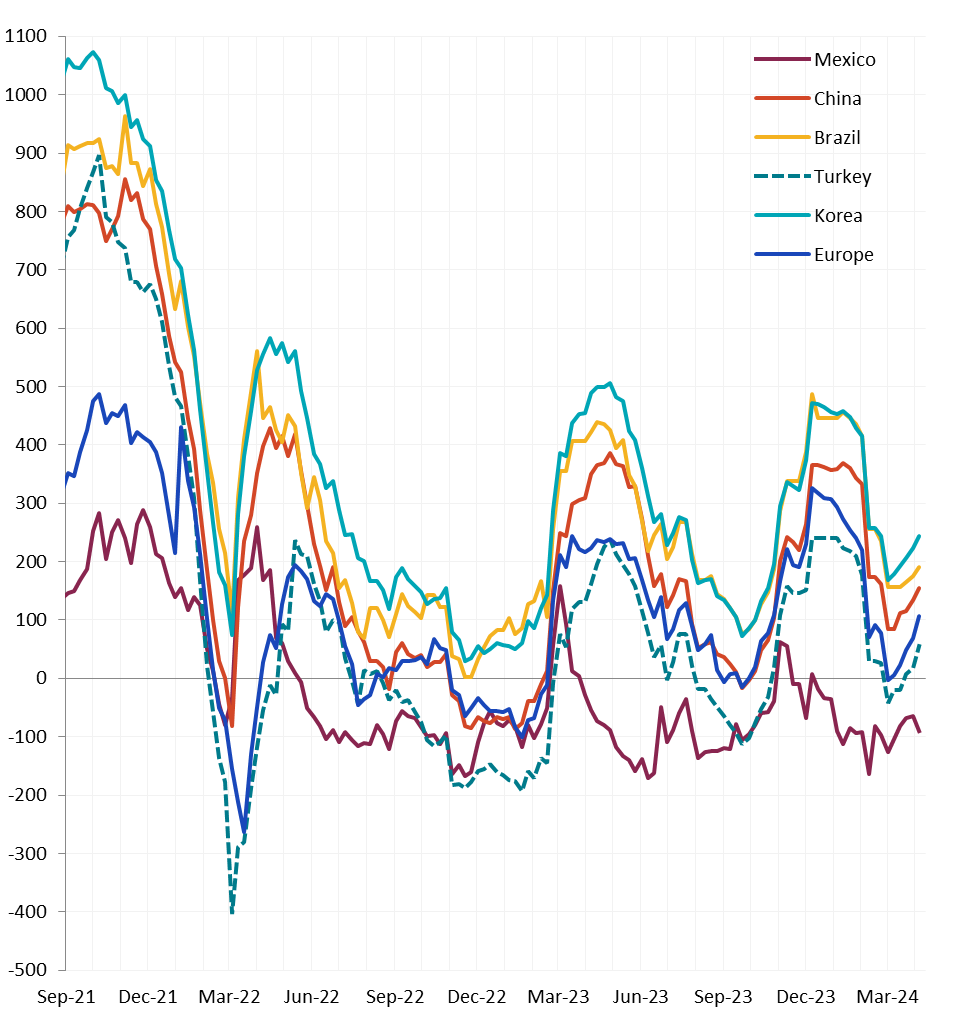

All watched global differentials generally widened further, except for Mexico, which saw a 5.2% price increase. Meanwhile, Europe and Turkey dropped by -2.0% and -3.1%, respectively.

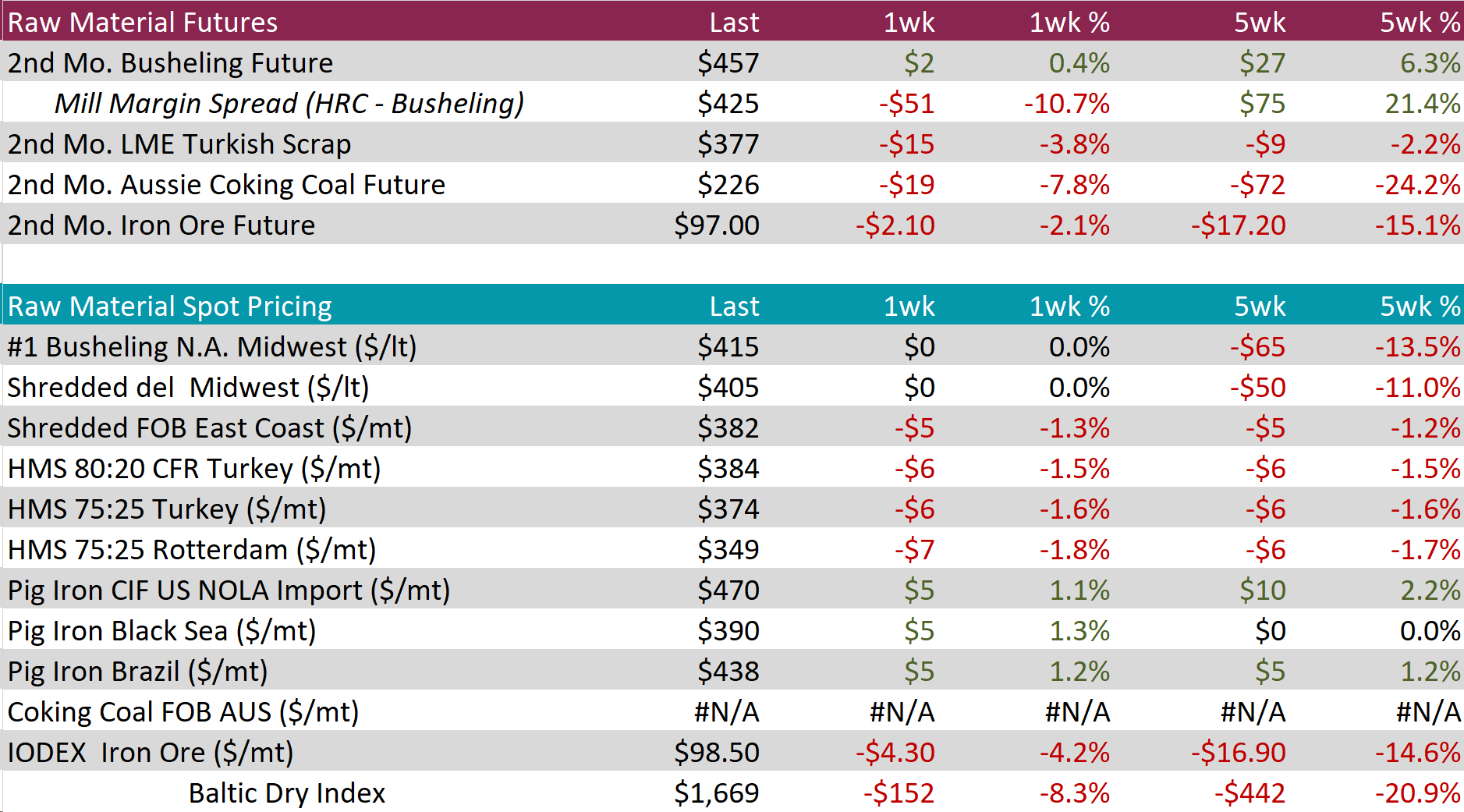

Scrap

The 2nd month busheling future rose by $2 or 0.4% to $457, continuing a gradual upward trend.

The Aussie coking coal 2nd month future plummeted by $19 or -7.8% to $226, hitting the lowest price since June 2023.

The 2nd month iron ore future experienced another down tick, declining by $2.10 or -2.1% to $97, reaching the lowest level since November 2022.

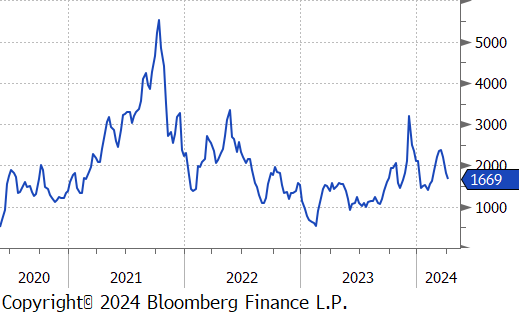

Dry Bulk / Freight

The Baltic Dry Index decreased further, falling by $152 or -8.3% to $1,669, marking the third week of declines.

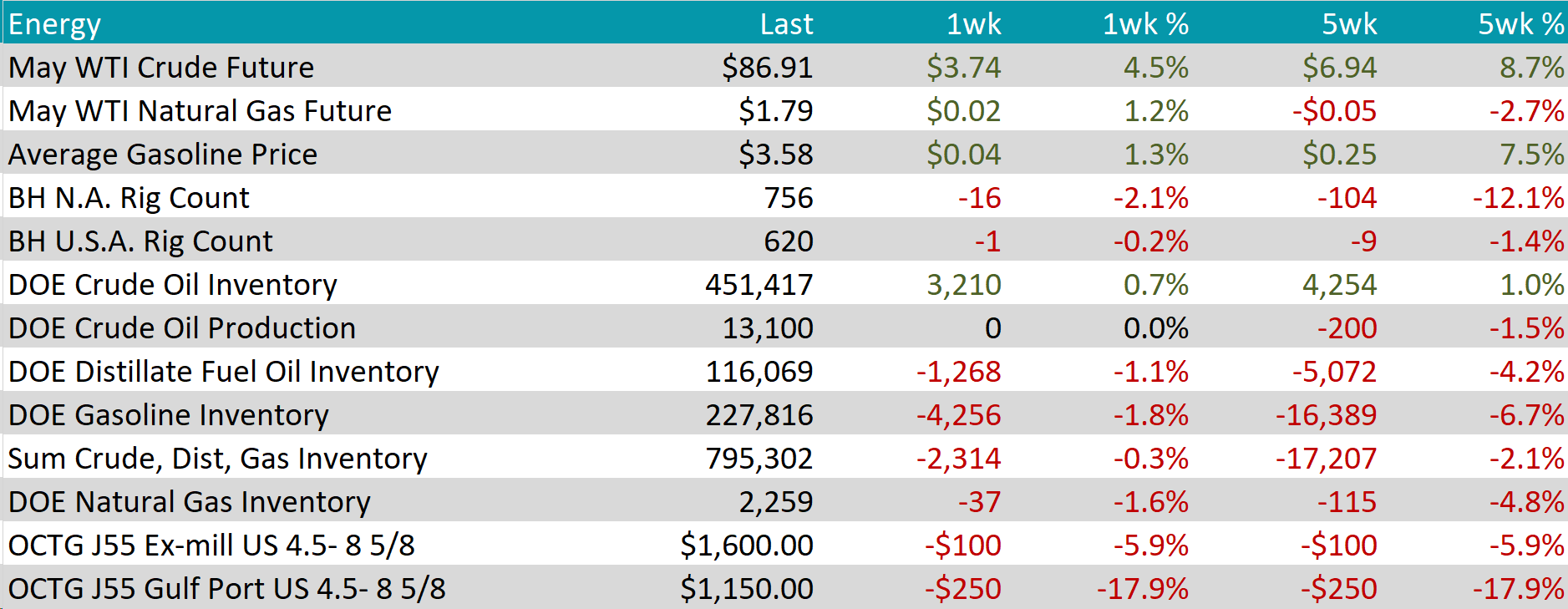

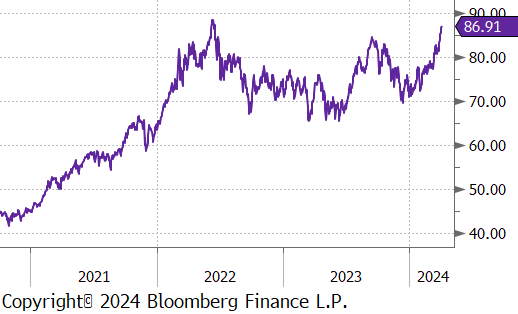

WTI crude oil future gained $3.74 or 4.5% to $86.91/bbl.

WTI natural gas future gained $0.02 or 1.2% to $1.79/bbl.

The aggregate inventory level experienced a slight decrease of -0.3%.

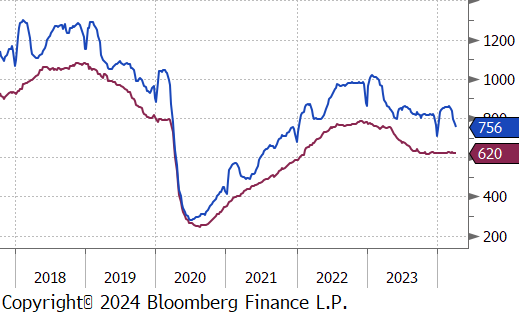

The Baker Hughes North American rig count reduced further, dropping by 16 rigs, bringing the total count to 756 rigs. The US rig count also had a decline, reducing by 1 rig, bringing the total count to 620 rigs.

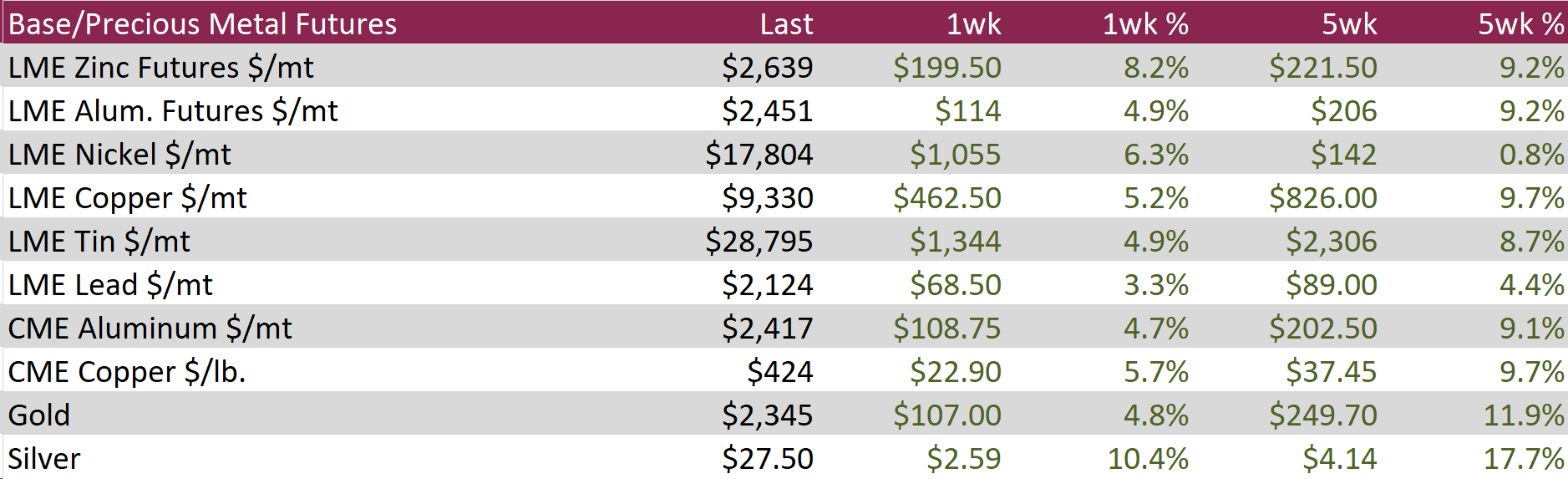

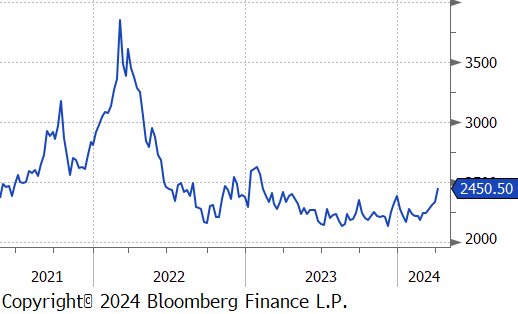

Aluminum prices leaped up by $114 or 4.9% to $2,451, marking a 14-month peak, buoyed by a broader rally in base metals. This surge was fueled by a weakening dollar, ongoing supply anxieties, and a revival in demand from China. Encouraging manufacturing PMI data from China in March indicated a positive response in factory activity to Beijing’s array of economic stimuli and support initiatives. Furthermore, the Aluminum Corp of China highlighted ongoing uncertainty in the country’s bauxite supply, heavily reliant on Guinea, which has experienced disruptions following an explosion at a critical fuel depot. Compounding the supply concerns, aluminum smelters in Yunnan, China’s fourth-largest production area for the metal, continued to face operational limitations due to the annual dry season.

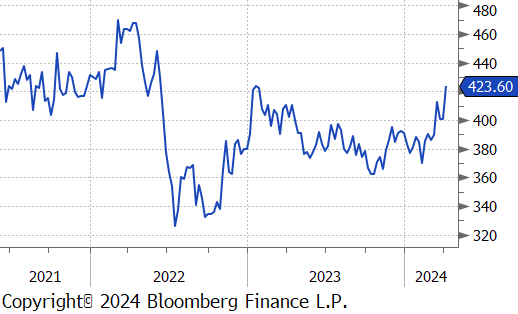

Copper climbed up by $22.90 or 5.7% to $424, reaching a 14-month high, driven by a weakening US dollar and escalating supply concerns. The Institute for Supply Management (ISM) reported a deceleration in US services activity and a significant reduction in the sector’s pricing pressures, setting the stage for potentially lower interest rates by the Federal Reserve. Such a scenario not only improves global manufacturing financial conditions but also exerts downward pressure on the dollar, which is used to benchmark copper prices. Consequently, this enhances the buying power of major copper importers, leading to a sharp uptick in market bids. Concurrently, robust manufacturing data from China, as indicated by both official and Caixin PMIs, dispelled fears of a downturn in demand from the world’s largest consumer of copper. Supply chain challenges, including logistical disruptions in Congo and drought conditions in Zambia, further strained copper supplies. These issues prompted Chinese smelters to consider a collective 10% cut in output to bolster profit margins.

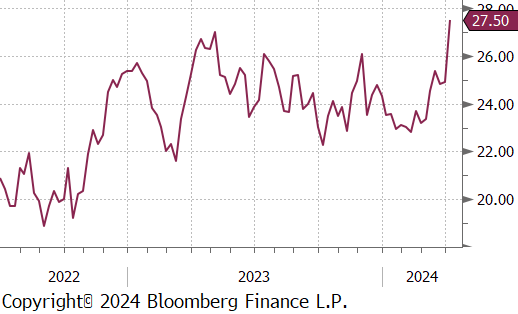

Silver rose by $2.59 or 10.4% to $27.50, after a strong U.S. jobs report reduced expectations for immediate Federal Reserve rate cuts. The economy added 303,000 jobs in March, exceeding predictions and leading to an unexpected drop in unemployment, with sustained wage growth making it less likely for the Fed to cut rates soon. Despite earlier comments from Fed officials suggesting a cautious approach to rate cuts, market expectations for a June reduction have decreased to 55%. While high interest rates generally decrease the appeal of non-yielding assets like silver, the metal still managed a 6.5% weekly gain, supported by Middle East tensions and continued hopes for monetary easing.

Arguably the most watched steel related economic data point came in significantly better than expectations. The ISM Manufacturing PMI surprised to the upside, printing 50.3, above expectations of 48.4. This marked the first expansionary print in 16 months. The S&P Global Manufacturing PMI also printed in expansion territory for the third straight month, albeit below expectations, at 51.9. This stands in contrast to very poor Fed Manufacturing surveys, which sharply reversed from their improving trend and pointed to contraction within the sector.

After last month’s upside surprise in Auto sales data, this month disappointed, with sales down to a seasonally adjusted annualized rate of 15.49M versus expectations of a slight increase to 15.85M.

Construction spending disappointed for the second straight month, with the total spending figure down -0.3%, versus expectations of a 0.7% rebound. Looking more closely, private residential spending continues to impress, up 0.7%. This was offset by a monthly decrease of -0.9% in private non-residential spending and the 1.2% decrease in public spending on the month caused the topline decline. Despite these monthly setbacks, the annual perspective offers a brighter outlook, with construction spending witnessing a robust 10.7% growth compared to the same month last year.

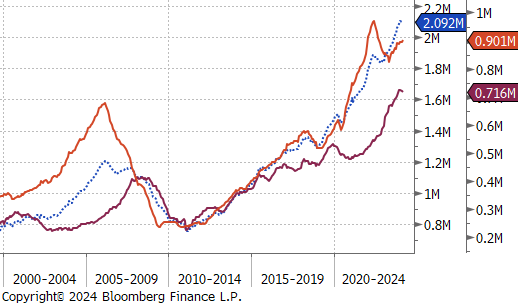

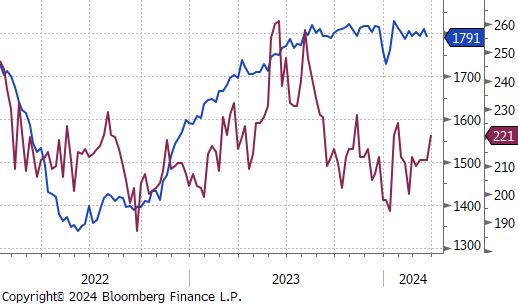

The latest job market data reveals several encouraging trends. The year-over-year increase in Challenger Job Cuts significantly slowed to 0.7% in March, down sharply from the 8.8% growth observed in February. In a surprising turn, the Change in Nonfarm Payrolls climbed to 303k, up from 275k in February, and well above the anticipated decline to 214k. However, the Change in Manufacturing Payrolls remained stagnant at 0, falling short of the expected increase to 3k and showing a slight recovery from the previous month’s decrease of -4k. Meanwhile, JOLTS Job Openings for February slightly declined to 8756k from 8863k but still managed to outperform forecasts, which had predicted a drop to 8730k. These figures indicate a resilient labor market, with positive momentum in employment despite some areas of softening.