Flack Capital Markets | Ferrous Financial Insider

December 1, 2023 – Issue #408

December 1, 2023 – Issue #408

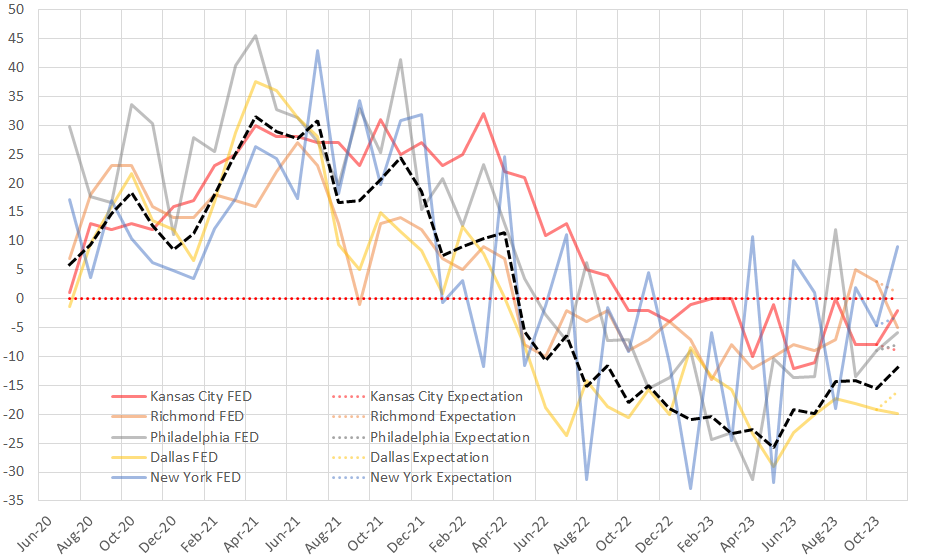

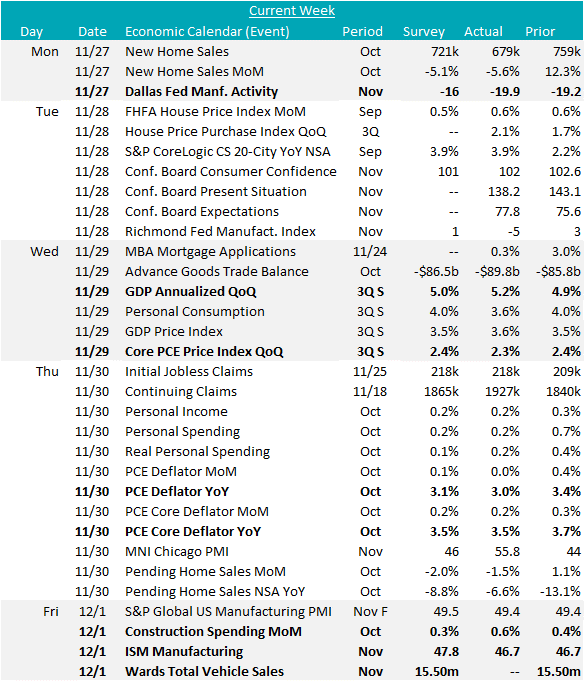

Data from the beginning of the month reports (ISM, Construction Spending, & Auto sales) provided mixed signals around the steel consuming sectors. Construction spending continues to beat expectations, driven mostly by private residential spending, and auto sales were slightly below expectations. Manufacturing data, however, continues to disappoint and the November U.S. ISM Manufacturing PMI printed “flat” at 46.7 and remains in contraction territory, now for the 13th straight month.

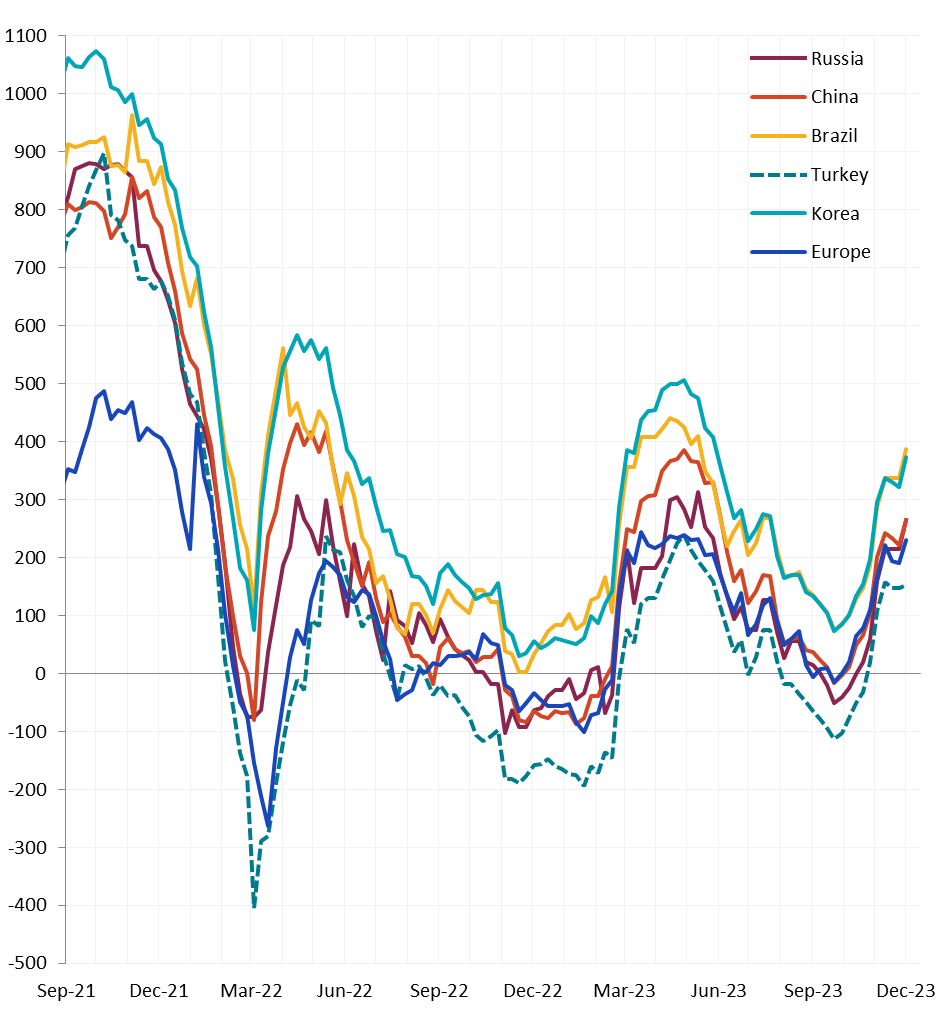

After beginning an uptrend in June, the last two months highlight the ongoing concerns in the industrial/manufacturing sector. In addition to the below expectations print in the November data, the forward-looking index, which subtracts inventories from demand components turned slightly negative as well, after 3 months in expansion territory. This contraction in activity is also shown in the full set of November FED manufacturing surveys in the second chart on the right. The clear takeaway is that the manufacturing sector remains subdued, and the underlying drivers suggest that it will remain restrained going into the beginning of next year.

At this point in the year, it is important to start thinking about how demand dynamics could start playing into price action as the calendar turns to 2024. The first factor to consider is that at this point, the market is likely beyond the midway point of the “holding rates” part of the rate hike cycle. Second, the current inventory rebalancing in the auto sector due to the resolution of the strikes will still require some time, but operations will be fully restarted in the beginning of the year. Finally, the current contraction in the ISM Manufacturing PMI is the second longest since 2000 and now 2 months longer than the what occurred in the Great Recession. While growth may not be around the corner, the sector has now worked through all the headwinds that were on the midyear horizon.

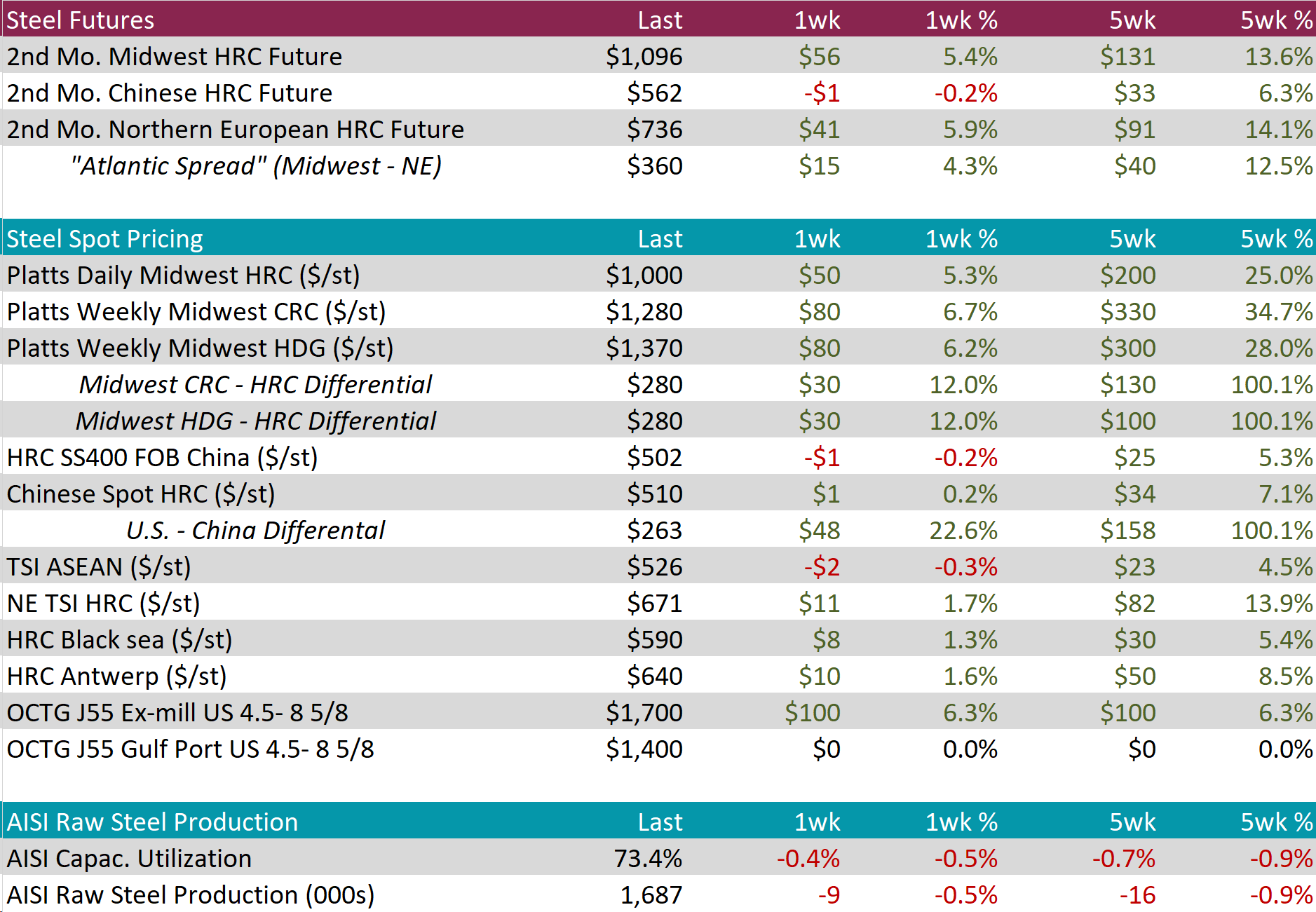

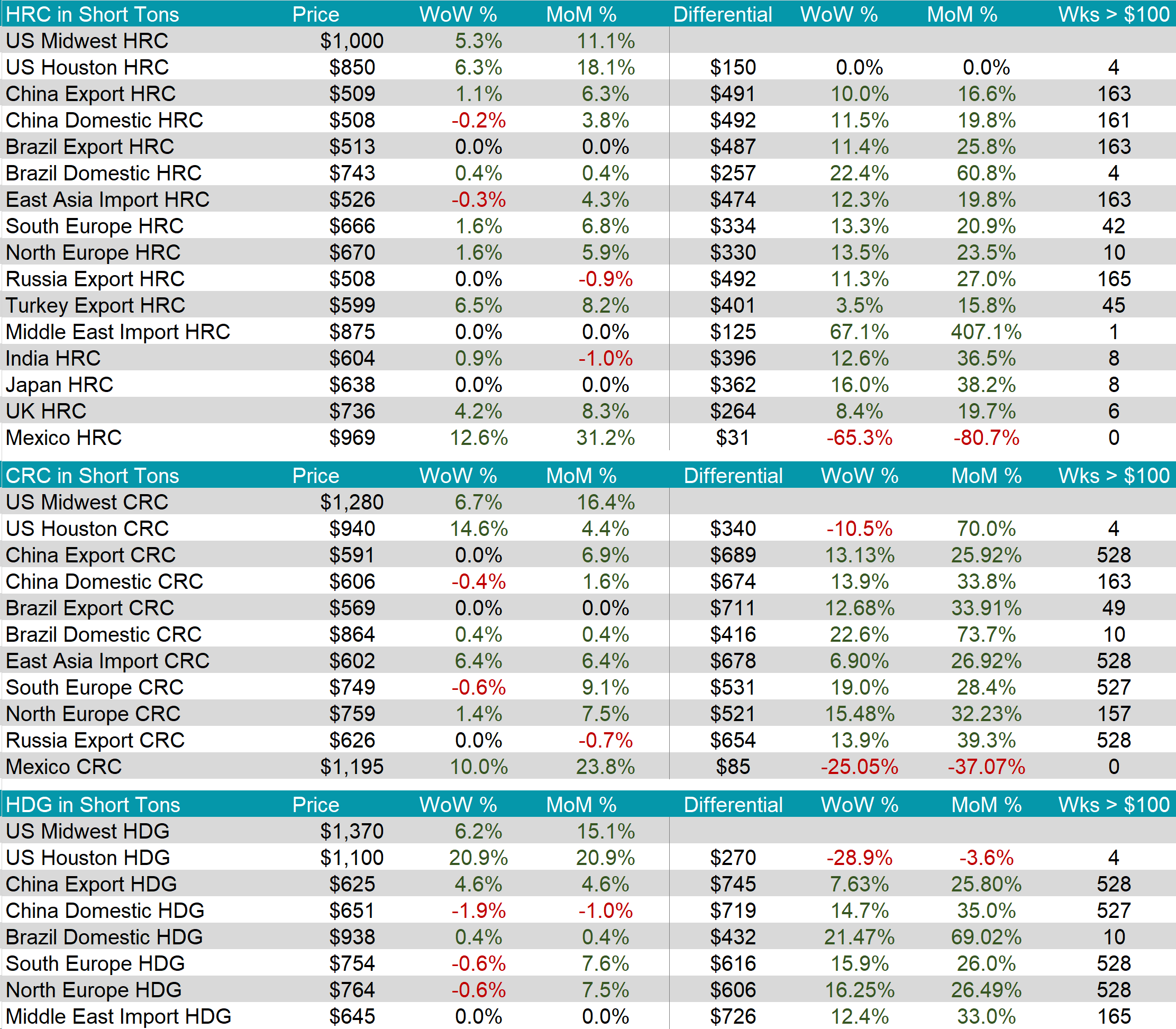

The HRC spot price jumped up by $50, or 5.3%, to $1,000, after remaining unchanged at $950 for three weeks. At the same time, the 2nd month future also jumped up, by $56, or 5.4%, to $1,096, hitting the highest price seen since April.

Tandem products both increased by $80, bringing the CRC up to $1,280 and HDG to $1,370, resulting in the HDG – HRC differential increasing by $30 to $280. This is the largest spread since

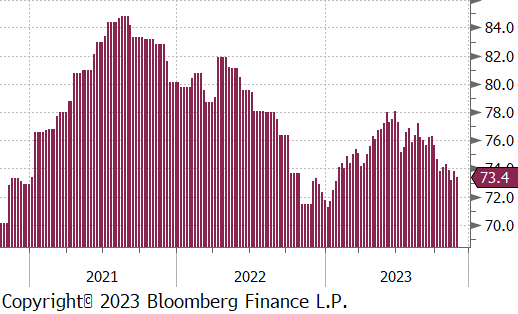

Mill production remains at relatively low levels, with capacity utilization ticking down by -0.4% to 73.4%, this brings raw steel production down to 1.687m net tons.

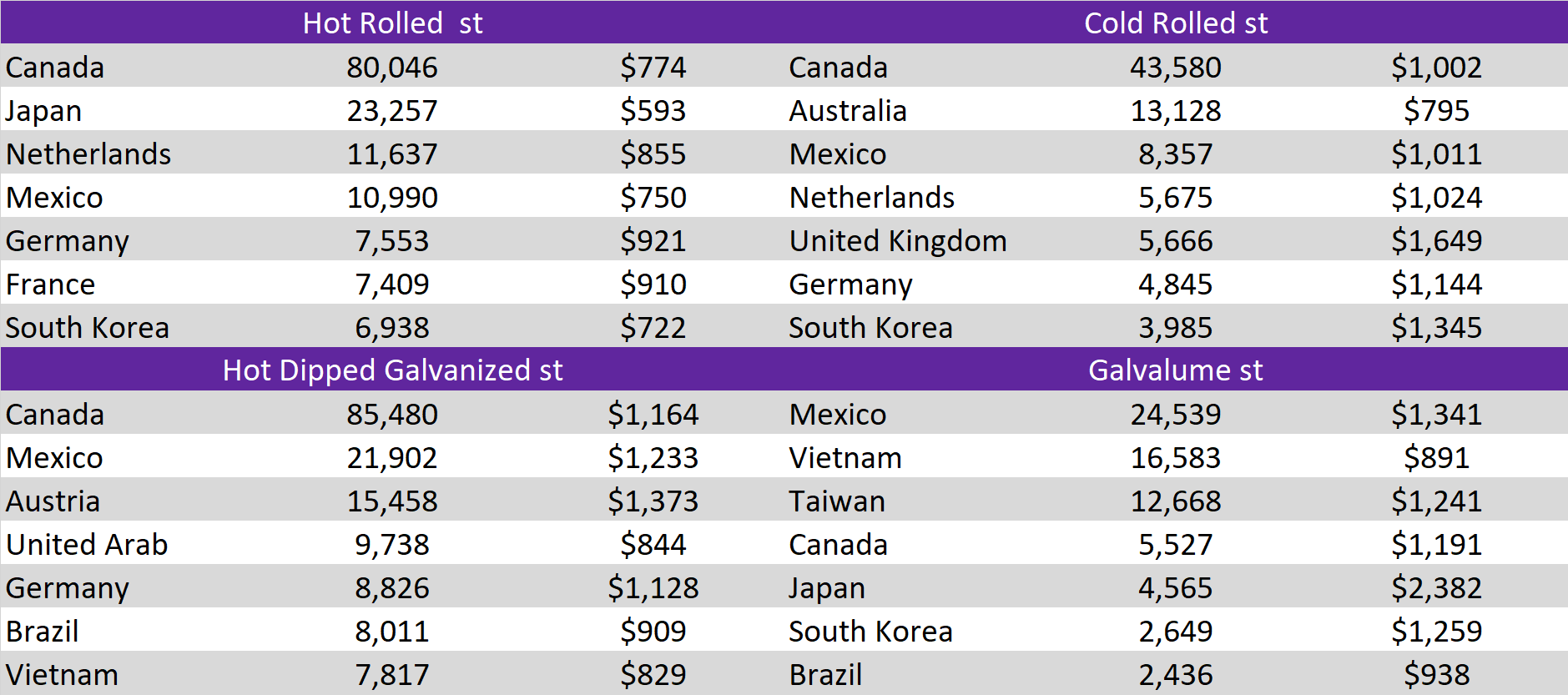

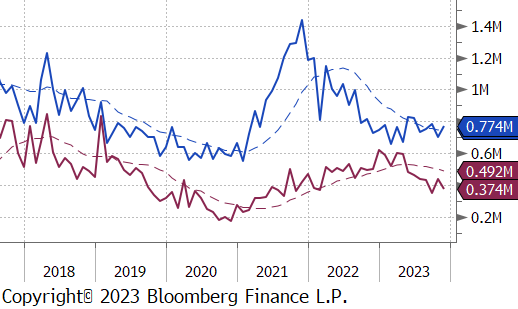

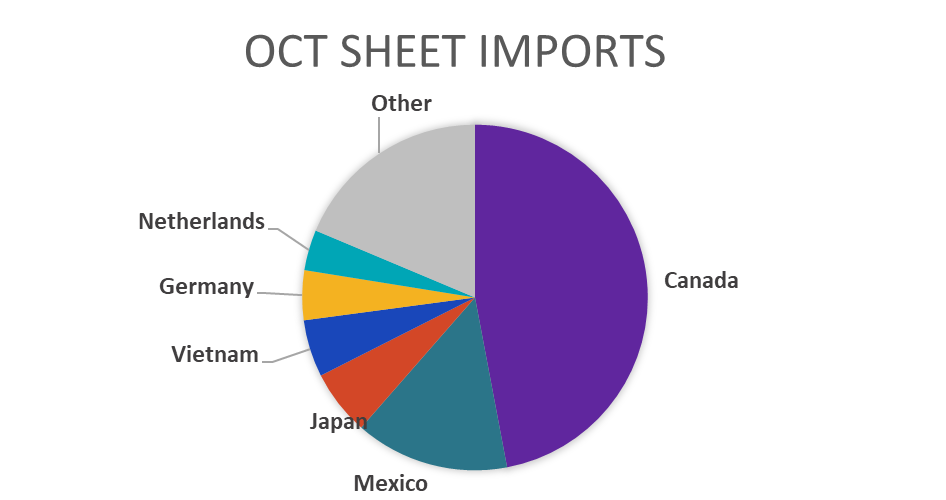

November Projection – Sheet 715k (down 8k MoM); Tube 325k (down 104k MoM)

October Projection – Sheet 723k (down 59k MoM); Tube 429k (up 79k MoM)

All watched global differentials rose up this week, with Brazil seeing the highest spread increase of 22.4%. Furthermore, the countries with the highest HRC price increases, besides the US, were Mexico, up 12.6%, Turkey, up 6.5%, and the UK, up 4.2%.

Scrap

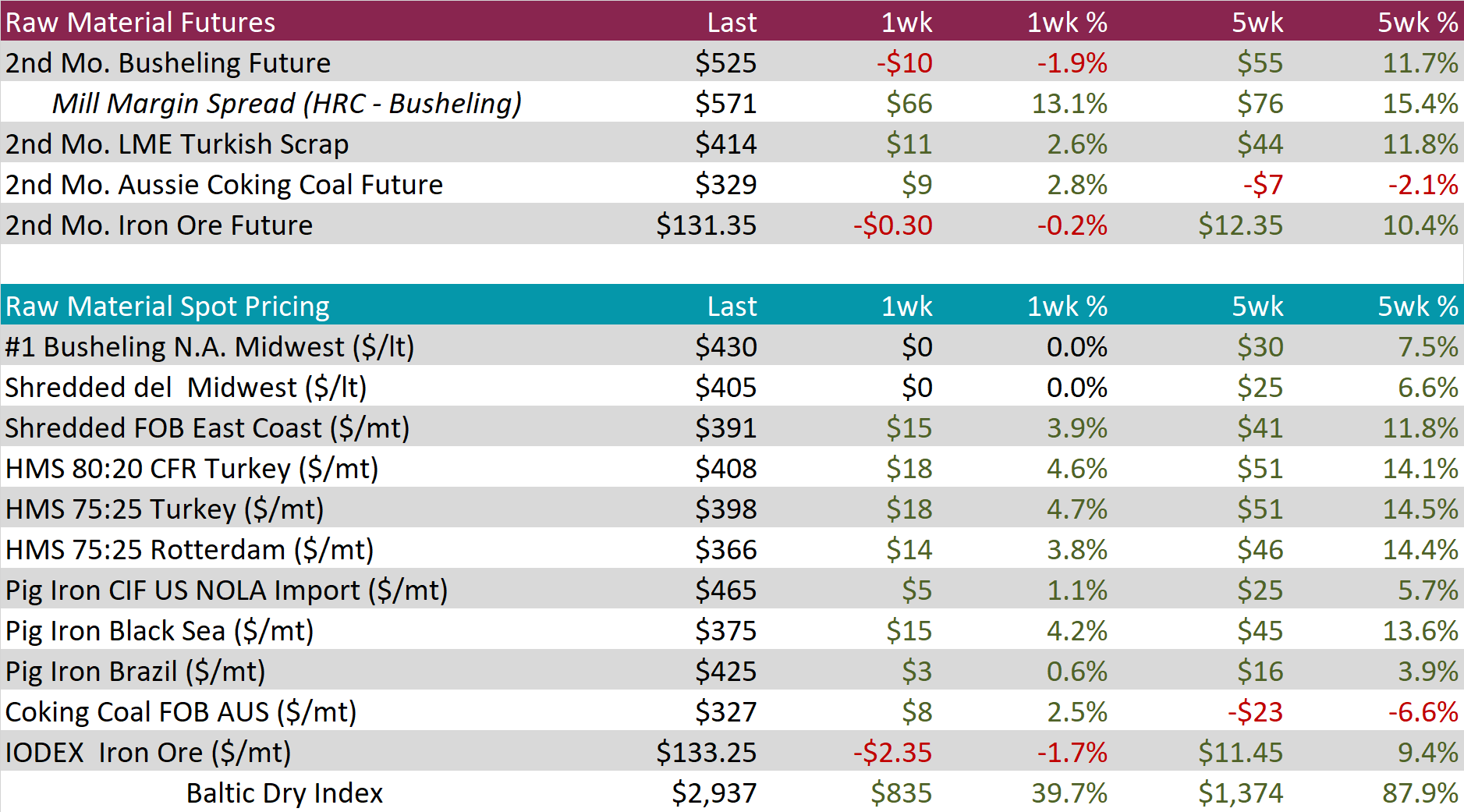

The 2nd month busheling future fell by $10, or 1.9%, to $525. This is the first price decrease in 7-weeks, ending the uptrend that gained a total of $110.

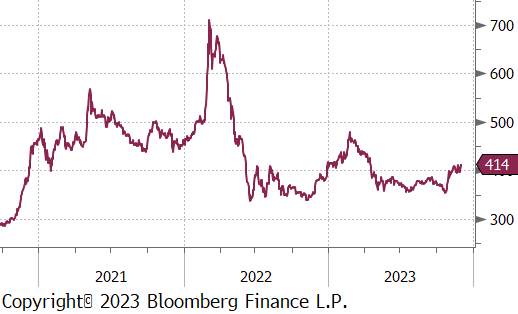

The LME Turkish scrap 2nd month future gained $11, or 2.6%, bringing the price up to $414. Over the past five weeks, the future has realized an 11.8% increase in price.

The 2nd month Aussie coking coal future rose by $9, or 2.8%, to $329. The price continues to hang on above $300, after its price surge in September

Dry Bulk / Freight

The Baltic Dry Index surged up by 835 points, or 39.7%, to $2,937. This is the highest-level hit since May 2022.

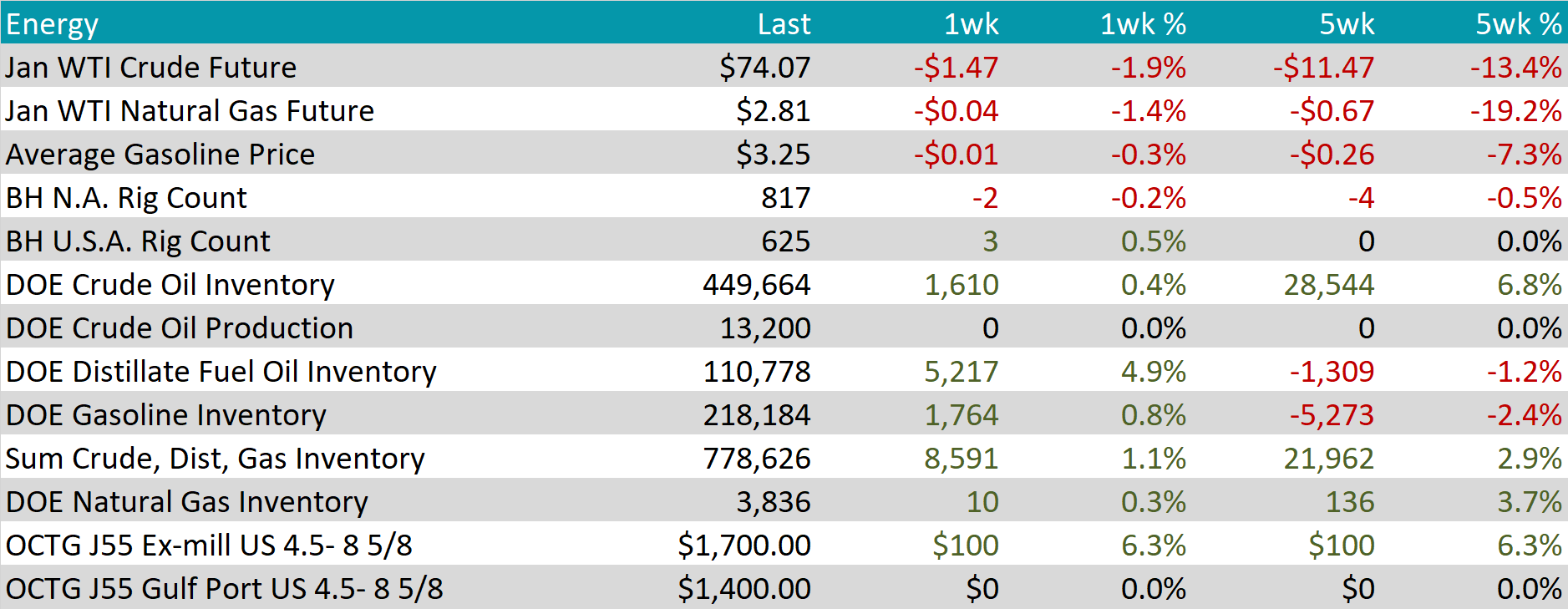

WTI crude oil future lost $1.47 or -1.9% to $74.07/bbl.

WTI natural gas future lost $0.04 or -1.4% to $2.81/bbl.

The aggregate inventory level jumped up again by 1.1%, bringing the total up to 0.779M.

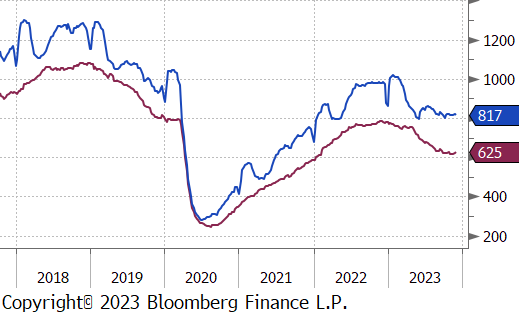

The Baker Hughes North American rig count reduced by 2, with a total count of rigs now at 817. On the other hand, the US rig count gained 3, with the total count now up to 625.

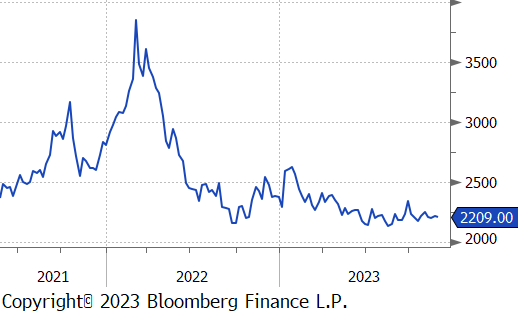

Aluminum fell $7, or -0.3%, to $2,209, edging nearer to the $2,200 threshold as supply concerns continue to coincide with a forecast for strong demand. China is still in restricted supply as expanding production has been halted and Indonesia’s ban on bauxite continues. Meanwhile, they and the PBoC are expected to pledge CNY 1 trillion to spur construction activity.

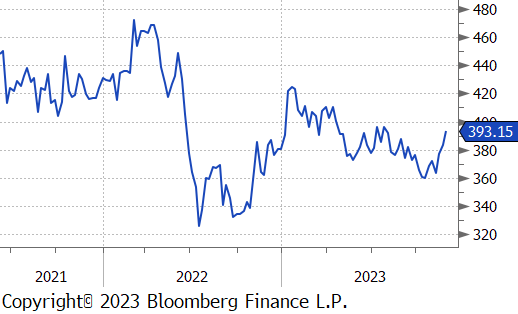

Copper rose by $9.90, or 2.6%, to $393, as concerns over supply heighten due to the shutdown of a major mine in Panama. This prompted several major Chinese copper smelters to agree to a 9% drop-in processing fees with copper miners, which has caused a scramble for supply, as the closure of the mine has upended the outlook for next year.

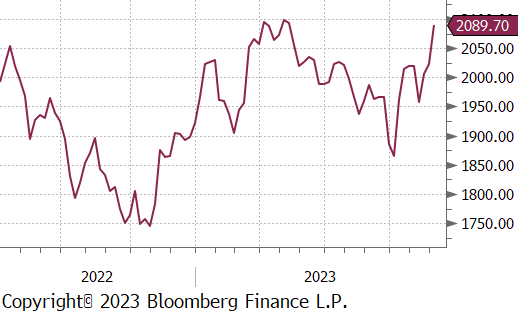

Gold jumped up by $66.20, or 3.3%, to $2,090. This occurs as expectations that the Federal Reserve will hold interest rates steady during this month’s meeting and could potentially start cutting rates next year grow. This belief from traders did not waver, even when the Fed Chair, Jerome Powell, pushed back against these “premature” talks of monetary easing. Markets have expectations of a 60% chance that the Fed could reduce its rates in March next year and are fully pricing in a cut in May.

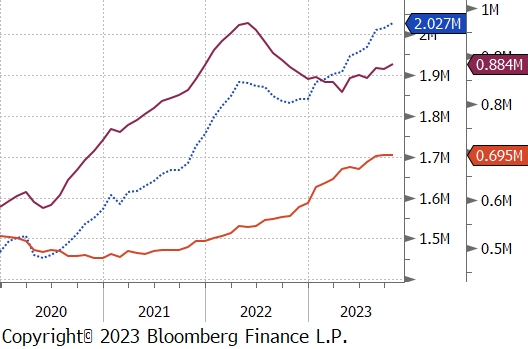

Construction spending MoM rose by 0.6% to a seasonally adjusted rate of $2,027.1 billion in October, following a downward revised 0.2% increase for September and beat market expectations of 0.4% growth. This growth was mainly driven by private spending, which saw a 0.7% increase, namely supported by the 1.3% increase in residential segment. Meanwhile, the non-residential segment went up by 0.1%, slighter higher but slowing.

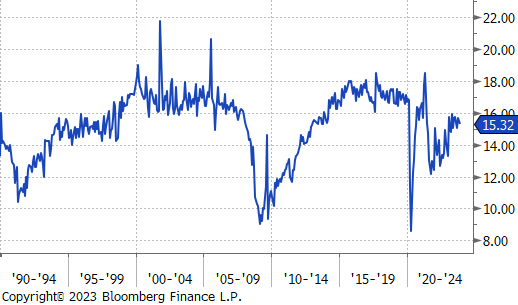

Wards total vehicle sales decreased to 15.32m in November from 15.50m in October and below the consensus forecast of 15.50. As the UAW strikes are resolved and the plants are getting back up to speed, there is potential upside in the coming months.

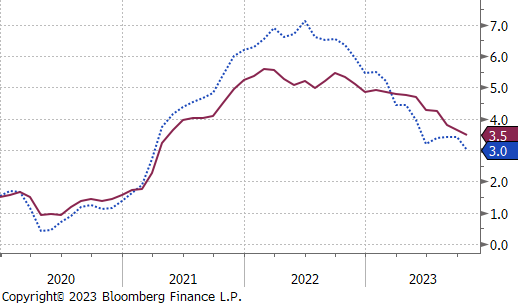

The PCE Core Deflator YoY, which excludes food and energy, eased to 3.5% in October, the lowest since April 2021, from the previous reading of 3.7% in September and was in line with market expectations. Meanwhile, the PCE Deflator YoY was 3%, down from 3.4% in the previous month and was just below estimates of 3.1%. The better-than-expected inflation figures suggest the FED will soon be able to equally evaluate the two components of its mandate.

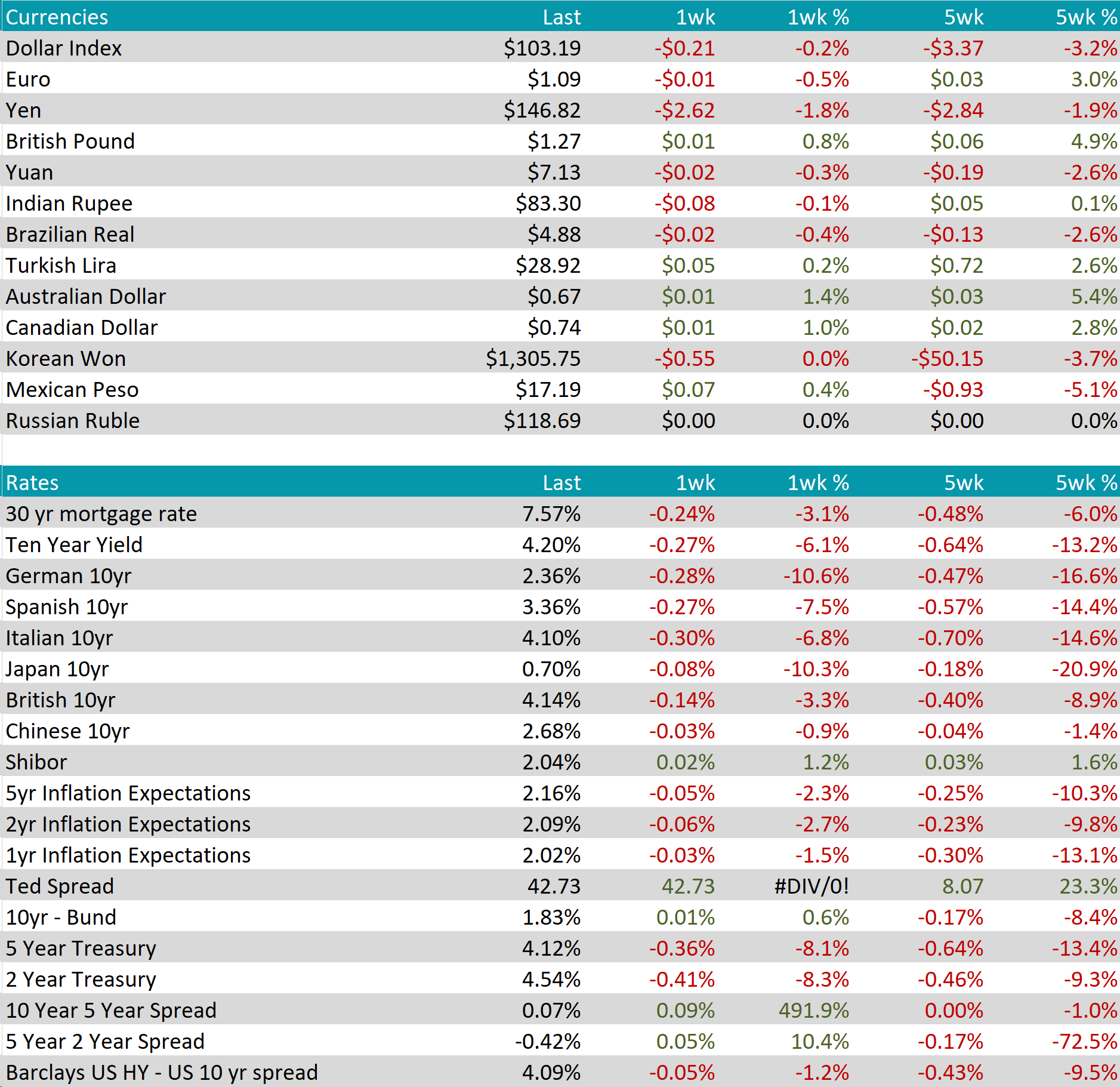

The US Dollar declined against the Yen, staying at its 12-week high. A Bank of Japan board member Asahi Noguchi emphasized Japan’s lack of wage-driven price growth, suggesting it’s too early to exit loose monetary policies, aligning with other BOJ officials’ views. Investors are now focusing on Tokyo’s inflation data as a leading indicator, while the BOJ has reaffirmed its commitment to accommodative monetary policies during its October policy meeting, making minor yield curve control adjustments.

The Euro declined below $1.09 due to hawkish remarks by Fed Chair Jerome Powell, who highlighted ongoing inflation concerns. Meanwhile, the Euro Area saw a faster-than-expected decrease in inflation, raising expectations of an earlier ECB interest rate cut. November’s inflation rate dropped to 2.4%, below the anticipated 2.7%, with the core rate falling to 3.6%, below the expected 3.9%.

The US 10 Yr Yield experienced a notable decline, reaching a 3-month low at 4.2%, sparking interest among traders, who await key labor market data to gain insights into the potential shifts in monetary policy. Factory orders fell beyond expectations. However, Federal Reserve Chair Jerome Powell’s reassurance that monetary policy is “sufficiently restrictive” raised speculation that the Fed might have completed its recent course of rate hikes. This sentiment led to an increase in market expectations for rate cuts in the first half of the upcoming year.