Flack Capital Markets | Ferrous Financial Insider

December 13, 2024 – Issue #462

December 13, 2024 – Issue #462

Overview:

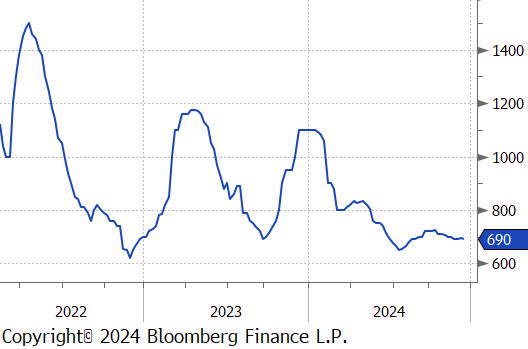

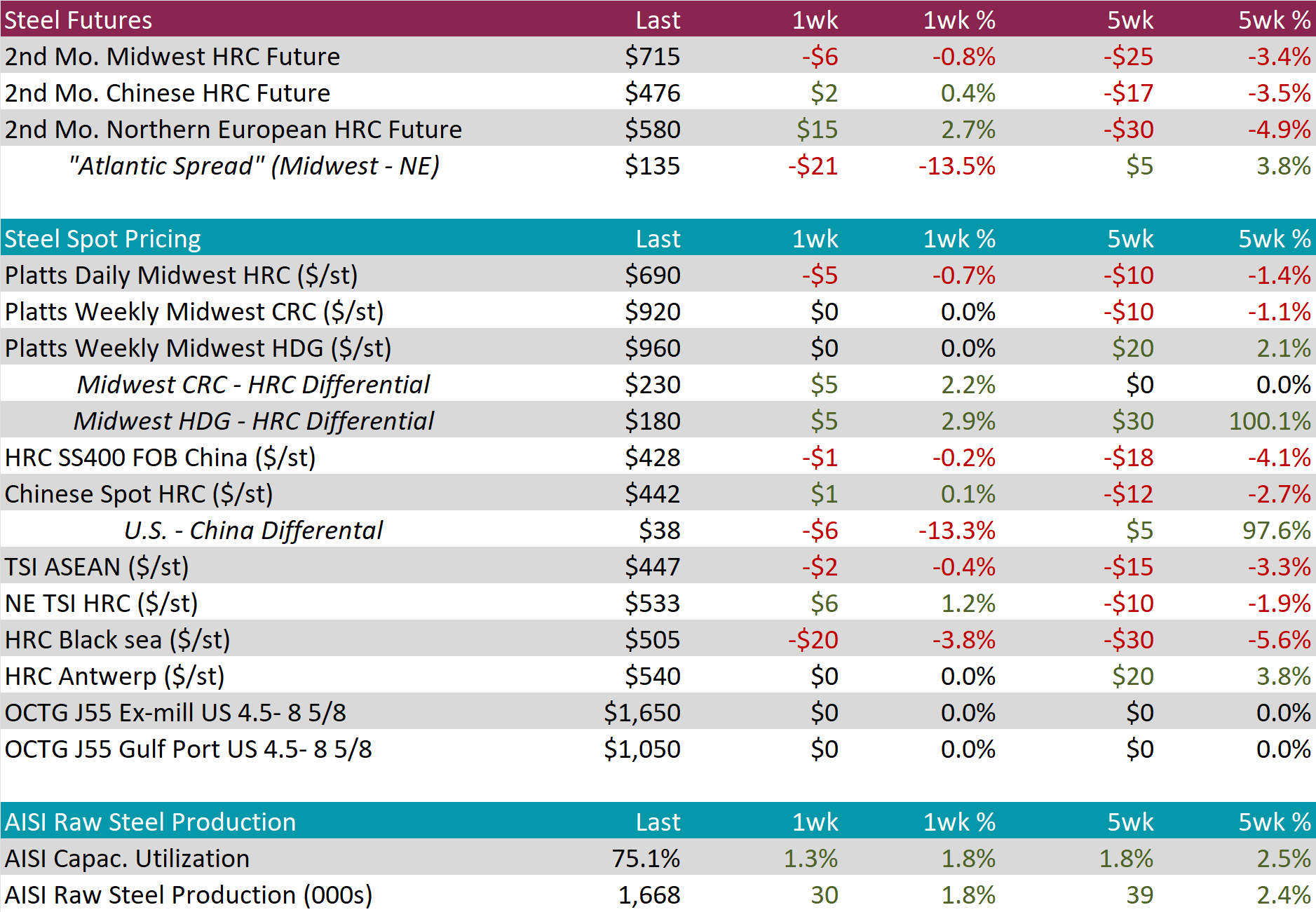

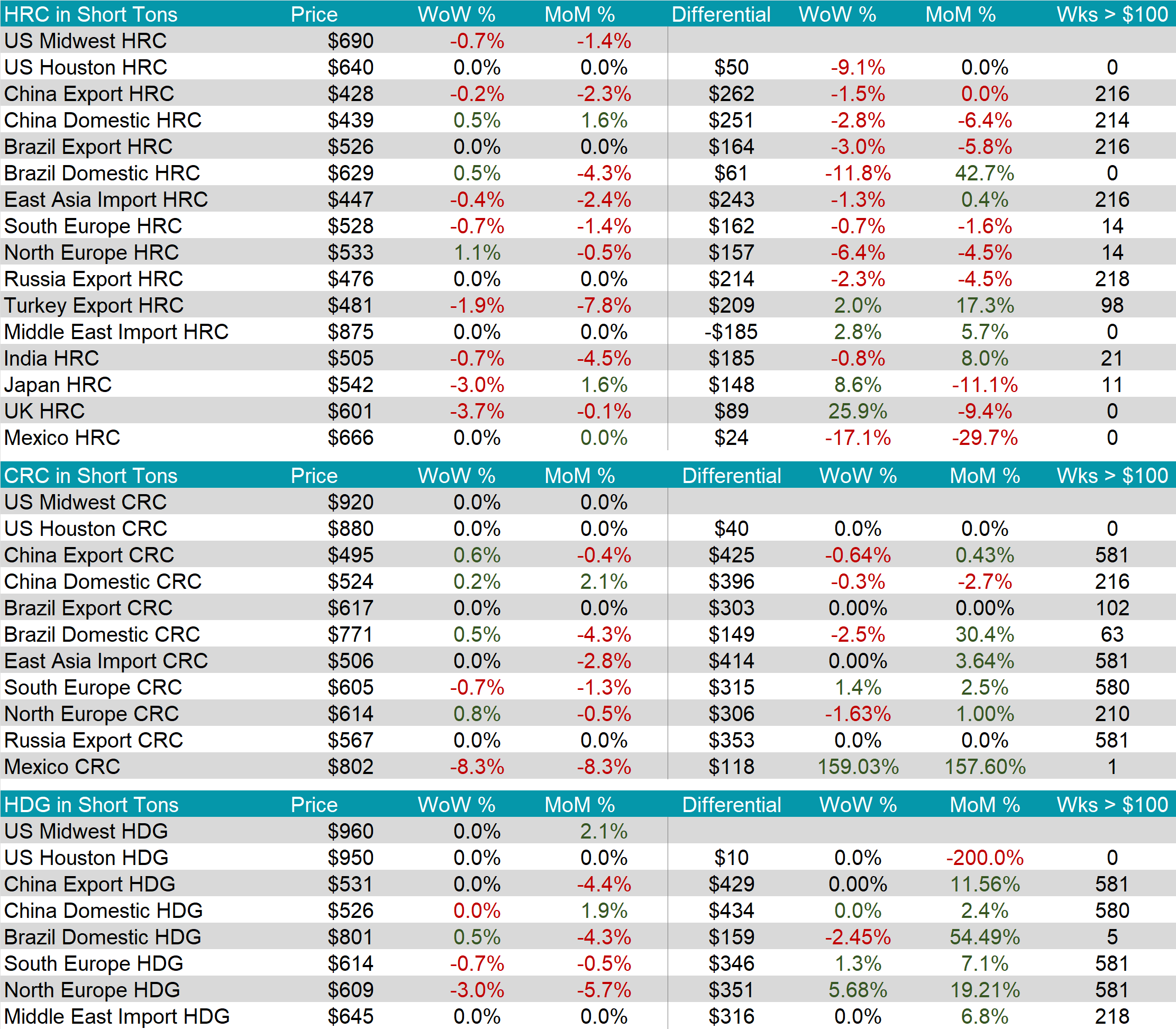

The HRC spot price declined by $5 or -0.7% to $690, reversing last week’s gain. At the same time, the HRC 2nd month future fell by $6 or -0.8% to $715, decreasing for the second consecutive week.

Tandem products both held steady, resulting in the HDG – HRC differential to rise by $5 or 2.9% to $180.

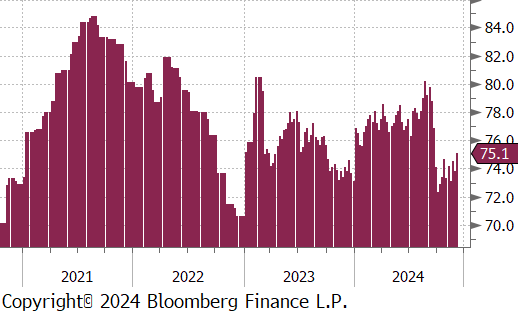

Mill production remained somewhat subdued, with capacity utilization ticking up by 1.3% to 75.1%, bringing raw steel production up to 1.668m net tons.

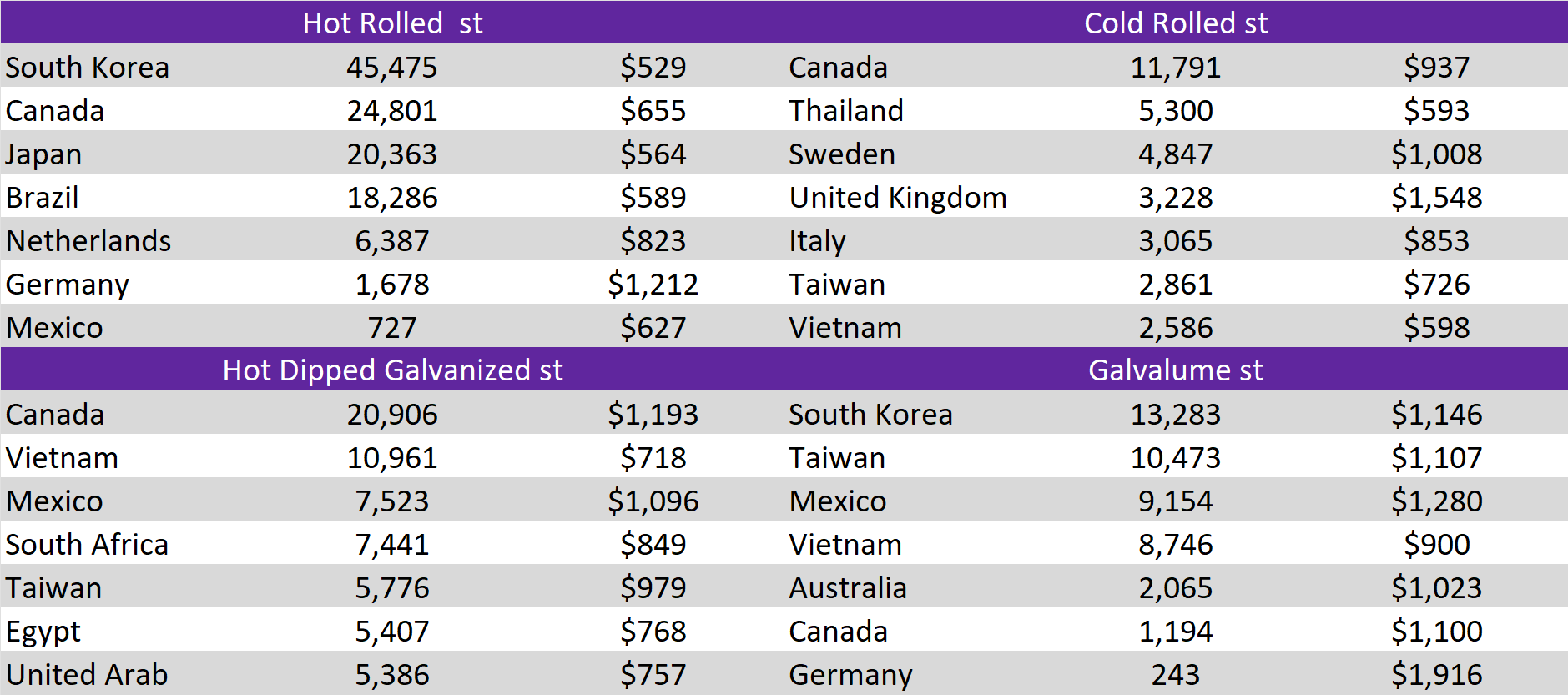

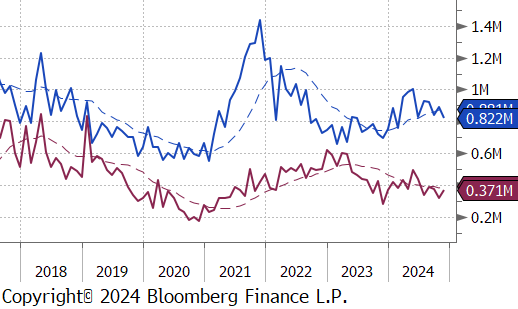

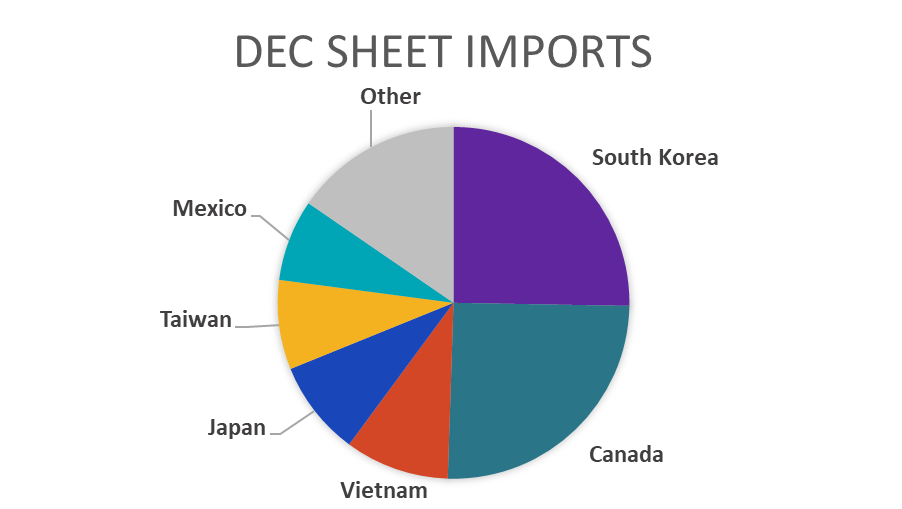

November Projection – Sheet 822k (down 71k MoM); Tube 371k (up 50k MoM)

October Census – Sheet 892k (up 51k MoM); Tube 320k (down 53k MoM)

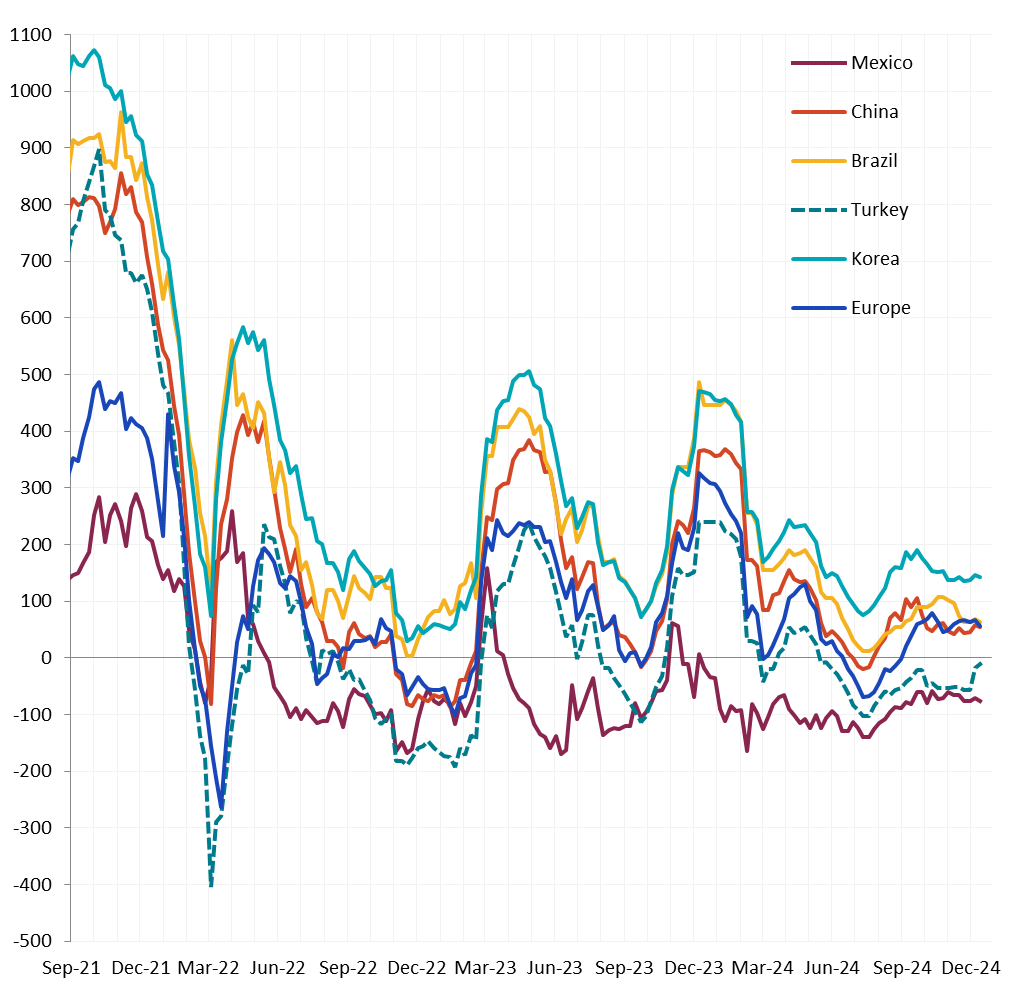

Watched global differentials were mixed this week, with China Export HRC falling by -0.2%, North Europe HRC rising by 1.1%, and Turkey Export HRC dropping by -1.9%.

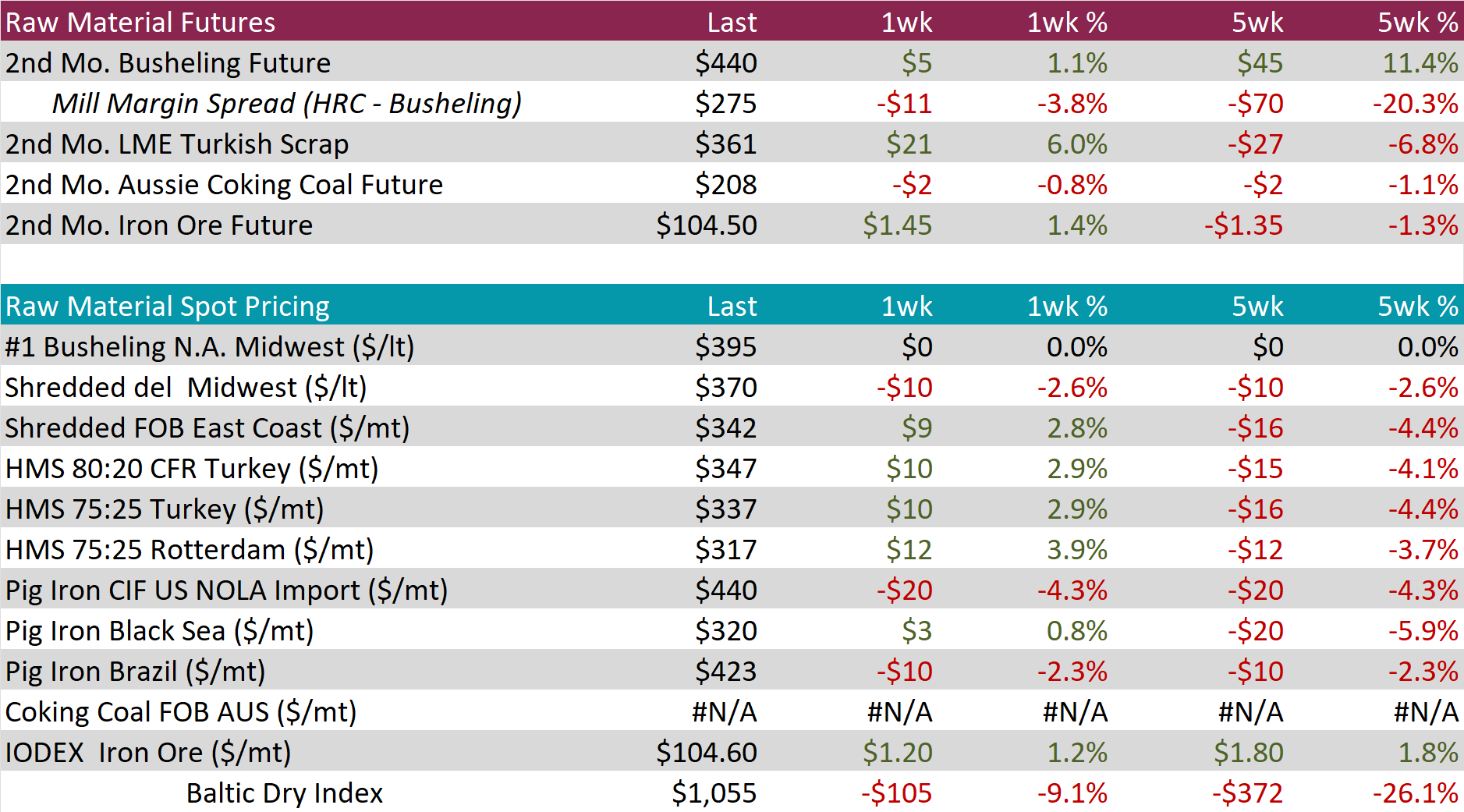

Scrap

The busheling 2nd month future rose by $5 or 1.1% to $440, bringing the five-week change to be up by $45 or 11.4%.

The LME Turkish scrap 2nd month future jumped up by $21 or 6.0% to $361, rebounding from four consecutive weeks of price declines.

The iron ore 2nd month future increased by $1.45 or 1.4% to $104.50, reaching the highest price in five weeks.

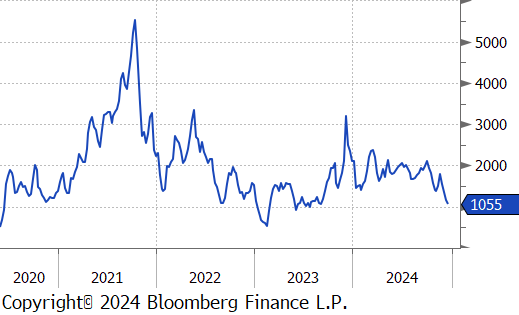

Dry Bulk / Freight

The Baltic Dry Index dropped by $105 or -9.1% to $1,055, declining for the fourth consecutive week and reaching the lowest level since July 2023.

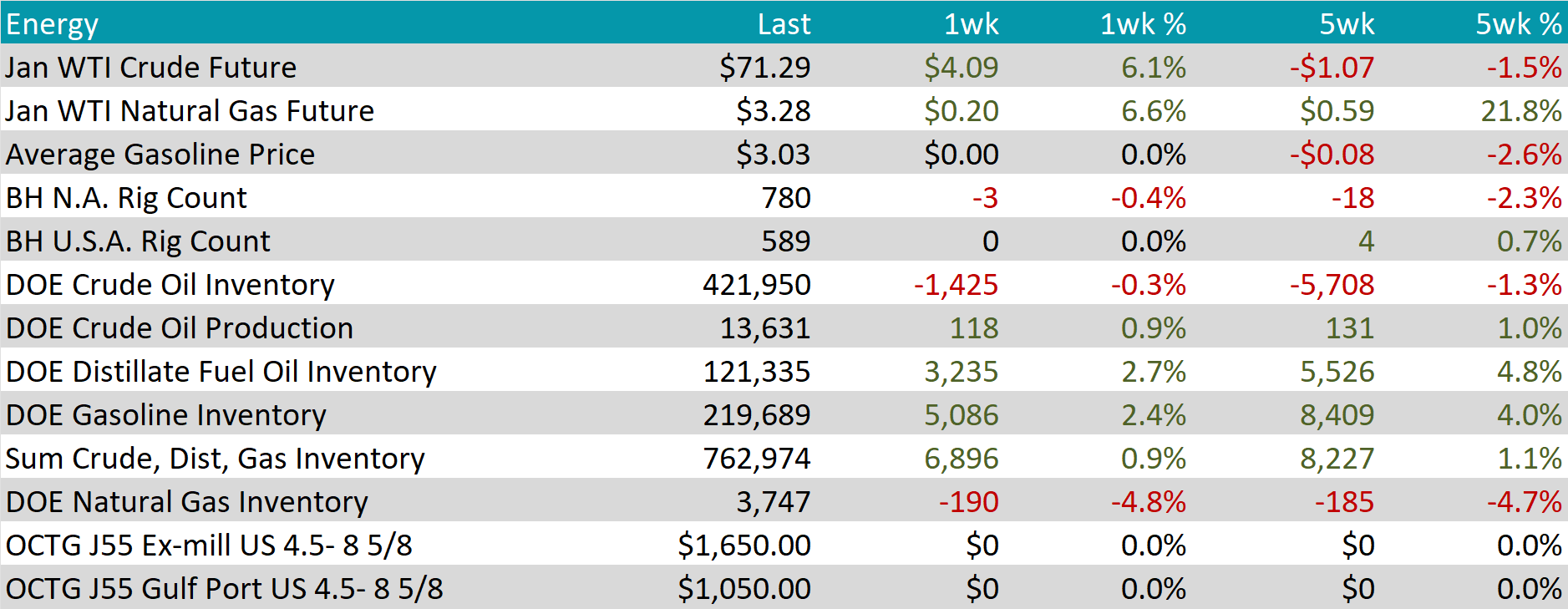

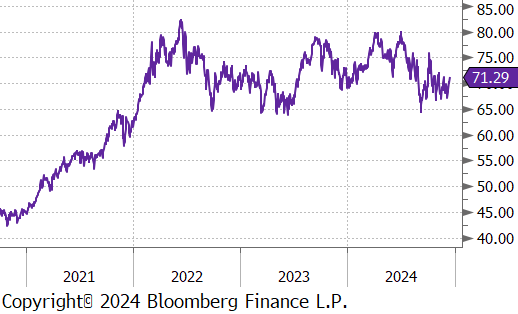

WTI crude oil future gained $4.09 or 6.1% to $71.29/bbl.

WTI natural gas future gained $0.20 or 6.6% to $3.28/bbl.

The aggregate inventory level continued to rise, increasing this week by 0.9%.

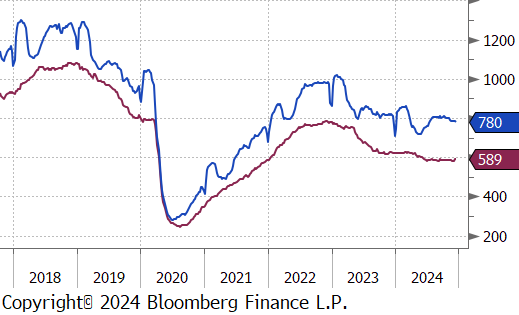

The Baker Hughes North American rig count reduced by 3 rigs, bringing the total count to 780 rigs. Meanwhile, the US rig count remained unchanged, keeping the total count at 589 rigs.

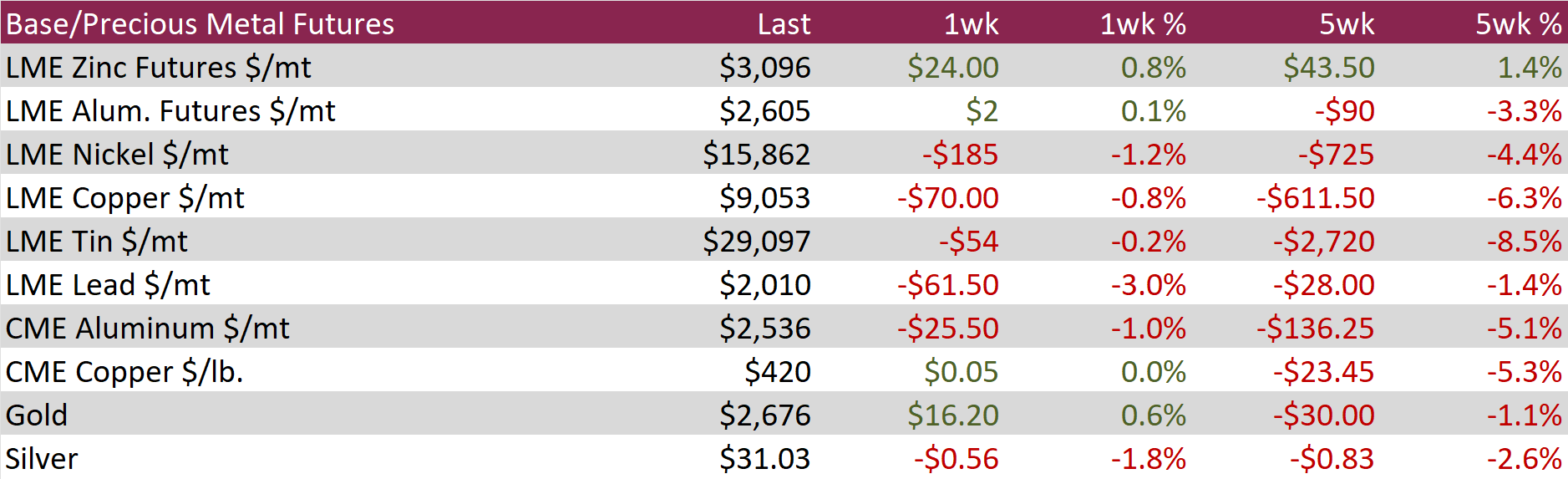

Aluminum futures rose slightly by $2 or 0.1% to $2,605. Reports suggest that China may allow the yuan to weaken through next year, a move aimed at amplifying the effects of looser monetary policy and bolstering export competitiveness amidst ongoing US tariff threats. This shift contributed to declines in base metals priced in dollar-denominated exchanges, as a weaker yuan reduces demand for imports. Meanwhile, increased rainfall in China’s Yunnan province boosted hydropower capacity, reducing energy costs for aluminum smelters and supporting output. However, this was counterbalanced by surging alumina prices driven by global supply disruptions and Beijing’s decision to end tax rebates on semi-manufactured aluminum exports in December. The policy change is expected to remove an estimated five million tonnes of aluminum from international markets, tightening global supply.

Copper futures ticked up slightly by $0.05 or 0.0% to $420 as demand concerns in China, the world’s largest copper consumer, weighed on prices. November data showed weaker-than-expected retail sales in China, despite industrial production exceeding forecasts. Additionally, new home prices declined for the 17th consecutive month, reflecting ongoing challenges in the property sector. Beijing’s recent policy pledges, including commitments to more proactive fiscal stimulus and looser monetary policy, failed to inspire optimism due to a lack of clarity on the scale of potential measures.

Precious Metals

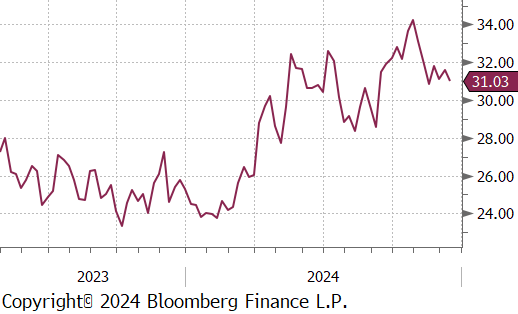

Silver dipped by $.056 or -1.8% to $31.03, as investors await the US Federal Reserve’s policy decision this week. The Fed is expected to announce a 25-basis point rate cut on Wednesday, but market sentiment has cooled regarding additional easing in 2024. Adding to the pressure on silver, demand concerns in top consumer China persisted. November data revealed weaker-than-expected retail sales and a 17th consecutive month of declining new home prices, reflecting ongoing challenges in consumption and the property sector. Beijing’s latest policy promises, including more proactive fiscal stimulus and looser monetary policy, failed to inspire confidence, as details on the scale of potential measures remain unclear.

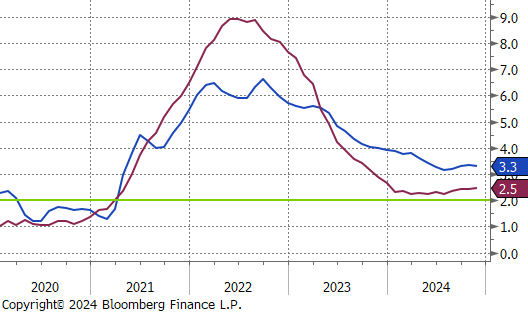

In November, the NFIB Small Business Optimism soared to 101.7, coming in above the 50-year average of 98 for the first time in 34 months and reaching the highest level since June 2021. This follows a 93.7 reading in October and exceeded expectations of an increase to 94.6. Additionally, the Uncertainty Index dropped by 12 points to 98 as future business conditions become clearer following the election.

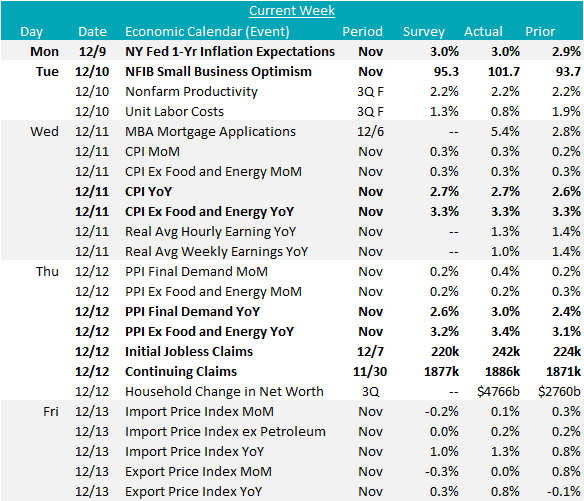

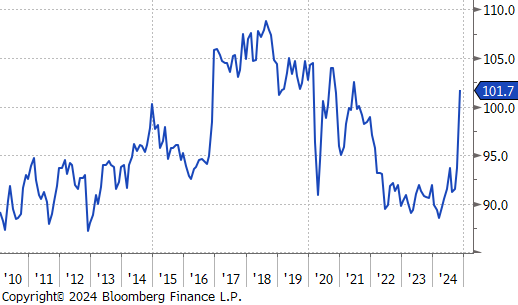

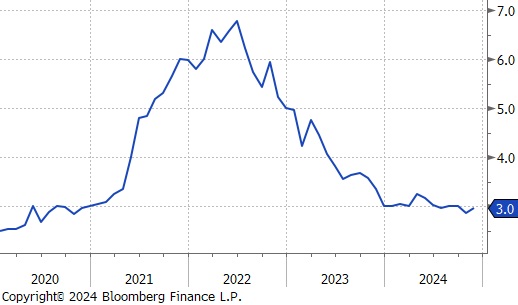

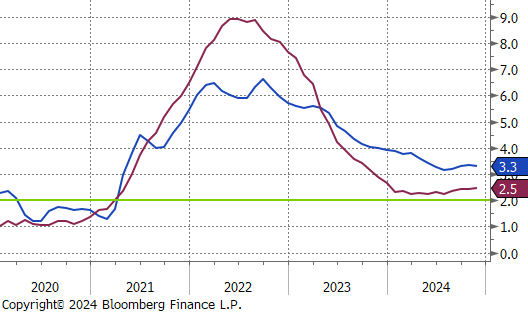

Both Topline and Core CPI (Consumer Price Index) rose 0.3% MoM, which is slightly higher than expected. This led to YoY increase to 2.7% and 3.3%, respectively. PPI (Producer Price Index) came in hotter – Topline and Core PPI were up 3% and 3.4% YoY, respectively, both beating expectations. While many have pointed to the anomaly of surging egg prices as a “one off” for the November Topline PPI, the fact remains that Core PPI (ex. Food & Energy) has been in a slow structural uptrend since last December. Finally, the November NY Fed 1yr-Inflation Expectations were in line with expectations at 3%. This was up from 2.9% in October.