Flack Capital Markets | Ferrous Financial Insider

December 15, 2023 – Issue #410

December 15, 2023 – Issue #410

**From the clerical side, this will be the final FFI Report of the year – see you in 2024.

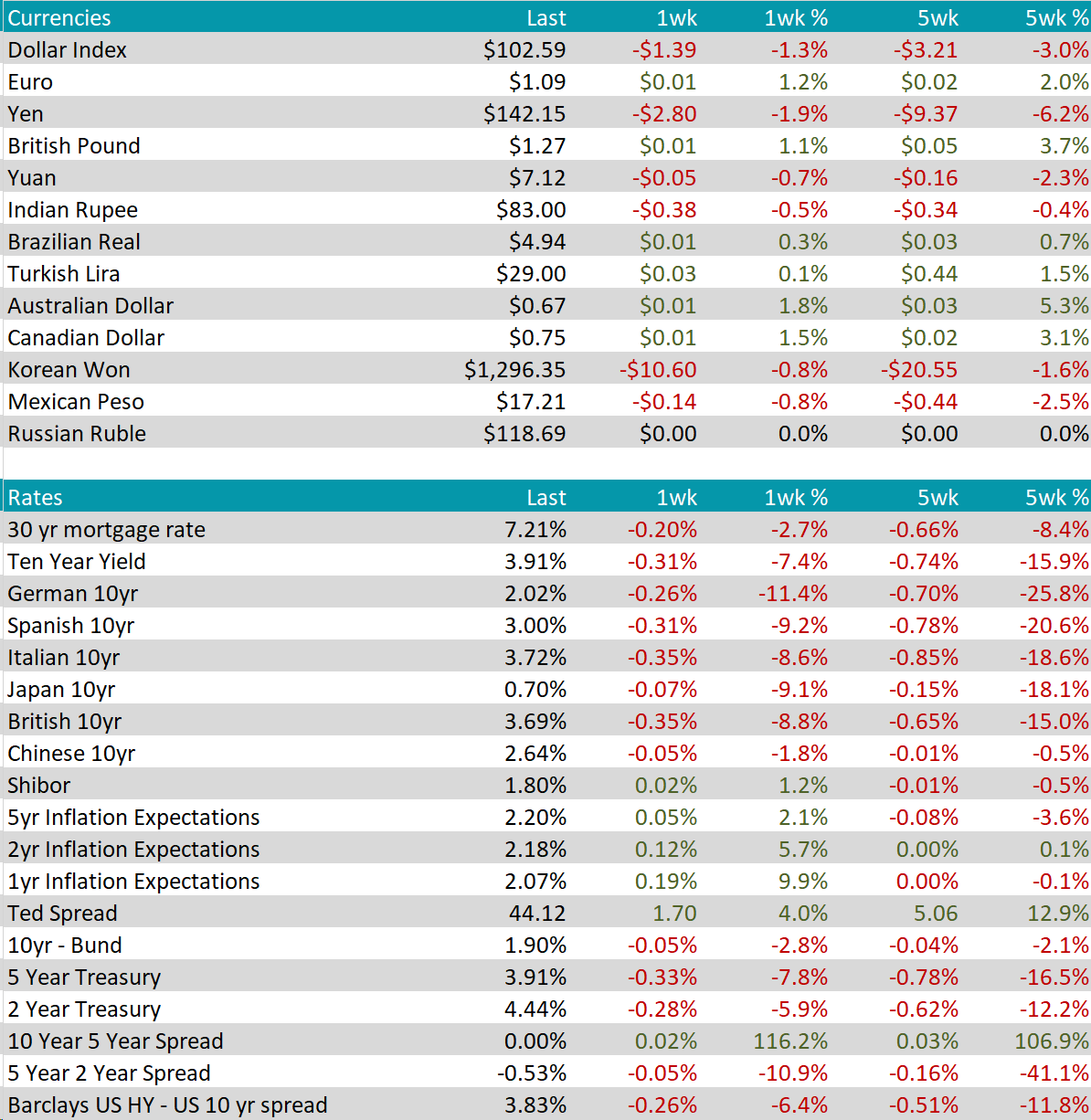

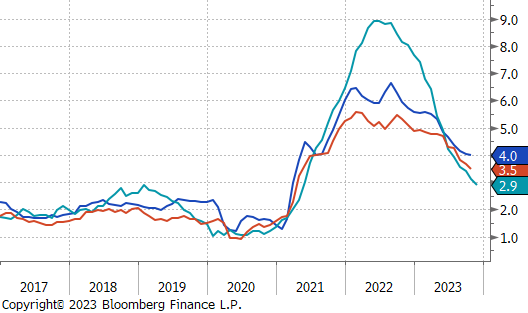

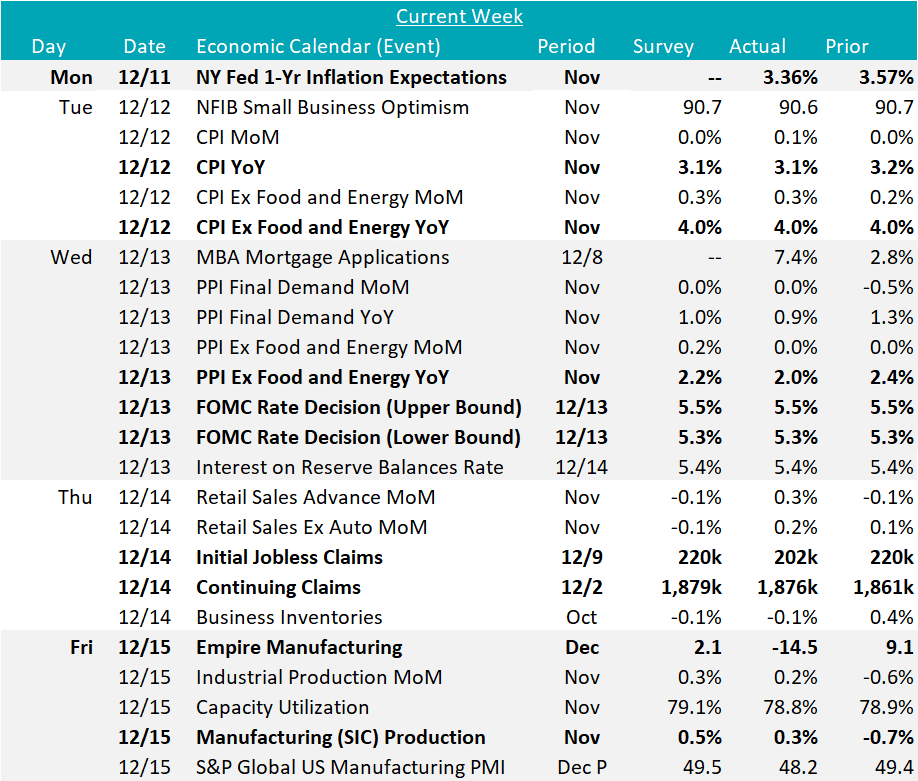

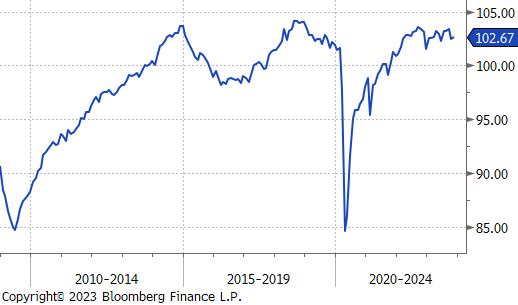

While last week’s FOMC rate decision was largely telegraphed, it did signify a sea change when the committee unanimously voted to hold Fed Funds Target Rates steady at 5.25-5.5%. This was because the forward-looking “dot plot” is no longer pricing any additional rate hikes and 75bps of cuts priced into the 2024 forecast. Further embedded in the SEP (Summary of Economic Projections) is a forecast for lower levels of 2024 year end inflation (2.4% Core PCE and unchanged 4.1% unemployment).

Furthermore, overall inflation data from last week came in below expectations for November. Core CPI YoY was unchanged at 4%, while the Topline CPI printed 3.1%, in line with expectations and down from last month’s 3.2% print. PPI (ex food & energy) YoY came in at 2%, below expectations of 2.2% and down from October’s print of 2.4%. The clear takeaway is that price pressure is cooling and there is additional disinflation in the pipeline. Looking forward, PCE Core YoY data will be released on Friday and expectations are for that figure to come in at 3.3%, down from October’s 3.5% print.

Turning to the steel and industrial sector, there is no doubt that the rapid increase in interest rates which started in March of 2022 has created a severe headwind for steel demand. As we look forward to next year, we anticipate that the removal of this restraint would also uniquely benefit the industrial sectors first. While it will likely be a bumpy road, there is no doubt that the outlook is rosier now than it was this time one year ago.

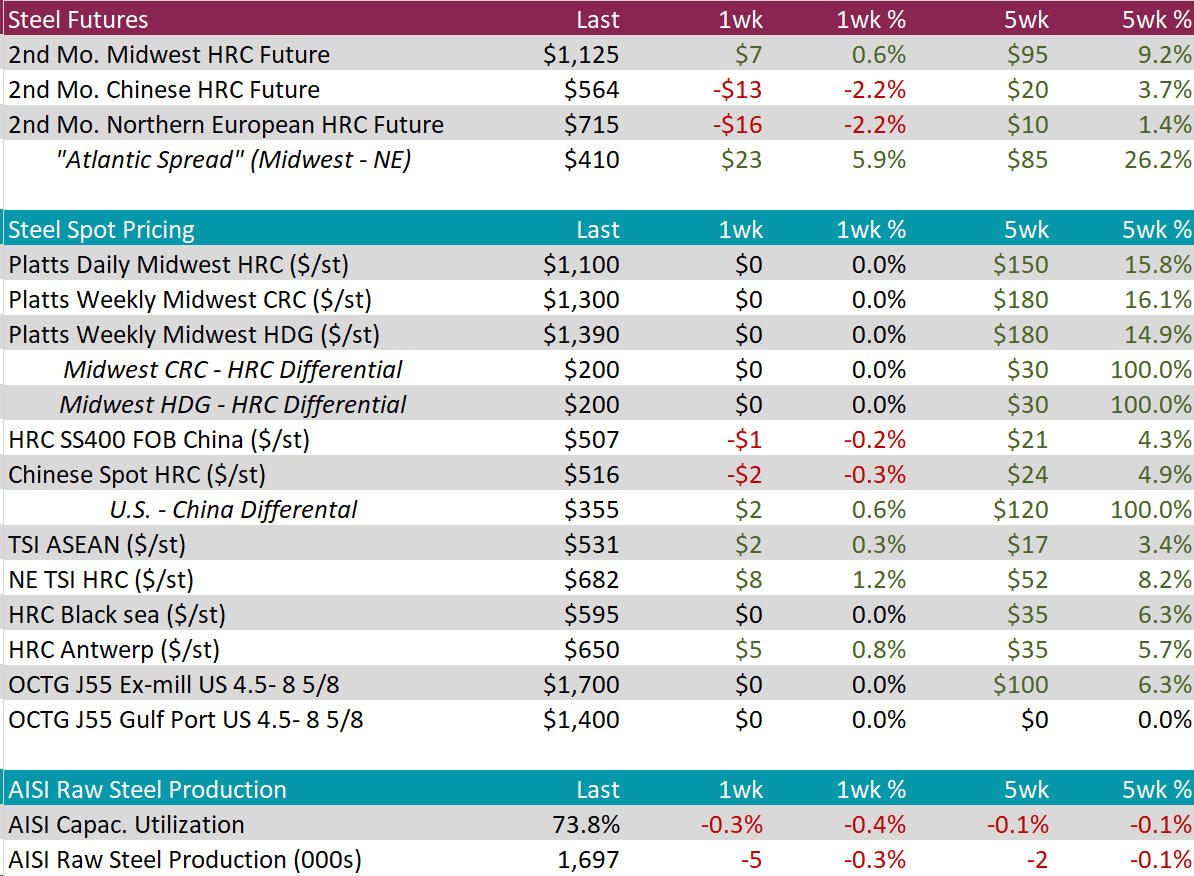

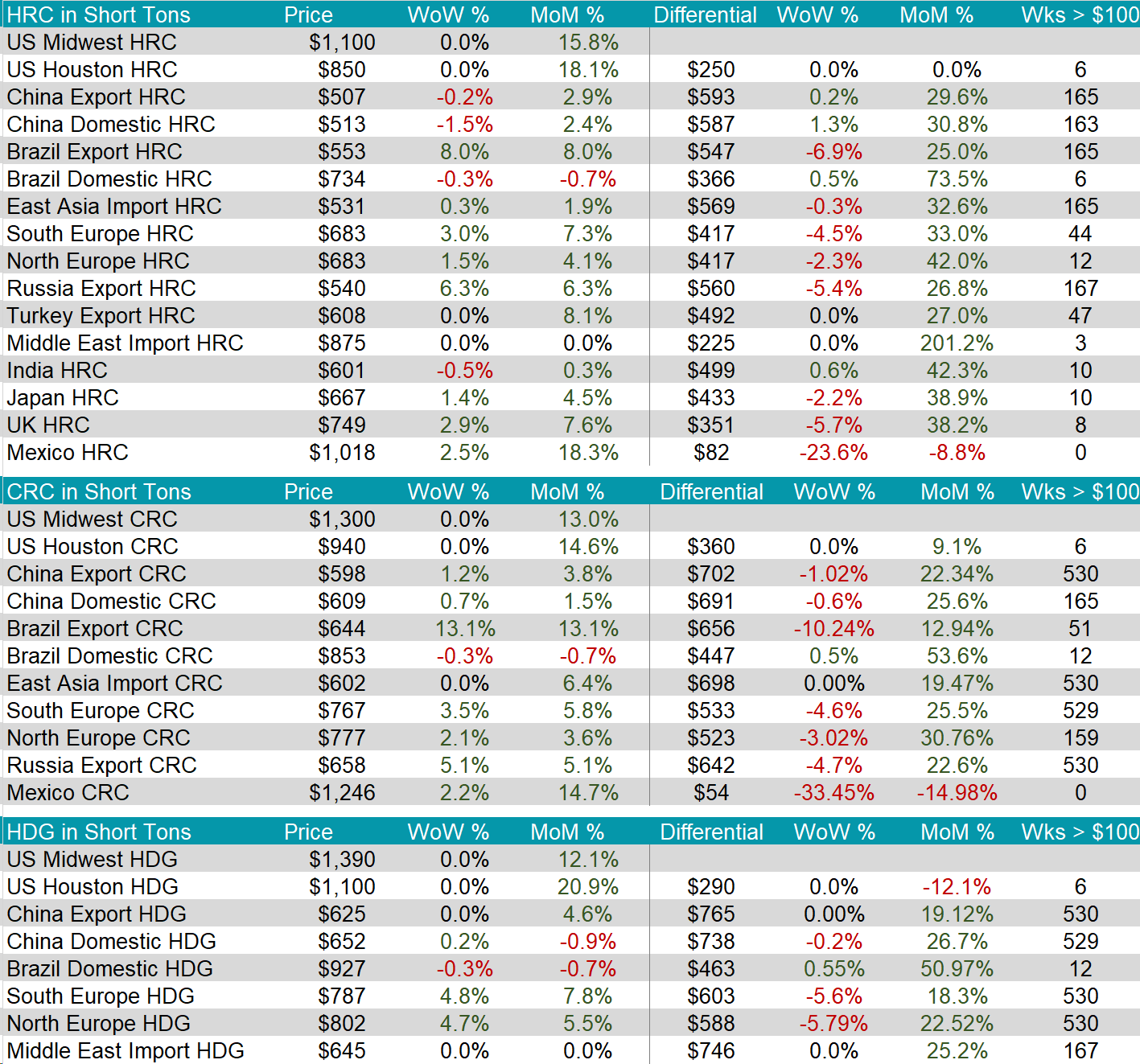

The HRC spot price remained unchanged at $1,100. At the same time the 2nd month future rose by $7 or 0.6% to $1,125, reaching a new price high since March.

Tandem products both remained unchanged, with the CRC staying at $1,300 and HDG staying at $1,390, resulting in both the CRC – HRC and HDG – HRC differentials remaining static at $200.

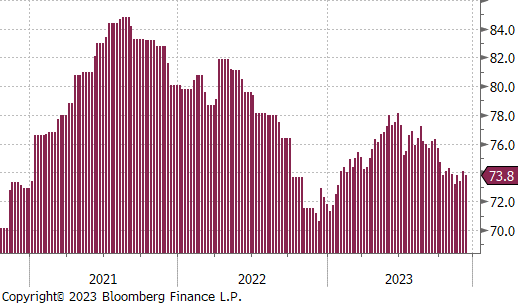

Mill production continues to stay at relatively low levels, with capacity utilization ticking down by 0.3% to 73.8%, bringing raw steel production down to 1.697m net tons.

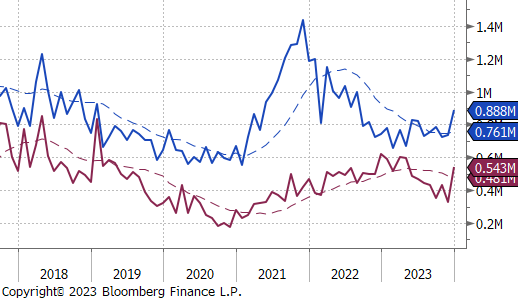

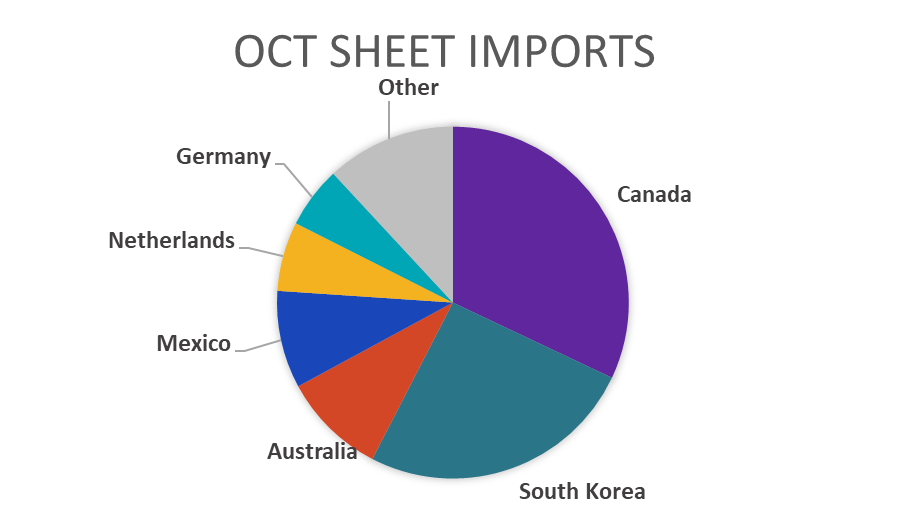

December Projection – Sheet 88k (up 150k MoM); Tube 543k (up 214k MoM)

November Projection – Sheet 737k (up 14k MoM); Tube 329k (down 99k MoM)

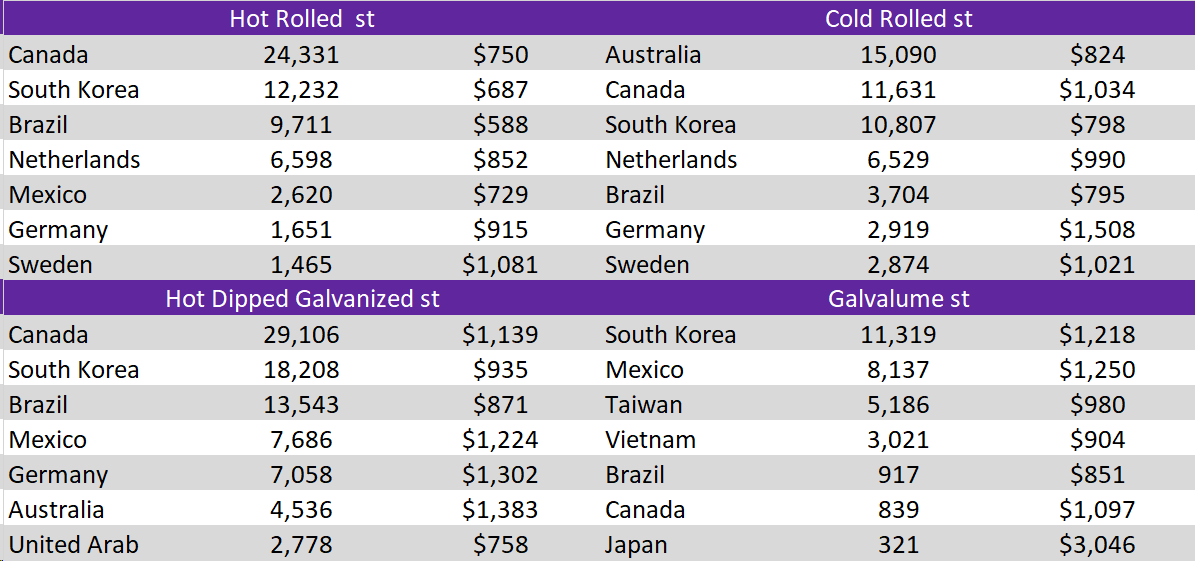

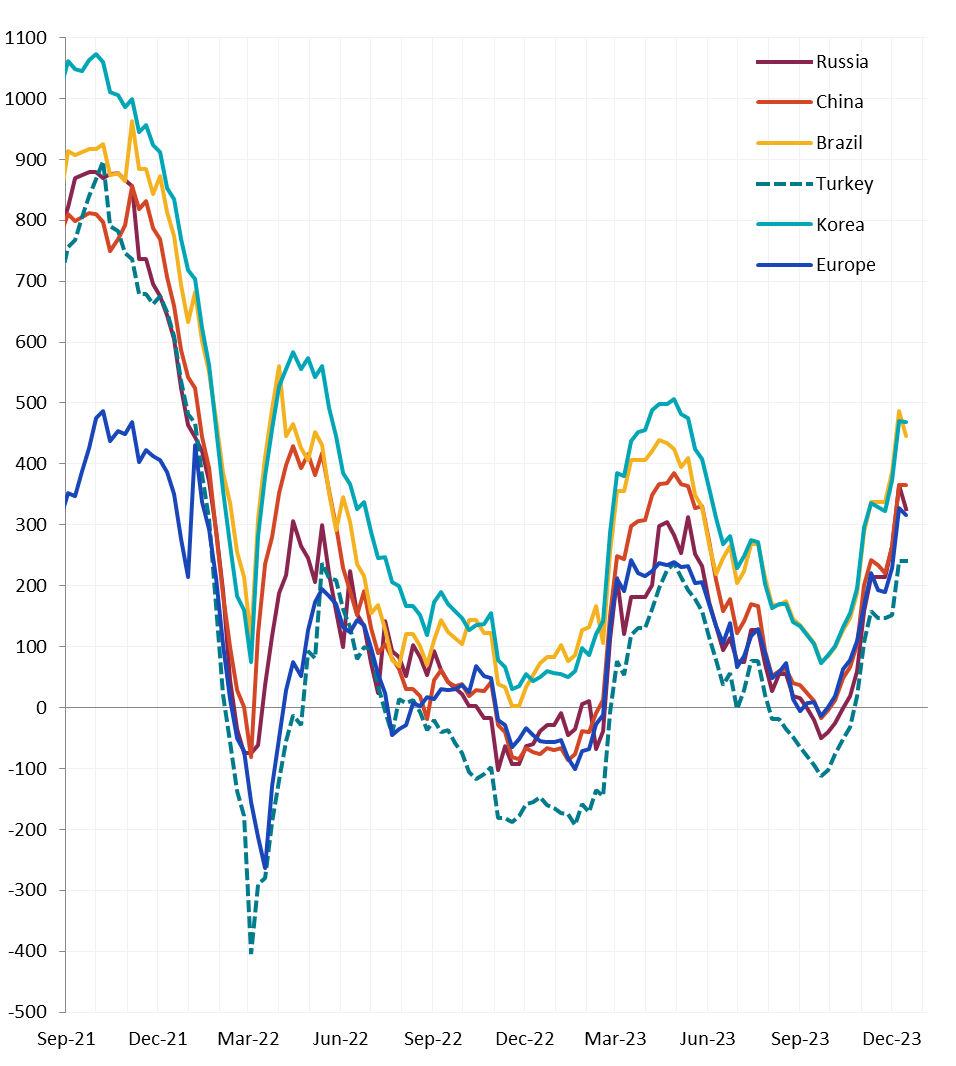

Watched global differentials were mixed this week, with the most notable changes coming from Brazil, with an 8.0% increase in HRC and Russia, with a 6.3% increase in HRC. Meanwhile, China continued to slow, seeing a -1.5% decrease in their domestic HRC.

Scrap

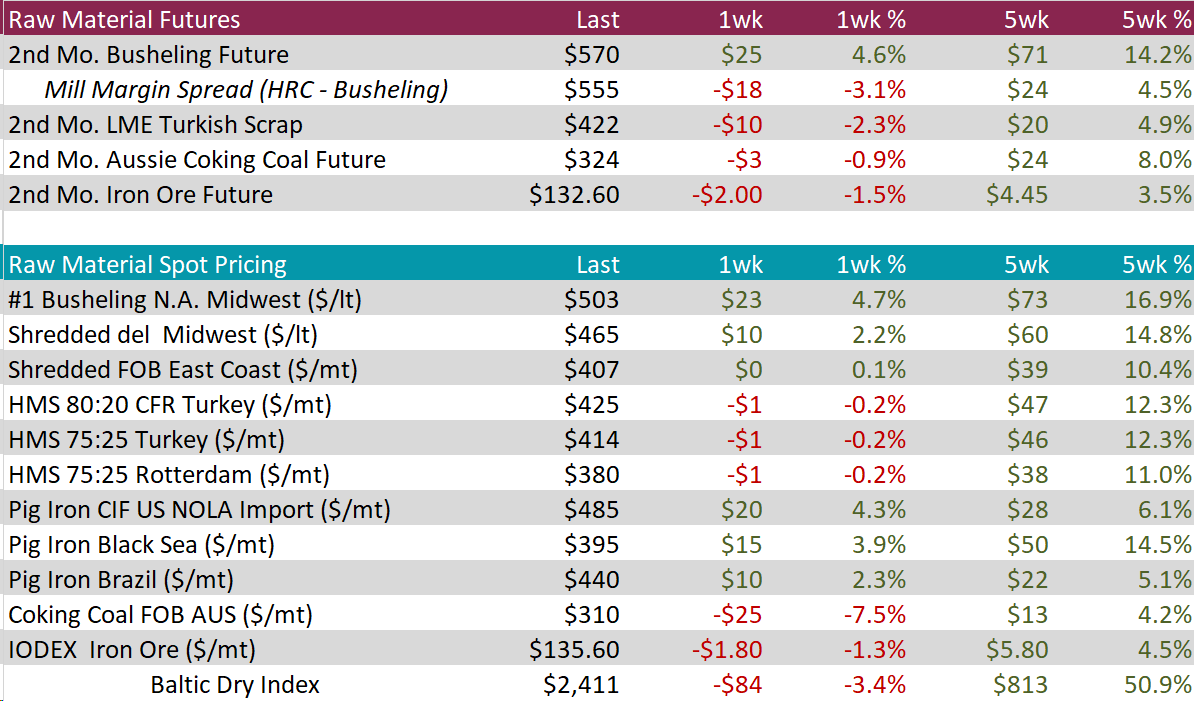

The 2nd month busheling future continued to make gains, increasing by $25 or 4.6% to $570, nearing the 2023 price high of $590. At the same time, the busheling spot price also made some gains, rising by $23 or 4.7% to $503.

The LME Turkish scrap 2nd month future fell by $10 or -2.3% to $422 after hitting a new price high since March last week.

The iron ore 2nd month future declined by $2 or -1.5% to $132.60 after hitting a 2023 price high the prior week. However, the price remains elevated compared to the price peak seen in March of this year.

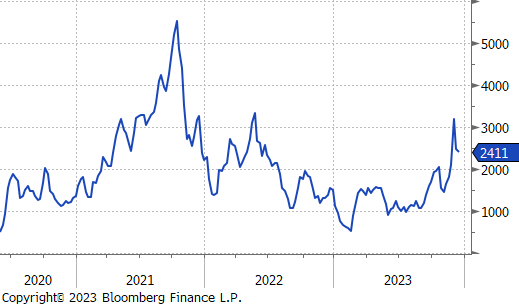

Dry Bulk / Freight

The Baltic Dry Index steadied a bit after seeing a significant drop of 442 points from the 2023 high of $2495 in the prior week, decreasing only by 84 points or -3.4% to $2,411.

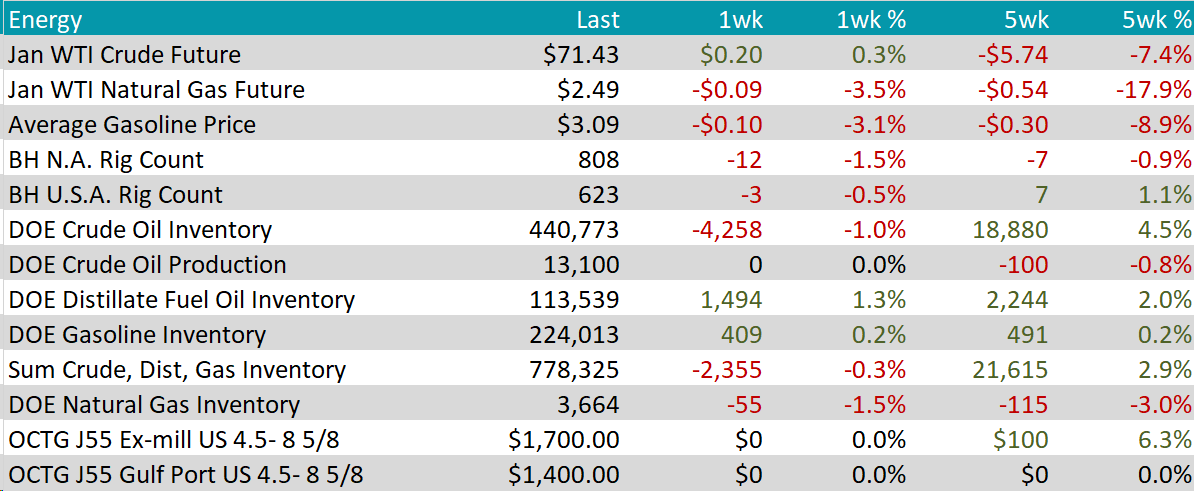

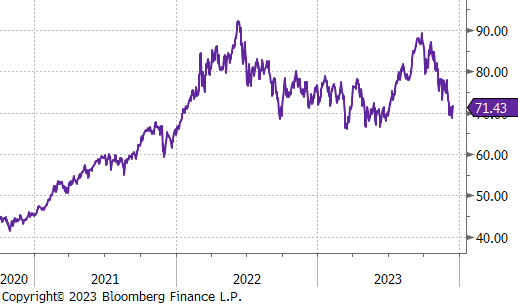

WTI crude oil future gained $0.20 or 0.3% to $71.43/bbl.

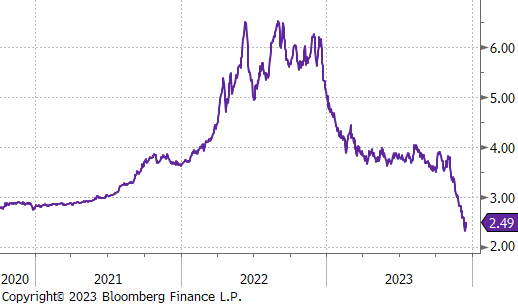

WTI natural gas future lost $0.09 or -3.5% to $2.49/bbl.

The aggregate inventory level fell by -0.3% to 0.778M.

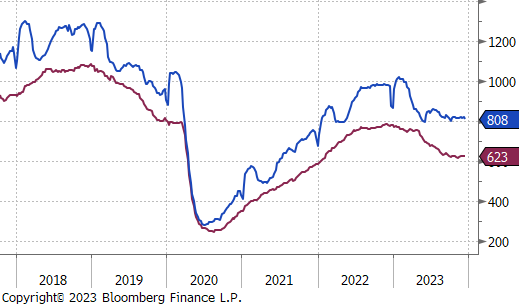

The Baker Hughes North American rig count dropped by 12, bringing the count down to 808 rigs. At the same time the US rig count fell by 3, bringing the count down to 623 rigs.

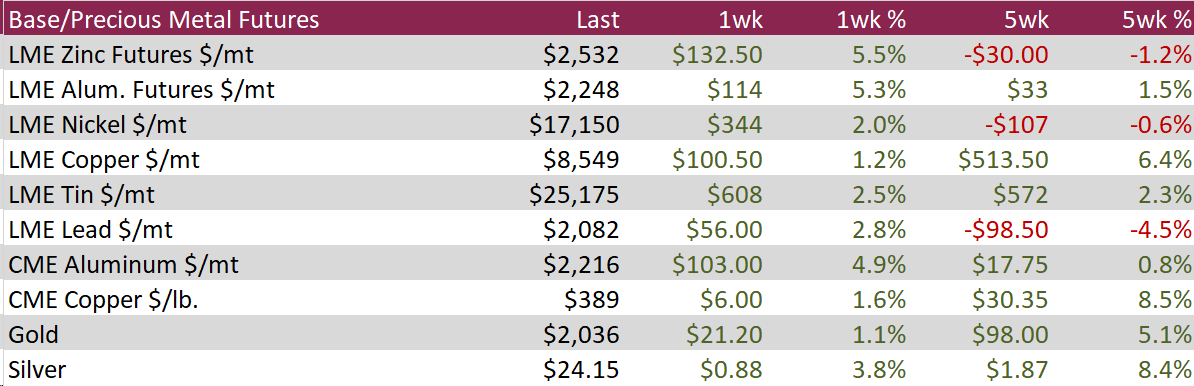

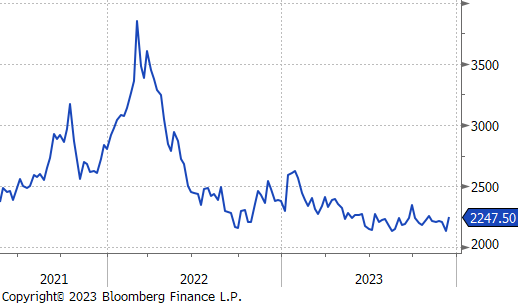

Aluminum surged by $114 or 5.3% to $2,248, surpassing the $2,200 mark and rebounding sharply from the 14-month low of $2,134 the week prior as signs of a pickup in demand countered the recent bearish sentiment. The indicator of increased demand came from China’s October customs data, where imports of unwrought aluminum alloy rose nearly 10% YoY to 109k tonnes, reflecting the country’s economic stimulus measures in bolstering manufacturers’ input procurement. On the other hand, the global outlook remains subdued, with Norsk Hydro, a key Norwegian producer, experiencing a 57% sales decline in Q3, a downturn in Chinese electric vehicle demand, and Alcoa incurring losses due to volatile energy prices.

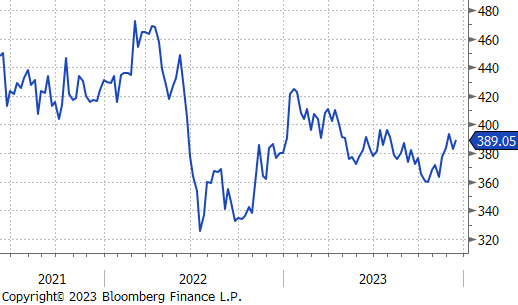

Copper rose by $6 or 1.6% to $389, approaching back to the most recent price high of $393 touch on December 1st, paralleling other base metals’ rise amid the Fed’s dovish projections, which weakened the dollar and bolstered industrial activity prospects. The Fed’s revised projections of more rate cuts next year and a lowered inflation outlook raised expectations of cheaper borrowing costs boosting manufacturing. The weakened dollar further spurred international demand for USD-priced base metals, elevating their prices. Additionally, supply-side pressures contributed to this trend, with Panama’s planned closure of First Quantum’s Cobre mine, a significant global supply source. However, restrained demand forecasts from China, following a lack of stimulus measures in recent policy meetings, tempered the upward movement.

Silver jumped back up by $0.88 of 3.8%, propelled by the dollar’s decline and falling yields following the Fed officials’ recent dovish remarks. They indicated a likelihood of three rate cuts in 2024, one more than previously anticipated, in response to a quicker-than-expected inflation slowdown. This has led the markets to anticipate over a 70% probability of a Fed rate cut by March next year. The potential for early monetary easing not only reduces the opportunity cost of holding bullion but also enhances the prospect for silver as an industrial component. Meanwhile, the European Central Bank and the Bank of England are resisting speculations of rate cuts.

Initial Jobless Claims experienced a notable decline, a 18k drop to 202k, which marked the lowest level of new claims in two months and highlighted the labor market’s tightness, raising concerns that the Fed may maintain high rates for longer than currently anticipated. Additionally, Continuing Claims showed a modest rise to 1876k after experiencing a significant drop the week prior. The recent trends in these figures suggest an easing in job-seeking challenges and reinforce the perception of a historically tight labor market. However, the fluctuating data in the past several weeks indicate some sign of possible cooling in the labor market, aligning with the Fed’s goal of a soft landing.

Manufacturing (SIC) Production grew MoM to 0.3% from the prior -0.7% but was below expectations of 0.5% for November. In a similar manner, Industrial Production MoM grew to 0.2% from the prior -0.6% but was below expectations of 0.3% growth for November. Despite not meeting expectations, these readings do signal signs that the industrial side is on the road to recovery, especially as we move into 2024 and the Fed begins their rate cuts, this huge burden on the sector will begin to ease allowing for growth.

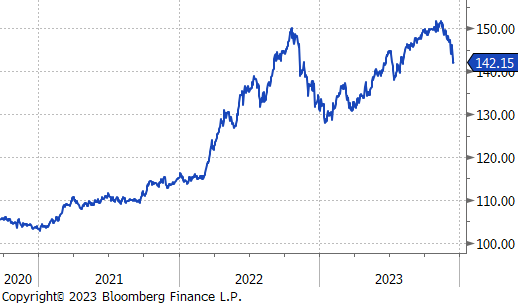

USDJPY:

Investors anticipated the Bank of Japan’s policy decision, looking for signs of unwinding ultra-loose monetary settings. BOJ Governor Kazuo Ueda discussed options, but officials reportedly don’t feel compelled to swiftly tighten policy without substantial evidence of wage growth. The yen stayed near its strongest levels since July, influenced by the sharp dollar weakening after the US Federal Reserve signaled three rate cuts in 2024.

The US 10-year Treasury note yield reached its lowest since late July, below 3.9%, as traders anticipated future rate cuts by the Federal Reserve. Despite the Fed signaling 75 basis points of cuts in 2024, policymakers, including NY Fed President John Williams, pushed back, stating rate cuts weren’t under serious consideration. Market focus this week is on PCE inflation data for insights into evolving price pressures.

The German 10-year Bund yield hit its lowest point since mid-January, dropping below 2.1%, influenced by the US Federal Reserve’s dovish stance and concerns over weak economic data. While the Fed hinted at three rate cuts in 2024, European central banks, including the ECB, stuck to plans for sustained tight policy. Despite assurances from Lagarde and Villeroy de Galhau against an imminent rate cut, markets priced in over 150 basis points of ECB rate cuts by end-2024. German private sector contraction deepened in December, exceeding market expectations, while Eurozone wage growth notably accelerated in Q3.