Flack Capital Markets | Ferrous Financial Insider

December 29, 2023 – Issue #412

December 29, 2023 – Issue #412

Overview:

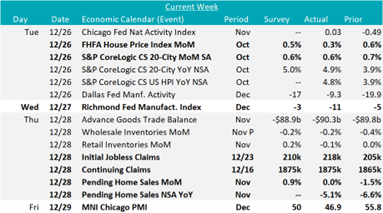

The HRC spot price continued to stay at $1,100, resulting in the 5-week price change to be $150 or 15.8%. At the same time, the 2nd month future fell by $33 or -2.9% to $1,093 after reaching a price high of $1,126 last week.

Tandem products both continued to remain unchanged, resulting in the HDG – HRC differential to stay at $200.

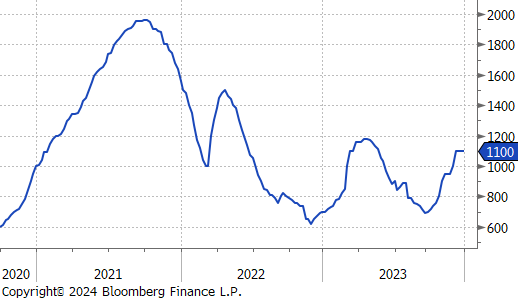

Mill production reversed the gains made last week, with capacity utilization dropping by -0.9% to 73.7%, bringing raw steel production down to 1.693m net tons.

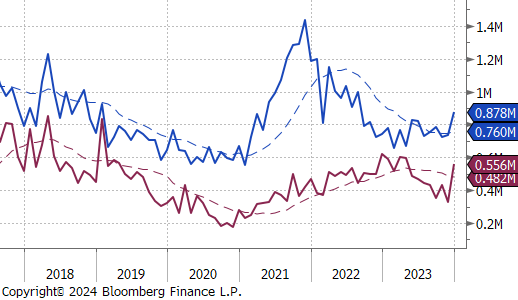

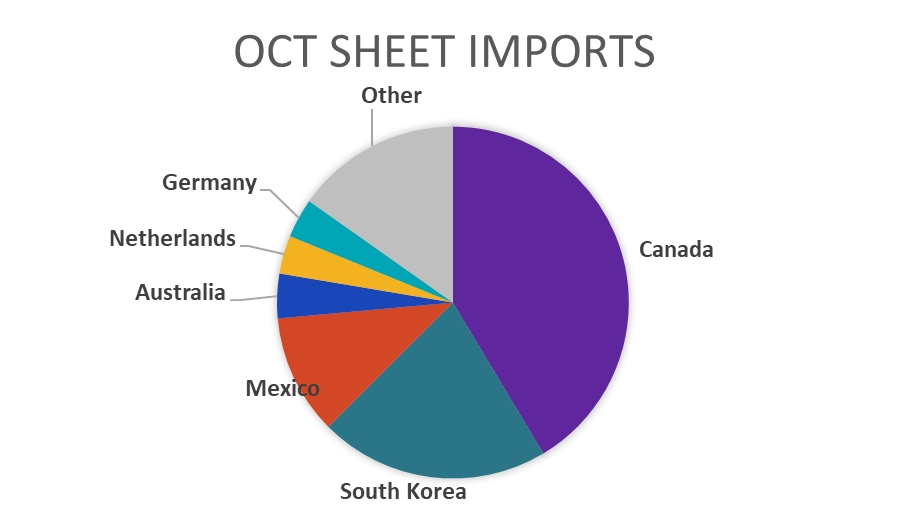

December Projection – Sheet 833k (up 134k MoM); Tube 510k (up 227k MoM)

November Projection – Sheet 699k (down 24k MoM); Tube 284k (down 145k MoM)

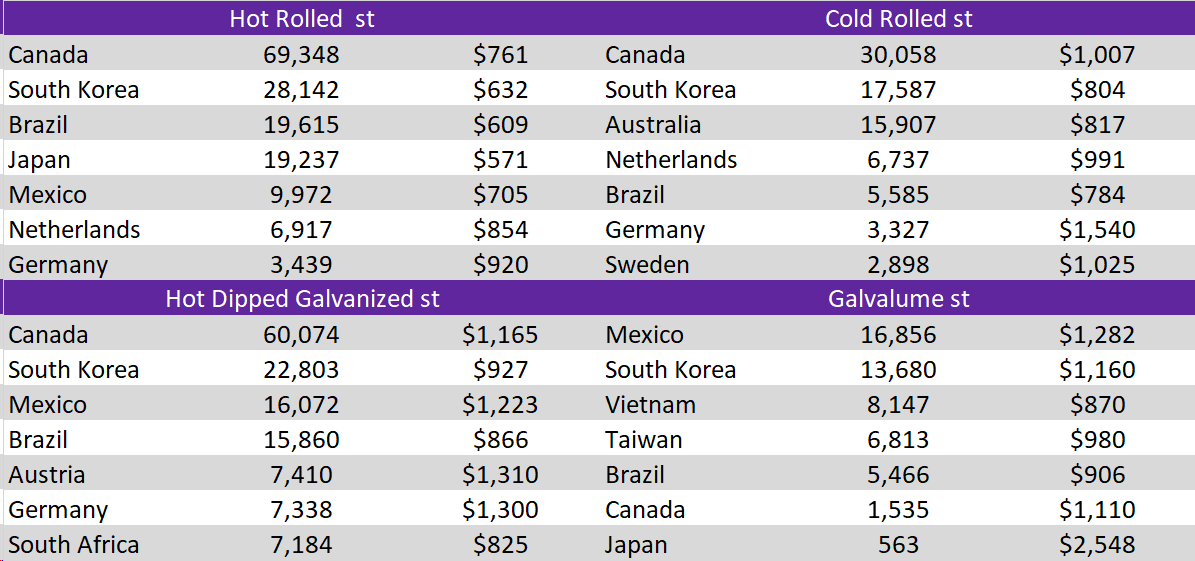

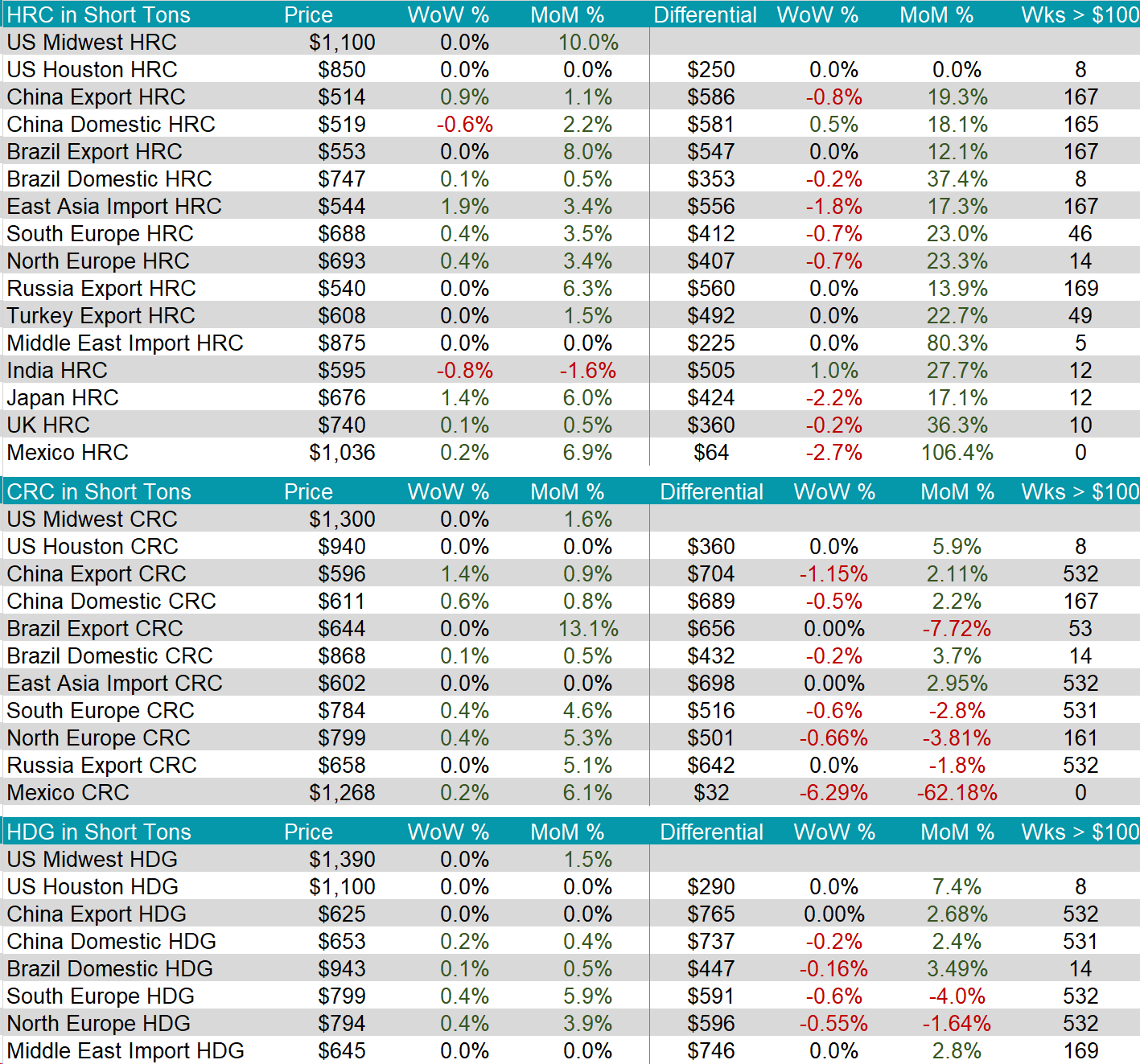

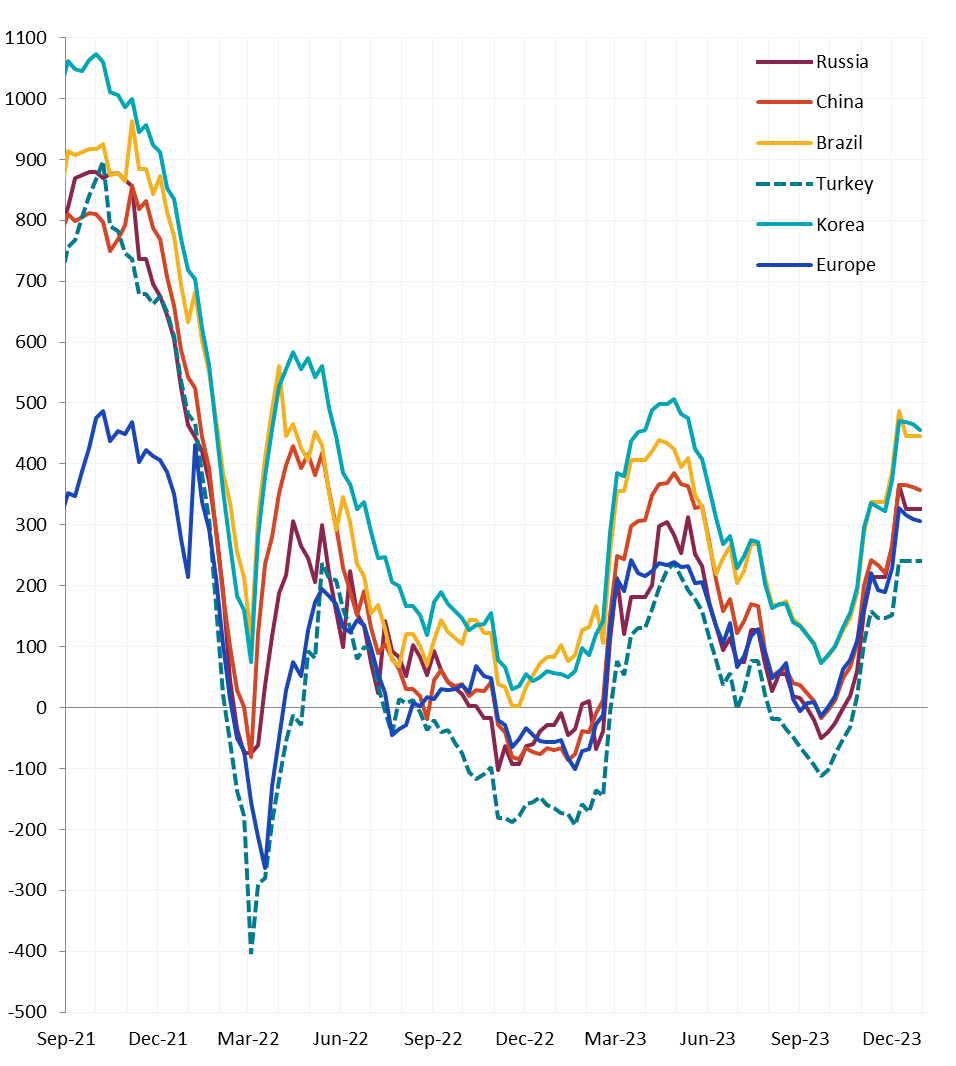

Watched global differentials were mainly down this week, with China having the biggest up-tick in price, a 0.9%. Other notable countries were East Asia, with a 1.9% increase, and Japan, with a 1.4% increase in price.

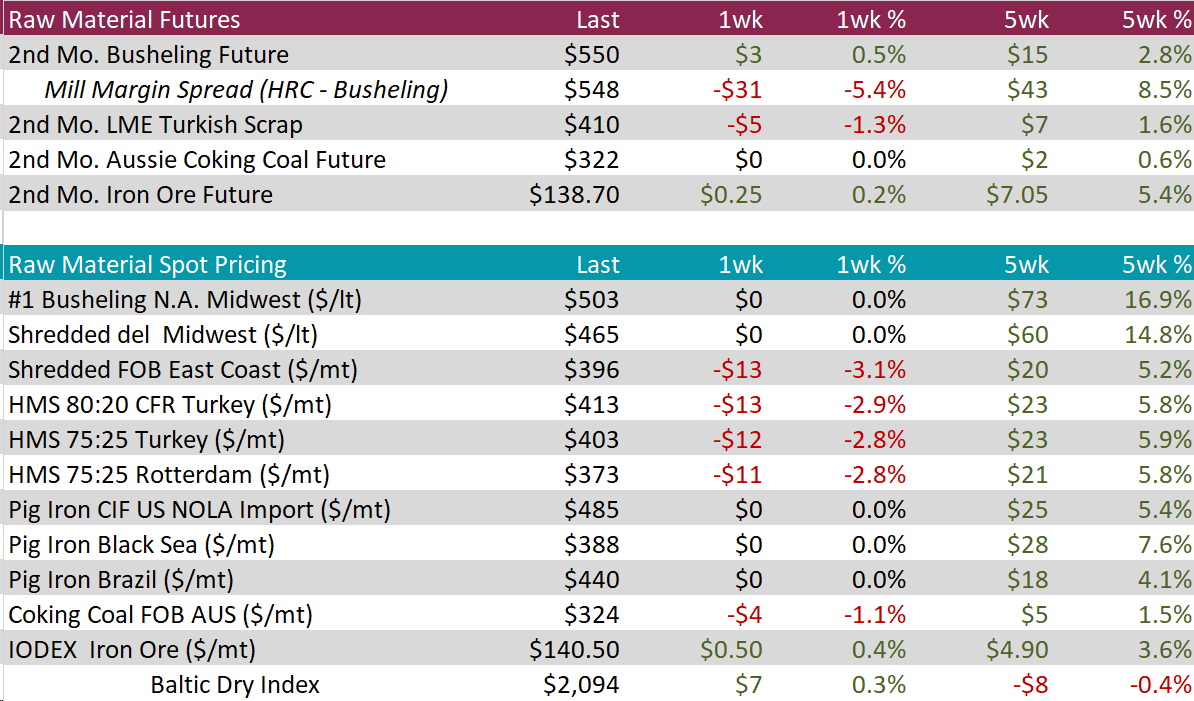

Scrap

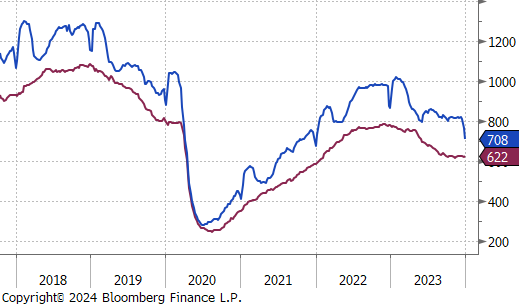

The 2nd month busheling future had a slight increase, going up by $3 or 0.5% to $550, after dropping down from $570 to $547 last week. Meanwhile, the busheling spot price remain unchanged at $503.

The 2nd month LME Turkish scrap future fell by $5 or -1.3% to $410. However, the 5-week change in price is up $7 or 1.6%.

The 2nd month iron ore future slightly rose, up $0.25 or 0.25 to $138.70, the price continued to be elevated at the 2023 price highs.

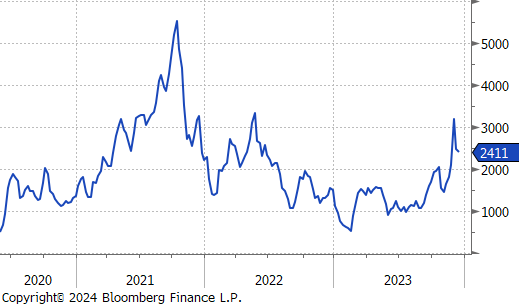

Dry Bulk / Freight

The Baltic Dry Index steadied after falling sharply down from the 2023 price high, going up by $7 or 0.3% to $2,094.

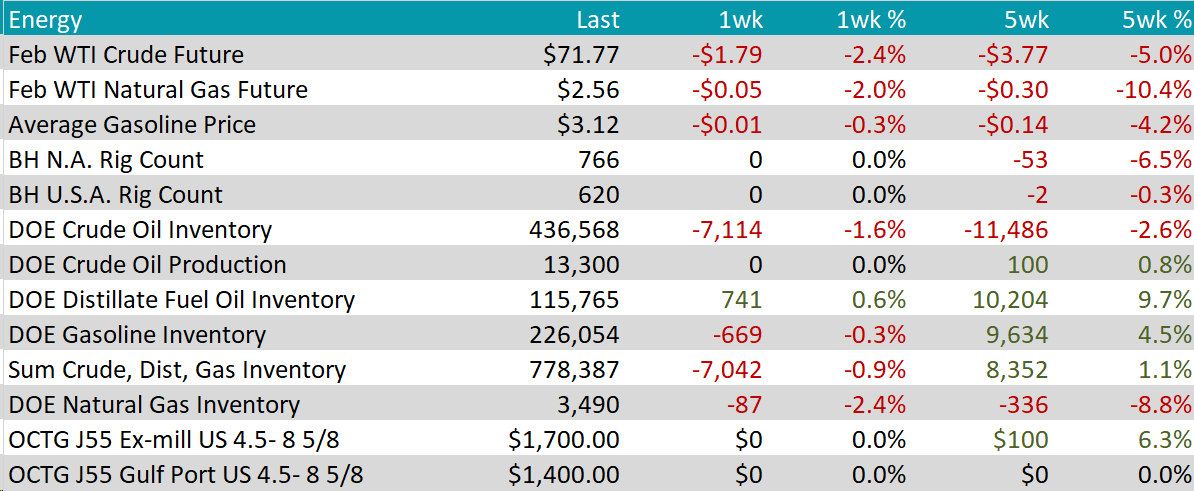

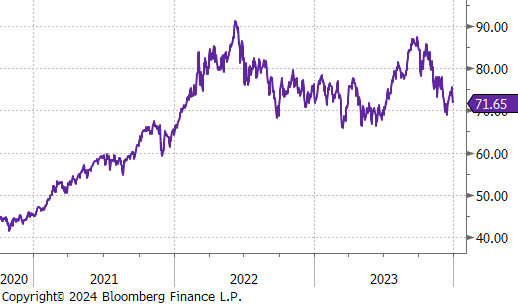

WTI crude oil future lost $1.79 or 2.4% to $71.77/bbl.

WTI natural gas future lost $0.05 or 2.0% to $2.56/bbl.

The aggregate inventory level declined by 0.9%.

The Baker Hughes North American rig count remained unchanged after dropping down by 42 rigs last week. The US rig count also remained unchanged, continuing to stay at 620 rigs.

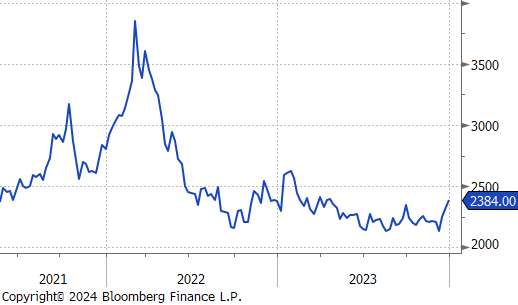

Aluminum surged by $52 or 2.2% to $2,378, poised to close the year at an eight-month high, driven by supply concerns and a late-year recovery. The price increase was fueled by expectations of a boost from the Chinese economic stimulus measures. Additionally, an explosion at a fuel depot in Guinea, the world’s third-largest bauxite producer, disrupted business activity in the region, intensifying supply worries and contributing to the metal’s strong year-end performance.

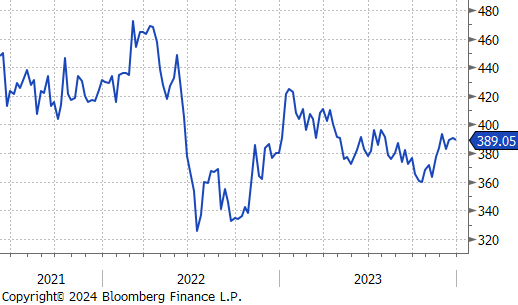

Copper rose by $1.95 or 0.5% to $392, set to end the year with a slight gain, sustained by strong demand and growing supply threats. Despite challenges from the Fed’s tightening measures and weak Chinese manufacturing, the need for copper in electrification technologies, driven by volatile energy prices and decarbonization efforts, remained high. Major market players, including Goldman Sachs, recommended long positions in copper, anticipating a 3% demand increase in 2024, amidst concerns from miners about long-term supply shortages. Short-term supply issues, such as First Quantum’s production halt in Panama and lowered supply forecasts from BHP and Anglo America, also contributed to copper’s price strength in 2023.

Gold climbed up by $14.40 or 0.7% to $2,084. In 2023 the price rose by more than 13%, its first annual gain in three years, and reaching a record high. This rise was largely driven by expectations that major central banks would begin reducing interest rates following a period of aggressive rate hikes that began in early 2022. Additionally, increasing geopolitical tensions in the Middle East and the ongoing conflict in Gaza have fueled demand for the safe-haven asset.

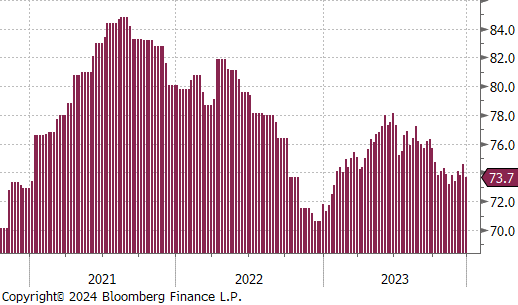

After notable surprises last week, this week has simply matched expectations. Manufacturing remains in decline but presents some signs of recovery, while housing data showed the ongoing affordability challenges. Overall, with no surprises in the latest reports, there’s a general sense of economic optimism as we enter the new year.

Housing data, which last week showed an encouraging signal overall with Housing Starts and Existing Home Sales beating expectations, this week indicated that affordability issues are still weighing on the market. Pending Home Sales MoM in November were stagnant at 0.0%, following a -1.5% drop in October and missed the anticipated 0.9% rebound, suggesting the influx of potential buyers remains sluggish despite the easing of interest rates. The FHFA House Price Index MoM increased by 0.3% in October from the previous month’s 0.6% rise and were below market expectations of a 0.5% increase.

Initial Jobless Claims came in above expectations of an increase to 210k, whereas Continuing Claims met expectations of an increase to 1875k from the prior reading of 1865k. These suggest some softening in the labor market before the end of the year and the results were consistent with growing expectations that the Fed is likely to start its cutting cycle in the first quarter of 2024.

Fed manufacturing survey data came in mixed, but both of this week’s releases show further contraction. Richmond printed down to -11, below expectations of a -3 print. Dallas printed up to -9.3, above last months -19.9 print, but not yet in positive territory.