Flack Capital Markets | Ferrous Financial Insider

December 6, 2024 – Issue #461

December 6, 2024 – Issue #461

Overview:

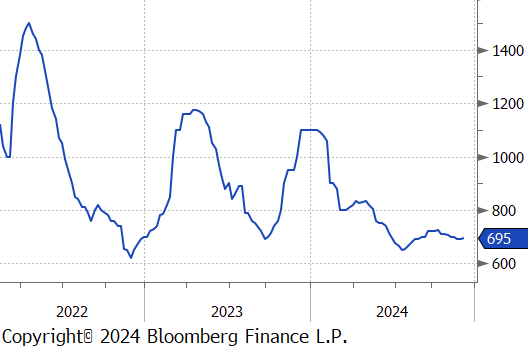

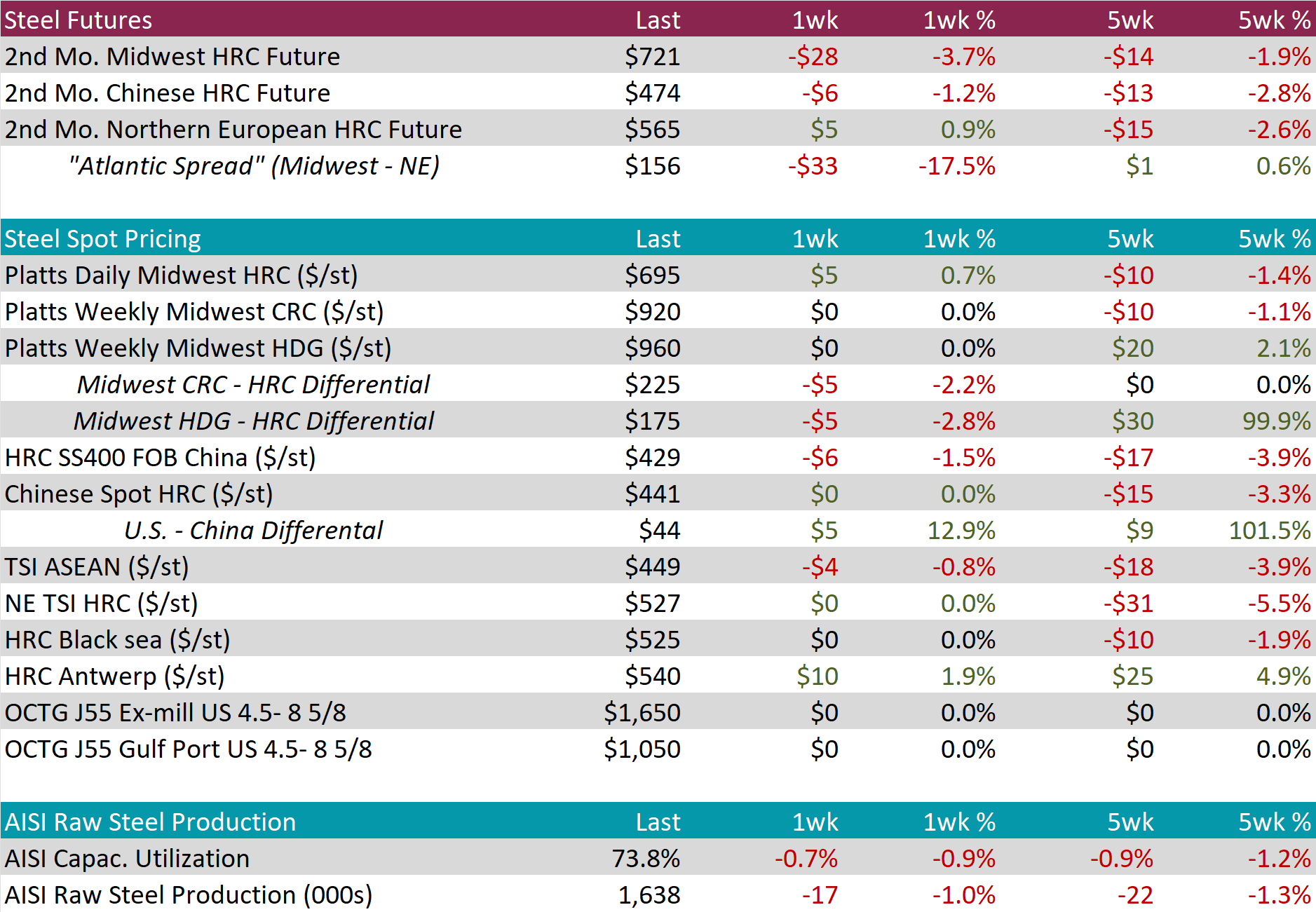

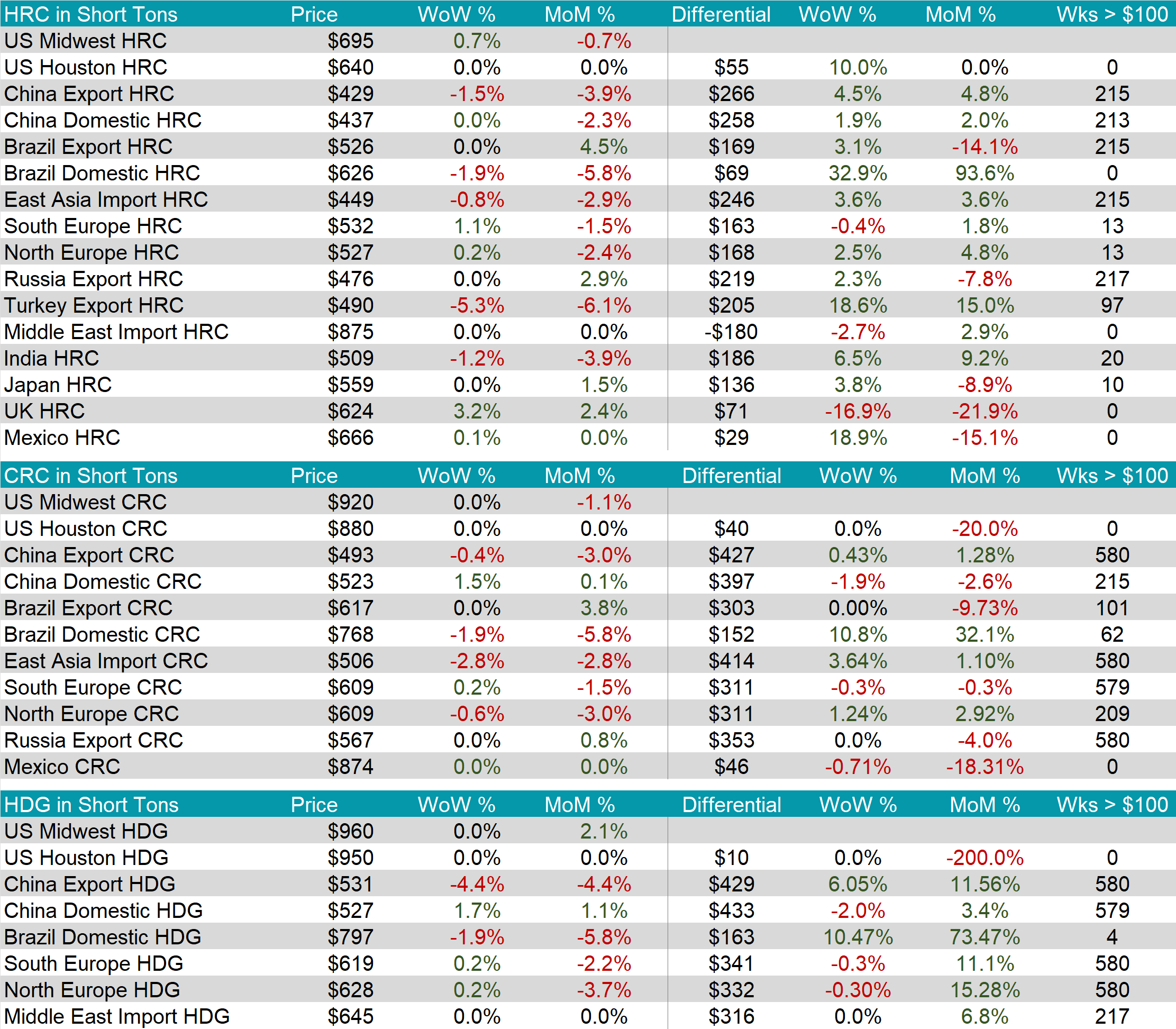

The HRC spot price rose by $5 or 0.7% to $695, marking the first increase in eight weeks. At the same time, the HRC 2nd month future dropped by $28 or -3.7% to $721, pulling back from last week’s gains.

Tandem products both remained unchanged, resulting in the HDG – HRC differential to decline by $5 or -2.8% to $175.

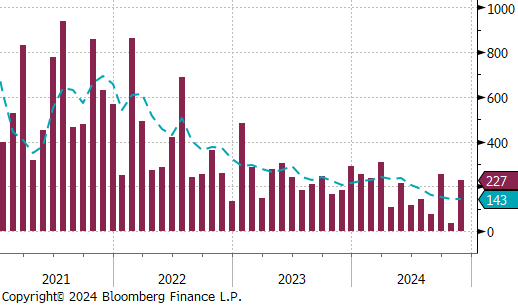

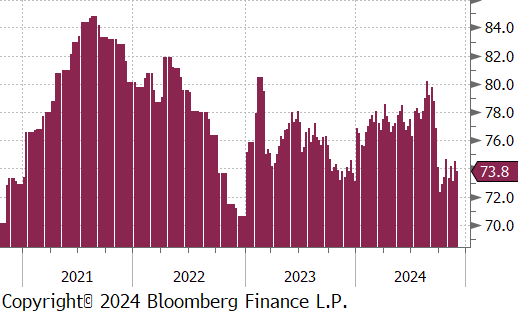

Mill production continues to remain subdued, with capacity utilization ticking down by -0.7% to 73.8%, bringing raw steel production down to 1.638m net tons, marking the tenth consecutive week below 1.7m.

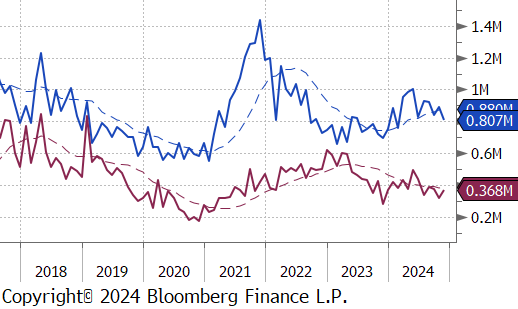

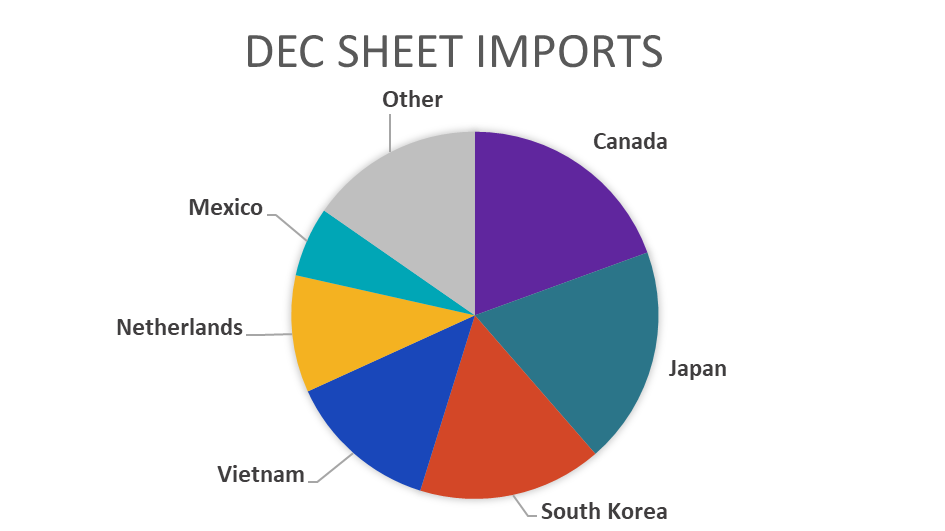

November Projection – Sheet 807k (down 85k MoM); Tube 368k (up 47k MoM)

October Census – Sheet 892k (up 51k MoM); Tube 320k (down 53k MoM)

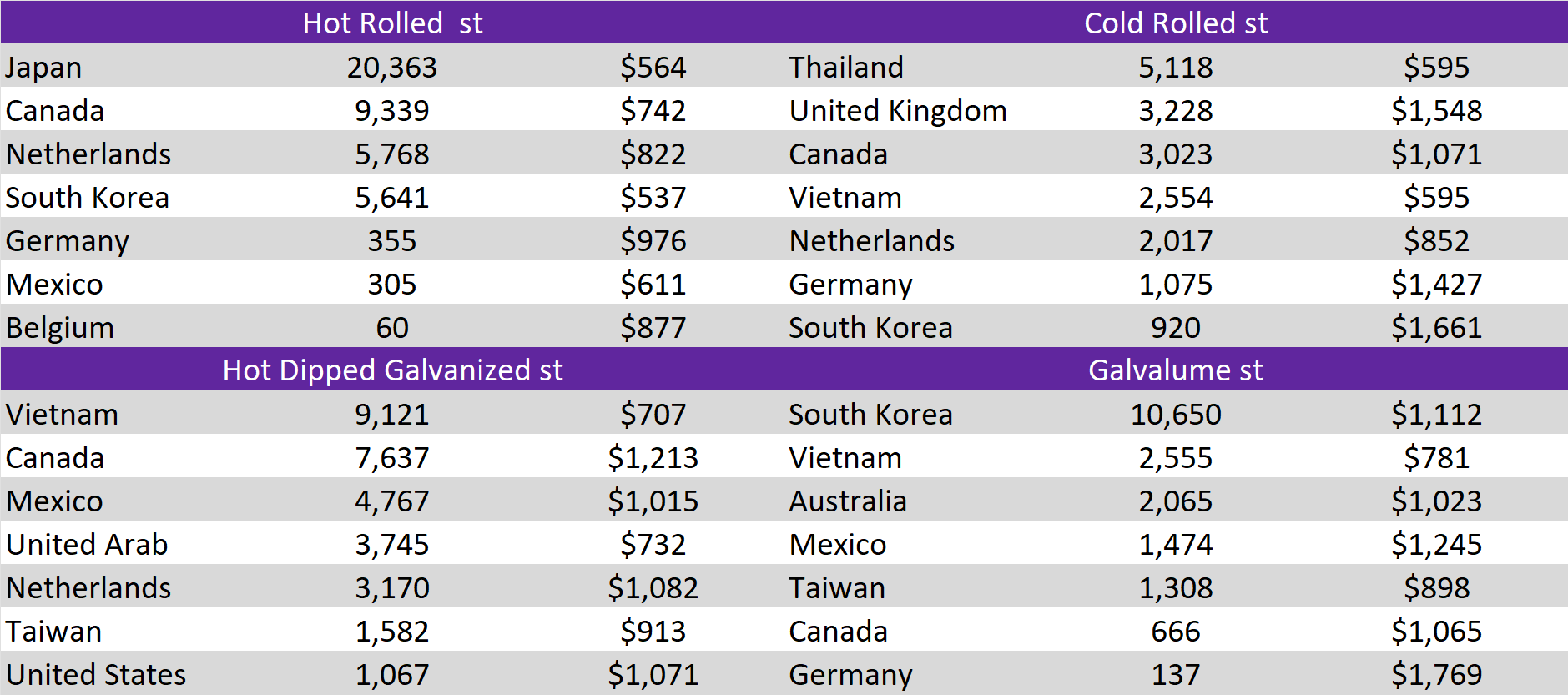

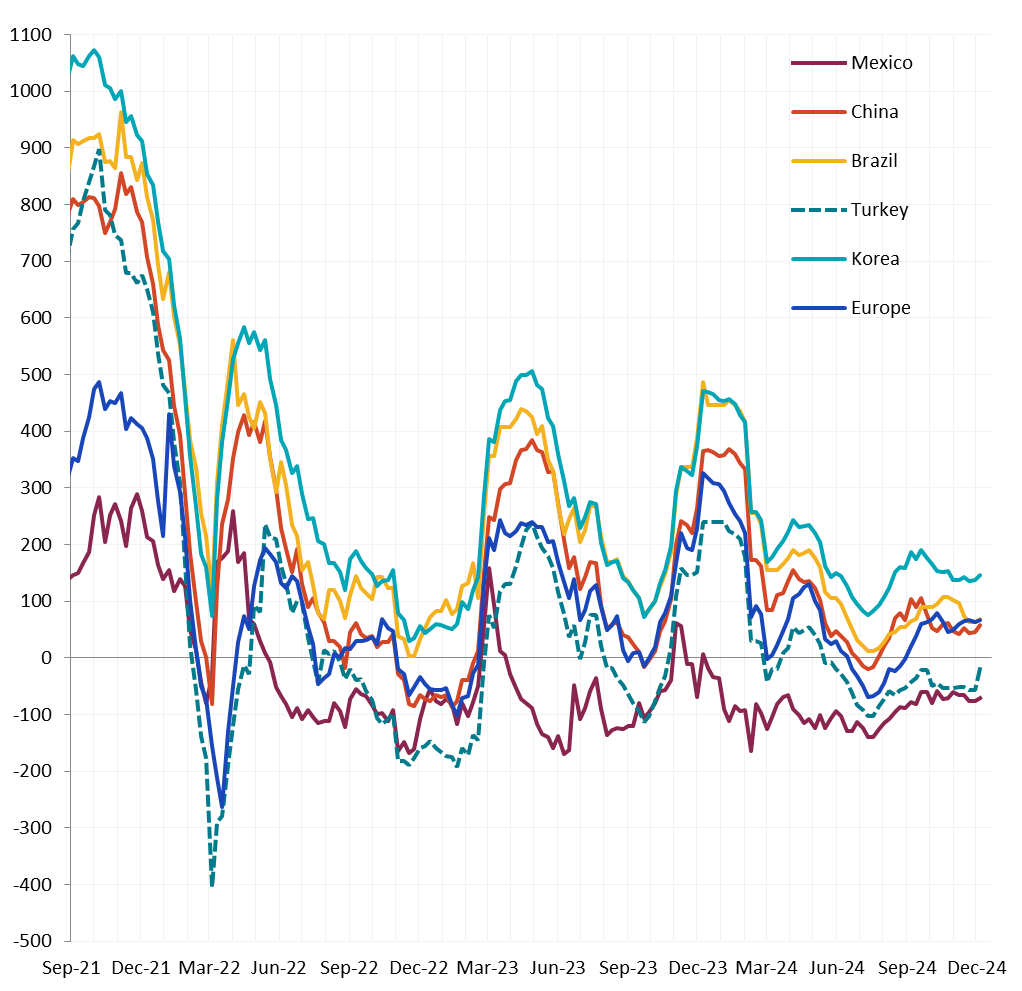

All watched global differentials expanded this week, with the China Export HRC price falling by -1.5%, Korea HRC down by -0.8%, and Turkey Export HRC price dropping by -5.3%.

Scrap

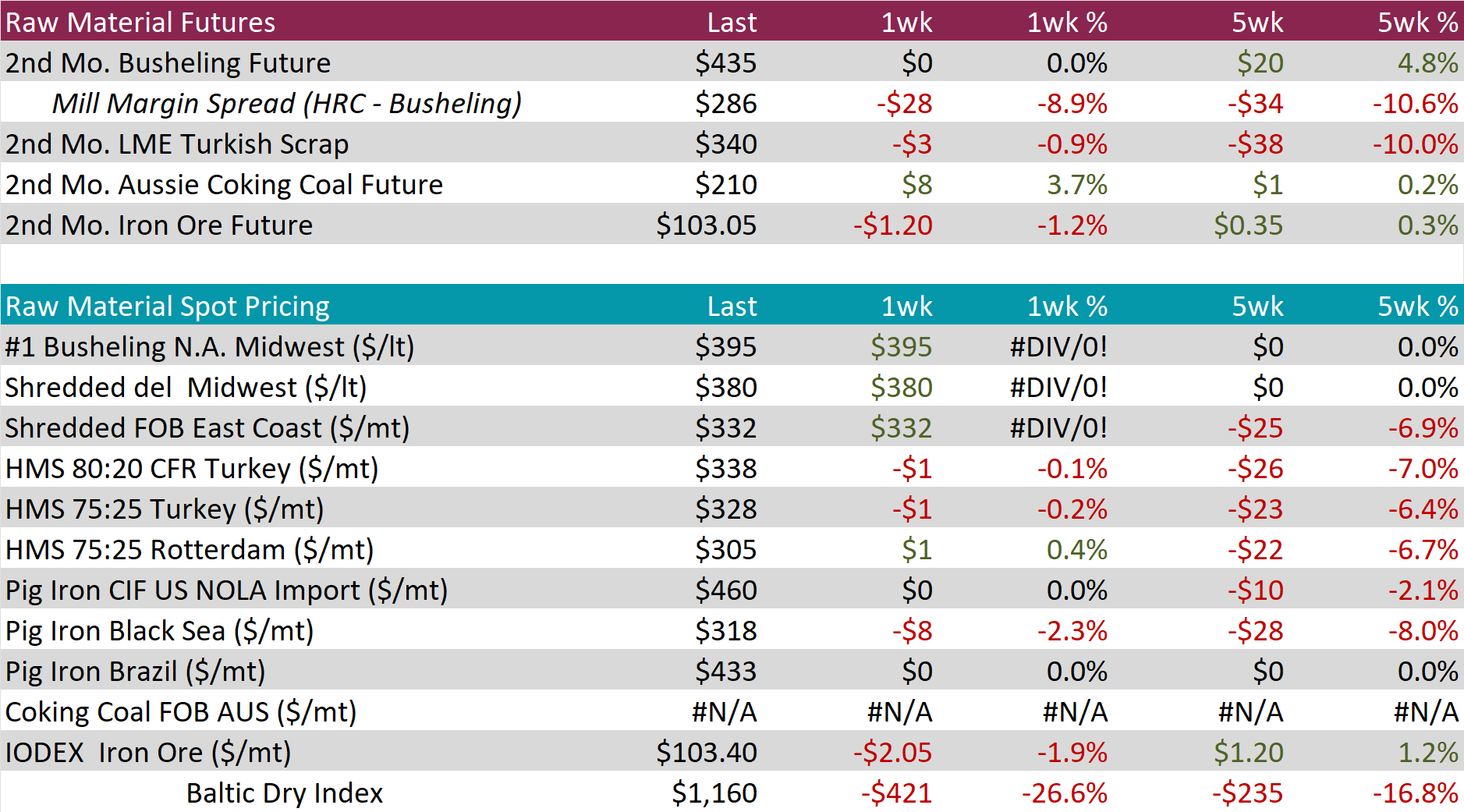

The busheling 2nd month future remained unchanged at $435, marking the third consecutive week at this price.

The Aussie coking coal 2nd month future rose by $8 or 3.7% to $210, rebounding from last week’s price decline.

The iron ore 2nd month future fell by $1.20 or -1.2% to $103.05, easing after two consecutive weeks of price increases.

Dry Bulk / Freight

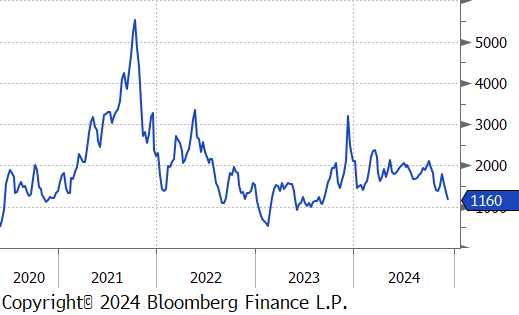

The Baltic Dry Index decreased by $421 or -26.6% to $1,160, marking the third consecutive week of price declines.

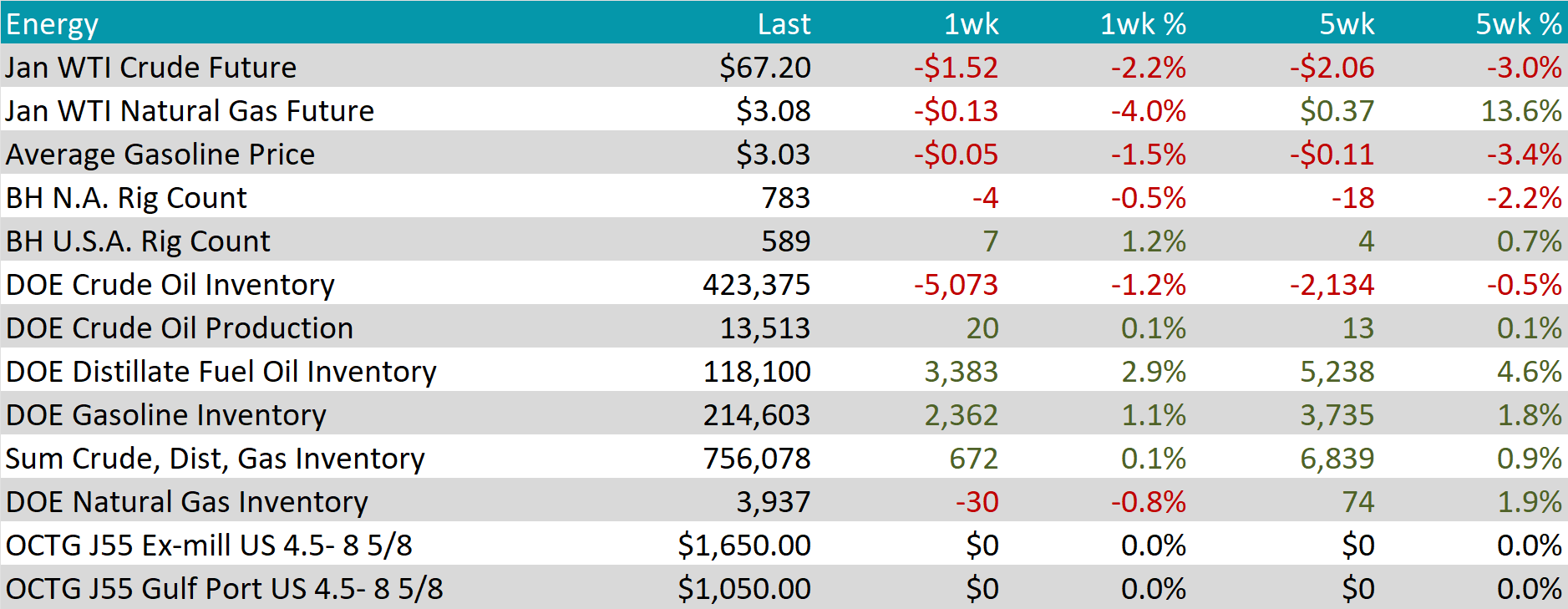

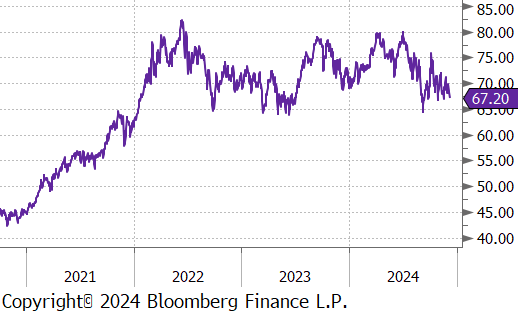

WTI crude oil future lost $1.52 or -2.2% to $67.20/bbl.

WTI natural gas future lost $0.13 or -4.0% to $3.08/bbl.

The aggregate inventory level experienced a slight increase, rising by 0.1%.

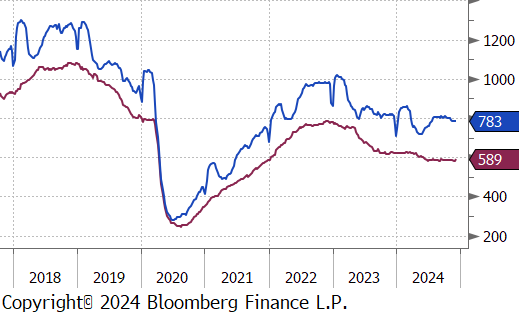

The Baker Hughes North American rig count reduced by 4 rigs, bringing the total count to 783 rigs. Meanwhile, the US rig count gained 7 rigs, bringing the total count to 589 rigs.

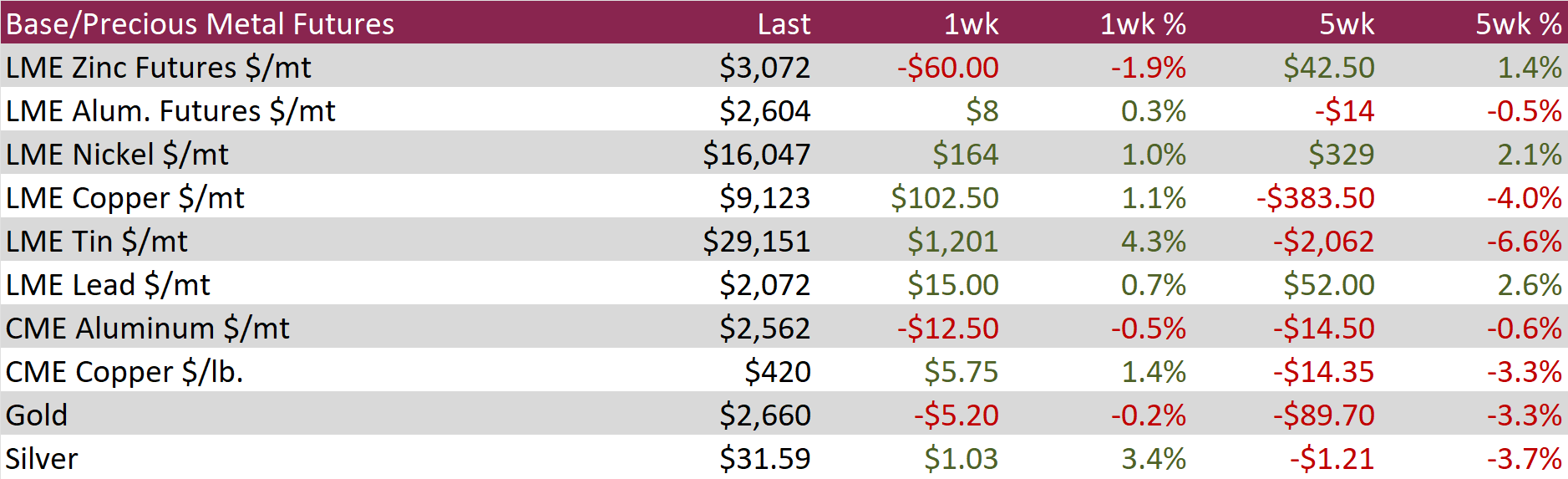

Aluminum futures rose by $8 or 0.3% to $2,604. Chinese aluminum smelters are scaling back production as soaring raw material costs strain the world’s largest aluminum producer. Alumina prices have more than doubled this year, despite a recent pullback from record highs, driven by supply disruptions across key regions, including Jamaica, Guinea, Australia, and China. This sharp increase in alumina costs stands in contrast to the more moderate 9% rise in aluminum futures on the London Metal Exchange (LME) this year, highlighting a growing disconnect between raw material input costs and the finished metal market.

Copper futures increased by $5.75 or 1.4% to $420, as optimism around large-scale economic support from China boosted the outlook for manufacturing demand in the world’s top copper consumer. The Politburo signaled a significant policy shift, announcing plans for a “moderately loose” monetary stance and “more proactive” fiscal stimulus in the coming year. This represents a notable departure from the cautious approach seen over the past decade, fueling market bets that stronger economic measures will drive sustained growth in China’s manufacturing sector, despite potential trade tensions with US President-elect Trump. Adding to the positive sentiment, China’s latest manufacturing PMI data showed expansion, with the Caixin index highlighting a sharp improvement among domestically-focused firms. These indicators reinforced expectations of robust copper demand, providing further momentum for base metals.

Precious Metals

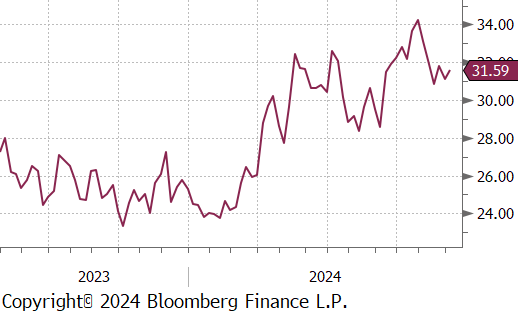

Silver increased by $1.03 or 3.4% to $31.59 as investors anticipated key US inflation data that could solidify expectations for a Federal Reserve interest rate cut this month. Markets now see an 83% probability of a 25-basis-point cut, a significant increase from 62% last week. Silver also tracked gains in gold, buoyed by the People’s Bank of China resuming gold purchases after a six-month hiatus. Attention is also on the Central Economic Work Conference in China, where policymakers will set economic priorities and targets for 2025. Markets are betting on additional stimulus measures from Beijing as the country navigates economic challenges, including potential trade tensions with U.S. President-elect Donald Trump. These developments have bolstered optimism for silver demand, given China’s role as the largest consumer of industrial metals.

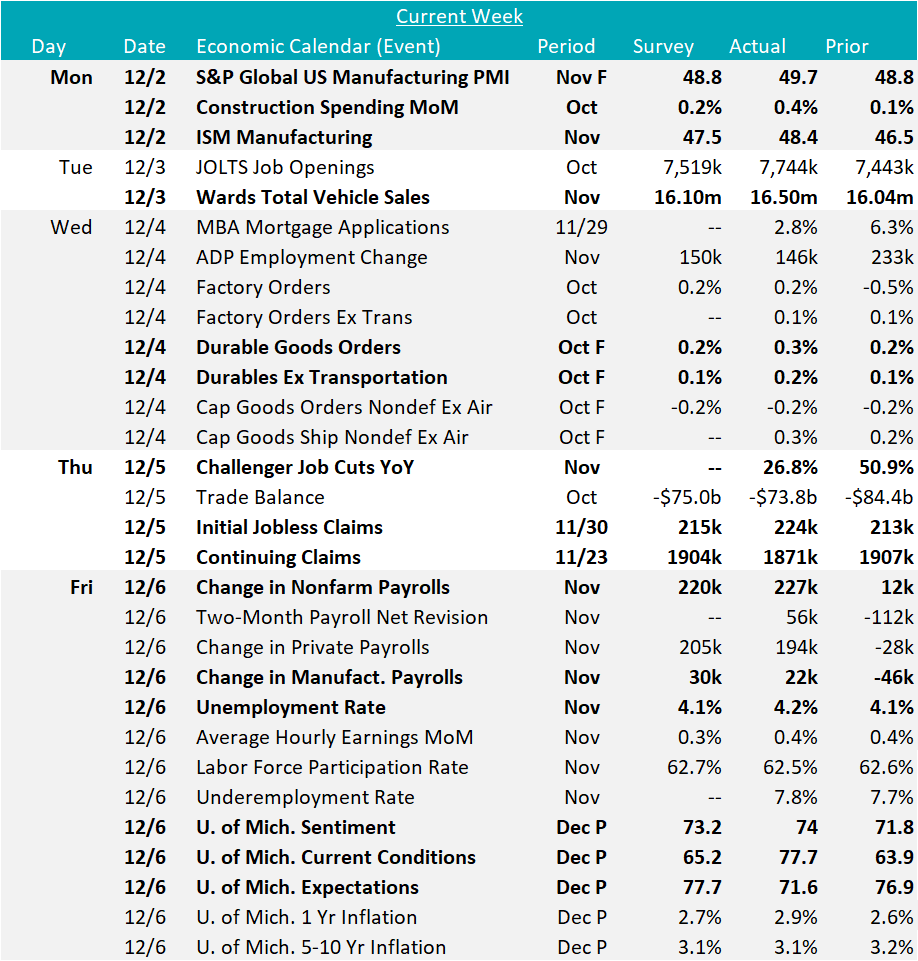

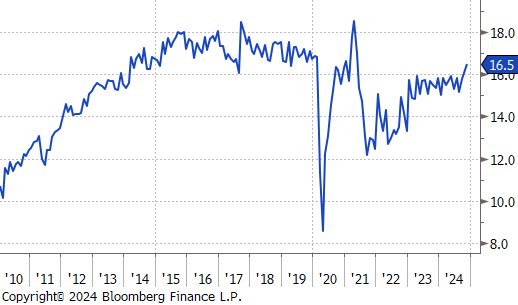

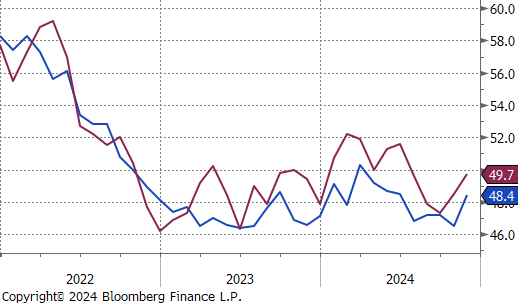

Manufacturing data showed positive momentum this week. Both November Manufacturing PMIs exceeded market expectations, rising to near stabilization in the sector: S&P Global US Manufacturing PMI jumped to 49.7 vs 48.8 and ISM Manufacturing PMI surged to 48.4 vs 47.5. Notably, growth in new orders was the main driver for these increases. Additionally, October’s Durable Goods Orders outperformed forecasts, increasing by 0.3% compared to 0.2%, with Durables Ex Transportation rising by 0.2%, surpassing the anticipated 0.1%.

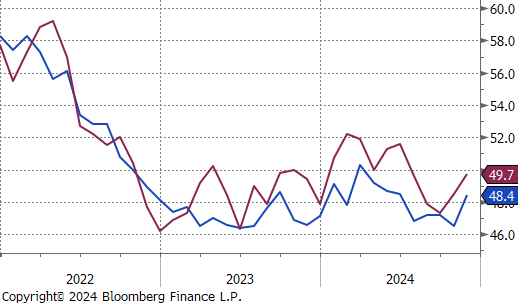

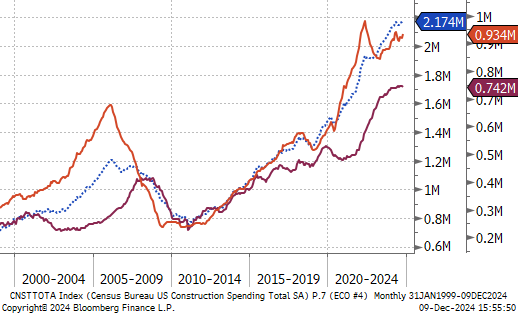

More key steel-consuming sectors saw upside surprises. Construction Spending in October rose by 0.4% compared to the expected 0.2%, with private spending leading the growth (up 0.7%), driven by a 1.5% advance in the residential segment. For the auto sector, Wards Total Vehicle Sales soared to 16.50m in November vs the projected 16.10m, the highest since May 2021.

November’s Change in Nonfarm Payrolls came in just above expectations, a clear signal that the concerns floated in last month’s print were in fact driven by hurricanes and labor disputes. The Unemployment Rate increased to 4.2% this month as well, as the labor force expanded. Initial claims came in slightly higher than expected but remains subdued, and continuing claims decreased.

The preliminary December University of Michigan Consumer Sentiment survey provided fascinating insight into how consumers at large view economic conditions, however it will take months for post election volatility to work its way out. The clearest signal at this point, appears to be slightly elevated inflation expectations, while topline sentiment reached an 8-month high.