Flack Capital Markets | Ferrous Financial Insider

February 7, 2025 – Issue #470

February 7, 2025 – Issue #470

Overview:

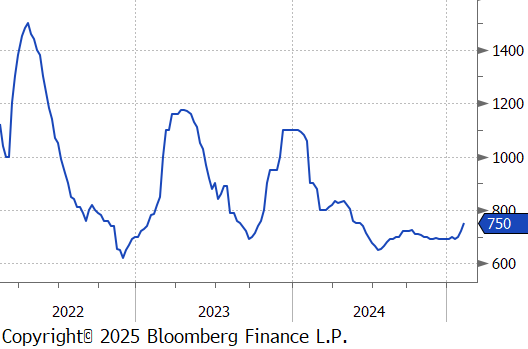

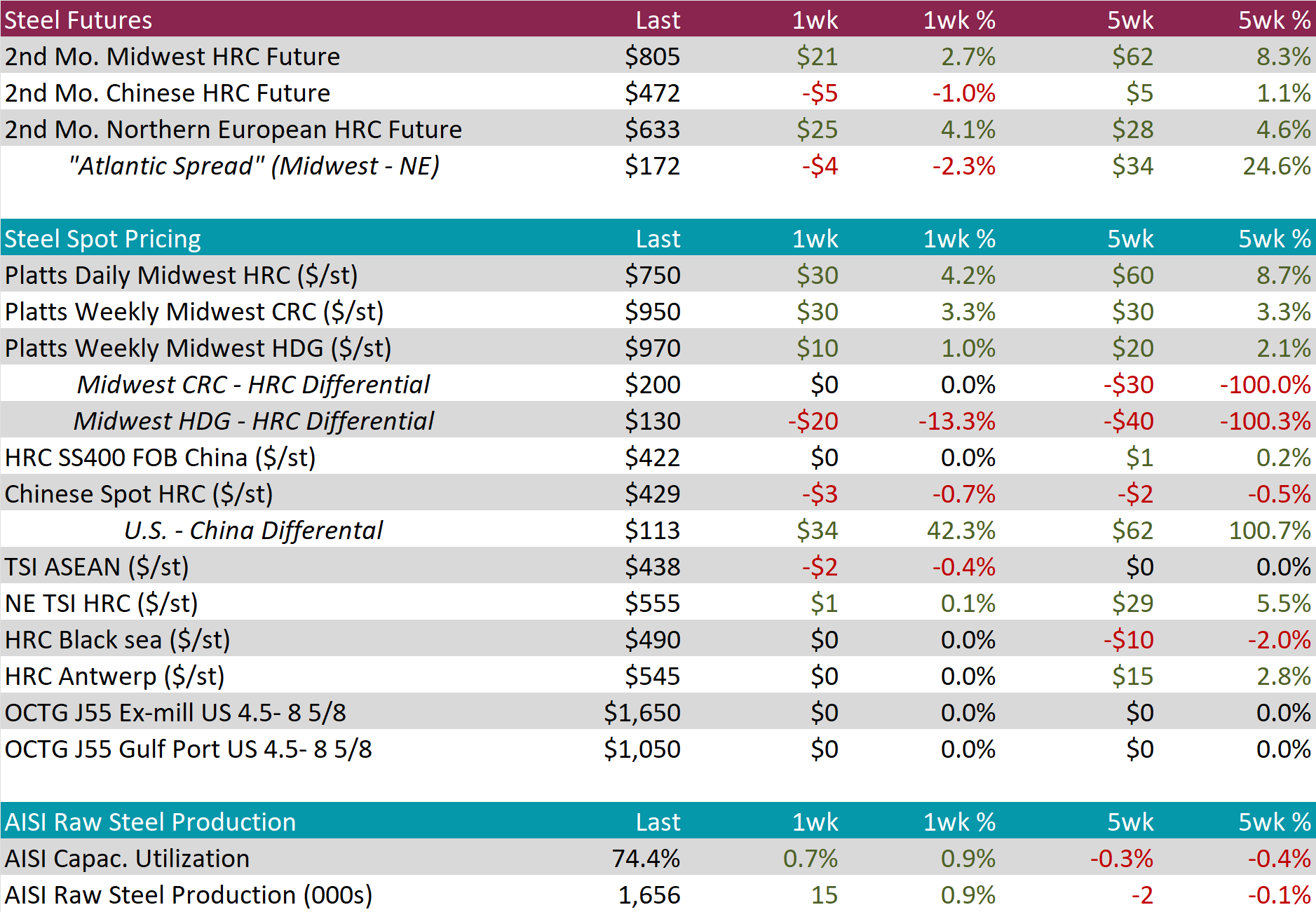

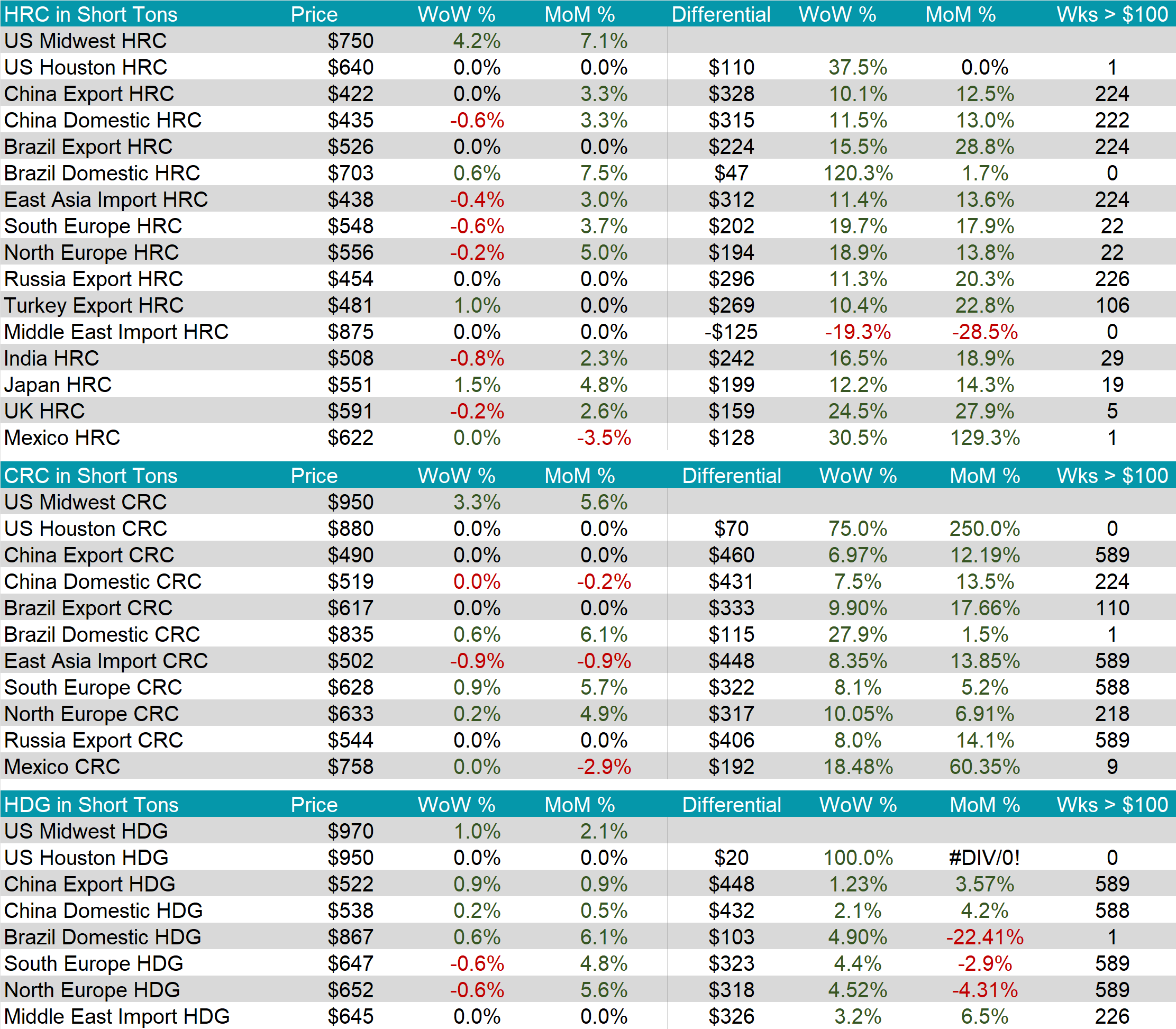

The HRC spot price surged by $30 or 4.2% to $750, marking the third consecutive week of increases and the highest price since May 2024. At the same time, the HRC 2nd month future jumped by $21 or 2.7% to $805, marking the second consecutive week of increases and the highest since April 2024.

Tandem products both increased, with CRC rising by $30 and HDG up by $10, resulting in the HDG – HRC differential to fall by $20 to $130.

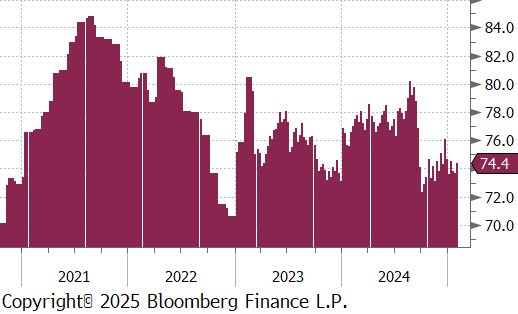

Mill production picked back up in momentum, with capacity utilization ticking up by 0.7% to 74.4%, bringing raw steel production up to 1.656m net tons.

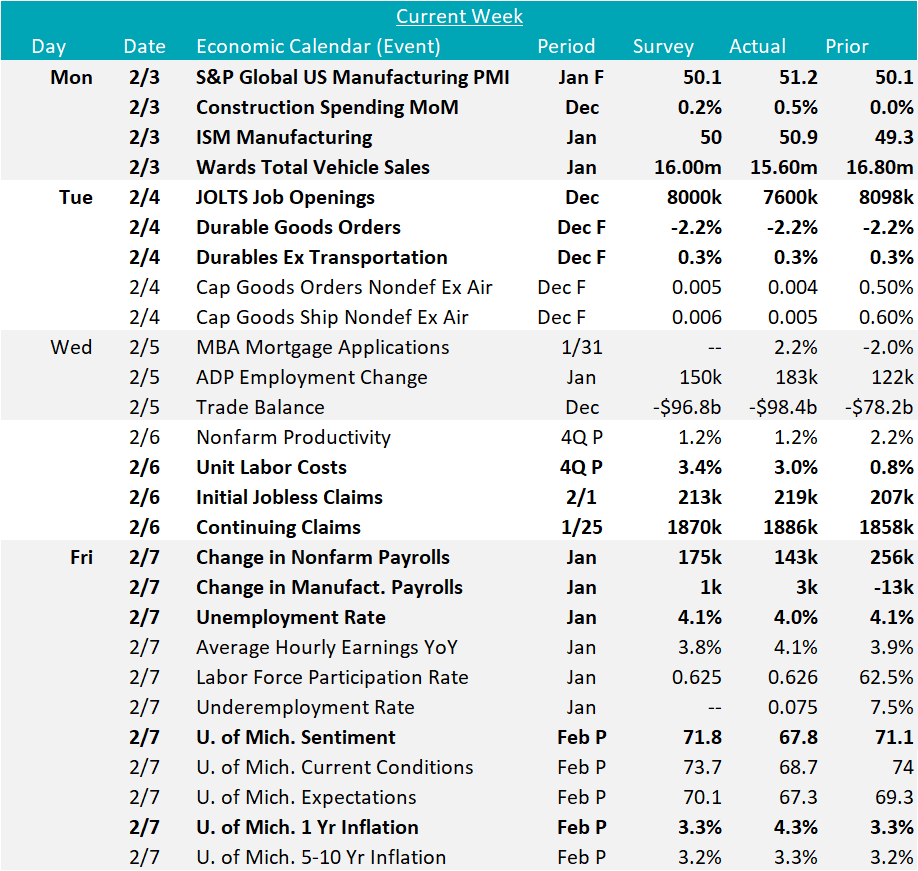

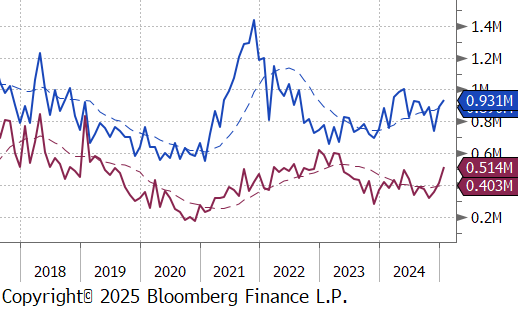

January Projection – Sheet 931k (up 39k MoM); Tube 514k (up 103k MoM)

December Census – Sheet 892k (up 150k MoM); Tube 411k (up 51k MoM)

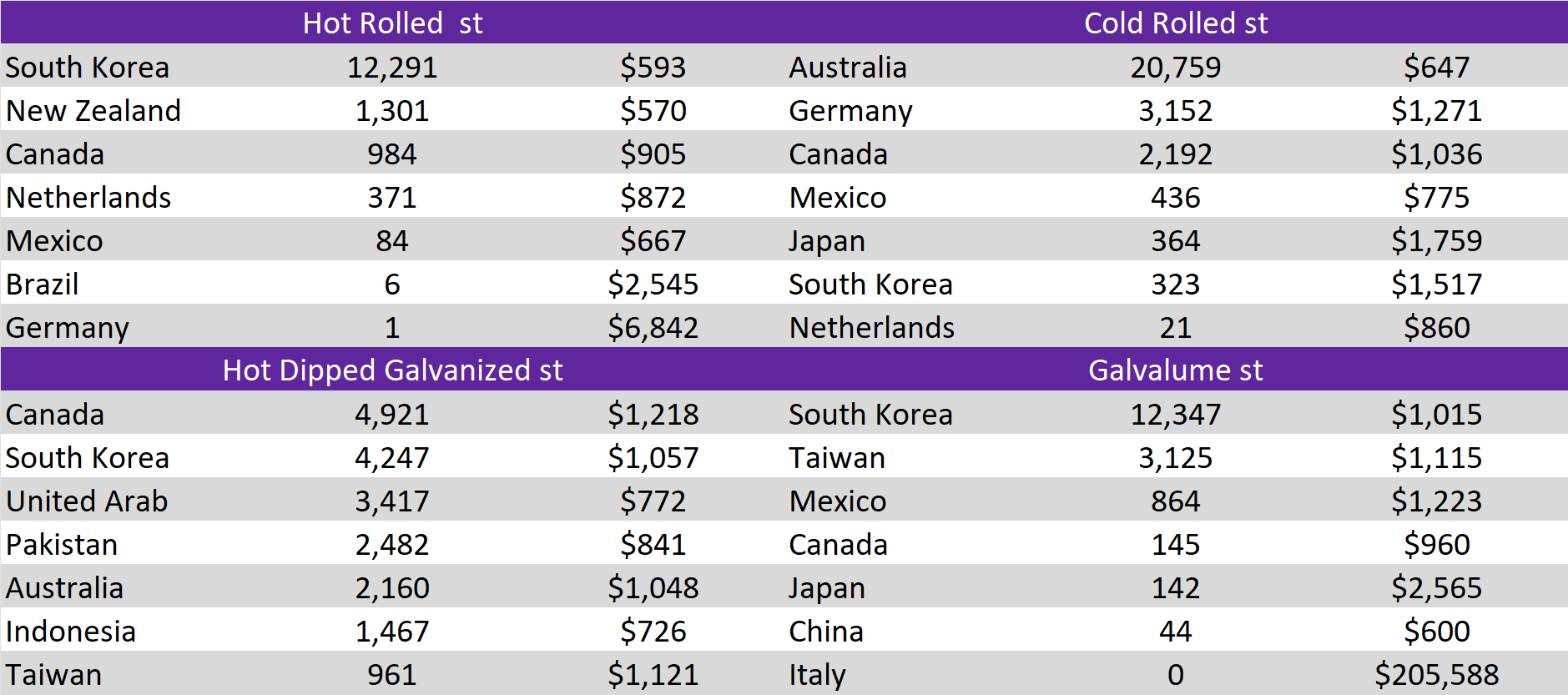

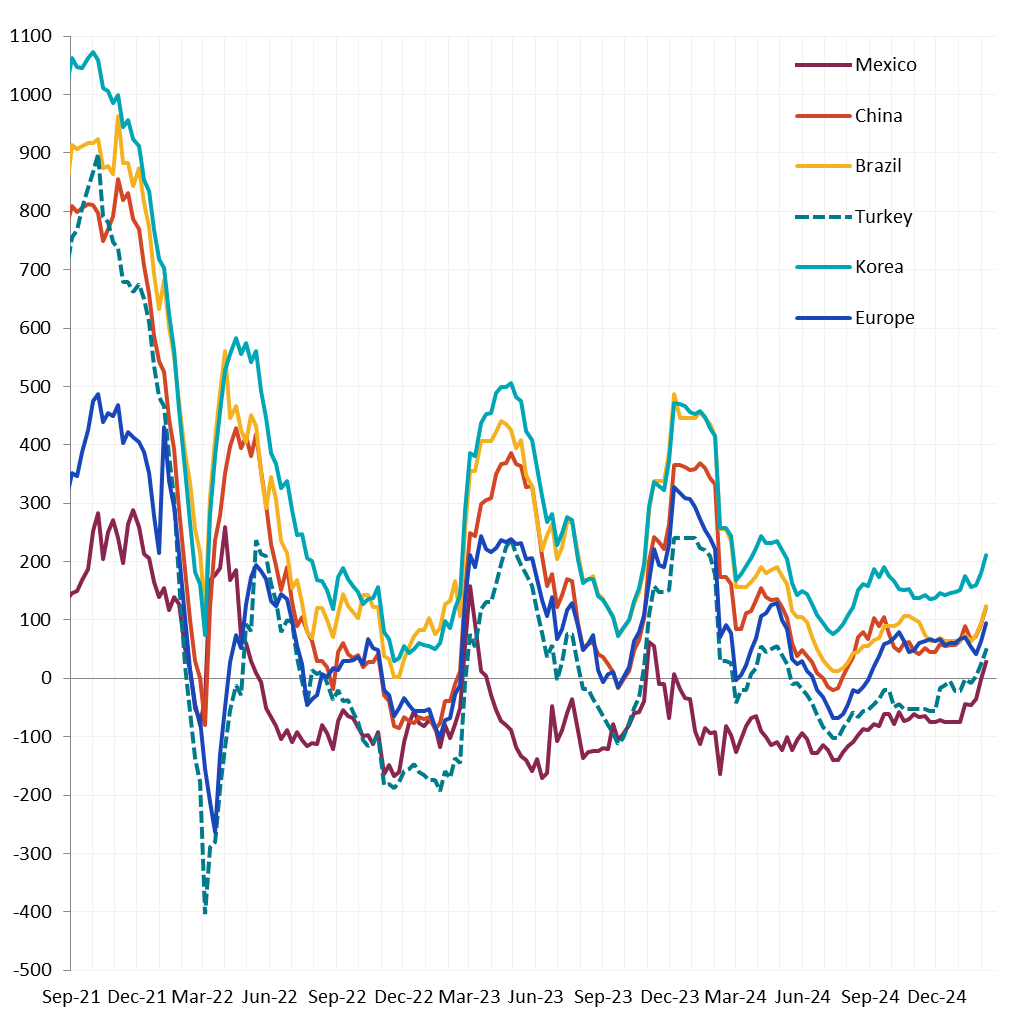

Differentials mainly expanded over the week, with Korea’s HRC price slipping by -0.4%, North Europe down by -0.2%, and Turkey Export HRC rising by 1.0%.

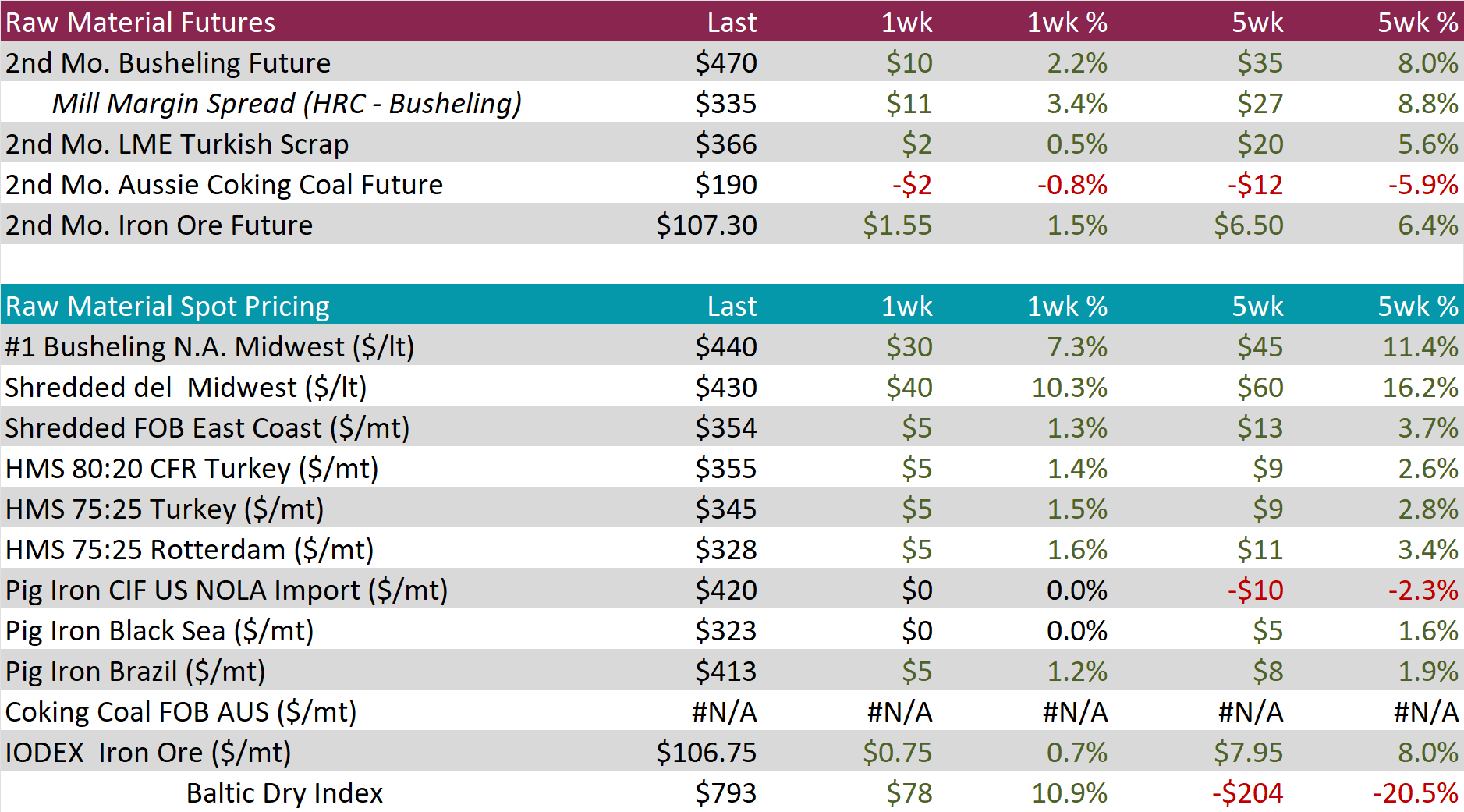

Scrap

The busheling 2nd month future rose by $10 or 2.2% to $470, reaching the highest price since February.

The LME Turkish scrap 2nd month future inched up by $2 or 0.5% to $366, increasing for the fourth consecutive week.

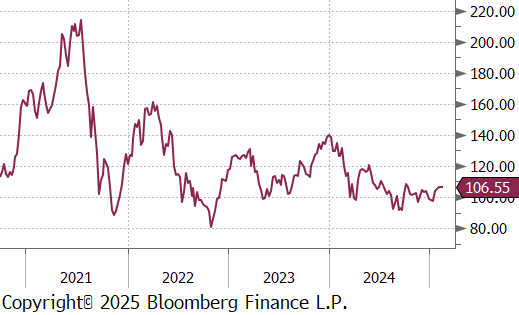

The iron ore 2nd month future increased by $1.55 or 1.5% to $107.3, marking the fourth consecutive week of making gains and the highest price since October 2024.

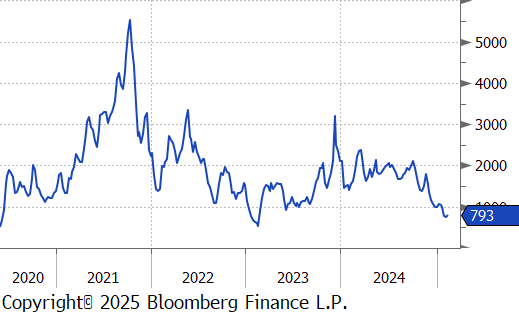

Dry Bulk / Freight

The Baltic Dry Index grew by $78 or 10.9% to $793, rebounding from two consecutive weeks of declines.

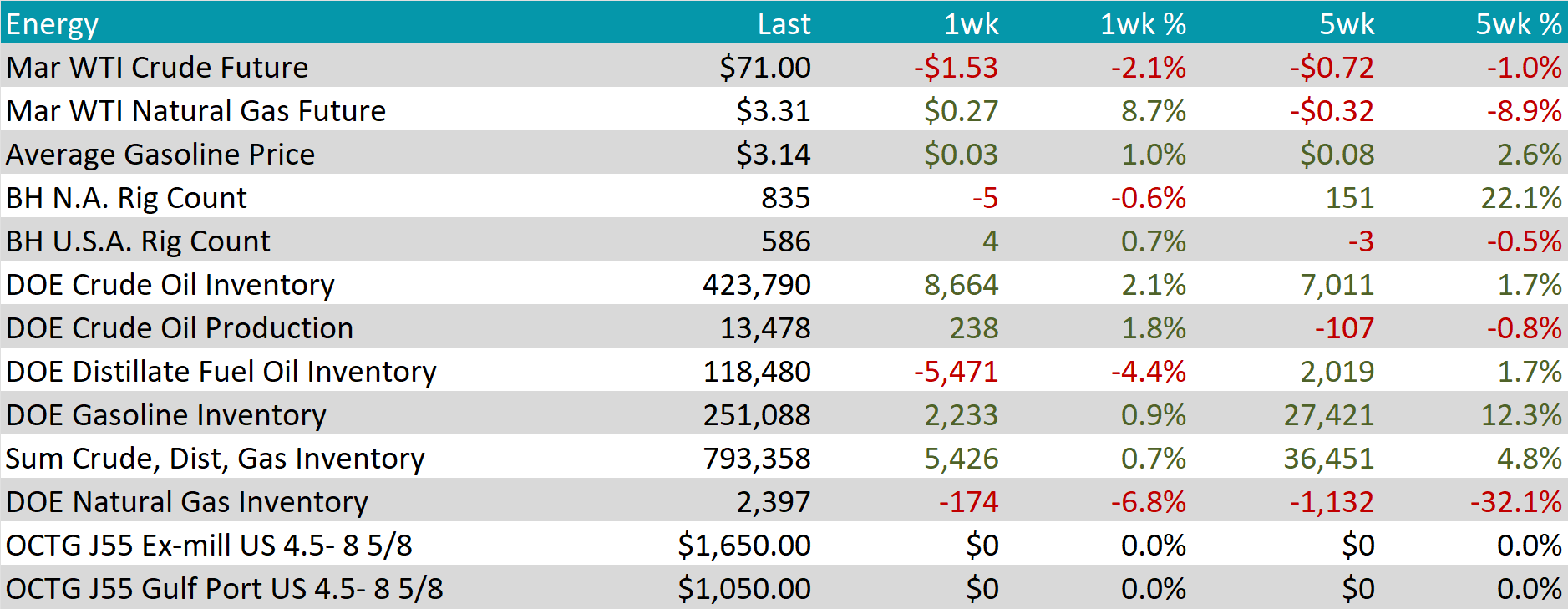

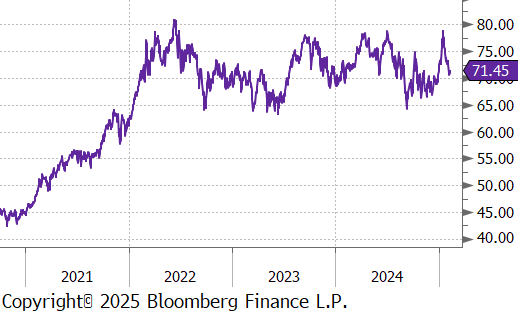

WTI crude oil future lost $1.53 or -2.1% to $71.00/bbl.

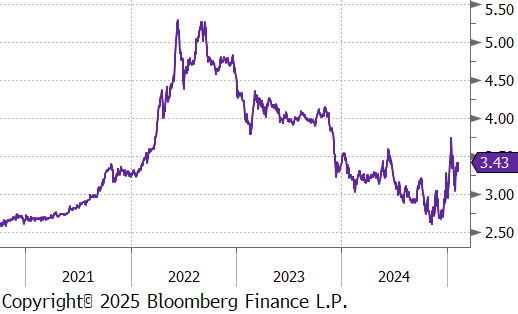

WTI natural gas future gained $0.27 or 8.7% to $3.31/bbl.

The aggregate inventory level increased further, rising by 0.7%.

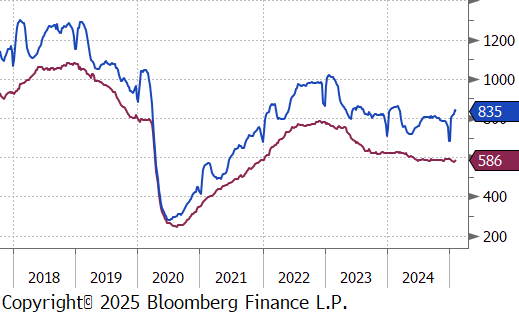

The Baker Hughes North American rig count reduced by 5 rigs, bringing the total count down to 835 rigs. Conversely, the US rig count gained 4 rigs, bringing the total count to 586.

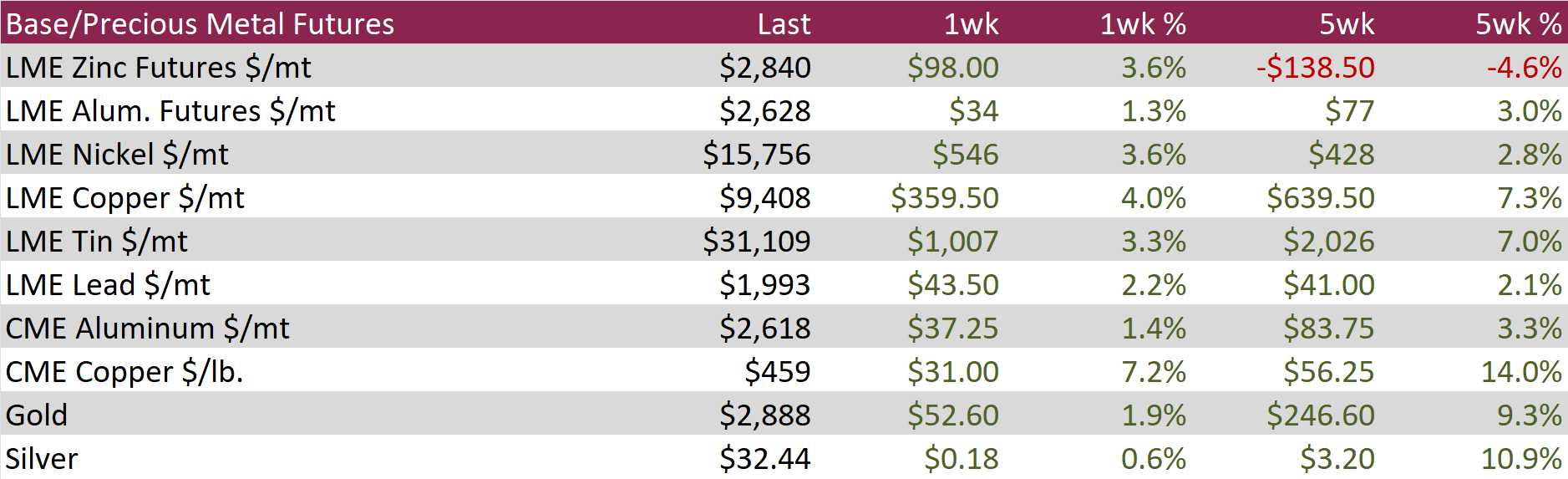

Aluminum futures increased by $34 or 1.3% to $2,628, supported by broad gains in base metals amid ongoing supply concerns and improving manufacturing indicators. In China, aluminum production reached a record 44 million tons in 2024, nearing the government-imposed cap of 45 million tons set in 2017 to prevent oversupply and meet carbon emissions targets. Also, the threat of looming tariffs continue to influence the price.

Copper futures rose by $31 or 7.2% to $459, hovering near four-month highs as tightening supply and recovering demand fueled bullish sentiment. Supply concerns mounted as delays caused by repairs and aging mines in Chile, the world’s top copper producer, threatened to constrain output. Meanwhile, demand rebounded as Chinese buyers returned to the market after the Lunar New Year, and U.S. consumers increased stockpiling ahead of potential trade restrictions. Heightened trade tensions added further uncertainty, as China’s retaliatory tariffs on select U.S. exports neared implementation, and German Chancellor Olaf Scholz warned that the EU is prepared to respond “within an hour” to any U.S. tariffs on European goods.

Precious Metals

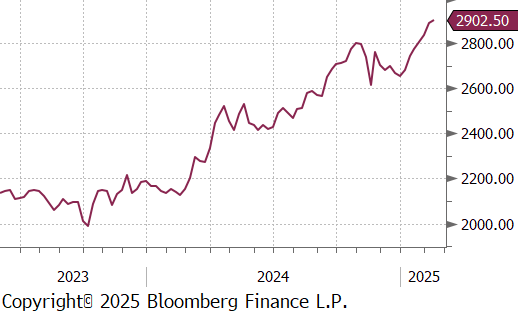

Gold advanced by $52.60 or 1.9% to $2,888, setting a record high as escalating trade tensions and global monetary easing fueled safe-haven demand. Expectations of looser monetary policy from major central banks continued to support non-yielding gold. Investors still anticipate two Federal Reserve rate cuts in 2024, despite strong labor data, aligning with the FOMC’s projections. Additionally, the Bank of England surprised markets with a more dovish-than-expected rate cut last week, while the Reserve Bank of India implemented its first rate reduction since its pandemic-era policy measures nearly five years ago. Further boosting bullion, the People’s Bank of China increased its gold reserves for the third consecutive month in January, underscoring ongoing central bank demand.

December Construction Spending figures came in strong to end the year up 0.5% MoM, above the expected increase be 0.2%. This was driven most significantly by increases in private residential spending, up 1.5%, while nonresidential spending also increased, 0.1%. YoY spending continues to expand, now for the 68th consecutive month.

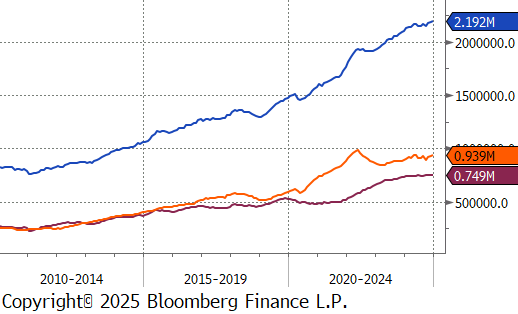

In January, Wards Total Vehicle Sales dropped to 15.60m from December’s 16.80m sales, missing the expectation of a decline to 16m. This is the lowest level of sales since August. Somewhat surprisingly, auto inventories and production remain in a downtrend. We anticipate that the drawdown in inventories will lead to an uptick in steel consumption over the next couple of months but anticipate that it will be short-lived.

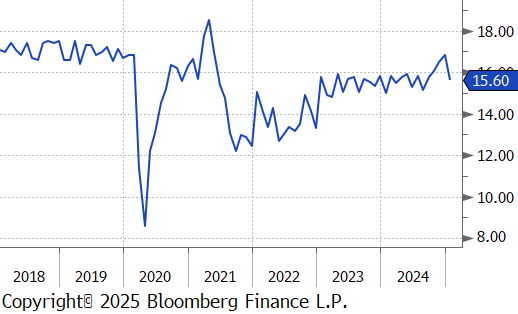

Manufacturing activity measured by the two prominent PMIs finally showed a breakthrough into expansion territory in January. The ISM Manufacturing PMI increased to 50.9, surpassing the market expected 49.3 and up from 49.2 in December. The S&P Global US Manufacturing PMI improved to 51.2 from the preliminary estimate of 50.1 and up from December’s 49.4.

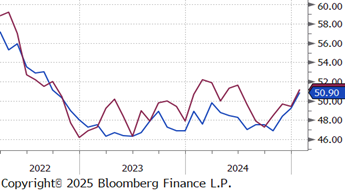

Finally, this week provided an all you can eat buffet of labor market data. Starting with a worse than anticipated job openings figure, down to 7.6M (resulting in 1.1 openings per unemployed worker) in December. As for January nonfarm payrolls the headline figure came in at 143k, below the expected level of 175k jobs added, while the unemployment rate decreased to 4%, below the expected 4.1%. Additionally, average hourly earnings (wages) rose to 4.1% YoY, above the expected decrease to 3.8%. What was more interesting, however, was the annual benchmark revision for 2024, which signaled that many of last years perceived cracks are smaller than expected.