Flack Capital Markets | Ferrous Financial Insider

February 16, 2024 – Issue #419

February 16, 2024 – Issue #419

Overview:

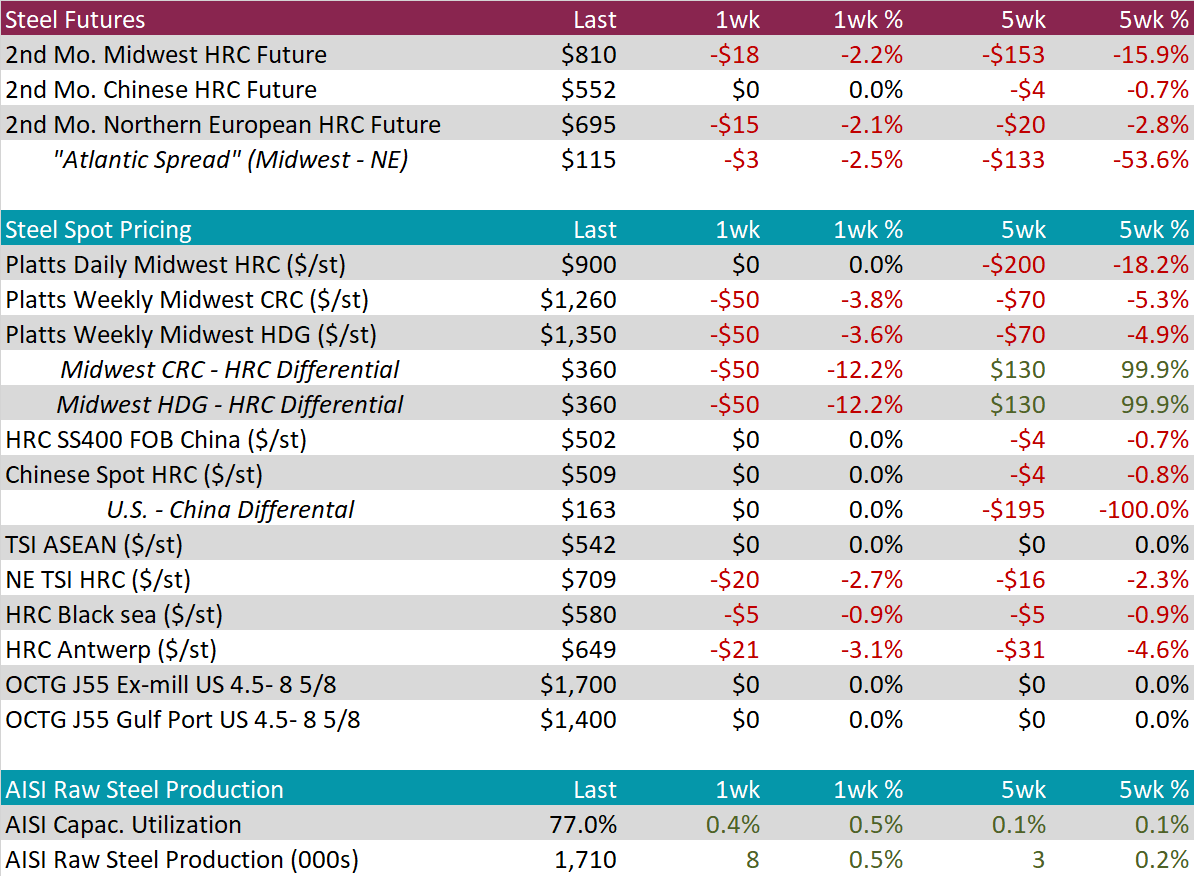

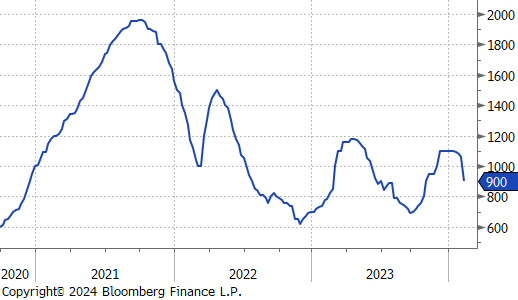

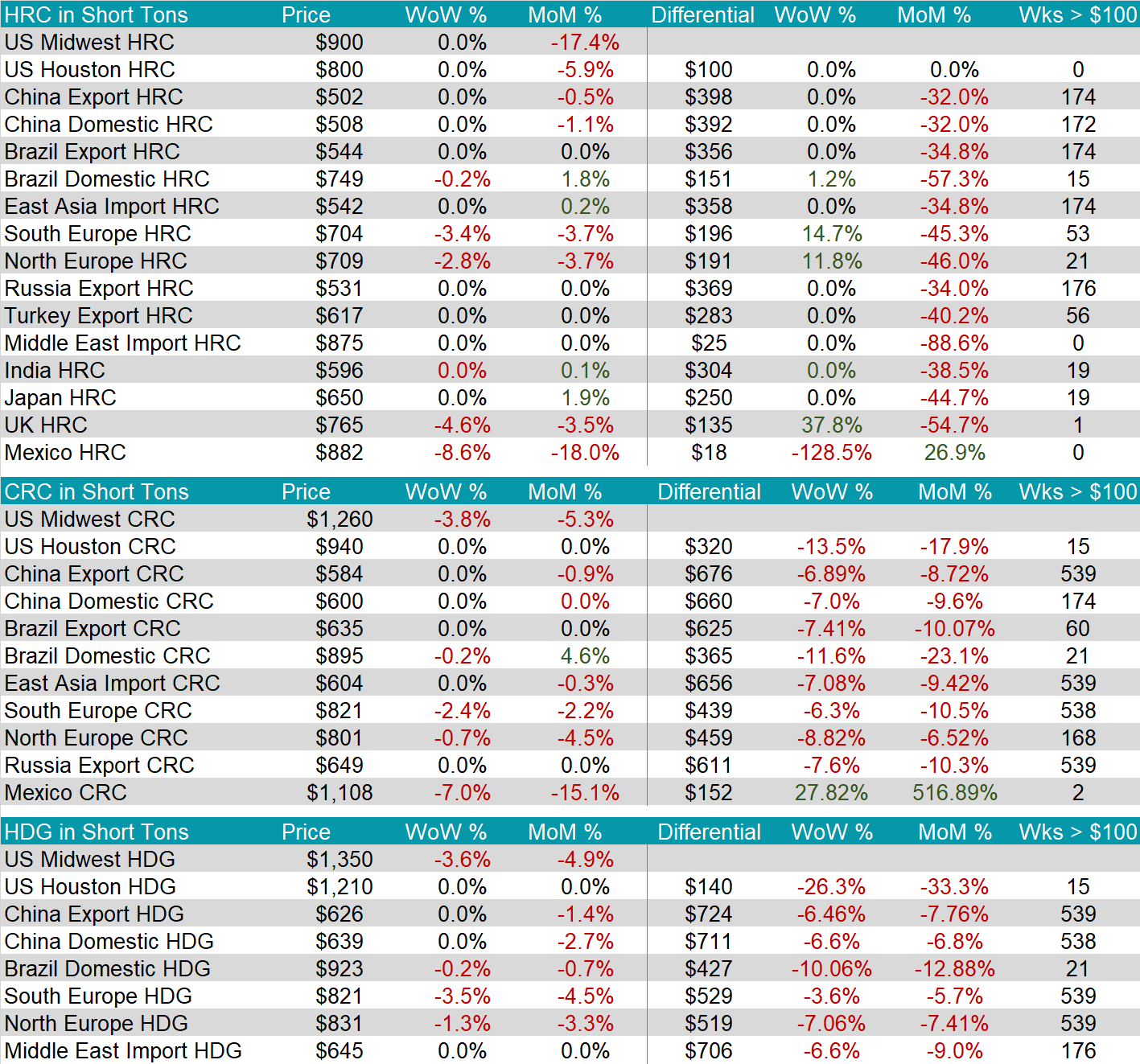

The HRC spot price remained static at $900, resulting in the 5-week price change to be down $200 or -18.2%. At the same time, the 2nd month future fell by $18 or -2.2% to $810, this is the lowest level hit since mid October 2023.

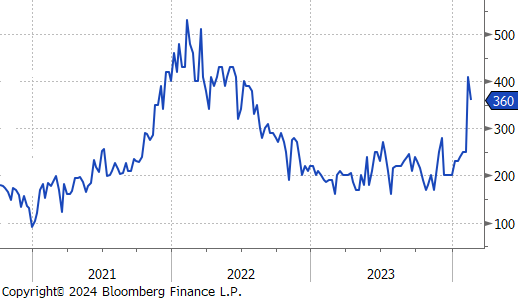

Tandem products both dropped by $50, resulting in the HDG – HRC Differential to also fall by $50, bringing the spread to $360, which is a slight retreat from last weeks $410.

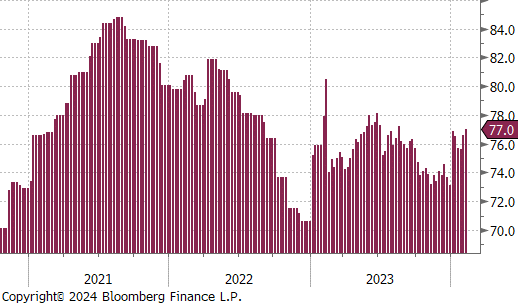

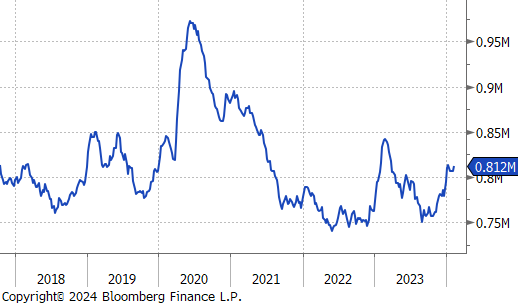

Mill production edged out of subdued levels, with capacity utilization ticking up by 0.4% to 77.0%, bringing raw steel production up to 1,710m net tons.

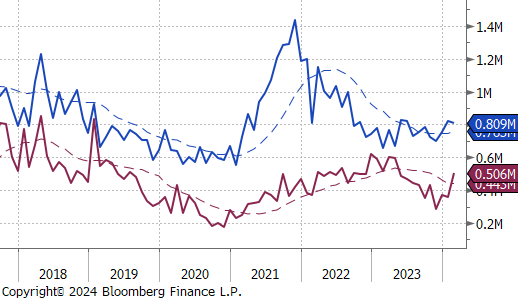

February Projection – Sheet 809k (down 13k MoM); Tube 506k (up 149k MoM)

January Projection – Sheet 822k (up 69k MoM); Tube 357k (down 14k MoM)

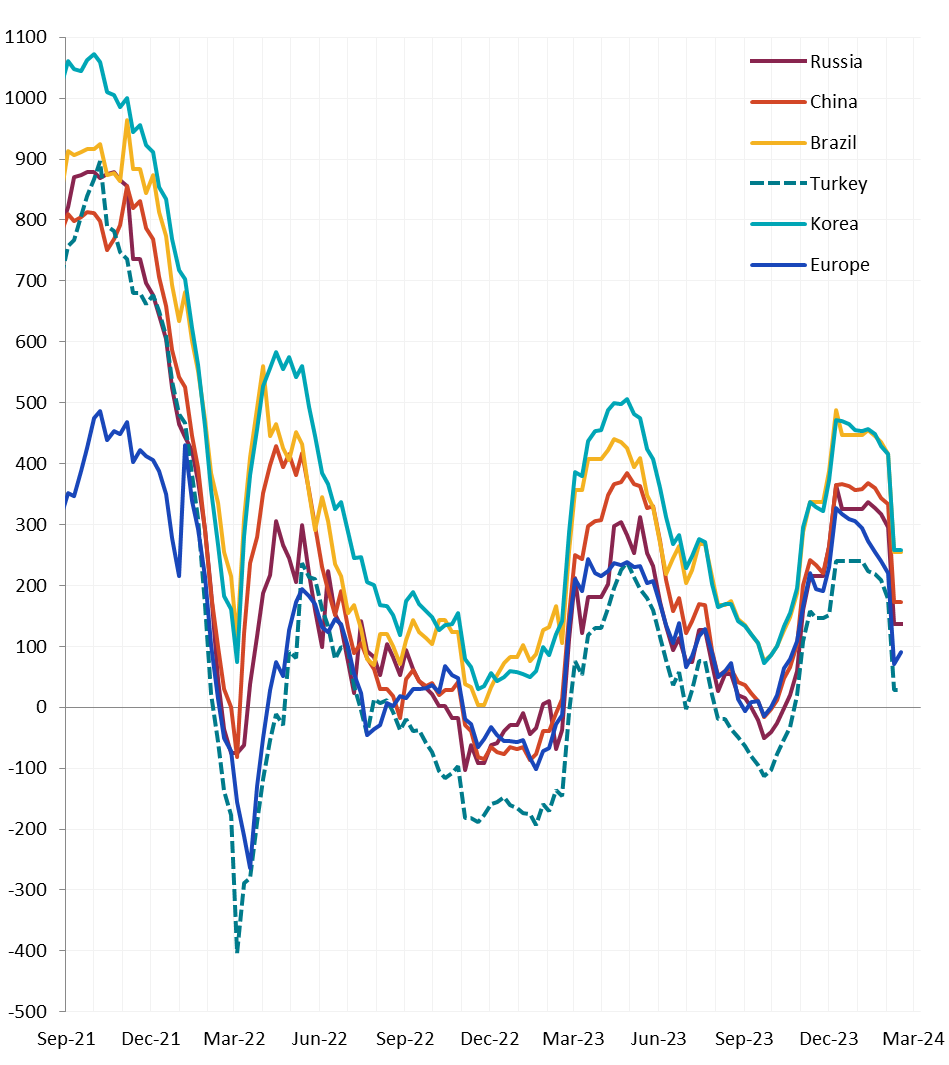

Watched global differentials either remained unchanged or increased, with South Europe HRC and Brazil HRC decreasing by -3.4% and -0.2%, respectively, being the only movers.

Scrap

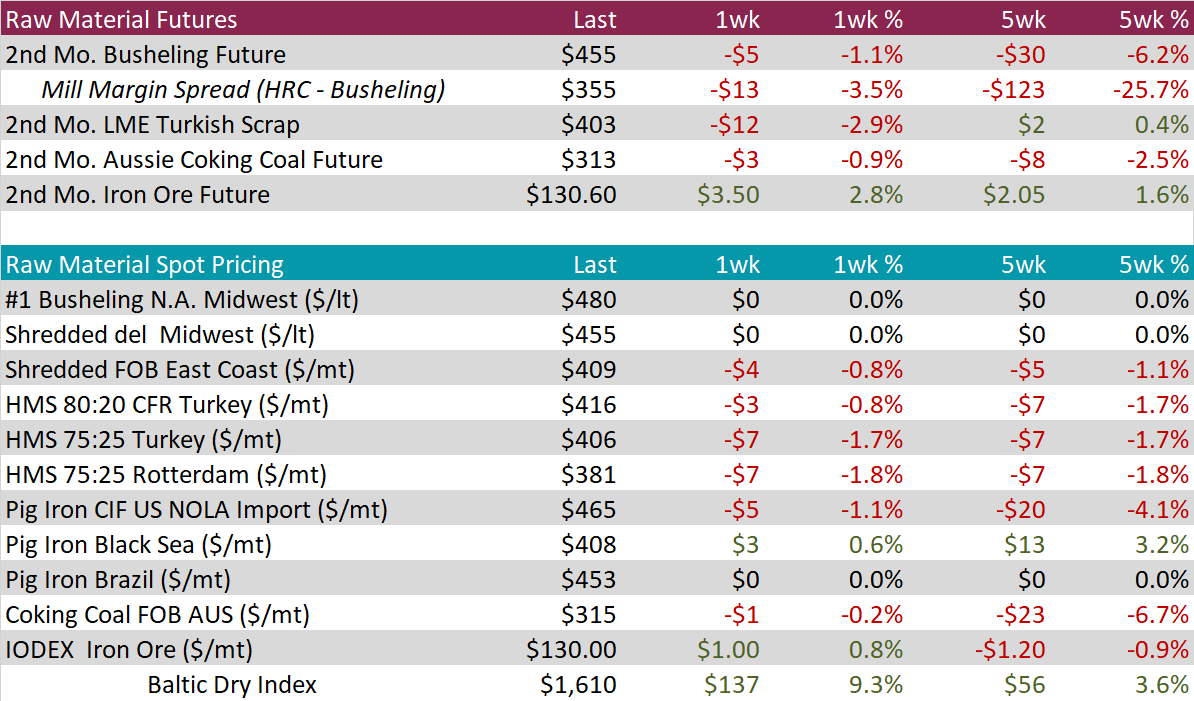

The 2nd month busheling future fell by $5 or -1.1% to $455, its lowest level since early December 2023. Meanwhile, the busheling spot price remained stagnant at $480.

The 2nd month LME Turkish scrap future declined by $12 or -2.9% to $403, continuing to remain just above the $400 price level.

The 2nd month iron ore future rose by $3.50 or 2.8% to $130.60, resulting in its 5-week price change to be up by $2.05 or 1.6%. At the same time, the iron ore spot price IODEX increased by $1 or 0.8% to $130.

Dry Bulk / Freight

The Baltic Dry Index ticked up by $137 or 9.3% to $1,610, continuing to recovery after its significant fall from the $3,000 level.

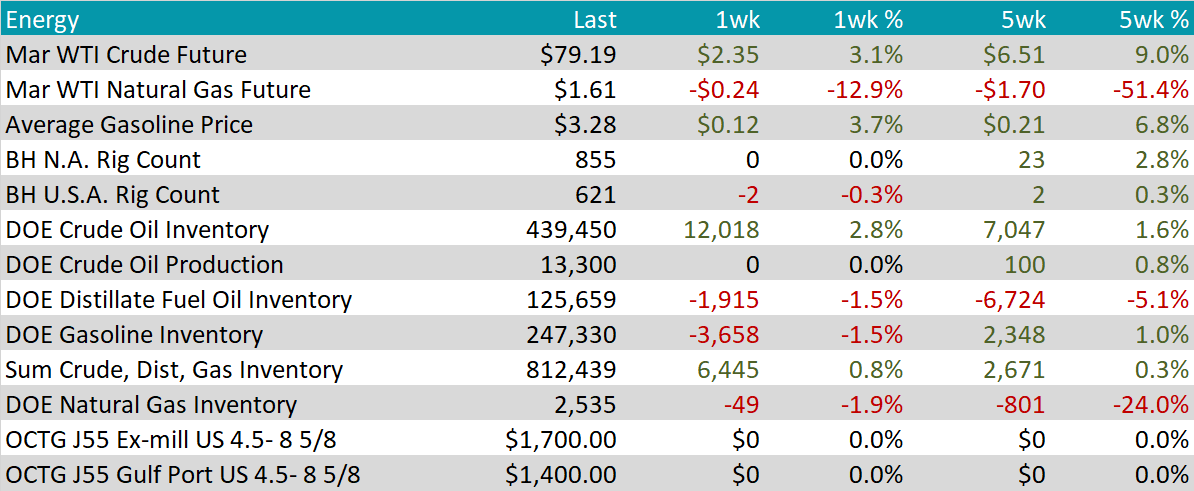

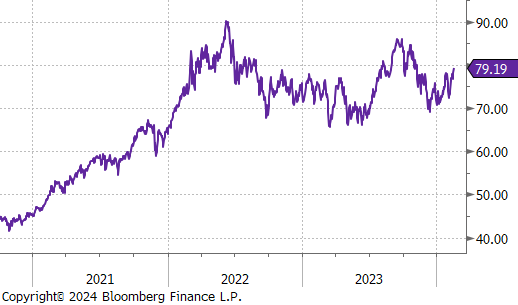

WTI crude oil future gained $2.35 or 3.1% to $79.19/bbl.

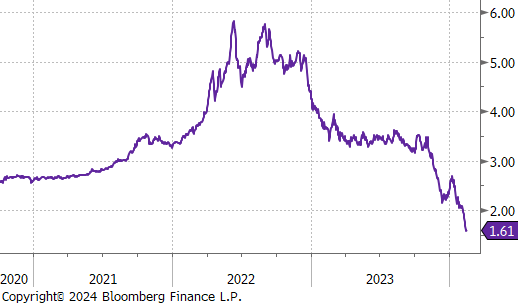

WTI natural gas future lost $0.24 or -12.9% to $1.61/bbl, continuing its downward trend, and hitting its lowest level since June 2020.

The aggregate inventory level ticked slightly up by 0.8%.

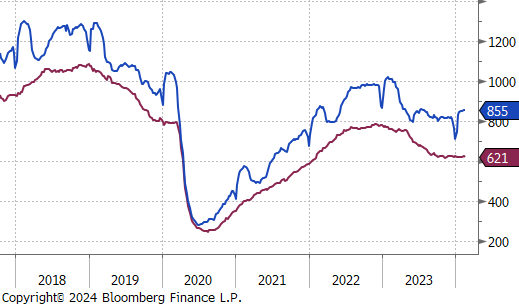

The Baker Hughes North American rig count remained steady at 855 rigs. At the same time, the US rig count fell by 2 rigs, bringing the count to 621 rigs.

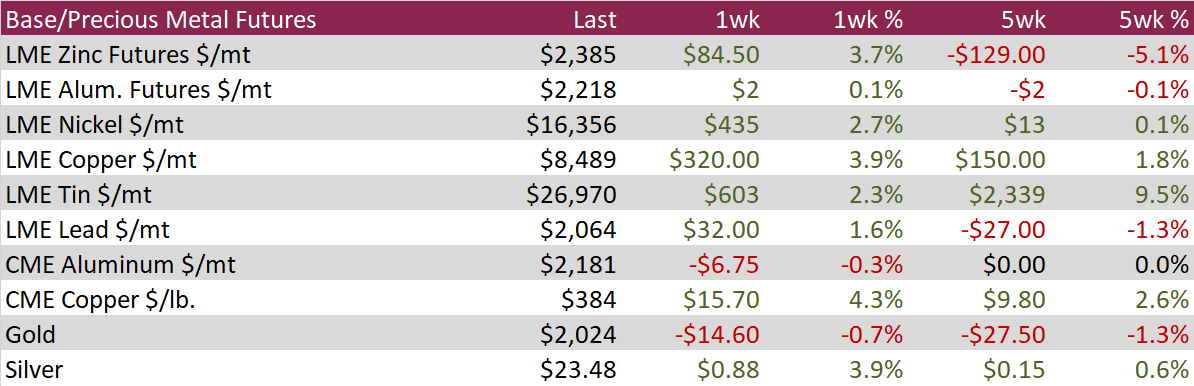

Aluminum rose by $2 or 0.1% to $2,218, driven by a gloomy outlook on global demand for base metals. Contributing to this decline was fresh data from China, the leading consumer, which revealed a weakening economic environment and falling consumer confidence. This trend has dampened expectations for purchases by major manufacturers. Additionally, the situation worsened when the UAE stepped in to facilitate bauxite shipments from Guinea following an explosion that threatened aluminum production logistics. Meanwhile, the market is closely monitoring the potential effects of further EU sanctions on Russian aluminum, which could limit its availability. These sanctions might expand to include more products beyond the current ban on wires, tubes, pipes, and foil. Despite these measures affecting only 12% of the EU’s aluminum imports, the industry body European Aluminium has advocated for a more extensive ban.

Copper increased by $15.70 or 4.3% to $384, recovering from a near-three-month low, following disappointing US retail data that fueled speculation about a Federal Reserve rate cut in the second quarter. This speculation weakened the dollar, which in turn made copper more affordable for international buyers and boosted demand for the metal in economies linked to US credit markets, positively affecting the base metals sector. However, the gains were tempered by concerns in China, a major consumer, where deflation hit a 14-year high, and manufacturing continued to contract for the fourth month in January. These economic indicators align with the declining Yangshan copper premium and a surge in Chinese warehouse inventories, which have soared by more than 120% year-to-date, reaching nearly 70,000 tonnes, as factories cut back on copper purchases.

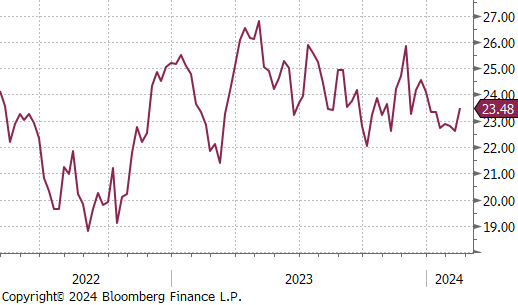

Silver rose by $0.88 or 3.9% to $23.48, a seven-week peak, in response to traders recalibrating their expectations for Federal Reserve rate cuts. The forthcoming minutes from the Federal Open Market Committee (FOMC) meeting and upcoming remarks from Fed officials are anticipated to shed light on the timing of the anticipated rate reduction. Whereas a cut in March was initially expected, the odds are now tilted towards a 53% chance of a 25-basis point decrease in June. The outlook for silver prices remains bullish for the year, underpinned by a weakening dollar and falling Treasury yields, as the Fed shifts towards more accommodative monetary policy.

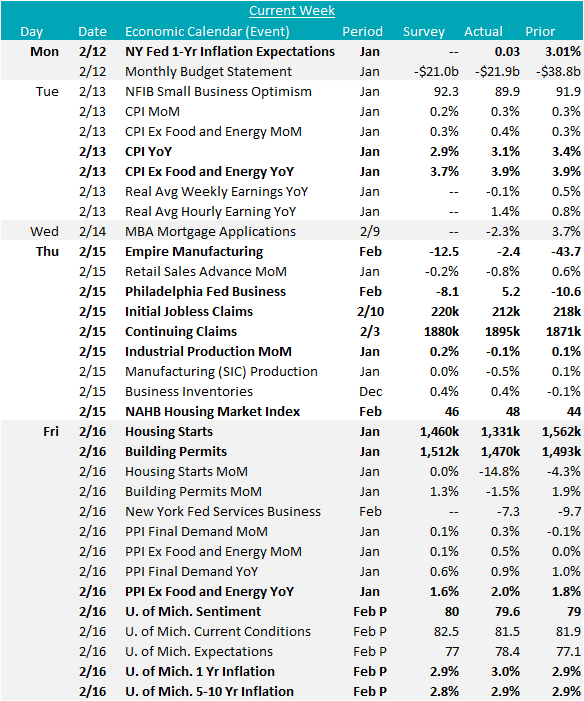

The inflation reports indicated a gradual easing, although slower than expected, suggesting higher for longer rates. Core CPI remained at 3.9%, defying expectations for a drop to 3.7%. PPI rose slightly to 2.0%, against a forecasted 1.6%. U. of Mich. 1-Yr Inflation Expectations increased slightly to 3.0%, and their 5-10 Yr Expectations stayed at 2.9%, not meeting the anticipated 2.8%. Sentiment rose to 80.0, above the expected 79.6, and NY Fed’s 1-Yr Expectations stayed at 3%.

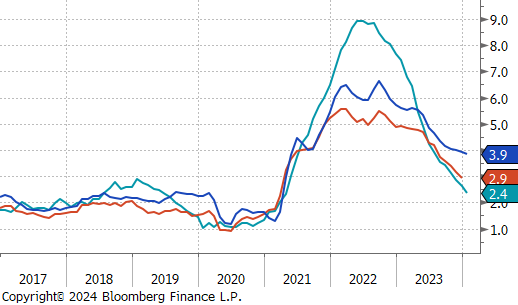

February’s Fed Manufacturing Surveys indicate an upturn in manufacturing, with the NY Empire rebounding to -2.4 from -43.7 and the Philadelphia rising to 5.2, marking its first expansion since August. This points to a potential gradual sector recovery, despite January’s Industrial Production figures dipping to -0.1% versus the expected 0.2% rise. Mixed readings from the manufacturing sector over the last 3 months highlight the fact that although the trend is towards recovery, it will likely continue to be on a rocky path for much of the spring.

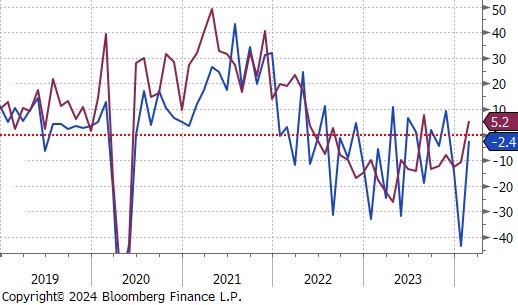

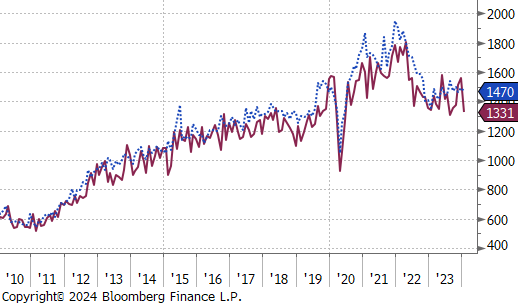

January’s housing data showed declines with Housing Starts falling to 1,331k, below the expected 1,460k, and Building Permits decreased to 1,470k, missing the forecasted rise to 1,512k. While this tranche of data disappointed, the underlying trend for permits continues to improve, suggesting that there is still optimism in the sector. This is also represented in the February NAHB Housing Market Index which rose to 48, exceeding the expected 46, indicating further positive momentum.