Flack Capital Markets | Ferrous Financial Insider

February 2, 2024 – Issue #417

February 2, 2024 – Issue #417

Overview:

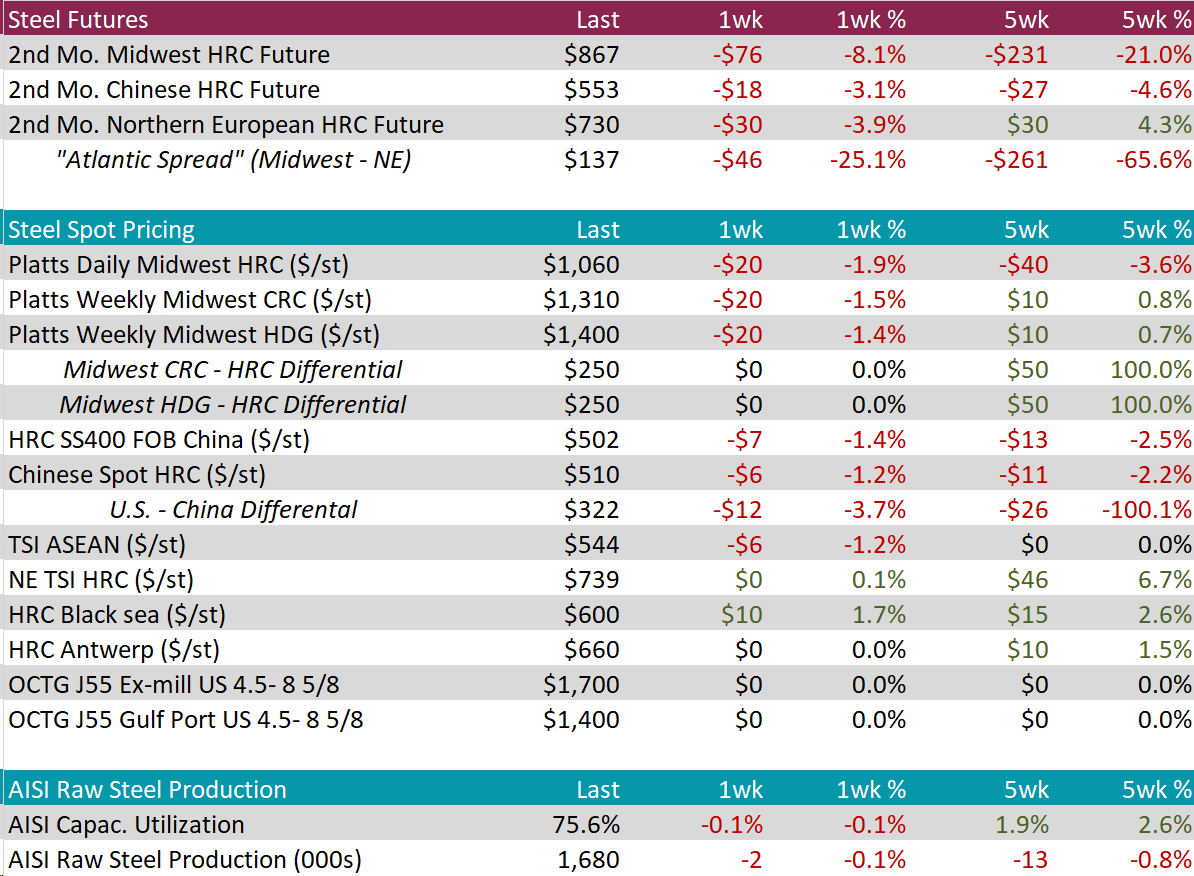

The HRC spot price fell by $20 or -1.9% to $1060. At the same time, the 2nd month future had a significant drop, falling by $76 or -8.1% to $867, reaching its lowest level since October 2023.

Tandem products both fell by $20 as well, resulting in the HDG – HRC Differential to remain static at $250.

Mill production continued to remain flat at relatively low levels, with capacity utilization ticking down by -0.1% to 75.6%, bringing raw steel production down to 1.680m net tons.

January Projection – Sheet 766k (up 14k MoM); Tube 361k (down 10k MoM)

December Projection – Sheet 753k (up 54k MoM); Tube 371k (up 87k MoM)

All watched global differentials fell further this week, with China and Brazil seeing the biggest price decreases, -2.4% and -1.2% respectively. Meanwhile, the Mexico HRC fell by -2.0%.

Scrap

The 2nd month busheling future fell by $3 or -0.6% to $475, making the five-week price change to fall by $75 or -13.6%. At the same time, the busheling spot price remained stagnant at $480.

The 2nd month Aussie coking coal future dropped by $11 or -3.3% to $312, maintaining just above the $300 price level.

The 2nd month iron ore future declined by $9.85 or -7.2% to $126.90, reaching its lowest price since November. Meanwhile, the spot price decreased by $8.15 or -6.0% to $128.

Dry Bulk / Freight

The Baltic Dry Index fell by $111 or -7.4% to $1,388, continuing its downward trend since hitting its most recent price high of $2,937 nine weeks ago.

WTI crude oil future lost $5.73 or -7.3% to $72.28/bbl.

WTI natural gas future lost $0.63 or -23.3% to $2.08/bbl, hitting its lowest level since April 2023.

The aggregate inventory level experienced a slight down tick, declining by 150 or 0.0%.

The Baker Hughes North American rig count remained unchanged at 851 rigs. The US rig count decreased by 2 rigs, bringing the total count to 619 rigs.

Aluminum fell by $41 or -1.8% to $2,234, as the global aluminum market is navigating through turbulent waters, marked by geopolitical strains and calculated corporate strategies. UK sanctions against Russian metals have led to a split among key players on the London Metal Exchange (LME), with firms like JPMorgan Chase & Co. continuing Russian aluminum transactions, whereas Citigroup Inc. opts out. This situation has triggered debates on potentially excluding Russian aluminum from the LME to dodge market disturbances, underscoring the intricate interplay between politics and commodity trading. Simultaneously, IXM, backed by CMOC Group, plans to dial down its aluminum division in 2024 to sharpen its focus on core commodities such as cobalt and copper, despite achieving record financial outcomes recently. This strategic pivot, aimed at navigating market sluggishness and high interest rates, reflects IXM’s flexible strategy towards seizing future aluminum market opportunities.

Copper dipped by $3.05 or -0.8% to $382, reflecting a week of losses fueled by dwindling demand from China and rising interest rates in the US. The contraction of China’s manufacturing sector for the fourth month in a row in January has added to the market’s pessimism. Additionally, a strong US employment report has tempered expectations for a rate cut by the Federal Reserve in March, forecasting a deceleration in industrial activity for the first quarter that may affect demand. On the flip side, a forecasted 5% drop in Glencore’s production in 2023, with a further reduction expected in 2024, might mitigate some of the downward pressure. Despite these headwinds, there remains hope that China will implement measures to bolster its economy.

Gold rose by $17.60 or 0.9% to $2,054, influenced by the dollar’s rise and an uptick in Treasury yields following robust US employment data, which cooled expectations for immediate Federal Reserve rate reductions and led investors to adjust their forecasts, now anticipating rate cuts totaling 127 basis points by the end of 2024, a notable decrease from the over 160 basis points anticipated at January’s outset.

Last week’s jobs report including the revisions to November and December show that the labor market continues to hold up impressively, with another 353k jobs added to Nonfarm payrolls in January. Additionally, the clear indication of caution towards near-term cuts from FED Chair Powell in Wednesday’s press conference was supported by the data. Not only did unemployment fall to 3.7%, but hourly earnings YoY significantly beat expectations, up 4.5% versus 4.1%.

January manufacturing data showed further contraction, driven by a lack of longer-term demand. The Dallas FED Manufacturing Survey and MNI Chicago PMI both came in below expectations, -27.4 vs -11, and -46 vs -48, respectively. The ISM Manufacturing PMI surprised and printed above expectations up to 49.1 vs 47.2 but it remains in contraction territory. The driver of this move was decreasing inventories (43.9, down from 46.2) and the highest new order print (52.5) in 20 months.

Total construction spending (SA) beat expectations, up 0.9% in December versus expectations of up 0.5%. The November data was also revised higher. The move was driven by a strong increase in private residential spending, up 1.4%, while private nonresidential spending cut into the gain, down slightly, 0.2%.

Auto sales disappointed in January, coming in at 15m (SAAR) compared to an expectation of 15.7m.

The Final University of Michigan consumer sentiment survey showed little change from preliminary data, outside a slight improvement in future expectations.