Flack Capital Markets | Ferrous Financial Insider

February 21, 2025 – Issue #472

February 21, 2025 – Issue #472

Overview:

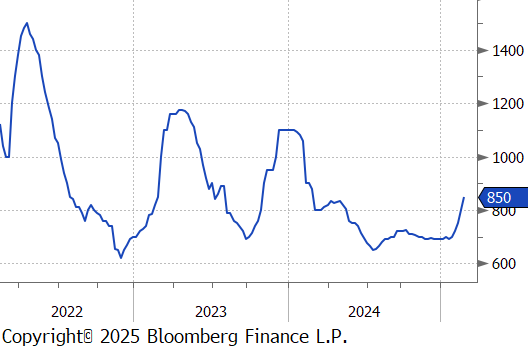

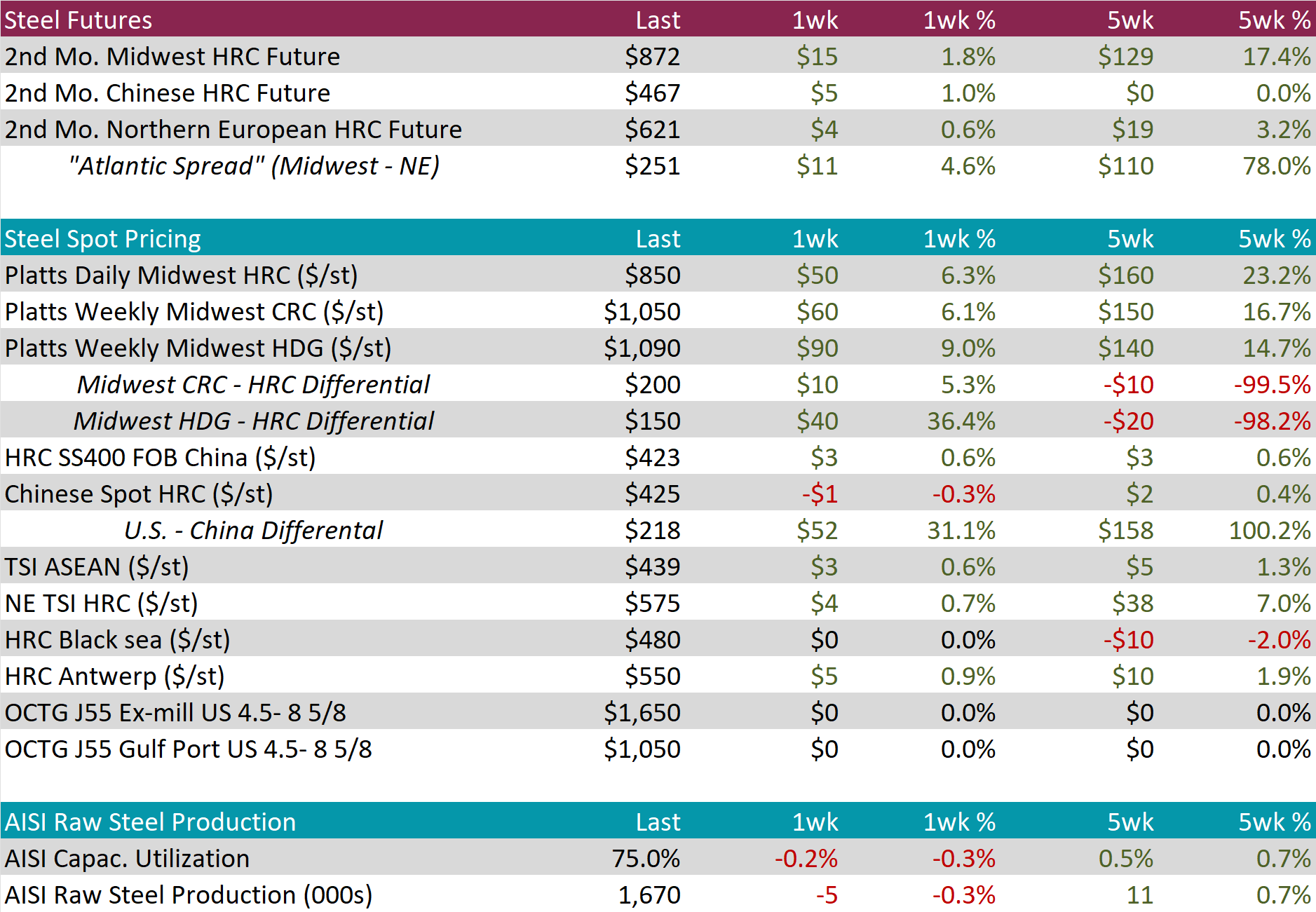

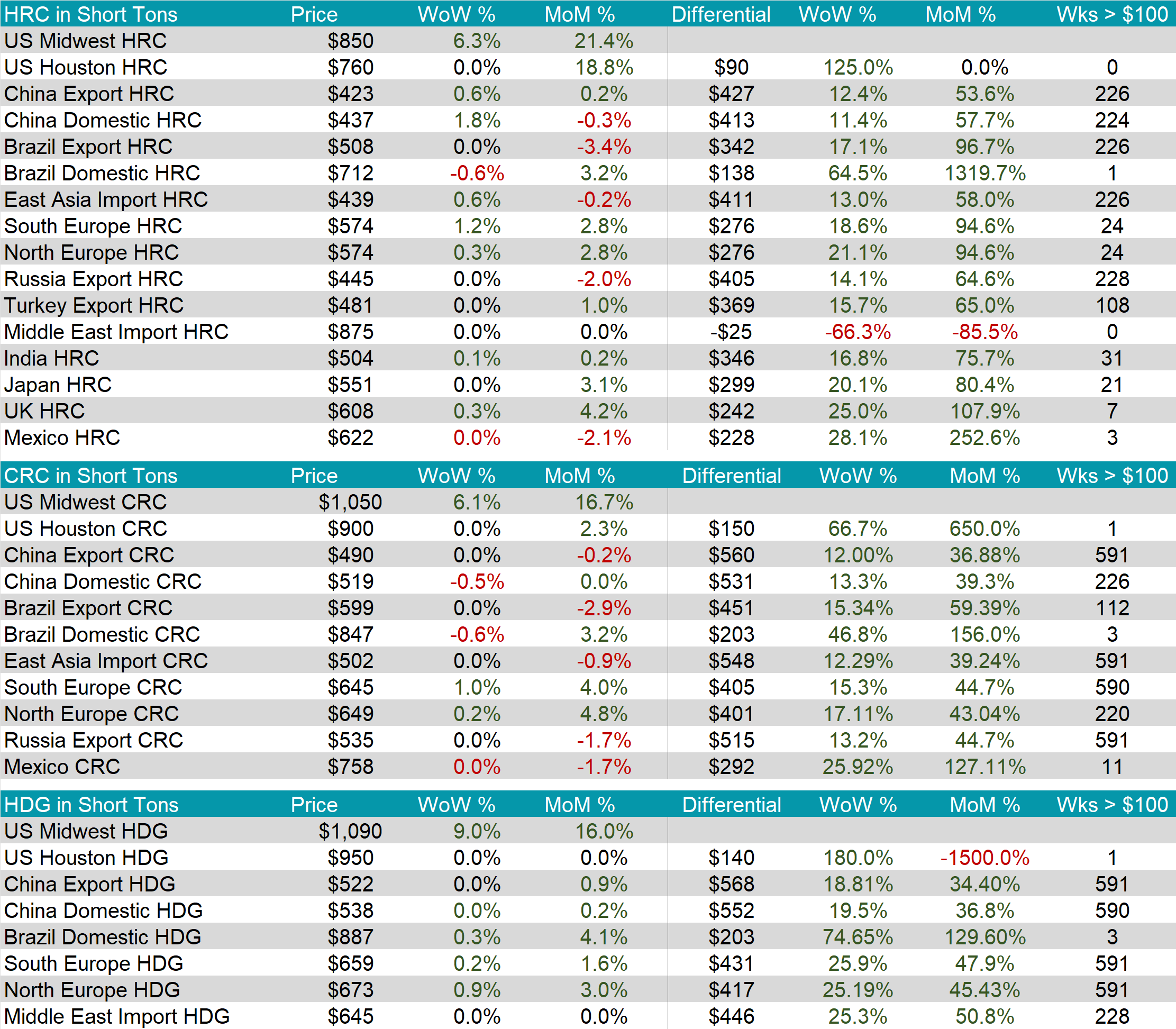

The HRC spot price surged by $50 or 6.3% to $850, marking the fifth consecutive week of increases. At the same time, the HRC 2nd month future also continued its upward trend, this week rising by $15 or 1.8% to $872, marking its fourth week of increases.

Tandem products both made gains, resulting in the HDG – HRC differential to rise by $40 to $150.

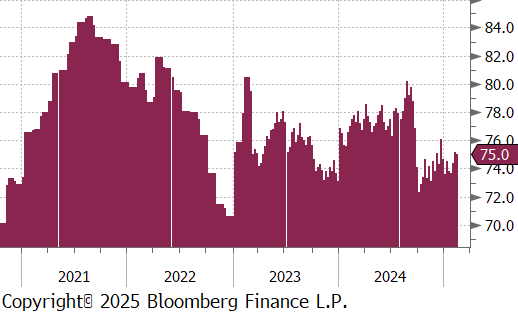

Mill production eased, with capacity utilization ticking down to -0.2% to 75.0%, bringing down raw steel production down to 1.670m net tons.

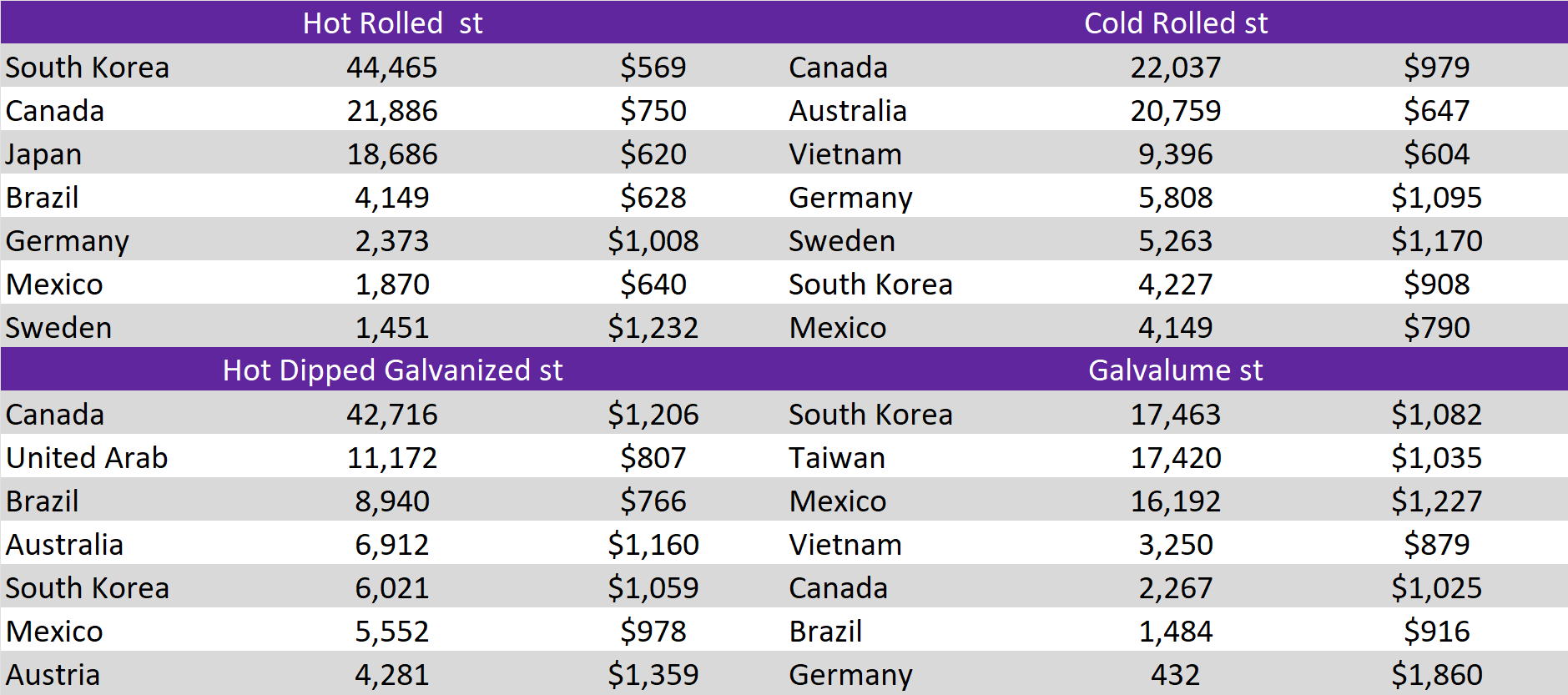

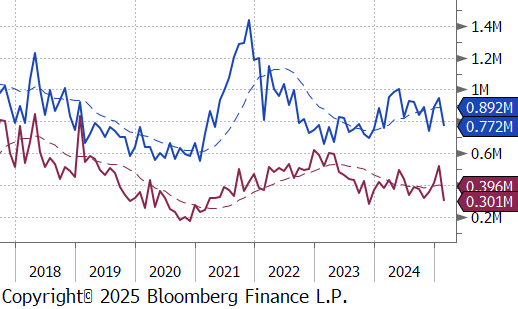

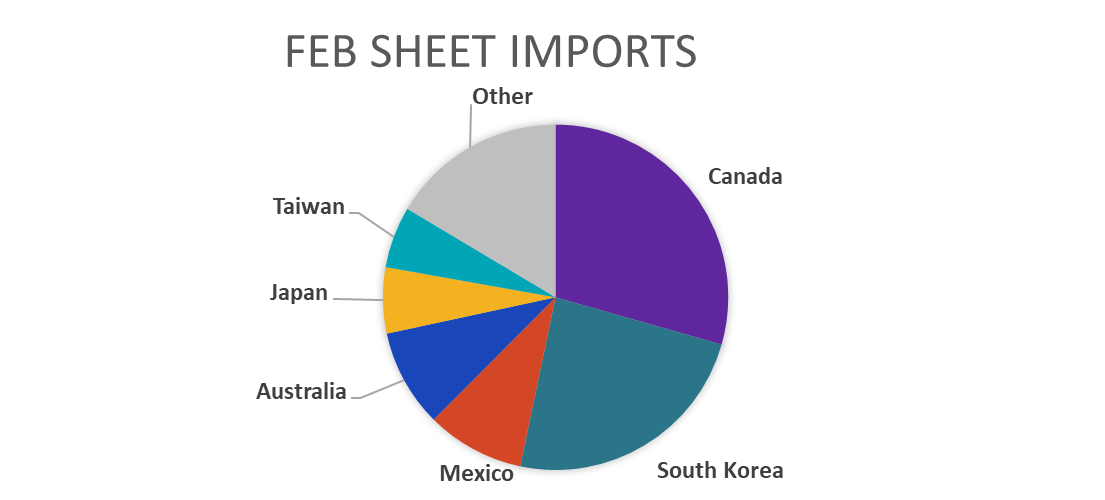

February Projection – Sheet 772k (down 177k MoM); Tube 301k (down 221k MoM)

January Projection – Sheet 949k (up 57k MoM); Tube 522k (up 110k MoM)

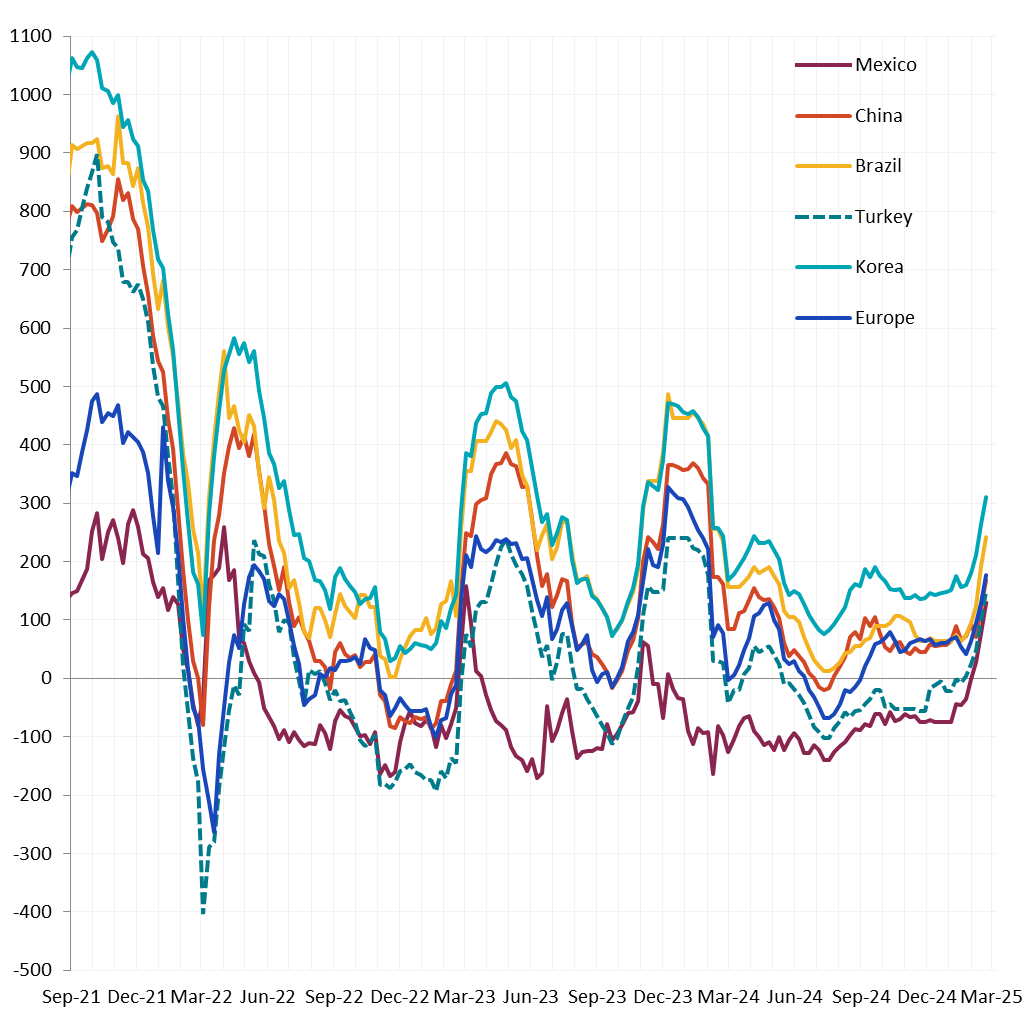

Global differentials continued to expand. China’s Export HRC and Korea’s HRC both rose by 0.6%, N Europe was up by 0.3%, while Mexico was essentially flat.

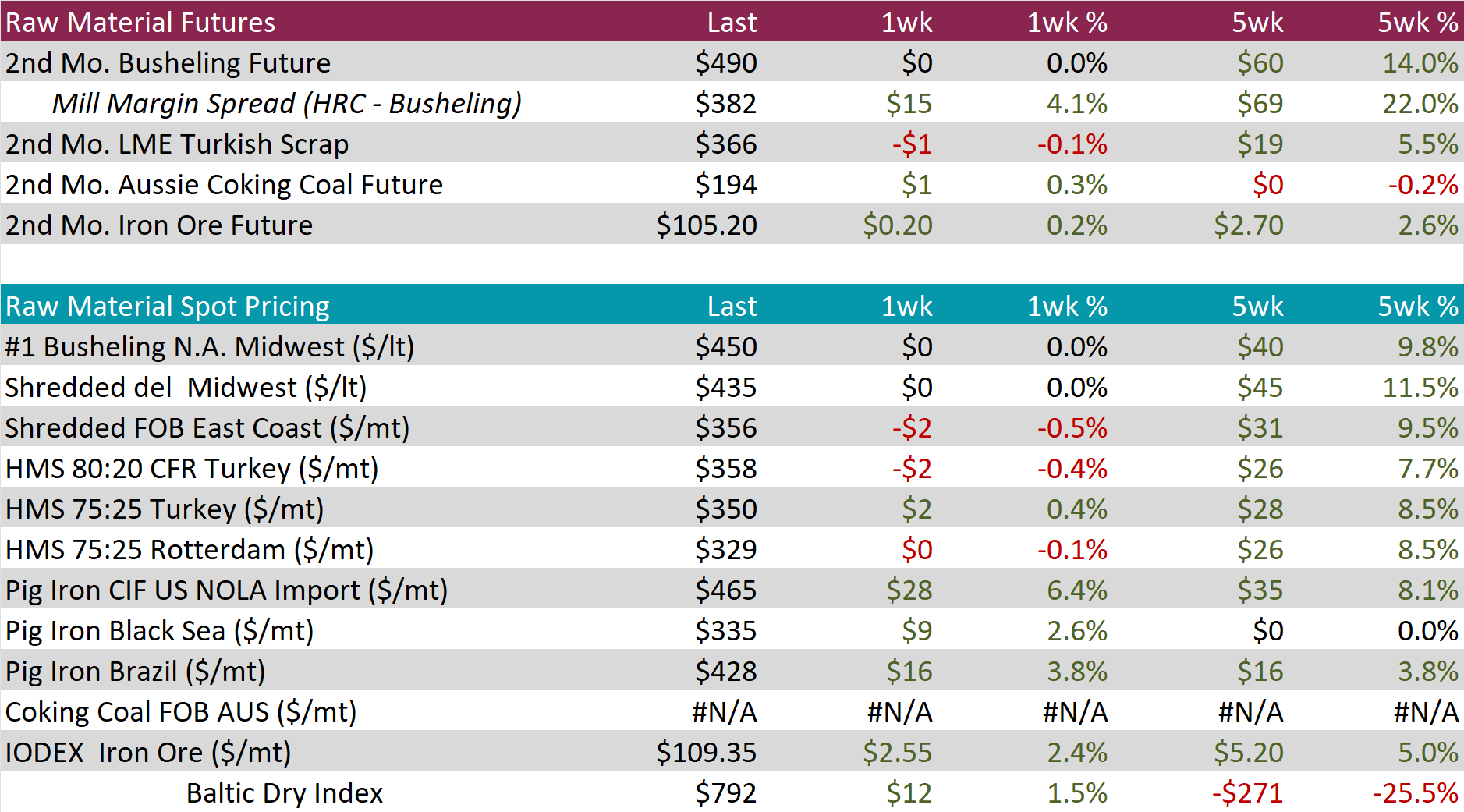

Scrap

The busheling 2nd month future held steady this week.

The Aussie coking coal 2nd month future inched up by $1 or 0.3% to $194, increasing for the second consecutive week.

The iron ore 2nd month future rose by $0.20 or 0.2% to $105.20, resulting in the five week change to be up by $2.70 or 2.6%.

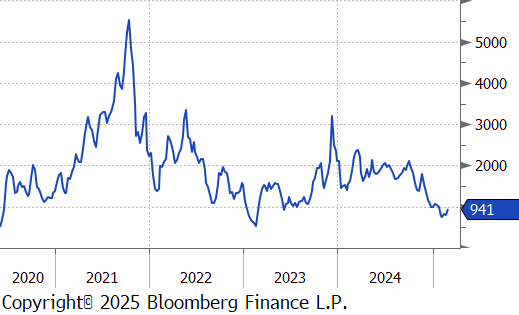

Dry Bulk / Freight

The Baltic Dry Index increased by $12 or 1.5% to $792, marking a rebound.

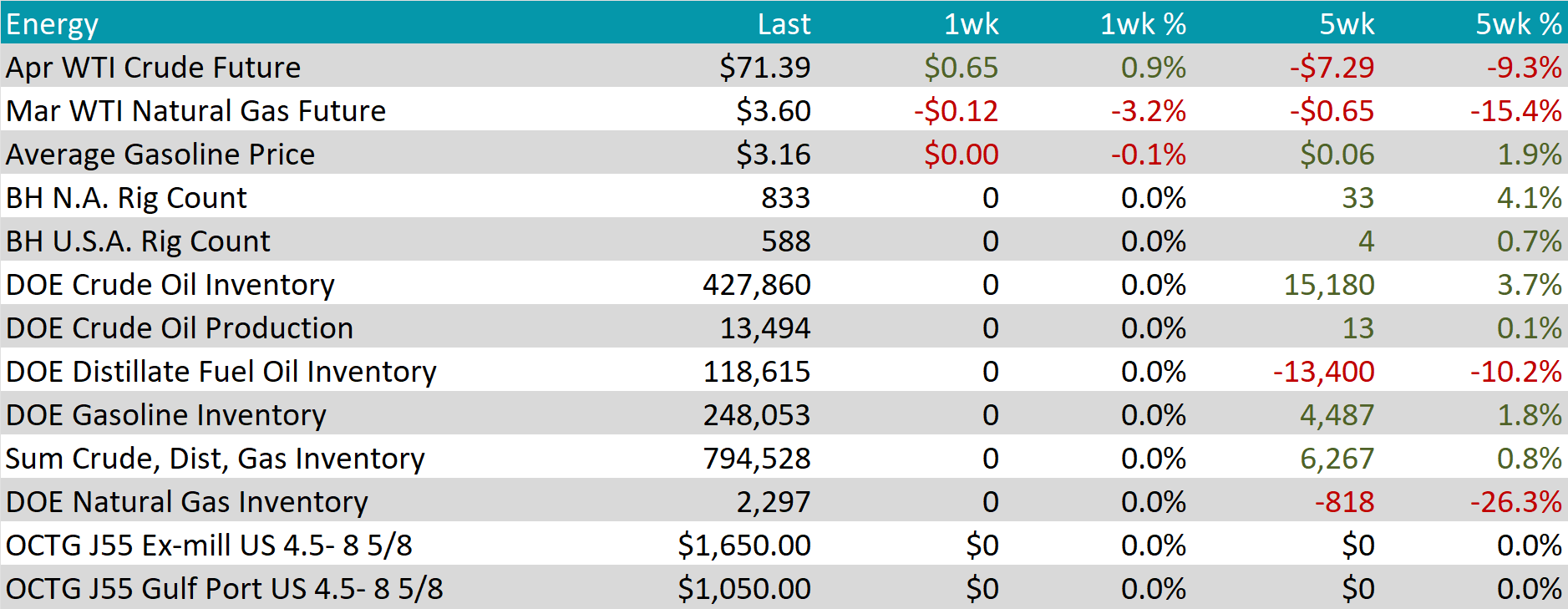

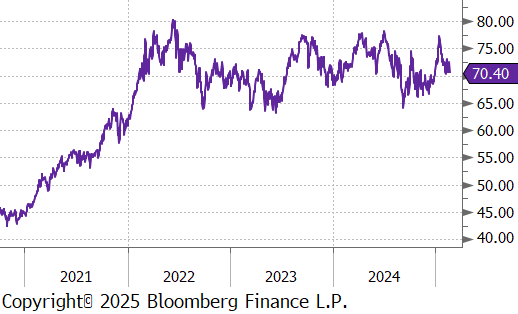

WTI crude oil future gained $0.65 or 0.9% to $71.39/bbl.

WTI natural gas future lost $0.12 or -3.2% to $3.60/bbl.

The aggregate inventory level was unchanged on the week.

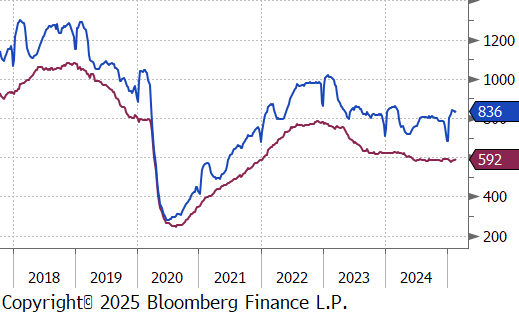

The Baker Hughes North American rig count held steady at 833, while US also remained unchanged at 588 rigs.

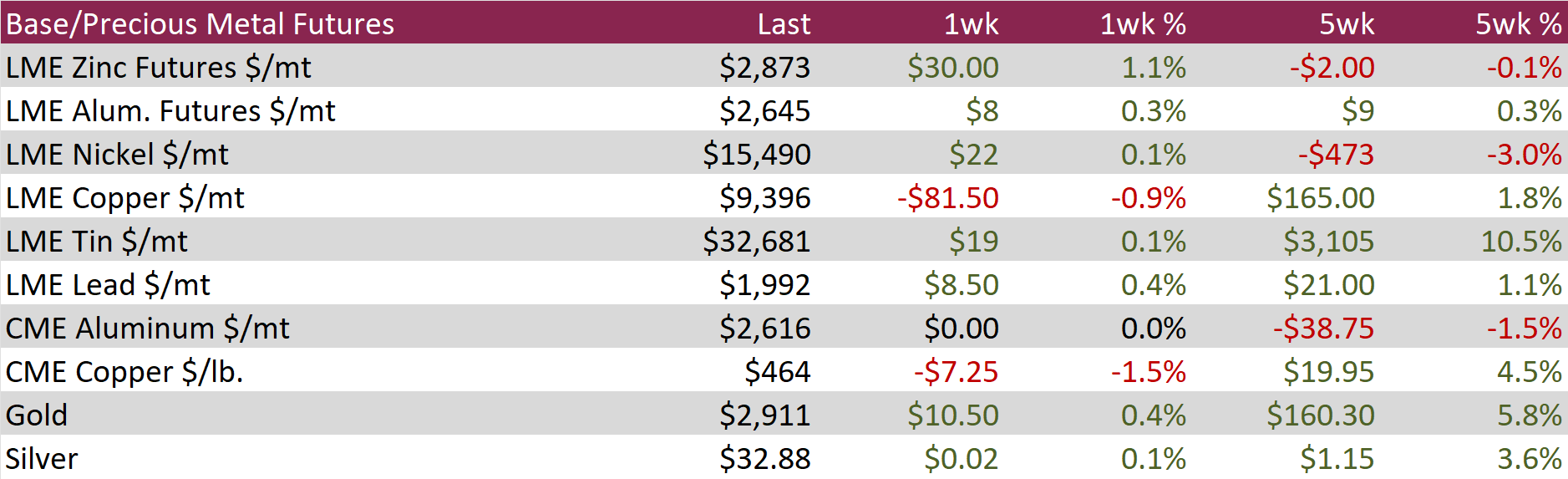

Aluminum futures rose by $8 or 0.3% to $2,645, retreating from the nine-month high of $2,730 reached on February 20th, as speculation grew that the U.S. government may ease some sanctions on Russia, alleviating concerns about constrained supply. The prospect of relaxed restrictions fueled a 50% surge in Rusal HDRs, the world’s largest aluminum producer outside China, in the third week of February, reflecting market expectations that the company could regain access to new export markets. This comes despite fresh warnings from the European Commission that it may impose additional sanctions on Russian aluminum. Meanwhile, China produced a record 44 million tons of aluminum in 2024, bringing output close to the government-imposed 45 million-ton cap established in 2017 to curb oversupply and meet carbon emission targets. With production expected to slow significantly, Beijing is balancing its industrial restrictions against a growing budget deficit and an expected fiscal stimulus push, supported by improving credit growth.

Copper futures fell by $7.25 or -1.5% to $464, hitting a two-week low, as signs of ample supply in key trading hubs pressured prices. In the U.S., President Donald Trump threatened to impose tariffs on copper imports but ultimately refrained, choosing instead to focus on steel and aluminum, ensuring a steady supply for domestic manufacturers. In China, refined copper production remained elevated, with treatment charges for smelters still below zero, highlighting significant overcapacity. Copper inventories also surged, with stockpiles exceeding 260,000 tonnes—three times higher than at the start of the year—while bonded warehouse stocks doubled to 33,000 tonnes. Meanwhile, a recent survey indicated that the global copper market experienced a substantial surplus last year, countering expectations that electrification-driven demand would lead to supply shortages.

Precious Metals

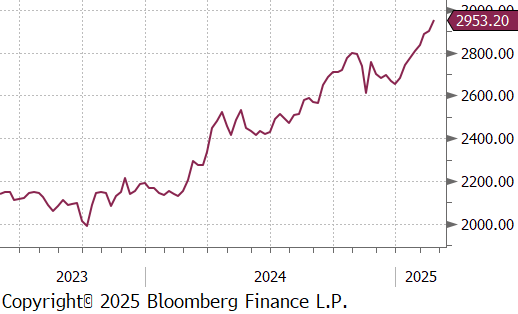

Gold increased by $10.50 or 0.4% to $2,911, as safe-haven demand surged amid heightened trade tensions following U.S. President Donald Trump’s latest tariff measures. The new duties now extend to lumber and forest products, adding to previously announced tariffs on imported cars, semiconductors, and pharmaceuticals, fueling inflation concerns and escalating trade uncertainty. Investor sentiment was further reflected in rising gold-backed ETF holdings, with SPDR Gold Trust reaching 904.38 tonnes, its highest level since August 2023. Meanwhile, markets are turning their attention to Friday’s U.S. Personal Consumption Expenditures (PCE) report, the Federal Reserve’s preferred inflation gauge. While price growth is expected to slow to its weakest pace since June, lingering inflationary pressures could keep the Fed cautious about cutting rates.

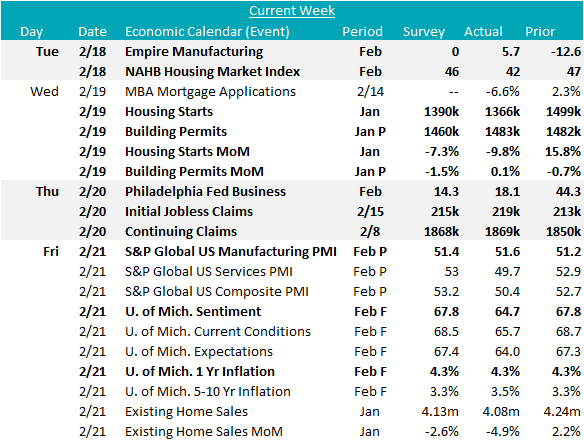

Early January Fed Manufacturing Surveys are continuing to point to early stages of a rebound in activity. Empire (NY) came in at 5.7, above the expected increase to 0. Philadelphia also came in at 18.1, better than the expected print at 14.3. New orders and shipments were primary drivers of this action, while employment contracted for both. Additionally, the preliminary S&P Global US Manufacturing PMI came in slightly better than expected (51.4), increasing to 51.6.

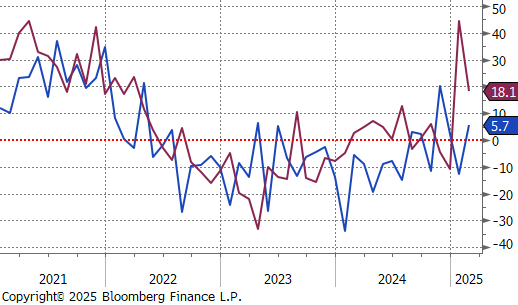

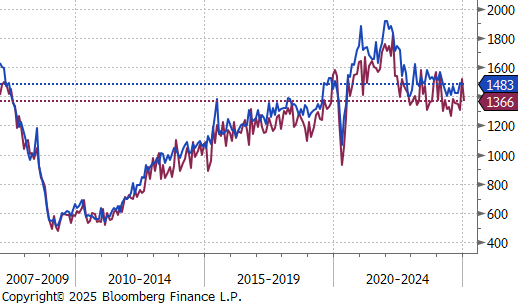

Housing data provided a mixed outlook, with building permits increasing 0.1% and clearly signaling further runway for builders, while housing starts fell 9.8% due largely to an unseasonably cold January. This was further confirmed by the NAHB Housing Market Index which printed at 42, a 5-month low, well below the expected slight decline to 46. The primary factor there, was a souring in expectations, which fell 13 point to 46 – the lowest reading since December 2023. Finally, existing home sales fell more significantly that expected, declining 4.9% to 4.08M.

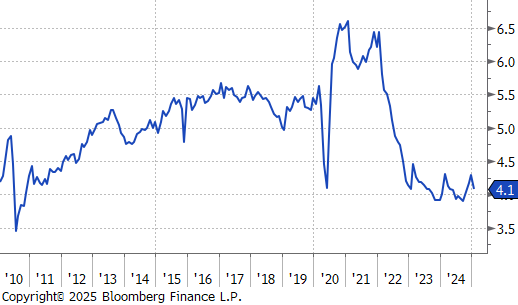

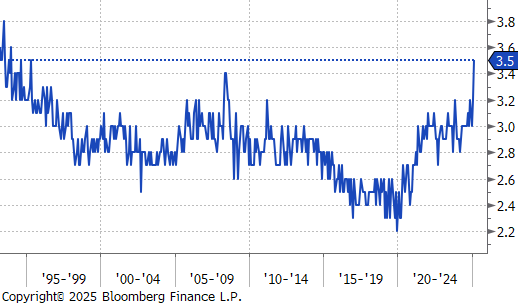

Finally, the final University of Michigan Consumer Sentiment Survey was released and painted a pessimistic picture after initially improving after President Trump’s victory in November. The main takeaway is significant concern around inflation. The 1yr Inflation Expectation held steady at 4.3%, while the 5-10yr Expectation ballooned to 3.5%, the highest reading since 1995. Coincidentally, 1995 is the only time a soft landing was successful following prolonged restrictive interest rate policy. With all of this in mind, we continue to believe that the FOMC will not be cutting interest rates this year.