Flack Capital Markets | Ferrous Financial Insider

February 23, 2024 – Issue #420

February 23, 2024 – Issue #420

Overview:

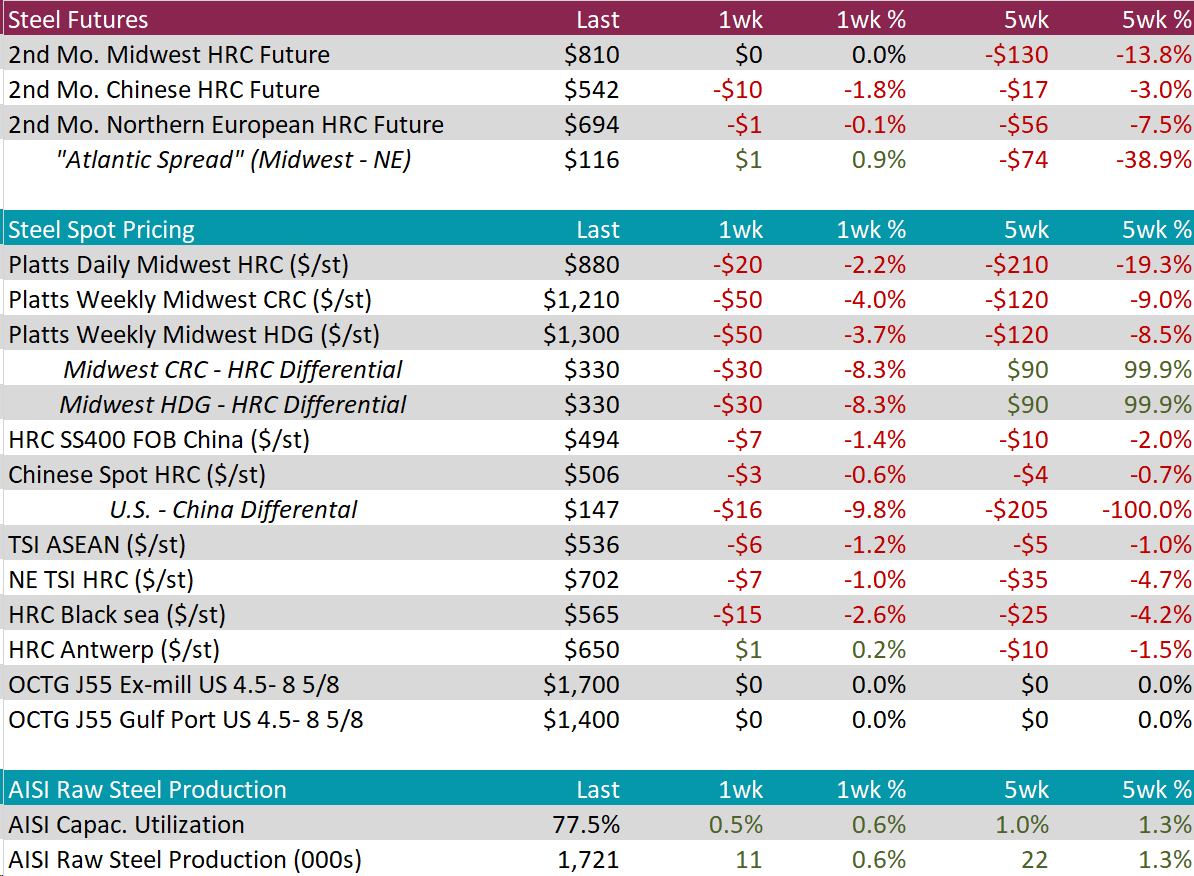

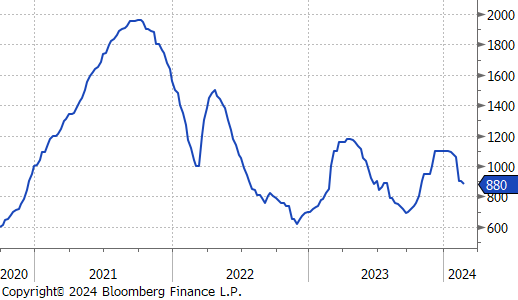

The HRC spot price fell by $20 or -2.2% to $880, continuing its downward trend from $1,100 which begun six-weeks ago, resulting in a -$220 price decline so far. Meanwhile, the 2nd month future remained static at $810, bringing the five-week price change to be down $130 or -13.8%.

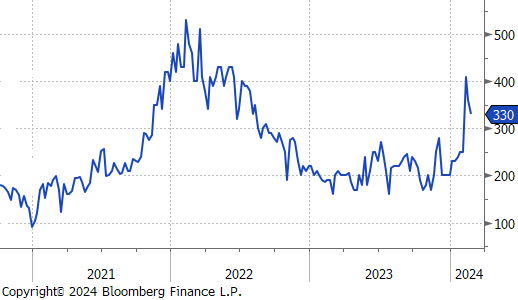

Tandem products both fell by $50, causing the HDG – HRC differential to decline by $30 or -8.3% to $330.

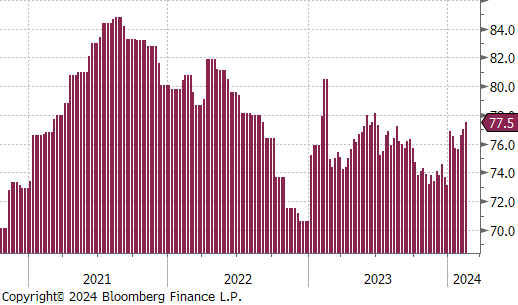

Mill production continued to ramp up from relatively low levels, with capacity utilization ticking up by 0.5% to 77.5% and raw steel production rising to 1.721m net tons.

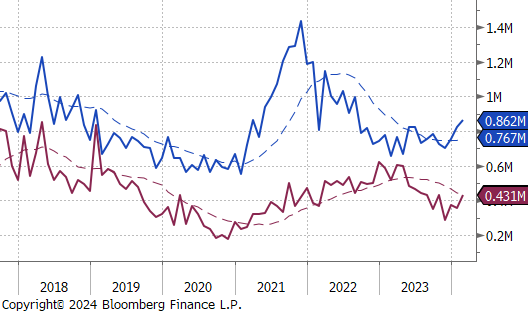

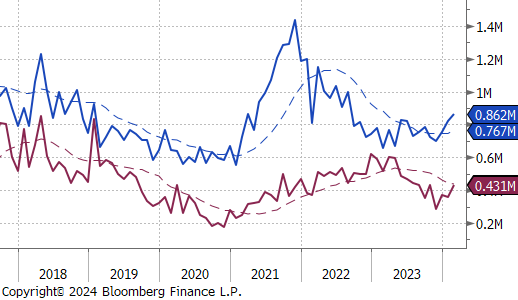

February Projection – Sheet 862k (up 40k MoM); Tube 431k (up 73k MoM)

January Projection – Sheet 822k (up 69k MoM); Tube 357k (down 14k MoM)

All watched global differentials declined, with the Turkey Export HRC experiencing the biggest decline of -2.2%. Another notable move was the US Houston HRC dropping by -5.0%.

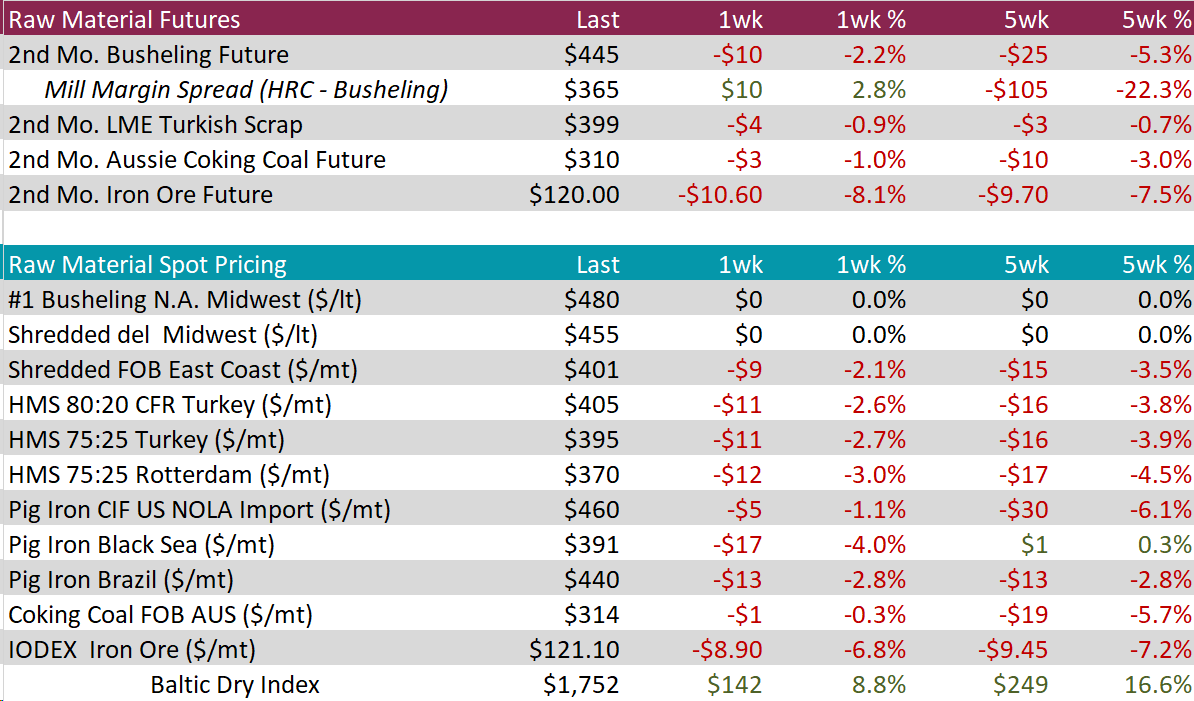

Scrap

The 2nd month busheling future fell by $10 or -2.2% to $445, bringing the total price decline from most recent peak of $570 ten-weeks ago to $125. Meanwhile, the busheling spot price continued to remain stagnant at $480.

The 2nd month Aussie coking coal future declined by $3 or -1.0% to $310, continuing to remain just above the $300 price level.

The 2nd month iron ore future dropped by $10.60 or -8.1% to $120, hitting its lowest price since late October 2023. At the same time, the iron ore spot price IODEX went down by $8.90 or -6.8% to $121.10, also hitting its lowest level since late October 2023.

Dry Bulk / Freight

The Baltic Dry Index experienced another up-tick, increasing by $142 or 8.8% to $1,752, continuing to rebound.

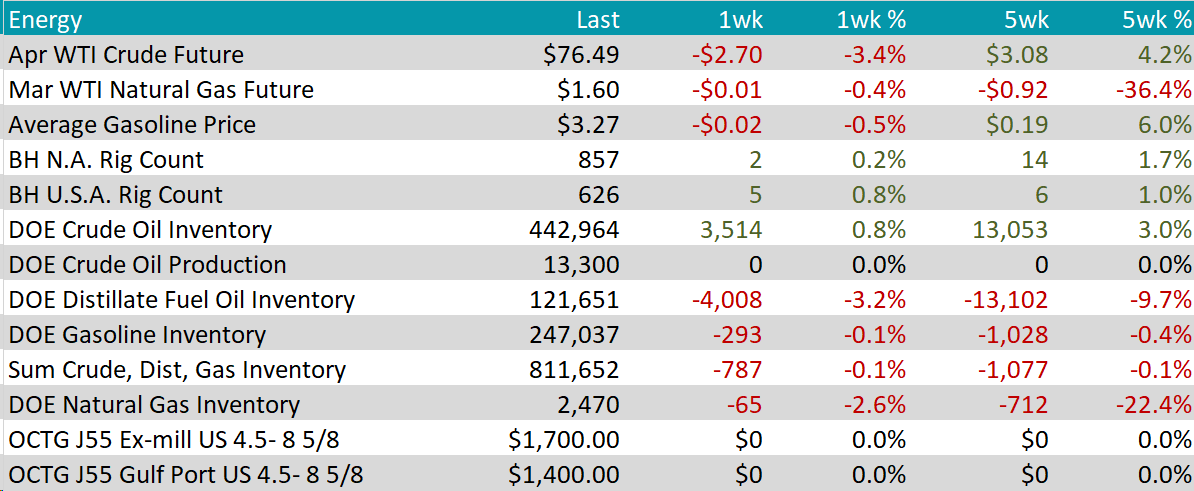

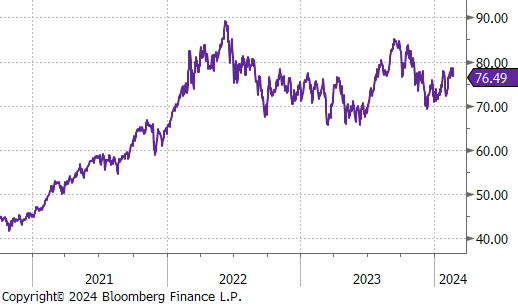

WTI crude oil future lost $2.70 or -3.4% to $76.49/bbl, continuing to fluctuate as it edges towards the $80 price level.

WTI natural gas future lost $0.01 or -0.4% to $1.60/bbl, steadying a bit around its lowest level since June 2020.

The aggregate inventory level experienced a slight down tick of -0.1%.

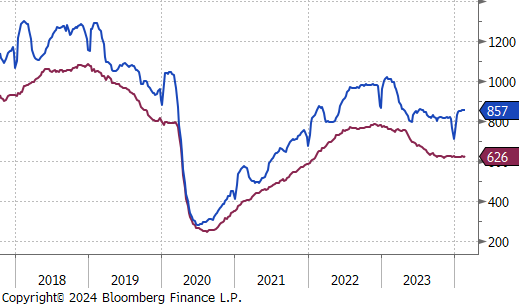

The Baker Hughes North American and US rig count both made gains, with the former adding 2 rigs, bringing the total count to 857 rigs and the latter increasing by 5 rigs, bringing the total count to 626 rigs.

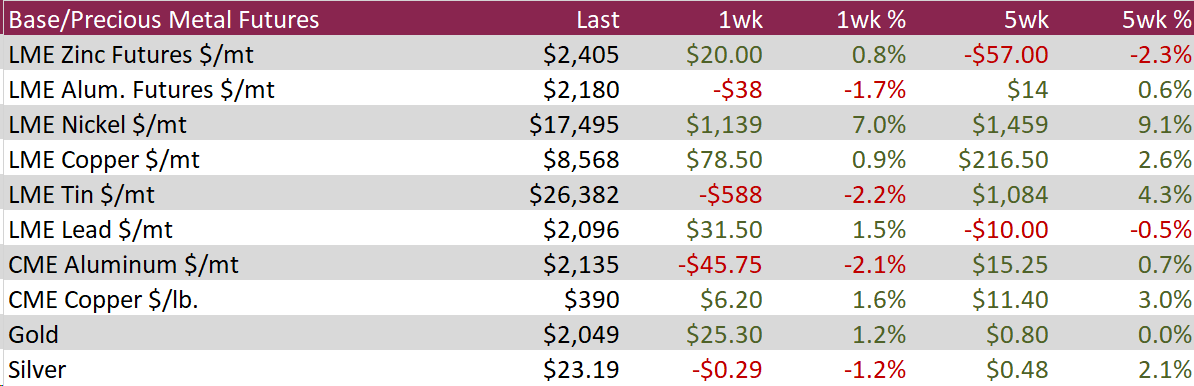

Aluminum fell by $38 or -1.7% to $2,180, after U.S. sanctions unexpectedly bypassed significant restrictions on Russian industrial metals. Market optimism had previously driven aluminum to its highest price since early February, anticipating supply constraints from potential sanctions linked to Russia’s geopolitical actions. However, the focus has now shifted towards demand-side concerns, influenced by China’s economic challenges, rising global borrowing costs, and the uncertain trajectory of the U.S. Federal Reserve’s policies.

Copper increased by $6.20 or 1.6% to $390, reaching a three-week peak. This reflects ongoing market evaluations of China’s stimulus measures and easing monetary policy, and their effects on base metal demand. Recent statistics revealed a significant jump in copper stockpiles within major Chinese warehouses, with figures reaching 181,323 tonnes by the end of February 23rd. This amount represents more than a twofold increase from pre-Lunar New Year levels and a nearly fivefold rise since the start of the year. Additionally, the decline in the Yangshan Copper Premium, which affects the cost of customs clearance, continued through February. These trends coincide with a gloomy outlook for industrial demand in China, exacerbated by the country’s diminishing property and financial sectors, as evidenced by four consecutive months of shrinking manufacturing PMI.

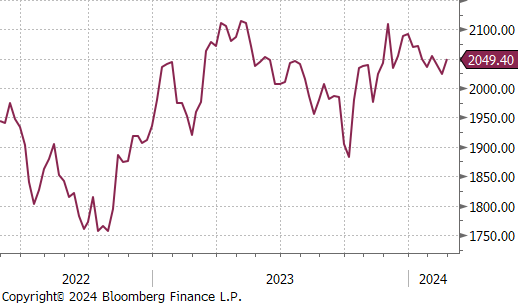

Gold rose by $25.30 or 1.2% to $2,049. This upward trend was supported by a weakening dollar and increased demand for gold as a safe haven. The uncertain landscape regarding the Federal Reserve’s interest rate cuts—owing to mixed signals from U.S. economic indicators—further fueled this scenario. Fed Governor Christopher Waller advocated for a pause in rate reductions for a few more months. This caution stems from wanting to assess if the high inflation report in January was an anomaly, aiming to ensure the Fed stays on course to meet its inflation goals. Waller warned that premature actions might undermine the central bank’s efforts against inflation, potentially causing significant economic damage. Additionally, escalating geopolitical conflicts in the Middle East, notably with Houthi militants attacking commercial ships, have also contributed to a surge in gold’s appeal.

The preliminary S&P Global US Manufacturing PMI data showed an encouraging signal printing at 51.5, above expectations of 50.7. This is the strongest level of manufacturing expansion since September 2022 and the second consecutive print in expansion territory, a feat that has not occurred in 15 months. This is a promising signal, however, after the prolonged period of contraction, we are still months away from a full manufacturing recovery.

The overall level of January Existing Home Sales came in 4m units, this higher than expected on an overall basis, after December data was revised higher. The uneven recovery remains intact since October’s 13-year low level for sales.

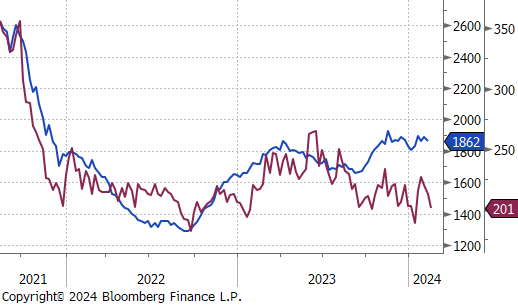

Jobless claims continue to show that the labor market is stable. Initial claims came in at 201k, below expectations of a slight increase to 216k. This is the lowest level in 5 weeks. Continuing claims also came in below expectations, down to 1,862k versus the survey estimate of 1,884k. The 4-week averages are both trending slightly higher, but well below levels of concern.