Flack Capital Markets | Ferrous Financial Insider

February 3, 2023 – Issue #365

February 3, 2023 – Issue #365

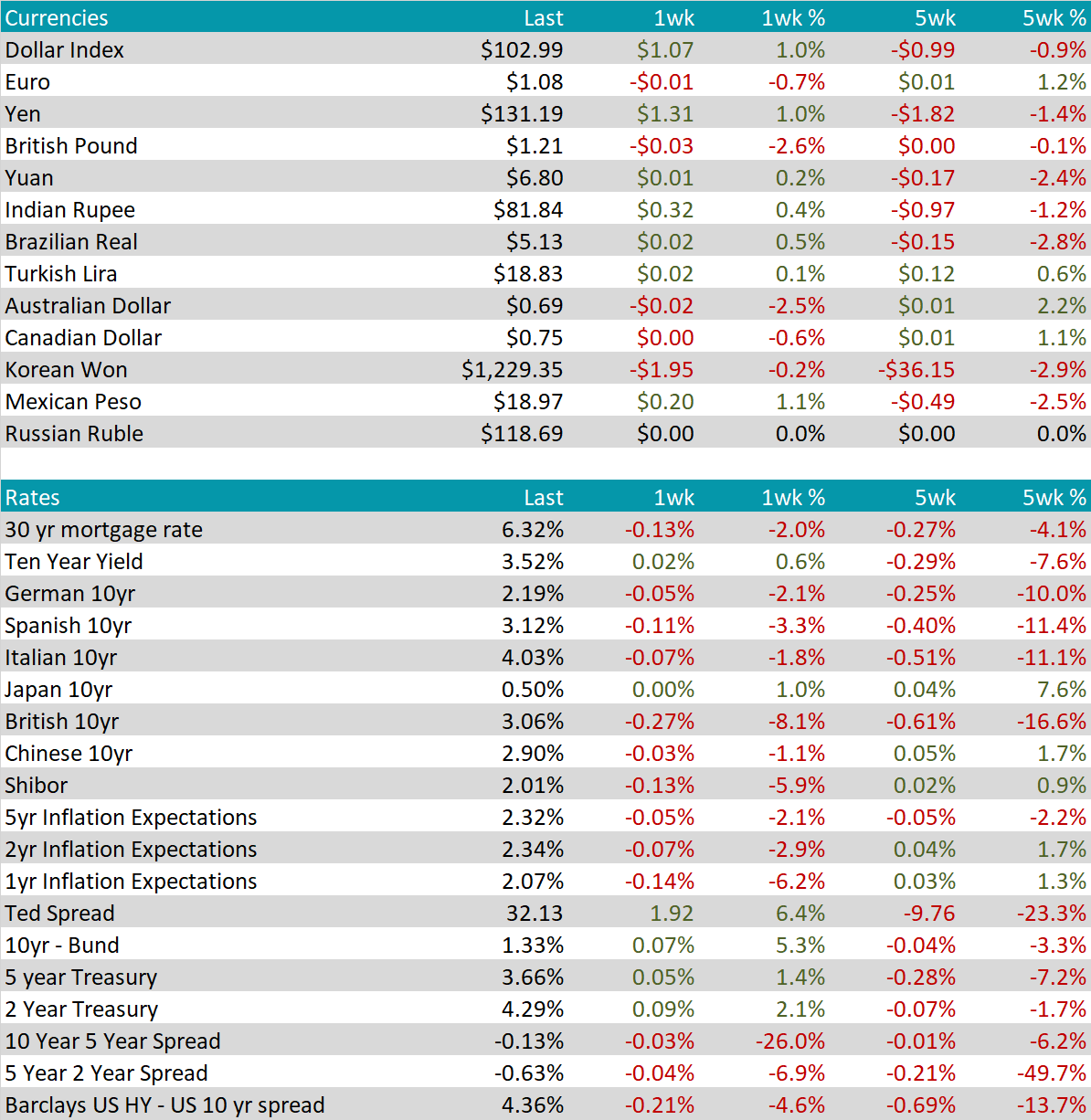

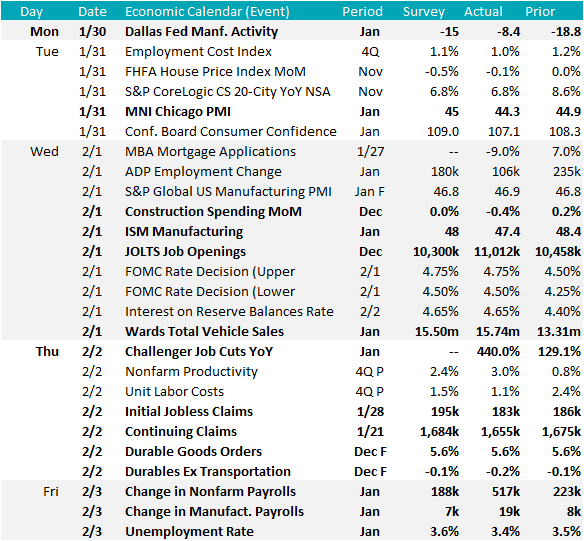

Last week, the beginning of the month economic data was released, and it highlighted recent concerns around the construction and manufacturing sectors. The ISM Manufacturing PMI for January printed at 47.7, just below expectations of 48 and deeper into contraction territory (below 50). Total seasonally adjusted construction spending in December also printed negative for the first time in 4 months, at 0.4%. At the same time, data from the Auto sector showed a marked improvement, as auto sales (annualized) were 15.7M units sold, well above expectations of 15.5M.

The murky economic data is in stark contrast with what we saw from January’s jobs report. The incredibly strong change in nonfarm payrolls in January more than doubled job growth in December, printing at 517k, and far exceeded expectations of a slowdown at 188k. Furthermore, the unemployment rate fell to 3.4%, a 53-year low. The takeaway, while there are valid concerns around manufacturing and construction, the U.S. economy is not collapsing in the way some feared late last year. Adjustments will need to be made in the higher for longer interest rate environment, however, the outlook for 2023 is improving.

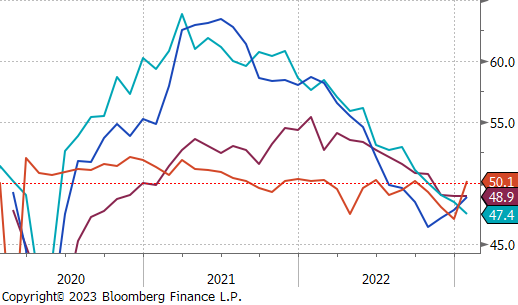

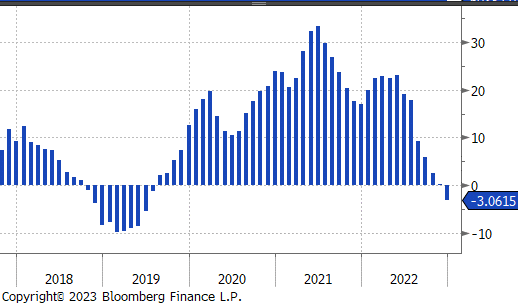

The top chart on the right is comprised of the orders subindexes (new orders & backlog) minus inventories which has been a reliable 2-month leading indicator for the topline manufacturing PMI number. The sharp drop in this composite index highlights concerns around demand, with both the new orders and backlog subindexes in contraction territory for the last 4 months. At the same time, the inventory subindex has been trending lower since August and should offer some support for steel demand if that continues.

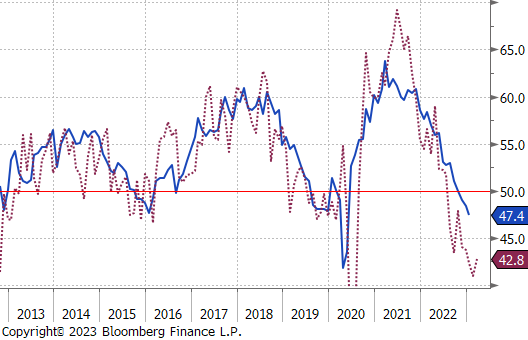

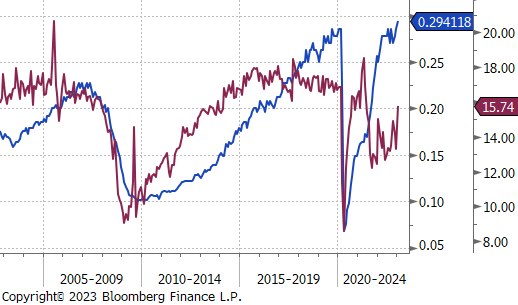

The second chart shows the Platts Midwest HRC index (orange) and the ISM Manufacturing PMI (white). The topline ISM Manufacturing PMI index printed in contraction and at its lowest level since May 2020, while the Midwest HRC price has diverged and rallied since mid-December.

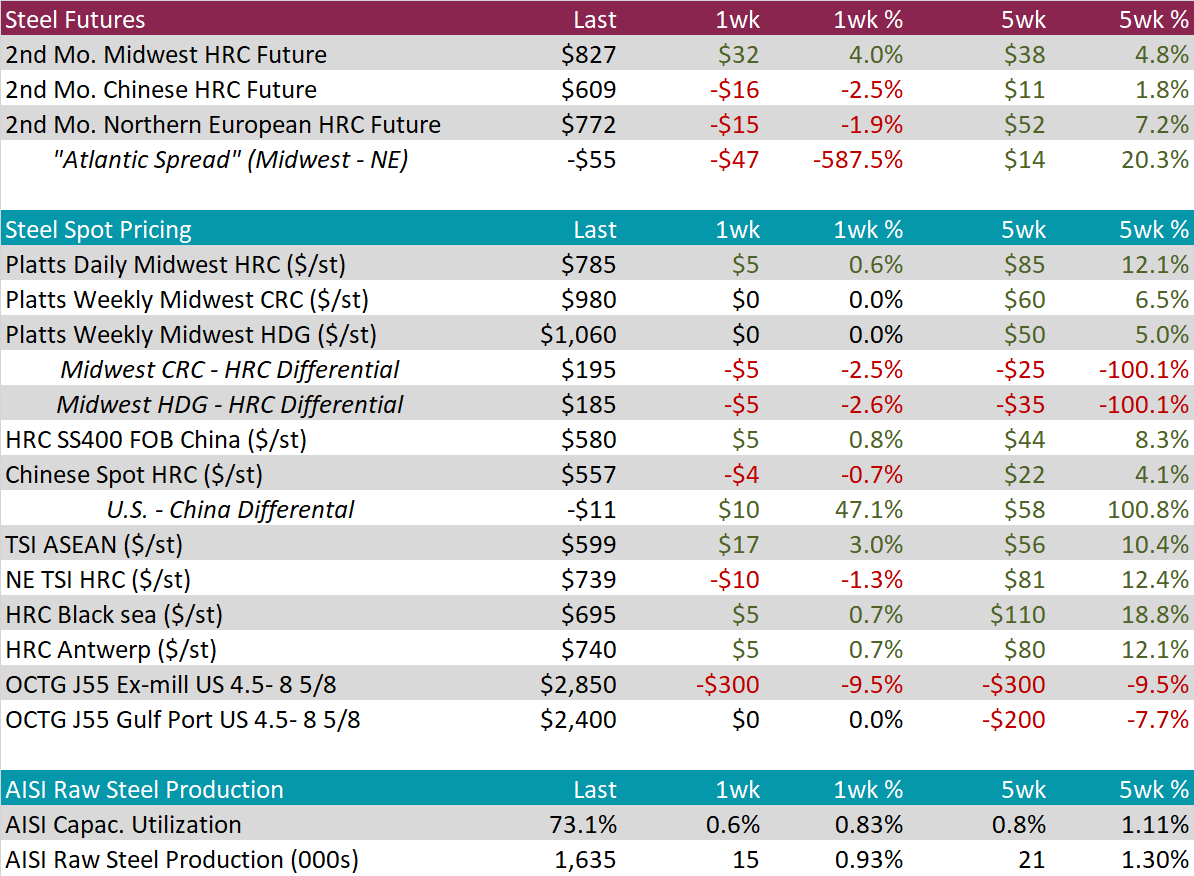

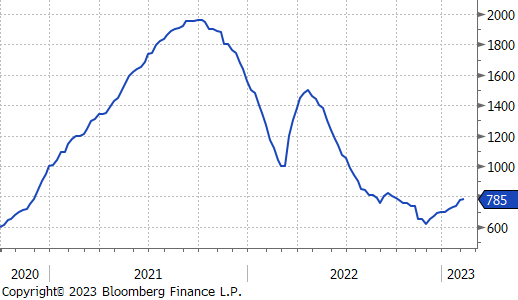

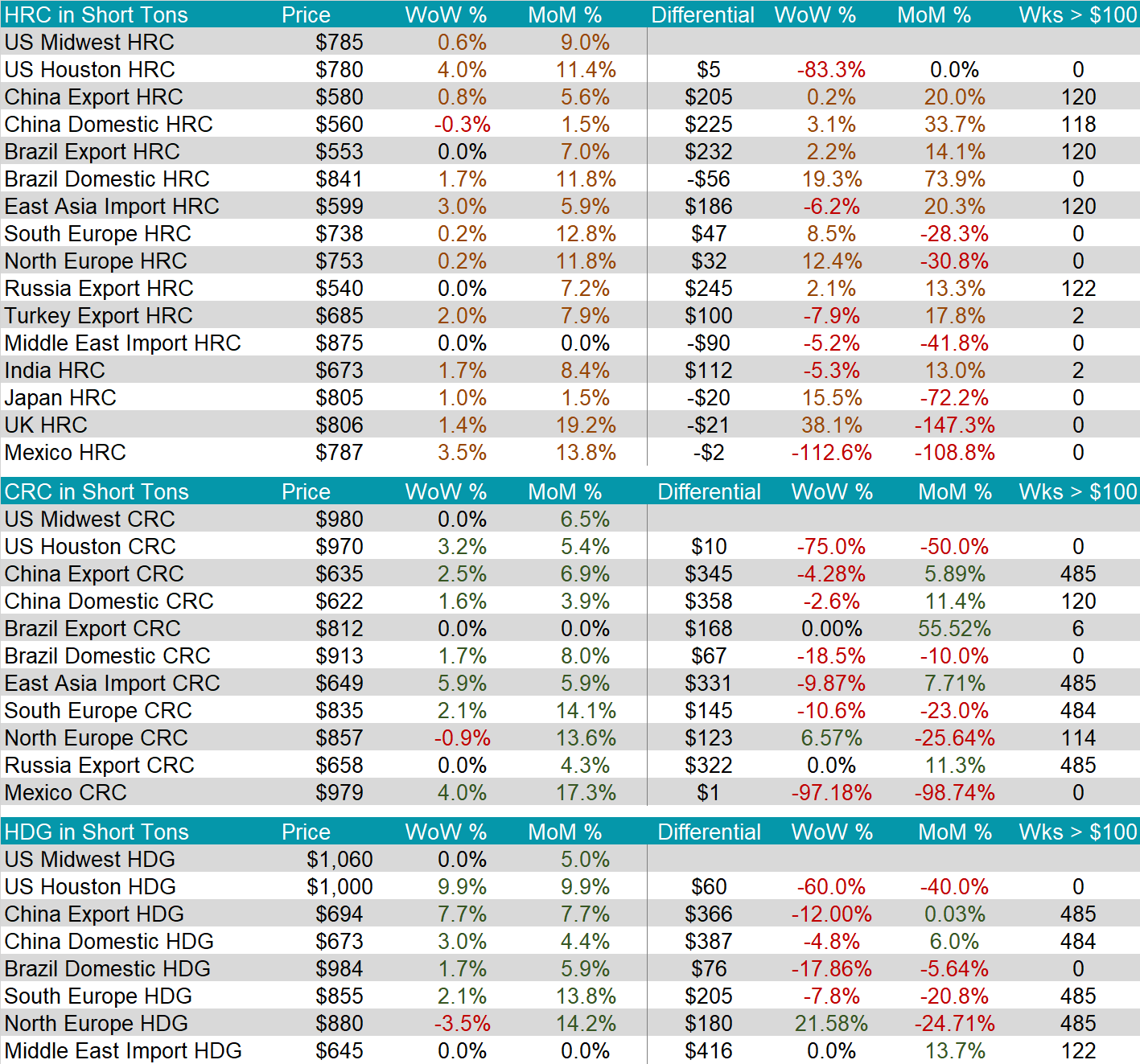

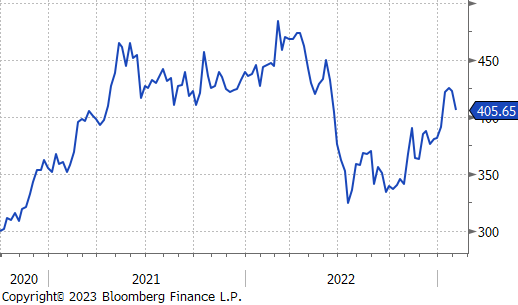

HRC – U.S. Domestic HRC was up another $5 last week and has now increased for 10 straight weeks. The initial catalyst for the rally was price increase announcements from the domestic mills, but it has found fundamental support from increasing global steel prices, higher input costs, and better than anticipated demand.

Tandem Products have not been as strong over the last month, with cold-rolled (CRC) up 6.5% and galvanized (HDG) prices up 5% over the period. This has caused the spread to tighten significantly compared to the levels we have observed since the end of 2021, with this week’s differential at the lowest level since May 2021.

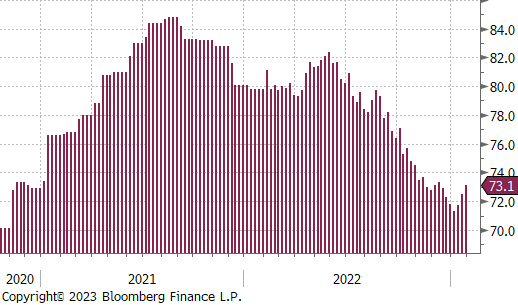

Production – Domestic raw steel capacity utilization has now risen for 4 straight weeks, up to 73.1%. This is well below the levels we observed in 2021 & 2022, but it is notable that the current pace of increasing utilization rates is significantly more pronounced than the brief uptick that occurred at the beginning of December, when mills started announcing price increases. The increase is well justified up to this point because of the meaningful reduction of import arrivals; however, there is a potential downside risk over the longer-term if indications around demand do not improve.

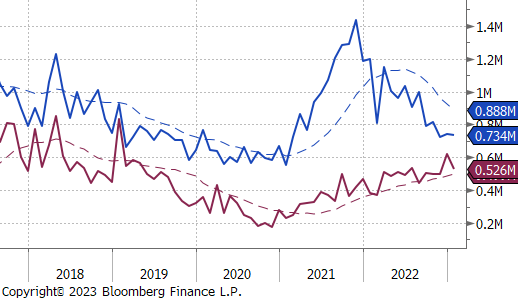

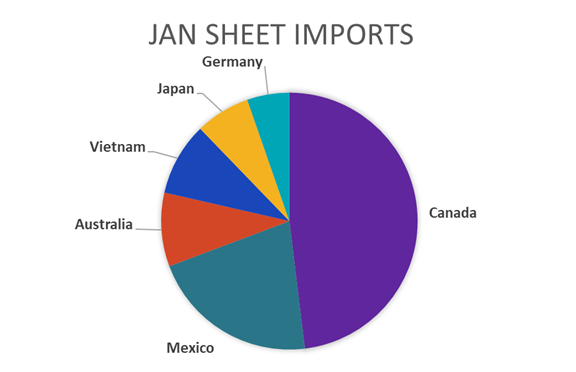

January Projection – Sheet 734k (down 9k MoM); Tube 526k (down 94k MoM)

December Census Data – Sheet 743k (up 18k MoM); Tube 621k (up 121k MoM)

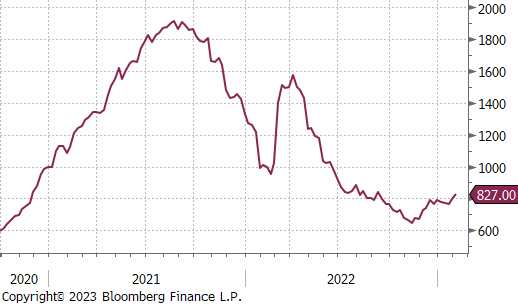

The average number of sheet arrivals over the last three months is 734k. This is significantly subdued compared to the average over the same period last year (~1.27M tpm), and thus supportive of higher domestic production.

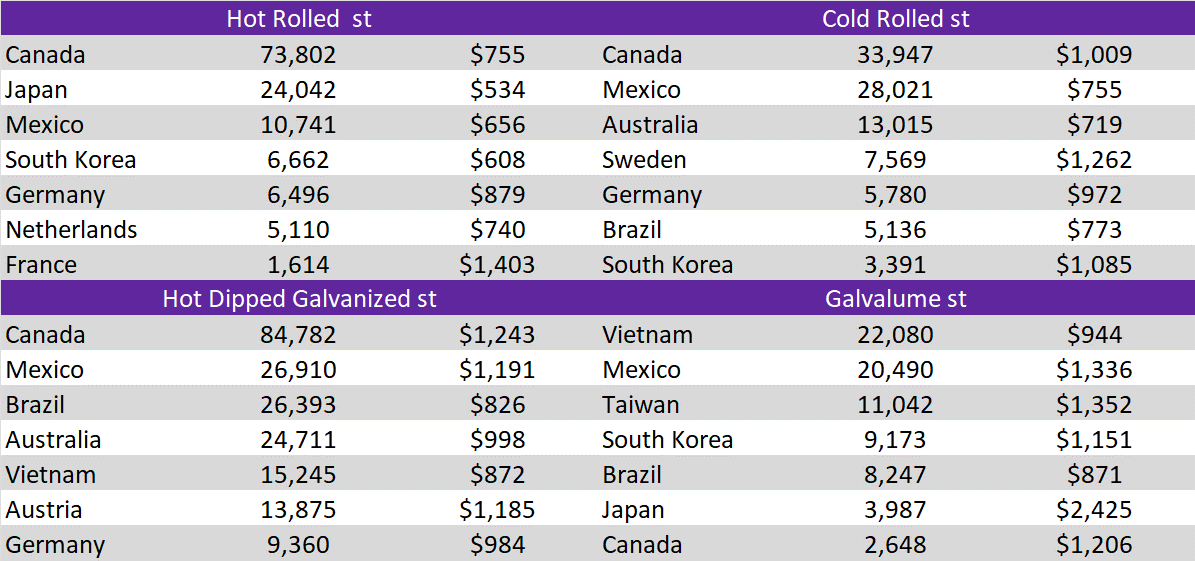

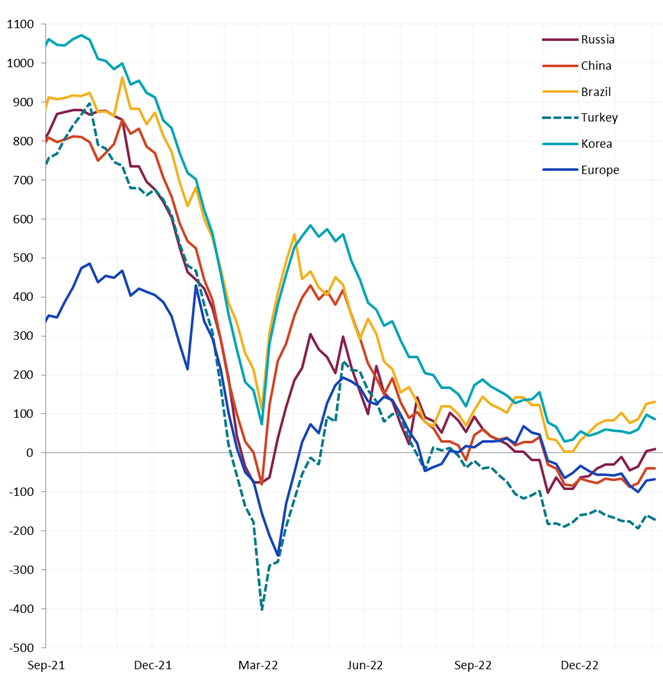

Differentials decreased in Korea and Turkey, while they were slightly higher for the remaining countries. There has been very little incentive to purchase material abroad since September of last year. Given the transportation lag, this clearly explains the depressed level of arrivals since November.

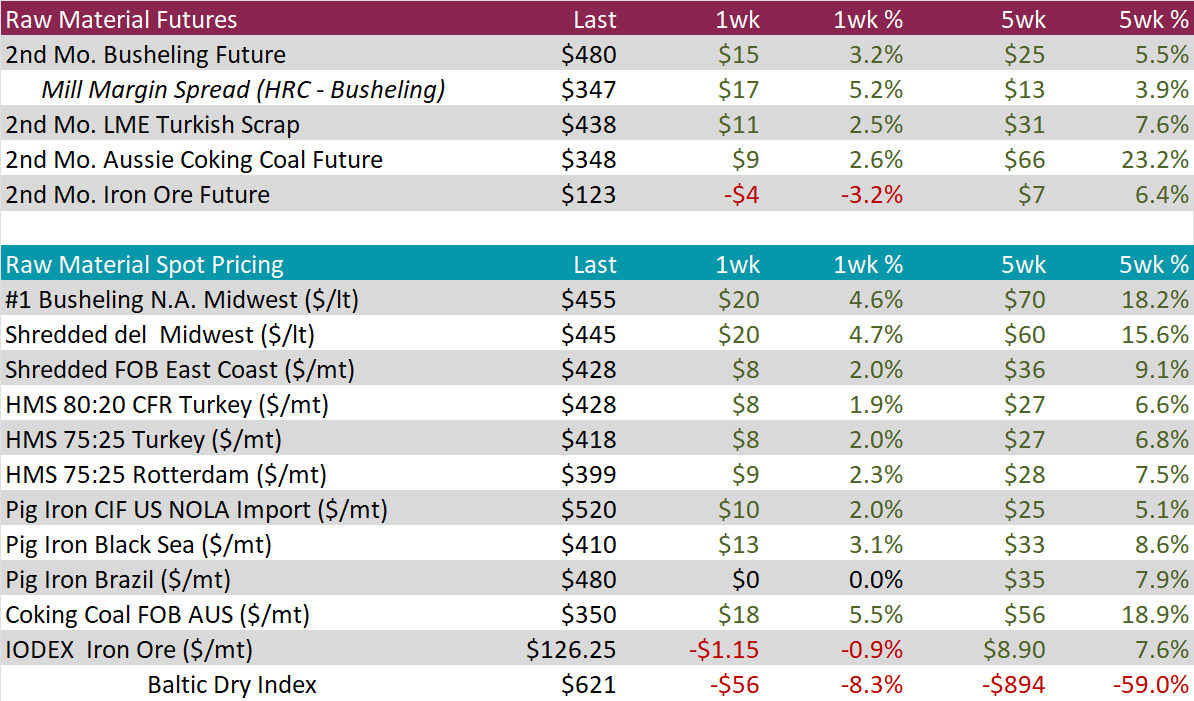

Busheling continues to grind higher in both the spot and futures markets. The March future, which is currently the 2nd month, is up 23.1% since bottoming in mid-October last year. In the spot market, the February settle is expected on the 10th and all indications are for a higher print. This would be the second month in a row of higher scrap prices. Rising input costs have been a large part of the rally in HRC.

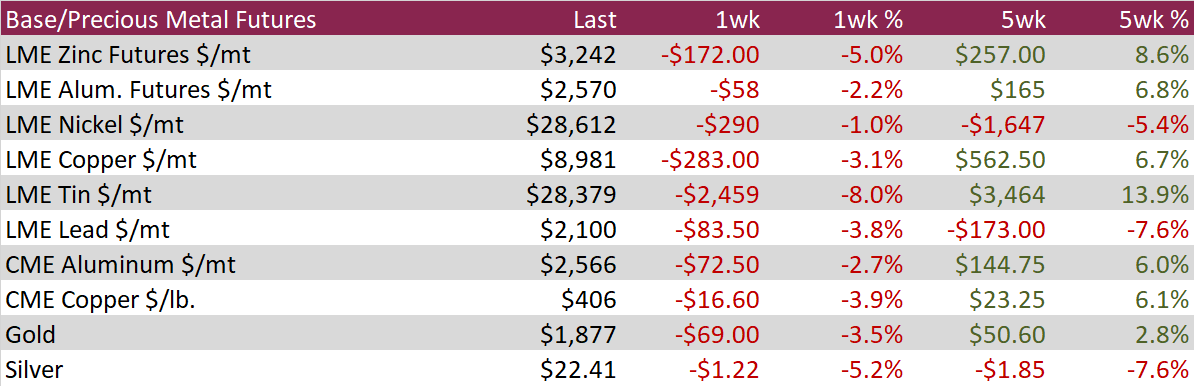

Coking Coal was the biggest mover last week as well as over the last 5 weeks. This is largely a signal of increasing demand from Chinese mills which have been steadily increasing production after the country moved away from its zero-COVID policies.

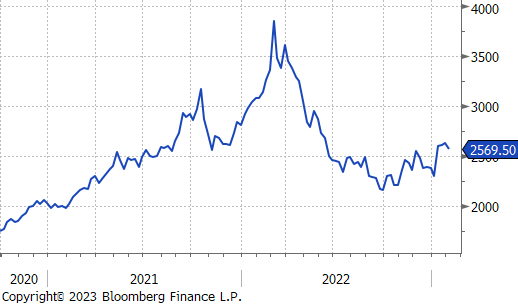

Iron ore has been in full rally mode since the end of last year, largely in anticipation of China reopening its economy and supporting the ailing construction sector. This rally continued immediately following the Lunar New Year holiday, but upward momentum started to lose steam towards the end of the week, leaving the March future and IODEX index both down 3.2%, and 0.9%, respectively.

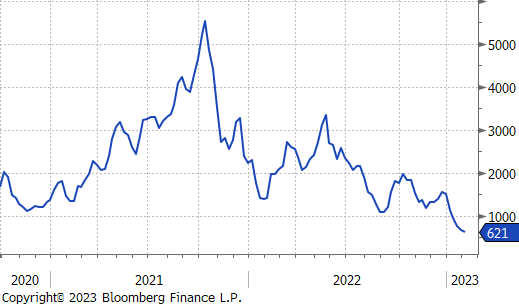

The Baltic Dry Index has been under significant pressure since the end of December, with the price down another 8.3% last week, and 59% over the last 5 weeks. The index is now at its lowest level since early-June 2020.

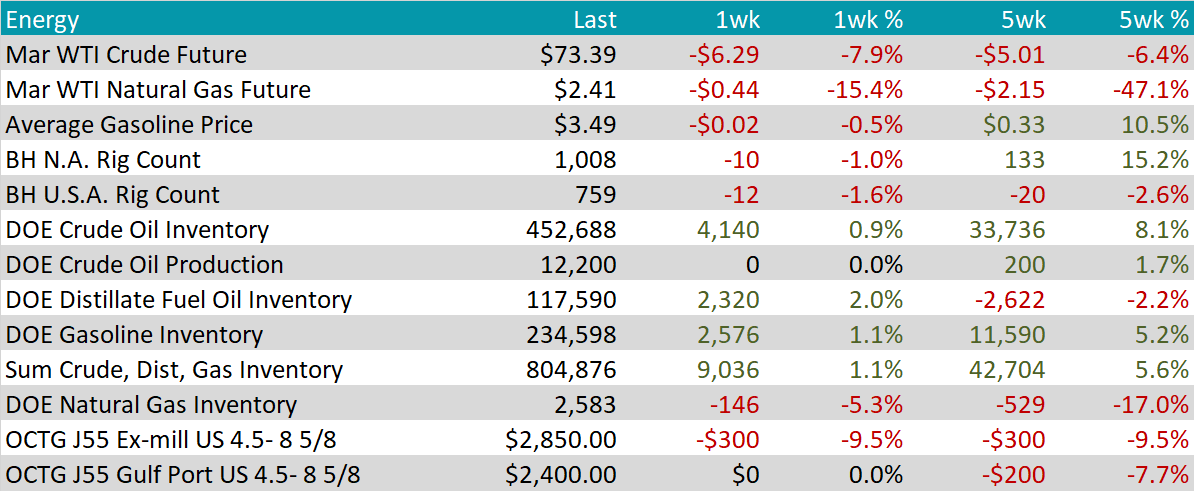

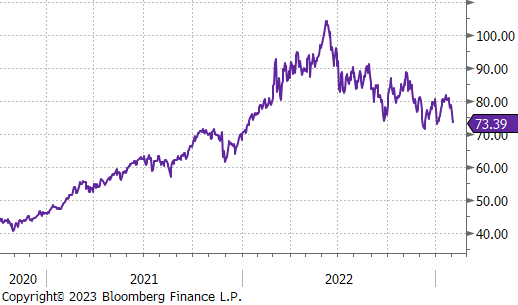

The March WTI Crude Oil future lost $6.29, or 7.9%, to $73.39/bbl. This move lower in crude prices was largely driven by rising domestic inventories, and some concerns around the potential strength of Chinese economic recovery.

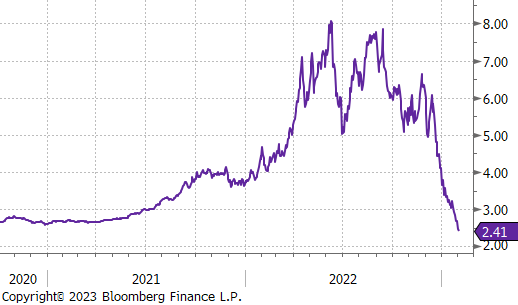

The March WTI Natural Gas future lost another $0.44, or 15.4%, to $2.41/bbl. Seasonally warm weather superseded the valid concerns about global availability. The price is down 47.1% over the last 5 weeks.

The aggregate inventory level rose another 1.1% this week. The current accumulated inventories are at their highest level since July 2021.

The Baker Hughes North American rig count decreased by 10 rigs, while the U.S. rig count decreased by another 12 rigs. The U.S. count stalled just below 800 in late November and has been trending lower since.

LME Aluminum futures fell 2.2% during the week as the recent rally fades amid signs of subdued demand in China, the top metals consumer, and as new US economic data raises prospects of more interest rate hikes. Aluminum has been wavering since surging to a 7-month high in mid-January when China abandoned its zero-COVID policy.

Copper futures on the CME fell 3.9% during the week, capping off the second consecutive week of declines. This follows a sharp rally in January, when China abandoned its zero-COVID policy and the US slowed the pace of rate hikes. China-backed miner MMG Ltd. has placed its huge Las Bambas copper mine in Peru on care and maintenance due to unrest ongoing since December 7, when Congress removed and arrested President Castillo.

Silver futures on the CME declined 5.2% during the week, after falling 4.7% on Friday, to cap off the third consecutive week of declines. The contraction came in the aftermath of Friday’s US Jobs number, which boosted the prospect for further rate hikes and sent the US dollar higher. According to CFTC data, non-commercials reduced their net long positions by about 5,000 contracts (-17%) in January.

Global Manufacturing PMIs – Overall, global manufacturing sectors improved in January, with 5 countries (incl. China Official) moving into expansion territory. However, of the 23 monitored countries, 14 remain in contraction territory, including 5 of the 6 major sectors: China CAIXAN, Japan, Europe, the U.S., and Germany.

December U.S. Construction Spending – As mentioned in the top of the report, seasonally adjusted construction spending was down 0.4% in December. Looking more closely at the two major private sectors, non-residential spending continues to grow at a strong YoY pace, up 15%, while residential spending decreased for the first time in 40 months, down 3.1% YoY.

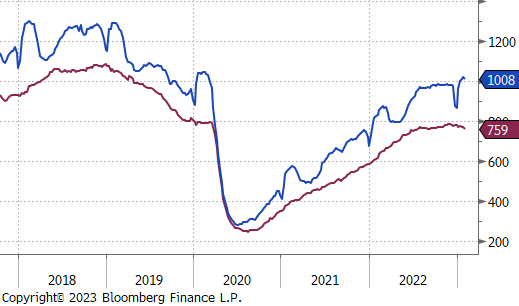

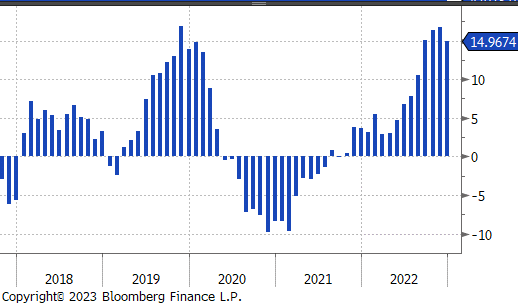

Autos sales & the labor market – The chart on the bottom shows the relationship between the unemployment rate and auto sales. The unemployment rate is inverted to show that declining unemployment typically leads to increasing auto sales. The labor market continues to hold up remarkably well given the continued hawkishness from the FOMC. With the unemployment rate moved back down to 3.4%, the gap between unemployment and auto sales continues to be a strong bullish signal for auto demand.

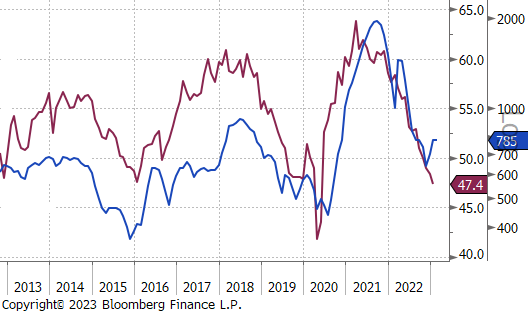

It was a wild week for the U.S. Dollar. After markets interpreted FED Chair Jerome Powell’s press conference as dovish, the dollar sold off under expectations that the “Fed Pivot” is right around the corner. On Friday, a red-hot jobs number signaled interest rates may remain higher for longer to keep inflation down.

The British Pound sold off most significantly compared to the dollar last week, down 2.6% on Friday’s close. Earlier in the week, the Bank of England raised rates for the 10th time but suggested that their tightening cycle might be coming to an end.

The ECB also hiked rates 50 bps last week, but comments from Bank President Christine Lagard sent European yields significantly lower after she suggested that inflation in Europe has peaked, and economic conditions are improving.

U.S. 10YR yields moved in similar fashion to the U.S. dollar this week, pushing lower during the mid-week FED press conference and rallying off the jobs report.