Flack Capital Markets | Ferrous Financial Insider

January 10, 2025 – Issue #466

January 10, 2025 – Issue #466

Overview:

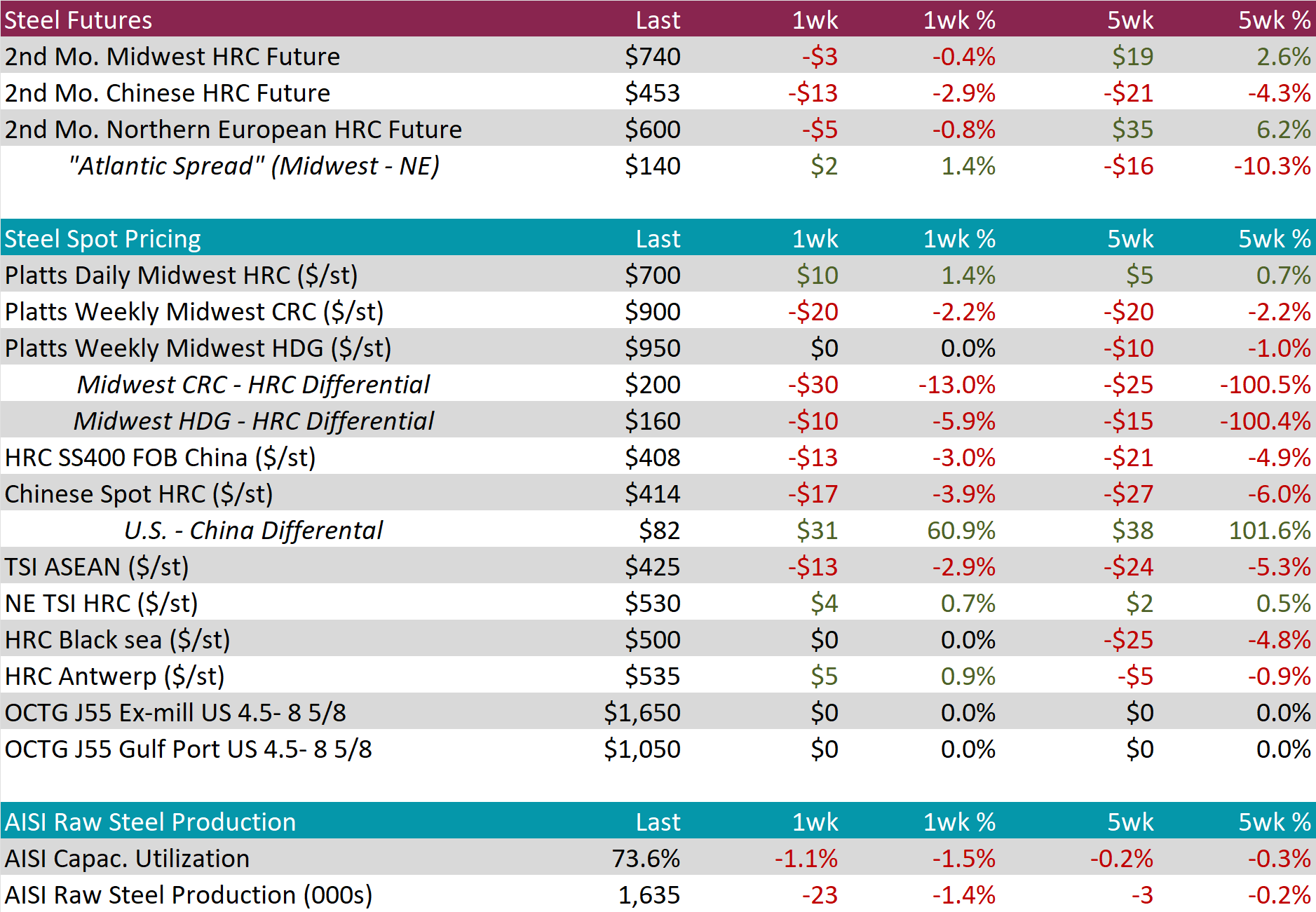

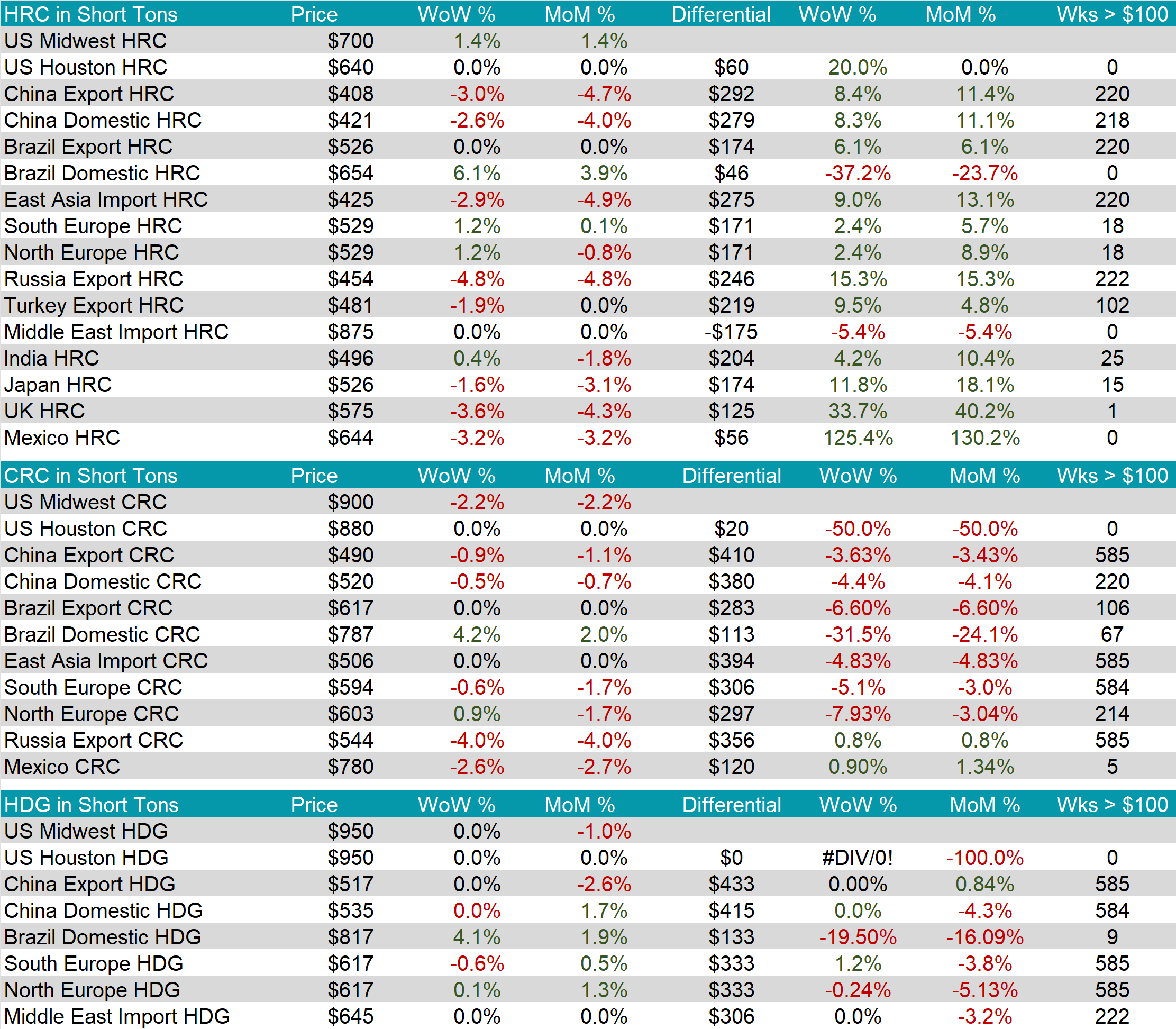

The HRC spot price rose by $10 or 1.4% to $700, marking the first price increase since October. At the same time, the HRC 2nd month future slipped by $3 or -0.4% to $740, marking the second consecutive week of price declines.

Tandem products were mixed, with CRC falling by $20 while HDG remained unchanged, resulting in the HDG – HRC differential to dip by $10 or -5.9% to $160.

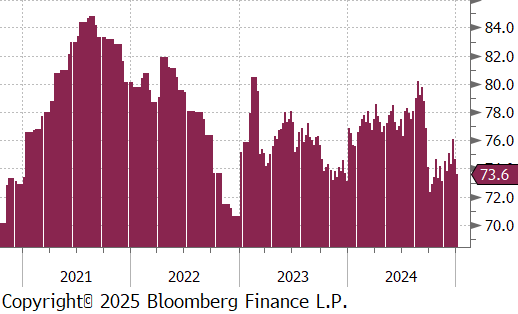

Mill production remained subdued, with capacity utilization ticking down by -1.1% to 73.6%, bringing raw steel production down to 1.635m net tons. This represents the first consecutive reduction in 13 weeks.

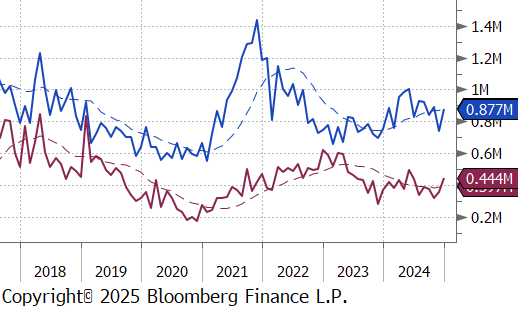

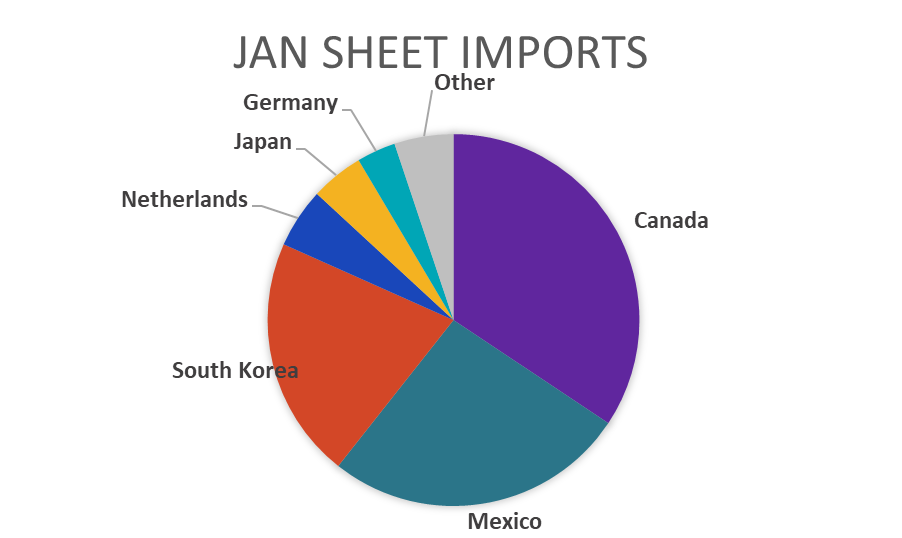

December Projection – Sheet 877k (up 134k MoM); Tube 444k (up 84k MoM)

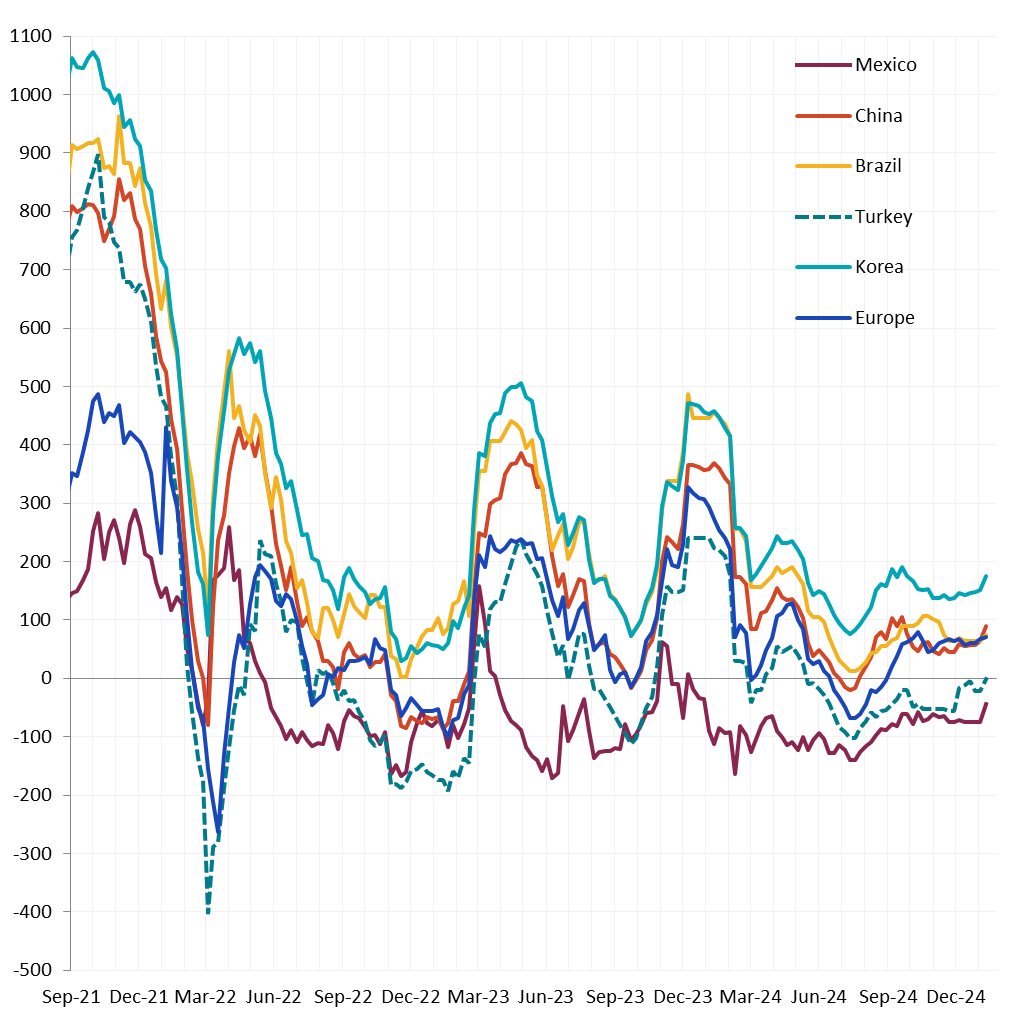

Watched global differentials expanded this week. China Export HRC dropped by -3%, Korea HRC fell by -2.9%, Turkey Export HRC decreased by -1.9%, while N Europe HRC experienced a 1.2% rise.

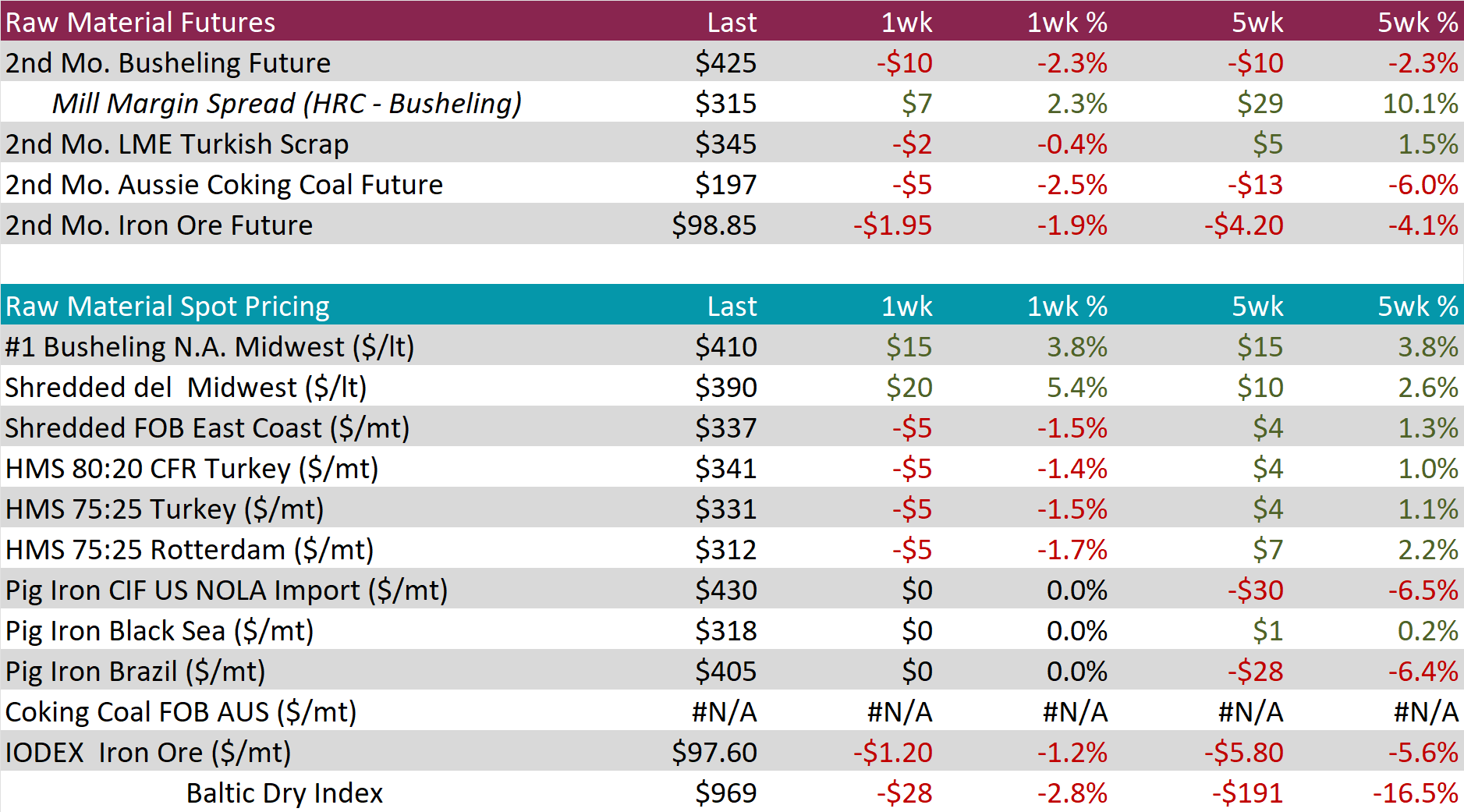

Scrap

The busheling 2nd month future declined by $10 or -2.3% to $425, marking the second consecutive week of price declines after holding steady at $440 for two straight weeks.

The Aussie coking coal 2nd month future dropped by $5 or -2.5% to $197, retreating from last week’s gain.

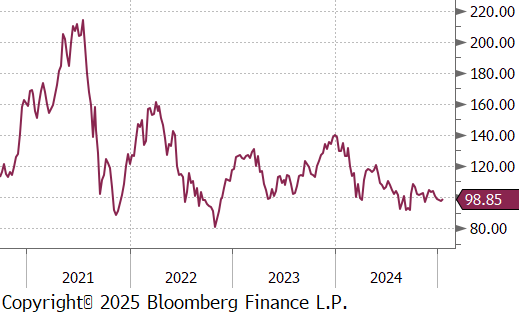

The iron ore 2nd month future slipped by $1.95 or -1.9% to $98.85, its lowest weekly ending in 8 weeks.

Dry Bulk / Freight

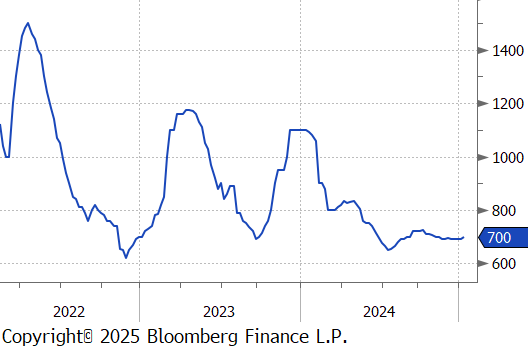

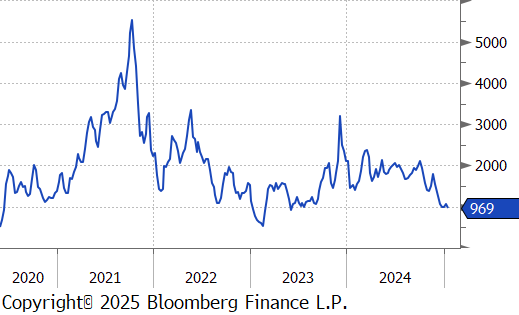

The Baltic Dry Index fell by $28 or -2.8% to $969, reaching the lowest level since June 2023.

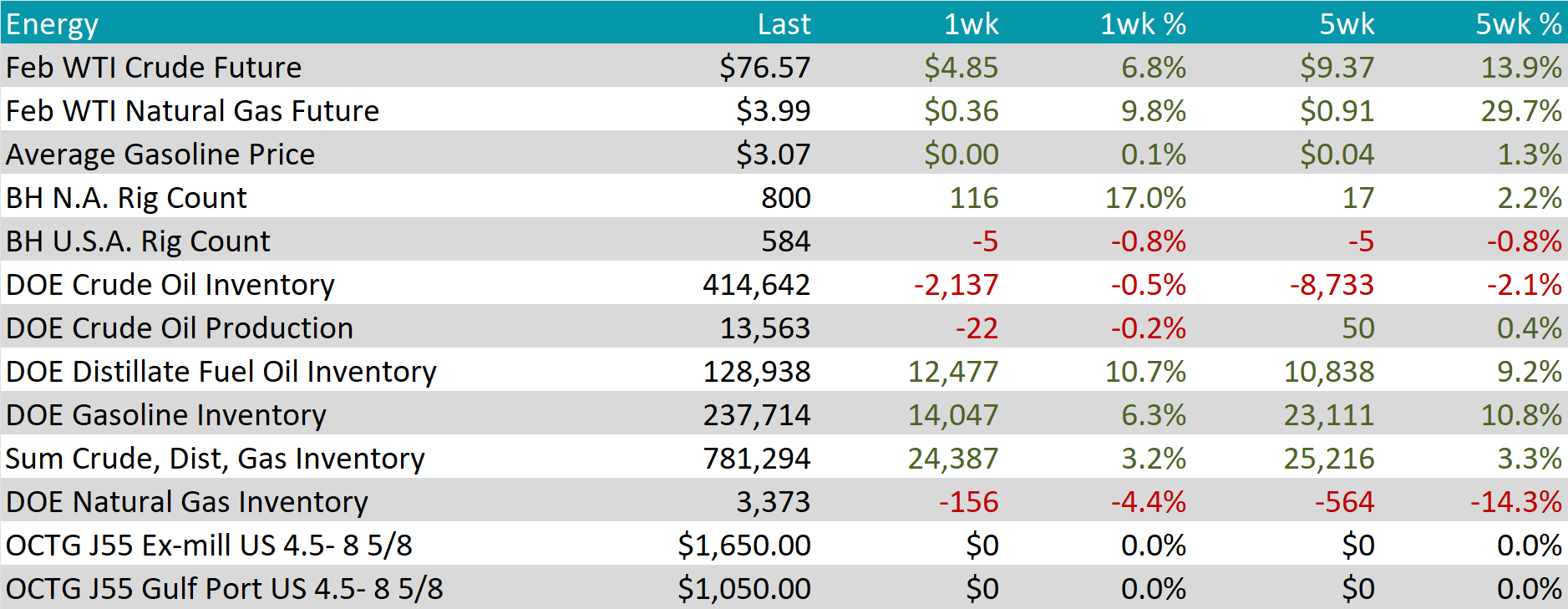

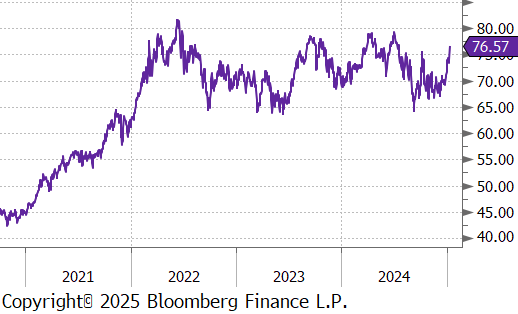

WTI crude oil future gained $4.85 or 6.8% to $76.57/bbl.

WTI natural gas future gained $0.36 or 9.8% to $3.99/bbl.

The aggregate inventory level experienced a notable increase, rising by 3.2%.

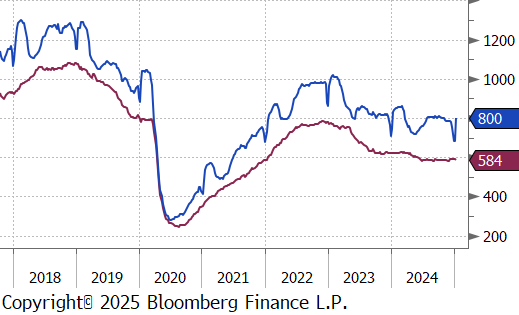

The Baker Hughes North American rig count jumped by 116 rigs, bringing the total count to 800 rigs, while the US rig count reduced by 5 rigs, bringing the total count to 584 rigs.

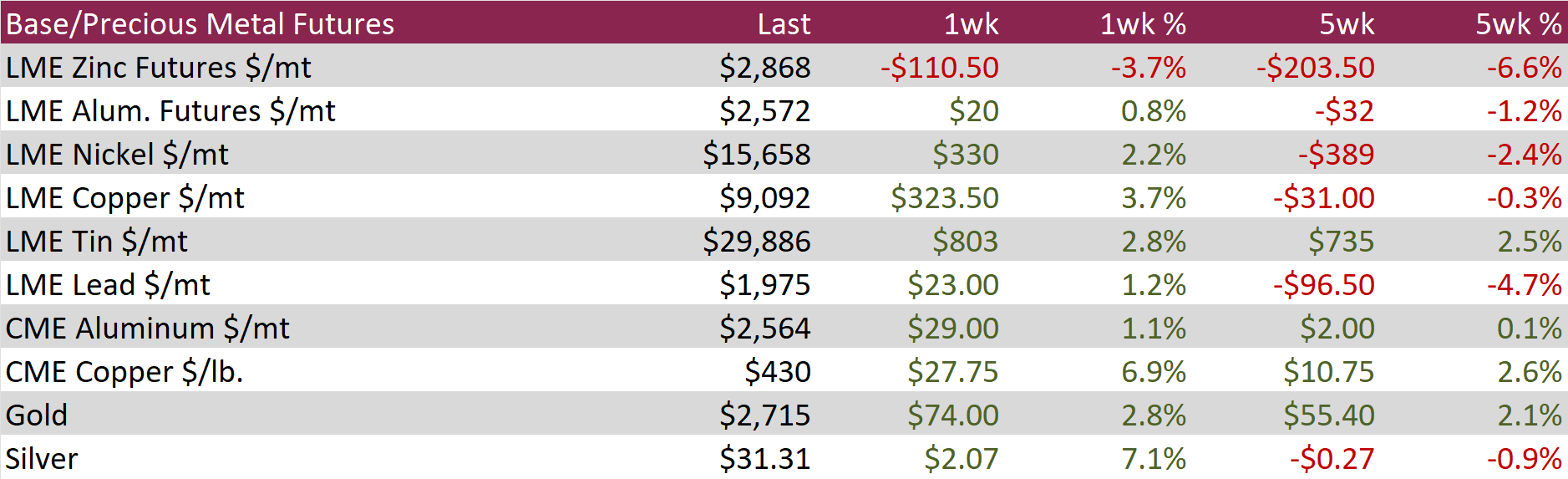

Aluminum futures increased by $20 or 0.8% to $2,572 and Copper futures rose by $27.75 or 6.9% to $430, hitting a recent high as optimism over increased demand offset the headwinds from a stronger US dollar. Data showed that China’s imports of unwrought copper and products surged by 18% in December to 559,000 tonnes, the highest level in over a year, reflecting stronger demand from smelters and signaling a potential uptick in manufacturing activity. Additionally, Chinese exports exceeded expectations, further bolstering confidence in the world’s top copper consumer. The rally in copper was also supported by the Chinese government’s commitment to robust economic stimulus through aggressive monetary and fiscal measures aimed at boosting consumption. However, gains were tempered by a strengthening dollar, which climbed on the back of strong US labor market data, making dollar-denominated commodities more expensive for international buyers.

Precious Metals

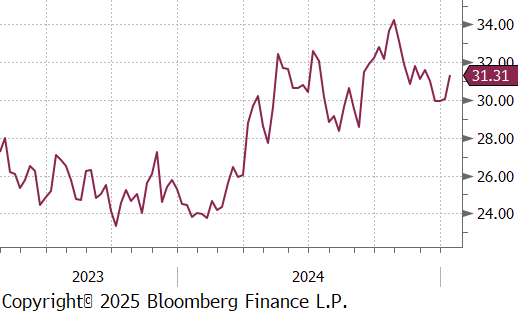

Silver increased by $2.07 or 7.1% to $31.31. The dollar’s rally followed stronger-than-expected US jobs data, which tempered expectations for additional Fed interest rate cuts this year. A firmer dollar makes dollar-denominated commodities like silver more expensive for foreign buyers, reducing their appeal. Looking ahead, market attention is shifting to US inflation data, which could provide further clarity on the Fed’s policy outlook. Silver gained nearly 3%, its strongest weekly performance since mid-November. The metal remains supported by robust industrial demand, driven by its critical role in renewable energy technologies and electronics, as well as persistent concerns over supply constraints.

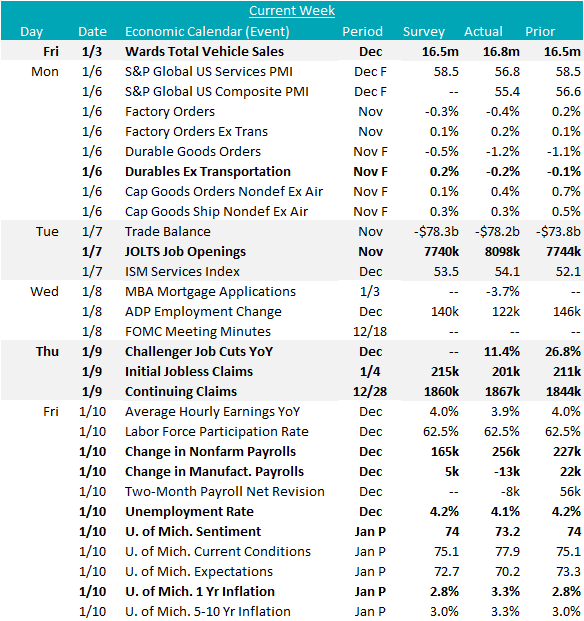

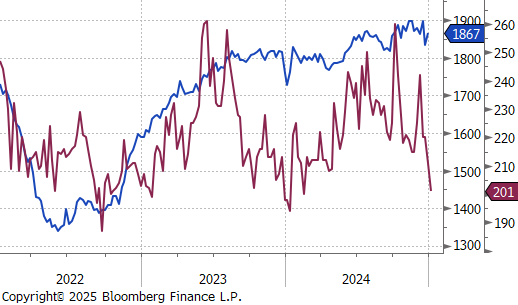

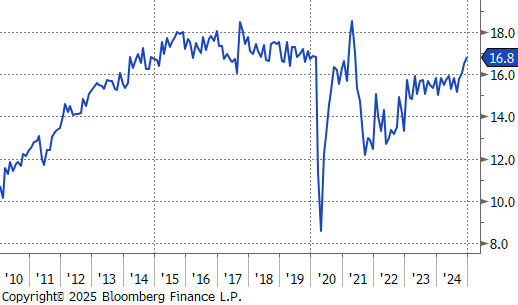

Auto sector data helped to start this week off with some optimism. December Total Vehicle Sales blew past the estimate, signaling a seasonally adjusted annualized rate of 16.8M – an impressive figure, multiplied by the fact we have seen 4 consecutive months of increases to wrap up 2024. All that said, there are persistent concerns around the sustainability of the current momentum. Today’s University of Michigan Consumer Sentiment Survey (more below) showed that buying conditions for vehicles remain incredibly weak, while moderately improving. That, coupled with the fact that interest rates for new or used autos haven’t budged much suggests that the current flurry in activity may be marginal consumers attempting to front run any tariffs.

The final November Durable Goods report signaled weak orders from the transportation sector, with topline MoM change to orders down -1.2%, vs an expected -0.5% print. Ex. Transportation also performed poorly, coming in at -0.2%, vs the expected 0.2% increase.

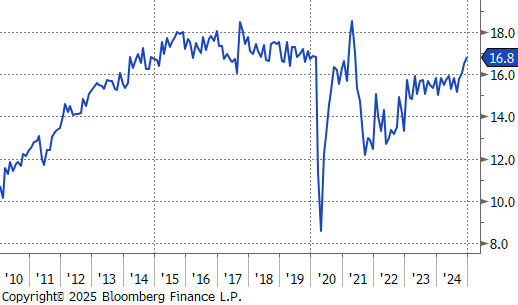

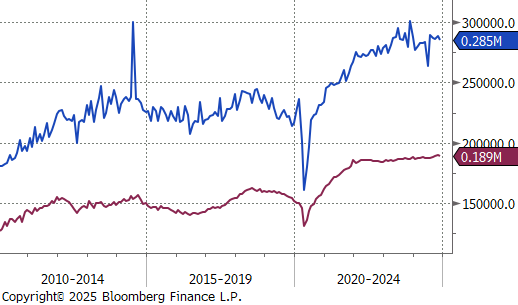

From a labor market perspective, this round of data potentially signals reacceleration from previously strong levels. November Job Openings surged to 8.1M, a 5-month high, and Initial Jobless Claims printed at 201k, their lowest level since February. All of this culminated in a robust addition in December hires, with Nonfarm Payrolls blowing past expectations of a 165k rise, up to 256k, the second consecutive month above 200k. Furthermore, the Unemployment rate dipped to 4.1%.

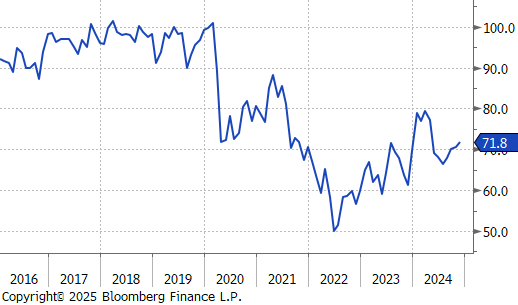

A more concerning signal from the aforementioned U. of M Consumer Sentiment Survey – the topline print dipped to 73.2, below the expected 74, and both 1yr and long-term inflation expectations surged to 3.3% (this is the highest reading for 1yr inflation expectations since 2008).