Flack Capital Markets | Ferrous Financial Insider

January 12, 2024 – Issue #414

January 12, 2024 – Issue #414

Overview:

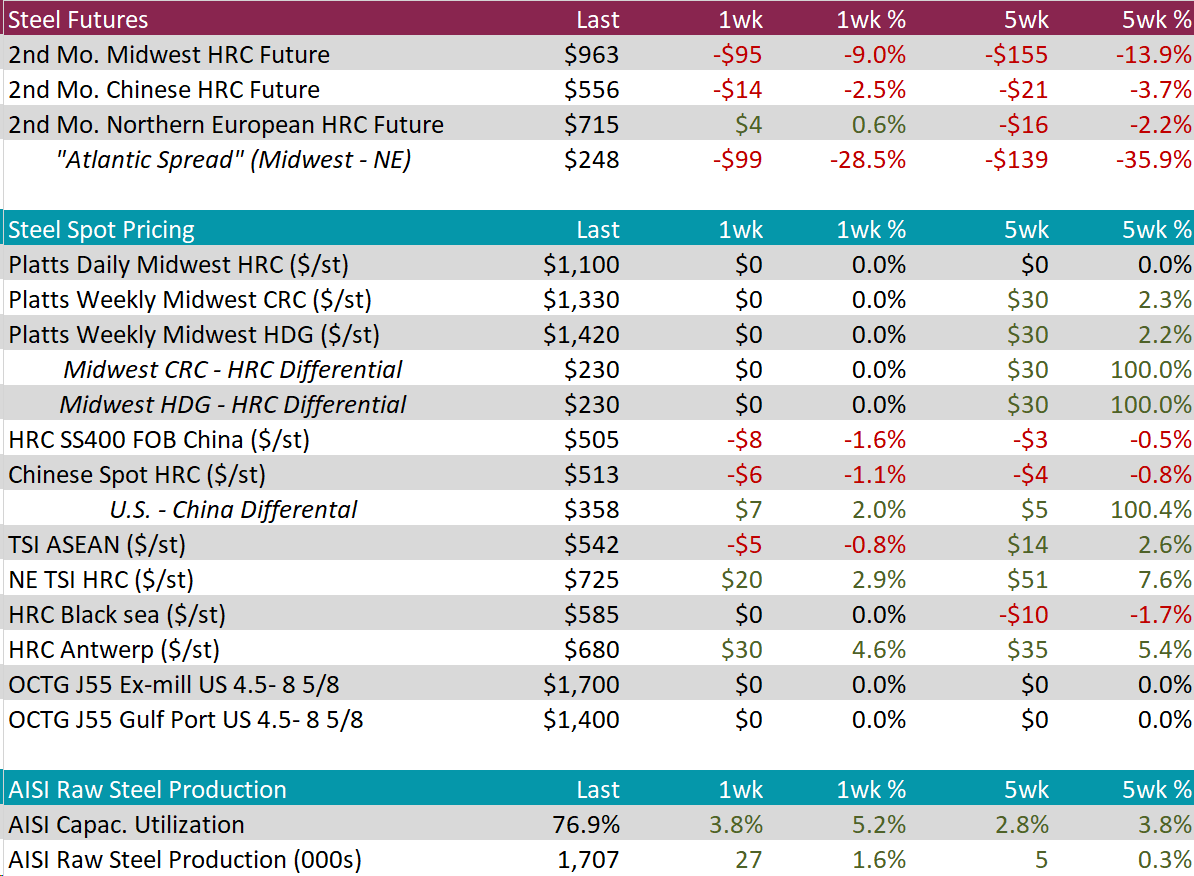

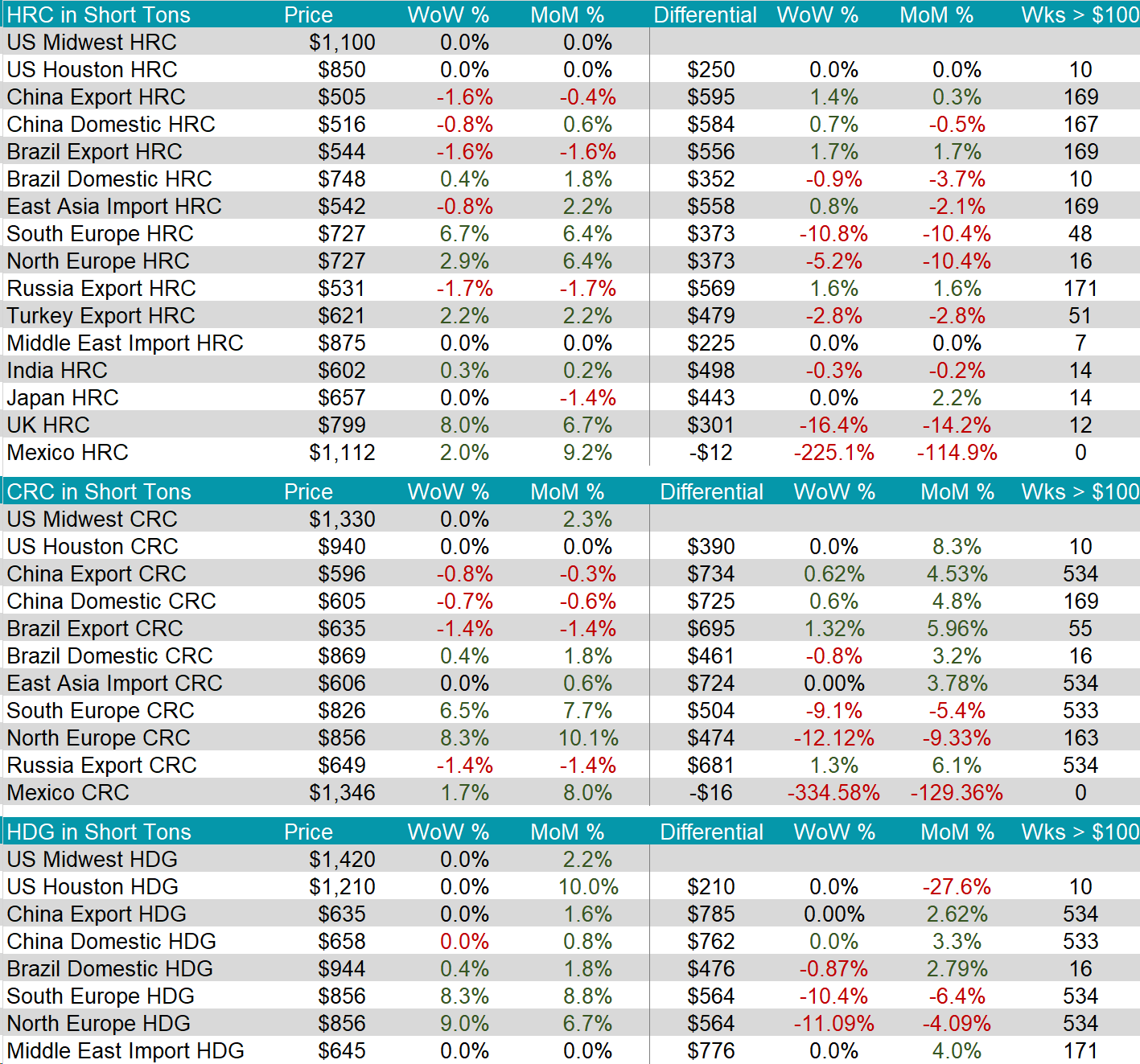

The HRC spot price continued to be static at $1,100, meanwhile the 2nd month future fell by $95 or -9.0% to $963, dropping back into $900s level after 9-weeks of being in the $1,000s.

Tandem products both remained unchanged, resulting in the HDG – HRC differential staying at $230, with the 5-week price change being $30.

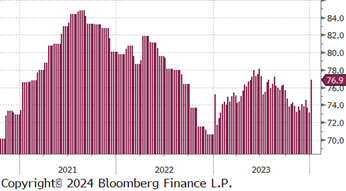

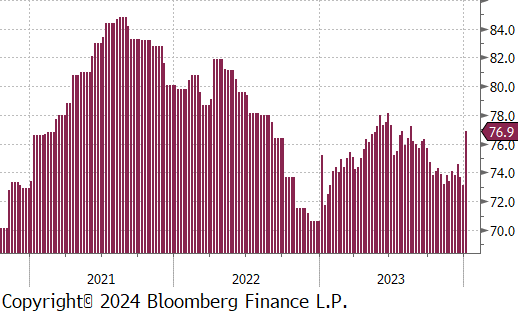

Mill production jumped out of the relatively lows levels it has been subdued at, with capacity utilization ticking up by 3.8% to 76.9%, bringing raw steel production up to 1.707m net tons.

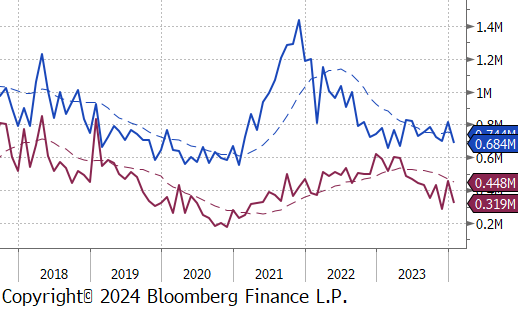

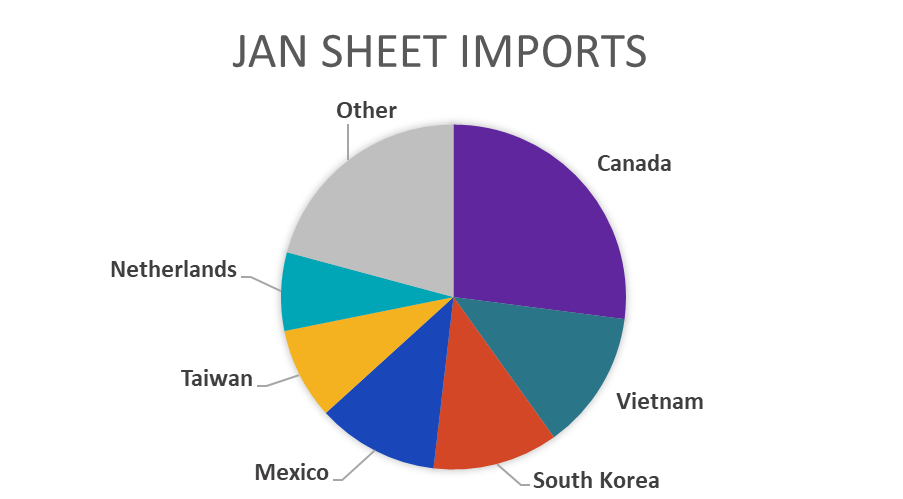

January Projection – Sheet 684k (down 133k MoM); Tube 319k (down 138k MoM)

December Projection – Sheet 817k (up 118k MoM); Tube 458k (up 174k MoM)

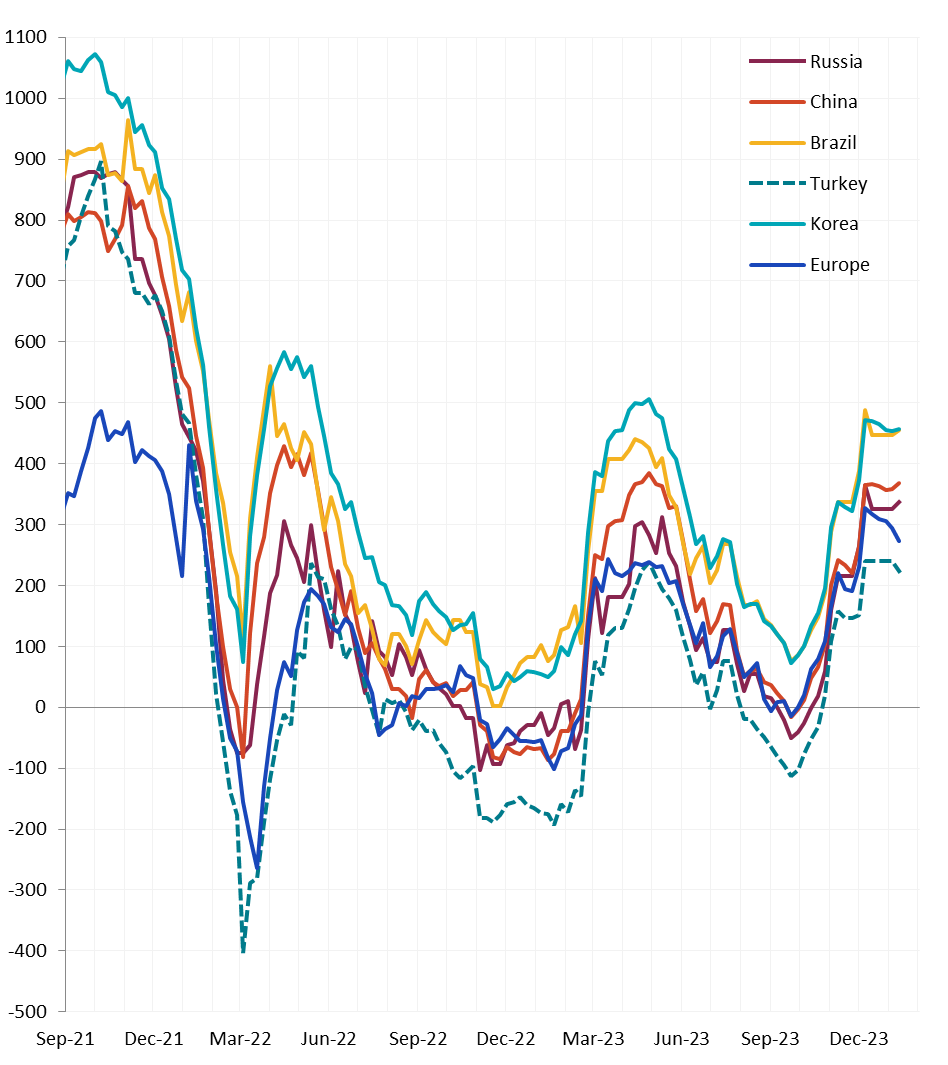

Watched global differentials were mixed this week, with South Europe HRC increasing by 6.7% and Brazil and China Export HRC both decreasing by -1.6%. Another notable country was the UK HRC rising by 8.0%.

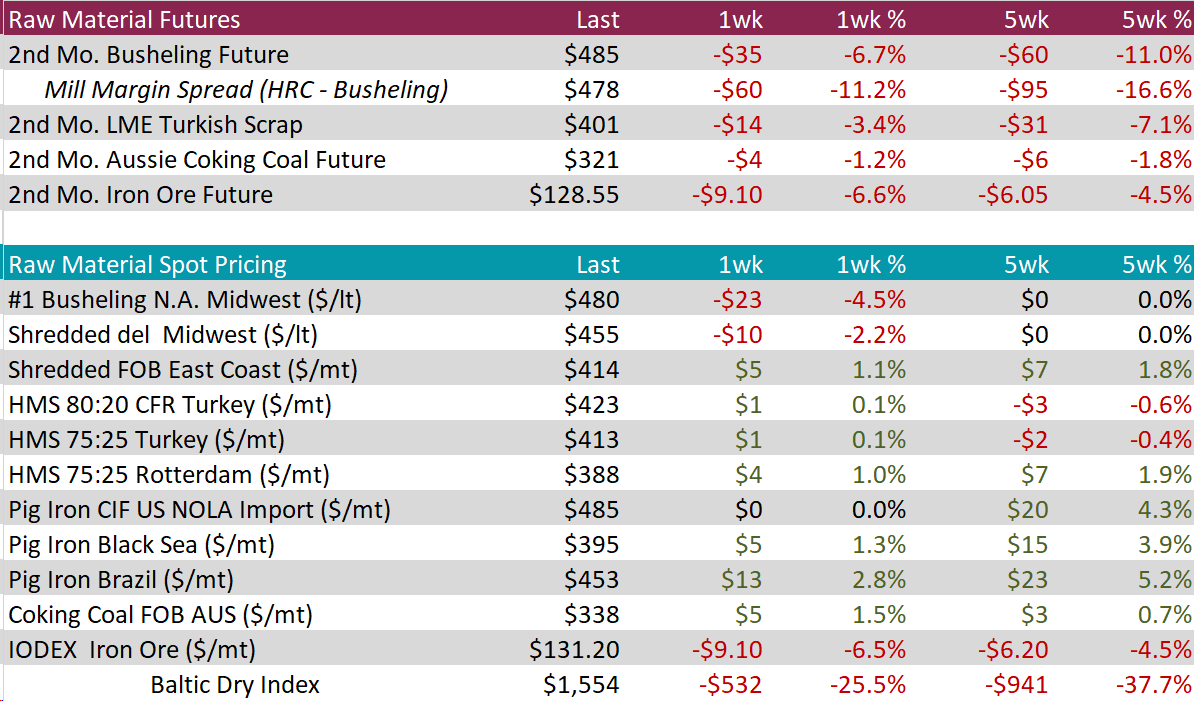

Scrap

The 2nd month busheling future fell by $35 or -6.7% to $485, continuing its drop from recent price high of $570 and the lowest it has been since late October. At the same time, the busheling spot price fell back down to $480, decreasing by $23 or -4.5%, after being at $502.50 for 4-weeks.

The 2nd month LME Turkish scrap future decreased by $14 or -3.4% to $401, reaching the lowest price level since mid-November.

The 2nd month iron ore future fell further from the recent price high of $138.70, decreasing by $9.10 or -6.6% to $128.55. Meanwhile, the iron ore spot price also fell by $9.10 or -6.5% to $131.20.

Dry Bulk / Freight

The Baltic Dry Index continued to drop, this week decreasing by $532 or -25.5% to $1,554, the lowest level seen since early-November and resulting in the 5-week price change dropping by $941 or -37.7%.

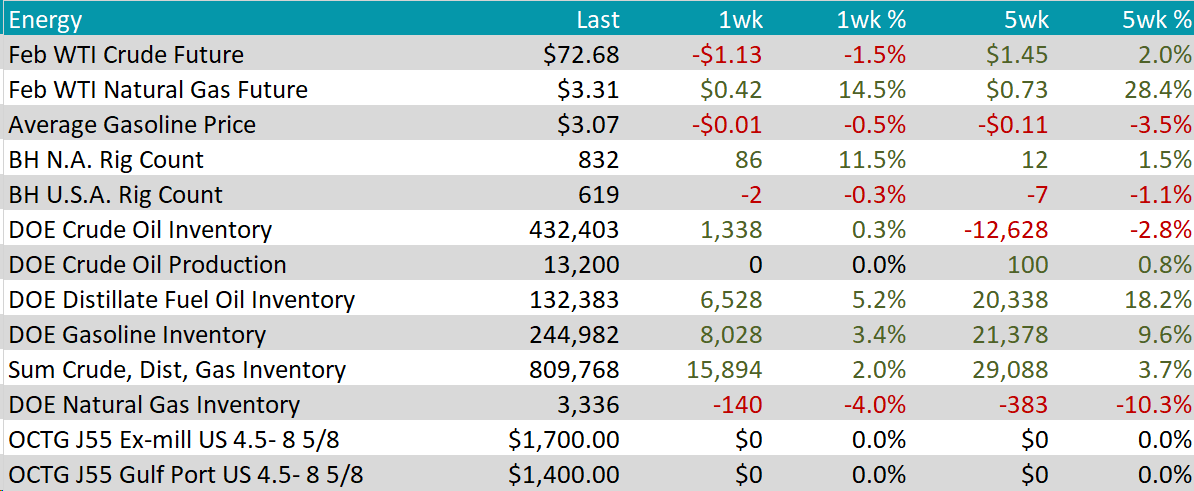

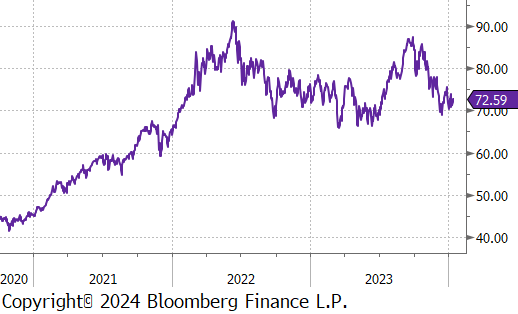

WTI crude oil future lost $1.13 or -1.5% to $72.68/bbl.

WTI natural gas future gained $0.42 or 14.5% to $3.31/bbl, continuing to rebound from recent price low of $2.49.

The aggregate inventory level ticked up by 2.0%, furthering its recent upward trend.

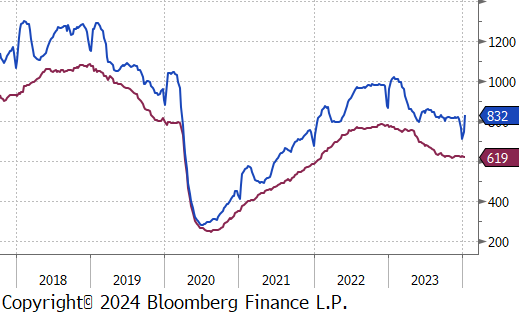

The Baker Hughes North American rig count significantly jumped up by 86 rigs, bring the total count to 832 rigs. At the same time, the US rig count fell by 2, bringing the total count to 619 rigs.

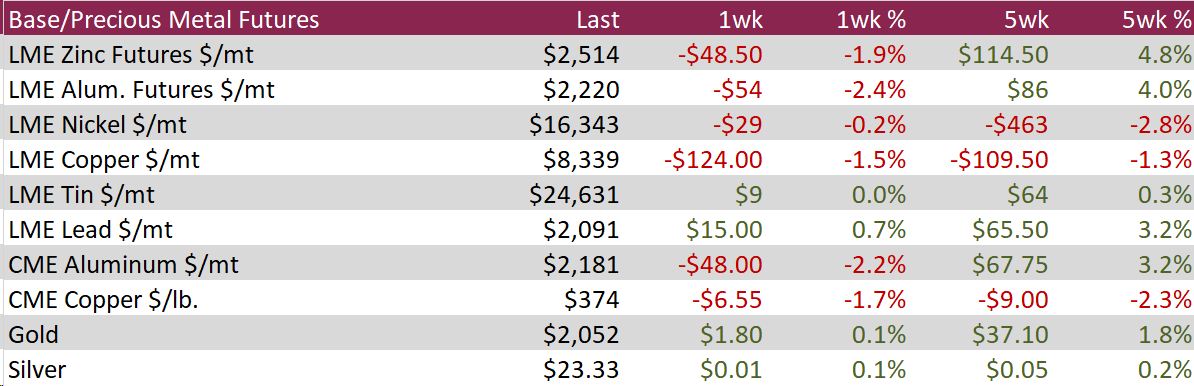

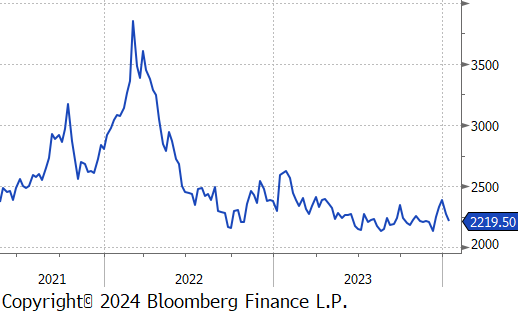

Aluminum futures continued its fall from the 8-month high of $2,387, dropping by $52 or 2.4% to $2,220. This decline was primarily due to the anticipated increase in the availability of key input materials. The price surge at the end of the year, caused by an explosion at a fuel depot in Guinea was short-lived. The subsequent investments from the UAW in Guinea’s bauxite infrastructure helped alleviate fears of a supply shortage, stabilizing prices. Furthermore, expectations of China’s stimulus measures have maintained steady demand.

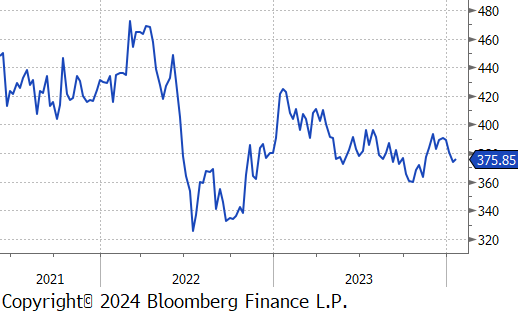

Copper futures fell by $6.55 or -1.7% to $374, continuing its drop from recent price high of $392.45 two-weeks ago. This occurs amid a strong dollar and as the market evaluates the demand prospects from major consumers for the year. Contributing to this outlook, the PBoC’s stimulus measures, signaling continued government support for the economy to prevent further slowdowns. The central bank asl set the daily yuan reference rate at its most significant deviation from predictions since November, bolstering the yuan. This move enhances the purchasing power of Chinese manufacturers for copper imports. However, a stronger recovery was limited by high inventory levels in major global warehouses. According to the Shanghai Futures Exchange, copper stockpiles in key Chinese warehouses increased by 8% to 33,130MT in the first week of January.

Silver saw a modest rise of $0.01 or 0.1% to $23.33, reaching a weekly high, buoyed by a muted dollar and lower treasury yields. This rise was spurred by the latest US producer inflation data, which led investors to anticipate a 70% likelihood of a Fed interest rate cut in March, enhancing the attractiveness of non-yielding assets like silver. Furthermore, silver’s status as a safe-haven asset is reinforced by ongoing tensions in the Middle East, particularly following the US and UK’s missile strikes on Houthi targets in Yemen. The metal is now expected to gain 0.6% over the week.

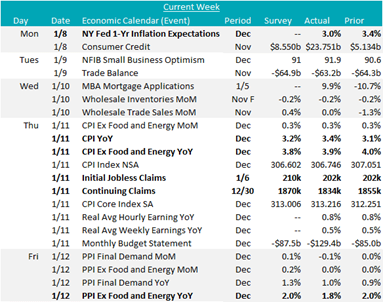

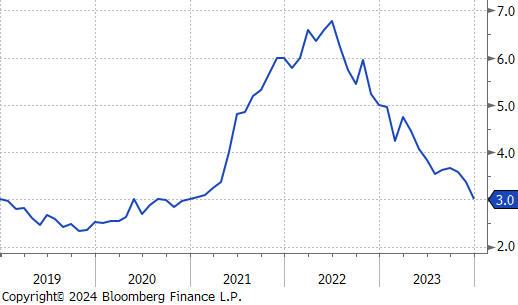

CPI (Ex Food & Energy) YoY increased by 3.9%, a slight slowing from the prior month’s reading of 4.0%, but above market forecasts of 3.8%. CPI YoY grew by 3.4%, also slightly above expectations of 3.2%, however an increase from 3.1% the prior month. These figures overall indicate that inflation is cooling, just less than market forecasts, highlighting that getting inflation to the target 2.0% will be a long process.

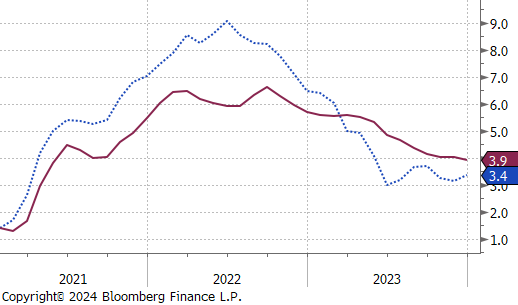

The NY Fed 1-Year Inflation Expectations for December came in at 3.0%, a substantial cooling from November’s 3.4%, suggesting optimism for further disinflation ahead. This is the lowest level since December 2020.

PPI (Ex Food & Energy) YoY rose by 1.8%, an easing from the 2% increase seen in November and below market estimates of 2.0%. This marked the lowest rate since December 2020, continuing the trend of disinflation in producer prices. While this is a promising topline trend, margins at the wholesale level have not been benefitting from this recent trend – which suggests that this low level of price inflation will not immediately trickle through to consumers.

Initial Jobless Claims remained unchanged at 202k, significantly below market expectations of a rise to 210k. Meanwhile, Continuing Claims fell to 1834k from 1855k the prior week, undercutting the census forecast of an increase to 1870k. This data, along with other recent job indicators, highlights the continued strength of the labor market, which provides the leeway for a continued hawkish stance from the FED.