Flack Capital Markets | Ferrous Financial Insider

January 3, 2025 – Issue #465

January 3, 2025 – Issue #465

Overview:

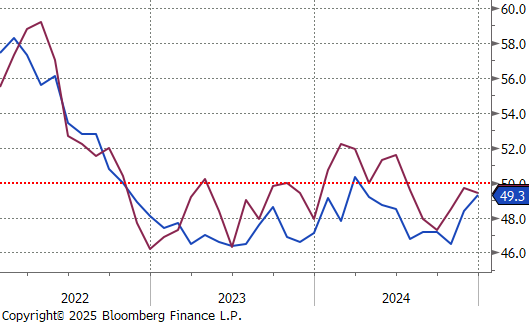

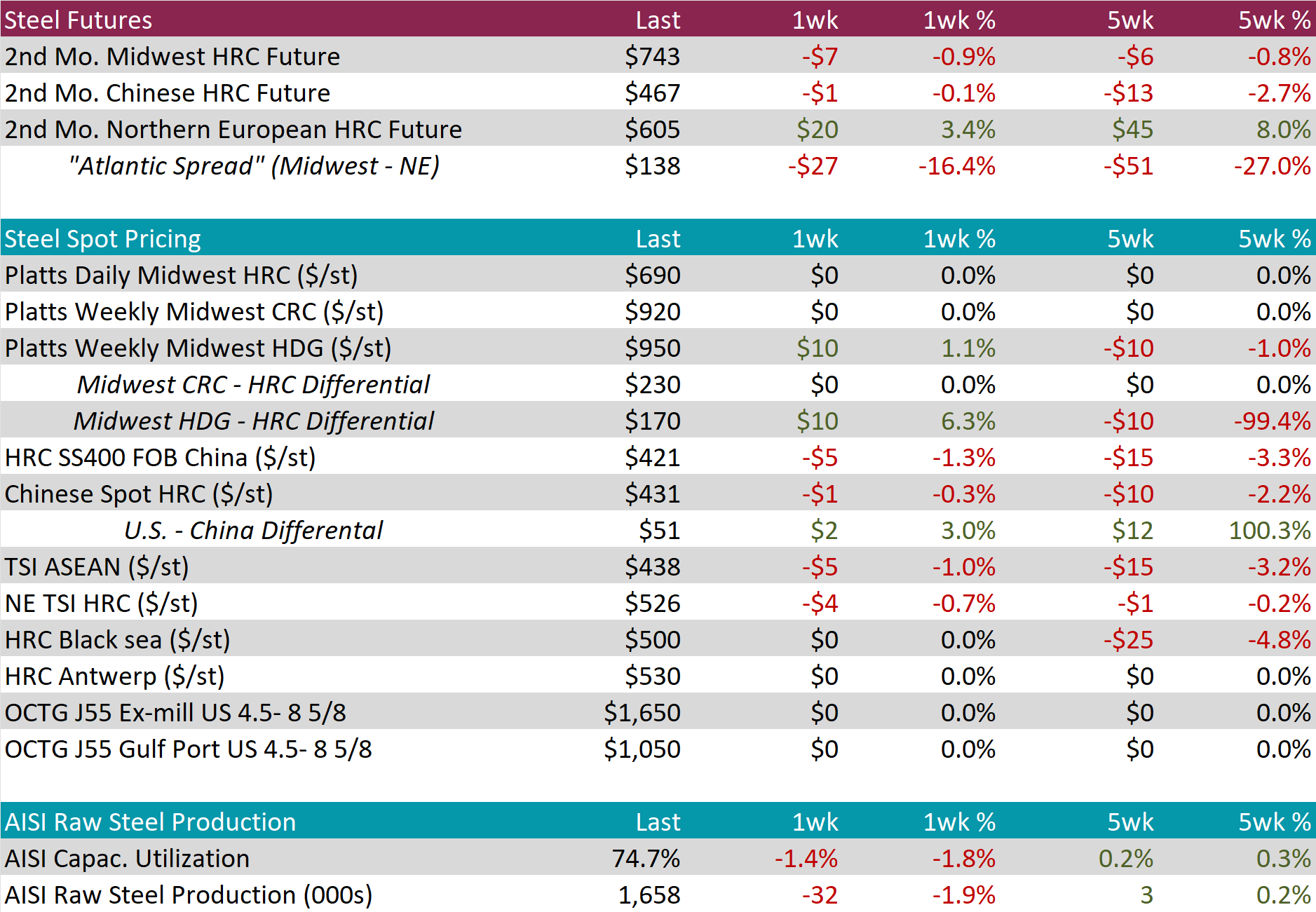

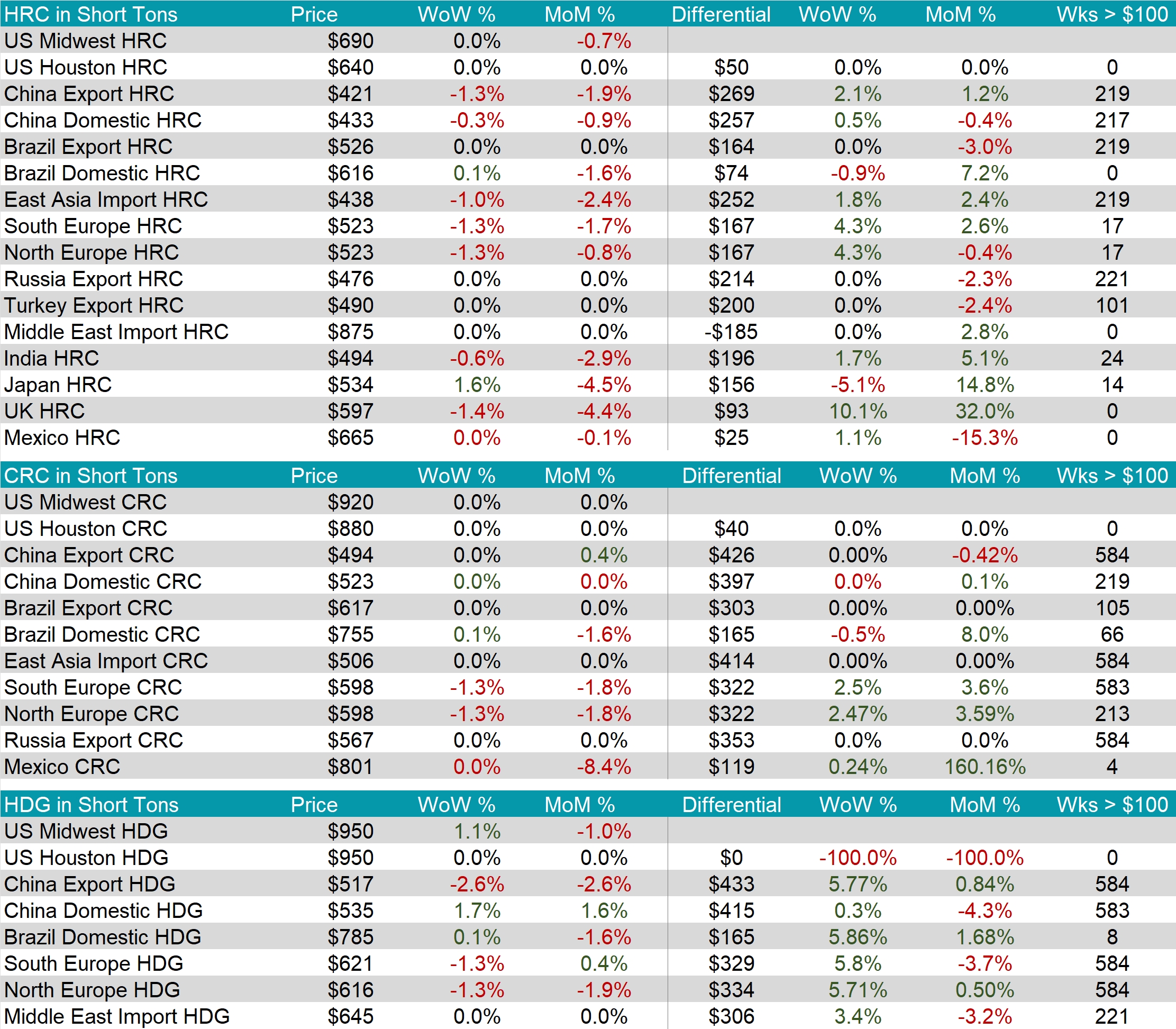

The HRC spot price was unchanged this week and has been relatively stable at the $690 level for the past 2 months. On the other hand, the 2nd month future fell by another $7 or 0.9%, down to $753.

Tandem products saw very little change, with CRC steady at $920, while the HDG-HRC differential increased to $170, up $10 or 6.3%.

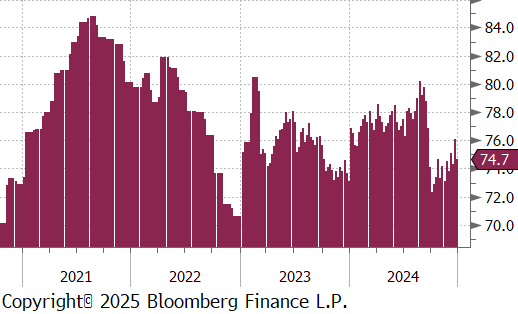

Mill production was down 32k to 1,658k, with capacity utilization decreasing 1.4% to 74.7%. Overall, domestic production is clearly trending higher with higher highs, and higher lows over the last 2 months.

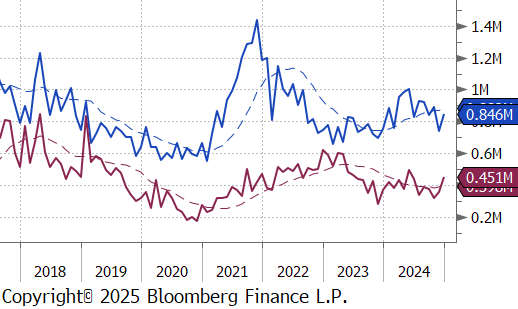

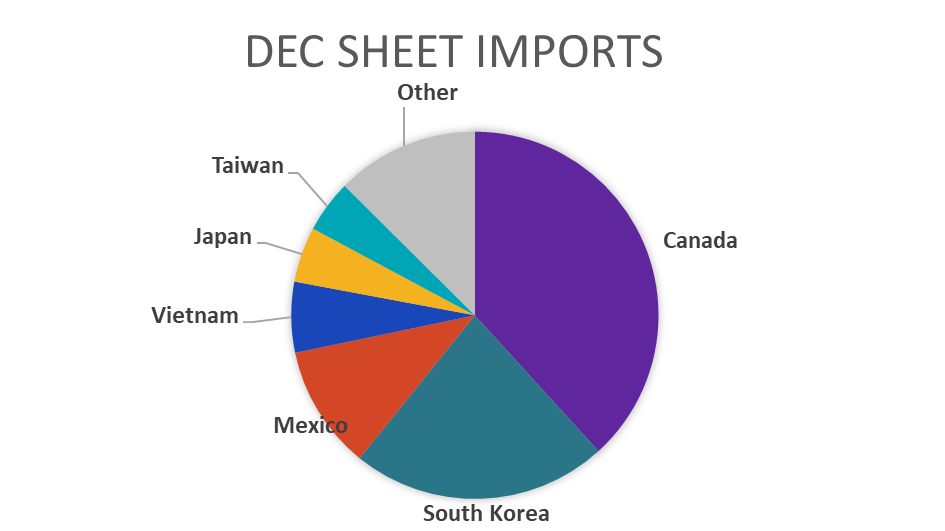

December Projection – Sheet 846k (up 104k MoM); Tube 451k (up 91k MoM)

November Projection – Sheet 742k (down 150k MoM); Tube 360k (up 39k MoM)

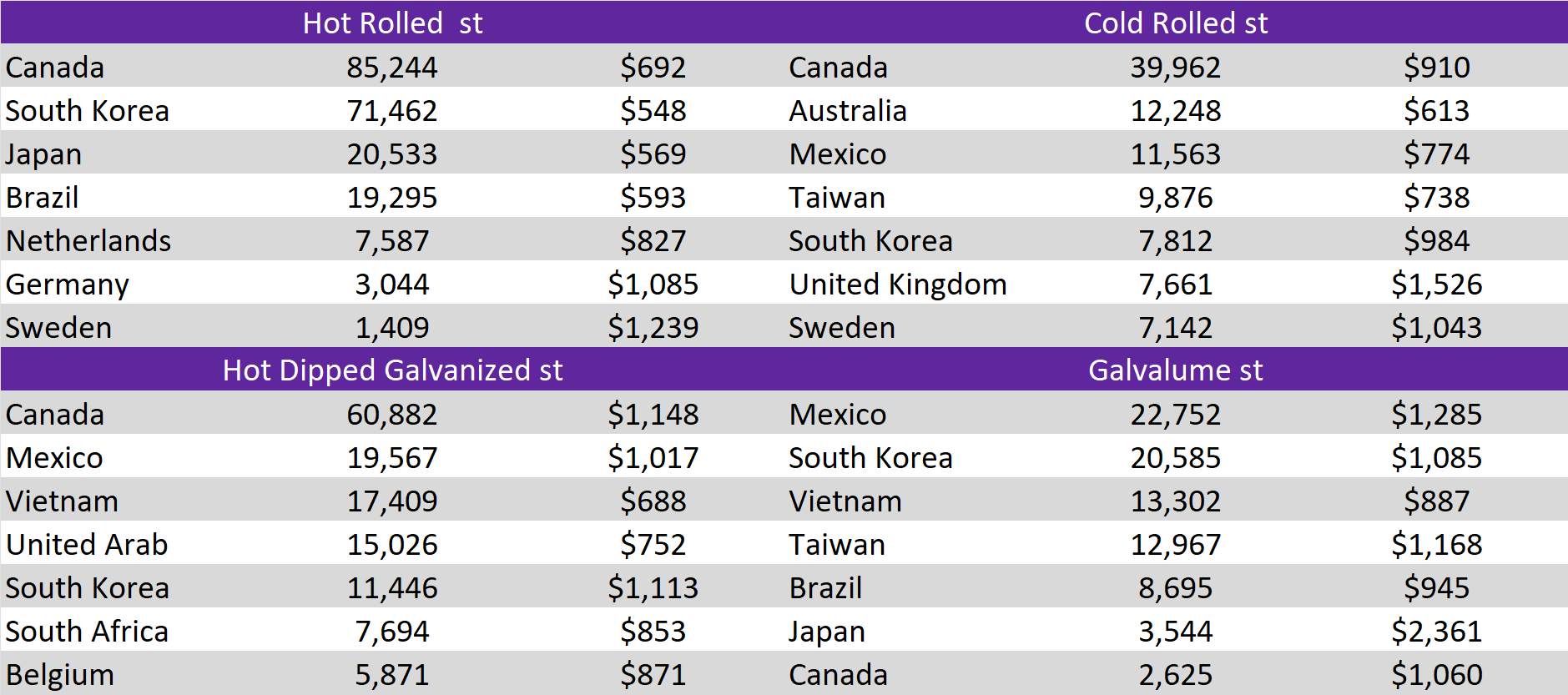

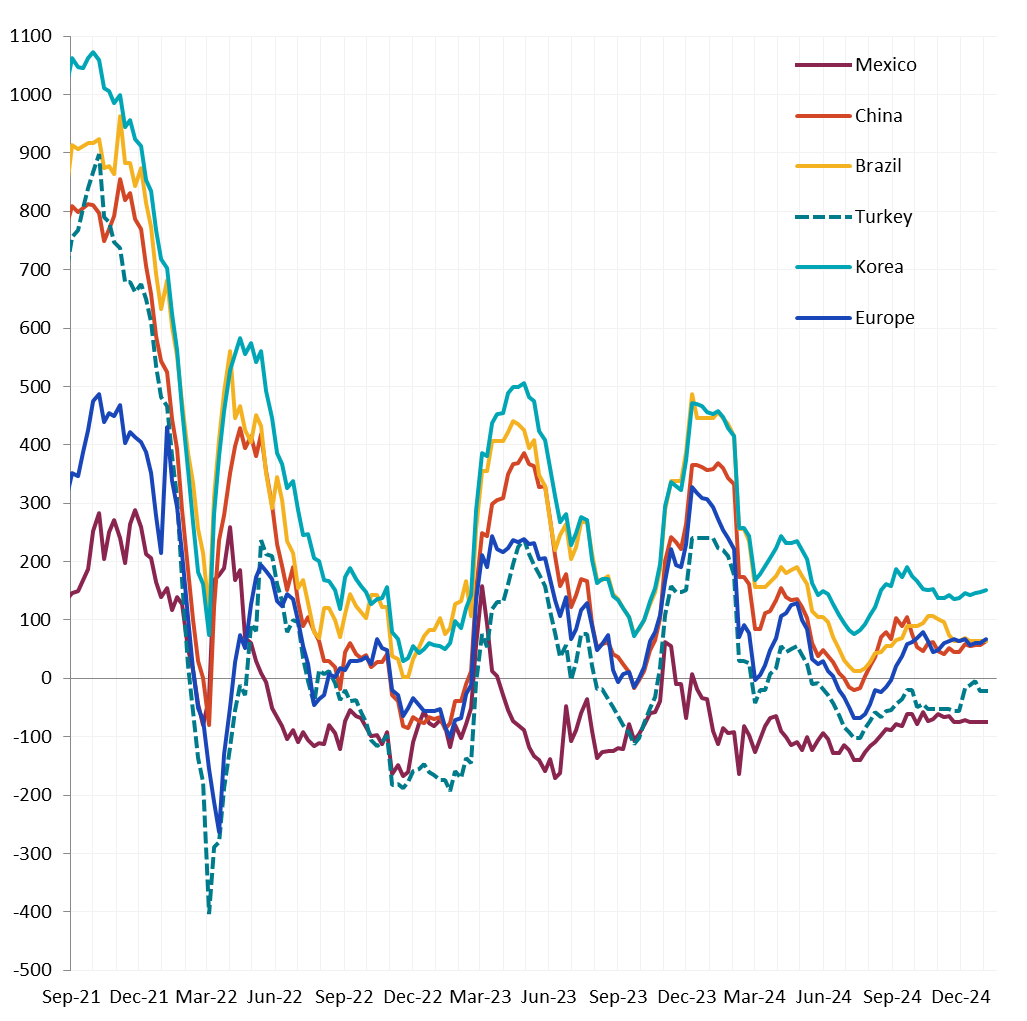

Differentials were slightly higher this week, as global prices mostly fell, led by China, Northern Europe, and Southeast Asia. The global differential continues to hold steady around that $50 level.

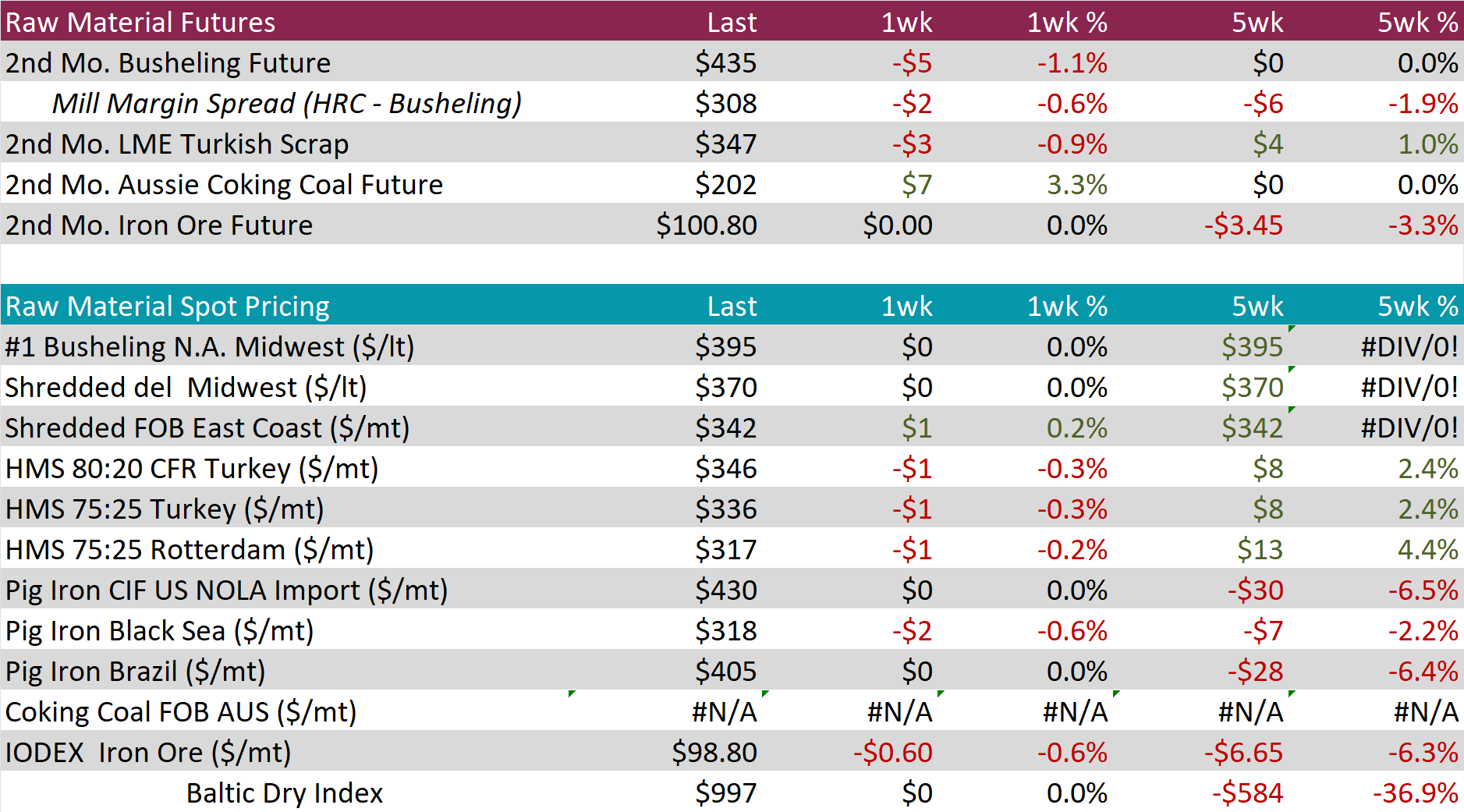

Scrap

The 2nd month busheling future fell by $5 or 1.1% on the week. January’s settlement will be the first month where the contract switches from Midwest to Chicago busheling, which had an ~$20 spread in December.

The 2nd month Aussie coking coal future rose by $7 last week, in an interesting contrast with its typically correlated counterpart, iron ore, which was unchanged.

Dry Bulk / Freight

The Baltic Dry Index did not publish fresh pricing data between the December 24th and January 3rd.

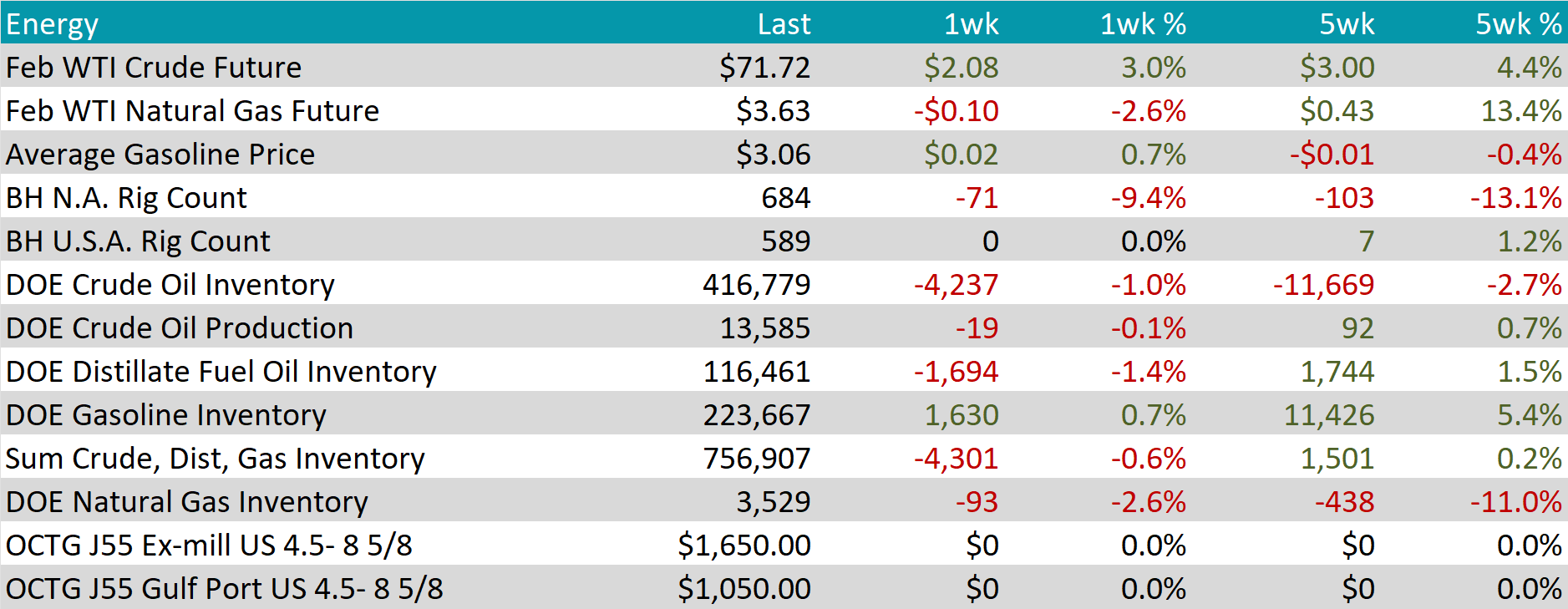

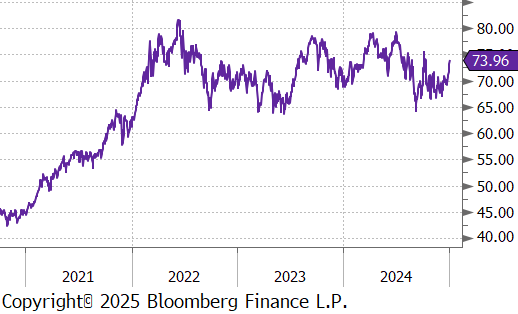

WTI crude oil future gained $2.08 or 3.0% to $71.72/bbl.

WTI natural gas future lost $0.10 or -2.6% to $3.63/bbl.

The aggregate inventory level experienced a slight decline of -0.6%.

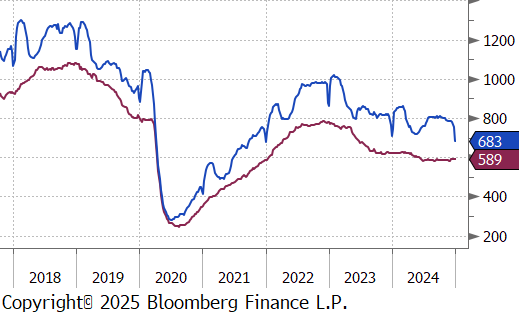

The Baker Hughes North American rig count plummeted by 71 rigs to 684, while the US rig count remain unchanged at 589 rigs.

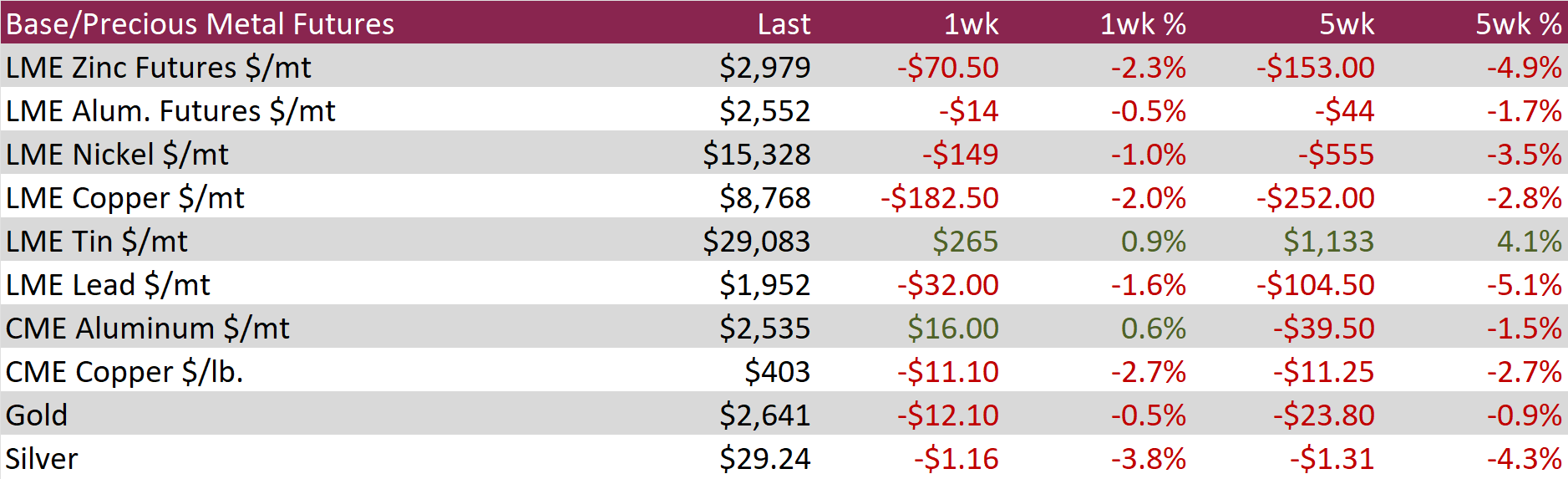

Aluminum futures fell by $14 or -0.5% to $2,552 and Copper futures declined by $11.10 or -2.7% to $403 as investors assessed mixed signals about the economic outlook in China, the world’s largest copper consumer. Beijing recently committed to “more proactive” macroeconomic policies and further interest rate cuts to spur economic growth. Positive signs came from data showing that China’s services sector expanded at its fastest pace in seven months in December, indicating robust consumption. However, copper prices faced headwinds from a strong US dollar, fueled by reduced expectations for Federal Reserve rate cuts this year. A stronger dollar raises the cost of dollar-denominated commodities, dampening demand from international buyers.

Precious Metals

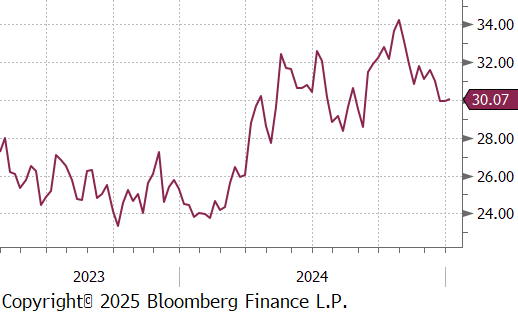

Silver slipped by $1.16 or -3.8% to $29.24 as investors awaited key US economic data that could shape the Federal Reserve’s monetary policy outlook. Attention is focused on Friday’s US jobs report, which may provide critical signals for silver’s next move. The metal found support from a brighter economic outlook in China, the world’s largest silver consumer. Beijing recently committed to “more proactive” macroeconomic policies and further interest rate cuts to bolster growth. Additionally, December data showed the Chinese services sector expanded at its fastest pace in seven months, highlighting robust domestic consumption.

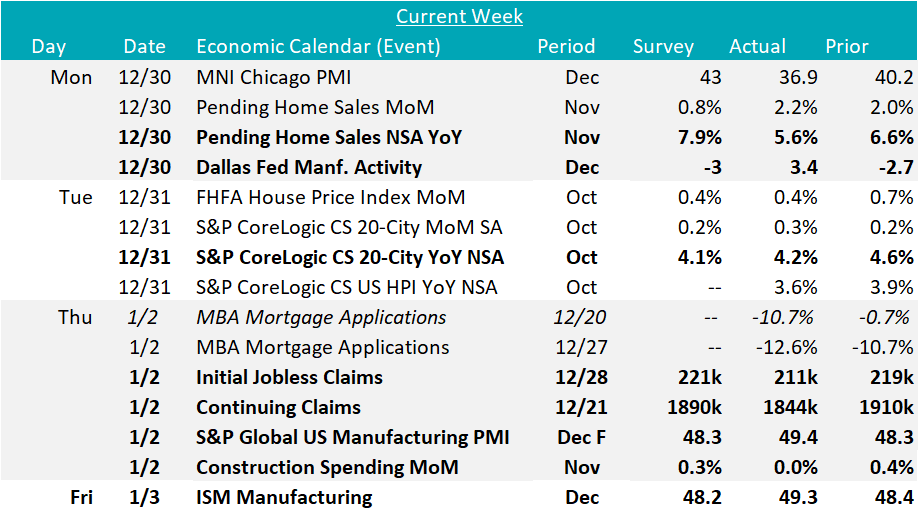

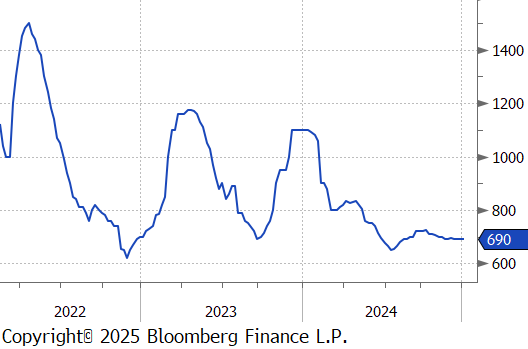

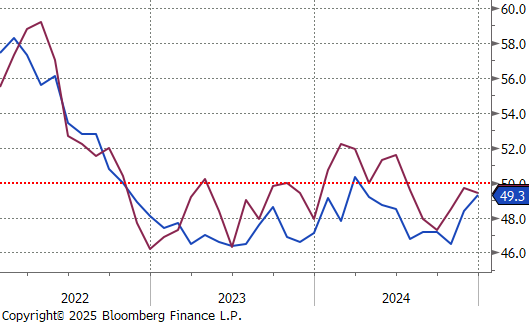

December manufacturing data from both the S&P Global and ISM Manufacturing PMIs came in above expectations rising to (49.4 vs expected 48.3) and (49.3 vs expected 48.2), respectively. The real reason for optimism when looking at these still contractionary prints comes from the subcomponents. The ISM New Orders index came in at 52.5, up 2.1 points from Novembers print which was also slightly expansionary. Furthermore, the Dallas Fed Manufacturing Index showed an expansion of activity in the region, printing up to 3.4, and beating expectations of a -3 print.

Limited housing data showed softer activity in December with NSA Pending Home Sales increasing 5.6% YoY versus an expected 7.9% increase, while MBA Mortgage Applications showed to consecutive weeks of double-digit percentage declines (seasonally normal around the holidays). Affordability continues to be a concern, with lagged October S&P CoreLogic 20-City YoY house prices cooling less than the expected 4.1%, still up 4.2%.

Jobless claims continue to show a stable labor market, with Initial claims at 211k, their lowest level since March, and continuing claims falling more than expected to 1.84M.