Flack Capital Markets | Ferrous Financial Insider

July 14, 2023 – Issue #388

July 14, 2023 – Issue #388

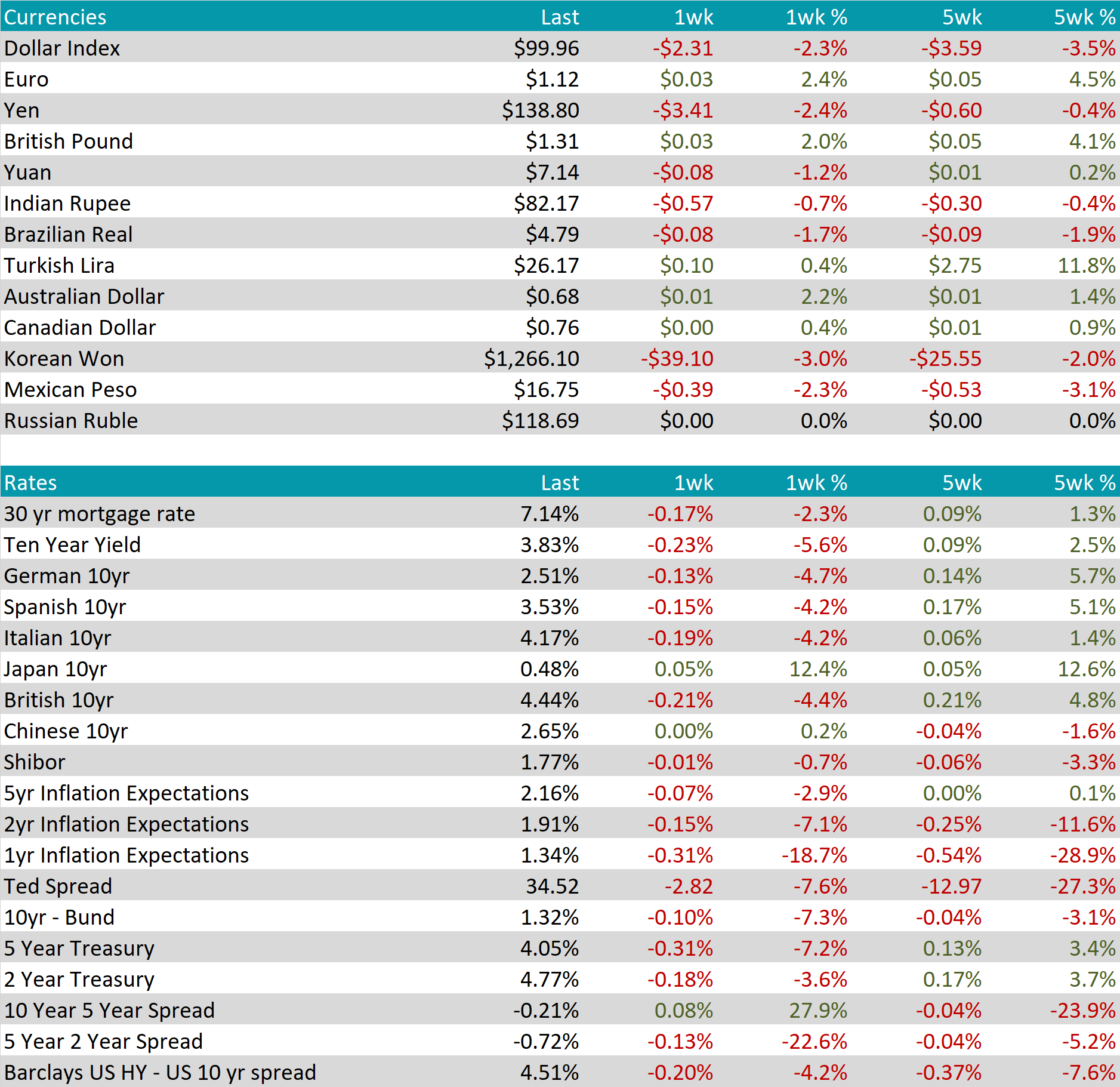

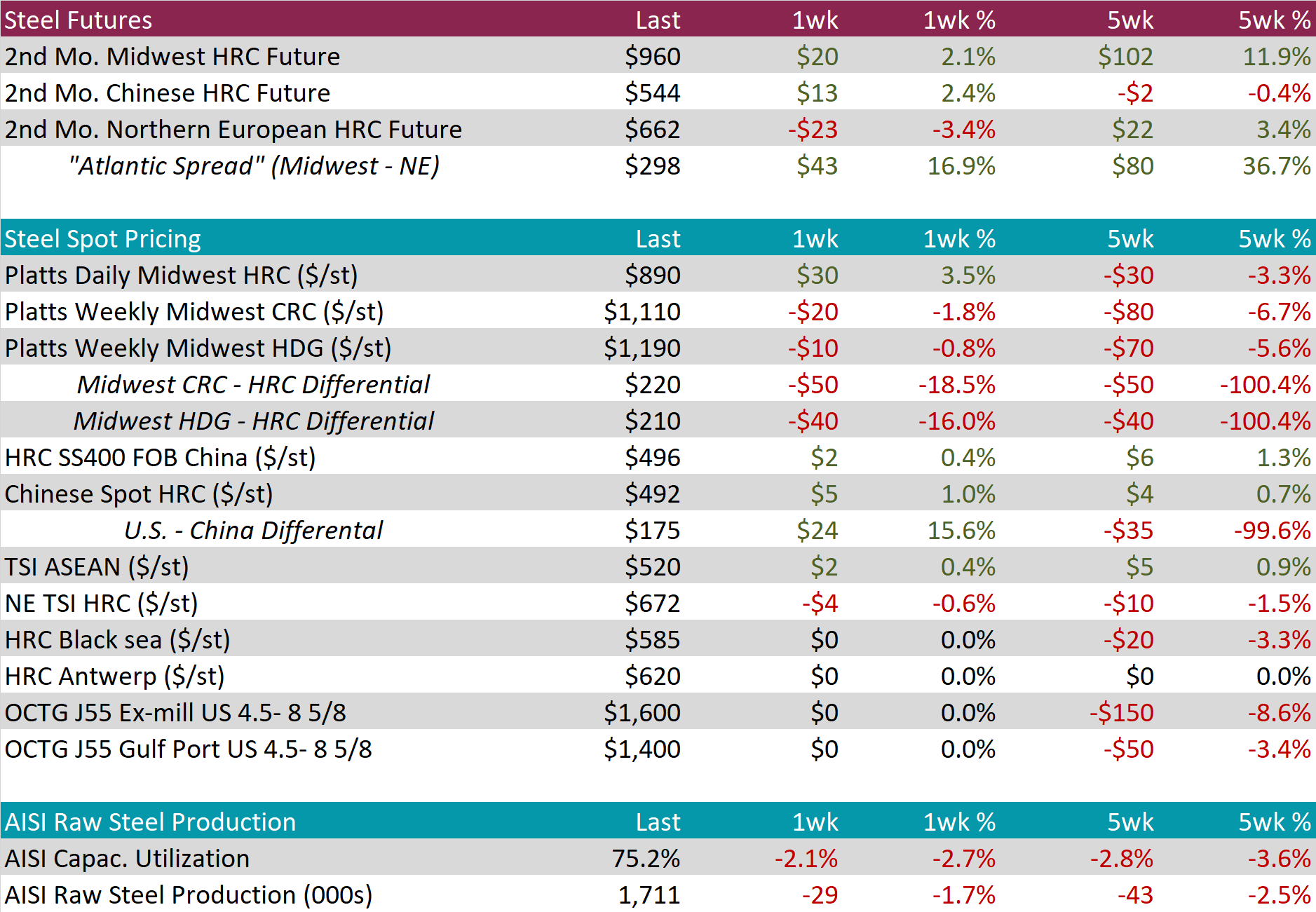

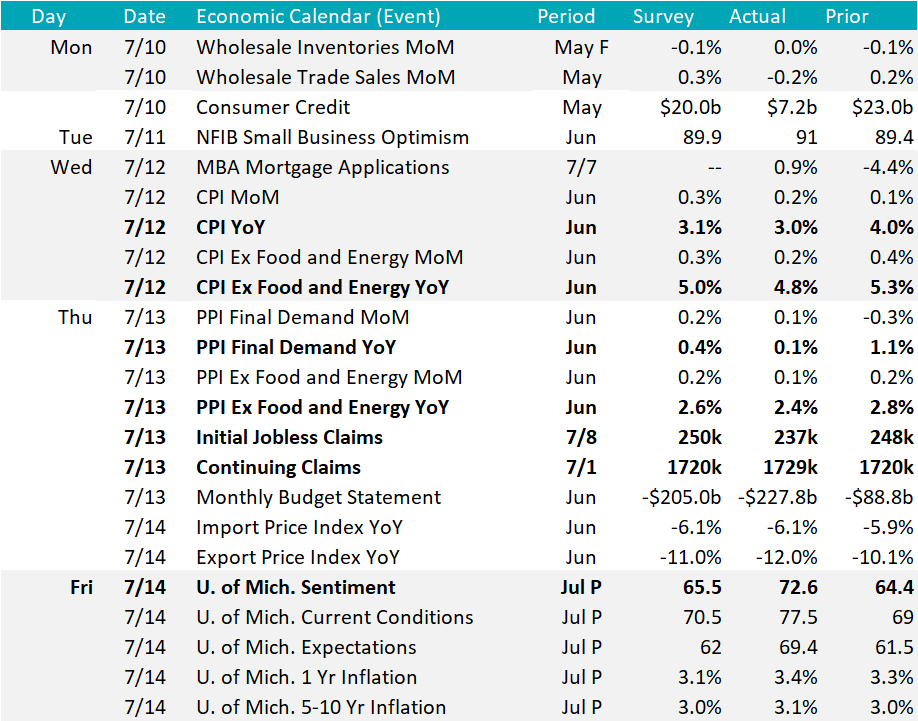

Early in the week, the headline Consumer Price Index (CPI) continued its recent moderation, with the headline print at 3% YoY, the lowest print since March 2021. Core CPI (ex. food and energy), also decreased and printed 4.8%, the lowest print since October 2021. The spread between headline and core CPI has stretched to its largest negative gap since April 2015. This suggests that further disinflation in underlying (core) price pressure is needed before the Federal Open Market Committee (FOMC) considers lowering interest rates. Core goods prices have declined by -0.1% month-over-month, reversing a concerning trend, while core services prices have shown the slowest monthly increase since September 2021, rising by 0.3%.

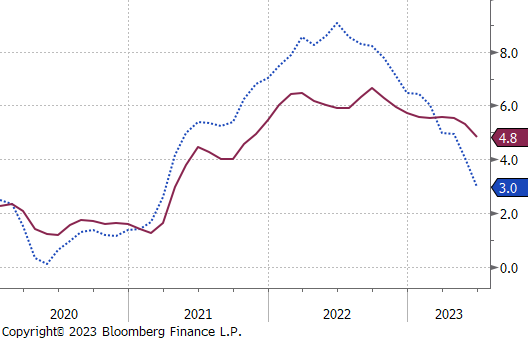

The headline Purchaser Price Index (PPI) also showed further disinflation, with the YoY figures printing at 0.1%, the lowest since August 2020. When excluding food and energy, the YoY figures are stickier but also indicate disinflation, at 2.4%, which was below expectations of 2.6% and the May print of 2.8%. Although this trend is promising, it is important to note that not all of this “margin relief” experienced by producers will necessarily be passed on to consumers. We anticipate that the corresponding headline and core figures will diverge barring a negative demand shock.

The trajectory of disinflation in the coming months will play a crucial role in determining the FOMC’s decision on terminal interest rates. While earlier in the year, a soft landing for the economy seemed improbable due to persistent elevated prices and rapidly rising interest rates, the current data reflecting disinflation suggests that such a scenario is now becoming a viable and welcomed possibility. This shift towards a potential soft landing offers a glimmer of hope for the U.S. economy as it strives for stable and sustainable growth.

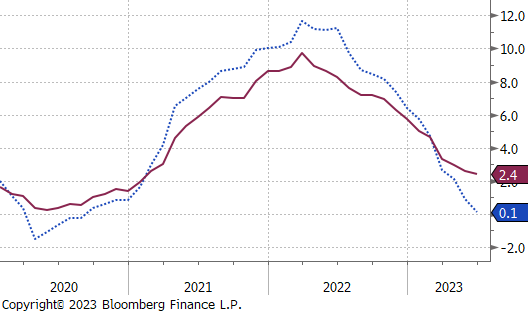

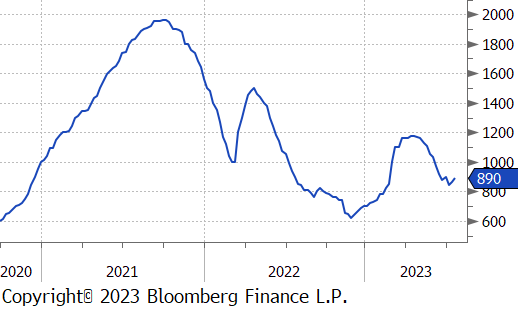

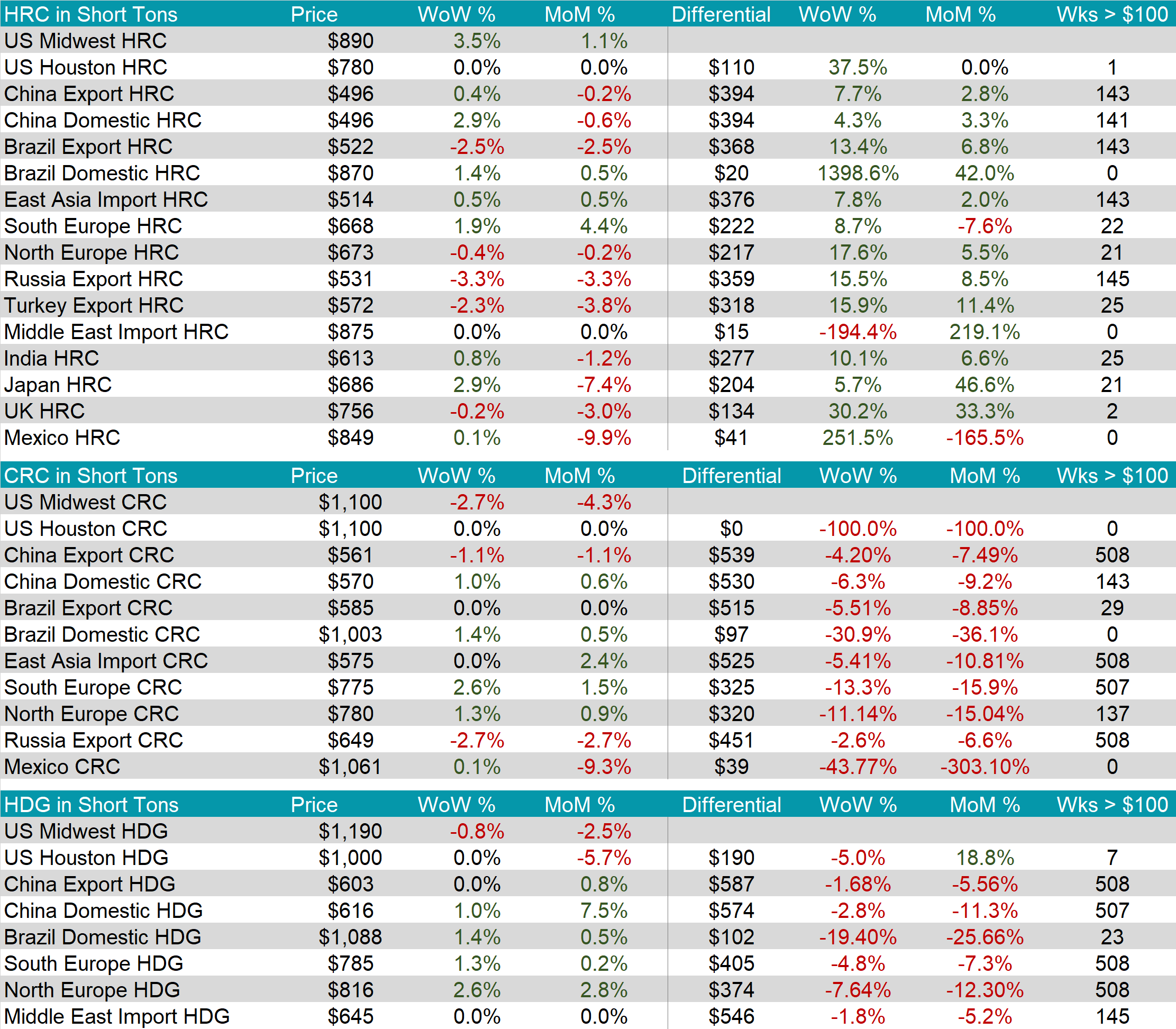

HRC spot and 2nd month future prices were up $30 or 3.5%, and $20 or 2.1%, respectively. Both appear to be losing momentum, with spot prices below and futures prices just above the announced targets from the recent price increases from the mills.

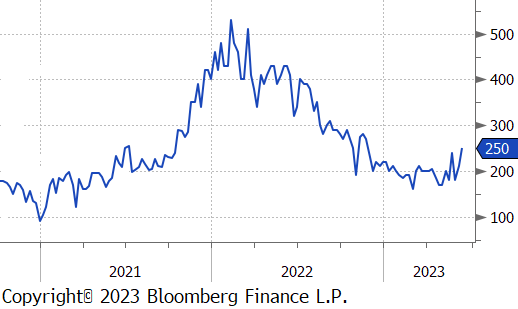

Tandem products both saw further weakness in the second week of July, causing the HDG-HRC spread to decrease by $40. At $210, this spread is slightly elevated compared to what we saw for most of the first half of the year.

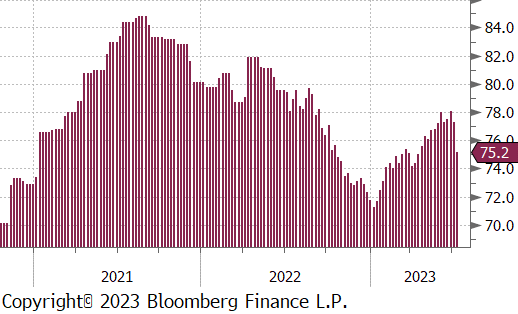

Mill production moved sharply lower last week, with capacity utilization down 2.1% to 75.2%.

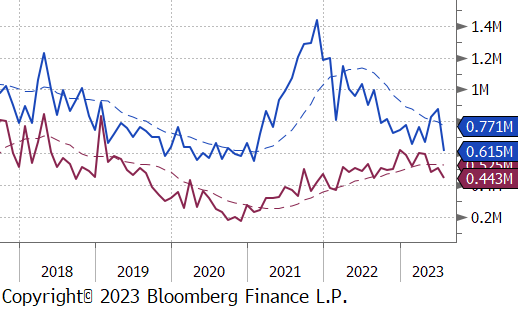

July Projection – Sheet 615k (down 265k MoM); Tube 443k (down 63k MoM)

June Projection – Sheet 880k (up 22k MoM); Tube 506k (up 54k MoM)

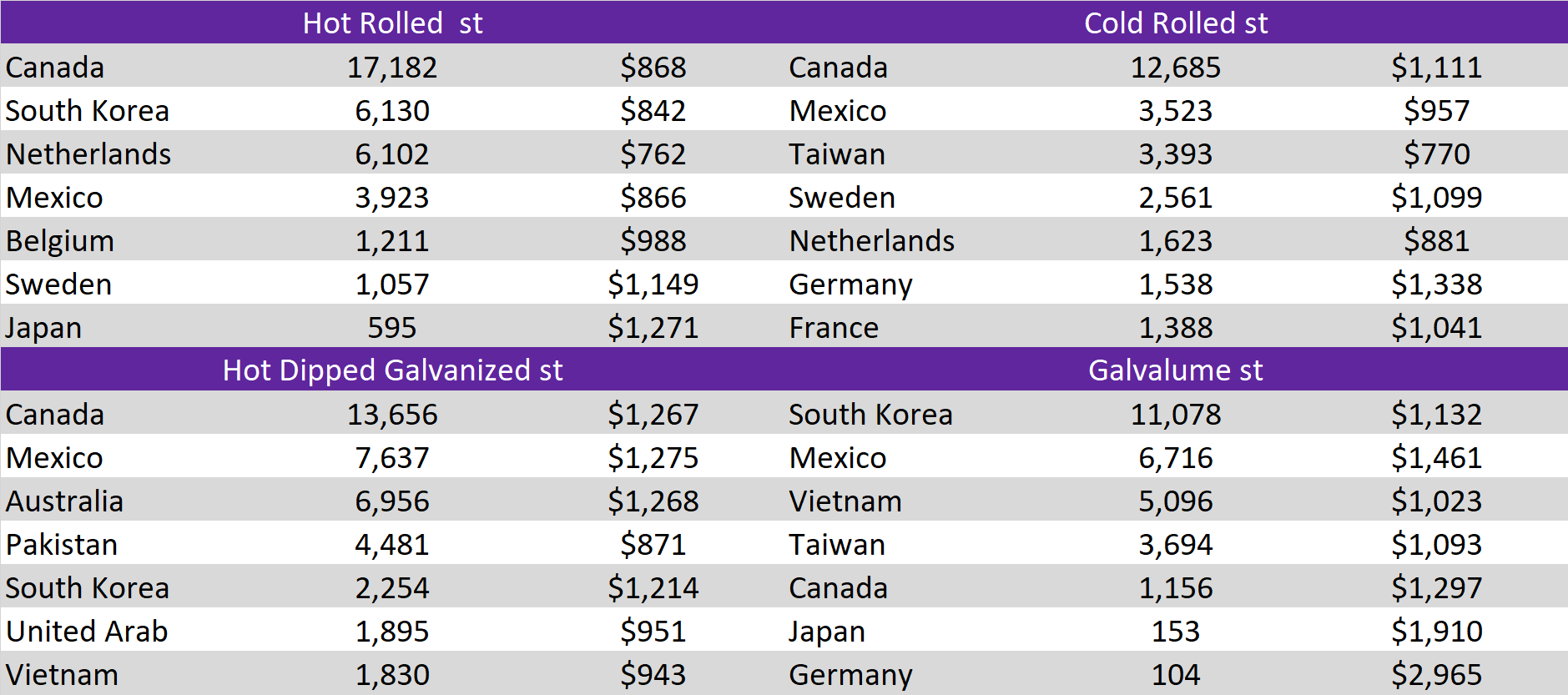

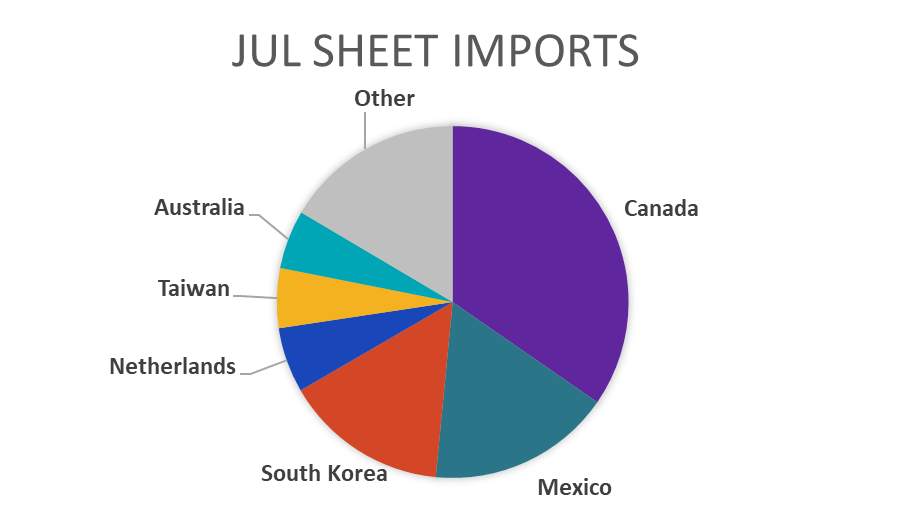

After two months of increases, preliminary data suggests that sheet arrivals are going to come in at the lowest level in over 2 years. Temporarily assuaging fears that a flood of cheap imports were coming to crash domestic prices.

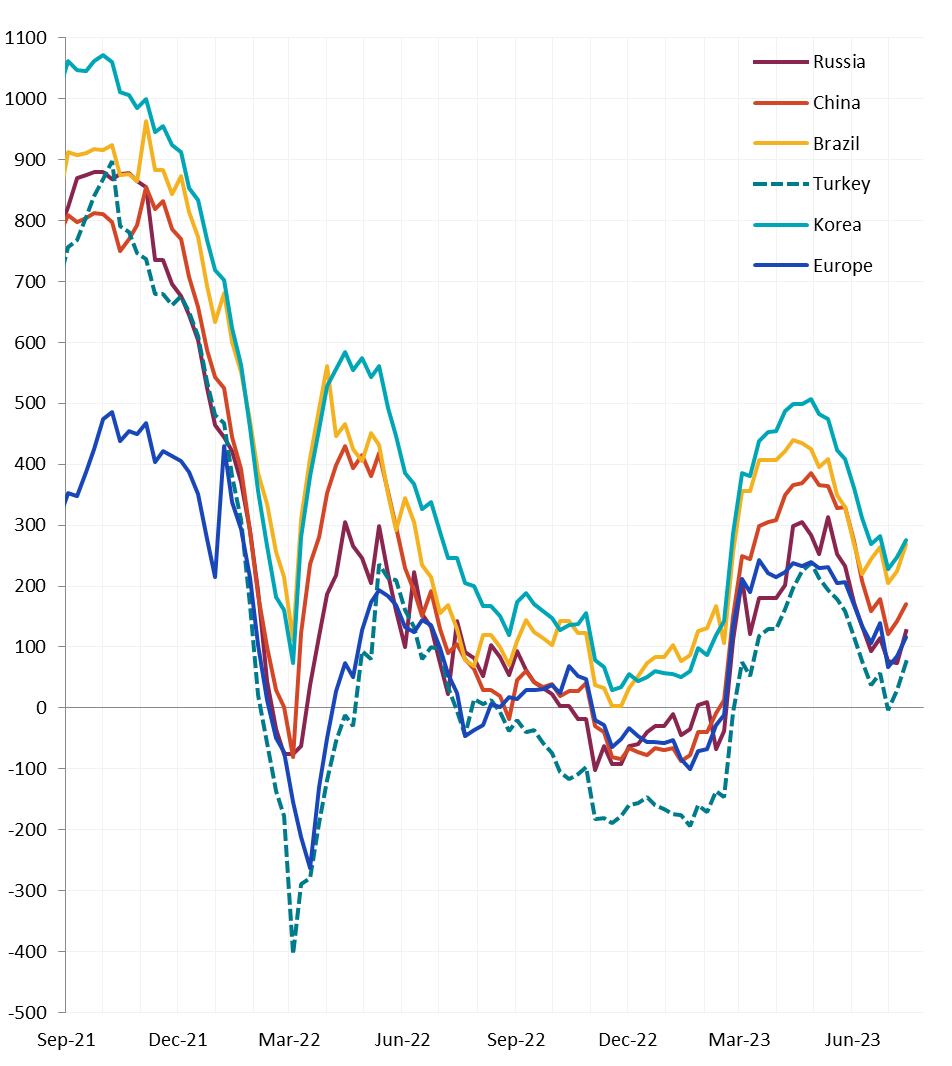

Global differentials increased for the second week in a row. The move has been driven mostly by increasing U.S. domestic HRC prices, as global prices are slowly grinding lower.

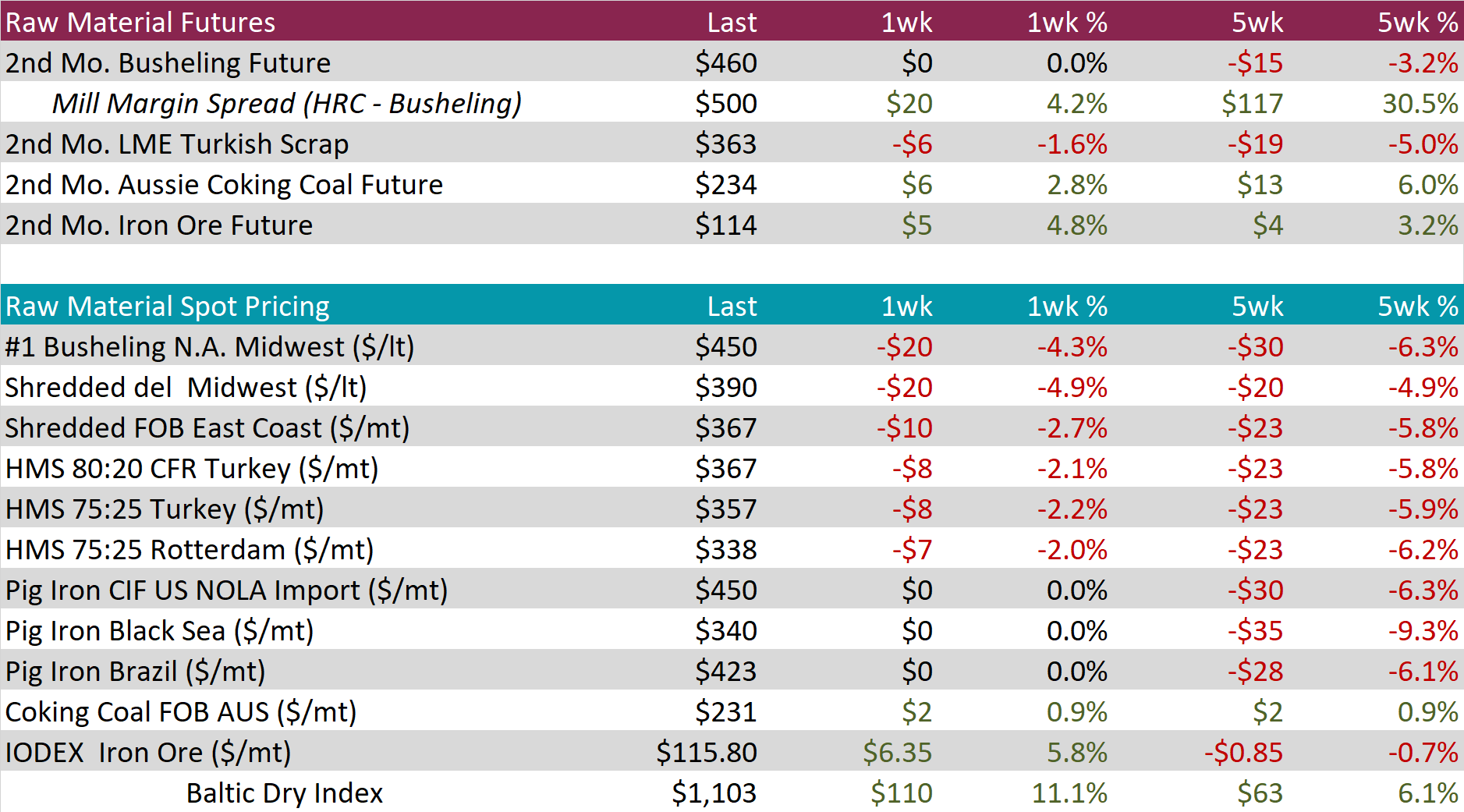

The July Busheling spot price settled down another $20 this month, while the 2nd month future was unchanged. Both prices are in the mid-$400’s, historically elevated but off recent highs. The increasing HRC future price drove mill margin higher, this week, as well. It is now up 30.5% over the last 5 weeks to a $500 spread.

The 2nd month Iron ore future was up $5 to $114. Given the recent bearish turn in global sentiment around China, iron ore has held up surprisingly well.

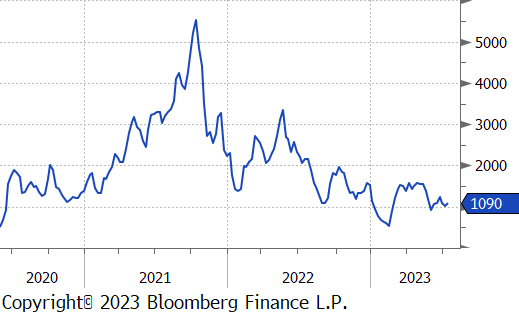

Dry Bulk / Freight

The Baltic dry index was up $110, or 11.1%, this week.

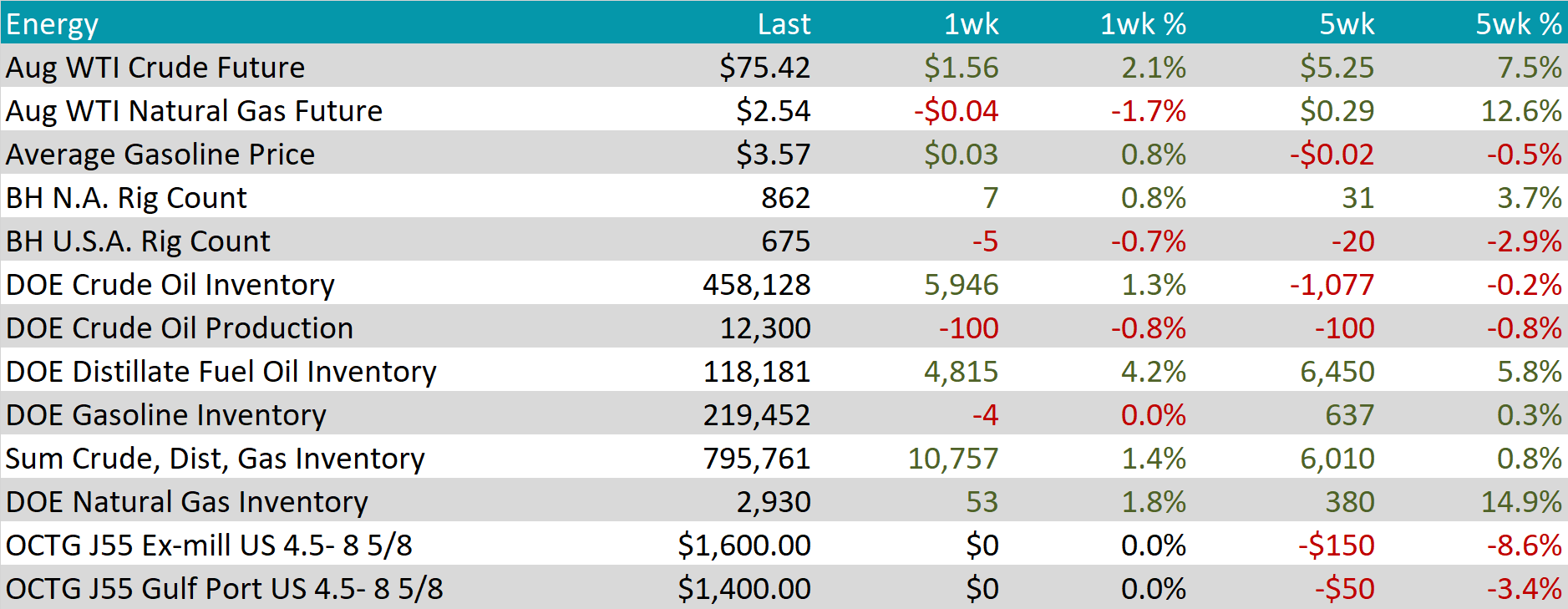

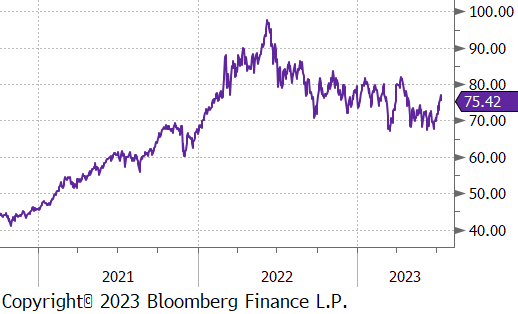

WTI crude oil future gained $1.56 or 2.1% to $75.42/bbl.

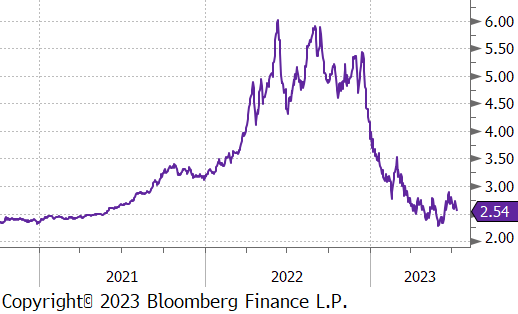

WTI natural gas future lost another $0.04 or 1.7% to $2.54/bbl.

The aggregate inventory level was up 1.4% this week.

The Baker Hughes North American rig count was up 7 rigs, while the U.S. rig count was down 5 rigs.

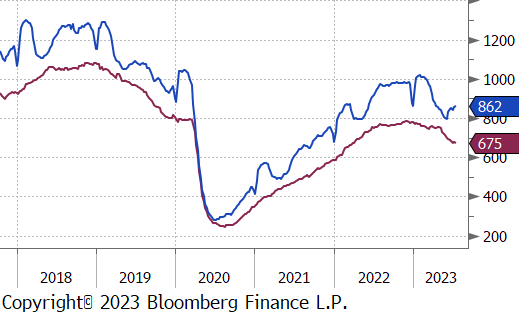

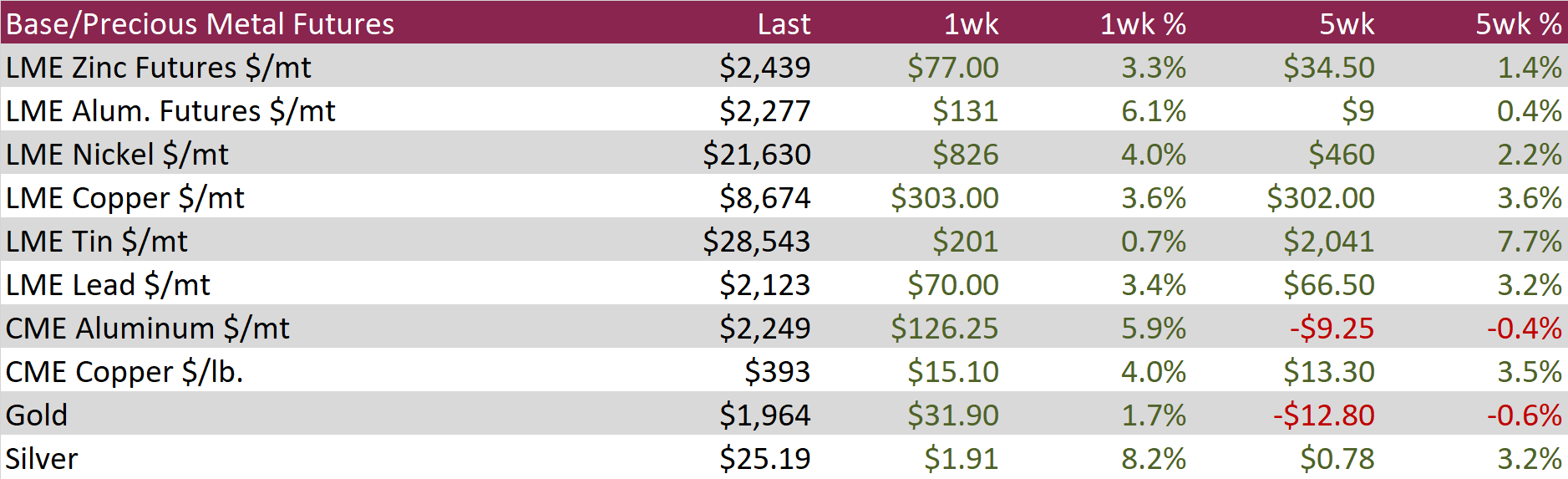

Aluminum rallied more than 6% this week, while copper gained more than 3% as a gauge of the US dollar fell to the lowest level since April 2022, making commodities cheaper for buyers in other currencies. Aluminum rebounded from a 10-month low as a heat wave is stretching electricity supplies in China’s Sichuan province, threatening local industrial production including aluminum smelting. Exchange inventories are still hovering near multi-year lows.

Copper climbed to a three-week high with the US Dollar easing after posting its biggest decline months. US Inflation data slowed, sparking hopes that the Federal Reserve could begin winding down its interest rate hikes. Copper was further buoyed by hopes that China would further stimulate the economy, boosting the demand for industrial metals. Copper inventories held in LME warehouses are hovering nearing the lowest level in 4 months.

Silver was the strongest performer of all industrial and precious metals, rallying more than 8% to notch its largest one-week net and percentage gain since March. Silver futures have rallied for 3 consecutive weeks mostly on the back of a weaker dollar and in hopes that the Fed Reserve will slow or pause its pace of interest rate hikes. Gains were further fueled by expectations of increased demand for industrial metals on the back of China stimulus.

In addition to CPI and PPI data (above), this week provided additional inflation related data. During times of economic uncertainty, customer surveys serve as valuable insights into the mindset of American consumers, providing context for potential downturns. The University of Michigan consumer sentiment survey holds particular significance as one of the most reputable and closely monitored surveys. The preliminary data for July showed promising indicators for current economic activity and future expectations, boding well for economic growth. However, the increasing expectations for growth also bring concerns about inflation in the near term, with the rate surpassing economist projections of 3% and reaching 3.4%. Federal Reserve Chair Jerome Powell has consistently highlighted the FOMC’s worry over consumer expectations for inflation becoming untethered from their 2% inflation target. Presently, the expectations remain within an acceptable range for the committee, but if they continue to stay elevated, this may keep the FOMC in a hawkish stance, leading to higher interest rates for a prolonged period.

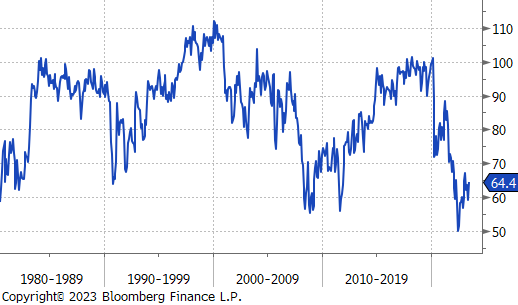

Global currency markets experienced notable movements recently. Weaker-than-expected US inflation data and signs of a potential end to the Federal Reserve’s policy tightening cycle influenced market sentiments, leading to overall U.S. dollar weakness, down $2.31 last week, ending below $100 for the first time since March 2022. Meanwhile, central banks in different regions faced unique challenges in managing inflation and interest rates. The British pound (GBPUSD) reached $1.31, its highest level since April 2022, as investors found it increasingly attractive due to a widening interest rate advantage over other developed economies. In the UK, rising wage growth added pressure on the Bank of England to continue raising interest rates. The euro (EURUSD) consolidated its gains above $1.12, hitting a high not seen since February 2022. In the Eurozone, despite a slowdown in economic growth, concerns regarding inflation persisted, necessitating further efforts by the European Central Bank. In June, Eurozone inflation decreased to a 17-month low of 5.5%, but the core rate remained significantly above the ECB’s target of 2%. Currently, interest rates in the Eurozone stand at 3.5%, but derivative markets indicate that rates may peak just below 4% by year-end.