Flack Capital Markets | Ferrous Financial Insider

July 28, 2023 – Issue #390

July 28, 2023 – Issue #390

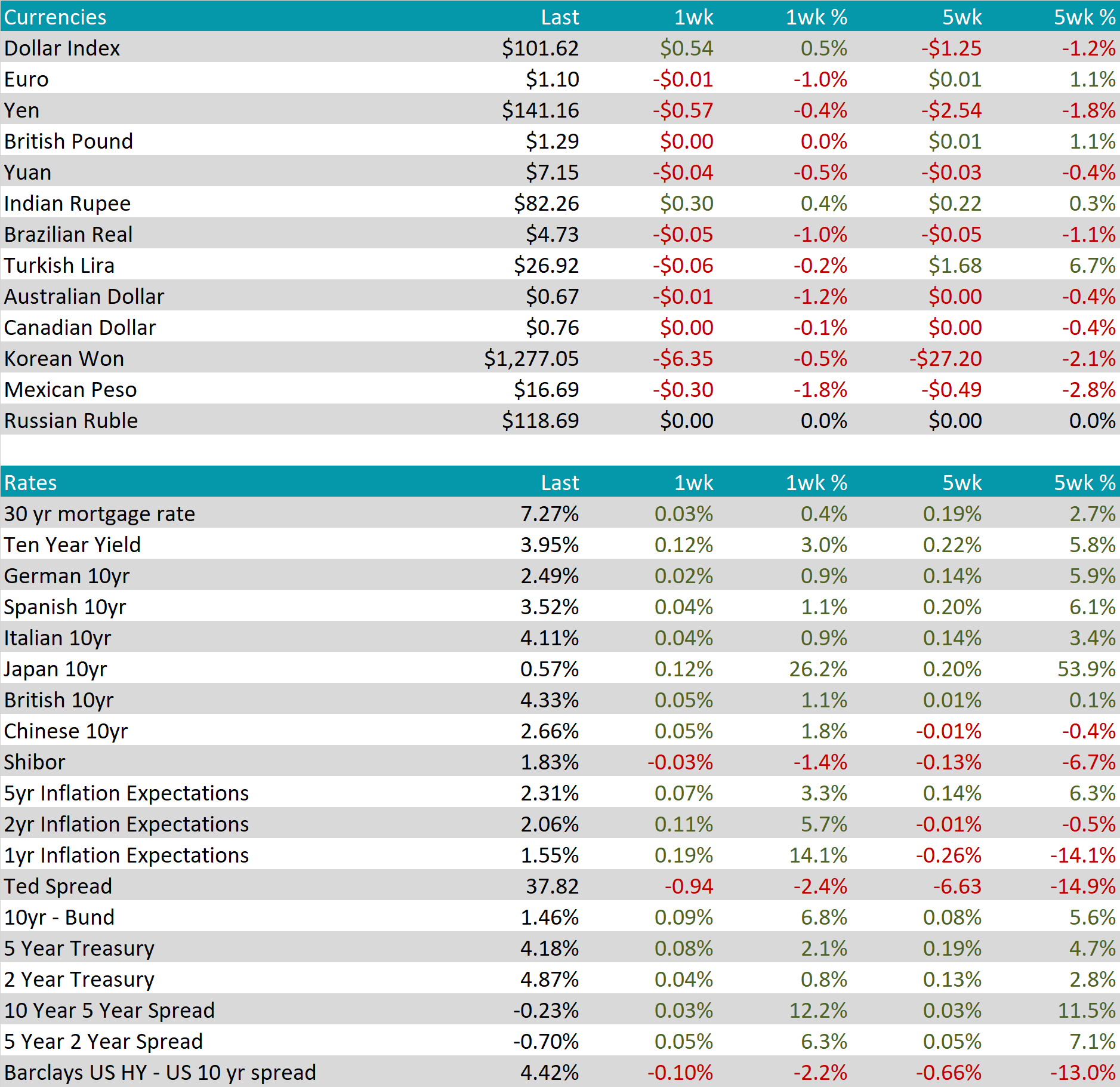

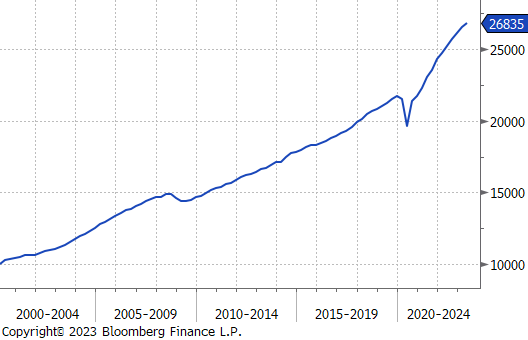

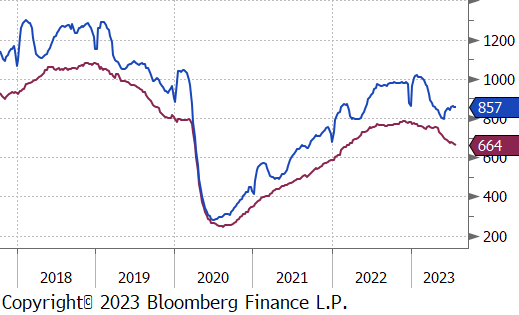

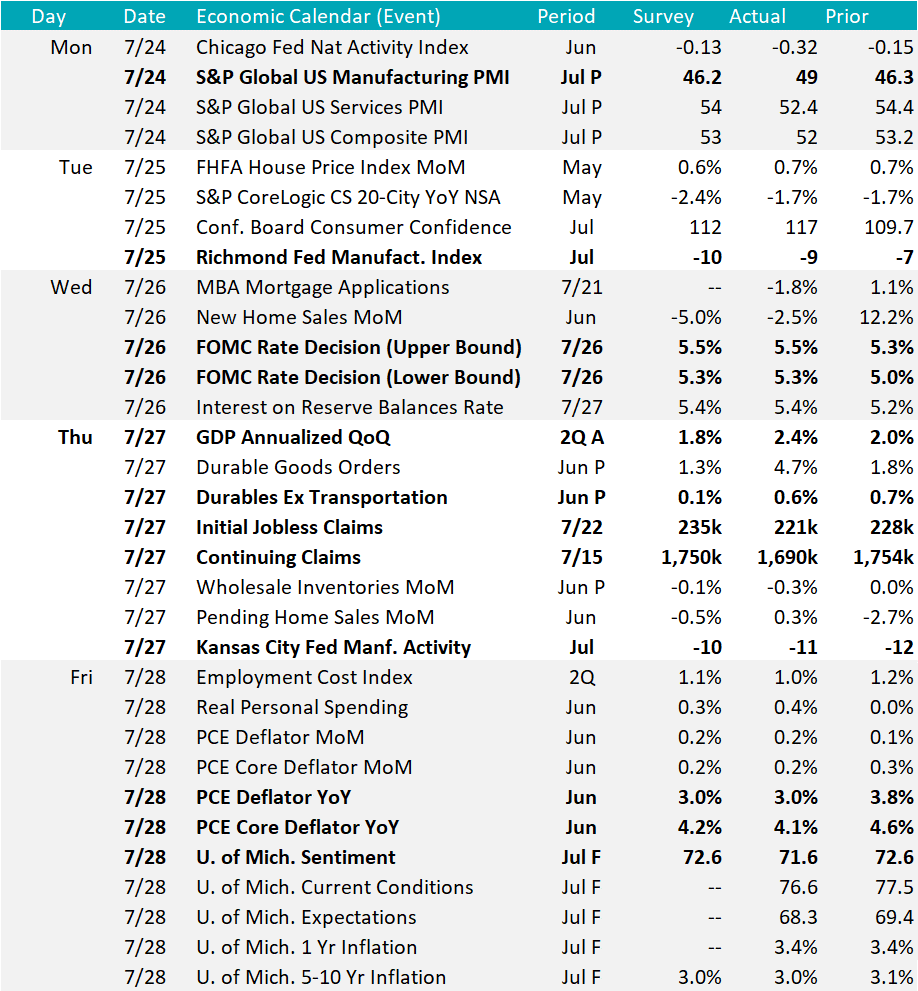

While the first week of the month is always the most important for economic data in the steel market, it is possible that with hindsight, this week of data will be one of the most meaningful for the broader economy over the next couple of months. Most importantly, the 2nd quarter US GDP far exceeded expectations with 2.4% growth compared to Q1, largely driven by robust consumer spending. Additionally, the best-case scenario of a “soft landing”, which seemed unlikely at the end of 2022, is starting to come into focus. YoY Core PCE Inflation came down to 4.1% in June, slightly below expectations of 4.2%. While this is still double the FEDs target, the 2nd chart on the right shows how this month’s print finally broke below the 4.5% level. Coupled with low jobless claims and a resilient job market, it should be expected that the FED will hold rates higher for longer to ensure that inflation does not rebound.

The emphasis on higher interest rates, influenced by a strong service sector, disproportionately affects manufacturing and industrial sectors due to increased risks associated with manufacturing, inventory, and carrying expenses. Since we know the Federal Reserve is likely to maintain this restrictive rate approach, given stable conditions in the broader economy and labor market, steel consuming sectors need to be proactively prepared for how to operate effectively in this new environment.

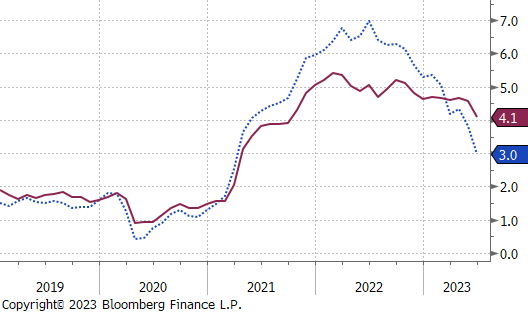

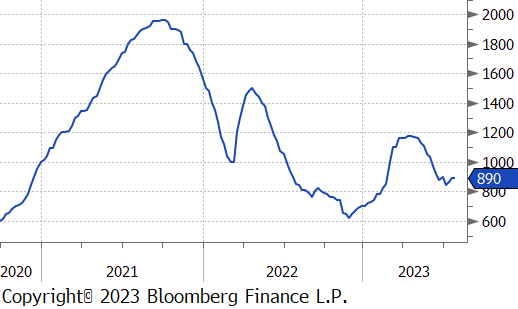

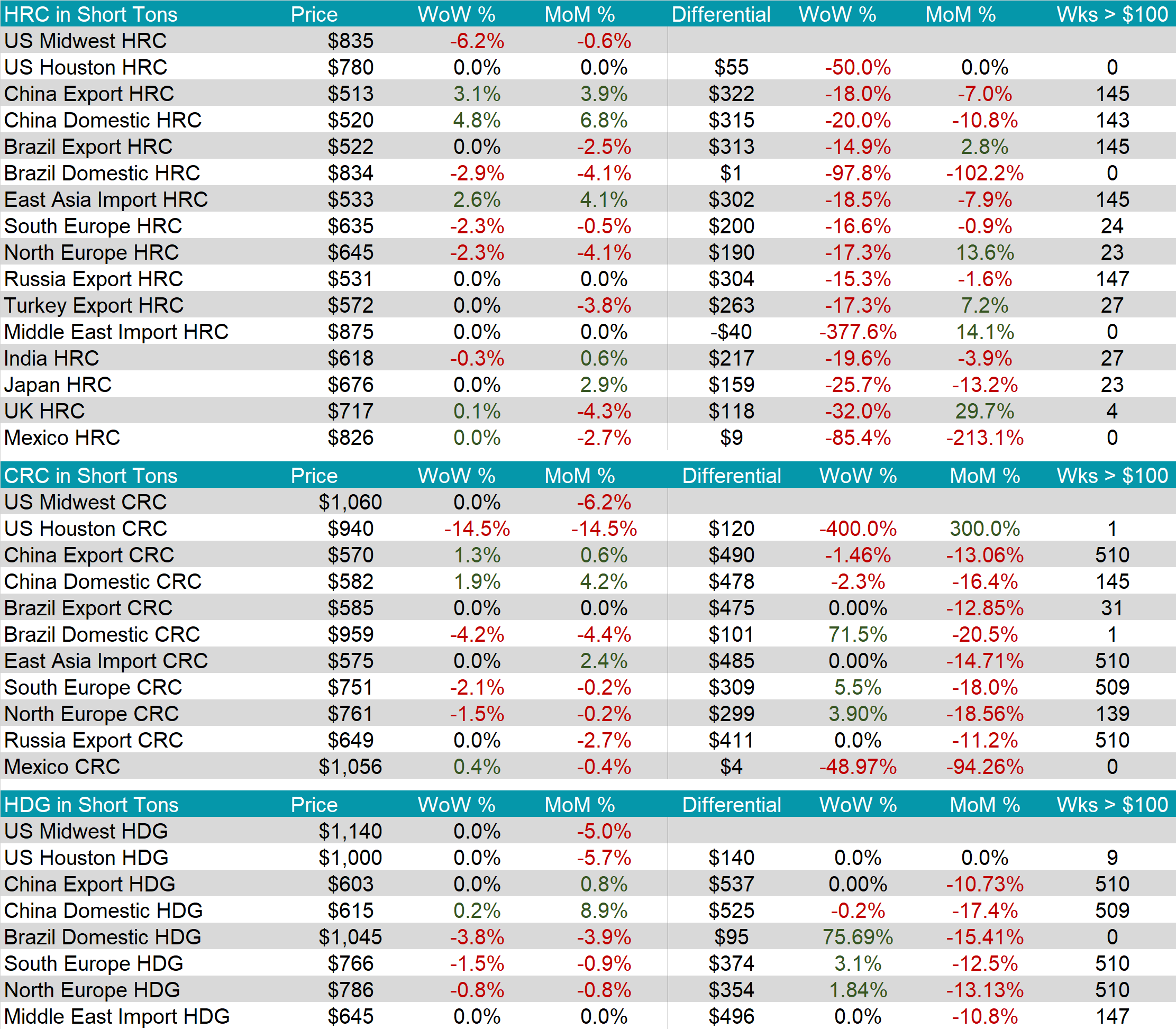

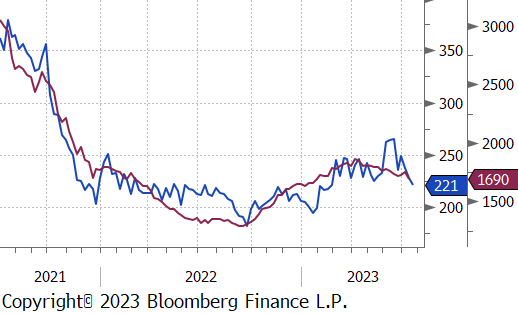

Both the spot and 2nd month future HRC prices fell this week. The spot price down $55 or 6.2%, and the future price lost $45 or 5.3%. Even with this week’s sharp move lower, these prices are above fundamental support levels and we do not anticipate higher prices until they fully converge.

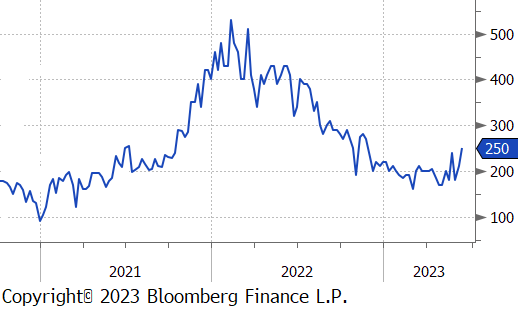

Tandem products were unchanged this week, however, the expectation for further downward pressure here as well. The current spread between HDG and HRC at $215 is elevated compared to historical norms.

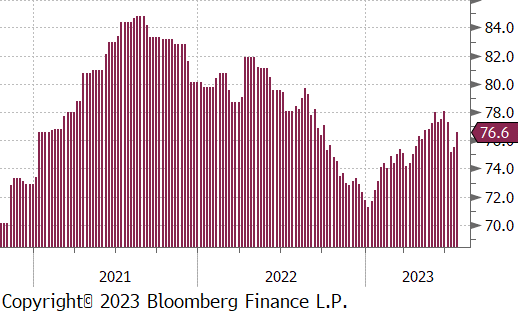

Mill production jumped this week, with capacity utilization up 1.1% to 76.6%. This is the second week of higher utilization, but the current level is still in a neutral position.

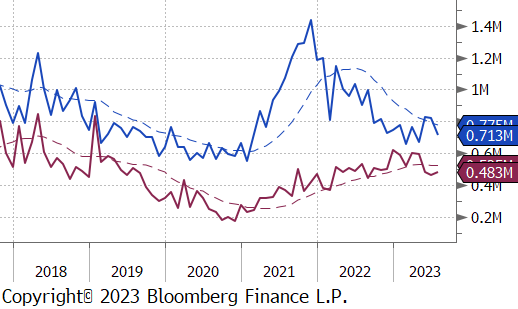

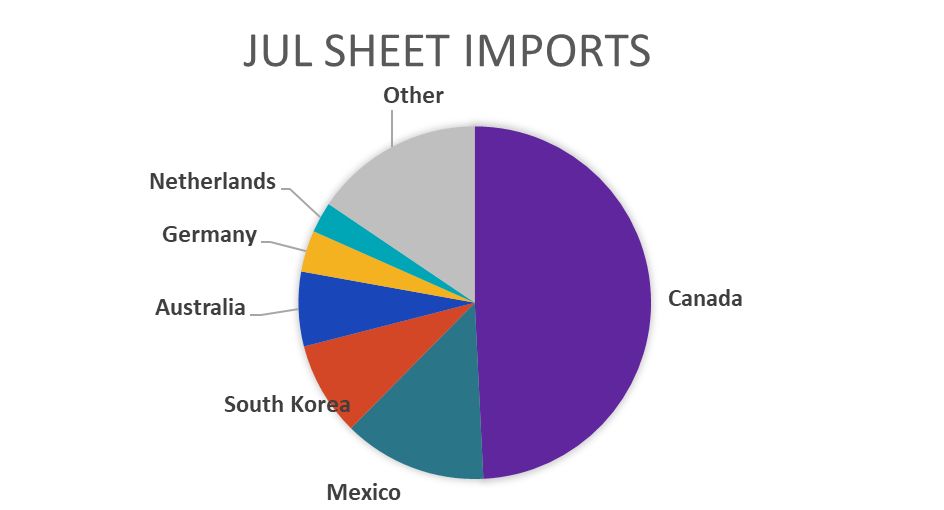

July Projection – Sheet 713k (down 109k MoM); Tube 483k (up 18k MoM)

June Census Data – Sheet 822k (down 35k MoM); Tube 465k (up 13k MoM)

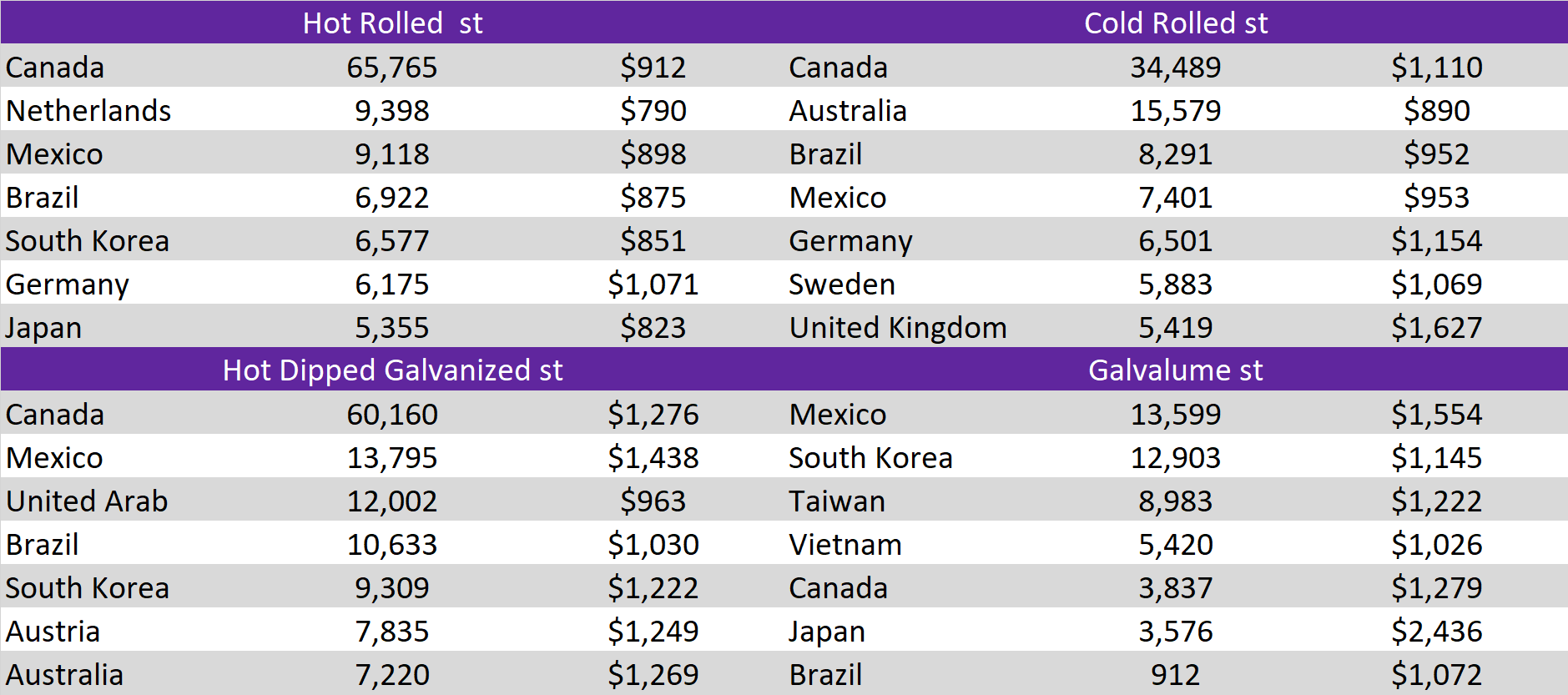

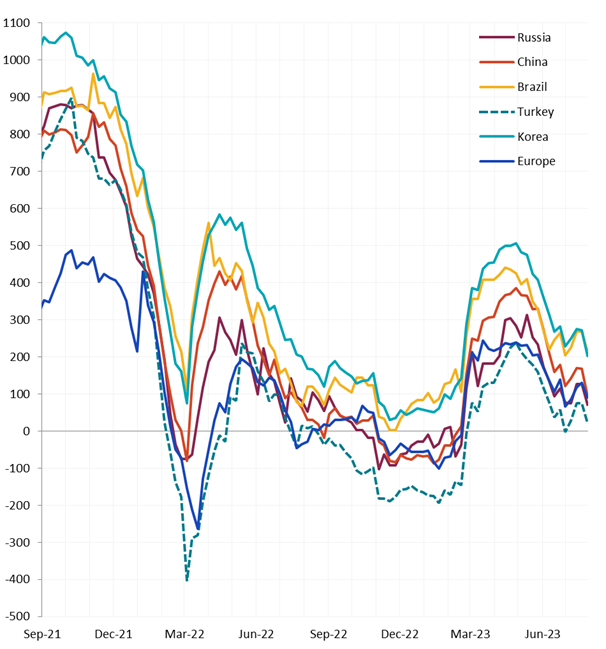

Global Differentials fell this week, along with the U.S. domestic price. Even with the sharp move lower, all of the watched differentials remain above the zero line, which means that the U.S. price is high compared to the rest of the world.

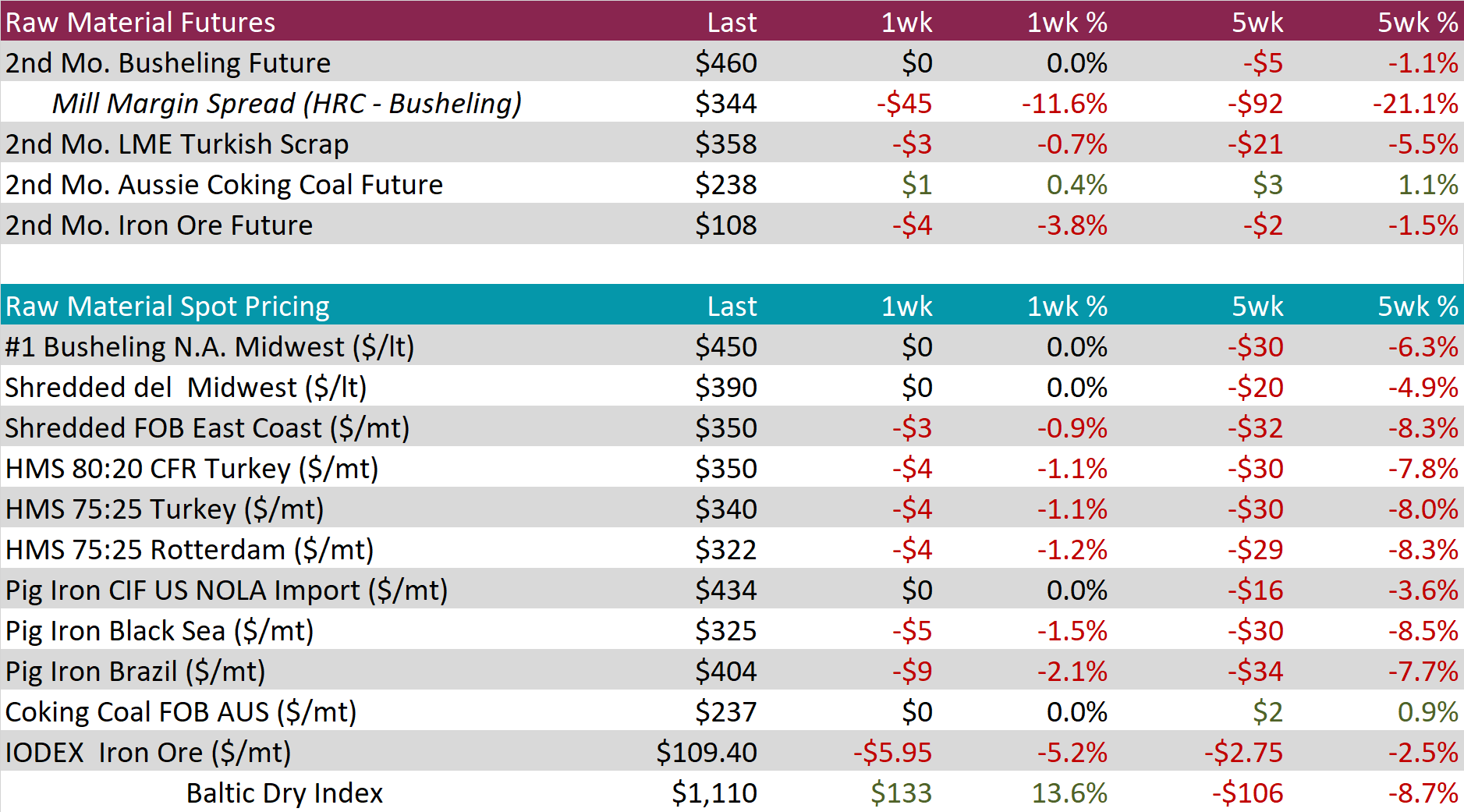

The scrap market was relatively quiet this week, with U.S. domestic spot prices and futures prices both unchanged for busheling. The sharp move lower in the HRC futures led to a further deterioration of the mill margin. However, the current level remains elevated compared to historic levels. As steel prices continue to fall, mill margin will offer an important signal for when the market has reached its bottom

The 2nd month iron ore future was down $4, or 3.8%, this week. This is a continuation of the recent trend where rumors of Chinese stimulus support prices, but eventually do not follow through and disappoint market expectations.

Dry Bulk / Freight

The Baltic dry index rebounded this week, up $133, or 13.6%.

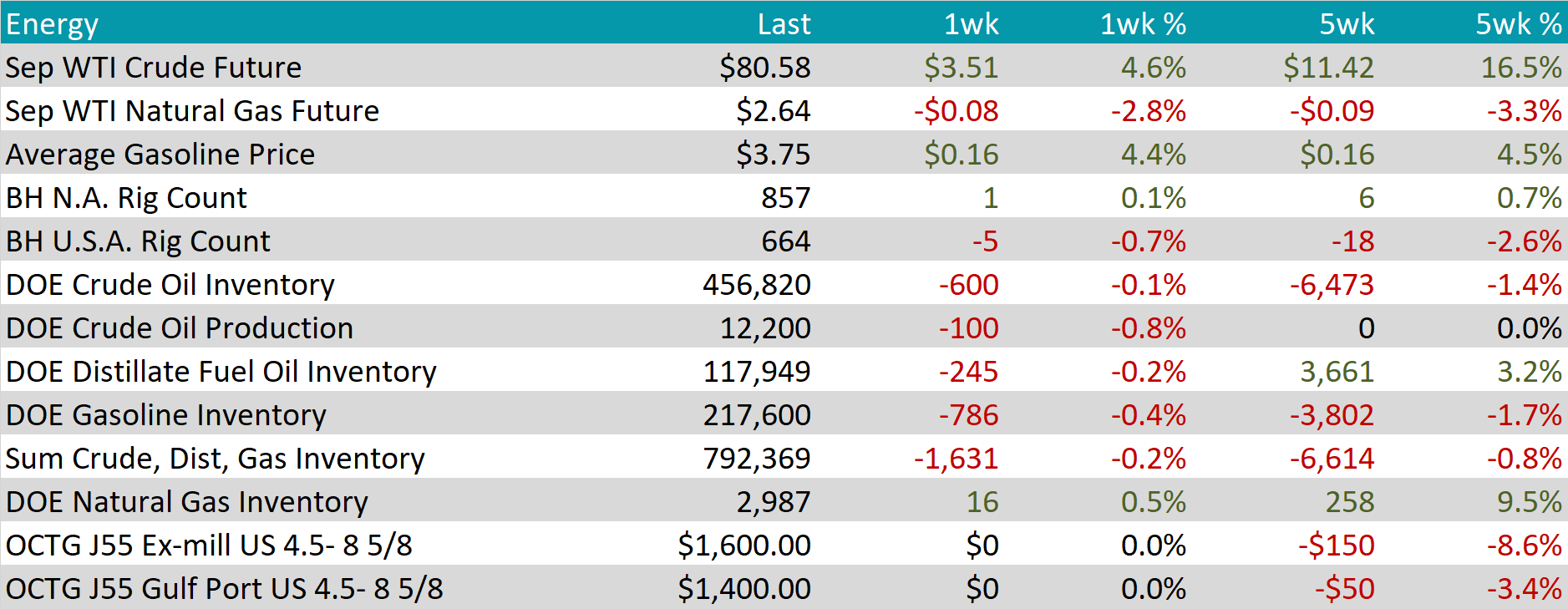

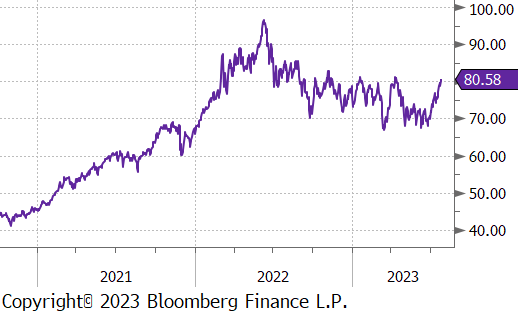

WTI crude oil future gained $3.51 or 4.6% to $80.58/bbl.

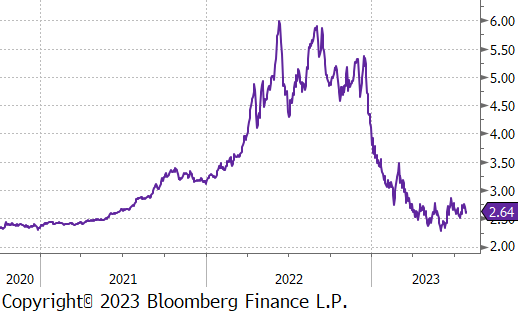

WTI natural gas future lost $0.08 or 2.8% to $2.64/bbl.

The aggregate inventory level was down another 0.2%, last week.

The Baker Hughes North American rig count was up 1 rig, while the U.S. count lost 5 rigs.

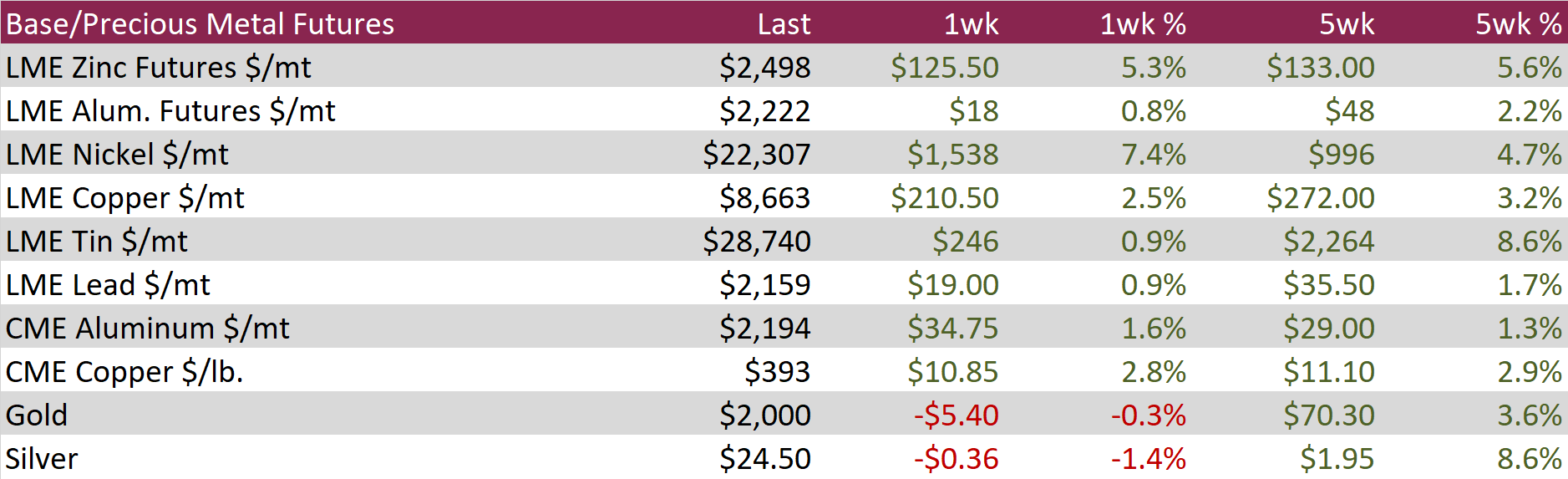

Aluminum futures rebounded by almost 1% alongside other base metals, benefitting from China’s indication of supporting its property market after the Chinese Communist Politburo meeting. However, compared to other base metals, aluminum’s performance was relatively weaker due to easing supply-side concerns. In China’s Yunnan province, smelters have resumed production after facing output limitations, and there are apprehensions about available stockpiles being mostly of Russian origin. Despite these challenges, aluminum managed to close higher for the week, showing resilience amid the evolving market dynamics.

Copper had an outstanding week, showcasing one of the strongest performances among all base metals. LME and COMEX futures surged by 2.5% and 2.8%, respectively. The red metal was particularly buoyed by optimism surrounding Chinese stimulus measures. Moreover, Codelco, a major copper producer globally, revealed a 14% decline in its first-half copper production and revised its annual copper production guidance lower. These factors contributed to the significant upswing in copper prices during the week.

Silver experienced a setback as COMEX Silver futures closed the week down by 1.4%. This came after an impressive 8.6% rally over the past five weeks. The demand for precious metals was bolstered by expectations that several central banks might be nearing the conclusion of their rate-hike campaigns.

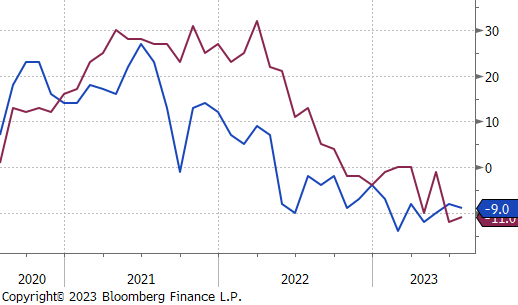

This week, we received more Fed Manufacturing surveys. Richmond printed below last month but better than expectations, while Kansas City printed above last month, though it was slightly below expectations. The overall takeaway between the two is that the manufacturing sector continues to contract, but underlying data suggests we may be approaching the bottom and could start seeing stabilization and growth in Q4.

Initial and continuing jobless claims both continued to recede, this signals that labor demand is still stable, albeit cooling.

The U.S. Dollar gained another $0.53 to $101.62. The British pound was down to $1.29 to its lowest point since July. Strong US second-quarter GDP figures made investors favor the USD instead.

The US 10-year Treasury yield rose 12 bps to 3.95%, reflecting a robust economy and reinforcing the likelihood of a strong stance by the Federal Reserve. In contrast, Japan’s 10-year government bond yield surged to 0.57%, the highest in nine years, attributed to the Bank of Japan’s move to allow the yield to surpass the previous 0.5% limit. This unexpected shift signifies a potential change in policy direction and normalization due to inflation and global interest rate pressures.