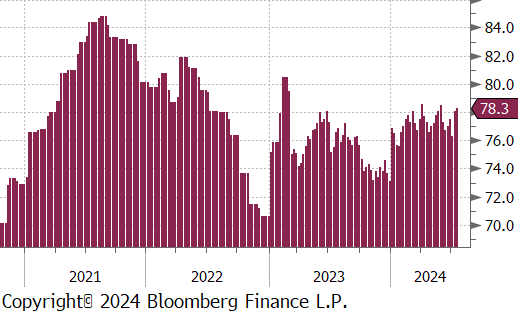

Flack Capital Markets | Ferrous Financial Insider

July 26, 2024 – Issue #442

July 26, 2024 – Issue #442

Overview:

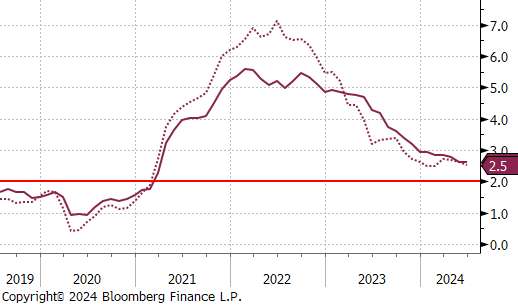

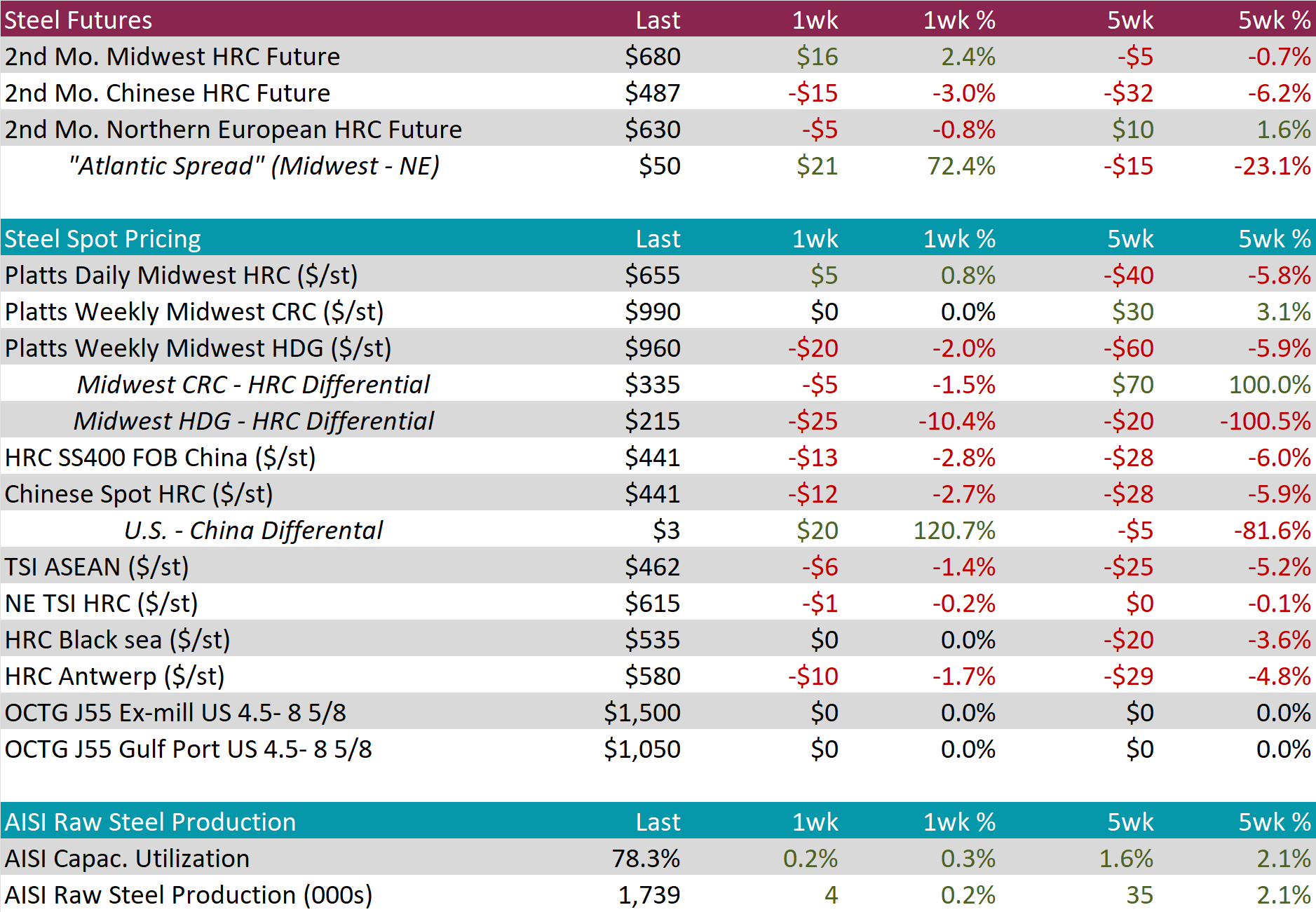

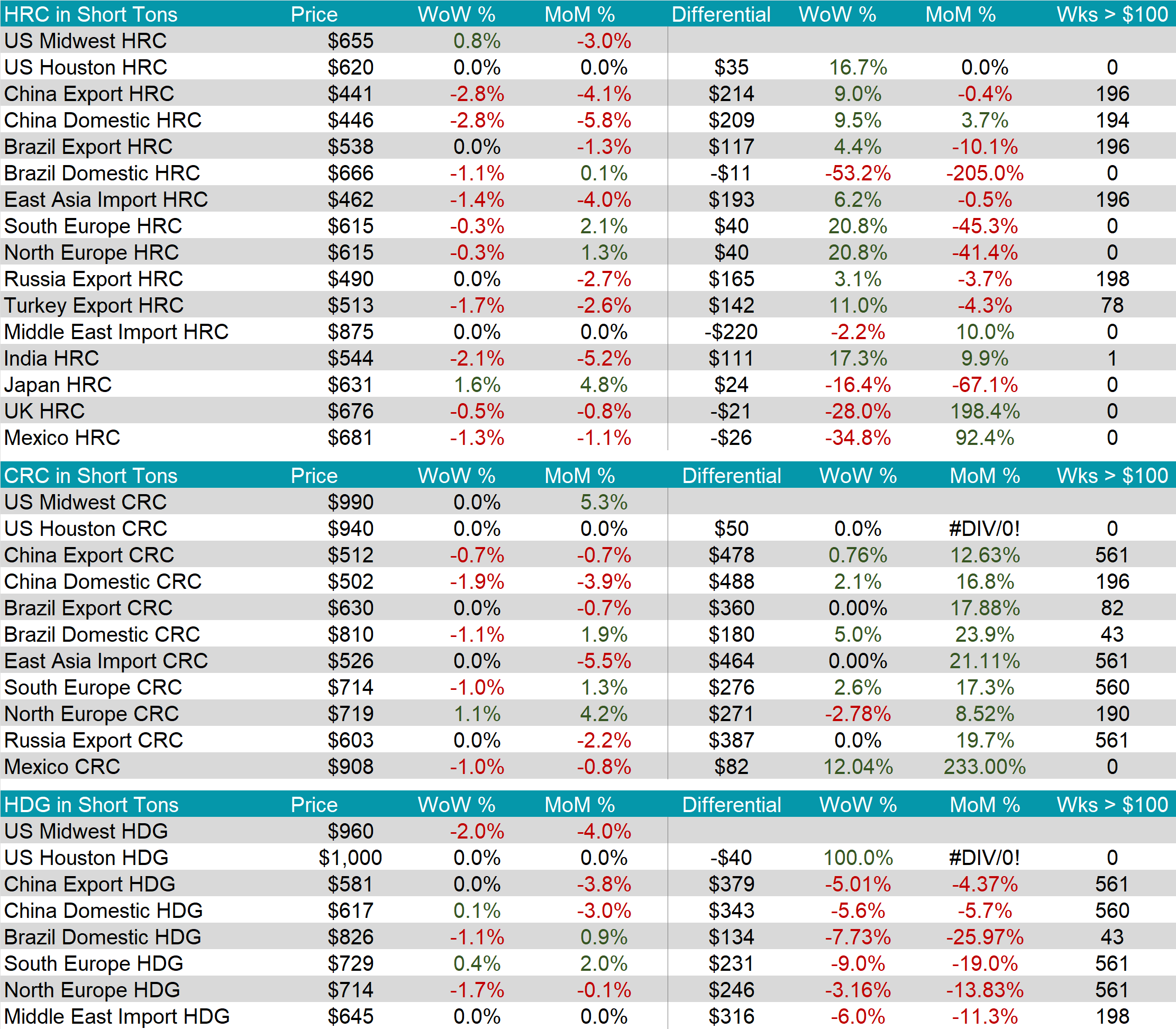

The HRC spot price rose by $5 or 0.8% to $655, marking the first price increase in fourteen weeks. However, the five-week price change continues to be down, -$40 or -5.8%. The HRC 2nd month future also increased, rising by $16 or 2.4% to $680, the first increase after two consecutive weeks of price declines.

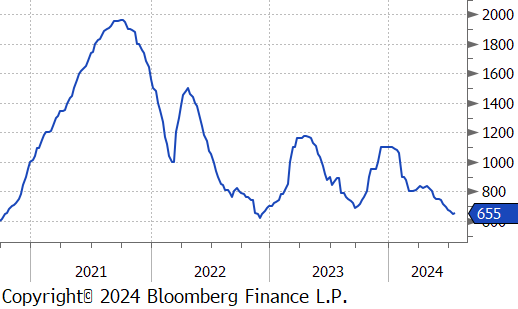

Tandem products were mixed, with CRC remaining unchanged and HDG falling by $20, resulting in the HDG – HRC differential dropping by $25 or -10.4% to $215.

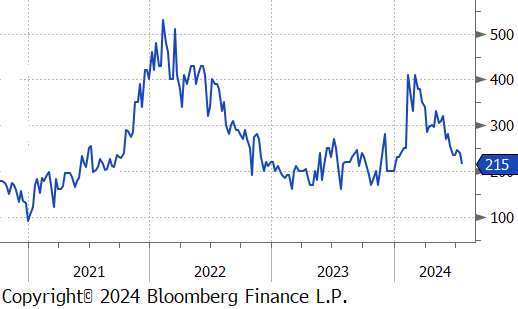

Mill production inched up further, with capacity utilization ticking up by 0.2% to 78.3%, bringing raw steel production to 1.739m net tons.

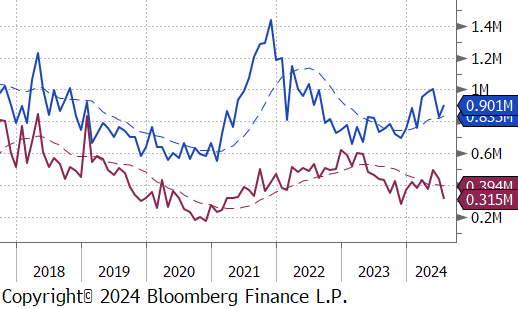

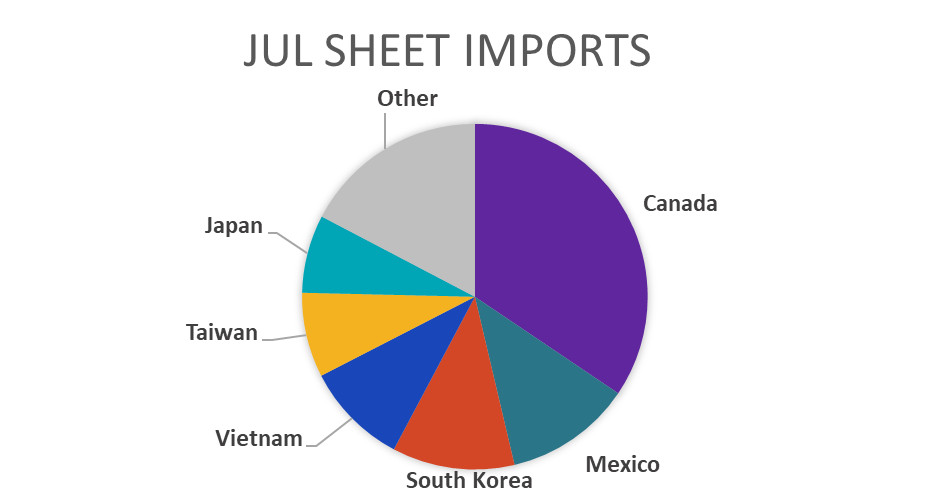

July Projection – Sheet 901k (up 76k MoM); Tube 353k (down 60k MoM)

June Census – Sheet 825k (down 179k MoM); Tube 414k (down 80k MoM)

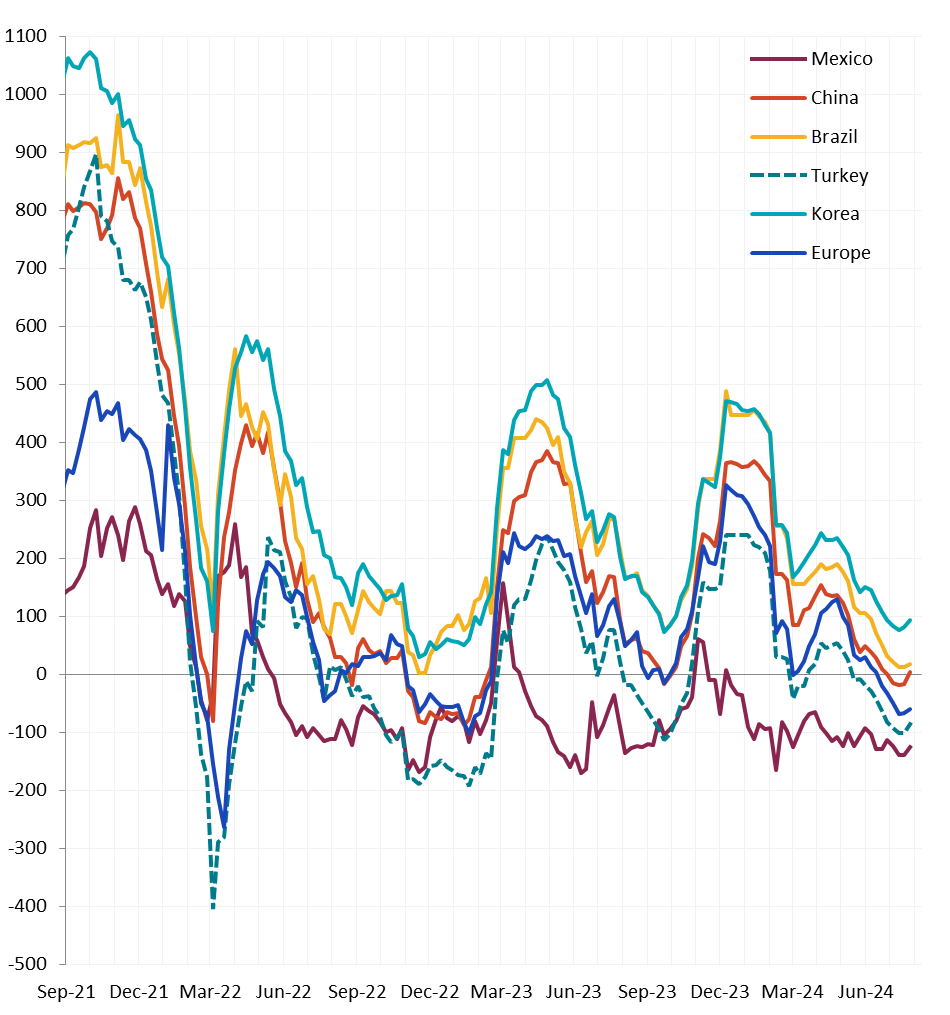

All watched global differentials mainly expanded slightly this week, with China Domestic and Export HRC dropping by -2.8%, Korea HRC down by 1.4%, and Turkey Export HRC falling by 1.7%.

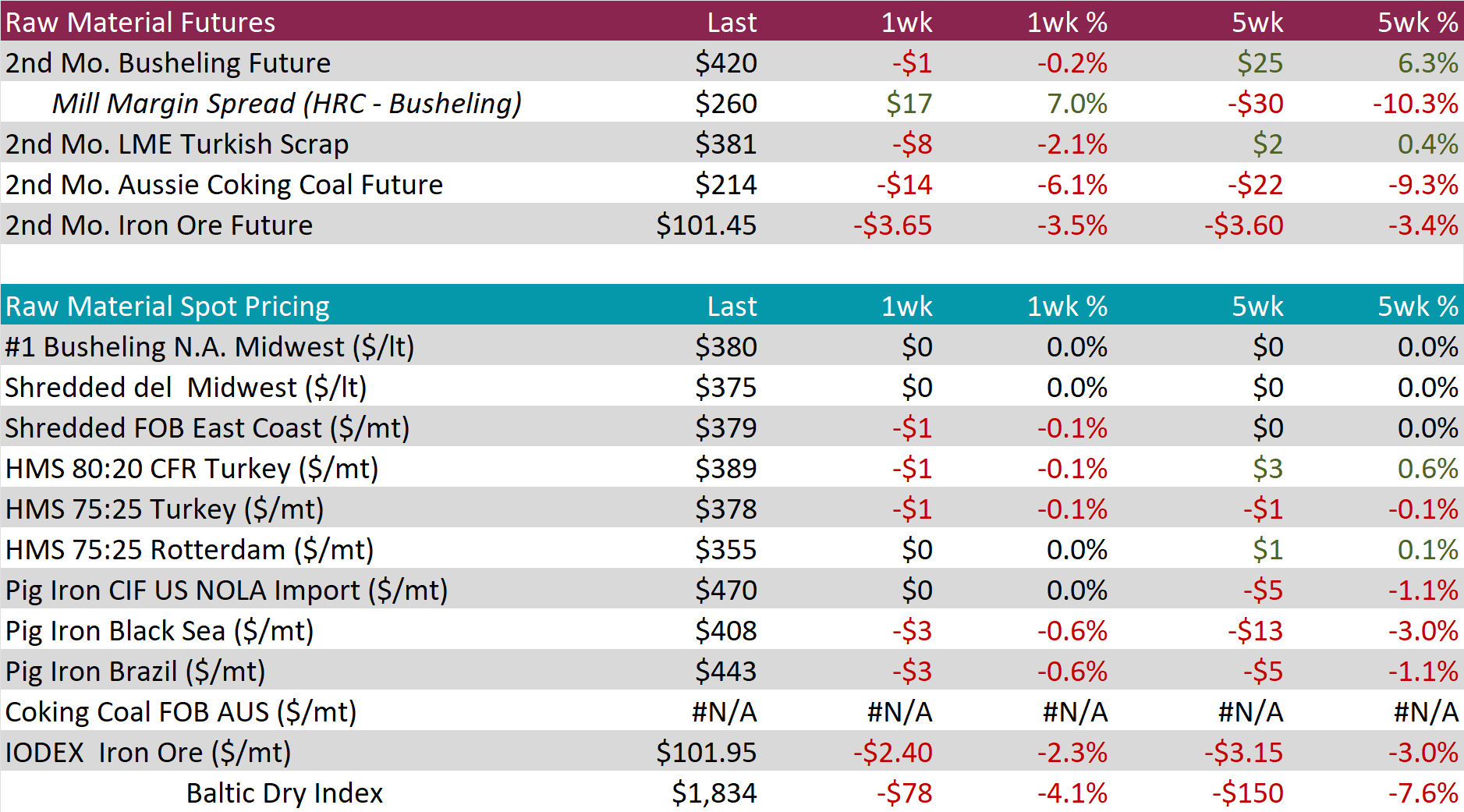

Scrap

The 2nd month busheling future dipped down by $1 or -0.2% to $420, marking the first price decline in five weeks, resulting in the five-week price change to still be up, by $25 or 6.3%.

The Aussie coking coal 2nd month future fell by $14 or -6.1% to $214, marking the third consecutive week of price declines and hitting the lowest price since July 2022.

The iron ore 2nd month future edged down by $3.65 or -3.5% to $101.45, similarly marking the third consecutive week of price decline and hitting the lowest price since early April.

Dry Bulk / Freight

The Baltic Dry Index declined for the second consecutive week, falling this week by $78 or -4.1% to $1,834, reaching its lowest price since late May.

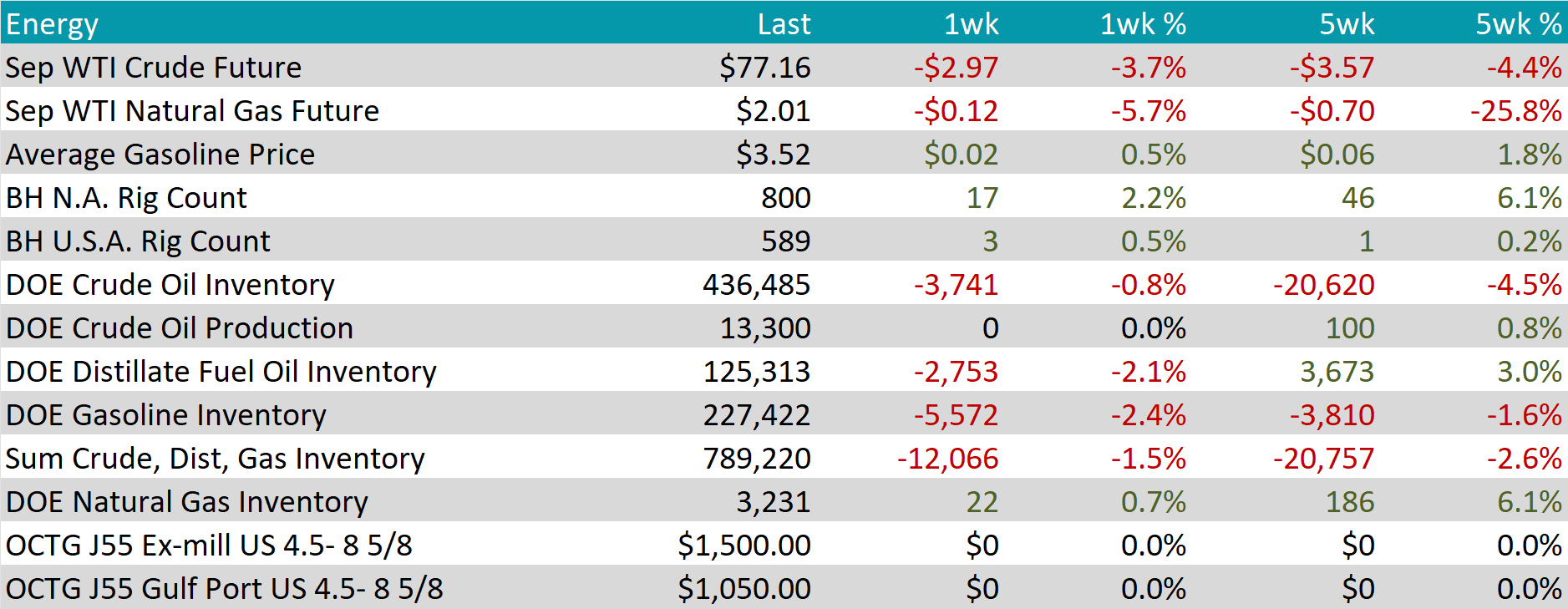

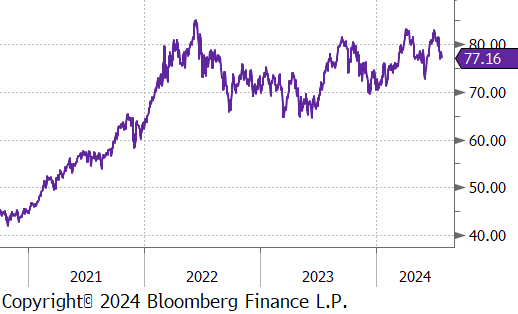

WTI crude oil future lost $2.97 or -3.7% to $77.16/bbl.

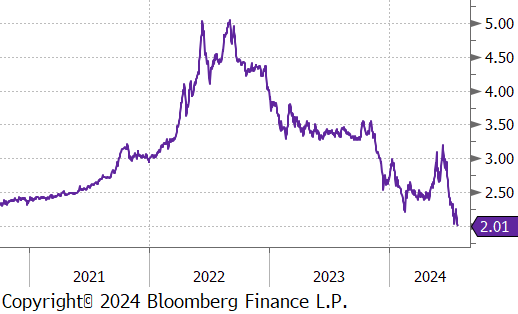

WTI natural gas future lost $0.12 or -5.7% to $2.01/bbl.

The aggregate inventory level experience a decline of -1.5%, hitting its lowest level since December 2023.

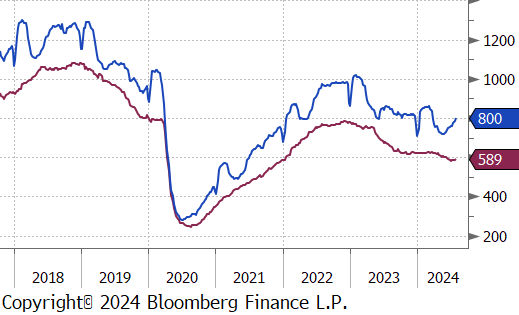

The Baker Hughes North American rig count added 17 rigs, bringing the total count to 800 rigs – its highest level since March. The US rig count also increased, adding 3 rigs, bringing the total count to 589 rigs.

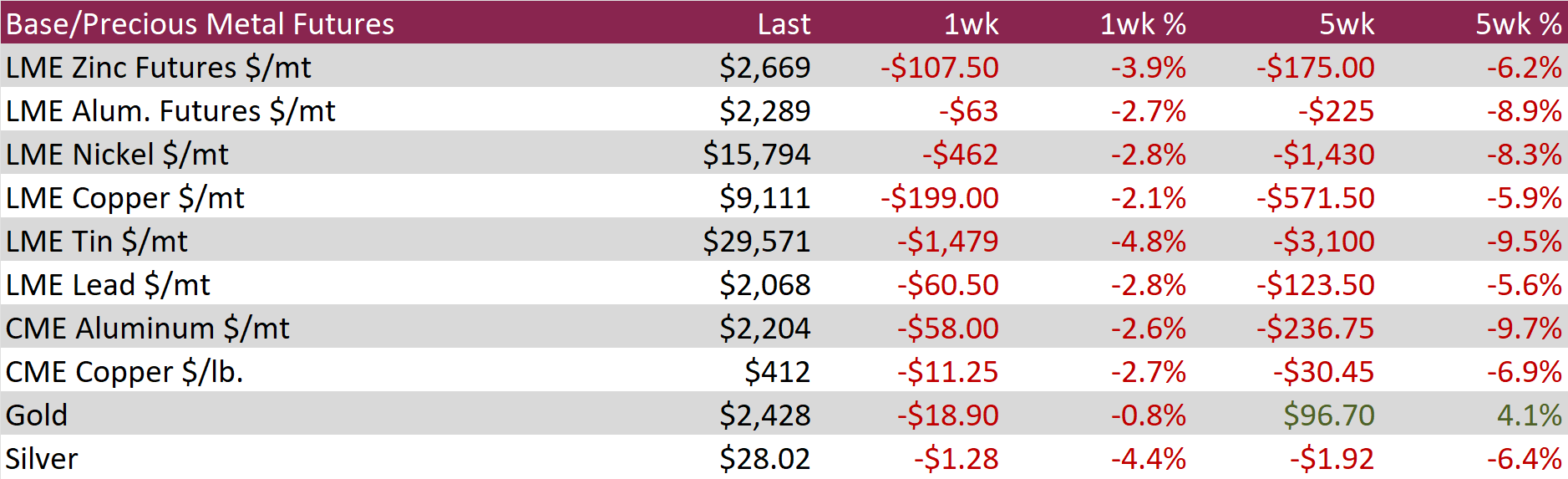

Aluminum futures dropped by $107.50 or -3.9% to $2,669, the lowest in over three months, mirroring a broader selloff in base metals driven by weak demand and ample supply from China. Improved hydropower availability in Yunnan, due to increased rainfall, enabled smelters to restart idled capacity, alleviating previous concerns about dry weather disrupting operations. Consequently, China’s primary aluminum output rose by 6.2% annually in June, reaching 3.76 million tonnes, the highest since November 2014. Meanwhile, economic data indicated that domestic demand for factory goods in China remained subdued. The NBS manufacturing PMI showed consecutive contractions in June, and a 109% surge in alumina exports suggested that manufacturers were increasingly reliant on export markets.

Copper futures fell by $11.25 or -2.7% to $412, reaching their lowest level in nearly four months due to escalating demand concerns from China, the top consumer. The Chinese government refrained from introducing stimulus measures to address the significant slowdown in its manufacturing sector. Instead, it emphasized a shift away from construction and traditional industries towards advanced technologies and new energies. This lack of economic support led to a market selloff in assets and base metals contracts, prompting the People’s Bank of China to implement substantial rate cuts. The market downturn was exacerbated by concerning factory activity data. The NBS manufacturing PMI contracting for a second consecutive month in June, forced smelters and factories to depend on foreign demand for growth, evidenced by a 187% annual surge in copper exports during this period. Additionally, the potential for trade barriers from the U.S. and Europe intensified the bearish sentiment.

Gold declined by $18.90 or -0.8% to $2,428. Expectations of rate cuts from the Federal Reserve continue to impact. The June US PCE reading, the Fed’s preferred inflation measure, met forecasts, but the core rate increased by 0.2%, slightly above the anticipated 0.1%. Despite this, markets remained confident in upcoming rate cuts, fully pricing in a reduction for the September meeting and expecting two additional cuts by year’s end. Rising geopolitical tensions in the Middle East further bolstered safe-haven assets like gold.

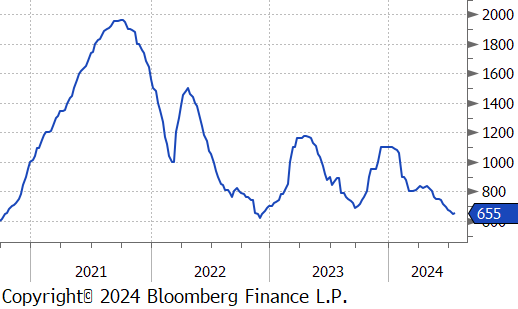

The most important release from this week was the upside surprise in Q2 GDP, printing up to 2.8%, well above expectations for a slightly rebound to 2.0% and up from the Q1 reading of 1.4%. The only component which was a drag on the economy was net exports which were down 0.7%. Consumption was the primary driver again, up 2.3%, and a continued encouraging signal of overall resilience.

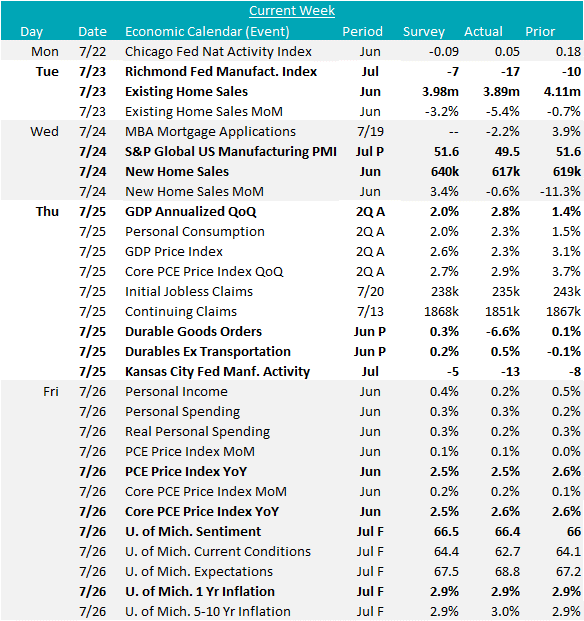

On the industrial side, data was far less rosy. In manufacturing, we saw the S&P Global Manufacturing PMI well below expectations, printing at 49.5, slightly into contraction territory, after expectations were for a flat print at 51.6. Additionally, both the K.C. and Richmond Fed Manufacturing Surveys came in well below expectations, also printing lower MoM, at -13 versus expected -5, and -17 versus expected -7, respectively. Finally, the preliminary topline Durable Goods New Orders data showed the steepest MoM decline since the pandemic, down 6.6% and well below the expected 0.3% rise. Taking a step back, (ex. Transportation) data, suggests this is a transportation issue, as underlying orders have been mostly improving since January.

On the housing front, June’s New Home and Existing Home Sales both disappointed as well. New printed -0.6% versus an expected increase of 3.4%, and existing came in at -5.4% versus an expected -3.2%, respectively. Low overall inventories and affordability concerns continued to negatively impact this sector.

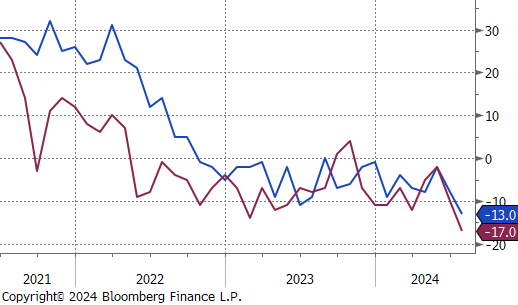

On the inflation side, Core PCE, the FED’s preferred gauge came in slightly higher than expected, up 0.2% MoM, resulting in a flat YoY reading at 2.6%, versus the expected 2.5%. Along with anchored U. of Mich. 1yr Inflation Expectations at 2.9%, the window for a cutting cycle appears to be broadening.