Flack Capital Markets | Ferrous Financial Insider

March 1, 2024 – Issue #421

March 1, 2024 – Issue #421

Overview:

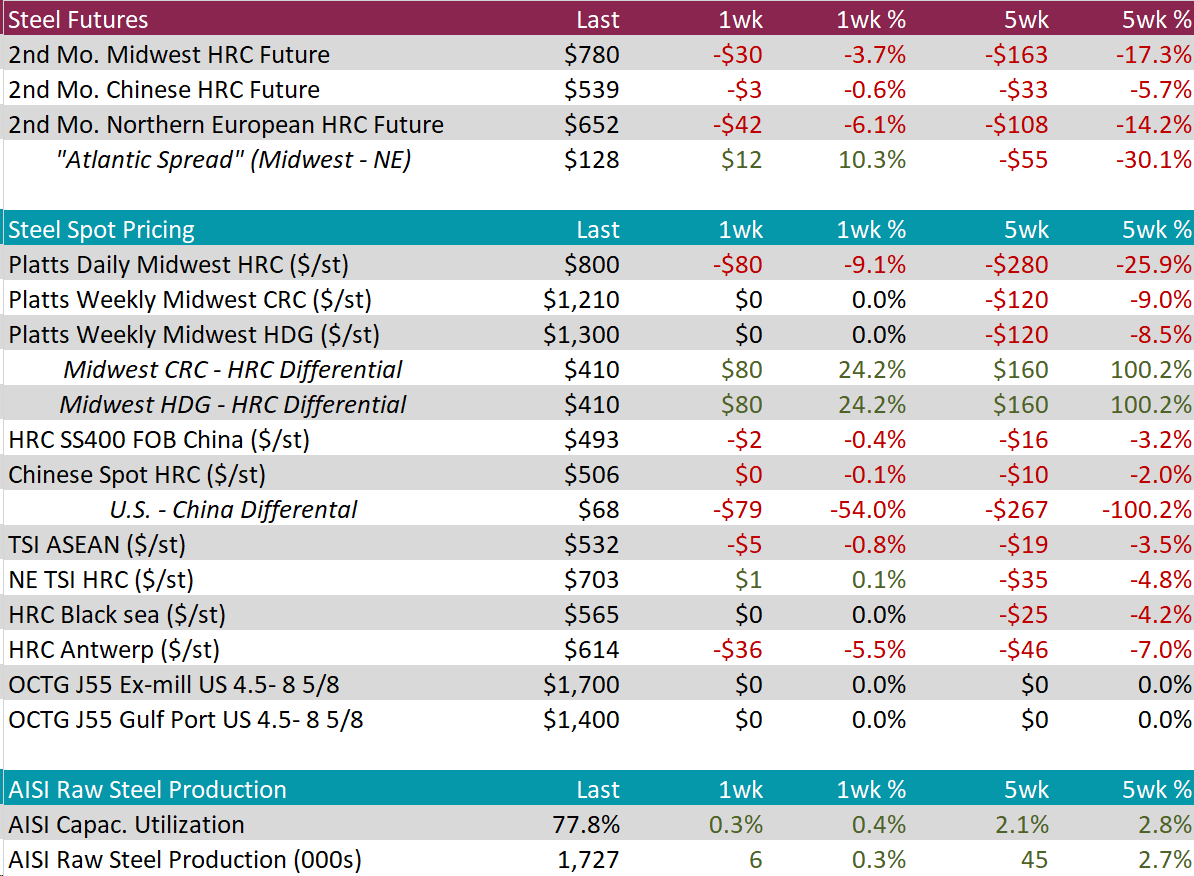

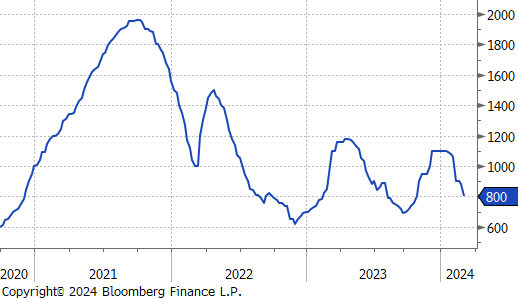

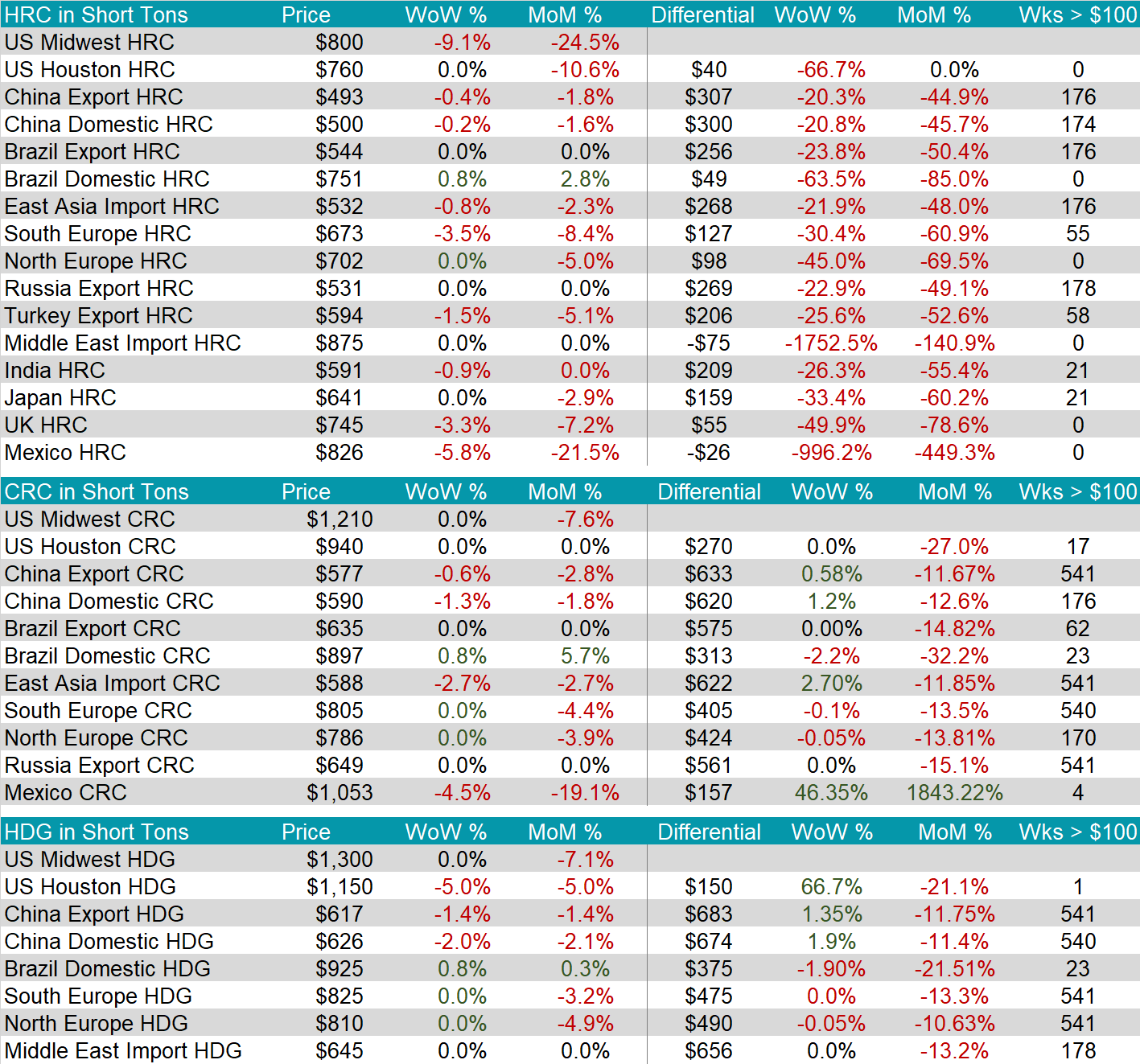

The HRC spot price declined further, falling by $80 or -9.1% to $800, marking a total of -$300 price decline since peaking at $1,100 seven-weeks ago. Meanwhile, the 2nd month future was down $30 or -3.7% to $780, reaching its lowest price since mid-October 2023.

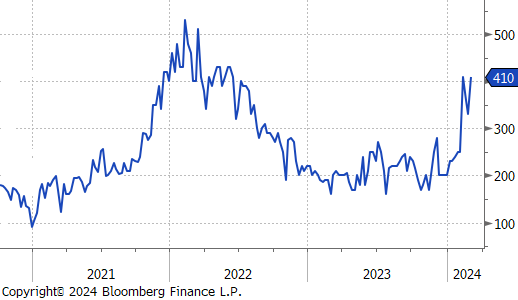

Tandem products both remained unchanged this week, resulting in the HDG – HRC differential to go up by $80 or 24.2% to $410.

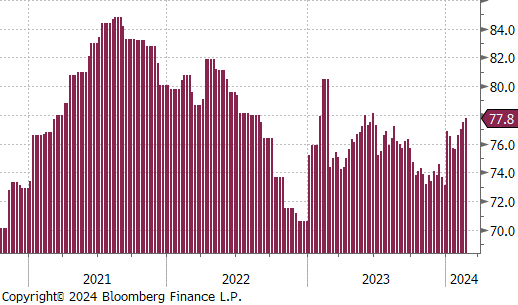

Mill production continued to ramp up from relatively low levels, with capacity utilization ticking up by 0.3% to 77.8%, bringing raw steel production up to 1.727m net tons.

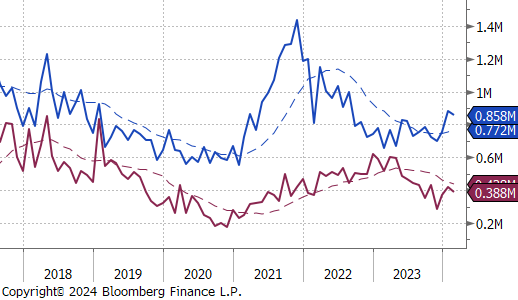

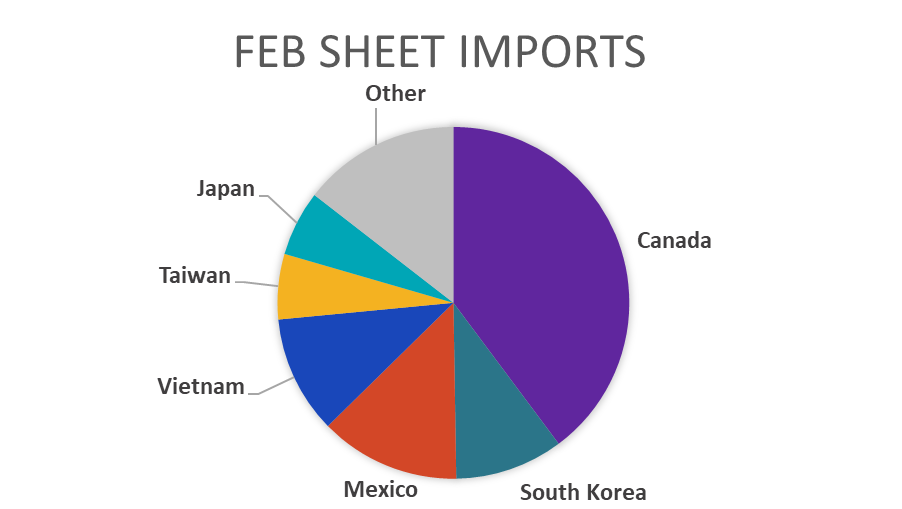

February Projection – Sheet 858k (down 24k MoM); Tube 388k (down 33k MoM)

January Projection – Sheet 882k (up 129k MoM); Tube 420k (up 49k MoM)

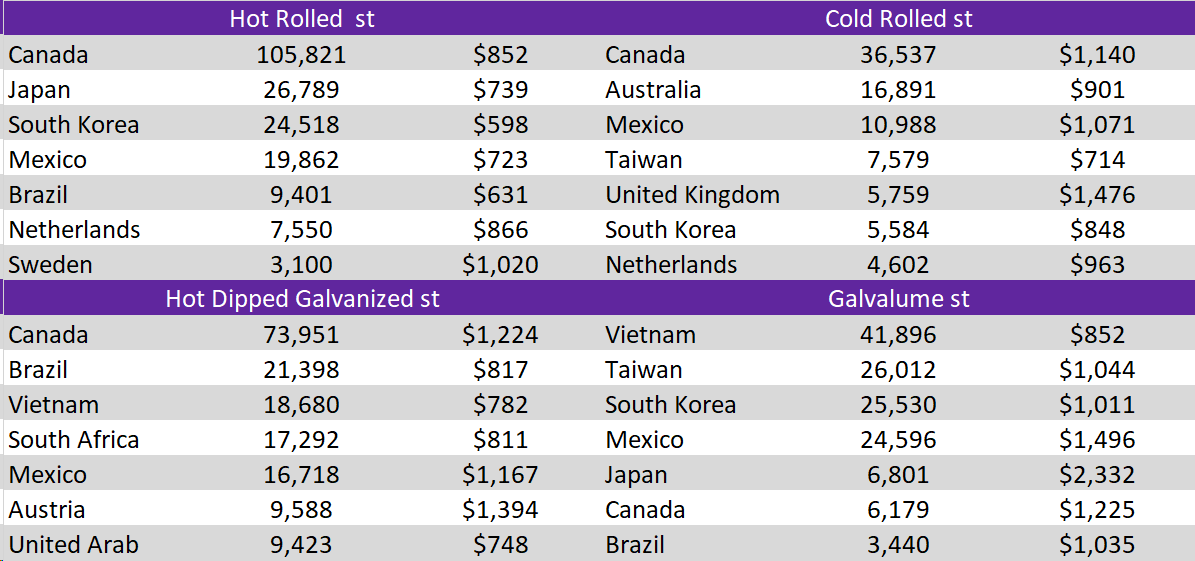

January arrivals hit the highest level of imports since August 2022.

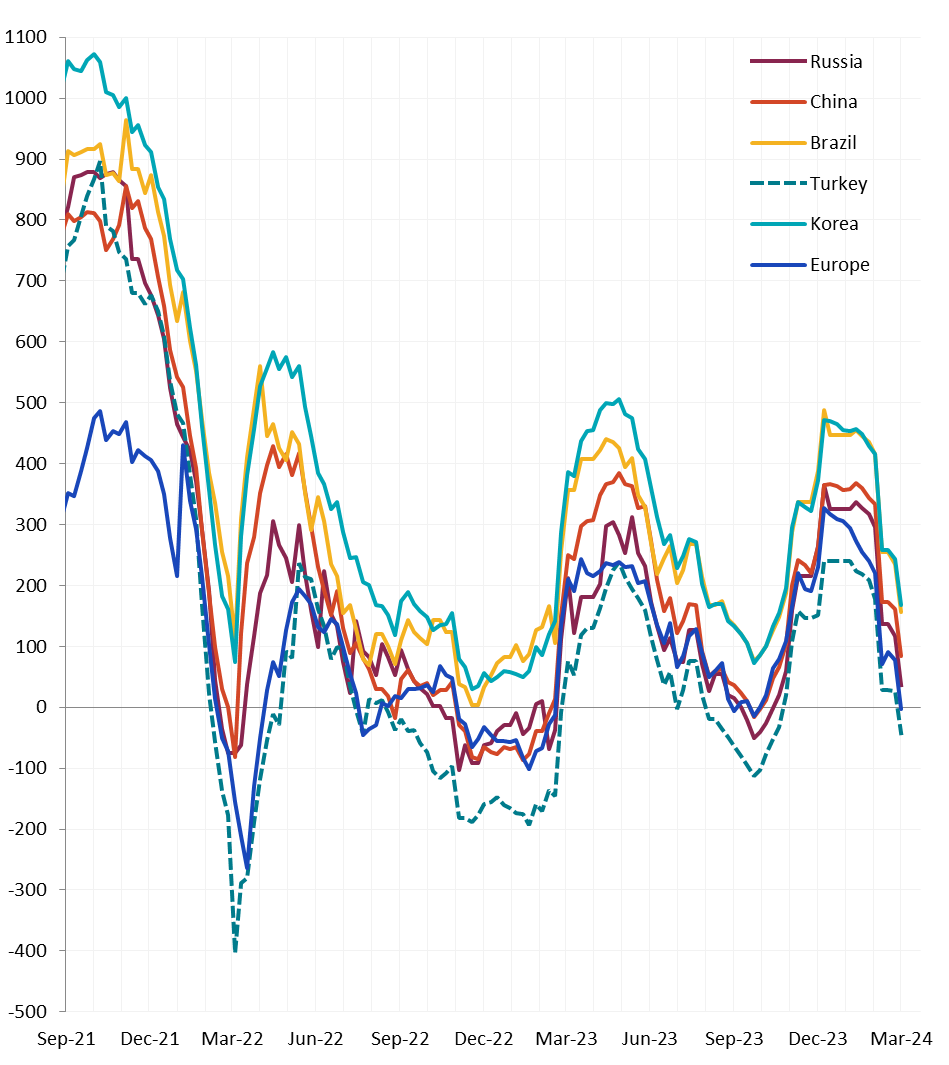

All watched global differentials contracted further this week, with the Europe HRC experiencing the biggest price decline of -3.5% and the Brazil Domestic HRC being the only price increase of 0.8%.

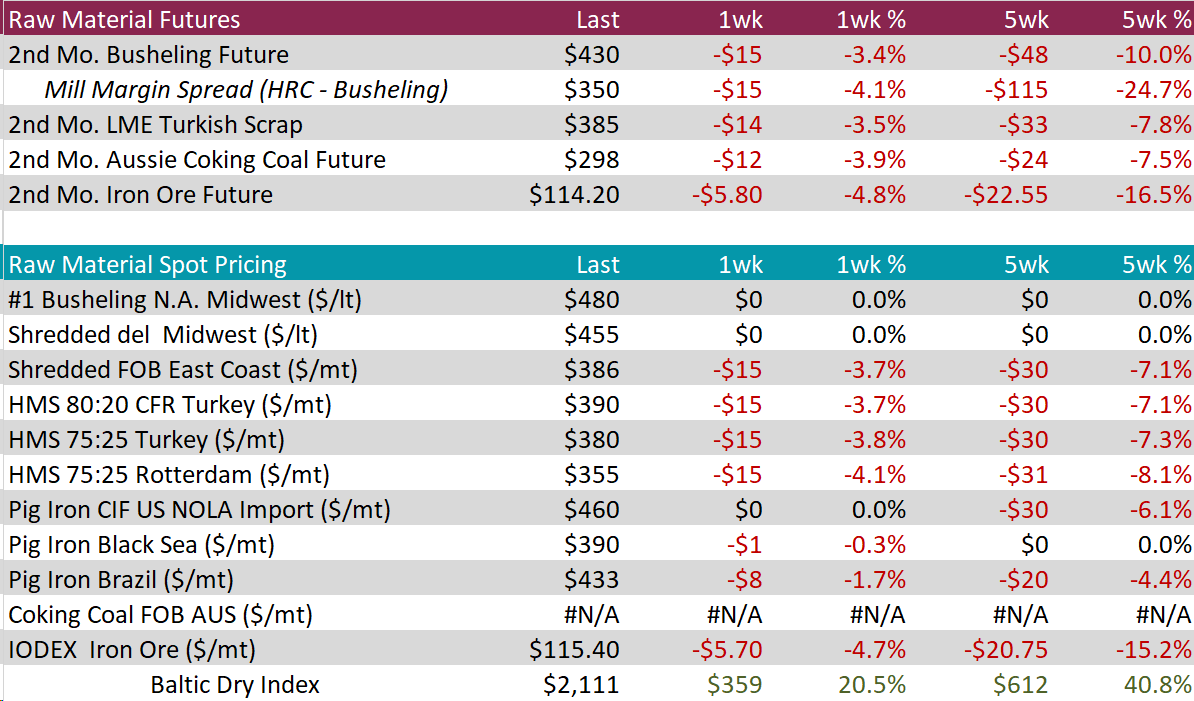

Scrap

The 2nd month busheling future fell by $15 or -3.4% to $430, reaching its lowest price since early October 2023. Next week, the busheling spot

price will adjust to March pricing.

The 2nd month Aussie coking coal declined by $12 or -3.9% to $298, breaking under the $300 price level for the first time since early September.

The 2nd month iron ore future decreased by $5.80 or -4.8% to $114.20, bringing the five-week price change down to $22.55 or -16.5%. Meanwhile, the iron ore spot price IODEX fell by $5.70 or -4.7% to $115.40.

Dry Bulk / Freight

The Baltic Dry Index rose by $359 or 20.5% to $2,111, finally breaking back through the $2,000 price level as it continues to rally.

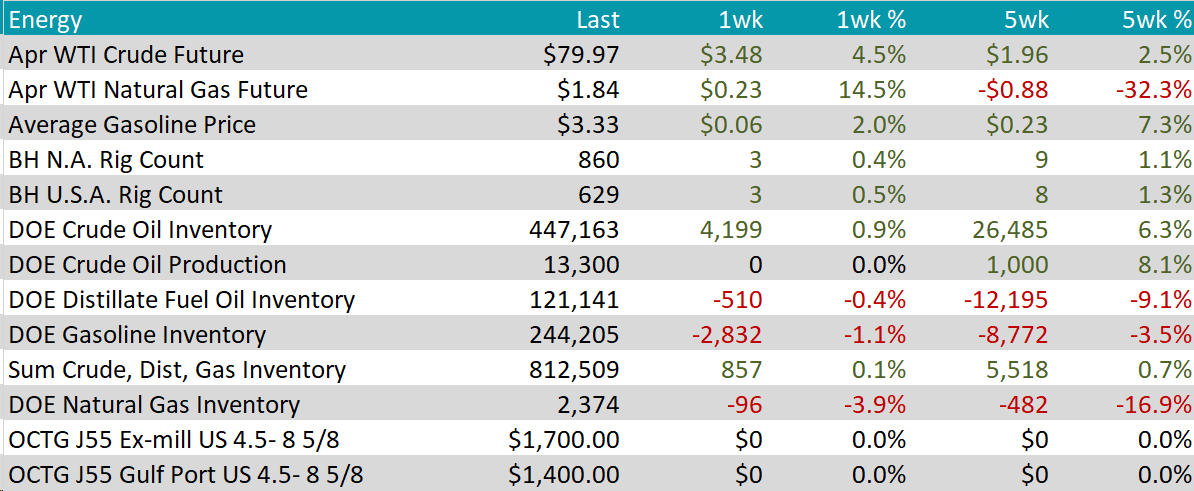

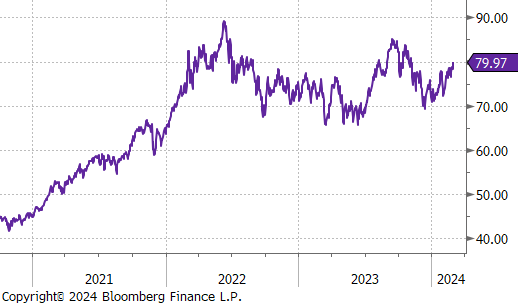

WTI crude oil future gained $3.48 or 4.5% to $79.97/bbl, nearly reaching the $80 price level and the highest it has been since November 2023.

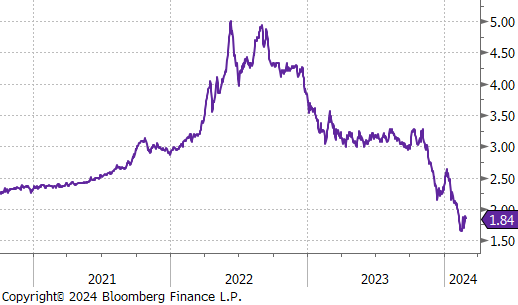

WTI natural gas future gained $0.23 or 14.5% to $1.84/bbl, furthering its recovery since hitting recent price low.

The aggregate inventory level slightly ticked up by 0.1%.

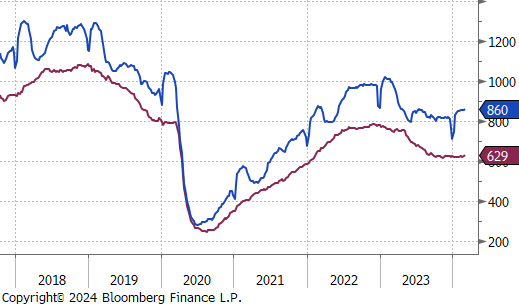

The Baker Hughes North American rig count gained 3 rigs, bringing the total count to 860 rigs. Similarly, the US rig count gained 3 rigs, bringing the total count to 629 rigs.

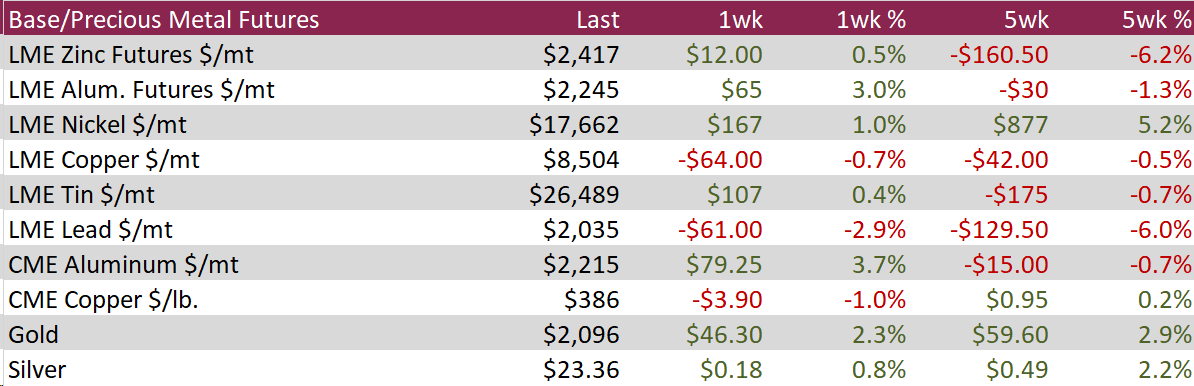

Aluminum rose by $65 or 3.0% to $2,245. This occurred as the upcoming legislative meetings in China are poised to influence global aluminum markets, with a focus on environmental sustainability, energy efficiency, and the transition to cleaner energy sources. Policies expected from these meetings may include tighter regulations on energy-intensive industries like aluminum production, potentially leading to production or capacity curbs. This shift towards greener investments and a renewed emphasis on energy efficiency could significantly impact aluminum pricing and production strategies, reflecting China’s balance between fostering economic growth and meeting its environmental and decarbonization goals.

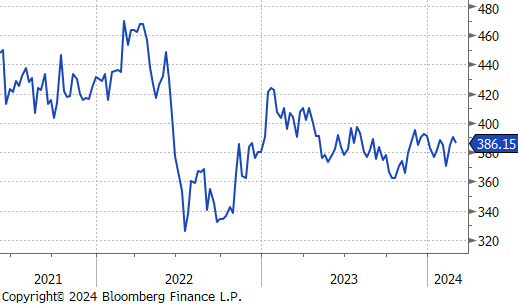

Copper fell by $3.90 or -1.0% to $386. This comes as Jiangxi Copper Co., a major Chinese copper producer, bolstered its stake in First Quantum Minerals Ltd. by purchasing $212 million worth of shares and has committed to buying $500 million in copper from First Quantum’s Zambian mine, underscoring a deepening partnership amidst efforts to offset losses from the Panama mine closure, which was a significant profit source. Furthermore, India’s Supreme Court has denied Vedanta Ltd.’s request to reopen its copper smelter, closed since 2018 for environmental violations, a decision that intensifies India’s reliance on copper imports amid rising demand. The ruling underscores India’s challenge in balancing economic growth and environmental sustainability, with domestic copper demand forecasted to nearly double by the end of the decade. This situation has attracted new investments, notably Adani Enterprises’ plan to establish a $1.2 billion copper production facility, signaling a shift in the country’s copper industry landscape amidst Vedanta’s operational and financial hurdles.

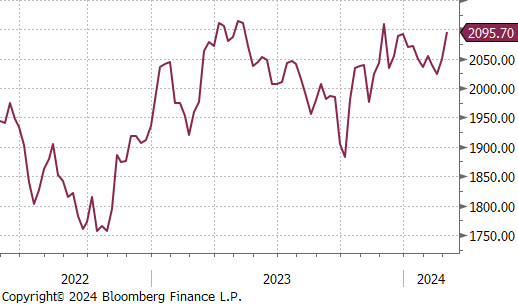

Gold jumped by $46.30 or 2.3% to $2,096, soaring to a record high and securing a second week of gains. This surge was propelled by a combination of the dollar’s decline, lower Treasury yields, and disappointing US economic indicators. February’s figures showed a continued downturn in US manufacturing, with the University of Michigan’s consumer surveys revealing similar trends of weakness. Additionally, data released on Thursday indicated that January’s year-over-year inflation increase was the smallest in almost three years. Considering these developments, New York Fed President John Williams anticipates a cut in interest rates later this year. He pointed to the easing inflation and a strong economy as reasons, arguing that the current economic landscape does not warrant an increase in rates.

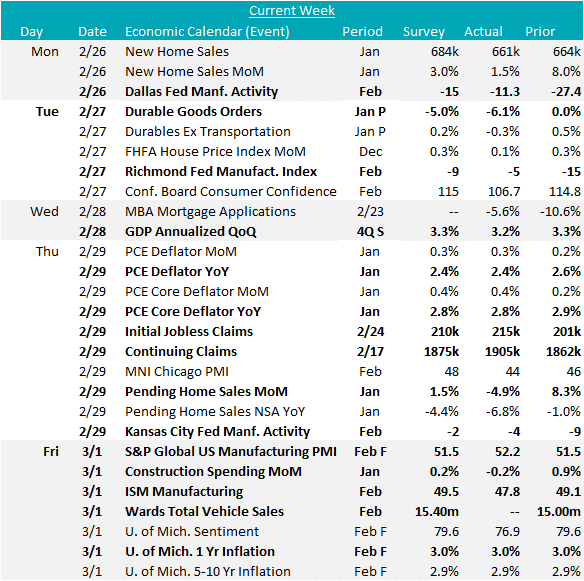

Final February S&P Global US Manufacturing PMI data came in at 52.2 higher than expectations of 51.5, pushing well into expansion territory. However, the more closely watched ISM Manufacturing PMI did the opposite, printing down to 47.8, below expectations of a slight increase to 49.5 The ISM Manu. PMI has now been in contraction territory for 17 months.

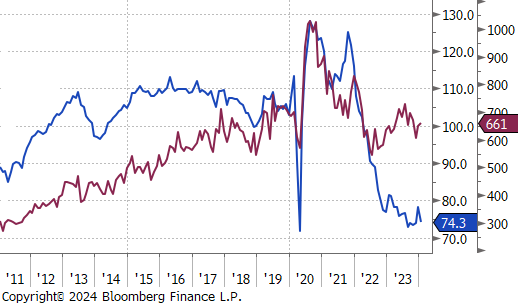

Pending Home Sales MoM dropped to -4.9%, a sharp decline from the previous 8.3% rise, and well below expectation of a 1.5% expansion. New Home Sales MoM came in below the forecasted 3.0% and fell to 1.5% growth from the previous month’s revised higher figure of 8.0%.

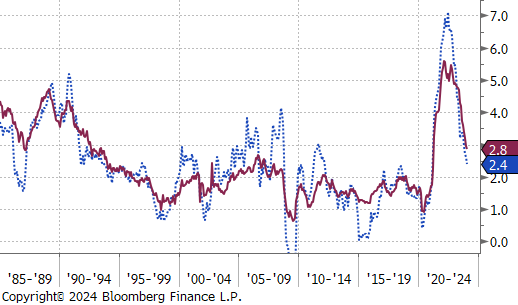

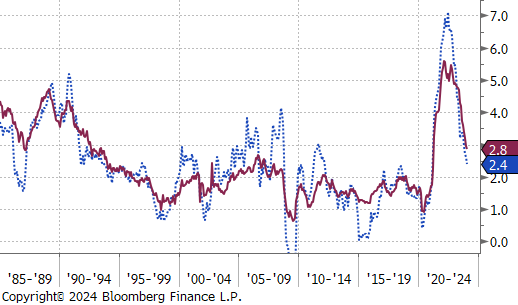

The PCE Deflator YoY came in at its lowest level since February 2021 at 2.4%, down from 2.6% the month prior, and in line with forecasts. The PCE Core Deflator YoY slightly slowed to 2.8% from December’s 2.9%, the lowest print since March 2021, in line with market expectations.

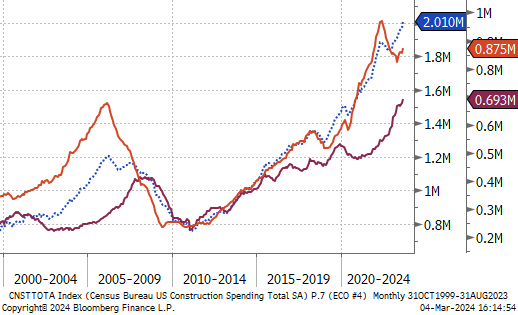

Construction Spending MoM was down -0.2% in January, it came in below the expected 0.2%, and down from 0.9% in December. This marks the first monthly contraction since December 2022, and was mainly driven by a downturn in public construction outweighing the slight increase in private spending.

The labor market showed a clear signal of softening in this week’s data, with both Initial and continuing jobless claims coming in above expectations. While increasing, initial claims remains well below the threshold which would cause near-term concern for the broader market.