Flack Capital Markets | Ferrous Financial Insider

March 10, 2023 – Issue #370

March 10, 2023 – Issue #370

Last week resulted in sustained upward momentum in the domestic market, culminating in significant, demand-driven, scrap price increases for March. With short-term supply and demand dynamics intact in steel market, the most notable development in the U.S. and global markets is the uncertainty surrounding the US banking sector following the failure of Silicon Valley Bank (SVB).

SVB, the 16th largest bank in the US had poor risk management practices in handling their exposure to US interest rates, which have risen dramatically in the past year. When faced with a wave of withdrawals, SVB was unable to raise the cash it needed to cover the outflows. As a result, US regulators stepped in to close the bank. The FDIC announced Sunday that insured depositors of SVB and Signature Bank (who also suffered a similar fate) would have access to all their money, effective Monday morning. However, this has led to concerns around further contagion in other regional banks. The Federal Reserve has created a new lending facility, which banks can use to borrow cash in exchange for posting certain assets as collateral.

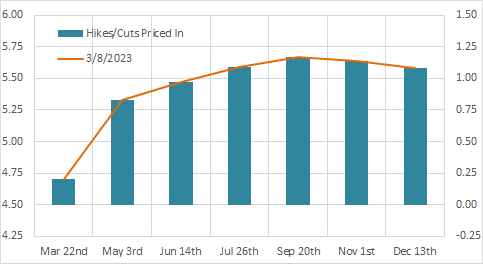

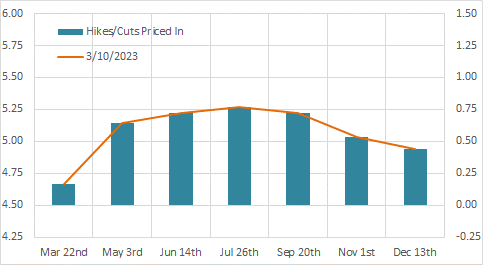

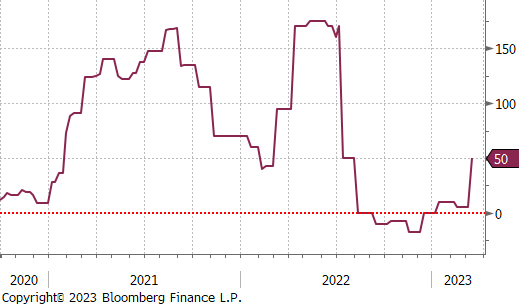

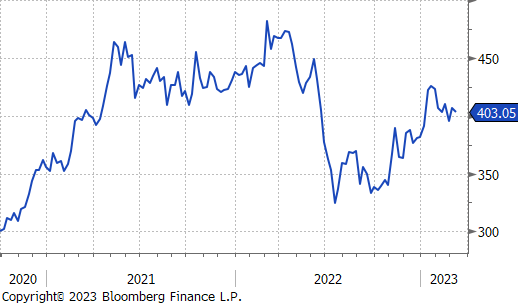

Stepping back, the most important question for the steel industry today is: “What is going to happen with interest rates?” The charts on the right show market expectations for where the Federal Reserve will set interest rates, based on economic data and inflation risks. Since early-February, expectations for where the terminal rate will end have been rapidly rising, culminating in 4 additional 25bps hikes and a peak of 5.75% in July, on Wednesday the 8th. Only two days later, those expectations changed dramatically, culminating in market expectations of a peak terminal rate at 5.25% in May and cuts later in the year. Since then, expectations have fallen further with the possibility of no hike during next week’s meeting potentially on the table. While the immediate rational behind a lower terminal rate is heighted recessionary fears, a recession is not guaranteed. Because of that, interest rate sensitive sectors like construction and automotive, with their extensive backlogs would benefit from lower rates.

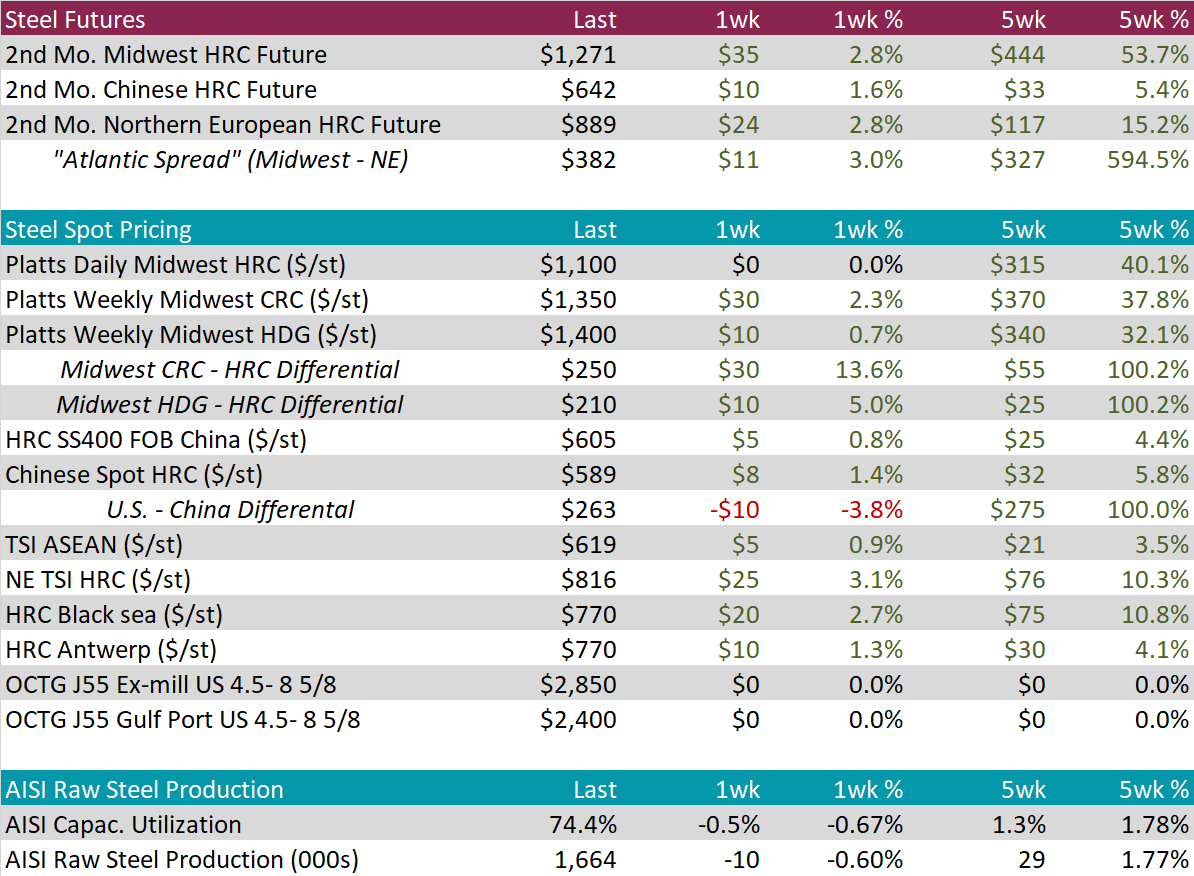

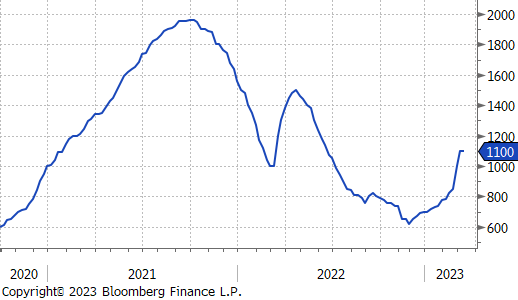

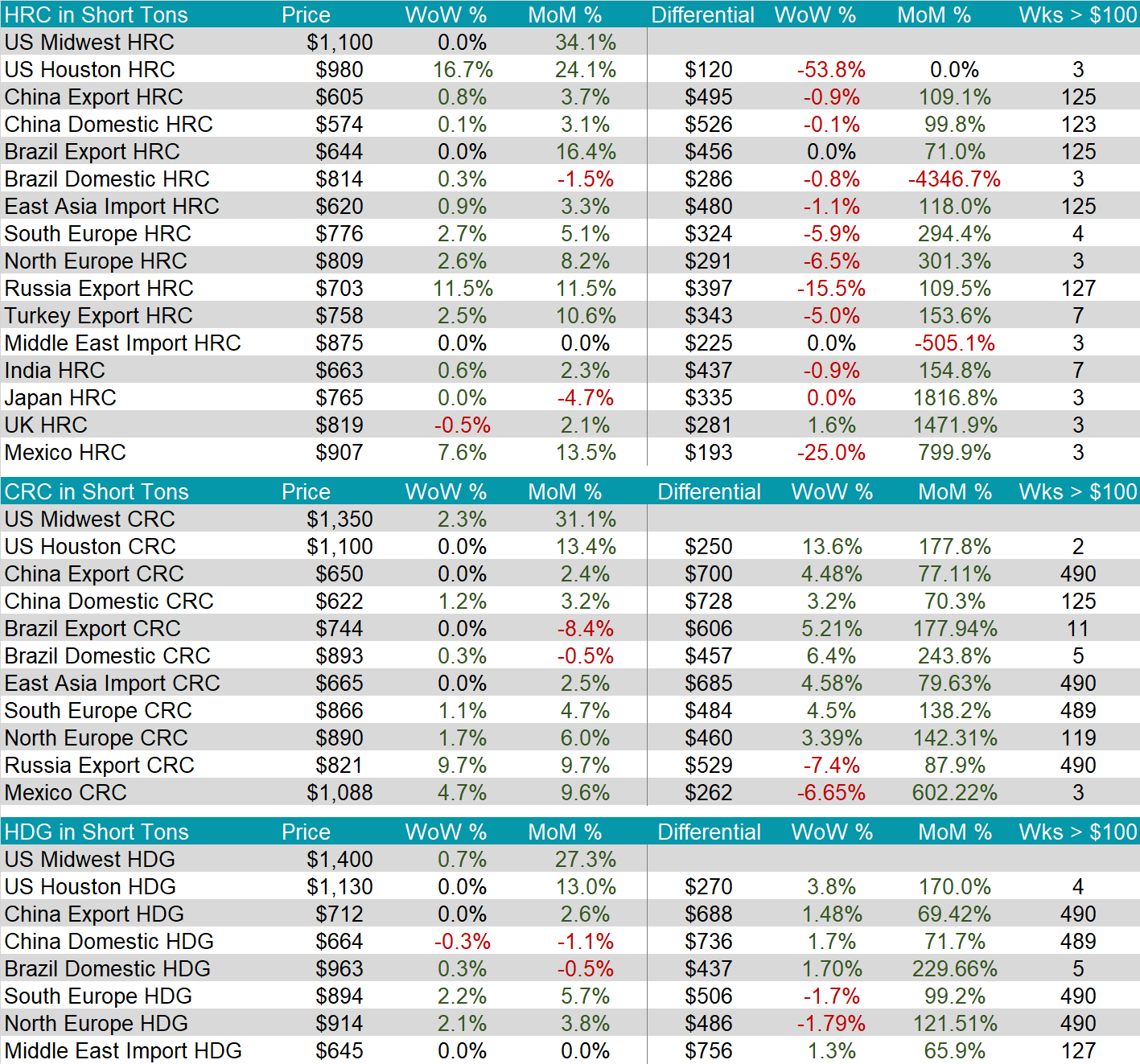

The HRC assessed spot price stalled last week at $1,100. Upward momentum in this price remains well intact with lead times pushing out further on the week.

Tandem products continued to rally this week, with CRC up another 2.3% and HDG up another 0.7%. Even with this week’s increases, HRC has seen a more significant rally over the last 5 weeks on a percentage basis, up 40.1% compared to 37.8% in CRC, and 32.1% in HDG.

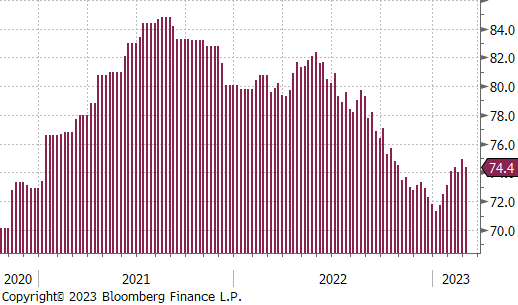

Production remains in an uptrend, even though capacity utilization and raw steel production (measured by AISI) were down slightly on the week.

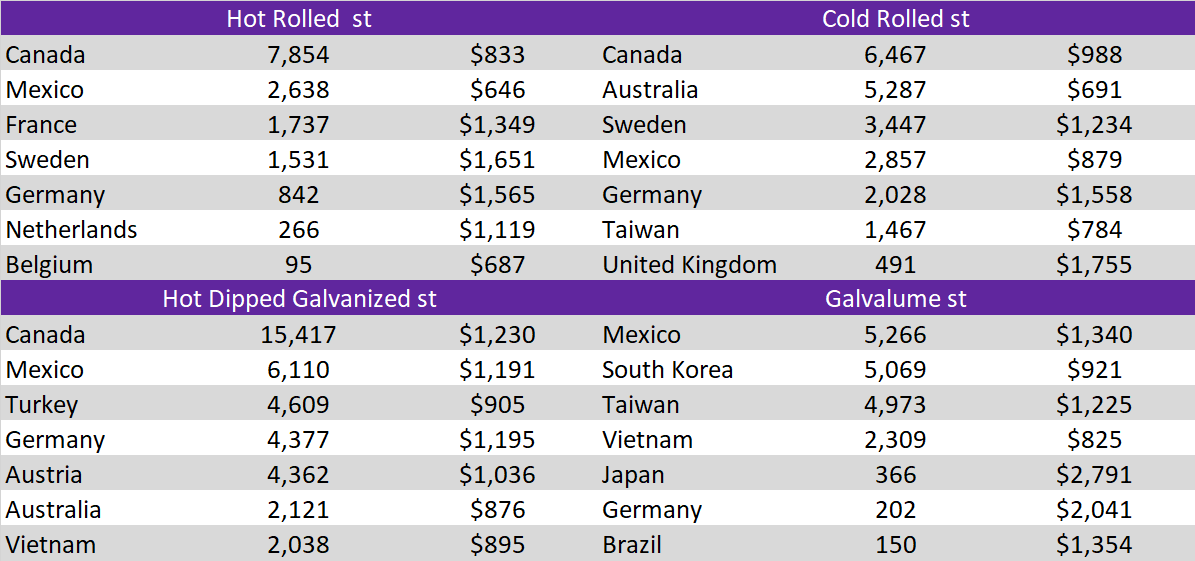

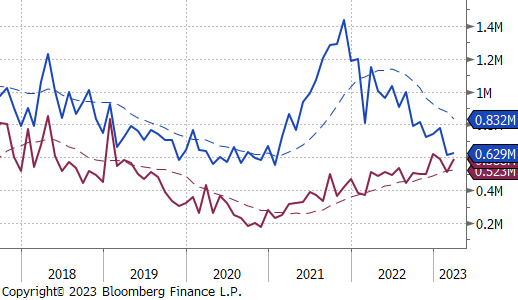

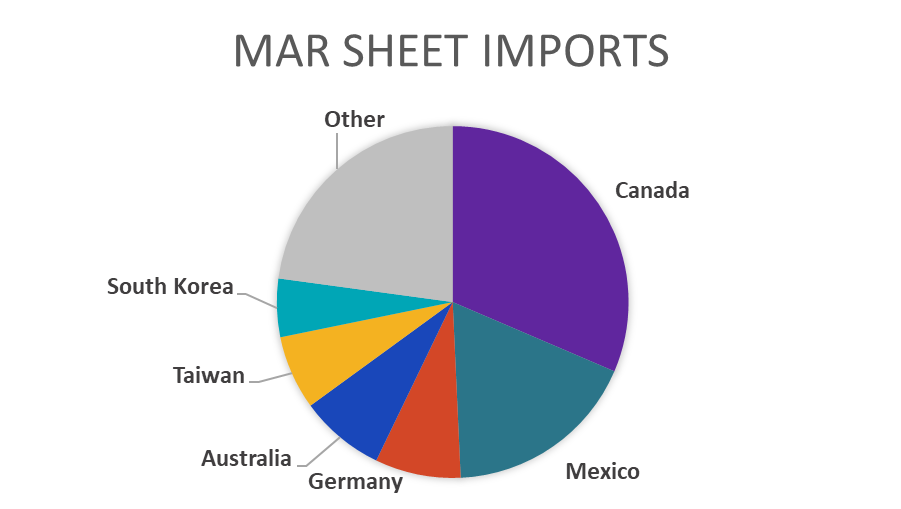

March Projection – Sheet 629k (up 18k MoM); Tube 588k (up 77k MoM)

February Projection – Sheet 611k (down 166k MoM); Tube 512k (down 75k MoM)

Arrivals continue to trend lower, with preliminary data for March suggesting only a moderate uptick.

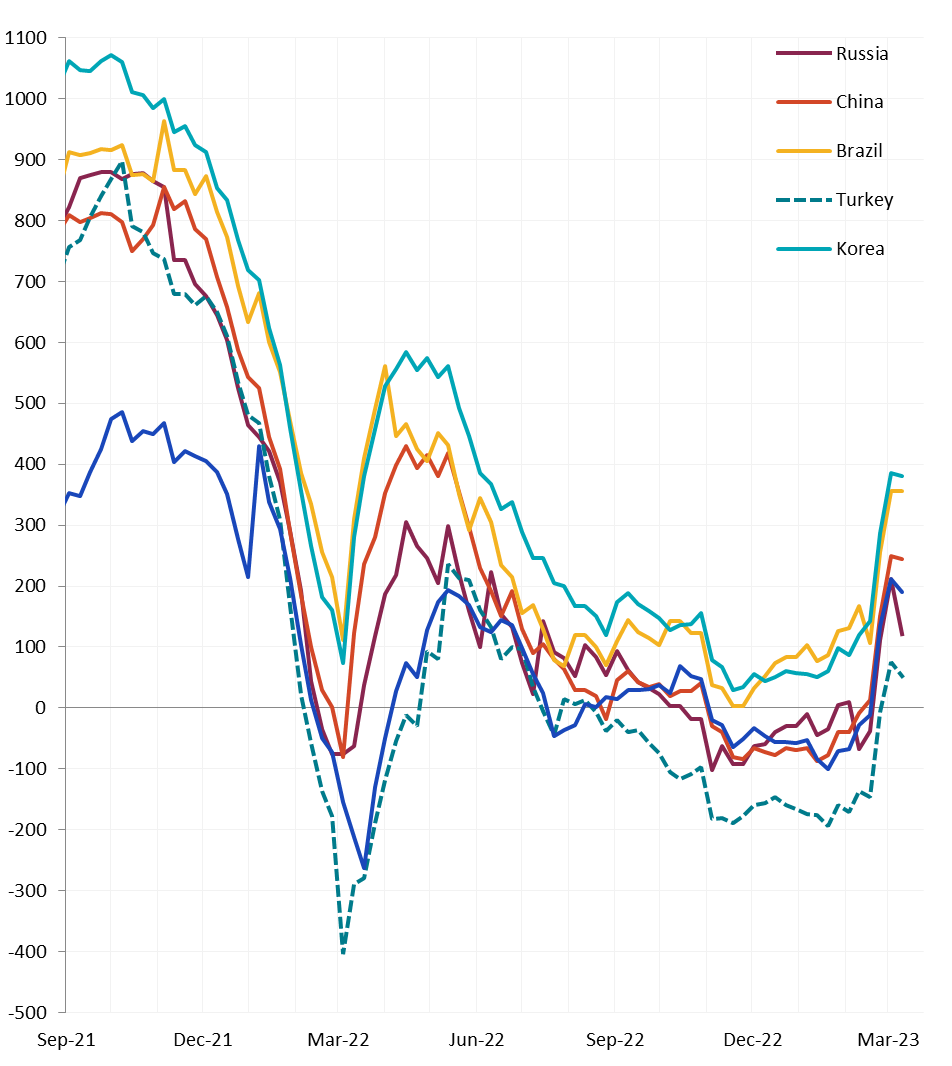

Differentials decreased last week, but only because of the pause in domestic HRC prices. There is additional upside risk in the global differentials compared to the current spot prices.

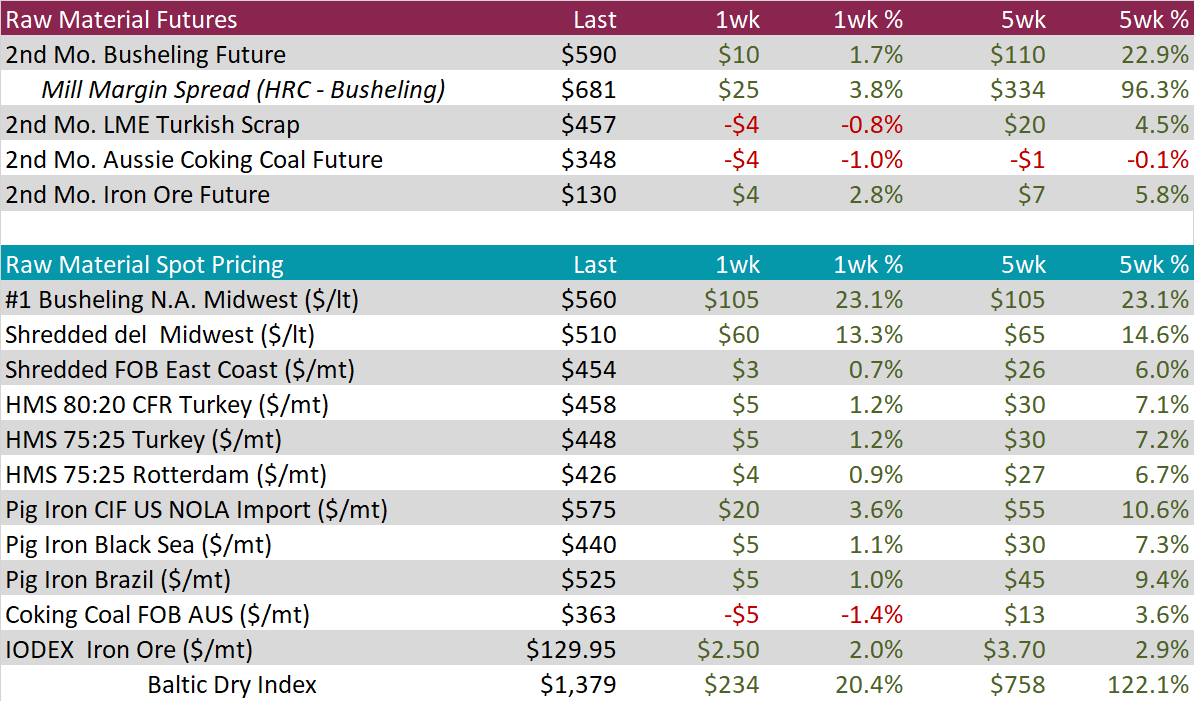

The most significant news coming out of the week in the domestic raw material market is the increase in busheling prices for March, up $105 or 23.1% on the week, to $560.

The 2nd month futures (May 2023) rallied another $10 or 1.7% this week; however, they continue to be outpaced by rising HRC futures. The result is further expansion of the mill margin curve (HRC – busheling), up another $25, to $681.

Another takeaway from the week was the expansion of the prime vs obsolete scrap spread which was up $45 to $50. This move brought the spread back up to a more historical level after trading at parity and even briefly negative from September to November 2022. The 10-year historical average of the spread is just below $40.

The Baltic dry index continued to rip higher last week, up another 20.4%. The index is now up 260% since briefly reaching its lowest level since May 2020 on February 16th.

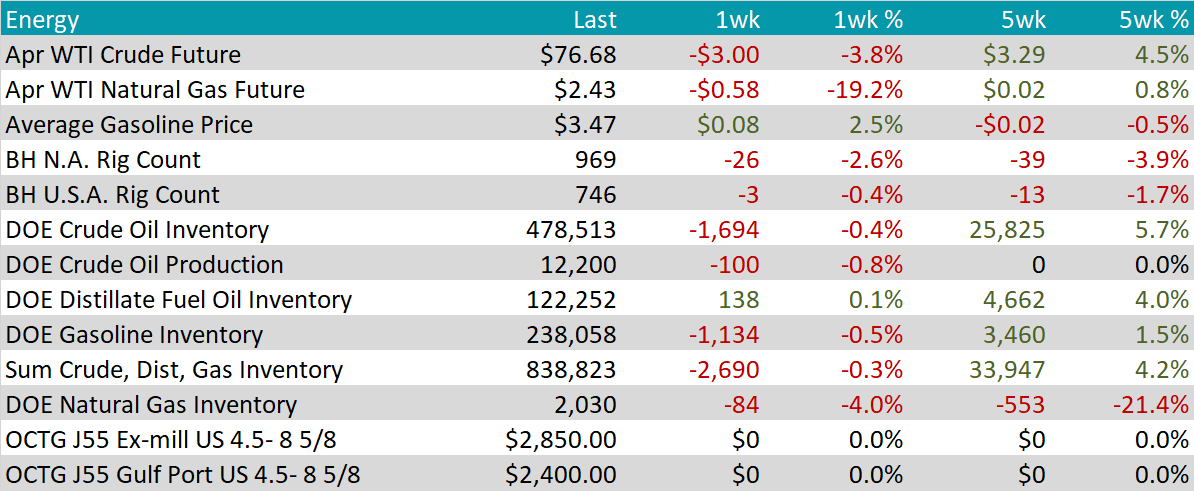

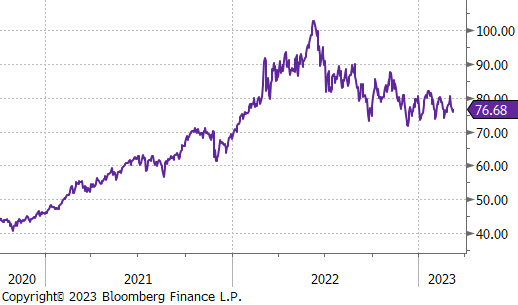

April WTI crude oil future lost $3 or 3.8% to $76.68/bbl.

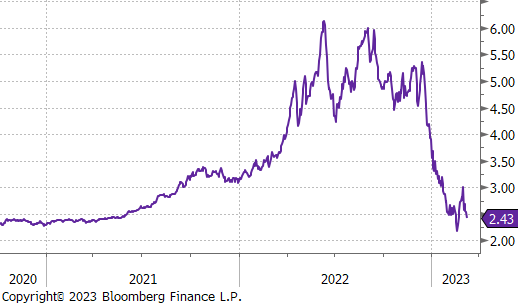

April WTI natural gas future lost $0.58 or 19.2% to $2.43/bbl.

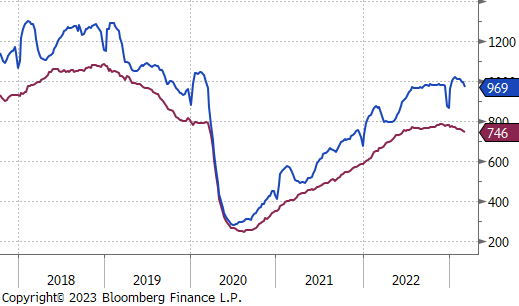

The aggregate inventory level dipped slightly, down 0.3% last week after a rapid restocking which started at the end of 2022.

The Baker Hughes North American rig count was down 26 rigs, and the U.S. rig count was down 3.

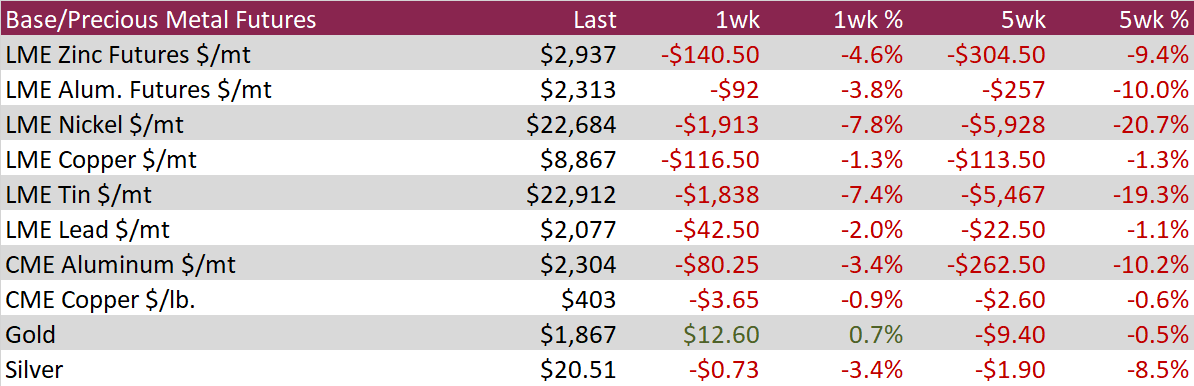

Aluminum futures fell 3.8% WoW despite announcements of additional production cuts due to high energy costs. The metal was weighed down by a stronger US Dollar and concerns over subdued demand from China after economic targets fell below market expectations. Furthermore, market participants priced in future rate hikes by the Fed that would make non-yielding assets like commodities appear less attractive.

Nickel prices trended lower last week as many bearish macro factors emerged, and speculators cut risk positions in non-yielding assets. The drop in nickel prices comes amid tight supply, where on-warrant nickel stocks on the LME fell an additional 2.23% and are at the lowest levels in nearly a year.

Silver finished the week down 3.4% despite a late rally on Friday the 10th after traders assessed the stronger-than-expected employment figures and market participants fled into safe-haven assets amid turmoil in the banking sector. Silver prices have fallen seven of the past eight weeks.

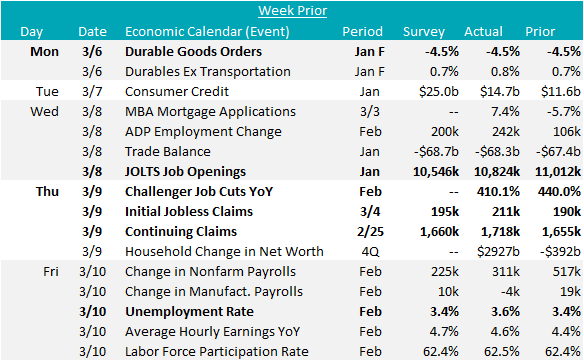

The labor market was the key theme in this week’s economic data. While there are signs of cooling, a resilient jobs market suggests that inflationary pressure persists.

The week culminated in the job’s report on Friday, with nonfarm payrolls increasing above expectations, wages accelerating below expectations, and a tick higher in the unemployment rate from 3.4% to 3.6%, due to a growing labor pool and increased participation. Earlier in the week January JOLTS job openings decreased from 11M to 10.8M, above market expectations of 10.5. Showing deceleration, but not at the rate the Fed is looking for. As it stands, the openings to available workers ratio is nearly 1.9 openings per worker. Finally, we saw both initial and continuing jobless claims jump, with continuing claims back up to the recent peak from mid-December, last year.

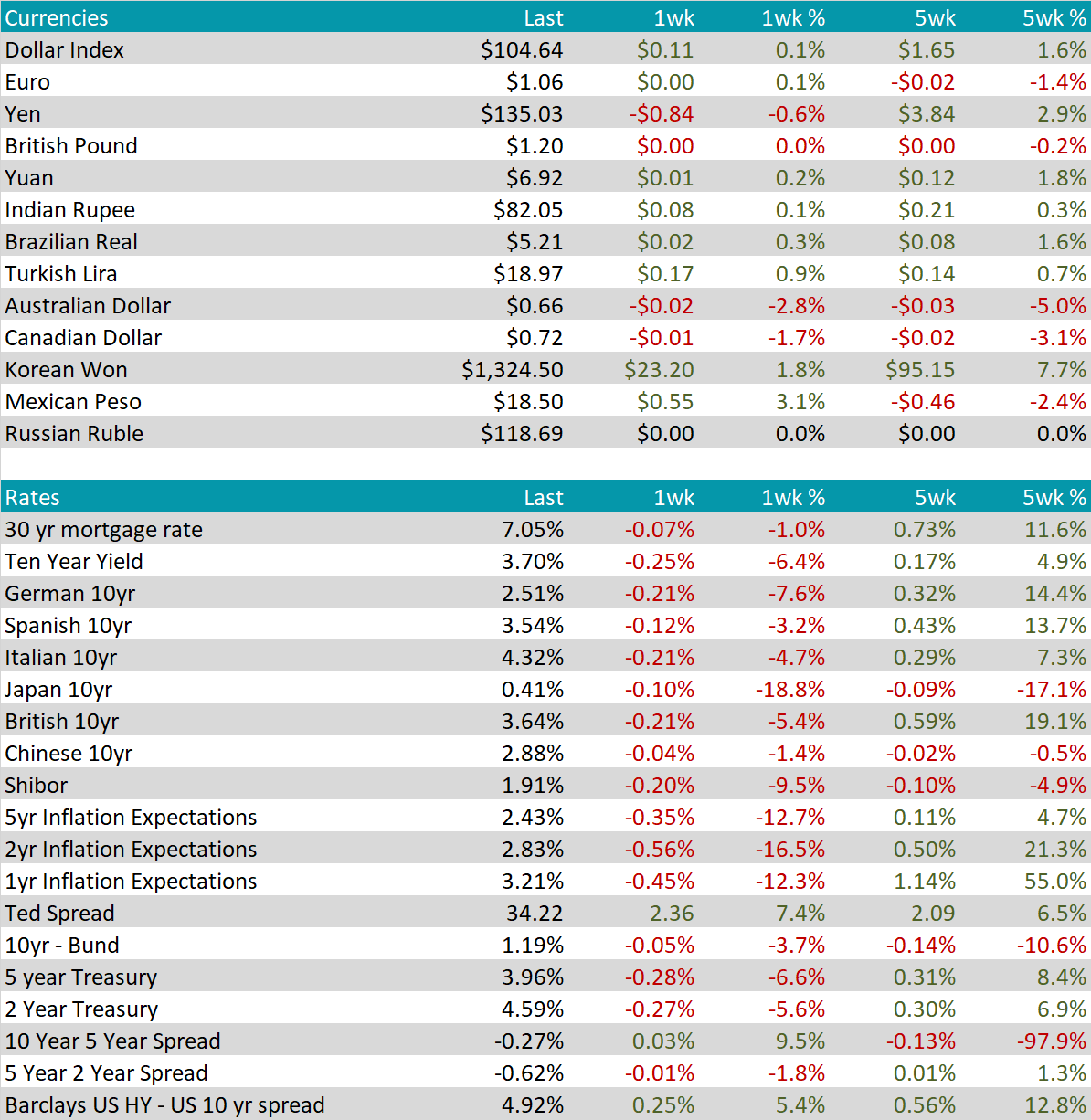

The U.S. dollar saw very little change, up $0.11 to 104.64. Of the major currencies, the Yen lost the most value against the move, down 0.6% on the week.

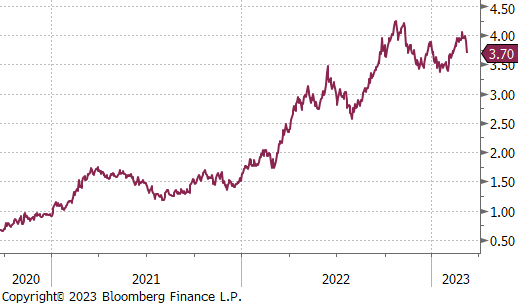

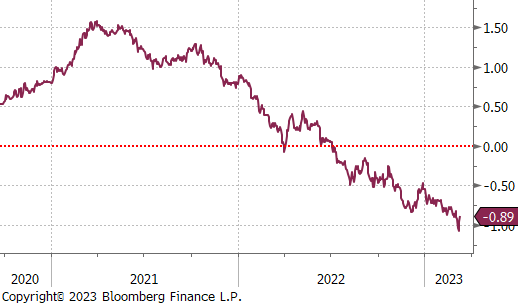

More significantly, this week saw some of the biggest moves in US rates history. The U.S. 10-year and 2-year note yield each touched 3.99% and 5.08% respectively, resulting in a 2Yr/10Yr spread at -1.09 on 3/8. This represented the most significant inversion of the yield curve since September 1981. By Friday the 10th, both had sharply sold off, but the 2-year was more significant, resulting in a 2yr/10yr spread of -0.89.