Flack Capital Markets | Ferrous Financial Insider

March 22, 2024 – Issue #424

March 22, 2024 – Issue #424

Overview:

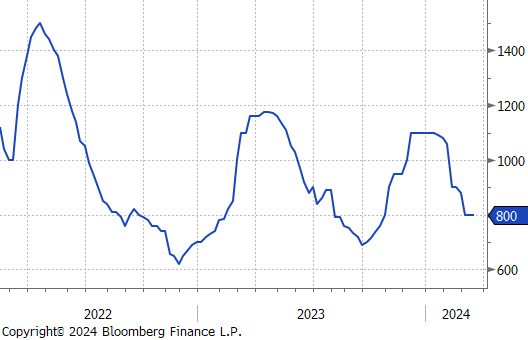

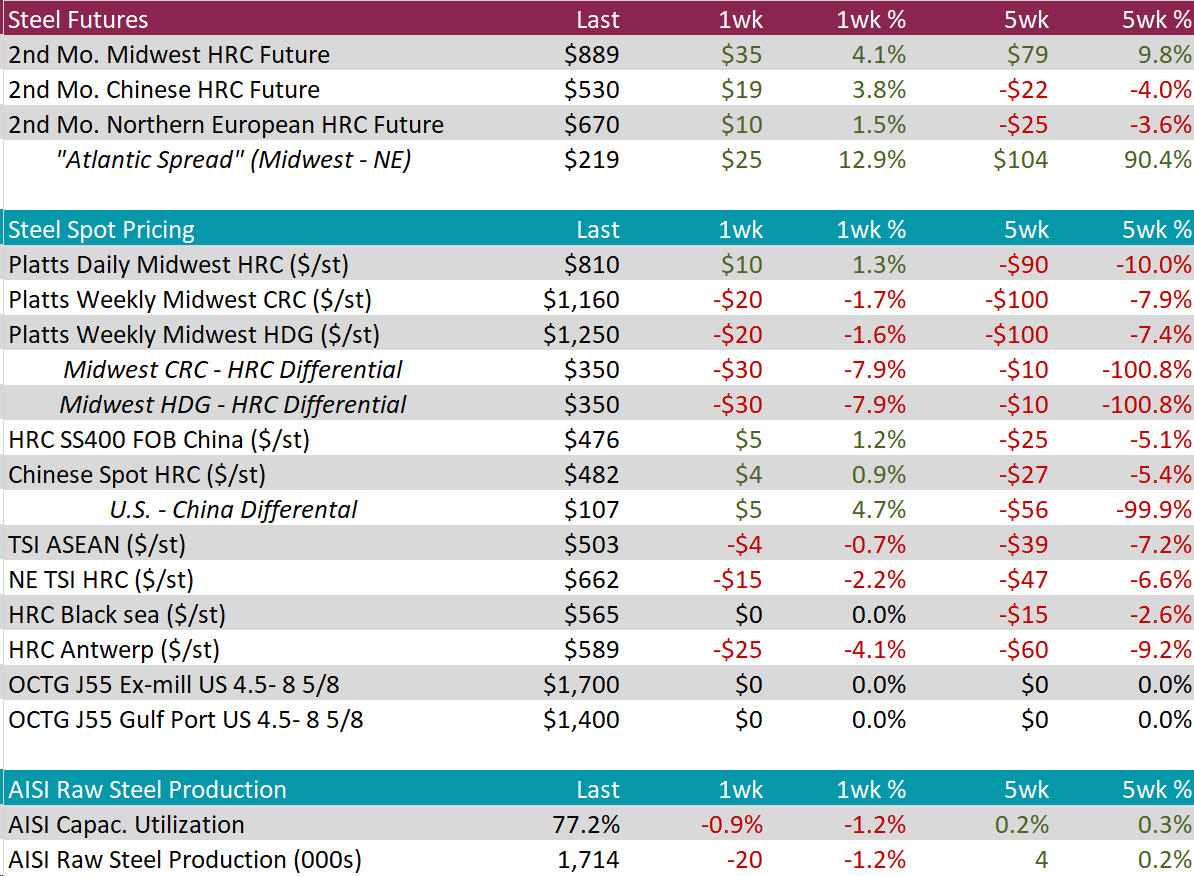

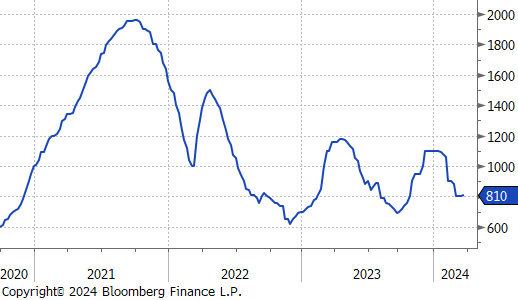

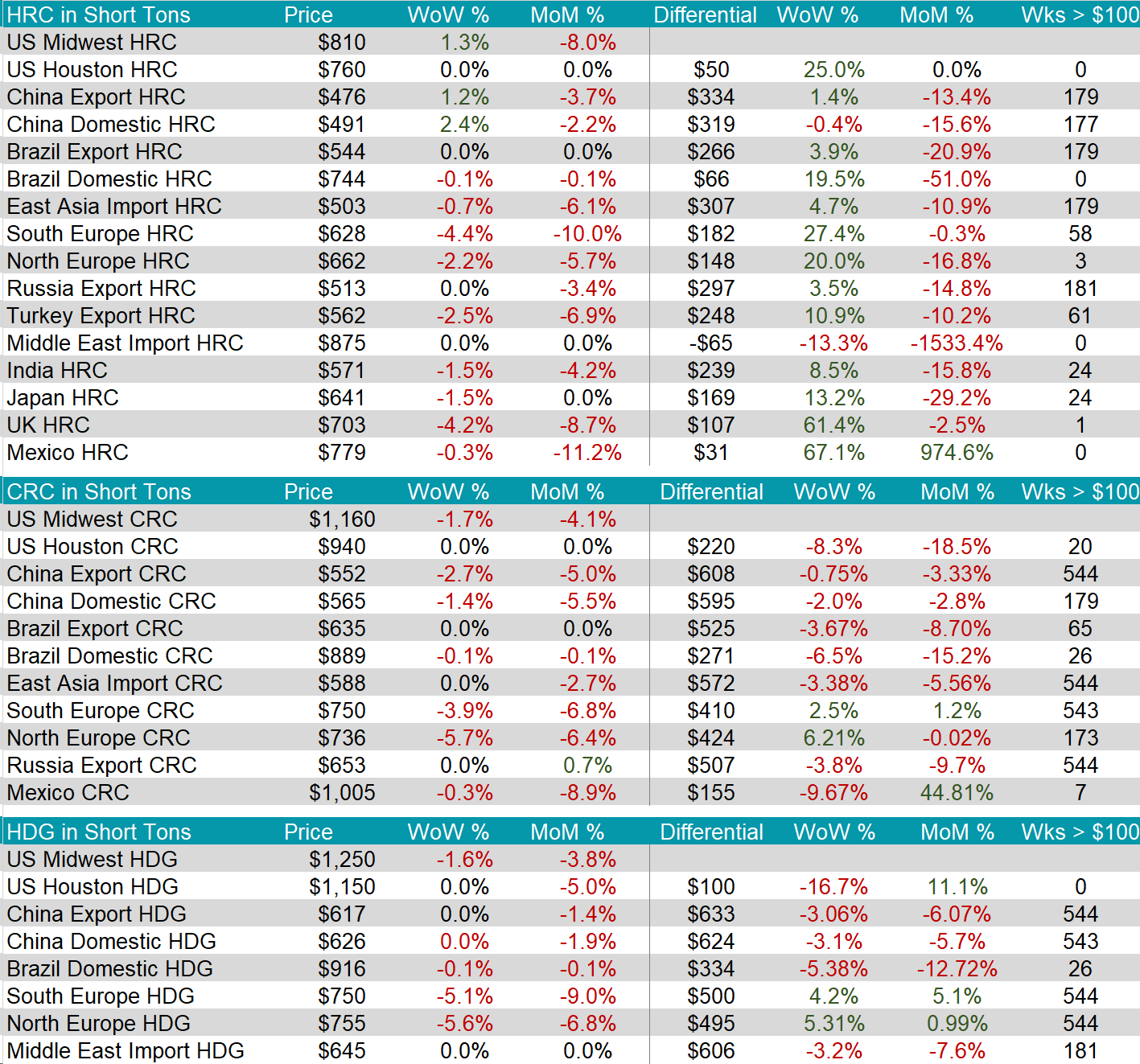

The HRC spot price rose by $10 or 1.3% to $810, marking the first price increase since peaking ten-weeks ago. At the same time, the 2nd month future jumped up by $35 or 4.1% to $889, hitting the highest price in eight-weeks.

Tandem products both fell by $20, resulting in the HRC – HDG Differential to decrease by $30 or -7.9% to $350.

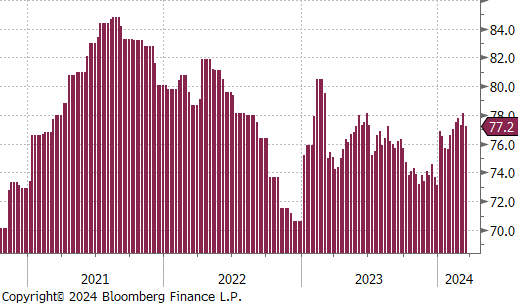

Mill production significantly pulled back after reaching its highest level in nearly 6 months, with capacity utilization ticking down by -0.9% to 77.2%, bringing raw steel production down to 1,714m net tons.

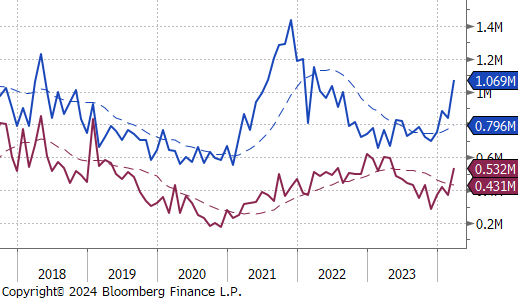

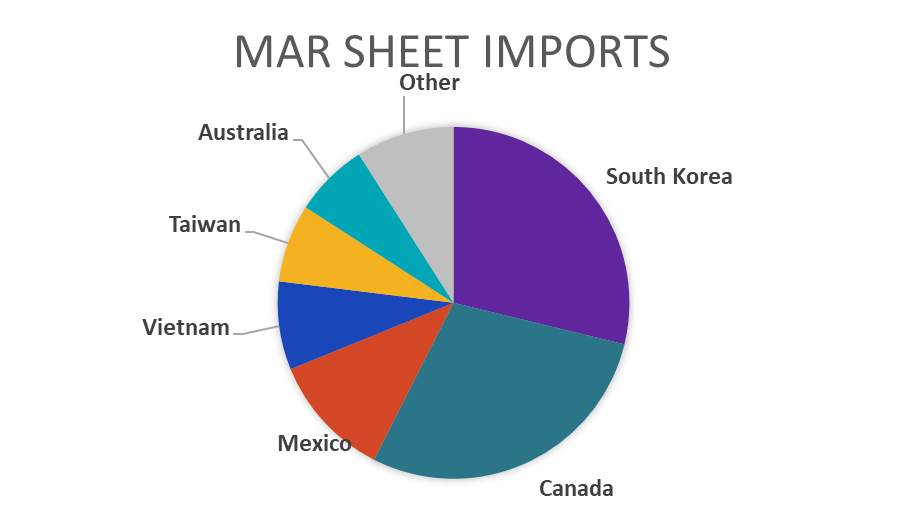

March Projection – Sheet 1069k (up 229k MoM); Tube 532k (up 164k MoM)

February Projection – Sheet 841k (down 41k MoM); Tube 369k (down 52k MoM)

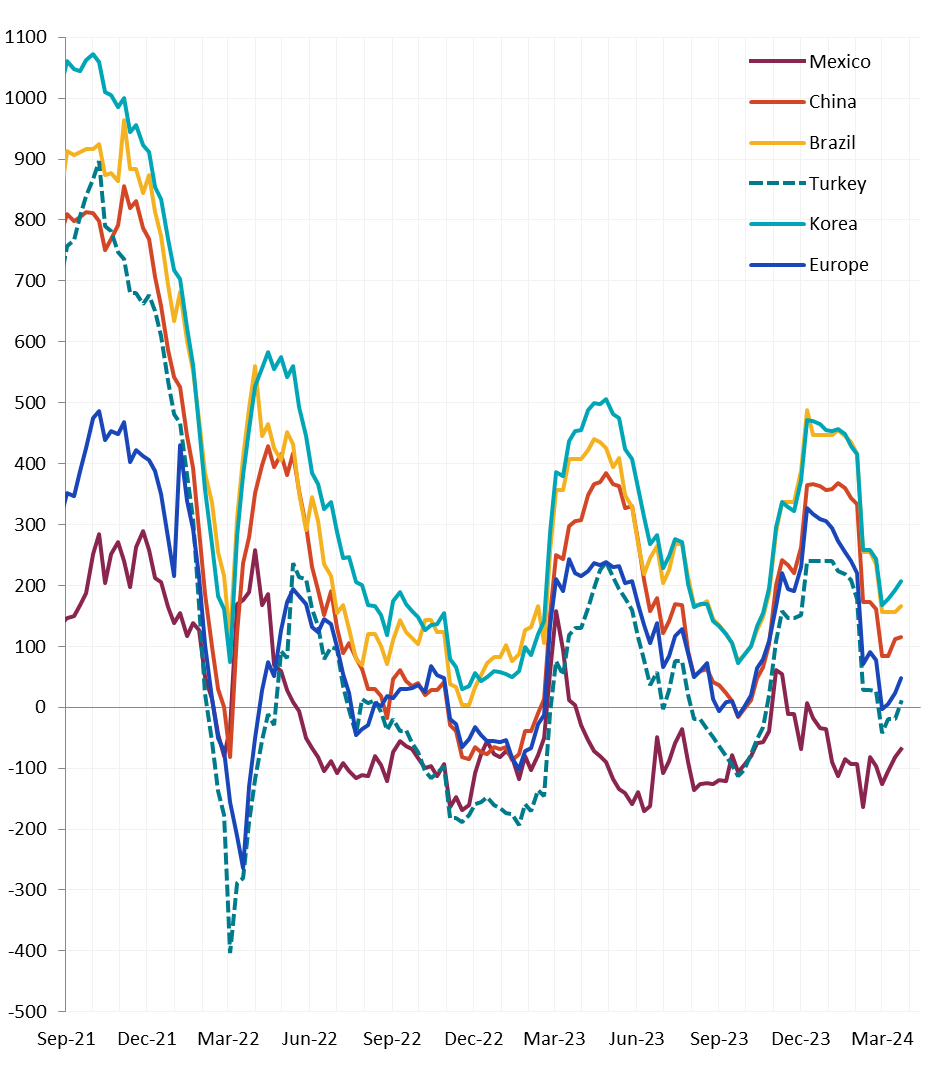

Watched global differentials all mostly widened, with China Export and Domestic HRC increasing by 1.2% and 2.4%, respectively. Other notable countries were South Europe HRC falling by -4.4% and UK HRC down by -4.2%.

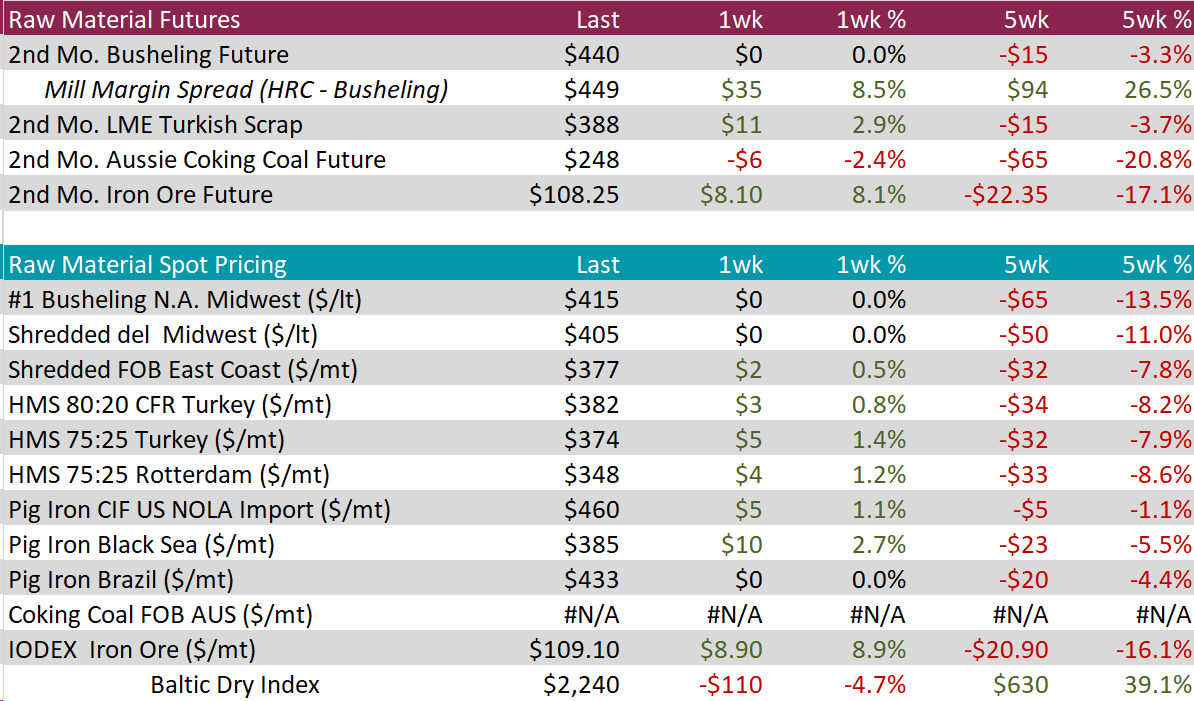

Scrap

The 2nd month busheling future held steady at $440. Similarly, the busheling spot price also remained unchanged, staying stagnant at $415.

The 2nd month LME Turkish scrap future climbed by $11 or 2.9% to $388, nearing the $400 price level it fell below five-weeks ago.

The 2nd month iron ore future increased by $8.10 or 8.1% to $108.25, significantly rebounding after its decline seen last week. Meanwhile, the spot price IODEX also experienced a rebound, rising by $8.90 or 8.9% to $109.10.

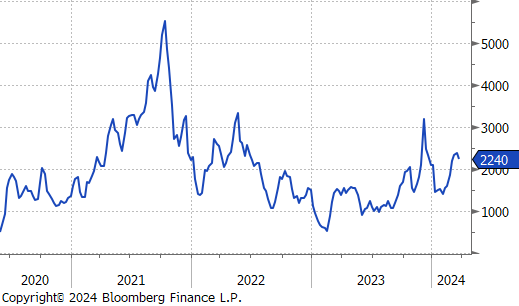

Dry Bulk / Freight

The Baltic Dry Index dropped by $110 or -4.7% to $2,240, marking its first price decrease since rallying from its most recent bottom of $1,388 touched seven-weeks ago.

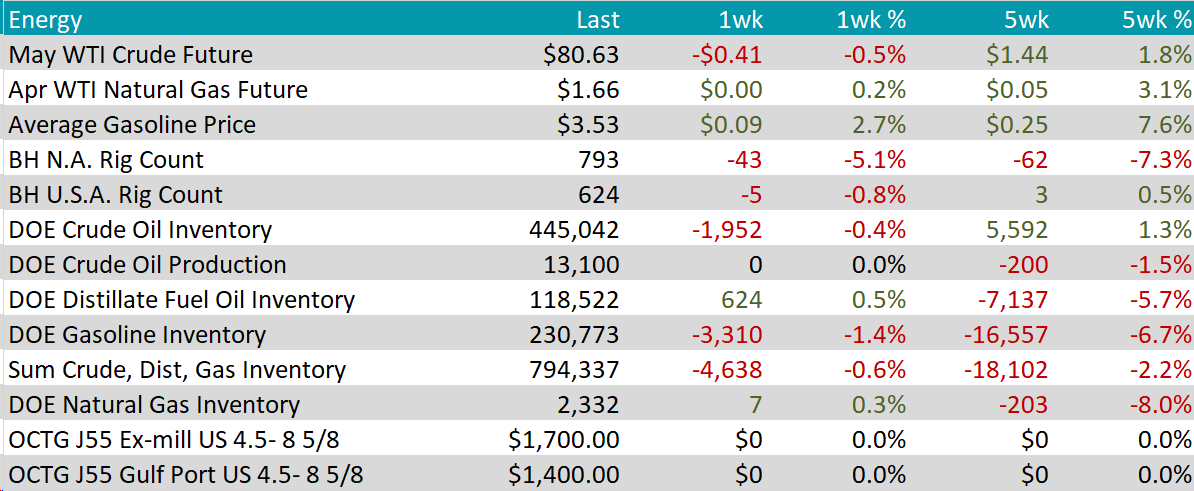

WTI crude oil future lost $0.41 or -0.5% to $80.63/bbl.

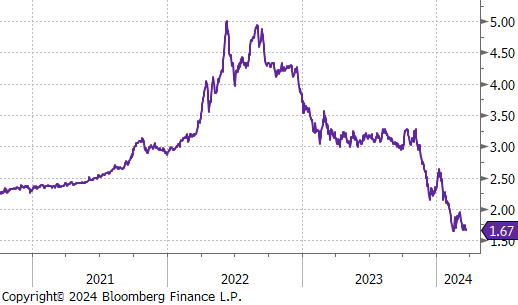

WTI natural gas future gained $0.00 or 0.2% to $1.66/bbl.

The aggregate inventory level continued to fall, experiencing a decline of -0.6%.

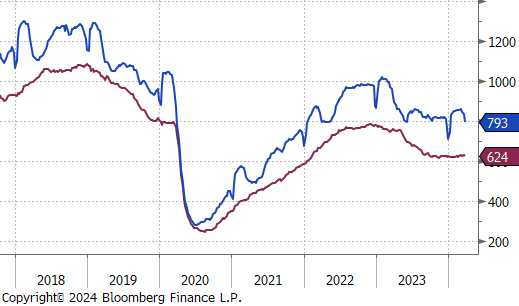

The Baker Hughes North American rig count substantially dropped by 43 rigs, bringing the total count down to 793 rigs. At the same time, the US rig count also experienced a reduction, taking off-line 5 rigs, bringing the total count to 624 rigs.

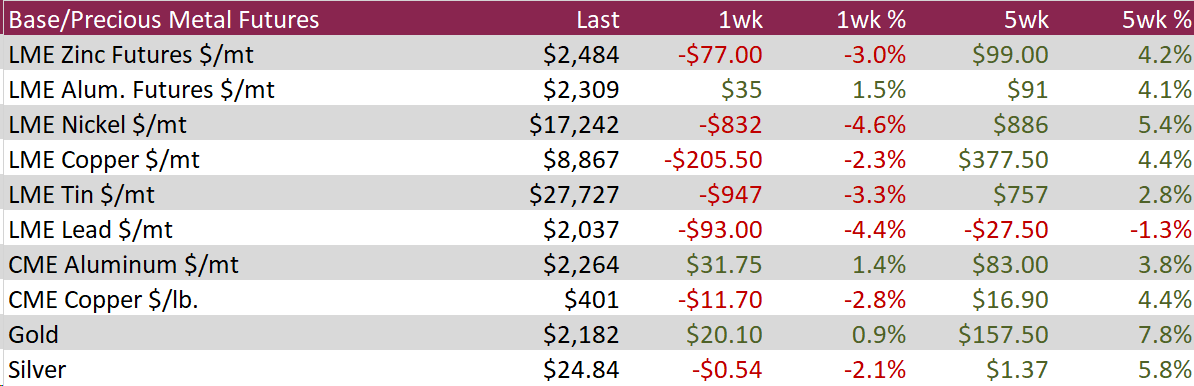

Aluminum surged to $2,309, rising by $35 or 1.5%, hitting a peak not seen since January 31st, driven by positive economic data from China and expectations of rising demand. China’s industrial output for January and February exceeded expectations with a 7% increase, partly due to a 5.5% rise in primary aluminum production encouraged by higher prices. Additionally, China’s imports of unwrought aluminum and its products soared by 93.6% to 720k tons during the same period, compared to the previous year. Despite a significant increase in aluminum inventories and production constraints in Yunnan due to seasonal factors, production is anticipated to resume with power supply improvements, though growth may be limited by power restrictions and maintenance at smelters.

Copper fell by $11.70 or -2.8% to $401, backing down from a near one-year high, amidst renewed concerns over the Chinese economy and its pressured property sector, overshadowing recent positive economic data. Despite a faster-than-expected rise in China’s February industrial output, fears of diminished demand for goods and housing dampened expectations for the country’s commodity consumption. A significant 20% increase in China’s copper stockpiles for the week ending March 15th highlighted a restocking trend, yet underscored concerns, evidenced by a notable decrease in the Yangshan copper premium. However, copper futures managed a 5% monthly increase, supported by strategic production cuts from smelters facing raw material shortages and operating losses.

Silver stabilized at $24.84, only slightly decreasing by $0.54 or -2.1%, following a near one-year high, as investors anticipate Federal Reserve officials’ speeches and key inflation data, eyeing potential monetary policy adjustments. The Fed’s projections of three interest rate cuts in 2024 have increased the appeal of non-yielding assets like silver, with market expectations for a rate cut in June rising significantly post-announcement. In Europe, the Swiss National Bank has begun its easing cycle, further influencing silver’s market dynamics. Silver’s role as a safe haven, amidst geopolitical tensions such as the war in Ukraine and Middle East conflicts, continues to support its value, especially in light of recent escalations like Russia’s major airstrikes on Ukraine’s energy infrastructure.

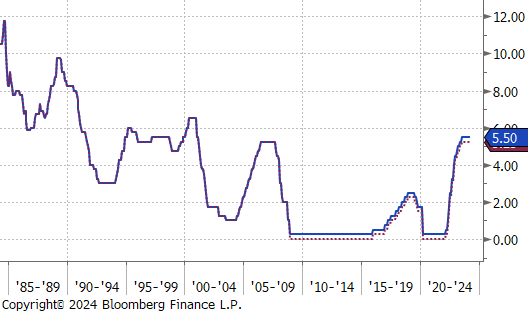

The most important event from the week was Wednesday’s FOMC meeting, where they also provided an update to the SEP (Summary of Economic Projections). Since its last publication in December, the median FED forecast for year-end 2024 points pointed to a stronger U.S. economy across the board:

Our interpretation of this tranche of data is that the FOMC members see the risks to price stability and fully employment as equally balanced – meaning although the last leg of inflation moving down to the 2% target may take longer than initially expected, the risk of high interest rates to the labor market is more significant than the risk of reigniting inflationary pressure. The market and the FED are now in line with three cuts this year (beginning in June). Internally, our view of the risks leads us to believe this will be too soon and too many.

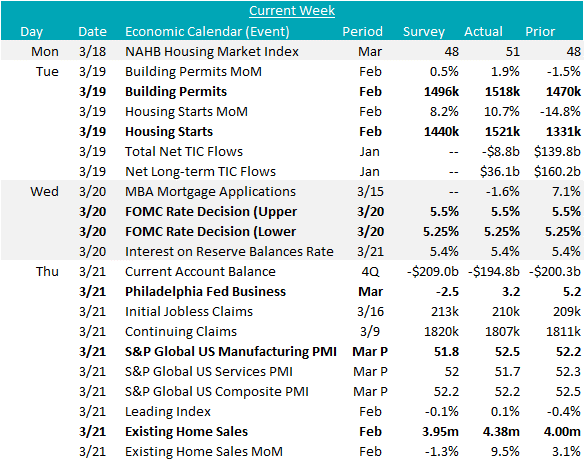

Outside of FED speak, we received the first round of monthly housing data. Building permit beat expectations, rising 1.9% versus an expected 0.5% increase. Housing starts also came in better than expectations, up 10.7% versus 8.2%. Furthermore, the NAHB (Builders) housing market index climbed to 51, surpassing the expected 48 print and reaching its highest level since July of last year. Existing home sales also came in quite strong, increasing 9.5% versus an expected drop, down 1.3%. This is the highest level of existing home sales since February 2023. This data points to a stable and growing housing market with a solid pipeline for continued activity

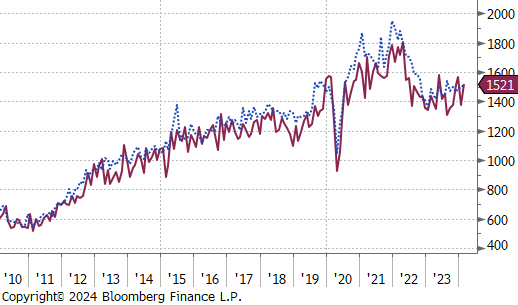

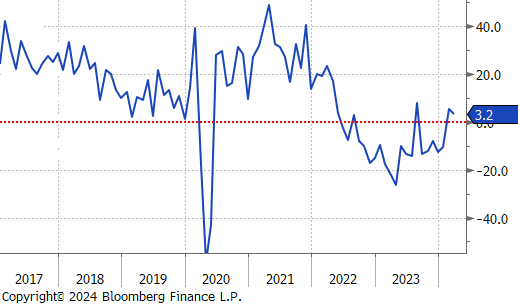

Finally, there was an update in the manufacturing sector. First, was the March Philly Fed manufacturing survey, which showed continued (albeit slowing compared to Feb) expansion in the region printing at 3.2 and beating expectations of a contraction at -2.5. Additionally, the S&P Global manufacturing PMI printed in its 3rd straight month of expansion at 52.5, above expectations at 51.8.