Flack Capital Markets | Ferrous Financial Insider

March 28, 2025 – Issue #477

March 28, 2025 – Issue #477

Overview:

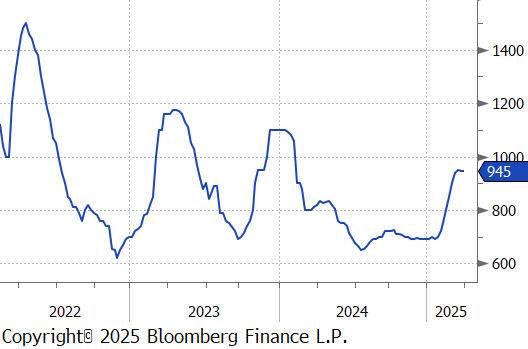

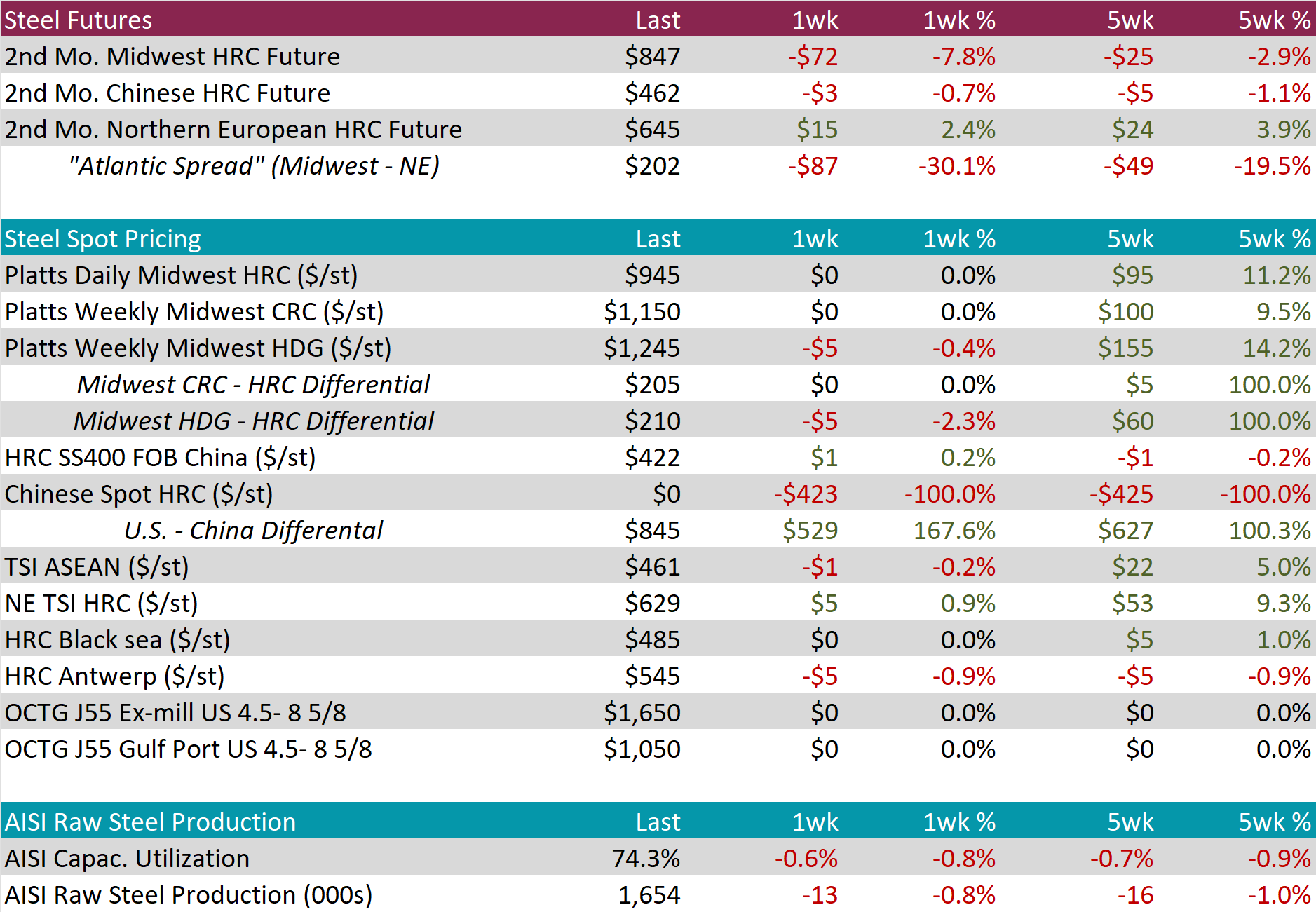

The HRC spot price held at $945. At the same time, the HRC 2nd month future declined by $72 or -7.8% to $847, marking the third consecutive week of falling and the lowest price in seven weeks.

Tandem products were mixed, CRC was unchanged while HDG slipped by $5, resulting in the HDG – HRC differential to dip by $5 or -2.3% to $210.

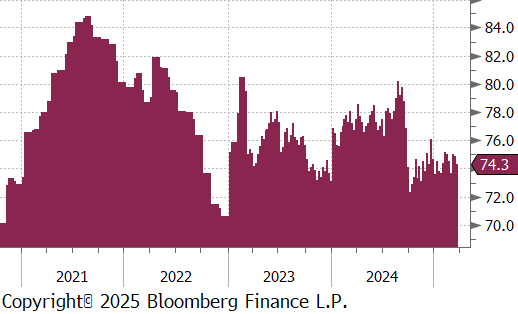

Mill production remained restrained, with capacity utilization ticking down by -0.6% to 74.3%, bringing raw steel production down to 1.654m net tons.

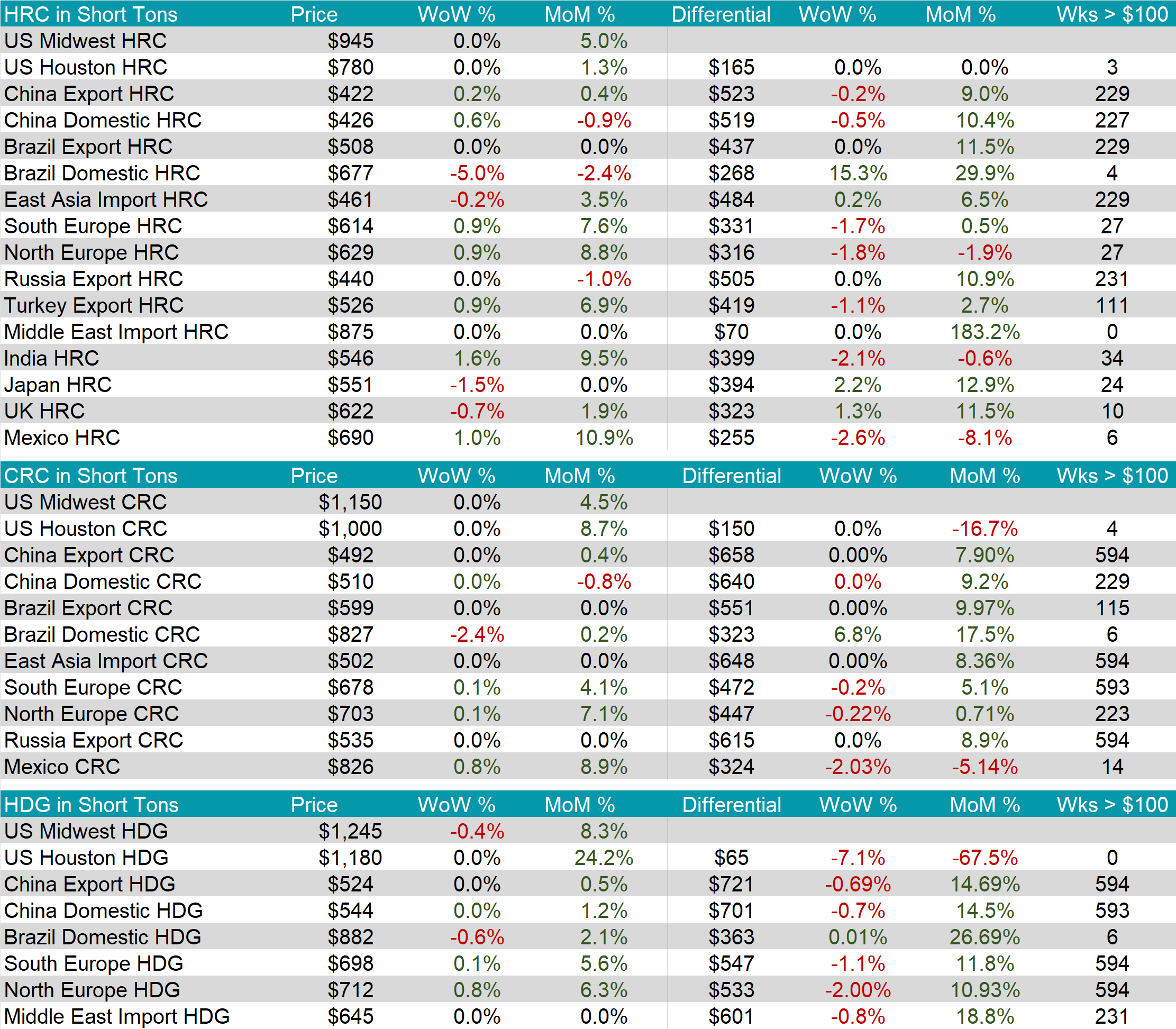

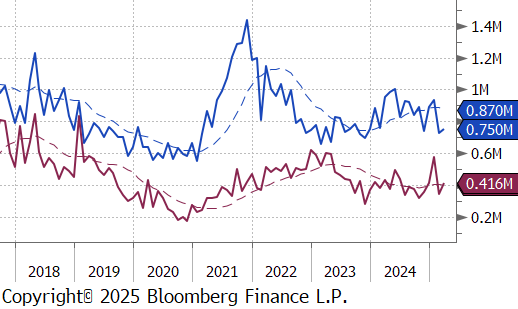

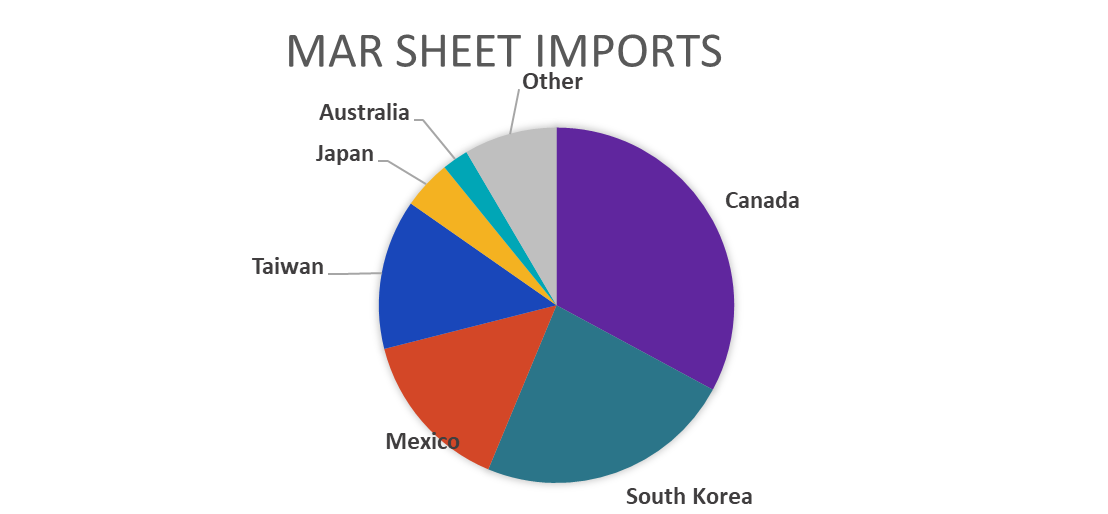

March Projection – Sheet 750k (up 24k MoM); Tube 416k (up 68k MoM)

February Census – Sheet 726k (down 209k MoM); Tube 348k (down 232k MoM)

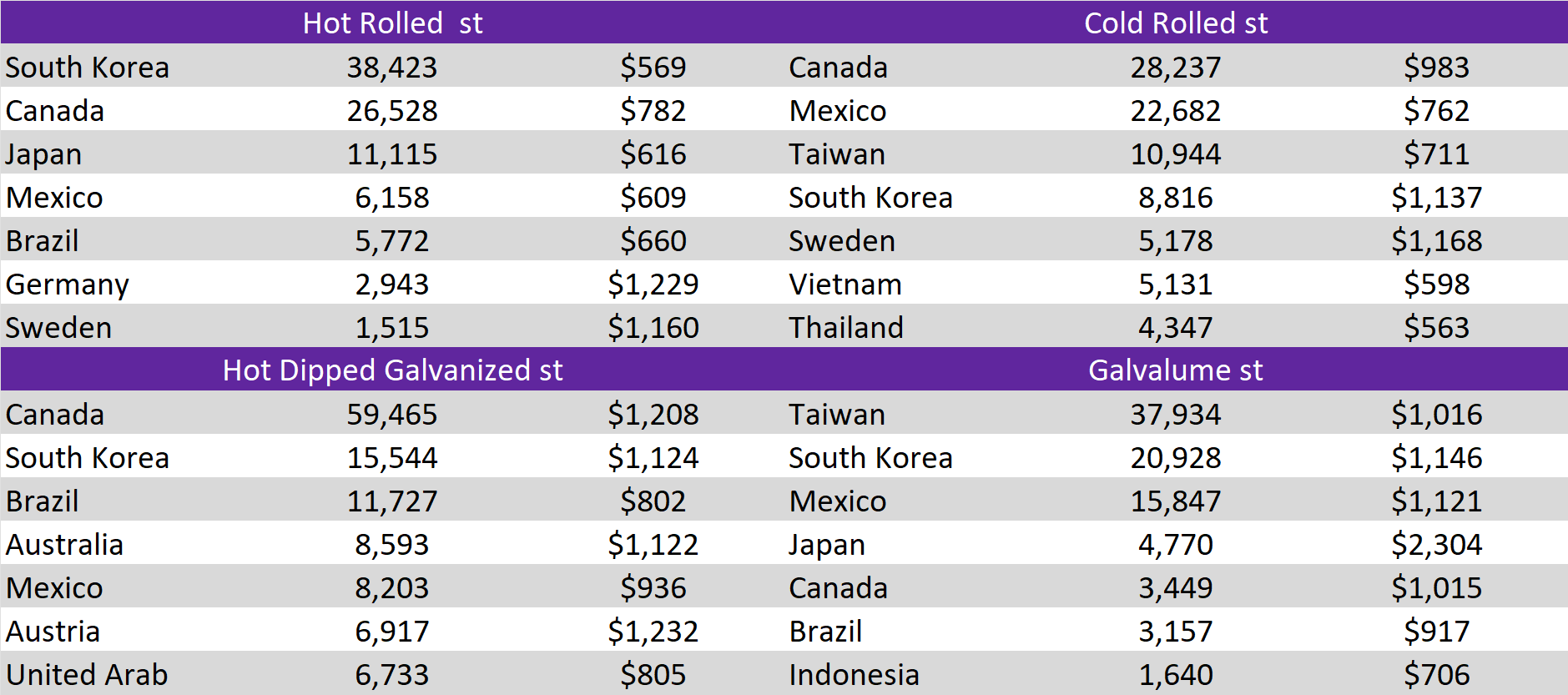

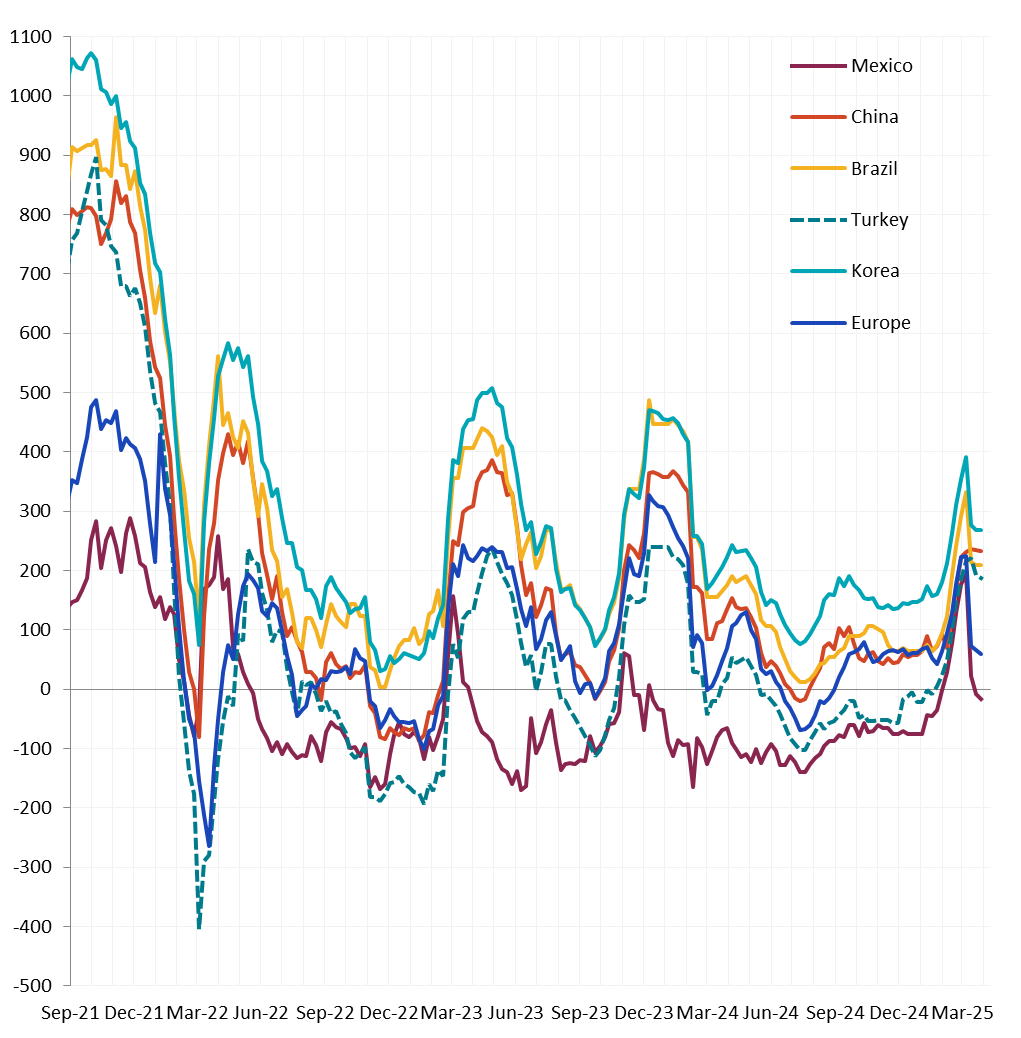

Global differentials were mixed. Main price changes include the China Export HRC rising by 0.2%, N Europe HRC and Turkey Export HRC were both up by 0.9%, while Korea HRC price fell by -0.2%.

Scrap

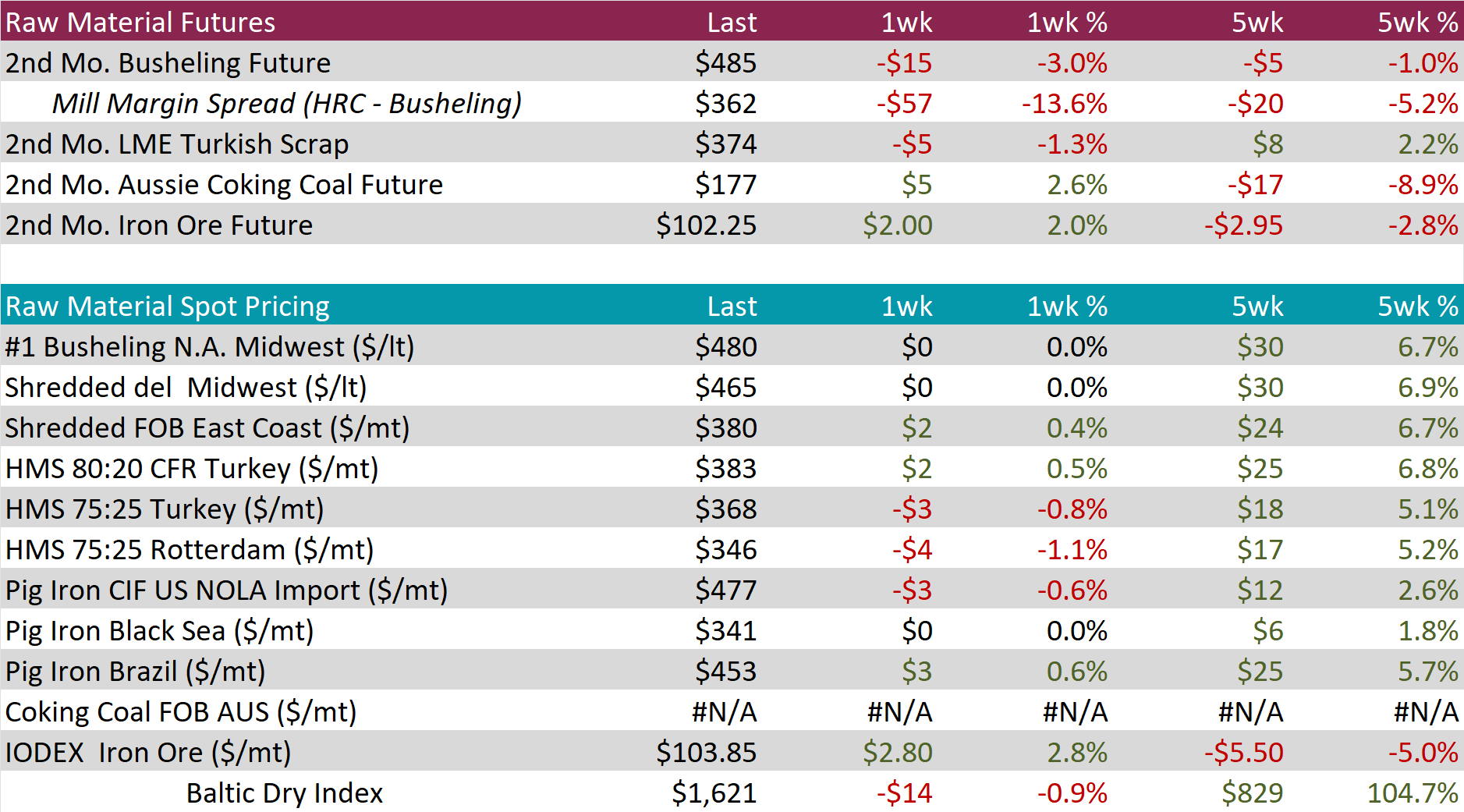

The busheling 2nd month future declined further, this week falling by $15 or -3.0% to $485, marking the third consecutive decrease and the lowest price in seven weeks.

The Aussie coking coal 2nd month future rose by $5 or 2.6% to $177. rebounding from four consecutive weeks of declines.

The iron ore 2nd month future increased by $2 or 2.0% to $102.25, rebounding from last weeks price drop and reaching the highest price in four weeks.

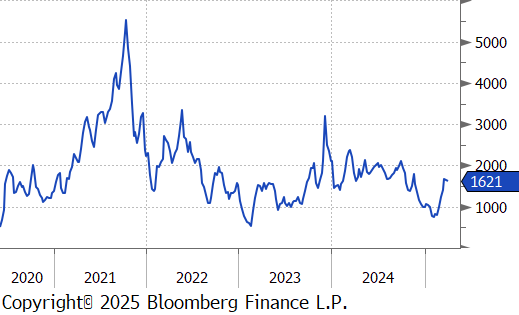

Dry Bulk / Freight

The Baltic Dry Index eased by $14 or -0.9% to $1,621, ending five weeks of consecutive gains.

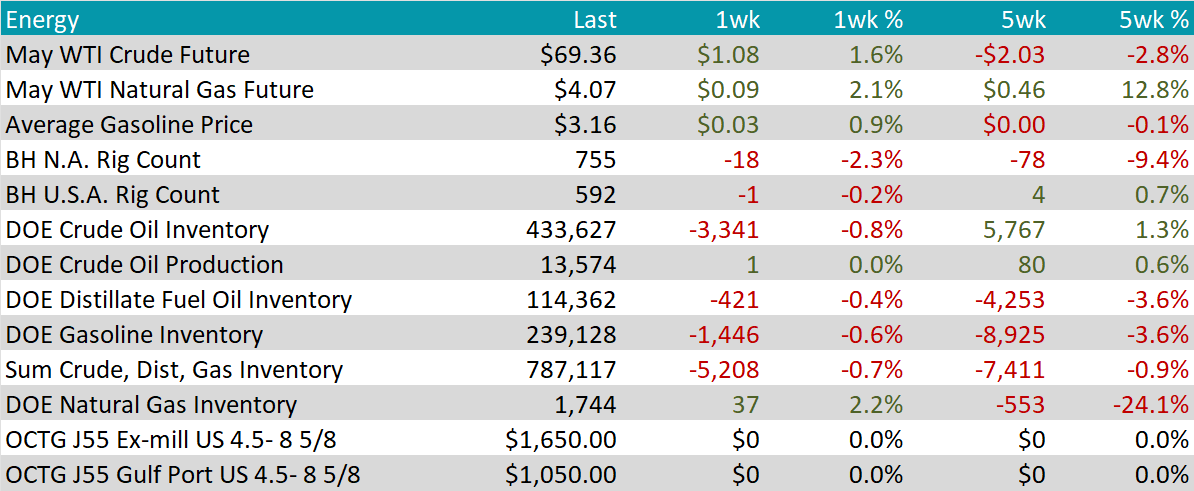

WTI crude oil future gained $1.08 or 1.6% to $69.36/bbl.

WTI natural gas future gained $0.09 or 2.1% to $4.07/bbl.

The aggregate inventory level fell further, this week experiencing a -0.7% decline.

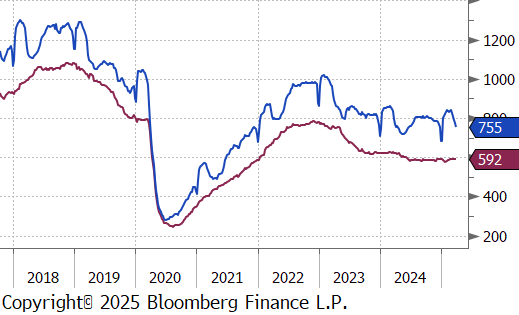

The Baker Hughes North American rig count reduced by 18 rigs, bringing the total count down to 755. Meanwhile, the US rig count slipped by 1 rig, bringing the total count to 592 rigs.

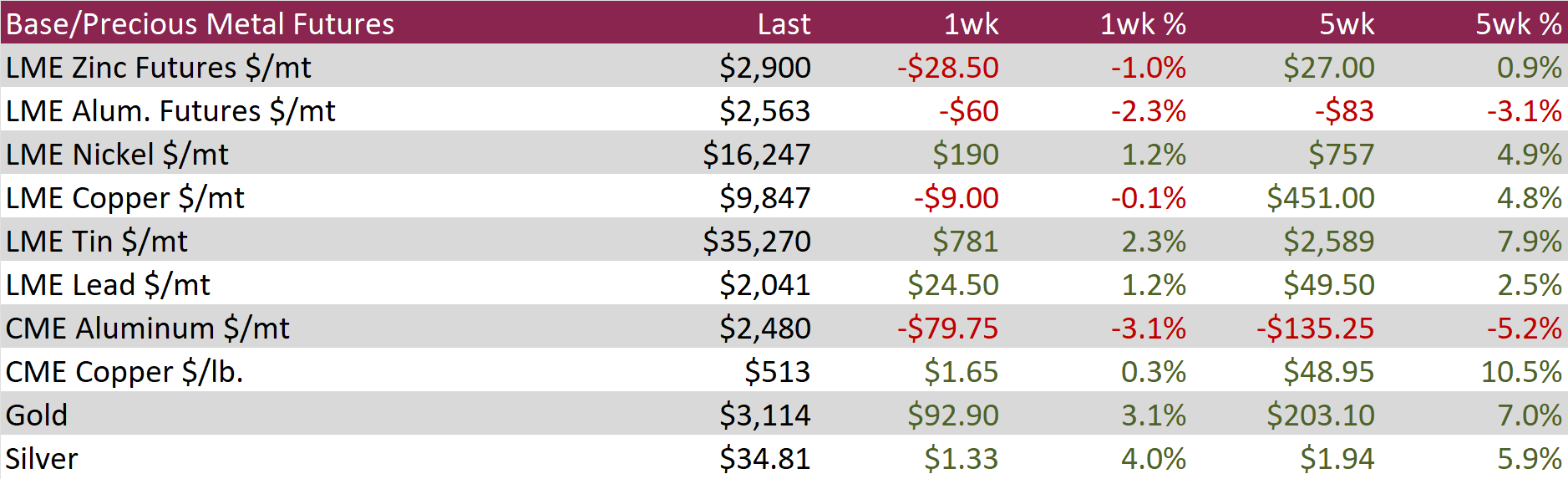

Aluminum futures dropped by $60 or -2.3% to $2,563, marking a 12-week low, as escalating trade tensions and tariffs fueled concerns over global demand. The U.S. slapped a 200% tariff on Russian aluminum. Additional tariffs on autos and industrial metals are expected, raising fears of supply chain disruptions and softer demand. Meanwhile, Canada banned Russian aluminum and steel imports, further reshaping global trade flows and intensifying uncertainty. These protectionist policies have pressured aluminum prices downward, as markets weigh the potential hit to industrial consumption. On the supply side, major alumina producers in Guinea, Australia, and China have expanded capacity to recover from last year’s disruptions, improving raw material availability. However, China’s record 44 million tons of aluminum production in 2024 suggests future output may slow, as Beijing enforces environmental caps to curb oversupply and meet carbon reduction targets.

Copper futures inched up by $1.65 or 0.3% to $513, pulling back from record highs as traders took profits while awaiting clarity on potential U.S. tariffs. The metal had surged to all-time highs after reports that Donald Trump planned to impose copper import tariffs within weeks, accelerating the expected timeline and sparking a rush to secure supply. In response, U.S. copper imports jumped to 500,000 tons, far above the usual 70,000-ton monthly average, tightening supply in key markets, especially in Asia. The scramble for material has also led U.S. companies to explore alternative suppliers in South America, highlighting concerns over long-term availability and potential shifts in global copper trade flows.

Precious Metals

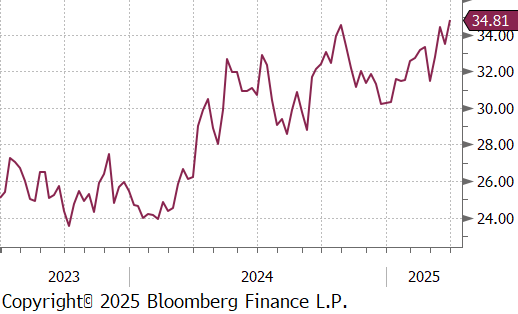

Silver grew by $1.33 or 4.0% to $34.81, approaching a 13-year high, as escalating trade tensions and economic uncertainty fueled demand for safe-haven assets. Over the weekend, Donald Trump reaffirmed plans for reciprocal tariffs on all countries, reportedly urging advisers to take a more aggressive stance—raising fears of retaliatory measures, inflationary pressures, and slower growth. Meanwhile, San Francisco Fed President Mary Daly suggested that weaker-than-expected inflation data has cast doubt on the Federal Reserve’s outlook, potentially delaying the anticipated two interest rate cuts this year. This uncertainty further strengthened investor interest in silver as a hedge against economic volatility.

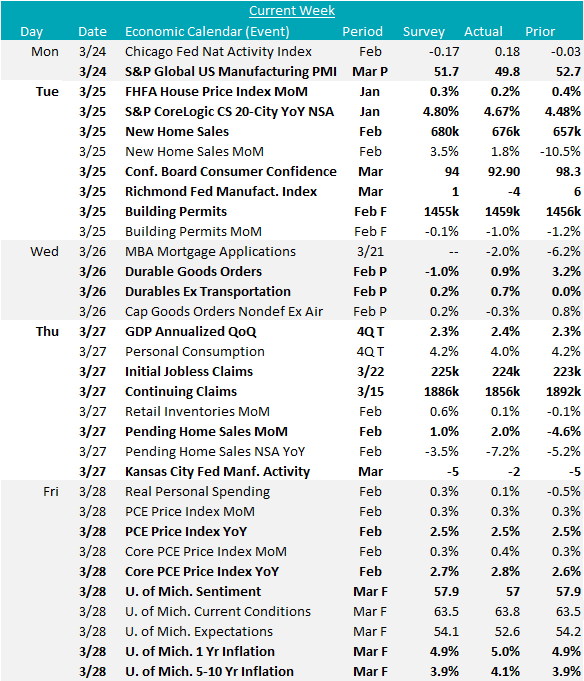

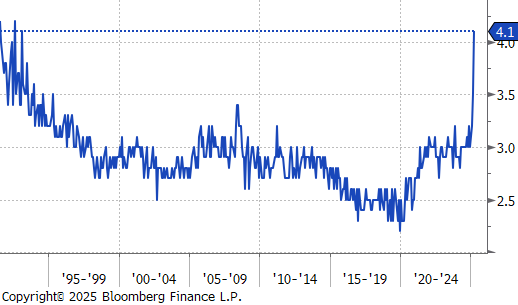

Manufacturing data took a step back this week, with the S&P Global US Manufacturing PMI slipping to 49.8, below the expected 51.7, marking a slight return to contraction territory. Regional FED Manufacturing surveys presented a mixed picture. Richmond fell to -4, missing the forecasted 1, while Kansas City rose to -2, performing slightly better than the expected -5 but both remain in contraction. On a more positive note, Durable Goods Orders posted a 0.9% increase, significantly above the anticipated -1% decline – though this may reflect tariff front-running, as firms accelerate purchases ahead of potential trade barriers.

In contrast, the housing market delivered a more optimistic set of data in February. New home sales rose 1.8% in February, reaching 676k (SA), though slightly below the expected 680k. Pending home sales also outperformed expectations, increasing 2% from January, double the forecasted 1% gain. Additionally, building permits saw a minor upward revision, increasing to 1,459k, up 3k from the preliminary estimate. These figures suggest a steady, albeit measured, recovery in the sector.

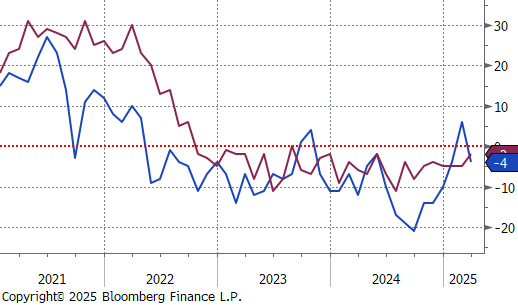

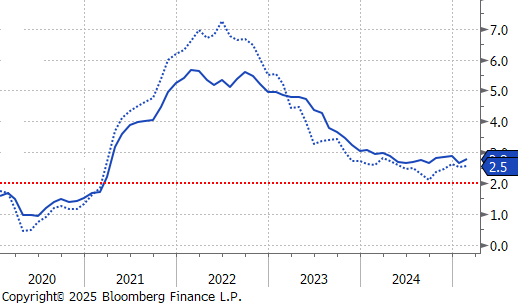

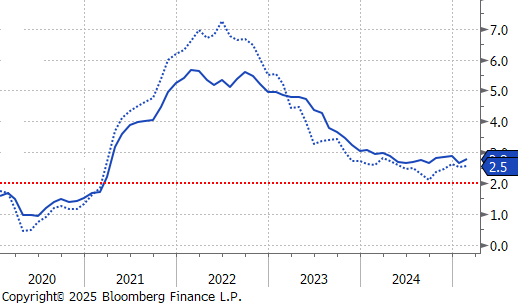

Inflation concerns remain front and center. The latest Core PCE reading came in at 2.8% YoY, exceeding expectations of 2.7%, signaling persistent inflationary pressures. More concerning, though, was the sharp increase in consumer inflation expectations. The final March University of Michigan Consumer Sentiment Survey showed 1-year inflation expectations surging to 5%, the highest since November 2022. Even more alarming, the 5-10-year expectation climbed to 4.1%, its highest level in 32 years, raising fears that inflation may become further entrenched. Taking a step back, the FOMC has noted that they will reserve judgement on consumer surveys for some time, to allow policy dynamics to settle – this suggests they will be slow to cut (or hike) this year.