Flack Capital Markets | Ferrous Financial Insider

May 24, 2024 – Issue #433

May 24, 2024 – Issue #433

Overview:

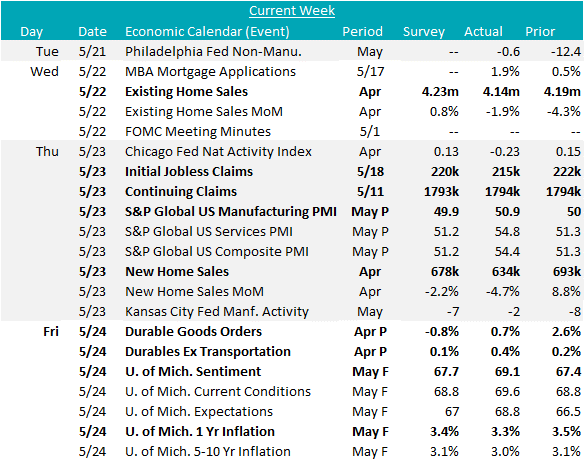

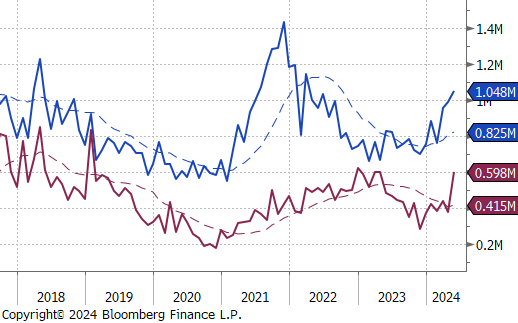

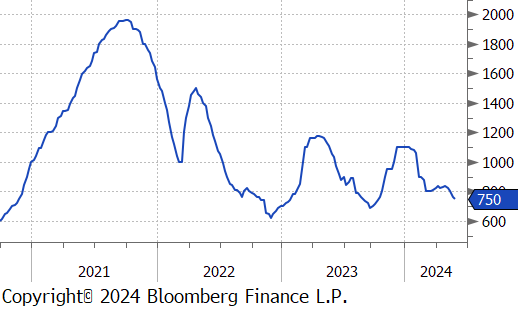

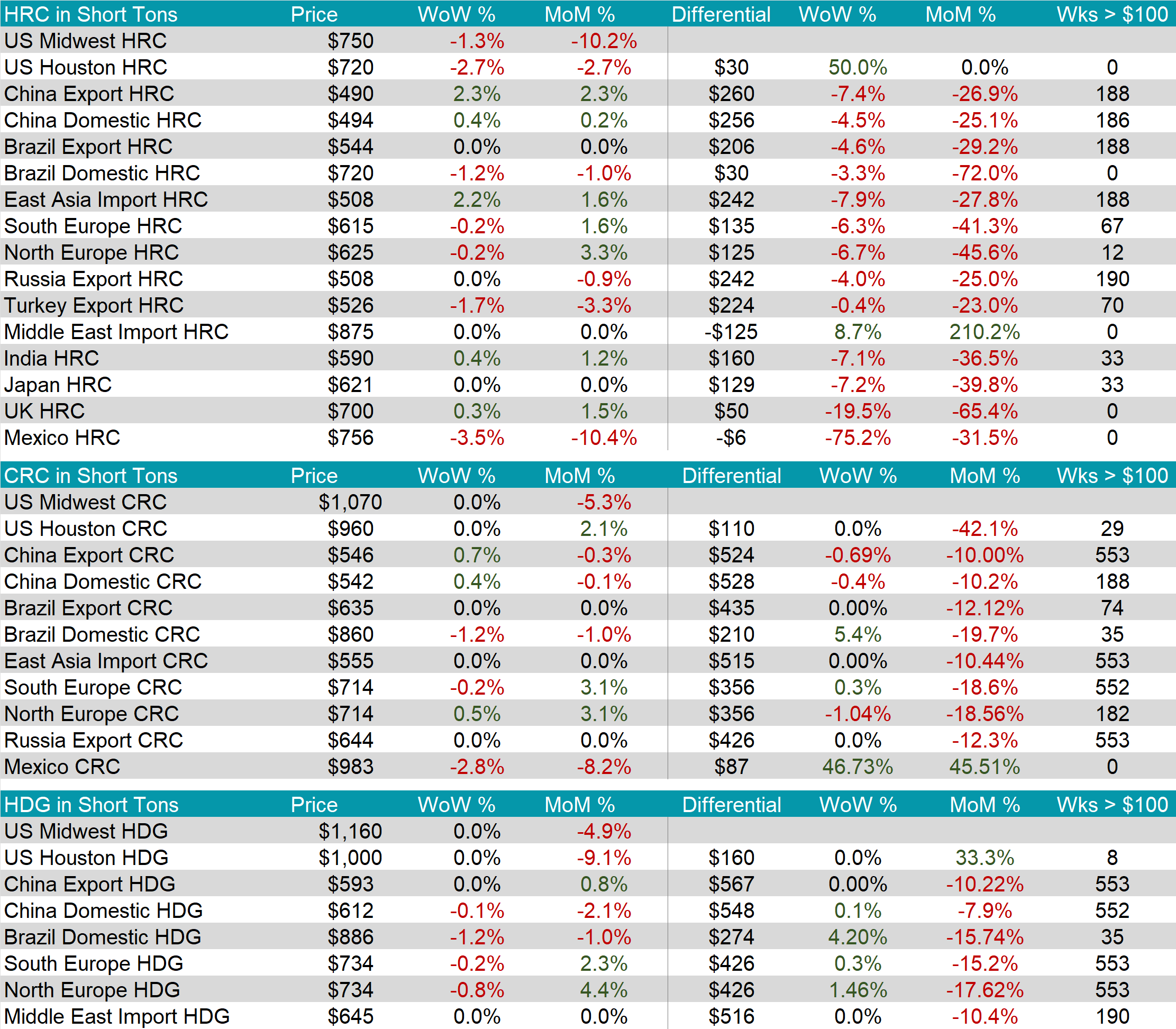

The HRC spot price dropped by $10 or -1.3% to $750, reaching the lowest price since mid-October 2023. At the same time, the 2nd month future dipped by $2 or -0.3% to $775.

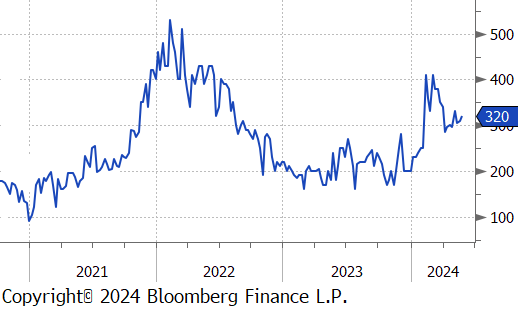

Tandem products both remained unchanged, resulting in the HDG – HRC differential to rise by $10 to $310.

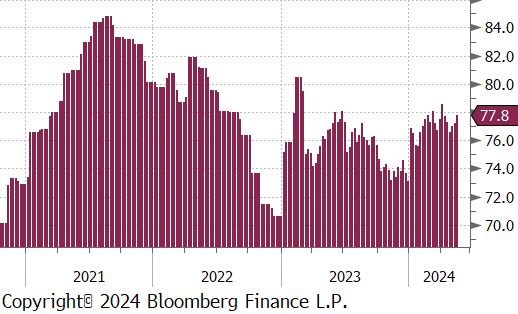

Mill production continued to increase, with capacity utilization ticking up by 0.6% to 77.8%, bringing raw steel production up to 1.728m net tons. This marks the highest level since early-April.

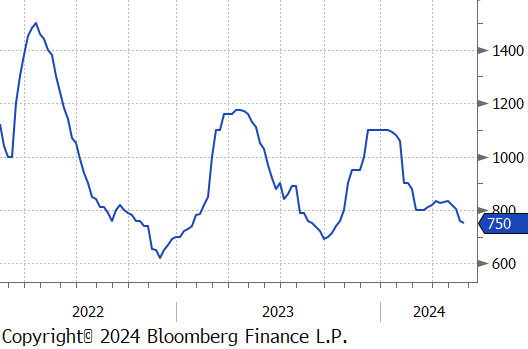

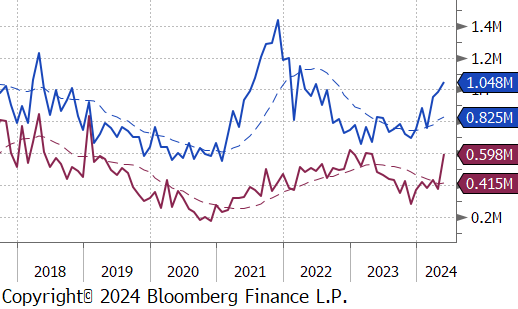

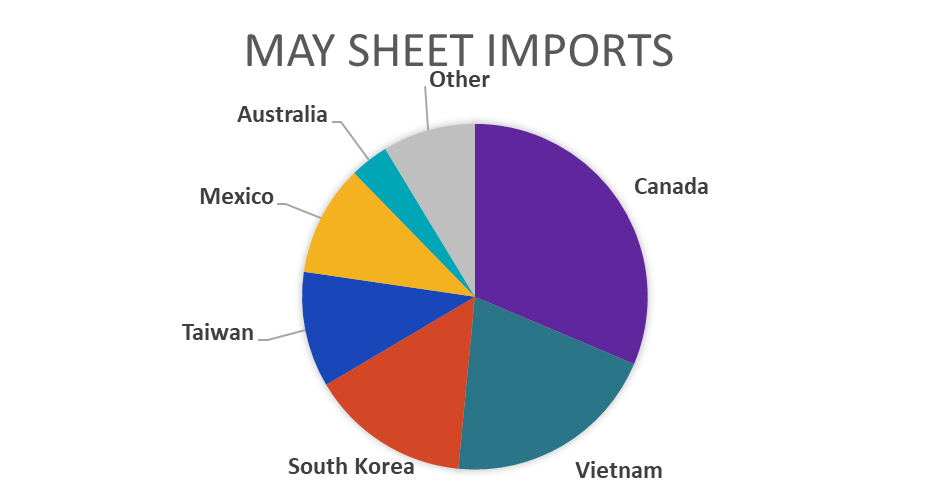

May Projection – Sheet 1048k (up 61k MoM); Tube 598k (up 222k MoM)

April Projection – Sheet 987k (up 31k MoM); Tube 376k (down 60k MoM)

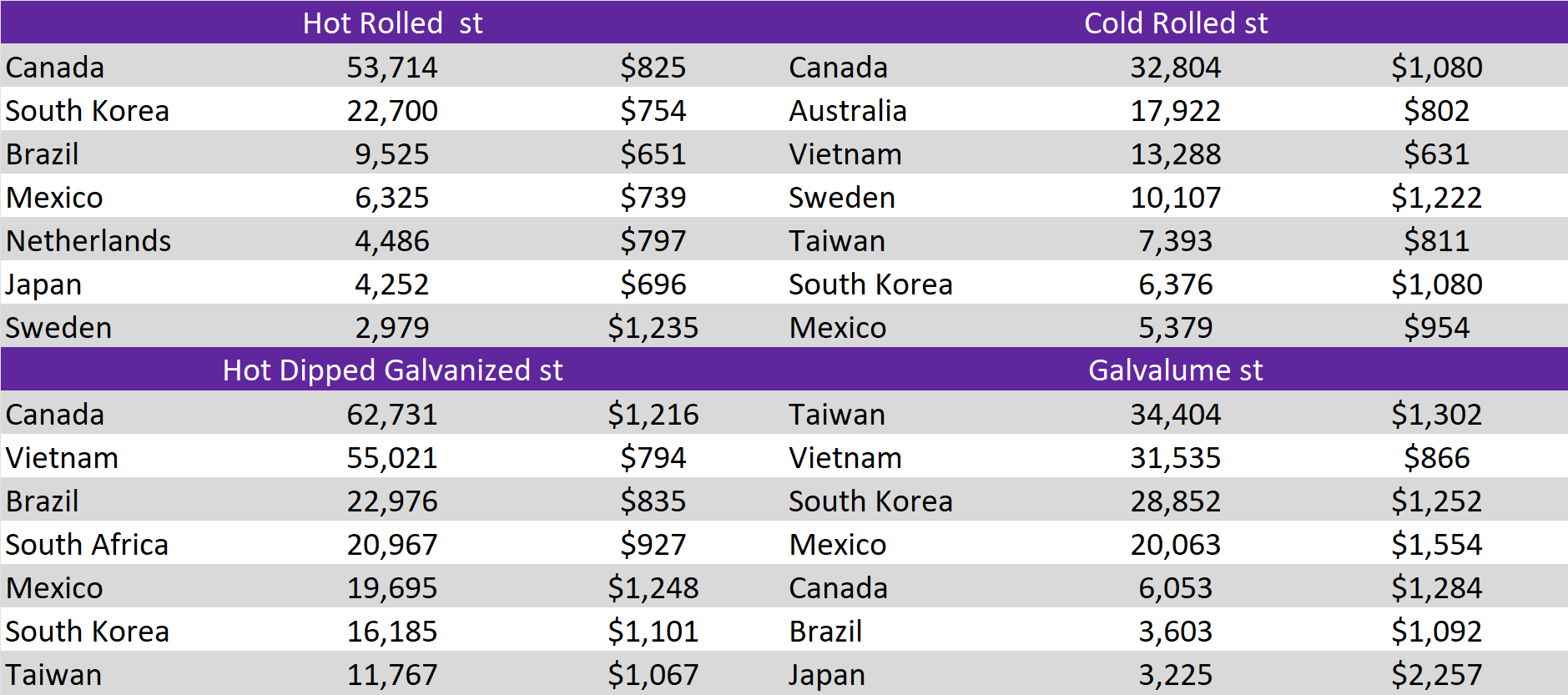

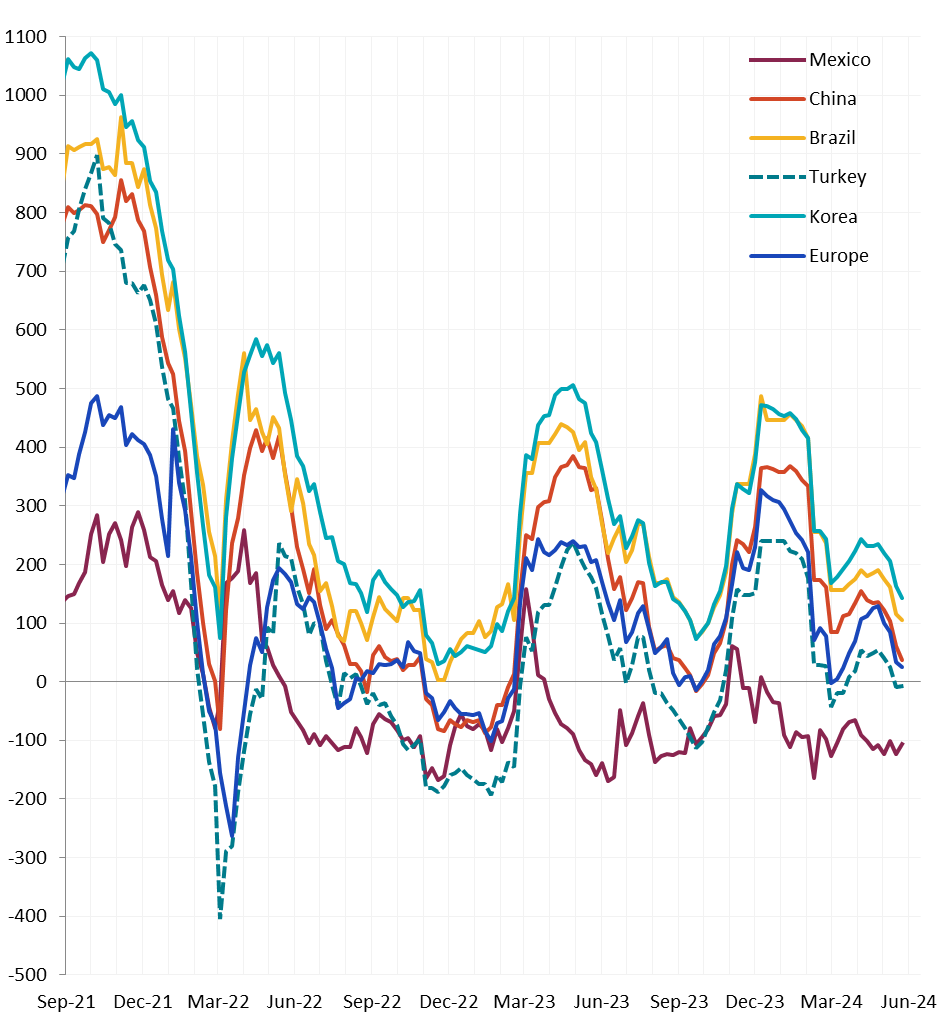

All watched global differentials contracted further. Most notable. Mexico HRC fell by -3.5% and the Houston HRC fell by -2.7%, while China Export HRC rose by 2.3%.

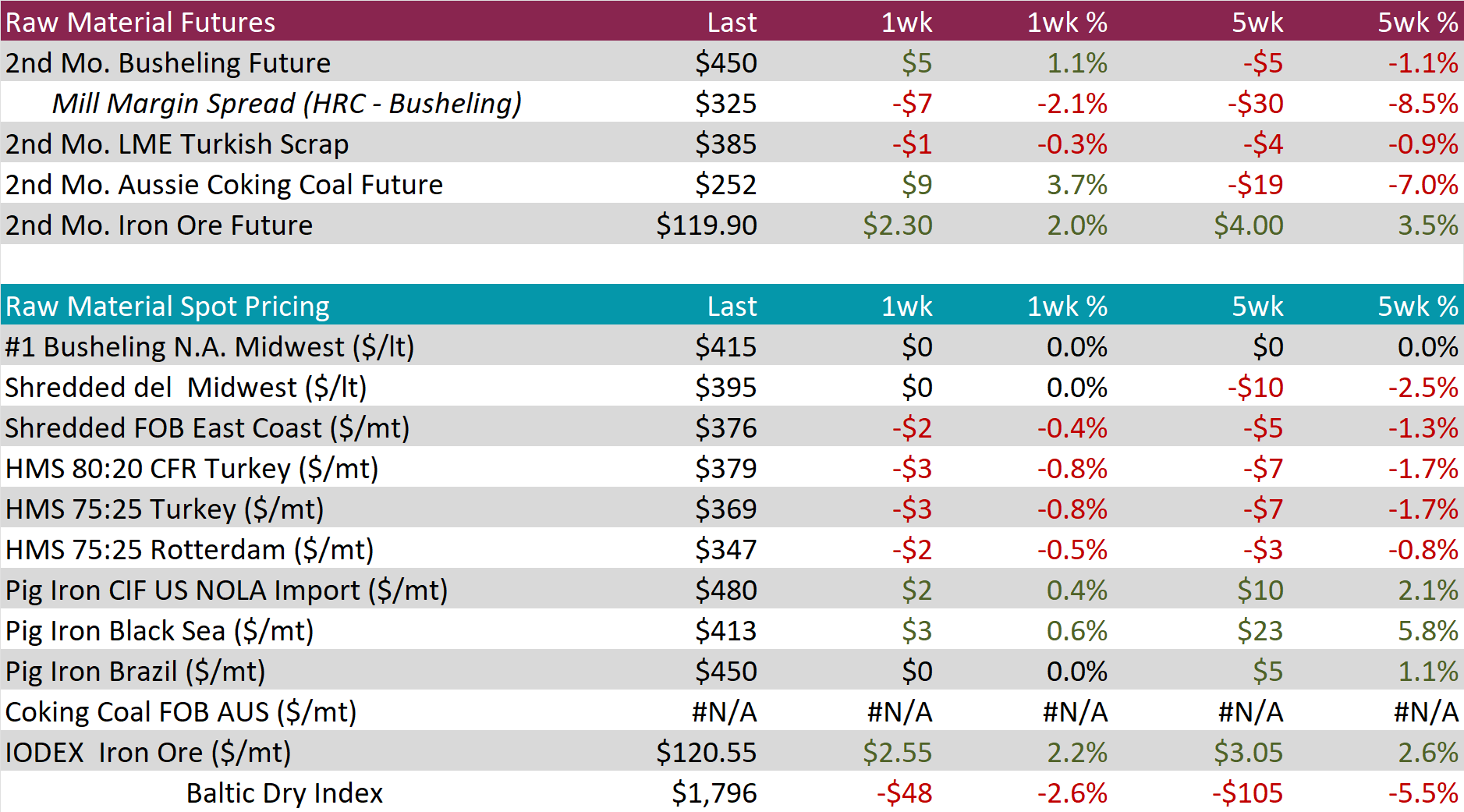

Scrap

The 2nd month busheling future rose by $5 or 1.1% to $450, bringing the five-week price change to be down by $5 or -1.1%.

The Aussie coking coal 2nd month future increased by $9 or 3.7% to $252, rebounding from last weeks price drop.

The 2nd month iron ore future climbed by $2.30 or 2.0% to $119.90, reaching back to levels last seen in February.

Dry Bulk / Freight

The Baltic Dry Index declined slightly by $48 or -2.6% to $1,796, further the decline from recent price high seen two weeks ago.

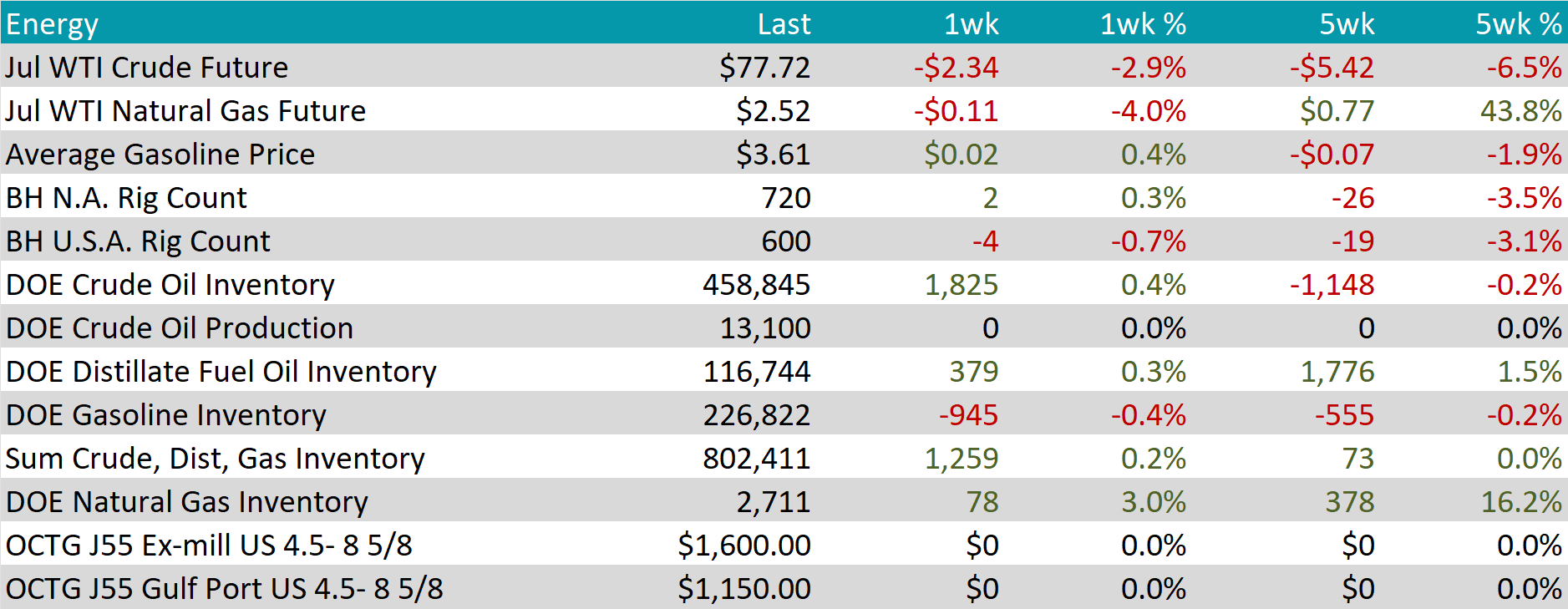

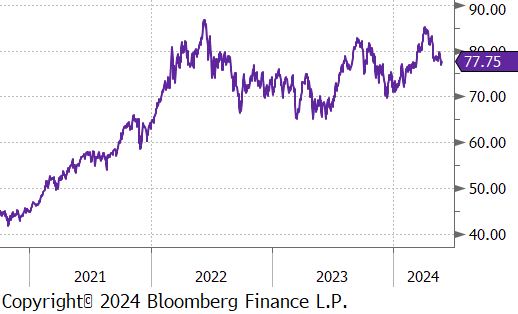

WTI crude oil future lost $2.34 or -2.9% to $77.72/bbl.

WTI natural gas future lost $0.11 or -4.0% to $2.52/bbl.

The aggregate inventory level experience a slight increase, rising by 0.2%.

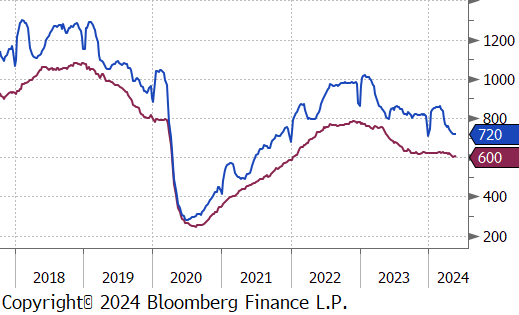

The Baker Hughes North American rig count gained 2 rigs, bring the total count to 720 rigs. On the other hand, the US rig count reduced by 4 rigs, bringing the total count to 600 rigs.

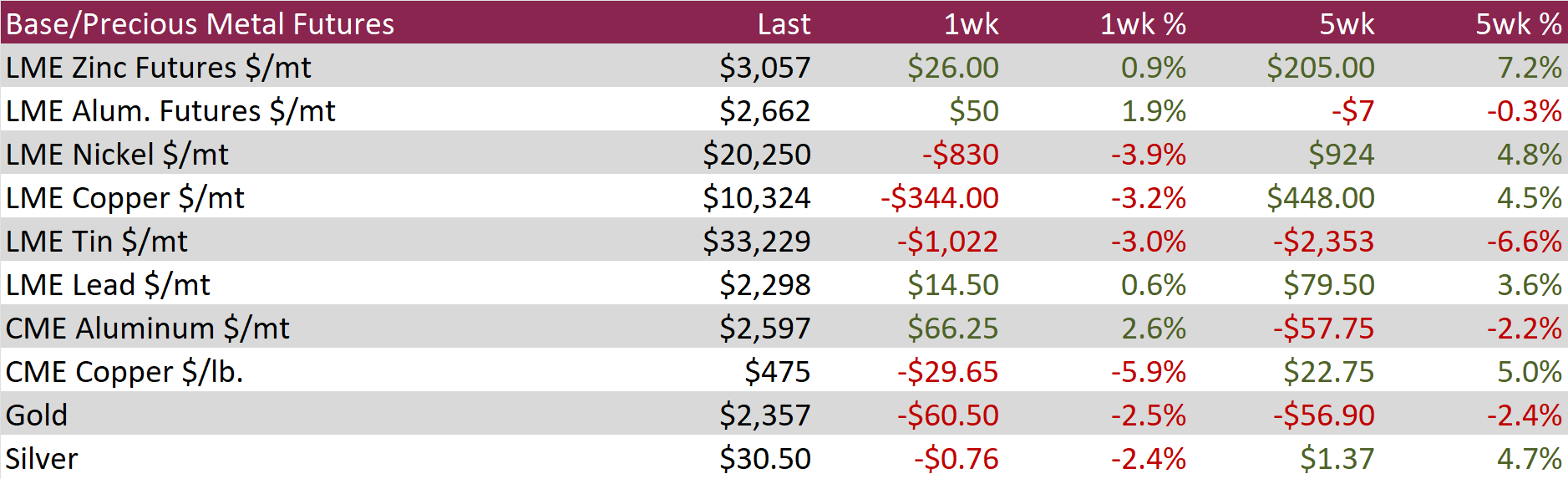

Aluminum futures climbed by $50 or 1.9% to $2,662, marking the highest level in two years and continuing the strong momentum seen in base metals due to supply disruptions. Gas shortages forced mining giant Rio Tinto to declare force majeure on alumina shipments from its Australian refineries, spotlighting supply concerns from the world’s second-largest producer. Additionally, uncertain weather conditions in Yunnan, a major Chinese aluminum-producing region, threatened the availability of hydroelectric power essential for production, compounding fears of inadequate output. Meanwhile, on-warrant aluminum stocks at the LME warehouse in Port Klang, Malaysia, sharply decreased following the critical May 15th delivery deadline. This drop reflects moves by trading giants to capitalize on new contract rules enacted after the US and UK imposed sanctions on Russian aluminum, further straining availability for clients restricted to purchasing specific non-Russian aluminum contracts.

Copper futures declined by $29.65 or -5.9% to $475, a significant drop from the record high, as subdued near-term demand countered the speculative surge that boosted base metals earlier this month. Despite a tight ore supply and reduced treatment volumes in China’s vast refining industry, import demand in China stayed low. This increase in inventories led to delivery prices from bonded warehouses falling below LME prices for the first time since records began in 2017, signaling weak physical demand. Nevertheless, speculative interest in copper has kept its prices 25% higher year-to-date, driven by its essential role in electrification projects, including grid-scale energy storage and data-center infrastructure. This interest is bolstered by expectations of increased Chinese market activity following Beijing’s significant economic support measures.

Gold edged down by $60.50 or -2.5%, stabilizing around $2,357, with investors adopting a cautious stance in anticipation of the upcoming US PCE inflation report, which is expected to provide insights into the Federal Reserve’s future policy direction. The report, due on Friday, is predicted to mirror the CPI, suggesting that inflation has not escalated. Additionally, forthcoming data on personal income and spending, also expected this week, are anticipated to indicate a slowdown. Meanwhile, geopolitical tensions in the Middle East have bolstered gold’s status as a safe-haven asset, following an Israeli airstrike that reportedly killed 45 people at a tent camp in Rafah. This incident has prompted international calls for the enforcement of a World Court order to cease Israel’s military actions. In other developments, China’s net gold imports through Hong Kong saw a significant reduction of 38% in April compared to the previous month, highlighting a decrease in demand within the region.

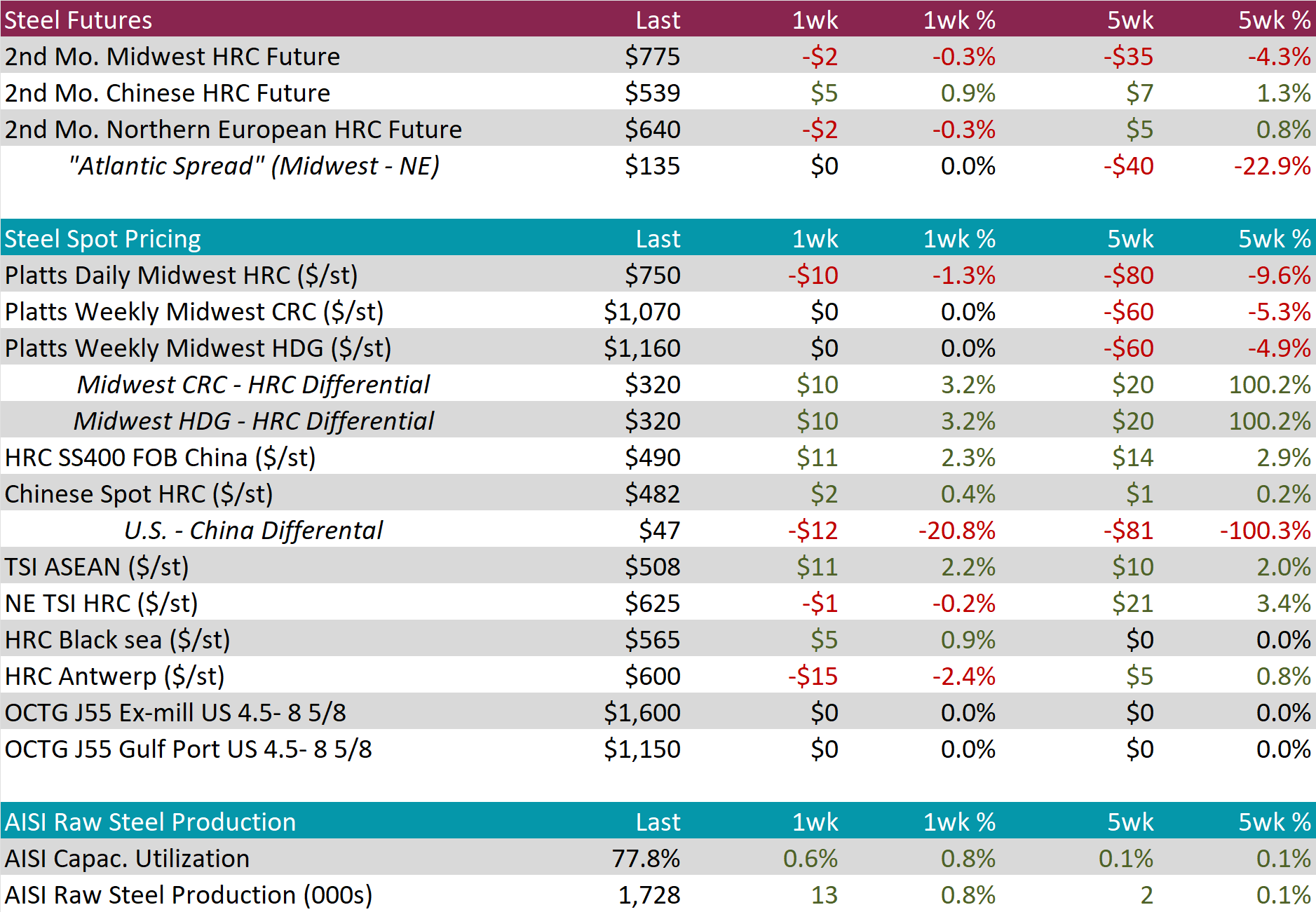

The Kansas City FED Manufacturing survey was up to -2, better than expectations of -7, but the index remains in contraction. Underlying data highlights the fact that a full recovery in the sector will take some time. Additionally, the preliminary May S&P Global Manufacturing PMI beat expectations of 49.9 and rose into expansion territory, to 50.9. This is 5th straight print in expansion territory. April preliminary Durable Goods surprised to the upside as well, with new orders up 0.7%, versus the expected 0.8%. This could also be an encouraging signal for the auto sector which is a major part of this index and has so far disappointed this year.

Housing data came in soft this week, continuing the trend from last week’s starts/permits below expectations. Existing home sales fell by -1.9% to an annual rate of 4.14m units, the lowest level in three months. This compares to an upwardly revised 4.22 million units in March and forecasts of 4.21 million. Similarly, new home sales declined by -4.7% to an annualized 634k, coming in well below projections of 680k. March was also revised down to 665k.

Last, the final May University of Michigan Consumer Sentiment survey data was released and showed that sentiment started improving as the month progressed. The topline index came in at 69.1, above the preliminary reading of 67.4. Both current conditions and expectations improved, but most importantly, the 1yr inflation expectations decreased from 3.5% to 3.3%. While this figure is still trending higher compared to earlier in the year, the severity of concern about prices was reduced.