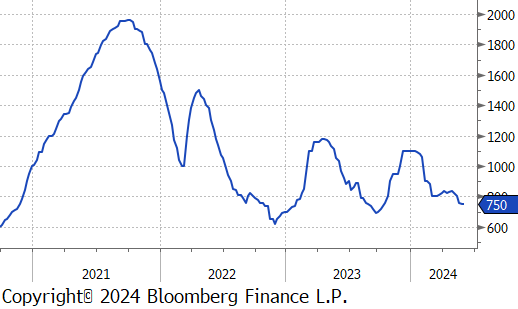

Flack Capital Markets | Ferrous Financial Insider

May 31, 2024 – Issue #434

May 31, 2024 – Issue #434

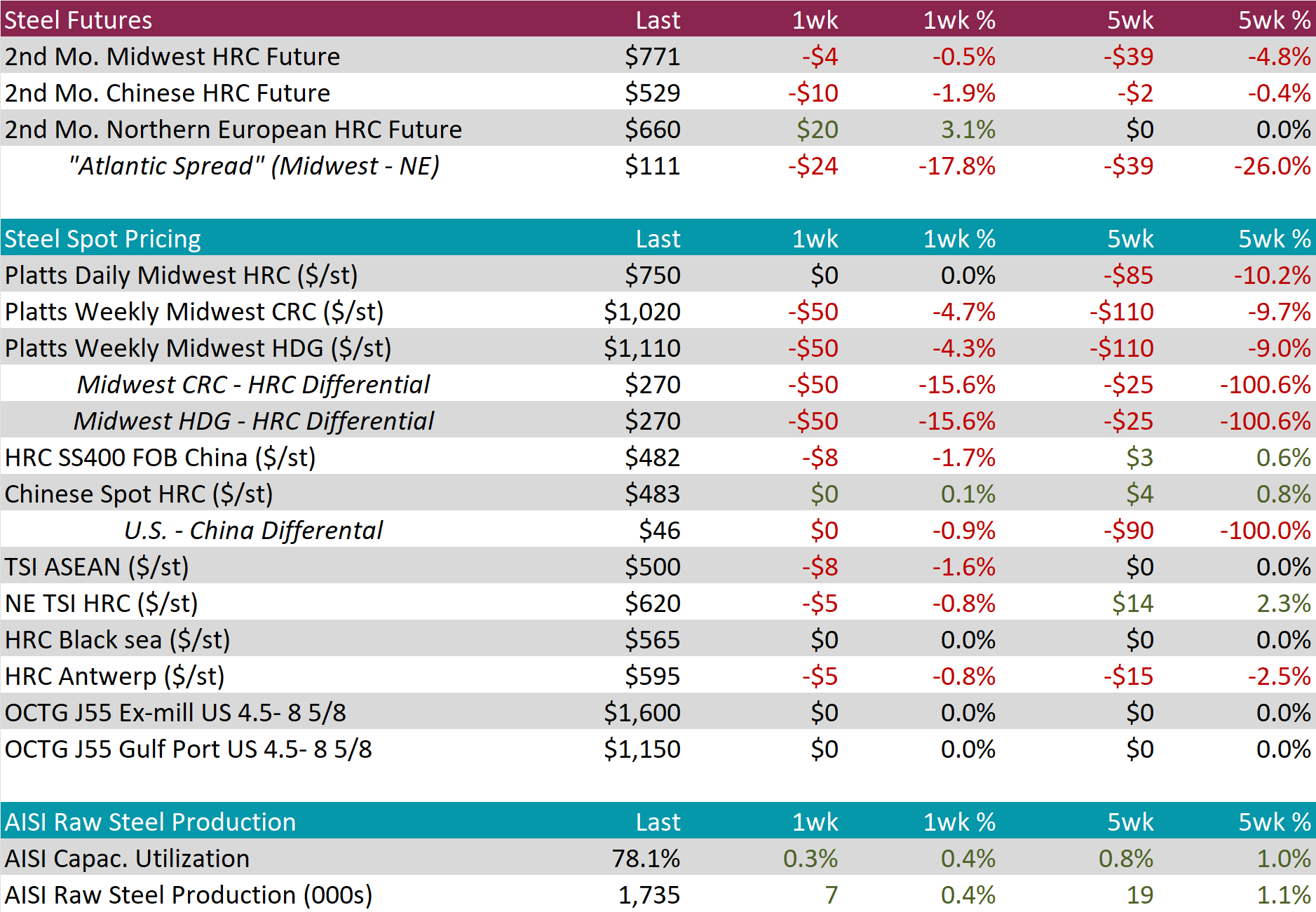

Overview:

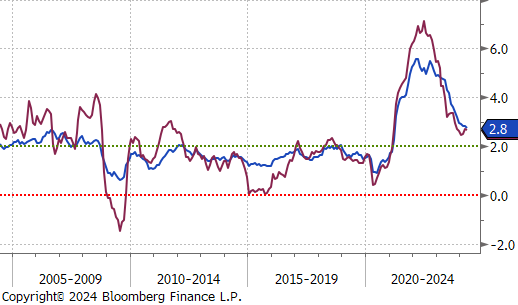

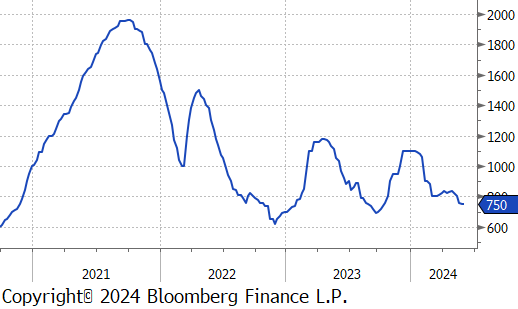

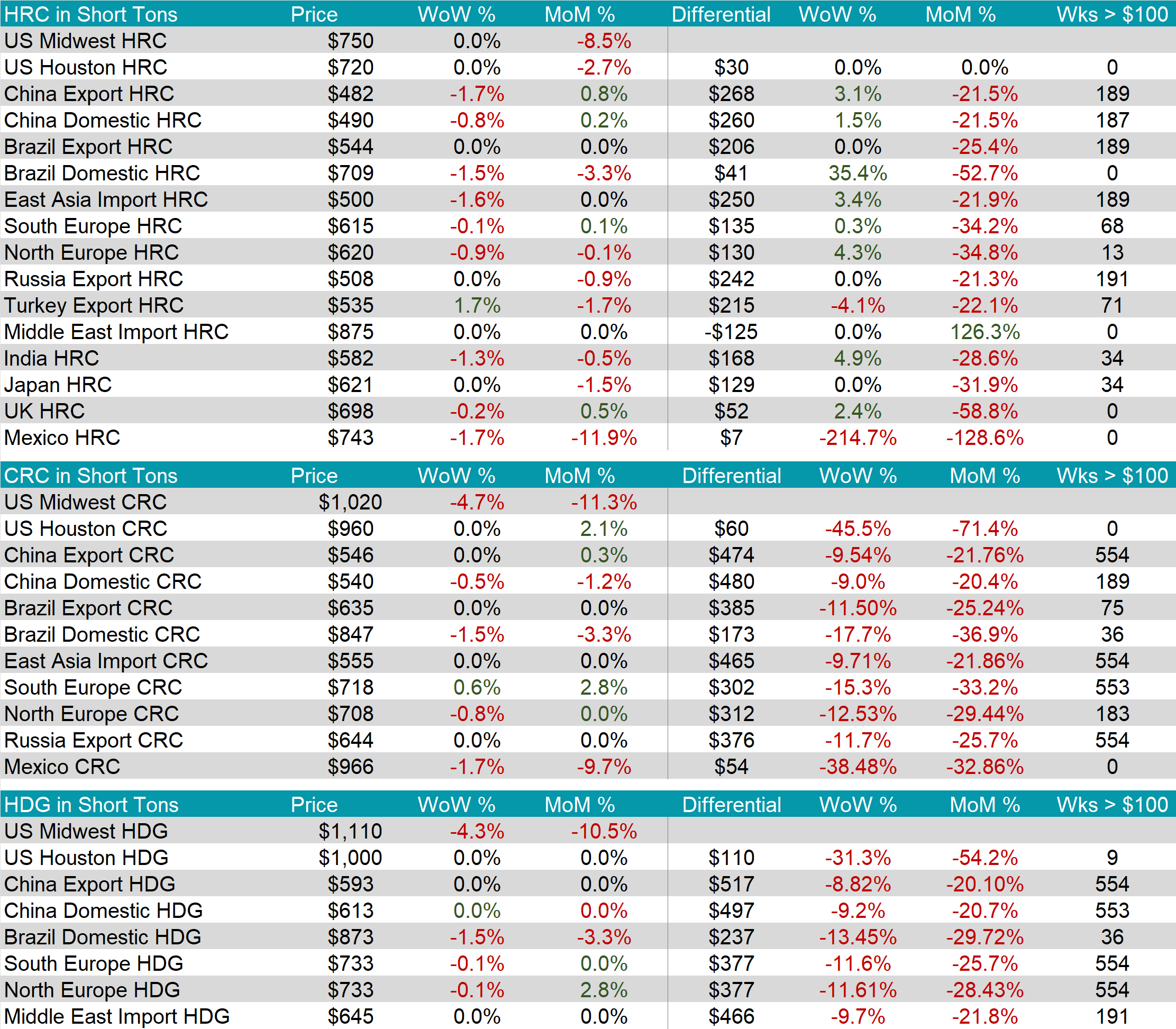

The HRC spot price held steady at $750, bringing the five-week price change to be down by $85 or -10.2%. At the same time, the HRC 2nd month future edged lower, falling by $4 or -0.5% to $771.

Tandem products both dropped by $50, resulting in the HDG – HRC differential to be down by $50 or -15.6% to $270, its lowest level since early 2024.

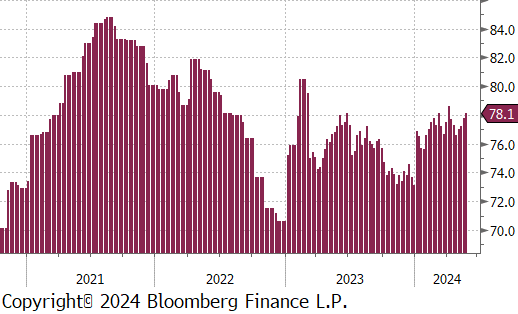

Mill production continued to ramp up, with capacity utilization ticking up by 0.3% to 78.1%, bringing raw steel production up to 1.735m net tons – a level not seen since early April.

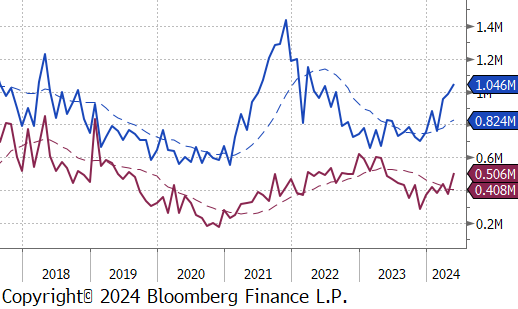

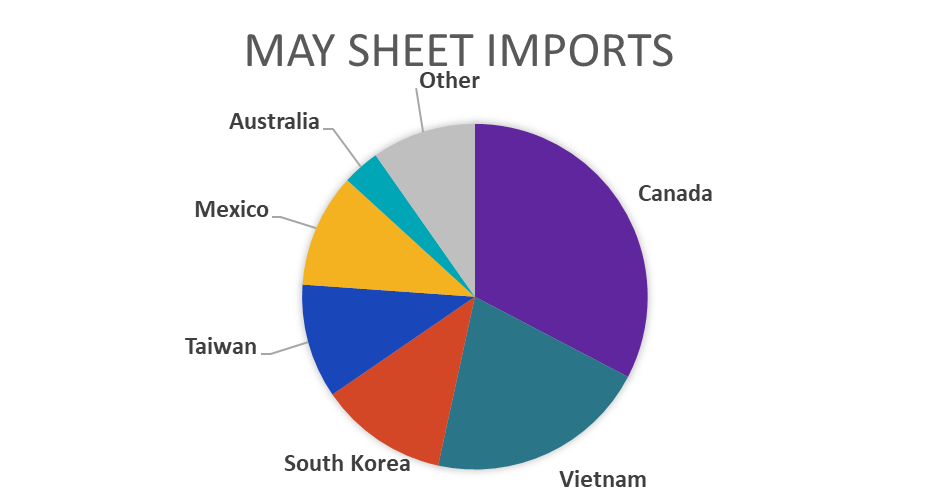

May Projection – Sheet 1046k (up 59k MoM); Tube 506k (up 130k MoM)

April Projection – Sheet 987k (up 31k MoM); Tube 376k (down 60k MoM)

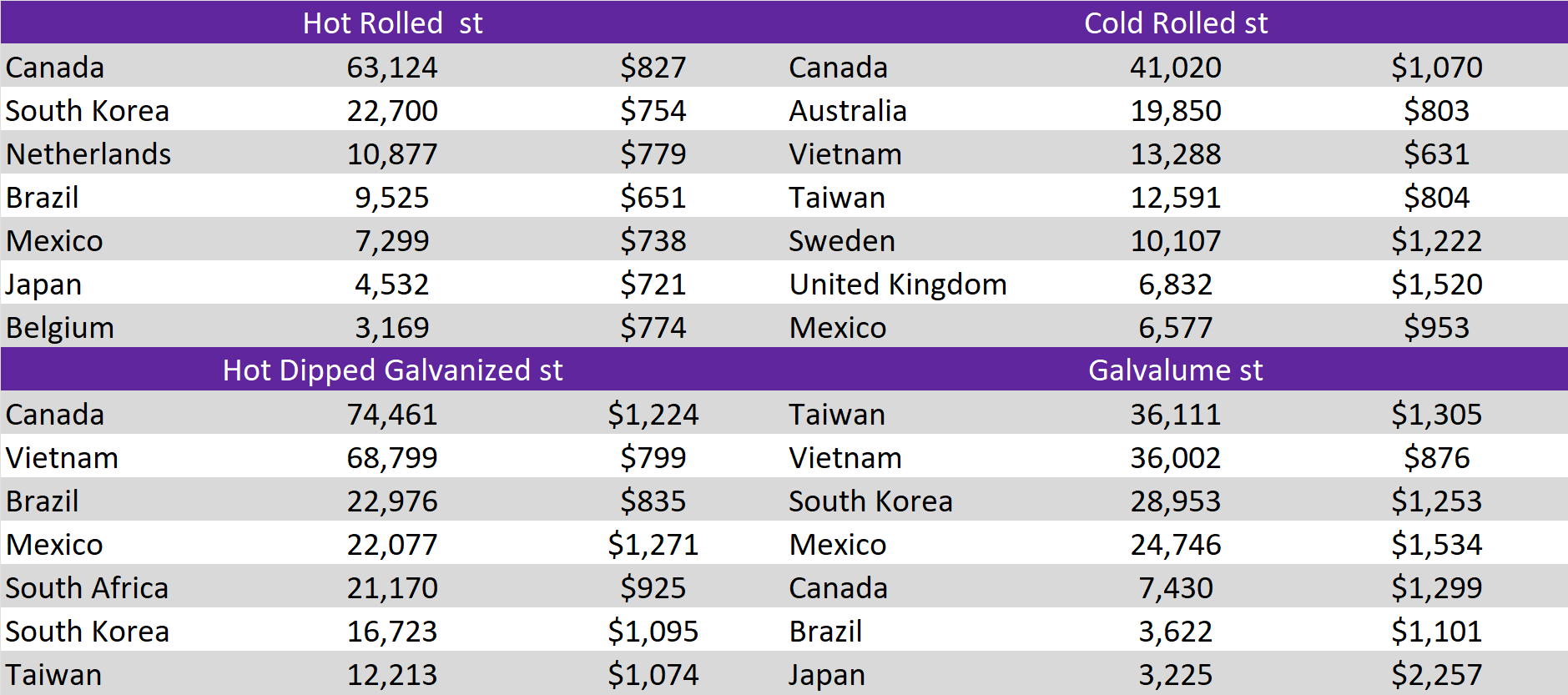

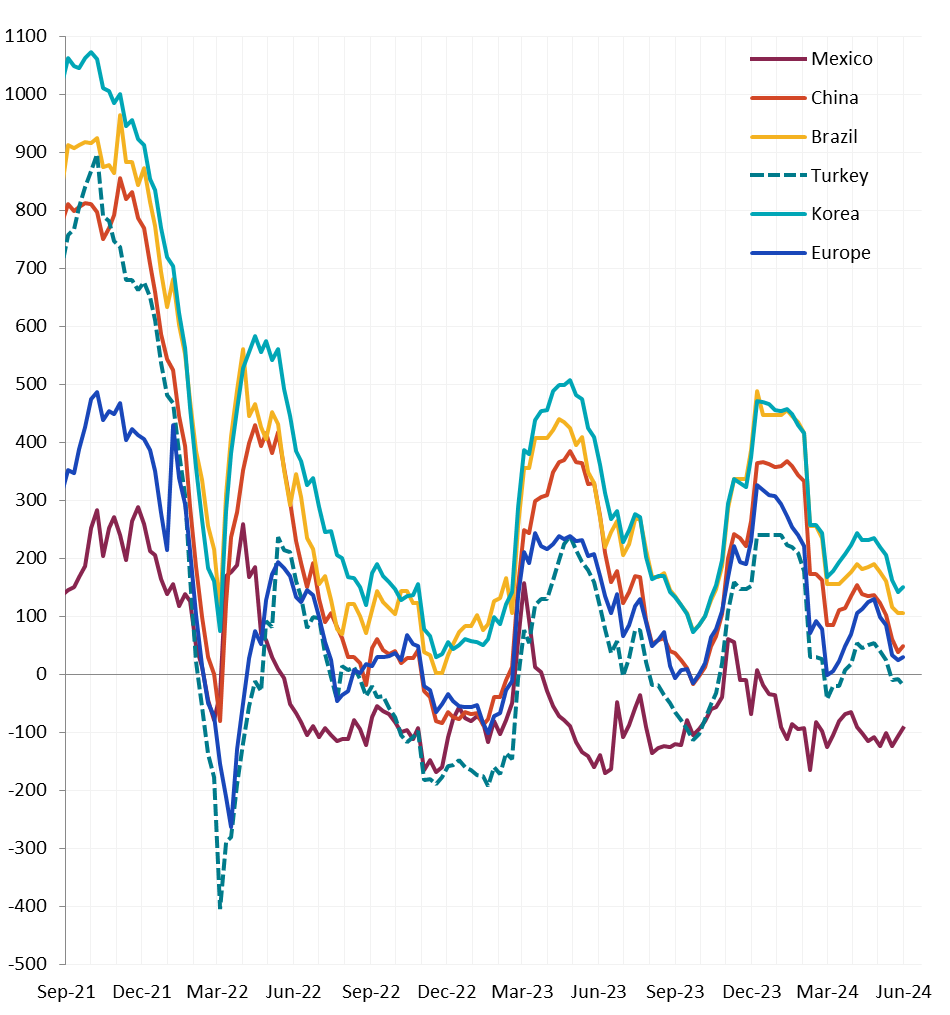

All watched global differentials expanded this week, except for Turkey’s and Mexico’s. Turkey’s Export HRC rose by 1.7%, while Mexico HRC fell by -1.7% and China Export HRC declined by -1.7%.

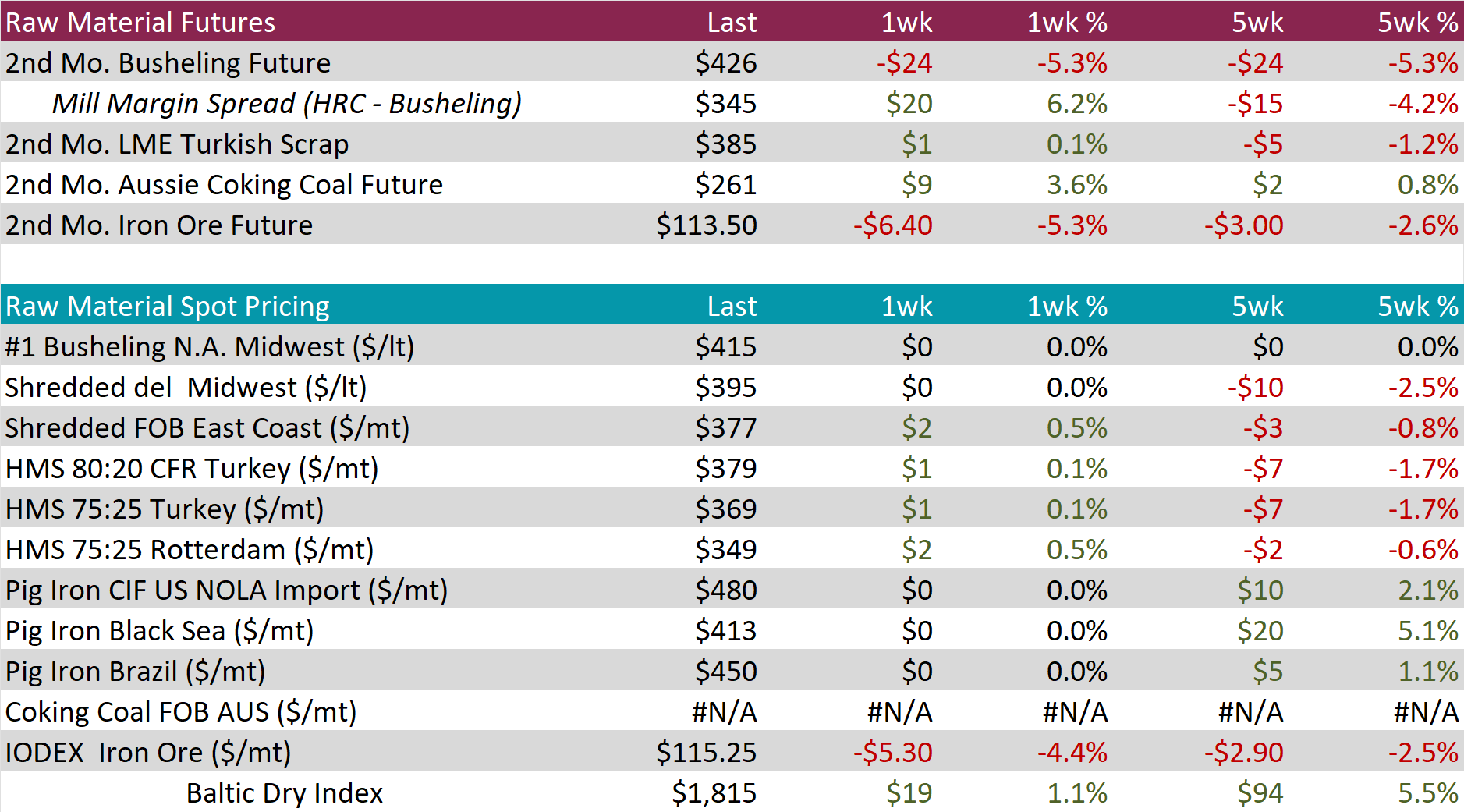

Scrap

The busheling 2nd month future dropped by $24 or -5.3% to $426, hitting its lowest price since October 2023.

The 2nd month Aussie coking coal future rose by $9 or 3.6% to $261, furthering last weeks increase and hitting the highest price in six-weeks.

The iron ore 2nd month future dipped by $6.40 or -5.3% to $113.50, reaching its lowest price in seven-weeks.

Dry Bulk / Freight

The Baltic Dry Index inched up by $19 or 1.1% to $1,815, easing from the previous two weeks price declines from its recent price high of $2,129.

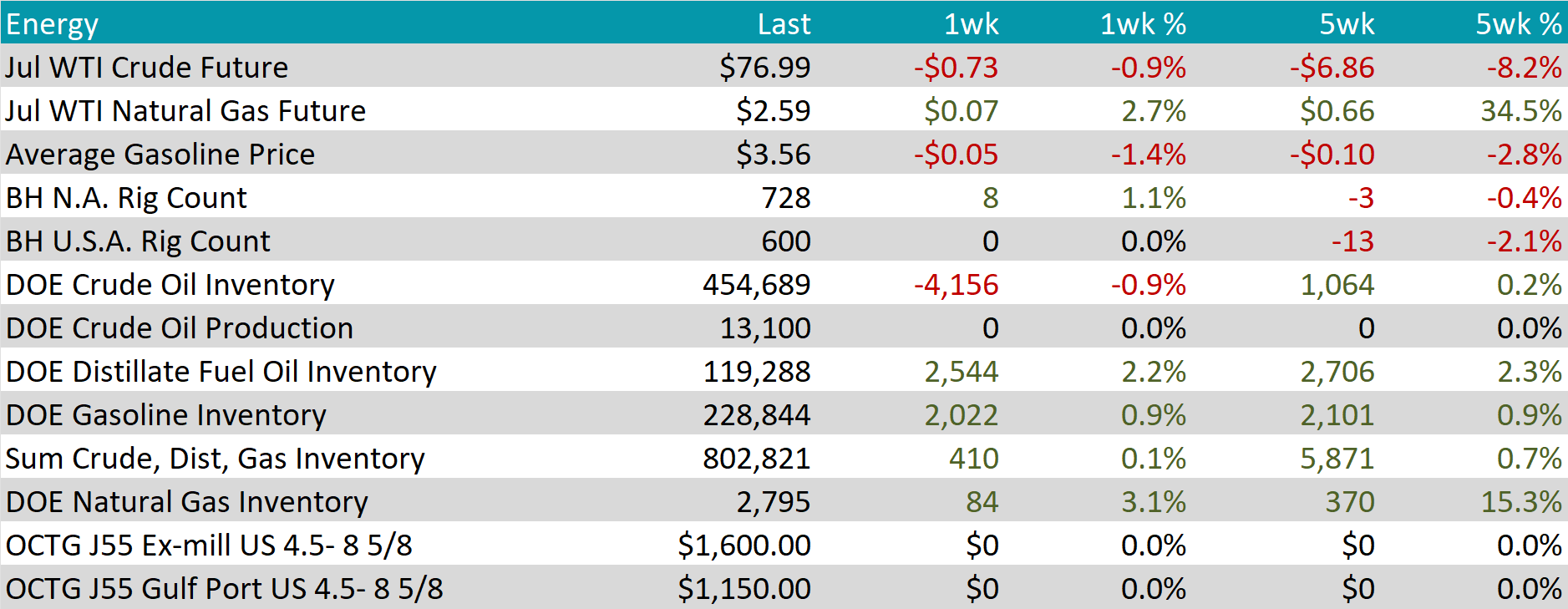

WTI crude oil future lost $0.73 or -0.9% to $76.99/bbl.

WTI natural gas future gained $0.07 or 2.7% to $2.59/bbl.

The aggregate inventory level experienced a slight increase of 0.1%.

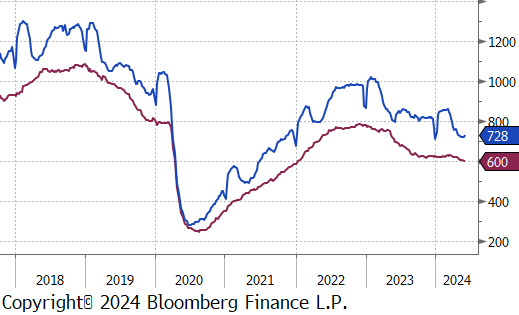

The Baker Hughes North American rig count gained 8 rigs, bringing the total count to 728 rigs, climbing off of recent lows. Meanwhile, the US count remained unchanged at 600, staying at its lowest level since January 2022.

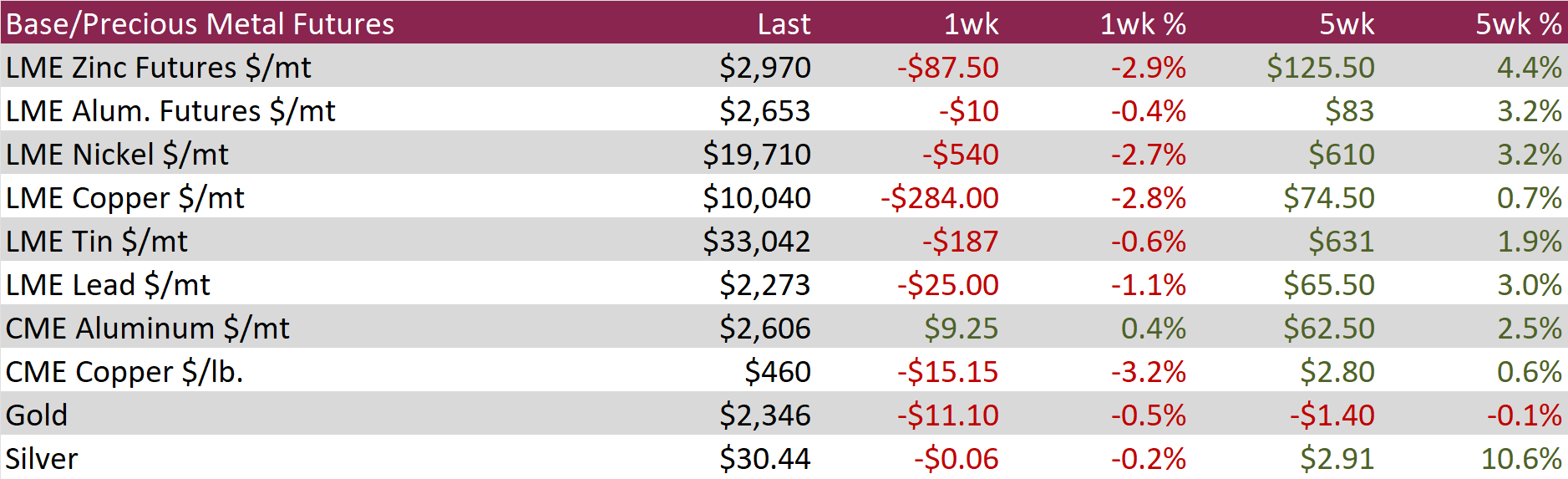

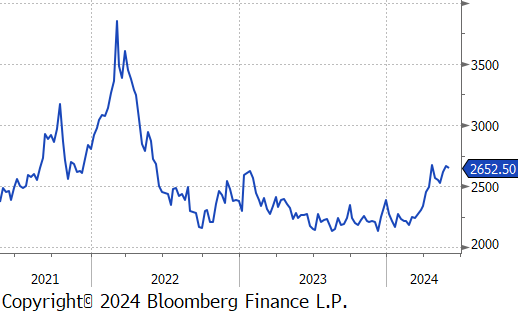

Aluminum fell by $10 or -0.4% t0 $2,653, edging off but maintaining two-year highs, driven by momentum in the base metals sector amidst continued supply challenges. A gas shortage compelled mining heavyweight Rio Tinto to declare force majeure on alumina shipments from its Australian refineries, highlighting supply concerns. Additionally, uncertain weather conditions in Yunnan, a major aluminum-producing region in China, threatened hydroelectric power availability, exacerbating production concerns. Concurrently, on-warrant aluminum stocks at the LME in Port Klang, Malaysia, significantly dropped post the May 15th delivery deadline, reflecting a sharp reduction in available tonnage. This decline was influenced by trading giants capitalizing on new contract rules following US and UK sanctions on Russian aluminum.

Copper dropped by $15.15 or -3.2% to $460, as lackluster near-term demand overshadowed the speculative momentum that had previously fueled the rally. Unexpected contraction in manufacturing activity, highlighted weak domestic demand for industrial goods and exacerbated concerns of oversupply. This was further intensified as increased scrap usage boosted refiner output, leading to higher inventories and pushing the price for delivery from bonded warehouses below LME prices for the first time since 2017, signaling low physical demand. Despite these challenges, speculative interest has kept copper prices 20% higher year-to-date, buoyed by its critical role in electrification projects like grid-scale energy storage and data-center infrastructure. This speculative interest aligns with heightened expectations for Chinese industrial activity following Beijing’s significant economic stimulus measures. Concurrently, the high costs associated with new mining developments have led companies to pursue mergers and acquisitions rather than new projects, affecting the supply side dynamics.

Gold fell by $11.10 or -0.5% to $2,346, as investors digested recent US inflation data and anticipated further economic reports to gauge the Federal Reserve’s potential timeline for easing monetary policy. Last Friday, data showed that core PCE prices in April slowed compared to March, while headline monthly and annual inflation rates stayed consistent with predictions, suggesting that the Fed may have some flexibility to lower interest rates later this year. Investors are now setting their sights on the forthcoming U.S. nonfarm payrolls and other key labor market data expected this week, with the market currently predicting just one rate cut for the year. In Europe, the ECB is anticipated to cut rates this week, though speculation about future rate adjustments has intensified after a higher-than-expected rise in May inflation. Similarly, the Bank of Canada is also expected to cut rates within the week.

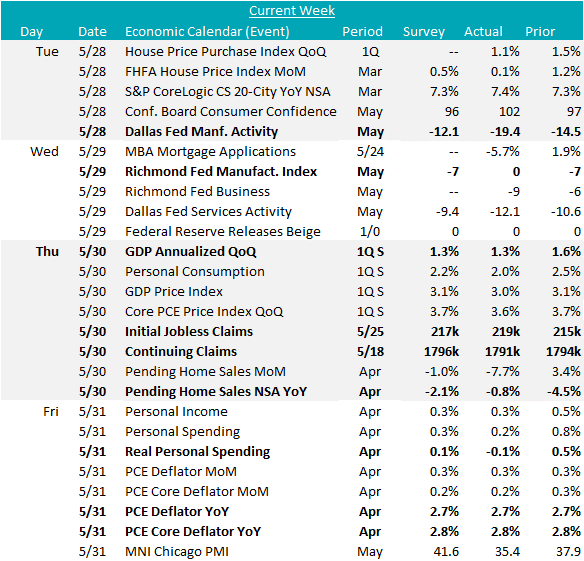

The FED Manufacturing survey provided opposing signals. Dallas printed down to -19.4, below an expected uptick at -12.1. Richmond, however, came in above expectations, printing 0, versus and expected -7. Now that we have all the Fed surveys, our expectation is that the ISM Manufacturing PMI for next week would tick higher but remain in slightly contraction territory, matching overall market expectations.

Pending home sales (NSA YoY) in April continued the recent trend of negative prints, but came in slightly better than expectations, down 0.8%. From the affordability side mortgage rates remain high and all this week’s measures of home prices continued to increase.

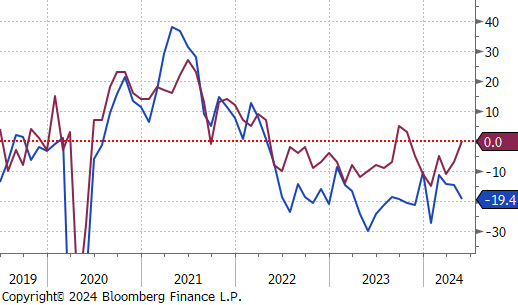

Finally, the Core PCE Deflator came in below expectations, with the YoY print down to 2.75%, from 2.81% in March. This is a welcome signal given the uptick in CPI, but more substantial progress will have to be made over the next two months before the data starts to see a worsening base effect. Because of this, FED Officials will likely continue to say more evidence is needed before interest rate cuts begin.