Flack Capital Markets | Ferrous Financial Insider

November 3, 2023 – Issue #404

November 3, 2023 – Issue #404

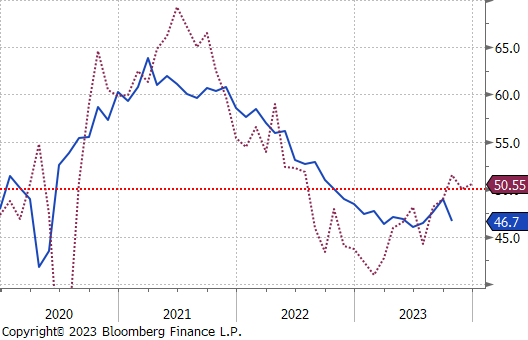

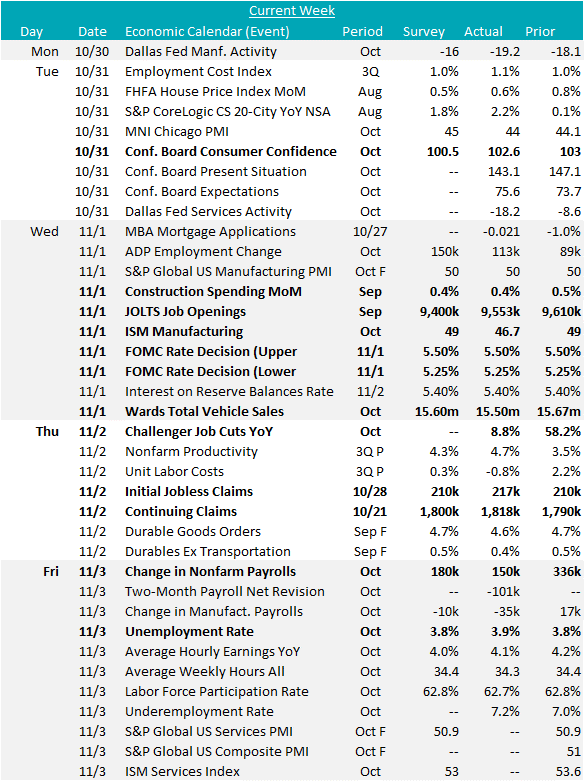

As is always the case, the beginning of the month provides valuable insight into economic activity and steel consumption. The broad takeaway is that steel consuming sector continue to perform better than expectations, albeit at an overall depressed level.

Total construction spending rose by 0.4% MoM, consistent with market expectation. Private spending grew by 0.4% in September, mainly driven by a 0.6% increase in the residential segment, with singly-family projects rising by 1.3%. Simultaneously, private nonresidential spending increased by 0.1%. Another notable signal from this month’s data was the positive revision to the prior months data, with total spending increasing from 0.4% to 1% MoM in August.

The other most notable economic datapoint was the ISM Manufacturing PMI which came in at 46.7, below expectations of a flat print at 49. Regardless of the level, the manufacturing sector continues to contract as the positive momentum which had been building since June was undercut by a negative turn in the new orders, employment, and backlog subcomponents. One important thing to consider is that we do not fully know how the UAW strike impacted the data and now that it appears to be fully in the rearview mirror, there could be a tailwind in the near term. Finally, the demand – inventories forecast continues to point to higher prints and slight expansion in the near term.

These divergent forces highlight the fact that the outlook remains uncertain. However, given where we are today compared to 6 months ago, the outlook for industrial production and steel consumption is meaningfully brighter. Mills have dramatically pulled back production resulting in a shortage, and the recent price announcements have woken buyers up and pulled them off the sidelines.

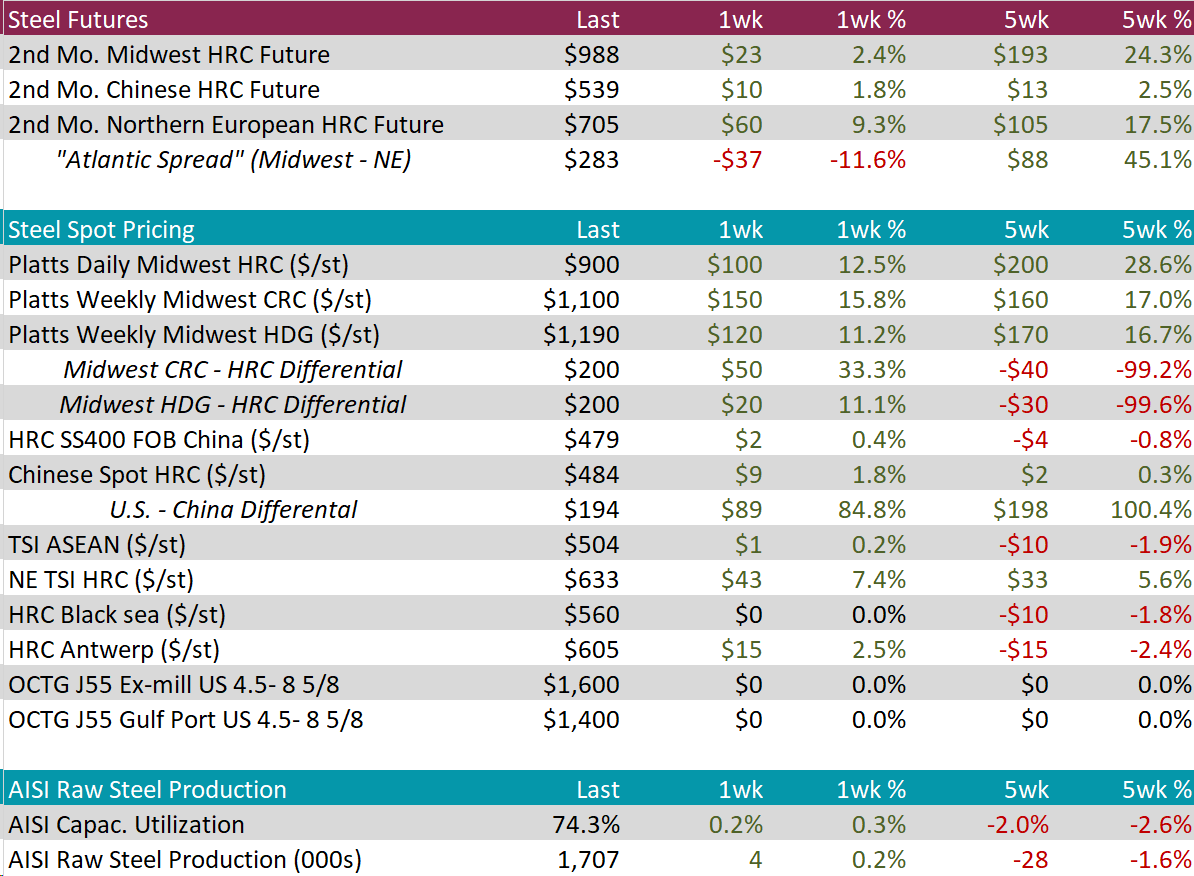

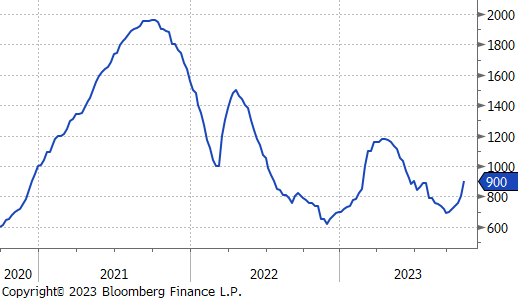

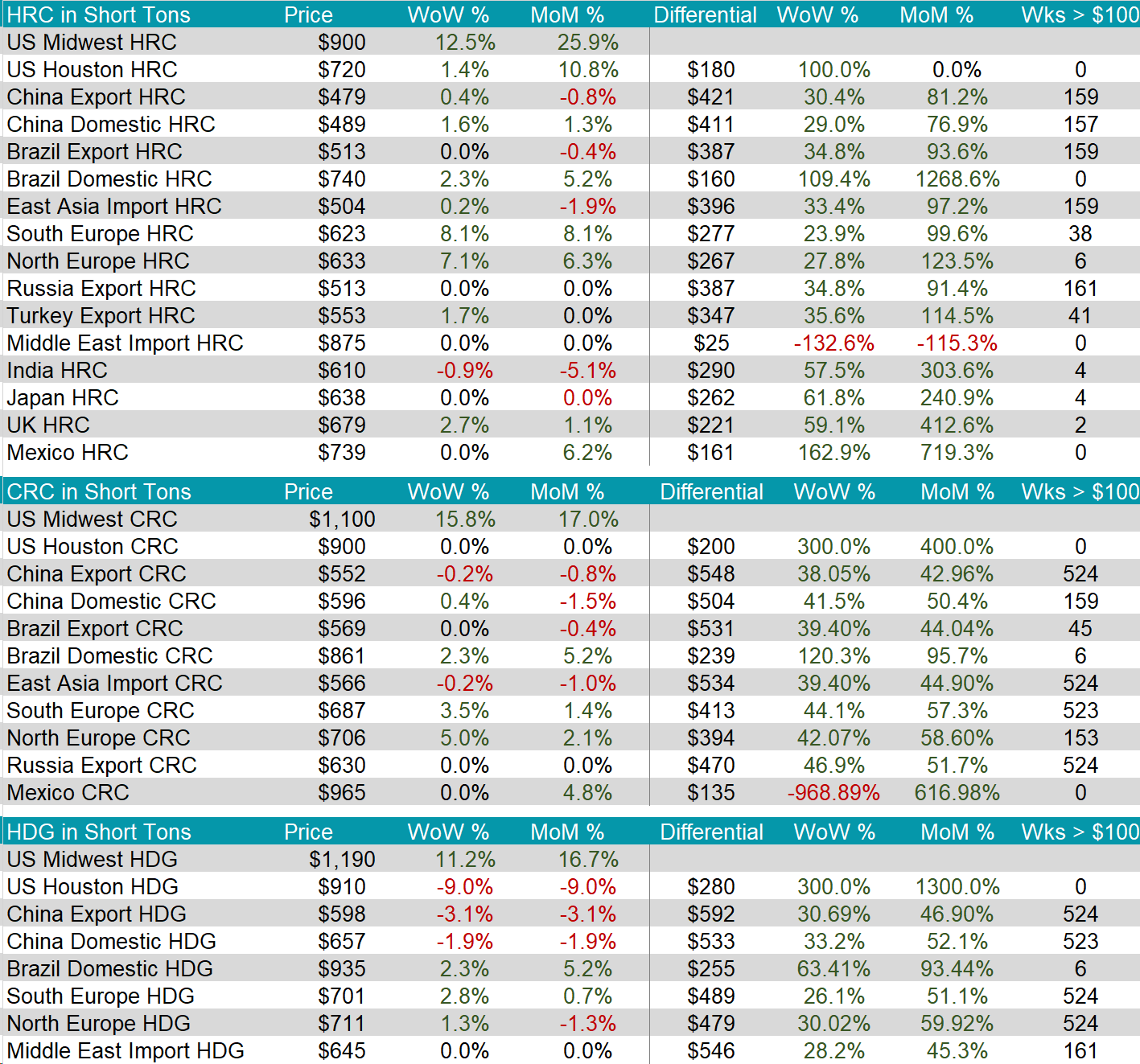

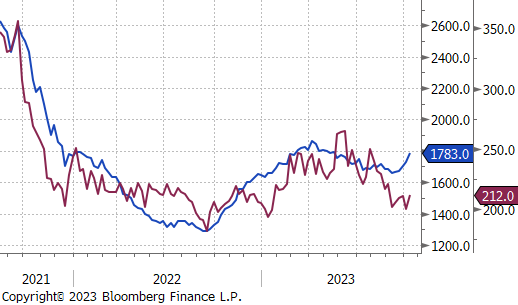

The HRC spot price rose by $100, or by 12.5%, to $900, rebounding from recent low of $690 back up to levels seen in June. The 2nd month future rose up by $23, or by 2.4%, to $988. This is the highest price seen since April and has increased by 24.3% over the last 5 weeks.

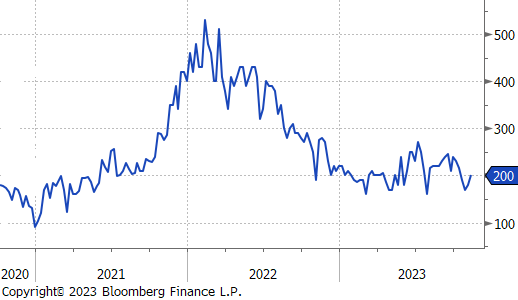

Tandem products both increased this week, with CRC up by $150, or 15.8%, and HDG up by $120, or 11.2%, resulting in the HDG – HRC differential rising by $20, or 11.1%, to $200.

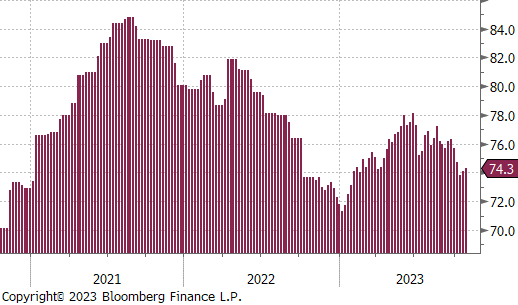

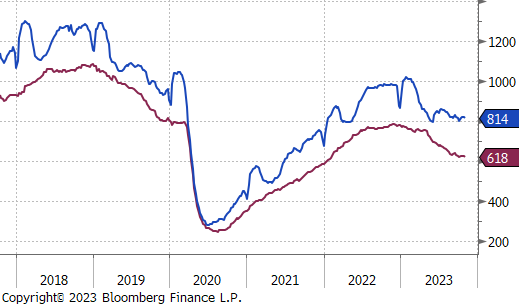

Mill production continued to tick up, with capacity utilization increasing by 0.2% to 74.3%, this brings raw steel production up to 1.707M tpm, this marks the third week of increases, reversing its recent downward trend.

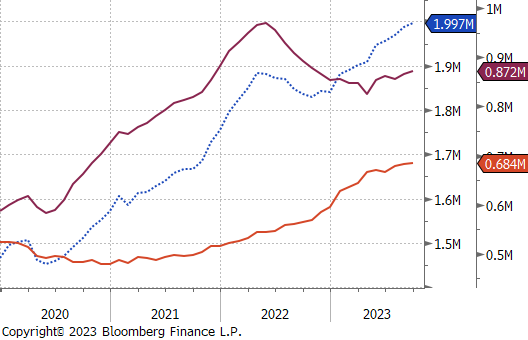

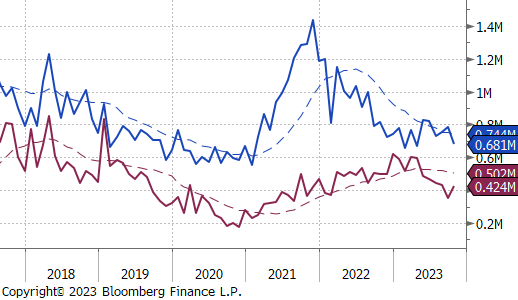

October Projection – Sheet 681k (down 101k MoM); Tube 424k (up 74k MoM)

September Projection – Sheet 782k (up 28k MoM); Tube 350k (down 80k MoM)

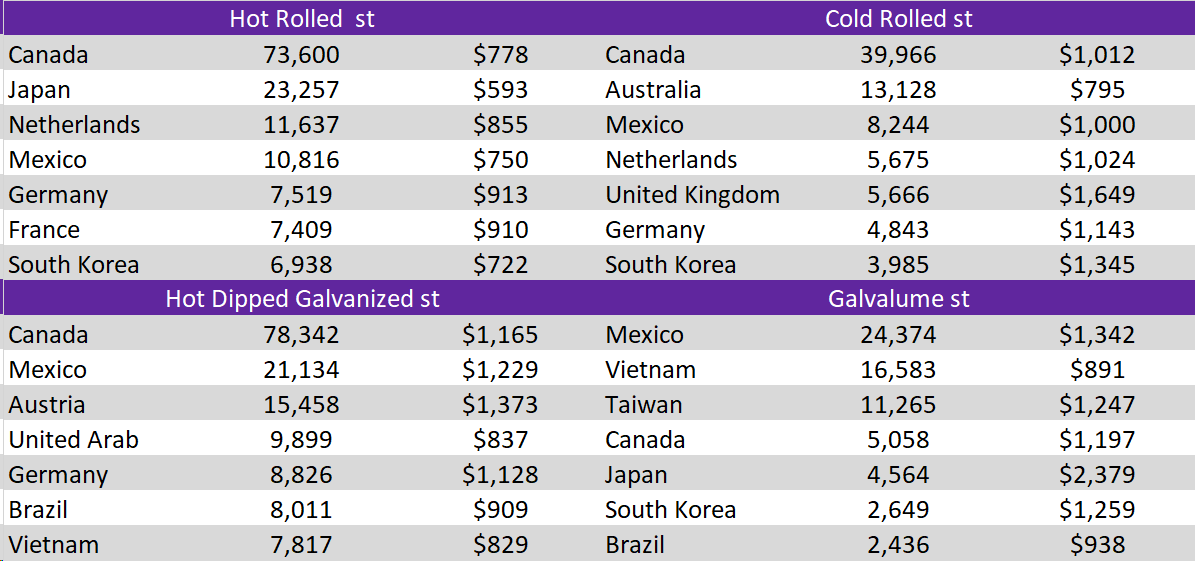

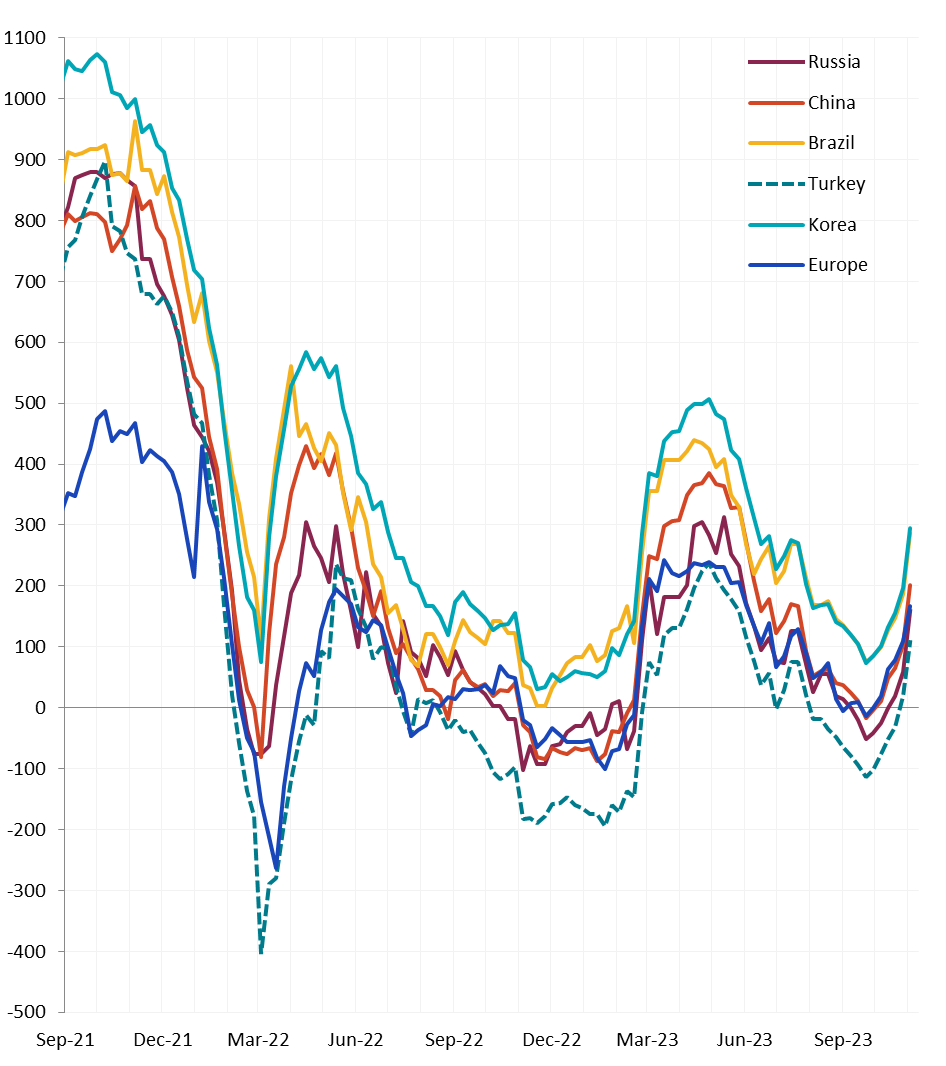

All the watched global differentials significantly increased this week, with the US domestic HRC price increasing by 12.5% and the South Europe HRC price increasing by 8.1%.

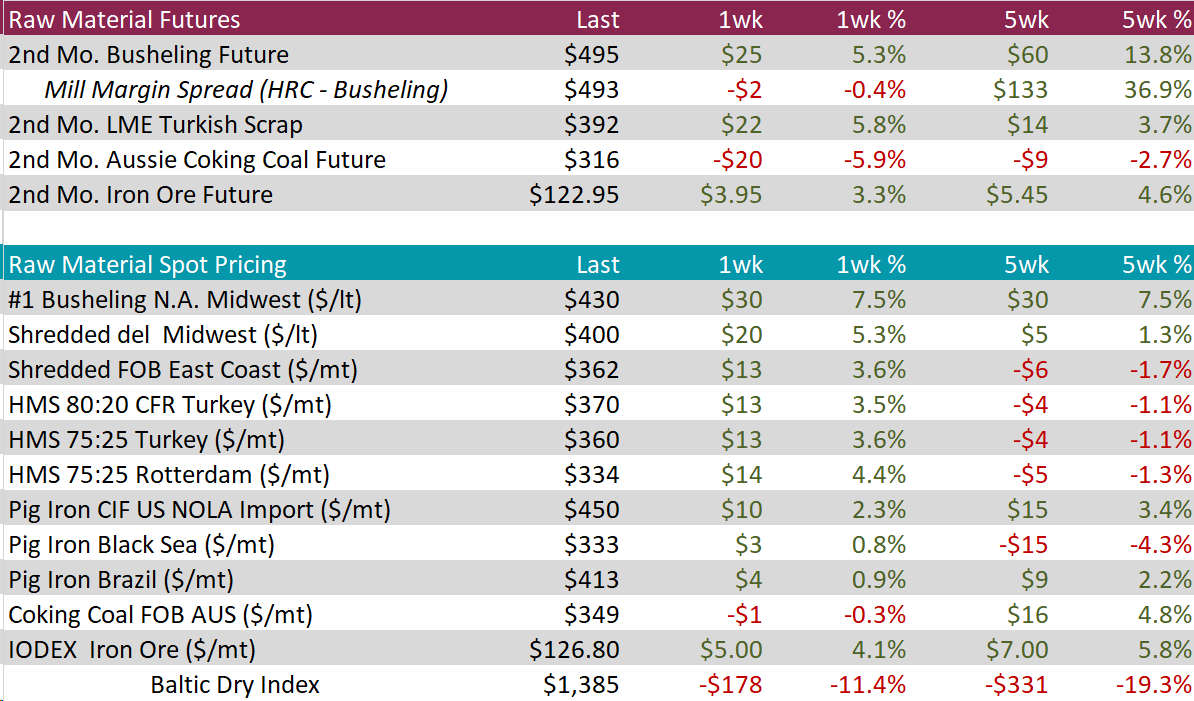

Scrap

The 2nd month busheling future continued its upward trend, rising by $25, or by 5.3%, bringing the price up to $495. This is the highest price seen since May.

The 2nd month LME Turkish scrap increased for the second week in a row, this time moving up by $22, or 5.8%, to $392, hitting seven-month high, rebounding significantly from recent low of $356.

The 2nd month Aussie coking coal future declined by $20, or -5.9%, to $316, reversing the gain of $17 seen last week.

Dry Bulk / Freight

The Baltic Dry Index jumped down again, marking the second week in a row of decreases, this time by $178, or -11.4%, bringing the price to $1,385.

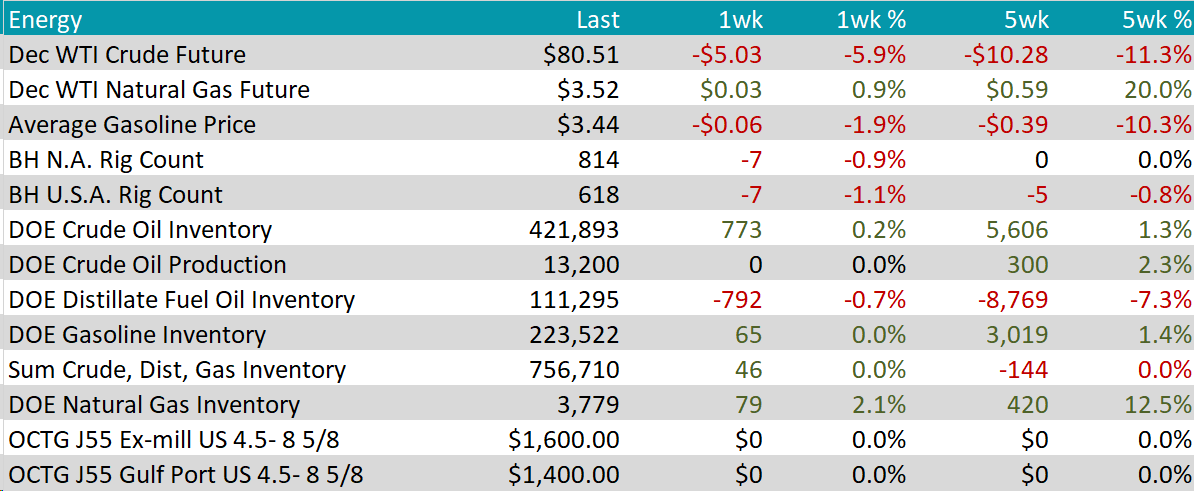

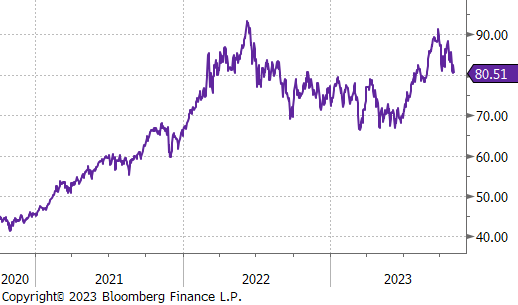

WTI crude oil future lost $5.03 or -5.9% to $80.51/bbl.

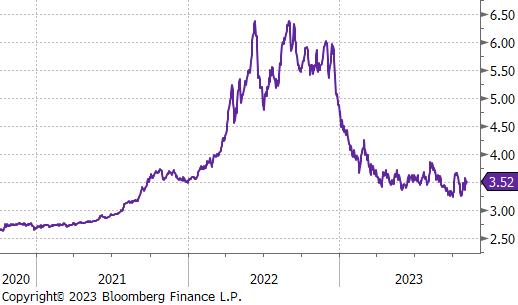

WTI natural gas future gained $0.03 or 0.9% to $3.52/bbl.

The aggregate inventory level was considered up, although rather insignificantly at 0.0%.

The Baker Hughes North American rig count declined by 7, and the US rig count also reduced by 7 rigs.

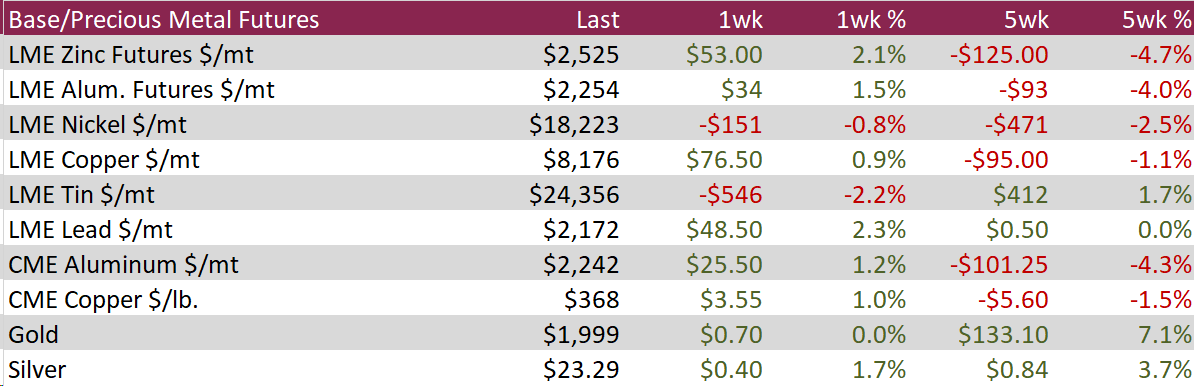

Aluminum futures increased to $2,254, up $53, or 2.1%, maintaining gains since rebounding from the two-month low of $2,176 on October 23rd. Supply/availability concerns continue to outweigh the prospect of restrained but improving demand in China. Notably, the chief commercial ore of aluminum, bauxite, was prohibited from export by Indonesia, thereby capping production levels.

In a similar vein, the improving demand/worsening supply dynamics caused the copper future to reach its highest point in one month, $368, after rising $3.55, or 1.0%. Domestically, the Federal Reserve signaled that it is likely done raising interest rates, which placed pressure on the dollar and lifted appetite for industrial inputs. Furthermore, Southern Copper, Teck, and Anglo American reduced their estimates for copper production this year due to operational issues in their South American mines.

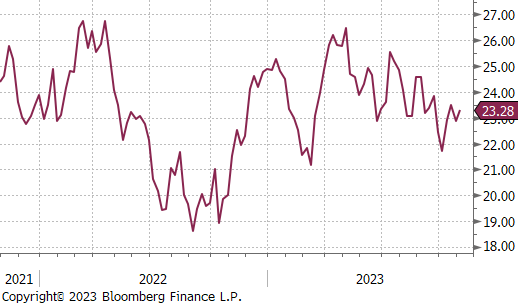

Silver seemingly stabilized at $23.29, up $0.40, or 1.7%. This comes as weak US jobs figures published sparked optimism that the Federal Reserve might have concluded its tightening cycle, resulting in a decline in both the US dollar and bond yields. On the other hand, the safe-haven premium associated with Israel-Hamas was washing out, there being no significant escalation in the conflict.

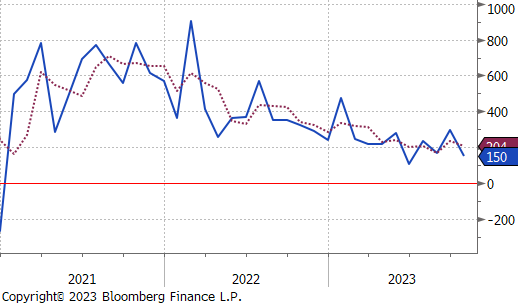

Initial and Continuing Jobless Claims both increased higher than market expectations last week, with continuing claims increasing more substantially than initial, implying that those unemployed are having greater difficulties finding employment. This data signals that labor market conditions are going through some softening, despite remaining at historically tight levels. Further evidence of a cooling, yet still at tight levels, is Change in Nonfarm Payrolls decreasing to 150k, below expectations of a decline to 180k from the surprising prior reading of 336k. Although much lower than expectations, signaling a cooling, this level of 150k is within a normal range when considering historical data, signaling still in tight levels.

October data for Wards Total Vehicle Sales came out at 15.50m, a bit lower than expectations of 15.60m, and down from Septembers reading of 15.67m. With the reconciliation of the UAW strikes there is potential for upside in the coming months.

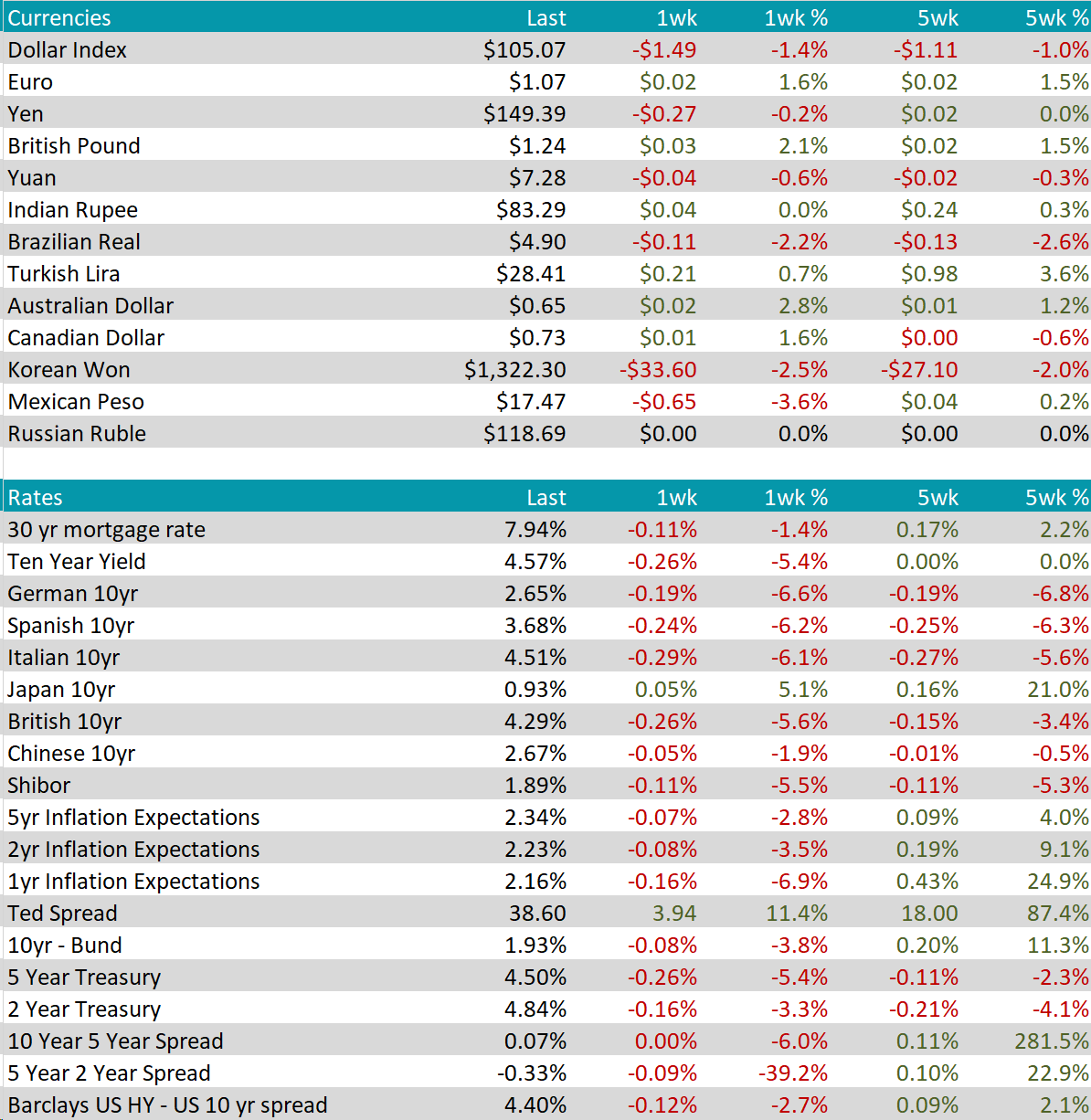

The Dollar Index (DXY) fell by 1.4% last week, breaking the $106 range, due to reinforced trader expectations of the Federal Reserve not raising interest rates. The US economy added 150,000 jobs in October, falling short of forecasts, and with high unemployment and slower wage growth added pressure to the dollar. Declining Treasury yields, with the US 10-year Yield hitting over one-month lows of 4.48%, furthered this pressure. Investors await guidance on rates from Fed officials this week.

The British pound rose above $1.235, supported by a slowdown in the US labor market and belief that the Fed’s tightening cycle has ended. The Bank of England maintained interest rates at 5.25%, signaling a commitment to elevated rates but with expectations of future rate cuts. Governor Bailey emphasized that rate cuts were not expected soon, but market anticipation suggests potential rate reductions. The UK central bank warned of a challenging economic outlook with stagnation in Q3 and marginal growth in Q4.

The German 10-year Bond Yield dropped to 2.65%, the lowest since mid-September, amid expectations that the Fed and ECB have finished rate hikes. The ECB kept interest rates unchanged, and gloomy economic data, including low inflation and contractions in GDP, supported this outlook. Furthermore, manufacturing and services showed deep contractions across major economies.