Flack Capital Markets | Ferrous Financial Insider

November 15, 2024 – Issue #458

November 15, 2024 – Issue #458

Overview:

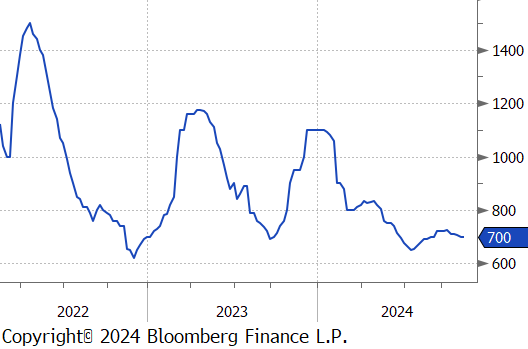

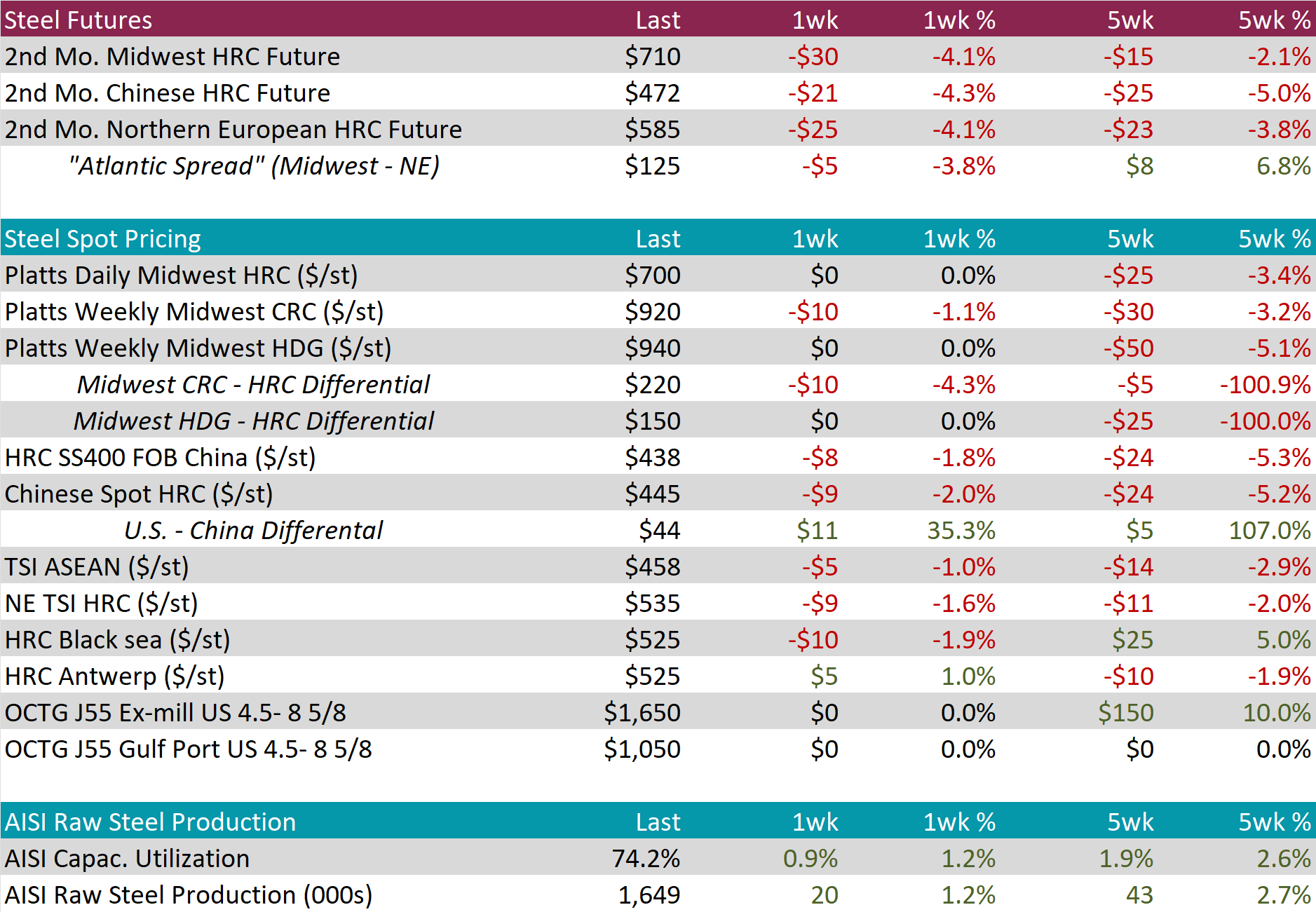

The HRC spot price held steady at $700, resulting in the five-week price change to be down by $25 or -3.4%. At the same time, the HRC 2nd month future declined by $30 or -4.1% to $710, ending the two consecutive weeks of price increases.

Tandem products were mixed, with CRC falling by $10 while HDG was unchanged, resulting in the HDG – HRC differential to hold steady at $150.

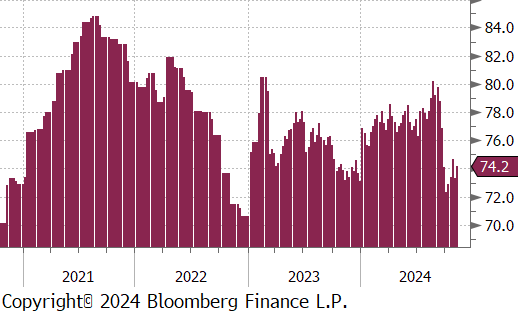

Mill production continues to remain somewhat subdued despite capacity utilization ticking up by 0.9% to 74.4%, bringing raw steel production up to 1.649m net tons.

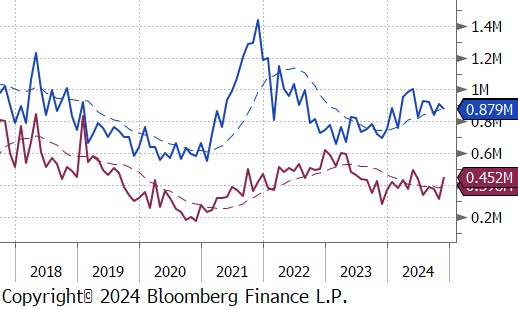

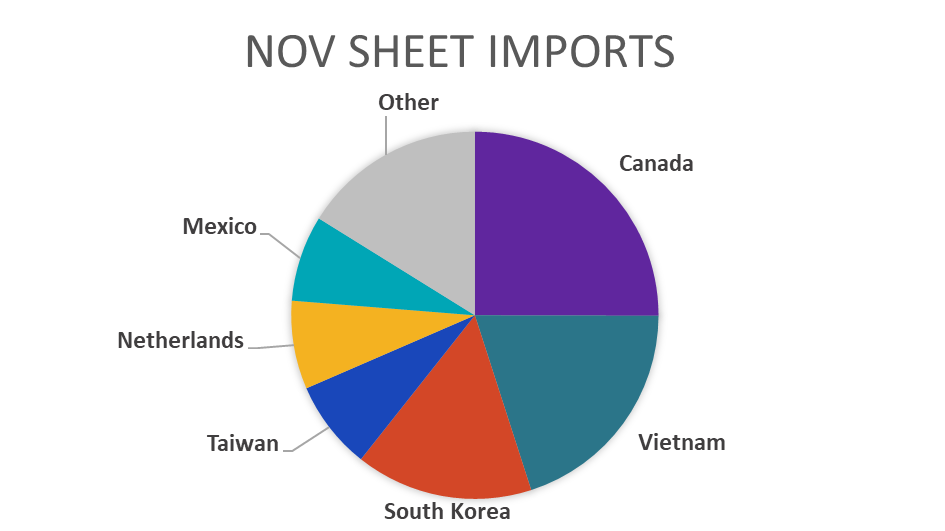

November Projection – Sheet 879k (down 31k MoM); Tube 452k (up 140k MoM)

October Projection – Sheet 909k (up 69k MoM); Tube 313k (down 61k MoM)

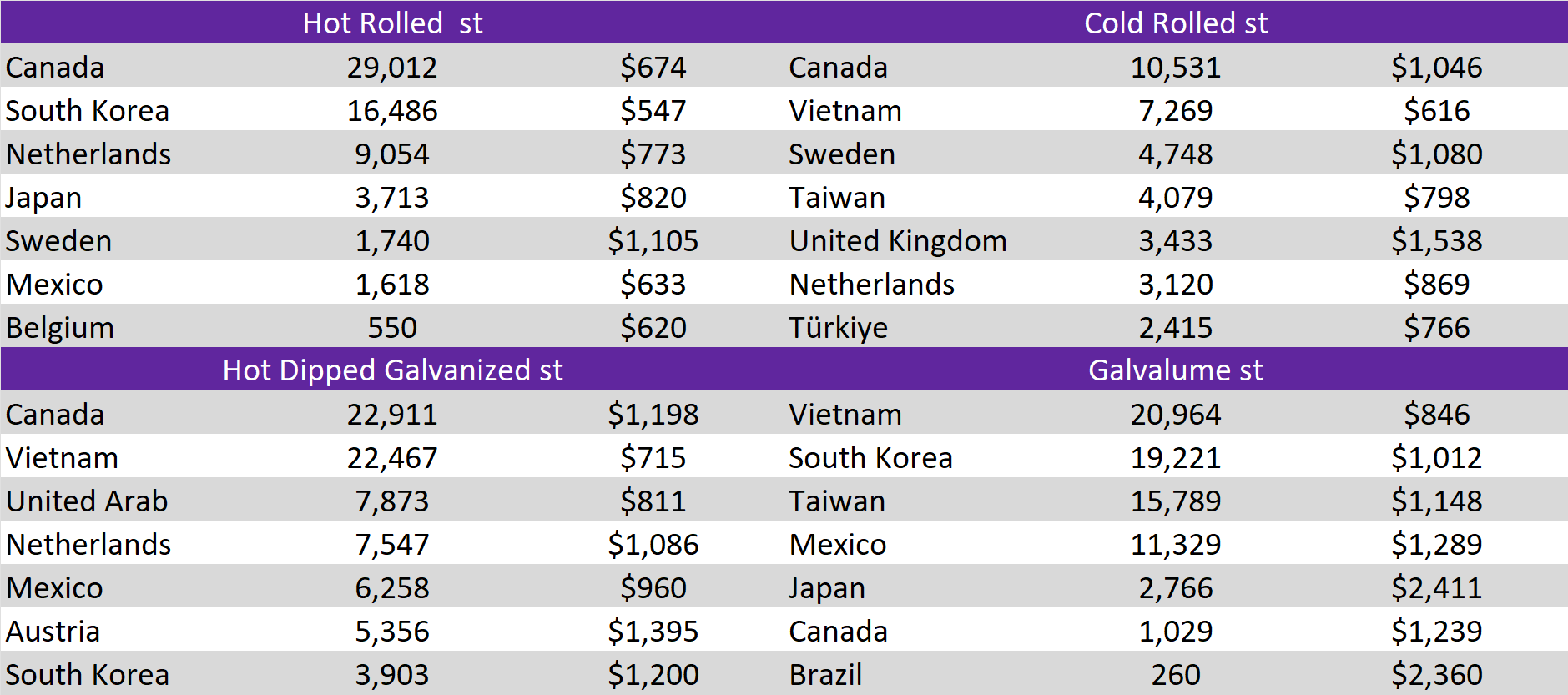

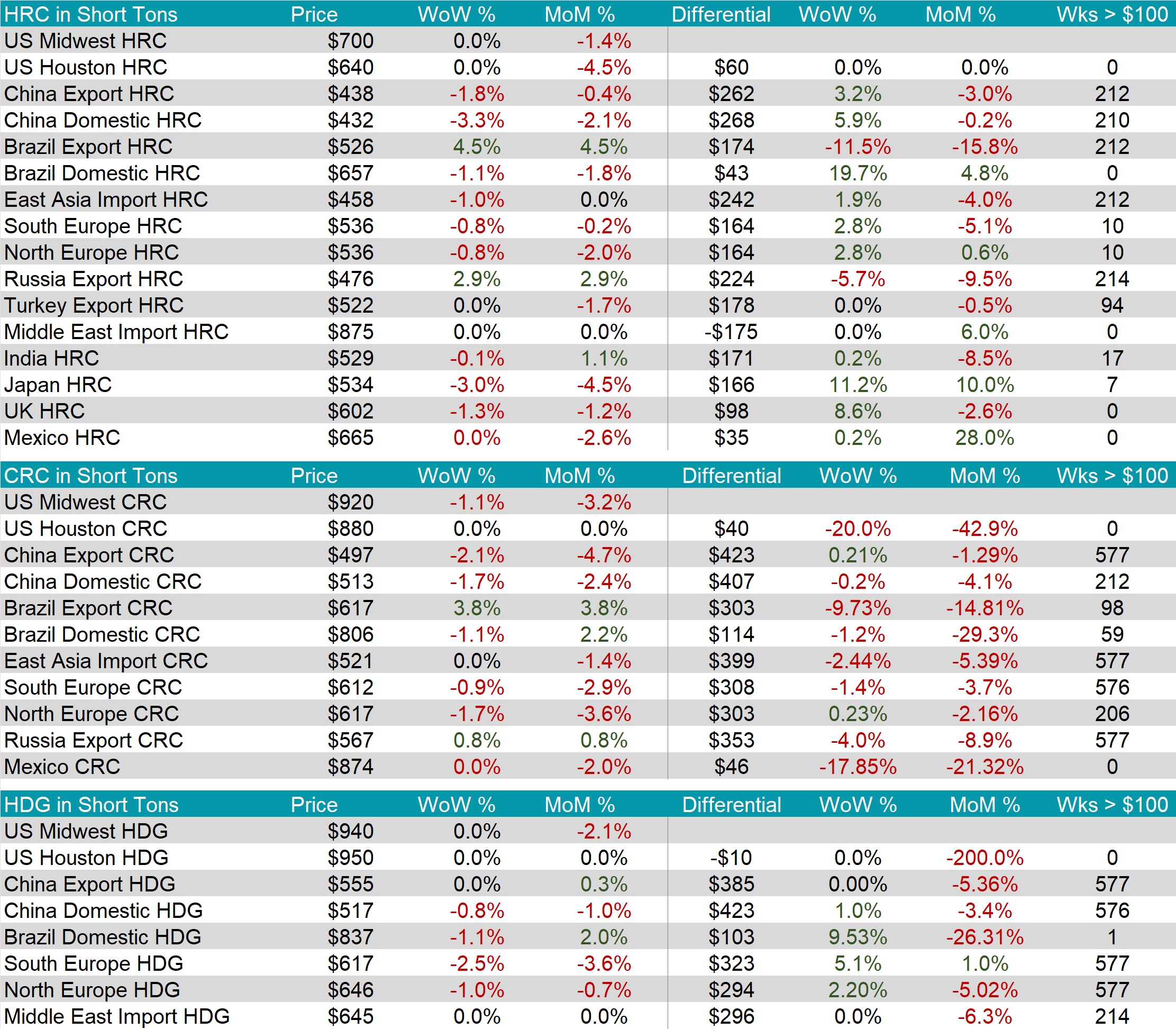

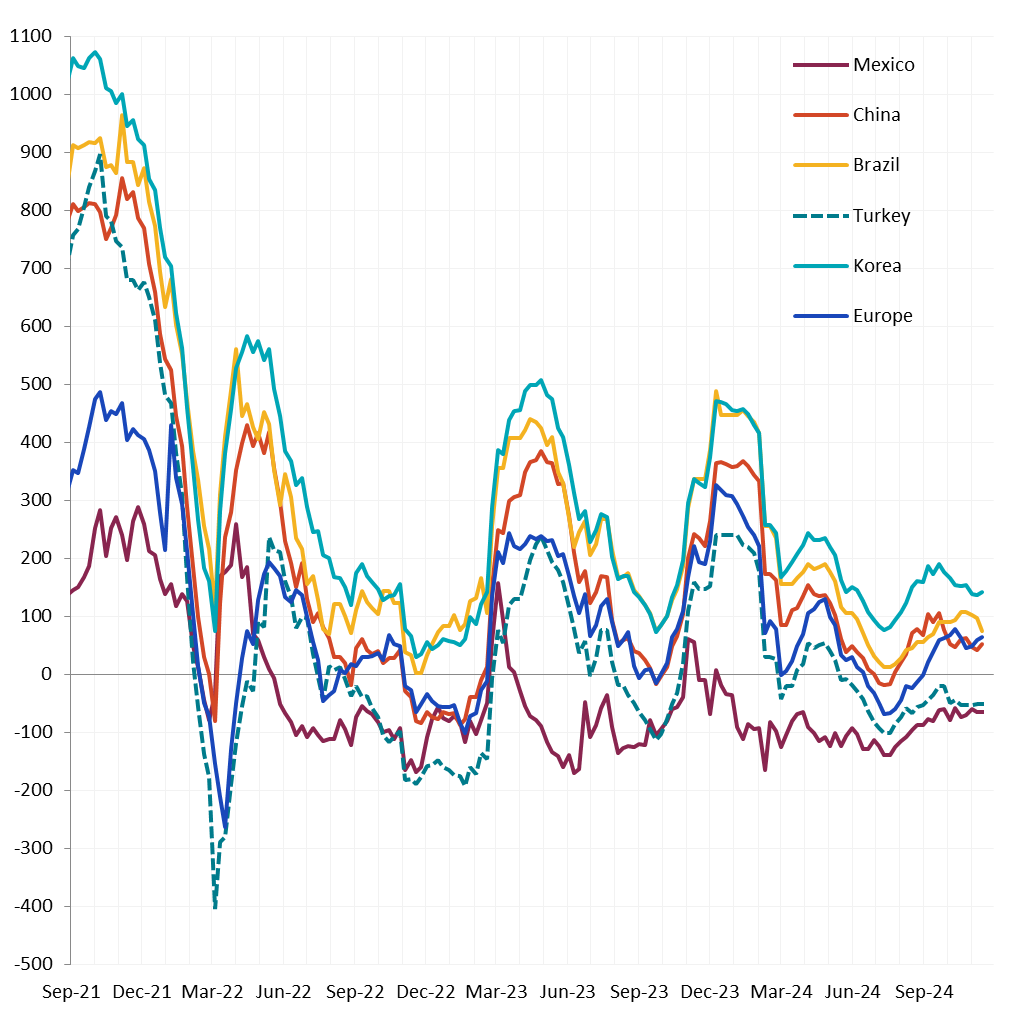

Watched global differentials mainly expanded, except for Brazil. Brazil export HRC rose by 4.5% and Russia Export HRC increased by 2.9%, all others declined or remained unchanged, with China Domestic HRC seeing the largest price drop of -3.3%.

Scrap

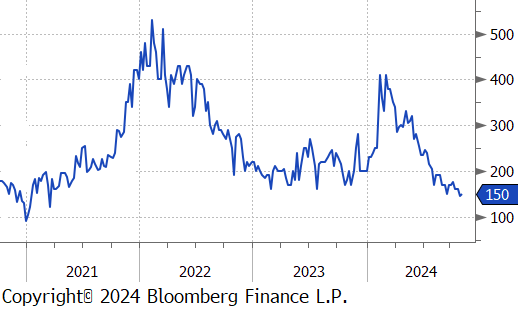

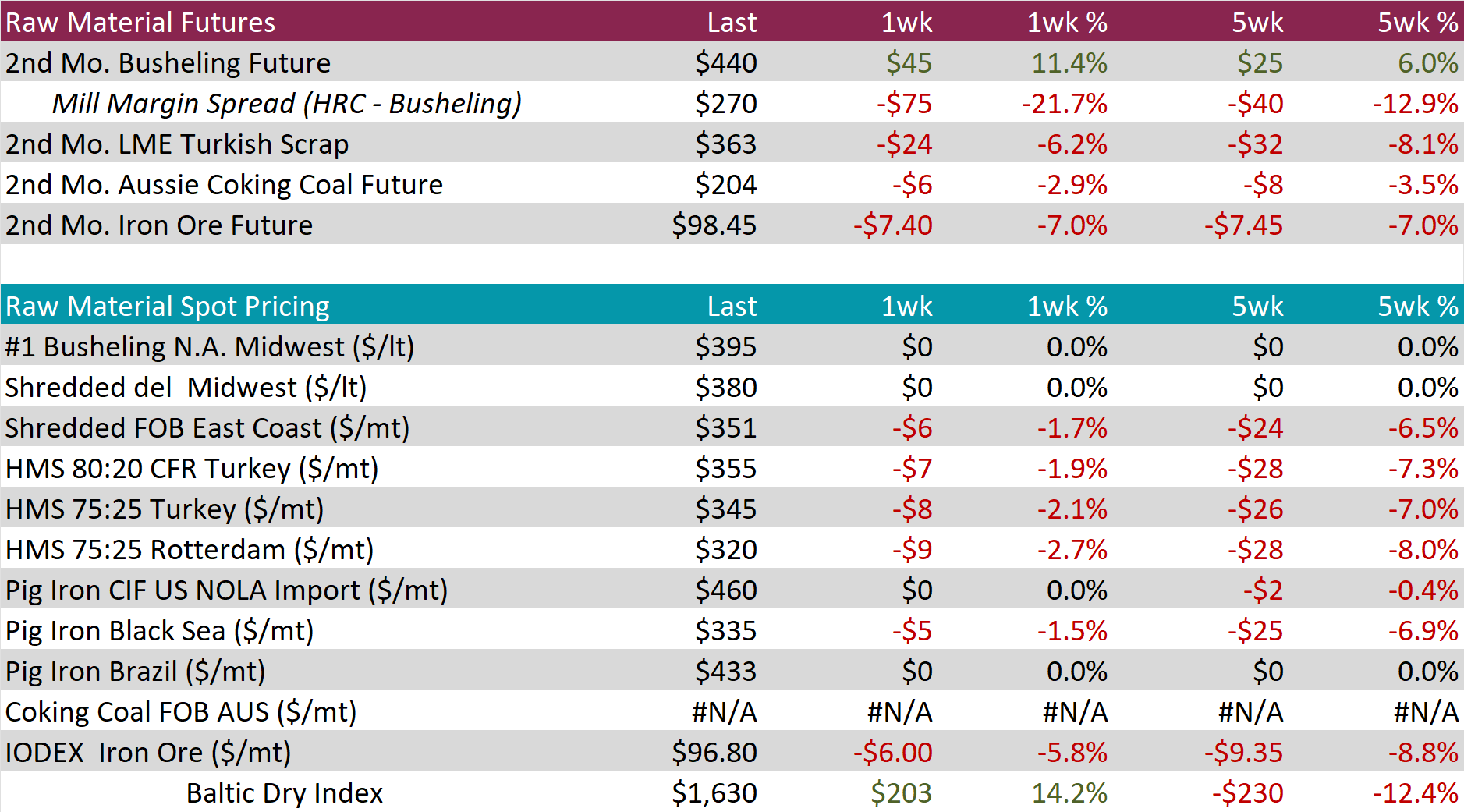

The busheling 2nd month future soared by $45 or 11.4% to $440, reaching the highest price since May.

The LME Turkish scrap 2nd month future dropped by $24 or -6.2% to $363, ending the two consecutive weeks of price increases and hitting the lowest price since August.

The iron ore 2nd month future declined by $7.40 or -7.0% to $98.45, falling to the lowest price in eight weeks.

Dry Bulk / Freight

The Baltic Dry Index jumped up by $203 or 14.2% to $1,630, marking two consecutive weeks of increases and the highest level in four weeks.

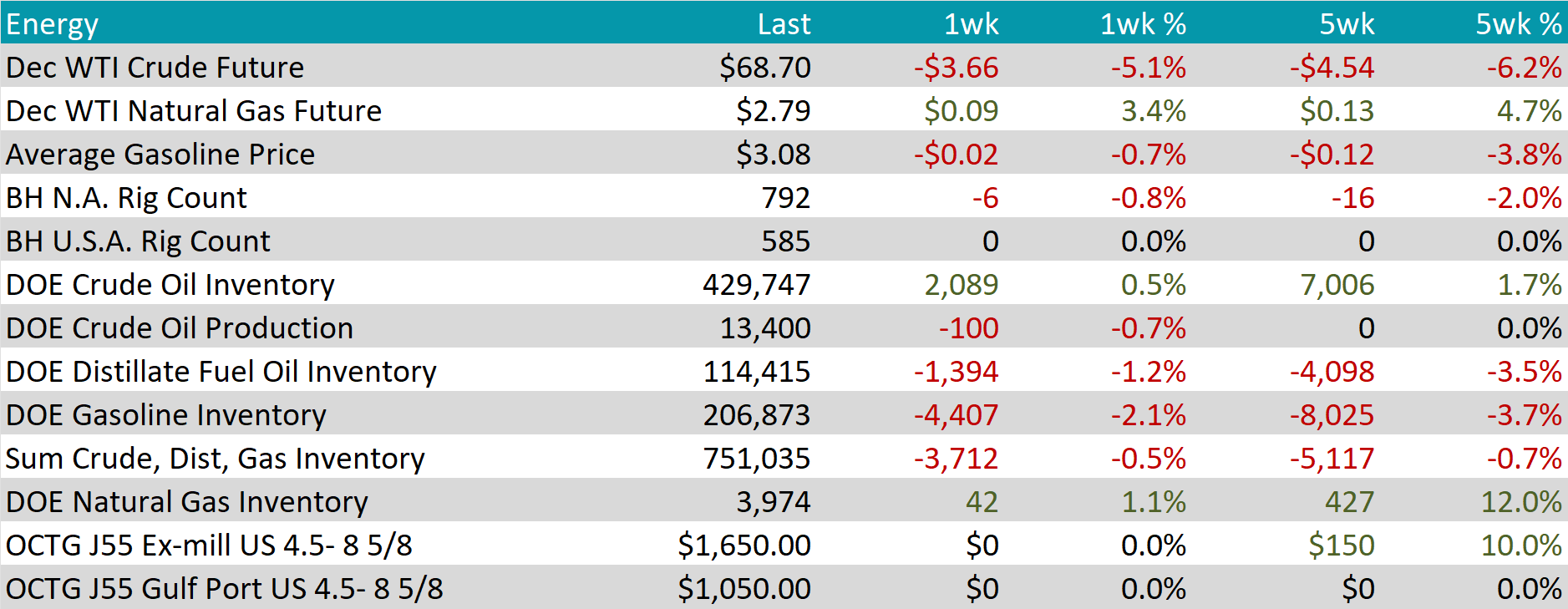

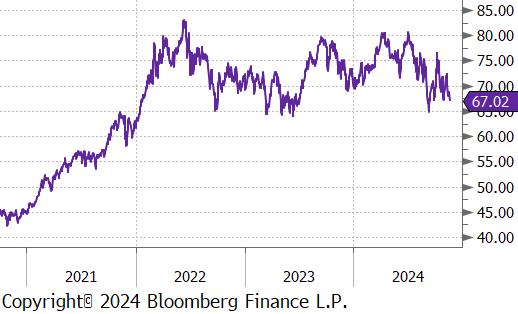

WTI crude oil future lost $3.66 or -5.1% to $68.70/bbl.

WTI natural gas future gained $0.09 or 3.4% to $2.79/bbl.

The aggregate inventory level experienced a decline, falling by -0.5%.

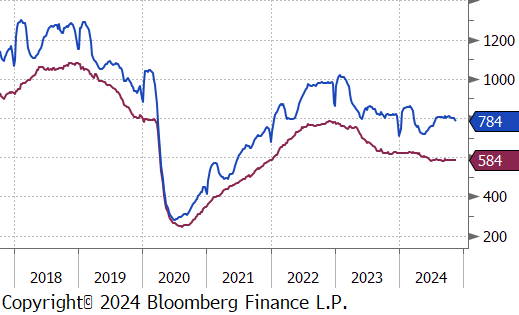

The Baker Hughes North American rig count reduced by 6 rigs, bringing the total count to 792 rigs. Meanwhile, the US rig count held steady at 585.

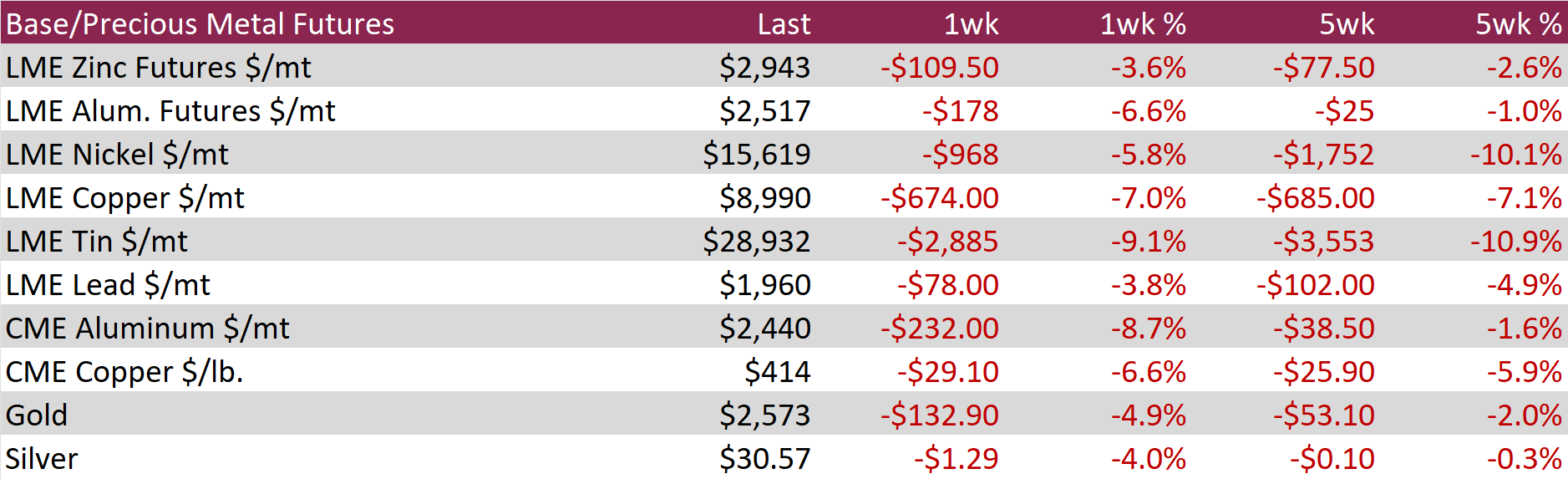

Aluminum futures fell by $178 or -6.6% to $2,517, in line with declines across other base metals. The drop followed China’s decision to refrain from introducing targeted stimulus measures. Instead, China unveiled a $1.4 trillion debt swap program to help local governments restructure off-balance sheet debt and secure better financing terms. However, the absence of direct initiatives to boost consumption tempered market expectations for stronger manufacturing demand. Despite the pullback, aluminum has outperformed other base metals this year, supported by a persistent supply crunch in alumina, a critical input for production. Meanwhile, bauxite prices neared record highs after Guinea, the world’s top exporter, blocked shipments from Emirates Global Aluminum. Combined with reduced bauxite output from Australia and Jamaica, this supply disruption has left Chinese smelters struggling to secure raw materials, driving ore inventories to their lowest levels since 2015.

Copper future dropped by $29.10 or -6.6% to $414, lingering near two-month lows amid ongoing demand concerns and a stronger US dollar. Market confidence in China’s recent stimulus efforts remains subdued, with little indication of a significant economic rebound to boost copper demand in the world’s top consumer. Investors are now turning their attention to China’s upcoming Loan Prime Rate decision, hoping for additional measures to stimulate growth. Meanwhile, copper prices faced further pressure from a rallying dollar after Federal Reserve Chair Jerome Powell emphasized that the Fed is in no hurry to cut interest rates, pointing to the resilience of the US economy.

Precious Metals

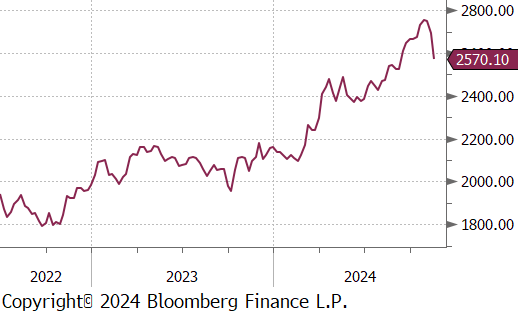

Gold declined by $132.90 or -4.9% to $2,573, its steepest weekly decline since 2021, as the US dollar’s rally paused, and geopolitical tensions fueled demand for safe-haven assets. President Joe Biden authorized Ukraine to use advanced long-range American weaponry within Russia, while Moscow deployed nearly 50,000 troops in Kursk to regain territory lost over the summer. Meanwhile, mixed signals from Federal Reserve officials last week added to market uncertainty about the timing and magnitude of potential rate cuts. Currently, markets are pricing in a 65% probability of a 25-basis point rate cut in December. Investors now await further comments from Fed policymakers this week for clearer insights into the future trajectory of US interest rates.

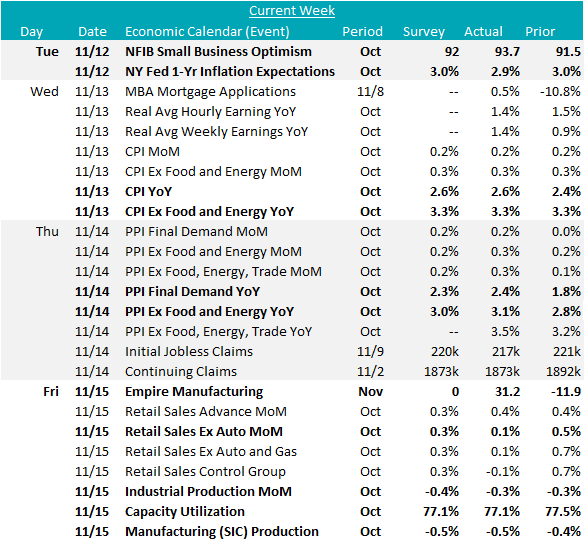

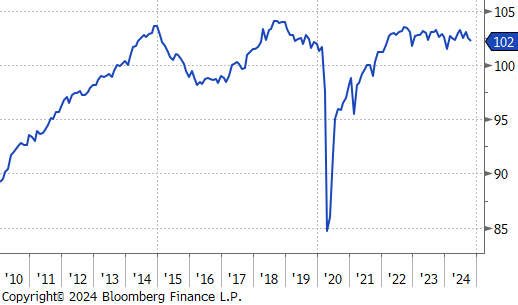

This week started with a promising reading in the October (pre-election) NFIB Small Business Optimism Index which came in at 93.7, above an expected 92. The fact that the index matched it’s July 2024 high (which, together, are the highest readings since February 2022) provides a clear signal that many of the recent headwinds are starting to subside.

Industrial data was mixed but does provide an encouraging signal when you consider the noise. First, the November Empire (NY) Manufacturing Survey ripped higher, to 31.2, versus the expected 0. This is the highest print since December 2021, but this is also the most volatile of the surveys – we look to Philadelphia and Kansas City for the most confident reads. Industrial Production for October came in at 0.3%, slightly better than the anticipated 0.4% contraction. Although the reading signals a further contraction in production, it is important to consider the backdrop. It is largely believed that the now concluded Boeing strike was the primary drag on activity. Under the context of that resolution, low-capacity utilization, and improving small business optimism, these figures are set up for strong resurgence in 2Q25.

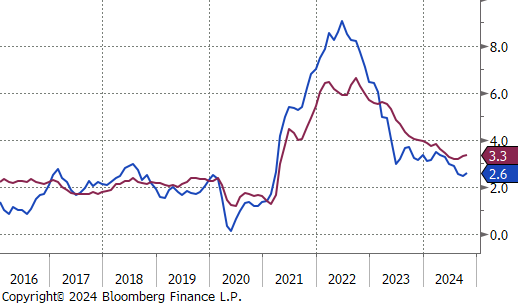

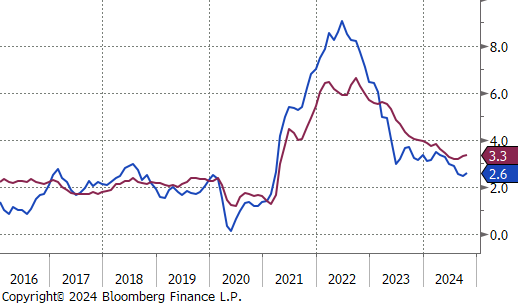

Finally, inflation data overall was a little too warm for comfort. CPI MoM was in line with expectations with Core (ex. Food & Energy) up 0.3% and Topline up 0.2%. Core CPI YoY has now increased for 4 straight months. Core PPI MoM printed 0.3%, higher than consensus expectations of a 0.2% increase, this resulted in an increase in the YoY reading to 3.1%, up from last months 2.8%. On the positive side, NY Fed Consumer Inflation Expectations showed a continued downward trend, coming in at 2.9% and below the expectation of 3%. This continued downward move in expectations may be the most important dynamic over the coming months. If consumers continue to believe price pressure is receding, the FED can continue to slowly move the policy rate down from its currently restrictive position. That said, recent data and “FED speak” suggests that the pace will soon be slowing – to the point where December meeting may result in a “hold”.