Flack Capital Markets | Ferrous Financial Insider

November 22, 2024 – Issue #459

November 22, 2024 – Issue #459

There will be no FFI next week, following Thanksgiving.

Overview:

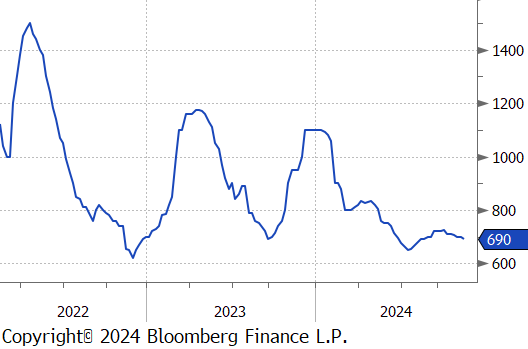

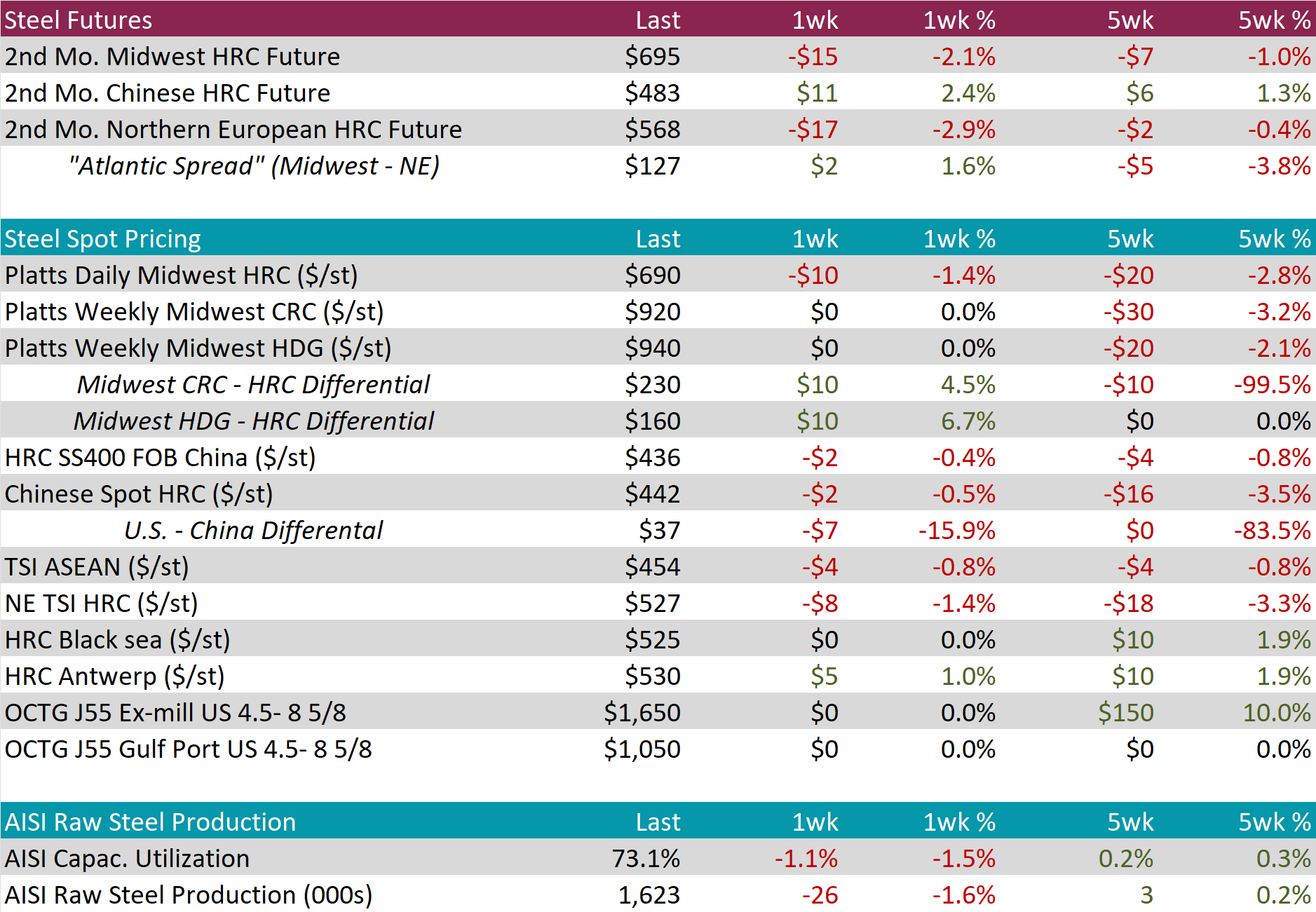

The HRC spot price declined by $10 or -1.4% to $690, furthering the downtrend in prices that begun six weeks ago. At the same time, the HRC 2nd month future fell by $15 or -2.1% to $695, decreasing for the second consecutive week and hitting the lowest price since August.

Tandem products both remained unchanged, resulting in the HDG – HRC differential to rise by $10 or 6.7% to $160.

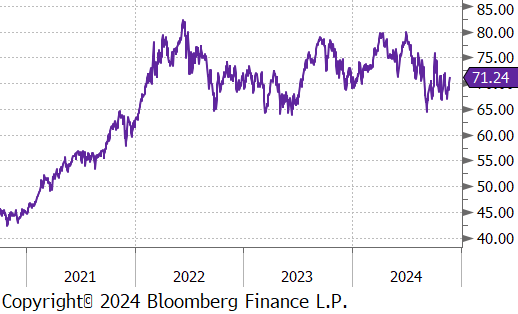

Mill production continued to remain subdued, with capacity utilization ticking down by -1.1% to 73.1%, bringing raw steel production down to 1.623m net tons.

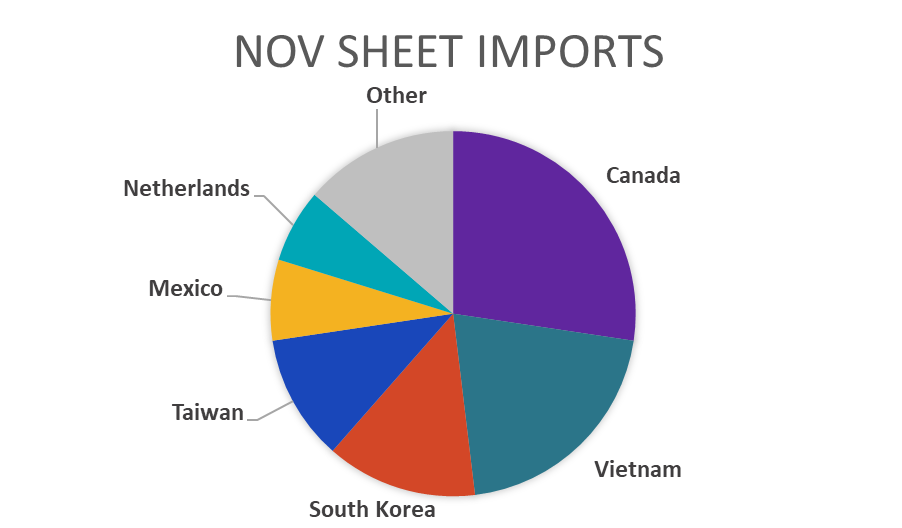

November Projection – Sheet 879k (down 30k MoM); Tube 411k (up 96k MoM)

October Projection – Sheet 910k (up 69k MoM); Tube 315k (down 58k MoM)

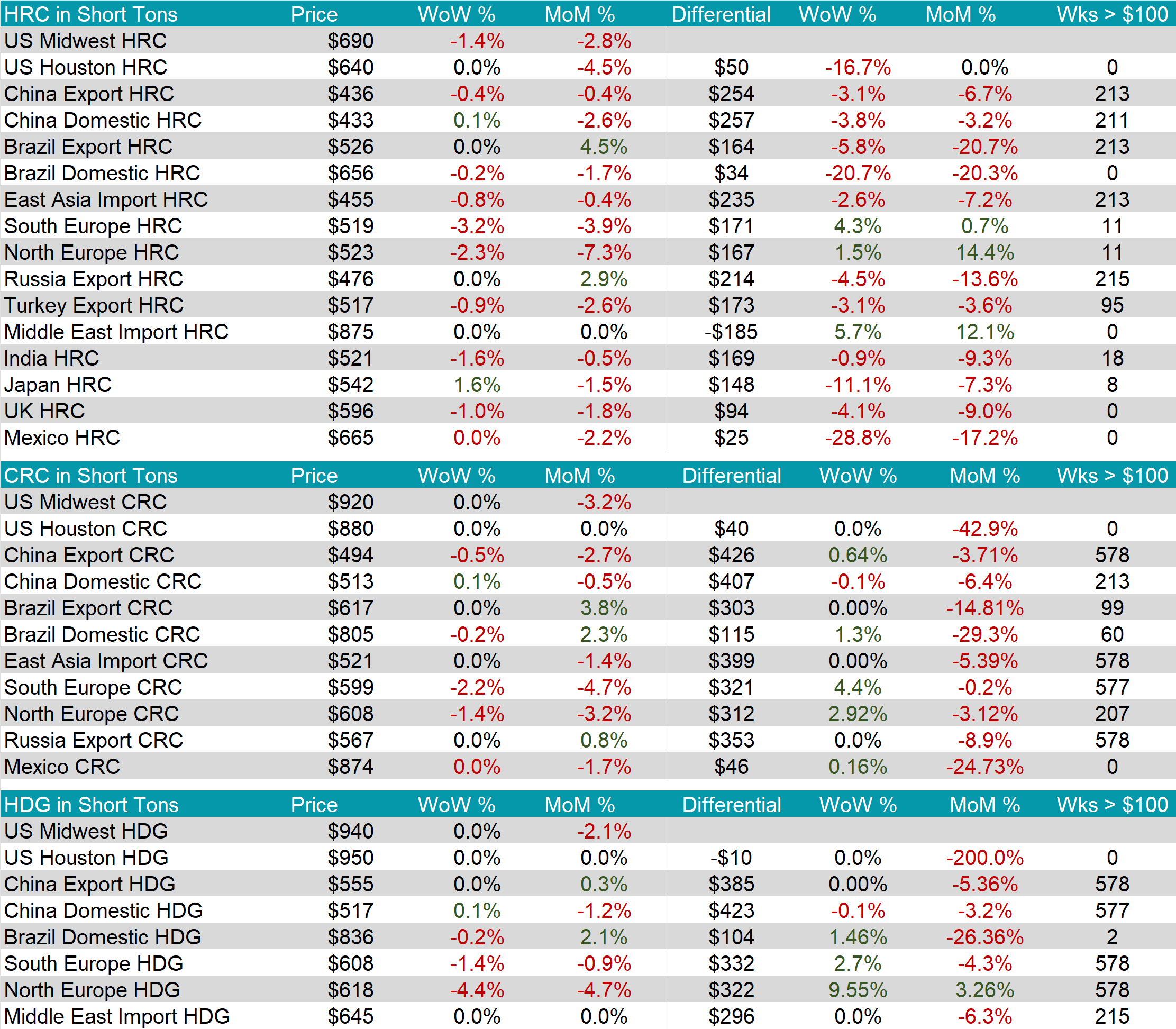

Watched global differentials all contracted except for Europe, with the North Europe HRC falling by -2.3%, while the other watched countries declined slighter.

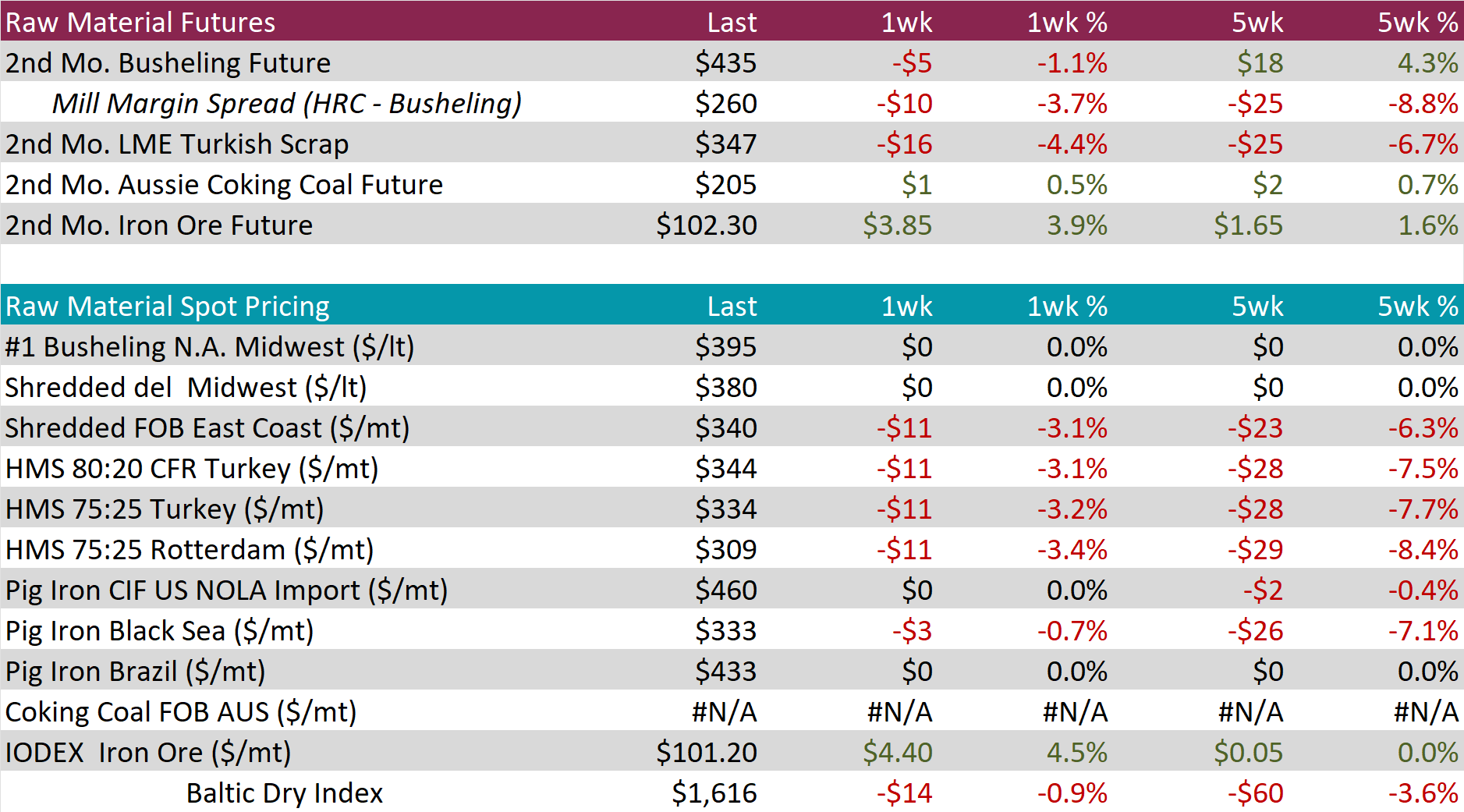

Scrap

The busheling 2nd month future dipped by $5 or -1.1% to $435, bringing the five-week price change to be up by $18 or 4.3%.

The LME Turkish scrap 2nd month future dropped by $16 or -4.4% to $347, marking the second consecutive week of price declines.

The iron ore 2nd month future rose by $3.85 or 3.9% to $102.30, rebounding from last weeks price drop.

Dry Bulk / Freight

The Baltic Dry Index slipped by $14 or -0.9% to $1,616, falling from last weeks price gain.

WTI crude oil future gained $1.40 or 2.0% to $70.10/bbl.

WTI natural gas future gained $0.55 or 19.9% to $3.34/bbl.

The aggregate inventory level experience an up tick, rising by 0.3%.

The Baker Hughes North American rig count reduced by 8 rigs, bringing the total count to 784 rigs. At the same time, the US rig count reduced by 1 rig, bringing the total count to 584 rigs.

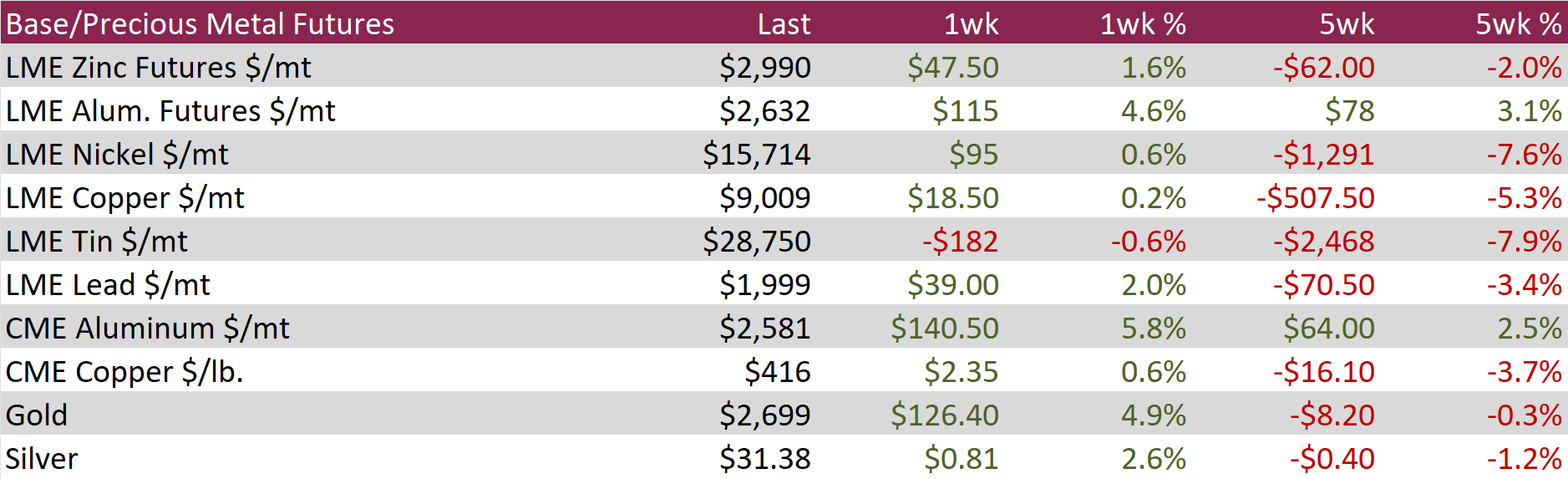

Aluminum future climbed by $47.50 or 1.6% to $2,990, driven by supply constraints from major producers and mixed signals about Chinese manufacturing demand. China announced plans to end tax rebates on exports of semi-manufactured aluminum products starting in December, a move estimated to remove approximately five million tonnes of supply from the global market. Meanwhile, bauxite prices surged toward record highs as Guinea, the world’s top exporter, halted shipments from Emirates Global Aluminum. This disruption, compounded by reduced bauxite output in Australia and Jamaica, has severely constrained supply for Chinese smelters, pushing ore inventories to their lowest levels since 2015.

Copper futures edged up by $2.35 or 0.6% to $416. The People’s Bank of China kept key lending rates unchanged, disappointing market expectations for additional stimulus to support economic growth. Meanwhile, global copper inventories continued to shrink due to robust consumption, underscoring steady demand. However, persistent global economic uncertainties are expected to maintain price volatility in the copper market.

Precious Metals

Gold jumped by $126.40 or 4.9% to $2,699. Investors are now focused on the Federal Reserve’s November meeting minutes and upcoming PCE inflation data for clues about the trajectory of U.S. interest rates. Current market sentiment shows a 56% probability of a 25bps rate cut in December, down from 62% last week. Last week, gold surged 6%, driven by heightened safe-haven demand amid escalating tensions in the Russia-Ukraine conflict.

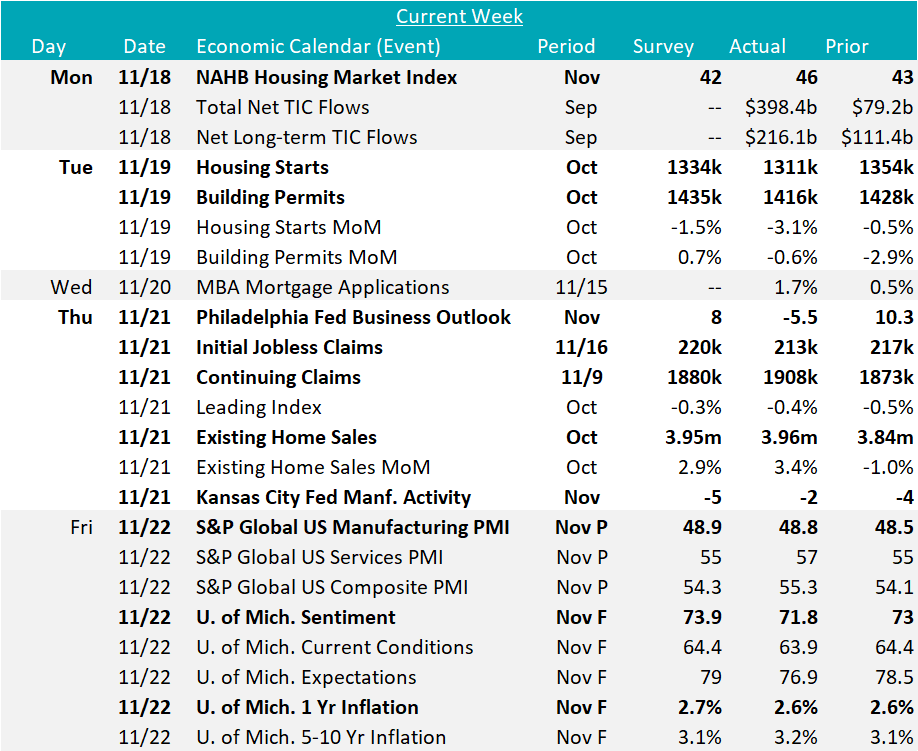

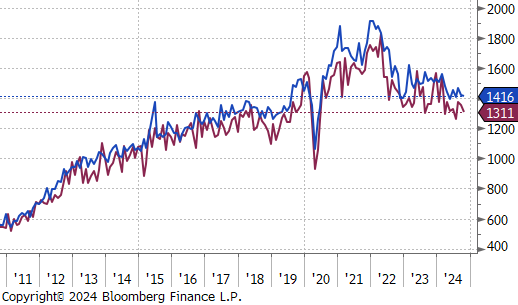

On the industrial side, November data signaled a further contraction in activity from both of this weeks Fed Manufacturing Surveys. Philadelphia was the more disappointment print at -5.5, coming in worse than the anticipated print lower from 10.3 to 8. Kansas City on the other hand was slightly more optimistic, coming in at -2, which while still in contraction territory is better than the expected -5. Furthermore, while the preliminary S&P Global US Manufacturing PMI increased to 48.8, it remains in contraction territory and was slightly below the expected 48.9.

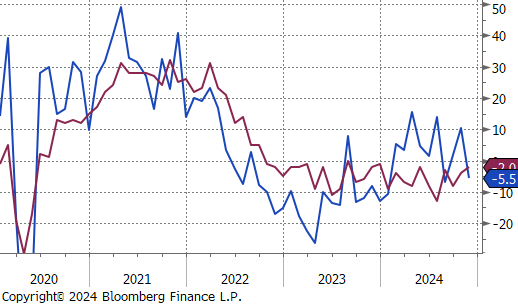

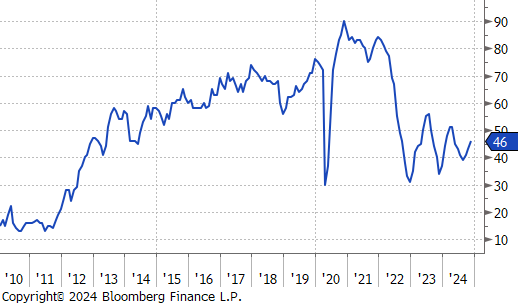

Housing sector data presented an optimistic outlook for the future, while current activity remains hampered by the rise in mortgage rates. There was improved optimism among homebuilders, with the NAHB Housing Market Index rising to 46 in November, surpassing expectations of a decline to 42 to reach the highest level in seven months. However, October’s Housing Starts and Building Permits both fell short of forecasts, with Starts at 1,311k vs the expected 1,334k and Permits at 1,416k vs the expected 1,435k. Meanwhile, Existing Home Sales for October increased to 3.96m, slightly exceeding the anticipated 3.95m.

Finally, the final University of Michigan Consumer Sentiment Survey for November rose to 71.8 from 70.5 MoM. While the final data came in below the preliminary estimate it is a clear signal of optimism following the election. Another dynamic that deserves attention is the shift in inflation expectations. After 1yr inflation expectations remained stubbornly high for most of the year, the last 3 months have provided a promising signal of lower expectations – this culminated in todays data, where the figure came in at 2.6%, down from last months print at 2.7%. On the other hand, the longer-term inflation expectations jumped from 3% to 3.2%, matching this cycles all-time high from November 2023. This shift was mirrored by the market’s immediate reaction to Trump’s victory, where longer-term yields rose more significantly than the near-term. This clearly signals a shift towards higher expectations of growth over Trumps administration, but also an increased risk of resurgent inflation which has yet to be fully trounced.