Flack Capital Markets | Ferrous Financial Insider

October 27, 2023 – Issue #403

October 27, 2023 – Issue #403

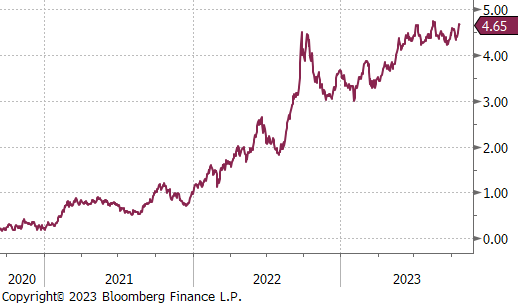

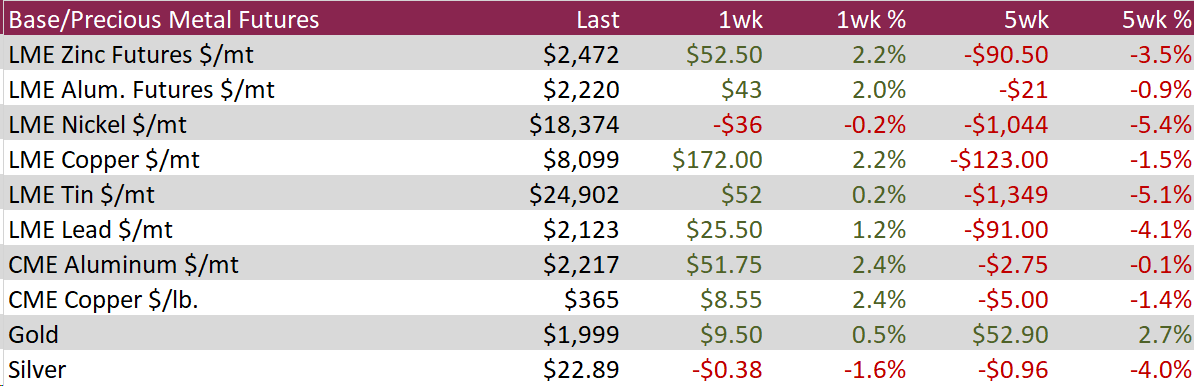

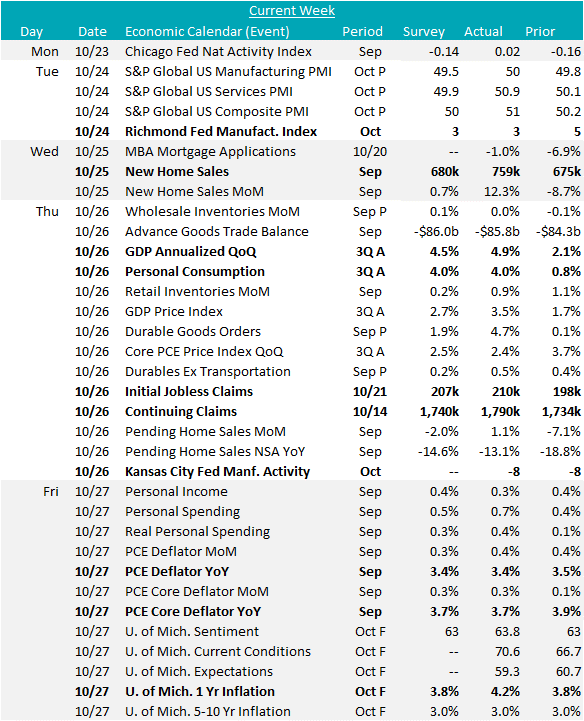

Last week’s most important data was GDP, and it did not disappoint. The preliminary release of 3Q23 GDP annualized QoQ came in at 4.9%, up from the 2nd quarter reading of 2.1% and above expectations of a 4.5% increase. This is the 5 straight quarter of growth following a 2-month contraction early last year.

This economic expansion was largely driven by consumer spending and a build of inventories. Following the upside surprise, many have noted that the pace of consumer spending is likely not sustainable given the current headwinds which are consequences of higher interest rates. However, the consumer debt to disposable income ratio is still better than pre-pandemic levels, the market is pricing that FED is done increasing rates, and inflation is clearly on a trend for continued relief.

That said, it is important to recognize that most of the recent economic growth has come from the service sector. Construction spending continues to hold up, and the auto strike appears to have had less of a negative impact on steel consumption than what mills anticipated, but manufacturing activity has been slow to recover since contracting late last year.

Looking forward, the imbalance between depressed inventories, restricted supply and soft demand in the industrial sector will dictate how far the current rally can go.

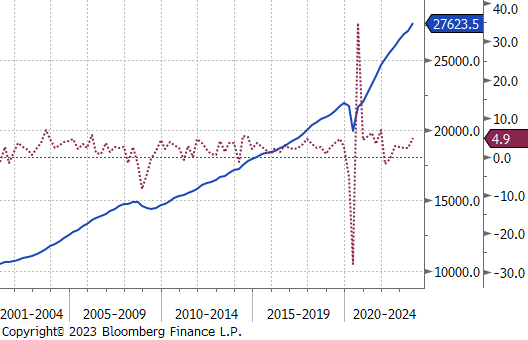

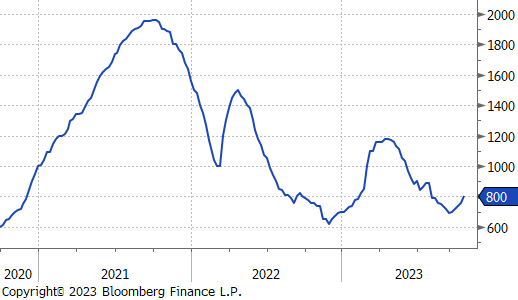

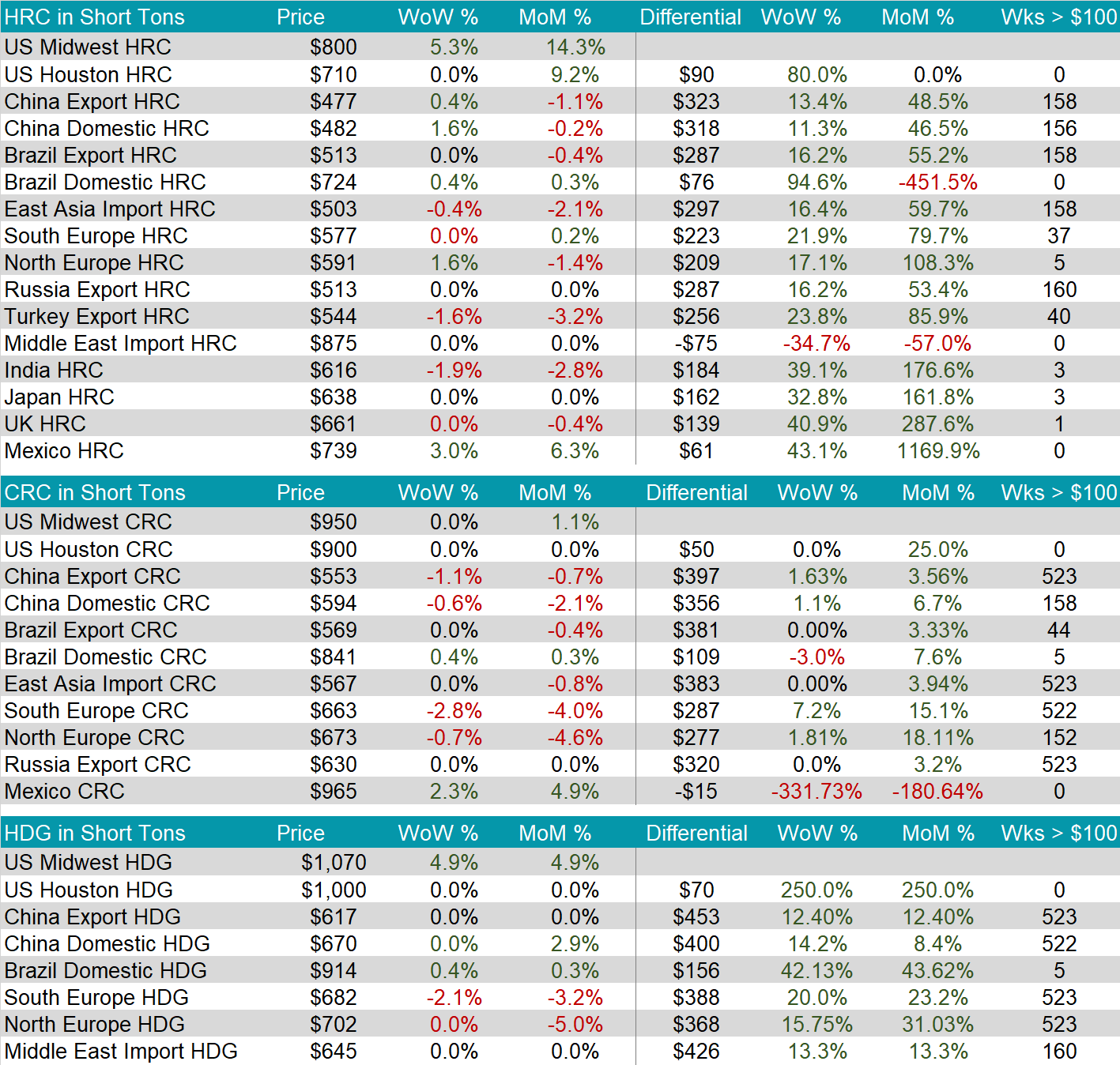

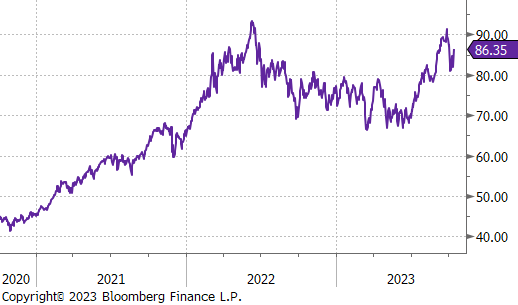

The HRC spot price increased again, marking the fifth week in a row, up to $800, up $40 or 5.3%. The 2nd month future also rose, up $161, or 20%, to $965. However, it is important to note that this increase is also impacted by the future rolling over from November to the December contract. The December future alone saw an also sizable increase of 12.5%.

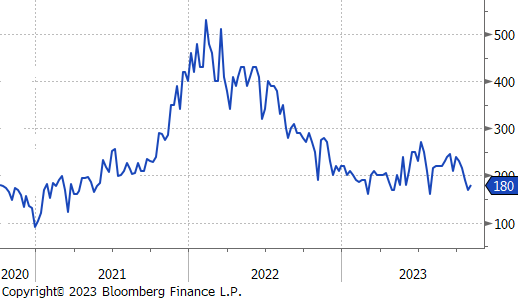

Tandem products were mixed this week, with CRC unchanging and HDG increasing by $50, or 4.9%, to $1,070, resulting in the HDG – HRC differential rising by $10, or 5.9%, to $180.

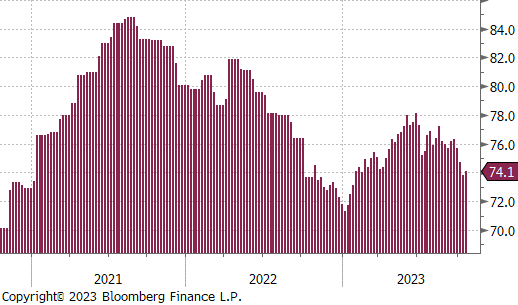

Mill production ticked up, with capacity utilization increasing by 0.3% to 74.1%. This movement is the first increase in three weeks, breaking it out of its recent trend of reductions.

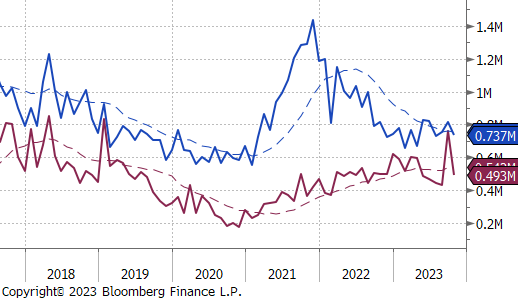

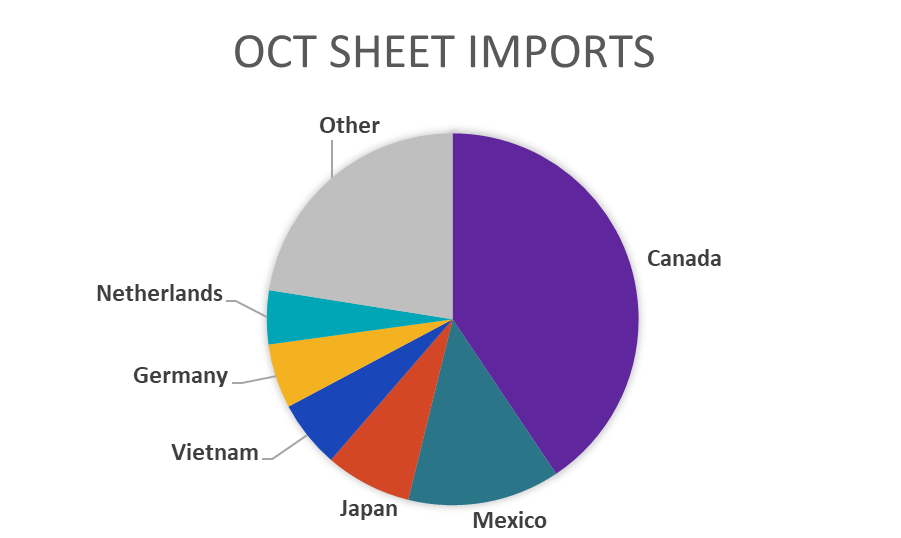

October Projection – Sheet 809k (down 67k MoM); Tube 425k (up 93k MoM)

September Projection – Sheet 765k (up 28k MoM); Tube 426k (down 80k MoM)

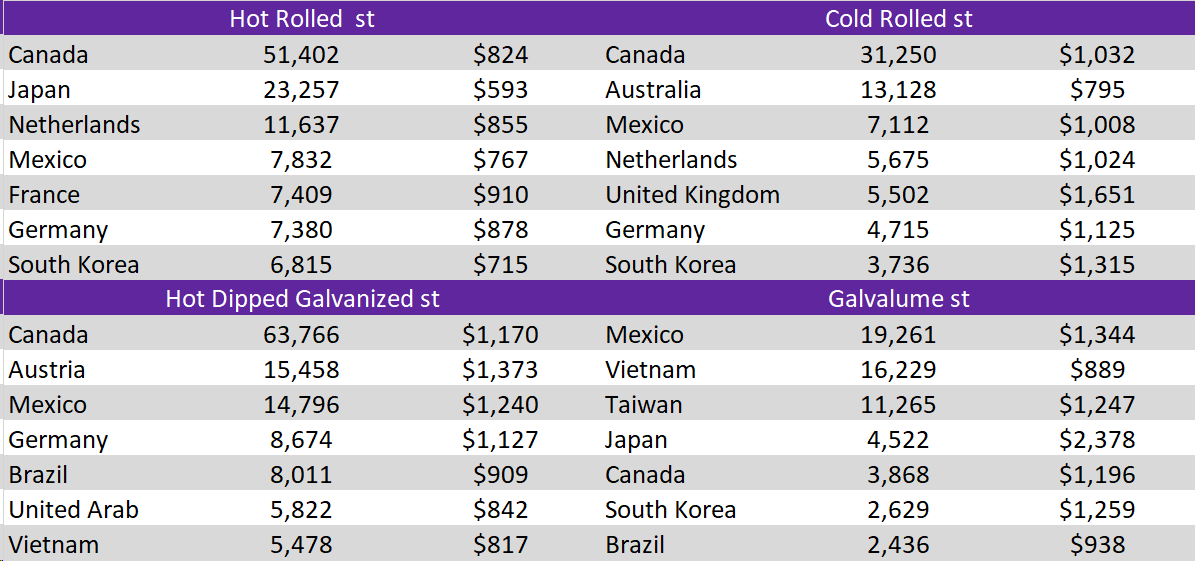

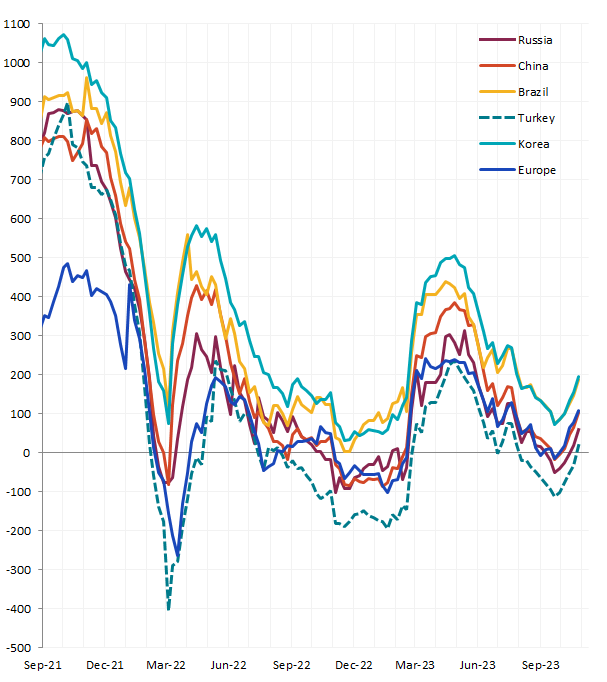

All of the watched global differentials were higher this week, with the US leading the rest of the world by having a 5.3% increase in HRC.

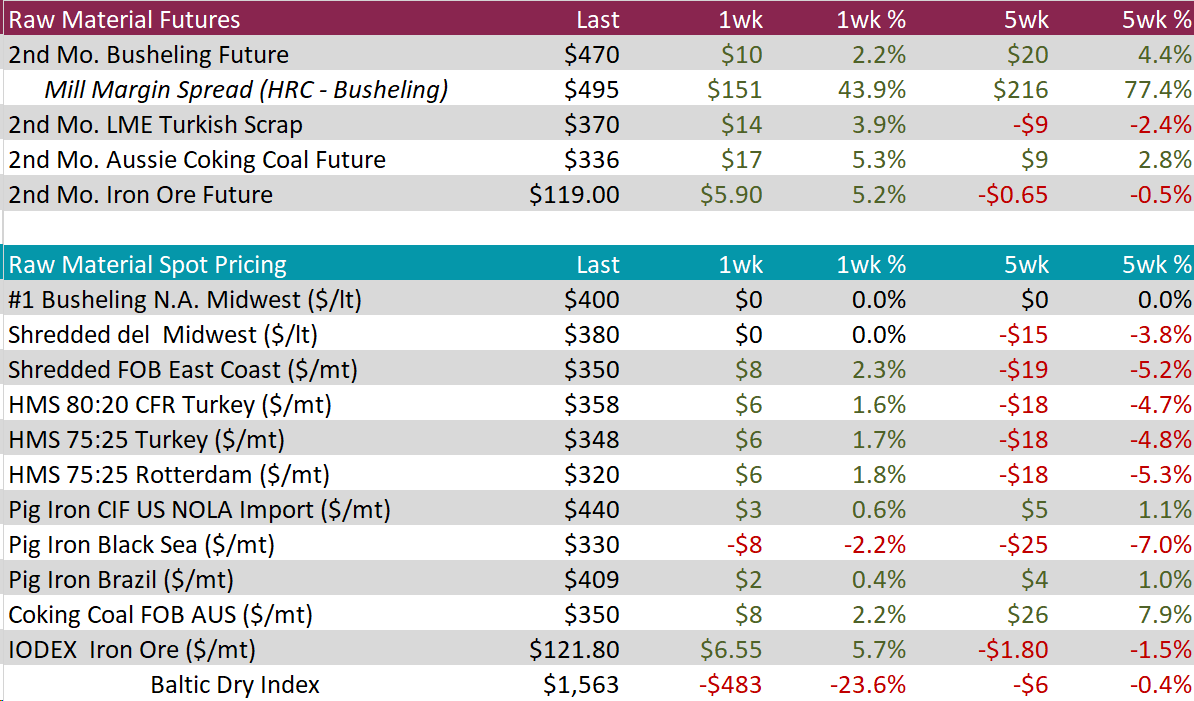

Scrap

The 2nd month busheling future rose again by $10, or 2.2%, bringing the price up to $470. This is approaching levels not seen since June 2023.

The 2nd month iron ore future increased by $5.90, or 5.2%, to $119. This is the first increase in price since decreasing from $120 to $113 over a five-week period.

The 2nd month LME Turkish scrap future rose for the first time in five weeks, shooting up by $14, or 3.9%, to $370. The five-week period saw a decrease in price from $383, which was the highest price seen since mid-June, to $356.

Dry Bulk / Freight

Baltic Dry Index jumped down by $483, or -23.6%, to $1,563. This movement notably breaks it out of its upward trend, which accumulated a total increase of $960 over seven weeks.

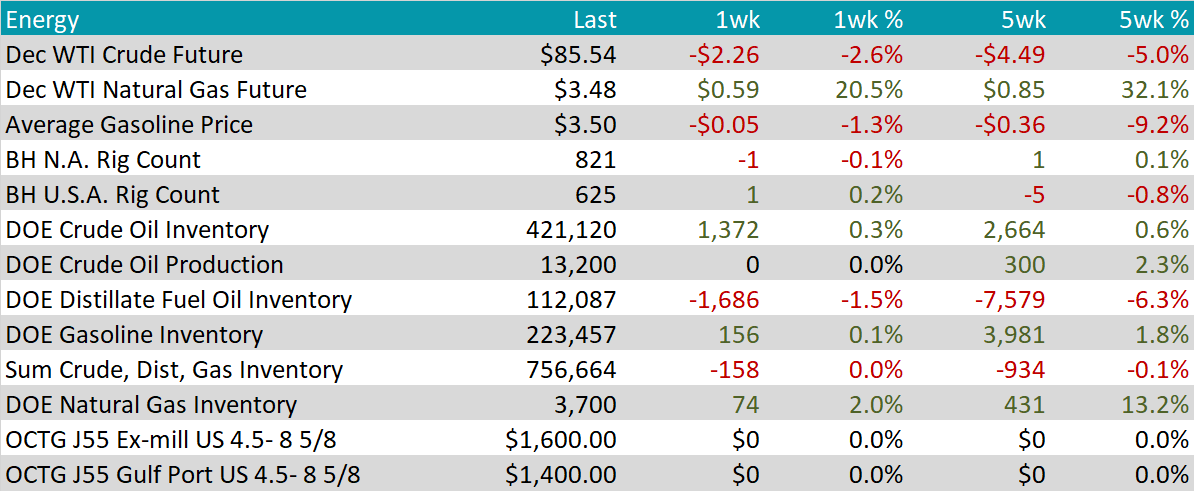

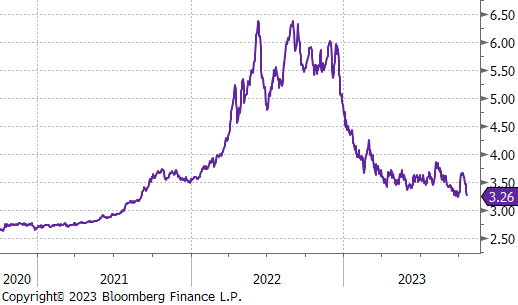

WTI crude oil future lost $2.26 or -2.6%% to $85.54/bbl.

WTI natural gas future gained $0.59 or 20.5% to $3.48/bbl.

The aggregate inventory level was considered down, although rather insignificantly at 0.0%.

The Baker Hughes North American rig count declined by 1 rig, whereas the US count increased by 1 rig. This comes after increases in rigs by both last week, albeit Baker Hughes had a larger increase in rigs than the US.

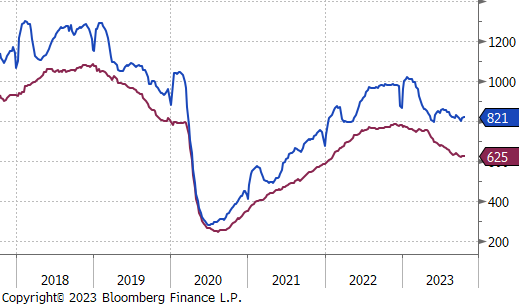

Following a two-month low of $2,176 reached on October 23, aluminum futures rose by $43, or 2.0%, to $2,220 per tonne. This recovery coincides with the announcement by the Chinese government that it will increase the budget deficit for manufacturing investment, improving the outlook for industrial inputs. This along with China stopping expansion of its production capacity to avoid oversupply and higher energy consumption from old, inefficient infrastructure, has led to concerns about supply.

Copper futures rose by $8.55, or 2.4%, to $365, the highest in one month. This comes amid expectations of robust demand and fresh blows to inventories. Due to Beijing widening its budget for manufacturing investment, concerns of low demand due to debt concerns for the residential construction sector have relieved. Furthermore, there was a jump in the Yangshan copper premium, signaling higher demand for physical deliveries in Asia.

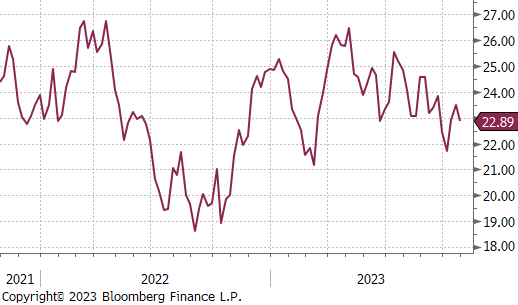

Silver has jumped up to $23.50, the highest in a month, lifted by demand for safe-haven assets, as Israel launched its ground war on Gaza, triggering geopolitical fears. Also, China’s stimulus measures and weaker dollar after positive economic data from Europe provided floor for the metal.

More Fed manufacturing surveys came in this week, with Richmond decreasing to 3 from the prior 5 print, aligning with expectations. Kansas City remained unchanged from the prior reading, staying steady at -8. Although neither of these show an increase in business activity for the month, firms are remaining relatively optimistic that there will be in their six-month outlook.

Initial and continuing jobless claims both increased and were both higher than market expectations. This could be signaling that the labor market is beginning to soften, especially after weeks of these readings surprising to the upside.

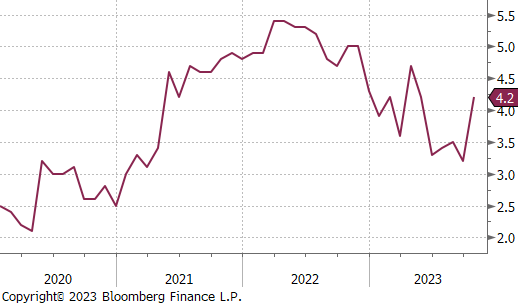

September’s Core PCE printed at 3.7% YoY, coming in ling with expectations, and down from August’s reading of 3.9%, implying a gradual easing of inflationary pressures. Despite this, the final October reading for University of Michigan 1-year inflation came in at 4.2%, an increase from the expectations of 3.8%. This suggests that although inflation is signaling relief, the fight to tame inflationary pressures is not over just quite yet.

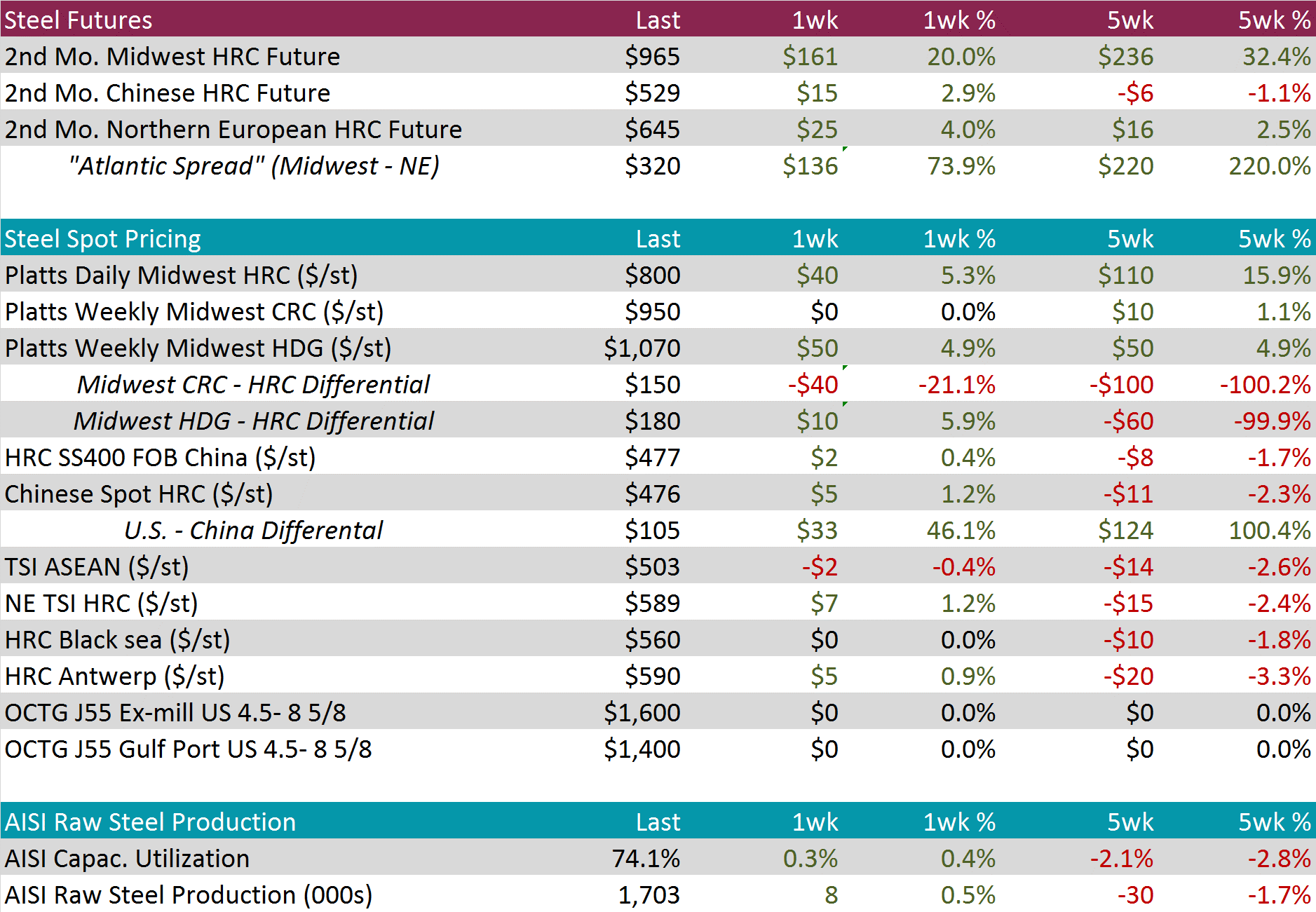

The US Dollar rebounded last week, closing at 106.56. It’s worth noting that DXY has maintained relative stability since mid-September, following a robust rally from 99 in mid-July. As we approach a week filled with central bank meetings, all eyes are on potential signals regarding future monetary policies for the remainder of the year. The greenback is poised to conclude October with a 0.5% gain, reflecting expectations of the Federal Reserve’s commitment to keeping borrowing costs elevated, supported by the continued resilience of the US economy compared to other major economies.

The Yen fell ahead the upcoming monetary policy meeting. It is widely anticipated that the Bank of Japan (BOJ) will maintain its policy rate at -0.1%. The USDJPY pair concluded the week at 149.66, inching closer to the crucial 150 level, which has served as significant resistance since its initial test in mid-September. A breach of this level could indicate further Yen weakness, prompting questions about the BOJ’s ability to support the weakening currency due to its ultra-easy monetary policy.

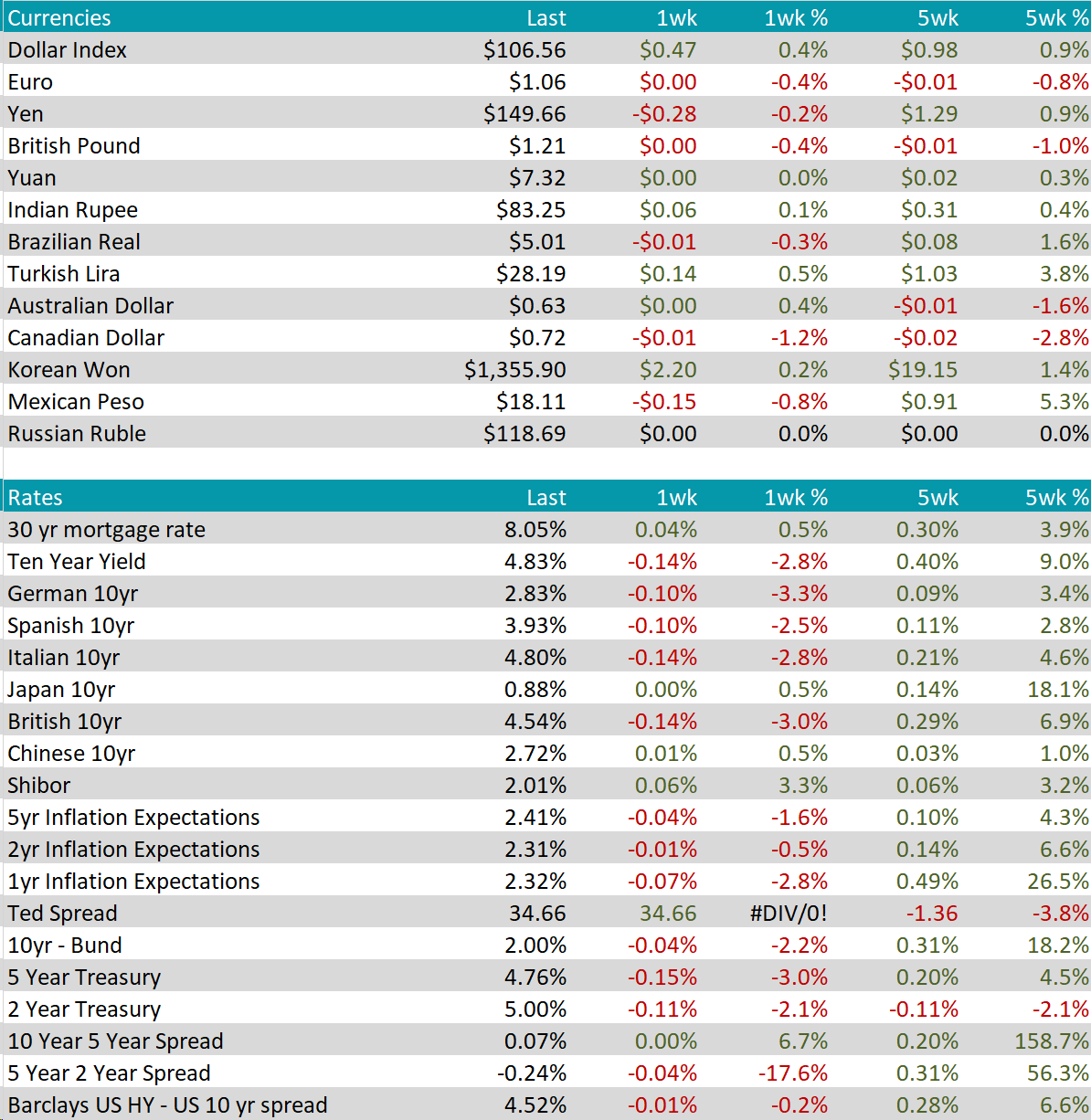

The US 10-year Treasury Yield decreased to 4.83%, marking its lowest point in two weeks. Traders are gearing up for a highly significant Federal Reserve meeting scheduled for this week. Although there’s a 98% market probability that the Fed will leave the Fed funds rate unchanged, participants are keenly watching for clues regarding the Fed’s intentions for December and the future.