Flack Capital Markets | Ferrous Financial Insider

September 22, 2023 – Issue #398

September 22, 2023 – Issue #398

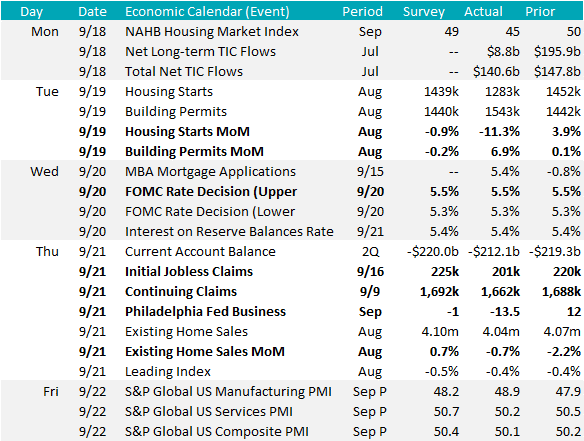

Over the last 3 months, the optimism around the possibility of a “soft landing” (i.e., a slowdown in inflation without a severe recession) has been building and is now as loud as we have heard during the entire hiking cycle. When the Fed began hiking rates at the current historic pace to tackle inflation, the underlying assumption from many was that they would move too fast, and something would break. While the long variable lags of interest rate policy are a reminder of the fact that we are not out of the woods, there is good reason for the aforementioned optimism. The labor market is cooling, but it continues to hold up remarkably well, GDP remains robust, and economic data continues to beat expectations. Outside of the fact the that FOMC voted to hold the Fed funds target rate steady, a few important datapoints came out of last week’s meeting. In the summary of economic projections, the Fed doubled their forecast for year end GDP from 1% to 2.1%, shrunk unemployment expectations from 4.1% to 3.8%, and decreased the Core PCE projection from 3.9% to 3.7%. The takeaway is clear, this forecast implies that the economy has the potential to thread the needle.

Since the beginning of the rate hike cycle, we have been closely watching the residential construction market as a canary in the coal mine for other interest rate sensitive industrial sectors. This month’s housing starts and building permits data provided one of the muddier signals of late. Starts were a significant miss to the downside, printing down 11.3% compared to last month and well below expectations of a mild down 0.9% move, this is the lowest level for housing starts since June 2020. However, when taking a step back there are a few reasons this may not be cause for major concern. Most importantly, building permits jumped up 6.9% compared to the expectation of down 0.2% and they are the highest since October of last year. Furthermore, the current level of starts remains well above the typical level for the 15 years prior.

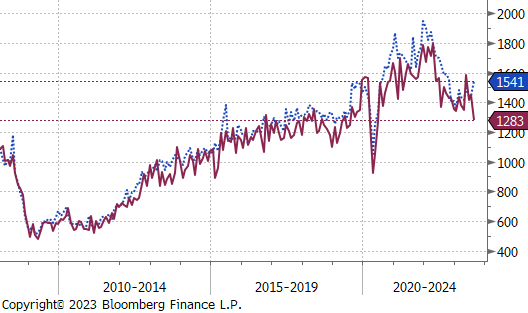

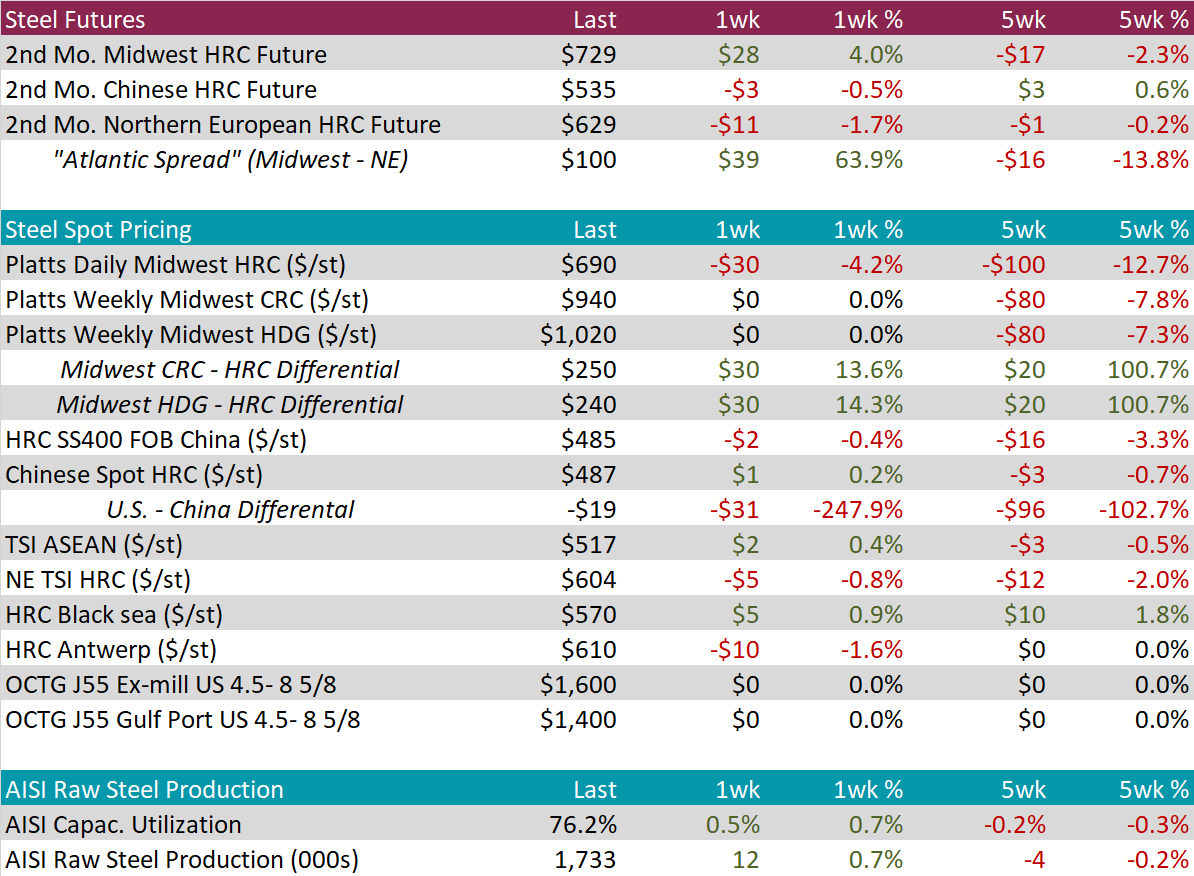

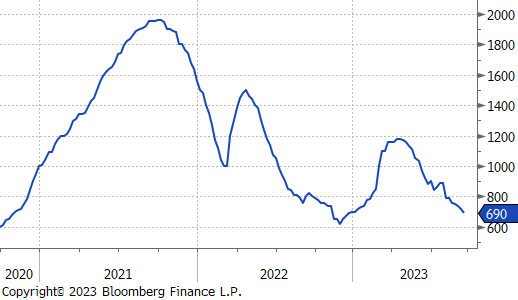

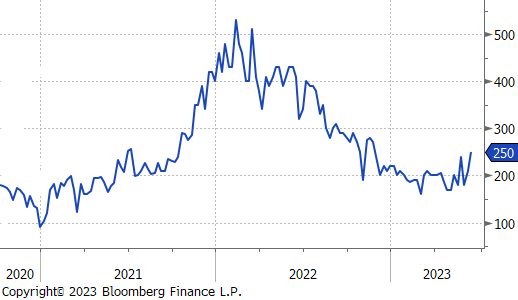

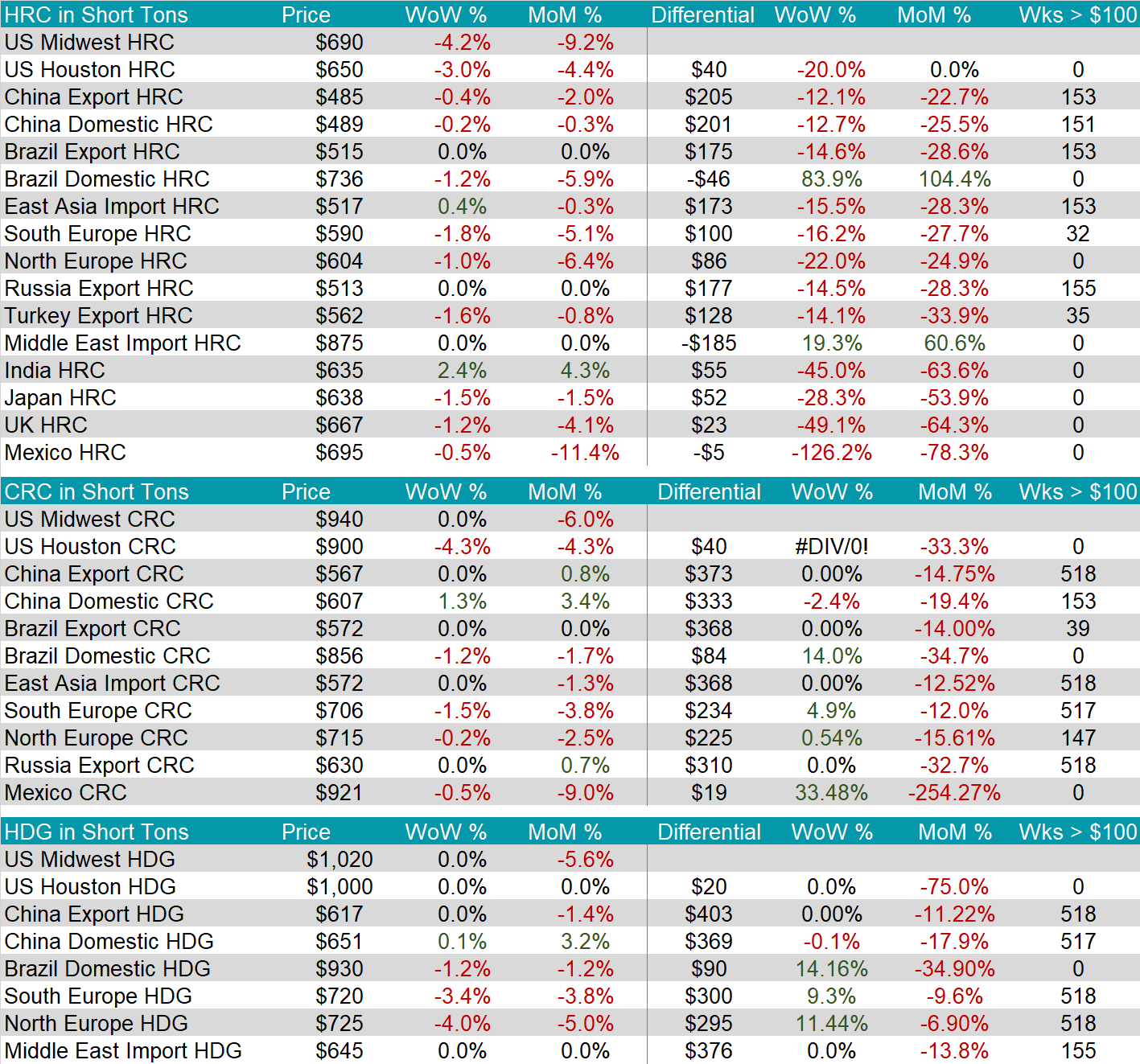

The HRC spot price fell further this week to $690, down $30 or 4.2%, doubling the rate of the week prior. This is the lowest the spot price has been all year, entering levels seen in December 2022.

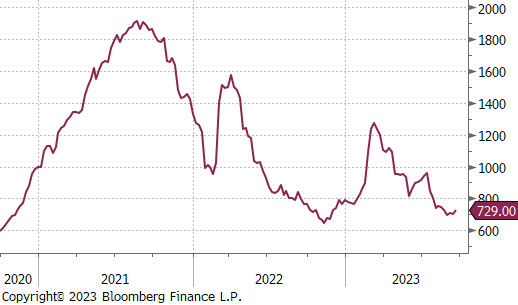

The 2nd month future rose this week to $729, up $28 or 4.0%. The entire curve rallied last week, up 5.4%, after trading in a tight range for three weeks prior. The primary catalyst for the rally was the surprise, temporary idling of Granite City Furnace B.

Tandem products both remained unchanged this week, resulting in the HDG – HRC Differential increasing by $30.

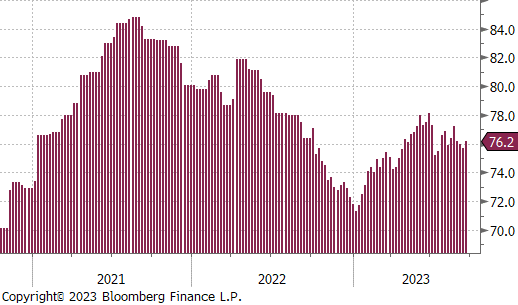

Mill production ticked higher this week, with capacity utilization increasing 0.3%, up to 76.2%. The current level remains within a neutral range, providing flexibility to increase or decrease as the demand outlook becomes clearer.

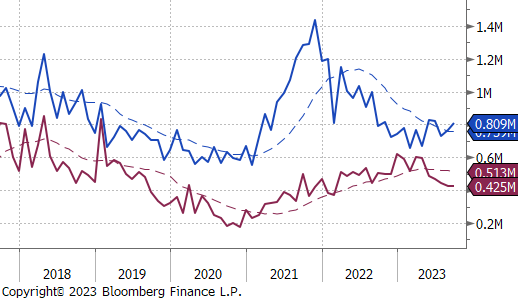

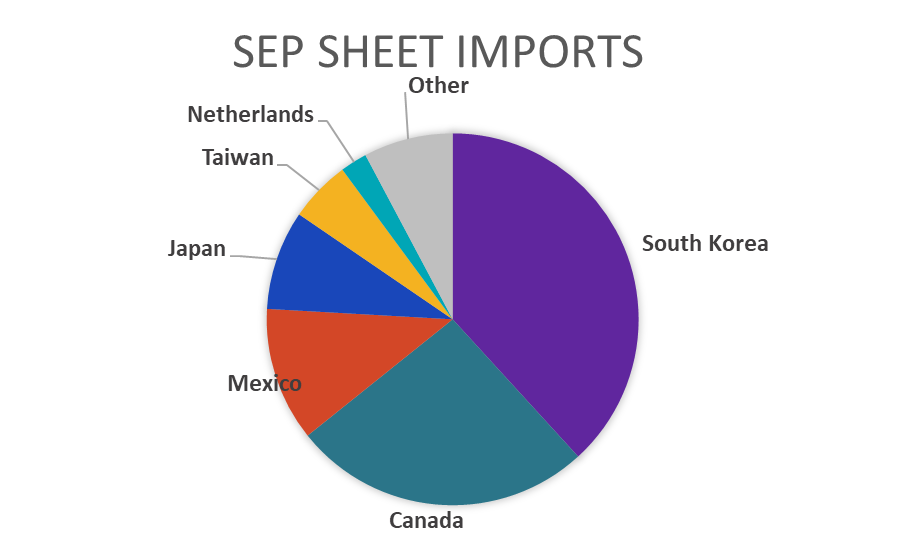

September Projection – Sheet 809k (up 44k MoM); Tube 425k (down 1k MoM)

August Projection – Sheet 765k (up 34k MoM); Tube 426k (down 16k MoM)

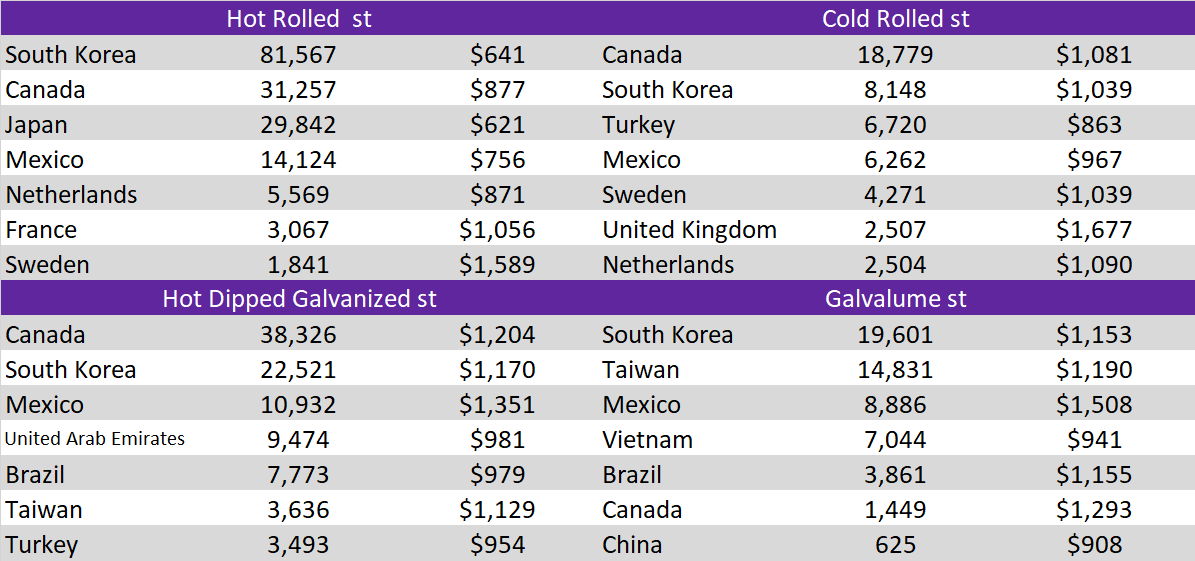

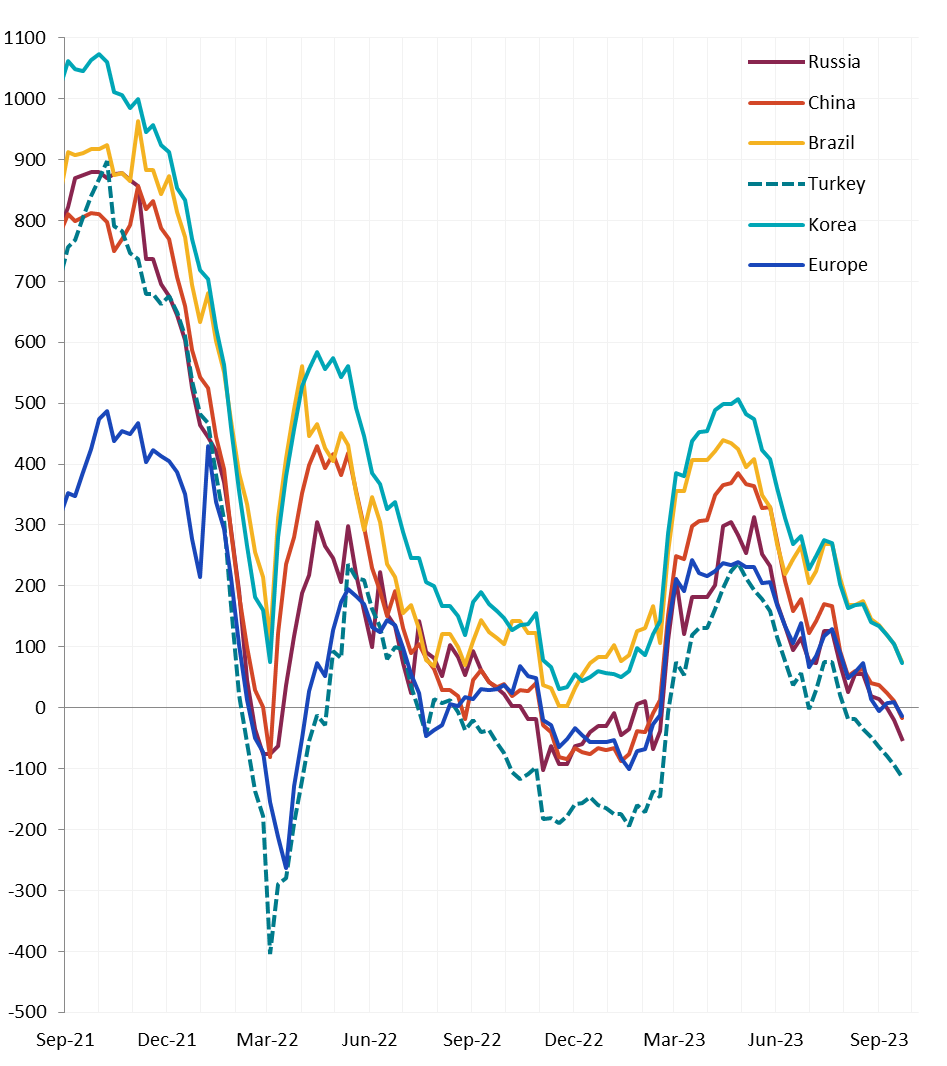

Global Differentials were all mostly down this week. The US domestic price fell the most. Korea and Brazil are the final two countries which do not have a negative differential.

Scrap

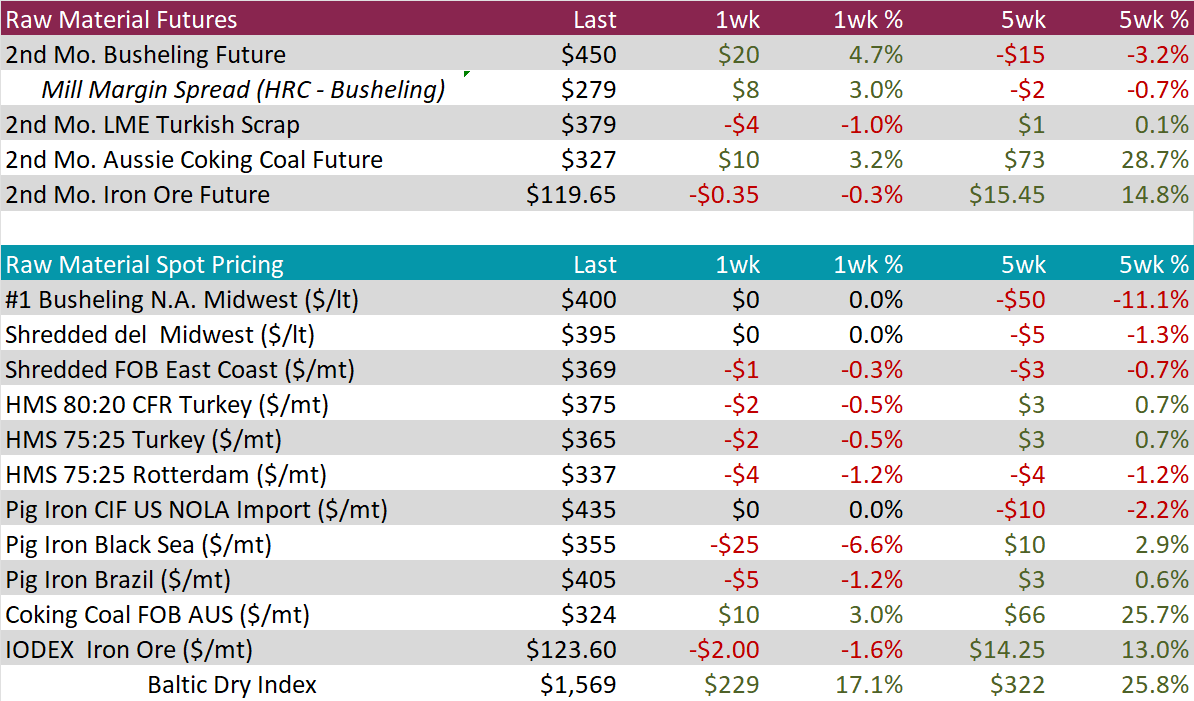

The 2nd month busheling future was up $20, or 4.7%, to $450. The mill margin spread slightly increased, by $8. However, the current level of $279 is still depressed compared to historical levels.

Pig Iron was unchanged, coming off from a decrease last week. If the auto strike lasts longer than market participants expect, we anticipate an increase in pig iron pricing because it is a substitute for higher grade scrap.

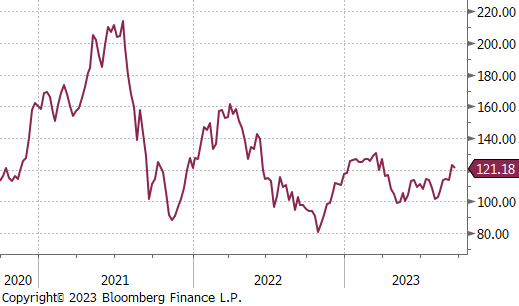

The 2nd month iron ore future was down $0.35, or 0.3%, to $119.65. Iron ore remains surprising buoyant due to the mixed stimulus/demand signal coming out of China.

Dry Bulk / Freight

The Baltic Dry Index was up $229, or 17.1%, this move breaks the index out of its previous range and suggests increased demand for freight.

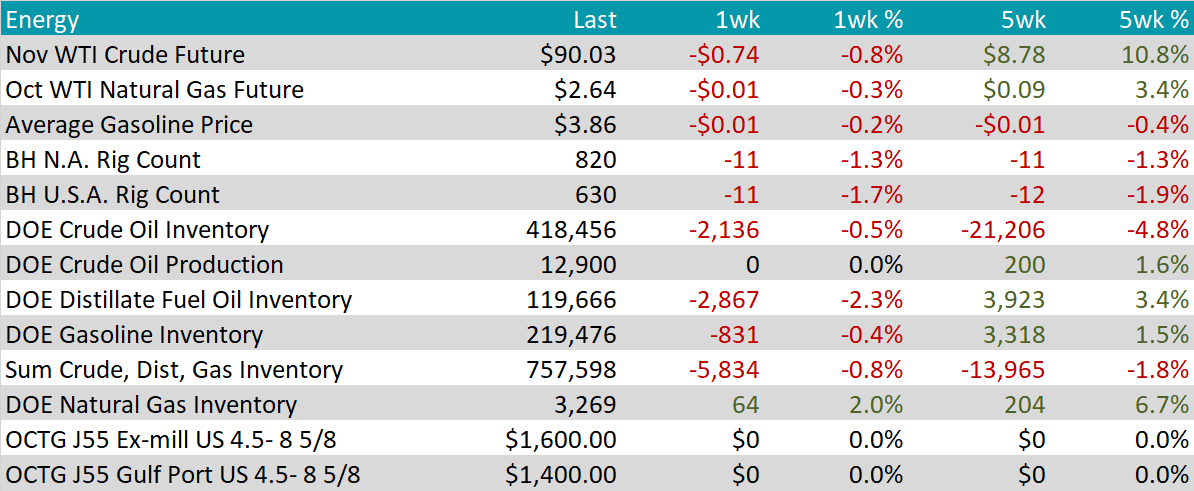

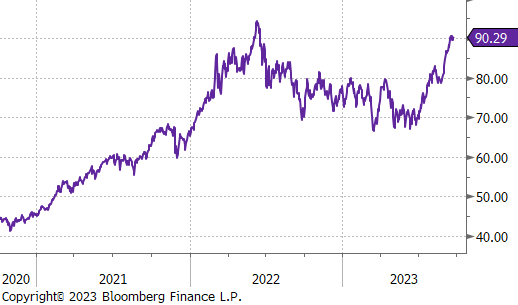

WTI crude oil future lost $0.74 or 0.8% to $90.03/bbl. The ongoing rally in crude has been driven by global production cuts, mainly coming from Saudi Arabia.

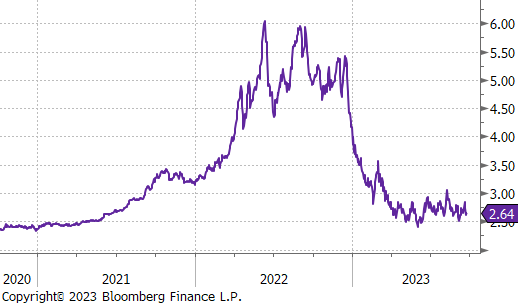

WTI natural gas future lost $0.01 or 0.3% to $2.64/bbl.

The aggregate inventory level was down slightly by 0.8%, after a recent jump in the week prior.

The Baker Hughes North American and the U.S. rig count were both down by 11 rigs.

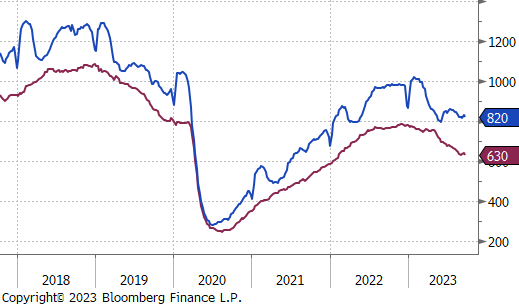

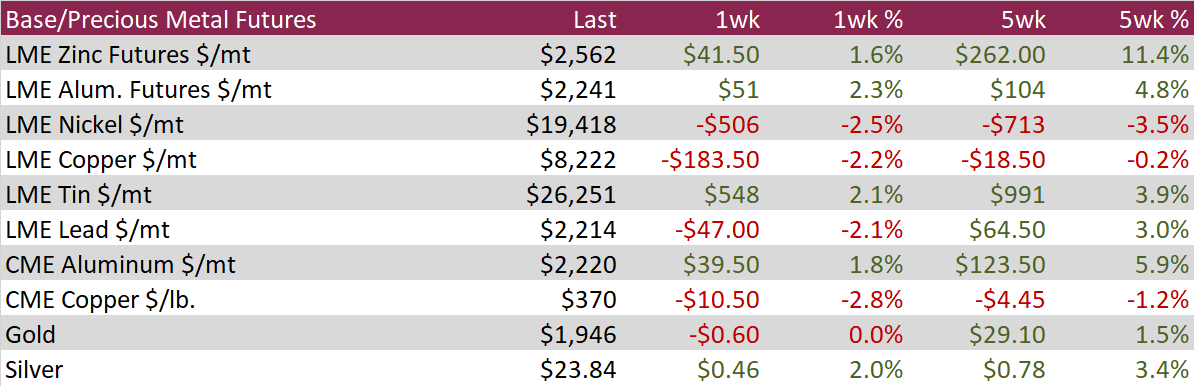

Aluminum futures surged by 2.3%, marking an extension of their five-week rally, which has now amounted to a substantial 4.8%. This notable rise allowed aluminum to reclaim the $2,200 level, a milestone it had not reached in three weeks. This impressive performance came despite ongoing auto strikes, now extending into their second week, which typically weaken demand. The driving force behind this rally was the significant reduction in immediately available aluminum inventories within LME warehouses, marking the most substantial decline seen in the past five weeks.

Copper contracted between 2.2% on the LME and 2.8% on COMEX, extending its 5-week flump. Unlike aluminum, copper inventories in LME-registered warehouses hit their highest level since May 2022 and have more than doubled in the past two months. Furthermore, hawkish Fed policy and a disappointing Chinese economic recovery have weighed on the copper price.

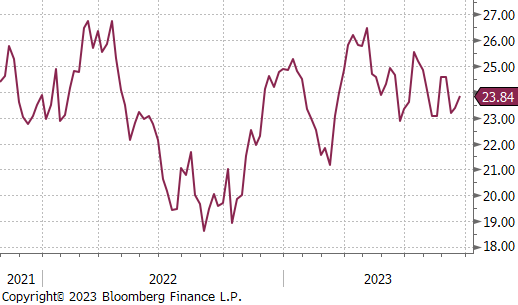

Silver exhibited remarkable resilience by shrugging off the hawkish positions taken by several central banks worldwide. Despite the relative strength of the US Dollar, silver managed to post a solid gain of +2.0% for the week. It’s worth noting that silver futures faced significant pressure throughout most of September, and the recent upturn could be interpreted as a relief rally in response to the previous downward trends.

This week, we received more Fed Manufacturing surveys. The most notable information being that the Philly FED printed at -13.5, down from the prior reading of 12 and well below economists’ expectations of -1. While one datapoint is not a trend, this month’s print is a concerning reversal after a promising prior trend higher.

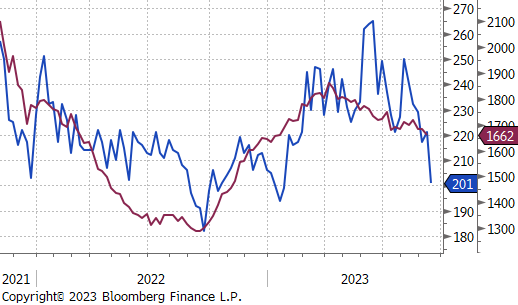

Looking to the weekly labor market data, initial and continuing jobless claims both decreased and came in below their expectations. Due to the fact that the data is lagged, we have not yet seen the potential ripple effect of the UAW strike. However, we will see layoffs in the rust belt and south rise if it is prolonged. Due to the more targeted nature of a “stand-up” strike, these downstream risks are more pronounced.

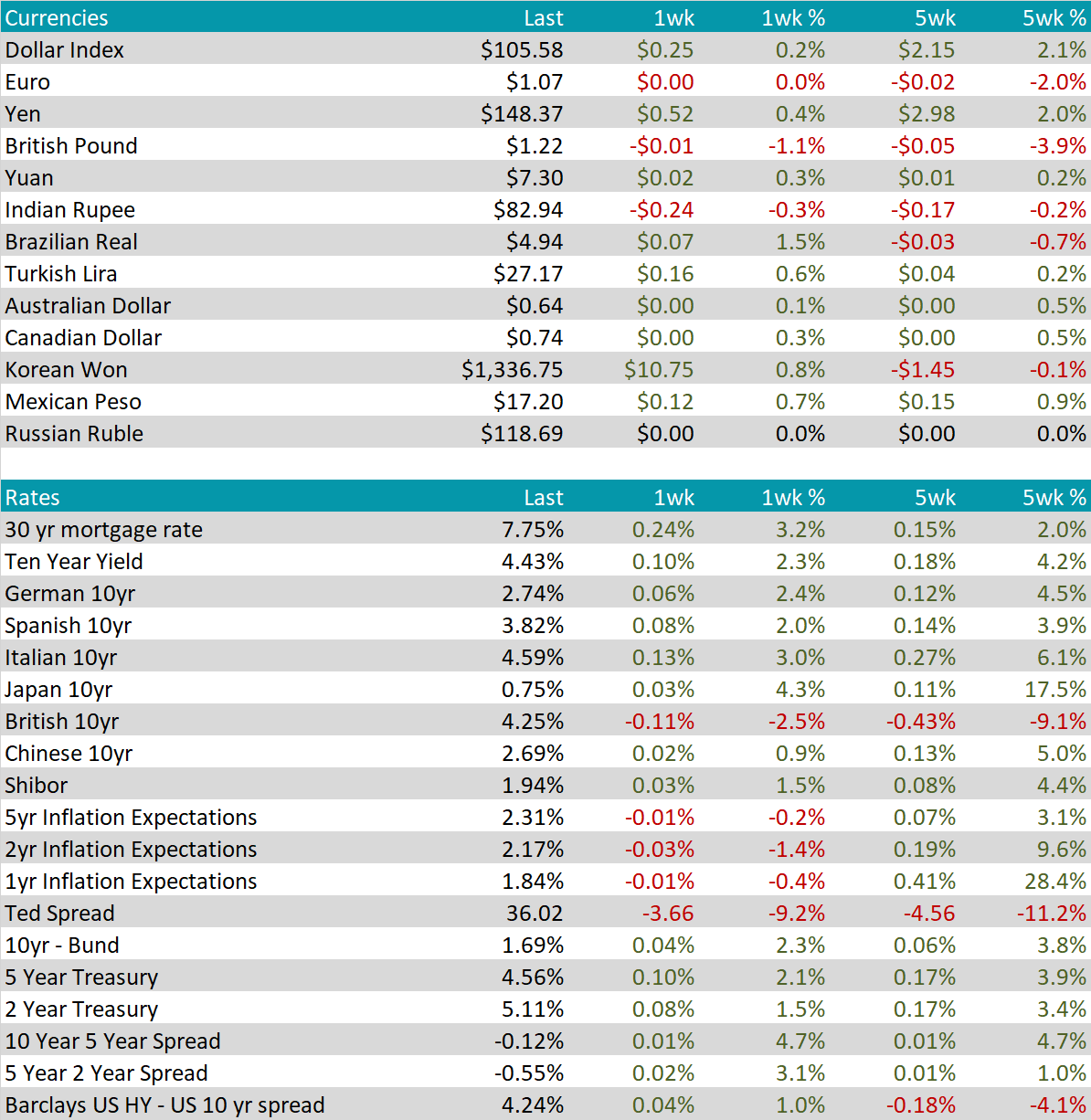

Last week, the GBPUSD currency pair experienced a notable decline, hitting 1.22, its lowest level since March 24th, marking its weakest monthly performance in a year. The latest PMI report revealed a significant contraction in business activity, the most severe in over 2.5 years. The Bank of England decided to maintain interest rates at 5.25% while committing to keeping rates elevated for a “significant” period. The market anticipates the BOE to maintain these rates at their upcoming meeting in November.

The USDJPY pair saw a significant increase, with the Yen dropping past to 148 against the US Dollar. The Bank of Japan maintained its ultra-easy monetary policy, emphasizing its commitment to achieving a sustainable 2% price stability target. These actions disappointed market expectations for any hints of ending the negative interest rates policy. Japan’s Finance Minister, Shunichi Suzuki, expressed readiness to explore various currency-related options, cautioning against abrupt Yen depreciation that could harm the economy.

The US 10-year Treasury yield concluded the week at 4.43%, coming close to the October 2007 highs of 4.5%. A robust US labor market and rising energy prices have increased concerns about the potential for prolonged inflation, increasing the likelihood of another rate hike by the Federal Reserve and the Fed maintaining higher rates for an extended period. In last week’s summary of economic projections, 12 of the 19 members said they were supportive of one additional 25 bps hike.