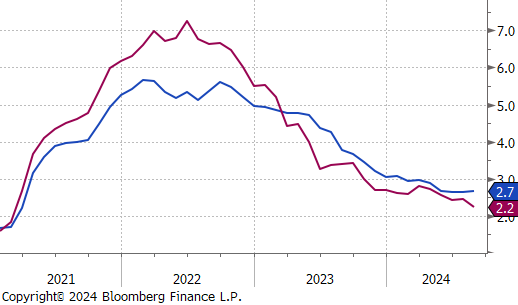

Flack Capital Markets | Ferrous Financial Insider

September 27, 2024 – Issue #451

September 27, 2024 – Issue #451

Overview:

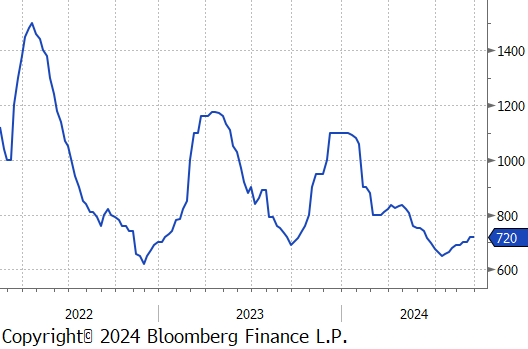

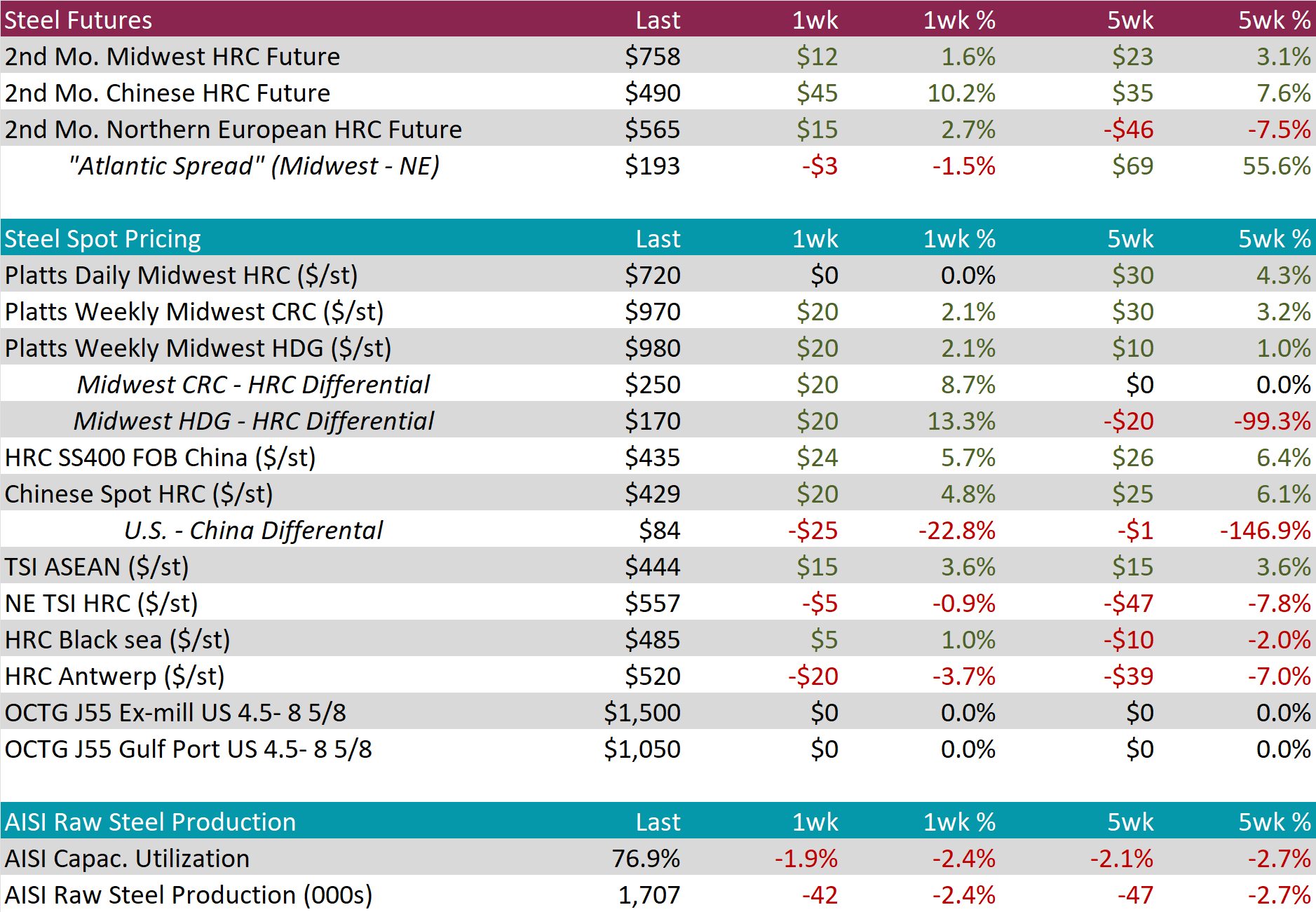

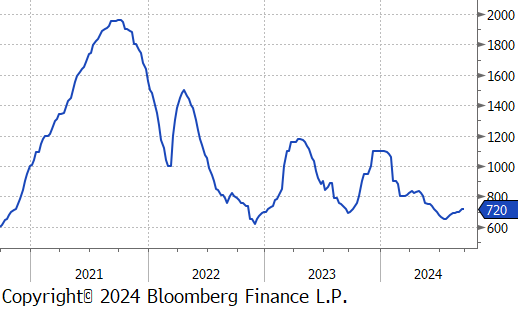

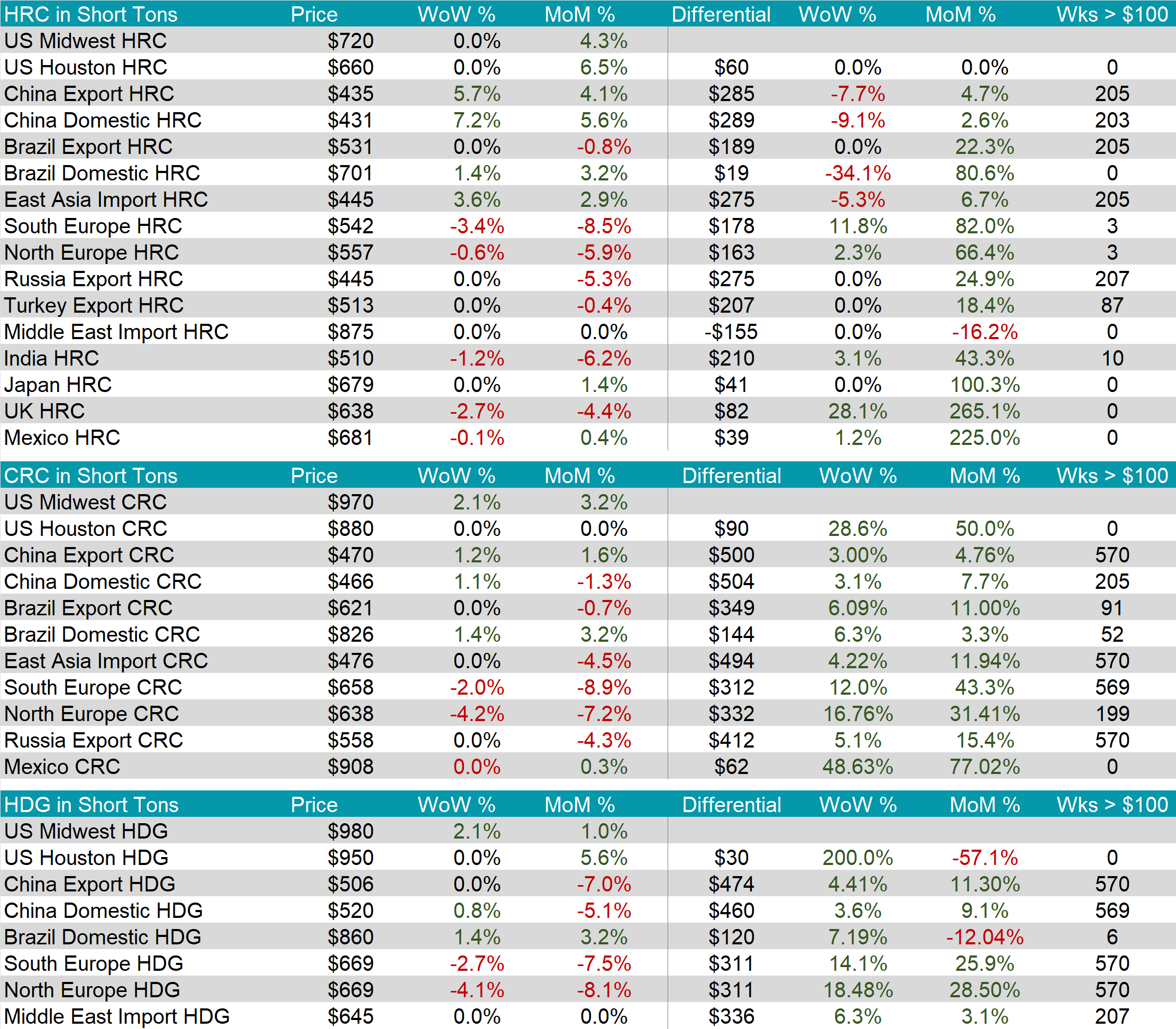

The HRC spot price remained unchanged at $720, bringing the five-week price change up to $30 or 4.3%. At the same, the HRC 2nd month future inched up by $12 or 1.6% to $758, reaching the highest price since May.

Tandem products both rose by $20, resulting in the HDG – HRC differential to widen by $20 or 13.3% to $170.

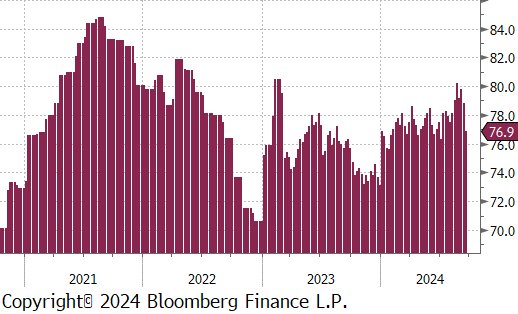

Mill production notably dropped, with capacity utilization ticking down by -1.9% to 76.9%, bringing raw steel production down to 1.707m net tons, the lowest level in eleven weeks.

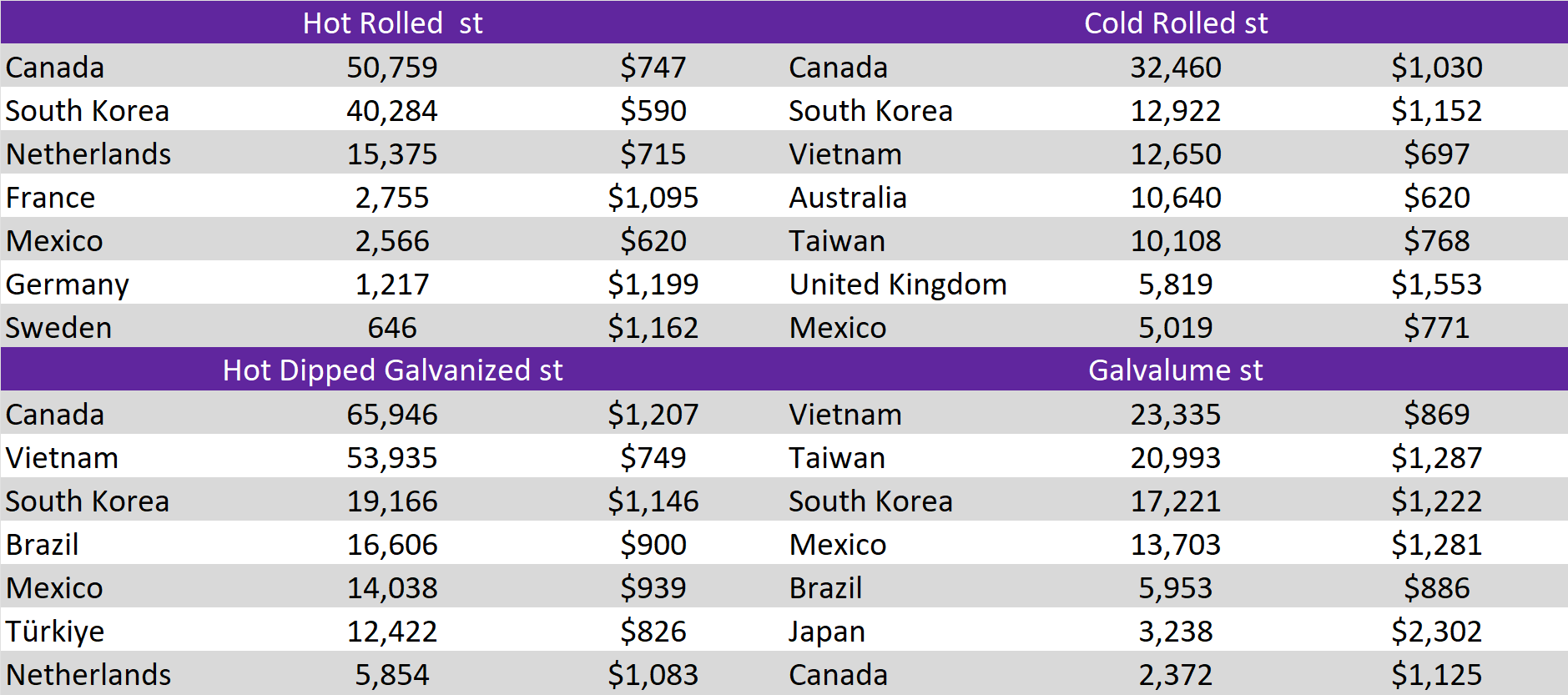

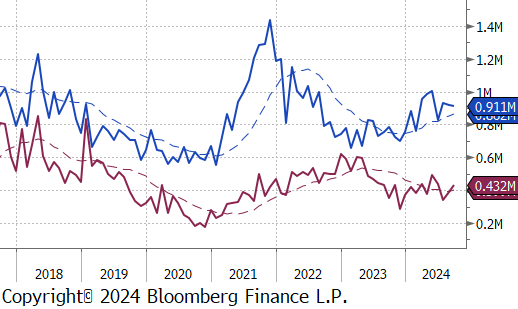

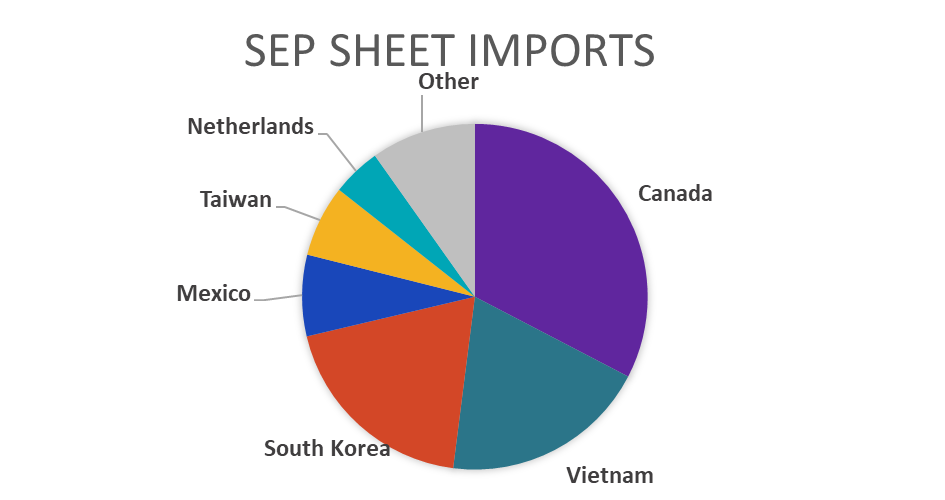

September Projection – Sheet 911k (down 8k MoM); Tube 432k (up 44k MoM)

August Census – Sheet 918k (down 12k MoM); Tube 389k (up 51k MoM)

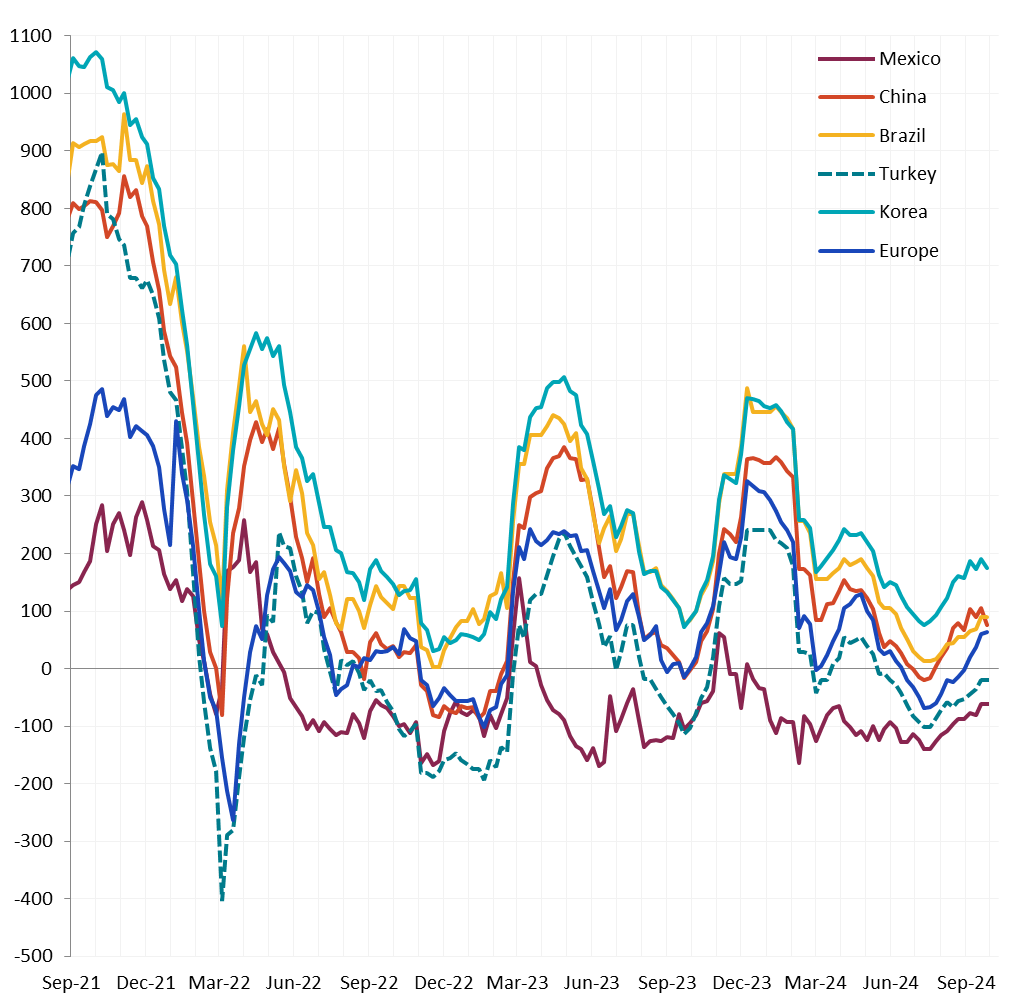

Watched global differentials were mixed this week, with China Export HRC surging by 5.7% and Korea’s HRC jumping by 3.6%, while North Europe’s HRC fell by -0.6%.

Scrap

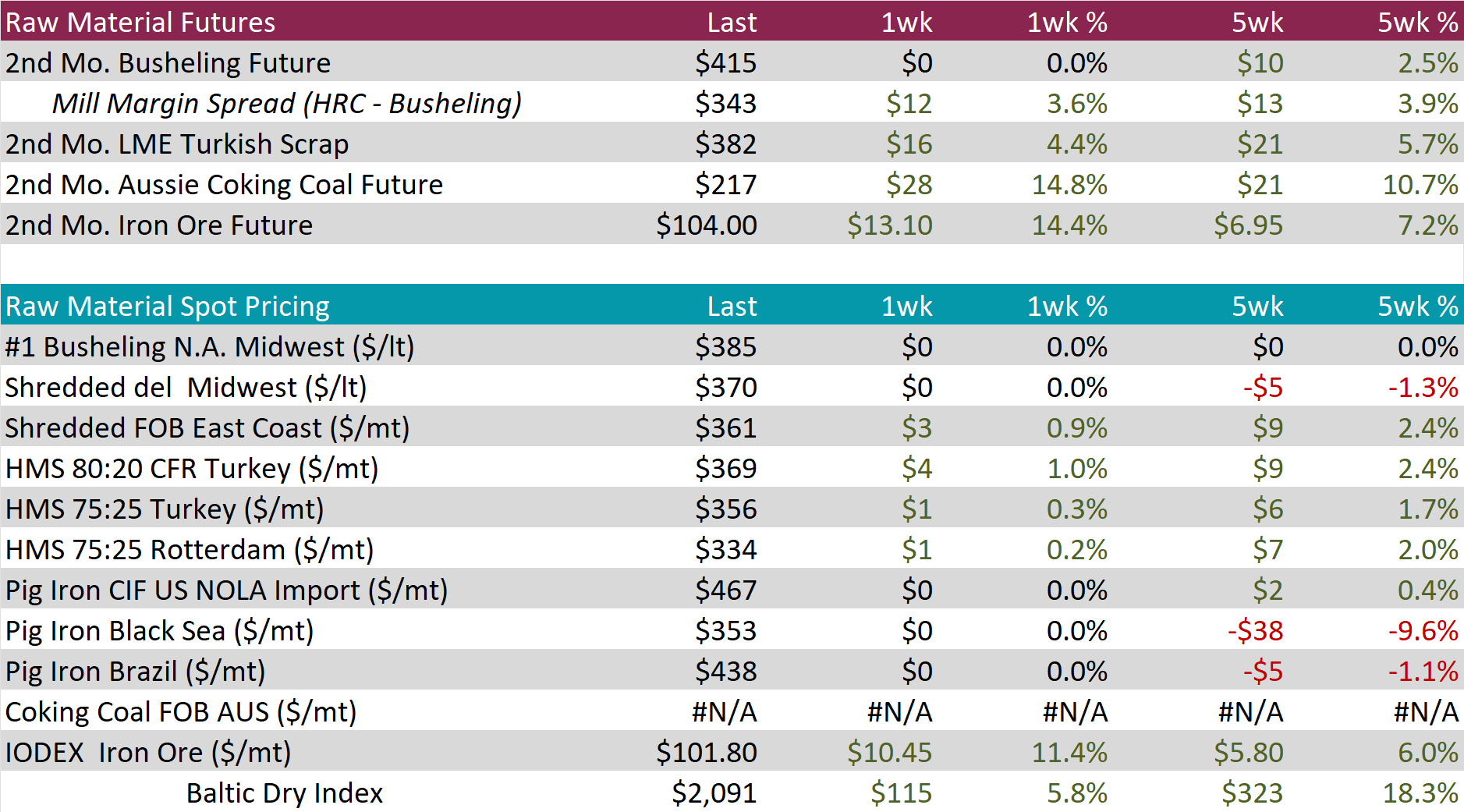

The busheling 2nd month future remained unchanged at $415, holding steady for the third consecutive week, bringing the five-week price change to be up by $10 or 2.5%.

The Aussie coking coal 2nd month future soared by $28 or 14.8% to $217, marking the third straight week of price increases and the highest in eight weeks.

The iron ore 2nd month future jumped by $13.10 or 14.4% to $104, reaching the highest price in ten weeks.

Dry Bulk / Freight

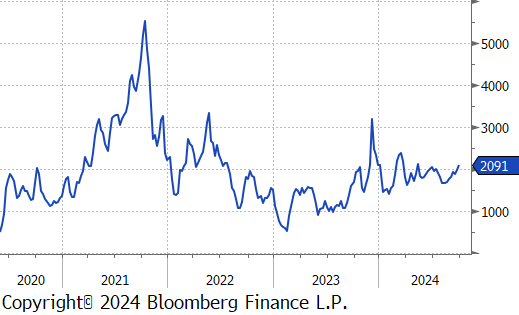

The Baltic Dry Index surged by $115 or 5.8% to $2,091, marking the fourth consecutive week of increases and hitting the highest level since March.

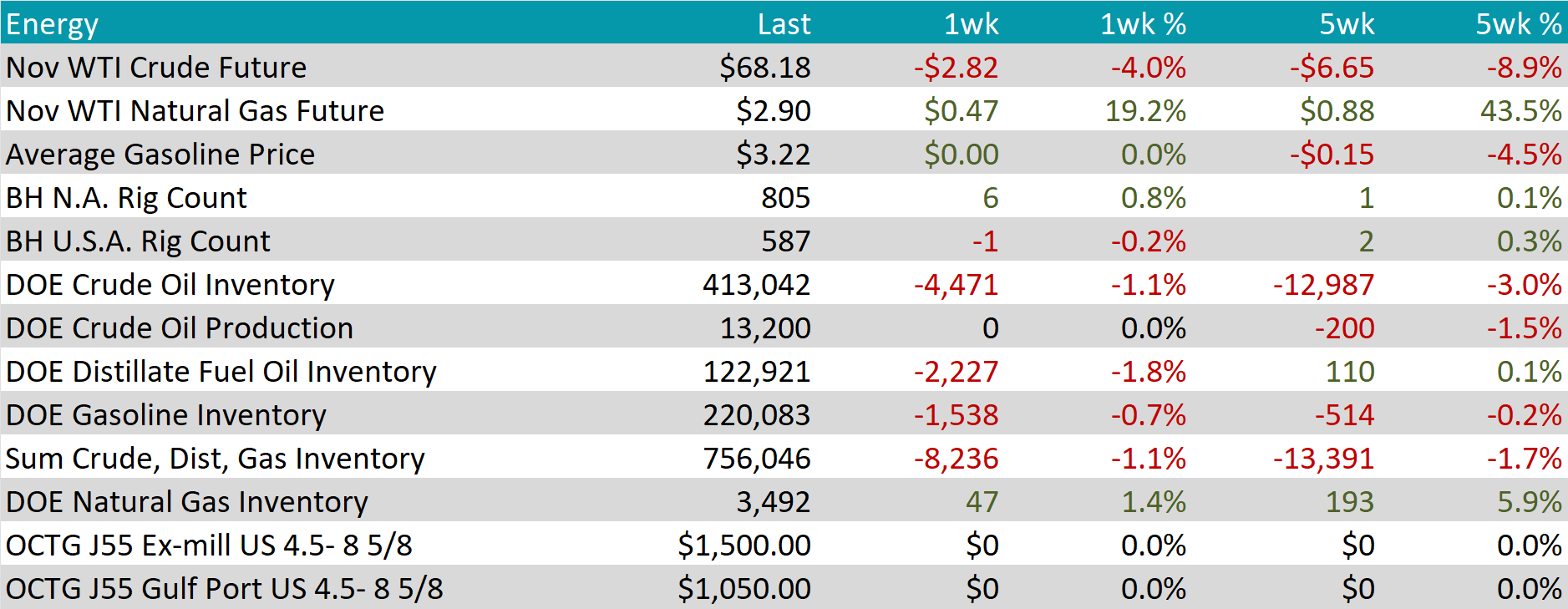

WTI crude oil future lost $2.82 or -4.0% to $68.18/bbl.

WTI natural gas future gained $0.47 or 19.2% to $2.90/bbl.

The aggregate inventory level slipped by -1.1%.

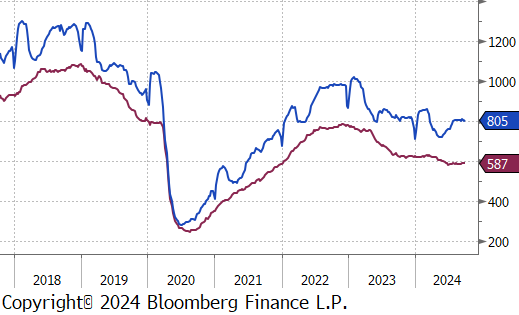

The Baker Hughes North American rig count added 6 rigs, bringing the total count to 805 rigs, while the US rig count declined by 1 rigs, bringing the total count to 587 rigs.

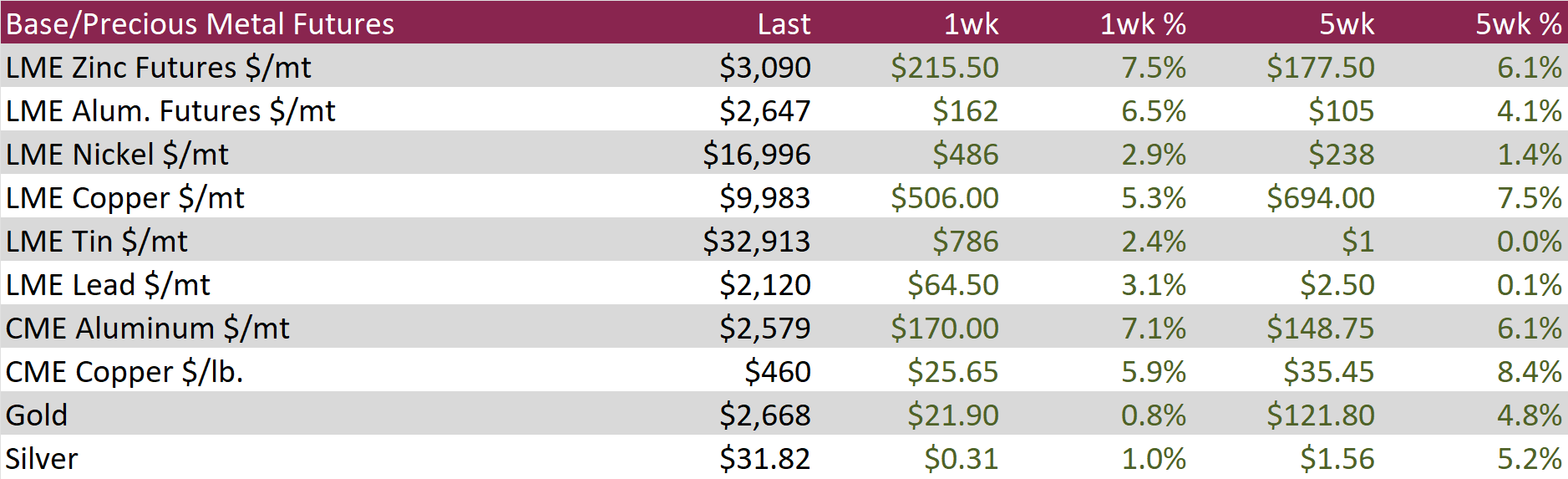

Aluminum futures soared by $162 or 6.5% to $2,647. This occurred amid a developing squeeze in the aluminum market at the LME, which has drawn significant attention ahead of LME week. This squeeze driven by controversial practices from warehouse operator Istim Metals, which controls around 50% of the exchange’s metal storage. Istim’s fee increases, and stock management have created long queues for metal withdrawals, frustrating traders and distorting prices. The situation, involving key players like Trafigura, could significantly impact global aluminum markets. This squeeze underscores ongoing concerns about the influence of private warehouse operators on the LME’s market dynamics.

Copper futures surged by $25.65 or 5.9% to $460, driven by China’s stimulus measures that boosted the economic outlook and demand prospects in the world’s largest copper consumer. In recent developments, the People’s Bank of China announced it would allow home buyers to refinance mortgages, alongside cutting the banks’ reserve requirement ratio by 50 basis points last week, which is expected to free up 1 trillion yuan in capital. Additionally, the central bank lowered key medium- and short-term rates to encourage borrowing and enhance liquidity. These actions followed the U.S. Federal Reserve’s earlier 50 basis point rate cut, part of its efforts to achieve a soft landing for the economy. The Fed’s move has provided other major central banks with more flexibility to adopt easing measures, further supporting a favorable environment for commodities like copper

Silver rose by $0.31 or 1.0% to $31.82. Bullion assets have been buoyed by expectations of further rate cuts from the Federal Reserve and other central banks. Silver has also gained from recent fiscal and monetary stimulus announcements aimed at boosting China’s economy; the world’s second-largest. These developments, along with broader gains in industrial metals, have improved the outlook for silver-demanding sectors such as electrification technologies and solar panel manufacturing.

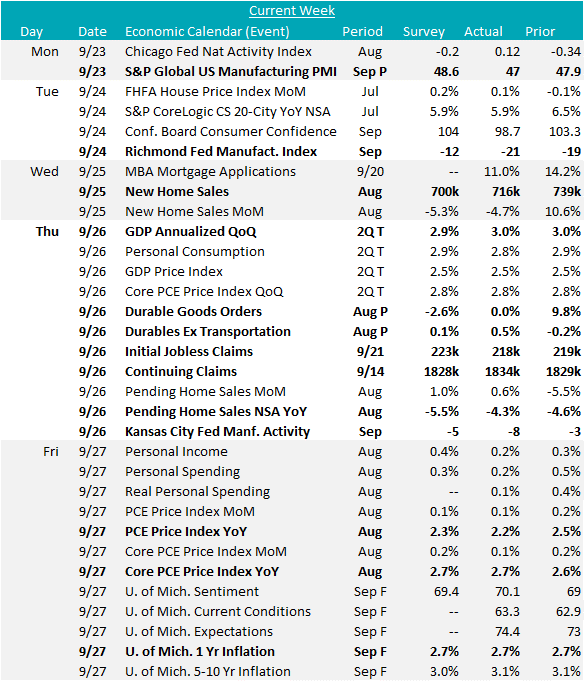

The preliminary September S&P Global Manufacturing PMI fell to 47, from 47.9 in August, and below the expectation of an increase to 48.5. This came along with worse than expected prints for this week’s Regional Fed Manufacturing Surveys. Richmond printed -21, down from -19 in August and below expectations of an improvement to -12. Kansas City also printed down to -8, from -3 and worse than the expected -5.

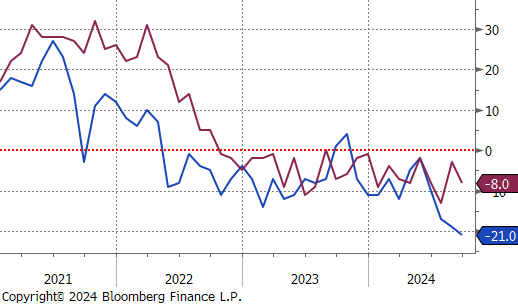

New home sales in August were down 4.7% compared to July but came in at 716k annualized homes sold, better than the expected 700k. Pending home sales rose 0.6% in August, below the expected 1% increase. Inventory data showed improvement, and initial data suggests that the recent decline in mortgage rates has led to a surge in refinancing, while mortgage applications saw another 11% weekly increase, up from last weeks impressive 14.2% surge.

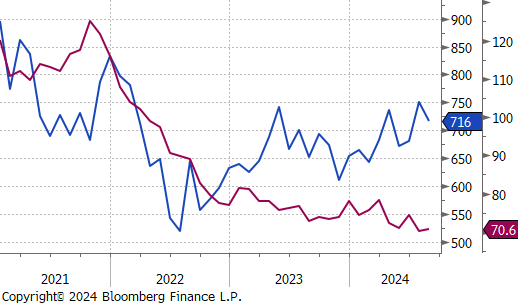

The best news of the week came from the continued disinflationary trend seen in PCE (Personal Consumption Expenditures); the FEDs preferred measure of inflation. Here we see both the Topline and Core measure coming in below expectations, (2.2% v 2.3%) and (2.7% v 2.7%), respectively. We anticipate both YoY measures to be sticky around current levels to end the year, due to 2H23’s significant disinflationary pressure, however, there is a real possibility that Core PCE could be back in the FEDs 2% target by the spring if the rapid cutting cycle does not lead to an overheated consumer. Encouragingly, the final September U. of Michigan Consumer Sentiment survey rose to 70.1, with consumer expectations of the 1yr inflation outlook sticky at 2.7% (the lowest level since December 2020).