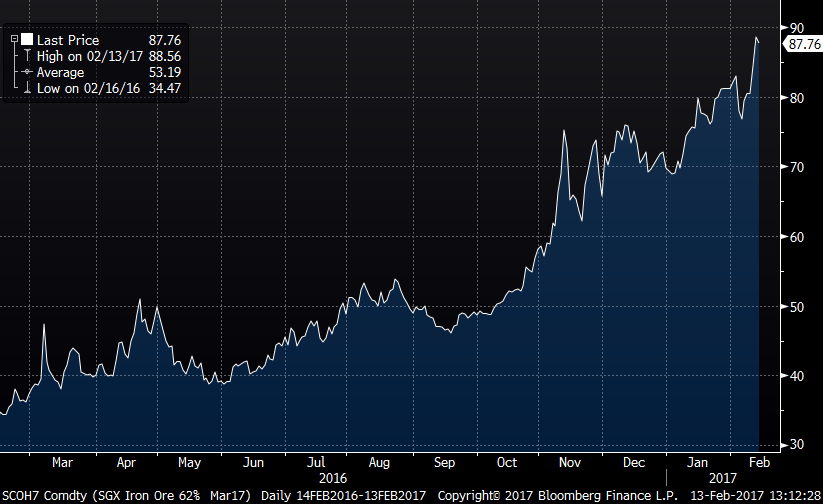

Last week’s edition outlined a strong domestic demand picture, while noting some concerns over the sharp collapse in scrap prices. Since then, iron ore has ripped higher taking scrap prices up with it.

March SGX Iron Ore Futures

March LME Turkish Scrap Futures

Chinese rebar futures also joined the rally. What is interesting and somewhat concerning is the run up in iron ore prices has been accompanied by a sharp run up in iron ore inventories. Industry reports indicate the rally in prices is being led by “speculation” in Chinese iron ore and rebar futures while many physical sellers are holding out for higher prices.

Chinese Iron Ore Inventory

All eyes will be on physical transactions to see if there is follow through confirming that this rally is for real. The iron ore futures market has a track record of sharp moves up and down due to Chinese traders have crowding in and out of directional trades.

US crude oil and aggregate energy (crude, gasoline and distillate) inventory levels are also reaching new highs at the same time that oil prices remain at relatively high levels.

D.O.E. Crude Oil Inventory

Aggregate Energy Inventory (Blue) vs. WTI Crude Oil Futures

On one hand, perhaps this phenomenon (rising prices and inventory levels) is a result of a sharp increase in demand outpacing a rationalized supply side (“this time it’s different”). On the other hand, these fundamentals are historically at odds with one another and usually result in a sharp fall in one or the other. Keep an eye on the inventory levels in the coming weeks and months. If they continue higher unchecked, the probability of a sharp price drop in ferrous and/or energy related products increases substantially.

Flat rolled prices were slightly lower, but still remain near recent highs.

European and Asian prices have persisted in a tight range for three months now.

HRC futures were mixed with little volatility. Sellers have backed off the aggressive selling seen in the last week of January. The second half has been indicated for sale as high as $580-585/st.

March CME HRC Futures vs. TSI Daily Midwest HRC Price

January flat rolled import data reversed significantly last week. HRC imports averaged 238k st per month in 2016. January is forecast almost 90k tons below this monthly average. January flat rolled imports are about 40k tons above the 2016 monthly average with increases in CRC and HDG compensating for the fall in HRC.

AISI Steel Capacity Utilization Rate and TSI Daily HRC Price

Utilization and production ticked down a bit last week.

Most scrap prices, iron ore futures and the IODEX rallied in excess of 5%.

The iron ore curve shifted $9/t higher remaining backwardated through 2017.

Chinese rebar futures rallied 8.5% last week. Turkish rebar and Black Sea billet also saw gains.

The second week of the month is always quiet on the economic front.

*Green is up up MoM, red is down MoM. Green/Red in the previous category indicates an upward or downward revision.

Stock markets saw nice gains in China, Japan and the US.

Steel related stocks were boosted by higher raw material prices.

US Steel

Iron ore miners gained with ore prices. All four stocks are in double digits for the first time since November, 2014.

Base metals gained across the board with copper gaining over 5% and zinc up 4.5%.

CME Copper

The dollar index rebounded almost 1% in a quiet week in the currencies market. The euro fell over 1% while the ruble gained 1%.

US Dollar Index

Euro

Russian Ruble

WTI crude oil futures were flat at $53.86 even as inventory levels gained almost 1.5%. Rig counts continue to increase and production rebounded. Natural gas slipped 1% while natural gas inventory fell.

WTI Crude Oil Futures

D.O.E. Crude Oil Inventory

D.O.E. Crude Oil Inventory Perspective (1982 – Present)

Baker Hughes US Rig Count

D.O.E. Crude Oil Production

D.O.E. Crude Oil Production Perspective (1984 – Present)

The US 10-year Treasury yield fell to 2.41%. German, Japanese and British yields slipped along with implied inflation expectations.

U.S. 10 Year Bond Yield

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or look to be highly likely. Upside risks look to be in charge.

Upside Risks:

– Sharp raw materials rally

– Energy industry rebound

– Big rally triggered by price increases/low inventory/restocking

– President Trump’s agenda

– Infrastructure bill/long-term solution to highway spending bill

– China getting serious about curtailing steel production

– Transportation supply constraints

– Post-election economic pick up

– Massive restocking (domestic and/or global)

– Unplanned domestic supply side disruptions

– China pumping up its “old economy”

– El Nino weather disrupting logistics in the southern hemisphere

Downside Risks:

– Chinese restrictions in property market

– Chinese constricting aggregate financing significantly

– The Chinese Financial Crisis

– Unexpected sharp China RMB devaluation

– Rebound in import volumes

– Increasing import differentials

– Resumption of US dollar rally/currency issues/sovereign default

– Higher interest rates slowing residential construction and auto sales

– Tightening financial conditions pressuring auto sales driven by sub-prime financing

– Oil and/or iron ore slide

– U.S. (manufacturing) recession

– Falling ferrous raw materials and global finished steel prices

– US domestic producers bringing back on capacity

– Economic downturn, especially in China or Europe reverberating to U.S.A.

– Weak demand in housing or automotive