Effective immediately, Flack Steel has changed its name to Flack Global Metals. This move reflects a consolidation of recent acquisitions that include Consolidated Metal Products (CMP) in Columbia, SC, and JD Steel Products in Toledo, OH. In a move toward increasing global reach and an expanded product line, Flack Global Metals now offers bare, pre-painted and coated metals, including aluminum, stainless, and galvalume. The new website, www.flackglobalmetals.com, focuses on the company’s positioning as The Next Generation Service Center.

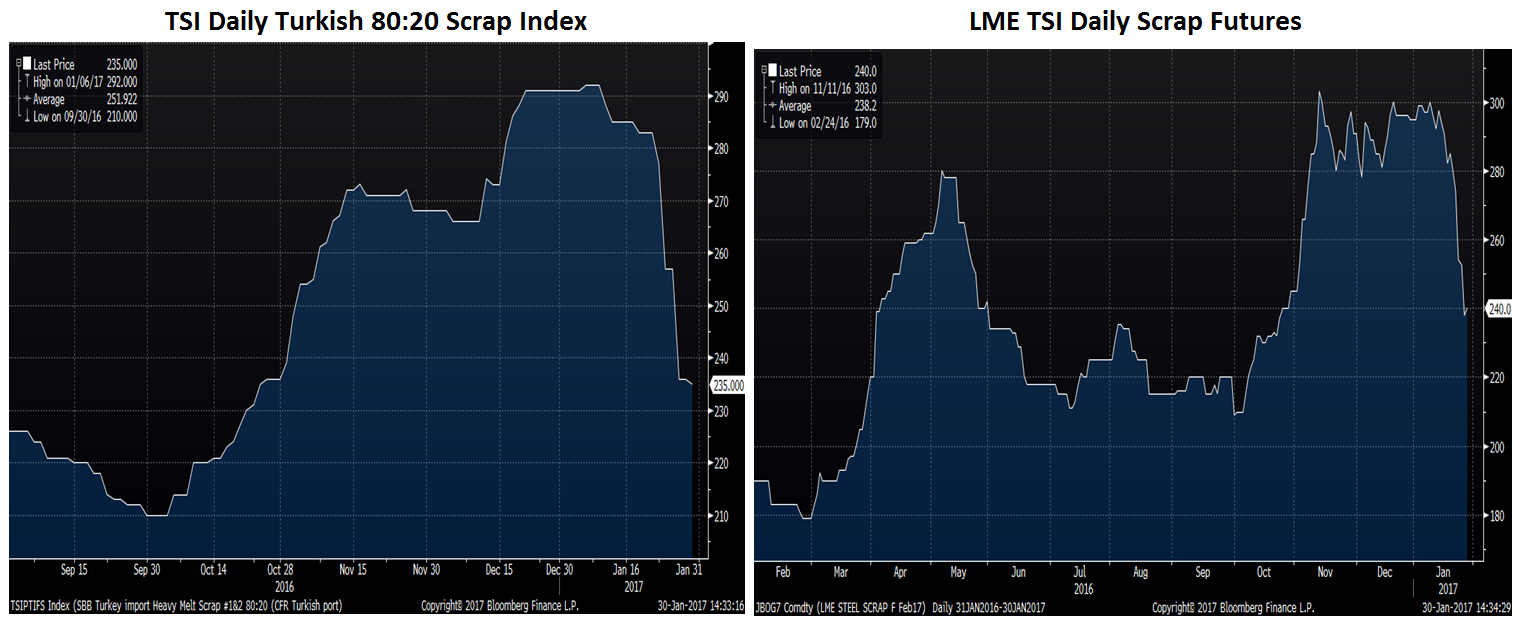

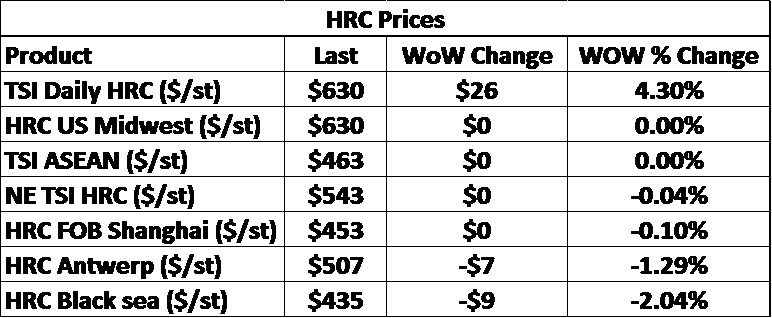

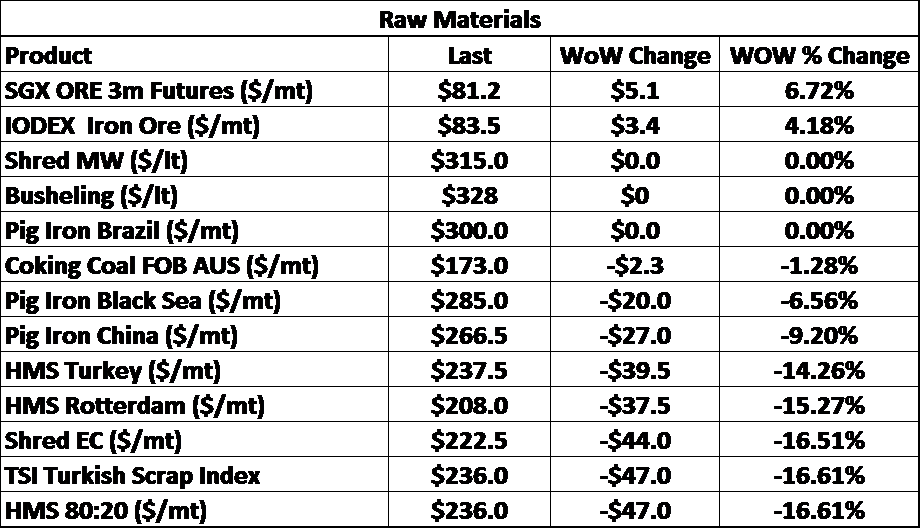

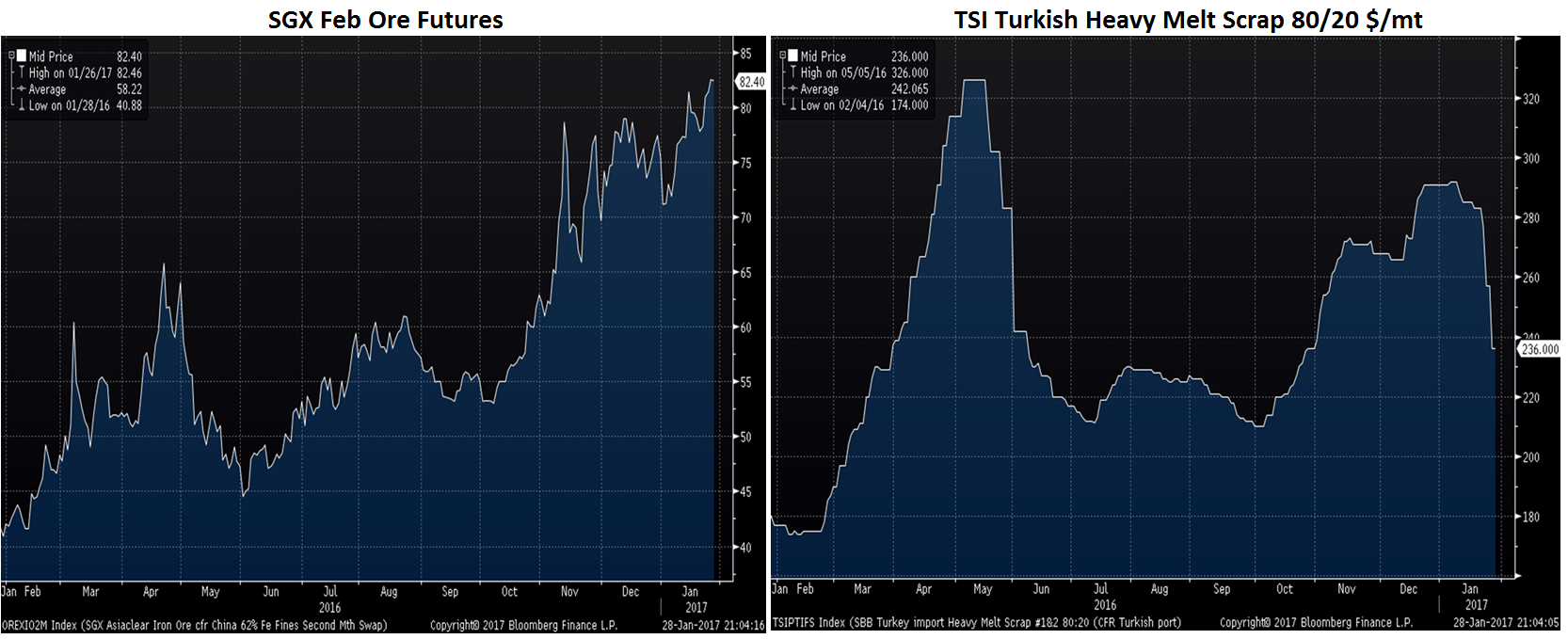

Turkish scrap prices crashed last week falling almost 20% in a very short time. Iron ore prices remain near recent highs leaving a bifurcated market where EAF mills have margin to give. The fall in scrap prices looks to be putting some pressure on domestic HRC prices.

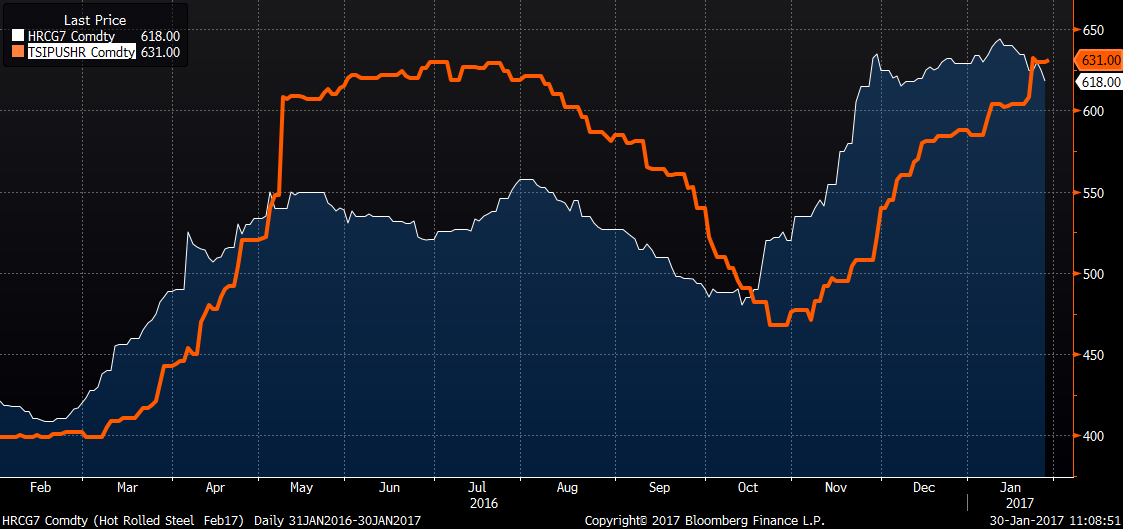

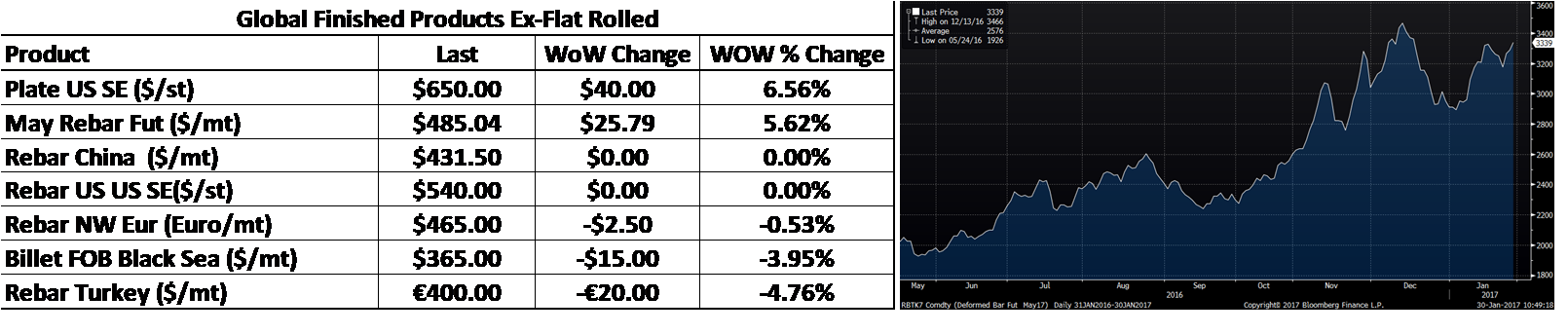

US flat rolled prices gained again consolidating near the $630 level.

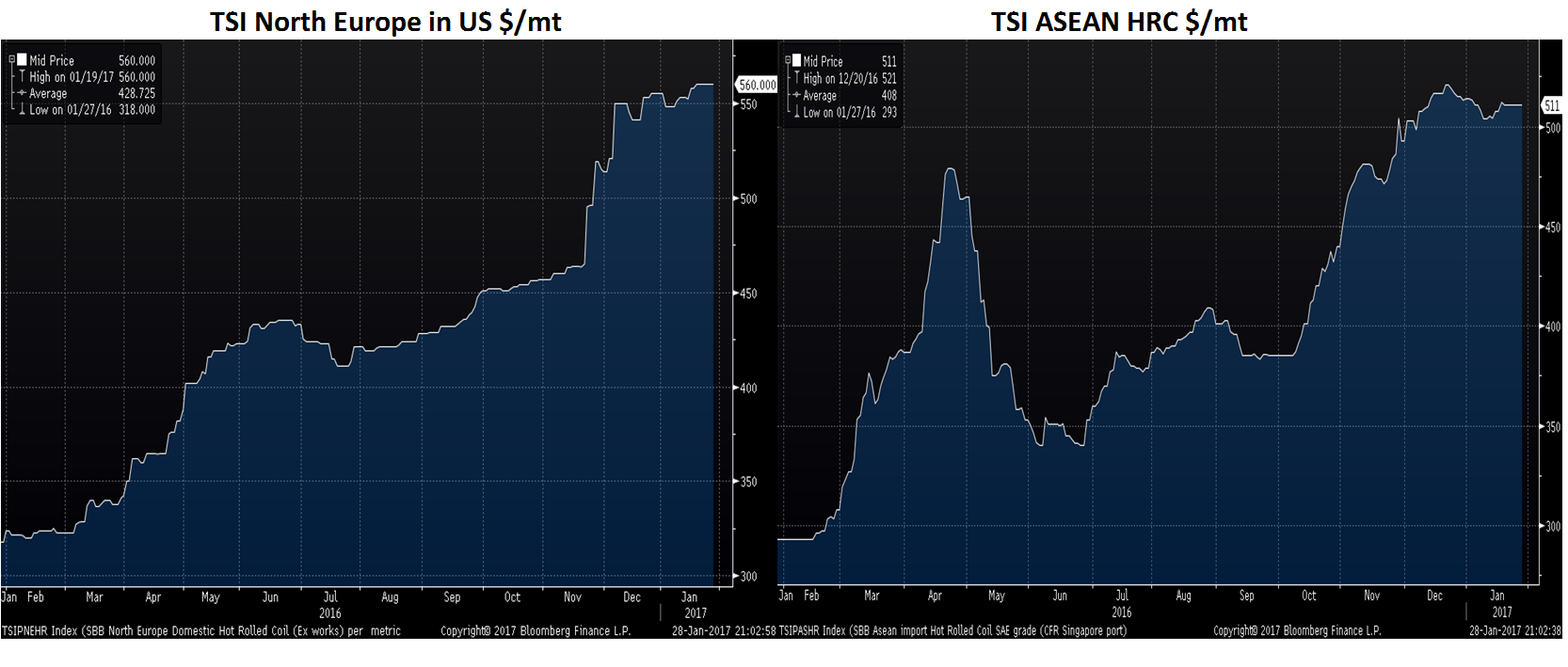

HRC futures were under serious pressure last week as the curve has shifted into major backwardation.

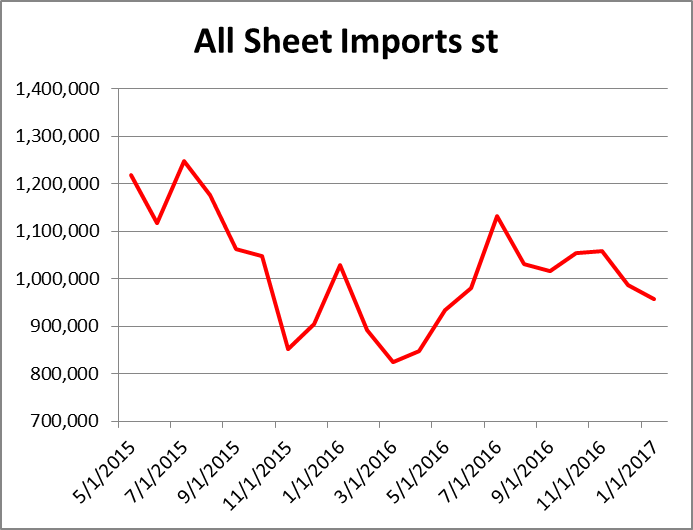

Import data continues to be weak with the fall in HRC imports eye-opening. HRC imports averaged 246k st per month from Jan. – Nov. 2016. December’s data is forecast to be 90k tons and January 135k tons below this monthly average.

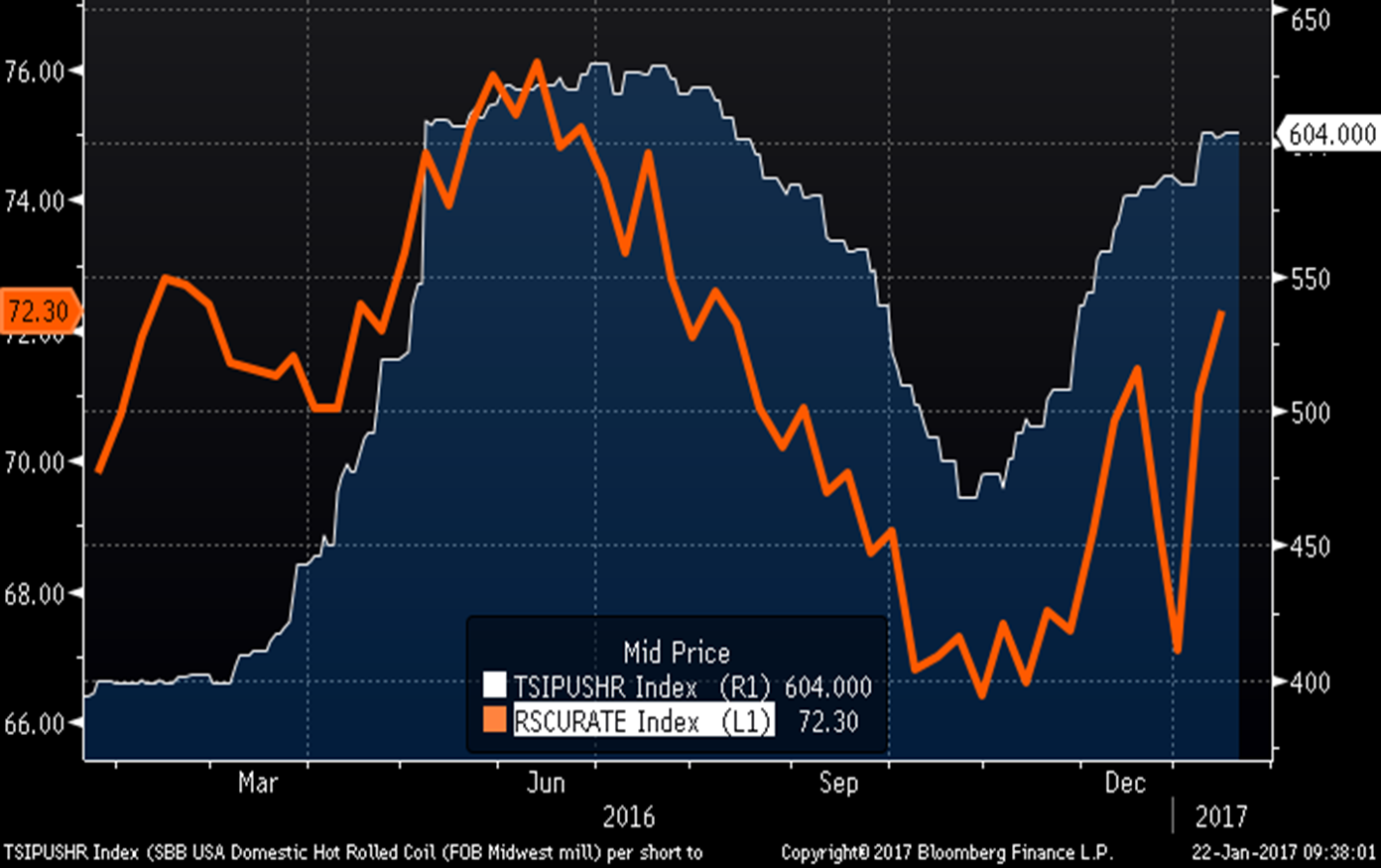

AISI Steel Capacity Utilization Rate and TSI Daily HRC Price

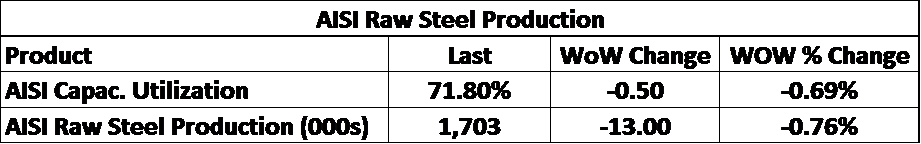

Utilization and production retreated.

The crashing scrap prices took pig iron with it. However, iron ore remains strong.

The iron ore curve remains backwardated and was quiet last week ahead of the Chinese New Year.

US Plate and Chinese rebar futures jumped while Black Sea billet and Turkish rebar fell.

Economic data was mixed with a worse than expected report on durable goods, existing home sales and new home sales. The KC Fed and Richmond Fed stayed at decent levels while the U of M Sentiment Index gained to 98.2.

*Green is up MoM, red is down MoM. Green/Red in the previous category indicates an upward or downward revision.

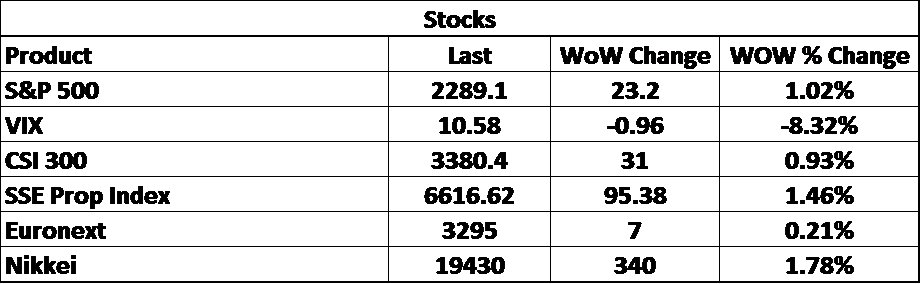

Stocks indexes were up nicely except in Europe where they were flat.

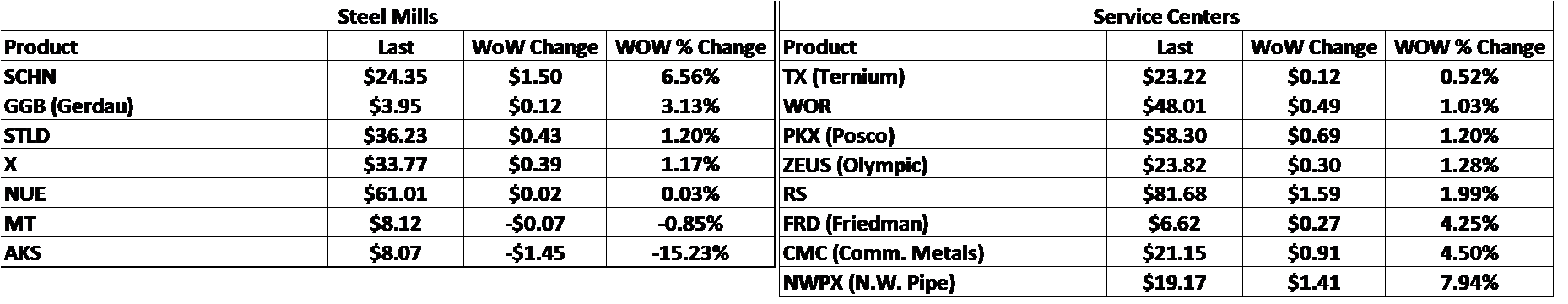

Steel stocks were mixed as AK Steel and Steel Dynamics announced earnings. NUE and X announce this week.

AK Steel

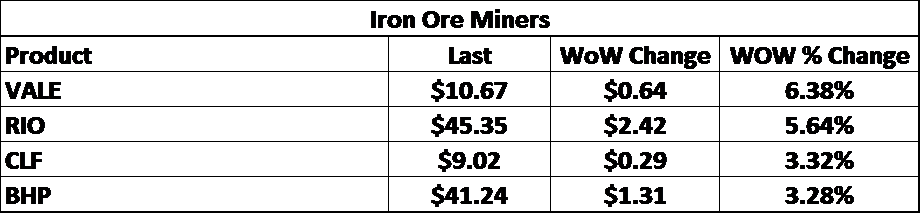

Iron ore miners all rallied.

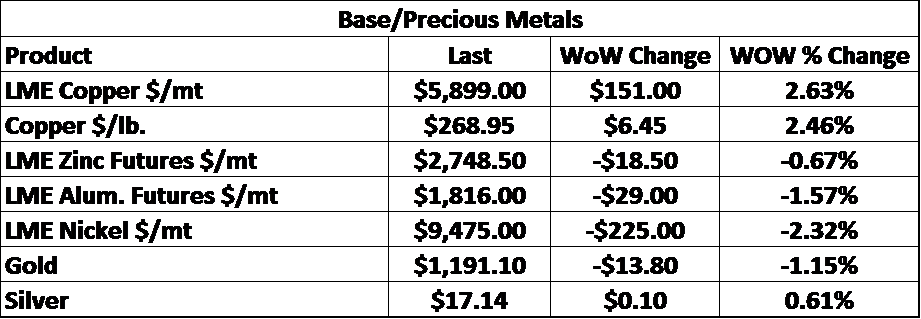

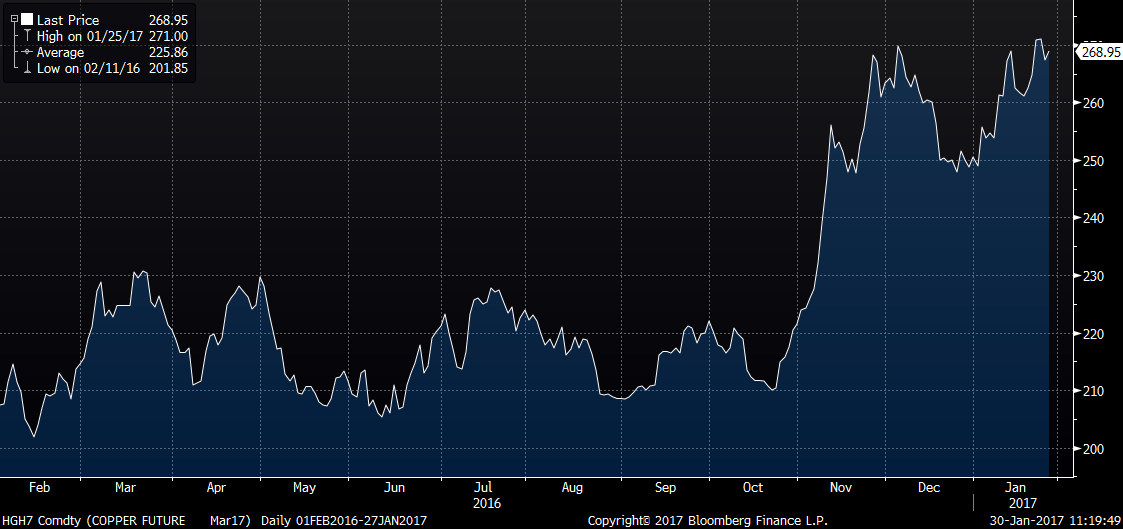

Base metals were mixed. Copper gained while zinc, aluminum and nickel all fell.

CME Copper

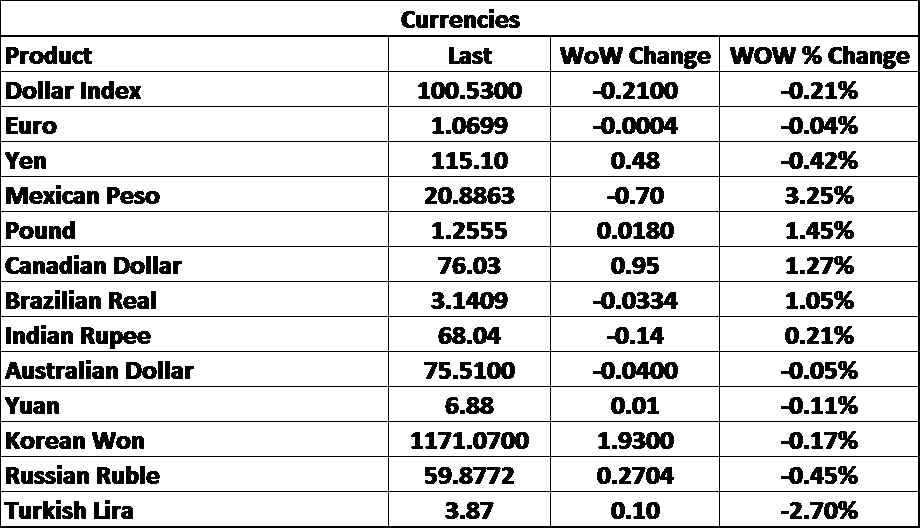

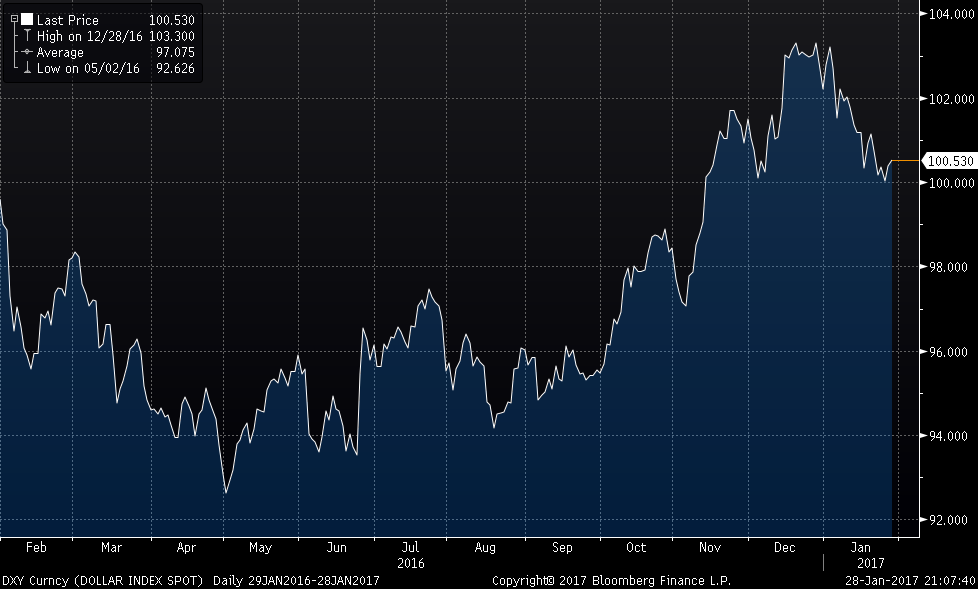

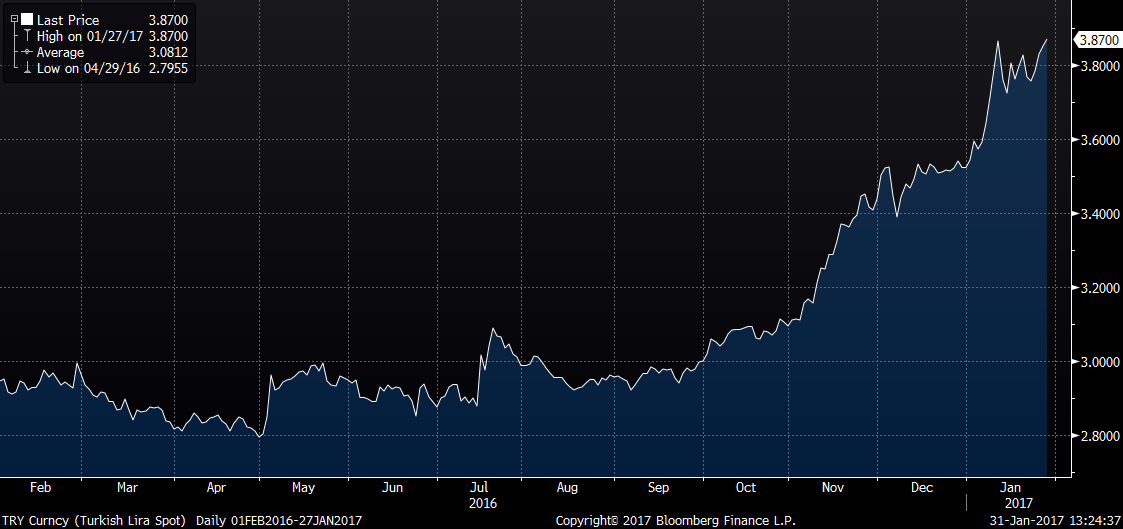

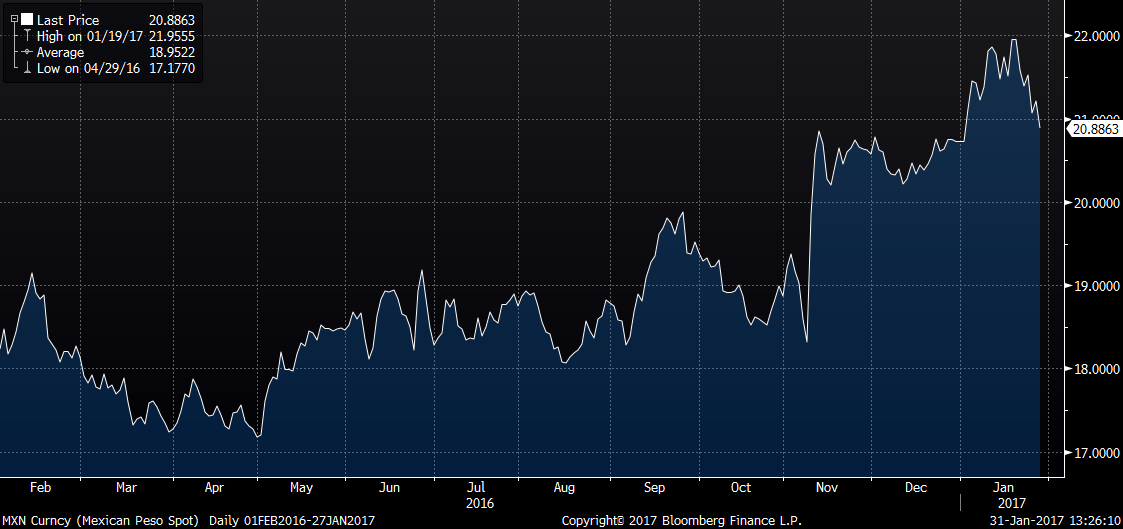

The dollar fell touching 100 at one point before closing at 100.53. The Mexican peso, British pound, Canadian dollar and Brazilian real all gained over 1%. The Turkish lira fell.

US Dollar Index

Turkish Lira

Mexican Peso

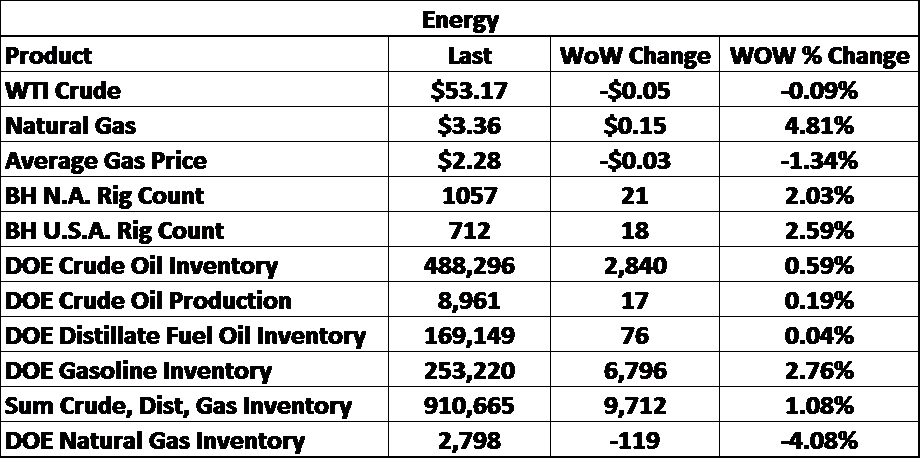

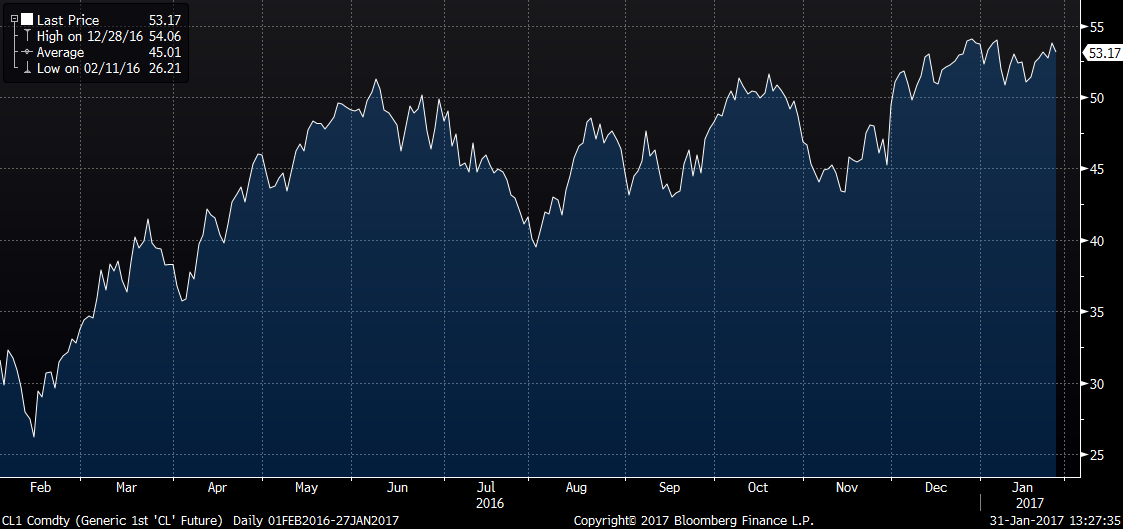

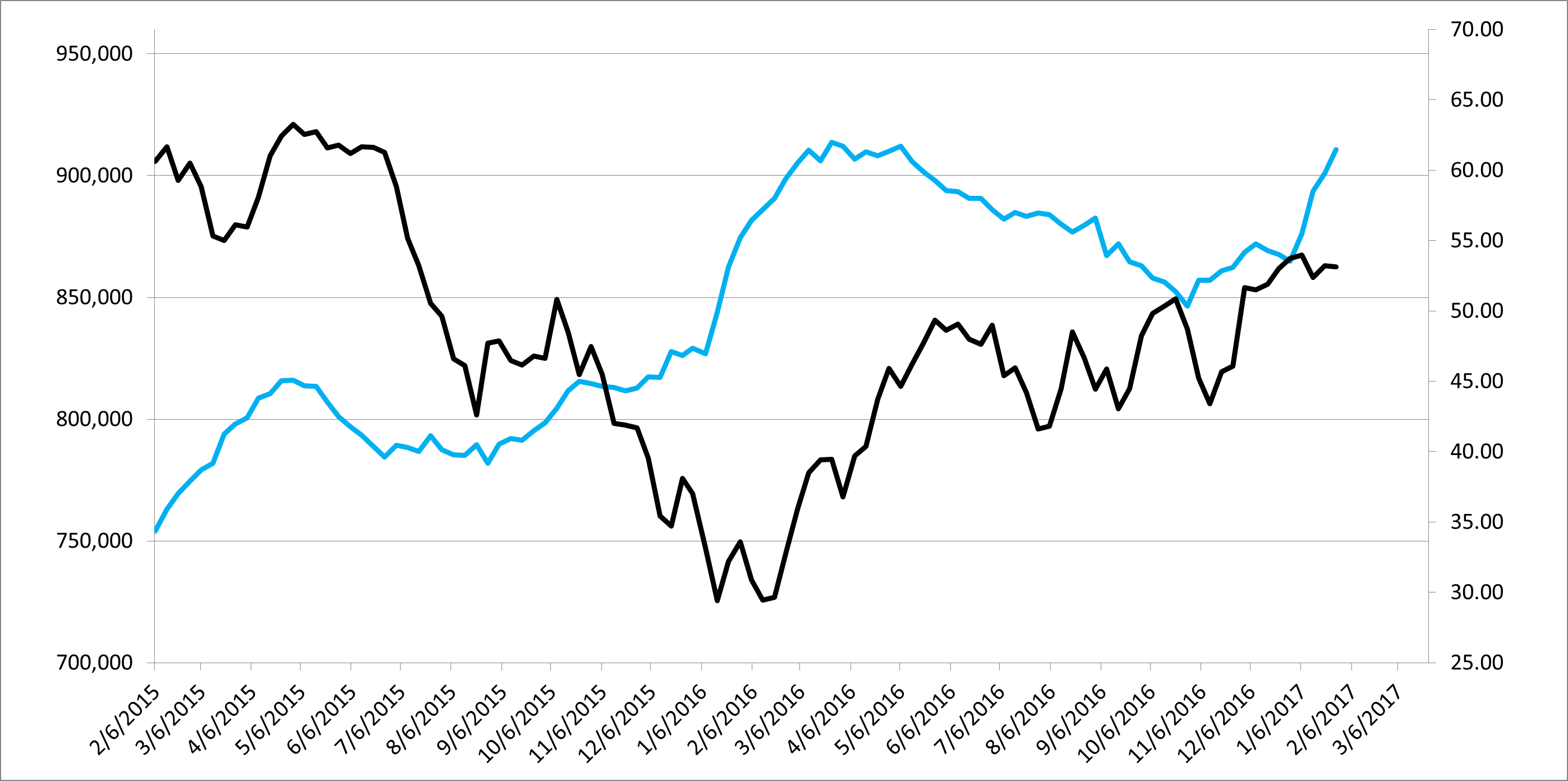

WTI crude oil futures were unchanged while natural gas gained almost 5%. Rig counts continue to build along with inventory levels. US crude oil production was up slightly.

WTI Crude Oil Futures

Aggregate Energy Inventory vs. WTI Crude Oil Futures

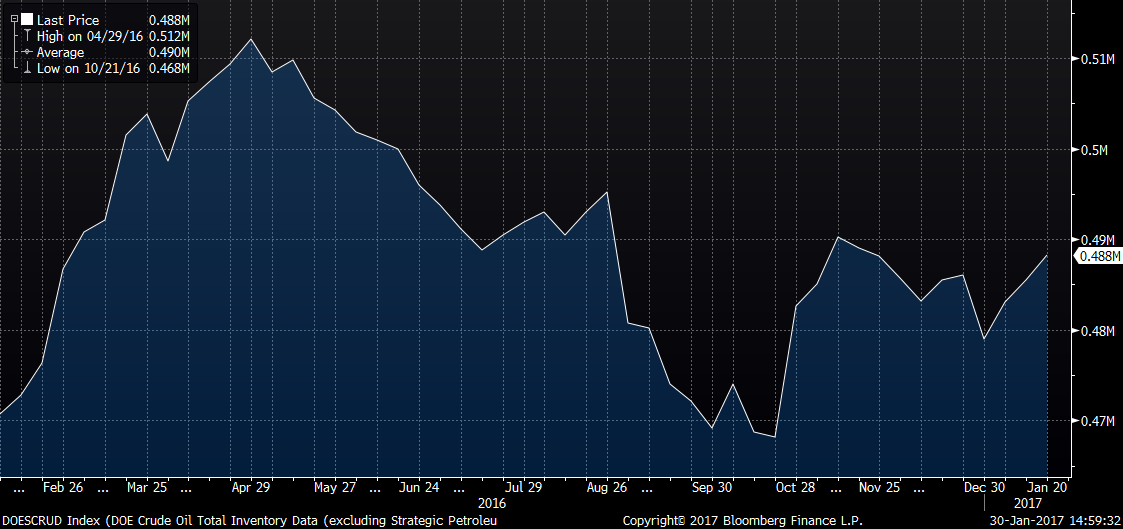

D.O.E. Crude Oil Inventory

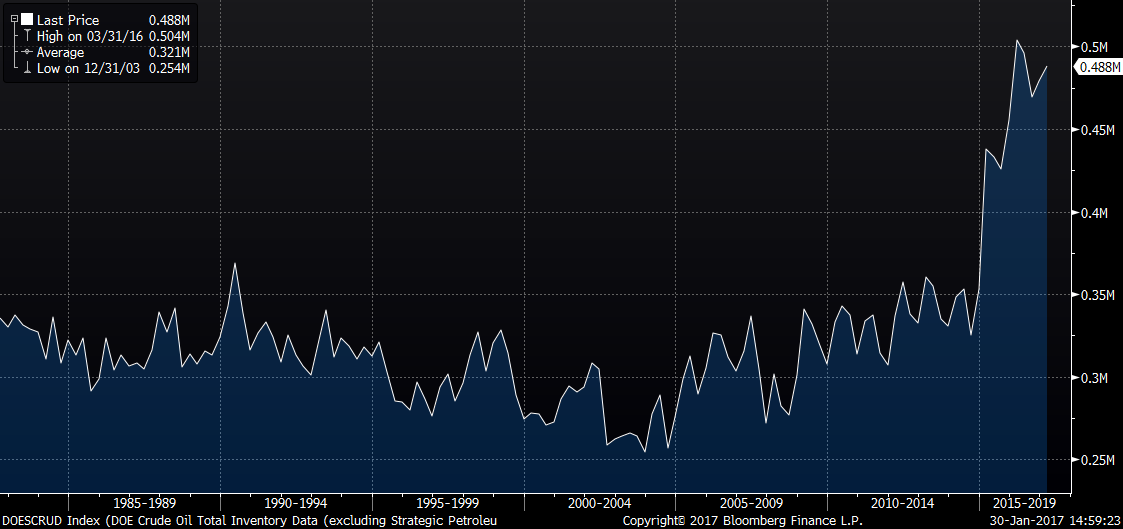

D.O.E. Crude Oil Inventory Perspective (1982 – Present)

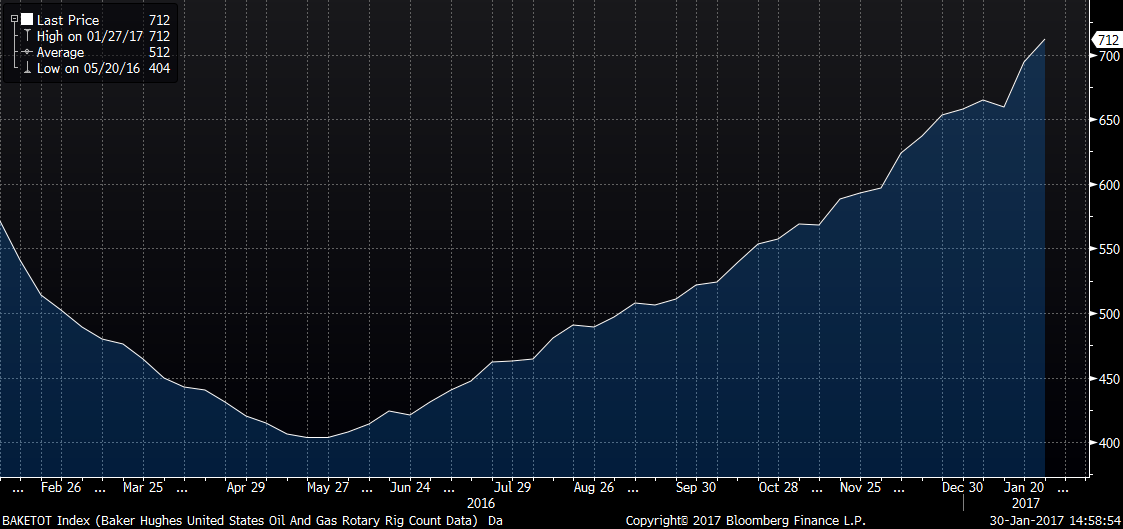

Baker Hughes US Rig Count

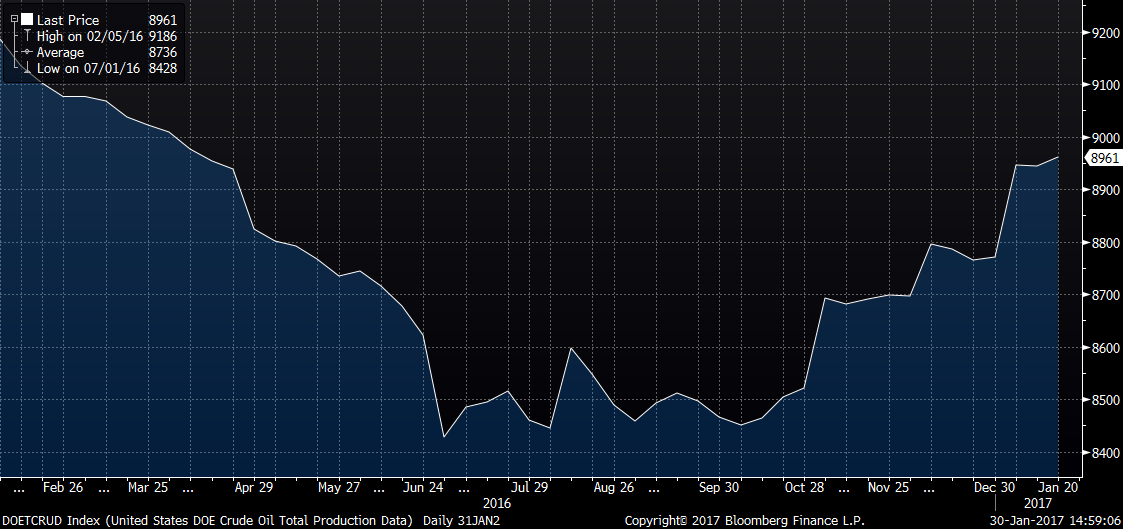

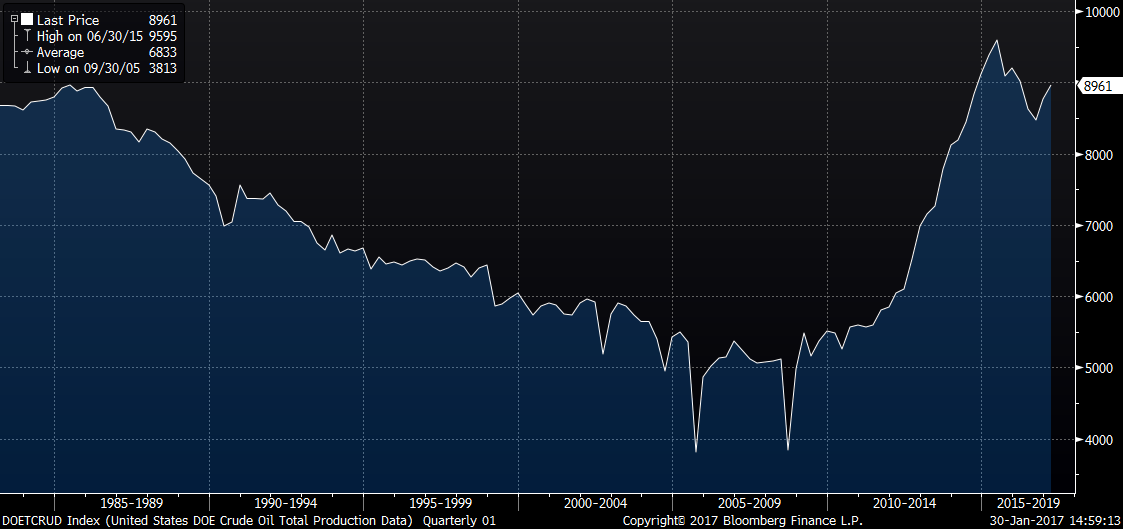

D.O.E. Crude Oil Production

D.O.E. Crude Oil Production Perspective (1984 – Present)

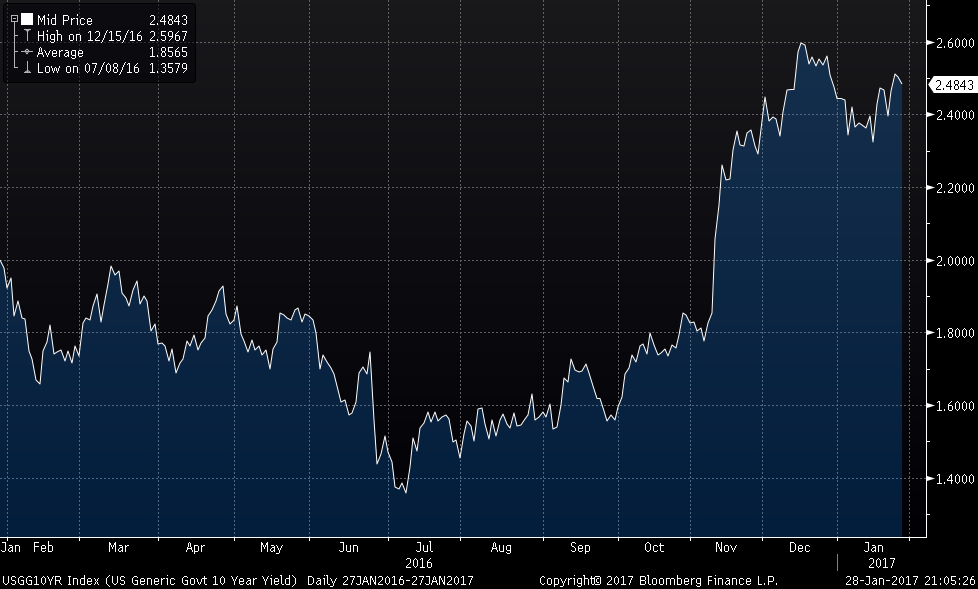

The US ten year rose to 2.48%. European rates jumped. Inflation expectations strengthened.

U.S. 10 Year Bond Yield

The list below details some upside and downside risks relevant to the industry. The bolded ones are occurring or look to be highly likely. Upside risks look to be in charge.

Upside Risks:

– Big rally triggered by price increases/low inventory/restocking

– President Trump’s agenda

– Energy industry rebound

– Essar labor issues

– Infrastructure bill/long-term solution to highway spending bill

– China getting serious about curtailing steel production

– Post-election economic pick up

– Massive restocking (domestic and/or global)

– Unplanned domestic supply side disruptions

– China pumping up its “old economy”

– El Nino weather disrupting logistics in the southern hemisphere

Downside Risks:

– The Chinese Financial Crisis

– China RMB devaluation

– Rebound in import volumes

– Increasing import differentials

– Resumption of US dollar rally/currency issues/sovereign default

– Higher interest rates slowing residential construction and auto sales

– Tightening financial conditions pressuring auto sales driven by sub-prime financing

– Oil and/or iron ore slide

– U.S. (manufacturing) recession

– Falling ferrous raw materials and global finished steel prices

– US domestic producers bringing back on capacity

– Economic downturn, especially in China or Europe reverberating to U.S.A.

– Weak demand in housing or automotive