Midwest flat rolled prices continued the rally that began at $365/st in December, 2015, however HRC has slipped 7.2% to $612 from the $660/st high set on March 20th, 2016. Thus far, prices have seen higher highs and higher lows. We remain positive on the domestic steel industry while watching some concerning developments in iron ore and Chinese finished steel prices as well as the domestic automotive industry. However, Chinese HRC and rebar prices have rebounding in recent weeks, import differentials have decreased materially and May import licenses look to move back in line with recent averages, especially a sharp decrease in HRC imports. Downward pressure on steel demand due to slowing demand in the automotive sector seems to be playing an outsized role at the moment. This week’s automotive sales report will be very interesting as May has been a stronger month for sales than April in the past four years.

Monthly Nominal US Auto Sales (NSA)

The “buy the dip” theme remains intact as fundamental data continues to be strong. We see the following data points as the foundation of our current view:

- Persistently low flat rolled inventory evidenced in the MSCI, ISM and Durable Goods reports

- A rebounding US energy industry

- A global uptrend in manufacturing purchasing managers indexes

- The Section 232 investigation launched by the Trump Administration

- Relatively low HRC imports with trade restrictions

There have been five regional manufacturing indexes that have reported so far this month. The Philadelphia, Dallas and K.C. indexes all improved MoM and YoY. The rebound in the energy sector is driving the Dallas and KC reports. The Empire and Richmond reports were downright ugly.

June CME HRC Futures vs. TSI Daily Midwest HRC Price

Midwest HRC Indexes continued lower and now sit between $595 – $612/st.

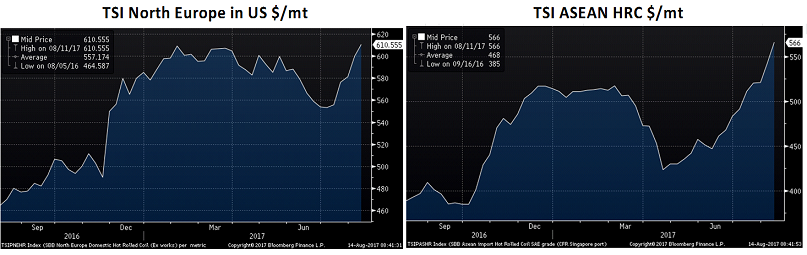

The TSI North European HRC Index fell $13 to $532/st while HRC Antwerp fell $3 to $489/st. The TSI ASEAN gained $14 to $414/st and has rallied 6% off April’s lows.

Chinese domestic HRC and rebar prices added gains to the rally off April’s low spot rebar prices making new highs.

CME Midwest futures mostly moved lower with June down $7 to $583, July down $3 to $580, August down $3 to $580 and September down $2 to $583. October was unchanged at $580 while November, December and Q1 moved down $6 to $574.

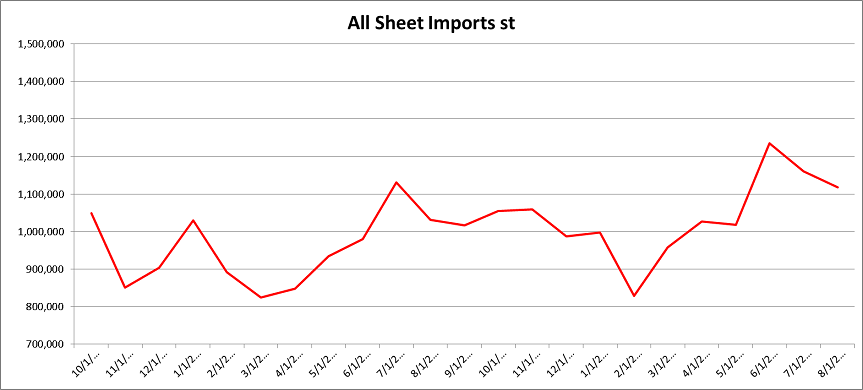

The import uptrend looks to be hitting a speedbump in May.

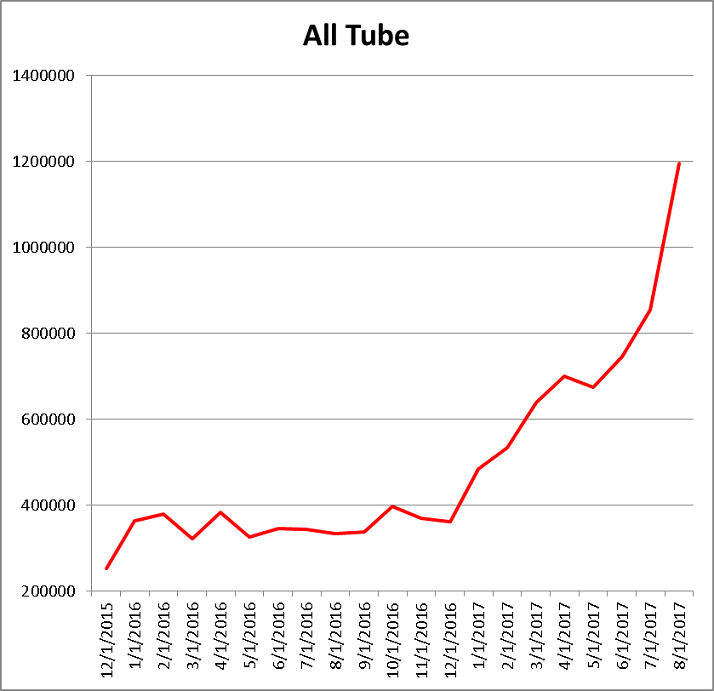

Tube imports have exploded and while they look to be correcting sharply in May, they are up huge YoY.

Actual April flat rolled imports of 1.027m st were much lower than forecasted. April pipe and tube imports at 700k st were the highest since April, 2015. May license data is forecasting a sharp reversal of the recent upward momentum with flat rolled falling back to 847k st and pipe and tube falling back to 530k st, a combined 350k st decrease.

- Relatively low HRC imports with trade restrictions

- 232 investigation launched by the Trump Administration

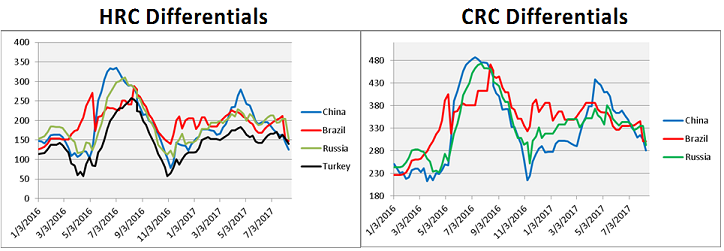

US price differentials (vs. R.O.W.) have rolled over dropping sharply in the past couple weeks. Starting at the end of March, the expectation for a surge of imported flat rolled material to arrive later this year gained steam and then was intensified as import differentials reached their highest levels since last summer. However, uncertainty brought by the 232 investigation, a sharp drop in May imports and falling global differentials could be a quick antidote to the recent downward pressure on sentiment resulting from these bloated differentials.

AISI Steel Capacity Utilization Rate and TSI Daily HRC Price

AISI production data improved to 74.7%.

Iron ore prices were down 7-8%. Australian coking coal and Black Sea pig iron prices also fell.

Scrap remains flat while iron ore futures made new lows.

Not much change in the shape of the iron ore curve as prices have fallen 12% in the past month.

May Chinese rebar gained 4.6% last week with Turkish rebar up 1.5% and NW European rebar down 1.5%.

The May Richmond Fed Manufacturing Index fell sharply to 1, missing expectations of 15. The Kansas City Fed Manufacturing Index gained 1 to 8, but missed expectations of 9. April New Home Sales fell to 569k from 621k and missed expectations of 610k. April SAAR Existing Home Sales at 5.57m were down MoM from 5.71m and missed expectations of 5.65m. April Durable Goods Orders were mostly disappointing. The second Q1 GDP estimate of 1.2% improved from the first estimate of 0.7% and was better than the expected 0.9%.

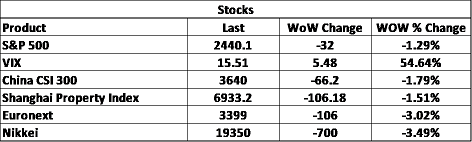

The S&P 500 continued to march to new all-time highs.

S&P 500

The Chinese 300, China’s equivalent of the S&P 500, and Shanghai Property Index have rebounded nicely since April’s sharp sell-off that bottomed in mid-May.

China CSI 300

Steel stocks were mixed.

AK Steel

Iron ore miners were mixed as well.

Base metals were mixed. LME zinc technicals look to have taken a positive turned and may have bottomed gaining almost 1% for the week. LME nickel continues lower probing recent lows.

LME 3 Month Zinc

LME 3 Month Nickel

The dollar closed the week at 97.44 with the euro approaching 1.12. Like a frog in a boiling pot, the dollar has quietly moved significantly lower, falling 6% from its January 3rd high of 103.82. Remember a weaker dollar is generally bullish for commodities. The Mexican peso gained 1.24% while the British pound gave back some of its recent gains.

US Dollar Index

British Pound

Mexican Peso

- A rebounding energy industry

WTI crude oil was down 1% to $49.80 while natural gas futures gained 1.7% to $3.31/mbtu. The US rig count added another 7 rigs to 908 while production continued higher. Crude oil inventory fell almost 1% and the aggregate inventory level shed 0.63%.

June WTI Crude Oil Futures

Aggregate Energy Inventory (Blue) vs. WTI Crude Oil Futures

D.O.E. Crude Oil Inventory

D.O.E. Crude Oil Inventory Perspective (1982 – Present)

Baker Hughes US Rig Count

D.O.E. Crude Oil Production

D.O.E. Crude Oil Production Perspective (1983 – Present)

The US 10-year Treasury was close to unchanged at 2.25%. 10 year rates moved lower in Europe and were flat in Japan.

U.S. 10 Year Bond Yield

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or look to be highly likely. Upside risks look to be in charge.

Upside Risks:

– Section 232 Investigation

– Low inventory levels/domestic or global restocking

– China pumping up its “old economy”

– Energy industry rebound

– Weaker dollar

– Border adjustment tax

– Big rally triggered by price increases/low inventory/restocking

– President Trump’s agenda

– Infrastructure bill/long-term solution to highway spending bill

– China getting serious about curtailing steel production

– Transportation supply constraints

– Essar labor issues

– Post-election economic pick up

– Unplanned domestic supply side disruptions

Downside Risks:

– Political uncertainty – Reflation trade reversing

– Increasing oil and iron ore inventory levels

– Sharp and persistent drop in oil and iron ore prices

– Automotive industry under pressure

– US domestic producers bringing back on capacity

– Higher interest rates slowing residential construction and auto sales

– Tightening financial conditions pressuring auto sales driven by sub-prime financing

– Chinese restrictions in property market

– The Chinese Financial Crisis

– Unexpected sharp China RMB devaluation

– Resumption of US dollar rally/currency issues/sovereign default

– U.S. (manufacturing) recession

– Falling ferrous raw materials and global finished steel prices

– Economic downturn, especially in China or Europe reverberating to U.S.A.

– Weak demand in housing