Market Commentary

As the price rally in the physical market continues to push higher, this was another comparatively quiet week, as a significant portion of buyers remain on the sideline in disbelief of how quickly the market changed. At the same time, last week’s apparent consolidation around $1,400 for HRC is a thing of the past. Lead times ticked higher again and although they remain relatively depressed compared to today’s elevated prices, the gap in price offerings between the mills is widening, clearly showing that they are selling through order books.

As we have in recent reports, we urge our customers to remain engaged in this market. Look for opportunities to lock in pricing that can work for you. In a time of high volatility, it is important to remember that simply waiting for lower prices is not an appropriate response if you care about your margins and maintaining a relationship with your customers. If the last three years have taught us anything, it should be that uncertainty around the global steel market remains at an all-time high. Without a clear solution to rising input costs and availability, there is no reason to believe that prices will start to turn any time soon.

In the remainder of the report, we will go over the recently released economic data for a snapshot of demand, which continues to show moderate growth on already elevated previous levels.

ISM PMI

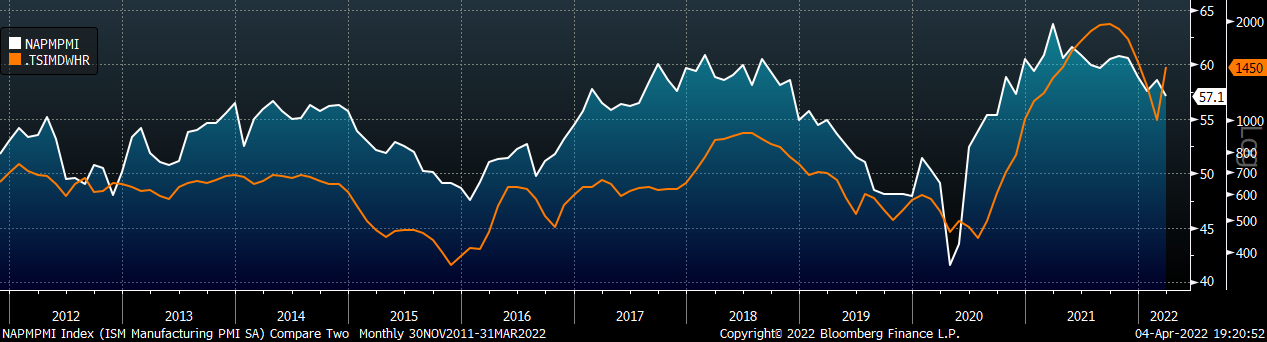

The chart below is the Platts Midwest HRC index (orange) and the ISM Manufacturing PMI (white). The topline ISM Manufacturing PMI index was lower but remains in expansion territory, while the Midwest HRC price sharply rebounded in March.

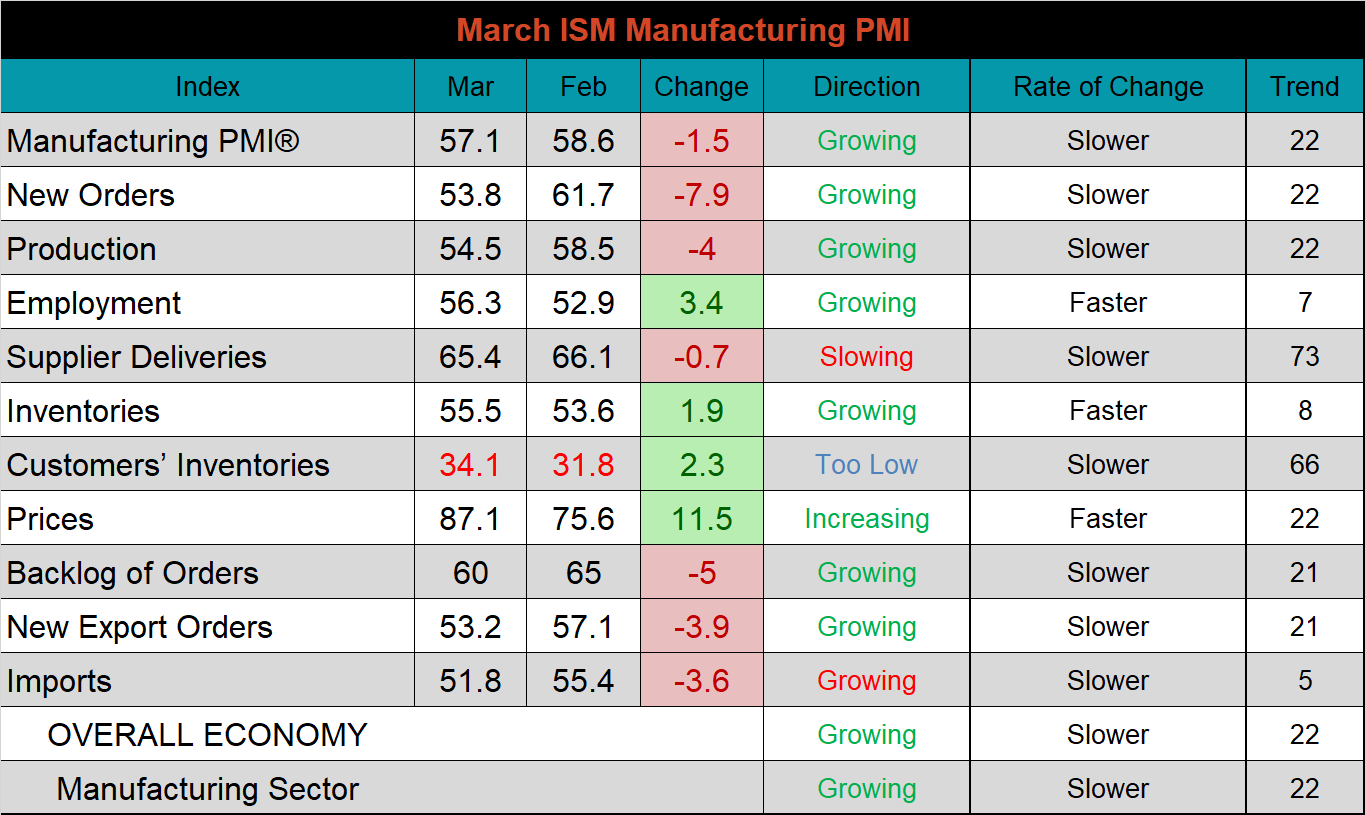

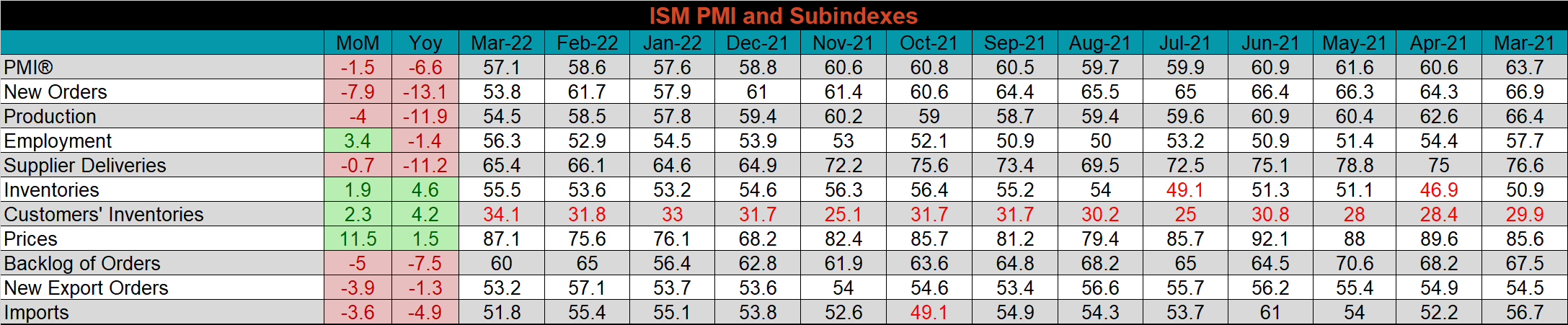

The March ISM Manufacturing PMI and subindexes are below.

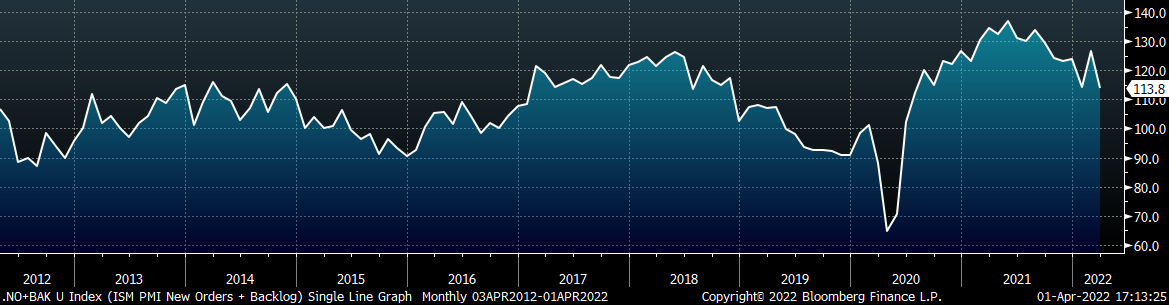

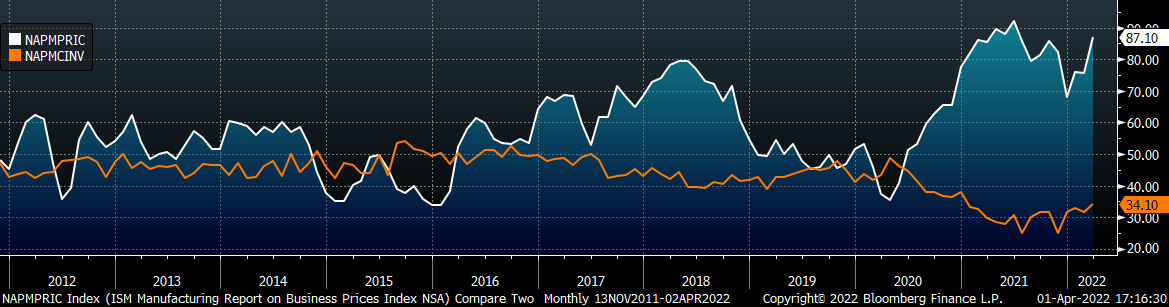

When the new batch of economic data is released, the first thing we look at is the new ISM Manufacturing PMI. This month, a topline number of slightly slower growth did not move the needle. However, there is one trend that does cause mild concern. Demand subindexes (new orders, backlog, & new export orders) saw the most significant monthly declines in growth. The chart below shows the new orders plus backlog subindexes, which reversed last month’s increases and have been in a downtrend since the middle of last year. A significant caveat to the concern is the fact that all three remain in expansion territory and have all continued to grow for at least 21 straight months. It is also important to note that these readings analyze the broad manufacturing sector – while this month’s a dip in the growth rate must be on everyone’s radar, further commentary in the report suggests that the backlog remains stronger for steel specific sectors. The second chart shows a different dynamic, with prices in white and customer inventories in orange. Over the last three years, customers have been operating with historically low inventories. This was in part due to supply disruption because of the pandemic, but also because many customers chose not to restock when material became available under the assumption that prices would continue falling back to “normal” levels. With inventories that low, it was a big gamble, and now that prices are in a rising environment again, it appears only a matter of time until buyers are forced back into the market to restock.

ISM Manufacturing PMI New Orders + Backlog

ISM Manufacturing PMI Prices (white) & Customer Inventories (orange)

The table below shows the historical values of each subindex over the last year.

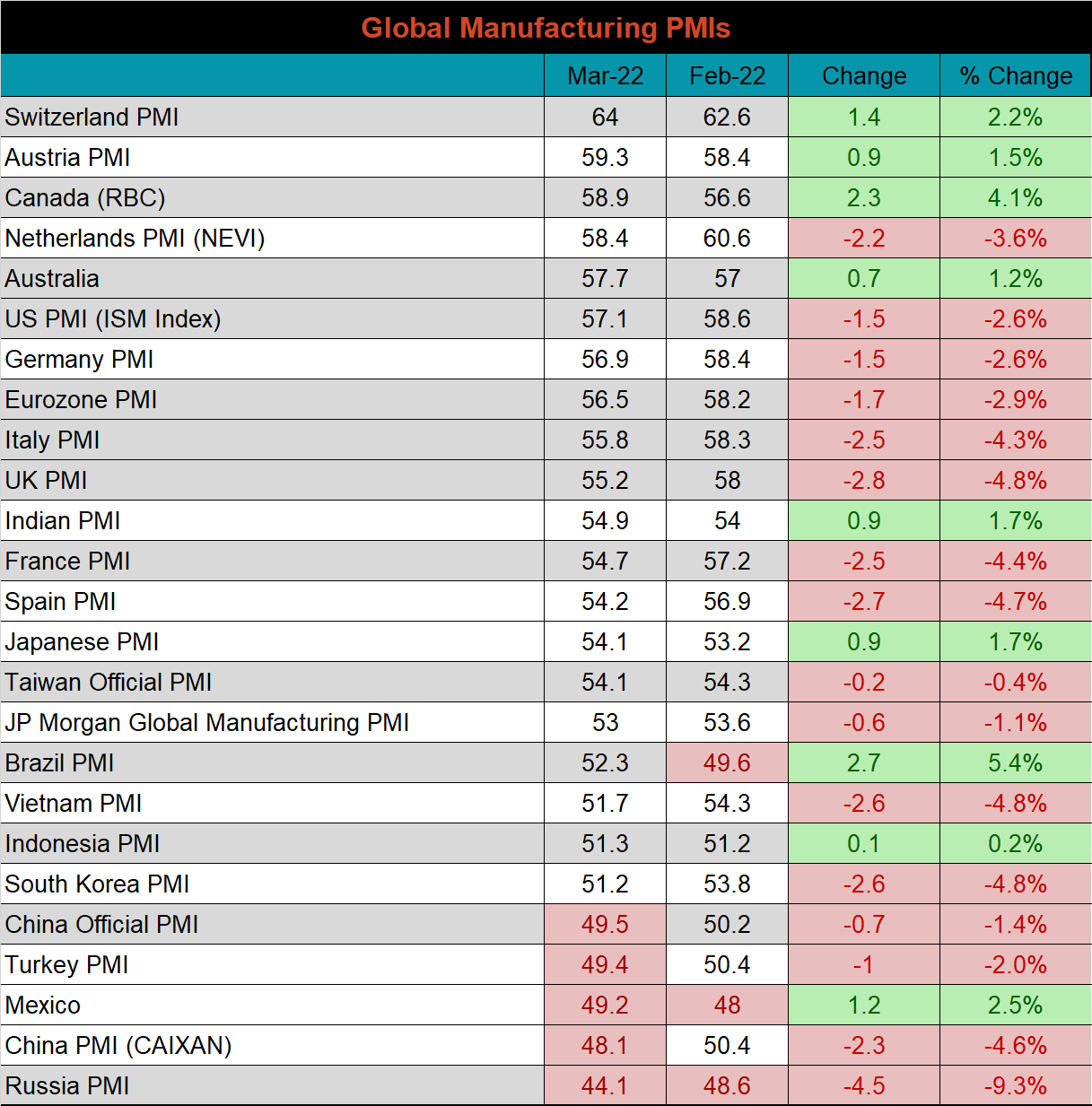

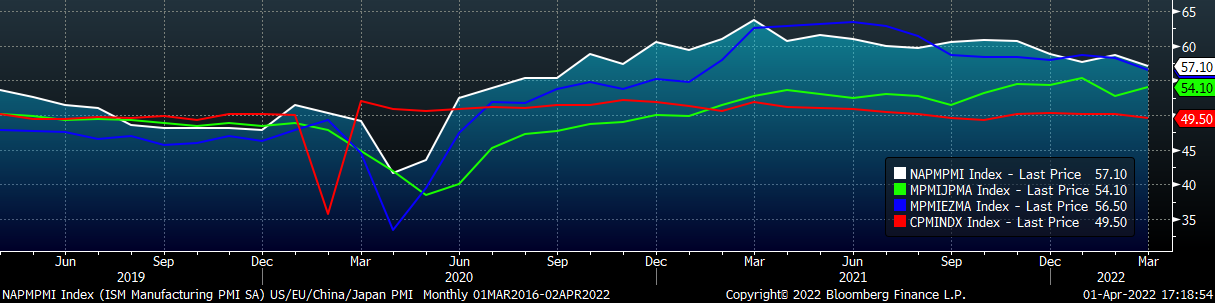

Global PMI

March global PMI printings depict another month of an expanding global manufacturing sector, albeit at a much slower pace. 17 of the 22 watched countries seeing their respective manufacturing industries grow, which China and Turkey joined Mexico and Russia in contraction territory.

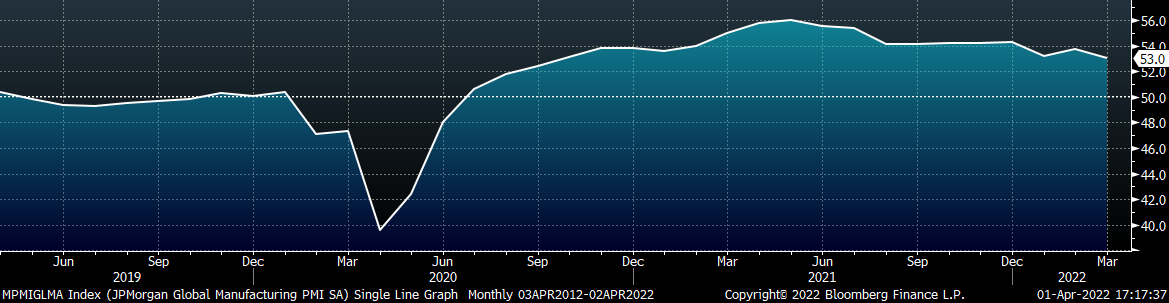

J.P. Morgan Global Manufacturing

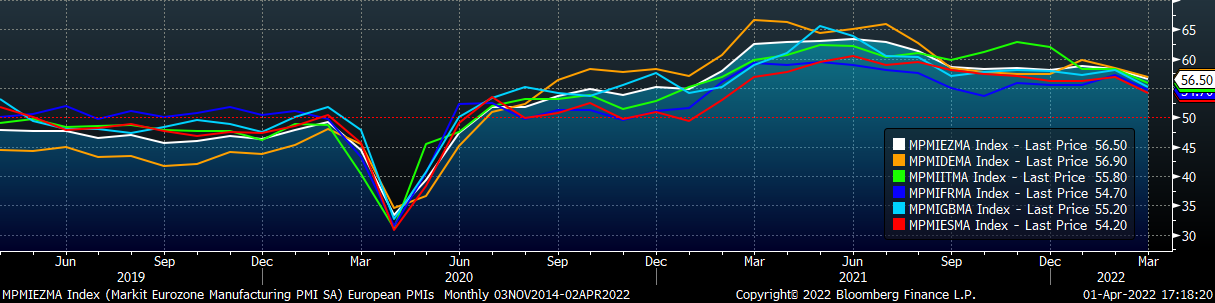

Eurozone (white), German (orange), Italian (green), Spanish (red), and French (blue), U.K. (teal) Manufacturing PMIs

US (white), Euro (blue), Chinese (red) and Japanese (green) Manufacturing PMIs

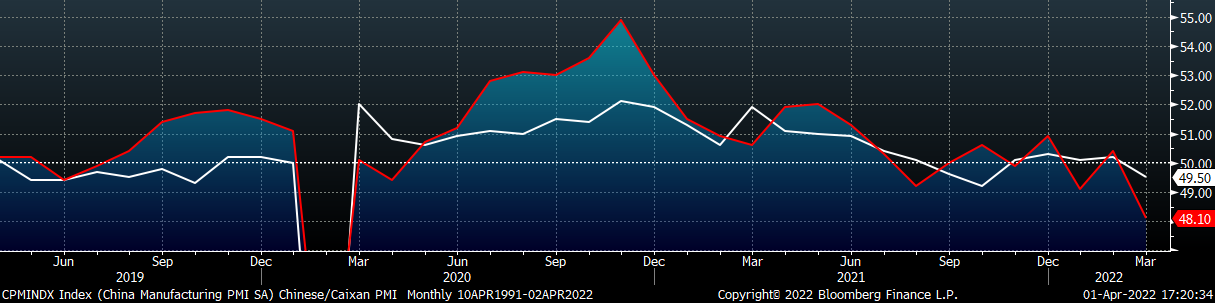

The Caixan and Chinese official PMI indexes both printed sharply lower, as economic slowdowns and pandemic shutdowns stifle economic activity.

China Official (white) and Caixan (red) Manufacturing PMIs

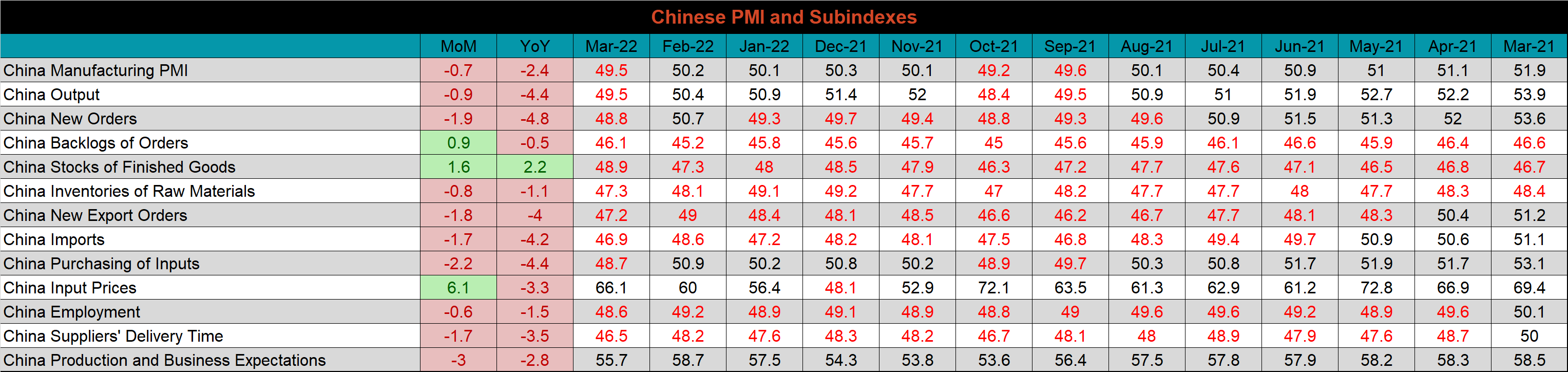

The table below breaks down China’s official manufacturing PMI subindexes. Input prices, jumped higher again, which continues to put significant pressure on the export heavy Chinese manufacturing sector.

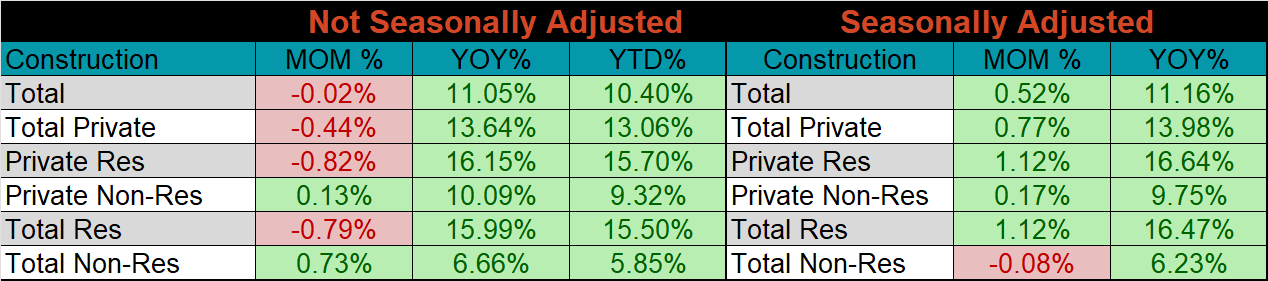

Construction Spending

February seasonally adjusted U.S. construction spending was up 0.5% compared to January, and 11.2% higher than February 2021. Construction spending remains red hot as the calendar turns to a period of increased activity.

February U.S. Construction Spending

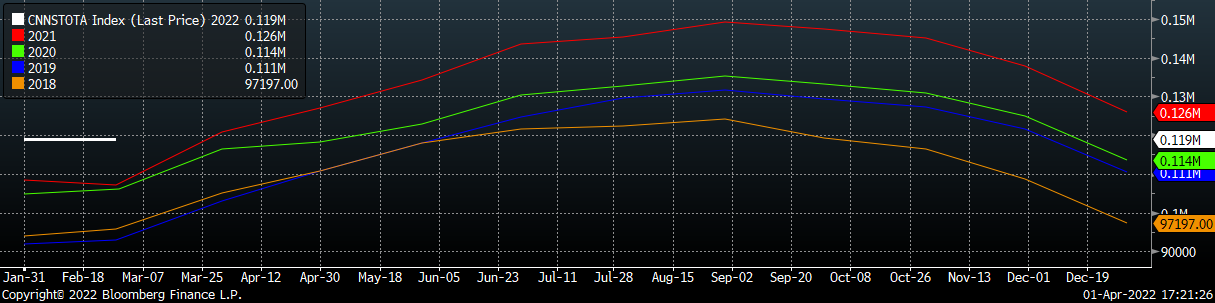

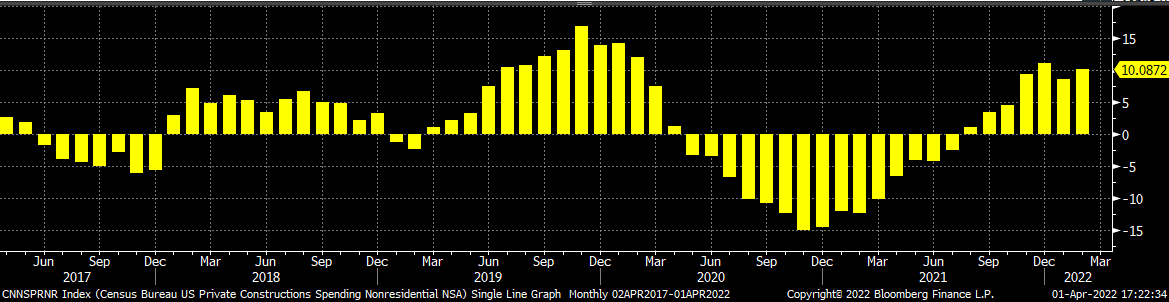

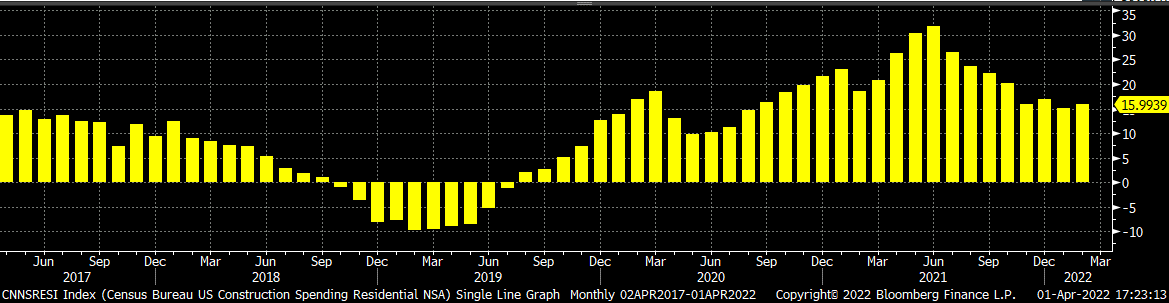

The white line in the chart below represents not seasonally adjusted construction spending in 2022 and compares it to the spending of the previous 4 years. The two bottom charts below show the YoY changes in construction spending. Both residential and non-residential spending continue to grow at historically strong rates YoY.

U.S. Construction Spending NSA

U.S. Private Nonresidential Construction Spending NSA YoY % Change

U.S. Residential Construction Spending NSA YoY % Change

Auto Sales

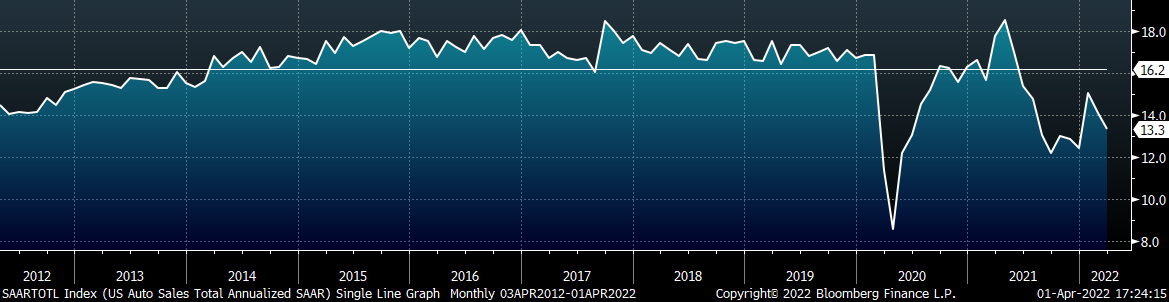

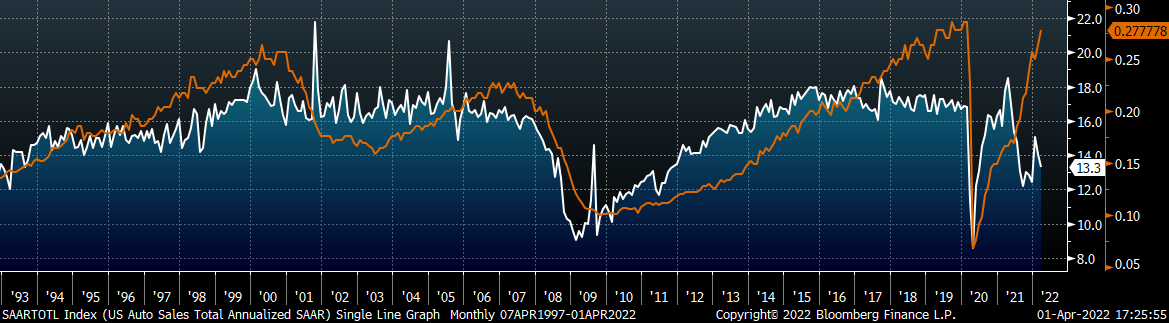

March U.S. light vehicle sales fell further to a 13.3m seasonally adjusted annualized rate (S.A.A.R) and remains below the 10-year average of 16.2m. The second chart shows the relationship between the unemployment rate and auto sales. The unemployment rate is inverted to show that declining unemployment typically leads to increasing auto sales. The labor market continues to improve and is a strong signal that pent up demand from the auto industry will lead to a higher floor for steel prices once the chip shortage is resolved.

March U.S. Auto Sales (S.A.A.R.)

March U.S. Auto Sales (orange) and the Inverted Unemployment Rate (white)

Risks

Below are the most pertinent upside and downside price risks:

Upside Risks:

- Inventory at end users and service centers below normal operational levels

- Higher share of discretionary income allocated to goods from steel intensive industries

- Changes in China’s policies regarding ferrous markets, including production cuts and exports

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Energy & construction industry rebound

- Easing labor and supply chain constraints allowing increased manufacturing activity

- Mills extending outages/taking down capacity to keep prices elevated

- Global supply chains and logistics restraints causing regional shortages

Downside Risks:

- Increased domestic production capacity

- Elevated price differentials and hedging opportunities leading to sustained higher imports

- Steel consumers substitute to lower cost alternatives

- Steel buyers and consumers “double ordering” to more than cover steel needs

- Tightening credit markets, as elevated prices push total costs to credit caps

- Supply chain disruptions allowing producers to catch up on orders

- Limited desire to restock at elevated prices, causing a “Buyer’s Strike”

- Economic slowdown caused by the emergence of Coronavirus Variants

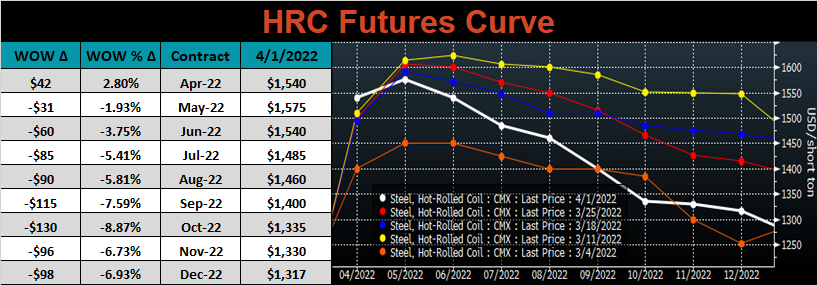

HRC Futures

All of the below data points are as of April 1, 2022.

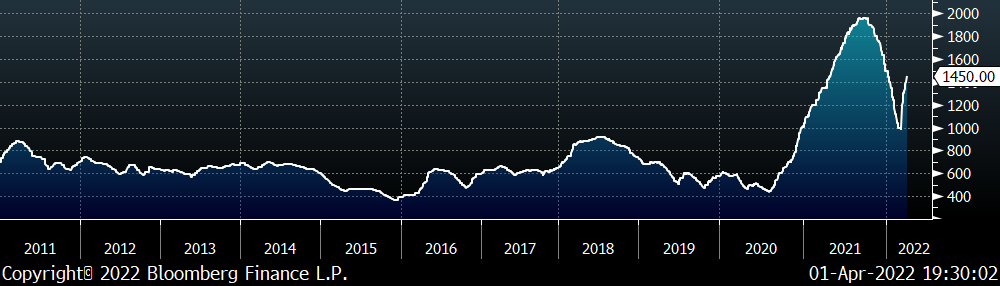

The Platts TSI Daily Midwest HRC Index was up another $70 to $1,450.

Platts TSI Daily Midwest HRC Index

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The entire curve sold off this week, most sharply in the back. The result is significant backwardation, suggesting a shortage of HRC in the near-term.

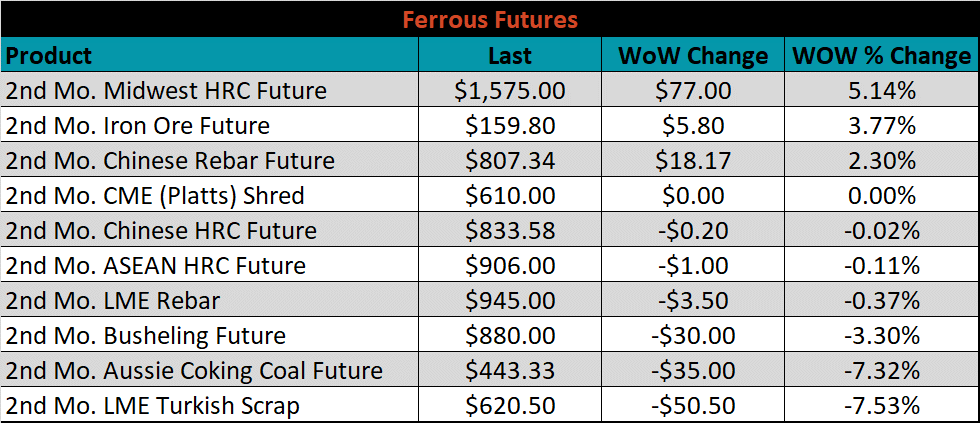

May ferrous futures were mixed. Aussie coking coal lost another 19.3%, while Turkish scrap gained 6%.

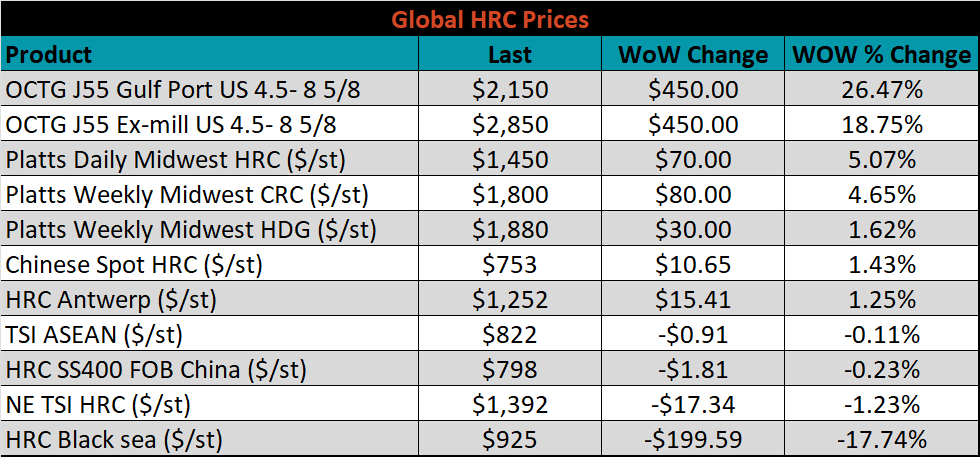

Global flat rolled indexes were mixed, with U.S. domestic prices rising most significantly, while Black Sea HRC gave back most of its gains from last week.

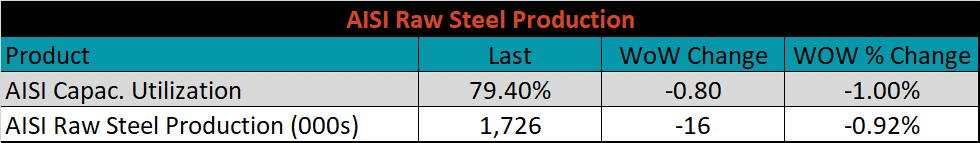

The AISI Capacity Utilization was down 0.8% to 79.4%.

AISI Steel Capacity Utilization Rate (orange) and Platts TSI Daily Midwest HRC Index (white)

Imports & Differentials

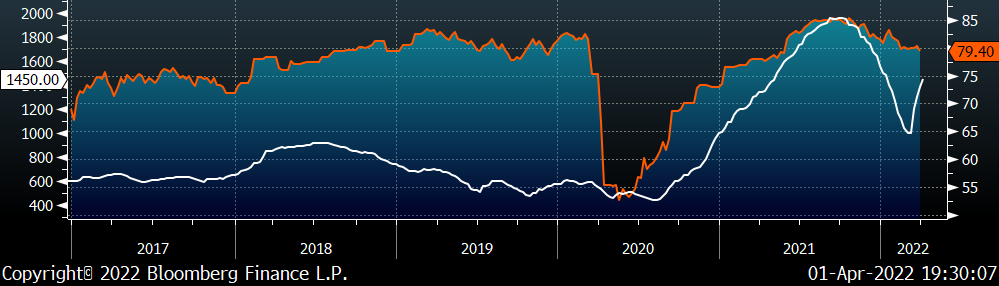

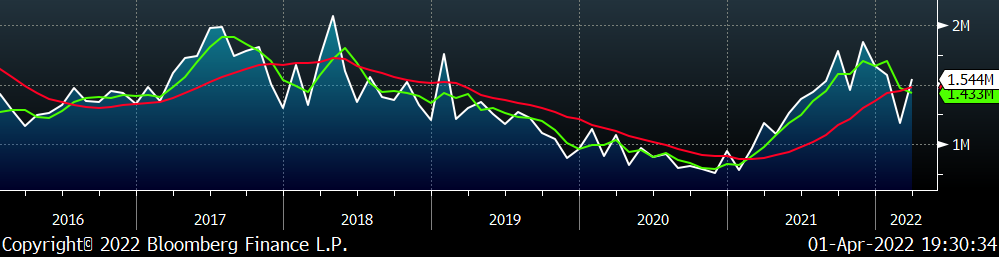

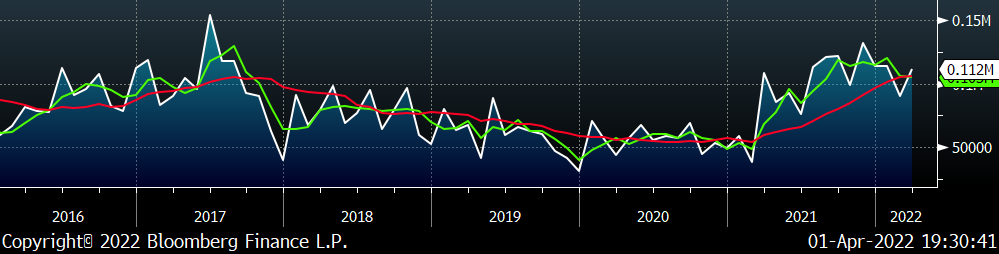

March flat rolled import license data is forecasting an increase of 252k to 1.06M MoM.

All Sheet Imports (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

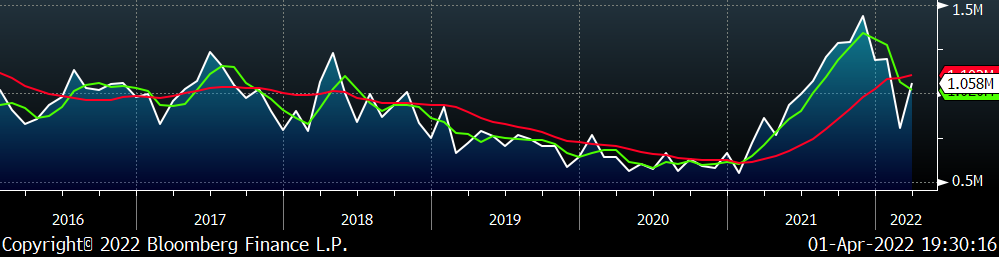

Tube imports license data is forecasting an increase of 117k to 486k in March.

All Tube Imports (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

All Sheet plus Tube (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

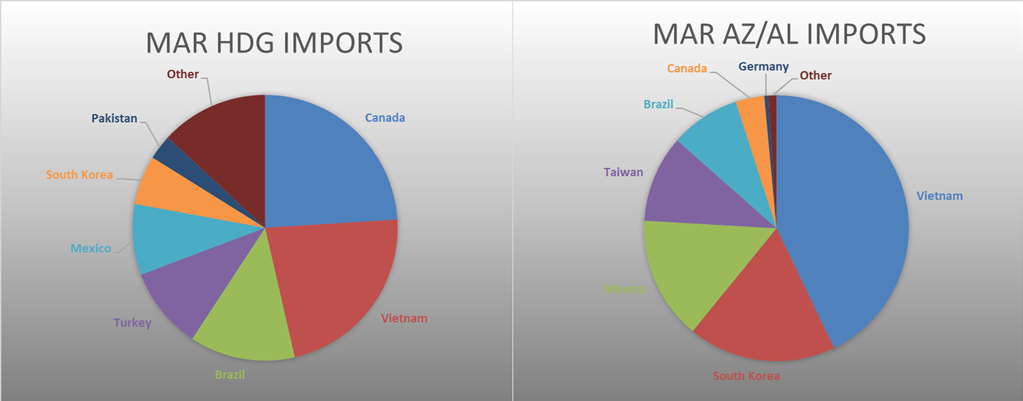

March AZ/AL import license data is forecasting an increase of 21k to 112k.

Galvalume Imports (white) w/ 3 Mo. (green) & 12 Mo. Moving Average (red)

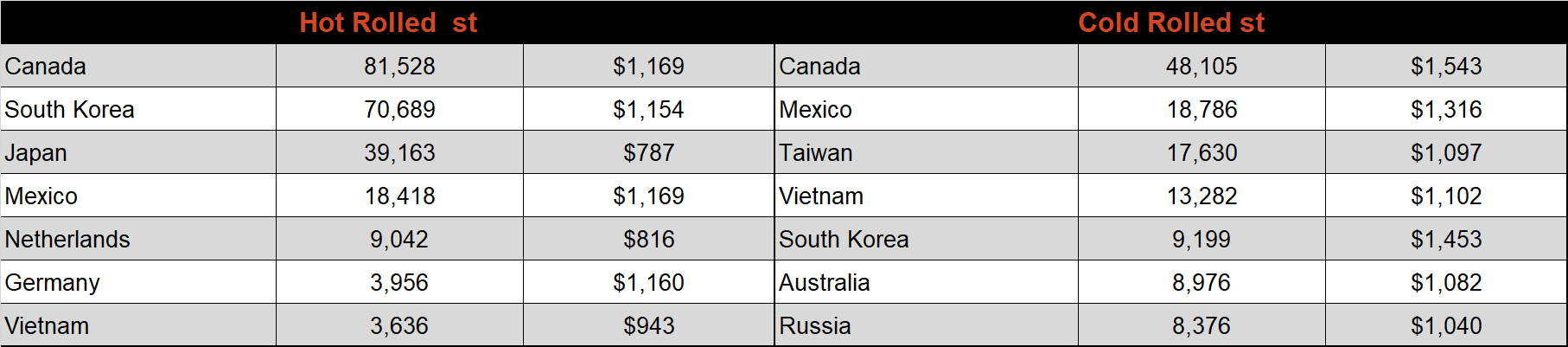

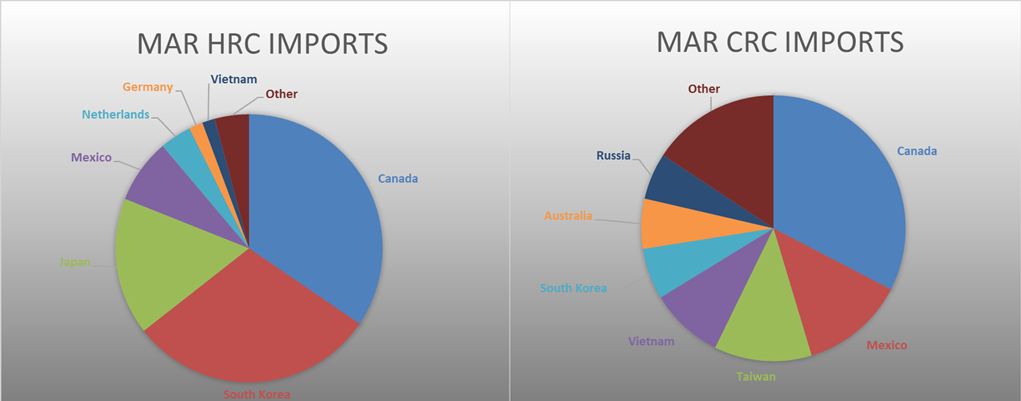

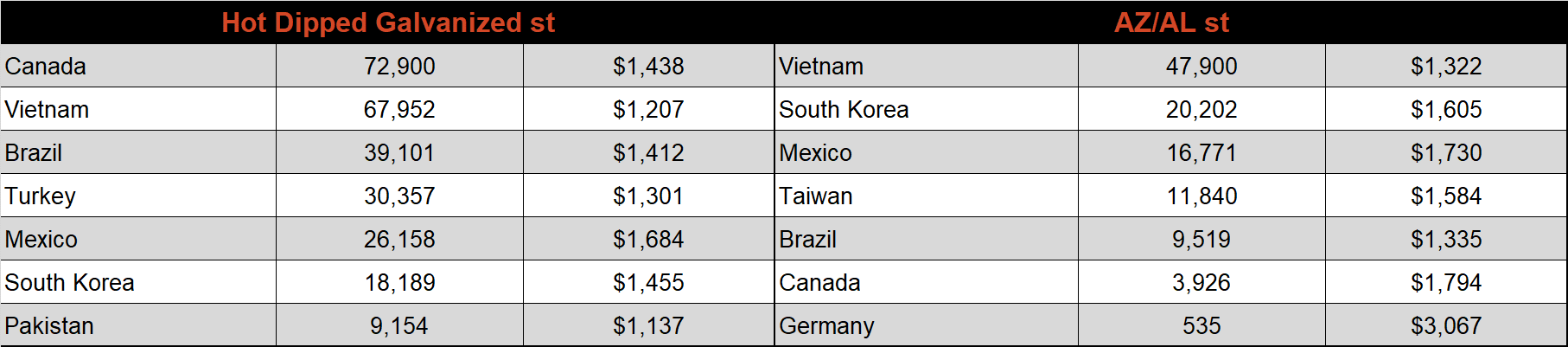

Below is March import license data through March 28th, 2022.

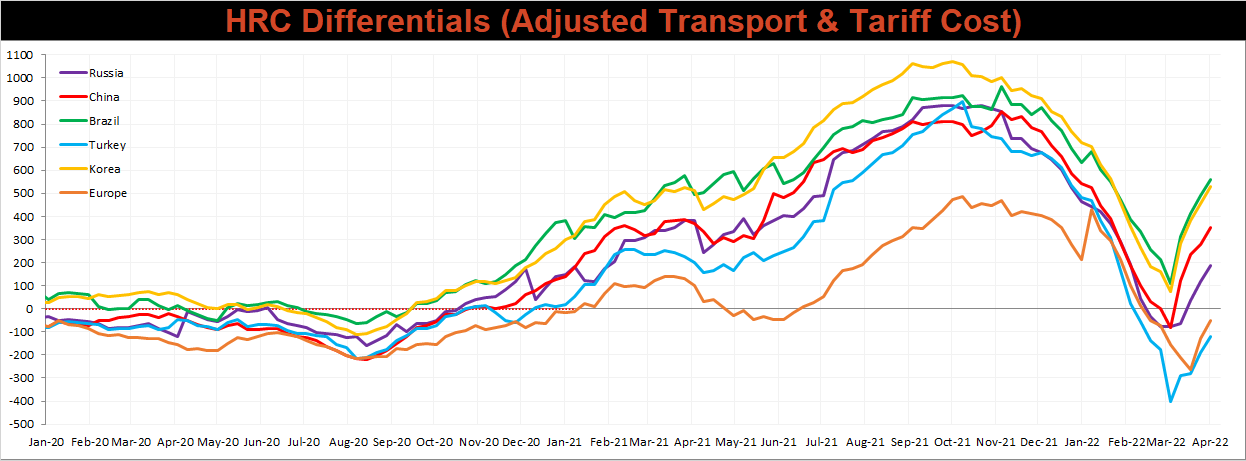

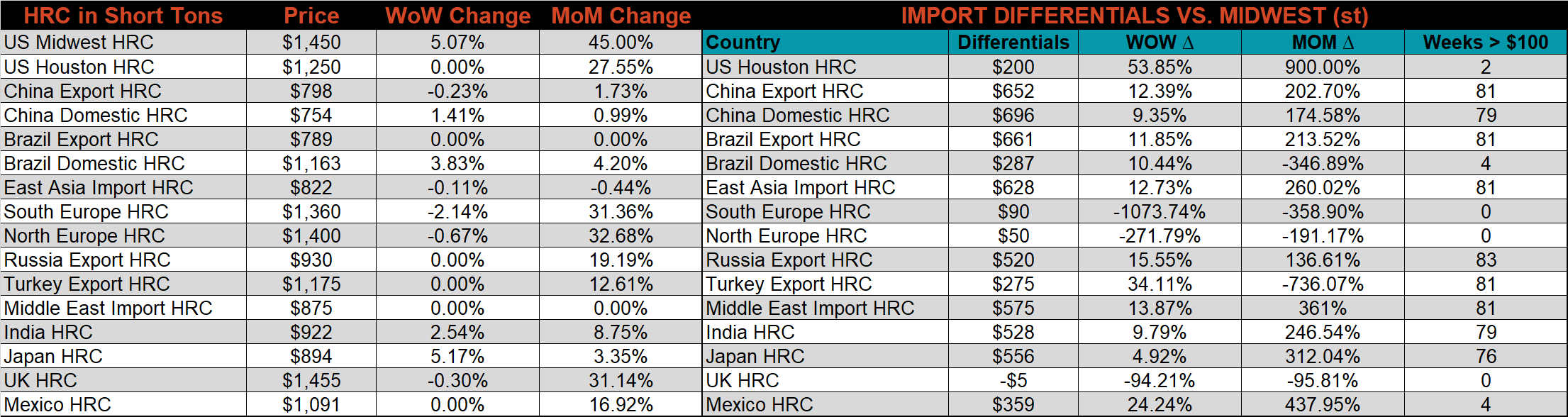

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Global differentials increased again this week, as the U.S. price continues to rally.

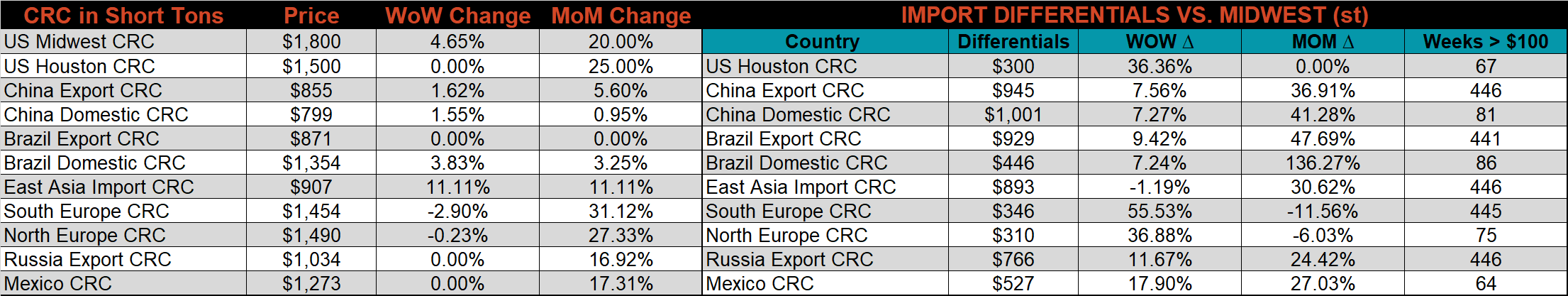

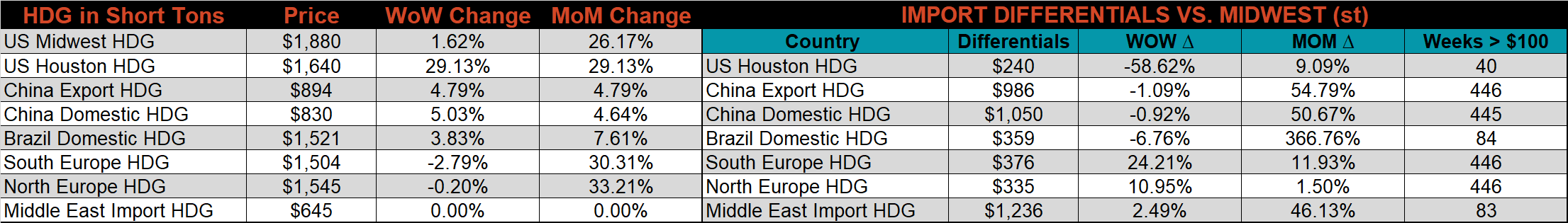

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, CRC & HDG prices were up 5.1%, 4.7%, and 1.6%, respectively. Outside of the U.S., the East Asian CRC price rose the most significantly, up 11.1%.

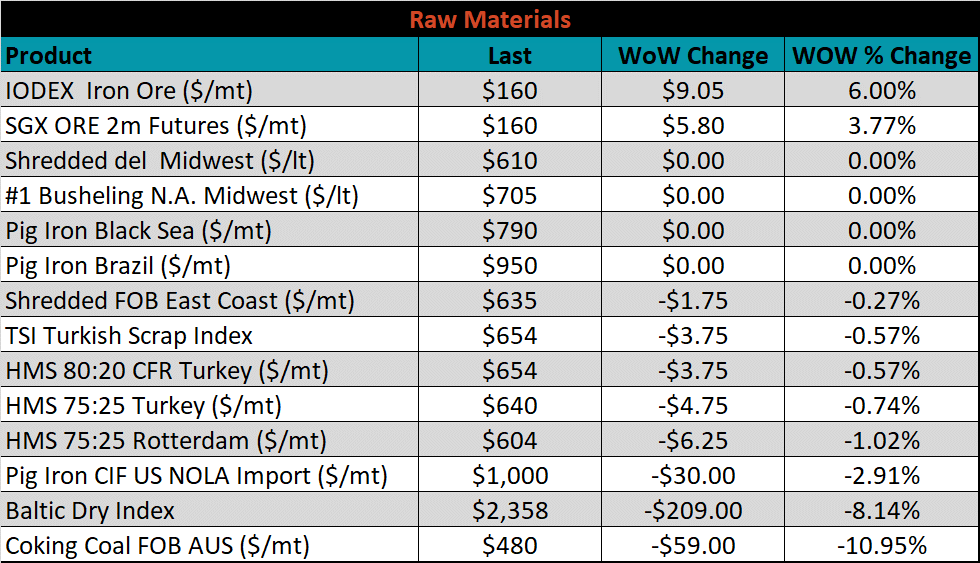

Raw Materials

Raw material prices were mixed, with Aussie coking coal was down another 11%.

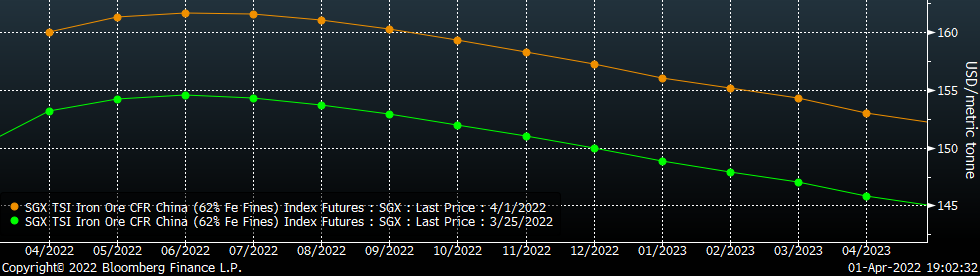

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the curve shifted higher at all expirations.

SGX Iron Ore Futures Curve

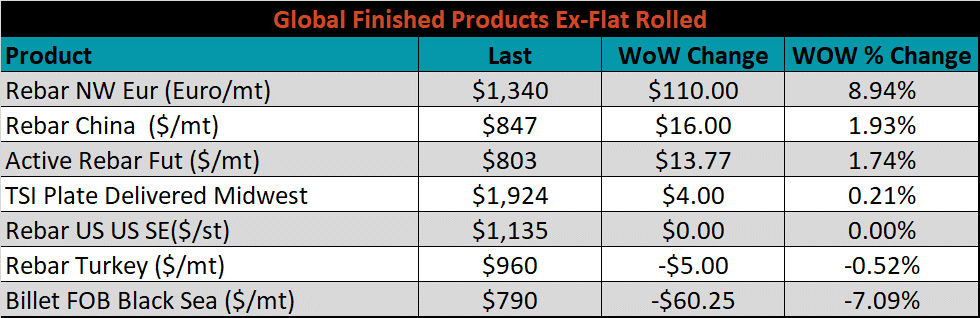

The ex-flat rolled prices are listed below.

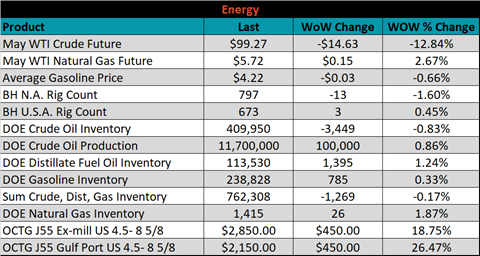

Energy

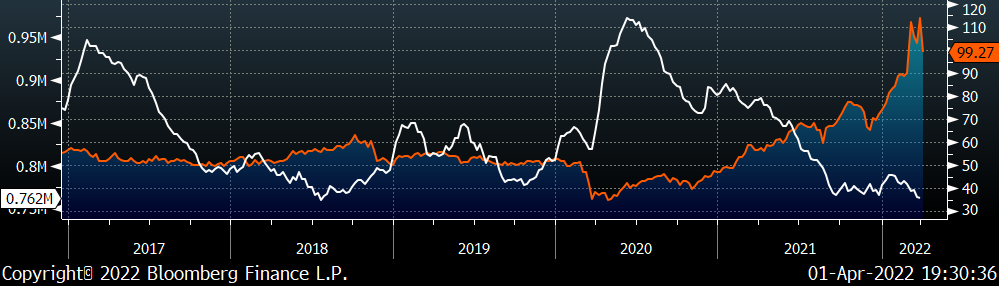

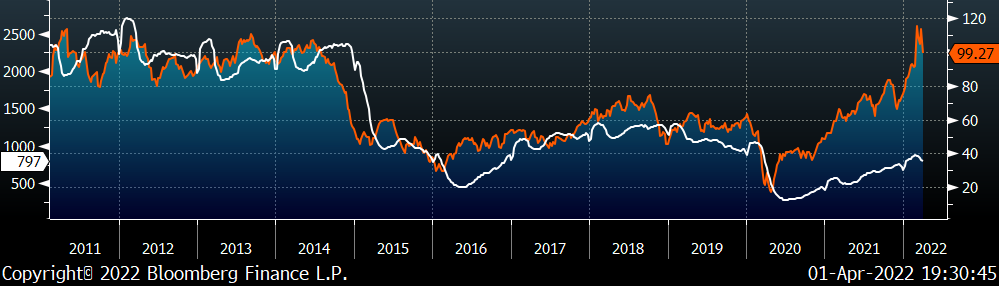

Last week, the May WTI crude oil future lost $14.63 or 12.8% to $99.27/bbl. The aggregate inventory level was down 0.2% and crude oil production rose to 11.7m bbl/day. The Baker Hughes North American rig count was down 13 rigs, and the U.S. rig count was up another 3 rigs.

May WTI Crude Oil Futures (orange) vs. Aggregate Energy Inventory (white)

Front Month WTI Crude Oil Future (orange) and Baker Hughes N.A. Rig Count (white)

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

- Inventory at end users and service centers below normal operational levels

- Higher share of discretionary income allocated to goods from steel intensive industries

- Changes in China’s policies regarding ferrous markets, including production cuts and exports

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Energy & construction industry rebound

- Easing labor and supply chain constraints allowing increased manufacturing activity

- Mills extending outages/taking down capacity to keep prices elevated

- Global supply chains and logistics restraints causing regional shortages

- A weakening US Dollar

- Fiscal policy measures including a new stimulus and/or infrastructure package

- Fluctuating auto production, pushing steel demand out into the future

- Low interest rates

- Threat of further protectionist trade policies muting imports

- Unexpected and sustained inflation

Downside Risks:

- Increased domestic production capacity

- Elevated price differentials and hedging opportunities leading to sustained higher imports

- Steel consumers substitute to lower cost alternatives

- Steel buyers and consumers “double ordering” to more than cover steel needs

- Tightening credit markets, as elevated prices push total costs to credit caps

- Supply chain disruptions allowing producers to catch up on orders

- Limited desire to restock at elevated prices, causing a “Buyer’s Strike”

- Economic slowdown caused by the emergence of Coronavirus Variants

- Reduction and/or removal of domestic trade barriers

- Political & geopolitical uncertainty

- Chinese restrictions in property market

- Unexpected sharp China RMB devaluation