Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

Last week was a quiet week in the physical market after the wave of panic buying earlier in the month has ebbed and upward momentum in pricing has slowed as a result. While transactions continue to occur around $1,500 for HRC, a breakdown of the traditional leading indicators has caused a lack of clarity around the next six weeks of steel pricing. As we have mentioned before, the incredible pace at the beginning of this rally was the result of dramatically higher input costs being pushed through the market by mills, however, we retain the view that a rally was eminent anyways. In our view, there is an overweight assumption in the market that increasing raw material costs were the only cause of these elevated prices. This view is, in turn, leading buyers to believe that as soon as scrap prices settle lower, mills will start chasing orders lower. For additional support of this theory, many point to lead times which continue to be only slightly elevated compared to historical norms.

The fact remains, however, that mills input costs and more importantly, the availability of raw materials are far from guaranteed. Rather than a lack of demand, it appears that uncertainty around these inputs is causing mills to keep lead times artificially low by only booking what they can physically guarantee at certain cost. Taking a step back, the takeaway from all of this is clear – both upside and downside risks are growing and the significant volatility we have seen over the last two years is not going away any time soon.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

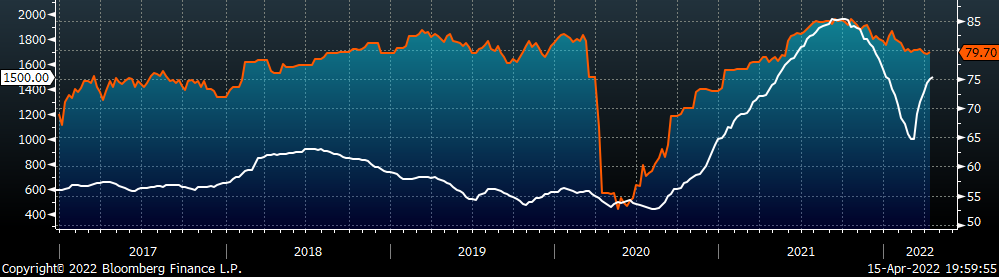

The Platts TSI Daily Midwest HRC Index was up another $20 to $1,500.

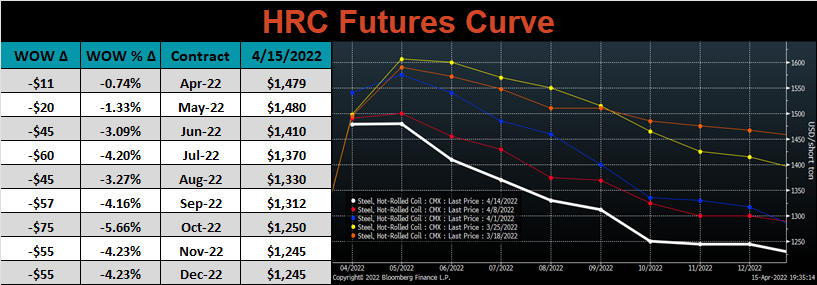

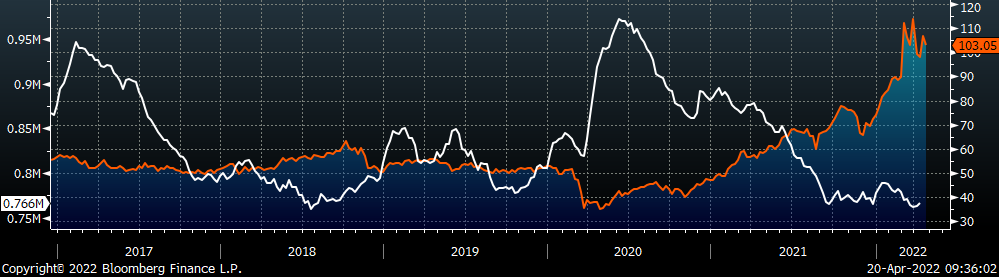

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The entire curve sold off last week, most significantly in the later months.

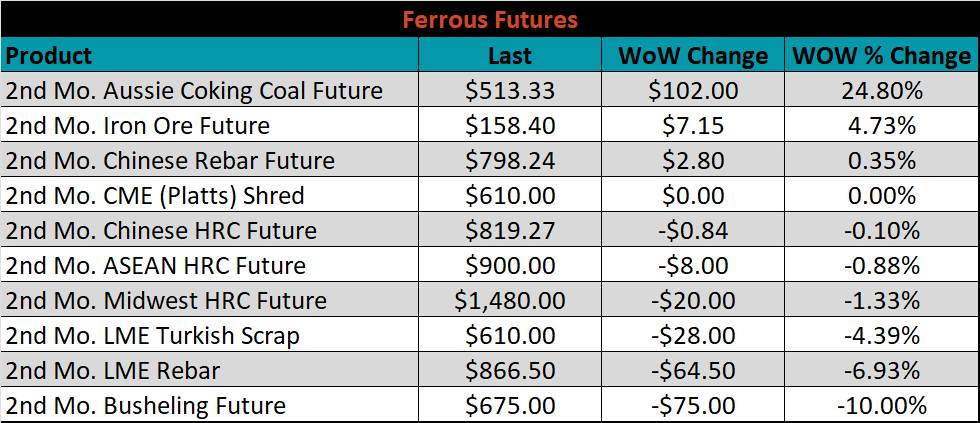

May ferrous futures were mixed. Aussie coking coal gained 24.8%, while busheling lost 10%.

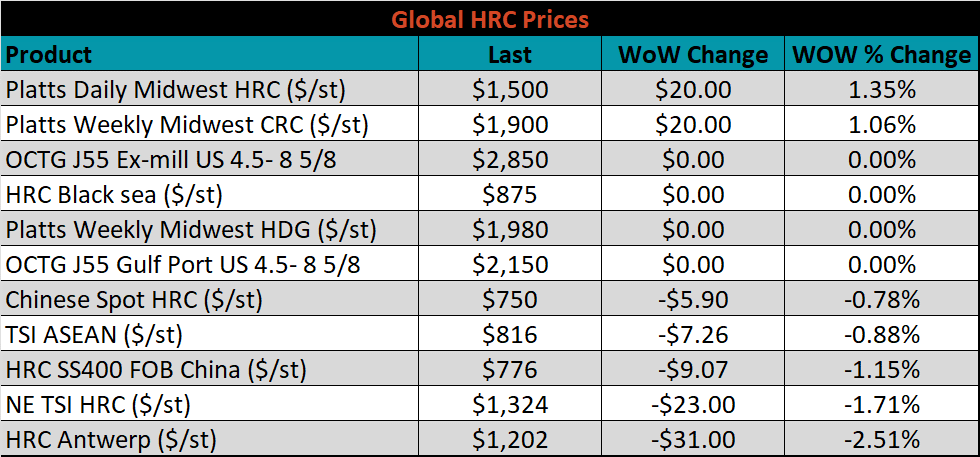

Global flat rolled indexes were mixed, with Antwerp HRC down 2.5%, while Midwest HRC was up 1.4%.

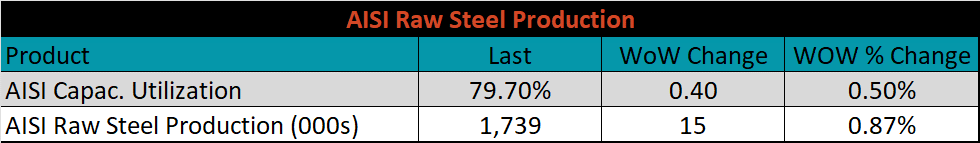

The AISI Capacity Utilization was up 0.4% to 79.7%.

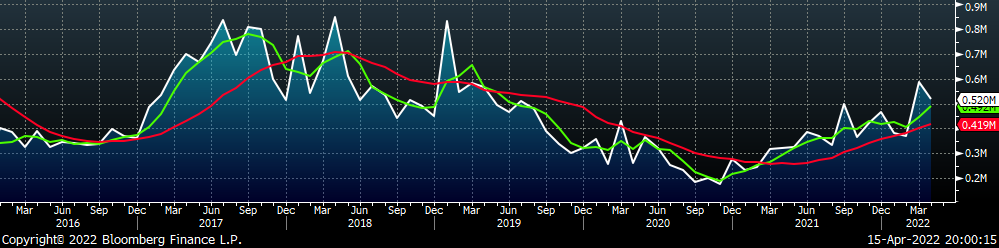

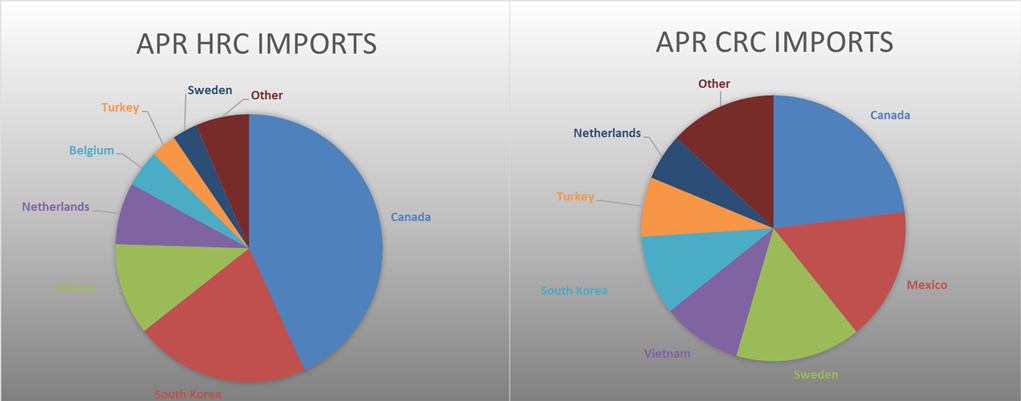

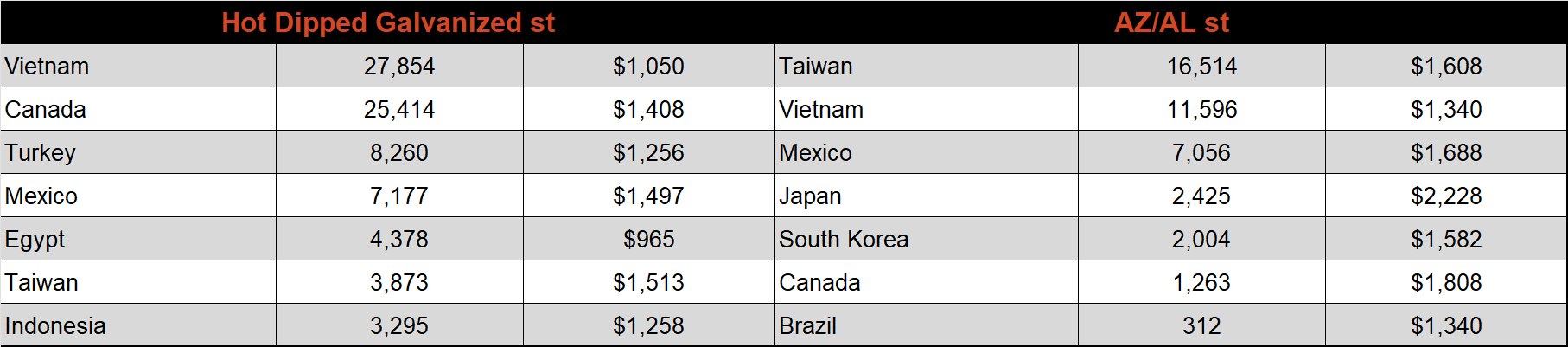

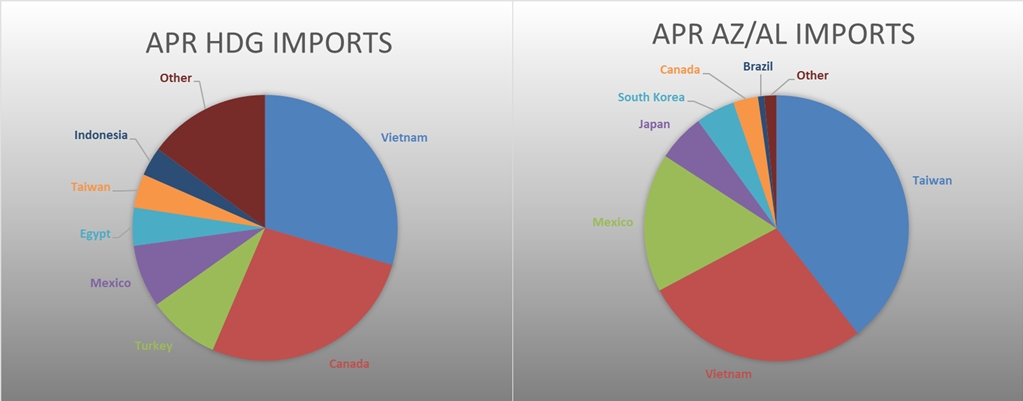

April flat rolled import license data is forecasting a decrease of 148k to 1.06M MoM.

Tube imports license data is forecasting a decrease of 65k to 520k in April.

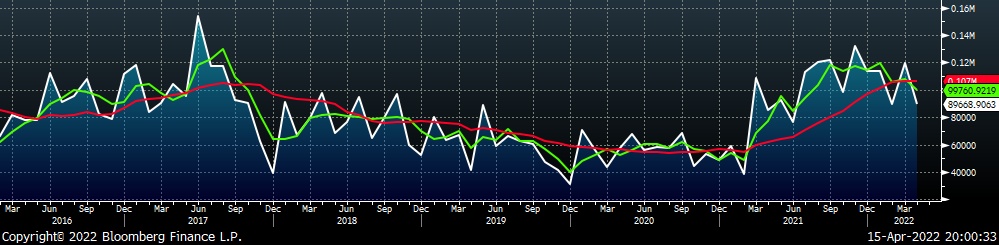

April AZ/AL import license data is forecasting a decrease of 30k to 90k.

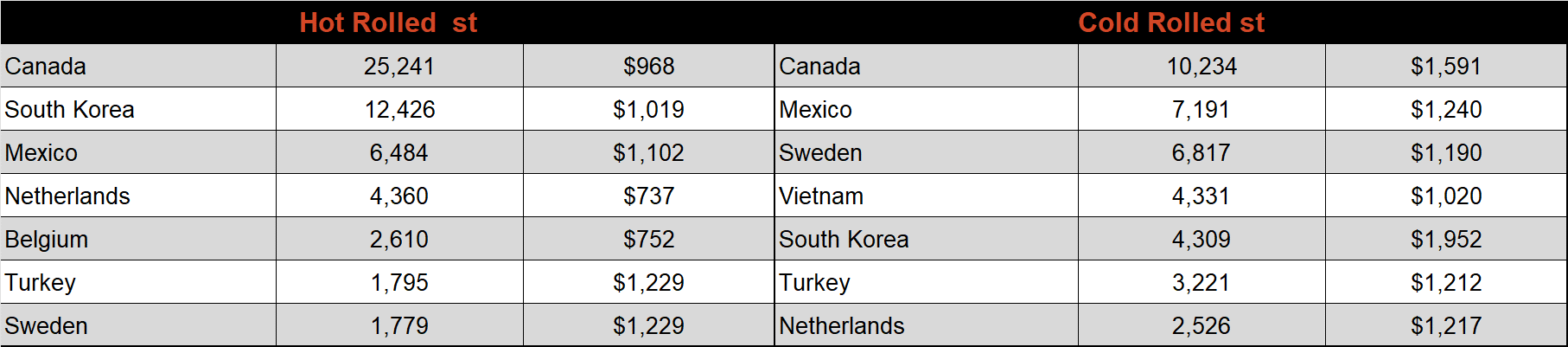

Below is April import license data through April 11th, 2022.

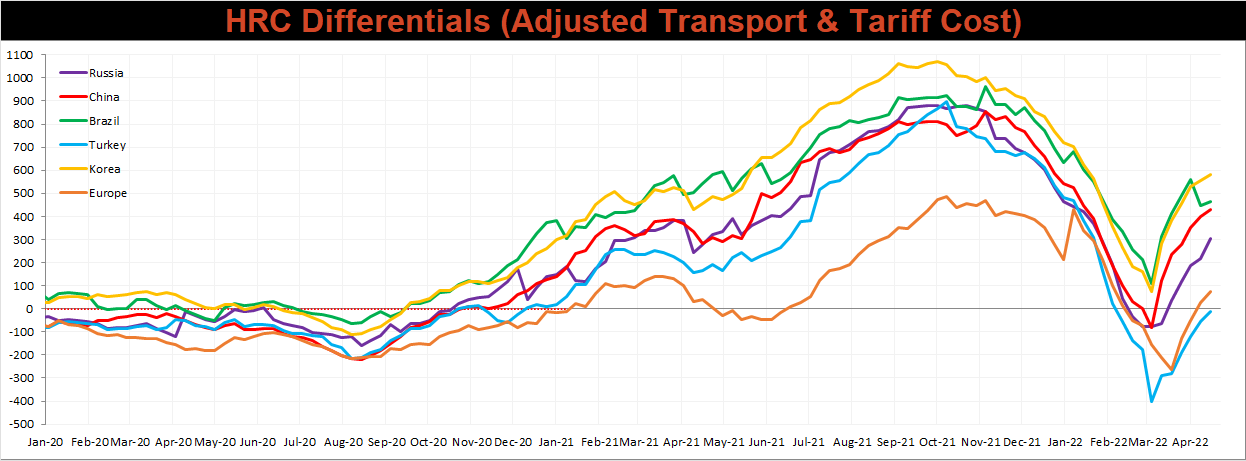

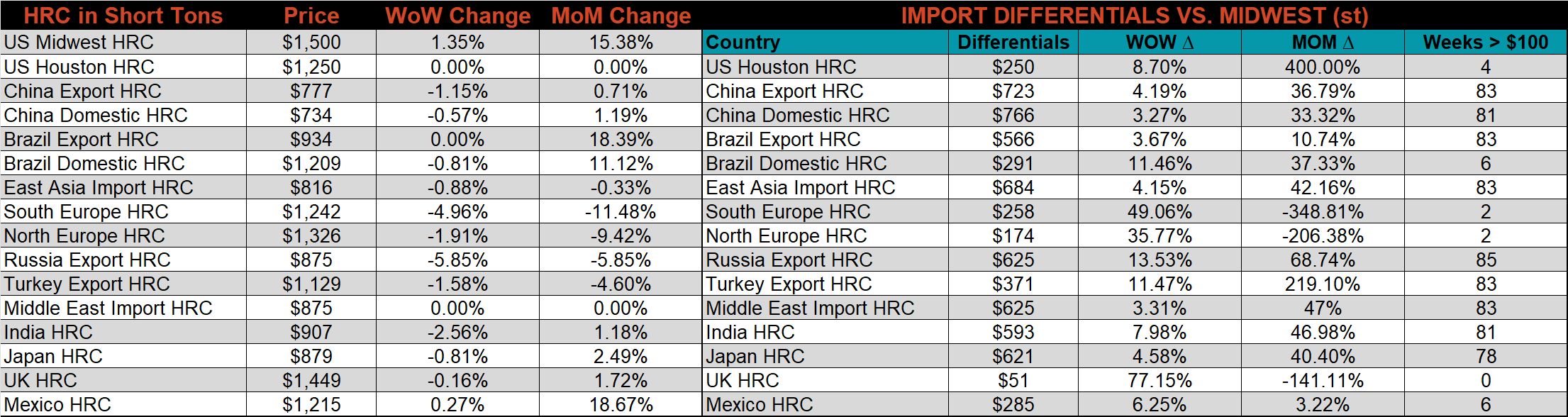

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Global differentials increased across the board this week, as the U.S. price continues to grind higher, while the rest of the world is trending flat to lower.

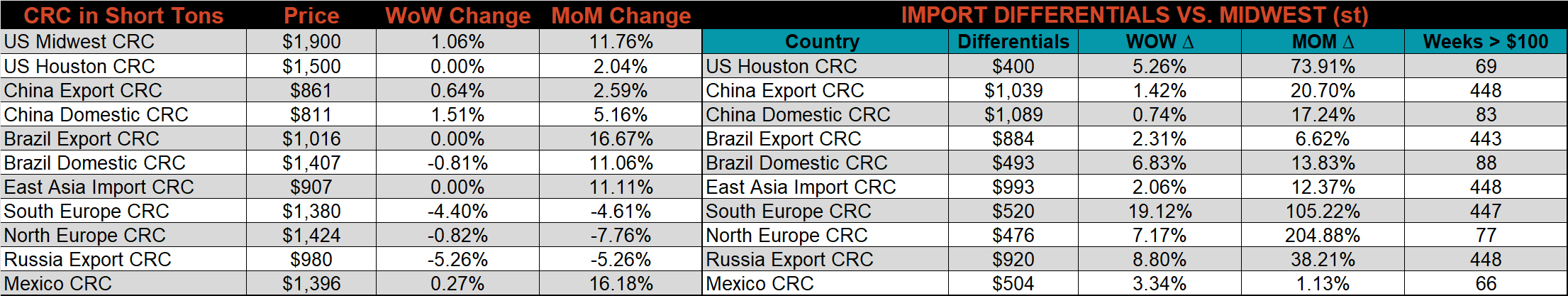

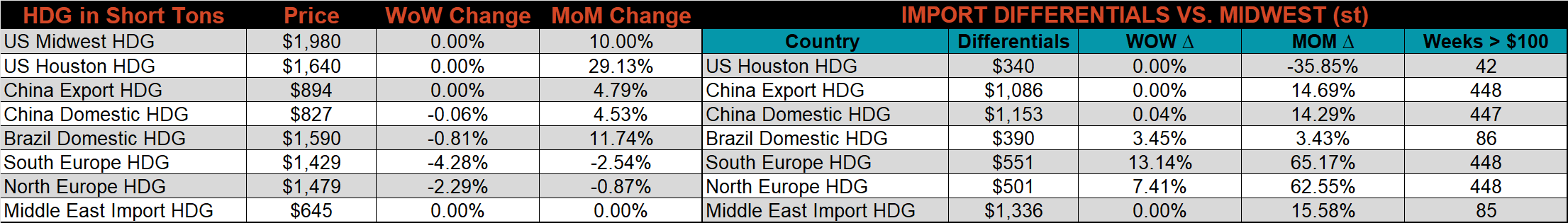

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC & CRC prices were up 1.4%, and 1.1%, respectively. The Midwest HDG price was unchanged. Outside of the U.S., the Southern European HRC price was down the most, 5%.

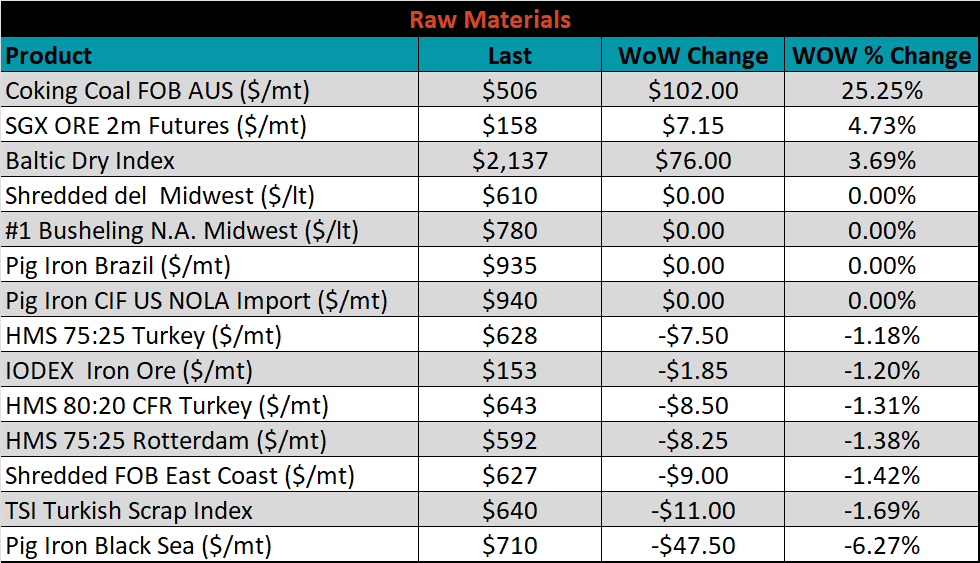

Raw material prices were mixed, with Aussie coking coal was up 25.3%, while Black Sea pig iron was down 6.3%.

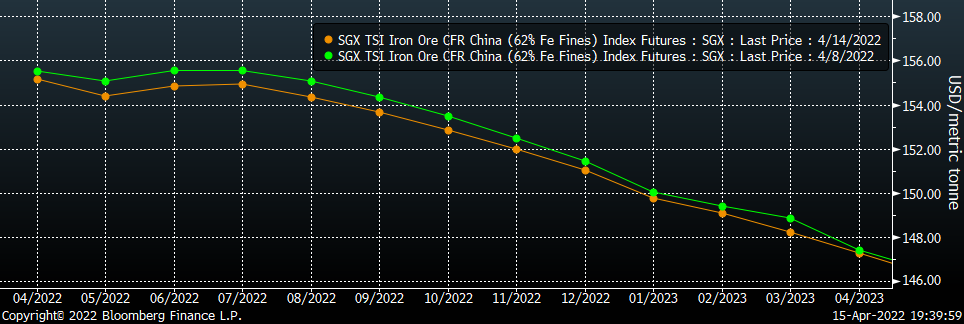

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted slightly lower at all expirations.

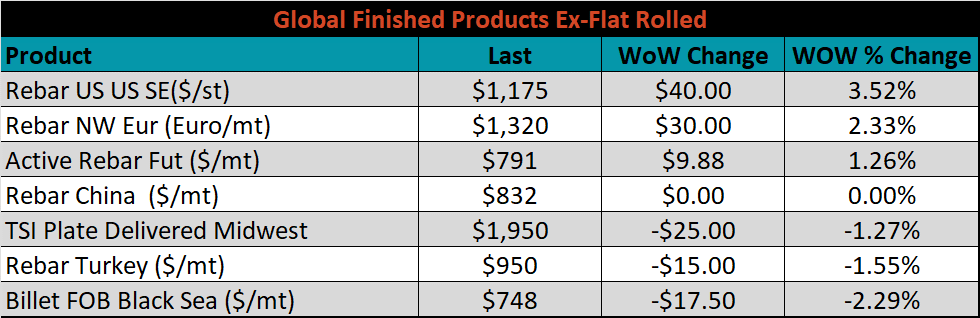

The ex-flat rolled prices are listed below.

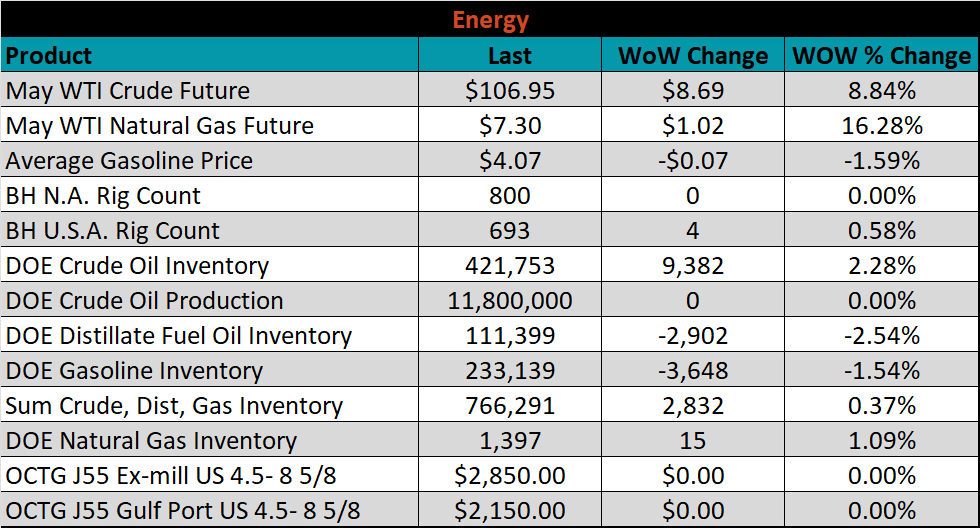

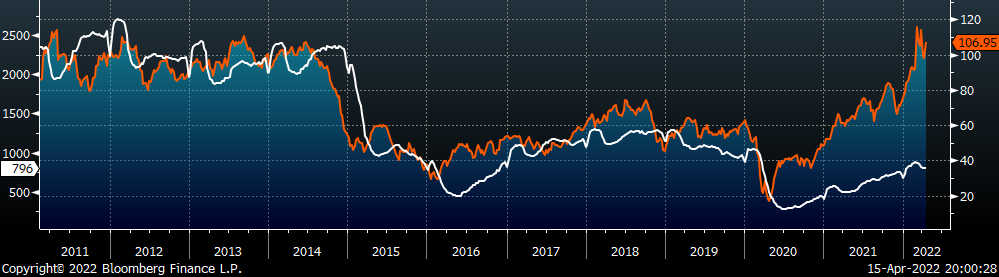

Last week, the May WTI crude oil future gained $8.69 or 8.8% to $106.95/bbl. The aggregate inventory level was up 0.4% and crude oil production remains at 11.8m bbl/day. The Baker Hughes North American rig count was unchanged, while the U.S. rig count was up another 4 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: