Content

-

Weekly Highlights

- Market Commentary

- Risks

Over the last week, we saw more of the same in ferrous markets: spot prices and fundamentals weakening as future pricing and sentiment improved. Eventually, these two forces will have to converge, but when and how that happens is still up in the air, adding to the uncertainty in the market. We also saw chaos in the oil market early this week and will look at its similarities and implications for the steel markets.

On Monday, the nearest expiring WTI crude oil future contract traded below zero into negative territory before recovering and expiring slightly above $9 per barrel on Tuesday. Before digging into negative prices, it is important to note that the drastic move was caused by people and funds holding positions in the future market who failed to understand the contract specifications and risks of those positions. Crude oil futures are physically delivered, meaning upon settling, those holding long positions are obligated to receive physical barrels of oil. One the other hand, domestic HRC futures are financially settled, meaning US dollars are exchanged at expiration, based on the executed buy and sell prices. Once the oil market found out that there were holders of long futures who had no intent or ability to take physical delivery, it forced them to pay a hefty price to exit those positions. Interestingly, this dislocation probably provided an opportunity for oil companies that insert the futures market in their physical operations. (If you want to transact and hold positions in future markets for your business, make sure to understand the risks or consult with experts. We are here to help!)

While the above scenario with negative prices occurred in the futures market, there are also locations in the US and globally where the spot oil price has turned negative. This means that sellers have to pay buyers to take their oil. This is driven by ballooning inventories and nonexistent demand causing a lack of storage for oil that has already been extracted. This is an important difference from the steel market. Generally, steel producers take orders for future delivery, and then produce the physical steel. The agreed price at the time of the order determines the spot price, which the futures are based on. If there are no orders, the mill will choose to reduce production. However, in the oil market, the physical crude oil is extracted and then it must be sold to determine the spot price. This difference allows steel mills to better control production and inventory levels, and we have seen them do this already in the face of diminishing demand.

However, fluctuations in inventory levels can occur further down the supply chain, and understanding how service centers manage inventory levels over the next few months will give insight into pricing.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

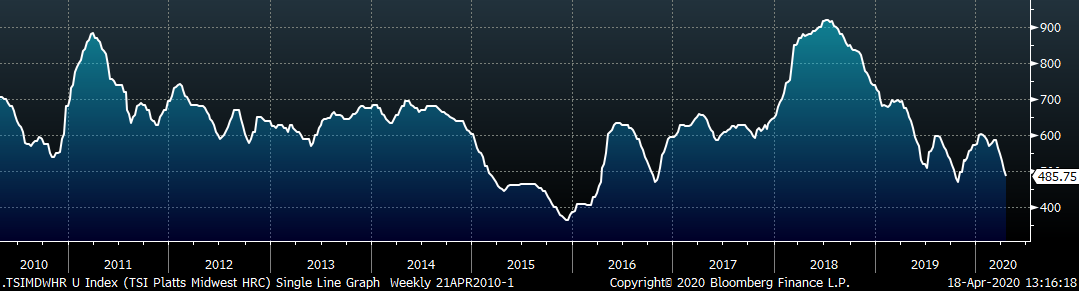

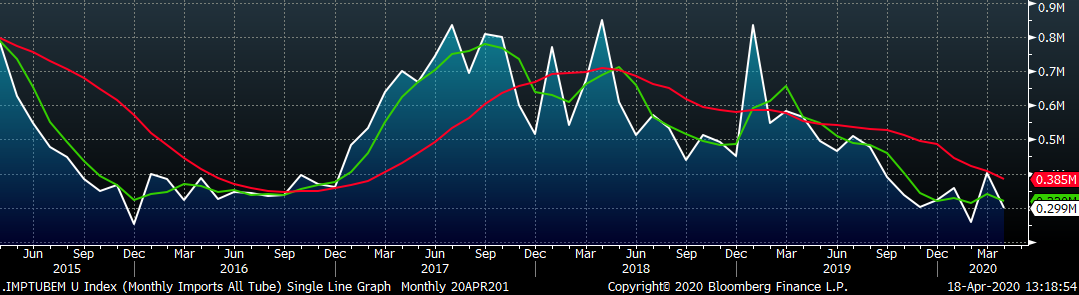

The Platts TSI Daily Midwest HRC Index was down another $17.25 to $485.75.

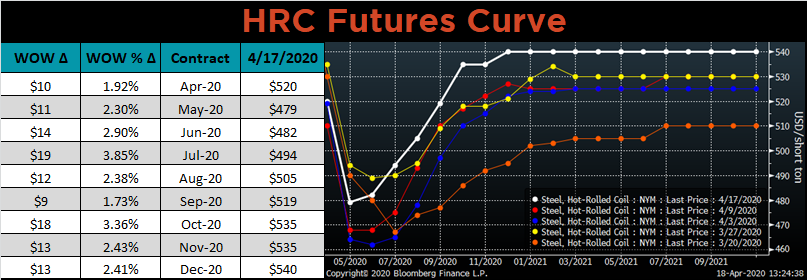

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The curve shifted higher for the second week in a row.

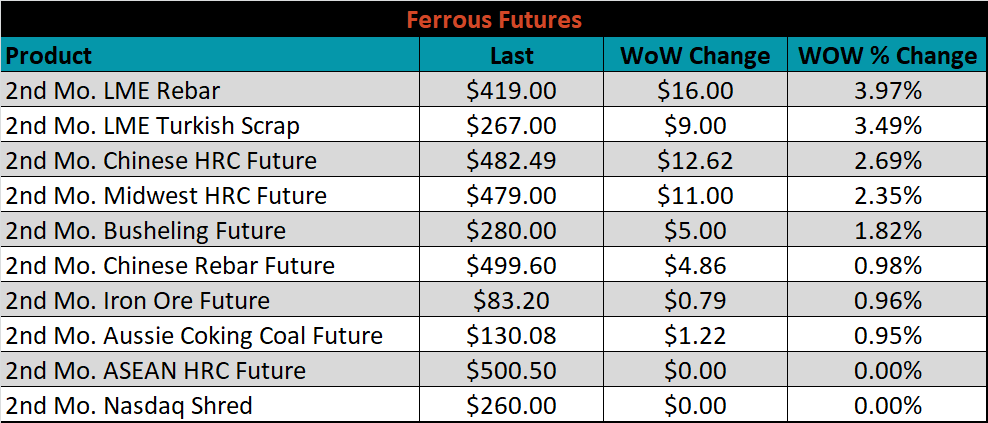

May ferrous futures were mostly higher, led by LME rebar and Turkish scrap, up 4% and 3.5%, respectively.

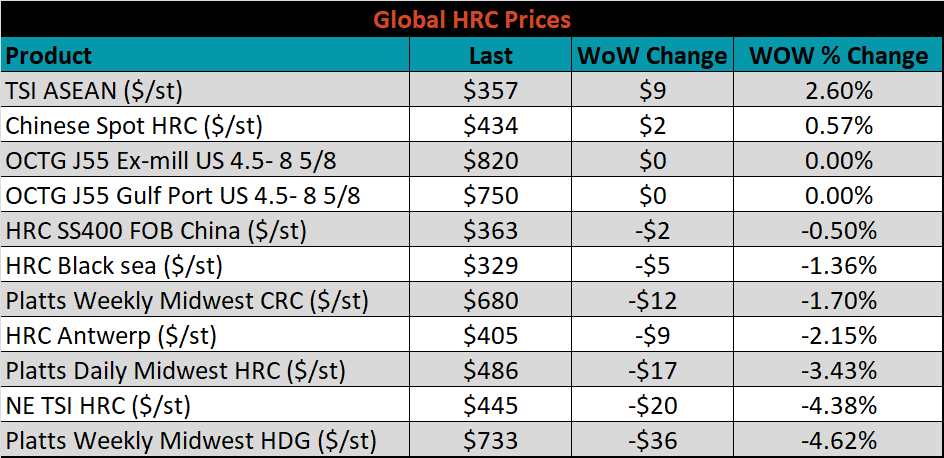

The global flat rolled indexes were mixed. Platts Midwest HDG was down 4.6%, while TSI ASEAN was up 2.6%.

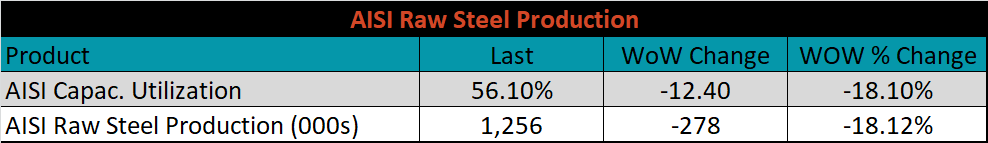

The AISI Capacity Utilization Rate was down another 12.4% to 56.1%.

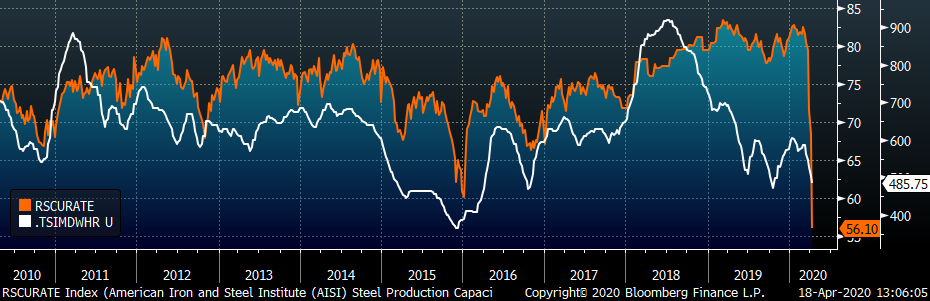

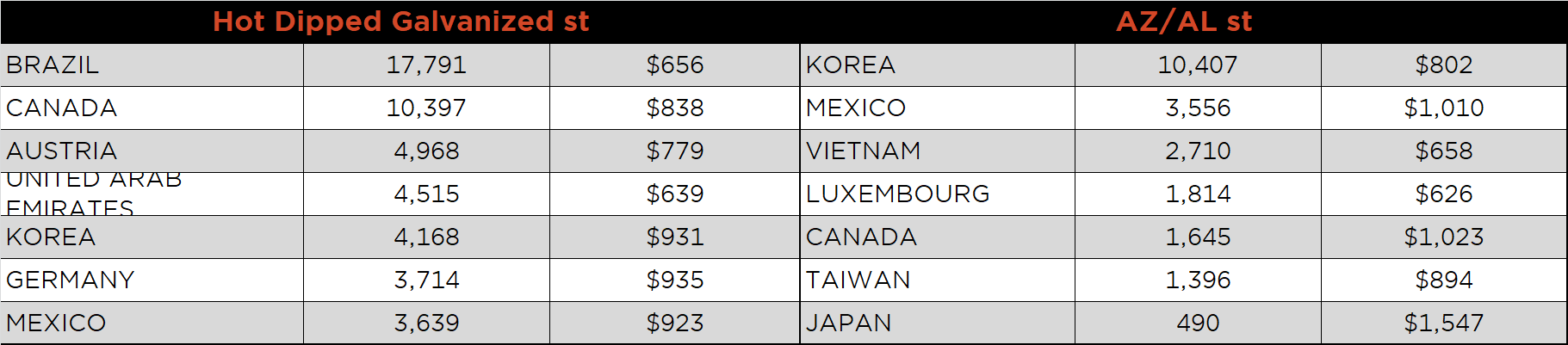

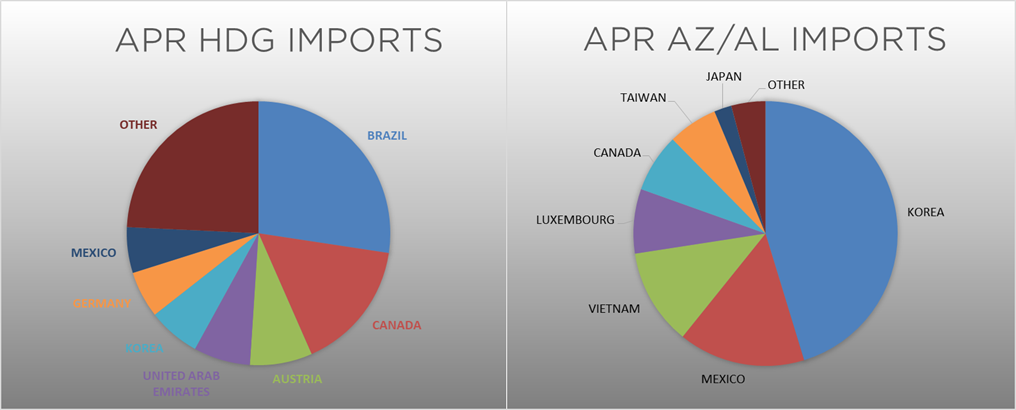

April flat rolled import license data is forecasting an increase of 25k to 707k MoM.

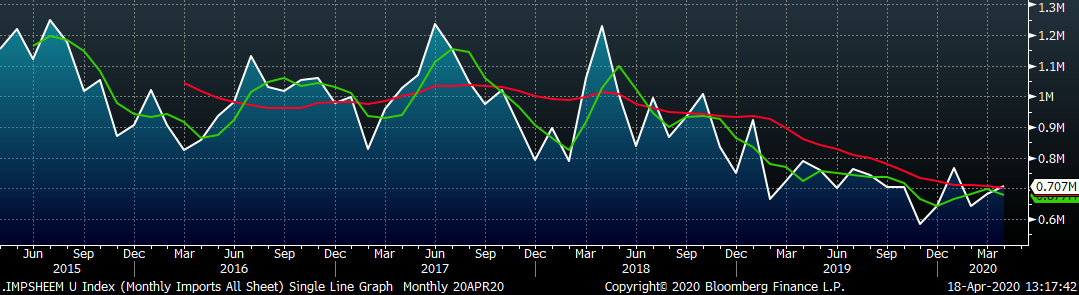

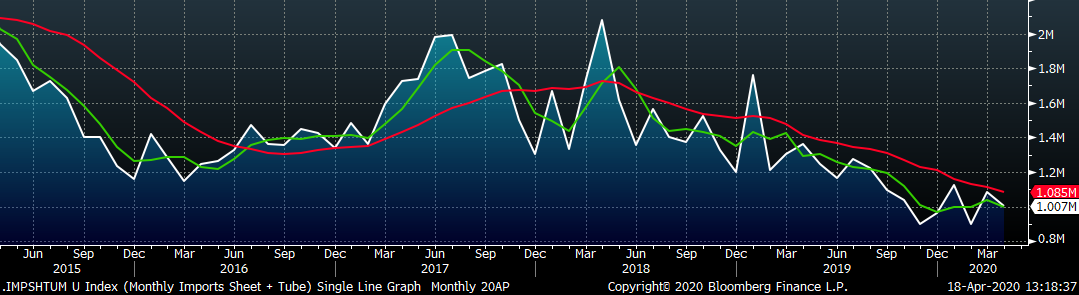

Tube imports license data is forecasting a MoM decrease of 102k to 299k tons in April.

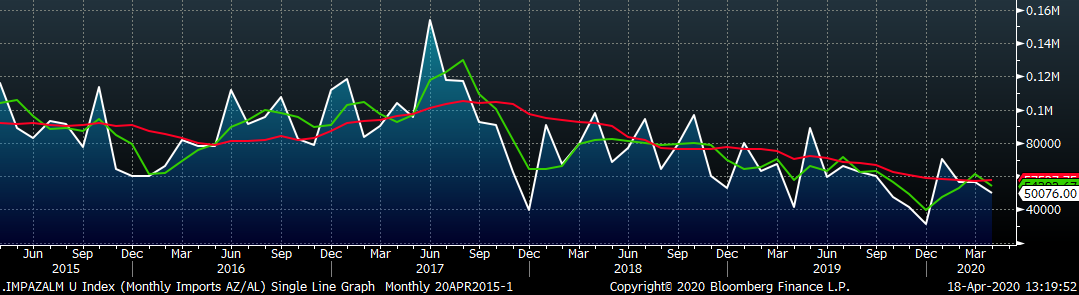

AZ/AL import license data is forecasting a decrease of 7k in April to 50k.

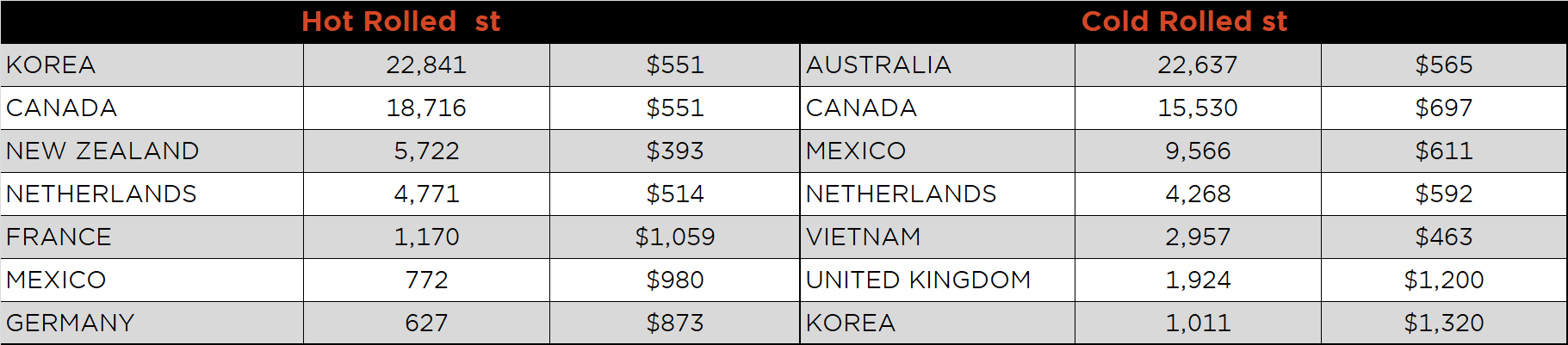

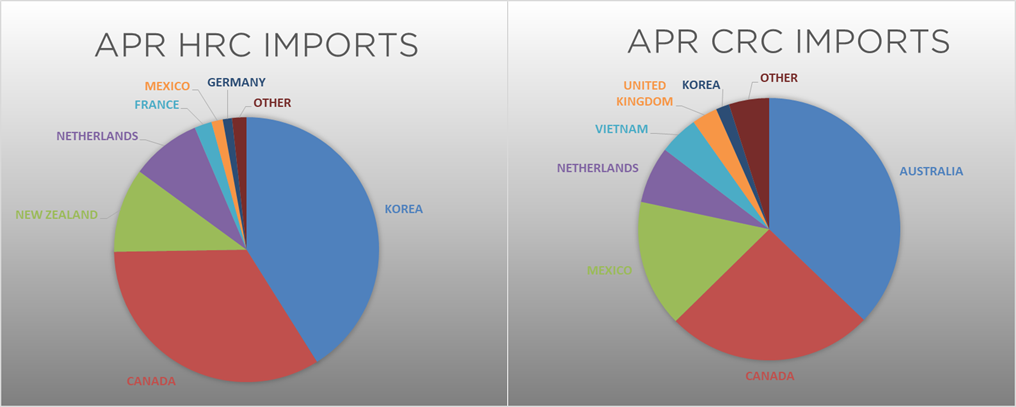

Below is April import license data through April 14, 2020.

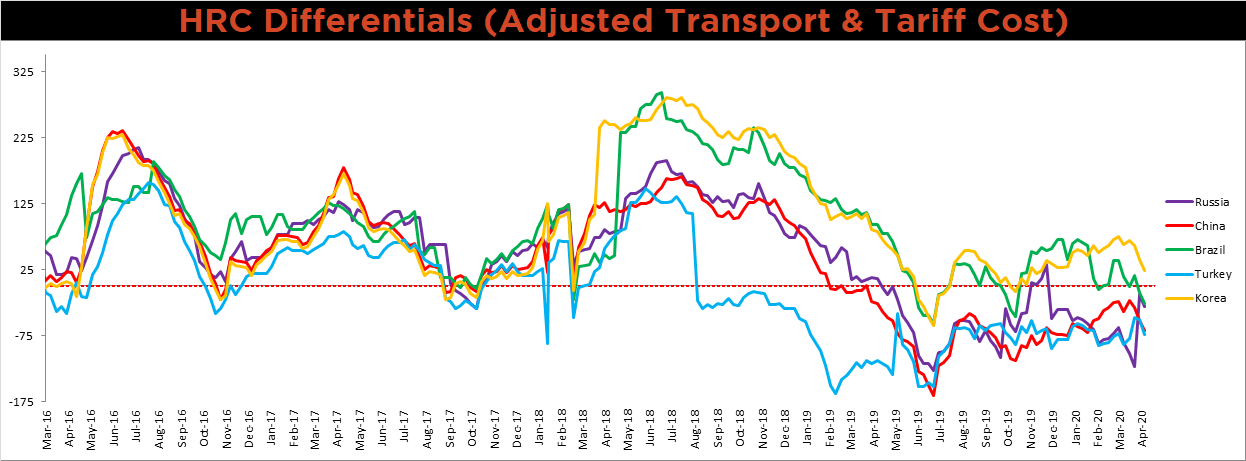

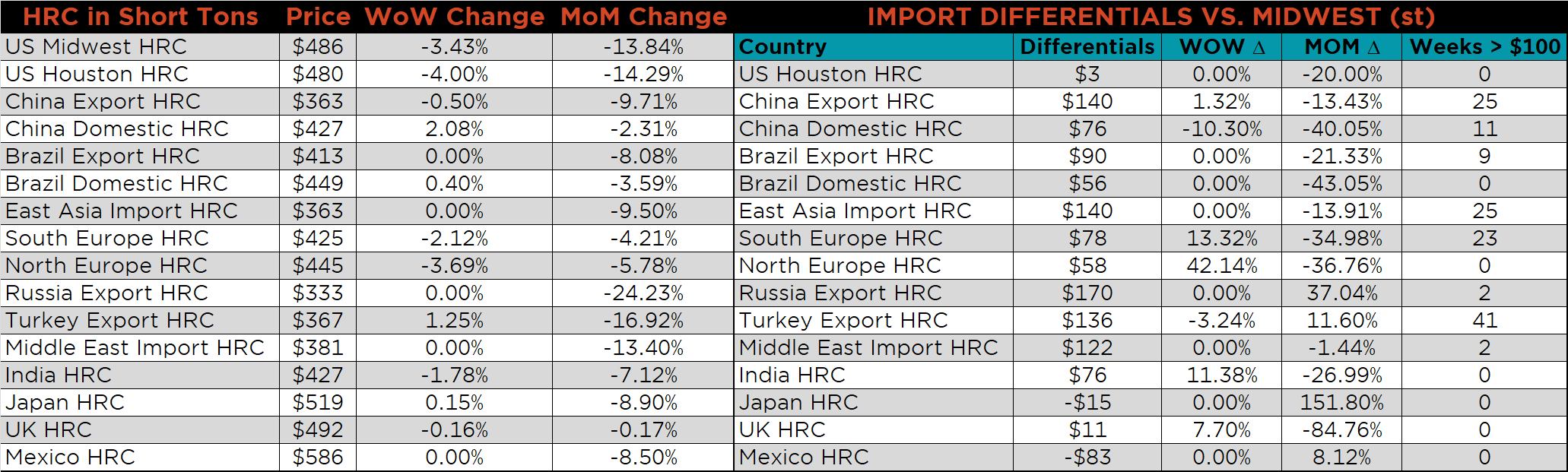

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All five countries differentials decreased as the U.S. domestic price continues to decline rapidly, searching for the floor.

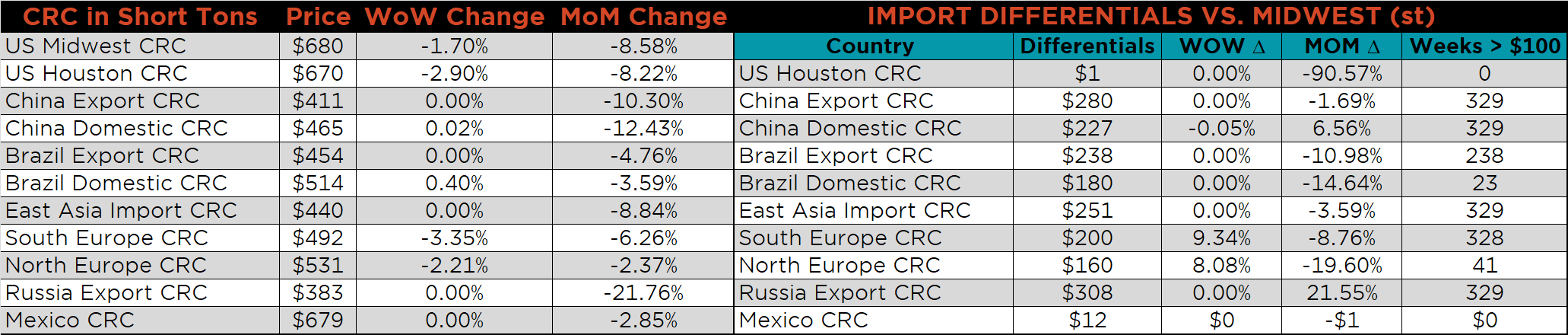

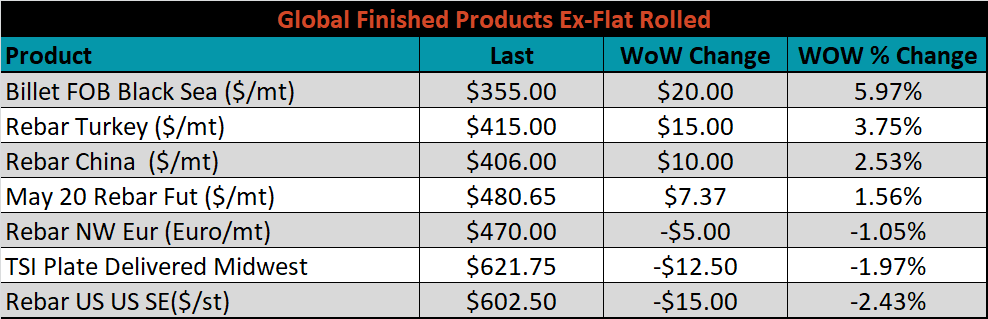

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, HRC and CRC prices were down 4.6%, 3.4% and 1.7%, respectively.

Raw material prices were mixed. Australian coking coal was down 1.5%, while Rotterdam HMS was up another 4.4%.

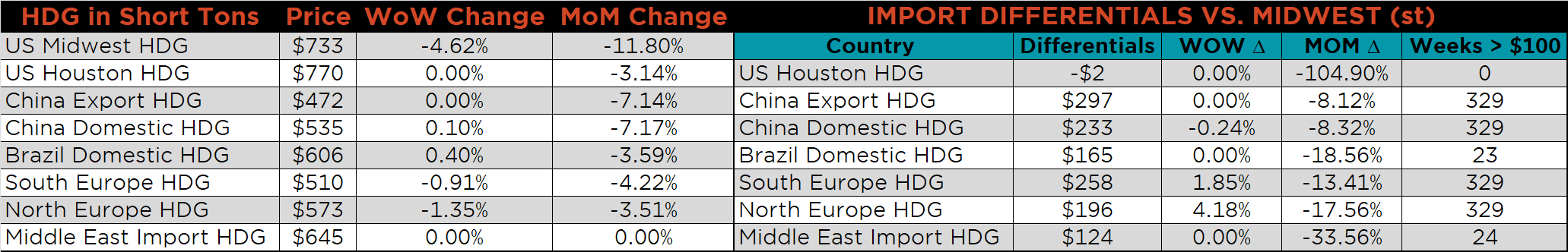

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. The entire curve shifted slightly higher.

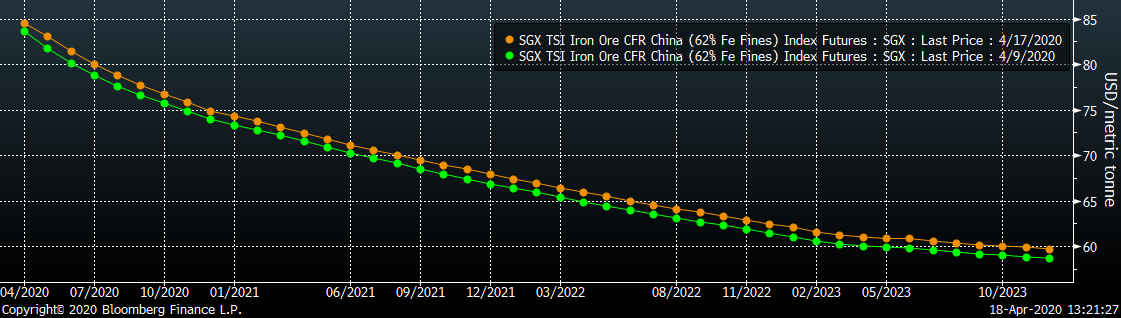

The ex-flat rolled prices are listed below.

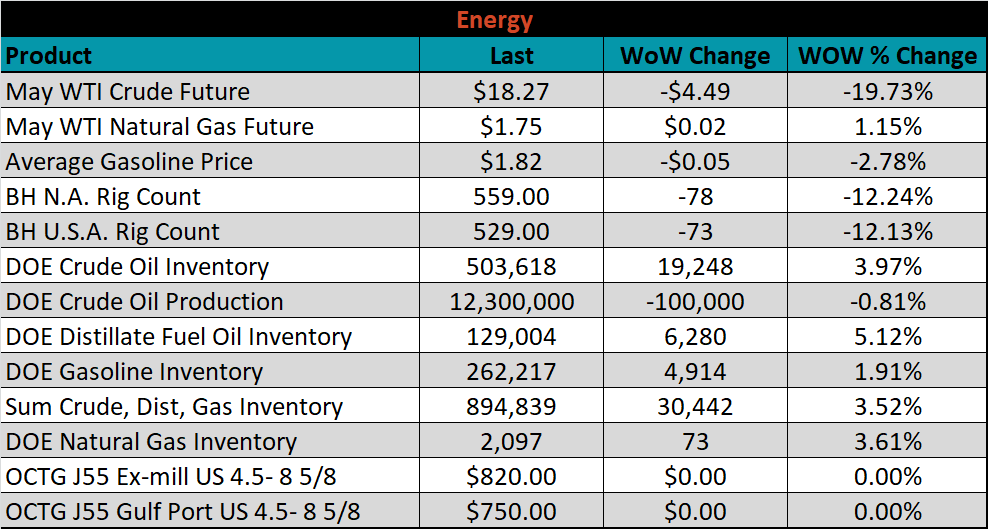

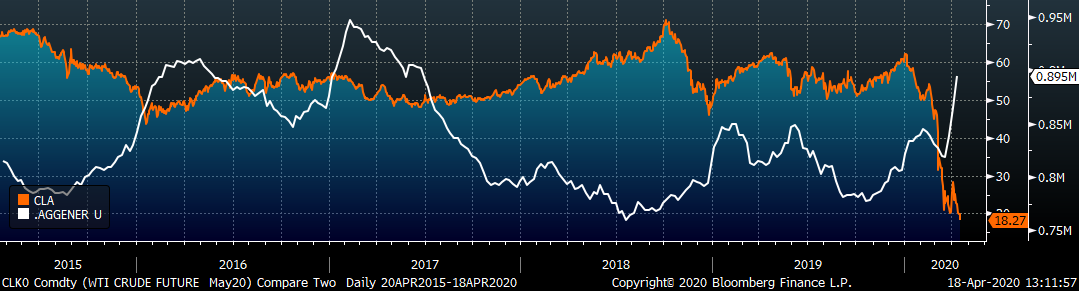

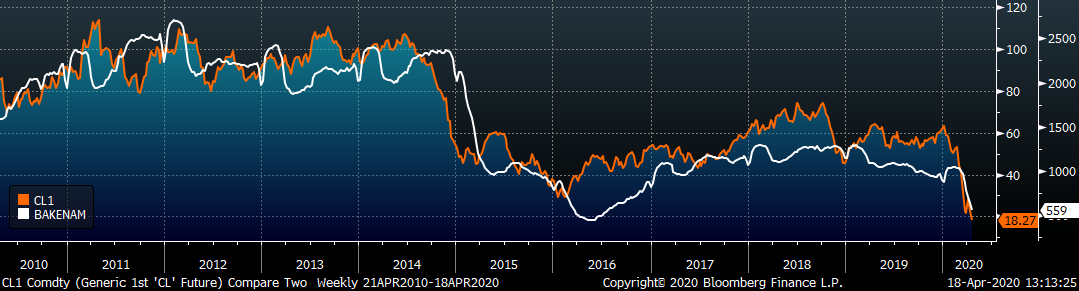

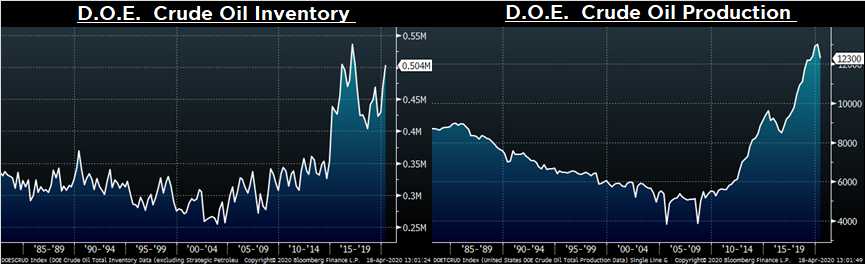

Last week, the May WTI crude oil future lost another $4.49 or 19.7% to $18.27/bbl. The aggregate inventory level was up 3.5% and crude oil production was down to 12.3m bbl/day. The Baker Hughes North American rig count was down another 78 rigs and the U.S. rig count was down 73 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: