Content

-

Weekly Highlights

- Market Commentary

- Risks

The spot price for HRC continues to increase with limited transactions occurring at elevated levels, while mills remain disciplined on maintaining 9-week lead times and not overbooking contracts further out. Much like in recent weeks, any spot material that surfaces is sold quickly and at new record levels. We are currently in the middle of an 8-month rally, and the most troubling part for anyone who is short steel, physically or financially, is that it remains entirely unclear when mills will be caught up. More recently, multiple mills have started forecasting that they will be reinstating contract minimums, to make their backlogs more manageable. Additionally, imports are coming at elevated levels, but these levels below expectations and are insufficient to meaningfully impact the structural shortage. In this week’s report we will dig deeper into why we are starting to believe dynamics in the steel market are not going back to the way they were in the past.

As this rally continued to reach new highs, the murmurs of a bubble in the steel market grew into a clamoring. While no one could have predicted the magnitude of the run up in price, individuals who have remained locked into their perspective of prior rallies are continually hurt by the ever-changing landscape. At FGM, we cannot tell you with any serious level of certainty where or when steel prices will peak, no one can, but we have always been proponents of closely following demand in relation to supply. With that in mind, we have come to believe that a fundamental shift is taking place that will change the domestic market going forward.

Our outlook is colored by three main factors; they each have short-term consequences, but the long-lasting effects could be more severe. The first factor is looming demand in the domestic market. Two main steel intensive subsectors appear prime to drive demand through the end of the year – auto and energy. One of the biggest surprises of last year was how quickly the auto sector bounced back, and while the chip shortage is placing a ceiling on current production, this will likely push demand out further than seasonal norms. Additionally, a strengthening labor market will support auto demand. As far as energy, crude oil and gasoline prices have lagged other commodities over the past year. New demand from the energy sector, that has been largely on the sidelines, poses a massive risk to already short physical steel supply, and thus prices.

The two remaining factors are global, specifically the European and Chinese markets. While Europe has been in the news lately for the poor rollout of vaccines, the signs that the region is recovering are starting to be more pronounced. Anecdotes of European importers buying everything on the global markets are commonplace, and as the region turns the corner economically, their demand for steel will be a significant roadblock for any supply relief in the U.S. domestic market. Finally, the long-awaited announcement – the Chinese government reduced export rebates, while also removing import tariffs, expressing their commitment to reduce steel production to curb emissions. Globally, this means diminishing already low supply. It is clear that the old rules no longer apply and it is time to start looking into the future to see where the forward curve can offer relief and stability to your prices when you already know you need to be purchasing steel.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

The Platts TSI Daily Midwest HRC Index increased by $40.75 to $1,429.50.

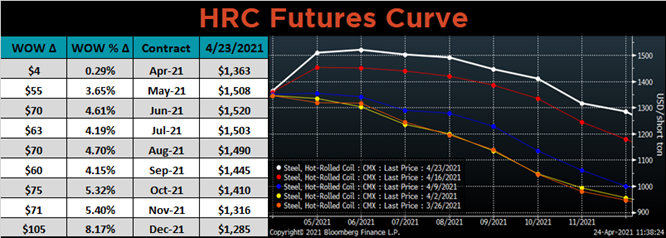

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the entire curve shifted higher at all expirations. The willingness of buyers to lock in HRC prices above $1250, 8 months in the future is a stark reminder of the severity of the structural shortage.

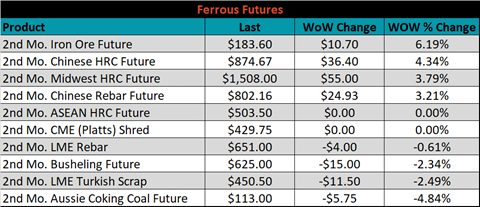

May ferrous futures were mixed. The iron ore future gained 6.2%, while Aussie coking coal lost 4.8%.

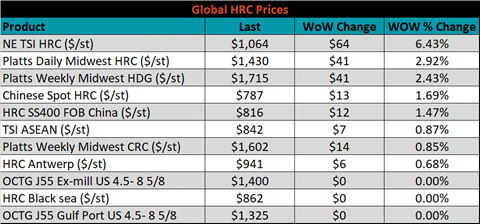

Global flat rolled indexes were all higher, led by Northern European HRC, up 6.4%.

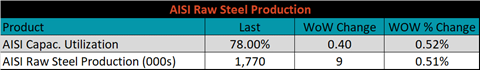

The AISI Capacity Utilization rate increased 0.4% to 78%.

Below is an updated look at our Mill Fill Index (white) and the 3-month moving average (red). The index shows a recovery in March after February weather and shipping tightness significantly diminished mills ability to get tons out the door. The increase is a welcome sign to a market that does not have enough steel, but more recent data shows that demand today remains well above this supply available.

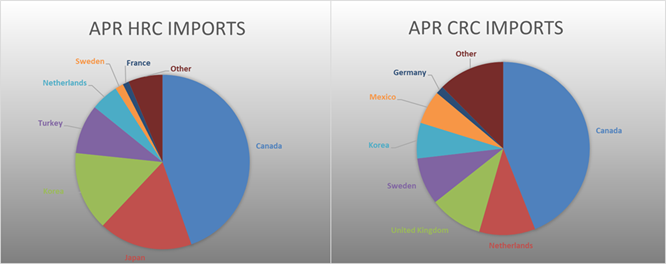

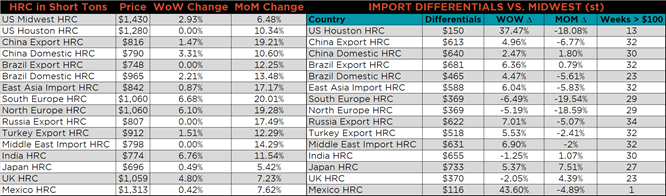

April flat rolled import license data is forecasting a decrease of 54k to 848k MoM.

Tube imports license data is forecasting a decrease of 78k to 277k in April.

April AZ/AL import license data is forecasting an increase of 4k to 116k.

Below is April import license data through April 20, 2021.

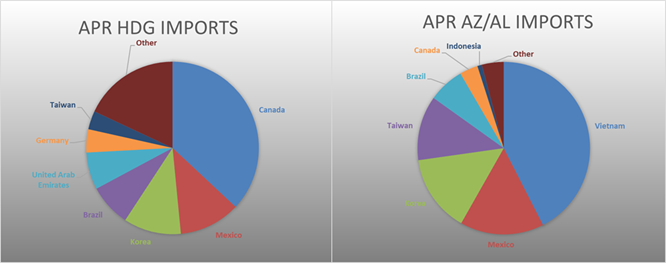

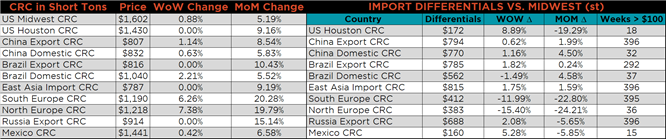

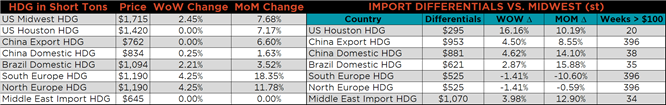

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the watched differentials increased again this week, as the U.S. price continued to push higher than global prices.

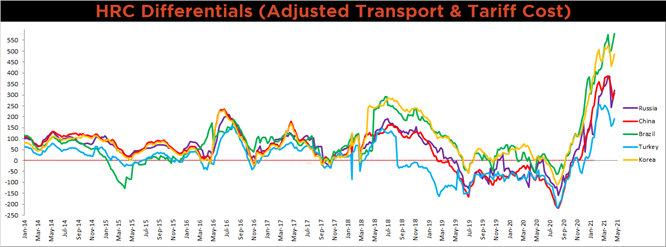

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, HDG & CRC prices were up, 2.9%, 4.5% and 0.9%, respectively. Globally, the Indian HRC price was up 6.8%.

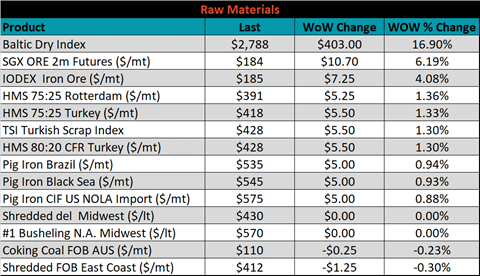

Raw material prices were mixed, June iron ore futures gained 6.2% while East Coast shredded was down slightly, just 0.3%.

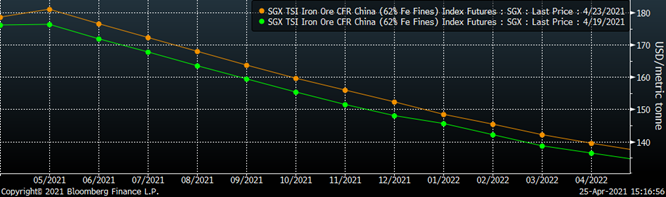

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week the curve shifted higher at all expirations, for the 3rd week in a row.

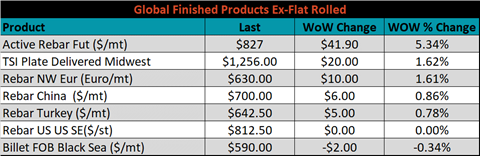

The ex-flat rolled prices are listed below.

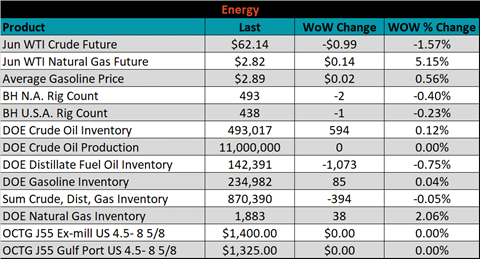

Last week, the June WTI crude oil future was down $0.99 or 1.6% to $62.14/bbl. The aggregate inventory level was down another 0.1%, while crude oil production remains at 11m bbl/day. The Baker Hughes North American rig count was down 2 rigs, and the U.S. rig count was down 1 rig.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: