Content

-

Weekly Highlights

- Market Commentary

- Risks

The steel market over the last several weeks, just like many of our lives in quarantine, has been extremely boring. Every week seems to be the same story – spot indexes drifting lower, forward curve trading in the same $20/st range, mills idling plants and reducing production, and uncertainty surrounding an economic restart and demand outlook. While this routine may encourage the expectation that there is no end in sight, it is important to stay vigilant as many indicators are pointing to abrupt changes in the market, which could occur in the very near future. We will discuss the most important signals below.

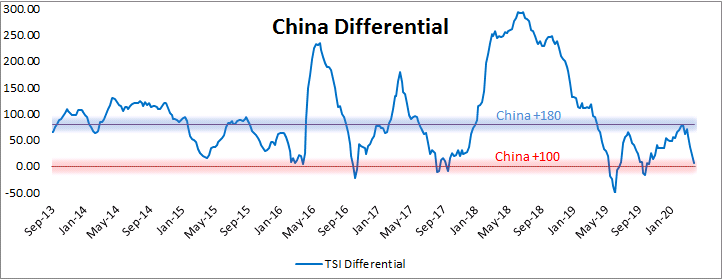

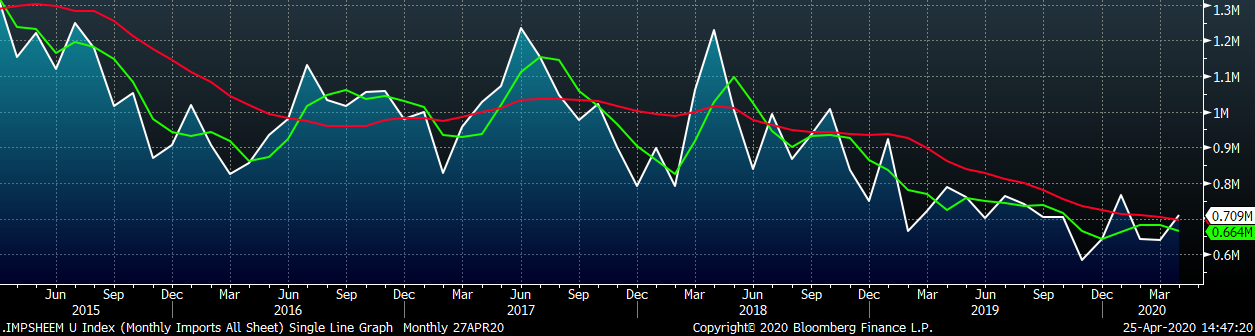

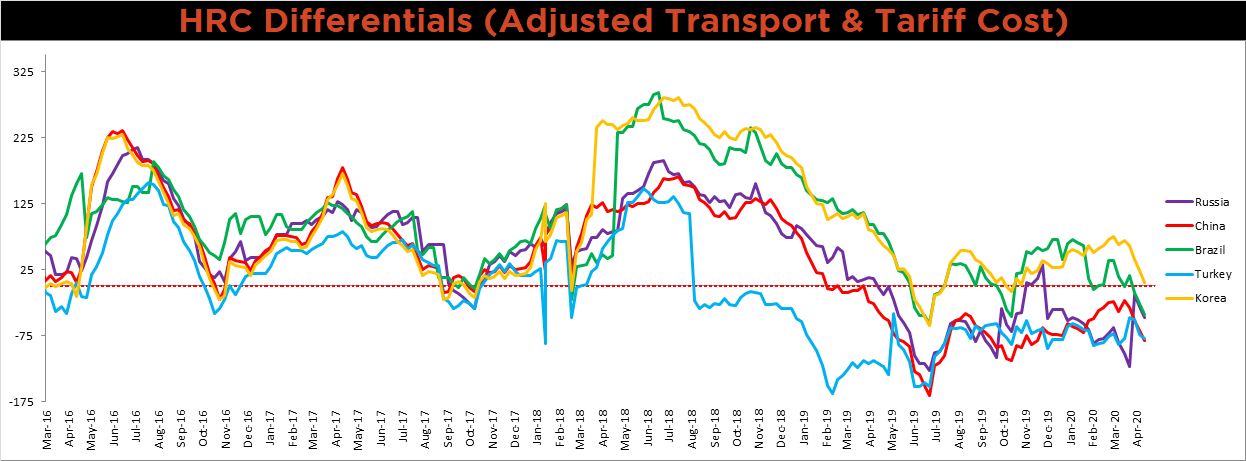

Frequent readers of this report have seen the below graph multiple times, showing the differential between the TSI Platts Midwest HRC Index and the Platts China export price.

The red line represents the differential level where the delivered price on material from China would theoretically be the same as the domestic price. While imports from China into the domestic market are non-existent, the export price tends to drive the world price making it a useful proxy for the general world price. The blue differential line is nearing historical low levels that tend to coincide with a bottom in domestic price. This is a signal that importing material is currently unattractive, in line with the low levels of imports we have seen recently. Moreover, supply chain disruptions are likely to add additional cost to importing, further discouraging foreign buys. This is bullish for spot prices over the next several months.

With limited foreign supply, many will turn to domestic mills to fill their current spot needs. However, we have seen swift and substantial production cuts at domestic producers, due to their expectations for declining spot pricing. With indexes reflecting spot activity below $450/st for HRC, discounted contract pricing is below the cost to produce the material. This is because raw material prices, namely scrap, has been resilient due to the constrained market where very little scrap is created. May busheling futures are trading near $300, indicating a metal spread to spot HRC below $150. Low or negative profits are unsustainable and will force further production cuts, paring an already limited domestic supply. This is also bullish for spot prices.

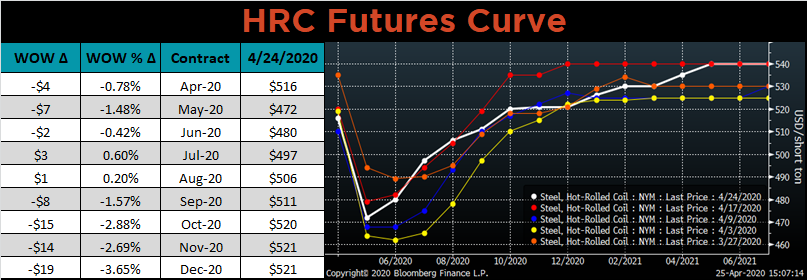

Looking at the market’s expectations on the forward curve, May future is trading near $470/st. This would suggest that spot transaction price will increase over the next month. This steep contago in the curve continues out into 2021, where the futures are priced nearly $100 higher than the current spot price. Our advice at FGM to a buyer right now would echo the message of the curve – Buy spot tons now, because they will be priced higher in the future. If we haven’t already hit the near-term bottom, we will reach it soon.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

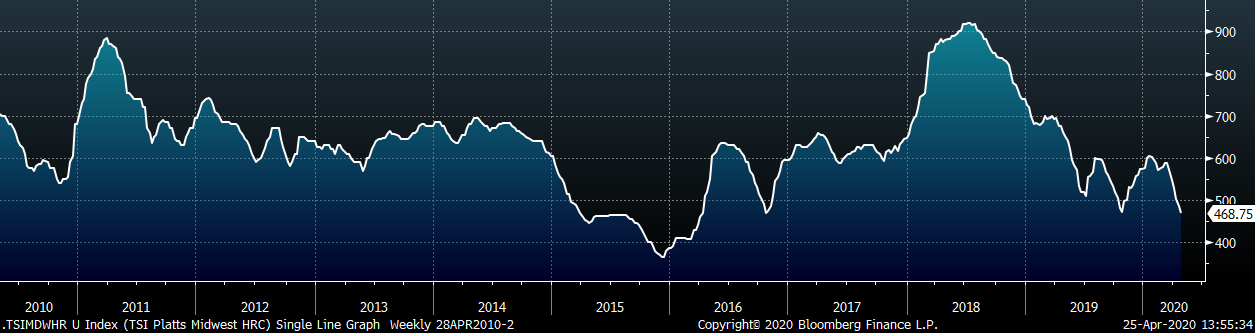

The Platts TSI Daily Midwest HRC Index was down another $17 to $468.75.

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The front of the curve was relatively flat, while the back shifted more significantly lower.

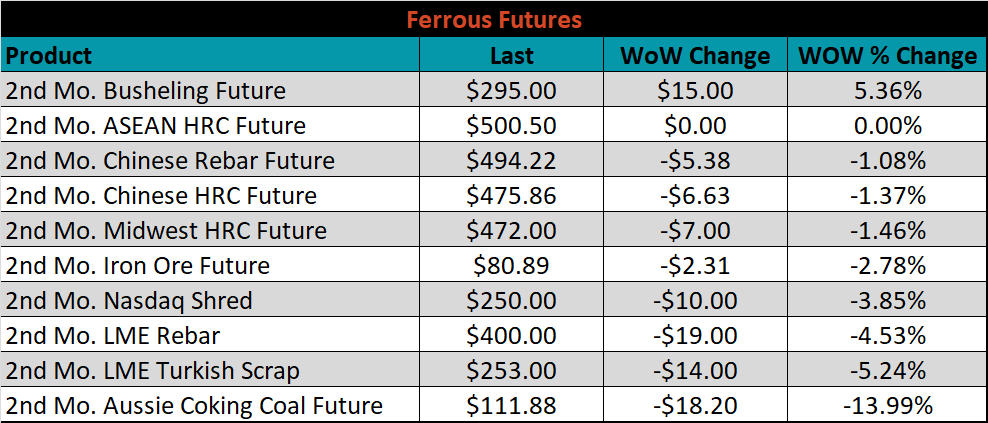

May ferrous futures were mixed. Busheling gained 5.36%, while Aussie coking coal lost 14%.

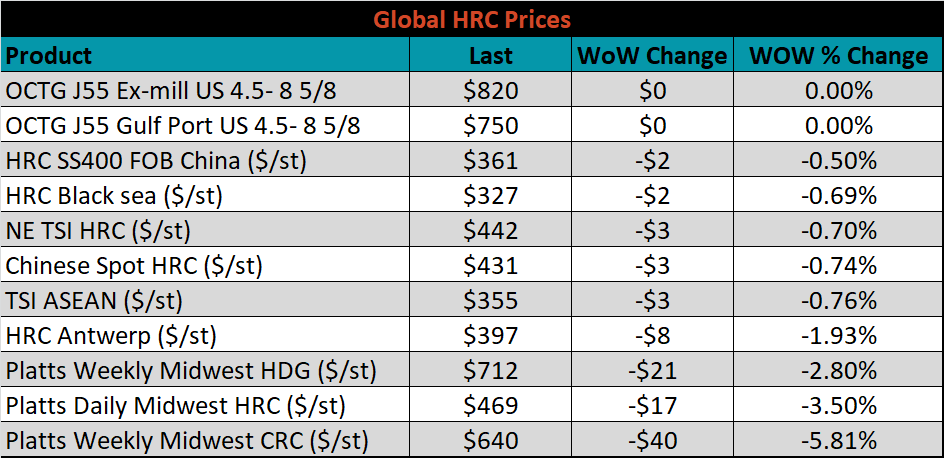

The global flat rolled indexes were all lower, led by Platts Midwest CRC and HRC, down 5.8% and 3.5%, respectively.

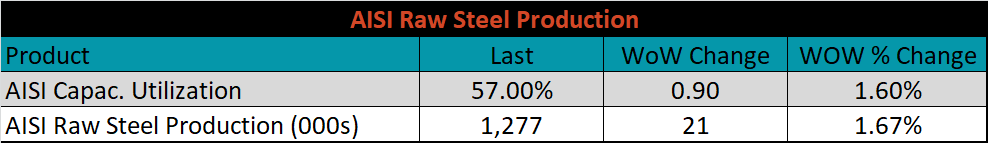

The AISI Capacity Utilization Rate bounced from its recent free fall, up 0.9% to 57%.

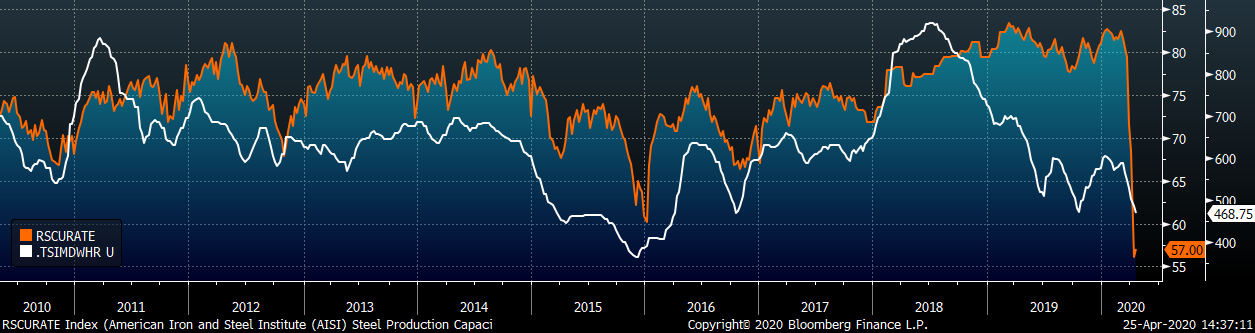

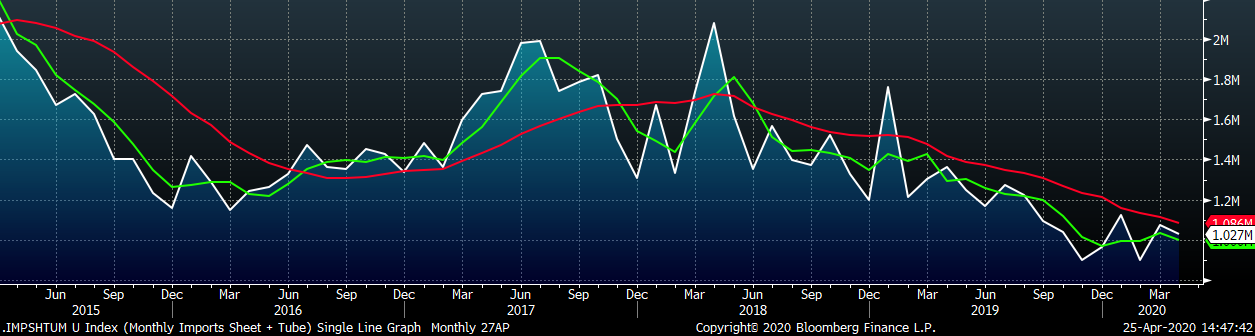

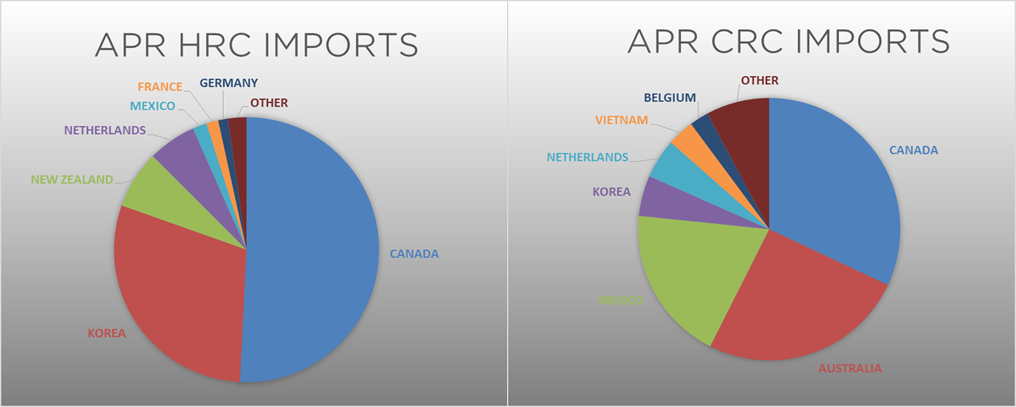

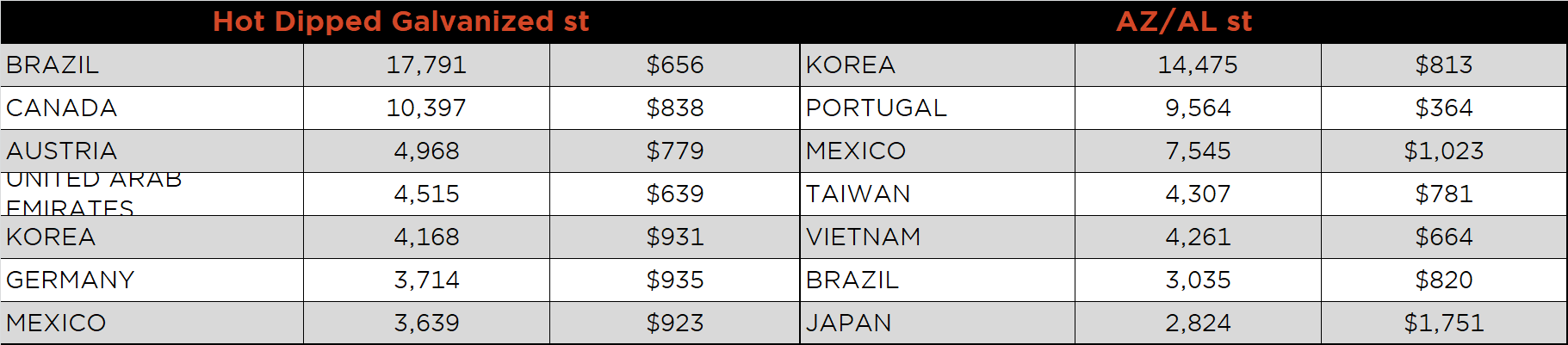

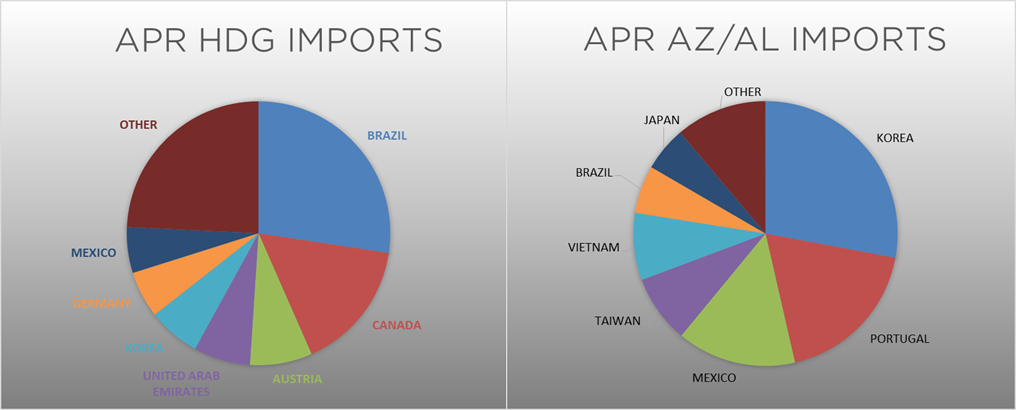

April flat rolled import license data is forecasting an increase of 68k to 709k MoM.

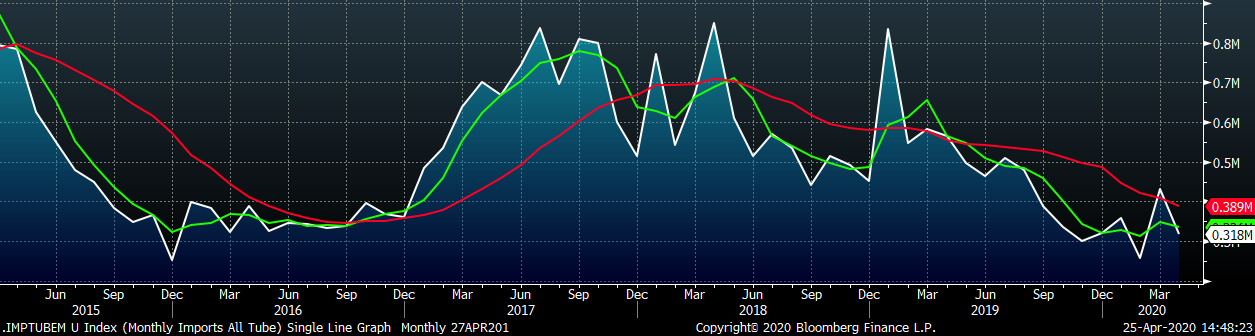

Tube imports license data is forecasting a MoM decrease of 113k to 318k tons in April.

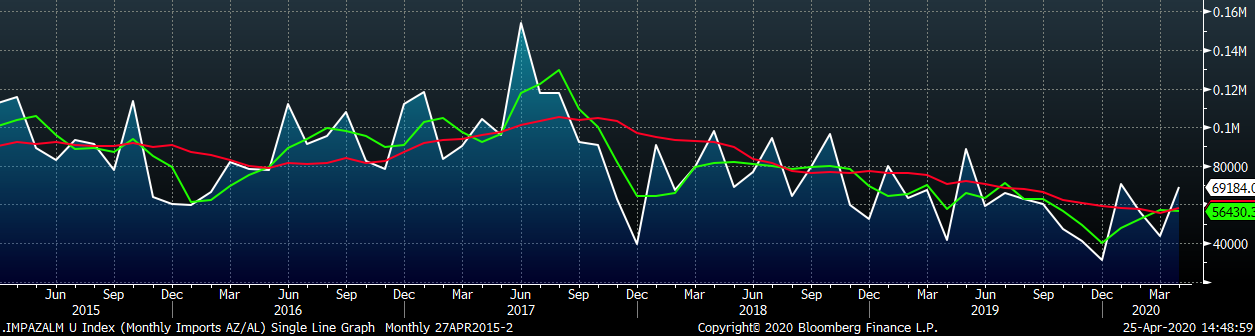

AZ/AL import license data is forecasting an increase of 25k in April to 69k.

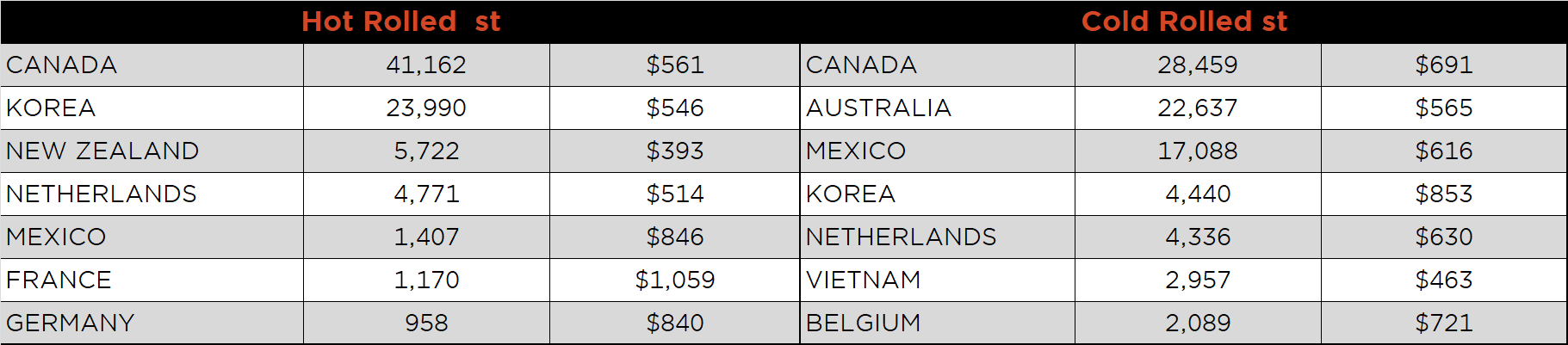

Below is April import license data through April 21, 2020.

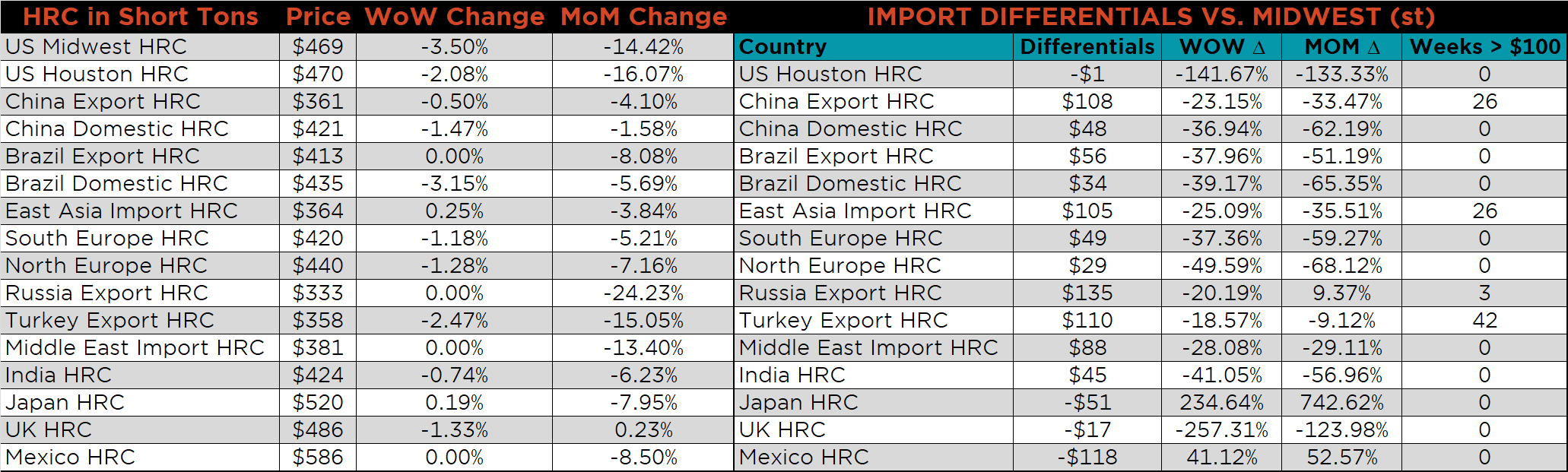

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All five countries differentials decreased again last week as the U.S. domestic price continues to decrease.

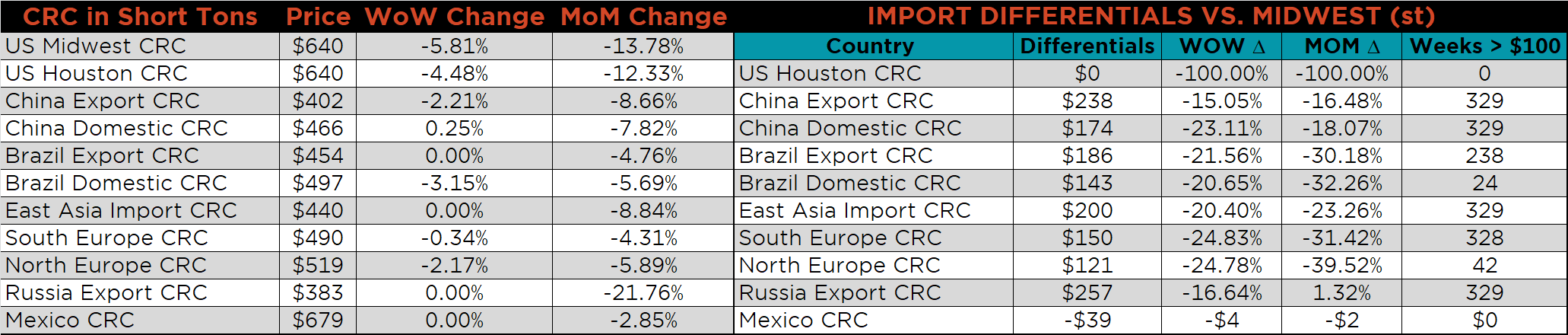

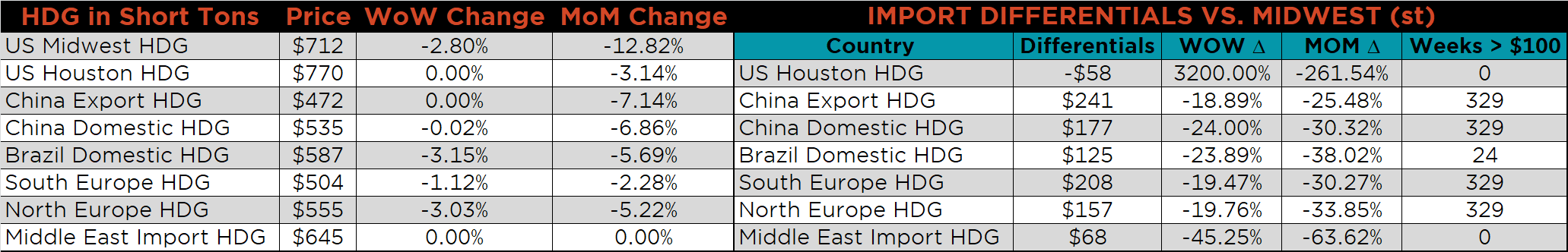

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest CRC, HRC and HDG prices were down 5.8%, 3.5% and 2.8%, respectively. Globally, the Turkish export HRC price was also down 2.5%.

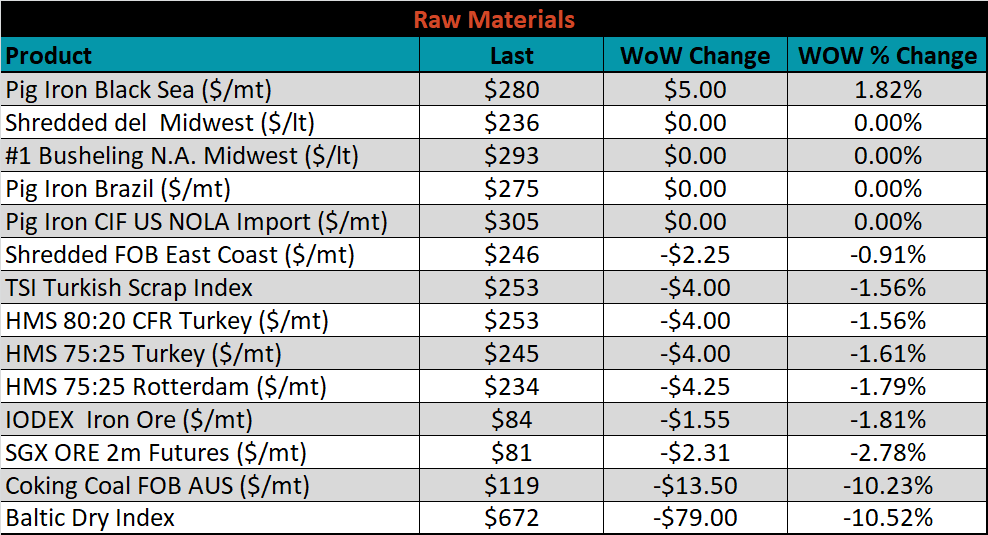

Raw material prices were mixed. Black Sea Pig Iron was up 1.8%, while Australian coking coal was down 10.2%.

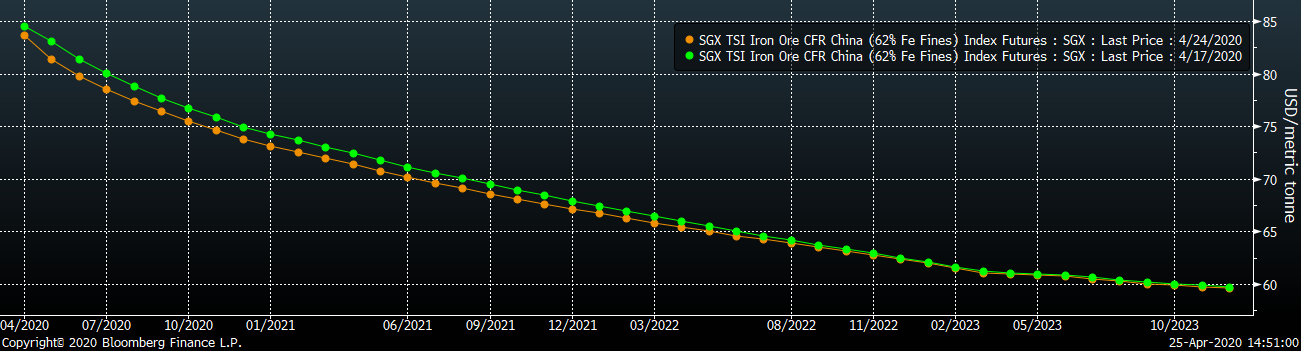

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. The front of the curve shifted slightly lower.

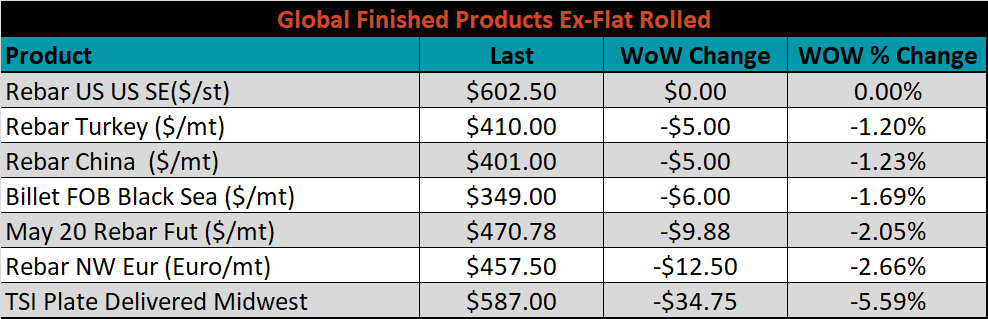

The ex-flat rolled prices are listed below.

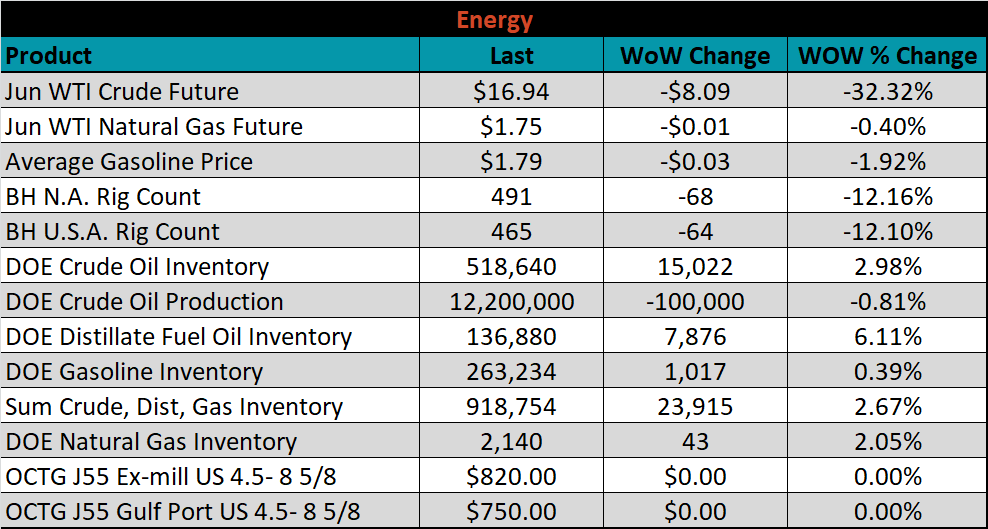

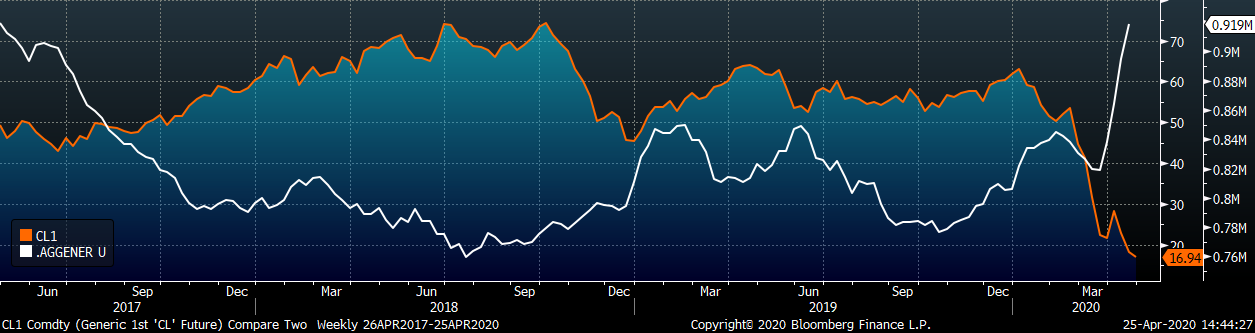

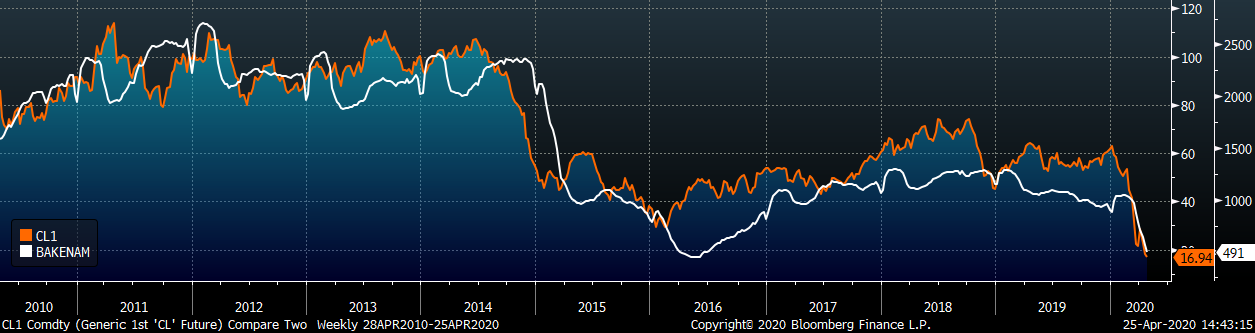

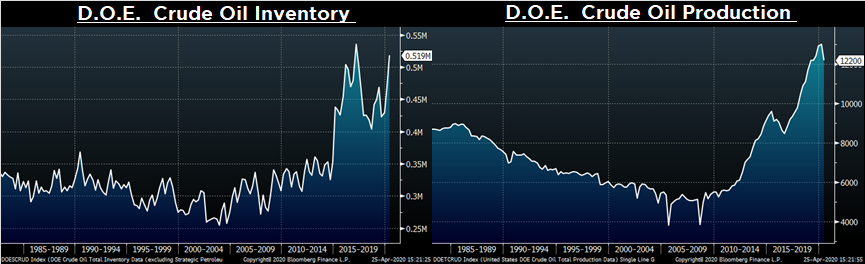

Last week, the June WTI crude oil future lost another $8.09 or 32.3% to $16.94/bbl. The aggregate inventory level was up 2.7% and crude oil production was down to 12.2m bbl/day. The Baker Hughes North American rig count was down another 68 rigs and the U.S. rig count was down 64 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: