Content

-

Weekly Highlights

- Market Commentary

- Durable Goods

- Upside & Downside Risks

Over the last couple of weeks, global news around ferrous markets have been driving the U.S. prices. The most important news from last week came on Thursday, April 7th when the Congress voted to remove the “most favored nation” trade status from Russia. While the new tariffs on steel and aluminum will have a measurable impact on prices, it should be noted that this means the worst-case scenario for global trade did not materialize. When Russia invaded the Ukraine, the global ferrous futures markets quickly reacted to the possibility of an impending raw material and finished steel shortage due to import bans and halted production in the CIS. Instead of placing a full ban on Russian exported metals (like the government did with oil, natural gas, coal, seafood, and alcohol) this vote results in new 20-25% tariffs on semi-finished steel, finished steel, aluminum, and most importantly for EAFs a $1.11/MT tariff on pig iron. What has become clear, even prior to the vote, is that Russian material will be making its way around the world whether through China, and India or through traditional supply chains at elevated prices. So, what does this mean for steel in the U.S. domestic market? While there are remaining details to be worked out with Russian exports, a prolonged shortage of raw materials does not appear to be on the horizon. However, if you are assuming this will result in relief for elevated spot pricing, we believe you have taken this news a step too far.

If you read the report dated February 18th, we make it clear that we were bullish in our price outlook for the rest of 2022. While the pace of the ensuing HRC rally was primarily driven by the war, we believed that the bottom was being established in the physical market and prices would start to rise anyways. All the fundamentals that were driving the market were pointing to higher domestic HRC prices. Global differentials were negative, demand was strong, raw material costs were high and rising, and supply chain issues and costs were not subsiding.

In the current domestic market, mill spot availability has continued tightening. Tons are out there, but they are priced higher than published spot prices and rather than chasing orders, mills are pushing back on buyers attempts to max-out contracts. The key takeaway from this should be that while the worst-case scenario did not come to pass, transactions are occurring at these levels and there is additional upside risk in the medium-term as demand picks up in warmer weather.

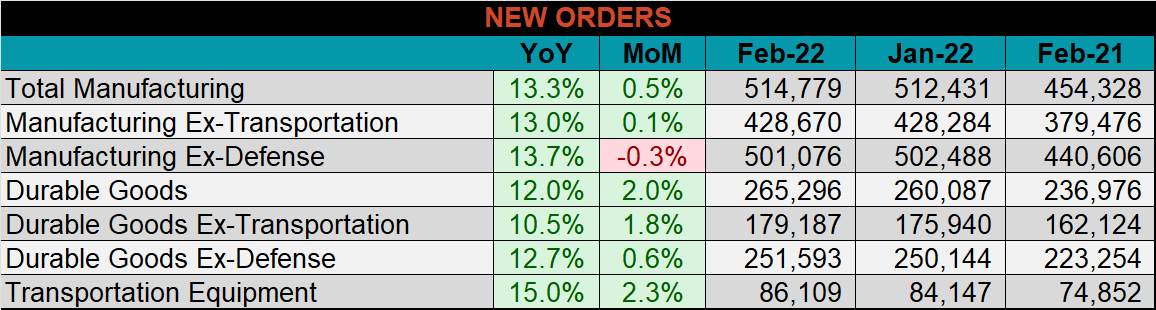

Below are final February new orders from the Durable Goods report, which shows growing demand within the manufacturing sector. Manufacturing ex-transportation new orders were up 13% compared to February 2021 and up slightly 0.1% compared to January.

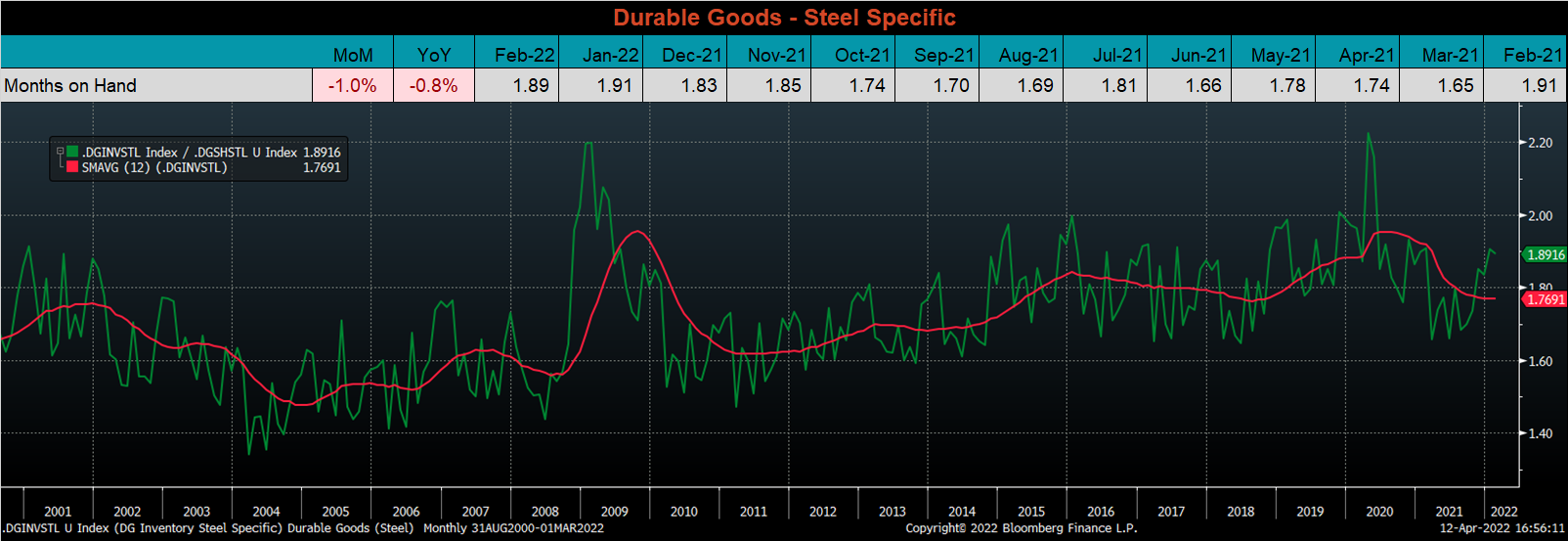

The chart looks at the months on hand (inventory divided by shipments) for durable goods categories that are steel intensive. Inventories for steel intensive manufactured goods have steadily grown for 14 straight months, since December 2020, while shipments have been flat since November 2021. This is causing the MOH to increase while the 12-month moving average leveled off. Another important factor to keep in mind is that the backlog within steel specific durable goods, which continues to expand as new orders have surpassed shipments 10 of the last 12 months.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

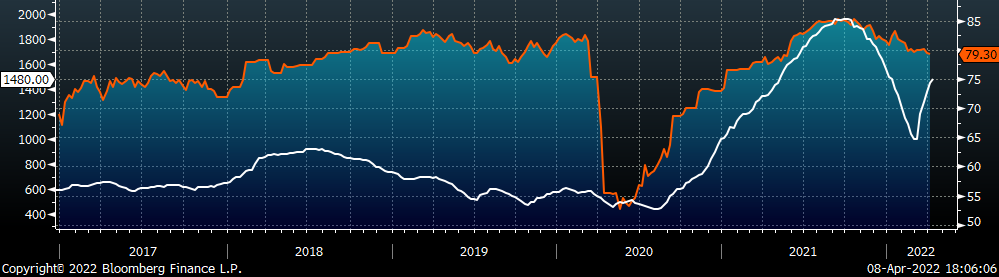

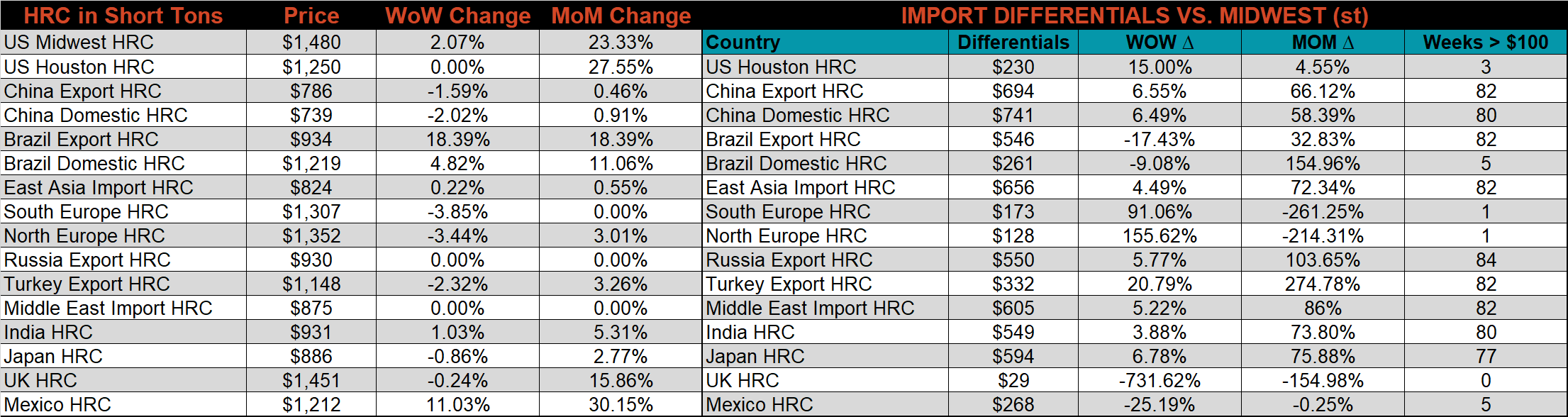

The Platts TSI Daily Midwest HRC Index was up another $30 to $1,480.

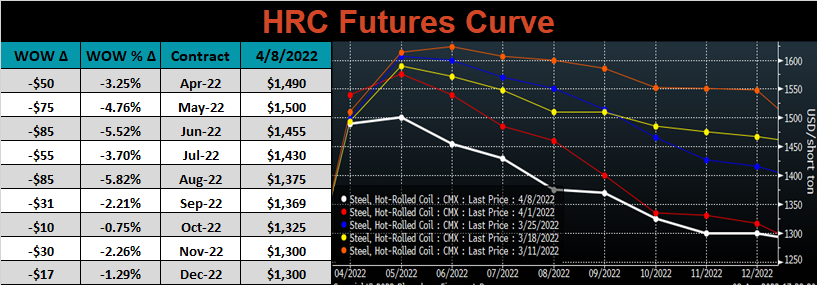

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The front of the curve sold off most significantly last week.

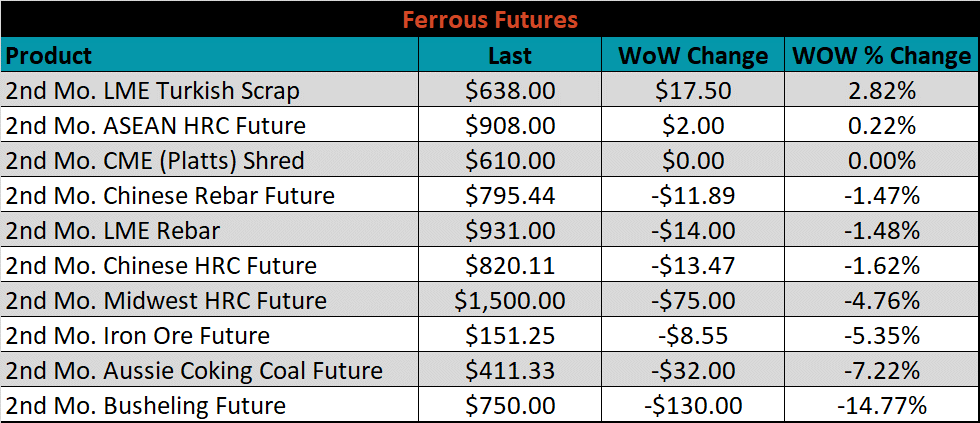

May ferrous futures were mostly lower, led by busheling, which lost 14.8%, while Turkish scrap gained another 2.8%.

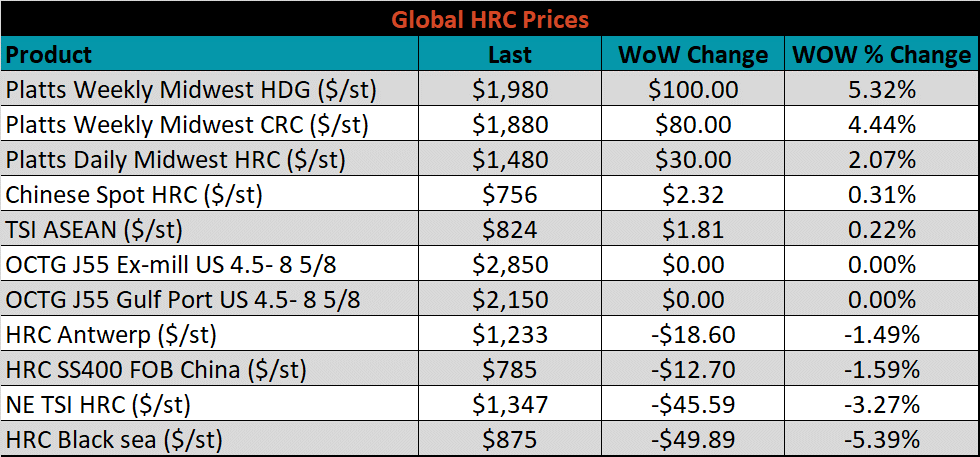

Global flat rolled indexes were mixed, with U.S. domestic prices rising most significantly for the second week in a row, while Black Sea HRC is down another 5.4%.

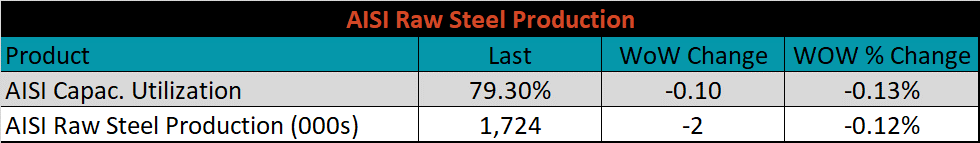

The AISI Capacity Utilization was down 0.1% to 79.3%.

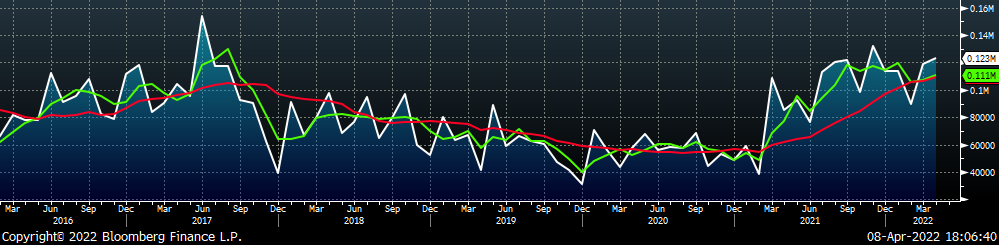

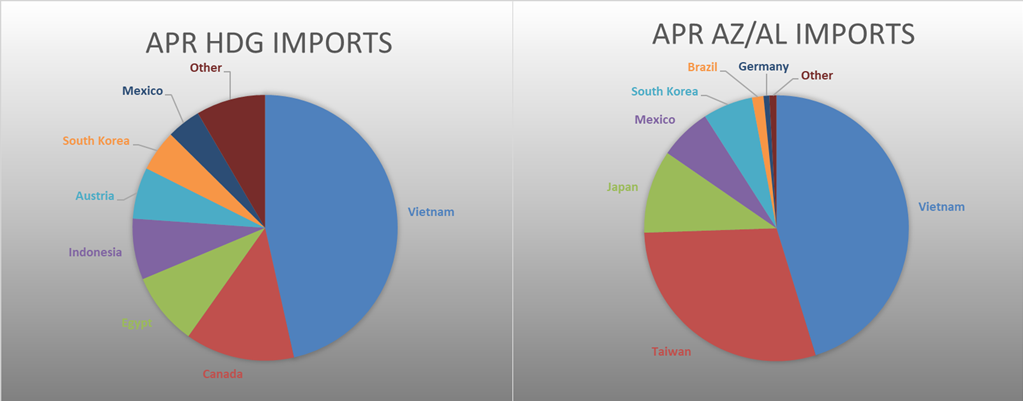

April flat rolled import license data is forecasting a decrease of 54k to 1.09M MoM.

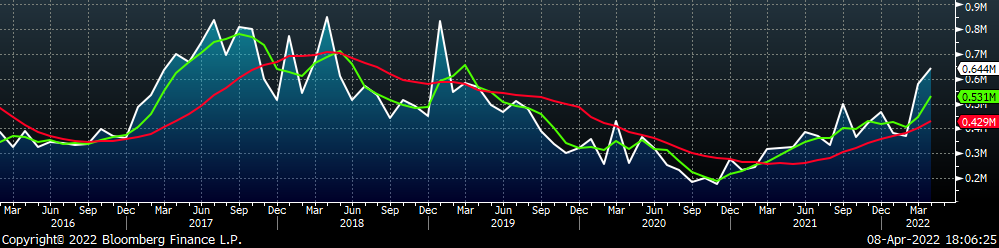

Tube imports license data is forecasting an increase of 63k to 644k in April.

April AZ/AL import license data is forecasting an increase of 4k to 123k.

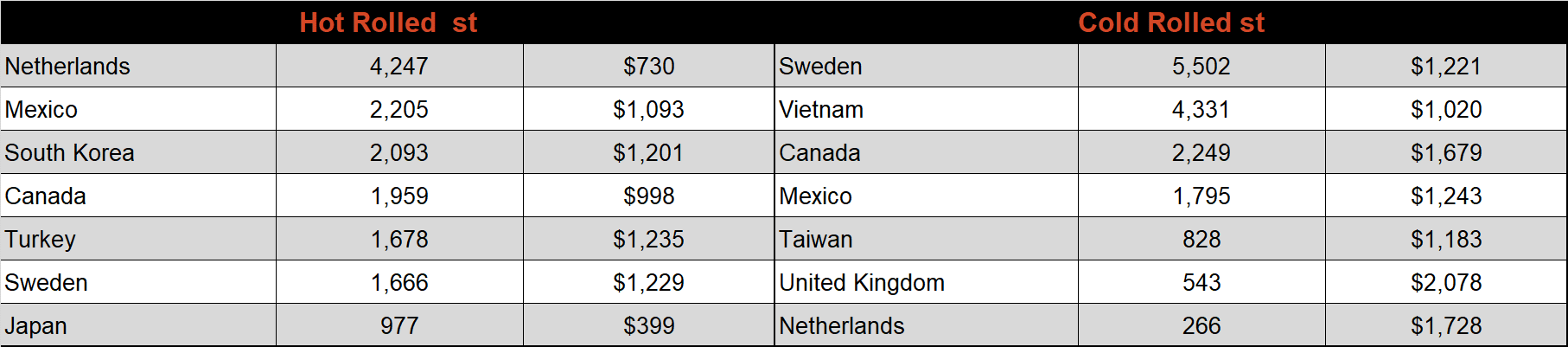

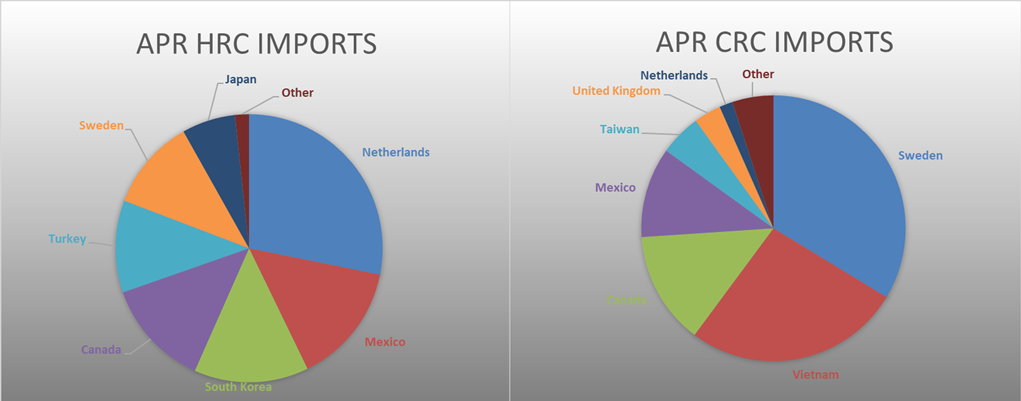

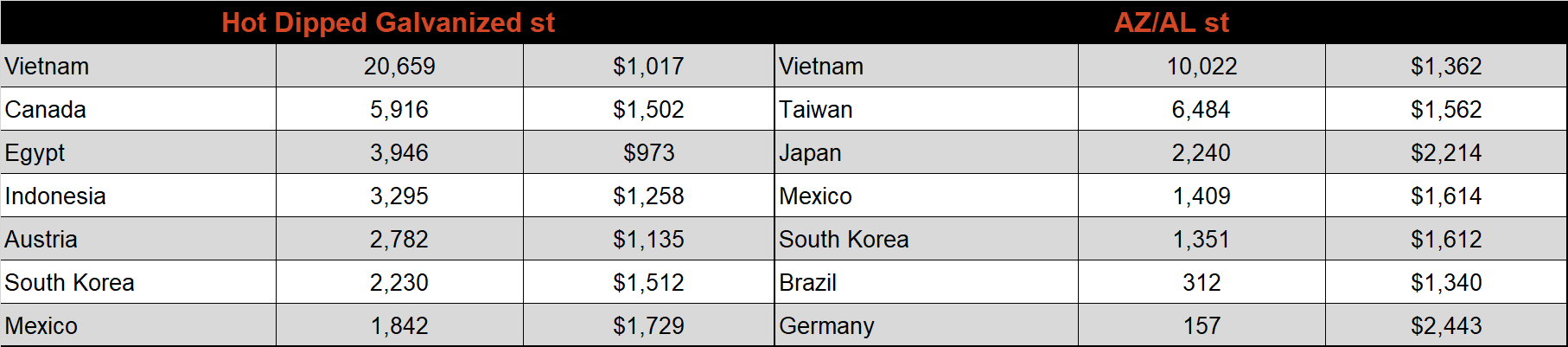

Below is April import license data through April 4th, 2022.

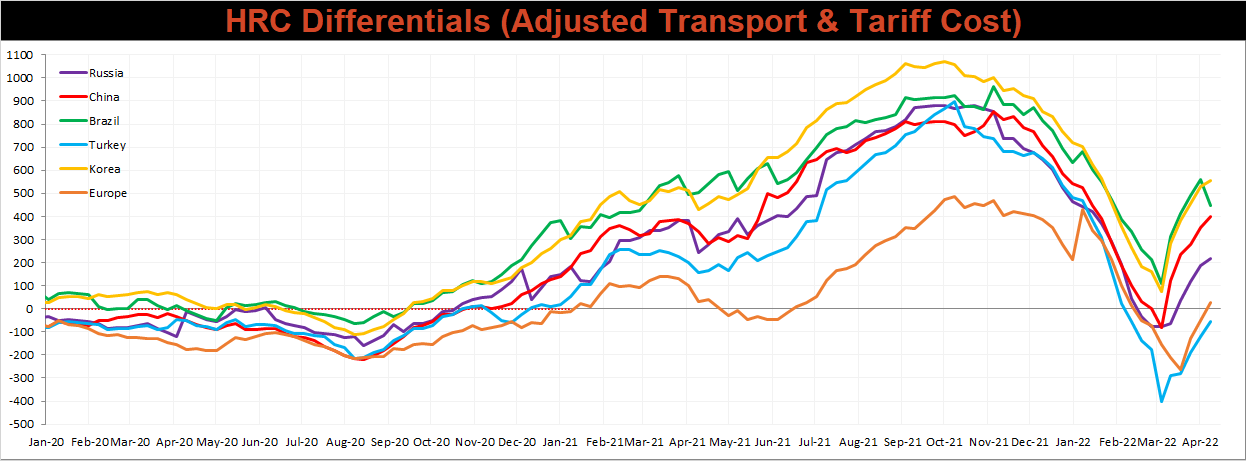

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Global differentials increased again this week, as the U.S. price continues to outpace most of the world. The exception this week was Brazil, who’s export price was severely lagged.

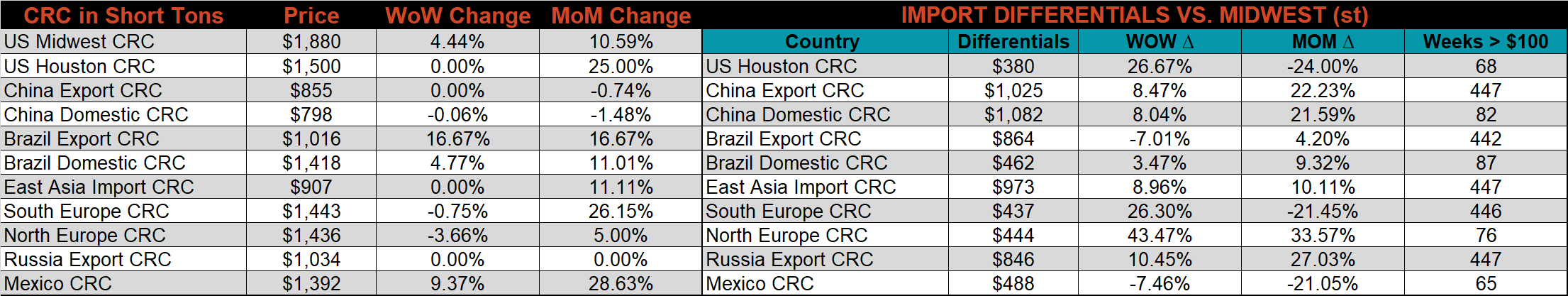

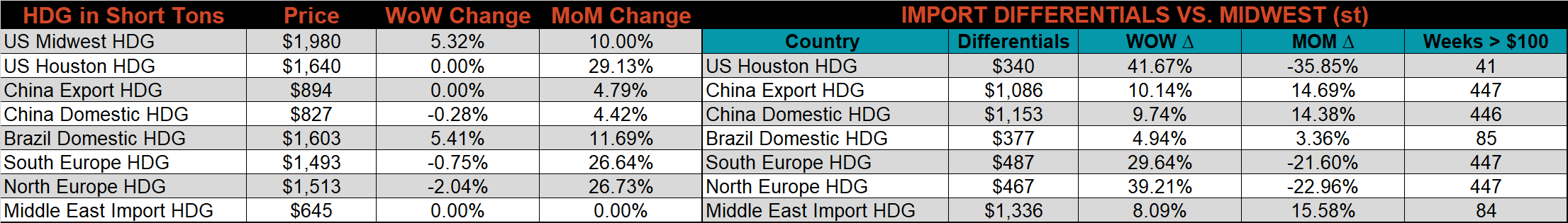

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, CRC & HRC prices were up 5.3%, 4.4%, and 2.1%, respectively. Outside of the U.S., the Brazilian HRC export price rose the most significantly, up 18.4%.

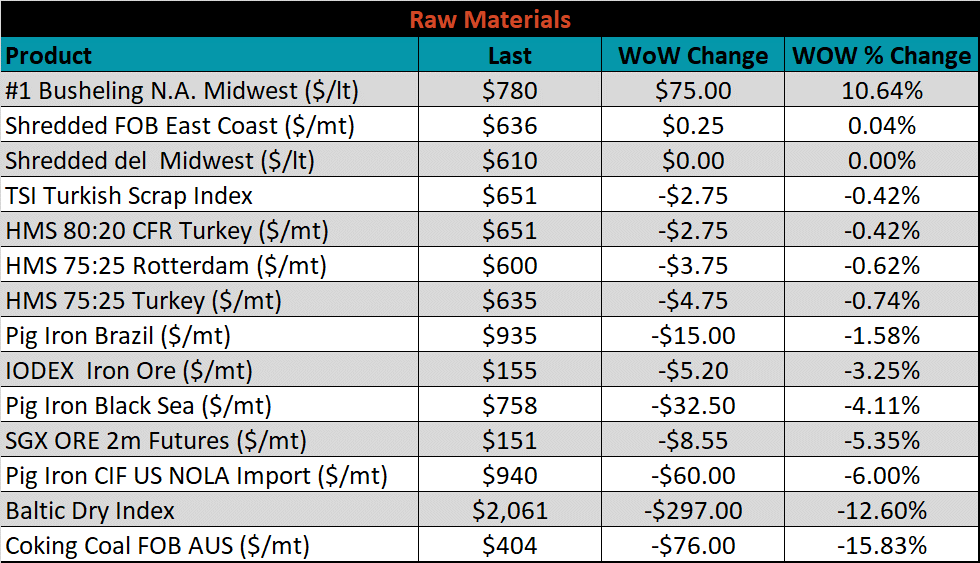

Raw material prices were mixed, with Aussie coking coal was down another 15.8%.

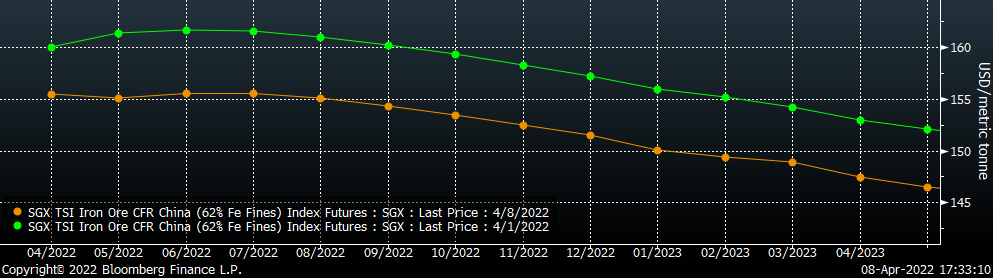

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted lower at all expirations.

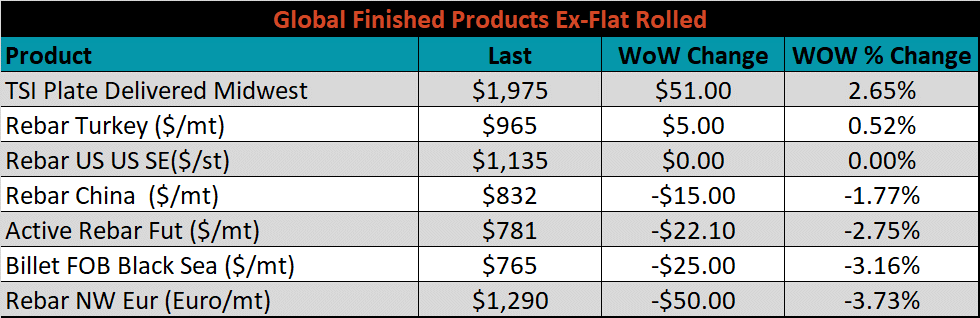

The ex-flat rolled prices are listed below.

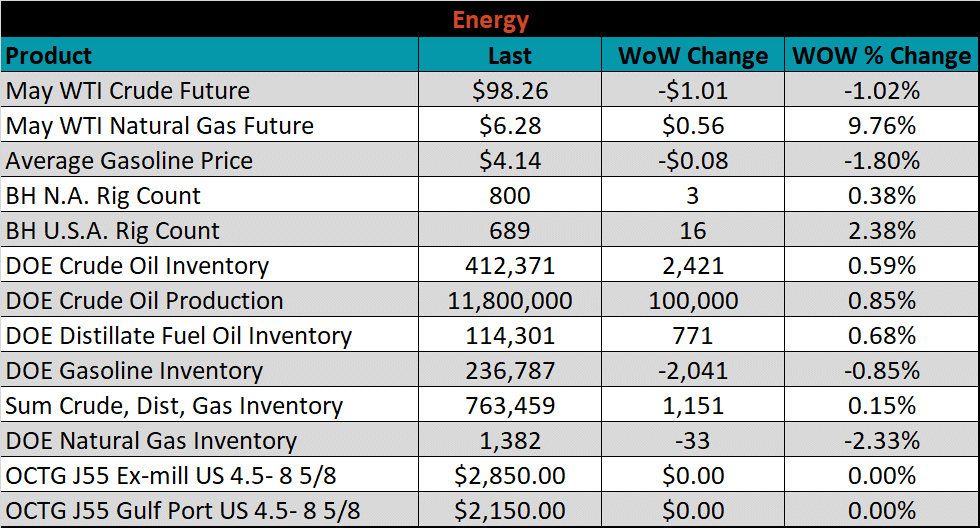

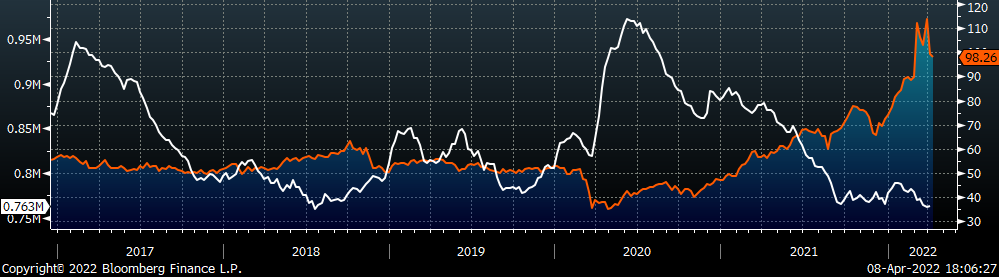

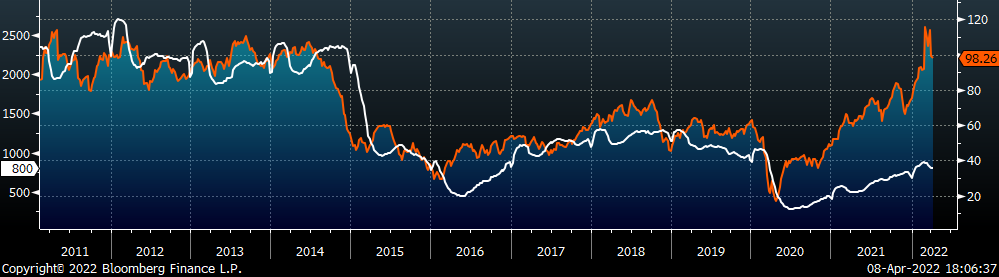

Last week, the May WTI crude oil future lost $1.01 or 1% to $98.26/bbl. The aggregate inventory level was up 0.2% and crude oil production rose to 11.8m bbl/day. The Baker Hughes North American rig count was up 3 rigs, and the U.S. rig count was up another 16 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: