Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

On Friday, the Chairman of the FOMC Jerome Powell shared remarks on the economy and FED policy in Jackson Hole, Wyoming. Leading up to the event there was ambiguity around whether the Federal Reserve would slow the pace of interest rate hikes or even cut rates in 2023. This speech however, made it clear that interest rates have not reached their peak and cuts should not be expected any time soon. Below are two quotes from the speech.

“The historical record cautions strongly against prematurely loosening policy.”

“We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored. We will keep at it until we are confident the job is done.”

The reason this matters for steel is because it clarified that monetary policy would remain restrictive until inflation returns to the neutral rate of 2%. This means that long term projects will be more expensive, and demand will cool as a result. At the same time, structural changes to the U.S. steel market have made the industry more dynamic and will lead to higher prices over the next 5-10 years. The limited number of suppliers are more capable of adjusting to any demand level than ever before. The combination of these conflicting forces will lead to even more volatility in steel prices if you are not hedging that risk.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

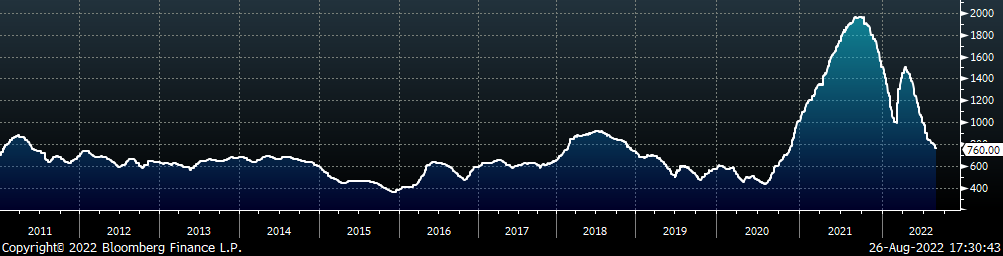

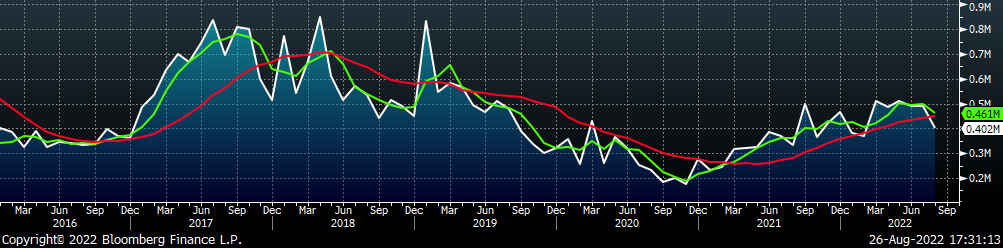

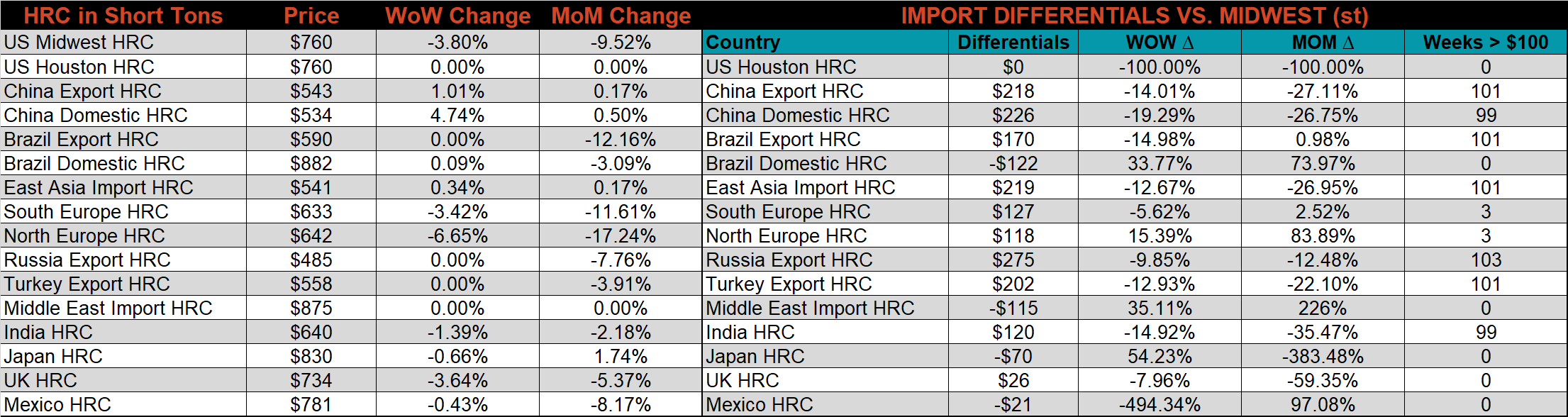

The Platts TSI Daily Midwest HRC Index was down another $30 to $760.

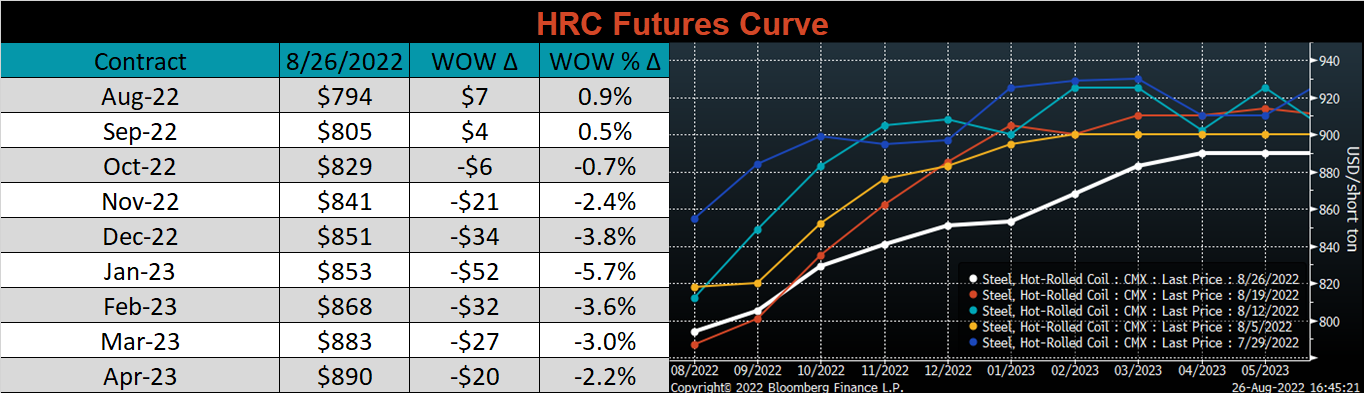

The CME Midwest HRC futures curve is above last Friday’s settlements in orange. The back of the curve moved lower last week, while the front was essentially unchanged.

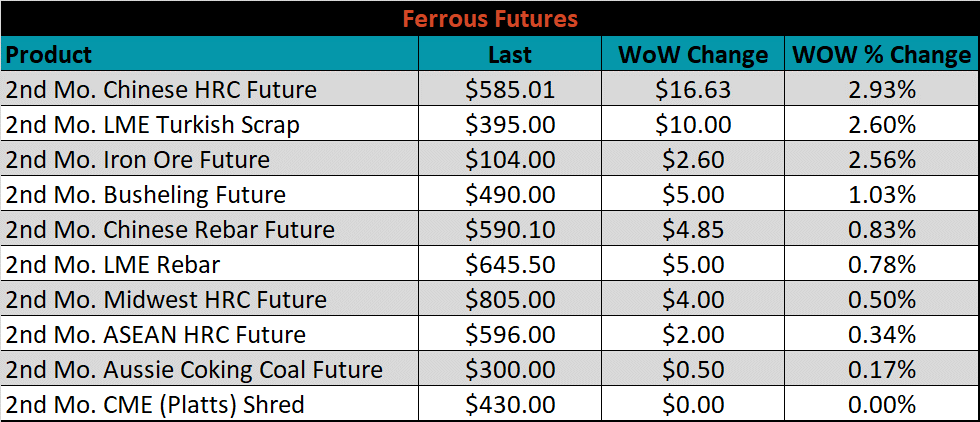

The 2nd month ferrous futures ended the week higher led by Chinese HRC, which gained 2.9%.

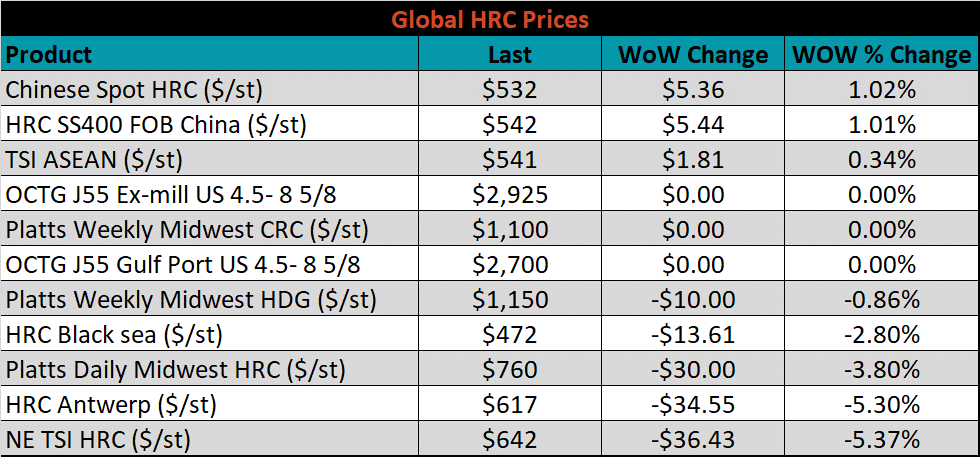

Global flat rolled indexes were mixed last week. Northern European HRC was down 5.4%, while Chinese spot HRC was up 1%.

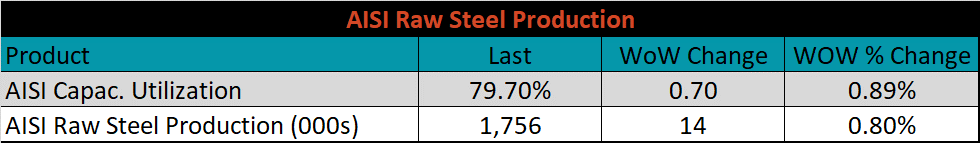

The AISI Capacity Utilization was up 0.7% to 79.7%.

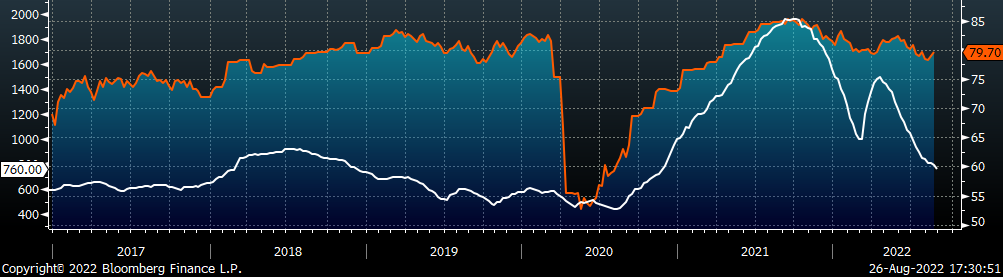

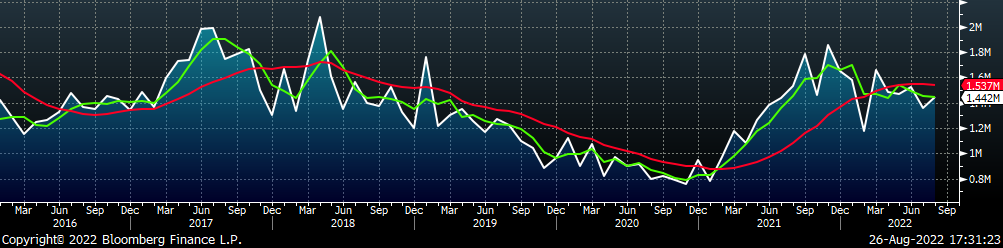

August flat rolled import license data is forecasting an increase of 168k to 1,039k MoM.

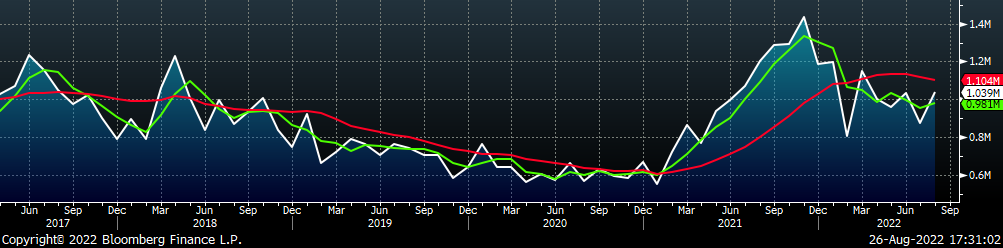

Tube imports license data is forecasting a decrease of 88k to 402k in August.

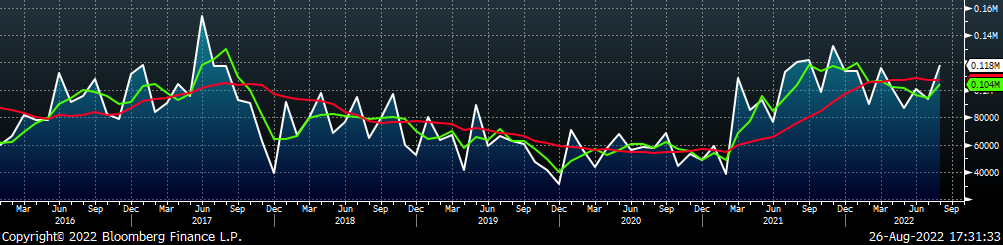

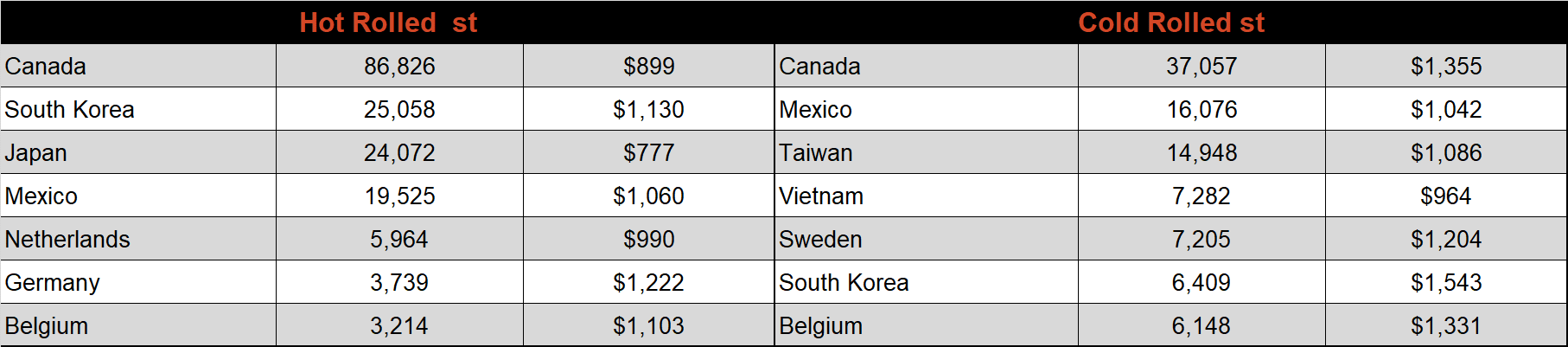

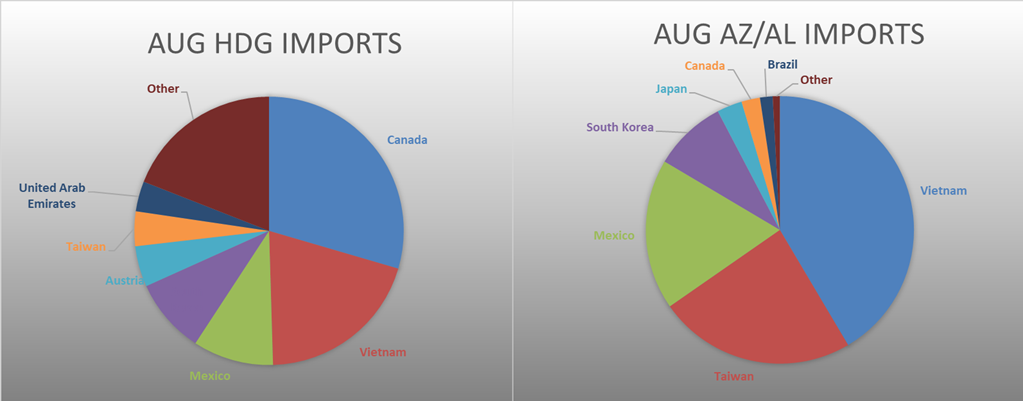

August AZ/AL import license data is forecasting an increase of 24k to 118k.

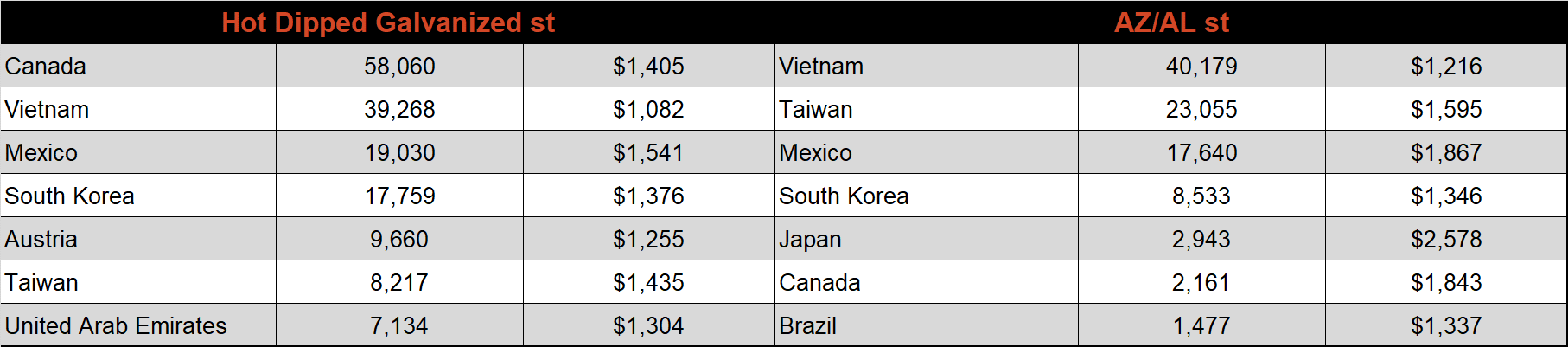

Below is August import license data through August 22nd, 2022.

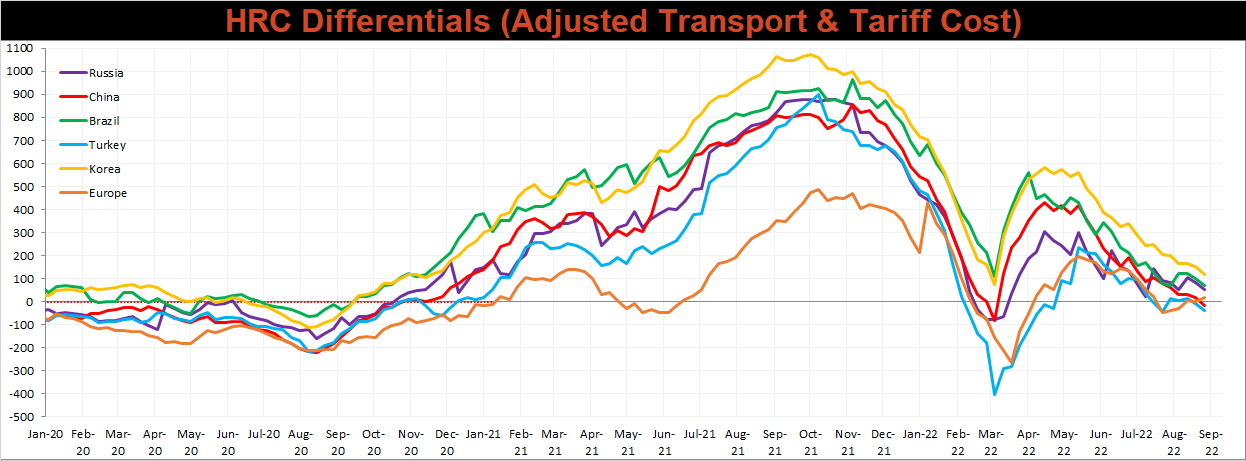

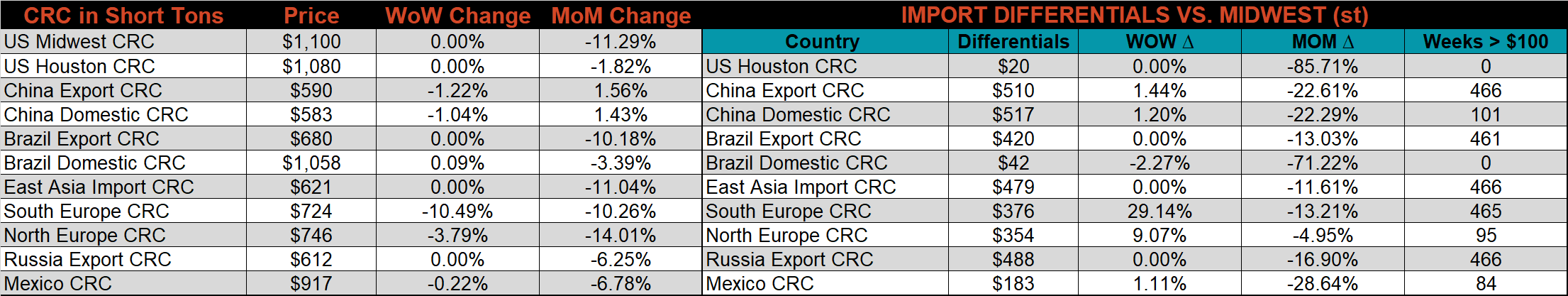

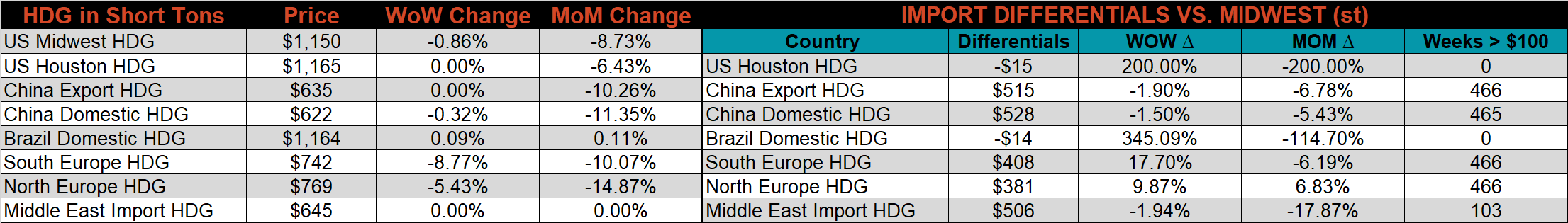

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials all the watched countries differentials (excluding Europe) were lower last week, as the U.S. Midwest price fell most significantly. Differentials at these levels suggest that the currently elevated import level should subside by the end of the year.

SBB Platt’s HRC, CRC, and HDG pricing is below. The Midwest HRC, & HDG prices were down 3.8%, and 0.9%, respectively, while CRC prices were unchanged.

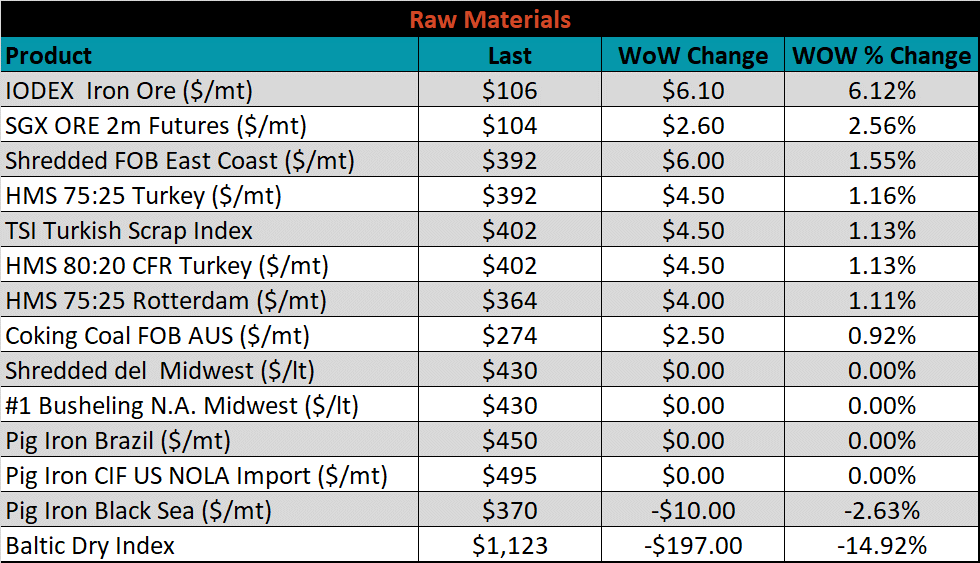

Raw material prices were mostly higher last week, with the IODEX iron ore index up 6.1%, while Black Sea pig iron ore was down 2.6%.

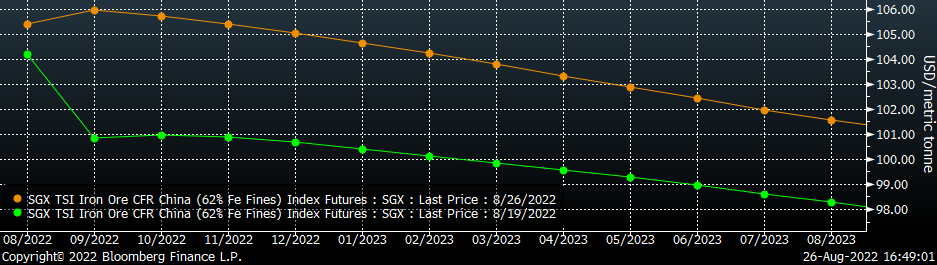

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve jumped sharply higher, most significantly in the front.

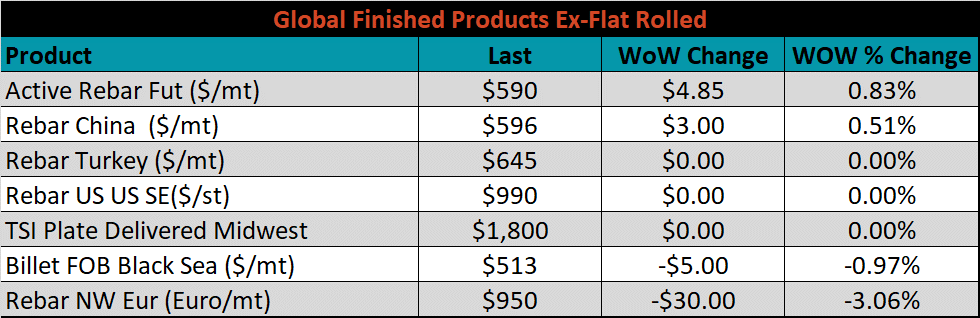

The ex-flat rolled prices are listed below.

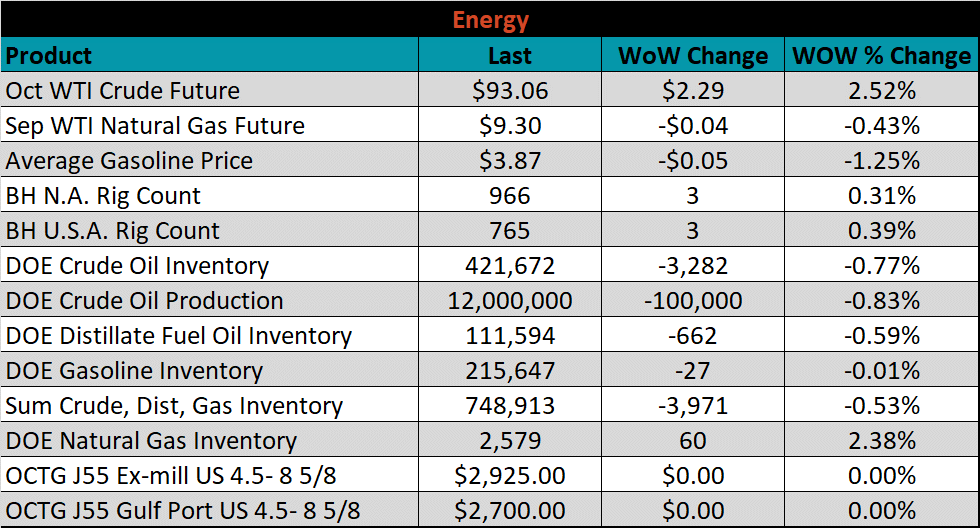

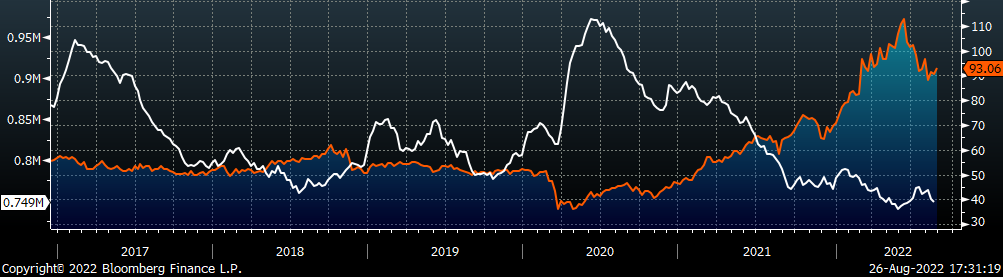

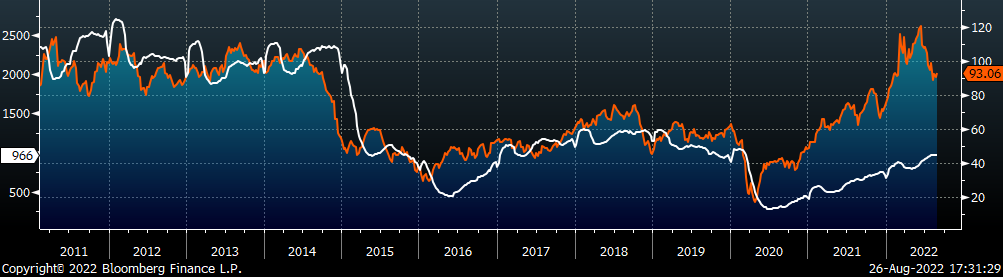

Last week, the October WTI crude oil future gained $2.29 or 2.5% to $93.06/bbl. The aggregate inventory level decreased another 0.3%. The Baker Hughes North American, and U.S. rig count both increased by 3 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: