Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

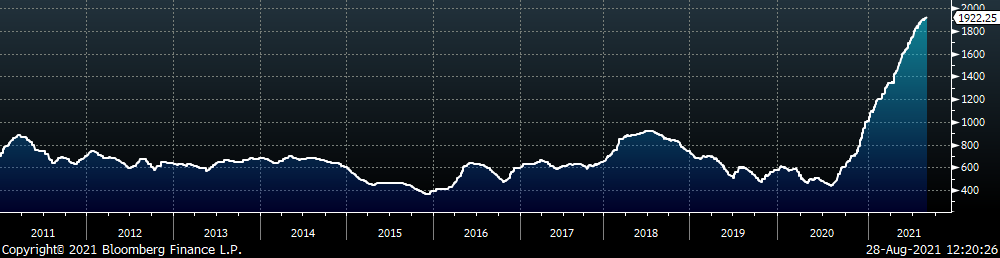

Last week was another strong week in the U.S. domestic steel market, as spot prices continue to climb. With the end of August quickly approaching, we have now seen 13 straight months of higher prices starting with a TSI Platts Midwest HRC monthly average of $459 in July 2020 and a current August average of $1,897 (as of the 27th). As we look forward through the rest 2021, many of the forces driving the rally remain intact. Seasonal demand is broad and strong and inventory levels are below normal operating levels, while consistent spot ton availability continues to be unreliable. On the other hand, downside risks continue to mount as steel prices push into rarified air. We continue to hold a bullish outlook on the market and believe the structural shortage will be the overriding factor driving steel prices in the U.S.; however, in the remainder of this report, we will address mounting risks we see on the horizon.

The chart below shows import arrivals starting in 2016 in white, with their 3-month (green) and 12-month (red) averages.

Since the beginning of the rally, sparce levels of imports have steady increased and now sheet imports have surpassed 1 million short tons in July, with August expected to match those levels with an ever-expanding global price differential as a backdrop. Further, anecdotal evidence suggests import levels should remain elevated well into 1Q22 as a lack of commitment from the mills on contracts has pushed buyers to look abroad. Additionally, mill profitability is at astronomical levels with raw materials stalling out and plateauing below 2008 price levels. We also anticipate the upcoming mill outages will put further downward pressure on scrap prices going into 4Q21. Finally, steel buyer frustration has intensified over the last six months, as downward pressure from these factors grew, while the price continued to rise, which has caused an aversion towards buying any speculative material, today. The combination of these dynamics appears to be slowing momentum and causing a consolidation of HRC prices below the $2,000 level, which seemed inevitable only a few weeks ago. However, slowing momentum and increasing downside risks don’t necessarily lead to lower pricing in the short term. In the coming weeks, a large amount of production is coming offline due to planned mill outages, while recent pockets of spot material have all but dried up. Buyers, that did not take advantage of Q3 import offers from earlier this summer or purchase any tons from the recent round of spot availability (while under the impression the market was turning around), who need material right now have nowhere to turn. This will likely keep prices elevated throughout the end of the year.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

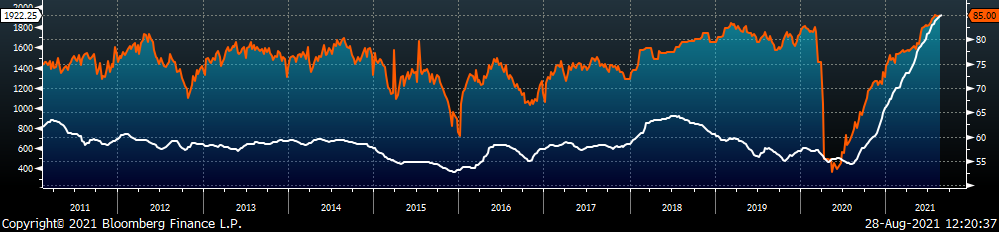

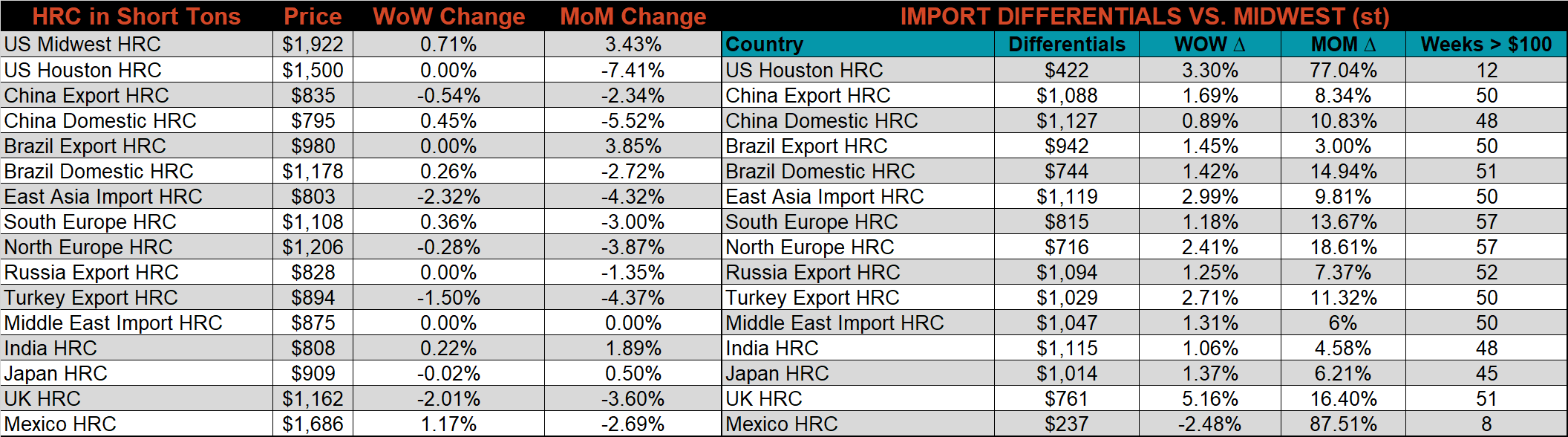

The Platts TSI Daily Midwest HRC Index increased by $13.50 to $1,922.25.

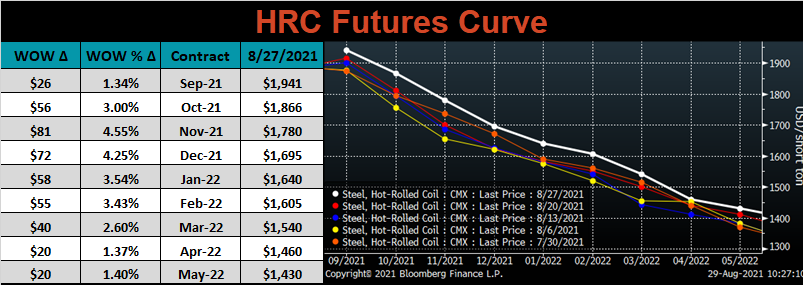

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the entire curve shifted higher, most significantly in 4Q21, each expiration saw a record high to end a week of upward momentum.

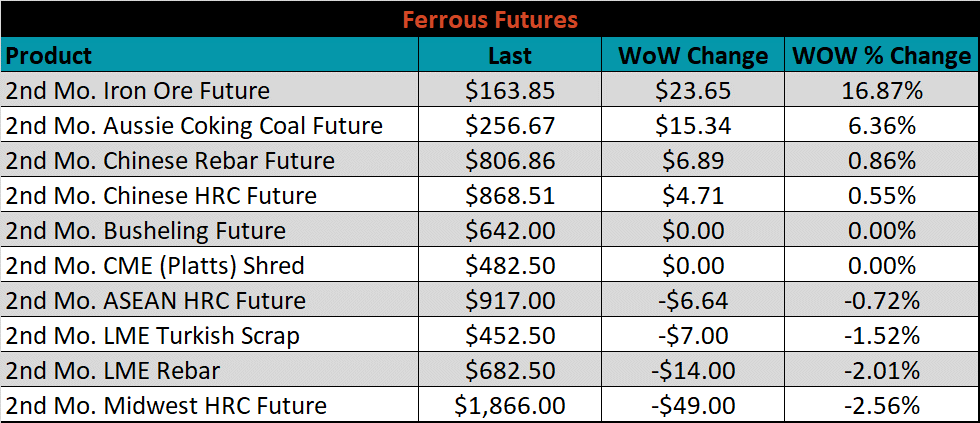

October ferrous futures were mixed. Iron ore bounced significantly, up 16.9%, after multiple weeks of dropping lower.

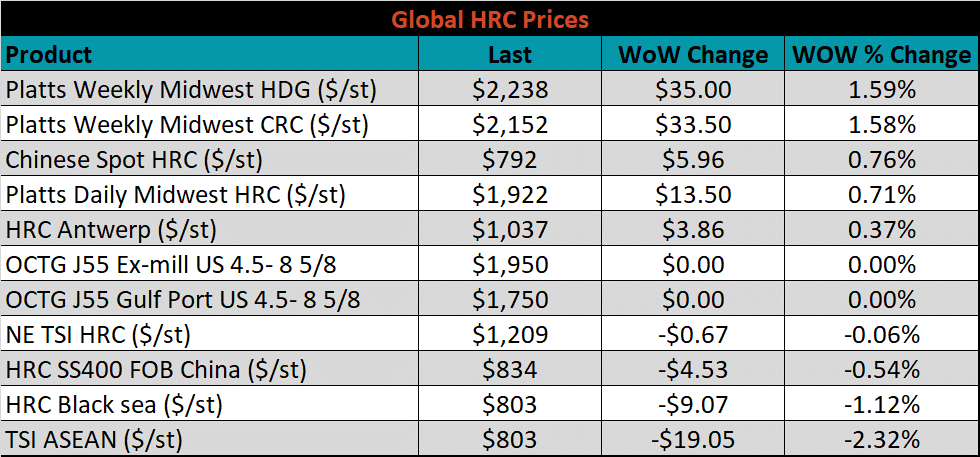

Global flat rolled indexes were mixed. The TSI Platts Midwest HDG price was up another 1.6%, while the TSI ASEAN HRC export price was down 2.3%.

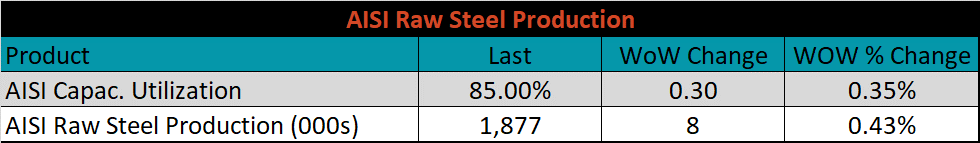

The AISI Capacity Utilization rate increased 0.3% to 85%.

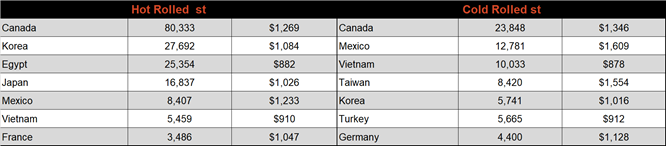

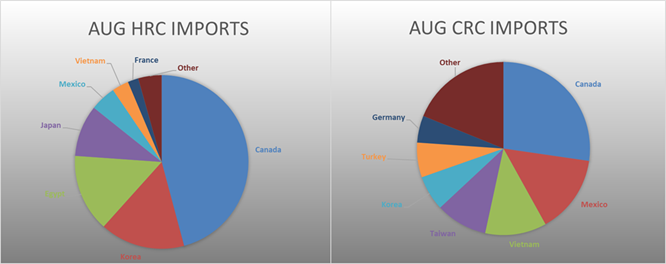

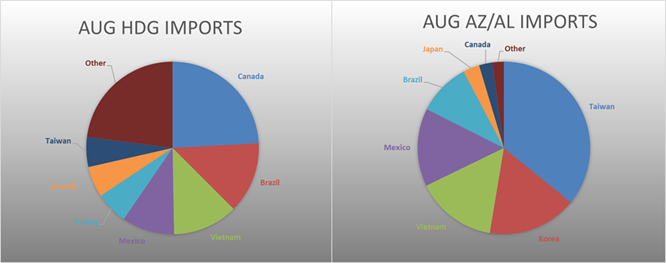

August flat rolled import license data is forecasting a decrease of 7k to 1.06M MoM.

Tube imports license data is forecasting a decrease of 1k to 367k in August.

August AZ/AL import license data is forecasting an increase of 20k to 133k.

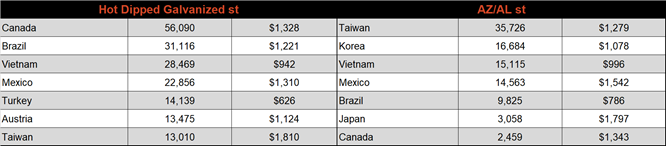

Below is August import license data through August 23rd, 2021.

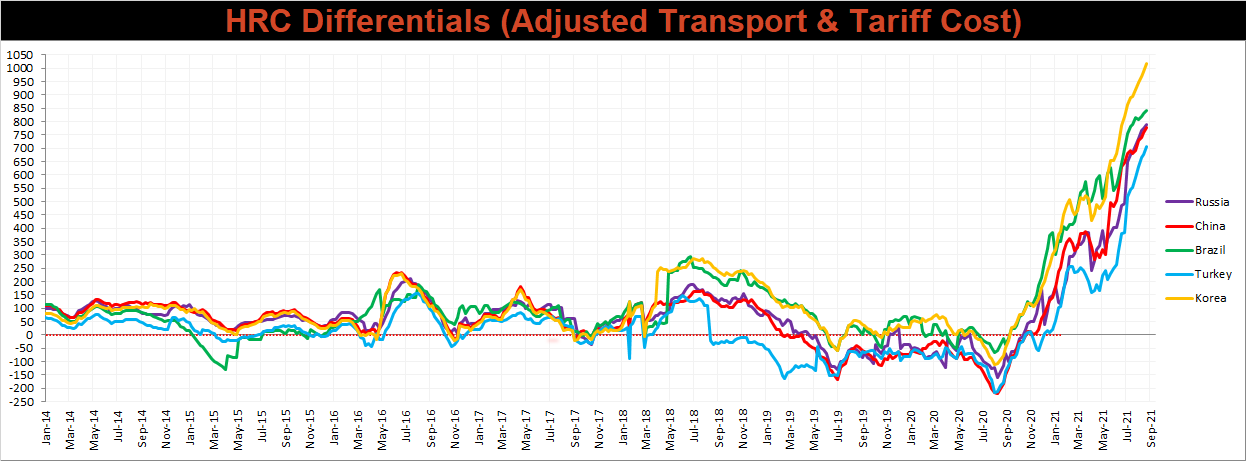

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials for all watched countries increased further this week, as the U.S. price continues grinding higher.

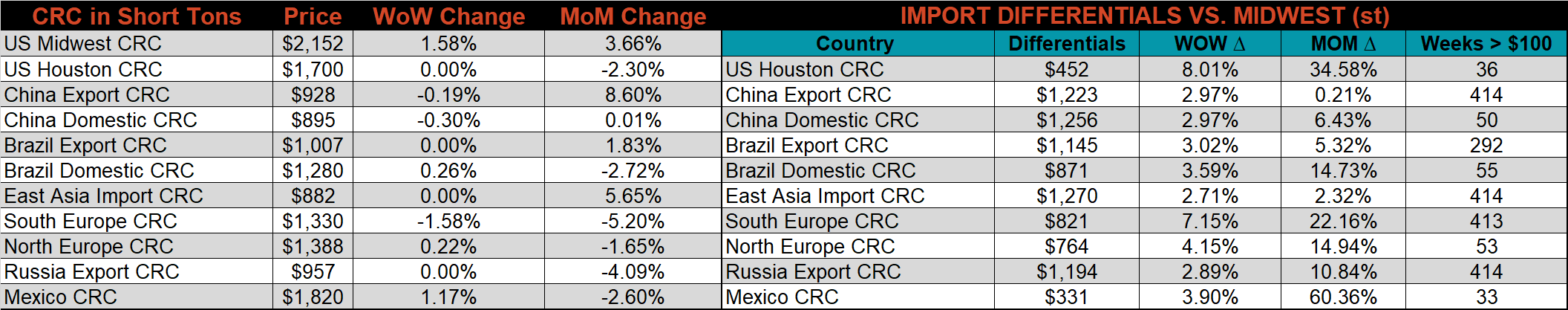

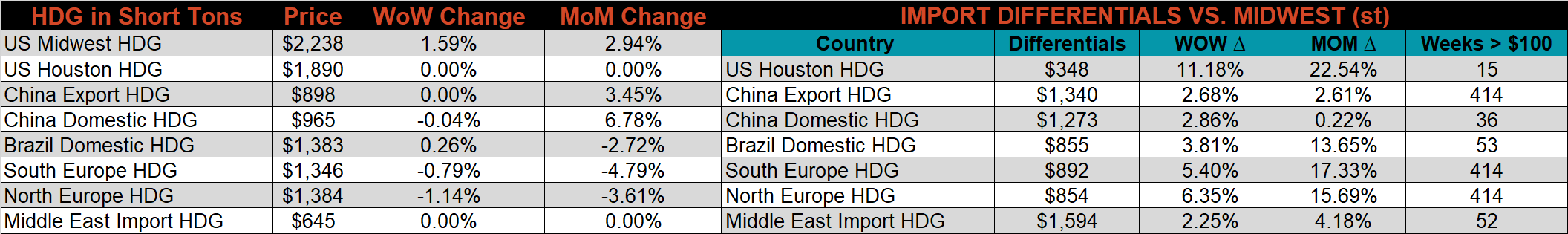

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, CRC, & HRC prices were up by 1.6%, 1.6%, and 0.7%, respectively. Outside of the U.S., the East Asian HRC export price was down 2.3%.

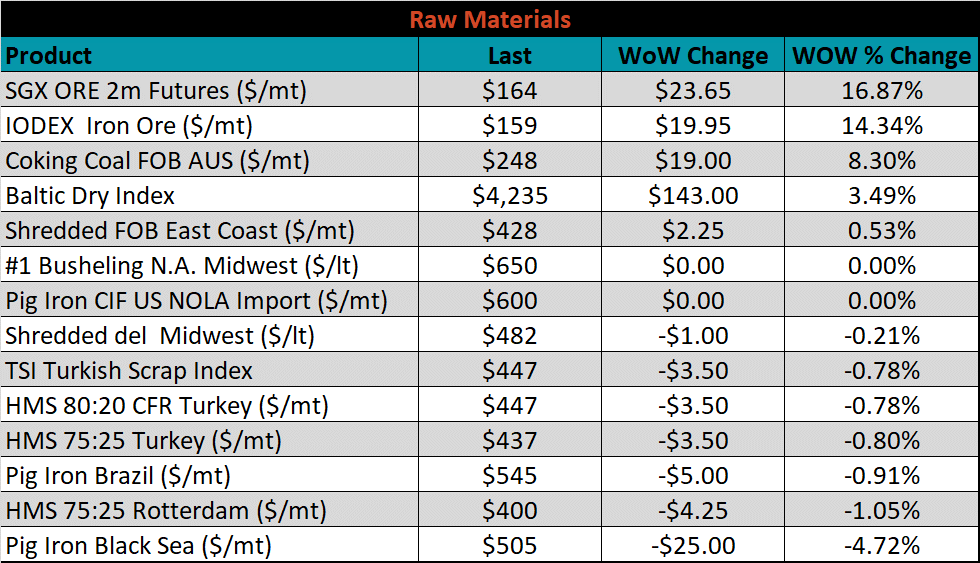

Raw material prices were mixed. The October iron ore future increased significantly, up 16.9%, while pig iron was down 4.7%.

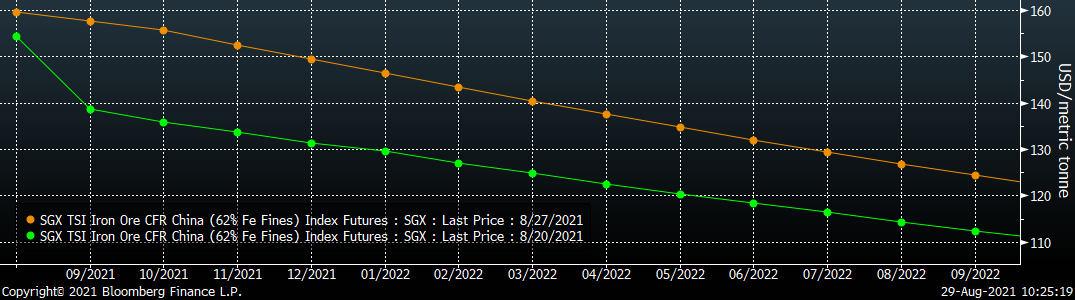

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve bounced after a significant 5 week decline.

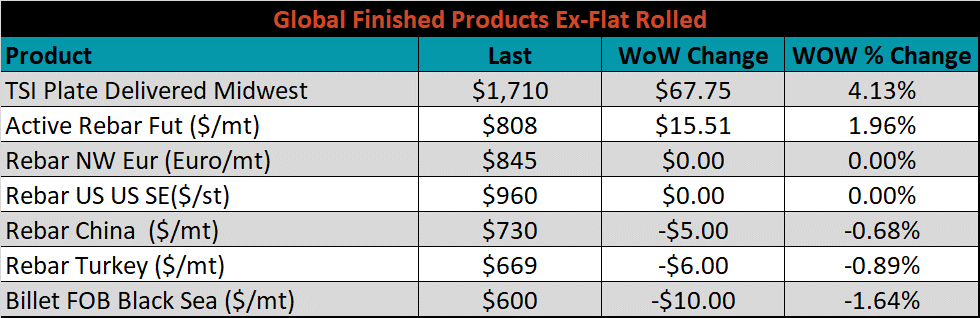

The ex-flat rolled prices are listed below.

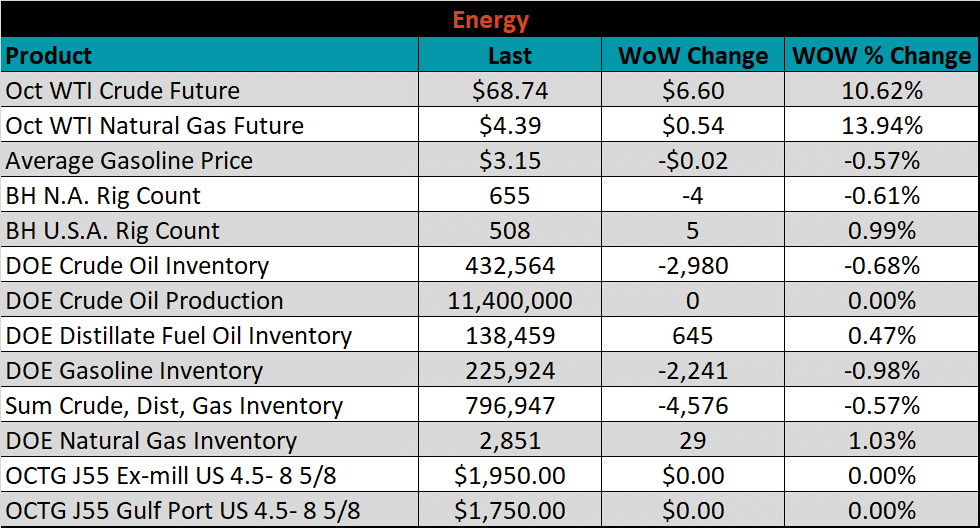

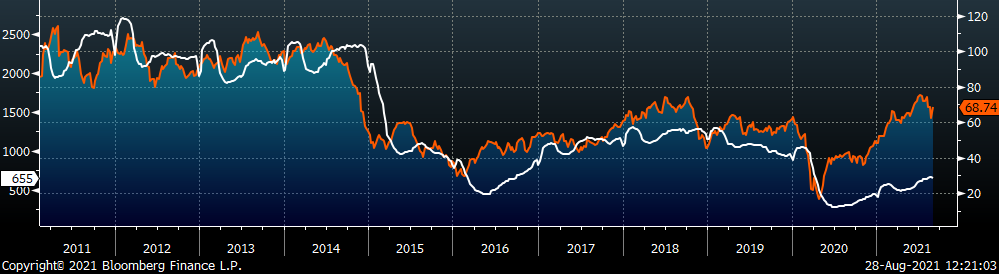

Last week, the October WTI crude oil future was up $6.60 or 10.6% to $68.74/bbl. The aggregate inventory level was down another 0.6%, and crude oil production was unchanged at 11.4m bbl/day. The Baker Hughes North American rig count was down another 4 rigs, while the U.S. rig count was up 5 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: