Content

-

Weekly Highlights

- Market Commentary

- Risks

Last week, we saw another round of price increase announcements, initially pushed by US Steel and other integrated producers, and followed by Nucor and the mini mills. Spot tons are difficult to find, and lead times have pushed out to highest levels since 2018, signaling that the spot market will be tight for several weeks. This is partially driven by several outages that are scheduled for the next few weeks. Some mini mills are holding off on quoting new spot tons as they wait for market prices to move higher, making sure that they capture the full extent of this price rally. With the current list of downside risks dwindling, especially in the short term, this rally is poised to continue. This week, we will discuss how changes in the market structure over the past few months, combined with the scrap market, are fueling higher prices.

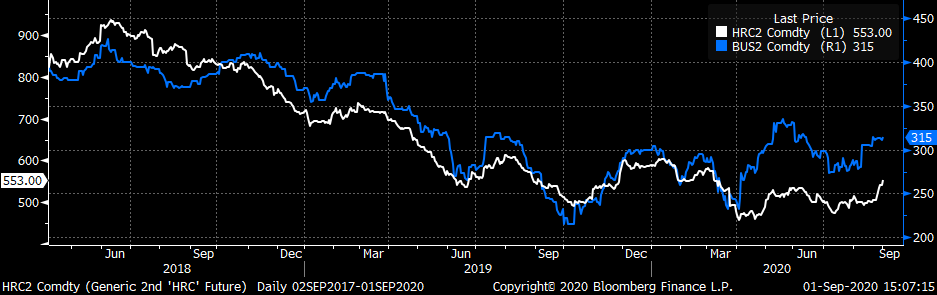

The fact that Nucor and other mini mills followed suit is significant, giving support to these price increases that did not exist when integrated mills unsuccessfully attempted to hike prices three weeks ago. During the second quarter, EAFs more or less produced near full utilization rates, while several blast furnaces were idled due to pandemic related shutdowns, specifically in the automotive sector. Therefore, tons from mini mills represented a larger share of the total market, increasing their ability to influence prices. Because EAFs function through converting scrap into finished steel, the change in market structure puts increased focus on scrap prices. The below chart compares busheling and HRC prices, using their respective 2nd month rolling future price.

This historically close relationship reached a tight level near the end of 2019 with the correlation between the two hitting 88.9%. However, since late spring, that correlation has declined with scrap prices moving higher while HRC prices remained depressed. These moves are fitting, given the market dynamics and the above-discussed EAF production levels during this time – mills competing to sell finished steel products among depleted demand, and sustained EAF demand for scrap while very little scrap was created. This caused a decline in the metal spread – HRC prices minus scrap prices – that is a proxy for EAF profitability per ton. However, as EAF’s increased their market share during this time, they were able to buffer the hit to their profits by continuing to produce significant amounts of material. Now that integrated producers brought back up blast furnaces and recovered some of lost market share, mini mill’s sensitivity to changes in scrap prices should return to the levels from 6 months ago. As scrap prices move higher in September, mini mills are getting behind finished product price increases.

As many buyers know, this environment of higher prices and extended lead times is incredibly difficult to maneuver. Obviously, those who hedged before this squeeze are in an advantageous position. However, implementing a hedge at this point will do little to protect against the current conditions. Hedging should be part of a long-term, overarching strategy that extends multiple months and/or years into the future.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

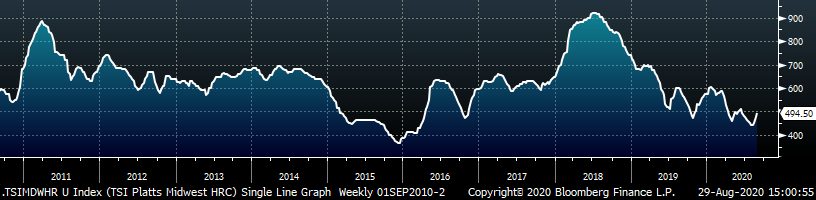

The Platts TSI Daily Midwest HRC Index was up $20.50 to $494.50.

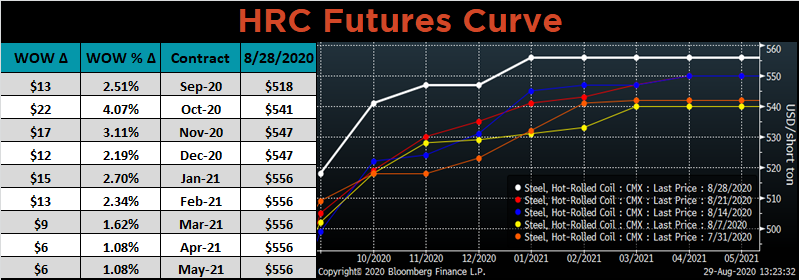

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The entire curve shifted higher, most significantly in the front.

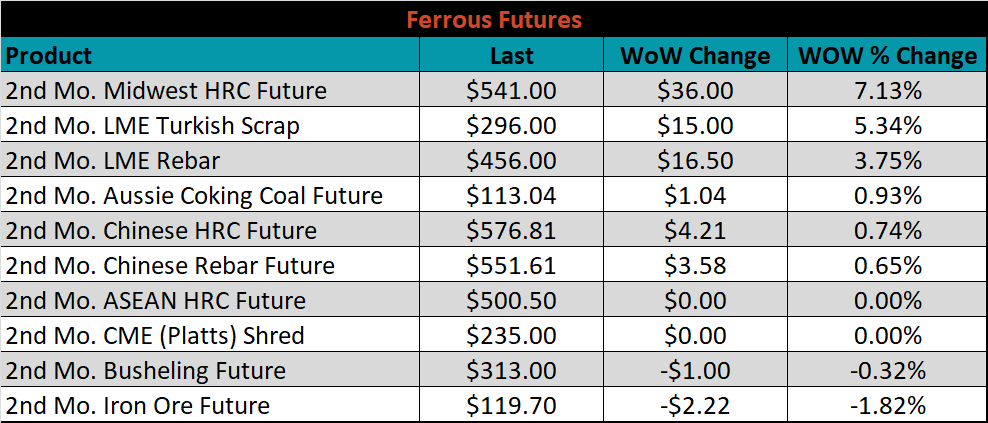

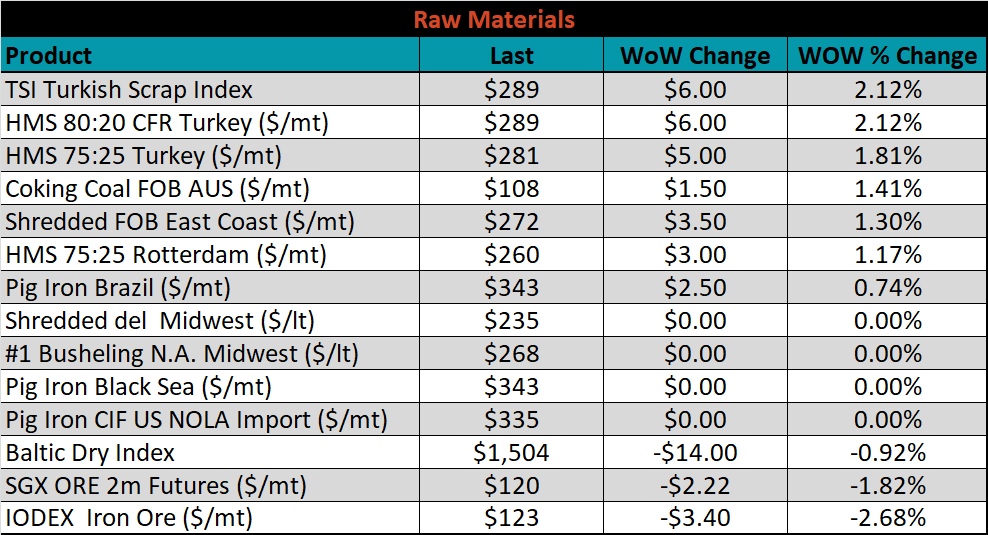

October ferrous futures were mixed. Iron ore dropped 1.8%, while LME Turkish scrap rose 5.3%.

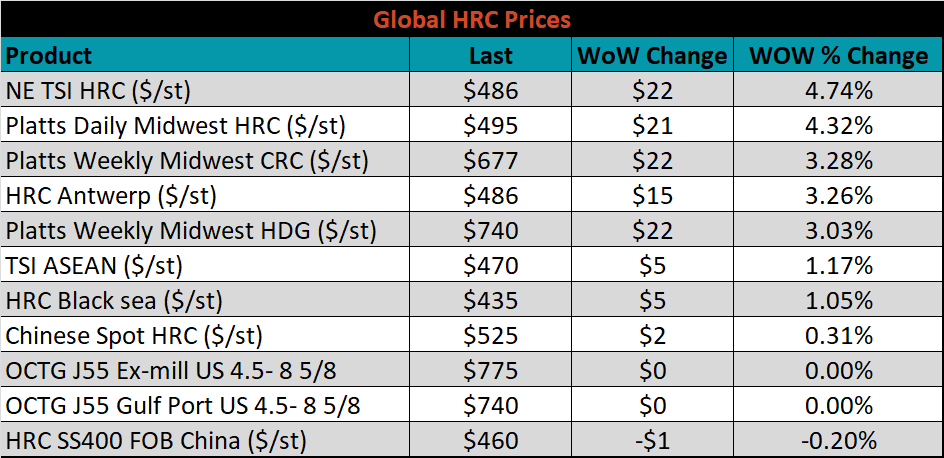

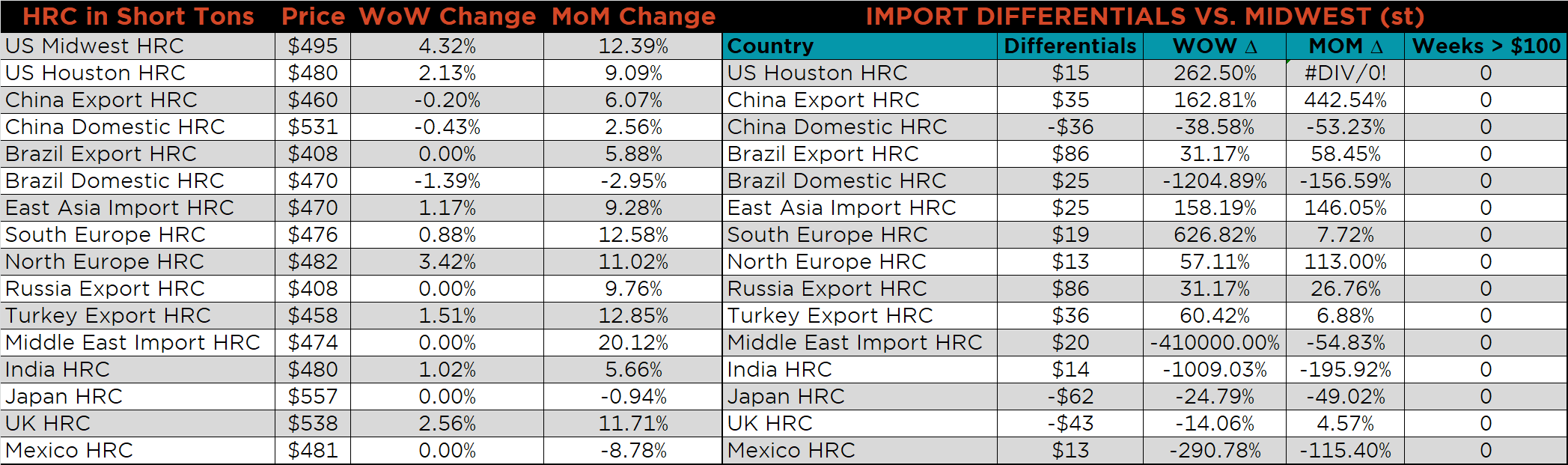

The global flat rolled indexes were mostly higher, led by Northern European HRC, up 4.7%; while China Export HRC was down 0.2%.

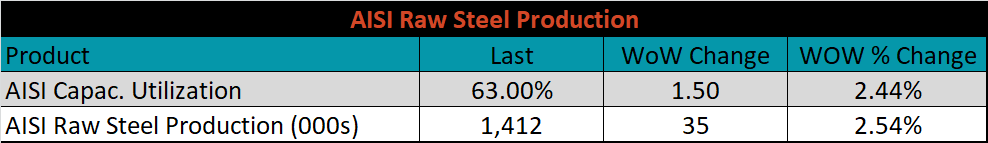

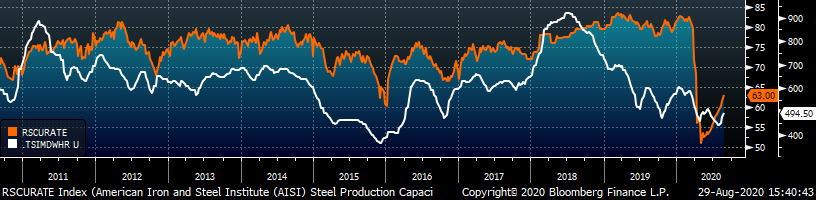

The AISI Capacity Utilization Rate was up another 1.5% to 63%.

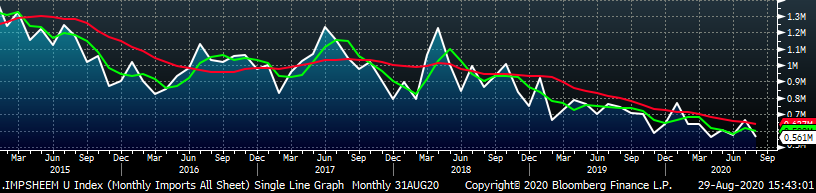

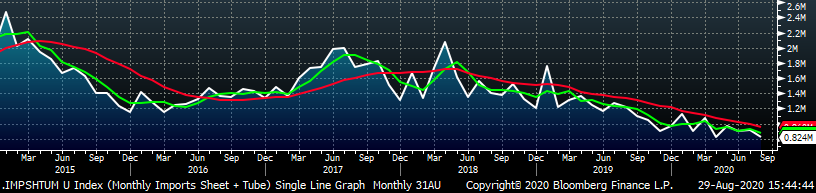

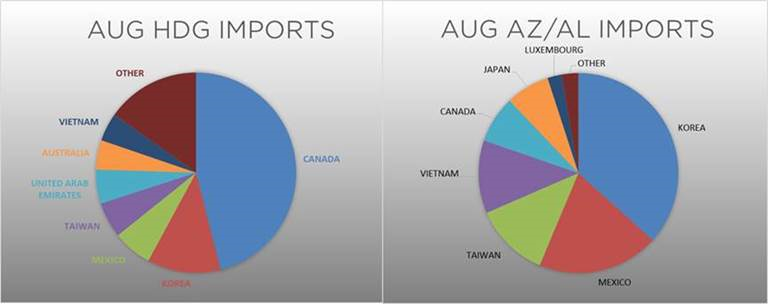

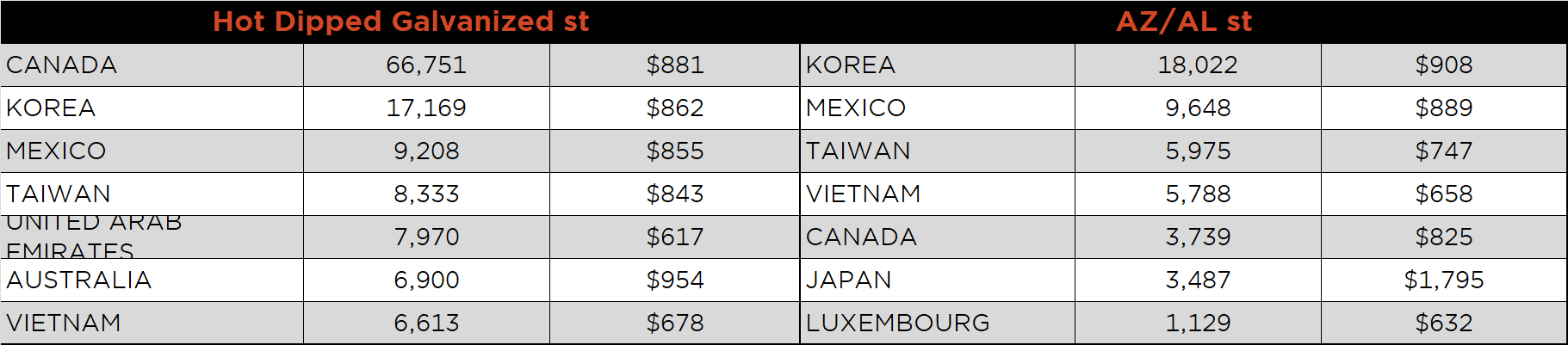

August flat rolled import license data is forecasting a decrease of 101k to 561k MoM.

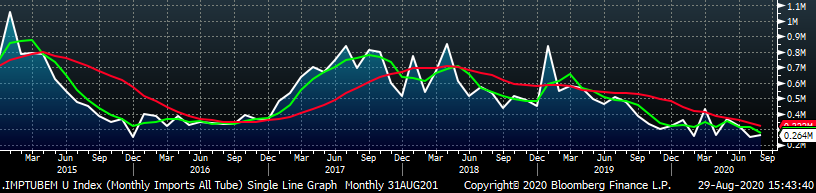

Tube imports license data is forecasting a MoM increase of 12k to 264k tons in August.

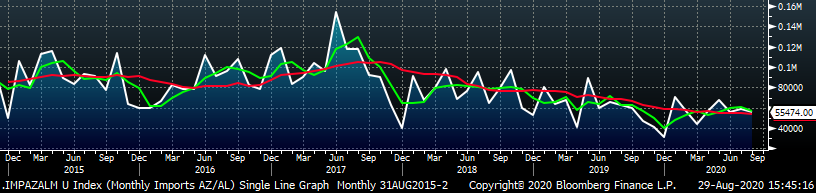

August AZ/AL import license data is forecasting a slight decrease to 55k.

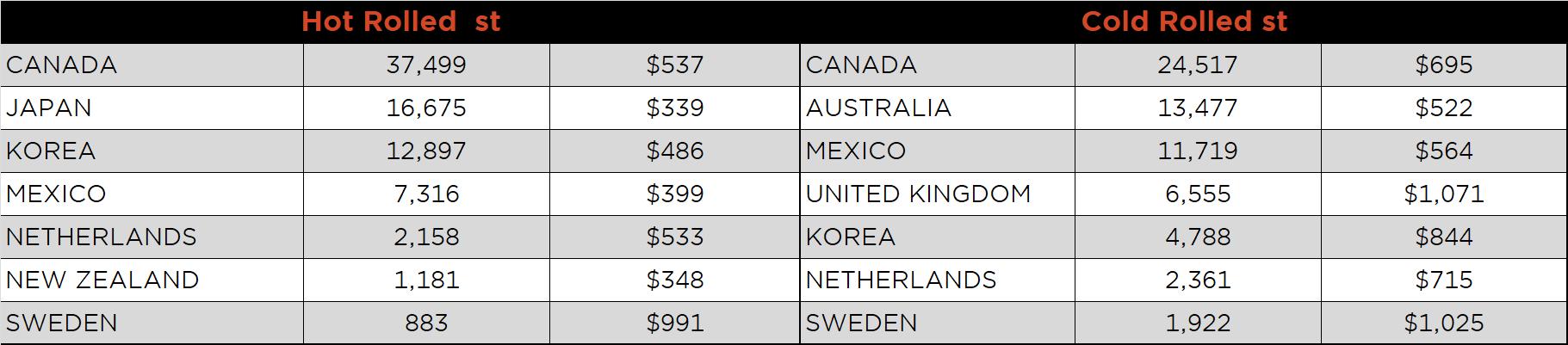

Below is July import license data through August 25, 2020.

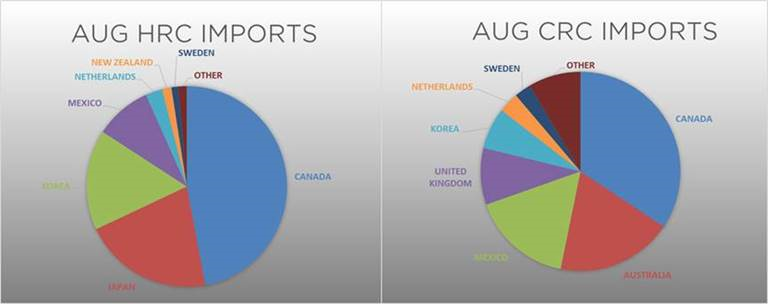

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the differentials increased again as the U.S. price increased dramatically.

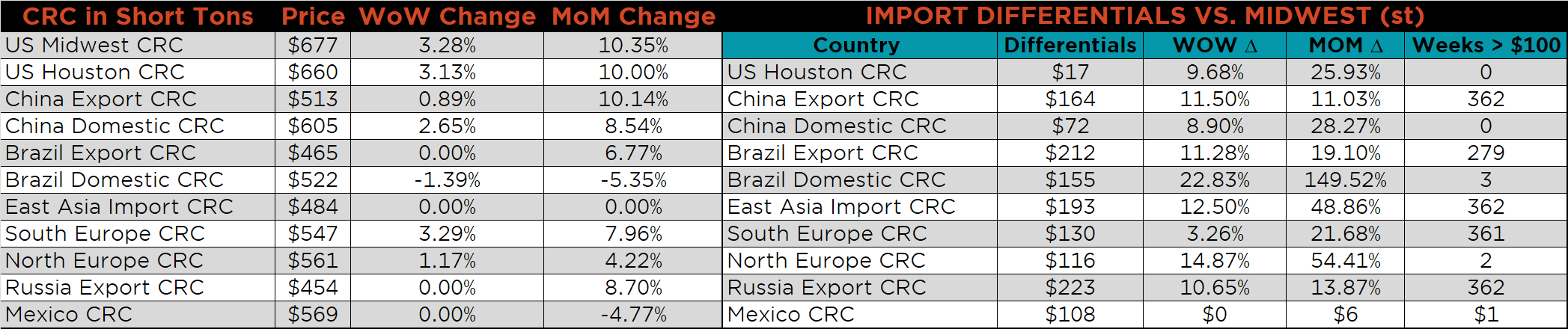

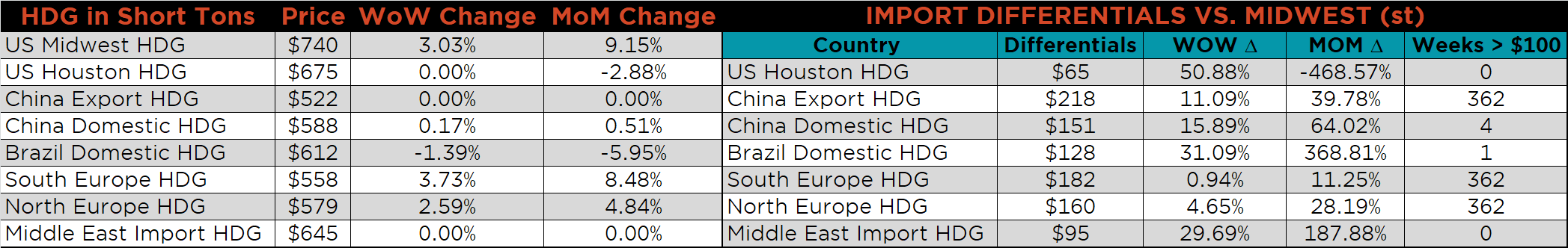

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, CRC and HDG prices were up, 4.3%, 3.3% and 3.0%, respectively. Globally, the Norther European HRC and HDG prices were up, 3.4% and 2.6%, respectively.

Raw material prices were mixed. Turkish scrap was up 2.1%, while IODEX iron ore was down 2.7%.

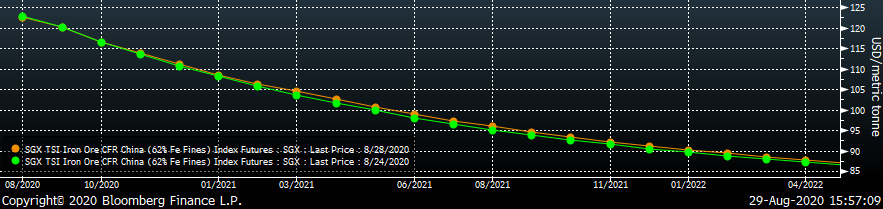

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. There was very little change in the curve since last week.

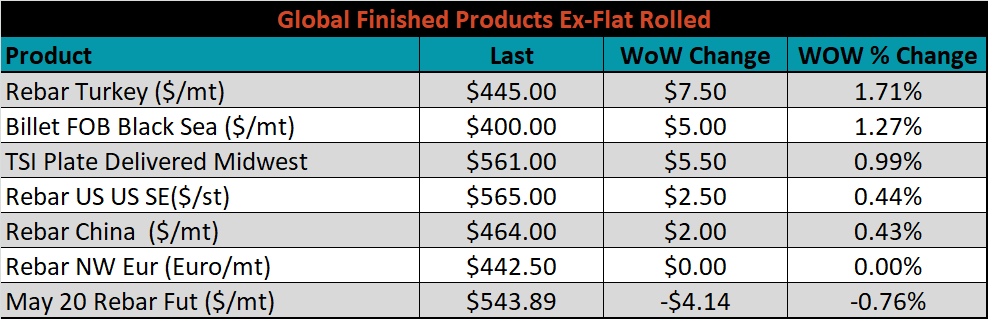

The ex-flat rolled prices are listed below.

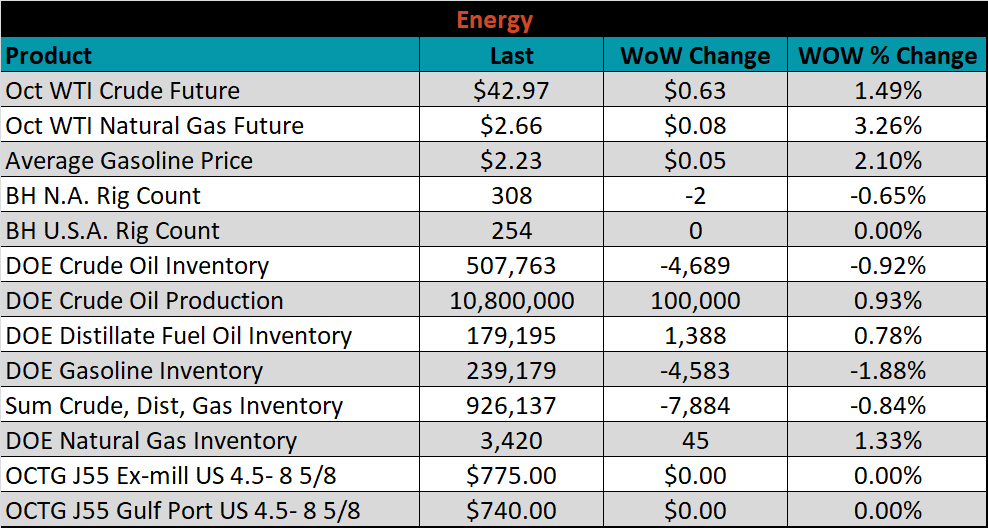

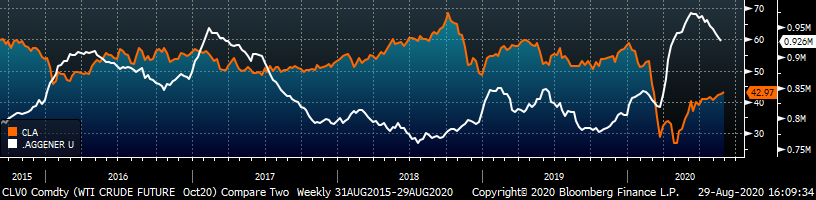

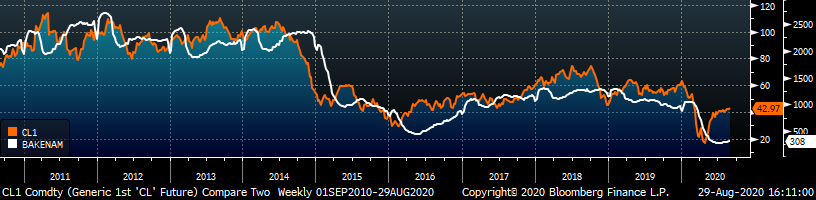

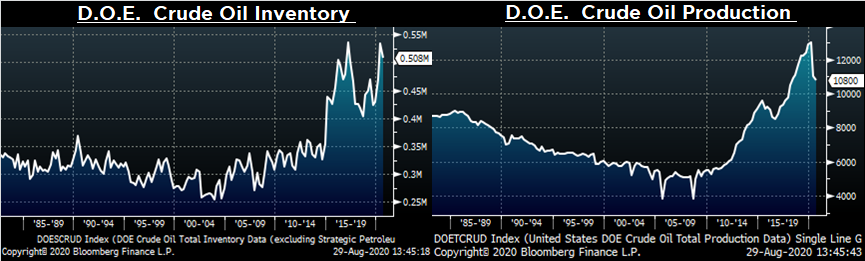

Last week, the October WTI crude oil future gained $0.63 or 1.5% to $42.97/bbl. The aggregate inventory level was down another 0.8%, while crude oil production rose to 10.8m bbl/day. The Baker Hughes North American rig count was down two rigs and the U.S. rig count was flat.

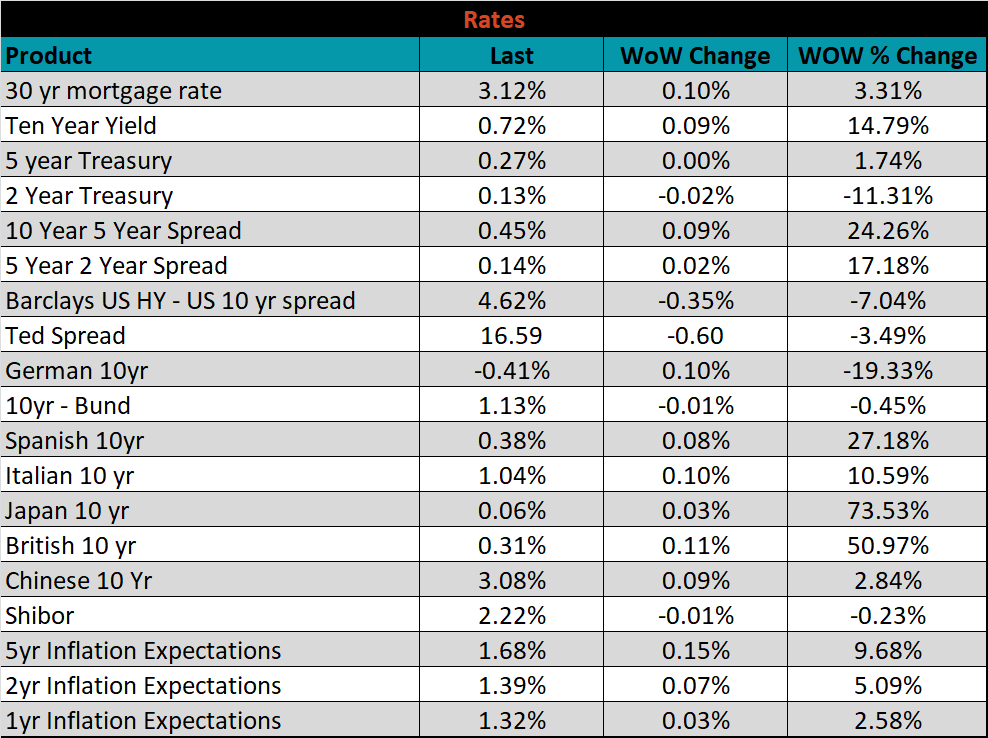

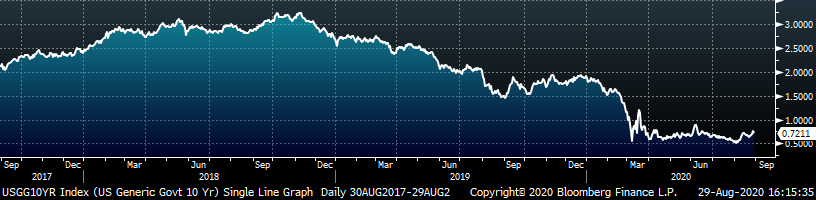

The U.S. 10-year yield was up 9 bps, closing the week at 0.72%. The Federal Reserve adjusted its inflation target to “an average of 2%”, indicating a lower Fed Funds rate for longer. This drove up market-based inflation expectations. The German 10-year yield was up 10 bps to minus 0.41%, while the Japanese 10-year yield was up 3 bps to 0.06%.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: